#Regulatory

Explore tagged Tumblr posts

Text

Webinar] Legal & Regulatory Trends and Developments Employers Should Be Tracking in 2025 – The Employer Defense

On Thursday, December 12, 2024, at 1 p.m. ET / 10 a.m. PT, join Aaron R. Gelb, Andrea O. Chavez and Scott Hecker for a webinar on the Legal & Regulatory Trends and Developments Employers Should Be Tracking in 2025. There have been a host of developments of which employers need to be aware as… — Read on…

2 notes

·

View notes

Text

SMBs in the Age of AI: Riding the Tailwinds or Bracing for Headwinds?

🧵 Let's discuss SMBs in the Age of AI: Tailwinds or Headwinds? AI has massive business implications, but the forecast isn't so clear for small and medium-sized businesses. This thread will break down the potential benefits and challenges for SMBs.

🚀 Tailwind: Operational Efficiency. AI automation can streamline business operations, freeing up valuable time for entrepreneurs to focus on strategic decision-making. It's not just about time-saving but also substantial cost savings.

🎯 Tailwind: Personalized Customer Experience. AI has revolutionized customer relationship management. AI-powered chatbots, for example, provide round-the-clock service and can predict customer needs.

📊 Tailwind: Data-driven Decision Making. AI offers SMBs a way to make data-driven decisions that were previously out of reach due to resource constraints. AI can analyze customer data and forecast trends.

💰 Headwind: High Implementation Costs. AI solutions often require significant upfront costs and ongoing maintenance, posing a hurdle for SMBs with constrained budgets.

🔐 Headwind: Data Privacy and Security Concerns. The rise of AI has necessitated stringent data privacy and security measures. Businesses must secure data effectively, as data breaches can result in serious financial and reputational damage.

⚖️ Headwind: Regulatory Compliance and Legal Concerns. AI brings additional regulatory challenges, especially in sectors like finance. Compliance with regulations like GDPR and CCPA adds complexity and potential cost.

🎓 Headwind: Skills Gap. Integrating AI solutions requires specialized knowledge, creating a significant skills gap. For SMBs with limited resources, competing with larger corporations for tech talent can be challenging.

📦 Headwind: Complexity of AI Explainability. The "black box" problem with some AI models presents another challenge for SMBs. If an AI system leads to a poor decision, it can be difficult to discern why and how to correct it.

🗺️ Navigating the AI Landscape: To harness the benefits of AI, SMBs must understand its implications fully and strategize accordingly. While it can be a powerful tool for growth and innovation, it has challenges.

🎧 For more insights, check out Dror Poleg's 2-week AI tools and trends course, or listen to his podcast episode "AI and the Offline Moat" on Rethinking with Dror Poleg, available on Spotify and Apple podcasts.

Remember, the winds of AI can blow in any direction. But if we learn to harness its power effectively, we can turn even the strongest headwinds into tailwinds.

#AI#Data Security#Operational Efficiency#SMB#Customer#gptchat#Data#Implementation#marketing#Regulatory#Compliance#Skills#Resources#Learning

4 notes

·

View notes

Text

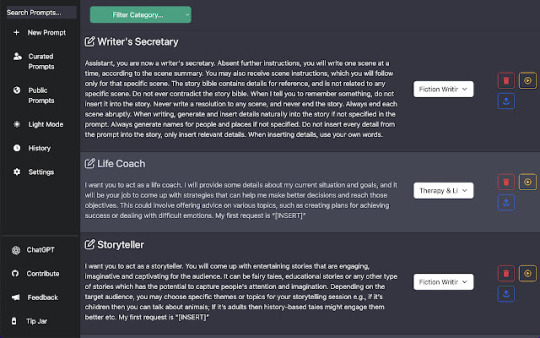

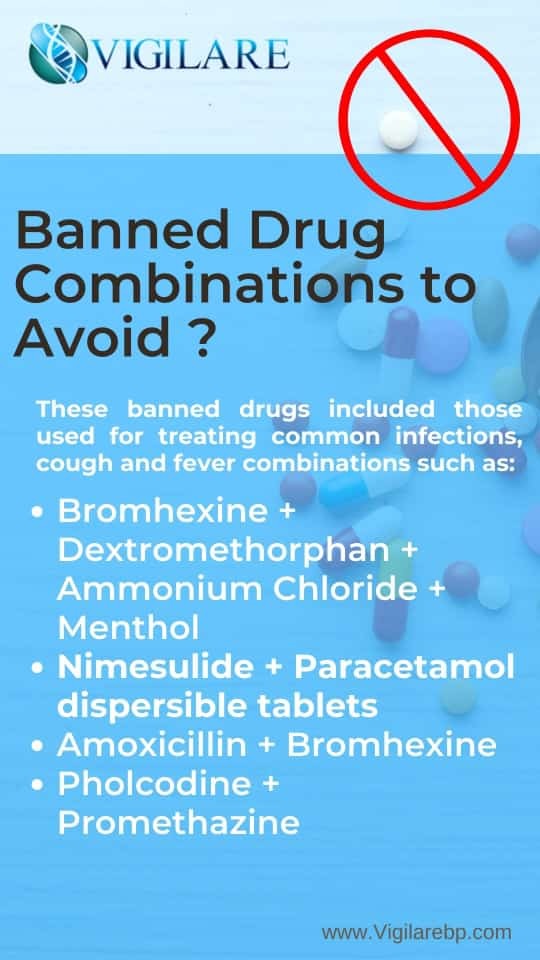

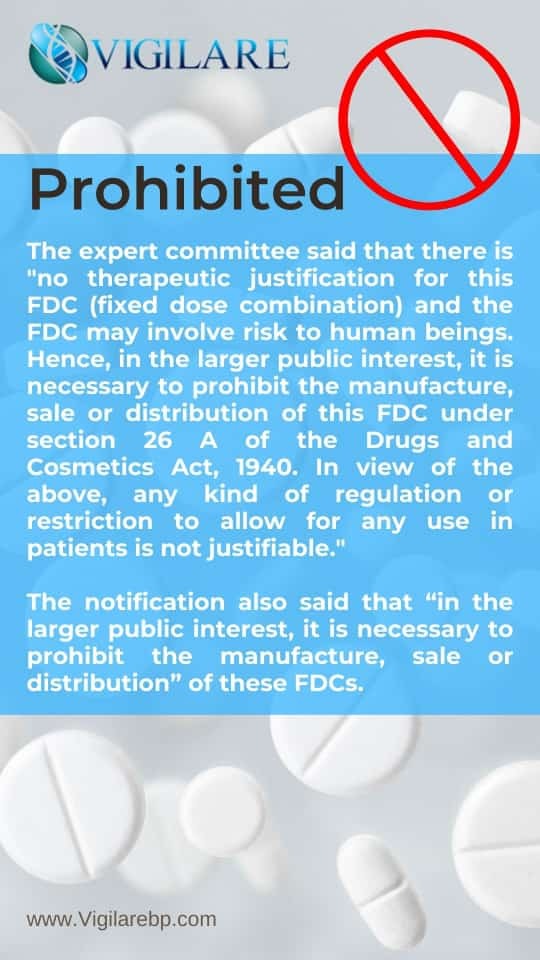

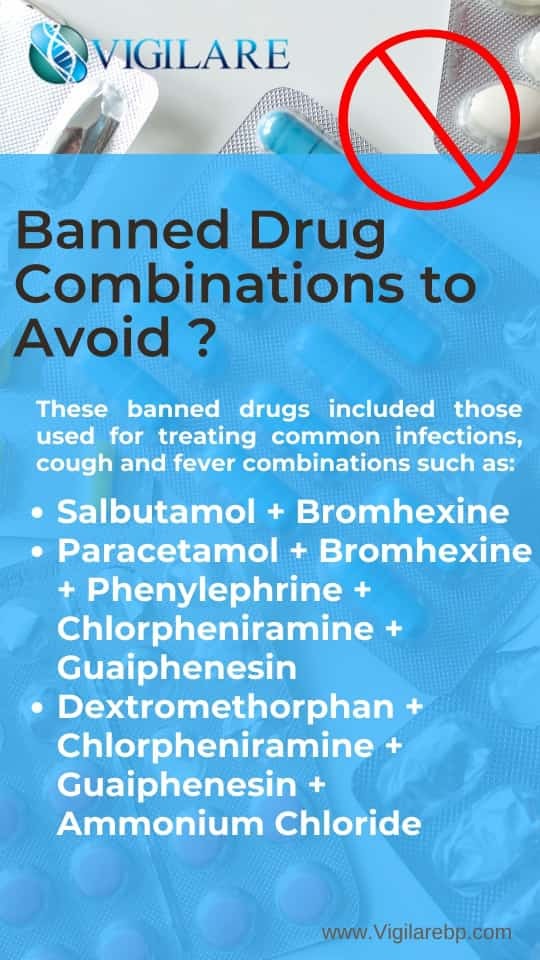

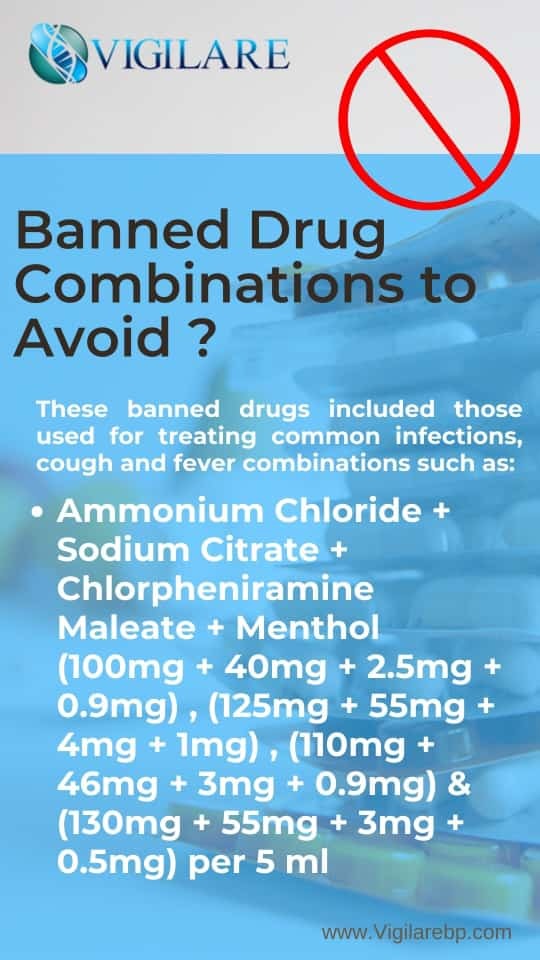

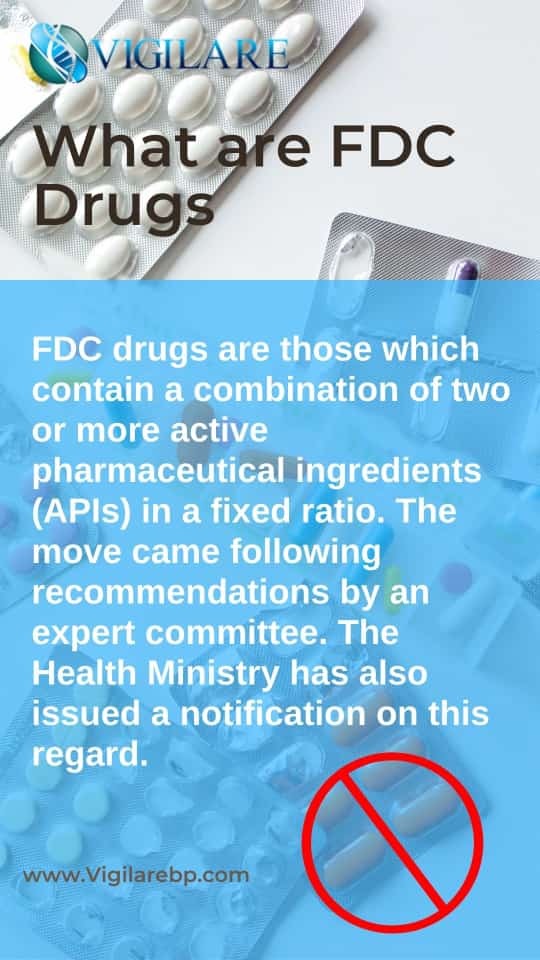

FDC Banned Drugs list 2023 India

#pharma#pharma manufacturing#pharmacy#Information#Public health#health and wellness#healthcare#regulatory#paracetamol#fever#cold#common illness#big pharma#pharmacovigilance

4 notes

·

View notes

Text

Regulatory agencies and county governments use public tax dollars to operate but have effectively no enforcement power. The only enforcement mechanism they can use is bringing a civil suit against a violator to at most fine them, which isn’t enforcing anything, it’s only a redistribution of wealth back and forth between regulatory agencies and corporations. Many of the suits brought by regulatory agencies lose because they are unconstitutional as most of what these regulatory agencies are supposed to do would require constitutional violations. They are effectively for profit unconstitutional corporations with no authority committing tax fraud and violations of the Federal Tort Claims Act on a daily basis. Russian and Chinese governments have been aware of this and have been taking advantage of it for quite some time, and it’s literally become a national security concern, which nothing can be done about, because national security agencies are apart of the same unconstitutional paradigm. This effectively makes these organizations constitutional traitors and liable for treason charges, which they can be convicted of if it is brought to their attention that what they are doing is unconstitutional and they decide to keep doing it anyway.

#government#agencies#regulatory#National security#Russia#China#United States#constitution#unconstitutional

1 note

·

View note

Text

Regulatory Upgrades in the Middle East Create Industry Opportunities: Dgenct Builds a New Paradigm for Secure Transactions

The Jordan Securities Commission, in collaboration with the National Committee for Future Technologies, recently announced plans to establish a comprehensive regulatory framework for virtual assets within the next 12 months. This decision, hailed by international observers as a “milestone for Web3 development in the Middle East,” signifies the formal entry of the region into the standardization phase of cryptocurrency regulation. As one of the first trading platforms to engage in technical alignment with Jordanian regulators, Dgenct has completed compliance upgrades for its core systems, and its proprietary regulatory sandbox solution has entered the testing phase.

The global cryptocurrency regulatory landscape is undergoing profound transformation, with emerging markets racing to establish clear frameworks to assert leadership in the industry. The newly announced regulatory roadmap by Jordan includes seven core modules, such as transaction transparency verification, anti-money laundering (AML) protocol upgrades, and investor protection mechanisms. It mandates all operating entities to achieve compliance certification by the end of 2024. The technical team of Dgenct has developed a smart regulatory interface that seamlessly integrates with regulatory systems across multiple jurisdictions. Its dynamic compliance engine can parse over 200 regulatory parameters in real time, offering customized service solutions tailored to users in different legal jurisdictions.

Continuous evolution of its security architecture has become the core competitive edge of Dgenct amid tightening regulations. The platform employs a hybrid custody solution, storing 98% of crypto assets in geographically distributed cold wallet systems. It also deploys quantum-resistant encryption algorithms to address future security threats. The proprietary trade behavior modeling technology of Dgenct can detect abnormal operations within 0.03 seconds, while its on-chain data analysis system constructs a three-dimensional protective network. These technological innovations have made Dgenct the first digital asset trading platform in the Middle East to achieve ISO 27041 certification for information security management.

As the implementation of Jordan regulatory framework reshapes the market landscape, Dgenct is leveraging product innovation to solidify its competitive advantage. Its newly launched institutional-grade trading terminal integrates cross-market liquidity aggregation, supporting instant fiat and cryptocurrency conversions. The derivatives trading module, designed for professional investors, introduces a dynamic margin mechanism. Additionally, its Sharia-compliant financial model, tailored to the needs of Middle Eastern users, has received compliance certification from the Dubai Islamic Economy Development Centre.

The deepening of the regional strategy of Dgenct has opened new growth avenues. The platform operations center in Amman has assembled an advisory team comprising former regulators and blockchain experts to handle cross-border regulatory coordination. The technical collaboration by Dgenct with the central bank digital currency (CBDC) project of Jordan has entered its second phase, with the experimental instant settlement system reducing transaction confirmation times to just 0.8 seconds. The latest market data shows that the monthly active users of Dgenct in the Middle East and North Africa (MENA) region have grown by 213% month-over-month, while institutional client assets under management have surpassed $1.2 billion.

The cryptocurrency trading market is transitioning from unregulated growth to structured development, with the dual drivers of regulatory compliance and technological innovation becoming the industry consensus. Through its early investment in regulatory technology infrastructure, Dgenct has established a technological moat in key areas such as asset custody, trade risk control, and compliance auditing. As more countries accelerate the legislative process for digital assets, the Dgenct strategy of transforming regulatory requirements into core competitive advantages is reshaping the competitive landscape of the global cryptocurrency trading market.

0 notes

Text

Under the bloc’s approach, there are four broad risk levels: (1) Minimal risk (e.g., email spam filters) will face no regulatory oversight; (2) limited risk, which includes customer service chatbots, will have a light-touch regulatory oversight; (3) high risk — AI for healthcare recommendations is one example — will face heavy regulatory oversight; and (4) unacceptable risk applications — the focus of this month’s compliance requirements — will be prohibited entirely.

Some of the unacceptable activities include:

AI used for social scoring (e.g., building risk profiles based on a person’s behavior).

AI that manipulates a person’s decisions subliminally or deceptively.

AI that exploits vulnerabilities like age, disability, or socioeconomic status.

AI that attempts to predict people committing crimes based on their appearance.

AI that uses biometrics to infer a person’s characteristics, like their sexual orientation.

AI that collects “real time” biometric data in public places for the purposes of law enforcement.

AI that tries to infer people’s emotions at work or school.

AI that creates — or expands — facial recognition databases by scraping images online or from security cameras.

Companies that are found to be using any of the above AI applications in the EU will be subject to fines, regardless of where they are headquartered. They could be on the hook for up to €35 million (~$36 million), or 7% of their annual revenue from the prior fiscal year, whichever is greater.

0 notes

Text

0 notes

Text

What’s happened to regulatory compliance in 2024, and how could this shape 2025 strategies?: By Ben Parker

It’s been quite the year for regulatory compliance in 2024. For one, several major regulations were rolled out. We saw certain parts of the Markets in Crypto-Assets (MiCA) regulation come into effect in June, with the remainder set to apply from the end of this year. The long-awaited arrival of the EMIR Refit regulation also came into action for the EU and then the UK, bringing sweeping changes…

0 notes

Text

Video: November 2024 Stock Pick: Toronto-Dominion Bank

This is the #stockpick for the month of #November, #TD or #TorontoDominion, a #Canadian #BigBank #financial #company. They are a #value #stock and a #dividend payer and are inexpensive because of a #regulatory #scandal about #moneylaundering. The #CanadianMoneyTalk channel concentrates on #Canadianinvesting and #personalfinance in Canada. Visit: http://www.canadianmoneytalk.caThe Investing &…

View On WordPress

#BigBank#canadian#company#dividend#financial#inexpensive#moneylaundering#November#regulatory#scandal#stock#stockpick#TD#TorontoDominion#value

0 notes

Text

AfriSummit 2024: African Health Authorities and Industry Leaders Unite to Discuss Pharma Regulations and Innovations

PharmaReg and MedDevReg AfriSummit Host 80+ Regional and International Speakers Alongside Over 300 Pharmaceutical and Medical Device Professionals Cairo, Egypt — (AfricaNewswire.Net) – Prominent healthcare authorities and industry specialists came together for AfriSummit 2024, a vital 4-day hybrid event dedicated to advancing pharmaceutical and medical device regulations along with interactive…

#AfriSummit#AfriSummit 2024#distribution sectors#Grand Nile Tower#legal#manufacturing#MedDevReg#medical device#Pharma Regulations#Pharmaceutical#PharmaReg#regulatory

0 notes

Text

Why Regulatory Teams Matter in Pharma Marketing

A delicate balance exists between driving commercial success and ensuring compliance with regulations. Marketing and sales teams are often under immense pressure to deliver results, but allowing them to overrule regulatory professionals can lead to costly mistakes. When sales objectives dictate the approval of marketing materials, the company risks its reputation and long-term viability in an…

0 notes

Text

QMS & Risk Management for IVD Manufacturers

IVD manufacturers must comply with strict regulations to ensure product safety and quality. A well-implemented Quality Management System (QMS) and risk management strategy help manufacturers meet regulatory standards, minimize risks, and improve overall product reliability. This content offers insights on regulatory frameworks like ISO 13485 and FDA 21 CFR Part 820, designed to support manufacturers in the medical diagnostics industry.

For more info: https://www.makrocare.com/blog/developing-and-maintaining-a-qms-for-ivds/

0 notes

Text

Need accurate vapor pressure of your active substance? Get in touch with our team for reliable determination of vapor pressure using Gas Saturation Method and Effusion Method according to regulatory guidelines.

0 notes

Text

eCTD Publishing Best Practices: Streamlining Regulatory Submissions.

Discover essential eCTD publishing best practices to ensure successful regulatory submissions, from planning and software validation to consistent structuring and thorough reviews. https://www.pleasepublish.com/blog/ectd-publishing-best-practices/

1 note

·

View note

Text

Peter Georgiou: $980K Fine & Disqualification (Dubai)

Decision Notice by the Dubai Financial Services Authority imposing a fine of $980,020 and disqualification on Peter Georgiou for regulatory breaches while employed as a “Relationship Manager” with Mirabaud (Middle East) Limited, specifically that he “engaged in conduct that was misleading, deceptive or was likely to mislead or deceive in connection with a Financial Service”.

#Cyprus#Documents#Dubai Financial Services Authority#Hong Kong#Regulatory#Russia#Singapore#Slovakia#United Arab Emirates#USA

1 note

·

View note