#Reduce Capital Gains Tax on Investments

Explore tagged Tumblr posts

Text

#Capital Gains Tax Minimization Strategies#Minimizing Capital Gains Tax on Stock Sales#Stock Sales Capital Gains Tax Planning#Tax Strategies for Stock Sales#Reduce Capital Gains Tax on Investments#Tax Planning for Stock Sale Profits#Capital Gains Tax Reduction Techniques#Investment Tax Minimization Strategies#Avoiding Capital Gains Tax on Stocks#Capital Gains Tax Planning for Investors

0 notes

Note

The weird radical/revolutionary politic larpers on this site are so allergic to political pragmatism I swear lmao. I am definitely left of the Democratic Party and I am certainly voting for Joe Biden in November. Not because I like him (I don’t). He is absolutely horrific on Gaza and that’s only the top (and priority considering there is a genocide going on there) of a list of complaints I have about him. I even voted uncommitted in my state’s presidential primary (the Pennsylvania one; I had to write it in) to protest. However, I’m still thinking pragmatically. Trump has said things that make me credibly think he will be worse on Gaza (insane that being worse on Gaza than Biden is possible but it is unfortunately), and that’s only the tip of the iceberg. Project 2025, the potential for him to appoint more deeply conservative justices, more of his aggressively screwing over poor and middle class people with his tax policies. And does anyone else remember the spike in hate crimes after the race was called for him in 2016? Before he was even inaugurated? Whether people vote or not in November we will still have to deal with one of these two men in office come January unless all of the internet ancom larpers overthrow the government by then (doubt), so I’d rather deal with the one who will be marginally less bad and who didn’t try to overthrow the government. Can’t have your revolution if nobody’s alive cause you kept pushing off politically participating because there was no perfect option. 👍

Political pragmatist anon, sorry for ranting in your askbox but I feel like I lose brain cells watching these people talk. The other day I saw someone say Biden is bad because Roe v. Wade fell under his administration… even though the reason for that was Trump appointed justices. 💀 (2/2)

Fucking insane. Sincerely.

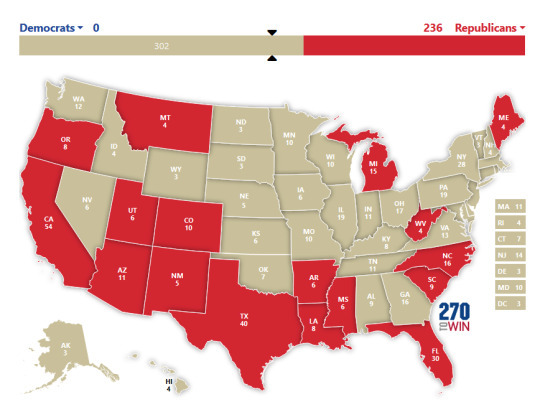

It's a completely, flatly binary choice for anyone with a brain stem and sincerity. It's distilled into the two below images:

Where all major third party candidates are even on the ballot

How many electoral votes the largest of those (green party, a.k.a. Jill Stein) would win if they won every single state they're on the ballot for.

They are literally, legally, incapable of winning the election. They are not on enough state ballots to win and Jill Stein would need to somehow win California and Texas to even "win" all the states they're on the ballot for. Which, again, would still not be enough to win the presidency and throw it to the currently existing Republican House of Representatives. Which would put Trump in office.

It's that straightforward. That simple. That BLARINGLY obvious to literally everyone except these people.

On the one hand you have:

Significant and continuous support for Israel and it's genocide

Record levels of pardons for low-level drug offenses

the gearing up of the strongest anti-trust regime since the early 20th century

the most aggressive NLRB I've seen in my lifetime, with massive wins and institutional changes to help workers

Including getting Rail strike workers a week of sick-leave that gets paid out at the end of the year, which is better than NYC and LA sick leave laws

Millions of people (not enough) getting student debt forgiveness

Some trillion dollars (not enough)of investment in renewable resources and infrastructure

Proposed taxes on unrealized capital gains (a.k.a. how billionaires never have any money but can still buy Kentucky, Iowa, and Twitter)

Effectively an end to overdraft fees

The explicit support of leftist world leaders like Lula de Silva. Who he has explicitly worked with to expand worker rights in South America.

Has capped (some, not enough, only a tiny amount really but it's something) some drug prices, including Insulin.

Reduced disability discrimination in medical treatment

Billions in additional national pre-k funding

Ending federal use of private prisons

Pushing bills to raise Social Security tax thresholds higher to help secure the General Fund

Increasing SSI benefits

and more

vs

Said Israel should just nuke Gaza and "get it over with"

Personally takes pride in and credit for getting Roe v Wade overturned

Is arguing in court that the President should be allowed to assassinate political rivals

Muslim Ban Bullshit, insistently

Actively damages our global standing and diplomatic efforts just by getting obsessed with having a Big Button

Implemented massive tax cuts on ich people, tax hikes on middle class and poor people, and actively wants to do it again

"Only wants to be a dictator for a little bit, guys, what's the big deal"

Is loudly publicly arguing that the US shouldn't honor its military alliances after-the-fact

Tore up an effective and substantial anti-nuclear-proliferation treaty with Iran

Had a DoEd that actively just refused to process student debt forgiveness applications that have been the law of the land for decades now

Has a long record of actively curtailing and weakening the NLRB and labor movement, including allowing managers to retaliate against workers, weakened workplace accommodation requirements for disabled people, and more

Rubber stamped a number of massive mergers building larger, more powerful top companies and increasing monopolistic practices

Fucking COVID Bullshit and hundreds of thousands of unnecessary deaths

Openly supporting fascists and wannabe-bootlicks ("Very fine people" being only the beginning of it

It's really not fucking close.

#biden#trump#gaza#palestine#politics#original content#union rights#realism#2024 election#jill stein#rfk jr#cornell west

209 notes

·

View notes

Text

Supply-Side Economics: A Theology of the Trickle

In the pantheon of modern economic ideologies, supply-side economics occupies a sanctified, if contested, altar. Heralded by its adherents as a blueprint for prosperity and dismissed by its critics as a gilded myth of plutocracy, supply-side economics is not merely a school of fiscal thought—it is a political theology dressed in the language of markets.

Genesis and Dogma: The Laffer Curve and Reagan’s Revelation

The intellectual scaffolding of supply-side economics rose from the ashes of stagflation in the 1970s, when Keynesian orthodoxy seemed impotent against the twin specters of inflation and unemployment. Into this void stepped figures like Arthur Laffer, whose now-iconic curve posited that tax rates too high would discourage work and investment, thereby reducing government revenue. The curve, scrawled infamously on a napkin, became scripture.

Ronald Reagan seized upon this narrative in the 1980s, inaugurating what came to be known—half in jest, half in dread—as Reaganomics. The strategy was elegantly simple, like all enduring myths: cut taxes, especially for the wealthy and corporations, deregulate, and let the invisible hand perform its alchemy. If the rich were liberated to pursue profit, their investments would create jobs, increase productivity, and lift all boats.

This was the theology of the trickle-down. It promised manna not from heaven, but from capital gains.

Material Consequences: Growth for Whom?

It is one thing to theorize prosperity and quite another to measure it. The decades following Reagan’s tax cuts did indeed see economic growth, but this growth was neither evenly distributed nor causally clear. While GDP expanded, so too did income inequality. Wages stagnated for the working class, while the top one percent accumulated unprecedented wealth. Productivity soared, yet the rewards were hoarded at the summit, not shared in the valleys.

Empirical studies have since cast doubt on the central dogma of supply-side economics. The International Monetary Fund and other institutions have shown repeatedly that tax cuts for the wealthy have a statistically negligible impact on economic growth but significantly exacerbate inequality. A 2020 study of 18 OECD countries over 50 years found no correlation between tax cuts for the rich and higher employment or investment. What did increase, however, was the wealth of those already wealthy.

In this light, supply-side economics becomes not a theory of prosperity, but a rationale for plutocracy.

Language as Incantation: Euphemism and Ideology

Observe the language of supply-side proponents: job creators, economic freedom, capital liberation. These are not neutral descriptors but euphemisms, crafted with precision to obscure power relations. The “job creator” becomes a secular deity, the beneficent force upon whom the economic well-being of all depends. Regulation is not oversight—it is burden. Taxation is not democratic redistribution—it is confiscation.

Such language reframes systemic questions of justice into technocratic debates over efficiency. It erases the agency of labor and community, replacing them with an individualized fantasy of entrepreneurial salvation.

In essence, it is not economics—it is propaganda.

The Global Export and the Neoliberal Consensus

Supply-side economics did not remain confined to the United States. Through the neoliberal turn of the late 20th century, its tenets were exported globally via institutions like the International Monetary Fund and World Bank, often imposed upon the Global South under the guise of structural adjustment. These programs dismantled public institutions, privatized communal assets, and opened markets to foreign capital—frequently with devastating human consequences.

The irony is suffocating: policies justified in the name of growth left many nations poorer, more unequal, and politically destabilized.

Toward a Reckoning: What Does an Economy Serve?

The central question, rarely asked in polite economic circles, is this: What is an economy for? Is it a mechanism to enrich shareholders, or a structure to meet human needs? Supply-side economics answers unequivocally: the former. It is not, in the end, a theory of society—it is a theory of capital.

History teaches us that no civilization survives on inequality indefinitely. The gilded palaces of Versailles did not insulate Louis XVI from history’s guillotine. Neither will contemporary oligarchs find lasting sanctuary in tax shelters or philanthropic foundations.

Conclusion: The Mirage of the Trickle

To invoke supply-side economics is to invoke a theology that asks for faith in the beneficence of capital, despite centuries of evidence to the contrary. It is, as Gore Vidal once said, “socialism for the rich and free enterprise for the poor.”

Let us be clear: economic growth is not inherently unjust. But when the gains of that growth are privatized while its costs are socialized, we do not have prosperity—we have extraction. And when an entire ideology serves to rationalize that extraction, it deserves not deference, but dissection.

“History does not weep for empires—it remembers their ashes.”

#dark-rx#Krasnov#donald trump#trump#trump administration#fuck trump#fuck musk#elon musk#musk#nazilism#president musk#president trump#trump 2024#trump is a threat to democracy#anti trump#traitor trump#trump is the enemy of the people

20 notes

·

View notes

Text

If your city is a Brand, it’s already too late

Long post time. What is it that drives gentrification? Also, what is gentrification? Is it when a city gets blue hair and pronouns? No, it probably already had those.

Gentrification is the result of concentration of wealth in the hands of business owners, including landlords, over and above the hands of residents.

Let’s start with rent. Rent, like any good, is priced according to the laws of supply and demand. Supply of available rental housing is primarily determined by construction costs and estimated return on investment for new construction, and property management costs and estimated return on investment for existing units.

Breaking that down a bit, the higher construction costs get the higher the rent needs to be to break even on new construction. Construction costs include labor (which can always go down but you want it high for moral and practical reasons), materials (highly variable depending on the project) and bureaucratic costs. A bureaucratic cost is a cost that is based on how projects fit into the legal and practical environment, and are usually non-negotiable. Dig Safe, a program which requires three days of surveying local records before breaking ground, is an example where the function is to prevent crews from flattening a neighborhood by puncturing a gas main. Environmental Impact Statements, Fire Codes, Habitability Guidelines, and other regulations increase costs to projects. These programs are good and need to exist, but do stop smaller projects from happening at all because the capital investment required just to actually break ground on a new house might cost as much as the land and materials put together at which point you might as well build another 120$/sqft luxury midrise.

Property management costs for existing units are largely dependent on age and wear. A unit with no occupant is going to depreciate little, and may also appreciate in value. Depreciation and appreciation here are sort of unintuitive because they can happen at the same time. Imagine an old luxury sports car with a high resale price. Driving depreciates the value because it’s literal condition is poorer, even as the resale value goes up over time. The appreciation needs to beat both inflation and the value of depreciation for it to go up in real value. For companies with large capital holdings however, losses such as through the upkeep of empty apartment buildings are useful to a point because they reduce these organizations’s tax burdens. A company that makes a killing on the stock market only has to pay taxes if they keep it: if they buy houses they then don’t rent, they can claim they “lost” their stock market earnings with “bad investments” and then pay no tax while saving the real estate to rent later. Again, this favors the largest possible projects and the largest possible operators because small companies can be killed by an unprofitable quarter or 4 while large ones explicitly benefit from unprofitability in reducing their tax burden.

Expected ROI is the final piece of this, which affects both new and existing units. Every private developer and landlord wants to make as much money as they can, unless they are explicitly are renting as a service. An example of renting as a service would be families, who will rent to each other at favorable rates or for free, privileging people with large and/or wealthy families that are friendly with each other. Now, ROI is also subject to supply and demand. Everyone wants to build 120$/sqft luxury apartments but once everybody does nobody can sell/rent for those prices without setting a price floor and waiting for buyers to catch up. If you are a small developer, you can’t afford to do this. Your expenses will eat you alive. If you are a big developer, though, those expenses are offsetting the gains you make and serving to reduce you tax bill. Units at prices nobody can pay are effectively furloughed, meaning off the market, and, so long as they remain cheap to maintain, will remain that way, artificially restricting supply. It doesn’t matter if it’s for sale or not when it’s at a price you can’t afford. (Sidebar, anyone who tells you that the minimum wage depresses hiring because it artificially restricts demand is lying to you. It’s not strictly false, but like the above it’s a multi-variable equation and blanket statements about cost of labor are aimed at killing wages.)

What this alludes to also is a need for greater income equality. In order for rental to be a competitive option with furlough, not only does the price of furlough have to be increased, the real value of wages have to be increased in order to create opportunities for people to splurge. This is a twofold strategy, of both increasing the rewards of putting units on the market and increasing the costs of keeping them off. If real wages barely cover cost of living, or don’t cover cost of living, nobody can realistically spend more real wages on rent regardless of the percentage of their income it is. (Real wages here refers to the political power implied by dollar wages. A dollar is really worth whatever it can be exchanged for, whether that is a candy bar or a square inch of a 144$/sqft condo) The real value of everything except time and land are also constantly going down because of constant improvements in manufacturing. The cost in acres of land and hours of labor of a pound of beef, a bolt of cloth, or a pint of beer have dropped dramatically in the last century. Unfortunately, land is one of the few things that remains in marxist terms uncommodifiable, because it cannot be fully abstracted from the physical properties that make it valuable and we can’t make more of it just by making a better machine. This means that as the real value of things goes down because of supply and demand, the value of land only goes up because the supply is hard capped. If the value of everything under capitalism must go down because of increased production, while the value of capitalist assets must go up, or the system collapses, it makes sense that land would become a fixed point in that equation, the marxist speed of light observable from all reference points. The best approximation of land as commodity is, what else, apartments, which make available as living space the empty air above us. Because production never stops, the value of everything but land must go down. Therefore, as time passes, the price of land, and hence the price of housing, must tend upwards. Therefore, in order for housing to remain affordable, real wages must grow. This is the opposite of what is currently happening, as real wages have gone down for decades.

This income inequality which is one facet of capitalism is not new. For as long as people have lived in urban areas there have been issues between the abject class, the working class, the ruling class, and the professional class, a four part distinction I will seriously argue for in opposition to a lot of marxist theorists. The ruling and working classes ought to be familiar, or at least self explanatory. However, the other two classes I identify, the professionals and the abject, are useful to this analysis because they fill both a racial gap in the primarily marxist analysis I put forward and identify the two most likely groups to rent, which is to say the worker who works to produce but owns without governing and the professional who works to govern but does not own. The ruling class both governs and owns, but its court is full of courtiers who are there to push various agendas from within the rule of law without per se producing. Likewise, the working class pensioner exists in opposition to the abject who is denied the opportunity or the resources to be productive explicitly as a means to manufacture a threat against which inter-class solidarity between the workers and the rulers is developed. The textbook nazi conspiracy theory about “elites” doing a great racial replacement picks out perfectly what I mean by both the racial character of the professional and the abject and their utilization to foster solidarity between your plumber uncle and Elon Musk. This is relevant to both the broad theme of gentrification and the narrow theme of rent because gentrification is a wedge issue that divides the working class and the professional class far more than its impact on any other. The working class’ disidentification with doctors, lawyers, PMCs and other yuppie types, as well as the professional class’ disidentification with union politics, illegalism, and radicalism in general is brought to firecrackers in virtually any conversation about gentrification which seems in passing to be more about tapas bars than about real politics. Likewise, these groups shared distrust of and disdain for the abject, who are explicitly labeled by the state as constitutionally guilty, is the basis for the very broken windows policing strategy that empties neighborhoods of minorities regardless of class. The Rent is Too Damn High, and excluding homeless people from the “working” working class is a big part of how we got here specifically because the interests of small time owners and small time government functionaries, carried to their conclusions, are necessarily self defeating. These two groups eliminate the presence of the abject from their spaces at their own financial peril.

In addition to class, there is also a specific historical movement that is crucial to the understanding of gentrification as it exists, which is the movement of factories in search of cheap labor. The United States is not a good place to find cheap urban labor. You build a factory and suddenly everyone complains about air quality and labor violations and you can’t just kill them because everyone has lawyers. You kill one (us citizen) organizer and the NLRB is trying to get you in court for intimidation. What’s the country come to? But a shipping container costs a quarter cent per mile and the goods aren’t perishable so you go to Guangzhou or Cape Town where you can kill union bosses in peace. But for the American city, that’s a loss of what once made land prime real estate. What jobs can replace the insatiable demand for labor that a 24 hour paper mill once produced? Service labor, which crucially is site specific and therefore not outsourceable, is what the US has predominantly turned to. (and arms manufacturing which is not outsourced for very different reasons) However, service labor is only in demand if there is already a stable population that can be served, which requires a constant influx of capital holders in demand of service. This is why Airbnb exists and is hollowing out rental availability, why Boston as a college town is the way it is, and why there are in fact so many damn tapas bars. Fred Salveucci talked about being able to go north of the expressway in the 70s and being able to get a plate of mac and beans for half a buck. I went looking for a 5$ slice of pizza on my lunch break today around Government Center and found two places that were boarded up and ended up spending 20$ at Chilacates. Cities are being slowly turned into Cancun, complete with the fences to keep out the homeless.

What can be done about this? Obviously the factors we’ve discussed that favor consolidation of housing are mostly either contained within a gordion’s knot of tax policy or intrinsic to capitalism/goods as commodities. But, given that we narrow our objectives to making the rent lower, some obvious weaknesses jump out: increasing the cost of vacancy forces units out of furlough, because companies are no longer able to justify the losses, and increasing real wages increases the availability of capital for workers to spend on rent. These are the prongs I talked about earlier.

Legal means to pursue each prong exist. Both a minimum wage and a maximum wage, depending on their implementation, can potentially increase real wages, and vacancy taxes directly increase the costs of vacancy. The government can also ignore the market and directly mandate maximum rents within certain parameters. This tends to decrease the long term supply of housing for the reasons discussed at the outset, given that if the revenues from house building don’t cover the costs of building, less gets built. However, any political movement that exists exclusively within the white lines of the law fails to genuinely threaten change. Landlords, like bosses, break the law constantly with the impunity that a lawyer provides them against consequence. This is why a healthy dose of illegalism is an important part of any effective political movement. The most direct action one can take is property occupation, or squatting. Squatter’s rights are nearly non-existent in the United States. The most leeway that any state grants to any unknown persons occupying a dwelling is 60 days notice to vacate the property, and there are states that allow no notice evictions or lack statutes governing squatting at all. Every single state regards the occupation of owned property as trespassing, meaning most kinds of squatting are prosecutable offenses. However, squatting, even temporarily in ways that don’t expose the squatter to liability provided they don’t get caught, can seriously impact the value of properties. You have heard of rent lowering gunshots. This is the serious version of that. At the same time, illegal action needs legal defense, both in terms of non-compliance with police to protect those willing to take illegal actions from arrest and in terms of legal, 1st amendment protected disruption to keep focus on the issue. The most effective movements have a radical wing and a institutionalist wing who do not acknowledge each other but share the same tactics and objectives.

If you are housed, you need to be willing to protect and support homeless people because they are your front line. Start or join an Occupy movement, where they are your peers in occupying a public space illegally in a way that is too public to prosecute. Give to people on the street, and smash anti-homeless architecture if nobody is watching. Be willing to distract cops if you see someone doing something dodgy so they can get away. Remember that following the law is a tactic, and so is breaking it.

The case for this being on my transit blog is arguably weak, but I felt compelled after a particularly hateful experience looking at facebook memes about homeless people on the T. You should want those people there. You should want those people breaking down the doors of luxury apartments and setting up shop. You should want them keeping your city safe because the cops you hire to separate you from them will train their guns on you next.

And for gods sake, don’t let your city become a brand. Branding is marketing. Branding is clean, and bloodless, and a gloved hand around your throat that leaves no fingerprints.

49 notes

·

View notes

Text

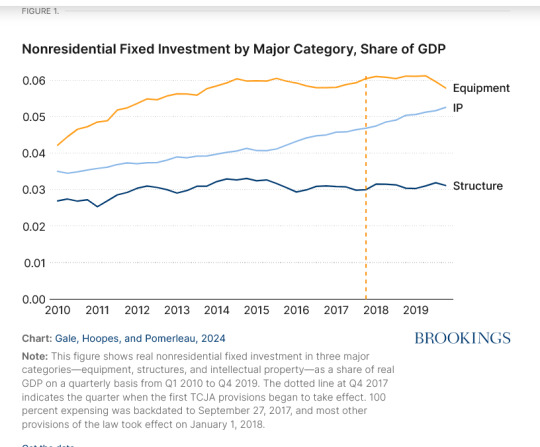

The Tax Cut and Jobs Act (TCJA) of 2017 aimed to increase business investment by cutting costs for business. Indeed, the legislation has been routinely described as having created the largest business tax cut in the nation’s history. It cut the top corporate tax rate from 35% to 21%, cut the top rate for many non-corporate businesses from 37% to 29.6%, and temporarily allowed firms to deduct the entire cost of certain investments as a current expense rather than depreciating it over time. All these changes reduced the after-tax cost of business investment.

But did these changes significantly boost investment? If they did not, the central raison d’etre for the corporate and business tax cuts disappears. Policymakers could then adjust these cuts and gain a viable revenue source to address historic and persistent federal deficits, all without unduly hurting the economy.

Certainly, TCJA supporters have “claimed victory” on the investment front. And in fact, careful recent research finds that TCJA raised real corporate investment in equipment and structures by 8 to 14%. But such investment accounts for only about half (54% in 2016) of aggregate investment. The rest consists of investment in equipment and structure by non-corporate businesses and intellectual property (IP) by both corporate and non-corporate businesses.

Perhaps surprisingly, several perspectives suggest that aggregate investment was not markedly influenced by the TCJA. First, the Act substantially reduced the cost of capital for investment in equipment and structures. But Figure 1 shows that aggregate real equipment investment rose only slightly as a share of real gross domestic product (GDP), from 5.9% in 2015-16 to just over 6.0% in 2018-19, and that investment in structures was the same share of GDP (3.1%) in those two periods. (After 2019, the COVID-19 pandemic and the massive fiscal and monetary response make it difficult to isolate the impact of TCJA on investment.) In addition, the International Monetary Fund found that investment growth after TCJA was smaller than would have been expected based on previous corporate tax cuts, instead explained by increases in aggregate demand.

Investment in IP grew faster than in equipment and structures. But unlike equipment and structures, IP investment had risen steadily in the years before TCJA and that trend essentially continued after TCJA. Indeed, some provisions of TCJA raised the cost of IP investment, so the law is an unlikely source for growth in this area.

Second, comparisons of Congressional Budget Office (CBO) investment projections with actual investment data show similar patterns. In early 2017, after President Trump took office and before TCJA was introduced, CBO projected that real investment in equipment and structures would rise by 8.3% from the first quarter of 2017 to the final quarter of 2019. The actual increase was only slightly higher than that estimate—8.6%.

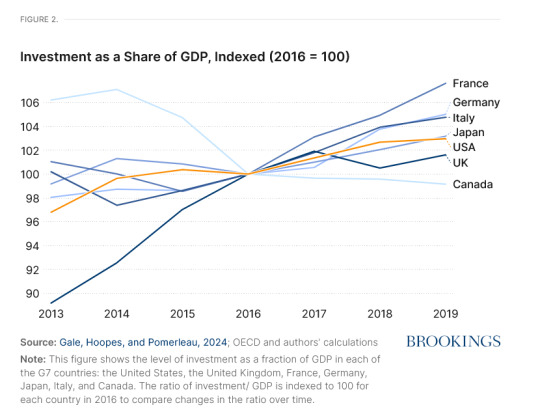

Third, comparisons of investment across countries similarly do not show significant impact of the Tax Cuts and Jobs Act. Figure 2 shows that, after 2017, the change in investment as a share of GDP in the United States was not exceptional compared to other Group of 7 countries (G-7 includes Canada, France, Germany, Italy, Japan, and United Kingdom). Although the U.S. economy had the second-highest growth rate in investment/GDP from 2013 to 2016, investment growth was not exceptional from 2016 to 2019. Indeed, the U.S. economy had only the fourth highest growth rate (essentially tied with Japan) in investment/GDP from 2016 to 2019, incorporating the period after the TCJA. Other than Japan, none of the other G-7 countries had major business tax reforms during this period.

Likewise, growth in U.S. investment in real terms (rather than as a share of GDP, not shown) from 2015-16 to 2018-19 was also unexceptional relative to other G-7 economies. Real investment in the U.S. economy grew about the same rate as in the United Kingdom, faster than Japan and Canada, but slower than Italy, Germany, and France.

There are two ways to make sense of the fact that, as a share of the economy, corporate investment in equipment and structure rose but aggregate investment did not: Either other factors reduced aggregate investment and offset the gains created by TCJA, or the TCJA reduced investment among non-corporate firms.

Certainly, factors other than the TCJA reduced investment over this period. Rising trade tensions and tariffs slowed growth. Estimates suggest that tariffs reduced GDP by roughly 0.3 percentage points relative to baseline in the short run. Industry-specific factors also played a role, such as delayed deliveries of Boeing’s 737 MAX plane, which reduced investment growth by 0.5 percentage points in 2019.

But fiscal policy was expansionary: Estimates find that the Bipartisan Budget Acts of 2018 and 2019 boosted GDP growth by between 0.75 and 1.75 percentage points. In addition, monetary policy was more accommodating in 2018 and 2019 than had been predicted pre-TCJA. When TCJA was enacted, Federal Reserve Officials projected a federal funds rate of 2.7% at the end of 2019, but it ended up being substantially lower at 1.625%.

The net effect of all these non-TCJA changes on investment was probably positive. They cannot explain the divergence in investment results.

That leaves the other possible explanation. The TCJA increased investment by firms with larger tax cuts, but those changes crowded out or came at the expense of investment by non-corporate businesses which received smaller or no tax cuts. In a nutshell: For a given investment project, the after-tax return increased by a greater amount for firms that received bigger tax cuts, so their ability to invest would have increased by more than firms with small or no tax cuts. They could expand at a lower cost and could have driven out the firms that got no or smaller tax cuts, since those firms faced a higher price of capital, material, and labor but no or smaller tax benefits. Under this interpretation, TCJA changed which firms did the investing but did not necessarily affect the overall level of investment. That is, TCJA reshuffled investment among firms.

The data support this alternative explanation. Kennedy et al. (see Figure A-7, Panel D) show that the ratio of investment to lagged capital fell from about 5% in 2017 to just over 2% in 2019 for S corporations, which received a smaller tax cut under TCJA. That ratio for similarly sized C corporations (who received a larger tax cut) followed the same trend through 2017, then rose to about 8.5% in 2019. These results imply a significant reallocation of investment from S corporations to C corporations.

Taken together, the available evidence suggests the TCJA largely failed in its major objective: It did not significantly boost aggregate investment. This also suggests that moderately raising the corporate tax rate would not adversely affect the economy, since business income in any year is largely the result of investments made in the past. In other words: Cutting the tax rate even more now would create substantial federal revenue losses that largely finance windfall gains to business owners who have already made investments. Policymakers could safely increase the rate and raise significant revenue. CBO estimates that raising the rate to 28% would raise $881 billion over the 2025-2034 period.

No policy is perfect, but the TCJA experience indicates that adjusting the corporate and business tax cuts in TCJA would bolster federal finances without significant costs to the economy. It might even help it.

13 notes

·

View notes

Text

GREEN PARTY MANIFESTO 2024 SUMMARY

tldr: there's a feeling of tension in this manifesto, between youthful zennial climatic ecosocialism and old-guard hippy-liberal environmentalism. this year the greens may well go from 1 MP to the dizzying heights of 2 (there's whispers on the wind that they may even get 3...), and the green council delegation is at 800-odd now, so this could easily be a changing-of-the-guard moment

with the great Berry and the ok Denyer in parliament the party could have more momentum in battling the starmerite government, and with that, it has the ability, the possibility to pick up more momentum. this is a big opportunity in the party's history - over the next five years it can and could be pushed into a holistic ecosocialist movement by the centrally influential mass party membership, and remove the last dregs of its tunnel vision to provide a lefty movement for everyone, green and pink, a Newfoundland coalition. with votes at 16 on the cards and this potential evolution of the party, 2029 could be a big moment for this country's left. whether or not the greens play the role of keystone is up to them

it is also the only manifesto to use the term 'neurodivergent'

💷ECONOMY

wealth tax of 1% on individuals with assets over §10m and 2% for assets over §1b (an extremely humble proposal), reform capital gains and investment dividend taxation to be at the same rates as income taxation, remove the income-based bands on national insurance contributions, ie raising total income taxation by 8% at §50k/a, – altogether raising government revenues by upwards of §70b/a

stratify VAT to reduce it for consumer stuff and hike it for stuff like financial services

permanent windfall tax on banks for whenever they get windfalls

perform a holistic land survey to get the data needed for a new, effective Land Tax

abolish the tax relief on existing freeports and SEZs

heavy carbon tax to raise a boatload of billions, rising progressively over a decade to allow industrial adaptation, for a ~§80b state windfall for five years that'll be for green investment as this windfall starts to recede

renationalise water and energy

§15 minimum wage, 10:1 pay ratio for all organisations public and private (ie §150 sort-of maximum wage, ~§300k/a), mandatory equal pay audits, 'support' lower hours and four-day weeks [clarification needed]

unambiguously define gig workers as workers with contract rights from day one, repeat offenders of gig-slavery will be banned from operating in the country

every City bank required to produce a strategy with a clear pathway to divestment of all fossil fuels "as soon as possible and at least by 2030", every City non-banking organisation simply to be banned from having fossil fuel in their portfolios, credit to be banned for repeat City climate offenders, mandate the BoE to fulfil the funding of the climate transition and climate leadership of the City, FCA to develop measures to ban fossil fuel share trading in the City and immediately prohibit all new shares in fossil fuels

"we will explore legal ways for companies to be transformed into mutual organisations"😈

develop regional cooperative banks to invest in regional SMEs, coops and community enterprises

diversify crop growth, promote local agricultural cooperatives and peripheral urban horticultural farms, give farmers a sort of collective bargain against grocers

aim towards a circular economy: require ten-year warranties on white goods, rollout of right-to-repair

tighten monopoly laws on media with a hard cap preventing >20% of a media market being owned by one individual or company and implement Leveson 2

🏥PUBLIC SERVICES

abolish tuition fees and cancel standing debt

surge nhs funding by §30B, triple labour's spending plans for everything, the entire budget, the entire state, everything

free personal care, with occupational therapy being part of this

35h/w free child care (eg seven hours over five days, or seven days of five hours)

renationalise many academies under local authorities, abolish the "charity" status of private schools and charge VAT

surge funding for smoking-cessation, addiction support and sexual health service

surge funding for public dentistry with free care for children and low-earners

free school breakfasts in primary school and free school lunches for all schools

one-month guarantee of access to mental health therapies

online access to PrEP

let school playing fields be used in the evenings by local sports clubs

greater funding for civic sports facilities and pools

🏠HOUSING

unambiguously-under-the-law nationalise the crown estate for an absolute fuckton of land and assets for housing and for green energy and rewilding for FREE

rent control for local authorities, ban no-fault evictions and introduce long-term leases, create private tenancy boards of tenants

local authorities to have right of first refusal on the purchase of certain properties at aggressive rates, such as unoccupied or uninsulated buildings

all new homes to be Passivhaus standard with mandatory solar panels and heat pumps

§30B across five years to insulate homes, §12B of which is for social homes, and §9B more for heat pumps, and §7B more for summer cooling

planning law reform: council planning mechanisms to priorities little developments all over the place rather than sprawling blobs, demolitions to require as thorough a planning application as erections, new developments required to not be car dependent

planning laws to require large-scale developments feature access to key community infrastructures such as transport, health and education, often mandating the construction of new key infrastructures, support nightlife and local culture in planning regulations

exempt pubs and local cultural events from VAT

building materials to be reusable, builders' waste rates to be surged to encourage use of reuse

750k new social homes in five years

🚄TRANSPORT

'a bus service to every village', restore local authority control and/or ownership of their busses

renationalise rail via franchise-concession lapsing, slowly assume ownership of the rolling stock (currently leased, and would continue to be so under labour's implementation of renationalisation) by buying a new train when the stock needs to be replaced

electrification agenda across the rail network, strategic approach to rail line and station reopenings

bring forward (sorta, the tories suspended it but labour says they'll reinstate it) the new petrol car ban from 2030 to 2027, existing petrol cars targeted to be off the road by 2034, investigate road-price charges as a replacement for petrol tax, hike road tax proportionally to vehicle weight, drop urban speed limits from 50kph to 30kph (or from 30mph to 20mph if you only speak Wrong), mass funding for freightrail and support logistics firms transitioning away from lorries

§2.5b/a for footpaths and cycleways, target of 50% of urban journeys to be extravehicular by 2030

frequent-flyer levy, ban on domestic flights within three-hour rail distance, remove the exemption of airline fuel from fuel tax, prioritise training of airline workers into other transportational jobs

👮FORCE

abolish the home office, transfer its police/security portfolio to the justice ministry and its citizenship/migration portfolio to a new migration ministry separate from the criminal justice system

abolish the kill the bill bill and restore the right to protest

recognise palestine, push for immediate ceasefire and prosecution of war crimes, back the south africa case, "[support] an urgent international effort to end the illegal occupation of palestinian land"

grant asylum-seekers the right to work before their application is granted

end the hostile environment

abolish Prevent

end routine stop-and-search and facial recognition

commission to reform 'counterproductive' drug regime, decriminalise personal possession

amend the Online Safety Act to "[protect] political debate from being manipulated by falsehoods, fakes and half-truths", ie actually protecting 'fReE sPeEcH' and not everything that rightists imply by that phrase

decriminalise sex work

reform laws to give artists IP protections against ai

cancel trident and disarm

push for nato reforms (in its and our interest, they're not russophiles, they're not galloway, it's ok): get it to adopt a no-first-use nuclear policy, get it to prioritise diplomatic action first rather than military reaction, get it to adopt a stronger line on only acting for the defence of its member states

right to roam🚶♂️

🌱CLIMATE

zero-carbon by 2040, rather than the ephemeral ostensible government target of 2050

stop all new oil/gas licenses, end all subsidy for oil/gas industries, regulate biofuels to end greenwashing, end subsidies for biomass

decarbonise energy by 2030, minimum threshold of energy infrastructures to be community owned, "end the de facto ban on onshore wind" with planning reform

massively expand the connections between the insular grid and the UCTE continental grid to increase electricity import and export and prevent the need for energy autarky

more targeted bans on single-use plastics

"give nature a legal personhood" ok grandma let’s get you to bed

§2b/a to local authorities for local small-business decarbonisation

"cease development of new nuclear power stations, as nuclear energy is much more expensive and slower to develop than renewables. we are clear that nuclear is a distraction from developing renewable energy and the risk to nuclear power stations from extreme climate events is rising fast. nuclear power stations carry an unacceptable risk for the communities living close to facilities and create unmanageable quantities of radioactive waste. they are also inextricably linked with the production of nuclear weapons. green MPs will campaign to phase out existing nuclear power stations." because some people just can't let go of the seventies. nuclear is good. nuclear is our friend

invest in r&d to find solutions to decarbonise 'residual' carbon in the economy, such as HGVs or mobile machinery

increase unharvested woodland by 50% (no time frame given), grants to farmers for scrub rewilding, rewet Pete Boggs, make 30% of the EEZ protected waters and ban bottom trawling

§4b/a in skills training to stop gas communities getting Thatchered, prioritising shifting these workers into offshore wind

a.. licensing scheme for all pet animals? you guys sure about that one

regulate animal farming with a goal of banning factory farms, ban mass routine antibiotics, ban cages/close confinement and animal mutilation

ban all hunting including coursing and "game", ban snaring, ban hunt-landscaping such as grouse moors, end the badger cull, mandate licensing of all animal workers with lifetime striking off for cruelty convictions, compulsory hedgehog holes in new fencing, 'push' for 'ending' horse and dog racing [clarification needed], new criminal offences for stealing and harming pets, 'work towards' banning animal testing

🗳️DEMOCRACY

proportional representation for parliament and all councils

abolish voter ID

votes at sixteen

votes for all visa'd migrants

restore the electoral commission's prosecutory powers and remove the cap on fines it can impose on parties

increase Short Money, especially for smaller parties

create a manifest legal category of organisation for think tanks, to allow better enforcement of lobbying and funding restrictions

consider fun new measures for political accessibility such as MP jobsharing and allowing public provision of offices for all parliamentary candidates

🎲OTHER STUFF

Self-ID including nonbinary recognition, including with an X passport marker

"work towards rejoining the eu as soon as the domestic political situation is favourable", join the eea now (with restored free movement)

let local authorities invest shares in sports teams, including professional ones, dividends ringfenced for public sports facilities and coaching

right to die

20 notes

·

View notes

Text

by John Kartch, Americans for tax Reform

Today ATR president Grover Norquist issued the following statement:

“On January 1, the State of New Hampshire became the eighth state with no state income tax.

New Hampshire joins Florida, Texas, Tennessee, Nevada, South Dakota, Wyoming and Alaska on the no-income-tax list.”

(The state of Washington recently lost this status as Democrats imposed a capital gains tax there.) “New Hampshire has never had an income tax on wages, but the state did tax dividends and interest at five percent. Residents saving for retirement paid taxes on savings and investments.

New Hampshire’s abolition of the last vestiges of the state income tax is part of a nationwide competition among the 50 states to reduce taxes to encourage investment, new jobs and the movement of people, both younger Americans beginning their working lives and older Americans retiring.

Federalism allows states to compete to attract new citizens and job creation by providing the best government at the lowest cost. No-income-tax states like Florida and Texas now see other states gaining on them in the rear view mirror, marching quickly to cut off the dead weight boat anchor of a state income tax.

The race is on to become the ninth no-income-tax state.

8 notes

·

View notes

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

93 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

September 4, 2024

Heather Cox Richardson

Sep 05, 2024

Long tonight, folks, but it’s been quite a day. And even still, I did not mention the day’s horrific shooting at a Georgia school.

Today, Vice President Kamala Harris announced a series of proposals to help entrepreneurs create small businesses. Like President Joe Biden, she and her running mate, Minnesota governor Tim Walz, argue that small businesses and entrepreneurs are the “engines of our economy.” In a statement today, they noted that “small businesses employ half of all private-sector workers in America—creating 70 percent of net new jobs since 2019—and do trillions of dollars of business every year.”

The Biden administration has boasted of the record number of new businesses created since Biden and Harris took office. There have been 19 million new business applications in that time. Harris said she and Walz are setting a goal of 25 million new business applications in their first term. Their plan, they say, is to “kickstart…more young, small, and innovative firms.”

To make this happen, they propose raising the deduction for startup expenses from its current level of $5,000 to $50,000, noting that the average amount a new business spends to get set up in its first year of operation is $40,000. They also propose funding a network of new and existing “federal, state, local, and private incubators and small business innovation hubs” that will make it easier for small business and local suppliers to get technical assistance, funding, customers, and so on.

They also promised to make low-interest and no-interest loans available for small businesses, to protect and expand the support of the Affordable Care Act for small business owners, and to guarantee that one third of federal contract money will go to small businesses. They promise to make it easier for small businesses to file taxes, reduce excessive occupational licensing requirements, and urge state and local governments to cut the red tape of burdensome regulations by streamlining them across jurisdictions.

Harris and Walz said they are committed to making the investments that will build the economy while also paying for them and reducing the deficit. “They also know,” their statement said, that “we need to support America as a locus of innovators, entrepreneurs, and workers coming together to create a better future.

Harris calls this a New Way Forward, but it is curiously close to the old Republican reforms of the Progressive Era, when entrepreneurs joined forces with workers and farmers to demand access to capital and a fair economic playing field after decades in which a few wealthy industrialists stacked the system in their own favor. When we look at that era, as well as the New Deal reforms of the 1930s, we tend to emphasize reforms designed to benefit workers and farmers, but members of those groups always allied with entrepreneurs shut out of the system by wealthy industrialists. The demand for securities and exchange law in the 1930s, for example, did not come from western farmers, but from entrepreneurs who knew they could not break into the system if established businesses made up the rules amongst themselves.

Harris recalled that Republican reform impulse when she said we must make the tax system fairer. She called for rolling back Trump’s tax cuts and implementing common-sense tax reforms for corporations and the richest Americans. She calls for setting a minimum income tax for billionaires, the corporate tax rate to 28% (it was 35% before the Trump tax cuts), and quadrupling the tax on the stock buybacks that overwhelmingly benefit the wealthiest Americans.

She emphasized that no one earning less than $400,000 a year will pay more in taxes under her plans, and called for a tax rate of 28% on long-term capital gains for those who earn more than a million dollars a year. This is up from the current 20% rate, but less than the 39.6% rate Biden proposed in his 2025 budget.

A Fox News Channel host applauded some of Harris’s ideas, saying, “When a political candidate comes up with what I think is a good idea, I have to call it a good idea. And a fifty thousand dollar…tax credit for startups or small businesses, coupled with less red tape, I’ve got to say, that is a good idea, regardless of her other tax ideas.”

This was a nice endorsement of Harris’s policies, coming as it did after yesterday’s assessment by economists for the Goldman Sachs Group saying that the nation’s economic growth would take a hit if Trump wins, but will grow under a Harris presidency if she also has the support of a Democratic House and Senate.

In her statement about economic policy, Harris called out Trump for supporting “himself and the biggest corporations” and noted that sixteen Nobel laureates have said that Trump’s policies would ignite inflation and trigger a recession by mid-2025. That recession, economists project, would cost more than 3 million jobs, explode the deficit, and raise costs. Harris pointed out that Project 2025 would cut funding for the Small Business Administration and make it harder for small businesses to get access to money.

For his part, Trump has doubled down on the idea that the United States is a failing nation. For the past week he has been telling a story about a residential building in Colorado taken over by a gang from Venezuela. But it appears the story is entirely made up. Similarly, Trump on Friday said at a right-wing Moms for Liberty event that public schools in America kidnap children and operate on them to change their sex. This is bonkers, but it is bonkers in a way that deliberately demonizes Trump’s opponents.

Trump’s vision of the United States is one of darkness and carnage. As Democratic vice presidential nominee Tim Walz said today, “It is a deliberate effort by some people to make them believe that our political system is broken. To make them believe that things are pessimistic. My God, every time I hear Donald Trump give a speech, it’s like the next screenplay for Mad Max or something. They are rooting against America.”

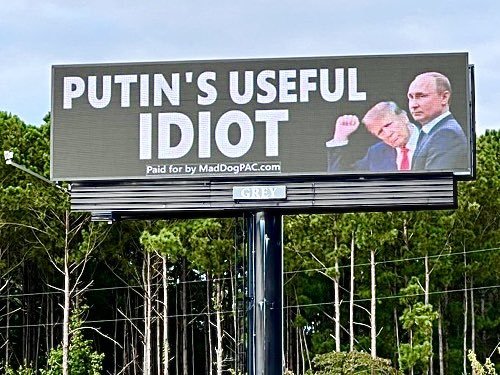

That bleak version of the United States, it turns out, echoes the talking points Russian handlers gave to their operatives working in the U.S. in an effort “to steer the U.S. public opinion in the right direction.” The Russians directed their U.S. employees to emphasize the following “campaign topics”: “Encroaching universal poverty. Record inflation. Halting of economic growth. Unaffordable prices for food and essential goods”; “Risk of job loss for white Americans”; “Privileges for people of color, perverts, and disabled”; “Constant lies of the [Democratic] administration about the real situation in the country”; “Threat of crime coming from people of color and immigrants”; “Overspending on foreign policy and at the interests of white US citizens”; “Constant lies to the voters by [Democrats] in power.”

The target audience of the campaign was “[Republican] voters,” [Trump] supporters, “Supporters of traditional family values,” and “White Americans, representing the lower-middle and middle class.” The focus was in particular on “[r]esidents of "swing states whose voting results impact the outcomes of the elections more than other states.

This information came out today when the Departments of Justice, State, and the Treasury announced sanctions against 10 individuals and 2 entities, and criminal charges against two employees of RT, a Russian state-controlled media outlet, who allegedly funded a company in the U.S. to hire right-wing social media influencers to push Russian propaganda before the 2024 election.

While the indictment does not name the Tennessee-based company the Russians funded, it appears to be Tenet Media, a company registered by Liam Donovan and Lauren Tam, who is associated with The Blaze and Turning Point USA, as well as RT. The two appear to be married. The indictment alleges that the company’s two founders knew they were working for the Russians, but suggests the six commentators—Lauren Southern, Tim Pool, Tayler Hansen, Matt Christiansen, Dave Rubin, and Benny Johnson, all staunch Trump supporters—did not know where their massive paychecks originated. After the story broke, five of the commentators denied any knowledge of the source of the company’s funding; some insisted their words were entirely their own.

One of the videos the company pushed at the request of the Russians was what appears to have been right-wing host Tucker Carlson’s visit to a grocery store in Russia where he praised the low prices (which even the company’s founders thought “just feels like overt shilling”).

Separately, the Department of Justice seized 32 internet domains that “the Russian government and Russian sponsored actors” have used to influence the 2024 election. In a malign influence campaign called “Doppelganger,” these domains produced fake articles that appeared to be from major U.S. news sites, to which influencers and fake social media profiles on Facebook, X, Truth Social, and YouTube then drove traffic.

Russian operatives called in bold type for Russia “to put a maximum effort to ensure that the [Republican] point of view (first and foremost, the opinion of [Trump] supporters) wins over the US public opinion. This includes provisions on peace in Ukraine in exchange for territories, the need to focus on the problems of the US economy, returning troops home from all over the world, etc.”

One of the documents produced in the affidavit justifying the seizure of the internet domains called for trying to stir up a conflict between the U.S. and Mexico in order to distract from the fact that the U.S. economy is “very healthy” under Biden.

Tonight, in an interview with Fox News Channel host Sean Hannity, Trump appeared to think he is running against Joe Biden. An internal email leaked to the press from the Trump campaign showed managers Chris LaCivita and Susie Wiles warning staff not to communicate with the press and suggested anyone doing so would be fired.

Today, Steph Curry of California’s Golden State Warriors basketball team and former representative Liz Cheney (R-WY) endorsed Vice President Kamala Harris for president. “Endorsing Kamala Harris is important for me and my family,” Curry said. “Knowing Kamala and having been around her, I understand she's qualified for this job."

“There was never a doubt that the courageous Liz Cheney would endorse Vice President Harris,” conservative judge J. Michael Luttig wrote, “because Liz Cheney stands for America. She is the very embodiment of country over party and country over self. And she fears no one—least of all the former president.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From an American#Heather cox Richardson#economic policy#election 2024#Kamala Harris campaign#Tenet Media#Russian Propaganda#useful idiots

18 notes

·

View notes

Text

B.2.2 Does the state have subsidiary functions?

Yes, it does. While, as discussed in the last section, the state is an instrument to maintain class rule this does not mean that it is limited to just defending the social relationships in a society and the economic and political sources of those relationships. No state has ever left its activities at that bare minimum. As well as defending the rich, their property and the specific forms of property rights they favoured, the state has numerous other subsidiary functions.

What these are has varied considerably over time and space and, consequently, it would be impossible to list them all. However, why it does is more straight forward. We can generalise two main forms of subsidiary functions of the state. The first one is to boost the interests of the ruling elite either nationally or internationally beyond just defending their property. The second is to protect society against the negative effects of the capitalist market. We will discuss each in turn and, for simplicity and relevance, we will concentrate on capitalism (see also section D.1).

The first main subsidiary function of the state is when it intervenes in society to help the capitalist class in some way. This can take obvious forms of intervention, such as subsidies, tax breaks, non-bid government contracts, protective tariffs to old, inefficient, industries, giving actual monopolies to certain firms or individuals, bailouts of corporations judged by state bureaucrats as too important to let fail, and so on. However, the state intervenes far more than that and in more subtle ways. Usually it does so to solve problems that arise in the course of capitalist development and which cannot, in general, be left to the market (at least initially). These are designed to benefit the capitalist class as a whole rather than just specific individuals, companies or sectors.

These interventions have taken different forms in different times and include state funding for industry (e.g. military spending); the creation of social infrastructure too expensive for private capital to provide (railways, motorways); the funding of research that companies cannot afford to undertake; protective tariffs to protect developing industries from more efficient international competition (the key to successful industrialisation as it allows capitalists to rip-off consumers, making them rich and increasing funds available for investment); giving capitalists preferential access to land and other natural resources; providing education to the general public that ensures they have the skills and attitude required by capitalists and the state (it is no accident that a key thing learned in school is how to survive boredom, being in a hierarchy and to do what it orders); imperialist ventures to create colonies or client states (or protect citizen’s capital invested abroad) in order to create markets or get access to raw materials and cheap labour; government spending to stimulate consumer demand in the face of recession and stagnation; maintaining a “natural” level of unemployment that can be used to discipline the working class, so ensuring they produce more, for less; manipulating the interest rate in order to try and reduce the effects of the business cycle and undermine workers’ gains in the class struggle.

These actions, and others like it, ensures that a key role of the state within capitalism “is essentially to socialise risk and cost, and to privatise power and profit.” Unsurprisingly, “with all the talk about minimising the state, in the OECD countries the state continues to grow relative to GNP.” [Noam Chomsky, Rogue States, p. 189] Hence David Deleon:

“Above all, the state remains an institution for the continuance of dominant socioeconomic relations, whether through such agencies as the military, the courts, politics or the police … Contemporary states have acquired … less primitive means to reinforce their property systems [than state violence — which is always the means of last, often first, resort]. States can regulate, moderate or resolve tensions in the economy by preventing the bankruptcies of key corporations, manipulating the economy through interest rates, supporting hierarchical ideology through tax benefits for churches and schools, and other tactics. In essence, it is not a neutral institution; it is powerfully for the status quo. The capitalist state, for example, is virtually a gyroscope centred in capital, balancing the system. If one sector of the economy earns a level of profit, let us say, that harms the rest of the system — such as oil producers’ causing public resentment and increased manufacturing costs — the state may redistribute some of that profit through taxation, or offer encouragement to competitors.” [“Anarchism on the origins and functions of the state: some basic notes”, Reinventing Anarchy, pp. 71–72]

In other words, the state acts to protect the long-term interests of the capitalist class as a whole (and ensure its own survival) by protecting the system. This role can and does clash with the interests of particular capitalists or even whole sections of the ruling class (see section B.2.6). But this conflict does not change the role of the state as the property owners’ policeman. Indeed, the state can be considered as a means for settling (in a peaceful and apparently independent manner) upper-class disputes over what to do to keep the system going.

This subsidiary role, it must be stressed, is no accident, It is part and parcel capitalism. Indeed, “successful industrial societies have consistently relied on departures from market orthodoxies, while condemning their victims [at home and abroad] to market discipline.” [Noam Chomsky, World Orders, Old and New, p. 113] While such state intervention grew greatly after the Second World War, the role of the state as active promoter of the capitalist class rather than just its passive defender as implied in capitalist ideology (i.e. as defender of property) has always been a feature of the system. As Kropotkin put it:

“every State reduces the peasants and the industrial workers to a life of misery, by means of taxes, and through the monopolies it creates in favour of the landlords, the cotton lords, the railway magnates, the publicans, and the like … we need only to look round, to see how everywhere in Europe and America the States are constituting monopolies in favour of capitalists at home, and still more in conquered lands [which are part of their empires].” [Evolution and Environment, p. 97]

By “monopolies,” it should be noted, Kropotkin meant general privileges and benefits rather than giving a certain firm total control over a market. This continues to this day by such means as, for example, privatising industries but providing them with state subsidies or by (mis-labelled) “free trade” agreements which impose protectionist measures such as intellectual property rights on the world market.

All this means that capitalism has rarely relied on purely economic power to keep the capitalists in their social position of dominance (either nationally, vis-à-vis the working class, or internationally, vis-à-vis competing foreign elites). While a “free market” capitalist regime in which the state reduces its intervention to simply protecting capitalist property rights has been approximated on a few occasions, this is not the standard state of the system — direct force, i.e. state action, almost always supplements it.

This is most obviously the case during the birth of capitalist production. Then the bourgeoisie wants and uses the power of the state to “regulate” wages (i.e. to keep them down to such levels as to maximise profits and force people attend work regularly), to lengthen the working day and to keep the labourer dependent on wage labour as their own means of income (by such means as enclosing land, enforcing property rights on unoccupied land, and so forth). As capitalism is not and has never been a “natural” development in society, it is not surprising that more and more state intervention is required to keep it going (and if even this was not the case, if force was essential to creating the system in the first place, the fact that it latter can survive without further direct intervention does not make the system any less statist). As such, “regulation” and other forms of state intervention continue to be used in order to skew the market in favour of the rich and so force working people to sell their labour on the bosses terms.

This form of state intervention is designed to prevent those greater evils which might threaten the efficiency of a capitalist economy or the social and economic position of the bosses. It is designed not to provide positive benefits for those subject to the elite (although this may be a side-effect). Which brings us to the other kind of state intervention, the attempts by society, by means of the state, to protect itself against the eroding effects of the capitalist market system.

Capitalism is an inherently anti-social system. By trying to treat labour (people) and land (the environment) as commodities, it has to break down communities and weaken eco-systems. This cannot but harm those subject to it and, as a consequence, this leads to pressure on government to intervene to mitigate the most damaging effects of unrestrained capitalism. Therefore, on one side there is the historical movement of the market, a movement that has not inherent limit and that therefore threatens society’s very existence. On the other there is society’s natural propensity to defend itself, and therefore to create institutions for its protection. Combine this with a desire for justice on behalf of the oppressed along with opposition to the worse inequalities and abuses of power and wealth and we have the potential for the state to act to combat the worse excesses of the system in order to keep the system as a whole going. After all, the government “cannot want society to break up, for it would mean that it and the dominant class would be deprived of the sources of exploitation.” [Malatesta, Op. Cit., p. 25]

Needless to say, the thrust for any system of social protection usually comes from below, from the people most directly affected by the negative effects of capitalism. In the face of mass protests the state may be used to grant concessions to the working class in cases where not doing so would threaten the integrity of the system as a whole. Thus, social struggle is the dynamic for understanding many, if not all, of the subsidiary functions acquired by the state over the years (this applies to pro-capitalist functions as these are usually driven by the need to bolster the profits and power of capitalists at the expense of the working class).

State legislation to set the length of the working day is an obvious example this. In the early period of capitalist development, the economic position of the capitalists was secure and, consequently, the state happily ignored the lengthening working day, thus allowing capitalists to appropriate more surplus value from workers and increase the rate of profit without interference. Whatever protests erupted were handled by troops. Later, however, after workers began to organise on a wider and wider scale, reducing the length of the working day became a key demand around which revolutionary socialist fervour was developing. In order to defuse this threat (and socialist revolution is the worst-case scenario for the capitalist), the state passed legislation to reduce the length of the working day.

Initially, the state was functioning purely as the protector of the capitalist class, using its powers simply to defend the property of the few against the many who used it (i.e. repressing the labour movement to allow the capitalists to do as they liked). In the second period, the state was granting concessions to the working class to eliminate a threat to the integrity of the system as a whole. Needless to say, once workers’ struggle calmed down and their bargaining position reduced by the normal workings of market (see section B.4.3), the legislation restricting the working day was happily ignored and became “dead laws.”

This suggests that there is a continuing tension and conflict between the efforts to establish, maintain, and spread the “free market” and the efforts to protect people and society from the consequences of its workings. Who wins this conflict depends on the relative strength of those involved (as does the actual reforms agreed to). Ultimately, what the state concedes, it can also take back. Thus the rise and fall of the welfare state — granted to stop more revolutionary change (see section D.1.3), it did not fundamentally challenge the existence of wage labour and was useful as a means of regulating capitalism but was “reformed” (i.e. made worse, rather than better) when it conflicted with the needs of the capitalist economy and the ruling elite felt strong enough to do so.

Of course, this form of state intervention does not change the nature nor role of the state as an instrument of minority power. Indeed, that nature cannot help but shape how the state tries to implement social protection and so if the state assumes functions it does so as much in the immediate interest of the capitalist class as in the interest of society in general. Even where it takes action under pressure from the general population or to try and mend the harm done by the capitalist market, its class and hierarchical character twists the results in ways useful primarily to the capitalist class or itself. This can be seen from how labour legislation is applied, for example. Thus even the “good” functions of the state are penetrated with and dominated by the state’s hierarchical nature. As Malatesta forcefully put it:

“The basic function of government … is always that of oppressing and exploiting the masses, of defending the oppressors and the exploiters … It is true that to these basic functions … other functions have been added in the course of history … hardly ever has a government existed … which did not combine with its oppressive and plundering activities others which were useful … to social life. But this does not detract from the fact that government is by nature oppressive … and that it is in origin and by its attitude, inevitably inclined to defend and strengthen the dominant class; indeed it confirms and aggravates the position … [I]t is enough to understand how and why it carries out these functions to find the practical evidence that whatever governments do is always motivated by the desire to dominate, and is always geared to defending, extending and perpetuating its privileges and those of the class of which it is both the representative and defender.” [Op. Cit., pp. 23–4]

This does not mean that these reforms should be abolished (the alternative is often worse, as neo-liberalism shows), it simply recognises that the state is not a neutral body and cannot be expected to act as if it were. Which, ironically, indicates another aspect of social protection reforms within capitalism: they make for good PR. By appearing to care for the interests of those harmed by capitalism, the state can obscure it real nature:

“A government cannot maintain itself for long without hiding its true nature behind a pretence of general usefulness; it cannot impose respect for the lives of the privileged if it does not appear to demand respect for all human life; it cannot impose acceptance of the privileges of the few if it does not pretend to be the guardian of the rights of all.” [Malatesta, Op. Cit., p. 24]