#Private Equity Real Estate Firm

Explore tagged Tumblr posts

Text

David Leavitt of ElmTree Funds - Bachelor of Arts from New School University

David Leavitt of ElmTree Funds has worked for over 14 years in fund management and has a comprehensive knowledge of mergers and acquisitions involving non-traditional real estate platforms. Mr. Leavitt started his career at Skadden, Arps, Slate Meagher & Flom LLP, and he has worked for PricewaterhouseCoopers in their real estate tax practice. He graduated from Chicago-Kent College of Law with his Juris Doctor.

#David Leavitt of ElmTree Funds#chief compliance officer#chiefcomplianceofficer#Private Equity Real Estate Firm#Chief Compliance Officer#An Attorney

1 note

·

View note

Text

Real Estate Legal Experts

Saraf and Partners are recognized as real estate legal experts, offering comprehensive legal services to clients in the real estate sector. Their expertise in real estate law ensures seamless transactions and mitigates potential legal challenges making Saraf and Partners the best Real Estate Law Firm.

#Top law firm in Delhi#Top law firm in India#Top lawyers in Delhi#Best law firm in India#Banking and finance lawyers#Banking & Finance Law firm#litigation and arbitration#Litigation firm in Delhi#M&A law firm#Best M&A lawyers#Restructuring and Insolvency Law#Legal Advice for Startups#Private equity law firm#Real Estate Law Firm#Real estate lawyers#legal services#Corporate law firm in Mumbai#Corporate law firm in Delhi

0 notes

Text

Investing In Private Equity Real Estate: Risks, Strategies and Opportunities

Explore how to invest wisely in private equity real estate. Learn strategies, risks, benefits and the basics of how to invest in private equity real estate.

Private equity real estate offers a wide choice for diversification and the possibility of a higher return as compared to traditional real estate investments. Helping investors develop the right strategies for operating in this global and profitable economy is the key to yielding the best investment benefits.

In this comprehensive guide, we will venture into the world of private equity real estate funds and disclose the details of this investment strategy for those considering taking advantage of it. Whether you are an experienced investor or just getting started, this guide will give you the knowledge you need to make the right decisions and succeed in private equity real estate.

0 notes

Text

How Real Estate Equity Investors Are Driving Innovation And Growth In The Industry?

Investing in Real Estate Equity: Real estate equity investors are individuals or entities who allocate capital into real estate assets, such as residential or commercial properties, with the goal of generating returns through property appreciation and rental income.

Diverse Investment Strategies: Real estate equity investors employ various strategies, including direct property ownership, real estate investment trusts (REITs), or participation in real estate partnerships. Each strategy offers unique advantages and risk profiles.

Risk and Reward: Real estate equity investing can offer potential for long-term wealth accumulation, but it also carries inherent risks, such as market fluctuations, property management challenges, and economic downturns. Diversification and due diligence are essential for mitigating these risks.

Building Wealth and Income: For many investors, real estate equity serves as a way to build wealth over time and create a source of passive income through rental properties or dividend payments from REITs, making it a popular choice within the broader investment landscape.

#the owl house#succession#entrepreneurial firm#Equity Capital Raise Business#Real Estate and Private Equity deals

0 notes

Text

Precision Global Corporation

Here at Precision Global Corporation, we make money shoulder to shoulder with our Partners. It’s our money on the line too. Therefore, one strategic, yet critical difference, which we believe is a massive advantage compared to other venture capital companies is our low overhead and controlled cost model. We align ourselves with operators that are the best and most efficient in the business. Therefore, we can have stringent cost controls in place. We do not believe in haphazardly passing costs through to our Partners. In place, we have a multi-step process to seek low cost, but effective options and suppliers for each of our operations. Micromanagement is key to our cost control and purchase order system. We handle it so that you do not have to.

Address: 106 W Kaufman St, Rockwall, TX 75087, USA Phone: 214-764-7291 Website: https://www.precisionglobalcorp.com

#Precision Global Real Estate#1031 Exchange#1031 Exchange Properties#Best Real Estate Partners#Private Equity Firm

0 notes

Link

There are numerous intriguing possibilities for real estate investment in 2021. In the big cities, the property values remained steady but have begun to alter for the better. The rental market is also anticipated to emerge from a period of stagnation. Many real estate investment firms are offering good deals for prospective customers. Strataprop - one of the best real estate firms doing their work with sheer excellence.

You can save an additional 1.5 Lakh Per Annum on the due interest if you are a first-time buyer. The stamp valuation is no more than 45 lakhs if the property qualifies for affordable housing. Additionally, this relaxation is valid through March 31, 2022.

Every city in India has a unique real estate market trend due to various direct and indirect causes. Bangalore has its real estate investment firms, which have flourished recently.

While selecting a city for a real estate investment, many more factors must be considered. The city's real estate market pricing patterns, forthcoming projects, connectivity, and other elements. However, the real estate companies like Strataprop in the city can help the new timers with their extensive process of real estate investments.

Bangalore’s Real Estate Investment Region

Bangalore has been favoured for real estate investments primarily due to its ease of living, expanding IT parks, and manufacturing hubs. Many real estate investment firms have also settled their office in the city to make the process seamless.

Residential real estate in Bangalore is steadily increasing. North and South Bangalore, along with potential real estate investment opportunities, has just been identified

Visit us At : https://strataprop.com/ Mumbai Parinee Crescenzo 10th Floor - B Wing Bandra Kurla Complex, Mumbai, Maharashtra 400051

Bengaluru (HQ) 6/1-1, Museum Rd, Shanthala Nagar, Ashok Nagar, Bengaluru, Karnataka 560001

0 notes

Text

Leveraged buyouts are not like mortgages

I'm coming to DEFCON! On FRIDAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Here's an open secret: the confusing jargon of finance is not the product of some inherent complexity that requires a whole new vocabulary. Rather, finance-talk is all obfuscation, because if we called finance tactics by their plain-language names, it would be obvious that the sector exists to defraud the public and loot the real economy.

Take "leveraged buyout," a polite name for stealing a whole goddamned company:

Identify a company that owns valuable assets that are required for its continued operation, such as the real-estate occupied by its outlets, or even its lines of credit with suppliers;

Approach lenders (usually banks) and ask for money to buy the company, offering the company itself (which you don't own!) as collateral on the loan;

Offer some of those loaned funds to shareholders of the company and convince a key block of those shareholders (for example, executives with large stock grants, or speculators who've acquired large positions in the company, or people who've inherited shares from early investors but are disengaged from the operation of the firm) to demand that the company be sold to the looters;

Call a vote on selling the company at the promised price, counting on the fact that many investors will not participate in that vote (for example, the big index funds like Vanguard almost never vote on motions like this), which means that a minority of shareholders can force the sale;

Once you own the company, start to strip-mine its assets: sell its real-estate, start stiffing suppliers, fire masses of workers, all in the name of "repaying the debts" that you took on to buy the company.

This process has its own euphemistic jargon, for example, "rightsizing" for layoffs, or "introducing efficiencies" for stiffing suppliers or selling key assets and leasing them back. The looters – usually organized as private equity funds or hedge funds – will extract all the liquid capital – and give it to themselves as a "special dividend." Increasingly, there's also a "divi recap," which is a euphemism for borrowing even more money backed by the company's assets and then handing it to the private equity fund:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

If you're a Sopranos fan, this will all sound familiar, because when the (comparatively honest) mafia does this to a business, it's called a "bust-out":

https://en.wikipedia.org/wiki/Bust_Out

The mafia destroys businesses on a onesy-twosey, retail scale; but private equity and hedge funds do their plunder wholesale.

It's how they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And it's what they did to hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

It's what happened to nursing homes, Armark, private prisons, funeral homes, pet groomers, nursing homes, Toys R Us, The Olive Garden and Pet Smart:

https://pluralistic.net/2023/06/02/plunderers/#farben

It's what happened to the housing co-ops of Cooper Village, Texas energy giant TXU, Old Country Buffet, Harrah's and Caesar's:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

And it's what's slated to happen to 2.9m Boomer-owned US businesses employing 32m people, whose owners are nearing retirement:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

Now, you can't demolish that much of the US productive economy without attracting some negative attention, so the looter spin-machine has perfected some talking points to hand-wave away the criticism that borrowing money using something you don't own as collateral in order to buy it and wreck it is obviously a dishonest (and potentially criminal) destructive practice.

The most common one is that borrowing money against an asset you don't own is just like getting a mortgage. This is such a badly flawed analogy that it is really a testament to the efficacy of the baffle-em-with-bullshit gambit to convince us all that we're too stupid to understand how finance works.

Sure: if I put an offer on your house, I will go to my credit union and ask the for a mortgage that uses your house as collateral. But the difference here is that you own your house, and the only way I can buy it – the only way I can actually get that mortgage – is if you agree to sell it to me.

Owner-occupied homes typically have uncomplicated ownership structures. Typically, they're owned by an individual or a couple. Sometimes they're the property of an estate that's divided up among multiple heirs, whose relationship is mediated by a will and a probate court. Title can be contested through a divorce, where disputes are settled by a divorce court. At the outer edge of complexity, you get things like polycules or lifelong roommates who've formed an LLC s they can own a house among several parties, but the LLC will have bylaws, and typically all those co-owners will be fully engaged in any sale process.

Leveraged buyouts don't target companies with simple ownership structures. They depend on firms whose equity is split among many parties, some of whom will be utterly disengaged from the firm's daily operations – say, the kids of an early employee who got a big stock grant but left before the company grew up. The looter needs to convince a few of these "owners" to force a vote on the acquisition, and then rely on the idea that many of the other shareholders will simply abstain from a vote. Asset managers are ubiquitous absentee owners who own large stakes in literally every major firm in the economy. The big funds – Vanguard, Blackrock, State Street – "buy the whole market" (a big share in every top-capitalized firm on a given stock exchange) and then seek to deliver returns equal to the overall performance of the market. If the market goes up by 5%, the index funds need to grow by 5%. If the market goes down by 5%, then so do those funds. The managers of those funds are trying to match the performance of the market, not improve on it (by voting on corporate governance decisions, say), or to beat it (by only buying stocks of companies they judge to be good bets):

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

Your family home is nothing like one of these companies. It doesn't have a bunch of minority shareholders who can force a vote, or a large block of disengaged "owners" who won't show up when that vote is called. There isn't a class of senior managers – Chief Kitchen Officer! – who have been granted large blocks of options that let them have a say in whether you will become homeless.

Now, there are homes that fit this description, and they're a fucking disaster. These are the "heirs property" homes, generally owned by the Black descendants of enslaved people who were given the proverbial 40 acres and a mule. Many prosperous majority Black settlements in the American South are composed of these kinds of lots.

Given the historical context – illiterate ex-slaves getting property as reparations or as reward for fighting with the Union Army – the titles for these lands are often muddy, with informal transfers from parents to kids sorted out with handshakes and not memorialized by hiring lawyers to update the deeds. This has created an irresistible opportunity for a certain kind of scammer, who will pull the deeds, hire genealogists to map the family trees of the original owners, and locate distant descendants with homeopathically small claims on the property. These descendants don't even know they own these claims, don't even know about these ancestors, and when they're offered a few thousand bucks for their claim, they naturally take it.

Now, armed with a claim on the property, the heirs property scammers force an auction of it, keeping the process under wraps until the last instant. If they're really lucky, they're the only bidder and they can buy the entire property for pennies on the dollar and then evict the family that has lived on it since Reconstruction. Sometimes, the family will get wind of the scam and show up to bid against the scammer, but the scammer has deep capital reserves and can easily win the auction, with the same result:

https://www.propublica.org/series/dispossessed

A similar outrage has been playing out for years in Hawai'i, where indigenous familial claims on ancestral lands have been diffused through descendants who don't even know they're co-owner of a place where their distant cousins have lived since pre-colonial times. These descendants are offered small sums to part with their stakes, which allows the speculator to force a sale and kick the indigenous Hawai'ians off their family lands so they can be turned into condos or hotels. Mark Zuckerberg used this "quiet title and partition" scam to dispossess hundreds of Hawai'ian families:

https://archive.is/g1YZ4

Heirs property and quiet title and partition are a much better analogy to a leveraged buyout than a mortgage is, because they're ways of stealing something valuable from people who depend on it and maintain it, and smashing it and selling it off.

Strip away all the jargon, and private equity is just another scam, albeit one with pretensions to respectability. Its practitioners are ripoff artists. You know the notorious "carried interest loophole" that politicians periodically discover and decry? "Carried interest" has nothing to do with the interest on a loan. The "carried interest" rule dates back to 16th century sea-captains, and it refers to the "interest" they had in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

Private equity managers are like sea captains in exactly the same way that leveraged buyouts are like mortgages: not at all.

And it's not like private equity is good to its investors: scams like "continuation funds" allow PE looters to steal all the money they made from strip mining valuable companies, so they show no profits on paper when it comes time to pay their investors:

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

Those investors are just as bamboozled as we are, which is why they keep giving more money to PE funds. Today, the "dry powder" (uninvested money) that PE holds has reached an all-time record high of $2.62 trillion – money from pension funds and rich people and sovereign wealth funds, stockpiled in anticipation of buying and destroying even more profitable, productive, useful businesses:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

The practices of PE are crooked as hell, and it's only the fact that they use euphemisms and deceptive analogies to home mortgages that keeps them from being shut down. The more we strip away the bullshit, the faster we'll be able to kill this cancer, and the more of the real economy we'll be able to preserve.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

#pluralistic#leveraged buyouts#lbos#divi recaps#mortgages#weaponized shelter#debt#finance#private equity#pe#mego#bust outs#plunder#looting

423 notes

·

View notes

Text

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities.— Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily.

. . .

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper.

That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”This trend is massive.

. . .

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

. . .

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street

.”It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

. . .

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

. . .

Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

. . .

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

To address the housing shortage and bring down prices for renters and homeowners alike, the Harris campaign’s plan calls for a historic expansion of the Low-Income Housing Tax Credit (LIHTC) and the first-ever tax incentive for homebuilders who build starter homes sold to first-time homebuyers. Building upon the Biden-Harris administration’s proposed $20 billion innovation fund, the campaign proposes a $40 billion fund that would support local innovations in housing supply solutions, catalyze innovative methods of construction financing, and empower developers and homebuilders to design and build affordable homes.

To cut red tape and bring down housing costs, the plan calls for streamlining permitting processes and reviews, including for transit-oriented development and conversions. The agenda also proposes making certain federal lands eligible to be repurposed for affordable housing development. Collectively, these policy proposals seek to create 3 million homes in the next four years.

The campaign plan cites the Biden-Harris administration’s ongoing actions to support the lowest-income renters, including its actions to expand rental assistance for veterans and other low-income renters, increase housing supply for people experiencing homelessness, enforce fair housing laws, and hold corporate landlords accountable.

Building upon these commitments, the Harris agenda calls upon Congress to pass the “Stop Predatory Investing Act,” which would remove key tax benefits for major investors who acquire large numbers of single-family rental homes (see Memo, 7/17/23), and the “Preventing the Algorithmic Facilitation of Rental Housing Cartels Act,” which would crack down on algorithmic rent-setting software that enables price-fixing among corporate landlords.

To make homeownership attainable, Vice President Harris’s proposal would provide up to $25,000 in downpayment assistance for first-time homebuyers who have paid their rent on time for two years. First-generation homeowners – those whose parents did not own homes – would receive more generous assistance.

Vice President Harris’s economic agenda also includes proposals to lower grocery costs, lower the costs of prescription drugs and relieve medical debt, and cut taxes for workers and families with children. The plan would restore the American Rescue Plan’s expanded Child Tax Credit, which provided up to $3,600 per child for low- and middle-income families for one year before it expired in 2022, and would enact a new $6,000 tax credit for families in the first year after their child is born. These measures to reduce expenses and boost household income would also improve housing security for low-income families, who often face impossible tradeoffs between paying rent and affording food, medical care, and other basic needs.

-----

Sorry for the length, but I thought this was really important.

26 notes

·

View notes

Note

does anyone know anything about Vince Dunn's family? because im confused lmao. so i know he has 2 brothers (which is how ive ended up being confused lmfao) i just seen that one played hockey, so i googled him to see if he still played & seen that he was born May 1996, BUT Vince was born October 1996 .. was his dad like throwing it around or somethin lmao, like how??

alriiiight y'all long vince (and daniella) post incoming buckle in

i think both brothers are his stepbrothers, including the one who played hockey (link) as vince was quoted saying the following here (there's a paywall but i screenshotted the important bit):

vince's legal last name is actually hyphenated (it's not paylor-dunn it's another name) - paylor is his mom's last name, dunn is his stepdad's last name (source)

vince still owns the other house which is this house here. he hasn't listed it or anything so who knows maybe he'll rent it out

this is the new house he bought and seemingly daniella has moved in with him which is very chaotic and funny.

the house was transferred to him from an LLC that is connected to Pitchbook, which is a private equity firm that is an arena partner & suite-level sponsor of CPA

source is a legal doc an anon sent to me. making the executive decision to not post it on here lol

as for why he's moving in with her, god only knows, but her family does come from a sizeable amount of money

daniella's father donald direnzo was an Executive Vice President at Cushman & Wakefield and is Co-Founder and Managing Partner at Toro Real Estate Partners

her uncle, august direnzo, is vice chairman at cushman & wakefield and her grandfather, donald direnzo sr. is executive vice chair at cushman & wakefield

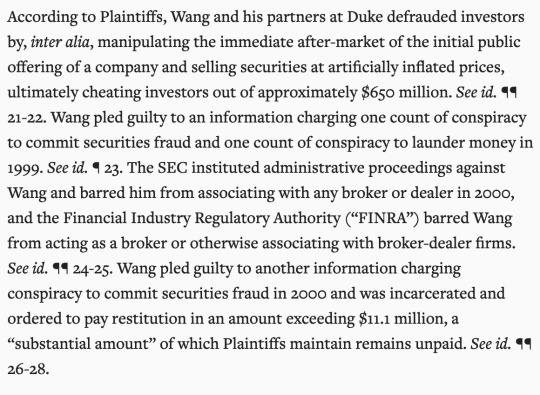

she has another uncle as well, joseph. him and her grandfather have been involved in a few court cases lol. here's one case, and here's my favorite - they've sued one guy who was associated with stratton oakmont (fraudulent investment firm depicted in the wolf of wall street) (source):

just for fun, her mom is christina direnzo

lots of chatter about the dunn update acc on tiktok. looks like a few of my anons believe, and even have proof, that she runs it - anon please share the proof!! 🙏

39 notes

·

View notes

Text

How Trump's billionaires are hijacking affordable housing

Thom Hartmann

October 24, 2024 8:52AM ET

Republican presidential nominee and former U.S. President Donald Trump attends the 79th annual Alfred E. Smith Memorial Foundation Dinner in New York City, U.S., October 17, 2024. REUTERS/Brendan McDermid

America’s morbidly rich billionaires are at it again, this time screwing the average family’s ability to have decent, affordable housing in their never-ending quest for more, more, more. Canada, New Zealand, Singapore, and Denmark have had enough and done something about it: we should, too.

There are a few things that are essential to “life, liberty, and the pursuit of happiness” that should never be purely left to the marketplace; these are the most important sectors where government intervention, regulation, and even subsidy are not just appropriate but essential. Housing is at the top of that list.

A few days ago I noted how, since the Reagan Revolution, the cost of housing has exploded in America, relative to working class income.

When my dad bought his home in the 1950s, for example, the median price of a single-family house was around 2.2 times the median American family income. Today the St. Louis Fed says the median house sells for $417,700 while the median American income is $40,480—a ratio of more than 10 to 1 between housing costs and annual income.

ALSO READ: He’s mentally ill:' NY laughs ahead of Trump's Madison Square Garden rally

In other words, housing is about five times more expensive (relative to income) than it was in the 1950s.

And now we’ve surged past a new tipping point, causing the homelessness that’s plagued America’s cities since George W. Bush’s deregulation-driven housing- and stock-market crash in 2008, exacerbated by Trump’s bungling America’s pandemic response.

And the principal cause of both that crash and today’s crisis of homelessness and housing affordability has one, single, primary cause: billionaires treating housing as an investment commodity.

A new report from Popular Democracy and the Institute for Policy Studies reveals how billionaire investors have become a major driver of the nationwide housing crisis. They summarize in their own words:

— Billionaire-backed private equity firms worm their way into different segments of the housing market to extract ever-increasing rents and value from multi-family rental, single-family homes, and mobile home park communities. — Global billionaires purchase billions in U.S. real estate to diversify their asset holdings, driving the creation of luxury housing that functions as “safety deposit boxes in the sky.” Estimates of hidden wealth are as high as $36 trillion globally, with billions parked in U.S. land and housing markets. — Wealthy investors are acquiring property and holding units vacant, so that in many communities the number of vacant units greatly exceeds the number of unhoused people. Nationwide there are 16 million vacant homes: that is, 28 vacant homes for every unhoused person. — Billionaire investors are buying up a large segment of the short-term rental market, preventing local residents from living in these homes, in order to cash in on tourism. These are not small owners with one unit, but corporate owners with multiple properties. — Billionaire investors and corporate landlords are targeting communities of color and low-income residents, in particular, with rent increases, high rates of eviction, and unhealthy living conditions. What’s more, billionaire-owned private equity firms are investing in subsidized housing, enjoying tax breaks and public benefits, while raising rents and evicting low-income tenants from housing they are only required to keep affordable, temporarily. (Emphasis theirs.)

It seems that everywhere you look in America you see the tragedy of the homelessness these billionaires are causing. Rarely, though, do you hear about the role of Wall Street and its billionaires in causing it.

The math, however, is irrefutable.

Thirty-two percent is the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes. And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires are making a killing.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper. That Zillow-funded study laid it out:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

This trend is massive.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville:

“In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; agents for the billionaire investor goliaths use fine-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes young families can afford to buy, billionaires then begin raising rents to extract as much cash as they can from local working class communities.

In the Nashville suburb of Spring Hill, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street billionaire investor] landlords was about $1,773 a month…”

As the Bank of International Settlements summarized in a 2014 retrospective study of the years since the Reagan/Gingrich changes in banking and finance:

“We describe a Pareto frontier along which different levels of risk-taking map into different levels of welfare for the two parties, pitting Main Street against Wall Street. … We also show that financial innovation, asymmetric compensation schemes, concentration in the banking system, and bailout expectations enable or encourage greater risk-taking and allocate greater surplus to Wall Street at the expense of Main Street.”

It’s a fancy way of saying that billionaire-owned big banks and hedge funds have made trillions on housing while you and your community are becoming destitute.

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor run by a major Trump supporter. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

As that new study from Popular Democracy and the Institute for Policy Studies found:

“[Billionaire Stephen Schwarzman’s] Blackstone is the largest corporate landlord in the world, with a vast and diversified real estate portfolio. It owns more than 300,000 residential units across the U.S., has $1 trillion in global assets, and nearly doubled its profits in 2021. “Blackstone owns 149,000 multi-family apartment units; 63,000 single-family homes; 70 mobile home parks with 13,000 lots through their subsidiary Treehouse Communities; and student housing, through American Campus Communities (144,300 beds in 205 properties as of 2022). Blackstone recently acquired 95,000 units of subsidized housing.”

In 2018, corporations and the billionaires that own or run them bought 1 out of every 10 homes sold in America, according to Dezember, noting that:

“Between 2006 and 2016, when the homeownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

And it’s gotten worse every year since then.

This all really took off around a decade ago following the Bush Crash, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to control the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

As Zillow found:

“The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity.

And as families are priced out of ownership and forced to rent, they become more vulnerable to homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable.

Singapore, Denmark, New Zealand, and parts of Canada have all put limits on billionaire, corporate, and foreign investment in housing, recognizing families’ residences as essential to life rather than purely a commodity. Multiple other countries are having that debate or moving to take similar actions as you read these words.

America should, too.

ALSO READ: Not even ‘Fox and Friends’ can hide Trump’s dementia

16 notes

·

View notes

Text

To raise enough cash to make the deal happen, Golden Gate sold off Red Lobster's real estate to another entity — in this case, a company called American Realty Capital Properties — and then immediately leased the restaurants back. The next year, Red Lobster bought back some sites, but many of its restaurants were suddenly strapped with added rent expenses. Even if Darden had kept Red Lobster, it's not clear it would have taken a different route: A press release from the time says it had contacted buyers to explore such a transaction. But in Maze's view, the sale of the real estate was sort of an original sin for Red Lobster's current troubles. He compared it to throwing out a spare parachute — chances are, you'll be OK, but if the first parachute fails, you're in deep trouble. "The thing that private equity does is just unload assets and monetize assets. And so they effectively paid for the purchase of Red Lobster by selling the real estate," he said. "It'll probably be fine, generally, but there's going to come a time in which your sales fall, your profitability is challenged, and your debt looks too bad, and then suddenly those leases are going to look awfully ugly." That time, according to recent reporting, is now. With struggling sales and operational losses, the leases are an added headache that is helping push the company to the brink, though bankruptcy may help Red Lobster get some wiggle room on them. Eileen Appelbaum, a codirector of the Center for Economic and Policy Research, a progressive think tank, and a longtime private-equity critic, said in 2014 that private equity wouldn't be the solution to Red Lobster's ills. She isn't surprised about how this is all turning out. "Once they sell the real estate, then the private-equity company is golden, and they've made their money back and probably more than what they paid," she said, noting that this was a common theme in other restaurants and retailers and adding: "The retail apocalypse is all about having your real estate sold out from under you so that you have to pay the rent in good times and in bad." After the real estate move, Golden Gate sold 25% of the company in 2016 to Thai Union, a Thailand seafood company, for $575 million and unloaded the rest of the company to an investor group called the Seafood Alliance, of which Thai Union was a part, in 2020. Golden Gate likely came out ahead, but the same can't be said for Thai Union, which also controls the Chicken of the Sea brand. It is now looking to get out of its stake in Red Lobster and took a one-time charge of $530 million on its investment in the fourth quarter of last year. In 2021, Red Lobster refinanced its debt, with one of its new lenders being Fortress Investment Group, an investment-management group and private-equity firm. According to Bloomberg, it's one of the "key lenders" involved in debt negotiations now.

23 notes

·

View notes

Text

The US Senate Finance Committee on Wednesday said its probe into Affinity Partners has uncovered that Serbian and Albanian government officials proactively approached the company with proposals for real estate projects in their countries.

The equity and investment firm is linked to Jared Kushner, former US President Donald Trump’s son-in-law and adviser.

In a letter to Affinity, Senate Finance Committee chair Senator Ron Wyden said the committee is now seeking to identify the specific officials involved in these communications and the intermediaries.

The Finance Committee letter was sent around the same time as Trump’s eldest son, Donald Trump Jr., was in Belgrade meeting Serbian businesspeople – and as the US presidential election campaign, in which Trump is the Republican candidate, enters its final stages.

Senator Wyden, a Democrat from Oregon, launched the investigation into Affinity Partners in June, following reports about its planned investments in Serbia and Albania.

In Serbia, the company is due to redevelop the former Yugoslav military HQ in Belgrade that was badly damaged in the 1999 NATO bombing of Yugoslavia.

In its communications with the Committee, Wyden said Affinity had confirmed the planned development of the Belgrade site would include a “museum described as a monument to ‘victims of NATO aggression’”.

Wyden was strongly critical of the suggested memorial: “It is wholly inappropriate for any foreign government to require an American firm to participate in that kind of anti-American historical revisionism, an act that whitewashes ethnic cleansing and genocide and falsely recasts NATO as an antagonist, and it is egregious that a firm founded and owned by family of a former and potential future President of the United States would agree to it,” he wrote.

The company is also planning to invest in luxury real-estate projects on the Albanian coast.

Affinity Partners has received $2 billion in funding from Saudi Arabia’s Public Investment Fund, among other foreign investors, media have reported.

In his initial letter to the company, Wyden sought records and information about “the tens of millions [of dollars] in payments Kushner is receiving from the Saudis and other foreign sources every year while exploiting private investment fund disclosure loopholes to shield the arrangement from public scrutiny”.

In a follow-up letter, published this week, Wyden requested “a detailed list of the Albanian government personnel, or individuals contacting Affinity on behalf of the Albanian government, that first contacted Affinity to discuss real estate investments in Albania”. It has made a similar request about Serbian officials.

Wyden is also seeking copies of all communications between Affinity employees and members of the Trump family related to these projects, including Kushner’s wife, Ivanka Trump.

Affinity has confirmed to Wyden that the Serbian and Albanian governments will have complete control over all aspects of these potential projects, including decision-making power over permits, local taxation and licenses for the projects.

However, Wynden wrote that this means that Serbia and Albania will have “potentially coercive control over the potential future President’s family’s investments”.

According to Wyden, such a level of government involvement leads to questions about the nature of these partnerships.

“For both proposed real estate developments, the Serbian and Albanian governments appear to own the land and have broad discretion over how it is used. These terms allow the Serbian and Albanian governments to extract unusual concessions from Affinity in the process,” Wyden asserted.

Questions over Saudi connection

According to Wyden’s letter, Affinity has earned $157 million in fees from foreign clients, including $87 million from Saudi Arabia’s government.

Affinity has disclosed to the Committee that it is charging its lead investor, the Saudi Public Investment Fund, a 1.25 per cent annual fee on $2 billion in committed funds, and that its other investors are paying closer to 2 per cent on committed funds.

Wyden claims Affinity’s fee structure is unusually high, given market trends and the relative inexperience of Kushner and of the firm’s Trump-connected employees in the industry.

Affinity has disclosed that its funds have not generated any return on investment so far, and that it has not distributed any earnings back to clients.

Wyden claims Affinity’s reliance on a handful of foreign government investors also raises concerns related to the Foreign Agents Registration Act, FARA, that regulates foreign advocacy and lobbying in the US.

“Since 100 per cent of Affinity’s outside capital and streams of income come from foreign sources, primarily sovereign wealth funds, I am concerned that Affinity’s private investment funds are being exploited by former US government officials as a loophole to receive compensation from foreign governments without disclosing these payments under FARA,” Wyden wrote.

The size of the Saudi investment has long raised questions. The New York Times reported claims in April 2022 that the investment “creates the appearance of potential payback for Mr Kushner’s actions in the White House – or of a bid for future favor if Mr Trump seeks and wins another presidential term in 2024”.

Serbia’s opposition first revealed the information that the US company would invest in Serbia in March.

The reports drew criticism because of suspicions of corruption but also because of the architectural and cultural value of the damaged former Yugoslav military HQ in Belgrade.

The building was built in 1965 and was designed by the renowned Serbian architect Nikola Dobrovic.

6 notes

·

View notes

Text

Best M&A Counsel

Saraf and Partners stand out as the best M&A counsel, renowned for their expertise and dedication to client success. Their meticulous approach and in-depth knowledge make them the preferred choice for clients seeking the best M&A lawyers.

#Top law firm in Delhi#Top law firm in India#Top lawyers in Delhi#Best law firm in India#Banking and finance lawyers#Banking & Finance Law firm#litigation and arbitration#Litigation firm in Delhi#M&A law firm#Best M&A lawyers#Restructuring and Insolvency Law#Legal Advice for Startups#Private equity law firm#Real Estate Law Firm#Real estate lawyers#legal services#Corporate law firm in Mumbai#Corporate law firm in Delhi

0 notes

Text

The bill would require the Internal Revenue Service to tax large funds that fail to sell off their single family homes over that timeframe. It already has some support in the house, where it is co-sponsored by the U.S. Representatives Nikema Williams and Linda Sánchez, as well as in the Senate, where it is cosponsored by Senator Tina Smith. Advocacy groups Private Equity Stakeholder Project, Consumer Action, and National Consumer Law Center have offered additional support.

The bill defines a hedge fund as partnerships, corporations, or real estate investment trusts that pool funds from investors and have $50 million or more in net value or assets under management, with exemptions for nonprofits and companies primarily focused on construction. Hedge funds failing to report single-family home purchases would face a $20,000 fine that would go toward a housing down payment trust fund. Funds that fail to sell off their housing stock in the timeframe required would face a tax of 50 percent of the fair market value for each property, with funds also going to the housing trust fund.

Merkley and Smith cite data from an Urban Institute report that said in 2011, no single entity owned more than 1,000 single-family rental homes, whereas by June 2022 hedge funds and institutional investors owned a cumulative 574,000 single-family homes. This includes large corporate owners like Invitation Homes, which owns more than 80,000 homes across the country. While corporate investors only own 5 percent of the nation’s single-family housing stock, the ownership is often concentrated in majority Black and Latino neighborhoods and in some neighborhoods, entire blocks have been purchased by investors.

The practice has ramped up since the beginning of the pandemic, with 28 percent of all homes sold in 2022 going to institutional investors according to Pew Charitable Trust. In 2021, a venture-funded company backed by Jeff Bezos and other billionaires also got in on the act.

19 notes

·

View notes

Text

Black inventors

From Perplexity:

Famous black inventors have significantly contributed to various fields, from everyday household items to groundbreaking technological advancements. Here are some notable figures:

George Crum (1824-1914): A chef who is credited with inventing the potato chip in 1853[1].

Frederick McKinley Jones (1893-1961): Developed refrigeration equipment for trucks, trains, ships, and planes, receiving over 40 patents. His invention, the Thermo King, revolutionized the food and medical transport industries[1].

Granville T. Woods (1856-1910): Accumulated almost 60 patents, improving railroad functioning. Notably, he invented the induction telegraph system for train communication[1].

George Washington Carver (1864-1943): An agricultural chemist who developed 518 products from peanuts and sweet potatoes, including ink, dye, soap, and synthetic rubber[1].

Madam C.J. Walker (1867-1919): Became the first African American woman self-made millionaire by creating a line of hair products for African American women[1].

Garrett Morgan (1877-1963): Invented the traffic signal and a safety hood that served as a prototype for the gas mask[1].

Mary Beatrice Davidson Kenner: Patented the sanitary belt in 1957, a significant advancement in women's health and hygiene[1].

Thomas L. Jennings (1791–1859): The first African American to receive a U.S. patent, for a dry-cleaning process[4].

Patricia Bath (1942-2019): Invented a laser cataract treatment, becoming the first African American female doctor to receive a medical patent[4].

Mark Dean (1957-present): Holds over 20 patents, including contributions to the creation of the color PC monitor and the first gigahertz chip[4].

Elijah McCoy (1844-1929): Known for his invention of the automatic lubricator for oiling steam engines, leading to the phrase "the real McCoy" to denote something authentic[4].

These inventors have left a lasting impact on society, demonstrating ingenuity and perseverance in the face of challenges.

Citations: [1] https://www.oprahdaily.com/life/work-money/g30877473/african-american-inventors/ [2] https://www.parents.com/kids/education/world-changing-black-inventors-that-every-kid-should-know-about/ [3] https://www.black-inventor.com [4] https://www.biography.com/inventors/g46697619/famous-black-inventors [5] https://en.wikipedia.org/wiki/List_of_African-American_inventors_and_scientists

From Gemini (formerly Bard):

20 Famous Black Investors with Short Descriptions:

Dr. Shirley Jackson: First Black woman to earn a doctorate in nuclear physics, invested in research and development for the U.S. Department of Defense.

Robert F. Smith: Founded Vista Equity Partners, a private equity firm with over $85 billion in assets under management. Known for his philanthropic endeavors.

Oprah Winfrey: Media mogul and investor, known for her investments in cable channels, production companies, and Weight Watchers.

Udayan I. Lekhraj: Founded CMG Partners, a private equity firm specializing in healthcare investments. Advocate for diversity and inclusion in venture capital.

Catherine Hughes: Founded Urban One, a media company serving the African American community. First Black woman to chair a publicly traded company in the U.S.

Rodney Bryant: Co-founded JUST Capital, a firm that measures and incentivizes corporations to prioritize stakeholder capitalism.

Ellen Johnson Sirleaf: Former President of Liberia, Nobel Peace Prize winner. Focused on economic development and investment in her country.

Ronald Lauder: CEO of Estee Lauder Companies, known for his investments in the beauty industry and philanthropic work.

Charles R. Bronfman: Chairman of The Seagram Company Ltd., invested in various industries including entertainment, real estate, and philanthropy.

John Rogers Jr.: Founded Ariel Investments, a mutual fund company with over $28 billion in assets under management. Advocate for responsible investing.

Marc Morial: Former mayor of New Orleans, currently president of the National Urban League. Focused on economic empowerment of Black communities.

Ronald Watkins: Founding CEO of Watkins Investing Group, invests in real estate and businesses within the Black community.

Melody Hobson: President and CEO of Ariel Investments, known for her work on financial literacy and diversity in boardrooms.

Aisha Evans: Founded BE Capital, a venture capital firm focused on Black and Latinx tech entrepreneurs.

Kevin Hart: Comedian and investor, known for his investments in production companies, streaming platforms, and sports teams.

Jay-Z: Rapper and entrepreneur, known for his investments in music streaming, sports teams, and venture capital funds.

Will Smith: Actor and investor, known for his investments in production companies, media platforms, and venture capital funds.

Serena Williams: Tennis champion and investor, known for her investments in venture capital funds focused on women and diverse founders.

Rihanna: Singer and entrepreneur, known for her investments in beauty brands, fashion lines, and technology startups.

LeBron James: Basketball player and investor, known for his investments in media companies, production companies, and technology startups.

Please note: This list is not exhaustive and can be debated in terms of individual importance and impact.

Reading List on Black Inventors:

Black Inventors: Lives That Mattered by Darlene R. Medford

Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space Race by Margot Lee Shetterly

Lifting the Veil: Celebrating the Unsung Heroes of Black History by Michael Hill

Lost Genius: The Forgotten Black Inventors Who Changed the World by Dennis Freeman

Pioneering Women in American Mathematics: From Agnes Scott to Emmy Noether by Pamela Prochazka

Black Inventors in Science and Technology by Shirley J. Smith

A Colored Man's Reminiscences of James M. Whitfield: With Recollections of the Early Struggles of Colored Men in Boston by Wilbur H. Siebert

Inventing the Future: Black Inventors in Science and Technology by Geneva Gay

African Americans in Science, Math, and Invention by Darlene R. Medford

Black Inventors in the United States by Darlene R. Medford

This list offers a variety of books covering different periods and areas of innovation by Black inventors. Consider exploring further based on your specific interests.

I hope this information is helpful!

#african american history#black history month#black history month 2024#dalle3#midjourney#black inventors#blackhistorymonth#africanamericanhistory#afrofuturism#solar punk#steampunk

15 notes

·

View notes

Text

Precision Global Corporation

Here at Precision Global Corporation, we make money shoulder to shoulder with our Partners. It’s our money on the line too. Therefore, one strategic, yet critical difference, which we believe is a massive advantage compared to other venture capital companies is our low overhead and controlled cost model. We align ourselves with operators that are the best and most efficient in the business. Therefore, we can have stringent cost controls in place. We do not believe in haphazardly passing costs through to our Partners. In place, we have a multi-step process to seek low cost, but effective options and suppliers for each of our operations. Micromanagement is key to our cost control and purchase order system. We handle it so that you do not have to.

Address: 106 W Kaufman St, Rockwall, TX 75087, USA Phone: 214-764-7291 Website: https://www.precisionglobalcorp.com

#Precision Global Real Estate#1031 Exchange#1031 Exchange Properties#Best Real Estate Partners#Private Equity Firm

0 notes