#Prepaid Card Provider Company in London

Explore tagged Tumblr posts

Text

Top Prepaid Card Provider Company in the UK

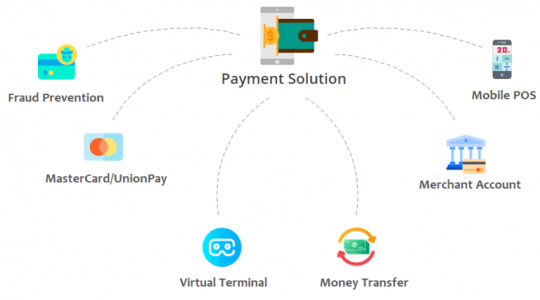

If you're looking for a reliable Prepaid Card Provider Company in UK, look no further than WhitelabelleWallet. Our prepaid card solutions are ideal for businesses of all sizes who want to offer their customers a secure and convenient way to make payments.

As a leading provider of prepaid card solutions, we offer a wide range of features that can be customised to suit the needs of your business. Our cards can be used anywhere in the world where Mastercard or Visa is accepted, making them a great option for international transactions.

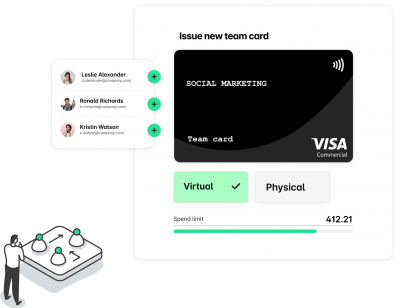

One of the key benefits of our prepaid cards is the ability to control and monitor spending. As a business owner, you can set limits on how much can be spent on the card, as well as where it can be used. This gives you peace of mind that your employees or customers are using the card responsibly.

Our prepaid cards also come with a range of security features, including chip and pin technology, fraud monitoring, and 3D secure authentication. This ensures that your transactions are safe and secure, and that you can quickly detect any fraudulent activity.

At Whitelabelled Wallet, we also offer a range of value-added services, such as mobile banking, real-time notifications, and cardholder support. This helps to create a seamless and convenient experience for your customers, and helps to build loyalty and trust.

With our flexible pricing plans and customisable features, our Prepaid Card Solution Provider Company in UK are the perfect choice for businesses who want to offer a reliable and convenient payment option for their customers. Contact us today to learn more about how we can help you grow your business with our prepaid card solutions.

offering businesses a customizable and convenient solution for their payment needs

Customization: WhiteLabelEwallet understands that different businesses have different needs when it comes to payment solutions. That's why they offer a fully customizable prepaid card solution that can be tailored to meet the unique requirements of each business. Businesses can choose from a range of features and services that best suit their needs, including transaction limits, spending restrictions, and real-time notifications.

Convenience: With the rise of e-commerce and online shopping, consumers are demanding convenient and secure payment solutions. WhiteLabelEwallet's prepaid cards offer just that. Customers can easily make purchases online or in-store with their prepaid cards, without having to worry about carrying cash or remembering PINs. Additionally, businesses can offer their customers the ability to top-up their prepaid cards online, making it a hassle-free payment option.

Security: WhiteLabelEwallet takes security seriously. Their prepaid cards are equipped with chip and pin technology, fraud monitoring, and 3D secure authentication, ensuring that all transactions are safe and secure. In addition, businesses have access to real-time transaction monitoring, which allows them to quickly detect any fraudulent activity and take action.

Cost-effectiveness: Traditional payment solutions can be costly, with high transaction fees and monthly charges. WhiteLabelEwallet's prepaid card solution is an affordable alternative, with flexible pricing plans and no hidden fees. This allows businesses to save money on payment processing and offer their customers a cost-effective payment solution.

Support: WhiteLabelEwallet provides businesses with dedicated support, helping them to set up and manage their prepaid card program. Businesses have access to a range of support services, including cardholder support, technical support, and marketing support.

#Prepaid Card Solution Provider Company in UK#Prepaid Card Solution Provider Company in London#Prepaid Card Provider Company in UK#Prepaid Card Provider Company in London#Prepaid Card Solution Company in UK#Prepaid Card Solution Company in London

0 notes

Link

Accept Cards Globally

Prepaid cards are convenient way to pay in-store or online. It’s also fascinatingly easy to pair it with a virtual card. If you are looking for an easy to use and globally accepted prepaid cards, look no further because White Label e-Wallet provides a physical prepaid card solution making us a Prepaid Card Provider Company in London and the UK. Our prepaid card allows you to check your e-Wallet balance whenever or wherever you might be. Ultimately, you can be sure that your transactions are safe with us because we are a credible and trusted White Label e-Wallet Prepaid Card Solution Provider in London and the UK that gives you great list of features and benefits. Additionally, partnering with us gives you a perk because we integrate and provide consultation on various cards such as prepaid cards, visa, and others. With White Label e-Wallet, rest assured that we got you and your business. We make it easy for you to create, test, and deploy the solution the you need.

Furthermore, visit our website by visiting us through this link or you can also talk to our expert by clicking this link.

#prepaidcardsolution#prepaidcardsolutionproviderinlondon#prepaid card solution provider in the UK#prepaid card provider company in london#prepaid card provider company in the UK

0 notes

Text

Virtual Cards for your Everyday Needs

The Future of Cashless Payment

A virtual card is an all-in-one solution if you want a cardless transaction in paying and shopping. How it works is that you can use it to make purchases online or in-app, and you can pay in-store with mobile payment services like Google Pay or Apple Pay.

UK Digital Company is a Virtual Card Solution Provider Company in London and the United Kingdom and a top Prepaid Virtual Card Solution Provider Company. Also, we are an International Prepaid Card Provider in the USA, Latin America, the UK, and European countries. Upgrade your virtual card experience and update your spending controls at any time in the dashboard or using an API.

There are many reasons why virtual cards are very useful. From convenience to better security, they’re incredibly handy as well. Also, for simplicity and effectiveness, many choose to hold their money in a company that offers an all-in-one solution to their financial needs. Moreover, businesses are swapping corporate plastic cards in favor of virtual prepaid cards. With this, UK Digital Company provides single-use cards and effortless subscription management that saves time and money.

A virtual card is an all-in-one solution if you want a cardless transaction in paying and shopping. How it works is that you can use it to make purchases online or in-app, and you can pay in-store with mobile payment services like Google Pay or Apple Pay.

UK Digital Company is a Virtual Card Solution Provider Company in London and the United Kingdom and a top Prepaid Virtual Card Solution Provider Company. Also, we are an International Prepaid Card Provider in the USA, Latin America, the UK, and European countries. Upgrade your virtual card experience and update your spending controls at any time in the dashboard or using an API.

There are many reasons why virtual cards are very useful. From convenience to better security, they’re incredibly handy as well. Also, for simplicity and effectiveness, many choose to hold their money in a company that offers an all-in-one solution to their financial needs. Moreover, businesses are swapping corporate plastic cards in favor of virtual prepaid cards. With this, UK Digital Company provides single-use cards and effortless subscription management that saves time and money.

#virtual card#virtual card solution provider company in london and the united kingdom#Prepaid Virtual Card Solution Provider Company#International Prepaid Card Provider

0 notes

Text

Custom Software Built on Assembly Line - Engineer AI

1) The Founders

Sachin Dev Duggal and his college mate Saurav Dhoot. Duggal, a serial entrepreneur, holds an engineering degree from Imperial College, London, and a master's degree in entrepreneurship from MIT. The duo set up their first company Nivio in 2004. They cashed out in 2012 and started SD Squared that finally evolved into Engineer.ai.

2) The Idea

"A decade ago, 'tech' was just a tag, but now, it is a must-have," says Duggal. "However, for millions of SMBs in India and elsewhere, buying expensive software or hiring in-house IT teams is not a viable option. So, we have built tech solutions to turn ideas into products at double the speed and tailored pricing."

3) How It Works

Customers can specify their concepts with the help of a drag-and-drop features menu on a human-assisted and AI-powered cloud platform called Builder. Here applications are developed in an assembly line manner to ensure speed, scale and cost efficiency. Simply put, each project is broken down into building blocks, and up to 60 per cent of the work is done by AI tools and automated processes. As most of the applications have standard features and repeat codes, these are automatically assembled in projects as per requirements and customers only pay for unique coding. The 'custom' part of the work is allocated to domain experts from a network of 50 software firms and 10,000 developers. Support and maintenance are provided for a monthly fee.

The start-up is also into cloud arbitrage and offers CloudOps, an AI-based cloud management platform for businesses to ensure smart usage and cost benefits. Plus, there is a prepaid card for buying cloud storage capacity.

Read Full Article @ https://www.businesstoday.in/magazine/the-buzz/custom-software-built-on-assembly-line/story/278877.html

4 notes

·

View notes

Text

Neteller.com Product Review

Trying to conveniently and securely gamble at online casinos or trade currencies on the foreign exchange market can be challenging. Neteller is a virtual wallet that is widely accepting at online casinos and Forex trading sites. Active gamblers, traders and shoppers continually battle with credit card fees especially when dealing with foreign countries. Neteller makes fees consistent.

About Neteller

The money transfer business opened in 1999 in Canada. The company now services customers in more than 200 countries. Currently operating from the Isle of Man, the service is listed with the United Kingdom government's Financial Conduct Authority. The FCA protects consumers and financial markets as well as promoting competition. Neteller is owned by the Paysafe Group, which is a public company. The Paysafe stock symbol is PAYS. It is traded on the London Stock Exchange.

Net+ card is part of the Neteller account. Members will receive a physical card in the mail after they deposit at least $20 in their Neteller account. There is no credit check for the Net+ card because it's not a credit card. Users can only spend what is on the card. The card balance limit is $10,000.

U.S. residents can fund their Net+ prepaid card through the following methods

MasterCard Debit

Visa Debit

MasterCard Credit

Visa Credit

The Neteller website lists Maestro and Visa Electron, but those cards are not available to U.S. residents.

Online gamblers oftentimes have trouble retrieving payouts from casinos because they won't send money to a credit card account. Neteller users have far less trouble. There is no waiting for a printed check or a transfer to a Western Union office. Most online casinos in the U.S. do not accept PayPal, but Neteller is very popular.

There is no U.S. federal law against online gambling in general. Gamblers can access U.S. casino websites such as the Golden Nugget and use Neteller for deposits and withdrawals.

There is a federal law that prohibits U.S. web sites from taking sportsbook bets, but that law involves banks. Users in the United States do not connect their bank accounts to the Neteller e-wallet service.

Certain U.S. states have laws against online gambling. U.S. gamblers can access international sportsbook casinos such as BetOnline.ag and fund their accounts using Neteller. BetOnline.ag's physical location is in Panama.

Neteller offers apps for Android and iPhone.

Many Forex trading websites seem to be accessible to most countries except the U.S. Other Forex web sites exclude all EU countries. It may be difficult for U.S. residents to find a Forex broker they can use and that accepts Neteller. Traders should be careful to use brokers that are regulated by an independent organization such as the FCA. Non-regulated brokers are notorious for charging hidden fees.

Top Features

Members in the U.S. can fund their Neteller account with major credit cards or debit cards with a MasterCard or Visa logo unlike some other e-wallet providers that require a bank account transfer.

The Net+ card carries the MasterCard logo, so cardholders can use it wherever MasterCard is accepted. These transactions do not incur a fee unless they involve foreign currency, just like a regular credit card or debit card.

For those wishing to deposit to or withdrawal from their account in a foreign currency, there is a foreign exchange fee calculator in the account menu on the website.

Neteller offers instant money transfers even to people who do not have an account. Recipients without an account will receive an email telling them to open a free account. The transfer is free if both parties use the same currency.

The Neteller VIP program has five levels. VIP status comes with fee discounts, higher ATM withdraw limits and loyalty points. There is a dedicated VIP manager to answer member questions.

VIP members have an option to open multiple accounts. Users can designate different currencies for each account to save on foreign exchange fees. Features improve as members ascend to higher VIP levels. To reach a level, members must pass a specific amount in the form of transfers to merchants per year. Transfer thresholds are as follows

Bronze – $10,000

Silver – $50,000

Gold – $100,000

Platinum – $500,000

Diamond – $2 million

The bank transfer / withdrawals feature is only for UK residents.

If Neteller members link their account to eWallet-Optimizer.com, they will quickly achieve the silver level and other benefits. Members must email a scan of their ID card to complete registration. The eWO account is free because the German company makes money through its partnership with Neteller.

Neteller offers a few affiliate programs. Websites can join the Neteller Affiliate program to earn 20 percent commissions on transfer to fees. They also can join the Net+ Card Affiliate program to earn $5 every time a new customer opens an account.

Members also can sign up to be ambassadors and receive a 20 percent revenue share from referrals on all their future transactions to merchants.

Businesses that want to offer Neteller as a payment option to their customers can fill out a form on the Neteller website to contact the sales department. Neteller even offers a joint affiliate program.

Neteller Fees

Members do not incur a fee when using Net+ prepaid card to to pay in shops, restaurants or online. There is a 3.39 percent fee for foreign currency exchanges. Making a withdrawal at an ATM will incur a fee of 1.75 percent. There is a monthly administration fee of $2.99. A paper statement costs $3. Replacing a lost card costs $5.

Members can make two withdrawals every 24 hours for a total of $500. The minimum withdrawal is $10. For U.S. residents, there is a 2.5 percent fee for deposits from credit and debit cards.

Those members who have a balance on their account but do not use Neteller for 14 months will be charged a $30 inactivity fee. The company will email the member one month before it charges the fee. To close an account, members must call.

Neteller is quite transparent about account fees on its website. This is in contrast to other e-wallet companies. PayPal Prepaid MasterCard users will need to find and download the cardholder agreement then search through the 23-page document to find the fee schedule. PayPal charges cardholders a $4.95 administrative fee every month.

Considering users have to fund their PayPal card via a bank account or their regular PayPal account, a bank debit card with a MasterCard logo would be a better deal. About the only thing more ridiculous than a PayPal debit card is a 401(k) debit card.

Neteller Security

To set up an account, members will need to enter their personal information including a full Social Security number. Other security measures include

Account ID number

Secure ID number

3 security questions

Two-step authentication

Automatic account timeout

The two-step authentication works with Android, iPhone and Blackberry devices. Users will have to install the Google authenticator and a barcode reader.

Often, gamblers and shoppers visit websites that may not appear to be completely reputable. By using a Neteller account, users avoid exposing their credit cards and bank accounts. Online gamblers sometimes visit new casino sites after being drawn in by the promise of bonuses, skip research and just type in their credit card number. Neteller accounts create an extra layer of security between personal financial information and vendors.

There are websites that curate lists of casinos with the best bonuses. Often, the promotions are temporary, so having a Neteller account can allow gamblers a convenient way to hop from casino to casino and quickly grab bonuses. Recently, the Silver Oak Casino offered a first-deposit bonus of $1,000 plus a 555 percent match bonus.

Criticism of Neteller

U.S. residents have to pay a 3.39 percent fee to buy things abroad. By comparison, American Express Blue Cash Everyday credit cardholders only pay a 2.7 percent foreign transaction fee.

In the U.S., bank transfers (ACH) are not allowed for funding a Neteller account. A bank debit card with a Visa or MasterCard logo can get around this, but there is a fee.

There seems to be only one way to withdrawl money from Neteller for U.S. residents, and that is to use the Net+ at an ATM. Thrifty consumers will want to search for fee-free ATMs in their area.

Those who do a lot of traveling may run into problems using their Neteller account while in non-serviced countries and banned countries. Banned countries include Iraq and Syria.

Customer Support

Neteller has 24/7 live customer support. Because of the company's extensive security features, customers can get locked out of their account. If this happens, they can call the support line and present identification.

There is an extensive and searchable frequently asked questions section on the website. Customers also can email member support.

Conclusion

Consumers who don't have credit cards and don't trust debit cards when shopping online at offshore vendors, Neteller can be a convenient alternative. The main markets for Neteller in the U.S. are online casinos and non-U.S. Forex trading sites. Neteller offers exceptional security for consumers and merchants.

0 notes

Text

Secrets The Car Rental Companies Don't Want You To Know

Secrets The Car Rental Companies Don't Want You To Know

Firstly, many car rental agencies in Italy leave much to be desired in terms of service, accessibility and opening hours, and some of them are to be avoided at all costs. Now in every country there are many agencies for door-to-door services for you and your luggage, which has make traveling fun and frolic. Airport car rental costs, on average, are higher than what you'll find away from the airport property. For our self-drive holiday in Hokkaido in June 2013, we used Toyota's Hokkaido website renta car beograd (in English) to book a rental car. At Centauro Rent a Car we offer a wide selection of cars available to hire at Faro which is renewed yearly. Additional features like baby seat, GPS navigation or mobile with local SIM card is also offered for additional price. All the cars come in the best condition and quality offering you the luxury just like your own vehicle. But by using , we found a prepaid-only special on a 4-day standard rental car for $12.35 a day with Advantage Rent-A-Car out of SFO.

A few years ago Spanish car hire firms introduced a full-to-empty” policy - you pay for the full tank (usually at an inflated price) when you pick up the car and can return it empty. Even if you must drive the same day your flight lands, you may not have to get the car at the airport. The rental car comes with a driver who is usually a local, and he can help you in talking with locals. The return of a vehicle prior to the nominated date does not entitle the renter to any refund on the unused portion of the originally agreed rental cost. These kind of driving companies got popular over the past few years, and in London alone there have been only few that provided this type of service and it wasn't exactly affordable for anyone. Once you have marked all the damage on the form, get the rental desk to sign it - even if it is a long walk or drive back.

Just refuel your car to the level agreed upon in the rental contract (there is a petrol station across the road from our Wellington Airport depot), and make your way back to the Omega branch in Miramar only five minutes from the terminal. FASTBREAK RETURN: Follow the airport signs for Car Rental return. Mainly clients for car leases observed within the airport as most of these will require a vehicle. But he says you must keep the car for the entirety of the rental because agencies can re-price rentals to the higher price if you return it early. Legal factor includes trust laws, copyright, patents, consumer protection, employment law, data protection, others affecting the car rental industry. The breakdown showed that the rental rate itself accounted for only $2,165 of the total—two weeks at $1,011 per week, plus $144 for one extra day.

Book online for a time and place to suit you, and you're free to enjoy your pick of our hire car fleet for the best possible price. Choose a vehicle class that suits the needs of your vacation, we have compact city cars, sedans, SUVs, minivans and passenger vans at Tampa Airport. ST (Strength Threats)- They been in the rental industry for a long time , also having a high number of loyal customers. Rent a car Plovdiv airport offer renta car beograd cars which have both automatic and manual transmission. Here is TOYOTA Rent a Car SAPPORO rental payment condition below. Contact an insurance agent to determine which cars have better rates than others. The following extras can be selected after the rental: GPS, child seats or booster seats, and additional driver. If you can prove to your insurance company that you drive fewer miles, they are likely to lower your premium.

Once you understand the terms and conditions you shall have the best experience renting out a car to meet your travel needs in Dubai or UAE. However, I was told that I could not dispute the transaction until it had actually materialized - in other words, until Hertz attempted to withdraw the money from my account, because car rental companies have special dispensation under the law - they can lawfully empty najam vozila sa vozacem your account, if it has been deemed that you have authorized them to do so. Bulgaria with its perplexing beauty offer ample opportunity to the car rental firms to grow and provide excellent services to the clients who are always traveling in and out of the country. Ioannis Kastrinakis is client representative at Cretarent, a rental company with 40 years of experience in Iraklion car rentals, Crete.

You get the best dive pickup trucks and rental cars and you get the benefit from our ZERO deductible Full Coverage Plan. Just hop on board the free shuttle bus that goes every fifteen minutes around-the-clock between the arrival hall and car rentals. If you'd like to use some discounts like Spring discount package, the period of rental must be maximum 14 days. You can even choose which booking sites to include in the results, making it easy to compare Enterprise car hire with your favourite car rental providers. You can use the Car rental Cape Town Airport services for as long as you need it and you will be presented with many cars that you can hire. We also offer sports models and convertibles which allow you to create a truly unforgettable trip as you drive through along the Alpine roads.

31 notes

·

View notes

Link

Virtual Card Solution for All-day Use

Virtual cards have been a trendsetter for the most time during the past few days. The thing is, virtual cards are not just a trend that stays overnight or two, but it's here to stay for a long time.

White Label Ewallet Company is a Virtual Card Solution Provider Company in London and the UK and a top Prepaid Virtual Card Solution Provider Company. Other than that, White Label Ewallet is an International Prepaid Virtual Card Provider in the USA, Latin America, the UK, and European countries, thus, we are known and trusted in many different countries.

Simplicity and effectiveness are the core elements of virtual cards, hence, an all-in-one solution financial solution for financial needs creates a great experience. Since there are a considerable number of competitions when it comes to virtual cards, only by becoming a one-stop-shop for your clients that you're able to maintain a niche and a steady, continuous growth in your business. Also, there's no denying that an all-in-one solution is increasing in popularity and use. That is being mentioned, our solution can help you in the creation and issuance, as well as, the management of virtual cards. With White Label Ewallet's virtual card solutions, rest assured that you can update your spending any time you want using our dashboard or our API. Moreover, as a Virtual Card Solution Provider, we offer you all you need in everyday scenarios. We provide a single-use card that you can use for individual payment and effortless subscription management to save you time and money by managing all your subscriptions in one platform.

So, you've got to know some of the advantages and benefits of virtual cards, right? Now, why should you choose us? Virtual cards represent the future of cashless payments. A lot of reasons to love virtual cards that include secure payments, fraud protection, spending control, convenient online shopping, easy payments, and transparency.

To learn more, visit our website today and invest in a company that understands your needs.

#White Label Ewallet#Virtual Card Solution Provider#White Label Ewallet Company#Virtual Card Solution Provider Company in London and the United Kingdom#Prepaid Virtual Card Solution Provider Company#International Prepaid Virtual Card Provider

0 notes

Link

UK Digital Company is a Virtual Card Solution Provider Company in London and the United Kingdom. We are also a Top Prepaid Virtual Card Solution Provider Company and an International Prepaid Card Provider in the USA, Latin America, the UK, and European countries. With us, you can now update your spending controls at any time in the dashboard or using our API. Thus, our solution can help you with the creation and issuance as well as management of virtual cards.

#virtual card#prepaid virtual card#uk digital company virtual card solution provider london united kingdom prepaid card provider usa uk latin america europe

0 notes

Text

Ecosia tree card

#Ecosia tree card registration

#Ecosia tree card android

#Ecosia tree card Offline

#Ecosia tree card free

#Ecosia tree card mac

They are not currently available in the App Store or Play Store.

#Ecosia tree card android

The TreeCard app for the Apple iPhone and Android smartphones will probably be available for download at the start of the payment option in early 2021. The wood cards will be sent from the beginning of 2021. You can find all the details and the option to secure a card on the official website. According to the company, 80 percent of the income goes into afforestation.

#Ecosia tree card Offline

This fee for the debit card payment, which is borne by offline and online stores, is then used to enable the management of the card and the planting of trees. As a credit card, it can also have pocket money ready for the children, which they can then spend or save.Įcosia makes money with the TreeCard by charging dealers and shops a fee for transactions. It is then used to pay for weekly purchases, visits to restaurants or online shopping. After receiving or registering in the app and linking to Apple Pay or Google Pay, money can then be loaded onto the debit card.

#Ecosia tree card free

The TreeCard is free for users (registration by December 1st) and free of charge. This is how the TreeCard from Ecosia works in detail By the way, you can also decide not to use a physical card, but only to use the TreeCard via the app created for this purpose and via Apple Pay, Google Pay or Samsung Pay.

#Ecosia tree card registration

For this, however, a tree is planted for each registration via the link. It's a referral link, but I don't get a commission. You can get a free and fee-free TreeCard order on the linked page. One tree can be planted for every $ 60 in sales - that's currently around 51,25 euros or 46,45 British pounds. Ecosia's debit cards are made from cherry wood with a core made from recycled plastic bottles. Around 300.000 cards can be made from one tree, so that production does not counteract the goal of afforestation. The TreeCard, which can be used as a prepaid card wherever MasterCard is also accepted, comes from the London offices of Ecosia.

#Ecosia tree card mac

TreeCard will be partnering with fintech platform Synapse, a backend technology provider for banking and financial services, to connect with users in the US while for UK customers open banking will be used for deposit services.Sir Apfelot recommendation: Clean up your Mac hard drive with CleanMyMac TreeCard - One tree for every $ 60 in sales The company will provide challenger bank services like spending alerts, in-app card management, and bill splitting. Users are able to reserve their cards now with the US likely to be the first launch location, Cox said. "We will soon be able to help fight climate change simply by buying a round of drinks in the pub or by doing the weekly shop." "I'm thrilled that Ecosia users will have another way to contribute to the fight against the climate emergency with TreeCard," said Ecosia CEO Christian Kroll. "We approached Ecosia in January about funding because of the synergies and closed the round in the summer."Įcosia has 15 million users worldwide and is run as a B corp and is obliged to put its profits into climate change initiatives rather than into executives' pockets. "I used Ecosia a lot at university and thought 'Why don't we make a fintech version of this,'" Cox told Business Insider. Other founders include Peter Francis, who recently raised $250,000 for refugee camps across Lebanon and Iraq, and James Dugan. The company was founded by 23-year-old Jamie Cox, who previously exited an existing fintech venture called Cashew which went through Y Combinator. TreeCard says it will donate 80% of its profits from interchange fees - the main revenue source for challenger banks - to deforestation initiatives and will be free to use. Partnering with Ecosia means that for every £45/$60 spent on the card, the company can plant a tree and care for it for three years through the search engine's existing network of 38 tree-planting locations worldwide. In partnership with Mastercard, TreeCard will offer a brand new wooden debit card to minimise plastic consumption, made from sustainably-produced cherry wood from the UK and recycled plastic bottles. The startup has received $1 million in seed funding from Ecosia, the search engine which has planted more than 110 million trees. That's the idea behind TreeCard, a debit card made from wood launching in 2021. For some it might be cutting down on meat or flying less, but now people can potentially help fight deforestation with their debit card. Visit Business Insider's homepage for more stories.įighting climate change comes in many forms.TreeCard is made of sustainable cherry tree wood and for every $60 spent by users, the startup will be able to plant a tree and sustain it for three years.The startup was founded by 23-year-old CEO Jamie Cox who previously exited a Y Combinator startup called Cashew.TreeCard, a new fintech startup, has raised $1 million in seed funding from tree planting search engine Ecosia.

0 notes

Text

What things should I consider before hiring a taxi service?

Nowadays, many newbie taxi services can be found in every nook and cranny of the city today and they woo passengers by offering discounted rates but don’t ensure safety. Here is the compilation of a few tips that can help you to choose a taxi service provider wisely

7 Qualities to Consider in a Taxi Service:

Check reputation: A popular taxi service is a clear sign that people trust it for the good experience it has to offer.

Private Taxi or Public Taxi: All the private cars are licensed and have insurance for the drivers and passengers as well. On request, you can ask for a baby seat too! On the other hand, for public taxis, you cannot choose your driver or the car for your transfer. Furthermore don’t risk getting one of them, with no license, no insurance, and no baby seat for your child.

Safety: Arriving safe and sound at the destination tops everyone’s priority list. Ensure that drivers are trained and the taxi is mechanically sound.

Reviews: Users always share their positive & negative reviews. Checking out a company’s reputation online and through referrals is a good idea.

Quality services: The chauffeur must be attentive, friendly, punctual, and should adhere to the traffic rules.

Clean Cab: A clean cab says a lot about the driver as it is a sign of professionalism and someone serious about the job.

Prices: Never risk your safety by making cost your priority. A perfect balance between quality service and price is a must!

Which is the best taxi service near London Heathrow Airport?

Without question, Black London Hackney carriage License cab, the most experienced drivers and honest. No, I am not a taxi driver, but I always use them when I can, my last dreadful experience with another well-known taxi company was so scary, the driver drove so recklessly that I refused to pay him and told him why he didn't even reply and we exited his cab without paying, I wish I could tell you more But I can't since I can't prove it.

Are there prepaid taxi services?

There are numerous prepaid taxi service providers in almost any area now to ease the passengers and offer a more convenient and comfortable travel experience. However, no longer all taxi organizations provide pay as you go taxis so be careful while you are seeking out one. The first-rate manner to locate one consistent with my enjoy is to look for a provider close to you. I for my part have attempted looking for an ABC Luxury Car Service and fortunately located All-Star Transportation.

Is Taxi service in demand in Gig Harbor?

Yes, Taxi services work as a lifeline of transportation in London. Taxis services are a great option in that they offer efficient answers to several challenges of the city. Taxi services provide easy and convenient transportation options to several people in the city. Most of the people in the city prefer taxi services in the city because they provide privacy and faster transportation options than public transportation means. The affordable taxi services Gig Harbor are especially preferred for airport transfers in the city. There are a large number of taxi service providers in the city. One of such taxi services which I trust the most is London Airport Cars. They offer cost-effective and comfortable London Airport Taxi.

Which are the best taxi services available in Gig Harbor?

You can happily travel by taxi and help the city taxi drivers make a living which but follow the following suggestions :

Travel only if he is of the same opinion to move via the Meter. Never agree with the driving force if he says the meter isn't running or it's much less luxurious or he simplest travels on a fixed foundation

Make sure you verify with him beforehand if he has a meter card. If no longer, then usually pay 1/2 of whatever points the meter shows. You'll become paying five-10rs greater but it really is nevertheless higher than getting fooled over a rate he would possibly quote.

Taxi drivers are known to drive the way they want, if it scares you or makes you uncomfortable being an accomplice while your driver breaks the law then prefer Ola cabs or Uber over the taxi

If you plan on traveling throughout the day then you can fix a rate and have him drive you around wherever you want. I normally pay around 600$-700$ for 4-5hours with not more than 40Kms of travel. That way he will be more inclined towards ensuring you reach everywhere on time and take the shortest route and suggest places for food or stay.

You don't have to tip the Rickshaw but even a 10$ tip can do wonders.

What are the benefits of Hiring a Taxi Services?

Hiring a taxi carrier or booking a cab for touring can be beneficial for us. If we e-book a ride, they can take the complete obligation to make us attain our destination without any danger.

Especially this time, in the COVID pandemic, traveling in a public vehicle is not safe at all. In that case, contacting a cab service provider will help you to travel safely and securely. Seatac airport car service is one of the best cab service providers who can provide various cabs as per your requirements. The cabs they provide are extremely clean and hygienic. We all need to follow these safety measures to stay safe and protected. As per my experience, I can say that Seatac airport car services are extremely good. They won't make you go through any booking cancellation and the price is very cheap. Check out their websites online by typing Seatac airport car service.

How can I start my own company as a taxi service?

Taxi business startups in the present scenario hugely attract business people to invest in the achievable marketplace online. It is really brilliant that you are also one among them planning having the same idea for an effective initiation.

You can smartly start your business by developing a taxi app like Uber available in the market.

For that, approach a better mobile app developer firstly. For i.e. Spot Rides

Go to their official website and examine their blogs, service deals, and other details.

Contact their business team for further inquiry and start your app development with the expert.

It would be so cost-effective while you choose an expert developer in the market for the taxi app development requirement.

0 notes

Text

How cashless transactions changed the public transit industry in COVID times

The COVID-19 epidemic has decimated public transportation utilization throughout the world, with ridership dropping by 90% or more in New York and London. The highly contagious coronavirus has heightened global awareness of the dangers of contacting high-contact public surfaces. Contact may be avoided in many circumstances. However, there are times when this is not the case.

Source: Statista (2010-2019)

From the graph of public transit ridership, we can see a sudden decrease in the ridership from 10.7 billion to 9.9 Billion in 2018, and ever since the trendline is showing a negative impact in ridership.

According to a survey performed by Northstar in early March 2020, about half of the Americans polled believed that taking public transit constituted a severe health risk.

With growing concern over the safety of the people and the drivers, the authorities face pressure to ban cash handling by bus drivers. Some agencies have gone as far as suspending fares to negate cash handling or fare enforcement because there aren’t any card validators at the rear doors where passengers are boarding.

When it comes to paying for public transport services, some of us are still using cash and which imposes a high risk to everyone who travels.

All of these EMV contactless initiatives focused on urban mobility are accelerating, especially because providing a touchless payment experience is now more vital than ever.

Source: McKinsey 2020 Digital payment consumer survey

Cashless payments were already predicted to expand at a 10.5 percent CAGR from 2019 to 2024, and this trend is expected to continue as contactless payments become more popular throughout the world.

More transportation agencies in the United States have emphasized the adoption of contactless payments in recent months. We've had multiple discussions on the need to be more nimble in providing these technologies more quickly.

Source: McKinsey 2020 Digital payment consumer survey

Mass transit agencies have traditionally taken cash or tokens as payment for public transportation, such as bus or subway systems. When it came to collecting fares, tokens had a number of benefits over cash.

Tokens have historically aided in the development of largely closed urban mass transit networks, in which only proprietary tokens could be used to pay for local transportation agency services.

History

Prepaid magnetic stripe cards began to replace tokens in the 1970s, and by the 1990s, several public transport agencies were experimenting with more sophisticated smart cards. Since Hong Kong pioneered the use of smart cards for public transport fare payments a decade ago, more than 100 cities across the world have adopted them.

In 1999, Washington, D.C. was the first American city to deploy a system-wide contactless smart card for mass transit. Chicago and San Francisco followed suit in 2002.

How it Works

Smart cards have integrated microchips that store data electronically. This technology allows for the tracking of payments as well as the monitoring of the ticket's validity and use. Generally, this technology is of 2 types - Contactless and contact-based.

In contact based the user should insert the card just like an ATM card we use and in contactless the card uses a short frequency radio identification chip to pay the fare when the client inserts the card within 4 inches or 10 cm of the scanner.

To get a better understanding of the current trends and issues that these new payment methods present to the transit sector in general, and the US transit market in particular, we need to understand the contactless business models in operation today.

Closed-loop and open-loop contactless payment systems are the most common. The closed-loop method makes use of a stored-value card that can only be used to pay for transportation. An open-loop system, as described in the transport sector, employs a payment mechanism that is accepted by companies other than the transit agency that issued the card.

There are two types of payment networks used by transit systems. One example is “a transportation system in which the transit operator sets up and manages its own payment system independently”. The second is a card network, which comprises “American Express, Discover, MasterCard, and Visa” in the United States.

Examples of the type of payments

Source: The Contactless Wave-A Case Study in Transit Payments

Benefits of cashless transit

Going digital has a lot of advantages in terms of cost reductions. According to a VISA poll, transportation agencies spend 3.5 times more on physical fees collection than they do on digital charges (14.5 cents a physical dollar versus 4.2 cents a digital dollar). This is due to a number of factors, including notably decreased travel associated with collecting and depositing cash, lower expenses associated with accounting mistakes, and fewer risks of cash-related criminality.

Fast and seamless payment experiences provide a compelling passenger experience, significant operational savings, and increased resource efficiency.

Passengers no longer need to queue for a paper ticket or 'top-up' smart tickets because payment is quick and uncomplicated.

The ability to quickly board the bus eliminates the need to interact with the driver, improves driver and passenger safety, and cuts dwell and run times.

Place validators so that passengers can board the bus and pay digitally using the back door (if one is available), promoting social distancing and allowing for faster boarding.

On-time performance and schedule adherence may be improved, which is the most important component in passenger happiness.

Digital payments can also help you make public transportation more appealing and easy for younger generations, while also improving your city's sustainability.

Drawbacks of a cashless transit

According to the FDIC's 2017 National Survey of Unbanked and Underbanked Americans, around 7% of the American population does not have a bank account, meaning they do not have a checking or savings account. So, the EMV cards can not be loaded with money automatically and the cards should be recharged manually through physical contact.

Despite the fact that smartphone ownership is increasing, not everyone who uses a transportation network owns a smartphone, and not everyone who possesses a smartphone understands how to book a ride and refill their smart card with money.

These gaps are due to a lack of awareness and complexity while using the systems etc.,

For Example, in Chicago, if Ventra did not also provide the opportunity to load money onto a card at a cash-accepting kiosk, up to 25% of the population would be unable to do so.

QRyde Single Electronic Payment System

QRyde is a closed-loop system that enables contactless transportation payments. The main purpose is to bridge the gap between the public transit or private transit operator that controls the transit systems & infrastructure, and the people by providing better and easy payment solutions without any system gaps.

QRyde Cloud has built-in connectivity with all forms of electronic payment systems and is designed to provide transportation systems with a totally cashless travel experience.

QR Code-based smart cards

Pic credits: Everything You Need to Know About Contactless Ticketing for Public Transport (Blog)

Recently, Macon County transit has implemented an electronic payment system for demand-responsive services in the area. With the help of this system, riders on public transportation no longer need to bring cash to pay for journeys. Riders can buy and reload a QR-code-based electronic card at MCT's office or upon boarding one of the buses.

Source: QRyde Blog

During the early pandemic days in 2019, QRyde provided the CICOA-Aging & in-home solutions by providing them with the electronic fare payment technology. The technology has allowed CICOA to manage the accounting of meals for more than 1,200 clients at 35 neighborhood meal sites and participating hospitals.

Source: Scan Card Technology Simplifies CICOA Meal Voucher System

QRyde provides technology for a complete back-office accounting system and assists agencies in providing better service to their constituents.

0 notes

Text

Wannabe ‘social bank’ Kroo swerves VCs to raise a $24.5M Series A from HNWs

Launched in February 2018, Kroo, the London-based consumer-facing fintech raised some seed funding last year for its prepaid card service which claims to offer more ‘social features’ in its drive towards offering full-blown banking services. Kroo’s pitch is that it removes friction from financial interactions with friends and family, and throws in some environmental initiatives as well, such as tree planting.

It’s now raised $24.5 million (£17.7 million) in a Series A funding round led by Rudy Karsan, a high-net-worth tech entrepreneur and founder of Karlani Capital. Kroo will use the funding in its drive towards a full banking license in early 2022.

The fund-raising is fairly unusual for a fintech startup that aspires to become a bank, given the lack of an institutional investor. However, this will give it a lot more freedom as it heads towards bank status next year.

Kroo currently offers a prepaid debit card plus an app to track personal and social finances, such as the ability to create payment groups with friends, track spending, and split and pay bills, removing the usual awkwardness around such things.

The company has also pledged to donate a percentage of profits to social causes, and launched a tree-planting referral scheme, so that every time a customer refers a friend, Kroo plants 20 trees.

Kroo CEO Andrea de Gottardo

CEO Andrea de Gottardo (pictured), who joined Kroo as Chief Risk Officer in 2018, said: “We want to build the world’s greatest social bank: a bank dedicated to its customers and to the world we live in. We’re going to do more than just work with Kroo customers to improve their relationship with money and provide them with access to fair loans. We’re going to offer them ways to actively take part in making our world a better place, like carbon offsetting and a tree-planting referral program.”

Karsan said: “The reason I’m excited about Kroo is that it has a concrete opportunity to dramatically change the way people feel about their bank, for good. Kroo has an exceptionally talented management team and a nimble tech stack that will enable the continuous delivery of banking features customers really care about.”

Speaking to me over a call, de Gottardo added: “We have raised, including the series A, over £30 million through high net worth individuals and syndicated investors. So we still haven’t done an institutional round. That was a choice.”

He elaborated: “We’re lucky enough to have Rudy Karsan, a high net worth, and an extremely supportive pool of investors that keep following on in the rounds. It was our intention get up to a Series A without any institutions, and to be free of the pressure from VC. It’s now highly likely we will go institutional for a Series B round.”

0 notes

Link

Prepaid Card Solution for Everyday Use

White Label Ewallet is a Prepaid Card Provider Company in London and the UK and also a Prepaid Card Solution Provider Company in London and the UK. Thus, we provide a value-added experience to our clients and customers that gives a whole lot of credibility and accessibility. Additionally, it's no doubt that virtual cards are the way to go these days. It has populated most of our banking and financial programs. With our prepaid card solution, you can just easily pair your virtual cards to your plastic prepaid card systems. An eWallet account issued can be used online or any store that accepts prepaid cards. This gives an understated comfort because it's easy to access and is ready to use anytime and anywhere you may be. White Label Ewallet gives you full-service management that your usual prepaid card has to offer, but more. For instance, prepaid alerts, prepaid service, card issuance services, prepaid statements, tokenizations, cross-border services, and many many more.

Furthermore, we integrate and provide consultation on various cards such as prepaid cards, visas, and others. These cards give you international acceptability and you can also choose a non-NFC card that can reside in your mobile phone for contactless payments. With your card, you have a number of advantages like available instant card issuance, load from any bank account--- domestic or international, international card program, pay at any POS terminals around the globe, and so much more. Now, if you're into the line of business, White Label Ewallet, our prepaid card offers provide a program for businesses to manage everything whatever your business size is. We simplify your options and spending capacity whether in small business, payroll, incentive, and tip network.

Easily create, test, and deploy prepaid cards on your own terms. We have an engine, compliance, payment, and sandbox that comprise dozens of great surprises to satisfy you in your financial investment and journey. Take advantage of these benefits by subscribing to our prepaid card offering by White Label Ewallet now. Stay informed and on top of your competition by visiting our website to learn more.

#White Label Ewallet#Prepaid Card Provider Company in London and the UK#Prepaid Card Solution Provider Company in London and the UK

0 notes