#virtual card solution provider company in london and the united kingdom

Explore tagged Tumblr posts

Link

Virtual Card Solution for All-day Use

Virtual cards have been a trendsetter for the most time during the past few days. The thing is, virtual cards are not just a trend that stays overnight or two, but it's here to stay for a long time.

White Label Ewallet Company is a Virtual Card Solution Provider Company in London and the UK and a top Prepaid Virtual Card Solution Provider Company. Other than that, White Label Ewallet is an International Prepaid Virtual Card Provider in the USA, Latin America, the UK, and European countries, thus, we are known and trusted in many different countries.

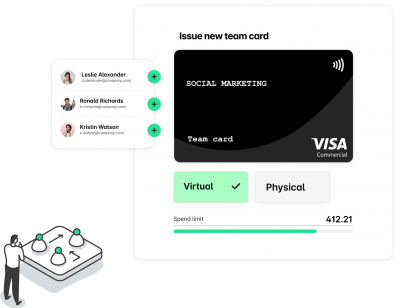

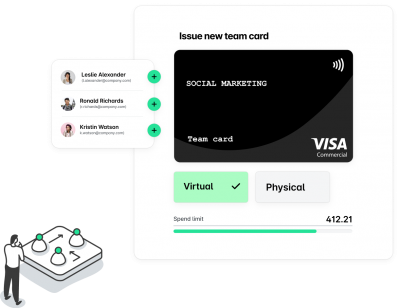

Simplicity and effectiveness are the core elements of virtual cards, hence, an all-in-one solution financial solution for financial needs creates a great experience. Since there are a considerable number of competitions when it comes to virtual cards, only by becoming a one-stop-shop for your clients that you're able to maintain a niche and a steady, continuous growth in your business. Also, there's no denying that an all-in-one solution is increasing in popularity and use. That is being mentioned, our solution can help you in the creation and issuance, as well as, the management of virtual cards. With White Label Ewallet's virtual card solutions, rest assured that you can update your spending any time you want using our dashboard or our API. Moreover, as a Virtual Card Solution Provider, we offer you all you need in everyday scenarios. We provide a single-use card that you can use for individual payment and effortless subscription management to save you time and money by managing all your subscriptions in one platform.

So, you've got to know some of the advantages and benefits of virtual cards, right? Now, why should you choose us? Virtual cards represent the future of cashless payments. A lot of reasons to love virtual cards that include secure payments, fraud protection, spending control, convenient online shopping, easy payments, and transparency.

To learn more, visit our website today and invest in a company that understands your needs.

#White Label Ewallet#Virtual Card Solution Provider#White Label Ewallet Company#Virtual Card Solution Provider Company in London and the United Kingdom#Prepaid Virtual Card Solution Provider Company#International Prepaid Virtual Card Provider

0 notes

Text

Virtual Cards for your Everyday Needs

The Future of Cashless Payment

A virtual card is an all-in-one solution if you want a cardless transaction in paying and shopping. How it works is that you can use it to make purchases online or in-app, and you can pay in-store with mobile payment services like Google Pay or Apple Pay.

UK Digital Company is a Virtual Card Solution Provider Company in London and the United Kingdom and a top Prepaid Virtual Card Solution Provider Company. Also, we are an International Prepaid Card Provider in the USA, Latin America, the UK, and European countries. Upgrade your virtual card experience and update your spending controls at any time in the dashboard or using an API.

There are many reasons why virtual cards are very useful. From convenience to better security, they’re incredibly handy as well. Also, for simplicity and effectiveness, many choose to hold their money in a company that offers an all-in-one solution to their financial needs. Moreover, businesses are swapping corporate plastic cards in favor of virtual prepaid cards. With this, UK Digital Company provides single-use cards and effortless subscription management that saves time and money.

A virtual card is an all-in-one solution if you want a cardless transaction in paying and shopping. How it works is that you can use it to make purchases online or in-app, and you can pay in-store with mobile payment services like Google Pay or Apple Pay.

UK Digital Company is a Virtual Card Solution Provider Company in London and the United Kingdom and a top Prepaid Virtual Card Solution Provider Company. Also, we are an International Prepaid Card Provider in the USA, Latin America, the UK, and European countries. Upgrade your virtual card experience and update your spending controls at any time in the dashboard or using an API.

There are many reasons why virtual cards are very useful. From convenience to better security, they’re incredibly handy as well. Also, for simplicity and effectiveness, many choose to hold their money in a company that offers an all-in-one solution to their financial needs. Moreover, businesses are swapping corporate plastic cards in favor of virtual prepaid cards. With this, UK Digital Company provides single-use cards and effortless subscription management that saves time and money.

#virtual card#virtual card solution provider company in london and the united kingdom#Prepaid Virtual Card Solution Provider Company#International Prepaid Card Provider

0 notes

Text

Role of Ebanking Solution Provider

Banking software provider in Netherlands banks with rich end- to- end capability and functionality to streamline their operations. They enable them to give individualized top- notch services to guests. Backed up with innovative robotization services and passionate expert advisers ; no bank will ever be packed out of business.

Emoneywallets of the banking system

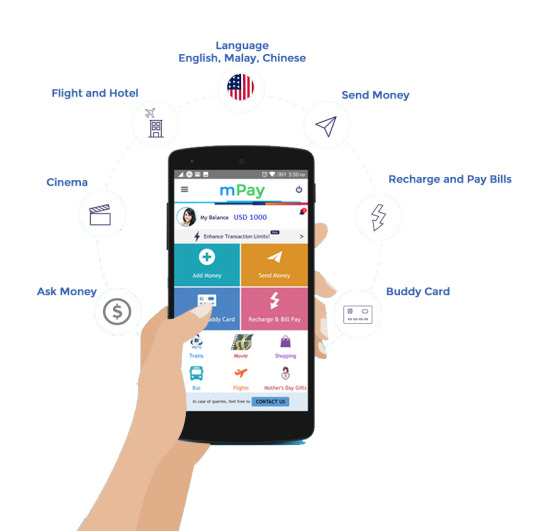

Ebanking Solution Provider in London enable fiscal institutions to manage their own finances and indeed give convenience to their guests. utmost inventors have created platforms that distribute digital and supported data across all channels. The software gives banks unlimited reach to guests moment, hereafter and indeed in the future. This helps them to understand client requirements indeed before they state them, and come up with the stylish way to meet them. Online banking results are substantially characterized by their capability to do further of the following;

1. confining Digital Fraud Best Practices

Banks face challenges to manage both impalpable and palpable means, security protocols are of great significance. While watchwords have been used for a long time to cover important information, some banks have fallen victims of attacks executed by cyber culprits who use crucial logging ways, sophisticated technology and phishing to compromise the bank’s systems.

moment, Banking software provider in Estonia are gaining fashionability as a result to guarding banking systems. So, what's banking security software? The software controls access to any system by matching the behavioural and physiological characteristics of an individual to database information.

Banking software has been designed to ameliorate functional effectiveness by barring tedious executive processes involved with maintaining access

cards, watchwords and leg figures. This technology has the capability to cover, track and report attendance situations and access to outfit.

As a supplement to conventional word access, banks that want to beef up security can incorporate a combination of biometric procedures and digital access. In fact, numerous companies use this online banking result moment.

2. The Rise In requirements Processing – Merchant Services

The failure and success of any bank depend on its client’s fiscal operation. But finance operation can be veritably grueling in moment’s terrain. Online banking results can be veritably helpful for digital banking, the leading Financial Apps Development Company in UK have worked with hundreds of guests in website design, strategy, marketing and data operation. They help banks to get good control over guests ’ finance operation.

A banking software is used by colorful banking companies to govern their income, lending, recessions, deposits, administration and much further. It helps maximize gains and ensures sustainability. Every bank should have good online banking results to face the challenge of administration services and operation of client finances.

3. Overview Of Motivation Credit

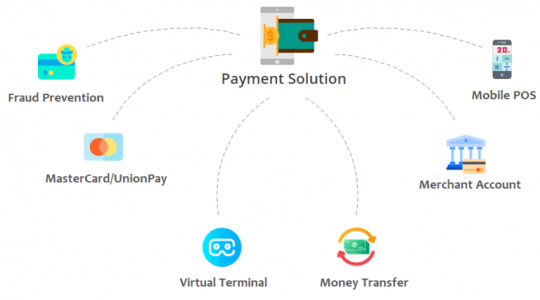

At present, electronic credits are the norm across the globe. Banks need a point that manages online banking results,e.g., credit cards, disbenefit cards,e-wallets and a range of systems. Thanks to digital banking software inventors, banks can cipher all credits fleetly and with a dropped liability of mortal- grounded crimes.

Conclusion

Banks should look for digital banking software inventors that can offer good fiscal operation at cost effective value. A good banking software can keep track of arrears, keep records streamlined, minimize paperwork, insure data integrity and security, balance several client accounts, coordinate balance wastes, income statements and indeed charges, keep all deals transparent and much further.

#Ebanking Solution Provider in London#Banking software provider in United Kingdom#Emoney solution Provider in Netherlands#Virtual Card Provider in Malta#Card program provide in France#Co Branding card provider in Spain#IBAN account provider in Manchester#IBAN account provider in Italy#White Label IBAN account in Italy#Mastercard Provider in Estonia#Money Transfer Sofware Provider in Haiti#ewallet Application Development Company in France

0 notes

Text

Airport to Airport Transfers

London has global airports located at various recommendations from the city centre. The airports are: London Heathrow, Gatwick, Luton, Stansted, London Town airport and the Southend. All airports present usage of equally public transportation and licensed individual taxis. Public transport typically involves buses, trains and the tube. Specific move instructors will also be available from these airports.heathrow to gatwick taxi These instructors run at regular intervals between the airport and a typical point in Key London.

London Heathrow is the busiest airport in the united states and is packed all through all conditions of the year. The airport is west of Main London. The Heathrow Express and Heathrow Connect are specific instructors working between the airport and the city. The airport is connected to three tube stations at Terminals Buses and private cabs may be availed external all terminal buildings. Gatwick is the second busiest airport in London. The Gatwick Express, Southern trains and First Capital Connect would be the major railway options that join one to the town from the airport. The National Express and Simple coach connect the airport to the city via roadways. Taxis may be pre booked or availed directly from the airport. Luton airport is located in Bedfordshire and is 32 miles far from Main London. First Money Connect teaches running to East midland, the National Show, Period Coach, Easy Bus and Dunstable Guided Busway join the airport to different parts of the city. Taxis could be availed directly outside the final building. Stansted airport like the majority of of its competitors is well linked by public transport. The airport is house to only one final and it offers access to certified taxis and minicabs directly. Many people utilising the London town airport go London for business purposes. These people choose chauffeured companies as it helps them achieve their destination any way you like and at the best time.

Though community transport is easily obtainable at all global airports, taxis remain the absolute most preferred method of London airport transfers. Taxis are relaxed, fast and offer a sense of luxury to all passengers. Going throughout winter continues a lot of chance as the weather can enjoy a spoilsport to your travel plans. Delays in journey timings, cancellations and absence of public transport are typical potential to happen throughout the extreme weather in winter. In such scenarios choosing a taxi in advance may help you handle the scenario better. Taxis offer free flight tracking companies and schedule your pick up automatically. For routes landing through the late hours of the night the only real solution to achieve the town properly should be to employ a taxi. Cab drivers are effectively qualified to take care of all traffic situations and can also keep you entertained throughout your travel with fascinating information.

London town airport is situated in the London borough of Newham and is the sole international airport in the United Kingdom to be found within the city. It's one of many busiest global airports in the united kingdom and serves passengers every year. With a development intend on the cards the capability of the airport is expected to grow dual over the following few years. London Heathrow airport is the most popular, advanced, largest and busiest airport in the country. It serves about people every year. Whilst the London city airport acts while the key bottom for organization tourists, Heathrow acts equally organization and discretion tourists at equal numbers.

Move between two airports is a very popular situation in the travel field. Most often the move needs to be facilitated smoothly inside a few hours. Considering the traffic conditions of the packed city and the significantly changing climate situations, airport moves show to be a difficult task. Tourists frequently question around the various opportunities and in virtually all cases they resort to aid from private registered taxis. Though community transfer may serve to be a cheaper option they can't be counted upon throughout such time limited situations.

Taxis are always fast and available 24 hours, all year round. Cab company vendors present free flight monitoring companies and 30 minutes free waiting time. In this manner you'll have exact information about your imminent flight. In the of a wait you are able to instantly examine the matter together with your airline. Cab solutions are variable and may change your get time accordingly. Once you pre guide your cab in on the web the supplier implies the quickest way to get to your location from the London City airport. They assist you to photograph the precise world and time map of one's vacation between the airports. You can call their customer support group anytime throughout the day for the queries. In case you are hesitant about achieving your location on time you may also examine the exact same along with your customer support executive and be totally reassured that everything can fall in place. Cab people look after the parking duty therefore providing you more relief.

The Heathrow airport may be the sixth busiest airport on the planet but don't concern yourself with achieving that airport on time with the umpteen solutions to reach the Heathrow airport from any part of London. The many transfers accessible to reach the Heathrow airport from any part of London include the Heathrow Show, National Express, Subterranean, Chauffeur companies and the Car employ services. The Heathrow Show could be the quickest way traveling, the National Express is probably the most convenient way, Undercover is the cheapest way, Chauffeur services is the absolute most luxurious way to travel and the private attention employ services is probably the most relaxed

1 note

·

View note

Text

The New Normal – Will Rising Demand For Innovative Services Continue After The Lockdowns Are Over?

LONDON, ENGLAND – APRIL 26: A man runs past The Tower Bridge on April 26, 2020 in London, England. … [+] Photo by Alex Pantling/Getty Images)

Getty Images

It’s four weeks into the United Kingdom’s lockdown and it seems that Britons are making a conscious effort to support small businesses operating in their areas.

According to a new report published this week by credit and debit card company, Barclaycard, around 55 percent of consumers plan to shop from local stores and markets. And it’s not just retailers who stand to benefit. Respondents also plan to use local services providers, such as plumbers and electricians rather than relying on national chains.

Not much is open at the moment, but Barclaycard’s figures do suggest that independent specialist food and liquor stores – which can continue to trade under the rules of the lockdown – have already enjoyed a 30.5 percent boost in sales.

That’s just one example of how the Covid-19 crisis is changing patterns of demand. Elsewhere, consumers and businesses are seeking out products and services they might not have considered if it were not for the epidemic. Witness a recent report published by the deVere Group suggesting that usage of fintech apps jumped 72 percent in Europe at the beginning of the crisis. Meanwhile, suppliers of video conferencing software and infrastructure have seen demand surge as home working becomes the norm. With streaming services such as Netflix also reporting rising demand, it seems like this is a good time to be in certain sectors of the digital economy.

Well perhaps. In the midst of a pandemic, everyone is forced to do things differently, whether that means using an app to access financial advice, watching a streamed movie instead of going out to the cinema, or holding the monthly board meeting via Zoom. But what about the longer term? When all this is over, will businesses and consumers simply return to their old ways of doing things or will the outbreak be a catalyst for permanent change?

Will It Last?

It’s a question many digital entrepreneurs must surely be asking themselves, particularly if they’ve seen demand for their own services rise over the last few months.

Bertie Hubbard – CEO and co-founder of MyTutor – is a case in point. Founded in 2014, MyTutor matches students with a community of tutors. Lessons delivered are online by video.

As Hubbard explains, the company has seen interest in its services rising since the onset of the crisis. “Initially, there as a period of uncertainty,” he says. “But then we witnessed a new willingness to try online learning.”

Certainly, there as a gap to be filled. Following school closures, the government quickly announced a system of assessment for those students who had been due to take key exams this year. However, more generally across the school system, pupils face a partial gap in their ongoing education, even with schools themselves providing online classes.

What we’re finding is that people are using our services to maintain engagement with education,” says Hubbard.

But will the spike in uptake last? Hubbard is optimistic that it will, believing that a Rubicon of sorts has been crossed. Traditionally, tutoring has been offered in a physical space, such as the home. Hubbard says online tutoring is more convenient and flexible, but it requires a willingness to experiment. “People often have a low tolerance for trying something new. But the crisis has accelerated adoption. We think people will see the benefits,” he says.

Proving Utility

You can hear similar arguments elsewhere – not least in the video conferencing and collaboration tools market where it’s thought that high levels of home working and online meetings will continue long after the lockdowns have ended. Again, the logic is, that concepts are being proved. You don’t have to drive 200 miles to a meeting. You can work just as efficiently from home – at least part of the time – and avoid a commute that is today hazardous but, even in better times, tedious.

Gaps In Healthcare

But the changes brought about by the pandemic may extend beyond variations on the online collaboration and video conferencing theme. The crisis is also highlighting the shortcomings of healthcare systems.

Paul Roberts is CEO of GPDQ, a healthcare business that was founded to supply a range of primary care services. “Our aim was to build a more sustainable healthcare system by delivering more care to patents out in the community,” he says.

The company started by offering private GP consultations, outside Britain’s National Health Service framework. However, it has since been commissioned by the NHS to offer consultations. As things stand, the company offers a range of services including GP visits and teleconsultations.

And as Roberts sees it, the Covid-19 crisis will drive innovation in healthcare, One possible outcome is that it will accelerate demand for remote consultations.

But he also sees a new awareness of problems that need to be solved. For instance, Covid-19 has brought to the surface shortcomings in primary care offered to care home residents in Britain, many of whom don’t get as many visits from GPs as they should. Roberts believes that a clear need to offer better primary care in this area means that companies like his – offering visits and consultations – can fill a yawning gap in provision. A gap that has never been clearer.

Just two examples but they suggest that over the long-term, solutions that come to prominence in the shadow of the Covid-19 crisis will have an opportunity to demonstrate their utility.

We’re all doing things differently now. We’re buying increasing numbers of goods online, accessing more online services, and experimenting with different modes of delivery. Maybe it will make sense to carry those changes into a more certain future. Less commuting and reduced pollution? Even greater volumes of goods delivered online? Virtual services, such as online education, coming to the fore? Healthcare efficiencies? These are questions that won’t be answered until the lockdowns end.

Source link

Tags: continue, covid-19, demand, Digital Economy, education tech, healthtech, Innovation, Innovative, Life after lockdown, lockdowns, normal, rising, Services

from WordPress https://ift.tt/3aEQ0ET via IFTTT

0 notes

Text

Cryptocurrency Card Issuer Wirex Granted E-Money License in the UK

European crypto card provider Wirex has been awarded an e-money license by the Financial Conduct Authority in the UK. The accreditation will allow the company to create e-money accounts in more than two dozen different currencies. Wirex hopes to secure similar licenses in Asia and North America.

Also read: Check Which Coins You Can Spend With Debit Cards and Why Upcoming Fuzex Chooses BCH

Wirex to Create E-Money Accounts in 25 Currencies

Wirex Limited, a major provider of cryptocurrency debit cards in Europe, has been granted an e-money license by the Financial Conduct Authority. The watchdog regulates over 56,000 companies and 125,000 approved persons in the United Kingdom.

In a tweet, Wirex says it is only the third company to have received the license so far and notes the importance of the development. It explains in a post published on its website that “gaining the FCA license will open up a much broader market,” giving the platform an opportunity to create e-money accounts in over 25 different currencies.

The fintech firm also revealed it is currently developing offerings in Asia, including Singapore and Japan, as well as in North America. It did not say, however, when exactly users in these markets will be able to take advantage of its services. According to previous reports, its contactless cryptocurrency cards were supposed to be launched in Asia during the second quarter of 2018.

We are more than proud to announce that Wirex Limited is only the third #crypto-friendly company in the world to have been granted an FCA e-money licence What does this mean for us? And more importantly, for you? https://t.co/NC2VivcG93

— Wirex (@wirexapp) August 23, 2018

The London-headquartered company became the first to reintroduce crypto debit cards in Europe after they were suspended by Visa last year. It offers both virtual and physical cards in around 30 countries from the European Economic Aria. Wirex started shipping the plastics to customers in the UK and Europe in May.

The cards initially supported bitcoin core (BTC), litecoin (LTC) and instant exchange with GBP, USD, and EUR. Last month Wirex announced the addition of ripple (XRP). The cards come with a chip and Cryptoback rewards. The virtual Visas offer deposits in a number of altcoins through a proprietary wallet. Wirex claims it has 1.8 million clients and says it has facilitated transactions worth $2 billion.

Bringing Crypto to the Mainstream

The company expects the new accreditation to boost trust in its platform and improve its reputation on the global stage. “Acquiring an FCA license has been our ambition since we started the company, so we’re thrilled to be at this point,” said Wirex co-founder Dmitry Lazarichev. “The license gives us the freedom to optimize our e-money offering, which will lead to lower costs and fees for our customers,” he detailed in a press release.

According Wirex’s other co-founder, Pavel Matveev, the company has a robust approach to security and compliance and is working closely with regulators around the world. “We’re on a path of continuous improvement and focusing on these important milestones is key to achieving our ambitious global expansion plans. The FCA e-money license is just the first step to creating a broad and versatile offering that meets the varying needs of consumers worldwide,” he said.

Matveev expressed his satisfaction with the FCA accreditation and emphasized that Wirex wants to bring cryptocurrencies into the mainstream while providing a solution for managing both crypto and fiat funds. The UK-based crypto company noted that the license has taken 9 months to acquire. It seems the long application process has been worth it as Wirex believes the internationally-recognized credentials from the British regulator will help assure customers the platform is maintaining high compliance standards.

Wirex’s FCA license is the last in a series of positive crypto developments in Great Britain. Last week, Crypto Facilities, a crypto futures exchange regulated by the same authority, announced the launch of the first bitcoin cash – dollar (BCH/USD) futures. In early August, US-based crypto exchange Coinbase revealed its UK customers will be able to buy cryptocurrencies with British pounds (GBP). According to a recently published report, the United Kingdom has what it takes to become a leader in the crypto industry.

What do you think about Wirex acquiring an e-money license in the UK? Share your thoughts on this development in the comments section below.

Images courtesy of Shutterstock, Wirex.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post Cryptocurrency Card Issuer Wirex Granted E-Money License in the UK appeared first on Bitcoin News.

READ MORE http://bit.ly/2BEsY4M

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

0 notes

Text

Cryptocurrency Card Issuer Wirex Granted E-Money License in the UK

European crypto card provider Wirex has been awarded an e-money license by the Financial Conduct Authority in the UK. The accreditation will allow the company to create e-money accounts in more than two dozen different currencies. Wirex hopes to secure similar licenses in Asia and North America.

Also read: Check Which Coins You Can Spend With Debit Cards and Why Upcoming Fuzex Chooses BCH

Wirex to Create E-Money Accounts in 25 Currencies

Wirex Limited, a major provider of cryptocurrency debit cards in Europe, has been granted an e-money license by the Financial Conduct Authority. The watchdog regulates over 56,000 companies and 125,000 approved persons in the United Kingdom.

In a tweet, Wirex says it is only the third company to have received the license so far and notes the importance of the development. It explains in a post published on its website that “gaining the FCA license will open up a much broader market,” giving the platform an opportunity to create e-money accounts in over 25 different currencies.

The fintech firm also revealed it is currently developing offerings in Asia, including Singapore and Japan, as well as in North America. It did not say, however, when exactly users in these markets will be able to take advantage of its services. According to previous reports, its contactless cryptocurrency cards were supposed to be launched in Asia during the second quarter of 2018.

We are more than proud to announce that Wirex Limited is only the third #crypto-friendly company in the world to have been granted an FCA e-money licence What does this mean for us? And more importantly, for you? https://t.co/NC2VivcG93

— Wirex (@wirexapp) August 23, 2018

The London-headquartered company became the first to reintroduce crypto debit cards in Europe after they were suspended by Visa last year. It offers both virtual and physical cards in around 30 countries from the European Economic Aria. Wirex started shipping the plastics to customers in the UK and Europe in May.

The cards initially supported bitcoin core (BTC), litecoin (LTC) and instant exchange with GBP, USD, and EUR. Last month Wirex announced the addition of ripple (XRP). The cards come with a chip and Cryptoback rewards. The virtual Visas offer deposits in a number of altcoins through a proprietary wallet. Wirex claims it has 1.8 million clients and says it has facilitated transactions worth $2 billion.

Bringing Crypto to the Mainstream

The company expects the new accreditation to boost trust in its platform and improve its reputation on the global stage. “Acquiring an FCA license has been our ambition since we started the company, so we’re thrilled to be at this point,” said Wirex co-founder Dmitry Lazarichev. “The license gives us the freedom to optimize our e-money offering, which will lead to lower costs and fees for our customers,” he detailed in a press release.

According Wirex’s other co-founder, Pavel Matveev, the company has a robust approach to security and compliance and is working closely with regulators around the world. “We’re on a path of continuous improvement and focusing on these important milestones is key to achieving our ambitious global expansion plans. The FCA e-money license is just the first step to creating a broad and versatile offering that meets the varying needs of consumers worldwide,” he said.

Matveev expressed his satisfaction with the FCA accreditation and emphasized that Wirex wants to bring cryptocurrencies into the mainstream while providing a solution for managing both crypto and fiat funds. The UK-based crypto company noted that the license has taken 9 months to acquire. It seems the long application process has been worth it as Wirex believes the internationally-recognized credentials from the British regulator will help assure customers the platform is maintaining high compliance standards.

Wirex’s FCA license is the last in a series of positive crypto developments in Great Britain. Last week, Crypto Facilities, a crypto futures exchange regulated by the same authority, announced the launch of the first bitcoin cash – dollar (BCH/USD) futures. In early August, US-based crypto exchange Coinbase revealed its UK customers will be able to buy cryptocurrencies with British pounds (GBP). According to a recently published report, the United Kingdom has what it takes to become a leader in the crypto industry.

What do you think about Wirex acquiring an e-money license in the UK? Share your thoughts on this development in the comments section below.

Images courtesy of Shutterstock, Wirex.

At Bitcoin.com there’s a bunch of free helpful services. For instance, have you seen our Tools page? You can even lookup the exchange rate for a transaction in the past. Or calculate the value of your current holdings. Or create a paper wallet. And much more.

The post Cryptocurrency Card Issuer Wirex Granted E-Money License in the UK appeared first on Bitcoin News.

Cryptocurrency Card Issuer Wirex Granted E-Money License in the UK published first on https://medium.com/@smartoptions

0 notes

Text

Hotel digital transformation can help overcome the impact of COVID-19

Digital transformation is one of the most reliable ways to enhance customer experience and drive industry growth. And a service industry like hospitality needs to focus on ways to attract and retain more customers with their improved solutions.

COVID-19 has turned many industries upside down, and one of the most affected hospitality business. While many independent hotels got shut down, on the other hand, hotel chains suspended the inauguration of their upcoming hotel projects. But now, the world has started breathing with the current pandemic.

Travel is resuming, and the hotel industry is innovating to overcome losses. When the American Hotel & Lodging Association (AHLA) introduced the Stay safe guidelines, they suggested reducing direct contact with the use of new technologies.

Digital technology has played a prominent role for the benefit of hotels in past years, and the hotel industry has evolved evidently to offer unique experiences to its customers. While many hotels are leveraging digital transformation technology to welcome guests, several hotel chains are still in the early stage of adopting and implementing technology.

So let’s go ahead and see how hotel chains can implement digital transformation in the booking process, loyalty program management, room service, etc to help hotels innovate and reduce physical touchpoints with their guests without compromising on user experience.

Internet of Things (IoT)

The installed base of the current Internet of Things connected devices is forecast to reach 21.5 billion units by 2025. Hotels can adopt IoT in many ways:

Self Check-in: Letting customers self-check-in adds value to a great first impression. It reduces wait time and gives control to the customer. With the use of a mobile app, customers can have immediate access to the guest room. Mobile can also enable guests to have access to any vital information and allow them to request and update their requirements.

Digital key card: Keyless Entry Systems can facilitate a seamless stay experience. Offering guests an electronic key card on mobile devices is one of the smartest ways of saving time and money and ensuring security. It also helps the hotel to collect data on room preferences and enhance the guest experience in the future.

Smart and personalized rooms: IoT enables the guests to manage room amenities on their mobile apps. Lighting preferences, thermostat settings, media sets, or even integrating voice recognition, everything can provide, strong control to guests. A mobile can act like a remote to also manage window shades, and the lock system offering home-like comfort and experience.

AR/VR

When mobile apps like Pokemon Go went viral, every industry tried leveraging the potential possibilities to step up customer engagement through AR and VR. A few years ago, Marriot enabled it’s guests to travel far from their hotel rooms using Marriott VR Postcards. You too can make travel more seamless for your guests.

Virtual Reality: It is the best discovery that allows guests to take a tour of the property without leaving their house. Brochures are now outdated. No traveler is up for carrying papers with them. Therefore, sharing a complete tour of hotel rooms and hotel services like spas and shopping arcade will build trust and comfort for travelers.

Augmented Reality: AR can further make guests experience things and places alive. With the use of a smartphone, a user can know his exact location, explore historical places, nearby restaurants, view hotel services, and so many things that are far beyond our imaginations. With the adoption of AR and VR, Airbnb recently took their customer experience to a whole new different level. Hotels can also advance it’s AR features by introducing an interactive map that provides guests with more useful information.

Mobile apps

Mobile is the most convenient way to communicate seamlessly with your guests. It offers a wide range of possibilities to improve the customer experience.

Booking: It is the quickest way for travelers to book hotels with a mobile app with just a tap.

Communication: With the use of a mobile app, guests can easily communicate with the staff. Moreover, the staff can respond to the guest’s requests and update them on any required information. Apps can also help to send in-app notifications and encourage guests to use hotel services.

Customer loyalty program: Mobile apps are an excellent way to reward guests for every service they use. It keeps them engaged and helps to boost a long term relationship.

Staff productivity: Hotel staff can get more organized by managing their tasks through a mobile app. Managers can stay informed about the staff capacity and their day’s job so they can smartly manage their responsibilities and advance productivity.

Artificial Intelligence (AI)

For the service industry, Artificial Intelligence (AI) development is perhaps one of the best ways to improve the customer experience.

Chatbots: Chatbots development, powered by AI, can respond to guest’s questions, saving up the staff’s time. Not just this. Hotel chatbots analyze the data received from different sources like guests’ shopping history, spa or salon usage, saved payment methods, food choices, and other actions taken by guests while interacting with a hotel app. And this data can further offer a personalized experience. From a simple task of booking to acting as a ‘digital concierge’ to guests while they are at the hotel, chatbots can make guests way too comfortable and satisfied.

Data and Analytics

Data: With digital transformations like IoT integrations, mobile applications, there is a constant flow of data. Data is crucial in the hotel business to retain guests. Many hotels collect and use customer data to determine their preferences, what they like, and what they don’t. The process of data collection can benefit hotels to come up with new features or ideas to attract more and more guests based on their behavior.

Analytics: Through analytics of the data, hotels can identify key factors that help in providing a high-quality customer experience. Analytics can also help identify the guests who are likely to return frequently and guests who are likely to spend more on upgrades and purchasing other amenities from the hotel. The hotel will be able to make smart decisions focussing and improvising their primary areas of business and continue to offer high value to its guests.

Final Words

Digital transformation is already here, and many hotels in the industry are now adopting it to upgrade their services. In the coming years, hotels that don’t adopt technology in their business might go outdated. Summarising the above points let us highlight some of the biggest advantages to hotels with the use of digital transformation.

Reduce wait time

Saves time and money

Make communication smoother and improve relationship building

Hotels get to know their customers

Improvement in business performance

A high rate of repeat customers

So, it’s time for you to make your hotel smart and lift your business post-COVID 19.

ABOUT US

WHO WE ARE?

We are a UK (London) based internet company managing projects all across the United Kingdom. With over 15 years combined experience and a team of 50+ web professionals on hand to assist with our projects your business is in the right hands

what we do?

Local Web Setup will help you build your online brand and guide you in the right direction to organically grow your business. We work remotely with our customers so no matter where you are we can still help your business. We offer Bespoke Website Design, CRM Web Applications, SEO, Social Media, Logos and a UK Support Team.

social media setup

We are a full service SEO agency . Our social media experts can help you establish your business objectives, identify your target audience, create engaging and share-worthy content and finally integrate your social media with all other aspects of your online presence.

logo Design

GET YOUR CUSTOM LOGO DESIGNED BY OUR PROFESSIONAL LOGO DESIGNERS A Logo is the eye of your branding make it stand out and match your business brand and creates a long-lasting impact on the stakeholders and general audience We will quote you depending on your business needs we wont charge you for more than you need.

Credit & Source – https://www.techaheadcorp.com/blog/hotel-digital-transformation/

0 notes

Link

All-in-one Solution

Virtual cards let you manage everything in one platform or API. The modern world, needs modern solution. White Label eWallet is a Virtual Card Solution Provider Company in London and the UK. White Label e-Wallet is also the top Prepaid Virtual Card Solution Provider Company and an International Prepaid Virtual Card Provider in the USA, Latin America, the UK, and European countries. The simplicity and straightforwardness of virtual card have made itself a practical all-in-one/one-stop-shop solution for financial needs. By becoming a one-stop-shop for your clients, it allows businesses to continuously grow and prosper. Choosing virtual card provides you with endless possibilities such as secure payments, convenient online shopping, fraud protection, spending control, transparency, and easy payments. White Label e-Wallet virtual card has got you covered from every day needs and transactions.

Learn more about the advantages of having a virtual card by visiting White Label e-Wallet website here or you can also talk to our experts.

#virtual card solution provider in london#virtual card solution provider in the united kingdom#prepaid virtual card solution provider company#international prepaid virtual card provider in the usa#international prepaid virtual card provider in latin america#international prepaid virtual card provider in the uk#international prepaid virtual card provider in european countries

0 notes

Link

UK Digital Company is a Virtual Card Solution Provider Company in London and the United Kingdom. We are also a Top Prepaid Virtual Card Solution Provider Company and an International Prepaid Card Provider in the USA, Latin America, the UK, and European countries. With us, you can now update your spending controls at any time in the dashboard or using our API. Thus, our solution can help you with the creation and issuance as well as management of virtual cards.

#virtual card#prepaid virtual card#uk digital company virtual card solution provider london united kingdom prepaid card provider usa uk latin america europe

0 notes

Text

CMSTrader Bitcoin Broker Review

New Post has been published on https://bitcoinbrokerreview.com/cmstrader-bitcoin-broker-review/

CMSTrader Bitcoin Broker Review

CMSTrader Bitcoin Broker Review

CMSTrade is a maure company with over 100 employees exiting out of marketing sales and a large group of trading experts in financial industry. they have been in the market now for some time and have earned the reputation of being a transparent and solid brokerage

Trading Bitcoin With CMStrader Bitcoin Broker.

AVAILABLE ON THE SIRIX PLATFORM –

You can trade Bitcoin with all the benefits of the INCREASINGLY popular SIRIX platform, including EA capability, back testing and industry-leading charting.

CMSTRADER SIRIX WEB TRADER

The Cmstrader Sirix Mobile Trader platform offers a complete trading solution to trade Bitcoin and other cryptocurrencies as well as regular Fiat currencies, precious metals, commodities and stock indices.

it offers also a social Trading module to allows you to trade without any experience

Benefits Sirix:

Trade in real time

Follow the purchase and sale price

Adjust the size of trading lots

Place new orders

Display simplified graphics

Copy trader ( or social trading)

no downloading required

extremely Intuitive

CMSTRADER SIRIX MOBILE TRADER PLATFORM

Follow the markets , and trade from anywhere

The Cmstrader Sirix Mobile Trader platform was designed to allow their clients to stay informed of the status of their account, at any time, from their mobile phone or tablet. like most mobile traders ir provides all the basics like the web-trader just in a more concise interface

Trading Account Options

ACCOUNT TYPE INFO Min. Deposit $500 Max. Leverage 1:200 Mini Account Yes Demo Account Yes Managed Account Yes Islamic Account Yes

Accounts Overview

Mini Silver Gold Leverage 1.200 1:200/1:300/1:400 1:200/1:300/1:400 Minimum Trade Volume 0.1 0.1 0.1 Hedging Allowed Yes Yes Yes Dealing Desk Instant No Dealing Desk Instant/No Dealing Desk CMS Credit Card No Yes Yes Daily Signals Yes Yes Yes Video Tutorials No Yes Yes Live Support 24/7 24/7 24/7 Spread Fixed Fixed Fixed Or Variable Platform Web Trader CMS Platform CMS Platform Mobile trader-Web Trader Mobile Trader-Web Trader Personal Account Manger No Yes Monitored Account Performance Analysis No No Monthly Report Daily Market Review Yes Yes Yes Financial Plan No Yes Yes Risk Management Plan No Yes Yes Rushed Withdrawal No No Yes Invite to VIP Events No Yes Yes Special Ventures No No Yes Minimum Deposit 500$ 10000$ 50000$

they Have a full service demo or practice account if you want to see their platform in action before you commit your funds. The demo account allows you to have access to the trading platforms and trade the markets virtually without suffering from any monetary risks.

CMSTrader Bitcoin Customer Service

CMStrader cares about their clients which means they offer great support at any time. They have pretty extensive FAQ section which can help you a lot.

also their site provides most of the information you might be looking for like the compliance form and complaint procedure as well as the any other company related information

However, if you have any specific issues there are two visible phone numbers, support option, live chat, Let Us Call You request as well as two other contact options.

their offices are all over the place

United Kingdom – 3 Temasek Ave,Office 7 35-37 Ludgate Hill, London, EC4M 7JN

Switzerland Case postale 236,Avenue de la Gare 39, 1001 Lausanne, Switzerland

Bahrain- 4-9 Bab Al Bahrain, Building 120, Road 1502, Manama, Kingdom of Bahrain

Australia- 18/9 Castlereagh St ,Sydney NSW 2000,Australia

Phone:

+44-2038687251

+61-290984409

+46-842002857

+34-910479735

Email:

#Bitcoin broker cmstrader#buy cmstrader bitcoin#CMSTrader bitcoin#cmstrader bitcoin Broker review#cmstrader bitcoin brokers#cmstrader bitcoin forex#cmstrader bitcoin platform#cmstrader bitcoin trading#cmstrader BTC#cmstrader BTC broker#cmstrader BTC brokers#cmstrader BTC forex#cmstrader BTC platform#cmstrader BTC trading#cmstrader buy BTC#CMSTrader review#CMSTrader reviews#cmstrader sell BTC#cmstrader trade BTC#cmstrader what is bitcoin#cmstrader what is BTC#sell cmstrader bitcoin#trade cmstrader bitcoin#Bitcoin Talk | lets talk about bitcoin and cryptocurrencies in general

0 notes

Text

New Post has been published on Atticusblog

New Post has been published on https://atticusblog.com/greater-access-to-finance-will-help-uk-businesses-grow/

Greater access to finance will help UK businesses grow

Since the United Kingdom voted to depart the EU, there were plenty of warnings that the economic system will go through as an end result.

It is too early to see how difficult Brexit will be in the end however up to now the small and medium-sized groups that pressure lots of our economy have shown resilience and, as we display these days, the UK has a real opportunity to build a new, sustainable, productive and activity-creating submit-Brexit financial model if it backs those dynamic marketers and businesses.

On Wednesday, we at the London Stock Exchange put up – in partnership with The Daily Telegraph – the modern annual edition of our “1,000 Companies to Inspire Britain” report which identifies the maximum dynamic and fastest-developing agencies throughout the United Kingdom. This document offers a platform to groups developing at extremely good charges – 70pc on common – and throughout various sectors.

Digital Marketing to Promote Businesses to Greater Heights of Success

Conventional or off-line marketing has existed given that the start of history. But, nowadays, if an enterprise is to reap success then, there is just no better opportunity to online marketing. To put it in short, online or virtual marketing is all about selling a business across the digital domain of the Internet. Some of the middle techniques for this line of advertising consist of web designing, email advertising, social media promoting, search engine optimization, content material advertising including films and others. This modern-day marketing concept is potential enough to make or smash main international brands and small-scale startup companies, at the side of everything that variety in between.greater building society internet banking.

Overlapping domains of traditional and virtual advertising and marketing

Any marketing approach through virtual media channels is virtual or on-line advertising. The area of virtual media is rapid increasing. Presently, social media channels, websites, TV, radio, cellular handsets and even nonvirtual media like billboards and transit displays are considered as digital advertising components. In other phrases, at present, traditional marketing consist of factors like P2P (man or woman to the character) advertising, elements of direct marketing that online advertising and marketing does now not cover and print advertising. Actually, the domains of off-line and on-line advertising are rapid overlapping every different. Elements of traditional advertising like online directories, URL touchdown pages, net banner advertising and marketing, QR codes and others have a robust reference to online marketing.greater alliance federal credit union.

Reasons to assign extra significance to virtual media

It is not just marketers and commercial enterprise proprietors who’re using the shift to virtual media. Even purchasers are contributing to this segment trade. The majority of virtual media channels, including various social media platforms and websites, can be more without difficulty tracked. Whereas, print media and other conventional advertising techniques are infrequently easy on that issue.

Greater NV online sign on

In contrast to conventional advertising, its on-line counterpart is a good deal price-powerful. Unlike strolling conventional advertising and marketing, one does now not want to invest a fortune in running online advertising campaigns. The present day marketing method is similarly ideal for small, medium and huge-scale companies, in addition to for startup manufacturers.

These days, purchasers do no longer flip through yellow pages or directories anymore, to locate any enterprise to avail its products or services. They Google the desired data, either the use of their handheld mobiles, laptops or computer systems. Thus, organizations rarely have any better alternative apart from relying on on-line advertising the use of the platform of virtual media.

Dependable web solutions groups

Why Pursue a Career in Finance?

In the olden days, a profession in finance did not offer something greater than a back workplace recording retaining task

A finance character becomes understood to be a record-keeping individual in an agency.

However, with the evolution of the business landscape, the role of finance has advanced and emerge as greater tough. In a cutting-edge organization, a finance character occupies a much broader role involving decision-making, making plans, controlling the financial operation of a commercial enterprise.

MSN personal finance

Within finance, you will find a diffusion of activity roles that are not confined to simply the accounting area. You can discover financial profession options in numerous industries which include economic provider, monetary planning, fund management, regulatory compliance, trading, financial control, and so forth.finance def.

These one-of-a-kind jobs require you to have completely special ability sets, and you may choose an economic career that suits your persona and skill stage.

If you’re analytically oriented, you could choose a profession in threat management, in which your job is to measure and control the chance faced by a financial institution or a monetary group. Alternatively, you may also be a part of the insurance industry as an actuary where you pass the danger of loss, and layout and fee new insurance merchandise. These jobs require quantity crunching capabilities. You also are predicted to be very diligent as a small mistake can turn into huge losses.

Bing finance app for excel 2013 download

On the alternative hand, if you are a completely outgoing character and prefer meeting people, you’ll be higher applicable for selling financial units. You may additionally want to enroll in a financial institution or an insurance business enterprise and sell their economic products to potential clients. In a financial institution, you’re anticipated to promote their financial products which include deposit money owed, credit cards, non-public loans, domestic loans, and so on. For a career in sales, most businesses offer you a thorough schooling on their products and common strategies for selling. You are anticipated to be a move-getter with the ability to shut deals quick. In maximum financial offerings establishments, you’re paid a respectable salary and a commission, that’s based totally on your sales objectives.

Can Your Company Grow?

If the economic climate seems to be shifting in a manner that would recommend now is the time to develop your operation, and making a decision to convey down the checkered flag and announce increase plans for your corporation, can your organization execute on that method?

I ask now not due to the fact your people don’t desire to grow, but whether or not they have the vital abilities to make matters manifest. Is your skills development approach been one that has often been building the talents humans want to perform their present day jobs, and does it permit for rapid deployment for increase demanding situations?grow game

First and most important, in case your education function has been reactive and strolling packages simply to hold the lighting on within the education room, you will have troubles growing. If your training branch operates without a schooling plan that models the strategy of the business enterprise, you have got a weak learning corporation with a view to preventing your ability to grow.

The Training Physical: Diagnose, Treat and Cure Your Training Department

So if the health of your schooling characteristic is unsure, begin by means of evaluating what is working and what is missing in a functional schooling department that returns at the cutting-edge funding. Do not continue to allocating any extra cash to this characteristic till you understand how it’s far running these days.grow thesaurus

Pointless Training: The Consequences of Inadequate Training Strategies

In the procedure of your assessment, pay attention to the cutting-edge training strategies and whether or not they are working on your adult newbies. And, are you education the whole thing that your employees need to carry out their jobs properly? I can not pressure enough that you need to look at what your personnel needs, now not every talent known to man that might study. During this manner, you just may also locate you are education useless capabilities simply due to the fact “we have always performed it that manner.”

In all the years I’ve been operating with agencies that need to rebuild they are getting to know functions, I even have by no means found a lack of will. People want to provide the great education, and they have the proper heart and spirit to paintings tough to make it manifest. What they regularly lack is the information of a way to provide proper education and mastering transfer.

For businesses that in reality have not had a studying feature, and spot no value, there is not an awful lot to be accomplished. Oh, certain, you can pontificate the best information of studying, however, your audience has no preference to listen to your message. I even have made it a non-public interest to hold song of these businesses, and through the years they absolutely disappear.What does grow mean.

You see there’s a primary similarity in every company

They all need humans to lead them to a characteristic. Granted, no longer each assignment is carried out by using a human in recent times, but no agency is without the human detail. It boggles my thoughts after I see an agency seeking to survive, not to mention develop, without training employees. Management in those agencies is centered simplest on the bottom line, and if someone cannot do the job they’re fired and replaced. This manner of firing and changing is going on till the proper person is observed. Sadly this leadership fashion is ordinary and is why I see the dearth of schooling in an employer as a key indicator for applicants to recall before accepting an employment provide.

0 notes

Link

Virtual Card Provider

Virtual card is a payment card that only exists in a virtual form. According to Statista, the number of users of contactless payment/tap to pay options on their mobile device in the United Kingdom in 2017 and 2020, with estimates for 2018 and 2019 and forecasts for 2021 to 2025. The number of people in the UK who use smartphones to pay contactless in stores is set to increase by nearly four million between 2020 and 2025.

White Label Ewallet is a Virtual Card Provider Company in the UK, Latin America, the USA, and European countries. The demand for all-in-one solutions is increasingly growing especially these times which, as we all can agree with, makes it ever more so convenient as well as management of virtual cards. Thus, we are a top Prepaid Virtual Card Solution Provider Company and an International Prepaid Virtual Card Provider in the UK, Latin America, the USA, and European countries. With a virtual card, there are so many advantages of virtual cards which include convenience, spending control, fraud protection, and subscription management (and many more). And for that matter, White Label Ewallet as a virtual card provider gives a better option than a credit. For that matter, we have single-use cards for individual payment, and it is much safer than sharing the company card all over the web.

Another reason is for an effortless subscription management which saves time and money by managing all your subscriptions under one platform. So, really, what’s in it for you? Well, there are a bunch of it. Virtual terminals represent the future of cashless payments. Other than the above-mentioned, it also gives you complete transparency, easier payment methods, and convenient online shopping.

Join the virtual community that experiences the best of convenience by using a virtual card. Start by visiting our website to learn more or you can talk to our experts to cut the best offers.

#white label ewallet#virtual card#virtual card provider company#prepaid virtual card solution provider company#prepaid virtual card provider#prepaid card solution

0 notes

Link

Prepaid Card Solution Provider in the UK

Physical cards are the most common cards used to pay bills, transactions, shopping, and many others. It can also be easily paired with virtual cards to plastic cards. White Label Ewallet is a Prepaid Card Solution Provider Company in London and the UK allowing you to easily access your eWallet account balance and ready-to-use card anywhere internationally. Thus, we are a Prepaid Card Provider Company in London and the UK with a lot of advantages (which we will dive into later).

White Label Ewallet can create, test, and deploy prepaid card terms such as in the case of engine which has multi-lingual and multi-currency support, real-time posting, etc. It also covers compliance, payment, and sandbox which help in reporting, dynamic security code, and widget library for developers and programmers. With White Label Ewallet, there are various of business solutions that business of all sizes can benefit from such as small businesses, incentives, payroll, and tips network that help you simplify spending and payroll.

According to fsb.org.uk, there were 5.5 million small businesses at the start of 2021in the UK. Whereas SMEs account for three fifths of the employment and around half of turnover in the UK private sector, thus, SMEs account 99.9% of the business population. Also, White Label Ewallet integrates and provides consultation on various cards like prepaid cards, visas, and others that are generally accepted worldwide. We all love a vacation away and what better way to spend is by using a prepaid card. With our card you can load and pay from any bank account, local or international bank, pay at any POS terminals around the globe, international card program, major currencies availability, and many others.

Get the best deals by visiting our website or by talking to our experts. We help you transform your prepaid card experience by making it easy card issuing and management.

#white label ewallet#prepaid card#prepaid card solution provider company#prepaid card provider#prepaid card provider company#prepaid card soluton

0 notes

Link

Prepaid Card Solution for Everyday Use

White Label Ewallet is a Prepaid Card Provider Company in London and the UK and also a Prepaid Card Solution Provider Company in London and the UK. Thus, we provide a value-added experience to our clients and customers that gives a whole lot of credibility and accessibility. Additionally, it's no doubt that virtual cards are the way to go these days. It has populated most of our banking and financial programs. With our prepaid card solution, you can just easily pair your virtual cards to your plastic prepaid card systems. An eWallet account issued can be used online or any store that accepts prepaid cards. This gives an understated comfort because it's easy to access and is ready to use anytime and anywhere you may be. White Label Ewallet gives you full-service management that your usual prepaid card has to offer, but more. For instance, prepaid alerts, prepaid service, card issuance services, prepaid statements, tokenizations, cross-border services, and many many more.

Furthermore, we integrate and provide consultation on various cards such as prepaid cards, visas, and others. These cards give you international acceptability and you can also choose a non-NFC card that can reside in your mobile phone for contactless payments. With your card, you have a number of advantages like available instant card issuance, load from any bank account--- domestic or international, international card program, pay at any POS terminals around the globe, and so much more. Now, if you're into the line of business, White Label Ewallet, our prepaid card offers provide a program for businesses to manage everything whatever your business size is. We simplify your options and spending capacity whether in small business, payroll, incentive, and tip network.

Easily create, test, and deploy prepaid cards on your own terms. We have an engine, compliance, payment, and sandbox that comprise dozens of great surprises to satisfy you in your financial investment and journey. Take advantage of these benefits by subscribing to our prepaid card offering by White Label Ewallet now. Stay informed and on top of your competition by visiting our website to learn more.

#White Label Ewallet#Prepaid Card Provider Company in London and the UK#Prepaid Card Solution Provider Company in London and the UK

0 notes

Link

Accept Cards Globally

Prepaid cards are convenient way to pay in-store or online. It’s also fascinatingly easy to pair it with a virtual card. If you are looking for an easy to use and globally accepted prepaid cards, look no further because White Label e-Wallet provides a physical prepaid card solution making us a Prepaid Card Provider Company in London and the UK. Our prepaid card allows you to check your e-Wallet balance whenever or wherever you might be. Ultimately, you can be sure that your transactions are safe with us because we are a credible and trusted White Label e-Wallet Prepaid Card Solution Provider in London and the UK that gives you great list of features and benefits. Additionally, partnering with us gives you a perk because we integrate and provide consultation on various cards such as prepaid cards, visa, and others. With White Label e-Wallet, rest assured that we got you and your business. We make it easy for you to create, test, and deploy the solution the you need.

Furthermore, visit our website by visiting us through this link or you can also talk to our expert by clicking this link.

#prepaidcardsolution#prepaidcardsolutionproviderinlondon#prepaid card solution provider in the UK#prepaid card provider company in london#prepaid card provider company in the UK

0 notes