#White Label Ewallet

Explore tagged Tumblr posts

Link

White Label Software Development Company

White label branding refers to a product manufacturing and marketing practice which have been made by a company and re-branded by another company to appear that product as their own product. Thus, white label software allows you to build your own name with fewer resources.

White Label Ewallet is a White Label Software Development Company in London, UK that is re-brandable and re-sellable items that are produced by one company to be rebranded and resold to another company. Our white label software solutions that provide bespoke back-office fleet management services making us a White Label Solution Company in London, UK, and a White Label Software Solutions Agency. White label software offers a lot of advantages such as an option to improvise on the software required from your white label software suppliers, it gives the sense of ownership, and it tremendously saves time.

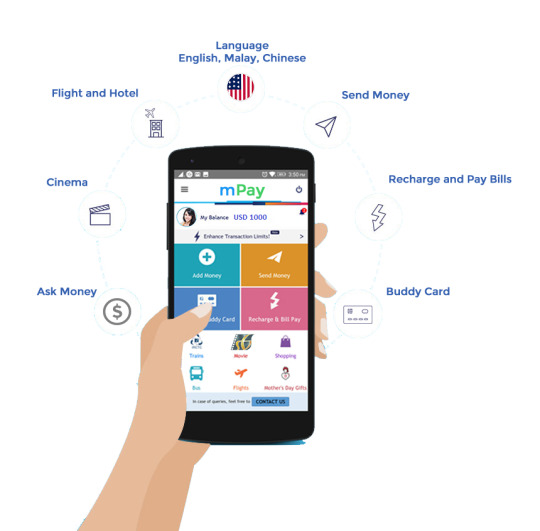

Furthermore, our white label has a mobile banking feature that include multi-factor authentication, communication engine, financial services, multi-currency, inbuilt loyalty management solution, card issuance, voucher management, NFC & QR payments. Our multiple payment approach protects your online purchases, financial services, safe & secure worldwide. For this matter, our cards are generally accepted worldwide allowing you to send and receive money, deposit money locally or internationally safely and instantly with low competitive transaction fees. Our cards also accept payments on your websites instantly, easy implementation on your website, SSL encryption, multi-currency payments account, all common payouts, and others. White Label Ewallet’s white label software provides bespoke back-office management services that is ready-made and ready-to-go.

White label software providers offer a quick and impressive way to get your name in front of your potential clients. Convenience is the king of customer service that impresses your customers because everybody loves a one-stop shop. There are still way too many benefits of white label software that you must learn by visiting our website today or talking to our experts to get the best deals.

#white label ewallet#white label software development company#white label solution company#white label software solutions agency#white label software#white label solution

0 notes

Text

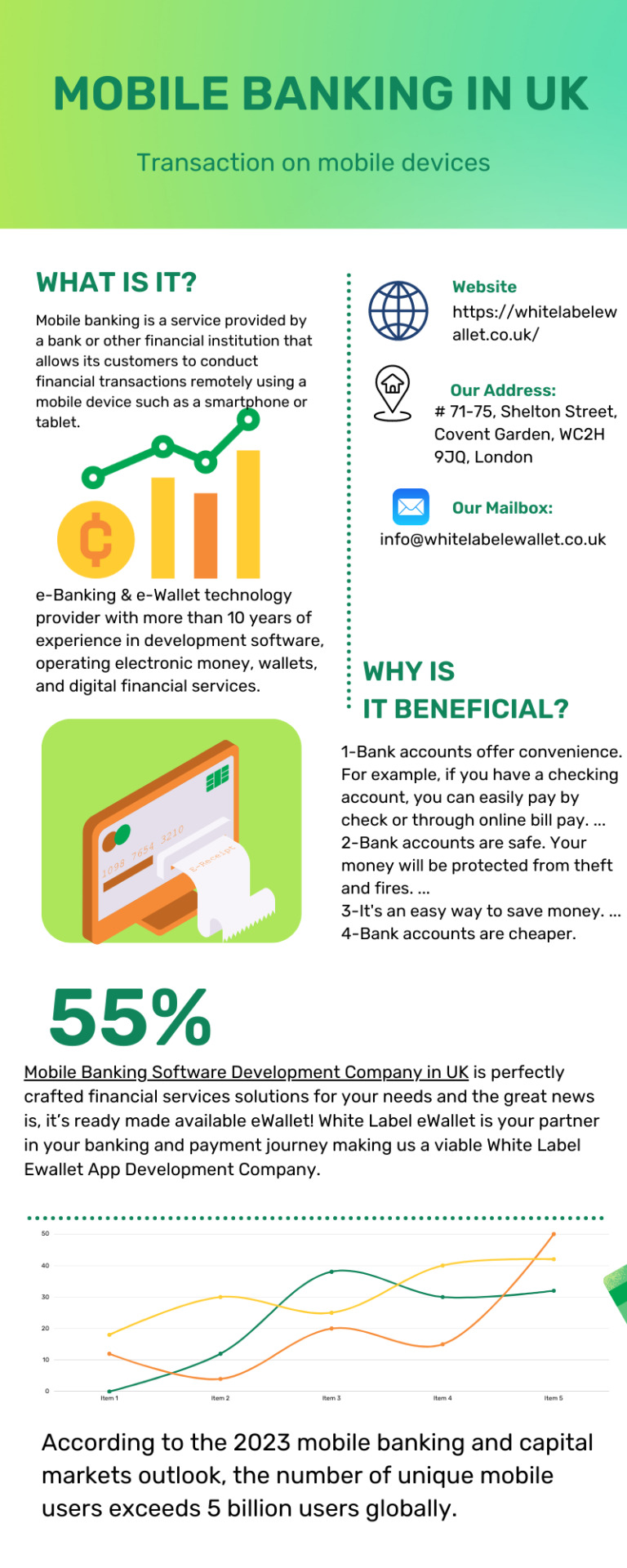

Mobile Banking Software Development Company in UK

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price.

#Ewallet Payment System Solution in London#Ewallet App Development Company#ewallet app development company in uk#ewallet software development company#white label ewallet app development company#ewallet app development company#white label ewallet app development company in uk

0 notes

Text

How can mobile banking apps help serve Fintech?

The Finance Industry and banking sector are among the top most heirs of digitalisation. The preface of Banking software provider in Lithuania has added further inflexibility and availability to banking. The ultramodern mobile banking system has changed the hand of Fintech.

It has revolutionised the operation of the finance assiduity by reducing overhead costs and enhancing client experience. Then are some of the points that state how can mobile banking apps help serve Fintech

Mobile Banking Apps give flawless relations And amicable Deals

Mobile banking services have brought a significant shift in the way individualities can handle their finances. It has handed great ease and convenience by allowing easy access from anywhere. Mobile banking software loaded with stoner-friendly features facilitates amicable finance deals. Whether it's allocating finance in finances, pullout of finances, or transfer of plutocrat, any type of finance sale fleetly. Also, the increase in operation of Money Transfer Software Provider in Netherlands deals has shown a growth of around 64.

Mobile Banking Apps Will Help Target Your followership And Ameliorate Services Banking and Finance is a customer- driven assiduity. Experience and commerce play an essential part. fiscal institutions and banks constantly are contending with each other and using client service as a great differentiator.

The mobile banking system has opened doors of openings for these institutions. It has eased better connections with guests. The finance institutions can efficiently reach the target followership and communicate about finance products.

likewise, mobile banking services play an essential part in gathering client perceptivity for service enhancement.The data attained from mobile banking apps give precious information to offer customised services to the target followership.

structure Mobile Banking Apps Can Reduce Cost And Ameliorate perimeters Fiscal institutions are utilising the power of the mobile banking system to convert branch guests to mobile banking guests.

Thereby reducing their cost and perfecting perimeters. The finance institution sees guests saving moment as a prospect for outspoken investment in the future.

Mobile Banking Apps Present New openings in the Lending Space

Mobile banking apps give believable information and client data to fiscal institutions. It's upgrading the functionality of fiscal institutions.The integration of Fintech has opened new avenues to detect new implicit guests. figure Mobile Banking Apps To Serve Underbanked Populations

A significant quantum of the underbanked population still doesn't comprehend the banking system. The preface of mobile banking services and systems is bridging this gap. guests are more likely to use their mobile phones to carry out fiscal deals.

Mobile banking apps are stimulating the growth of fintech by enabling them to explore untapped areas.

THE BOTTOM LINE

Without a doubt, Mobile banking services are the future of finance. They are changing the overall functioning and operations of the finance sector.

Its impact on the customers and target audience is humungous. Hence, modern banks must unfold the fintech trends and incorporate mobile banking services strategically to boost their growth and development.

#Ebanking Solution Provider in London#Banking software provider in Malta#Emoney solution Provider in Malta#Virtual Card Provider in Malta#Card program provide in Birmingham#Co Branding card provider in Netherlands#White Label IBAN account in Italy#Mastercard Provider in Netherlands#Money Transfer Sofware Provider in Malta#ewallet Application Development Company in Estonia

0 notes

Text

Features of Innovative Mobile Banking Software Company That Merit Your Prominence

Mobile banking apps are revolutionising the planet of banking and finance. ATMs are being replaced by the convenience of mobile banking apps, where you'll check your accounts, make deposits and withdrawals, and transfer money to friends or family at any time, among other things.

If you’re curious about learning more about how to find a superior mobile app for your needs, please read on! We’ve listed a number of our favourite features below that you should be on the lookout for to make an informed decision.

Why are mobile banking applications becoming more popular?

While traditional banking services are available to individuals since the 1930s and early 40s, it wasn’t until the late 1980s that the primary ATM machines were installed at the doors of businesses and homes. Nowadays, ATM machines are getting increasingly rare as smartphones and tablet devices are taking over as mobile banking options for millions of people.

This shift stems from security concerns, like identity theft and fraud. Nowadays, there are more smartphone users than desktop users, so it only is sensible that mobile banking apps would become more popular instead of bank ATMs. additionally , social responsibility is another issue at play here.

The Most Important Characteristics of a Good Mobile Banking Apps

You should make your Mobile Banking Apps Development Company in USA purchase decision based on various features. We’ve listed a number of the most important ones for you below:

1. Security

Security is usually going to be an essential factor, especially when it involves banking apps. this is often one of the main reasons Mobile Banking Software Company in USA have become so popular – they’re more secure than traditional bank ATMs. Data transmitted is encrypted and secure. Access to your account through a mobile app requires two-factor authentication, a bit like your desktop computer does with its browser version of your bank’s website.

2. Functionality

It’s essential that a mobile banking app can provide you with all of the features you would like and nothing more. for instance , if you’re employing a mobile banking app for basic checking and transferring funds. Then, you want to be ato view the same within no time quickly time. The features should be sufficient to urge the job done without spending more money.

3. Design and UI

The design and UI of the mobile app should be as par with the industry standards. the pictures and graphics on an excellent mobile app are optimised, and there's no loading time. Moreover, the interface of a sound mobile app is carefully planned by integrating the simplest of technology and including vital ergonomic features. The interface must be well-planned, and therefore the app must be easy to navigate.

How work Online mobile banking for You

You can learn more about features such as security, functionality, design and caching by reading reviews from users who have Used different mobile banking apps. you'll also find some in the App Store or Google Play Store that are rated highly. additionally to the above, you ought to also make sure that your mobile banking app is easy to use and even offers a user guide if you need help navigating it. confine mind that mobile banking apps are still in their early days, so there could also be bugs or other issues that you might have to deal with. If you’re employing a new version of your mobile banking app, it'd take some time to get used to it and figure out how to use all the features.

Online Banking Timeline

The 21st century brought an influx of latest financial institutions and new technologies. Online banking technology provided more features than were ever possible in previous decades, giving more people access to more opportunities to manage their money online.

Tips and Advice on Mobile Banking Security

When it involves banking, security is usually going to be a significant concern. But when you’re making deposits and withdrawals, there are ways you'll stay safe while banking online.

1. Basic Online Banking Security

We recommend getting one immediately if you don’t have already got a high-end credit card with online banking. With these sorts of credit cards, you'll enjoy all the same benefits that traditional credit cards offer and increased security for your online banking information. you'll also be protected if someone steals your data from a website and uses your bank accounts for fraudulent purchases or money transfers.

2. Password Security

You should always use a strong password when online banking or using any other type of secure application. the foremost robust passwords are at least eight characters long and contain letters, numbers and symbols. However, it's also essential to have a different password to protect your account in case someone gets hold of your login information.

3. Two-factor authentication

Two-factor authentication may be a secure authentication process that uses two different authentication factors to identify you. First, you'll enter your username and password. Still, you'll also get an additional one-time code sent to an email address or phone number that only has access to the applications you have authenticated.

4. Pop-up blockers

Pop-up ads can hamper your computer and make it challenging to navigate the websites you are visiting. If a pop-up opens once you are banking or making e of financial transaction, click on the “X” to urge rid of it. this may ensure that your information isn’t jeopardised at any time.

5. founded alerts

If you’re using online banking, it’s essential to line up notifications that will let you know if someone tries to transfer money out of one of your accounts or if some one has tried to log into one of your accounts without permission.

Conclusion

Technology has done wonders for the banking system , making it easier to deposit a check, pay bills or transfer money. Mobile banking may be a great way to stay in touch with your finances when you’re on the go and ensure that your information is safe from fraud by using secure apps. If you’re trying to find a way to simplify your banking experience and get the most out of all the available features, then mobile banking might be exactly what you’ve been looking for.

#Financial Mobile Apps Development Company in USA#Ewallet Mobile Apps Development Company in USA#White Label Solution Company in USA#Fintech Solution Company in Europe

0 notes

Photo

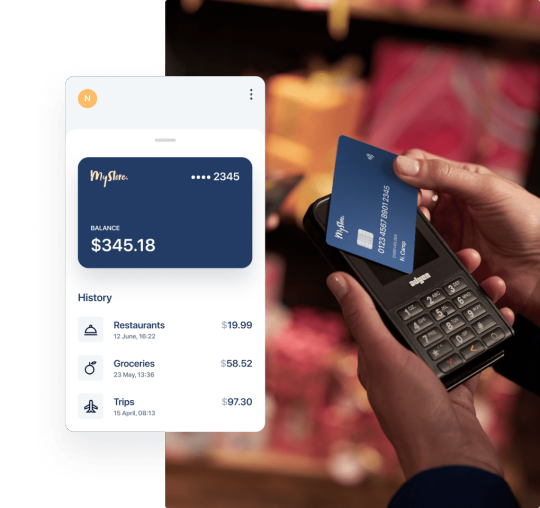

You can send and receive money on mobile devices by using R Pay Wallet. After we add your branding, your users will be able to use it right away.

Visit: https://bit.ly/digital-wallet-system

0 notes

Link

Paving the Way for a Cashless Society

Ewalletscard is leading the way for a cashless society. We are also the best e-wallet and payment software provider company in various countries like Asia, the EU, Latin America, and the Caribbean regions. Our global presence extends to the USA, the UK, France, Estonia, Singapore, Thailand, and Myanmar. As a leading company in e-wallets, we make reliable services and solutions that fit your requirements. On top of other credibility adhered to Ewalletscard, we are also an Ewallet App Development Company and a White Label Ewallet App Development Company in the USA.

Furthermore, we currently have 80+ active clients, over 55 projects done, and more than 23 experts, all in 6 years of purposefully making every business more successful. Our paving the way for a cashless society stems from the mission to focus on and understand your requirements to ensure that your needs fit your unique business concept and that will bring growth and profit without stressing too much. As an e-wallet company, we always make sure that our vision for a cashless society goes beyond the border making every possibility for higher quality service and a good foundation of comfort for everyone. With that being said, it is important to know the things that can drastically improve your life when you switch to us, Ewalletscard. First and foremost, we all want convenience and security when it comes to our transactions. Other than that, as we endeavor to more practical choices such as e-wallets, we usually bear in mind the rewards and points that we can earn when we shop and to be able to track every transaction that we made. Needless to say, these are all the things that we want in a cashless society. The good news here is that Ewalletscard gives you these but with so much more value-added unto it.

Leap into the world of e-wallets today to experience a better way of looking at finances. Learn more by visiting our website.

#ewalletscard#ewallet app development company#white label ewallet app development company in the usa#payment software#ewallet#payment software provider company

0 notes

Text

White Label Ewallet Software Development Company in USA

Top White Label Ewallet Software Development Company in USA. Best White label ewallet Software solution Company in USA.

#White Label Ewallet Solution Company in USA#White Label Ewallet Software Company#White Label Ewallet Software Company in USA#White Label Ewallet Software Development Company#White Label Ewallet Solution in USA

0 notes

Photo

#Digital wallet platform#Mobile Wallet Platform#ewallet script#ewallet platform php#ewallet app source code#mobile wallet software#digital wallet solution#digital wallet software#white label mobile wallet platform

0 notes

Photo

#Digital wallet platform#Mobile Wallet Platform#Digital wallet software#Mobile wallet software#ewallet platform php#ewallet script#ewallet app source code#white label mobile wallet platform#digital wallet solution

0 notes

Photo

#white label mobile wallet platform#Mobile Wallet Platform#Digital wallet platform#digital wallet software#mobile wallet software#ewallet script#ewallet platform php#ewallet app source code

0 notes

Photo

#Digital wallet platform#Digital wallet Software#Mobile Wallet Platform#mobile wallet software#white label mobie wallet platform#ewallet app source code#ewallet platform php#ewallet script#ewallet app development

0 notes

Link

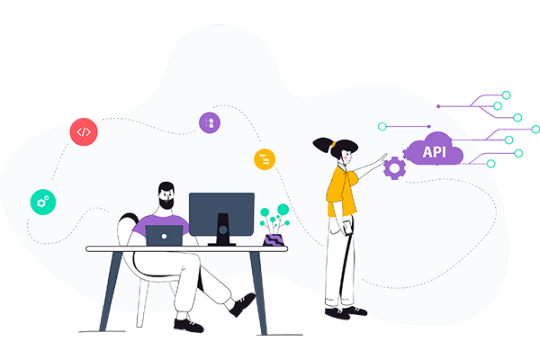

Payment API Provider Company

API stands for Application Payment Interference that enables eCommerce businesses to seamlessly manage payments. It optimizes the payment process for both businesses and shoppers to make transactions faster, easier, and secure. As set out in the Payment Services Regulations in 2017, an API license enables you to offer services such as remittance, payment processing, and payment accounts.

White Label Ewallet open banking API enables the creation of digital ecosystems that clients can enjoy a full range of services from single digital location. Thus, we are a Payment API Solution Company in London, UK, and a leading API Solution Provider Agency. Our company provides real solutions to problems in terms of an easier payment option making us an Online Payment API Services Provider Company in the UK. Additionally, the latest data from the UK’s Open Banking Implementation Entity (OBIE), the body charged with overseeing the rollout of the technology shows that the number of API calls increased from 66.8 million in 2018 to almost 5.1 billion in 2021 while the number of open banking payments made has grown from 320, 000 in 2018 to over 3.4 million in 2020. Hence, it is sometimes easier to solve the customers problems by being direct and straightforward to drastically improve your business’ perception and image. Our eMoney Wallet APIs will surely help you create the perfect customer journey. Furthermore, our White Label API ecosystems include customers, QR pay, checkout financing, auto loan, accounts, and mortgages. We simplify and customize your services without having to fill out endless forms.

White Label Ewallet simplifies onboarding processes for your new customers and identifying and meeting all their payment, financing, and insurance needs. By choosing White Label Ewallet, we make sure that we will help you achieve an easier payment solution. Check our website to learn more or talk to our expert to get the best deals.

#white label ewallet#api#payment api solution company#online payment api services provider company#online banking#white label api

0 notes

Text

Ewallet Payment System Solution in London

Best ewallet payment system development company in UK, London (United Kingdom). Wallet solution and services provider for digital and mobile online payments

#Ewallet Payment System Solution in London#Ewallet App Development Company in UK#White Label Ewallet App Development Company#Ewallet Software Development Company

0 notes

Text

Money Transfer Software Provider in United Kingdom

#Money Transfer Software Provider in United Kingdom#ewallet Application Development Company in France#Money Transfer Sofware Provider in Haiti#Mastercard Provider in Berlin#Mastercard Provider in Estonia#White Label IBAN account in Berlin#IBAN account provider in Haiti#Co Branding card provider in Italy#Card program provide in Paris#Virtual Card Provider in Birmingham#Emoney solution Provider in United Kingdom#Banking Transfer Provider solution in Haiti#Ebanking Solution Provider in Paris

0 notes

Text

#Ewallet App Development Company#Ewallet App Development Company in USA#White Label Ewallet App Development Company#White Label Ewallet App Development Company in USA#Ewallet Software Development Company

1 note

·

View note

Link

A New Way to Pay

Ewallets are one of the best and the most innovative way to pay for your family, friends, and colleagues. It's a new way to look at finances for payment platforms for online businesses. Thus, Ewalletscard provides an e-wallet system that is perfect for businesses that want to have a bank-like system. Ewalletscard stands a good name in the industry because we are a White Label Ewallet Software Development Company and an Ewallet App Development Company. Aside from that, Ewalletscard is an Ewallet Payment System Solution in Washington and the USA. Our superior banking software offers a lot of features that businesses are widely using such as mini-bank for financial institutions, schools, supermarkets, and taxes. The features include an easy onboarding process, authentication and validation, P2P transfers, domestic and international transfers, and others. Furthermore, it's also important to know the key features of digital e-wallets such as bank account integration, receiving payments, adding money, safe and secure, QR pay, and various others.

Using an e-wallet, you can be sure that you have everything you need is right under your fingertips. This means that it covers all business sizes. Whether you are a well-established business, start-up, small-medium enterprise, or enterprise, we offer payment solutions that meet your business needs. The benefits of the e-wallet platform are limitless. The benefits include but are not limited to the following: customer onboarding, mobile/web wallet, tariffs and fees, currencies and rates, card program, AML/KYC, and others. With all the benefits from Ewalletscard, there is no denying that with us, you can get the best of an e-wallet experience without too must stress. It also allows you a convenient and secure way to pay bills and fund your wallet for your next transaction.

Furthermore, an e-wallet is already a practical choice to do everything on your phone in the comfort of your home. But isn't it so much better to have more reasons why you need to choose Ewalletscard as your e-wallet partner? Ewalletscard provides you the freedom to make secure online payments worldwide without compromising your security and privacy. Moreover, Ewalletscard offers a clear foundation when it comes to transparency in payment, hassle-free payments, multi-currency, and professional assistance.

Visit our website today to learn more.

#ewalletscard#white label ewallet software development company#ewallet app development company#ewallet payment system solution

0 notes