#Ewallet Payment System Solution in London

Explore tagged Tumblr posts

Text

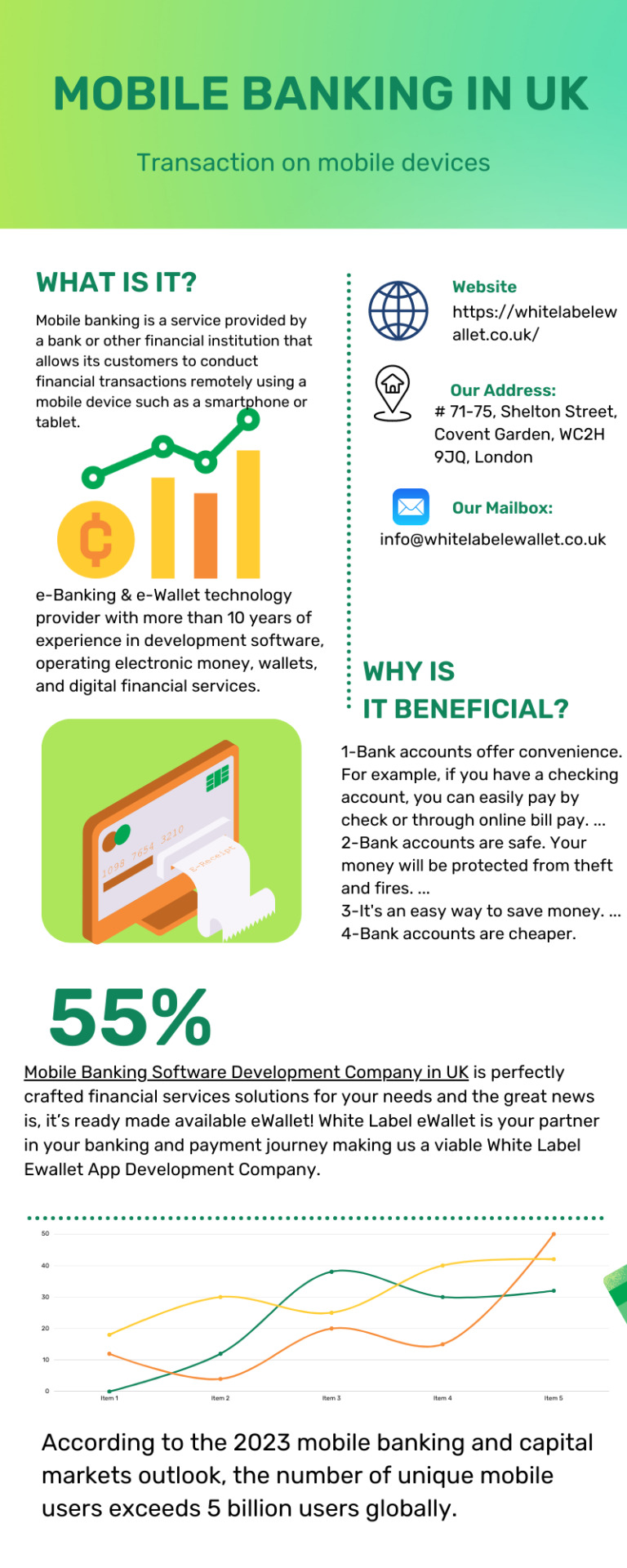

Mobile Banking Software Development Company in UK

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price.

#Ewallet Payment System Solution in London#Ewallet App Development Company#ewallet app development company in uk#ewallet software development company#white label ewallet app development company#ewallet app development company#white label ewallet app development company in uk

0 notes

Link

#Ewallet Payment System Solution Company in London#Ewallet Payment System Solution Company in Hong Kong#Ewallet Payment System Solution Company

0 notes

Link

Best Ewallet software development company in London UK. Top Ewallet System Solution in United Kingdom for mobile wallets, digital wallets online Payments. Hire Ewallet Software Developer.

#Best Ewallet Software Development Company in UK#Best Ewallet Software Development Company in London#Ewallet Software Development Company in UK#Ewallet Software Development Company in London#Ewallet Software Company in UK#Ewallet Software Company in London

1 note

·

View note

Link

Simple and Easy Ewallet System

The advancement of technology has paved way to a modern way of living in the society. Thus, the cashless society has been a single, most-used technology in this generation and the future to come. White Label Ewallet as an Ewallet Apps Development Company in the UK provides a new and fresh perspective to see finances and as a paying method. Now more than ever, we can send money to and from overseas families and friends. Pay debts and bills in the comfort of your living room and buy items online without the hassle of the crowds. The best part is that these are just few things that eWallets benefit us from. With our eWallet, you can just link your bank account and do all the things you usually do---only that it’s easier and simpler. Furthermore, White Label Ewallet is the best Ewallet Payment System Solution Company in the UK and London. We are also the top eWallet Payment System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool that offers an open platform technology for contactless payments and mobile payments with unique security features through tokenization.

There are so many advantages and reasons why you should partner with us. We have a partner program that offers competitive advantages through a combination of industry expertise, cutting-edge technology, and personalized approach. With White Label Ewallet eWallet system, you can have everything in the palm of your hands. You can send and receive money securely, deposit money locally and pay worldwide, accept payments through your website, secure data transfer, low transaction fee, multi-currency payment accounts, and easy implementation on your website. We want a future-ready payment gateway that’s why we have build a future-grade technology built for your experience.

Join thousands of eWallet users around the world and experience a safe and secure digital payment journey with guaranteed user-satisfaction. Transform your eWallet with us by visiting our website today or talking to our expert to get the best deals.

#white label ewallet#ewallet apps development company#ewallet payment system#ewallet payment system solution company#white label ewallet system

0 notes

Link

Contactless payments are the new way to pay your friends, families, and even business associates. With our e-Wallet, payments are made easy and secure, thus, payment has never been this easy!

As an e-Wallet Apps Development Company in the UK, we provide contactless payments as a new way to look at finances. Consequently, we have an open platform technology for contactless payments with a unique security features called tokenization. Furthermore, we are named as the best e-Wallet Software Development Company in London and the United Kingdom and the top e-Wallet System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool for mobile wallets and digital wallets online payments, respectively.

#e-wallet#ukdigitalcompany ewalletapps ewalletdevelopmentcompany unitedkingdom ewalletsystemsolution mobilewallets onlinepayments tokenization

0 notes

Photo

Best Ewallet software development company in London UK. Top Ewallet System Solution in United Kingdom for mobile wallets, digital wallets online Payments. Hire Ewallet Software Developer.

0 notes

Text

The Best Technology for Your Ecommerce Business

In a competitive industry like ecommerce, you always need to make sure that you are using the best technology to make your business as competitive as possible. In ecommerce, there are many excellent types of technology that can help you succeed in many different ways, whether this is with the running of the store, improving the customer experience, or improving your business’s reputation. So, what are a few of the best types of technology to use for your online store? Here are a few of the best types that you should be considering in 2021.

Product Videos

Product videos are becoming increasingly common in ecommerce, particularly when it comes to fashion. Product videos give the visitor a chance to see the product “in action” and will give them a better idea of what to expect. The biggest drawback in online shopping is not seeing and holding the product in real life, so you need to do all that you can to give visitors an idea of what your products are like, and videos are one of the best ways to do this.

Mobile Commerce

These days, people are shopping on their smartphones and tablets instead of on desktop computers and laptops, which means that your store needs to be mobile-friendly. This means that the website needs to load properly, navigation is easy to use on a small screen, and that all of the buttons and links are tap-friendly so that people can easily navigate your store on a smartphone.

WooCommerce Development

WooCommerce is a superb open-source platform to build your store, but if you want to impress and convert visitors, it is important to use a top WooCommerce agency London. The top agencies will know how to build a store that will convert and make monthly improvements so that you are always progressing, improving, and developing your store to take your business to new heights.

Fast, Easy & Secure Payments

If you have a high percentage of cart abandonment, then you might find that your payment system is the problem. Slow checkouts will drive customers away, so it is worth looking into one-click checkouts, eWallet payments, and saving details for faster future purchases. Security is also an issue and one that needs to be taken seriously, so you could also utilize blockchain, multi-factor authentication, and biometrics to improve security and help consumers to shop with confidence.

Chatbots

As an ecommerce business, you need to respond to questions that the consumer has about your products quickly; otherwise, you will lose out to the competition. This is time-consuming and not always possible (particularly when it comes to different time zones), which is why a chatbot is such a good solution. A chatbot could dramatically increase conversions and improve the customer experience while also reducing the amount of customer service work that you have to do.

Technology plays a huge role in ecommerce, and it is vital that you keep up to date to stay competitive and improve the customer experience.

https://techchuck.com/2021/03/31/the-best-technology-for-your-ecommerce-business/

0 notes

Text

Can Blockchain and Cryptocurrencies Alone Save $2 Trillion in Preventing Cybercrime? –

It’s hard not to view cryptocurrencies as the architect of the downfall in internet security. Quantifiable digital assets are now more common than ever online, and represent an increasingly attractive prospect for online fraudsters and hackers.

Forbes has forecast that cybercrime costs could be set to top $2 trillion in 2019, and cryptocurrencies have played a big role in enabling the rise of ransomware attacks that have become much more common today.

In May 2017, ransomware became international news as the WannaCry cryptoworm infected over 200,000 computers in 150 countries worldwide.

Source: Statista

The attack encrypted sensitive data in computers operating on Microsoft Windows and attackers demanded a payment sent in Bitcoin for the release of any encrypted files.

Bitcoin’s accessibility acted like the carrot on the stick for would-be hackers. This has created a prevalence for ransomware in Asia and Africa, with almost 10 percent of all attacks occurring in Thailand, with the United Arab Emirates and Iran close behind.

Cryptocurrencies may have exacerbated the problem of cybercrime, but can it, alongside blockchain, help to find a solution?

Intricate security

While blockchain rose to prominence through its symbiotic relationship to Bitcoin among many major cryptocurrencies, it’s continually being identified for uses in online security.

A blockchain acts as an incorruptible ledger of economic transactions that can be programmed for uses outside of finance and applied to just about anything of value. When somebody interacts with a blockchain, it automatically validates any changes made through a network of peer-to-peer computers known as ‘nodes.’

If a transaction is made through blockchain, it’s verified within each node and a new block of data is added to an untamperable chain of information.

The exponential growth of blockchain technology has leveraged the introduction of ‘smart contracts’, which have been identified as a potential solution for the frailties within cybersecurity today.

Blockchain growth

Source: Statista

It’s through smart contracts that transactions can be made whilst their details can be kept both transparent and secure. Writing about their new smart contracts-based Ethereum trading platform, Confideal stated: “To put it simply, code is not law, but smart contracts created on a platform enabling the execution of said contracts and dispute resolution may be one.”

Wallet protection

In our somewhat volatile financial climate, cryptocurrencies were seen as a potential solution for keeping our finances protected from insecure markets – but our digital money is no good if it’s vulnerable to falling into the wrong hands.

Blockchain wallets offer online protection for cryptocurrencies. They’re similar to real-world wallets in that they store a range of different currencies in one place and act as the first port of call for when you’re planning on trading your financial investments.

A private and public key for any transaction is saved online in the cryptocurrency wallet store, and whenever the owner wishes to make a purchase or sell their currency, it causes multiple blockchains to work in tandem to authenticate the transaction.

As with many high-level encryption processes, the role blockchain plays in keeping eWallets safe can sound complex. However, IT solutions company, New Gen Apps explains how a transaction works thus:

“Assume that someone has sent you some Bitcoin or any other digital currency. When the sender does this, he is actually assigning you, the owner of that currency, to the address of your Blockchain wallet.

Now, for you to the private key in your wallet must match the public key that the currency is assigned so that you could spend those coins. When both the keys will match, the balance in your wallet will increase. In this process, the exchange of currency is not there but a transaction is committed, recorded on Blockchain, and the changes are then seen in the wallet.”

Demand for decentralisation

One of the most important assets of blockchain is the fact that it’s decentralised. This means that it’s free of any influence from large organisations – which in turn provides the platform with much greater autonomy.

There’s no real ownership involved in blockchains, which means the data they hold isn’t influenced by national laws of any particular nation or state.

According to FOTON, by utilizing a decentralized system, customers can often save up to eight percent in fees, which translates into ~$36 billion a year in the cryptocurrency market.

Image Source: Foton (Centralised system (left) and decentralised system (right))

Transactions that occur in a blockchain are able to be audited or traced. Public blockchains also rely on a distributed network to run, so there’ll never be a single point of failure. As such, would-be attackers will find it much more difficult to hack a large number of peers distributed across the world than through focusing on a single large data center.

Dmytro Spilka

Dmytro is a founder of Solvid, a creative Inbound Marketing & Software Development Start-Up in London, UK. His work has been featured in numerous publications, including The Next Web, Entrepreneur, Huff Post, B2C & Business.com.

Source

[Telegram Channel | Original Article ]

0 notes

Text

The FinTech and Cryptocurrency Marriage

New Post has been published on https://bitcoinonlinetrading.com/fintech-cryptocurrency-marriage/

The FinTech and Cryptocurrency Marriage

The FinTech and Cryptocurrency Marriage;

How Companies are Capitalizing on the Digital Currency Revolution

According to CoinMarketcap.com the value of cryptocurrencies as of December 20th was $611,496,367,369 measuring 1368 cryptocurrencies. With comments from Bloomberg like “ Fintech plus cryptocurrency equals about $7 billion” regarding the recent rise of Longfin Corp. ( NASDAQ: LFIN ), investors are on the hunt for what’s next in the sector.

Fintech company Longfin Corp.’s ( NASDAQ: LFIN ) stock saw a 2700% increase following news of the acquisition of Ziddu.com, a Blockchain-empowered solutions provider that offers Microfinance Lending against Collateralized Warehouse Receipts in the form of Ziddu Coins.

From the press release: Ziddu Coin is a smart contract that enables SME’s, processors, manufacturers, importers and exporters using cryptocurrencies across continents. Ziddu Coins are loosely pegged to Ethereum and Bitcoin. The importers/exporters convert offered Ziddu coins into Ethereum or Bitcoin and use the proceeds for their working capital needs.

At the end of the contract, importers/exporters will realize their proceeds and pay back their funds through cryptocurrencies only.

Depending upon the risk profile of the counterparty, the interest will vary from 12% to 48%. “The advent of Blockchain technology has caught the imagination of the global financial services industry; blockchain is emerging as a technological revolution that is set to disrupt the financial services infrastructure. Cryptocurrencies such as Bitcoin and Ethereum will act as a global financing currency to avail credit against hard currencies of many emerging markets.” Says Venkat Meenavalli, Chairman of Longfin Corp.

Longfin is a US-based, global FinTech company powered by Artificial Intelligence (AI) and Machine Learning. The company, through its wholly-owned subsidiary, Stampede Tradex Pte. Ltd, delivers foreign exchange and finance solutions to importers/exporters and SMEs.

Longfin also provides cryptocurrency-based financial service for importers/exporters with Ziddu coins from its blockchain-empowered subsidiary Ziddu.com. Currently, Longfin has operations in London, Singapore, Dubai, New York, Miami and India.

In October Spindle, Inc. ( OTCQB: SPDL ), a provider of unified commerce solutions reported that it has entered into a binding letter of intent to acquire all of the shares of a privately held and profitable payments processing company. According to the 8K filed, Spindle will acquire 100% of the ownership in VyaPay, LLC ( https://www.vyapay.com/ ).

According to the filings the term sheet expires December 31, 2017. If completed, it will give Spindle entry into the crypto space according to a merchant processing site http://1f16.com/merchant-processing .

“VyaPay is the leader in the “New Age”. Whether you are aware of Crypto-Currencies or not, VyaPay is already the solution in taking and receiving today’s leading Crypto-Currencies. As the World is changing, so is the “Money” being used. You want to be with a progressive leader in solving all of your Merchant Processing needs. Do not lose business by being “Un-Accommodating” to all forms of Cash. “ One small fintech company has made its way to Davos as it focuses on the crypto/blockchain sector.

On December 12 th Glance Technologies Inc.( CSE:GET.CN )( OTCQB:GLNNF ) announced that it will be attending and speaking on a panel at the inaugural Blockchain Davos event to be held in Davos, Switzerland – January 23 – 26, 2018. Glance will also be a sponsor of the event.

From the Press release:

Blockchain Davos

Each year in January, the top global leaders gather in Davos from every country and sector to collaborate on developing shared initiatives to improve the condition of our world. Led by 2017’s blockchain boom and the “Fourth Industrial Revolution”, Blockchain Davos is a gathering to build partnerships for a decentralized future. Blockchain Davos is an exclusive invite only conference for attendees. The event is timed to coincide with the annual World Economic Forum, which is also being held in Davos.

Glance is attending the event to raise awareness of its upcoming cryptocurrency and to make further inroads into the worldwide cryptocurrency and blockchain community. Glance’s planned cryptocurrency is a rewards based token that will be granted as rewards to users of the Glance Pay mobile payment app every time they spend on the Glance Pay mobile payment network, whether they have paid with the new cryptocurrency or via other payment methods. This strategy is intended to support rapid adoption of the cryptocurrency to a broad range of consumers, although the app will also be marketed to crypto users in leading urban centers. Glance also intends to apply elements of its anti-fraud technology to this cryptocurrency to reduce the risk associated with converting traditional currencies to and from cryptocurrencies.

Glance Technologies owns and operates Glance Pay, a streamlined payment system that revolutionizes how smartphone users choose where to dine, order goods and services, make payments, access digital receipts, redeem digital deals, earn great rewards & interact with merchants NetCents Technology Inc ( CSE: NC / Frankfurt: 26N) just announced on December 14th the development and imminent launch of a proprietary cryptocurrency platform to round out the NC Exchange. Yesterday, NetCents paused the ability of users to purchase Bitcoin and Ethereum via the NC Exchange due to processing delays with the Company’s exchange partners. Coinciding with the updated exchange functionality, the Company will be launching a new, updated website.

The new website, eWallet, and NC Exchange will focus on improving site usability and flow, thus streamlining the process for site users. NetCents is a next-generation online payment processing platform, offering consumers and merchants online services for managing electronic payments.

#Bitcoin#Bitcoin news#financial_news#FinTech#frankfurt#glance technologies#investing#longfin corp lo#netcents technology inc.#spindle#ziddu.com#Bitcoin Talk

0 notes

Text

Ewallet Payment System Solution in London

Best ewallet payment system development company in UK, London (United Kingdom). Wallet solution and services provider for digital and mobile online payments

#Ewallet Payment System Solution in London#Ewallet App Development Company in UK#White Label Ewallet App Development Company#Ewallet Software Development Company

0 notes

Link

Future-ready Payment Gateway

Contactless payments are a new way to look at finances, especially these days. It's a new way to pay your friends, families, businesses, and even your business associates (or you can also include your bills). As an eWallet Apps Development Company in the UK, we have developed an ecosystem of easily managing your money through a phone or a dashboard.

The great news is that it has a special security feature called tokenization that protects everything you do in the app. The open technology platform also fundamentally creates contactless payments and mobile payments that are secured, safe, and reliable. Furthermore, there are a bunch of advantages that you can get in an eWallet system. There's an undeniable convenience in sending and receiving funds, for instance. Our Wallet is a limitless tool that makes your purchasing power more in control, easy, and just really, in a few taps. And if you want more, we also provide you with a new way of connecting with people because we have a quick and easy 24-hour period fund transfer to anyone you know.

Well, there are more competitive benefits of eWallet, that's why partnering with one allows having more leverage than others. White Label Ewallet, through a long list of experiences, has laid down an advantage in enhanced industry expertise and cutting-edge technology that deploys solutions and services right in front of you. Partnering with us also means a personalized approach and a more in-depth understanding of your requirement at hand. Some of the things you can get by partnering with us are the following: (1) Secured online send and receive funds, (2) Deposit money locally and pay internationally, (3) Instantly accept payments on your website, (4) Competitive transaction-fee, (5) Easy implementation on your website, (6) Secure data transfer (7) Multi-currency payment accounts.

White Label Ewallet is your friendly and innovative partner in your financial journey, thus, we have made sure a future-proof, future-ready payment gateway for you that guarantees you a great user experience. Additionally, we offer mobile app maintenance to our existing mobile apps. With White Label Ewallet, we make sure to transform and elevate the eWallet system that is sure to make a great first impression on you and your potential customers.

Make it a point to make yourself more convenient and productive by choosing a payment gateway solution that creates an easy environment for you, your business, and your customers. Choose White Label Ewallet today and get your business up and running seamlessly. Visit our website today to learn more.

0 notes

Link

Secure your payments online

White label provides a contactless payment as a new way to look at finances and the way to pay friends, family, and even businesses. White Label eWallet is an e-Wallet Apps Development Company in the UK that gives you an easy option to add money or funds by only linking your bank details which you can manage over a phone or a dashboard. Additionally, White Label eWallet is the best e-Wallet Payment System Solution Company in London and an eWallet Payment System Solution in the UK and top e-Wallet Payment System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool.

There are a lot of benefits that eWallet payment system offers. This includes an open platform technology and mobile wallets with tokenization features to secure your payments online.

Get the best features and benefits of e-Wallet payment solution by visiting our website through this link.

#ewalletappsdevelopmentcompany#whitelabelewallet#ewalletpaymentsystemsolutioncompanyinlondon#ewalletpaymentsystemsolutioncompanyintheuk#ewalletsystemsolution#ewalletpaymentsystem

0 notes

Text

The FinTech and Cryptocurrency Marriage

New Post has been published on https://bitcoinonlinetrading.com/fintech-cryptocurrency-marriage/

The FinTech and Cryptocurrency Marriage

The FinTech and Cryptocurrency Marriage;

How Companies are Capitalizing on the Digital Currency Revolution

According to CoinMarketcap.com the value of cryptocurrencies as of December 20th was $611,496,367,369 measuring 1368 cryptocurrencies. With comments from Bloomberg like “ Fintech plus cryptocurrency equals about $7 billion” regarding the recent rise of Longfin Corp. ( NASDAQ: LFIN ), investors are on the hunt for what’s next in the sector.

Fintech company Longfin Corp.’s ( NASDAQ: LFIN ) stock saw a 2700% increase following news of the acquisition of Ziddu.com, a Blockchain-empowered solutions provider that offers Microfinance Lending against Collateralized Warehouse Receipts in the form of Ziddu Coins.

From the press release: Ziddu Coin is a smart contract that enables SME’s, processors, manufacturers, importers and exporters using cryptocurrencies across continents. Ziddu Coins are loosely pegged to Ethereum and Bitcoin. The importers/exporters convert offered Ziddu coins into Ethereum or Bitcoin and use the proceeds for their working capital needs.

At the end of the contract, importers/exporters will realize their proceeds and pay back their funds through cryptocurrencies only.

Depending upon the risk profile of the counterparty, the interest will vary from 12% to 48%. “The advent of Blockchain technology has caught the imagination of the global financial services industry; blockchain is emerging as a technological revolution that is set to disrupt the financial services infrastructure. Cryptocurrencies such as Bitcoin and Ethereum will act as a global financing currency to avail credit against hard currencies of many emerging markets.” Says Venkat Meenavalli, Chairman of Longfin Corp.

Longfin is a US-based, global FinTech company powered by Artificial Intelligence (AI) and Machine Learning. The company, through its wholly-owned subsidiary, Stampede Tradex Pte. Ltd, delivers foreign exchange and finance solutions to importers/exporters and SMEs.

Longfin also provides cryptocurrency-based financial service for importers/exporters with Ziddu coins from its blockchain-empowered subsidiary Ziddu.com. Currently, Longfin has operations in London, Singapore, Dubai, New York, Miami and India.

In October Spindle, Inc. ( OTCQB: SPDL ), a provider of unified commerce solutions reported that it has entered into a binding letter of intent to acquire all of the shares of a privately held and profitable payments processing company. According to the 8K filed, Spindle will acquire 100% of the ownership in VyaPay, LLC ( https://www.vyapay.com/ ).

According to the filings the term sheet expires December 31, 2017. If completed, it will give Spindle entry into the crypto space according to a merchant processing site http://1f16.com/merchant-processing .

“VyaPay is the leader in the “New Age”. Whether you are aware of Crypto-Currencies or not, VyaPay is already the solution in taking and receiving today’s leading Crypto-Currencies. As the World is changing, so is the “Money” being used. You want to be with a progressive leader in solving all of your Merchant Processing needs. Do not lose business by being “Un-Accommodating” to all forms of Cash. “ One small fintech company has made its way to Davos as it focuses on the crypto/blockchain sector.

On December 12 th Glance Technologies Inc.( CSE:GET.CN )( OTCQB:GLNNF ) announced that it will be attending and speaking on a panel at the inaugural Blockchain Davos event to be held in Davos, Switzerland – January 23 – 26, 2018. Glance will also be a sponsor of the event.

From the Press release:

Blockchain Davos

Each year in January, the top global leaders gather in Davos from every country and sector to collaborate on developing shared initiatives to improve the condition of our world. Led by 2017’s blockchain boom and the “Fourth Industrial Revolution”, Blockchain Davos is a gathering to build partnerships for a decentralized future. Blockchain Davos is an exclusive invite only conference for attendees. The event is timed to coincide with the annual World Economic Forum, which is also being held in Davos.

Glance is attending the event to raise awareness of its upcoming cryptocurrency and to make further inroads into the worldwide cryptocurrency and blockchain community. Glance’s planned cryptocurrency is a rewards based token that will be granted as rewards to users of the Glance Pay mobile payment app every time they spend on the Glance Pay mobile payment network, whether they have paid with the new cryptocurrency or via other payment methods. This strategy is intended to support rapid adoption of the cryptocurrency to a broad range of consumers, although the app will also be marketed to crypto users in leading urban centers. Glance also intends to apply elements of its anti-fraud technology to this cryptocurrency to reduce the risk associated with converting traditional currencies to and from cryptocurrencies.

Glance Technologies owns and operates Glance Pay, a streamlined payment system that revolutionizes how smartphone users choose where to dine, order goods and services, make payments, access digital receipts, redeem digital deals, earn great rewards & interact with merchants NetCents Technology Inc ( CSE: NC / Frankfurt: 26N) just announced on December 14th the development and imminent launch of a proprietary cryptocurrency platform to round out the NC Exchange. Yesterday, NetCents paused the ability of users to purchase Bitcoin and Ethereum via the NC Exchange due to processing delays with the Company’s exchange partners. Coinciding with the updated exchange functionality, the Company will be launching a new, updated website.

The new website, eWallet, and NC Exchange will focus on improving site usability and flow, thus streamlining the process for site users. NetCents is a next-generation online payment processing platform, offering consumers and merchants online services for managing electronic payments.

#Bitcoin#Bitcoin news#financial_news#FinTech#frankfurt#glance technologies#investing#longfin corp lo#netcents technology inc.#spindle#ziddu.com#Bitcoin Talk

0 notes

Text

The FinTech and Cryptocurrency Marriage

New Post has been published on https://bitcoinonlinetrading.com/fintech-cryptocurrency-marriage/

The FinTech and Cryptocurrency Marriage

The FinTech and Cryptocurrency Marriage;

How Companies are Capitalizing on the Digital Currency Revolution

According to CoinMarketcap.com the value of cryptocurrencies as of December 20th was $611,496,367,369 measuring 1368 cryptocurrencies. With comments from Bloomberg like “ Fintech plus cryptocurrency equals about $7 billion” regarding the recent rise of Longfin Corp. ( NASDAQ: LFIN ), investors are on the hunt for what’s next in the sector.

Fintech company Longfin Corp.’s ( NASDAQ: LFIN ) stock saw a 2700% increase following news of the acquisition of Ziddu.com, a Blockchain-empowered solutions provider that offers Microfinance Lending against Collateralized Warehouse Receipts in the form of Ziddu Coins.

From the press release: Ziddu Coin is a smart contract that enables SME’s, processors, manufacturers, importers and exporters using cryptocurrencies across continents. Ziddu Coins are loosely pegged to Ethereum and Bitcoin. The importers/exporters convert offered Ziddu coins into Ethereum or Bitcoin and use the proceeds for their working capital needs.

At the end of the contract, importers/exporters will realize their proceeds and pay back their funds through cryptocurrencies only.

Depending upon the risk profile of the counterparty, the interest will vary from 12% to 48%. “The advent of Blockchain technology has caught the imagination of the global financial services industry; blockchain is emerging as a technological revolution that is set to disrupt the financial services infrastructure. Cryptocurrencies such as Bitcoin and Ethereum will act as a global financing currency to avail credit against hard currencies of many emerging markets.” Says Venkat Meenavalli, Chairman of Longfin Corp.

Longfin is a US-based, global FinTech company powered by Artificial Intelligence (AI) and Machine Learning. The company, through its wholly-owned subsidiary, Stampede Tradex Pte. Ltd, delivers foreign exchange and finance solutions to importers/exporters and SMEs.

Longfin also provides cryptocurrency-based financial service for importers/exporters with Ziddu coins from its blockchain-empowered subsidiary Ziddu.com. Currently, Longfin has operations in London, Singapore, Dubai, New York, Miami and India.

In October Spindle, Inc. ( OTCQB: SPDL ), a provider of unified commerce solutions reported that it has entered into a binding letter of intent to acquire all of the shares of a privately held and profitable payments processing company. According to the 8K filed, Spindle will acquire 100% of the ownership in VyaPay, LLC ( https://www.vyapay.com/ ).

According to the filings the term sheet expires December 31, 2017. If completed, it will give Spindle entry into the crypto space according to a merchant processing site http://1f16.com/merchant-processing .

“VyaPay is the leader in the “New Age”. Whether you are aware of Crypto-Currencies or not, VyaPay is already the solution in taking and receiving today’s leading Crypto-Currencies. As the World is changing, so is the “Money” being used. You want to be with a progressive leader in solving all of your Merchant Processing needs. Do not lose business by being “Un-Accommodating” to all forms of Cash. “ One small fintech company has made its way to Davos as it focuses on the crypto/blockchain sector.

On December 12 th Glance Technologies Inc.( CSE:GET.CN )( OTCQB:GLNNF ) announced that it will be attending and speaking on a panel at the inaugural Blockchain Davos event to be held in Davos, Switzerland – January 23 – 26, 2018. Glance will also be a sponsor of the event.

From the Press release:

Blockchain Davos

Each year in January, the top global leaders gather in Davos from every country and sector to collaborate on developing shared initiatives to improve the condition of our world. Led by 2017’s blockchain boom and the “Fourth Industrial Revolution”, Blockchain Davos is a gathering to build partnerships for a decentralized future. Blockchain Davos is an exclusive invite only conference for attendees. The event is timed to coincide with the annual World Economic Forum, which is also being held in Davos.

Glance is attending the event to raise awareness of its upcoming cryptocurrency and to make further inroads into the worldwide cryptocurrency and blockchain community. Glance’s planned cryptocurrency is a rewards based token that will be granted as rewards to users of the Glance Pay mobile payment app every time they spend on the Glance Pay mobile payment network, whether they have paid with the new cryptocurrency or via other payment methods. This strategy is intended to support rapid adoption of the cryptocurrency to a broad range of consumers, although the app will also be marketed to crypto users in leading urban centers. Glance also intends to apply elements of its anti-fraud technology to this cryptocurrency to reduce the risk associated with converting traditional currencies to and from cryptocurrencies.

Glance Technologies owns and operates Glance Pay, a streamlined payment system that revolutionizes how smartphone users choose where to dine, order goods and services, make payments, access digital receipts, redeem digital deals, earn great rewards & interact with merchants NetCents Technology Inc ( CSE: NC / Frankfurt: 26N) just announced on December 14th the development and imminent launch of a proprietary cryptocurrency platform to round out the NC Exchange. Yesterday, NetCents paused the ability of users to purchase Bitcoin and Ethereum via the NC Exchange due to processing delays with the Company’s exchange partners. Coinciding with the updated exchange functionality, the Company will be launching a new, updated website.

The new website, eWallet, and NC Exchange will focus on improving site usability and flow, thus streamlining the process for site users. NetCents is a next-generation online payment processing platform, offering consumers and merchants online services for managing electronic payments.

#Bitcoin#Bitcoin news#financial_news#FinTech#frankfurt#glance technologies#investing#longfin corp lo#netcents technology inc.#spindle#ziddu.com#Bitcoin Talk

0 notes

Text

The FinTech and Cryptocurrency Marriage

New Post has been published on https://bitcoinonlinetrading.com/fintech-cryptocurrency-marriage/

The FinTech and Cryptocurrency Marriage

The FinTech and Cryptocurrency Marriage;

How Companies are Capitalizing on the Digital Currency Revolution

According to CoinMarketcap.com the value of cryptocurrencies as of December 20th was $611,496,367,369 measuring 1368 cryptocurrencies. With comments from Bloomberg like “ Fintech plus cryptocurrency equals about $7 billion” regarding the recent rise of Longfin Corp. ( NASDAQ: LFIN ), investors are on the hunt for what’s next in the sector.

Fintech company Longfin Corp.’s ( NASDAQ: LFIN ) stock saw a 2700% increase following news of the acquisition of Ziddu.com, a Blockchain-empowered solutions provider that offers Microfinance Lending against Collateralized Warehouse Receipts in the form of Ziddu Coins.

From the press release: Ziddu Coin is a smart contract that enables SME’s, processors, manufacturers, importers and exporters using cryptocurrencies across continents. Ziddu Coins are loosely pegged to Ethereum and Bitcoin. The importers/exporters convert offered Ziddu coins into Ethereum or Bitcoin and use the proceeds for their working capital needs.

At the end of the contract, importers/exporters will realize their proceeds and pay back their funds through cryptocurrencies only.

Depending upon the risk profile of the counterparty, the interest will vary from 12% to 48%. “The advent of Blockchain technology has caught the imagination of the global financial services industry; blockchain is emerging as a technological revolution that is set to disrupt the financial services infrastructure. Cryptocurrencies such as Bitcoin and Ethereum will act as a global financing currency to avail credit against hard currencies of many emerging markets.” Says Venkat Meenavalli, Chairman of Longfin Corp.

Longfin is a US-based, global FinTech company powered by Artificial Intelligence (AI) and Machine Learning. The company, through its wholly-owned subsidiary, Stampede Tradex Pte. Ltd, delivers foreign exchange and finance solutions to importers/exporters and SMEs.

Longfin also provides cryptocurrency-based financial service for importers/exporters with Ziddu coins from its blockchain-empowered subsidiary Ziddu.com. Currently, Longfin has operations in London, Singapore, Dubai, New York, Miami and India.

In October Spindle, Inc. ( OTCQB: SPDL ), a provider of unified commerce solutions reported that it has entered into a binding letter of intent to acquire all of the shares of a privately held and profitable payments processing company. According to the 8K filed, Spindle will acquire 100% of the ownership in VyaPay, LLC ( https://www.vyapay.com/ ).

According to the filings the term sheet expires December 31, 2017. If completed, it will give Spindle entry into the crypto space according to a merchant processing site http://1f16.com/merchant-processing .

“VyaPay is the leader in the “New Age”. Whether you are aware of Crypto-Currencies or not, VyaPay is already the solution in taking and receiving today’s leading Crypto-Currencies. As the World is changing, so is the “Money” being used. You want to be with a progressive leader in solving all of your Merchant Processing needs. Do not lose business by being “Un-Accommodating” to all forms of Cash. “ One small fintech company has made its way to Davos as it focuses on the crypto/blockchain sector.

On December 12 th Glance Technologies Inc.( CSE:GET.CN )( OTCQB:GLNNF ) announced that it will be attending and speaking on a panel at the inaugural Blockchain Davos event to be held in Davos, Switzerland – January 23 – 26, 2018. Glance will also be a sponsor of the event.

From the Press release:

Blockchain Davos

Each year in January, the top global leaders gather in Davos from every country and sector to collaborate on developing shared initiatives to improve the condition of our world. Led by 2017’s blockchain boom and the “Fourth Industrial Revolution”, Blockchain Davos is a gathering to build partnerships for a decentralized future. Blockchain Davos is an exclusive invite only conference for attendees. The event is timed to coincide with the annual World Economic Forum, which is also being held in Davos.

Glance is attending the event to raise awareness of its upcoming cryptocurrency and to make further inroads into the worldwide cryptocurrency and blockchain community. Glance’s planned cryptocurrency is a rewards based token that will be granted as rewards to users of the Glance Pay mobile payment app every time they spend on the Glance Pay mobile payment network, whether they have paid with the new cryptocurrency or via other payment methods. This strategy is intended to support rapid adoption of the cryptocurrency to a broad range of consumers, although the app will also be marketed to crypto users in leading urban centers. Glance also intends to apply elements of its anti-fraud technology to this cryptocurrency to reduce the risk associated with converting traditional currencies to and from cryptocurrencies.

Glance Technologies owns and operates Glance Pay, a streamlined payment system that revolutionizes how smartphone users choose where to dine, order goods and services, make payments, access digital receipts, redeem digital deals, earn great rewards & interact with merchants NetCents Technology Inc ( CSE: NC / Frankfurt: 26N) just announced on December 14th the development and imminent launch of a proprietary cryptocurrency platform to round out the NC Exchange. Yesterday, NetCents paused the ability of users to purchase Bitcoin and Ethereum via the NC Exchange due to processing delays with the Company’s exchange partners. Coinciding with the updated exchange functionality, the Company will be launching a new, updated website.

The new website, eWallet, and NC Exchange will focus on improving site usability and flow, thus streamlining the process for site users. NetCents is a next-generation online payment processing platform, offering consumers and merchants online services for managing electronic payments.

#Bitcoin#Bitcoin news#financial_news#FinTech#frankfurt#glance technologies#investing#longfin corp lo#netcents technology inc.#spindle#ziddu.com#Bitcoin Talk

0 notes

Text

The FinTech and Cryptocurrency Marriage

New Post has been published on https://bitcoinonlinetrading.com/fintech-cryptocurrency-marriage/

The FinTech and Cryptocurrency Marriage

The FinTech and Cryptocurrency Marriage;

How Companies are Capitalizing on the Digital Currency Revolution

According to CoinMarketcap.com the value of cryptocurrencies as of December 20th was $611,496,367,369 measuring 1368 cryptocurrencies. With comments from Bloomberg like “ Fintech plus cryptocurrency equals about $7 billion” regarding the recent rise of Longfin Corp. ( NASDAQ: LFIN ), investors are on the hunt for what’s next in the sector.

Fintech company Longfin Corp.’s ( NASDAQ: LFIN ) stock saw a 2700% increase following news of the acquisition of Ziddu.com, a Blockchain-empowered solutions provider that offers Microfinance Lending against Collateralized Warehouse Receipts in the form of Ziddu Coins.

From the press release: Ziddu Coin is a smart contract that enables SME’s, processors, manufacturers, importers and exporters using cryptocurrencies across continents. Ziddu Coins are loosely pegged to Ethereum and Bitcoin. The importers/exporters convert offered Ziddu coins into Ethereum or Bitcoin and use the proceeds for their working capital needs.

At the end of the contract, importers/exporters will realize their proceeds and pay back their funds through cryptocurrencies only.

Depending upon the risk profile of the counterparty, the interest will vary from 12% to 48%. “The advent of Blockchain technology has caught the imagination of the global financial services industry; blockchain is emerging as a technological revolution that is set to disrupt the financial services infrastructure. Cryptocurrencies such as Bitcoin and Ethereum will act as a global financing currency to avail credit against hard currencies of many emerging markets.” Says Venkat Meenavalli, Chairman of Longfin Corp.

Longfin is a US-based, global FinTech company powered by Artificial Intelligence (AI) and Machine Learning. The company, through its wholly-owned subsidiary, Stampede Tradex Pte. Ltd, delivers foreign exchange and finance solutions to importers/exporters and SMEs.

Longfin also provides cryptocurrency-based financial service for importers/exporters with Ziddu coins from its blockchain-empowered subsidiary Ziddu.com. Currently, Longfin has operations in London, Singapore, Dubai, New York, Miami and India.

In October Spindle, Inc. ( OTCQB: SPDL ), a provider of unified commerce solutions reported that it has entered into a binding letter of intent to acquire all of the shares of a privately held and profitable payments processing company. According to the 8K filed, Spindle will acquire 100% of the ownership in VyaPay, LLC ( https://www.vyapay.com/ ).

According to the filings the term sheet expires December 31, 2017. If completed, it will give Spindle entry into the crypto space according to a merchant processing site http://1f16.com/merchant-processing .

“VyaPay is the leader in the “New Age”. Whether you are aware of Crypto-Currencies or not, VyaPay is already the solution in taking and receiving today’s leading Crypto-Currencies. As the World is changing, so is the “Money” being used. You want to be with a progressive leader in solving all of your Merchant Processing needs. Do not lose business by being “Un-Accommodating” to all forms of Cash. “ One small fintech company has made its way to Davos as it focuses on the crypto/blockchain sector.

On December 12 th Glance Technologies Inc.( CSE:GET.CN )( OTCQB:GLNNF ) announced that it will be attending and speaking on a panel at the inaugural Blockchain Davos event to be held in Davos, Switzerland – January 23 – 26, 2018. Glance will also be a sponsor of the event.

From the Press release:

Blockchain Davos

Each year in January, the top global leaders gather in Davos from every country and sector to collaborate on developing shared initiatives to improve the condition of our world. Led by 2017’s blockchain boom and the “Fourth Industrial Revolution”, Blockchain Davos is a gathering to build partnerships for a decentralized future. Blockchain Davos is an exclusive invite only conference for attendees. The event is timed to coincide with the annual World Economic Forum, which is also being held in Davos.

Glance is attending the event to raise awareness of its upcoming cryptocurrency and to make further inroads into the worldwide cryptocurrency and blockchain community. Glance’s planned cryptocurrency is a rewards based token that will be granted as rewards to users of the Glance Pay mobile payment app every time they spend on the Glance Pay mobile payment network, whether they have paid with the new cryptocurrency or via other payment methods. This strategy is intended to support rapid adoption of the cryptocurrency to a broad range of consumers, although the app will also be marketed to crypto users in leading urban centers. Glance also intends to apply elements of its anti-fraud technology to this cryptocurrency to reduce the risk associated with converting traditional currencies to and from cryptocurrencies.

Glance Technologies owns and operates Glance Pay, a streamlined payment system that revolutionizes how smartphone users choose where to dine, order goods and services, make payments, access digital receipts, redeem digital deals, earn great rewards & interact with merchants NetCents Technology Inc ( CSE: NC / Frankfurt: 26N) just announced on December 14th the development and imminent launch of a proprietary cryptocurrency platform to round out the NC Exchange. Yesterday, NetCents paused the ability of users to purchase Bitcoin and Ethereum via the NC Exchange due to processing delays with the Company’s exchange partners. Coinciding with the updated exchange functionality, the Company will be launching a new, updated website.

The new website, eWallet, and NC Exchange will focus on improving site usability and flow, thus streamlining the process for site users. NetCents is a next-generation online payment processing platform, offering consumers and merchants online services for managing electronic payments.

#Bitcoin#Bitcoin news#financial_news#FinTech#frankfurt#glance technologies#investing#longfin corp lo#netcents technology inc.#spindle#ziddu.com#Bitcoin Talk

0 notes