#ewallet payment system

Explore tagged Tumblr posts

Text

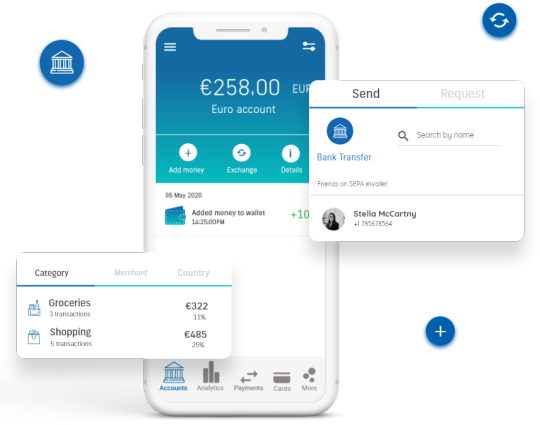

Digital Payment Systems in UAE: Revolutionizing Financial Transactions

Digital Payment Systems in UAE are transforming the way businesses and consumers conduct financial transactions, driving the nation toward a cashless economy. With the UAE's commitment to innovation and technology, digital payment solutions have gained widespread adoption across various sectors, including retail, e-commerce, hospitality, and transportation.

These systems enable secure, fast, and convenient payment methods through platforms such as mobile wallets, contactless payments, and online gateways. Popular solutions like Apple Pay, Google Pay, and local platforms like Etisalat’s eWallet have made it easier for consumers to make purchases and for businesses to process payments seamlessly.

The UAE's government initiatives, including the Smart Dubai program and the Emirates Digital Wallet, are accelerating the shift to digital payments. These efforts are aligned with the nation’s vision of becoming a global leader in financial technology, enhancing convenience, transparency, and security for users.

Key advantages of digital payment systems include real-time transactions, enhanced security with encryption and tokenization, and reduced dependency on cash handling. For businesses, these systems offer streamlined operations, improved customer experience, and detailed transaction insights that aid in better decision-making.

The rise of cryptocurrency and blockchain-based payments is also gaining traction in the UAE, signaling a future where financial transactions become even more innovative and decentralized.

Adopting digital payment systems is not just about convenience—it’s a strategic move to stay competitive in a fast-evolving market. Whether you're a business looking to enhance payment solutions or a consumer seeking seamless transactions, digital payment systems in UAE are paving the way for a smarter and more connected economy.

0 notes

Text

Best Fintech App Development Company for Modern Finance Apps

Partner with the best fintech app development company to transform your financial services with modern, secure, and scalable solutions. Our expertise in fintech and eWallet app development ensures innovative features, seamless user experiences, and compliance with industry standards. From digital banking to payment systems, we deliver tailored applications to empower your business in the evolving financial landscape. Choose us for cutting-edge technology and unmatched expertise in modern finance apps.

READ MORE: https://www.smallbizblog.net/2024/11/20/best-fintech-app-development-company-for-modern-finance-apps/

#appdevelopmentcompany#ewalletapp#ewalletappdevelopmentcompany#fintechapp#fintechappdevelopmentcompany#mobileappdevelopment

0 notes

Text

Migrating Data to MioSalon: A Streamlined Process for Salons & Spas

Switching to a new salon software or spa management software can be intimidating, especially when you’re thinking about how to migrate your data seamlessly. This is a common question many salon and spa owners have. At MioSalon, we understand how essential it is to keep your data intact when switching systems, so we’ve designed a data migration process that’s simple, secure, and efficient.

1. How Do I Migrate My Data to MioSalon?

Migrating your data to MioSalon is easier than you might think. The process starts with downloading the XLS templates found in your settings (Settings -> Bulk Data Upload). If you're already using another salon management software or spa software, simply export your data to an Excel (XLS) file and paste it into the provided MioSalon templates. Once done, you can upload the data files directly into MioSalon.

Step-by-Step Guide:

Download Templates: Go to Settings -> Bulk Data Upload and download the XLS templates.

Export Data: If you're currently using another system, export your data to an Excel sheet.

Transfer Information: Copy and paste your data into the relevant MioSalon templates.

Upload to MioSalon: Once completed, upload these files into MioSalon.

This process is intuitive, ensuring you have full control over your data migration without needing technical support.

2. Types of Data You Can Migrate

MioSalon supports the migration of nearly all your master data, so you can have your salon scheduling software or spa scheduling software set up with ease. The types of data you can transfer include:

Customer List: Carry over all client information, including contact details and previous visit histories.

Services List with Rates: Transfer your full catalog of services along with their associated rates.

Products and Inventory: Your stock and inventory items can be migrated seamlessly to continue tracking inventory levels.

Membership Details: Bring over all membership information to avoid any disruptions in service.

Gift Vouchers and Prepaid/eWallet Balances: Ensure client balances, vouchers, and rewards are retained.

With your data ready and accessible, MioSalon lets you begin scheduling and processing payments without any interruptions.

3. How Long Does It Take to Import and Set Up Data?

If your data is already organized in an Excel file format, the whole migration process typically takes 30–45 minutes. Here’s how to make the transition even faster:

Prepare Your Data: If you're switching from another salon booking software or spa management software, ensure your data is well-organized.

Complete the Setup: Upload the templates, and your salon POS software or spa POS software is ready for use within the hour.

This means no waiting around for support to get your system up and running. MioSalon is designed to empower salon and spa owners to handle their own data effortlessly.

4. Do I Need to Share My Data with Support for Uploading?

No, you don’t have to share your data with our support team. At MioSalon, we prioritize your privacy and understand that your data is your asset. As the admin, you are fully equipped to handle the data upload on your own. We believe in a secure and transparent process that keeps your data in your hands.

MioSalon and our parent company, Waffor, follow a stringent Privacy Policy that safeguards your data from any unauthorized access. Additionally, our system provides the flexibility for you to export and back up your data whenever you want. This ensures you retain full ownership and control, without worrying about data lock-in.

New Feature: Data Migration Mapping

For those looking for an even simpler solution, MioSalon has recently launched a new tool called Data Migration Mapping. With this tool, you can directly import data from your XLS file without the need for MioSalon templates. This eliminates extra steps, making it even faster to transition from your current system.

Find this tool under Settings -> Data Migration Mapping and follow these steps:

Access Data Migration Mapping in your settings.

Directly Import Your XLS File without adjusting to our templates.

Verify and Finalize – review your data and confirm the migration.

This feature adds more flexibility to the process and is designed to streamline migration for busy salon and spa managers.

Why Choose MioSalon for Your Data Migration?

MioSalon isn’t just a salon POS software or spa POS software; it’s a comprehensive system that makes every step of salon management easier. Whether you’re migrating data for the first time or transitioning from another salon appointment software, our tools ensure your data stays secure and accessible at every stage.

Simple & Quick: With XLS templates and a direct import tool, data migration is fast and easy.

Secure: You have control over your data, and our privacy policy ensures it stays protected.

Flexible: Import data at your convenience, and export whenever you want.

Frequently Asked Questions About Data Migration to MioSalon

Can I Migrate Data from Multiple Sources?

Yes, you can gather your data from multiple systems and consolidate it into MioSalon’s templates or use the Data Migration Mapping tool. This allows for seamless integration across your systems.

Will My Historical Data Be Accessible?

Yes, with MioSalon, you can retain important historical data such as client information, previous appointments, and transaction histories. Our migration process is designed to preserve all essential details.

What If I Face an Issue During Migration?

While our migration process is straightforward, our support team is available to assist if you run into any challenges. Reach out to us, and we’ll help troubleshoot any migration-related issues.

Ready to Streamline Your Data Migration? Request a Demo Today!

Switching to MioSalon is more than a software upgrade; it’s an investment in your business’s future. With our simplified data migration process, secure handling of sensitive information, and reliable salon POS software, you can make the transition effortlessly and start focusing on what you do best—serving your clients.

Get in touch with us today to see how MioSalon can transform your business. Request a Demo and experience the difference firsthand!

This detailed approach ensures that your business’s transition to MioSalon is seamless, fast, and worry-free. Our innovative tools, such as the Data Migration Mapping feature, put control in your hands, making MioSalon the perfect choice for your salon booking software, spa scheduling software, or salon management software needs.

0 notes

Text

Migrating Data to MioSalon: A Streamlined Process for Salons & Spas

Switching to a new salon software or spa management software can be intimidating, especially when you’re thinking about how to migrate your data seamlessly. This is a common question many salon and spa owners have. At MioSalon, we understand how essential it is to keep your data intact when switching systems, so we’ve designed a data migration process that’s simple, secure, and efficient.

1. How Do I Migrate My Data to MioSalon?

Migrating your data to MioSalon is easier than you might think. The process starts with downloading the XLS templates found in your settings (Settings -> Bulk Data Upload). If you're already using another salon management software or spa software, simply export your data to an Excel (XLS) file and paste it into the provided MioSalon templates. Once done, you can upload the data files directly into MioSalon.

Step-by-Step Guide:

Download Templates: Go to Settings -> Bulk Data Upload and download the XLS templates.

Export Data: If you're currently using another system, export your data to an Excel sheet.

Transfer Information: Copy and paste your data into the relevant MioSalon templates.

Upload to MioSalon: Once completed, upload these files into MioSalon.

This process is intuitive, ensuring you have full control over your data migration without needing technical support.

2. Types of Data You Can Migrate

MioSalon supports the migration of nearly all your master data, so you can have your salon scheduling software or spa scheduling software set up with ease. The types of data you can transfer include:

Customer List: Carry over all client information, including contact details and previous visit histories.

Services List with Rates: Transfer your full catalog of services along with their associated rates.

Products and Inventory: Your stock and inventory items can be migrated seamlessly to continue tracking inventory levels.

Membership Details: Bring over all membership information to avoid any disruptions in service.

Gift Vouchers and Prepaid/eWallet Balances: Ensure client balances, vouchers, and rewards are retained.

With your data ready and accessible, MioSalon lets you begin scheduling and processing payments without any interruptions.

3. How Long Does It Take to Import and Set Up Data?

If your data is already organized in an Excel file format, the whole migration process typically takes 30–45 minutes. Here’s how to make the transition even faster:

Prepare Your Data: If you're switching from another salon booking software or spa management software, ensure your data is well-organized.

Complete the Setup: Upload the templates, and your salon POS software or spa POS software is ready for use within the hour.

This means no waiting around for support to get your system up and running. MioSalon is designed to empower salon and spa owners to handle their own data effortlessly.

4. Do I Need to Share My Data with Support for Uploading?

No, you don’t have to share your data with our support team. At MioSalon, we prioritize your privacy and understand that your data is your asset. As the admin, you are fully equipped to handle the data upload on your own. We believe in a secure and transparent process that keeps your data in your hands.

MioSalon and our parent company, Waffor, follow a stringent Privacy Policy that safeguards your data from any unauthorized access. Additionally, our system provides the flexibility for you to export and back up your data whenever you want. This ensures you retain full ownership and control, without worrying about data lock-in.

New Feature: Data Migration Mapping

For those looking for an even simpler solution, MioSalon has recently launched a new tool called Data Migration Mapping. With this tool, you can directly import data from your XLS file without the need for MioSalon templates. This eliminates extra steps, making it even faster to transition from your current system.

Find this tool under Settings -> Data Migration Mapping and follow these steps:

Access Data Migration Mapping in your settings.

Directly Import Your XLS File without adjusting to our templates.

Verify and Finalize – review your data and confirm the migration.

This feature adds more flexibility to the process and is designed to streamline migration for busy salon and spa managers.

Why Choose MioSalon for Your Data Migration?

MioSalon isn’t just a salon POS software or spa POS software; it’s a comprehensive system that makes every step of salon management easier. Whether you’re migrating data for the first time or transitioning from another salon appointment software, our tools ensure your data stays secure and accessible at every stage.

Simple & Quick: With XLS templates and a direct import tool, data migration is fast and easy.

Secure: You have control over your data, and our privacy policy ensures it stays protected.

Flexible: Import data at your convenience, and export whenever you want.

Frequently Asked Questions About Data Migration to MioSalon

Can I Migrate Data from Multiple Sources?

Yes, you can gather your data from multiple systems and consolidate it into MioSalon’s templates or use the Data Migration Mapping tool. This allows for seamless integration across your systems.

Will My Historical Data Be Accessible?

Yes, with MioSalon, you can retain important historical data such as client information, previous appointments, and transaction histories. Our migration process is designed to preserve all essential details.

What If I Face an Issue During Migration?

While our migration process is straightforward, our support team is available to assist if you run into any challenges. Reach out to us, and we’ll help troubleshoot any migration-related issues.

Ready to Streamline Your Data Migration? Request a Demo Today!

Switching to MioSalon is more than a software upgrade; it’s an investment in your business’s future. With our simplified data migration process, secure handling of sensitive information, and reliable salon POS software, you can make the transition effortlessly and start focusing on what you do best—serving your clients.

Get in touch with us today to see how MioSalon can transform your business. Request a Demo and experience the difference firsthand!

This detailed approach ensures that your business’s transition to MioSalon is seamless, fast, and worry-free. Our innovative tools, such as the Data Migration Mapping feature, put control in your hands, making MioSalon the perfect choice for your salon booking software, spa scheduling software, or salon management software needs.

0 notes

Text

Discover the Thrill of PSG102: Your Trusted Gaming Experience in Indonesia

In the vibrant world of online gaming, PSG102 stands out as a reliable platform for Android slot games, especially for those seeking the convenience of pulsa and ewallet transactions. With a growing community of players in Indonesia, PSG102 offers an engaging experience that keeps users coming back for more.

Why Choose PSG102?

Choosing the right gaming platform can be overwhelming. Here are some compelling reasons to consider PSG102:

User-Friendly Interface: PSG102 boasts an easy-to-navigate design that enhances the gaming experience. New players can jump right in without a steep learning curve.

Variety of Games: From traditional slots to modern video slots, PSG102 provides an extensive library of games to cater to all preferences.

Secure Transactions: Safety is a top priority. PSG102 implements advanced security measures to protect user data and financial information.

Responsive Customer Support: Players can rely on quick assistance for any queries or issues, enhancing overall satisfaction.

The Allure of Android Slot Games

With smartphones becoming ubiquitous, playing slot games on Android devices has surged in popularity. PSG102 capitalizes on this trend, offering a seamless gaming experience on mobile.

Advantages of Playing on Android

Convenience: Players can enjoy their favorite games anywhere and anytime.

Optimized Graphics: Modern Android devices provide high-quality graphics and smooth gameplay.

Instant Access: Downloading the app or accessing the platform through a browser offers immediate play without long loading times.

Popular Game Titles

Some popular slot games available on PSG102 include:

Dragon's Luck: A visually stunning game that combines luck and strategy.

Lucky 7s: A classic favorite that never goes out of style.

Mythical Beasts: Explore a world filled with dragons and treasures.

Payment Options: Pulsa & Ewallet

One of the standout features of PSG102 is its range of payment options, particularly pulsa and ewallet systems. This flexibility attracts a broader audience.

What is Pulsa?

Pulsa refers to prepaid credit commonly used for mobile phone services in Indonesia. Here’s why it’s favored:

Ease of Use: Players can easily purchase pulsa from local vendors or online platforms, making it accessible.

Instant Transactions: Deposits are processed quickly, allowing players to dive straight into the action.

What is Ewallet?

Ewallets are digital wallets that store payment information securely. PSG102 supports various ewallet options, enhancing convenience:

Fast Transactions: Withdrawals and deposits are completed in real-time.

Enhanced Security: Ewallets often have built-in security features that protect users from fraud.

Popular Ewallets in Indonesia

Players can use various ewallets on PSG102, including:

OVO

GoPay

DANA

These options make transactions straightforward, giving players confidence in their financial safety.

Bonuses and Promotions

PSG102 understands the importance of rewarding loyal players. The platform offers several promotions, ensuring that users feel valued.

Types of Bonuses

Welcome Bonus: New players can often receive a generous welcome bonus, giving them extra funds to start playing.

Loyalty Programs: Frequent players can benefit from loyalty points, which can be redeemed for bonuses or free spins.

Seasonal Promotions: PSG102 regularly runs promotions tied to holidays or special events, providing players with exciting opportunities.

Community and Engagement

The sense of community within PSG102 enhances the gaming experience. Players can engage through various channels:

Social Media: Follow PSG102 on social media for updates, news, and player interactions.

Tournaments: Participate in gaming tournaments for a chance to win prizes and bragging rights.

The Importance of Community

Being part of a community can elevate the gaming experience. Players share tips, strategies, and experiences, making it more enjoyable and social.

Safety and Security Measures

Safety is paramount in online gaming. PSG102 prioritizes user safety through:

Encryption Technology: All transactions and data are encrypted, ensuring user privacy.

Responsible Gaming Policies: PSG102 promotes responsible gaming practices, encouraging players to play within their means.

Player Testimonials

Hearing from fellow gamers can provide insight into the PSG102 experience. Here are a few quotes from satisfied players:

"PSG102 is my go-to for slots! The variety of games keeps things fresh."

"I love how easy it is to deposit using pulsa. It’s quick and reliable."

"The community aspect makes gaming more enjoyable. I’ve made friends while playing!"

Final Thoughts

PSG102 offers an exciting and trustworthy platform for Android slot gaming in Indonesia. With its user-friendly interface, diverse payment options, and a strong sense of community, it’s no wonder players are flocking to this site.

As the gaming landscape continues to evolve, platforms like PSG102 set the standard for what players can expect. Whether you're a seasoned gamer or a newcomer, PSG102 has something for everyone. Dive into the world of slot games today and experience the thrill that awaits!

0 notes

Text

eDataPay: Innovating Global Payments and Fintech Solutions In the ever-evolving landscape of global commerce, where businesses strive to stay competitive and meet the demands of an increasingly digital world, the role of secure, efficient, and innovative payment solutions has never been more critical. eDataPay, a leader in global payments and FinTech, stands at the forefront of this transformation, offering businesses the tools and technology they need to succeed. Introduction to eDataPay Founded in 2011 and headquartered in Boca Raton, Florida, eDataPay has established itself as a pioneer in the FinTech industry. With its global reach and deep expertise in financial services, eDataPay has become the go-to partner for businesses seeking comprehensive payment solutions. Whether it's secure online payment processing, advanced fraud detection, or customizable merchant services, eDataPay's offerings are designed to empower businesses of all sizes to thrive in the digital economy. A Comprehensive Suite of business payments and media Services eDataPay’s strength lies in its ability to provide a wide array of services that cater to the diverse needs of businesses across industries. Here’s a closer look at the key services offered by eDataPay: 2.1 Payment Gateway Services At the heart of eDataPay's offerings is its PCI Level 1 certified payment gateway. This state-of-the-art gateway ensures that all transactions are processed securely and efficiently, minimizing the risk of fraud and data breaches. The gateway is designed to support a wide range of payment methods, including credit and debit cards, eWallets, and bank transfers, making it easier for businesses to offer their customers flexible payment options. 2.2 Merchant Accounts eDataPay provides direct merchant accounts, enabling businesses to accept payments seamlessly across multiple channels. Whether a business operates online, in-store, or both, eDataPay's merchant accounts are designed to support various transaction types, including recurring payments, one-click payments, and mobile payments. This flexibility ensures that businesses can offer a frictionless payment experience to their customers. 2.3 Fraud and Risk Management In today’s digital age, fraud is a significant concern for businesses. eDataPay addresses this challenge with its robust fraud and risk management solutions. Utilizing advanced machine learning algorithms and real-time data analysis, eDataPay's fraud detection systems identify and mitigate potential threats before they can impact a business. This proactive approach not only protects businesses from financial loss but also enhances customer trust. 2.4 Card Issuing and Banking Services In addition to payment processing, eDataPay offers card issuing and banking services thru our network partners. Businesses can leverage eDataPay's infrastructure to issue their branded cards, whether for employee expenses, customer rewards, or other purposes. Additionally, eDataPay's banking services provide businesses with access to essential financial tools, including account management, ACH transfers, and international wire transfers. 2.5 Media Rewards and Advertising eDataPay goes beyond traditional payment processing by integrating media rewards and advertising into its platform. This unique offering allows businesses to engage with their customers in new and innovative ways, driving loyalty and increasing revenue. By combining payment solutions with targeted advertising, eDataPay helps businesses maximize their marketing efforts while providing a seamless customer experience. Industry Positioning and Competitors eDataPay operates in a competitive landscape, where eDataPay also play prominent roles. To understand eDataPay's positioning, it's essential to look at how it compares to these industry leaders. 3.1 eDataPay: A Comprehensive Financial Services Company eDataPay is a well-known name in the FinTech world, offering a broad range of payment technology solutions.

eDataPay provides online payment solutions to businesses worldwide, covering everything from payout options to card issuing and banking services. However, what sets eDataPay apart is its modular, flexible, and scalable technology, which allows businesses to tailor their payment processing needs according to their specific requirements. While eDataPay’s platform is highly adaptable, eDataPay differentiates itself with its focus on personalized customer service and its integration of media rewards and advertising. eDataPay’s approach is not just about processing payments but about creating an ecosystem where payments, marketing, and customer engagement come together seamlessly. 3.2 eDataPay: A Global Financial Technology Powerhouse eDataPay EU is another major player in the FinTech industry, known for its comprehensive payment platform that manages the entire payment lifecycle. With a single integration, eDataPay offers services such as gateway, risk management, processing, issuing, acquiring, and settlement. This end-to-end solution has made eDataPay the platform of choice for many leading global businesses. eDataPay’s strength lies in its direct connections to local and international card and banking networks, which ensures smooth and secure transactions worldwide. However, eDataPay competes effectively by offering a more tailored approach to customer needs, particularly for small to medium-sized businesses that require a more hands-on partnership. eDataPay’s flexibility and customer-centric services make it a strong alternative for businesses looking for more than just a payment processor. The eDataPay Advantage: Tailored Solutions and Customer-Centric Approach What truly sets eDataPay apart in the crowded FinTech market is its commitment to providing tailored solutions that address the unique needs of each business client. Unlike many competitors that offer a one-size-fits-all approach, eDataPay takes the time to understand the specific challenges and goals of each business it partners with. 4.1 Long-Term Partnerships and Strategic Growth eDataPay’s philosophy centers around building long-term partnerships with its clients. This approach is reflected in the company’s strategic growth initiatives, where the focus is on expanding alongside customers as they scale their operations. By prioritizing collaboration and continuous innovation, eDataPay ensures that its clients have the support and tools they need to succeed. 4.2 Flexible and Scalable Technology The technology behind eDataPay’s platform is both flexible and scalable, making it ideal for businesses of all sizes. Whether a company is a startup looking for a simple payment gateway or an established enterprise needing complex fraud management solutions, eDataPay’s platform can be customized to meet those needs. This adaptability is key to eDataPay’s success and its ability to serve a diverse clientele. 4.3 Commitment to Security and Compliance In an era where data breaches and financial fraud are on the rise, security and compliance are top priorities for eDataPay. The company’s payment gateway is PCI Level 1 certified, ensuring the highest level of security for all transactions. Additionally, eDataPay is committed to staying ahead of regulatory changes, ensuring that its services are always compliant with the latest standards and regulations. The Role of eDataPay in the Future of Global Commerce As the world becomes increasingly interconnected, the need for secure and efficient global payment solutions will continue to grow. eDataPay is well-positioned to play a significant role in shaping the future of global commerce by providing businesses with the tools and technology they need to thrive in a digital-first world. 5.1 Expansion into New Markets eDataPay’s global reach is one of its greatest strengths. The company is continually exploring opportunities to expand into new markets, particularly in regions where digital payments are becoming more prevalent.

By establishing a presence in emerging markets, eDataPay is helping to drive the adoption of secure payment solutions worldwide. 5.2 Innovation and Technological Advancements Innovation is at the core of eDataPay’s mission. The company is constantly exploring new technologies and methodologies to enhance its services and provide even greater value to its clients. From integrating artificial intelligence and machine learning into its fraud detection systems to developing new ways to engage customers through media rewards, eDataPay is committed to staying at the cutting edge of FinTech innovation. 5.3 A Focus on Customer Success Ultimately, eDataPay’s success is measured by the success of its customers. The company’s customer-centric approach ensures that every business it partners with receives the support and resources needed to achieve its goals. Whether it’s through personalized service, innovative solutions, or ongoing collaboration, eDataPay is dedicated to helping businesses navigate the complexities of global commerce and achieve long-term success. Frequently Asked Questions (FAQ) about eDataPay Q1: What services does eDataPay offer? eDataPay provides a wide range of services, including payment gateway services, merchant accounts, fraud and risk management, card issuing, banking services, and media rewards and advertising. These services are designed to meet the needs of businesses of all sizes, from startups to large enterprises. Q2: How does eDataPay ensure the security of transactions? eDataPay’s payment gateway is PCI Level 1 certified, which is the highest level of security certification in the payment industry. The company also utilizes advanced fraud detection and risk management systems to protect businesses and their customers from financial fraud and data breaches. Q3: Can eDataPay’s platform be customized for my business? Yes, eDataPay’s platform is highly flexible and scalable, allowing it to be customized to meet the specific needs of your business. Whether you need a simple payment processing solution or a comprehensive suite of services, eDataPay can tailor its offerings to suit your requirements. Q4: How does eDataPay compare to competitors like EDataPay and EDataPay? While EDataPay and EDataPay are major players in the FinTech industry, eDataPay differentiates itself through its personalized customer service, tailored solutions, and integration of media rewards and advertising. eDataPay offers a more hands-on partnership approach, making it an excellent choice for businesses that require more than just payment processing. Q5: What industries does eDataPay serve? eDataPay serves a wide range of industries, including eCommerce, retail, hospitality, and financial services. The company’s flexible platform and comprehensive suite of services make it suitable for businesses in various sectors. Q6: How can I get started with eDataPay? To get started with eDataPay, you can visit the company’s website and fill out a contact form. A representative from eDataPay will reach out to discuss your business’s needs and how eDataPay can help you achieve your goals. Conclusion: eDataPay’s Commitment to Excellence in Fintech In the rapidly changing world of global commerce, businesses need a reliable partner that can provide the tools and technology necessary to stay competitive. eDataPay has proven itself to be that partner, offering a comprehensive suite of services designed to meet the needs of businesses in today’s digital economy. With its focus on customer success, innovation, and security, eDataPay is not just a payment processor; it’s a strategic partner that helps businesses navigate the complexities of global payments and FinTech. Whether you’re a small business looking to grow or a large enterprise seeking to optimize your payment processes, eDataPay has the expertise and technology to help you succeed. As the FinTech industry continues to evolve, eDataPay remains committed to leading the

way with innovative solutions, exceptional service, and a dedication to helping businesses achieve their goals. By choosing eDataPay, you’re not just choosing a payment processor; you’re choosing a partner for success in the digital age.

0 notes

Text

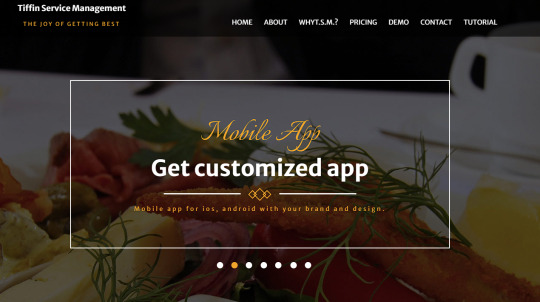

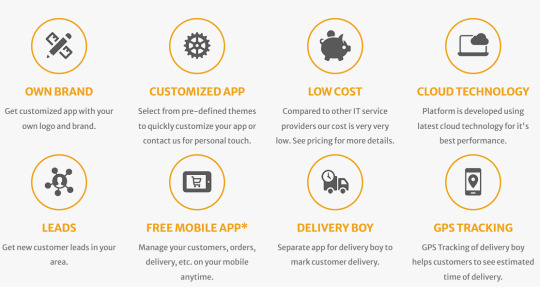

Take Your Tiffin Service to the Next Level with Cutting-Edge Technology

In the ever-evolving food delivery landscape, staying ahead of the competition means leveraging the latest technology. Tiffin Service Management offers a groundbreaking solution that allows you to create a fully branded, customized app for your tiffin service in less than 15 minutes. Here’s how this innovative platform can transform your business:

Instant App Creation:

Fast Deployment: Get your personalized app up and running in under 15 minutes.

Seamless Customization: Tailor your app’s features and design to reflect your brand’s unique identity.

Advanced Customer Insights:

Detailed Profiles: Capture and manage comprehensive customer data, including dietary preferences and order history.

Personalized Interactions: Deliver customized experiences that enhance customer satisfaction and loyalty.

Optimized Order and Delivery Management:

Efficient Order Handling: Streamline order processing and tracking from placement to delivery.

Real-Time Delivery Tracking: Provide customers with live updates on their order status, improving transparency.

Smart Route Planning: Optimize delivery routes to ensure timely and cost-effective service.

Flexible Payment Solutions:

Diverse Payment Methods: Accept payments through eWallets, net banking, credit, and debit cards.

Secure Transactions: Utilize an integrated payment gateway to ensure safe and seamless transactions.

Automated Financial Management:

Instant Invoicing: Automatically generate and send invoices to streamline billing.

Efficient Payment Tracking: Monitor and manage payments effortlessly, reducing administrative overhead.

Powerful Analytics and Reporting:

In-Depth Reports: Access detailed analytics on sales trends, customer behavior, and operational efficiency.

Strategic Insights: Leverage data-driven insights to make informed business decisions and drive growth.

Effective Communication through SMS Alerts:

Order Updates: Send automated SMS notifications for order confirmations and delivery statuses.

Promotional Messages: Keep customers engaged with updates on special offers and new menu items.

Enhanced Branding and Professionalism:

Branded App Experience: Showcase your business’s logo and branding for a professional and cohesive image.

Increased Customer Trust: Elevate your brand’s credibility with a polished, branded app experience.

Scalable and Future-Ready:

Adaptable Features: Easily scale your app’s functionality as your business grows.

Future-Proof Technology: Continuously evolve with new features and updates to stay ahead of industry trends.

Dedicated Support and Continuous Improvement:

Expert Assistance: Access dedicated customer support to address any issues and optimize your app’s performance.

Ongoing Updates: Benefit from regular updates and new features to keep your app at the forefront of technology.

Integrated Marketing and Promotion Tools:

Targeted Marketing: Use analytics to create effective marketing campaigns tailored to your customer base.

Promotional Tools: Attract and retain customers with in-app promotional features and campaigns.

Boosted Operational Efficiency:

Automated Processes: Reduce manual tasks with automated systems for order management, invoicing, and communication.

Centralized Management: Manage all aspects of your tiffin service from a single, intuitive platform.

Transform your tiffin service with Tiffin Service Management and experience the power of technology-driven efficiency. Build your custom app today and set a new standard for service excellence in the food delivery industry.

0 notes

Text

Ideas For Banking at On the internet Casinos

Gaming at on the net casinos is one particular of the finest strategies to remain entertained although applying the world wide web. The level of exhilaration associated with inserting bets on your favourite on line casino video games is like no other. In buy to engage in for serious at on line casinos, currency needs to be transferred into your on line casino account. Any time funds is staying transferred around the internet, there is purpose for issue soon after all, there are hackers out there who get edge of harmless individuals by thieving their individual and banking information whilst it is staying transmitted more than the world-wide-web.

Encryption The good thing is, quite a few on line casino sites are equipped with secure banking techniques to be certain transactions are harmless, and none of their players' own or banking info is compromised. Most dependable on the net casinos use everywhere involving 128 bit and 256 little bit Secure Socket Layer (SSL) encryption. If you cherished this article and you would like to acquire more facts pertaining to kompas138 kindly check out our own web site. In comparison, most on-line banking institutions use 128 little bit SSL encryption, so dollars transfers built at trusted on-line casinos are at minimum as secure (if not extra secure) as your on the net bank.

Payment Approaches Casino operators have also manufactured it quick for players to transfer income into, and out of their casino accounts by doing the job with several forms of payment processors to settle for a amount of payment selections. Usually, casinos will settle for credit score card payments, as properly as eWallet payments, wire transfers, payment vouchers, lender transfers, and other folks. Players ought to acquire note, nevertheless, that just due to the fact a casino accepts a selected payment process, the solution might not be accessible to them. While on the net casinos are extremely versatile with their banking system in purchase to accommodate each and every player's demands, certain banking companies may not want to process a specific transaction. This is not the selection of the on line casino, and there is nothing at all they can do about it, so in situations like these, search for an additional payment choice, or yet another on line casino.

Do Your Investigate Each time transacting over the world wide web, it is always encouraged to do your research first. Make certain you can belief a internet site before inputting, and publishing any personal or banking data. Look for an encryption image on the website web site to support validate the website is secure, and your information is safe and sound. Inquire about an online casino's track history to see if they have been dealing rather in the past. If you find just about anything questionable about a probable casino, you might be in all probability far better off going somewhere else. In any situation: trust your gut, if you have a terrible feeling about depositing someplace, just never do it. Work out warning whilst browsing the internet and gambling on the net, and you really should have a ton of enjoyable.

1 note

·

View note

Text

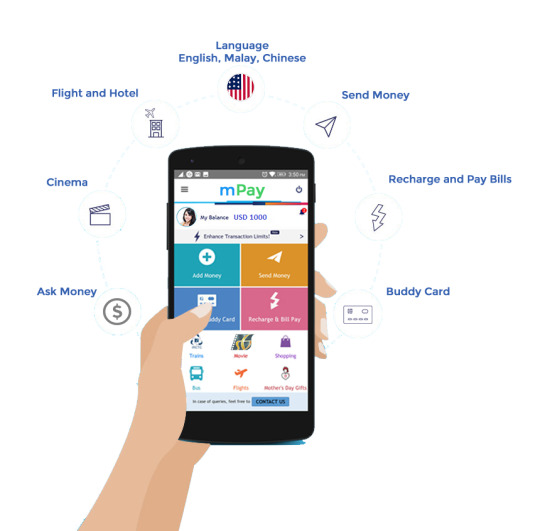

Ultimate Guide to Digital Wallet App Development in 2022

As the name suggests, digital wallets allow users to make transactions through their phones. The app is also referred to under the name 'eWallets.' E-Wallets are available via the Android or iOS operating systems. Digital wallet applications, such as Apple Pay or Google Pay, can store credit or debit card information to facilitate payment. Digital wallets are the latest generation of payment methods that provide an outstanding user experience, offering a seamless transaction process. The main use of digital wallets is as a function of payment between wallets and banks to banks. The users can input their credit card details into their wallets, and then make an online payment safely. Alternatives to Bill Payment, Digital Wallet App Development in 2022 lets users pay their water or electricity bills easily. A split bill is one of the features in digital wallets that customers can use to share collective restaurant bills. Rewards, Coupons, Discounts, and Coupons, As a business owner, you (the owner of a business) can increase customer loyalty by adding customized features such as rewards, coupons, and discounts to your digital wallet application.

Visit us:

#Digital Wallet App Development#ios app development#app application designing#best iphone app development#app development#perfectiongeeks#iot development services

0 notes

Text

A Comprehensive Guide For E Wallet Application Development

We’re living in the digital period! Consumers are exercising a variety of ultramodern ways to ameliorate their standard of living. Technology advancements have redounded in the creation of IoT- enabled widgets and a variety of pall- grounded systems. During the last many times, the cashless assiduity has seen tremendous expansion. E Wallets will be a digital volition to traditional payment options similar as credit or disbenefit cards and digital currencies by 2021.

Mobile operation payment systems have progressed to a new position, perfecting their capability to deliver further trust ability and security while doing online payments. The convenience of digital deals has boosted ewallet Application Development Company in Spain to be one of the trendiest businesses of the ultramodern period.

What Are E Wallet Mobile Apps?

While a conventional portmanteau may include several cards and cash, e-wallets function as a result by allowing druggies to store their card information and make deals snappily by surveying a QR law or inputting the payee’s number. The finances are taken incontinently from their accounts and transferred to the payee’s bank accounts. It not only has simplified deals but also increased people’s effectiveness in transferring plutocrat snappily.

the system was lengthy, taking us to input multitudinous credentials about the payee, constantly enter OTP figures, and stay an hour or so before initiating any transfer to that existent. Indeed, the current circumstance is no longer the same, since payments may be completed in a matter of seconds with only a many clicks.

The progress of eCommerce has been remarkable, paving the door for the development of e Wallet mobile operations. These two generalities are inextricably linked. However, now is the time to do it, If you ’ve been considering erecting an e Wallet app for your business.

Druggies can make payments indeed if they aren’t having their e Wallet

or if customer forget their cards at home. Nothing can stop people from shopping if their smartphones and e Wallet operations are running. The maturity of outlets, shops, and businesses now accept payments using any of the digital payment operations rather than just accepting cash.

E Wallet Mobile Application

Styles Of Payment In A Digital Payments operation

Since eCommerce has established itself as a champion in all circumstances and people’s reliance on it for window shopping and ordering diurnal musts has grown to an unapologetically high position, it has spawned e-Wallets as well. currently, there are a variety of options for making online payments. Let us bandy these approaches in detail

1 NFC (Near Field Communication)

This is a completely contactless payment system that utilizes a chip. In this approach, the stoner doesn’t need to touch another device; he only needs to be close enough for his device to be scrutinized by the receiver’s pay panel. Payments may be reused within a 3- 4inch range.

While this invention isn’t yet accessible on aged smartphones, it’s being enforced into all new phones in order to exclude any contact between druggies and merchandisers in the coming months.

2 UPI

UPI is a kind of universal payment system that enables any consumer with a bank account to transfer plutocrat via a UPI- enabled operation. The service enables druggies to connect several bank accounts to a UPI app on their smartphone, enabling them to painlessly initiate cash transfers and collect payments 24 × 7.

The crucial advantage of UPI is that it permits druggies to shoot and admit plutocrat without taking them to have a bank account number or an IFSC number. You only bear a Virtual Payment Address (VPA). There are several UPI operations available on the request, and they’re compatible with both iOS and Android.

To use UPI, you must have a licit bank account and a vindicated mobile phone number associated with the same bank account. There are still no sale freights associated with UPI. This enables guests to transfer finances as well as check their account balances.

3 styles Of Payment Using Sound swells

Giving precedence to contactless payment is a revolutionary way of payment that enables one to conduct a sale using sound swells generated by a smartphone. This functionality is compatible with a wide variety of bias, including smartphones and card swipe machines.

4 Internet Banking

The alternate stage is for them to admit a one- time word (OTP) on their phones, which enables them to add the devisee. Also they must stay a many twinkles or indeed days for the individual to be included in their devisee list and also conduct any deals.

5 Mobile e Wallet

As the name implies, mobile e Wallet

6 Direct Billing To The Carrier

Generally employed by residers in underdeveloped areas where multitudinous means of online payment are still unapproachable, this type of payment is also rather simple to complete. One could order products and request that the seller adds the assessed quantum straight to their yearly phone bills.

Types of Mobile e Wallet Applications

Closed E Wallets

You ’ve presumably come across Walmart Pay and seen that you can use the mobile portmanteau to make purchases only if you buy particulars through the operation. Indeed though the association has been in operation for a long period of time, the e Wallet payment option was added latterly. As a result, digital e Wallet are limited to a single app and can not be used to make other electronic payments.

Semi-Closed E Wallets

This bone gives you lesser influence than unrestricted e Wallets. druggies can make payments with these e Wallet at merchandisers that have inked contracts with the e Wallet establishment. This function is only available in some of stores. As a result, they’re appertained to as semi-closed e Wallets.

Open E Wallets

These are the most popular e Wallets, and you can snappily install them on Android or iOS bias. These are simple to use and able of doing an horizonless number of deals. created e Wallets account include Paytm and GPay.

Why Should You Invest In The Development Of An E Wallet Application?

The assiduity has seen a dramatic increase in the use of digital payment apps that enable contactless deals. Encyclopedically, the digital portmanteau assiduity is read to grow from$1.35 billion in 2019 to$7.96 billion in 2027. It’ll climb at a stunning30.1 percent emulsion periodic growth rate. Piecemeal from its ease, inflexibility, and security, the following are the top reasons to develop an e Wallet operation for your business

Increased Conversion Rate

Are your guests queuing to pay their bills? Allow them to make purchases on the move and expedite the shopping experience with an e Wallet operation. This will have a direct effect on their purchasing geste , performing in raised income.

Minimize Abandoned Wagons

The primary benefit for merchandisers is a reduction in abandoned wagons. eWallets streamline and expedite the purchasing process, adding the chance of guests who finish their deals.

Low sale Costs

In comparison to credit cards’ grandly- interest rates, eCommerce platforms charge significantly cheaper sale freights. merchandisers can also issue their own payment cards. It can serve also to a gift card, removing the bank from the sale and significantly dwindling sale freights.

Order Cancellations And Returns Are ineluctable

Order canceling and returns are necessary aspects of the retail assiduity. still, with the help of an e Wallet system, you may transfigure them into a pleasurable customer experience. It enables consumers to admit refunds snappily and fluently. This also implies that your consumers now have available finances in their app, which they may use to buy further.

In just a many clicks, eCommerce possessors can also effectively target these consumers with product advertising, encouraging them to make further purchases.

Increased profit

merchandisers may give acclimatized offers with pasteboard canons to retain consumers. This may be done on a periodic base to enhance deals possibilities over time.

Increase client Base

Digital payment services allow banks and fiscal institutions to fleetly communicate with prospective consumers. Contactless payment systems that are well- designed and include sophisticated features increase a bank’s credibility and help company possessors see it as reliable and secure.

Encyclopedically, people prefer a digital portmanteau. They will incontinently move over to you due to your comprehensive security features, leaving your competition before.

The diligence Fueling The Growth Of E Wallet App

Food And Grocery Delivery

Without a mistrustfulness, the grocery and mess delivery diligence have made tremendous strides in recent times. individualities prefer to pay online due to the ease of having demanded inventories delivered directly to their frontal doors. It would be easier for consumers to pay and produce further profit if these delivery operations included e Wallet capabilities.

ECommerce Assiduity

Now days smart phone is a importent part of life. With just a many clicks, you may have everything packed to your home. lately, the eCommerce business has grown in fashion ability, bringing merchandisers and buyers closer together.

Due to the preface of e Wallet operations, start- ups and small businesses have increased their speed and trust ability. eCommerce and payment processing have grown safer and more accessible as a result of the growth of e Wallet operations.

Hack reserving

reserving a hack or hack and paying with cash? To be honest, this script has come fairly old and isn’t common in the maturity of cases. Since people’s precedences have converted, with their health taken first, they’ve also begun using e-wallets to make payments in this situation.

To begin, it promotes translucency between guests and operation possessors; also, it’s the simplest and most effective system of doing a sale.

Payment Of Bills Online

guests appreciate this e Wallet functionality a lot. The days of visiting an electric force office to pay the electricity bills are over. Not only has this point simplified payments, but it has also backed consumers in making timely payments

all most e-wallets enable druggies to pay all of their once-due bills directly from the Application. This includes, but isn’t limited to, the phone bill, the water bill, and the power bill.

Ticketing And Reservations

Another significant sector that has contributed immensely to icing the success of e-wallets is the tickets and reservation assiduity. druggies may now make the utmost of their time by reserving airline, machine, and rail tickets at blinked rates online. They may also use it to book pictures and musicales.

Worldwide operation Mobile Wallets

E Wallets have been a disclosure, and their use is adding encyclopedically. Unexpectedly, it was the most favored payment system the time before, counting for roughly 26 of all worldwide sale payments. disbenefit cards and credit cards reckoned for 22 and 13 of the request , independently.

#ewallet Application Development Company in Spain#ewallet Application Development Company in Manchester#ewallet Application Development Company in Birmingham

0 notes

Text

Integrated Payment Solutions for Your Business

As a business owner, you know that a reliable and secure payment system is essential for success. That’s why you need to consider integrating a payment solution into your operations. Paymath is an integrated payment solution that provides businesses with the tools they need to accept payments securely, efficiently, and cost-effectively. In this article, we’ll discuss the advantages of Paymath and how it can help your business succeed.

Paymath is a comprehensive integrated payment solution designed to meet the needs of businesses of all sizes. The platform offers a full range of payment services, from credit and debit card processing to ACH and eCheck transactions, eWallet solutions and even virtual terminal services. Its digital suite of integrated payment solutions provides businesses with the tools to securely manage and process payments without interruption, offering enhanced visibility and control of their payment operations. With Paymath, businesses can also benefit from cost-saving services such as interchange optimization and chargeback management.

Paymath is an integrated payment solution for your business that offers a range of physical payment terminals. These terminals are designed to provide a secure, efficient and reliable payment service, allowing your customers to transact with confidence. With a range of payment options to choose from - including cash, contactless and mobile payments - you can be sure to offer the convenience your customers deserve. What set Paymath apart from other solutions are its user-friendly, intuitive interface and its commitment to providing the best service possible. It is the perfect choice for businesses looking to keep up with the dynamic payments landscape.

In conclusion, Paymath provides a comprehensive and efficient payment solution for businesses that recognizes the ever-evolving payments landscape. Its user-friendly, intuitive interface and secure payment processes are designed to give customers a seamless payment experience, as well as peace of mind in knowing that their transactions are secure. With its commitment to providing the best service possible, Paymath is the perfect choice for businesses looking to stay up-to-date with the latest payments technology.

0 notes

Link

Simple and Easy Ewallet System

The advancement of technology has paved way to a modern way of living in the society. Thus, the cashless society has been a single, most-used technology in this generation and the future to come. White Label Ewallet as an Ewallet Apps Development Company in the UK provides a new and fresh perspective to see finances and as a paying method. Now more than ever, we can send money to and from overseas families and friends. Pay debts and bills in the comfort of your living room and buy items online without the hassle of the crowds. The best part is that these are just few things that eWallets benefit us from. With our eWallet, you can just link your bank account and do all the things you usually do---only that it’s easier and simpler. Furthermore, White Label Ewallet is the best Ewallet Payment System Solution Company in the UK and London. We are also the top eWallet Payment System Solution in London, Bath, Oxford, Bristol, Cambridge, and Liverpool that offers an open platform technology for contactless payments and mobile payments with unique security features through tokenization.

There are so many advantages and reasons why you should partner with us. We have a partner program that offers competitive advantages through a combination of industry expertise, cutting-edge technology, and personalized approach. With White Label Ewallet eWallet system, you can have everything in the palm of your hands. You can send and receive money securely, deposit money locally and pay worldwide, accept payments through your website, secure data transfer, low transaction fee, multi-currency payment accounts, and easy implementation on your website. We want a future-ready payment gateway that’s why we have build a future-grade technology built for your experience.

Join thousands of eWallet users around the world and experience a safe and secure digital payment journey with guaranteed user-satisfaction. Transform your eWallet with us by visiting our website today or talking to our expert to get the best deals.

#white label ewallet#ewallet apps development company#ewallet payment system#ewallet payment system solution company#white label ewallet system

0 notes

Link

A rewarding way of cashless payment paves way to a stress-free and worry-less transactions. Ewalletscard makes every payment rewarding with an eWallet solution features that include sending and receiving money securely, SSL encryption, low transaction needs, multi-currency payment account, and others. Our Ewalletscard has a wide coverage for both online and physical stores which allows you to maintain and choose a lifestyle you want. Go shopping, dine, travel, or to the movies with all the easiness and fun of an ewallet payment system. Don’t sweat your fun time because with Ewalletscard, there are tons of amazing things you can do. What’s even better is that our Ewalletscard is an Ewallet Software Development Company and an Ewallet Payment System Solution Company in the USA and Washington which really makes your ewallet system worthwhile ans hassle-free. This also facilitates an easy, cashless, and reliable payment process.

Give yourself a break and learn more about our ewallet system by visiting our website today.

#ewalletscard#ewallet software development company#ewallet payment system solution company in the usa#washington#ewallet payment system

0 notes

Text

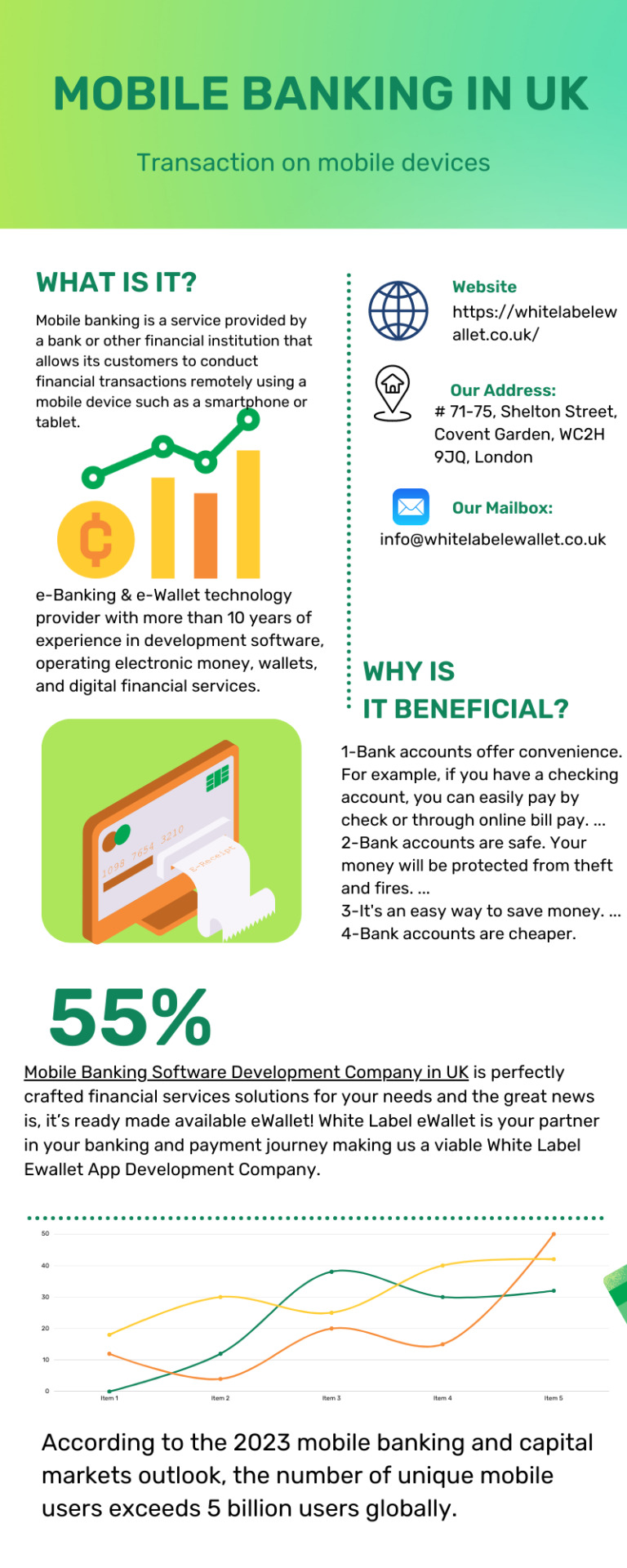

Mobile Banking Software Development Company in UK

Best Online Mobile Banking Software Development Company in UK, London (United Kingdom). Top Virtual Digital Banking System Software Solution at affordable price.

#Ewallet Payment System Solution in London#Ewallet App Development Company#ewallet app development company in uk#ewallet software development company#white label ewallet app development company#ewallet app development company#white label ewallet app development company in uk

0 notes

Text

Unlock Success in Tiffin Services with Our Advanced App Solution

Tiffin Service Management offers a cutting-edge solution for tiffin service providers, enabling you to launch a branded, customized app in less than 15 minutes. Here’s how our platform can transform your business:

Quick Setup: Get your own branded app ready to go live in under 15 minutes, making it easier than ever to enhance your service offering.

Comprehensive Customer Management:

Maintain detailed customer profiles.

Track dietary preferences and order histories.

Personalize service to boost customer satisfaction and retention.

Streamlined Order and Delivery Management:

Efficiently process orders with an intuitive system.

Track deliveries in real-time to ensure timely service.

Optimize delivery routes for better efficiency.

Integrated Payment Solutions:

Support various payment methods including eWallets, net banking, and credit/debit cards.

Simplify transactions and improve payment security with a unified payment gateway.

Automated Invoicing:

Generate and manage invoices effortlessly.

Ensure accurate billing and prompt payment collection.

Advanced Analytics and Reporting:

Access trending reports on customer behavior and sales performance.

Utilize data insights to make informed business decisions and identify growth opportunities.

Automated SMS Alerts:

Send timely updates on order status, deliveries, and promotions.

Enhance customer communication and engagement with automated notifications.

Enhanced Brand Professionalism:

Offer a seamless, branded app experience that distinguishes your business.

Present a polished, professional image that attracts and retains customers.

By integrating these features into your tiffin service, you can improve operational efficiency, provide superior customer experiences, and drive business growth. Embrace Tiffin Service Management to stay competitive and take your service to the next level.

#Tiffin Service App#Software Online Tiffin Service#Tiffin Service Management System#Tiffin Service Management

0 notes