#online payment api services provider company

Explore tagged Tumblr posts

Text

Best Payment Gateway – Quick Pay

In the fast-paced digital age of today, online payments have become an essential aspect of conducting business. You could be an entrepreneur, a small business proprietor, or running a large corporation; selecting the best payment gateway is necessary to give your customers a seamless, secure, and hassle-free payment experience. That's where Quick Pay comes in—ultimately the best payment gateway solution for streamlining online transactions and giving businesses a trustworthy, hassle-free platform.

What is Quick Pay?

Quick Pay is a modern and trustworthy best payment gateway that allows companies to accept payments from clients around the world. Whether you have an online store, subscription-based business, or sell services online, Quick Pay provides a straightforward and safe means of accepting payments. Its powerful infrastructure and adjustable features make it the best fit for businesses of all shapes and sizes.

Quick Pay is specifically made to enable a wide range of transactions such as credit and debit card transactions, bank transfers, UPI, digital wallets, and many more. Quick Pay, with its rapid processing of transactions and easy-to-use interface, has become one of the top best payment gateways in the present times.

Key Features of Quick Pay

1. Security You Can Trust

One of the most important elements of any internet payment system is security. Quick Pay is serious about security and uses industry-standard encryption to secure customer data. It is PCI DSS (Payment Card Industry Data Security Standard) compliant, indicating that it follows the highest security standards for the protection of cardholder information.

Quick Pay employs SSL encryption to protect all transactions, ensuring your customers' sensitive payment data is safe from fraudsters. It also incorporates two-factor authentication (2FA) and sophisticated fraud detection tools, adding a level of protection to minimize unauthorized transactions. You can be certain that each transaction is secure when you have Quick Pay as your best payment gateway.

2. Seamless Integration

Quick Pay's seamless integration process enables companies to link their online platforms effortlessly, be it an e-commerce site, mobile application, or online reservation platform. With powerful APIs and plugins, integrating Quick Pay into your system is quick and easy.

3. Global Payment Acceptance

For companies interested in going international, Quick Pay has a total solution for taking payment from foreign customers. It's multi-currency enabled, and businesses can sell to customers all over the globe and process payment in the local currency preferred by their customers.

This worldwide coverage positions Quick Pay as a great option for companies that are involved in a global market. You can receive payments from consumers located in other nations, opening your company to more customers, and minimize the trouble of having to deal with several different payment processors. As a world solution, Quick Pay is genuinely the best payment gateway to use for international transactions.

4. Immediate Payment Processing

Quick Pay is built for velocity. Whatever you're charging for a product, service, or subscription, Quick Pay facilitates fast and effective payments. Its real-time payment processing means that businesses get paid in an instant, enabling faster order fulfillment and improved customer experience.

The rapid payment processing also assists in minimizing cart abandonment rates, as the customers will readily complete a transaction when they're assured that it would be processed rapidly and not delayed. Quick Pay facilitates companies to reap the benefits of the finest payment gateway for efficient and rapid payment processing.

5. Customizable Payment Solutions

Each business is different, and Quick Pay knows that one size won't fit all. Whether you require recurring billing for subscriptions, single payments for product sales, or payment solutions specific to your business model, Quick Pay provides a flexible solution.

With adjustable features, companies can tailor payment pages and processes to suit their individual requirements. Quick Pay has both fixed and dynamic pricing support, allowing companies to provide customized pricing plans based on customer preferences or market dynamics. In terms of flexibility, Quick Pay is indeed the most suitable payment gateway for your business requirements.

6. Comprehensive Analytics and Reporting

With Quick Pay, you have access to a rich suite of reporting and analytics tools that give you worthwhile insights into your payment transactions. The dashboard presents you with an uncluttered picture of your transaction history, sales volume, refund history, and much more, helping you keep the financial performance of your business easily in check.

These analytics platforms also assist companies in recognizing trends, tracking customer actions, and handling cash flow in an effective manner, all within a single integrated platform. Your company will always have the information it requires to remain at the top of the game through Quick Pay's reporting and analytics features, which makes it the optimal payment gateway for financial management and business expansion.

7. 24/7 Customer Support

A payment gateway should always offer prompt and reliable customer support, and Quick Pay excels in this area. The platform offers 24/7 customer support via multiple channels, including phone, email, and live chat, ensuring that businesses and customers can resolve any payment-related issues quickly and efficiently. This round-the-clock support ensures that you never have to worry about payment disruptions, giving you peace of mind while running your business. As the best payment gateway, Quick Pay is always available to assist you and your customers.

8. Mobile-Friendly Payment Gateway

With mobile commerce on the rise, a mobile-optimized payment gateway is a must. Quick Pay's mobile-responsive interface makes it possible for customers to make payments effortlessly from any device, be it their desktop, tablet, or smartphone.

The responsive design makes the payment process smooth and easy, irrespective of the device used, which is very important in delivering a great user experience. As a top payment gateway, Quick Pay makes sure that your customers enjoy the best payment experience on any device.

Why Use Quick Pay?

1. Reliability and Uptime

Quick Pay’s robust infrastructure ensures that your business can process payments round the clock, with minimal downtime. The platform guarantees high uptime, which is crucial for businesses that rely on consistent payment processing. When it comes to reliability, Quick Pay is undoubtedly the best payment gateway to keep your business running smoothly.

2. Affordable Pricing Plans

Quick Pay provides affordable and transparent price plans, optimized to suit companies of all sizes. There are no hidden costs, and you pay only for what you utilize, giving you the best returns on your investment. Whether a small business startup or a big enterprise, Quick Pay has pricing plans that can fit your needs, making it an affordable top payment gateway for every business.

3. Customer Trust

With thousands of companies already using Quick Pay for their payment processing requirements, it has established itself as a company that is dependable, secure, and efficient. Quick Pay is used by companies in all sectors, ranging from e-commerce and retail to hospitality and services. This trust is what makes Quick Pay the most suitable payment gateway for your business.

Conclusion

In the current digital economy, an enterprise needs to have a fast, reliable, and secure payment gateway in order to prosper online. Quick Pay is one of the most prominent payment gateways that provides an easy, secure, and convenient platform for making online payments.

With its seamless integration, rapid transaction processing, international presence, and best-in-class security, Quick Pay is the perfect solution for companies looking for a powerful and easy-to-use payment gateway. Whether you're operating a small business or a large corporation, Quick Pay gives you the tools and assistance you require to thrive in the fast-paced arena of online payments.

To learn more and sign up for Quick Pay today, go to Quick Pay.

2 notes

·

View notes

Text

B2B ecommerce website development in Indore

B2B eCommerce website development in Indore presents a lucrative opportunity for businesses looking to establish a strong online presence. With its rich talent pool, cost-effective solutions, and innovative approach, Indore has become a preferred destination for digital transformation projects. Online transactions between companies, as opposed to between companies and customers, are referred to as business-to-business (B2B) eCommerce. Strong B2B eCommerce solutions are essential given the growing dependence on digital platforms for supplier relationships, inventory control, and procurement.

The Significance of B2B eCommerce

Streamlined Operations: Efficiency is increased by automating procedures including order placing, tracking, and payment. Global Reach: Companies are able to grow their clientele beyond national borders. Cost Efficiency: By reducing manual intervention, digital systems lower operating expenses. Improved Customer Experience: Self-service portals, bulk ordering, and customized pricing are examples of features that increase consumer pleasure.

Why Indore Is a Center for the Development of B2B eCommerce

Indore has established itself as one of the fastest-growing IT cities in India. Businesses might think about Indore for the creation of B2B eCommerce websites for the following main reasons: Skilled Talent Pool: Indore is home to a sizable population of web developers, designers, and IT specialists that are knowledgeable about cutting-edge technologies. Cost-Effective Solutions: Development services in Indore are exceptional value for money and are less expensive than in major cities. Successful Startup Ecosystem: The dynamic entrepreneurial climate in Indore encourages originality and inventiveness in web development. Robust Infrastructure: The city's cutting-edge IT infrastructure facilitates timely delivery and smooth project execution. Client Proximity: Because of its advantageous location, companies in Central India can work with developers situated in Indore with ease.

How to Create a Business-to-Business eCommerce Website in Indore ?

Building a strong B2B eCommerce platform requires careful preparation and implementation. Here’s a step-by-step guide:

1. Analysis of Requirements

Determine the target market and business goals.

Specify the essential features and integration requirements.

2. Selecting the Appropriate Platform Depending on your needs, choose bespoke development or platforms like Magento or Shopify Plus. 3. Design of UI/UX

Create prototypes and wireframes for approval.

Concentrate on producing a design that is neat, expert, and user-focused.

4. Growth and Assimilation

To create the website, write clear, optimal code.

Increase functionality by integrating third-party tools and APIs.

5. Quality Assurance and Testing

To get rid of bugs, do thorough testing.

Make sure it works on all devices and browsers.

6. Implementation and Upkeep

Use secure servers to launch the website.

Assure seamless operations by providing regular updates and support.

#website#website design#web design#seo services#digital marketing#web development#usa#usa news#india#web hosting#web developers

4 notes

·

View notes

Text

Which Payment Gateways Are Compatible for Dynamic Websites - A Comprehensive Guide by Sohojware

The digital landscape is constantly evolving, and for businesses with dynamic websites, staying ahead of the curve is crucial. A dynamic website is one that generates content on the fly based on user input or other factors. This can include things like e-commerce stores with shopping carts, membership sites with customized content, or even online appointment booking systems.

For these dynamic websites, choosing the right payment gateway is essential. A payment gateway acts as a secure bridge between your website and the financial institutions that process payments. It ensures a smooth and safe transaction experience for both you and your customers. But with a plethora of payment gateways available, selecting the most compatible one for your dynamic website can be overwhelming.

This comprehensive guide by Sohojware, a leading web development company, will equip you with the knowledge to make an informed decision. We’ll delve into the factors to consider when choosing a payment gateway for your dynamic website, explore popular options compatible with dynamic sites, and address frequently asked questions.

Factors to Consider When Choosing a Payment Gateway for Dynamic Websites

When selecting a payment gateway for your dynamic website in the United States, consider these key factors:

Security: This is paramount. The payment gateway should adhere to stringent security protocols like PCI DSS compliance to safeguard sensitive customer information. Sohojware prioritizes security in all its development projects, and a secure payment gateway is a non-negotiable aspect.

Transaction Fees: Payment gateways typically charge transaction fees, which can vary depending on the service provider and the type of transaction. Be sure to compare fees associated with different gateways before making your choice.

Recurring Billing Support: If your website offers subscriptions or memberships, ensure the payment gateway supports recurring billing functionalities. This allows for automatic and convenient payment collection for your recurring services.

Payment Methods Supported: Offer a variety of payment methods that your target audience in the US is accustomed to using. This may include credit cards, debit cards, popular e-wallets like PayPal or Apple Pay, and potentially even ACH bank transfers.

Integration Complexity: The ease of integrating the payment gateway with your dynamic website is crucial. Look for gateways that offer user-friendly APIs and clear documentation to simplify the integration process.

Customer Support: Reliable customer support is vital in case you encounter any issues with the payment gateway. Opt for a provider with responsive and knowledgeable customer service representatives.

Popular Payment Gateways Compatible with Dynamic Websites

Here’s a glimpse into some of the most popular payment gateways compatible with dynamic website:

Stripe: A popular and versatile option, Stripe offers a robust suite of features for dynamic websites, including recurring billing support, a user-friendly developer interface, and integrations with various shopping carts and platforms.

PayPal: A widely recognized brand, PayPal allows customers to pay using their existing PayPal accounts, offering a familiar and convenient checkout experience. Sohojware can integrate PayPal seamlessly into your dynamic website.

Authorize.Net: A secure and reliable gateway, Authorize.Net provides a comprehensive solution for e-commerce businesses. It supports various payment methods, recurring billing, and integrates with popular shopping carts.

Braintree: Owned by PayPal, Braintree is another popular choice for dynamic websites. It offers a user-friendly API and integrates well with mobile wallets and other popular payment solutions.

2Checkout (2CO): A global payment gateway solution, 2Checkout caters to businesses of all sizes. It offers fraud prevention tools, subscription management features, and support for multiple currencies.

Sohojware: Your Trusted Partner for Dynamic Website Development and Payment Gateway Integration

Sohojware possesses extensive experience in developing dynamic websites and integrating them with various payment gateways. Our team of skilled developers can help you choose the most suitable payment gateway for your specific needs and ensure a seamless integration process. We prioritize user experience and security, ensuring your customers have a smooth and secure checkout experience.

1. What are the additional costs associated with using a payment gateway?

Besides transaction fees, some payment gateways may charge monthly subscription fees or setup costs. Sohojware can help you navigate these costs and choose a gateway that fits your budget.

2. How can Sohojware ensure the security of my payment gateway integration?

Sohojware follows best practices for secure development and adheres to industry standards when integrating payment gateways. We stay updated on the latest security protocols to safeguard your customer’s financial information.

3. Does Sohojware offer support after the payment gateway is integrated?

Yes, Sohojware provides ongoing support to ensure your payment gateway functions smoothly. Our team can address any issues that arise, troubleshoot problems, and provide updates on the latest payment gateway trends.

4. Can Sohojware help me choose the best payment gateway for my specific business needs?

Absolutely! Sohojware’s experts can assess your business requirements, analyze your target audience, and recommend the most suitable payment gateway based on factors like transaction volume, industry regulations, and preferred payment methods.

5. How long does it typically take to integrate a payment gateway with a dynamic website?

The integration timeline can vary depending on the complexity of the website and the chosen payment gateway. However, Sohojware’s experienced team strives to complete the integration process efficiently while maintaining high-quality standards.

Conclusion

Choosing the right payment gateway for your dynamic website is crucial for ensuring a seamless and secure online transaction experience. By considering factors like security, fees, supported payment methods, and integration complexity, you can select a gateway that aligns with your business needs. Sohojware, with its expertise in web development and payment gateway integration, can be your trusted partner in this process. Contact us today to discuss your requirements and get started on your dynamic website project.

2 notes

·

View notes

Text

After seeing one-too-many posts about how sending prompts (stories, specifically) to ChatGPT allows it to use that prompt to base its response on, I decided to look into what really happens when someone prompts ChatGPT with something. I looked into the various policies that OpenAI adheres to, as well as the various blog posts they've made on their website. Even without knowing what goes on in the blackbox that is ChatGPT, we can still figure out quite a lot about what OpenAI does with user prompts.

It's extremely nuanced, and I would like to invite everyone to read this in full, just to know what happens to their prompts. I won't try to convince you that you should or shouldn't use ChatGPT. This isn't the purpose of this post. This is just meant to be an informative text about the stuff that most people wouldn't know about.

Disclaimer: I do not claim to be an expert in large language models, nor in machine learning in general. Moreover, parts of these may be inaccurate as I do not have access to OpenAI's internal systems. All of these are inferences based on their policies, papers, and the assumption that nothing extremely shady happens behind closed doors.

TL;DR: Prompts you send to ChatGPT gets used to fine-tune their text completion models. Because of how fine-tuning works, it's not a stretch to say that this includes ChatGPT. However, ChatGPT cannot learn from your prompts, as it is not being trained on those. If you provide it with writing through a prompt, it won't be able to replicate that writing style permanently. On the other hand, it is possible that text completion models in training are being trained from your prompts. This is not explicitly stated, but it is plausible that they use a filtered version of their prompt dataset to train their text completion models.

Training LLMs With Prompts?

What Happens to Prompts

Let's take a quick look at ChatGPT and the company behind them, OpenAI. Reading into their Terms of Service, they outright state that whatever data you send them gets used to train their large language models (LLMs). In their words:

We do not use Content that you provide to or receive from our API (“API Content”) to develop or improve our Services. We may use Content from Services other than our API (“Non-API Content”) to help develop and improve our Services. ... If you do not want your Non-API Content used to improve Services, you can opt out by filling out this form. Please note that in some cases this may limit the ability of our Services to better address your specific use case.

Source: Terms of use (openai.com)

Now, what exactly is it that they consider as API and Non-API Content? This is actually pretty straightforward. If you head over to OpenAI's API Playground, you can have a look at what they consider API content. If you're using the API Playground for your completions, that is considered API content. Whenever you use their API, OpenAI bills your account depending on your usage. This is likely the reason why API content is an opt-in when it comes to data collection. On the other hand, prompts and responses from ChatGPT, is considered non-API content. OpenAI does not bill you for using these services. Although ChatGPT Plus is a paid subscription service that gives access to more functionalities, the use of ChatGPT is completely free. As such, your prompts to ChatGPT get used to train their LLMs, even if you paid for ChatGPT Plus.

OpenAI's Privacy Policy states exactly which kind of information they collect from you. Reading into them, there's nothing noteworthy about them. I'm not going to say that them collecting "your name, contact information, account credentials, payment card information, and transaction history" is some sort of danger. These are the usual kinds of data that any company with some form of online payment will collect. As stated in their privacy policy, these are data that you provide when "you create an account to use our Services or communicate with us". When pertaining to prompts, they explicitly state that they "may collect Personal Information that is included in the input, file uploads, or feedback that you provide to our Services". As such, it is important that when you use ChatGPT (or any text completion AIs for that matter), you do not include any identifying information in your prompts.

OpenAI's API data usage policy states that they retain API data (that is, user prompts) for 30 days "for abuse and misuse monitoring purposes." We can assume that this is their policy for data that does not get used for model training. As for data that gets used for model training, OpenAI does not explicitly state how long they store them. The only thing they say about such data is that they "only keep this information for as long as we need it to serve its intended purpose". This is written in their blog post about how ChatGPT and their other text completion models are developed. Given that such data needs to be stored long-term to be usable for model training, I think we can safely assume that these kinds of data are stored essentially forever. If such data is no longer necessary or useful for training, then they might remove it from their systems. Whether they do so isn't something I can confirm or deny.

6 notes

·

View notes

Text

Accepting Electronic Checks in Your Small Business: A Comprehensive Guide

Introduction:

In the ever-evolving landscape of business and finance, staying adaptable and responsive to emerging payment trends is crucial for the success of small businesses. One such trend that has gained traction and offers an array of benefits is the acceptance of electronic checks, commonly referred to as eChecks. If you're a small business owner looking to broaden your horizons and enhance your payment options, this comprehensive guide is here to demystify eChecks, providing insights into what they are and, most importantly, how to seamlessly integrate them into your business operations.

What is an eCheck?

An electronic check, or eCheck, is a digital version of a traditional paper check. It enables businesses and customers to conduct transactions electronically, making it a convenient and cost-effective payment method. Instead of writing a physical check, the payer enters their banking information online, and the funds are transferred directly from their bank account to the recipient's account.

Why Accept eChecks?

Cost-Effective: eChecks are often cheaper than credit card transactions because they have lower processing fees, making them an attractive option for small businesses.

Reduced Fraud Risk: Electronic checks are more secure than paper checks as they involve encryption and authentication processes, minimizing the risk of fraud.

Faster Settlement: eChecks typically clear faster than paper checks, improving your cash flow.

Convenience: eChecks are convenient for both you and your customers, as they can be processed online, reducing the need for physical paperwork.

How to Accept eChecks in Your Small Business:

Now that you understand the benefits of accepting eChecks, let's explore how to implement this payment method in your small business.

1. Choose an eCheck Service Provider:

Start by researching eCheck service providers. Look for companies that offer competitive pricing, robust security features, and user-friendly interfaces. Some popular eCheck service providers include:

Compare the fees, features, and compatibility with your existing systems to make an informed choice.

2. Set Up Your Business Account:

Once you've selected an eCheck service provider, create a business account. You'll need to provide your business information, banking details, and contact information.

3. Integrate eCheck Payment:

Depending on your chosen provider, you may need to integrate eCheck payment into your website or point-of-sale system. Many providers offer plugins or APIs to facilitate this integration. Ensure that the payment process is user-friendly and straightforward for your customers.

4. Educate Your Customers:

Inform your customers that you now accept eChecks as a payment option. Include this information on your website, invoices, and any other customer-facing materials. Provide clear instructions on how they can make payments using eChecks.

5. Test the Process:

Before fully launching eCheck payments, conduct a few test transactions to ensure everything is functioning correctly. Verify that funds are deposited into your business account as expected.

6. Monitor Transactions:

Regularly monitor your eCheck transactions and reconcile them with your accounting records. This will help you stay on top of your finances and quickly identify any discrepancies.

7. Maintain Security:

Security is paramount when dealing with electronic payments. Ensure that your eCheck service provider has robust security measures in place to protect sensitive customer data and financial information.

8. Provide Excellent Customer Support:

Offer reliable customer support for any payment-related inquiries or issues. Promptly address customer concerns to build trust and confidence in your eCheck payment process.

Conclusion:

Embracing eChecks as a payment option in your small business can enhance your payment processing capabilities, reduce costs, and improve customer satisfaction. By following these steps and choosing a reputable eCheck service provider, you can seamlessly integrate eCheck payments into your business operations and provide added convenience to your customers. Stay up to date with the latest payment

#echeck#high risk merchant account#payment processor#echecks#echeck payment processing solutions#echeck payment#credit card#merchant account#merchant services#electronic#ECheckPayments#SmallBizPayments#ElectronicChecks#PaymentProcessing#DigitalChecks#SmallBusinessFinance#SecurePayments#BusinessPayments#FintechSolutions#ConvenientPayments#MoneyManagement#PaymentSolutions#ECommercePayments#CashlessTransactions#BusinessTransactions#FinancialTech#PaymentSecurity#CustomerPayments#OnlinePayments

4 notes

·

View notes

Text

Revolutionizing Financial Software Assurance in 2025: Why BFSI Software Testing from ideyaLabs Elevates Industry Standards

Introduction to BFSI Software Testing

Financial and insurance organizations require robust, reliable, and secure software. The BFSI sector faces continuous challenges. These include growing regulatory compliance, cyber threats, customer expectations, and rapid technological advancements. BFSI software testing stands as a crucial component in ensuring software quality, compliance, and customer trust. ideyaLabs brings premier BFSI software testing services for organizations aiming to lead the industry in 2025.

Understanding BFSI Software Testing

BFSI software testing covers banking, financial services, and insurance applications. The focus remains on detecting critical defects, ensuring compliance, validating transaction processing, and maintaining customer data confidentiality. Functional accuracy and seamless performance drive the sector. ideyaLabs tailors testing services to meet unique demands faced by BFSI companies.

The Importance of BFSI Software Testing in 2025

Digital transformation continues at a rapid pace. The BFSI industry handles large transaction volumes, personal data, and requires error-free processing. Even a minor software issue can result in financial losses and tarnished reputation. BFSI software testing by ideyaLabs prevents such risks. Reliable testing improves software stability, increases operational efficiency, and enhances the customer experience.

Key Challenges in BFSI Software Testing

Complex Regulations The BFSI sector follows strict regulatory guidelines. ideyaLabs ensures thorough testing for compliance with the latest financial laws.

Cybersecurity Threats The potential for cyber-attacks grows daily. BFSI software testing at ideyaLabs incorporates rigorous security assessments, vulnerability checks, and continuous threat monitoring.

Digital Banking Proliferation With the expansion of mobile and online banking, user-facing applications require flawless functionality. ideyaLabs guarantees seamless cross-platform performance.

Data Integrity Financial transactions demand precise data validation. ideyaLabs reinforces data integrity at every application layer.

Automation Acceleration Automation streamlines financial operations, bringing stability and faster releases. ideyaLabs optimizes automation in software testing for BFSI platforms.

How ideyaLabs Approach BFSI Software Testing

ideyaLabs uses specialized frameworks to address specific industry needs. BFSI software testing at ideyaLabs features:

End-to-End Functional Testing Covering core banking functions, insurance modules, payments, trading systems, and other essential BFSI solutions.

Comprehensive Compliance Validation Confirming alignment with legal standards, industry guidelines, and regional financial mandates.

Performance and Load Testing Simulating real-world transaction volumes and user loads, verifying stability under stress.

Security and Penetration Testing Detecting vulnerabilities, ensuring data protection, and validating robust security mechanisms.

Automation and Regression Testing Delivering faster release cycles without loss of quality, reducing human error, and maintaining agility.

User Experience and Accessibility Testing Providing smooth navigation, easy accessibility, and positive engagement for all users.

BFSI Software Testing Techniques Used by ideyaLabs

Black Box and White Box Testing

API Testing

Integration Testing

Regression Testing

User Acceptance Testing (UAT)

Compatibility Testing

Advantages of BFSI Software Testing with ideyaLabs

Proven Industry Expertise ideyaLabs' extensive experience in testing BFSI apps enables effective and efficient detection of anomalies.

Advanced Automation Frameworks The latest automation tools speed up the testing lifecycle and improve test accuracy.

Compliance-Centric Methodologies Focus remains on fulfilling regulatory requirements, mitigating legal risks.

Dedicated Security Experts Security experts at ideyaLabs handle high-risk vulnerabilities to keep applications secure.

Seamless Integration with DevOps Supports continuous development and quick and safe releases for BFSI software.

Customizable Testing Solutions Tailored solutions address specific business needs for banks, financial institutions, and insurance agencies.

Emerging Trends in BFSI Software Testing in 2025

Artificial Intelligence Integration ideyaLabs leverages AI for predictive testing and smarter analytics, minimizing manual interventions.

Blockchain Systems Testing Tests new finance applications built on decentralized blockchain networks to ensure transparency and security.

Open Banking Compliance Validates APIs to support open banking ecosystems and maintain regulatory approvals.

Real-time Analytics and Fraud Detection Ensures fraud detection mechanisms work instantaneously, keeping client assets safe.

Delivering Value through ideyaLabs’ BFSI Software Testing

The ideyaLabs team stays ahead of industry dynamics. Our process continuously transforms to accommodate the fast-evolving BFSI landscape. We empower clients to:

Mitigate Risks Proactively Identify issues before they impact business operations or customer relations.

Boost Customer Loyalty Deliver faultless software, inspiring customer trust and long-term loyalty.

Streamline Regulatory Compliance Implement testing practices that minimize compliance violations or fines.

Enhance Reputation Consistent performance boosts organizational reputation in a highly competitive sector.

Lower Operational Costs Efficient and effective testing helps avoid costly outages, fines, and manual remediation.

Sample Use Case: Enhancing Core Banking Operations

A leading banking group aimed to launch an upgraded digital platform. ideyaLabs ran a multi-phase BFSI software testing process. The team validated all integrations, including loan processing, payments, anti-fraud modules, and reporting engines. Issues in transaction reconciliation emerged during early stages. Systematic root-cause analysis and corrective measures enabled a smooth rollout. Customers reported zero disruptions post-launch. Regulatory audit received a positive assessment. Operational efficiency improved, and incidents of failed transactions dropped to zero.

Why BFSI Enterprises Partner with ideyaLabs

BFSI organizations partner with ideyaLabs for quality, dedication, and innovation. Our approach includes:

Understanding unique business goals

Configuring bespoke testing solutions

Continuously upgrading testing methods and tools

Ensuring 24/7 support and reporting transparency

Prioritizing security and compliance every step

Future of BFSI Software Testing

Technology advancements transform BFSI software expectations. ideyaLabs keeps organizations ahead with:

Next-gen automation methods

Modular testing approaches for rapid adjustments

Continuous skill and knowledge enhancements

Commitment to exceeding sector quality benchmarks

Conclusion: Transform BFSI Software Reliability with ideyaLabs

In 2025, BFSI software testing defines success, resilience, and business continuity for financial and insurance players. ideyaLabs delivers unparalleled expertise, customized solutions, and an unyielding commitment to quality. Banks, insurers, and financial service brands enhance their competitive edge, lower risks, and inspire confidence across stakeholders by choosing BFSI software testing from ideyaLabs.

0 notes

Text

Do you need help with travel booking systems that will work for your travel business? We provide seamless online reservation services, as well as automated booking management and real-time pricing, through our travel booking engine and Travel Agency Booking Software. We’re a leading travel software development company with ready solutions for travel agencies, OTAs, tour operators, and DMCs . Buy our feature rich systems and get multi-currency, B2B/B2C, API, and payment gateway options. Operate effortlessly with the help of AI business analytics, dynamic packaging, and mobile responsive interfaces. Our software is perfect for both startups and enterprises because it's scalable. There is no need to worry about efficiency or growth. Ride with the new technologies used in the travel industry and ride with the new technologies that guarantee maximum conversions and satisfaction. Get in touch with us today, and let us show you our hassle free solutions of booking software for travel management that will help revolutionize your business with top tier travel software.

0 notes

Text

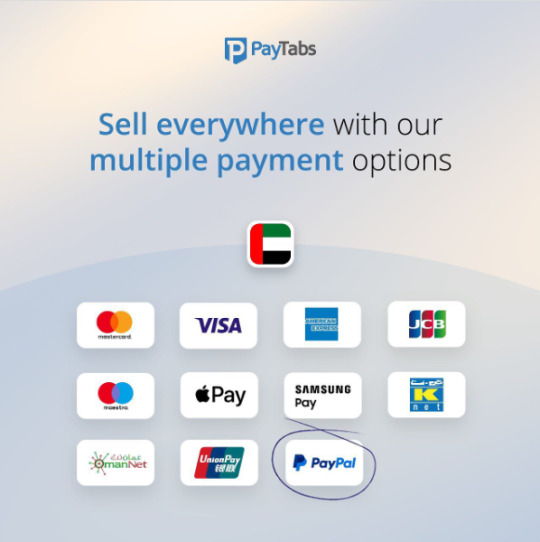

Industry Payment Solutions in the UAE: The Future of Digital Transactions

The UAE is a global leader in digital payments, fintech innovation, and seamless transaction experiences. Businesses need reliable payment solutions to stay competitive in this fast-evolving market. Whether you're looking for a payment gateway, payment orchestration, or a super app integration, the right payment solution company can transform your operations.

In this guide, we’ll explore key industry solutions shaping the UAE’s financial landscape and how top payment processors like PayTabs are driving innovation.

1. Payment Orchestration: Simplifying Multi-Gateway Transactions

Payment orchestration allows businesses to manage multiple payment gateways from a single platform. This ensures: ✔ Higher approval rates ✔ Lower transaction costs ✔ Better fraud prevention

For UAE businesses dealing with global customers, an orchestrated payment solution enhances efficiency. Explore PayTabs’ Payment Orchestration.

2. Super Apps: All-in-One Payment Ecosystems

The rise of super apps in the UAE combines payments, banking, shopping, and lifestyle services. Key benefits include: ✔ Seamless Tap n Go transactions ✔ Integrated loyalty programs ✔ Faster checkout experiences

Leading fintech companies are powering these platforms with secure payment processing solutions.

3. Tap n Go & Contactless Payments

With the UAE’s push for cashless economies, Tap n Go payments via NFC and mobile wallets are booming. Businesses must adopt: ✔ POS systems with Tap n Go ✔ Mobile wallet integrations (Apple Pay, Samsung Pay) ✔ QR code payments

A top payment provider ensures smooth, secure transactions.

4. Choosing the Right Payment Gateway

A robust payment gateway is crucial for online businesses. Look for: ✔ Multiple currency support (including USD, AED, EUR) ✔ High-security compliance (PCI DSS, 3D Secure) ✔ Fast checkout integrations (PayPal, Apple Pay, Samsung Pay)

Leading providers like PayTabs and PayPal offer seamless payment experiences tailored for UAE businesses. Whether you need a local payment gateway or global solutions like PayPal, selecting the right partner ensures smooth transactions. Learn More About PayTabs Gateway

Why Include PayPal?

Global Trust: PayPal is widely recognized for secure cross-border transactions.

Buyer/Seller Protection: Reduces fraud risks for UAE e-commerce businesses.

Multi-Currency Support: Essential for UAE’s international trade hub.

The UAE’s digital payment landscape thrives on diversity—from PayTabs’ orchestration to PayPal’s global reach. Whether you’re a startup or enterprise, leveraging the right payment provider fuels growth.

5. Why Partner with a Top Fintech Company?

The best payment solution companies in the UAE provide: ✔ Custom payment processing ✔ Fraud prevention tools ✔ Scalable APIs for growth

As a leading fintech company, PayTabs supports SMEs and enterprises with cutting-edge solutions.

The UAE’s digital payment landscape is evolving rapidly, with payment orchestration, super apps, and Tap n Go leading the change. Partnering with a trusted payment provider ensures your business stays ahead.

Ready to upgrade your payment solutions? Discover PayTabs’ Industry Solutions today!

0 notes

Text

What Are the Latest Trends in Android App Development for 2025?

Android development has been leading mobile technology, with new tools, frameworks, and user expectations driving development. Moving into 2025, the Android world is adapting innovative technologies and techniques that are transforming apps' development, delivery, and use.

For companies, being current with the most recent trends in Android app development is essential to keep them competitive in the online world. In this article, we discuss the top five trends that will rule Android app development in 2025.

1. AI-Powered Apps and Machine Learning Integration

Artificial Intelligence (AI) and Machine Learning (ML) have been the game-changers in the mobile app market, and their impact on Android application development is increasing day by day. From chatbots and voice assistants to predictive analytics and personalized user interfaces, AI-based apps are becoming increasingly sophisticated.

AI-powered apps provide customized user experiences, automate customer service, improve security via facial recognition, and even offer smart content recommendations. To illustrate, e-commerce apps may utilize AI to recommend products based on user activity, and fitness apps may provide customized exercise regimens.

Android developers can embed Google's ML Kit and TensorFlow Lite to include AI features directly within their applications. The emphasis should be on user convenience and engagement through smart features.

2. Cross-Platform Development with Flutter

Although native Android app development remains very popular, cross-platform development tools such as Flutter are becoming extremely popular. Flutter, supported by Google, enables developers to create apps for Android, iOS, web, and desktop from a single codebase.

Cross-platform development saves time and money and provides uniform user experiences across platforms. Flutter, in specific, is renowned for its speed, stunning UI designs, and large community of developers.

Companies can implement Flutter for quicker app deployment without having to sacrifice quality. It's perfect for startups and companies that need to have a single codebase for diverse platforms while providing native-quality performance.

3. Enhanced App Security and Privacy

As data breaches become an increasing issue, app security has become a priority for developers and users. Android apps in 2025 will incorporate advanced security features such as biometric authentication, end-to-end encryption, and secure data storage.

Users are more conscious of data privacy concerns, and they want apps that prioritize security. An app with strong security features not only secures user data but also gains the trust of its users.

Android developers need to prioritize secure app design, utilize HTTPS for secure data transfer, and employ biometric authentication via Android's BiometricPrompt API. Regular security patches and vulnerability scans are also necessary.

4. 5G Technology-Driven Apps

5G technology is revolutionizing app design and the app experience. With ultra-fast data speeds and ultra-low latency, 5G makes it possible for developers to create very immersive apps with sophisticated features such as real-time video streaming, cloud gaming, augmented reality (AR), and virtual reality (VR).

5G makes apps capable of offering high-quality video, smooth live streaming, faster downloads, and near-instant responses. This creates new opportunities for sectors such as gaming, e-commerce, education, and healthcare.

Android developers can harness the potential of 5G to build rich multimedia experiences. Apps can utilize 5G for live streaming of video, remote AR/VR experiences, and real-time multiplayer gaming.

5. Super Apps and Modular App Development

Super apps — single platforms with multiple services (e.g., payments, food delivery, shopping, messaging) — are gaining more popularity in the Android space. They make user experiences easier with many features laid out within one interface.

Modular app development is concerned with creating apps with independent, reusable modules. This makes it easier to update quickly, maintain, and scale.

Super apps improve the convenience of users, whereas modular app development enables developers to easily maintain and enhance app functionality without breaking the user experience.

Companies can consider transforming their current apps into super apps through consolidating various services. For developers, embracing modular architecture (like Android's Jetpack modules) can facilitate easier app maintenance and scalability

Conclusion

Android development in 2025 is about embracing emerging technologies, securing the user, and providing frictionless cross-platform interactions. Companies which keep themselves well-versed on these trends shall be more geared towards connecting their users and be able to have an upper hand over competitors.

For those intending to develop or enhance their Android apps with these new trends, it is important to hire a reputable digital solutions provider. Globosoft Technologies is such a reputable firm that provides professional Android app development services. Being seasoned players in the industry, they assist companies in developing feature-packed, secure, and high-performance applications.

Whether you are a new startup or an established company, Globosoft's knowledge of Android App Development in Kochi and Android App Development in Ernakulam can guide you through the changing digital landscape with confidence.

#Mobile App Development in Kochi#IOS App Development in Kochi#Android App Development in Kochi#Mobile App Development in Cochin#IOS App Development in Cochin#IOS App Development in Ernakulam#Android App Development in Ernakulam

0 notes

Text

Essential APIs for Mobile App Developers

In the fast-paced world of mobile app development, APIs (Application Programming Interfaces) have become indispensable tools. They allow mobile applications to communicate with external services, platforms, and systems efficiently and securely. For developers and businesses alike, choosing the right APIs can mean the difference between an average app and a market-leading product.

Whether you're a startup founder, product manager, or CTO, understanding which APIs are essential is crucial when working with a mobile app development company in London. APIs not only enhance functionality but also accelerate development time, improve user experience, and ensure seamless integration with third-party services.

In this post, we’ll explore the most essential APIs for mobile app developers today — and why partnering with experienced mobile app designers in London can help you make the best choices for your product.

1. Authentication APIs

Every secure mobile app begins with authentication. Whether your app requires simple email/password sign-ins or complex multi-factor authentication, there are powerful APIs available.

Key Options:

Firebase Authentication (Google): Easy integration with social logins like Google, Facebook, Twitter.

Auth0: A flexible solution supporting multi-factor authentication and enterprise SSO.

Apple Sign-In API: Mandatory for iOS apps that offer third-party logins.

A skilled mobile app developer in London can guide you in selecting and implementing the right authentication API based on your app’s audience and compliance needs.

2. Payment and E-commerce APIs

With the rise of mobile commerce, integrating secure and seamless payment options has become essential. Whether you're building an e-commerce platform, a subscription service, or an on-demand app, payment APIs ensure smooth financial transactions.

Popular APIs:

Stripe: Offers a rich set of tools for online payments, subscriptions, and billing.

PayPal/Braintree: Provides reliable and globally accepted payment solutions.

Square API: Best for retail or restaurant-related mobile apps.

Apple Pay & Google Pay: Ensure smooth native payment experiences on iOS and Android devices.

Working with an experienced app development company in London ensures compliance with GDPR and PCI-DSS standards while also optimizing the checkout experience.

3. Maps and Location APIs

Location-based services are at the heart of apps in travel, delivery, ride-sharing, and fitness. Maps and geolocation APIs allow apps to provide real-time directions, geofencing, and location tracking.

Key APIs:

Google Maps Platform: Provides location tracking, geocoding, routes, and live traffic data.

Mapbox: Offers customizable maps and offline capabilities.

Apple MapKit: Native integration for iOS apps.

Mobile app designers in London often work on apps for sectors like transport, tourism, and delivery — making map integration a high-demand feature in the UK capital.

4. Push Notification APIs

Push notifications are vital for user engagement. They remind users of updates, promotions, and actions they need to take within an app.

Reliable APIs:

Firebase Cloud Messaging (FCM): A free service for sending push notifications to both Android and iOS.

OneSignal: A robust cross-platform solution for targeting and segmentation.

Airship (formerly Urban Airship): Offers advanced engagement analytics and messaging automation.

An app developer in London with experience in engagement strategies can help fine-tune notification delivery to avoid user fatigue while maximizing retention.

5. Analytics and Performance Monitoring APIs

Understanding how users interact with your app is critical for success. Analytics APIs allow developers and marketers to track key performance indicators (KPIs), user flows, and crash reports.

Essential APIs:

Google Firebase Analytics: Tracks in-app behavior, user segments, and conversion funnels.

Mixpanel: Focuses on user interactions and advanced segmentation.

Crashlytics: Monitors crashes in real-time with diagnostic reporting.

A mobile app development company in London can implement custom tracking events to align analytics data with your business goals.

6. Social Media Integration APIs

For apps that require user-generated content, social sharing, or community-building, social media APIs are essential. They allow users to connect their accounts, share content, and interact with others.

Widely Used APIs:

Facebook Graph API

Instagram Basic Display API

Twitter API v2

LinkedIn API

Incorporating these APIs correctly ensures smoother user onboarding and improved social engagement. Mobile app designers in London often recommend strategic integration to boost organic app growth.

7. Streaming and Media APIs

If your app involves media — whether it's video streaming, music, or live events — media handling APIs are vital for delivering smooth and high-quality experiences.

Leading APIs:

Vimeo API / YouTube Data API: For video content management and streaming.

JW Player API: A customizable video player with analytics.

Spotify SDK / Apple MusicKit: For apps with music streaming features.

An app development company in London can help you navigate licensing requirements and bandwidth optimization strategies essential for media-heavy apps.

8. Chat and Communication APIs

Real-time communication is a must-have in apps for support, customer service, or community interaction.

Commonly Used APIs:

Twilio: Enables SMS, voice, video, and chat.

Sendbird: In-app messaging and chat.

Agora: For real-time video and audio calls.

With the growing demand for remote communication tools, app developers in London are integrating these APIs into educational platforms, dating apps, and telehealth solutions.

9. Cloud Storage APIs

Cloud storage APIs enable mobile apps to save data securely and access it on multiple devices, allowing seamless user experiences and data synchronization.

Popular Solutions:

Firebase Realtime Database / Firestore

Amazon S3 (AWS)

Microsoft Azure Blob Storage

A mobile app developer in London can assist in choosing a scalable, secure cloud backend for storing images, documents, user data, and more.

10. IoT and Wearable APIs

As smart devices continue to rise in popularity, integrating mobile apps with IoT systems or wearables is becoming increasingly common.

Top APIs:

Apple HealthKit & Google Fit: For health and fitness tracking apps.

Samsung SmartThings API

Bluetooth Low Energy (BLE) APIs: For real-time device-to-device communication.

Apps designed with IoT in mind are especially popular in sectors like health tech, smart homes, and transportation — areas where mobile app designers in London are making a mark.

Why APIs Matter for Business Success

APIs reduce the time and cost of development while significantly enhancing app functionality. Instead of building every feature from scratch, developers can leverage best-in-class services through APIs — whether it’s processing payments, delivering maps, or enabling real-time chat.

However, selecting the wrong API or poorly integrating it can lead to performance bottlenecks, security issues, and a poor user experience. That’s why many businesses prefer to work with a trusted app development company in London that brings both strategic and technical expertise to the table.

Final Thoughts

In 2025 and beyond, mobile app success will be driven by smart integration, seamless functionality, and speed to market — all of which are enabled by the right APIs. Whether you're building an app for consumers or enterprises, using the right combination of APIs will allow you to deliver a superior experience while optimizing development resources.

Choosing the right mobile app development company in London or collaborating with expert mobile app designers in London can dramatically improve your product’s success rate. From authentication to analytics and from social integration to cloud storage, the APIs you select today will shape the user experience tomorrow.

If you're looking to build a robust, future-ready app, consider hiring an experienced mobile app developer in London or an app developer in London with proven knowledge of integrating modern APIs and delivering scalable digital products.

#mobile app development company in london#mobile app designers in london#app development company in london#mobile app developer in london#app developer in london#Essential APIs for Mobile App Developers

0 notes

Text

Integrating Customer Management Software with ERP and Accounting Tools

In today’s fast-paced and competitive business environment, having siloed systems for customer data, enterprise resource planning (ERP), and accounting can lead to missed opportunities, poor customer service, and inefficient operations. To bridge these gaps, businesses are increasingly integrating Customer Management Software (CMS) with ERP and accounting tools—and the results are transformative.

This blog explores the benefits, process, and best practices for integrating customer management systems with ERP and accounting platforms, particularly for growing businesses in dynamic markets like the UAE, KSA, and beyond.

Why Integration Matters

1. Eliminates Data Silos

When your CRM or customer management software works in isolation from ERP and accounting tools, it creates fragmented data. Sales, support, and finance teams may all have different versions of customer information, leading to inefficiencies and errors.

Integration ensures a single source of truth, enabling departments to access consistent and updated customer data across systems.

2. Enhances Customer Experience

When customer information—including orders, billing, service history, and payment status—is accessible in real time, businesses can offer faster and more personalized support. Sales reps can see invoice statuses, support teams can track delivery schedules, and finance teams can follow up on pending payments with context.

3. Improves Financial Accuracy

Linking customer transactions to your accounting tool allows for automated invoice generation, payment tracking, and financial reporting. This reduces manual data entry, human error, and delays in cash flow management.

4. Streamlines Business Operations

With integrated systems, you can automate workflows like order-to-cash, lead-to-invoice, and customer lifecycle management. This leads to improved efficiency and reduced operational costs.

Key Features to Look for in Integrated Systems

Real-Time Data Sync: Instant updates between systems ensure consistency.

Customizable Workflows: Automate business processes according to your operations.

Role-Based Access: Ensure team members only see relevant data.

Scalability: Ability to grow with your business.

Cloud Accessibility: For remote teams and multi-location support.

Best Practices for Integration

✅ Choose Compatible Platforms

Ensure your customer management software supports APIs or built-in integrations with your ERP/accounting systems like SAP, Oracle, QuickBooks, or Zoho Books.

✅ Define Integration Objectives

Clearly outline what you want to achieve: Is it better customer visibility, faster billing, or improved reporting? This will guide the scope and timeline.

✅ Start with Core Modules

Begin by integrating the most critical functions like customer data, sales orders, and invoices. You can gradually expand to include support tickets, inventory, and analytics.

✅ Ensure Data Clean-Up Before Integration

Old or duplicate data can cause sync issues. Clean and validate customer records before integration.

✅ Train Your Team

Employees need to understand how to use the integrated system effectively. Provide training and documentation for smooth onboarding.

Examples of Integration in Action

Retail Business in Dubai integrated their customer management system with ERP to sync online orders with inventory and finance—reducing delivery errors by 35%.

Service Company in Muscat linked customer profiles with accounting software, enabling real-time invoicing and reducing payment delays by 50%.

Conclusion

Integrating Customer Management Software with ERP and accounting tools isn’t just about technology—it’s about unlocking business value. By aligning departments, automating processes, and delivering a seamless customer experience, businesses can achieve higher efficiency, better decision-making, and improved profitability.

If you're looking to upgrade your current systems or implement an integrated CRM-ERP solution tailored to your region (UAE, Oman, KSA, etc.), choosing the right software partner is essential.

0 notes

Text

Is Mobile Recharge Business Profitable?

The increasing reliance on smartphones and digital services has made mobile and DTH recharge a part of daily life for millions. This growing demand presents a lucrative opportunity for entrepreneurs. But is the mobile recharge business truly profitable? The answer is yes—when powered by the right technology and strategy.

Rising Demand for Digital Recharge Services

India's mobile user base is expanding rapidly. With people preferring digital convenience over physical recharge shops, the shift to online recharges is stronger than ever. By leveraging a reliable mobile and DTH recharge API, businesses can offer users quick, seamless recharge services and earn a commission on every transaction.

Recharge Software: Your Business Backbone

A successful recharge business depends heavily on the technology that powers it. A feature-rich recharge software automates the entire process—from user management and transaction handling to real-time reporting and multi-operator support.

Custom recharge software development ensures your platform is tailored to your needs, scalable, and easy to manage, making it ideal for startups and established businesses alike.

Choosing the Right Recharge API

The core of any recharge platform is its API. A high-performance mobile and DTH recharge API ensures fast, secure, and reliable transactions across multiple service providers. Choosing the best multi recharge API not only reduces downtime but also improves customer satisfaction and retention.

Maximize Earnings with AePS Integration

To diversify income and add value, many recharge businesses are integrating banking services through Aadhaar Enabled Payment System (AePS). Partnering with a trusted AePS API provider company enables you to offer services like cash withdrawal, balance inquiry, and money transfer—especially valuable in rural and semi-urban areas.

These services increase your platform’s utility and boost transaction volume, leading to higher earnings.

Low Investment, High Returns

One of the biggest advantages of entering the mobile recharge business is its low startup cost. With minimal investment in software and API integration, you can start earning immediately. You can also build a distributor and retailer network under your brand to multiply income sources.

As your customer base grows, so does your profit margin—making this a smart and scalable business opportunity.

Final Thoughts

The mobile recharge business is not only profitable but also sustainable in the long run. With the right recharge software, a dependable mobile and DTH recharge API, and value-added services like AePS, you can establish a strong digital platform and grow your income steadily.

To succeed:

Choose a reliable mobile and DTH recharge API

Invest in professional recharge software development

Partner with an experienced AePS API provider company

Work with the best multi recharge API for seamless service delivery

Ready to launch your recharge business? Get in touch with us for robust software and powerful APIs that help you start, manage, and grow a profitable recharge business.

0 notes

Text

Aurionpro Payments API Integration by Infinity Webinfo Pvt Ltd

In today's fast-paced digital landscape, businesses are constantly looking for solutions that streamline their payment systems, enhance customer experience, and ensure smooth transactions. This is where Aurionpro Payments API integration comes into play. Partnering with Infinity Webinfo Pvt Ltd, a renowned website developer, this integration offers a state-of-the-art solution that enables seamless bill payments and more.

Understanding the Need for Effective Bill Payment Software

As businesses grow and expand their online presence, efficient bill payment software becomes crucial. Traditional methods of bill payment, often reliant on manual processes, are becoming increasingly outdated. Customers demand faster, secure, and convenient ways to pay their bills online, and businesses need a reliable system to keep up with these expectations.

Aurionpro Payments API, a leading name in payment technology, offers a robust solution designed to integrate easily with websites, mobile apps, and business systems. The seamless integration of this API into existing systems can automate and optimize the entire billing process, significantly reducing manual intervention and improving transaction accuracy.

The Role of Infinity Webinfo Pvt Ltd in Enhancing Payment Solutions

Infinity Webinfo Pvt Ltd, a leading website developer, has taken a giant leap forward in offering integrated solutions for bill payment systems by incorporating Aurionpro Payments API. With a focus on innovative web development, the company ensures that businesses can integrate and implement Aurionpro Payments technology into their platforms without any hassle.

By choosing Infinity Webinfo Pvt Ltd as their development partner, businesses can tap into a well-rounded service offering. The team at Infinity Webinfo is adept at designing user-friendly websites that seamlessly connect with payment systems, making bill payments smoother for users. Whether it's a one-time bill payment or recurring payments, their expertise guarantees the creation of a custom-tailored solution that aligns with each business's specific needs.

Key Features of Aurionpro Payments API Integrations

Modular Integration Options: The platform supports various integration methods, such as H2H APIs, widgets, and SDKs, enabling businesses to select the integration path that aligns with their technical capabilities and business requirements .

Low-Code and No-Code Capabilities: Aurionpro Payments provides low-code and no-code tools, facilitating rapid deployment and customization without extensive coding expertise.

White-Label Solutions: Businesses can leverage white-label solutions to offer branded payment experiences to their customers, enhancing brand consistency and customer trust.

Seamless QuickBooks Integration: The platform integrates with QuickBooks, allowing for automated synchronization of financial data, reducing manual data entry and minimizing errors .

Partner and Reseller Management: Aurionpro Payments enables efficient onboarding and management of partner and reseller networks, streamlining operations and expanding business reach .

Frictionless Checkout: The platform offers a seamless checkout experience, minimizing user interactions and enhancing customer satisfaction

Benefits of Integrating Aurionpro Payments API

Enhanced User Experience: Integrating the Aurionpro Payments API allows customers to make payments quickly and easily. With minimal clicks, customers can pay their bills without friction. This smooth process leads to higher customer satisfaction and retention.

Security: With the growing concern around online fraud and data breaches, Aurionpro Payments API ensures top-notch security for every transaction. It employs advanced encryption protocols to protect sensitive financial data and offers fraud prevention measures.

Scalability: The integration is designed to scale with the business, allowing companies to grow without worrying about payment bottlenecks. Businesses of any size can benefit from the API’s flexible infrastructure.

Customization: The API can be fully customized to meet the specific needs of each business, whether it's managing subscriptions, processing invoices, or handling complex billing scenarios.

Comprehensive Reporting: With integrated payment systems, businesses gain access to comprehensive reporting tools that provide insights into transactions, payments, and overall billing efficiency.

The Future of Online Bill Payments with Infinity Webinfo Pvt Ltd

By offering Aurionpro Payments API integration, Infinity Webinfo Pvt Ltd is setting the stage for the future of online transactions and bill payments. The seamless connection between these two entities is a game-changer for businesses looking to provide hassle-free bill payment experiences. As more companies turn to digital solutions for their payment needs, this collaboration offers them a competitive edge.

Infinity Webinfo Pvt Ltd continues to be a trusted website developer for businesses looking to modernize their websites and enhance customer engagement. Their innovative solutions, combined with Aurionpro Payments API, enable businesses to build and maintain efficient and secure bill payment systems.

Conclusion

Integrating Aurionpro Payments API with the expertise of Infinity Webinfo Pvt Ltd creates a winning combination for businesses seeking robust, secure, and scalable bill payment solutions. As the demand for seamless payment systems grows, this partnership is well-positioned to lead the way, providing businesses with the tools they need to succeed in an increasingly digital world. Whether you’re a startup or an established enterprise, embracing this advanced bill payment software integration can help streamline your operations and improve customer satisfaction.

Contact Now :- +91 97110 90237

0 notes

Text

Top Benefits of Hiring a Shopify Development Company in India

Rise of E-commerce in India

The online commerce market is booming, and businesses worldwide are turning towards Shopify and similar websites to start their online businesses. If you're in search of building or boosting your online shop, finding a Shopify development agency in India is one of the smartest decisions you will make. India has become an international hub for web development services due to its proficient developers, lower costs, and superior solutions.

What is a Shopify Development Company?

A Shopify development company is a group of experts engaged in developing, designing, customizing, and maintaining Shopify stores. They provide services such as:

Shopify store setup

Custom theme development

App integrations

Store migration

Performance optimization

Ongoing support and maintenance

These services enable eCommerce businesses to create feature-rich and user-friendly online stores.

Why Use a Shopify Development Company in India?

India has thousands of talented developers with experience working on behalf of clients around the world. Below are reasons why companies across the globe hire Indian Shopify experts

1. Low Cost

It is cheaper hiring an Indian Shopify development agency compared to those located in the United States, UK, or Australia. In this case, you obtain the same quality work at significantly reduced rates and stay within budget.

2. Experienced and Talent Developers

Indian developers are known for their technical skills and problem-solving abilities. Many professionals are Shopify-certified and have years of experience working on complex eCommerce projects.

3. Time Zone Advantage

India's time zone allows for round-the-clock productivity. When you sleep, your Indian team continues to work, which can speed up the project timeline.

4. Effective Communication

Indian companies mostly use a platform like Slack, Zoom, and Trello to keep it simple in communicating with each other and make their project updates visible. Most are literate in English, ensuring that communication would not be problematic.

5. Customization Flexibility

The Indian firms tend to be more flexible in style. Whether one wants a whole store setup or just theme customizing, solutions can be arranged as per business needs.

Key Services Provided by Shopify Development Firms in India

Some of the key services provided are:

Shopify Store Setup: Setting up a new store from ground up, including product listing, categories, and payment settings.

Custom Design & Themes: Creating a custom look for your store that reflects your brand identity.

App Integration: Adding marketing, analytics, and payment apps to increase your store's functionality.

SEO Optimization: Optimizing search engine ranking with proper on-page SEO configuration.

Shopify Plus Development: Managing enterprise-level features for larger enterprises.

Third-Party API Integration: Integrating your store with outside systems such as CRMs, ERPs, and shipping companies.

Speed Optimization: Optimizing load times for improved user experience and increased conversions.

How to Select the Best Shopify Development Company in India

While choosing a company, consider the following:

Check Portfolio: Check their previous work and industries catered.

Read Client Reviews: Check testimonials and ratings on sites like Clutch, Google, or Upwork.

Request a Quote: Request a detailed proposal to know their pricing and service model.

Discuss Timelines: Ensure they can deliver according to your project timelines.

Ask About Support: Ensure they offer post-launch support and periodic updates.

Employing a Shopify development company in India can provide your eCommerce company with the professional assistance it requires without necessarily blowing the budget. With the right people, you can create a quick, safe, and beautiful Shopify store that assists you in attracting consumers and increasing revenue.

Whether you're a startup trying to get up and running quickly or an existing brand trying to scale, having an Indian Shopify expert as a partner can be a game-changer. Be sure to do your research, ask the right questions, and select a company that shares your business objectives.

0 notes

Text

Achyuta Software Private Limited – Lucknow’s Leading Software & Mobile App Development Company

Innovate. Digitize. Grow.

In the fast-paced digital world, businesses must evolve with technology to remain relevant. That’s where Achyuta Software Private Limited comes in—your trusted partner for software development, mobile app creation, and digital transformation services. Proudly based in Lucknow, we’re recognized as one of the most reliable and efficient IT solution providers in India.

🚀 About Achyuta Software

At Achyuta Software, we turn your ideas into innovative technology. From startups to established enterprises, we work with organizations of all sizes to build tailored digital solutions. Our mission is simple: empower businesses through smart software.

With a dedicated team of developers, designers, and digital strategists, we focus on crafting robust, secure, and scalable applications—on time and within budget.

📱 Mobile App Development – Future in Your Hands

We specialize in mobile apps that are fast, smooth, and user-friendly. Whether you’re building a new app or improving an existing one, we ensure it stands out in a crowded marketplace.

Our mobile app services include: ✅ Android and iOS Development ✅ Flutter & Cross-Platform Apps ✅ E-commerce & Utility Apps ✅ Secure Payment Gateway Integration ✅ Push Notifications, GPS & API Integration

💻 Custom Software Solutions

Efficiency starts with the right tools. Our customized software helps businesses automate, streamline, and grow.

We develop: ✅ ERP & CRM Solutions ✅ School, Coaching & Institute Portals ✅ Task & Project Management Systems ✅ Billing, POS & Inventory Software ✅ HR & Attendance Management Tools

🌐 Web Development That Works

Your website is your digital storefront. We create beautiful, responsive, and SEO-ready websites that turn visitors into customers.

Our web services include: ✅ Business & Service Websites ✅ Online Booking & Ticketing Portals ✅ Travel & Tour Portals ✅ Admin Dashboards & Web Applications ✅ Real-Time Data & Analytics Panels

🎯 Why Achyuta Software?

💼 Client-Focused Development

🛠️ Customizable & Scalable Solutions

📈 SEO & Performance Optimization

⏱️ Timely Delivery & Transparent Workflow

🤝 Post-Launch Support & Maintenance

We believe in building relationships, not just software. Your success is our priority.

🏢 Serving Multiple Industries:

Education & Coaching

Travel & Hospitality

Healthcare & Wellness

Retail & E-commerce

Events & Ticketing

Real Estate & Construction

At Achyuta Software, we also offer custom web portals, event management platforms, and mobile applications to enhance your brand's digital reach.

📍 Visit Us: Prankvin Tower, 1st Floor, D3/31F, Vibhuti Khand, Gomti Nagar, Lucknow – 226010 📞 Call Now: 08069409499 📧 Email: [email protected] 🔗 Explore Our Work: https://achyutagroup.com

Achyuta Software – Empowering Your Business Through Innovation.

#gamedev#devlog#graphic design#coding#branding#html#artificial intelligence#indiedev#linux#machine learning#web developers#web development#website#web design#app development#app developers

0 notes