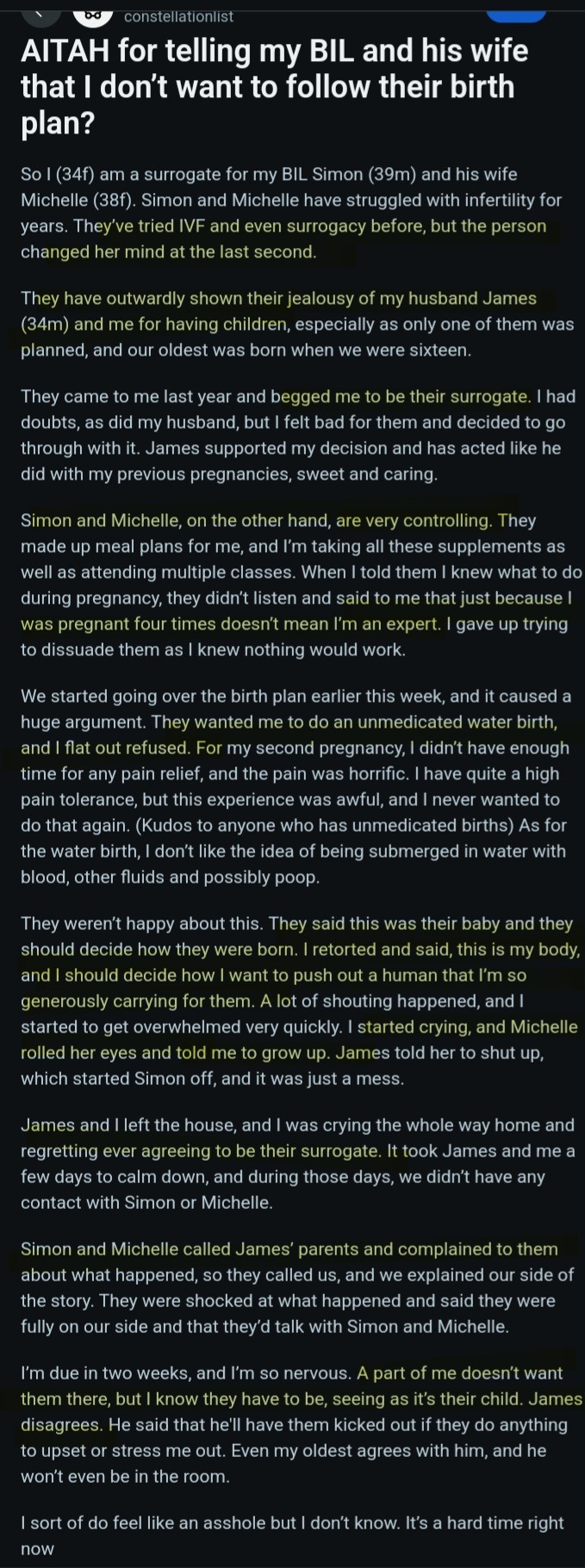

#Premium Healthcare Plan

Explore tagged Tumblr posts

Text

Why Americans Are Fed Up with Health Insurers

Anger at healthcare insurers and healthcare providers is not new, but ways of expressing that anger should not get out of control.

Like you, I was shocked and saddened by the brutal murder of a man on a street in Manhattan, singled out because he was CEO of a major health insurance company. And like you, I have been frustrated and angered with the health insurance industry, both as a practicing physician and as a patient. This article reviews the reasons behind frustration and anger and how they might or might not be…

0 notes

Text

How income affects your Medicare drug coverage premiums

You could pay a higher monthly premium for Medicare drug coverage (Part D) depending on your income. This includes Part D coverage you get from a Medicare drug plan, a Medicare Advantage Plan with drug coverage, or a Medicare Cost Plan that includes drug coverage. This is true even if your drug coverage is through your employer. Download this bulletin to learn more about extra Medicare drug…

View On WordPress

#healthinsuranceinPA#healthinsurancenearby#HealthInsuranceNearMe#healthinsuranceNJ#Aetna Medicare#affordable care act#Blue Cross Medicare Plans#compliance#health insurance#Healthcare reform#Individual Mandate#medicare#Medicare Advantage#Medicare Donut Hole#Medicare OEP#medicare open enrollment#Medicare Part B#Medicare Part B Premiums#medicare part d#Medicare Part D Coverage Gap#Medicare Prescription Drug#medicare supplements#MSA: Medicare Savings Accounts#Pennie Health Insurance#Short Term Health Insurtnce

0 notes

Text

If the united states doesn't want to provide proper healthcare at the government level then employers should at least be forced to disclose the details of their plans including premiums and coverage in job postings.

Tired of getting hired by places only to find the "insurance" the offer costs more than you make in a paycheck.

218 notes

·

View notes

Text

Please pay close attention to the language used to talk about public service workers and civil servants in the coming days.

There is (understandably) a lot of anger and frustration felt by people who have been left behind, ignored, and swept aside by bureaucratic processes limiting access to benefits and aid. SSA has notoriously denied most first disability benefits applications, FEMA has left people without housing after disasters for far too long, there's red tape everywhere and it's harmful first and foremost to people without the time and resources (money, health) to navigate the systems. This is all true.

BUT. (And this is the important part of this post.) The new administration is, purposely, leveraging those feelings to get public support for gutting those systems and programs from the inside out. The truth is that we need these programs, and we need the everyday people who work to deliver them. We can't afford to vilify them.

Pay attention to the language in the new executive orders, such as:

"Return to Work" (as if everyday public servants have not been breaking their backs trying to get passports processed, job offers sent, and critical grants awarded, whether or not they do some of that work from home or in a too-small, poorly maintained office)

"Improving Accountability" (as if agency heads are all corrupt or something, rather than just being people who the new administration is afraid will choose to be accountable to their conscience rather than accountable to King Trump)

Yeah, yeah, every office will have some bad managers, some underperforming employees, and bad agency leadership once in a while. This is NORMAL. Literally look at ANY office, private sector or public sector or academia or whatever. Rank and file government employees are not inherently evil, or lazy, or entitled, any more than the rest of the workforce.

And in fact, government employee pay has fallen far behind inflation while the benefits have been slowly stripped away over the last decade or two (pensions cost more and pay less; healthcare options are expensive and don't cover as much as some other private plans; annual raises are a joke and barely even cover the rise in insurance premiums let alone housing).

By and large, the people working in those day to day public service positions care about the mission of their agency, and helping people, because you kind of have to at some level in order to sacrifice higher pay for literally the same work. The ONE concrete advantage of a government job over industry is the stability... But the Trump administration is fighting tooth and nail to get rid of that so they can fire large swathes of the workforce and shut down public service programs.

If they can't fire everyone, they'll start by getting as many as they possibly can to quit.

Stoking public anger at civil servants is one of the tactics they are using to put the pressure on and get people to leave. Many federal workers are already scared to talk about where they work because of fear of harassment. Republican leaders encourage this shit. Why would anyone want to stay in a job they're underpaid, underappreciated, and now being publicly vilified for? A few might, for the mission; others will decide their safety is more important, or that they can't sacrifice any more.

You might think, why do we care if a few gov employees quit when there's so many of them? Well, most government programs are ALREADY severely understaffed. We're ALREADY going to have an even harder time accessing services and programs when people inevitably quit and program funding gets shut down.

We need these workers to stay. We need them to be there busting their asses over the next months to get important things processed before the option is taken away. We need them to stand up to Trump's political cronies and hold the line and drag their feet when told to implement harmful policies. We need them to buy us time to vote in 2026 and save some of the programs that serve our most vulnerable populations. No, the programs aren't perfect, but that doesn't justify sitting back and letting Trump completely gut them!

Take some time to thank a public servant in the next weeks. We need them more than most of us realize, and we can't afford to let Trump's propaganda make us blame the people standing between his policies, and us.

#politics#I'm just really pissed off about the phrase Return To Work today#like dude#these people are busting ass#see that other post going around about the people working overtime to process trans people's passports and mail them before 1/20#thank your public servants guys#they're having a rough time#US politics

15 notes

·

View notes

Text

Truly is a handy tool to be able to get conservatives around me infatuated with the ACA once you walk them thru the revenue generation + the fact that the wheels are not greased by their tax dollars, but Big Insurance foots the bill instead (not really footing a bill if they turn huge profits for it later, but)

The ACA is built for everyone. I have known doctors that are on ACA plans. It is not a shameful thing and it is not indicative of a financial failure to sign up. It is being a smart consumer! It is knowing your options! Sometimes it isn't the best choice for you, but arent you somewhat relieved that it's still there if your other choices fall thru? It's stability and it's something that saves your life and your loved ones lives.

A big reason the ACA is the target of so much misinformation is largely due to the fact that it is the stone that will take down Goliath, and political power is cemented by dodging those stones on campaign trails.

The ACA isn't even enough in my opinion! It's a skeleton to build from. First flaw in US healthcare was pre-existing conditions (risk pools). The ACA can be boiled down to its most base elements as "a for-profit health care model that does not use risk pools" OR "a health care model that becomes less profitable the less sick your customers are"

THIS was the olive branch across aisles in the spirit of maintaining profitability and related capital interests.

The ACA is a springboard for next levels of development like "a health care model that thrives without relying on profit from premiums". Solidify that stage and then build up again! We MUST go in stages to ensure we do not leave people behind or drop people who need us. The ACA is a fucking tank built to carry us all, baby.

And again:

OPEN ENROLLMENT IS ACTIVE RIGHT NOW! 11/1/2024 - 1/15/2025!

There are people waiting to help you sign up!

#Creepy chatter#Yeah I'm the one talking to dads around me lol#No one changes their mind in front of you but I'm glad they can get to a doctor now

35 notes

·

View notes

Text

Nope, Trump didn't "salvage" Obamacare as J.D. Vance claimed.

Some fact-checking from the vice presidential debate. From NPR.

During his presidency, Trump undermined the Affordable Care Act in many ways — for instance, by slashing funding for advertising and free "navigators" who help people sign up for a health insurance plan on HealthCare.gov. And rather than deciding to "save" the ACA, he tried hard to get Congress to repeal it, and failed. The Biden administration has reversed course from Trump's management of the Affordable Care Act. Increased subsidies have made premiums more affordable in the marketplaces, and enrollment has surged. The uninsurance rate has dropped to its lowest point ever during the Biden administration. The Affordable Care Act was passed in 2010 and is entrenched in the health care system. Republicans successfully ran against Obamacare for about a decade, but it has faded as a campaign issue this year.

So just the opposite of what J.D. claimed. The Trump administration didn't save Obamacare, it tried to sabotage and kill it.

People who have a weirdly nostalgic view of the Trump administration forget how he tried to kill Obamacare with help from the Republican majority 115th Congress. From its inception, Republicans in Congress have tried to kill Obamacare 70 times.

Obamacare may not be perfect, but it is superior to what existed previously. The bulk of people who hate it are connected to Big Pharma, for profit medical corporations, and the Republicans who get big campaign contributions from them.

The name Obamacare tells us a lot. It was coined as term of disparagement for the Affordable Care Act by Republicans. But it became so popular that Republicans ended up shooting themselves in the foot by eternally connecting the ACA to the Democratic president who was the driving force behind it.

Trump has had nine years to come up with a viable alternative to Obamacare. But the "stable genius" still can't put together a coherent sentence about what he'd replace it with.

For affordable healthcare, vote Democratic to improve it or vote MAGA Republican to destroy it.

#obamacare#affordable healthcare#the aca#affordable care act#vice presidential debate#j.d. vance#fact checking#republican attempts to kill obamacare#trump's attempts to undermine obamacare#donald trump#weird donald#republicans tried to kill obamacare 70 times#biden saved obamacare#election 2024#vote blue no matter who

33 notes

·

View notes

Text

youtube

Social Security and Medicare are two programs that help support us as we age. Social Security provides financial support in retirement, while Medicare ensures access to healthcare services.

Social Security offers income for retirees or those unable to work due to health reasons. It also extends support to families who've lost loved ones, providing survivor benefits.

Meanwhile, Medicare steps in to offer health insurance for individuals aged 65 and older, as well as those with certain disabilities or illnesses.

When it comes to enrolling, the Social Security Administration (SSA) partners with the Centers for Medicare and Medicaid Services (CMS) to guide older Americans through the process. SSA sends out enrollment packages before your Medicare enrollment period begins, typically three months before you turn 65.

If you're already receiving Social Security benefits at age 65, you'll likely be automatically enrolled in Medicare. But if not, you'll need to apply through the SSA website.

Now, on to payments. Once enrolled, most individuals pay monthly premiums for Medicare Part B, that covers outpatient treatments. Social Security simplifies this process by deducting Part B premiums directly from benefit payments. If you have Medicare Advantage or Part D plans, you can also set up deductions from your benefits.

30 notes

·

View notes

Note

In the uk you have the NHS but you can also go private meaning you pay money for things like surgeries/therapy/etc.

The nhs is free to everyone so you dont pay money and because of this you can be on a much longer waiting list especially if what you need isnt deemed urgent/life threatening (think mental health services, dental, etc)

If you go private you get things much faster as you're not on the general waiting list. Most people who go private are usually middle and upper class as low income families cant afford private healthcare.

Some things such as dental healthcare are free until you turn 18, if you needed braces but are past 18 you then have to pay for them.

I also think I need to point out that low income british families dont have a lot to spare. £150 procedure may sound like a bargain for americans but sound like a nightmare to brits because of the difference in economy and way we function over here.

Also I don't know much about Simons past but he may have lived in/on a council house/council estate (a house given to you by the government). These houses are usually given to single parents, mentally/chronically ill people, old people, low income etc. They are usually seen as the poor/trashy part of wherever you live (not sure if theres a similar thing in America) but if you come from a council house/council house you're usually bullied for it is what I'm trying to say.

(+ + English is not my first language and I wasnt born in the uk but my dad was ++ however I have been here since primary school (10) and I'm still living here so I know a little)

i think it's kinda crazy how...even though you get free (mostly) healthcare, that there are still instances where upper and middle class-ers are winning because they have money to spare on better services. it's insane.

even in my own company, we have similar hierarchies of healthcare (but still, i think, worse than uk in a lot of ways). there's a plan where you pay $0 out of your paycheck, but it's terrible. like long lines, insane premiums/copays, and very poor service (like...if you're pregnant, you get a different OB/GYN at every appointment).

i'm lucky enough that i'm able to pay for mine, so i have the plan where i can go to any doctor i want without a referral, have pretty cheap co-pay (for example, my last visit to an urgent care was $300, but after insurance it was $25) and low premium (just meaning i pay less out-of-pocket), and get a lot of benefits like "free" therapy and checkups and things like that. but i still pay like...basically $160/month for that. and that doesn't include my dental plan or other types of insurance that i pay for every month. 🫠

also, we do have public housing, which i think is similar to what you described as a council house. if you've ever watched like..."the wire" or like an american cop show, they sometimes refer to them as "the projects." it just means a place where government sticks low-income people, and they're unfortunately considered to be not safe for a variety of reasons. when i used to live in nyc, they were usually places that i avoided especially at night.

i think no matter what country you come from, the poor and low income get the shit-end of every stick, and no one really cares to improve those conditions. i think america has the money to fix a lot of these problems, but we spend so much money on things that we really don't need to be spending it on (*cough* like the $800b military budget *cough cough*).

this makes me sad to think about simon in that situation ); i know he's fictional but seriously, that's terrible.

15 notes

·

View notes

Text

Re: Insurance.

I have one of the best healthcare policies available and I pay $20 a month in premiums for it. Before this insurance, I had horrible plans offered to me that cost $65 to $200 PER PAYCHECK and had ridiculous copays and deductibles and all this other shit I had to meet that made no sense. My insurance now? $20 a month and my plan is copay only. That means when I go to the doctor, I only pay $30. I don't get a bill in the mail afterward. When I had my biopsies? I paid $40 for my specialist copay but I didn't get a bill after, I only got a letter stating that my insurance paid all $10,000 of my biopsies. When I was much younger, I had to go off medication that I am supposed to be on for the rest of my life because I lost insurance and the meds cost $350/month. I pay $3 with my insurance. And people are like, "Well, now that you have it so good, don't you want to gatekeep this level of care?" NO. I. DON'T. I want everybody to have this level of care and this level of access. We're bled dry via our taxes and none of that goes back to us. I want every single person who needs medical care to be able to get it. I think that's important. Because I know people who say that if they get diagnosed with cancer, they won't fight because the bills will be too much and their family will be left with nothing. That's RIDICULOUS. EVERYBODY DESERVES HEALTHCARE!!!!

4 notes

·

View notes

Text

Also, part of healthcare in America is gambling with your health.

"If you're relatively healthy, you might want to consider a low-premium, high deductible plan"

Meaning (generalizing from the marketplace prices I've seen) you'll save about $5,000 a year if you don't have any emergencies and lose about $9,000 if you do.

Don't worry, I'm sure nobody would choose these plans because they don't have an extra $5,000 a year to throw at monthly premiums even though they're likely to need serious medical care in the near future...

Not to mention, I'm sure nobody just decides to forgo the premiums at all and just not have insurance because of the cost...

24 notes

·

View notes

Text

Lodha Wakad Pune: Premium Residential Project in a Prime Location

Lodha Wakad Pune is an upcoming premium residential project in one of the city's most sought-after locations. Known for its world-class amenities, strategic location, and luxurious living spaces, this project redefines the concept of modern urban living. With a focus on comfort, convenience, and connectivity, Lodha Wakad Pune is designed to cater to the needs of families, professionals, and investors looking for high returns in Pune's thriving real estate market.

Location Advantage of Lodha Wakad Pune

Wakad is one of Pune’s fastest-growing suburbs, offering excellent infrastructure, seamless connectivity, and a vibrant social environment. Lodha Wakad enjoys proximity to key locations such as:

Hinjewadi IT Park – A major employment hub for IT and software professionals.

Mumbai-Pune Expressway – Ensuring quick access to Mumbai and other parts of Maharashtra.

Educational institutions – Reputed schools and colleges like Indira College, Akshara International School, and Orchid School are within easy reach.

Healthcare facilities – Top hospitals such as Aditya Birla Hospital and Ruby Hall Clinic are nearby.

Shopping and entertainment – Malls, multiplexes, and shopping centers like Phoenix Marketcity and Xion Mall enhance the lifestyle experience.

Lodha Wakad Pune Project Overview

Lodha Wakad Pune offers 2 BHK and 3 BHK premium residences, crafted with contemporary designs and world-class specifications. Each home is designed to provide ample ventilation, natural light, and optimal space utilization, ensuring an elegant and functional living experience.

Key Features of Lodha Wakad Project

Spacious and well-designed apartments with premium fittings.

Gated community with 24/7 security and advanced surveillance.

Eco-friendly infrastructure with rainwater harvesting and energy-efficient designs.

High-speed elevators, power backup, and ample parking space.

Smart home features for a seamless and modern lifestyle.

World-Class Amenities at Lodha Wakad Pune

Lodha Wakad offers a host of amenities that elevate the living experience for residents:

Swimming pool with a deck area for relaxation.

State-of-the-art gymnasium for fitness enthusiasts.

Clubhouse and community hall for social gatherings and events.

Landscaped gardens and walking tracks for a serene living environment.

Dedicated kids’ play area for children's entertainment.

Sports facilities including tennis, basketball, and cricket practice nets.

Meditation and yoga zone to promote a healthy and peaceful lifestyle.

Lodha Wakad Pune: Floor Plans and Pricing

Lodha Wakad offers well-planned 2 BHK and 3 BHK apartments to suit different family sizes and budget preferences. The pricing is competitive, ensuring high value for money and great investment potential.

2 BHK Apartments – Spacious and efficiently designed, ideal for small families and professionals.

3 BHK Apartments – Larger units for families looking for extra space and luxury.

Premium Penthouses – Exclusive units offering breathtaking views and opulent living spaces.

Investment Potential of Lodha Wakad Project

Wakad is a high-demand residential and commercial area, making Lodha Wakad Project an excellent investment choice. The locality has seen consistent appreciation in property values, and with upcoming infrastructure developments, the returns are expected to grow even further. Some key reasons to invest include:

Proximity to IT hubs – Attracting a growing population of professionals.

Rising rental demand – Ensuring lucrative rental income for investors.

Strong infrastructure growth – With metro connectivity and road expansions in progress.

Connectivity and Transport Facilities

Lodha Wakad Pune enjoys seamless connectivity to key locations in Pune and beyond:

Metro Connectivity – The Pune Metro expansion will further boost accessibility.

Well-developed road network – Smooth connectivity to Baner, Balewadi, and Pimple Saudagar.

Pune Railway Station – Located just a short drive away.

Pune International Airport – Ensuring easy domestic and international travel.

Why Choose Lodha Wakad Pune?

Reputed Developer – Lodha Group is known for delivering world-class projects with top-notch construction quality.

Prime Location – Wakad is one of the most rapidly developing areas in Pune, offering a well-balanced lifestyle.

Luxurious Living Spaces – Thoughtfully designed residences with modern amenities.

High Return on Investment – A promising real estate opportunity with rising property values.

Sustainable and Smart Living – Green features, smart home technology, and top-tier security measures.

Conclusion

Lodha Wakad Pune is a perfect blend of luxury, convenience, and investment potential. Whether you are looking for a dream home or a profitable real estate investment, this project is an ideal choice. With its strategic location, premium features, and excellent connectivity, Lodha Wakad Pune sets a new benchmark for upscale urban living.

If you're planning to invest in a premium residential project in Pune, Lodha Wakad should be at the top of your list. Secure your future in a vibrant, well-connected, and luxurious community today!

3 notes

·

View notes

Text

I have a high deductible health plan which means that my monthly premium is low, but I have to pay for healthcare myself until a certain limit where insurance kicks in (at first it will pay 70-80% and then at another limit it will pay 100%).

For the first time ever it looks like I’m going to hit either one or both of those limits this year, which kind of rationalizes me to get as much as possible out of my plan.

I have things I’ve been putting off for years that I think I’m gonna get seen this year, I’m gonna be like the million dollar man where they can rebuild me stronger! faster! better!

13 notes

·

View notes

Text

I had another conversation with someone who didn't have health insurance today about ACA that she didn't know existed as an option. Ever since I got my first ACA plan last year after turning 26 I have been a big ACA fan because this piece of landmark legislation is the reason I have health insurance instead of being in thousands of dollars of medical debt. It bugs the ever living shit out of me whenever I see internet leftists saying things like "the ACA didn't do anything because it is not medicare for all." It really speaks to me about the privilege that these people likely have because they're not noticing the amount of monumental positive change and harm reduction that was made by the bill.

The ACA is a bill that is comprehensive, and walks, talks, and chews gum at the same time, and I think a lot of people who are either a.) too young to remember how health insurance in this country worked before the ACA or b.) have not had to get government subsidized health insurance because they have always had either their parents' insurance or employer insurance really and truly don't get it. I am obviously too young to remember how healthcare worked before the ACA because I am under 30, but I do have a mom who works in healthcare and lots of older relatives that talk about it a lot so I was pretty familiar with the concept despite this.

I am low-income, in school, and have an employer that doesn't offer me employer subsidized plans, so the ACA quickly became pretty important to me as a person with lifelong disability, higher than normal cancer predisposition and a need for lifelong psychiatric care.

Also, if you are in your 20s but under 26 and still on your parents' health insurance? Bam! You are directly benefiting from the ACA. Before the ACA you would not have been able to be on your parents insurance plan in your 20s.

Some things that the ACA did:

Made it affordable for people who are above the medicaid income limit and/or self-employed to independently purchase health insurance. Before the ACA premiums for independently purchased health plans could be $500+ for individual plans! If you were one of the many Americans who worked multiple part-time jobs that did not provide PT employees with insurance, you were basically fucked and uninsured. If you were a small business or self-employed, you were also fucked. The creation of the healthcare dot gov health insurance marketplace, which is open to anyone was a massive success of the bill, and millions of Americans benefit from it. During open enrollment (or after a specific life event such as "turned 26," or "became unemployed") a person can log on to health care dot gov, see a wide range of plans, and purchase one. The government then provides you with a premium subsidy (which is what your employer does for you if you have an employer plan) to lower the cost of the premium. Subsidies are calculated based on a person's income so people with lower incomes get higher subsidies.

Obviously there is some nuance, and a coverage gap with ACA plans for individuals who make above $60,000 (and are not a small business obtaining a group contract with an insurance company) where premiums are still very expensive because they are ineligible for the majority of the premium tax subsidy, which is a major ACA weakness, but for everyone in the $30,000-$55,000 gap and for owners of small businesses that want to offer plans for their employees, the benefits are huge. I am able to get a PPO with a low deductible, low OOP for less than $200/mo in premiums! There is exactly zero way that I would have been able to do that if I were trying to get insured pre-ACA.

Made it so that insurance companies could not discriminate against patients with so-called pre-existing conditions — so basically if you are disabled, the insurance company can no longer: a.) decline to provide you coverage or b.) increase your premiums/ reduce your plan benefits because you have a disability or get something like, oh, idk, FUCKING CANCER. Like there were people who got cancer and found out that their insurer dropped them because they did not want to pay out for expensive cancer treatment. That was a thing that was legal for health insurance companies to do before the ACA, and they fucking did that. The pre-existing conditions clause was one of the biggest benefits that has been touted since the beginning of the bill's conception and passage. Under the ACA, all health insurance companies are banned from denying plan applications for any reason, or from revoking plan coverage for any reason that isn't "patient stopped paying their premium." Made it so that children could stay on their parents' health insurance plans until they were 26 instead of being booted at 18. Made it so that all plans must provide some level of coverage for a list of specific EHBs (Essential Health Benefits) such as "emergency room care," "prenatal and pregnancy related care," "preventative care such as doctor recommended cancer screenings for patients" "office visits with general practitioners," etc.

If you have an marketplace plan or medicare/medicaid, that plan MUST provide you with contraceptives at no cost to you regardless of whether or not you have met your deductible. Democrats also wanted this to be true for all other plans, but unfortunately in 2014, whacko religious conservatives got themselves an exemption for "companies with fervently held religious beliefs against contraception" from providing this coverage in their employer subsidized plans in the bullshit case of Burwell v. Hobby Lobby Stores, Inc., which was decided by a conservative majority vote in the Supreme Court. A case which had other broad and shitty implications btw, and which is yet another example of why allowing weird conservatives to get elected to the presidency is bad for America. btw, in the original intention of the ACA they wanted to also include mandatory coverage for abortion services. Unfortunately, the Republicans (and a group of stupid pro-life dems who suck, and to my knowledge are not in congress now) torpedoed this provision despite Nancy Pelosi's best efforts and refused to pass the bill at all as long as this provision remained in it. Reason #10000000 Republicans suck.

Lots more that I'm not naming here, but I hope you get the idea. My point is that even though ACA was not a medicare for all bill, it was a landmark (and very needed) piece of healthcare reform legislation that changed a lot about the landscape of health insurance in America. Tragically, right wing and far left smearing of it has obscured the truth about the many good things that the bill did do. Was it perfect? Absolutely the fuck not! Even Obama himself admits this. What it was was a major victory against injustices in the system, and a massive piece of harm reduction legislation, and I wish that more Americans credited it for the things it did do.

Dems managed to get the bill passed with the vast majority of their highest priorities still in it despite major republic ratfuckery combined with a minority of independents and dems who sucked. Pelosi walked circles around these fuckers day and night to get this bill passed, and I for one am deeply grateful. Because of the ACA I can get the healthcare that I desperately need as a disabled person with higher than normal cancer risk. I can get my desperately needed medications and see all of my doctors because of this piece of legislation. I was able to get surgery to remove CANCER from my body becuase of this legislation, so yeah, fuck everyone going "the ACA is bad because it's not perfect medicare for all." Girl (gender neutral), I (and many other people) would not be surviving if it were not for this bill, and I for one, think that that is a whole heck of a lot better than all of us dying because y'all want to wait for perfect legislation. Harm reduction is good and is an important step on the road to bigger and better change. Universal health care has risen to more popular and broad public opinion/knowledge because the ACA passed.

Yeah, anyways this is rant about how fucking stupid anti-ACA people are. To deny the gains of meaningful healthcare reform is a clear sign of privilege, ignorance, and tunnel vision that lets perfect be the enemy of good or better.

This is also a post about a clear and obvious way that Dems are infinitely different (and better) than republicans. Voting dem is harm reduction. Not voting, voting third party or protest write in voting is a vote for republicans. And republicans??? They give exactly zero shits about anyone other than themselves. They support stupid and insane religious conservative politics, and look to fuck over the American people (and everyone else abroad) at every turn because they don't believe in helping people; their convictions are all about hate, prejudice, fearmongering, and a right-wing Christian Theocracy. They would rather see millions of people die than give dems a win, because they are spiteful and hateful. They want us to be afraid, disengaged, disorganized and fighting one another, because their ideas, convictions and beliefs are deeply unpopular, and if we organize against them, they will lose.

#long post for ts#aca#affordable care act#us pol#pol#margaret babbles#I don't care if this is controversial opinion here on tumblr dot com#it's something that needs saying and I am going to say out loud till the cows come home because it's the truth#and we have the truth on our side while they have lies fear and hate

6 notes

·

View notes

Text

Find the Best Home for Sell in Dubai with Little Homes Real Estate

Why Buy a Home in Dubai?

Dubai is a global hub of luxury, innovation, and high-quality living. With stunning architecture, world-class amenities, and a strong real estate market, it's an excellent place to invest in property. Whether you’re looking for a family home or an investment opportunity, finding the right home for sell in Dubai can be a life-changing decision.

At Little Homes Real Estate, we help buyers discover their perfect homes with ease. Our team offers expert guidance, ensuring you get the best property that suits your lifestyle and budget.

Types of Homes Available in Dubai

Dubai offers a wide variety of homes, catering to different needs and preferences:

Apartments – Ideal for individuals or couples, apartments in areas like Downtown Dubai, Dubai Marina, and Business Bay offer modern amenities and breathtaking city views.

Villas – Perfect for families, villas in Palm Jumeirah, Arabian Ranches, and Emirates Hills provide spacious living areas, private gardens, and premium facilities.

Townhouses – A great option for those who want a balance between an apartment and a villa, townhouses offer modern living spaces with community benefits.

Penthouses – Luxury at its finest, penthouses in Dubai feature exclusive designs, rooftop terraces, and stunning skyline views.

Why Invest in a Home for Sell in Dubai?

Investing in a home for sell in Dubai comes with several benefits:

Tax-Free Ownership: Dubai offers 0% property tax, making it an attractive investment destination.

High Rental Yields: Properties in Dubai generate strong rental returns, making them a lucrative option for investors.

World-Class Infrastructure: Dubai is known for its excellent roads, public transport, healthcare, and educational institutions.

Secure and Stable Market: With strict regulations and transparency, the Dubai real estate market is safe and reliable for buyers.

How Little Homes Real Estate Helps You Find the Perfect Home

Finding the right home for sell in Dubai can be overwhelming, but Little Homes Real Estate makes the process simple. Our services include:

A wide range of properties in prime locations

Professional consultation and market insights

Assistance with legal paperwork and financial planning

Personalized support from property selection to final purchase

Start Your Home Buying Journey Today!

If you’re searching for a home for sell in Dubai, now is the perfect time to invest. With Little Homes Real Estate, you get access to the best properties and expert guidance to make your dream home a reality.

Contact us today and let us help you find the perfect home in Dubai!

2 notes

·

View notes

Text

No one is entitled to biological offspring and how can they include surrogacy in the Act without implying that couples are entitled to women to be surrogates?

A trio of Democratic senators are introducing a "Right to IVF Act" that would, among other things, force private health insurance plans to cover assisted reproduction treatments such as in vitro fertilization (IVF), egg freezing, and gestational surrogacy.

The measure provides no exception or accommodations for religious objections, all but ensuring massive legal battles over the mandate should it pass.

The "sweeping legislative package" (as the senators describe it) combines several existing pieces of legislation, including the Access to Family Building Act and the Family Building Federal Employees Health Benefit Fairness Act sponsored by Sen. Tammy Duckworth (D–Ill.), the Veteran Families Health Services Act from Sen. Patty Murray (D–Wash.), and the Access to Infertility Treatment and Care Act from Sen. Cory Booker (D–N.J.).

Booker's contribution here is probably the most controversial. It requires coverage for assisted reproduction from any health care plan that covers obstetric services.

A Reverse Contraception Mandate

Remember the Affordable Care Act's contraception mandate, which required private health insurance plans to cover birth control (allegedly) at no cost to plan participants? It spawned some big legal battles over the rights of religious employers and institutions not to offer staff health plans that included birth control coverage.

Booker's Access to Infertility Treatment and Care Act is a lot like the Obamacare contraception mandate, except instead of requiring health care plans to cover the costs of avoiding pregnancy it would require them to cover treatments to help people become pregnant.

The bill states that all group health plans or health insurance issuers offering group or individual health insurance must cover assisted reproduction and fertility preservation treatments if they cover any obstetric services. It defines assisted reproductive technology as "treatments or procedures that involve the handling of human egg, sperm, and embryo outside of the body with the intent of facilitating a pregnancy, including in vitro fertilization, egg, embryo, or sperm cryopreservation, egg or embryo donation, and gestational surrogacy."

Health insurance plans could only require participant cost-sharing (in the form of co-pays, deductibles, etc.) for such services to the same extent that they require cost-sharing for similar services.

What Could Go Wrong?

It seems like it should go without saying by now but there is no such thing as government-mandated healthcare savings. Authorities can order health care plans to cover IVF (or contraception or whatever) and cap point-of-service costs for plan participants, but health insurers will inevitably pass these costs on to consumers in other ways—leading to higher insurance premiums overall or other health care cost increases.

Yes, IVF and other fertility procedures are expensive. But a mandate like this could actually risk raising IVF costs.

When a lot of people are paying out of pocket for fertility treatments, medical professionals have an incentive to keep costs affordable in order to attract patients. If everyone's insurance covers IVF and patients needn't bother with comparing costs or weighing costs versus benefits, there's nothing to stop medical providers from raising prices greatly. We'll see the same cost inflation we've seen in other sectors of the U.S. healthcare marketplace—a situation that not only balloons health care spending generally (and gets passed on to consumers one way or another) but makes fertility treatments out of reach for people who don't have insurance that covers such treatments.

Raising costs isn't the only issue here, of course. There's the matter of more government intervention in private markets (something some of us are still wild-eyed enough to oppose!).

Offering employee health care plans that cover IVF could be a good selling point for recruiting potential employees or keeping existing employees happy. But there's no reason that every employer should have to do so, just because lawmakers want IVF to be more accessible.

It's unfair to employers—big or small, religious or non-religious—to say they all must take on the costs of offering health care plans that cover pricey fertility treatments. And Booker's bill contains no exceptions for small businesses or for entities with religious or ethical objections.

A lot of religious people are morally opposed to things like IVF and surrogacy. This measure would force religious employers to subsidize and tacitly condone these things if they wanted to offer employees health care plans with any obstetrics coverage at all.

As with any government intervention in free markets, there's the possibility that this fertility treatment mandate would distort incentives. IVF can certainly be an invaluable tool for folks experiencing infertility. But it's also very expensive and very taxing—emotionally and physically—for the women undergoing it, with far from universal success rates. The new mandate could encourage people who may not be good candidates for IVF to keep trying it, perhaps nudging them away from other options (like adoption) that might be better suited to their circumstances.

'Access' Vs. Whatever This Is

Since Roe v. Wade was overturned, many Americans have worried that the legal regime change would pave the way for outlawing things like contraception or IVF, too. Encoding into law (or legal precedent) the idea that fertilized eggs are people could have negative implications for these things, even if many conservative politicians pledge (and demonstrate) that IVF and birth control are safe. In response, some progressive politicians—perhaps genuinely concerned, perhaps sensing political opportunity (or why not both?)—have started talking a lot about the need to protect access to IVF across the country.

As much as I agree with this goal, I think IVF's legality is better off as a state-by-state matter. That said, the "protect IVF nationwide" impulse wouldn't be so bad if "protecting access" simply meant making sure that the procedure was legal.

But as we've seen again and again over the past couple decades, Democrats tend to define health care and medicine "access" differently.

The new Right to IVF Act would establish a national right to provide or receive assisted reproduction services. In their press release, the senators say this last bit would "pre-empt any state effort to limit such access and ensur[e] no hopeful parent—or their doctors—are punished for trying to start or grow a family." OK.

But that's not all it would do. The bill's text states that "an individual has a statutory right under this Act, including without prohibition or unreasonable limitation or interference (such as due to financial cost or detriment to the individual's health, including mental health), to—(A) access assisted reproductive technology; (B) continue or complete an ongoing assisted reproductive technology treatment or procedure pursuant to a written plan or agreement with a health care provider; and (C) retain all rights regarding the use or disposition of reproductive genetic materials, including gametes."

Note that bit about financial cost. It's kind of confusingly worded and it's unclear exactly what that would mean in practice. But it could give the government leeway to directly intervene if they think IVF is broadly unaffordable or to place more demands on individual health care facilities, providers, insurance plans, etc., to help cover the costs of IVF for people whom it would otherwise be financially out of reach.

This is the distilled essence of how Democrats go too far on issues like this. They're not content to say "People shouldn't be punished for utilizing/offering IVF" or that the practice shouldn't be illegal. They look at authoritarian or overreaching possibilities from the other side (like banning or criminalizing IVF) and respond with overreaching proposals of their own.

The proble with increasing access to IVF is what happens when the couple needs a surrogate to have biological offspring? Will they beg and pester the women in their lives? Will the affordable IVF compensate surrogates fairly?

#usa#Right to IVF Act#Democratic making it easier to exploit women#Anti surrogacy#the Access to Family Building Act#the Family Building Federal Employees Health Benefit Fairness Act#Sen. Tammy Duckworth (D–Ill.)#the Veteran Families Health Services Act#Sen. Patty Murray (D–Wash.)#the Access to Infertility Treatment and Care Act#Sen. Cory Booker (D–N.J.).

11 notes

·

View notes

Text

The monthly premium for my health insurance now: €139,20

The monthly premium for my health insurance from January 1st (if I don't change anything): €144,90

Welcome to the Netherlands - where we have healthcare for all*

*all who can afford to drop €200+ a month on their premium so it actually covers the things they need.

The insurance I have now is the basic deal that everyone has to have + dental. I'm considering dropping that and pray I don't get a cavity next year.

The basic plan doesn't cover the insoles I need to walk without pain. I should get new ones fitted every year but that's 250 euro and I don't have that much money to spare - ever - so I'm still wearing the ones from last year and the year before.

And on top of all that you have to pay €385 of your healthcare costs a year yourself no matter what. Rich or poor, you have to pay the 385.

In short - fuck this country, fuck the vvd, fuck everyone who voted for these assholes, fuck everyone who is planning on voting for them, and fuck everyone who is planning on voting for Omtzigt because he's just as bad.

Nieuwe bestuurscultuur me reet!

20 notes

·

View notes