#Pre IPO consulting

Explore tagged Tumblr posts

Text

Unlock IPO Success with Pre IPO Consulting Services Today

Pre IPO consulting is considered as the boon for the one who has taken the benefit of this process because this procedure is helping the organizations from unnecessary failure to be accomplished in such regard. Few years back, the early investors have seen the potential in the firms to invest further in the organization interested in the IPO launch. The significant returns any organization have exploring may filled the world with potential yet requiring the navigation in a careful manner. The investors including the friends, family, official investors and high net worth individuals. By pouring the funds in the pre IPO process so that the companies are investing in the large stock markets by start planning to go public by listing process. Pre IPO consulting is always helping the large as well as the small organizations to go public with confidence so as to grab the required amount of funds from the market whichever is defined or in some other case, one must get even more than the expectations. Many tech startups may raise the capital using the best techniques required for the launch of the IPO process, Pre IPO consulting may be considered helpful in IPO rounds and pre IPO investment by raising the capital as much as one can. Pre IPO consulting may become helpful for those who wants to trade publicly in the stock market by diluting their equity in the public and wants to raise maximum funds with the help of the process to be popularly known as IPO.

Visit Us:-

#pre ipo consulting#pre IPO consulting in india#pre IPO consulting services#india Ipo Services#India Ipo Process

0 notes

Text

Find the best SME IPO Consultant in India to list your sme to the exchange. We are leading the SME IPO Consultancy service since 1995 in India. For more detail visit our website SME IPO Consultant ASC Group.

#sme ipo consultant#ipo consulting services#ipo consultant#ipo consulting firms#bse sme listing consultants#pre ipo consulting#ipo advisory firms#ipo financial advisor#financial advisor ipo#pre ipo advisory#ipo readiness consulting#ipo readiness accounting#ipo preparedness#ipo readiness services#public company readiness#ipo readiness assessment#ipo readiness#initial public offering readiness#sme ipo readiness

0 notes

Text

How Mutual Fund Advisors in Nashik Can Help You Invest Wisely

Investing your money can be a smart way to grow your wealth over time. But with so many mutual fund investment company in Nashik, it can be hard to know where to start. That’s where mutual fund advisors in Nashik come in. They can guide you through the process and help you make informed decisions.

What Are Mutual Funds?

A mutual fund is a form of investment in which a group of individuals combine their money to purchase stocks, bonds, or other assets. Professional fund managers oversee this pooled money and make investment decisions on behalf of the investors. Mutual funds are popular because they offer diversification, which means spreading your money across different investments to reduce risk.

Benefits of Investing in Mutual Funds

Professional Management: When you invest in a mutual fund, your money is managed by experienced professionals. They have the knowledge and expertise to make smart investment decisions.

Diversification: Mutual funds invest in multiple assets like stocks, bonds, gold, etc. This diversification helps in spreading out risk. If one investment doesn’t perform well, others might do better, balancing out the overall performance.

Liquidity: You can buy and sell mutual funds easily. You can redeem your fund and get money in the bank account in the matter of days.

Affordability: You can invest in mutual funds with just Rs. 500 and Rs. 100 in some funds. Even low-ticket size investors can invest in mutual funds easily.

Why choose us?

We are a well-known investment expert in Nashik. Whether you want to invest in mutual funds, portfolio management, or get yourself insurance, we offer comprehensive financial services. Our goal is to help you achieve your financial dreams, whether it’s saving for retirement, planning for your child’s education, or simply growing your wealth.

How we can help

We have a team of experienced mutual fund experts. We can help you select a mutual fund according to your financial goals and risk tolerance. Here are some ways we can assist you:

Personalized Advice: We take the time to understand your financial situation and goals. Based on this, they recommend mutual funds that are suitable for you.

Regular Monitoring: Investing is not a one-time activity. Our team regularly monitors your investments and makes adjustments as needed to ensure they stay on track.

Education and Support: We believe in educating their clients about investments. We provide clear and simple explanations, so you understand where your money is going and how it is growing.

Conclusion

Investing doesn’t have to be complicated. With the right guidance from us, you can make informed decisions and work towards achieving your financial goals. Whether you’re looking to save for the future, grow your wealth, or plan for major life events, our team of experts is here to help. So, take the first step towards a secure financial future with the most trusted mutual fund agents.

#financial planning advisor in Nashik#investment services in Nashik#wealth management experts in Nashik#pre ipo investing planner in Nashik#ESOP Shares#employee stock ownership plan services in Nashik#Systematic Investment Plan in Nashik#finance management company in Nashik#AMFI registered mutual fund distributor in Nashik#systematic Investment Plan in Nashik#mutual fund advisors in Nashik#mutual fund investment company in Nashik#mutual fund investments agency in Nashik#mutual fund distributor in Nashik#wealth management advisor in Nashik#mutual fund expert in Nashik#mutual fund agent in Nashik#best mutual fund advisor in Nashik#mutual fund investment advisor in Nashik#financial services in Nashik#financial goals planning in Nashik#best financial advisors in Nashik#top financial consulting companies in Nashik#best sip provider in Nashik financial advisor in Nashik#best agent for mutual funds in Nashik#personal financial advisor in Nashik#financial planning consultation in Nashik#financial investment advisor in Nashik#term life insurance policy in Nashik#whole life insurance for seniors in Nashik

1 note

·

View note

Text

Echoes of Jade and eternal Gold

Rex Lapis/ Zhongli x Reader [Read more at Ao3!]

{In the ancient days of Liyue, the land was steeped in strife, where gods clashed and calamities raged without end. Rex Lapis, the stalwart defender of Guili Plains, rose as a god of war fighting for peace. Yet, among his countless adversaries, one stood unmatched: Ipos, the god of massacres, a force of chaos whose name became synonymous with dread. Their battles carved scars into the land, a testament to their enmity. But as the Archon War drew to a close, Ipos vanished without a trace, leaving behind only bloodstained whispers of her fate. [Ipos is Y/N. The story is told from three different timelines. First, Pre-Archon war and Archon war timeline where Y/N's origins are discussed and Y/N is addressed as Ipos in third person. A lot of the story revolves around that, Y/N had two lovers during the time and that is shown in some chapters. Second, post-cataclysm, where Y/N is retiring to be a wine merchant and Y/N is referred to as "you". This is where the slow burn romance between Rex Lapis and Y/N happens. Third, Modern day Liyue, where Y/N is married to a certain funeral consultant, and is currently telling the story to people (and ruining Iron Tongue Tian's business). Modern Day Liyue will not be mentioned a lot.]}

Chapter 1- Prologue

“Ah, gather 'round, my friends! Let me tell you a tale of ancient Liyue—a time when our land quaked beneath the shadows of gods and monsters alike,” Iron Tongue Tian began, his voice rich with gravitas as he gestured to the rapt audience.

“In those distant days, Liyue was beset by calamity, its skies darkened by the fury of two titans. The first, a serpentine terror known as Ipos, the God of Massacres, was no mere beast but a storm incarnate. With a sweep of her wrath, forests would wither, the air itself turning to venom. Thousands fell to her unrelenting might, their cries swallowed by the chaos she wrought. If Osial was a threat, Ipos was a tempest that consumed the very heart of Liyue, her power so great that even the most revered of gods dared not tread near her stronghold in Chenyu Vale.

"Imagine, if you will, a world where she had triumphed. They say Liyue would have been reduced to a wasteland, naught but ash and ruin. And atop a mountain of corpses, it would be her serpentine form that claimed the divine throne. Such a thought, chilling as it is, was not far from reality."

He leaned forward, lowering his voice to a conspiratorial hush, drawing the listeners closer. "But against this living calamity stood a mountain dragon, steadfast and unyielding. Yes, our very own Rex Lapis, the Geo Archon himself! Rallying his adepti, he waged war against the serpent, his every strike a testament to his resolve to protect this land. The battles between them—ah, they shook the heavens and carved the earth! It was said that the very mountains trembled under their fury.”

Tian paused, letting the weight of his words sink in before continuing. “Yet even Rex Lapis, mighty as he was, could not strike her down. No, for Ipos was as cunning as she was cruel. As the war raged on, she was cornered at last, driven to the depths of the Chasm. It is there, they say, that the blood-red trees we see today were born, their roots steeped in the blood she shed in her desperation.

“And what became of her? Ah, therein lies the mystery, my friends. Some say she was defeated, others that she fled to heal her wounds in the endless dark of the Chasm, waiting for the day she might rise again. But one thing is certain: her reign of terror ended not by her choice, but by the will of the Geo Archon, the stalwart shield of Liyue.”

With a dramatic sweep of his arms, Iron Tongue Tian concluded, his voice brimming with pride. “So tonight, as you walk the streets of this blessed harbor, give thanks to Rex Lapis, the mountain dragon who tamed the storm. And should you ever wander near the Chasm, beware the whispers of the serpent—lest her slumber be disturbed.”

The crowd shivered, murmuring among themselves, as Tian’s story settled over them like the mist rolling off the peaks of Jueyun Karst.

The murmuring crowd stilled as the figure's voice sliced through the air, sharp and dripping with disdain. "What utter garbage," you muttered, swirling the golden liquid in your cup before taking a measured sip of osmanthus wine.

Nearby, a group of children turned their curious gazes toward you. One, bolder than the rest, asked, "Garbage? What do you mean, Auntie Y/N?"

You tilted your head slightly, feigning surprise, though the smirk tugging at your lips betrayed your amusement. "Hmm? Oh, listen well, children. Adults who spin stories for a living are skilled liars. Lies, after all, make for better tales." You leaned closer, your voice dropping into a conspiratorial whisper. "Be like Auntie. Build an empire of wine instead—far more profitable and far less dramatic."

The children giggled, though their laughter was quickly interrupted by a familiar exasperated sigh. "Auntie Y/N, you’re driving away my customers again," Iron Tongue Tian groaned, rubbing his temples as he stepped forward. His frustration was palpable, and for good reason—you had become the bane of his storytelling ventures as of late.

You turned to him with a casual shrug, clearly unfazed. "Then tell better stories, Tian. If you had a shred of accuracy in your words, perhaps I’d even recommend you to people." You smirked, taking another sip of your wine, your tone sharp yet somehow playful.

Tian’s eyes narrowed. Everyone knew you were no ordinary critic. Your words carried weight, laced with an unnerving certainty that suggested firsthand knowledge. It didn’t help that your husband, the ever-enigmatic funeral consultant, seemed to share the same uncanny knack for historical accuracy. Together, you made for an odd couple, one steeped in mystery, and most had long since learned not to pry too deeply.

"You know, Auntie Y/N," Tian retorted, his voice tight with barely restrained annoyance, "it’s easy to mock from the sidelines. But if you’re so certain my tales are lacking, why don’t you tell one yourself?"

You laughed, low and melodic, and fixed him with a challenging look. "Oh, Tian, you wouldn’t want that. The truth is rarely as entertaining as your flights of fancy." You waved a dismissive hand, already turning back to the children, who were now looking at you with wide-eyed fascination.

"Now, where were we? Ah, yes. Life lessons. Drink wine, build an empire, and never believe everything you hear," you said, raising your cup in a mock toast.

Tian groaned audibly, while the crowd—half intrigued and half bewildered—couldn’t decide whether to laugh or quietly slink away. Such was the chaos you seemed to bring wherever you went, though you, as always, seemed to revel in it.

You were, by now, everyone's "Auntie," though your youthful visage spoke of a life untouched by time. The people of Liyue chalked it up to good fortune—or perhaps just good genes. None dared to pry further.

"Very well," you relented, setting your cup down with deliberate ease. A slow grin spread across your face, sharp and knowing, as if you held the keys to secrets long buried. "You’ve convinced me. Let me tell you the true story of the God of Massacres. One that will make even the strongest piss themselves."

The crowd leaned in, breathless, and thus began the tale.

#zhongli × reader#genshin zhongli#zhongli#zhongli smut#rex lapis#morax x reader#genshin morax#morax#genshin impact morax#zhongli genshin impact

13 notes

·

View notes

Text

Investing in Swiggy Unlisted Shares: Growth Prospects in the Food Tech Industry

One of the leading food tech companies in the country, Swiggy has been known to be a major player in the sector of online food delivery. It had its inception in 2014, and soon after it expanded into quick commerce with offerings like Instamart, which has diversified its revenue streams as well as increased the market footprint. With an upcoming IPO anticipated by the end of the year 2024, the demand for the unlisted shares of Swiggy has surged, making it a popular choice for pre-IPO investors.

Current Financial Performance and Valuation

1) Revenue and Losses

Swiggy reported revenues of Rs 5,476 crore in 2024, reflecting a 58% increase from the previous year. However, its losses remain substantial, at around Rs 1,600 crore in 2024. Despite these losses, Swiggy's valuation reached $14.74 billion as of June 2024, with an IPO target of $15 billion.

2) Pre-IPO Share Price

Swiggy's unlisted shares have been trading actively, with prices rising from ₹350 to ₹460-₹450 per share amid the IPO buzz. This increase signals investor confidence, driven by the company's growth trajectory and potential market performance post-IPO.

3) Market Dynamics

The food tech industry is witnessing robust growth, with Swiggy capturing 43% of the Indian market. Swiggy’s quick-commerce arm, Instamart, has also become a key driver, positioning the company well against competitors like Blinkit and Zomato.

Buy Swiggy Unlisted Shares from Altius Investech!

Prospects of Investment

1) Potential for high returns

The demand for Swiggy's unlisted shares is due to the anticipation of an impressive IPO performance, which is similar to the performance of its competitor Zomato. Early investors stand to benefit greatly in the form of capital gain, especially when the company's valuation matches or exceeds expectations following the listing of Altius Investech.

2) Growth Strategy

Swiggy's expansion into other services than food delivery, including grocery deliveries (Instamart) along with express delivery (Swiggy Genie), has improved their business plan. The diversification approach could assist Swiggy gain a larger market share, increasing its revenue streams, and increasing overall profitability over the long run.

You Can Also Read Our Other Blogs

Zomato vs Swiggy: A Detailed Comparison of India’s Leading Food Delivery Giants

Unveiling Swiggy: A Comprehensive Overview of India’s Prominent Food Delivery Platform

3) Risks to be Considered

Despite its promising growth, Swiggy has yet to gain profitability and this could affect its value post-IPO. The company's cash burn and negative financial bottom line pose serious issues, particularly in a market that is volatile. Investors need to weigh these concerns against potential gains, taking into consideration the potential gains in the short term from the IPO as well as the long-term potential growth

Final Thoughts

Despite the high risks, it could be a very rewarding opportunity to be investing in Swiggy Unlisted Shares, as it is driven by strong market interest, alongside the company’s extended offerings of service. However, prospective investors should consider the ongoing losses of the company too. Additionally, they should also look at the competitive dynamics of the food tech industry.

Thorough due diligence and consideration of personal risk tolerance are important considerations before making investment decisions. If you are keen to explore this investment further, then consulting a financial advisor, and staying updated on Swiggy’s IPO timeline and market developments remain advisable.

0 notes

Text

The assistance of India IPO consultation, your expert consulting partner, get off to a good IPO start. Pre-IPO consultants in India can rely on the individualized support of our committed personnel to guarantee a seamless transition from planning to compliance. Acquire pertinent knowledge about investor expectations, market trends, and financial tactics to position your business for a prosperous public launch. Our all-inclusive solution is customized for Indian companies and takes into account the particular regional environment. Join forces with us and allow our all-inclusive advice open the door for your business to prosper in the exciting world of IPOs. Strategic planning is the first step to success, and we are here to help you every step of the way.

0 notes

Text

Global Top 27 Companies Accounted for 62% of total Household Appliances Color-Coated Sheet market (QYResearch, 2021)

Home appliance color-coated sheet is a pre-coated sheet, which is a pre-coated product made of metal coil as the base material and coated or laminated with various organic coatings or plastic films on the surface. The home appliance color-coated sheet series products are widely used and have bright colors. They not only have the strength of steel sheets and good formability, but also have good corrosion resistance and flexibility of paint films.

According to the new market research report “Global Household Appliances Color-Coated Sheet Market Report 2023-2029”, published by QYResearch, the global Household Appliances Color-Coated Sheet market size is projected to reach USD 3.88 billion by 2029, at a CAGR of 3.1% during the forecast period.

Figure. Global Household Appliances Color-Coated Sheet Market Size (US$ Million), 2018-2029

Above data is based on report from QYResearch: Global Household Appliances Color-Coated Sheet Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch..

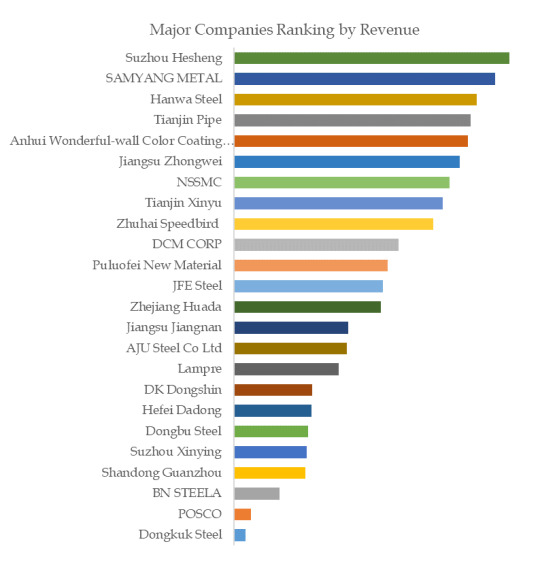

Figure. Global Household Appliances Color-Coated Sheet Top 27 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

Above data is based on report from QYResearch: Global Household Appliances Color-Coated Sheet Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

The global key manufacturers of Household Appliances Color-Coated Sheet include Shenzhen Huamei, Qingdao Hegang New Material Technology, Hebei Zhaojian Metal Product, Jiangyin Haimei, Yieh Phui (China), Suzhou Yangtze New Materials, Jiangsu Liba, Dingchuan Shengyu, Suzhou Hesheng, SAMYANG METAL, etc. In 2021, the global top 10 players had a share approximately 62.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

Formidium Launches Razor State Consulting to Support Fund Managers and Pre-IPO Companies

Formidium Launches Razor State Consulting | www.razorstate.com

0 notes

Text

Formidium Launches Razor State Consulting | www.razorstate.com

Based in Chicago, IL, Razor State is a division of Formidium Corp, the leading technology-enabled fund administrator. Razor State provides outsourced financial accounting and operations support solutions to fund managers and the pre-IPO corporate community. Razor State’s services help companies reduce their costs, improve their efficiency, and focus on their business. Razor State clients benefit from the resources, expertise, and services of a highly trained staff that becomes a partner in their journey.

1 note

·

View note

Text

Effortless Fundraising with Dedicated India IPO Services

India IPO, your trusted partner to navigate Complex IPO World. Offering IPO education, expertise, and innovative strategies, our comprehensive consultancy services are designed to bring “Your Company’s Purpose to Life”. As a leading business and IPO consultancy firm, we are dedicated to delivering A-Z information and IPO services to PAN India. Our extensive knowledge and experience, altogether, help every member of our team to specialize in tailor-made solutions that pave the way “From IPO Journey to its Success.”

Our expertise helps to navigate regulatory requirements, and our effective marketing strategies result in higher subscription rates and stronger listing gains for all our clients

Visit Us:-

#india ipo services#india ipo#pre ipo consulting#ipo consultants in delhi#ipo consultants#ipo consultants in india

0 notes

Text

ASC Group guides businesses in launching successful BSE SME listing consultants with end-to-end support. we have 50+ bse sme ipo listing consultant service since 1995.

#SME IPO consultant#IPO consulting services#BSE SME listing consultants#IPO consultant#Pre IPO advisory services#Pre IPO advisory#IPO readiness#IPO readiness services#IPO financial advisor#ipo advisory services#IPO advisory firms#ipo consulting firms#pre ipo consulting

0 notes

Text

In today’s competitive business landscape, an Initial Public Offering (IPO) is a powerful tool for Small and Medium Enterprises (SMEs) to scale their operations, enhance credibility, and attract investments. However, navigating the complex IPO process requires expertise and strategic planning. This is where ASC Group steps in as your trusted partner for IPO consulting services.

Understanding SME IPOs Consultant

An SME IPO is a public offering specifically designed for small and medium-sized enterprises to raise capital by listing on the SME platform of stock exchanges like the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE). It opens doors for businesses to access public funds, gain visibility, and grow exponentially.

Why Choose IPO Consulting Services?

The IPO journey is complex and involves numerous regulatory, financial, and operational challenges. Engaging expert IPO consultants ensures:

Compliance with Regulations: Meeting all legal and regulatory requirements for a successful listing.

Strategic Planning: Tailoring the IPO process to align with your business goals.

Efficient Execution: Streamlined processes from pre-IPO advisory to post-IPO compliance.

ASC Group: Your Trusted BSE SME Listing Consultants

ASC Group specializes in offering comprehensive IPO consulting services, guiding businesses through every stage of the IPO process. Whether you’re preparing for an SME IPO or looking to optimize your listing strategy, ASC Group provides unmatched expertise.

Our Core IPO Services

Pre-IPO Advisory

Assessing IPO readiness.

Identifying and addressing potential roadblocks.

Designing a robust strategy for a successful IPO.

IPO Readiness Services

Preparing financial statements and reports.

Ensuring regulatory compliance.

Developing a compelling value proposition for investors.

IPO Financial Advisor

Structuring and pricing the offering.

Assisting in financial modeling and valuation.

Providing expert guidance for investor presentations.

BSE SME Listing Consultants

Navigating the SME platform requirements of stock exchanges like BSE.

Preparing documentation and filing with regulatory authorities.

Supporting due diligence processes.

Post-IPO Compliance and Support

Ensuring adherence to post-listing regulations.

Assisting in shareholder communications and investor relations.

Why ASC Group?

ASC Group stands out among IPO advisory firms due to its:

Extensive Experience: Years of expertise in IPO consulting and SME listings.

Holistic Approach: From pre-IPO consulting to post-IPO support, we cover it all.

Customized Solutions: Tailored strategies to meet the unique needs of each client.

Expert Team: A dedicated team of financial advisors, legal experts, and consultants.

Benefits of Partnering with ASC Group

Smooth IPO Process: Minimized delays and seamless execution.

Enhanced Market Credibility: Positioning your business for long-term success.

Access to Capital: Unlocking growth opportunities through public funding.

Investor Confidence: Building trust with potential investors through transparency and compliance.

Conclusion

Embarking on the IPO journey can be a game-changer for SMEs, but it requires meticulous planning and expert guidance. ASC Group, with its proven track record and dedicated services, is your go-to partner for IPO consulting services. From pre-IPO advisory to post-IPO compliance, ASC Group ensures a hassle-free experience, enabling you to focus on what matters most — growing your business.

Partner with ASC Group, the leading IPO advisory firm, and take the first step towards a successful SME IPO. Contact us today to explore our comprehensive IPO readiness services and achieve your financial milestones with confidence.

Get in touch with ASC Group today to streamline your SME IPO Consultant and achieve your business goals.

Contact: +91 +91 9999043311

0 notes

Text

PharmaEasy's Growth Story: Unlisted Shares as a Testament to Success

Introduction to PharmaEasy

PharmaEasy, the leading online pharmacy and healthcare platform in India has been making waves in the market with its exceptional growth story. With a commitment to providing accessible and affordable healthcare solutions to millions of people across the country, PharmaEasy has become synonymous with convenience and reliability. In this blog post, we will delve into PharmaEasy's journey from its humble beginnings to becoming a game-changer in the pharmaceutical industry. We will also explore the significance of unlisted shares in the stock market and how PharmaEasy's unlisted shares have performed over time. So sit back, relax, and join us on this exciting ride as we unravel PharmaEasy's success story!

History and Growth of the Company

PharmaEasy, a leading healthcare technology platform in India, has an impressive history and a remarkable journey of growth. Founded in 2015 by Dharmil Sheth, Dr. Dhaval Shah, and Hardik Dedhia, the company started with a vision to make healthcare accessible and affordable for all. In its early years, PharmaEasy focused on providing online medicine delivery services to customers across Mumbai. With its user-friendly app and efficient delivery network, the company quickly gained traction and expanded its operations to other cities. As time went on, PharmaEasy diversified its offerings by partnering with local pharmacies to provide diagnostic tests as well as consultations with doctors through telemedicine. This move not only increased convenience for users but also positioned PharmaEasy as a one-stop solution for all their healthcare needs. The year 2020 was particularly significant for PharmaEasy as it witnessed unprecedented growth amidst the COVID-19 pandemic. The demand for online healthcare services skyrocketed during this period, and PharmaEasy emerged as a lifeline for many patients who were unable or reluctant to visit physical stores. To further strengthen its position in the market, PharmaEasy went on an acquisition spree. It acquired Medlife - another prominent player in the e-pharmacy space - thereby expanding its customer base exponentially. Today, after several rounds of funding and strategic partnerships with major investors like API Holdings (parent company), CDPQ (Caisse de dépôt et placement du Québec), TPG Growth among others; Pharmeasy has become one of India's largest digital health platforms serving millions of customers nationwide. With such rapid growth over the years fueled by innovation and customer-centricity at its core; it comes as no surprise that PharmaEasy's unlisted shares have become highly sought after by investors looking to capitalize on the success story that continues unfolding before our eyes.

Unlisted Shares and Their Importance in the Stock Market

Unlisted shares play a significant role in the stock market, offering investors unique opportunities and potential for high returns. Unlike listed shares that are traded on exchanges, unlisted shares belong to companies that have not yet gone public or chosen to be listed. One of the key advantages of investing in unlisted shares is the potential for early entry into promising companies. Investors who can identify these opportunities early on may benefit from substantial gains once the company goes public. Unlisted shares also provide diversification benefits as they often represent companies from various sectors and industries. Moreover, unlisted shares allow investors to participate in pre-IPO rounds, enabling them to invest at a lower valuation before the company's value potentially increases upon listing. This can result in higher returns compared to those who invest only after an IPO. Additionally, investing in unlisted shares allows individuals to support innovative startups and contribute directly to their growth story. By providing capital during their early stages, investors help fuel innovation and entrepreneurial endeavors. However, it is important to note that investing in unlisted shares comes with its own set of risks. These investments tend to be illiquid since there is no established market for trading them like listed stocks. Additionally, information about these companies may be limited or difficult to obtain compared to publicly listed firms. While investing in unlisted shares offers unique opportunities for high returns and supporting promising businesses' growth journey; it requires careful evaluation of the risks involved alongside thorough research and due diligence before making any investment decisions

PharmaEasy's Unlisted Shares and their Performance

One of the key indicators of a company's success is how its shares perform in the stock market. In the case of PharmaEasy, its unlisted shares have been attracting significant attention. These unlisted shares are traded privately among investors, providing an opportunity to own a stake in the company before it goes public. The performance of PharmaEasy's unlisted shares has been nothing short of impressive. Investors who had the foresight to invest in these shares early on have reaped substantial returns. As more people become aware of PharmaEasy's growth potential, demand for its unlisted shares continues to rise. What sets PharmaEasy apart is its innovative approach to healthcare delivery. With a robust digital platform that connects patients with pharmacies and diagnostic centers, they have revolutionized how people access medical services. This unique business model has contributed to their rapid growth and increasing valuation. Investing in PharmaEasy's unlisted shares not only provides an opportunity for financial gains but also allows investors to support a company that is making a positive impact on society. By investing in this promising healthcare tech start-up, individuals can align their investment goals with their values. As more investors recognize the potential value of owning PharmaEasy's unlisted shares, it further solidifies the company as an attractive investment option within the pharmaceutical industry. The growing interest from both institutional and retail investors speaks volumes about confidence in PharmaEasy's prospects. In conclusion (not part of my answer), PharMaesy has established itself as one of India’s leading online pharmacy platforms with tremendous growth potential ahead. Its performance in terms of revenue generation and customer acquisition has attracted investor interest, resulting in strong demand for its unlisted shares. As PharMaesy continues expanding into new markets and diversifying its offerings through strategic partnerships, it will likely continue demonstrating strong performance across various metrics, making it an enticing prospect for those interested i the Indian e-commerce sector.

Future Plans and Expansion for PharmaEasy

PharmaEasy, the leading online pharmacy platform in India, has achieved remarkable success since its inception. With a strong customer base and partnerships with top pharmaceutical companies, the company is now looking towards expanding its services and reaching even greater heights. One of PharmaEasy's key plans is to enhance its product offerings. The company aims to provide a wider range of healthcare products including medical devices, personal care items, wellness supplements, and more. By diversifying their offerings, PharmaEasy aims to become a one-stop solution for all healthcare needs. Additionally, PharmaEasy is focused on expanding its reach to smaller towns and rural areas across India. The company recognizes the need for affordable and accessible healthcare options in these regions and seeks to bridge this gap by providing doorstep delivery of medications. This expansion will not only benefit underserved communities but also contribute significantly to the company's growth. Another crucial aspect of PharmaEasy's plans is technological innovation. The company aims to leverage cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) algorithms to improve user experience on their platform. By investing in technology-driven solutions like predictive analysis for inventory management or personalized recommendations based on user data, Pharmeasy strives to offer seamless experiences that meet individual customer needs. Furthermore, international expansion is also part of PharmaEasy's growth strategy. As they continue to dominate the Indian market, they are exploring opportunities in neighboring countries where there may be similar demand for convenient medication delivery services.

Conclusion

PharmaEasy's growth story is truly remarkable, and its unlisted shares have played a significant role in reflecting the company's success. As part of API Holdings pharmeasy has established itself as a leading player in the healthcare industry by providing convenient access to medicines and other healthcare products. Through strategic partnerships, innovative technologies, and customer-centric approaches, PharmaEasy has experienced rapid expansion and impressive revenue growth. Its commitment to delivering quality service has earned it a loyal customer base and placed it at the forefront of India's e-pharmacy market. The performance of PharmaEasy's unlisted shares further reinforces its position as an attractive investment opportunity. With increasing investor interest in digital health platforms like PharmaEasy, these unlisted shares have become highly sought after. Looking ahead, PharmaEasy shows no signs of slowing down. The company has ambitious plans for future growth and aims to expand its services across more cities in India while also exploring opportunities beyond national borders. By continuously enhancing their offerings and leveraging technology advancements, they are well-positioned to seize new opportunities in the evolving healthcare landscape.

1 note

·

View note

Text

Executive Placement Consultant Los Angeles | Executive Placement Agency Los Angeles

Our Los Angeles office provides search and assessment services at the CEO, board, and senior management levels across all industries. As a executive placement consultant in Los Angeles our hands-on recruiters have experience working with private, public, pre-IPO, and non-profit organizations. Executive search firms identify and recruit highly qualified candidates for senior roles, including C-suite positions, on behalf of their clients.

1 note

·

View note

Text

Public Issue IPO: An Introduction to the World of Investment Opportunities

Initial Public Offerings (IPOs) have long been an exciting avenue for investors to get a taste of the stock market's potential and capitalize on promising companies. A Public Issue IPO, in particular, offers an opportunity for the general public to participate in the issuance and purchase of shares from a company that has decided to go public. In this blog post, we will delve into the concept of Public Issue IPOs, explore their benefits, risks, and highlight some key considerations for potential investors.

Understanding Public Issue IPOs:

A Public Issue IPO occurs when a company decides to raise capital by issuing shares to the general public for the first time. Prior to going public, the company is typically privately held, and ownership is limited to a select group of investors. Going public through an IPO allows the company to tap into the public's capital and expand its investor base.

Benefits of Public Issue IPOs:

Investment Opportunity: Public Issue IPOs provide an opportunity for individuals to invest in companies that were previously inaccessible. By investing in an IPO, individuals can become early stakeholders in promising businesses with growth potential.

Potential for Capital Appreciation: IPOs often witness a surge in stock price immediately after the company goes public. If the company performs well and meets market expectations, investors may witness significant capital appreciation on their initial investment.

Diversification: Investing in a Public Issue IPO enables investors to diversify their portfolio by adding a new asset class to their existing mix of investments. This diversification helps mitigate risk and potentially enhance returns.

Risks and Considerations:

Volatility: IPOs are known for their inherent volatility. Newly listed stocks may experience substantial price swings due to market sentiment and speculation. Investors should be prepared for short-term price fluctuations and carefully assess their risk tolerance.

Lack of Historical Data: Unlike established public companies, IPOs have limited historical financial data available for analysis. This makes it challenging for investors to evaluate the company's long-term prospects and make informed investment decisions.

Lock-Up Periods: It is common for pre-IPO shareholders, such as company founders and early investors, to have lock-up agreements that restrict them from selling their shares for a certain period after the IPO. These lock-up periods can lead to additional selling pressure once the restrictions are lifted, potentially impacting the stock's price.

Key Steps for Investing in Public Issue IPOs:

Research: Thoroughly research the company's business model, industry trends, and competitive landscape. Understand the company's financials, growth potential, and risk factors.

Consult Professionals: Seek guidance from financial advisors or brokerage firms with expertise in IPO investments. Their insights can help you navigate the complexities associated with IPOs.

Read the Prospectus: The prospectus contains important information about the IPO, including the company's financials, risks, and offering details. Read it carefully to make an informed decision.

Evaluate Valuation: Assess the IPO's valuation by comparing it with industry peers and considering the company's growth prospects. Evaluate whether the offering price is reasonable based on these factors.

Assess Long-Term Potential: Look beyond short-term price movements and evaluate the company's long-term potential. Consider factors like competitive advantage, market share, and management team.

Conclusion:

Public Issue IPOs provide an opportunity for individual investors to participate in a company's growth journey and potentially reap rewards. However, they also come with risks and uncertainties. It's important to conduct thorough research, seek professional advice, and assess the long-term potential before making any investment decisions. By doing so, investors can position themselves to make informed choices in the world of Public Issue IPOs and potentially benefit from this dynamic investment avenue.

Source :- https://rrsfinance.wordpress.com/2023/06/07/public-issue-ipo-an-introduction-to-the-world-of-investment-opportunities/

1 note

·

View note