#India Ipo Process

Explore tagged Tumblr posts

Text

New Malayalam Steel Limited IPO | India IPO

New Malayalam Steel Limited is a prominent manufacturer of galvanized pipes, tubes, and sheets. The company operates an advanced electric resistance welding tube mill, boasting an impressive installed capacity of 3,500 metric tonnes. Situated in the scenic state of Kerala, India, this manufacturing unit is equipped with state-of-the-art technology, ensuring high-quality production and efficiency.

New Malayalam Steel Limited is a prominent manufacturer of galvanized pipes, tubes, and sheets. The company operates an advanced electric resistance welding tube mill, boasting an impressive installed capacity of 3,500 metric tonnes. Situated in the scenic state of Kerala, India, this manufacturing unit is equipped with state-of-the-art technology, ensuring high-quality production and efficiency.

Visit Us:-

0 notes

Text

Discover the evolution of Initial Public Offerings (IPOs) from the 1980s and 1990s to today and how it impacts your investments. Explore insights at Infiny Solutions: https://infinysolutions.com/ipos-in-1980s-and-1990s-vs-today-and-what-it-means-for-you/. Uncover the changes in IPO trends and their significance for your financial strategy.

#IPOs#IPOs Share Price#IPOs In India#IPOs Process#IPOs Service#IPOs Meaning#unclaimed dividends and unclaimed shares#Initial Public Offering

0 notes

Text

Your IPO Guide: How to Navigate Stock Market Entry - IPO Initial Public Offering Meaning

IPO Initial Public Offering Meaning :How IPO Works ?Process Of IPO STEP BY STEP :Pros & Cons :Pros of an IPO:Cons of an IPO:Conclusions: FAQs IPO Initial Public Offering Meaning :Where Can I Get IPO Process Pdf For Ipo Process Steps ?How To Download Ipo Process In India Pdf ?Ipo Initial Public Offering Example ? IPO Initial Public Offering Meaning : An IPO, or Initial Public Offering, is when a…

View On WordPress

#Ipo initial public offering example#ipo meaning#ipo process in india pdf#ipo process pdf#ipo process steps

0 notes

Text

Special Purpose Acquisition Companies (SPACs) and Their Relevance to Indian Firms

Special Purpose Acquisition Companies, or SPACs, have become a buzzword in global financial markets. As an innovative way to take companies public, SPACs offer a faster and more flexible alternative to traditional Initial Public Offerings (IPOs). While the model has gained significant traction in the United States, it presents a unique opportunity for Indian firms looking to expand and raise capital abroad. However, challenges related to regulatory frameworks and market risks still persist. This blog explores what SPACs are, their advantages, and how they might fit into the Indian corporate landscape.

What is a SPAC?

A SPAC is essentially a “blank-check” company with no commercial operations. Its sole purpose is to raise funds through an IPO to merge with a private company, allowing the target company to become publicly listed without going through the traditional IPO process. Investors buy into a SPAC based on the expertise of its sponsors, trusting them to identify and acquire a promising target. If no acquisition takes place within a set timeframe (usually 24 months), the SPAC must return the money to investors.

Key Characteristics of SPACs:

Speed and efficiency: Companies can become publicly listed faster than via a standard IPO.

• Lower regulatory scrutiny: SPAC mergers avoid much of the red tape associated with IPOs.

• Pre-negotiated valuations: Target companies can negotiate valuations with the SPAC sponsors rather than relying on fluctuating market conditions.

The Global Rise of SPACs

SPACs became especially popular in 2020 and 2021, accounting for nearly half of all IPOs in the United States during that period. Successful companies like Virgin Galactic and DraftKings used SPACs to go public, paving the way for others to explore this model. Investment banks, venture capitalists, and private equity firms have embraced SPACs as a quick, lucrative way to introduce companies to public markets.

Why SPACs gained momentum:

1. Volatile markets: During periods of market uncertainty, SPACs offer companies more predictability in terms of valuation and timeline.

2. Demand for faster capital access: Startups and high-growth firms, particularly in sectors like technology and healthcare, found SPACs an attractive way to secure investments.

The Relevance of SPACs for Indian Firms

Indian firms, especially those in technology, fintech, renewable energy, and pharmaceuticals, are increasingly eyeing global markets. SPACs offer a convenient way for these firms to list abroad, particularly on exchanges such as the NASDAQ or the New York Stock Exchange (NYSE).

Advantages of SPACs for Indian Firms:

1. Global Market Access: Companies looking to expand internationally can benefit from SPACs by gaining a listing on prestigious foreign exchanges.

2. Flexible Valuation Models: Indian startups and unicorns often find it challenging to secure favorable valuations through traditional IPOs. SPACs offer them the opportunity to negotiate more favorable terms.

3. Capital for Growth: Indian firms in growth-intensive sectors can leverage SPAC mergers to secure quick funding for global expansion.

Challenges Indian Firms May Face

While SPACs hold immense potential, Indian companies encounter several regulatory and market barriers in leveraging this route effectively:

1. Regulatory Uncertainty: The Securities and Exchange Board of India (SEBI) has yet to create clear guidelines on SPAC transactions, adding a layer of uncertainty for companies and investors.

2. Foreign Exchange and FEMA Regulations: Indian firms must navigate the complexities of Foreign Exchange Management Act (FEMA) regulations to raise capital abroad.

3. Speculative Nature of SPACs: Not all SPACs find suitable acquisition targets, leading to market skepticism and reputational risks.

Examples of Indian Companies Exploring SPACs

Some Indian firms have already started testing the SPAC model. For instance, ReNew Power, a leading renewable energy company, merged with a U.S.-based SPAC to get listed on the NASDAQ. This case shows that Indian firms, especially in industries aligned with global trends like sustainability, can find success through SPAC mergers.

In addition, startups in the tech and digital economy sectors are increasingly considering SPACs to bypass the lengthy regulatory processes involved in listing on Indian exchanges. However, SEBI’s reluctance to recognize SPACs domestically means these companies currently need to explore foreign exchanges for listings

What Lies Ahead: Will SPACs Become a Mainstay in India?

As Indian companies continue to expand globally, SPACs offer an alternative path to raise capital and build international credibility. If SEBI introduces SPAC-friendly regulations, India could see a surge in SPAC-based listings—both domestically and internationally. Additionally, financial hubs such as Singapore and Hong Kong are emerging as attractive venues for SPAC deals, offering Indian firms new avenues for public listings.

Conclusion

SPACs present a promising yet challenging opportunity for Indian firms looking to expand and raise capital in global markets. With advantages such as flexible valuations, quicker listings, and access to foreign capital, this model can benefit high-growth Indian companies in technology, healthcare, and renewable energy. However, regulatory uncertainties and market risks need to be addressed for Indian firms to fully capitalize on this trend.

As the world watches the evolution of SPACs, Indian firms and regulators must adapt to these changing dynamics. With the right policies in place, SPACs could become a pivotal part of India’s global corporate strategy.

By understanding and engaging with this evolving financial mechanism, Indian firms can position themselves for success in global markets. As you build your corporate law portfolio, tracking these trends will showcase your knowledge of innovative legal and financial strategies—an essential skill for future corporate lawyers.

2 notes

·

View notes

Text

Comparing the Top Online Trading Apps: Which One Is Right for You?

The online stock trading app industry has experienced a tremendous surge since the onset of the pandemic in 2020. Thanks to improved internet speeds and the growing interest in financial literacy, mobile-based stock trading has undergone a significant transformation. Each day, more Indians are experiencing the seamless shift towards incredibly smooth and flexible trading options, all available at the touch of a button.

As these apps continue to gain widespread adoption, even beginners can enter the world of trading with ease. These applications not only enable the buying and selling of financial assets but also offer a range of other valuable services. The only requirement is a reliable internet connection to ensure these trading apps operate smoothly.

This article has listed some of the best online trading apps so that you can choose any one of them.

Top Three Online Trading Apps

The list of the best online trading app is as follows.

1. Zerodha Kite

Zerodha boasts over 100 million active clients, contributing significantly to India's retail trading volumes, making up about 15% of the total. This app is highly recommended for both beginners and experienced traders and investors, thanks to its robust technological platform.

Zerodha's flagship mobile trading software, Kite, is developed in-house. The current Kite 3.0 web platform offers a wide array of features, including market watch, advanced charting with over 100 indicators, and advanced order types such as cover orders and good till triggered (GTT) orders, ensuring swift order placements.

Furthermore, users can also utilise Zerodha Kite as a Chrome extension, enabling features like order placement and stock tracking for added convenience.

2. Kotak Securities

Opening a trading account at Kotak Securities comes with the advantage of zero account opening fees. Additionally, there are discounted rates for investors below 30 years of age, making it a cost-effective option. The account setup process is streamlined, with minimal steps involved.

Kotak Securities enables users to engage in a wide range of financial activities, including trading in stocks, IPOs, derivatives, mutual funds, currency, and commodities. Furthermore, it offers opportunities for global investments through its trading app. This app is thoughtfully designed, featuring a user-friendly interface accessible on iOS, Android, and Windows platforms. It also provides valuable extras like margin funding, real-time portfolio tracking, and live stock quotes with charting options.

3. Upstox

Upstox PRO, supported by Tiger Global and endorsed by prominent investors like Indian tycoon Ratan Tata and Tiger Global Management, is a well-known discount broker app. It offers a range of trading and investment opportunities, encompassing stocks, currencies, commodities, and mutual funds. For experienced and seasoned investors, it is an ideal choice, featuring advanced tools such as TradingView and ChartsIQ libraries.

Online trading apps offer a diverse array of financial products and services, consolidating your investment and financial management in one convenient platform. You can engage in activities such as trading equities, participating in IPOs, trading derivatives, investing in mutual funds, placing fixed deposits, dealing in commodities, and trading currency.

2 notes

·

View notes

Text

» Sys•Cyber ✴️🔆✴️ Site Map

Systems

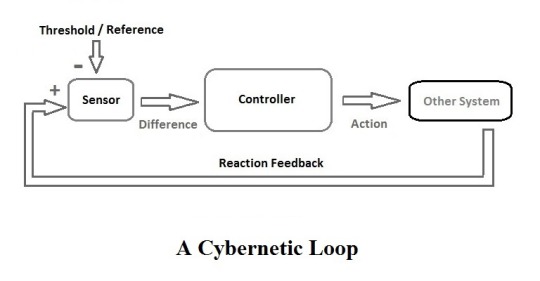

Basic IPO system with control feedback — O'Reilly.com. This is a simple depiction of the most powerful systemic structure known to operate at all hierarchical levels in the universe. It is, if you will, the process that makes fractals in nature arise.

Mandelbrot set

Mandelbrot spire

A system is a group of interacting or interrelated elements that act according to a set of rules to form a unified whole. A system, surrounded and influenced by its environment, is described by its boundaries, structure and purpose and is expressed in its functioning. Systems are the subjects of study of systems theory and other systems sciences. Systems have several common properties and characteristics, including structure, function, behavior and interconnectivity.

— Wikipedia

Dr. Shailendra Singh Thakur, Professor at Gyan Ganga Group of Institutions, Jabalpur, India. See Dr. Thakur's complete System Engineering course slides here.

Life was simple before World War II. After that, we had systems.

— Grace Murray Hopper

Cybernetics

Cybernetic feedback loop by Baango, CC 4.0 Wikimedia Commons

Cybernetics is a wide-ranging field concerned with circular causal processes such as feedback. Norbert Wiener named the field after an example of circular causal feedback — that of steering a ship where the helmsman adjusts their steering in response to the effect it is observed as having, enabling a steady course to be maintained amongst disturbances such as cross-winds or the tide. Cybernetics is concerned with circular causal processes however they are embodied, including in ecological, technological, biological, cognitive and social systems and also in the context of practical activities such as designing, learning, managing, etc. Its transdisciplinary character has meant that cybernetics intersects with a number of other fields, leading to it having both wide influence and diverse interpretations.

— Wikipedia

Cybernetic feedback loop by Orzetto, CC 4.0 Wikimedia Commons

What Are Cybernetics and Systems Science? Principia Cybernetica Web

Heinz von Foerster once told Stuart Umpleby that Norbert Wiener preferred the term "cybernetician" rather than "cyberneticist", perhaps because Wiener was a mathematician rather than a physicist.

3 notes

·

View notes

Text

Best platform to buy unlisted shares is Bharatinvest

The best way to grow your wealth is through stocks. Investment in the stock market has become a common thing these days. However, several investors find that publicly traded companies appear more than that of their unlisted counterparts. Private equity investments, including unlisted shares, let investors gain a stake in a company before it goes public. It allows them to profit from its rapid growth.

In this article, we will be looking at Bharatinvest. This is one of the most well-known online exchanges for unlisted shares. Read on to learn more about Bharatinvest and the benefits involved in investing at Bharatinvest.

What are Unlisted Shares?

Stock in a company that is not publicly traded is called "unlisted shares." Private investors, venture capitalists, and early staff members may hold stock in a company before it goes public. Investing in unlisted shares may appeal to those looking for greater returns and the chance to support innovative, up-and-coming companies. You can plan to buy sell Swiggy unlisted shares or buy sell Pharmeasy unlisted shares.

Introducing Bharatinvest

Bharatinvest is the most popular website in India for buying and selling shares that are not publicly traded. The platform facilitates transactions between buyers and sellers of unlisted shares in a transparent and secure setting. Due to its simple interface, strong security measures, and extensive investment opportunities, Bharatinvest has become the go-to platform for individuals investigating the unlisted share market.

Why Choose Bharatinvest?

With Bharatinvest, investors have access to unlisted shares from a wide range of industries and stages of development. Investors can use Bharatinvest to put money into various companies, from cutting-edge startups to well-established corporations readying themselves for an IPO.

Verified Listings and Diligent Research:

Each company that wants to be listed on Bharatinvest must pass a rigorous verification process. Due diligence is performed on each company to provide investors with accurate data upon which to base investment decisions. The platform's dedication to thorough research increases confidence in its reliability. You do not have to worry if you plan to buy sell Bira unlisted share.

Transparent and Secure Transactions:

Bharatinvest highly values transparency and trustworthiness in its dealings with other parties. The platform uses state-of-the-art security measures to protect users' personal and financial information. Because Bharatinvest uses escrow accounts to hold investor funds until transactions are finalized, investors can rest assured that their money is safe.

Investor Support and Education:

Bharatinvest understands that investing in unlisted shares may be a new experience for many investors. The platform fills in the informational gaps for investors by providing them with articles, blogs, and the perspectives of industry professionals. You can contact the helpful customer service team anytime with questions or concerns. If you plan to buy sell Capgemini Technology Services unlisted share you can easily invest in Bharatinvest.

Liquidity Options:

The importance of liquidity to investors is something Bharatinvest takes seriously. Unlisted shares can be bought and sold on the secondary market provided by the platform. Because of this feature, investors can get out of their investments whenever they like, keeping the investment fluid and responsive to shifting market conditions.

Conclusion Bharatinvest is the go-to site for savvy traders who want access to the potentially lucrative market for unlisted shares. Bharatinvest is the gold standard of the unlisted share market thanks to its extensive investment options, meticulous research, transparent transactions, and investor-centric approach. With the help of the platform's tools, investors can tap into the value of unlisted shares and profit from the expansion of promising businesses. Start investing in unlisted shares with Bharatinvest and reap the benefits of early-stage investing.

5 notes

·

View notes

Text

[ad_1] Gurugram, Haryana, India Pristyn Care, India’s leading healthcare provider specializing in secondary care surgeries, has filed its audited financials for the year 2023-24. The results highlight strong revenue growth and a significant reduction in operational costs across key segments. The company reported consolidated revenue of ₹632 crore, reflecting a solid 28% year-on-year increase. In its largest business segment, Secondary Care surgeries, Pristyn Care achieved a 42% reduction in EBITDA burn, showcasing improved operational efficiency. This performance was driven by a rise in organic patient traffic, which grew from under 40% to nearly 60%, helping the company reduce marketing expenses by 60% and contributing to the EBITDA improvement. Looking forward to 2024-25, the surgery business is expected to see another 35% revenue increase, along with a further 60%+ reduction in EBITDA burn. These projections align with Pristyn Care’s goal of achieving profitability by 2026. The company’s growth has been supported by investments in advanced medical technology, which have boosted its market share for high-value surgeries. Improved insurance partnerships have also simplified pre- and post-authorization processes, making the patient experience smoother. “Our strong financial performance in FY 24 reflects the trust our patients place in us and the relentless dedication of our team. As we focus on achieving profitability by FY 26 and preparing for an IPO by FY 28, we are committed to transforming healthcare delivery in India through innovation, efficiency, and patient-centric care,” said Harsimarbir Singh, Co-founder, Pristyn Care. With a presence in over 30 cities operating 100 clinics and operating patients across 200 hospitals, Pristyn Care continues to redefine Secondary Care surgeries in India. As the company sets its sights on the next phase of growth, it remains dedicated to delivering superior healthcare outcomes while creating long-term value for its stakeholders. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

[ad_1] Gurugram, Haryana, India Pristyn Care, India’s leading healthcare provider specializing in secondary care surgeries, has filed its audited financials for the year 2023-24. The results highlight strong revenue growth and a significant reduction in operational costs across key segments. The company reported consolidated revenue of ₹632 crore, reflecting a solid 28% year-on-year increase. In its largest business segment, Secondary Care surgeries, Pristyn Care achieved a 42% reduction in EBITDA burn, showcasing improved operational efficiency. This performance was driven by a rise in organic patient traffic, which grew from under 40% to nearly 60%, helping the company reduce marketing expenses by 60% and contributing to the EBITDA improvement. Looking forward to 2024-25, the surgery business is expected to see another 35% revenue increase, along with a further 60%+ reduction in EBITDA burn. These projections align with Pristyn Care’s goal of achieving profitability by 2026. The company’s growth has been supported by investments in advanced medical technology, which have boosted its market share for high-value surgeries. Improved insurance partnerships have also simplified pre- and post-authorization processes, making the patient experience smoother. “Our strong financial performance in FY 24 reflects the trust our patients place in us and the relentless dedication of our team. As we focus on achieving profitability by FY 26 and preparing for an IPO by FY 28, we are committed to transforming healthcare delivery in India through innovation, efficiency, and patient-centric care,” said Harsimarbir Singh, Co-founder, Pristyn Care. With a presence in over 30 cities operating 100 clinics and operating patients across 200 hospitals, Pristyn Care continues to redefine Secondary Care surgeries in India. As the company sets its sights on the next phase of growth, it remains dedicated to delivering superior healthcare outcomes while creating long-term value for its stakeholders. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

Indo Farm Equipment Limited IPO 2024

Indo Farm Equipment Limited IPO 2024

निःशुल्क डीमैट खाता खोलें

Indo Farm Equipment Limited, established in 1994, is an ISO certified company based in Himachal Pradesh, India.

It specializes in manufacturing tractors, cranes, engines, and diesel gensets, aiming to provide affordable and high-quality agricultural equipment for farmers.

The company began its operations with a single model of 50 HP tractors and has since expanded its product range to include tractors from 20 HP to 110 HP, with plans for a 110 HP model currently under development.

In 2008, Indo Farm diversified into the production of Pick-N-Carry cranes, enhancing its capacity utilization and catering to the industrial and construction sectors.

The manufacturing facility spans 34 acres and is equipped with state-of-the-art technology, including induction furnaces and CNC machining centers, ensuring high-quality production standards

The Indo Farm Equipment Limited IPO is set to open for subscription from December 31, 2024, to January 2, 2025.

This IPO aims to raise approximately ₹260.15 crore, making it a significant opportunity for investors looking to enter the market before the new year.

Indo Farm Equipment Limited IPO 2024: A Comprehensive Overview :Indo Farm Equipment Limited IPO 2024

The Indo Farm Equipment Limited IPO is an exciting opportunity for investors, marking the last public offering of 2024. Here’s everything you need to know about this IPO.

निःशुल्क डीमैट खाता खोलें

IPO Details

IPO Opening Date: December 31, 2024

IPO Closing Date: January 2, 2025

Listing Date: January 7, 2025

Price Band: ₹204 to ₹215 per share

Lot Size: 69 shares

Total Issue Size: ₹260.15 crore

Fresh Issue: ₹184.90 crore (0.86 crore shares)

Offer for Sale: ₹75.25 crore (0.35 crore shares)

Indo Farm Equipment Limited IPO 2024: Company Background

youtube

Indo Farm Equipment Limited operates through a robust distribution network, with over 140 dealers across various states in India, and exports its products to more than 30 countries.

The company also has an in-house finance subsidiary, Barota Finance, to facilitate easy financing for its customers.

The company is committed to innovation and sustainability, continuously upgrading its manufacturing processes to meet changing market demands and regulatory standards.

With a focus on delivering excellent after-sales service, Indo Farm aims to be a reliable partner for farmers and businesses alike.

Indo Farm Equipment Limited, established in 1994, specializes in manufacturing agricultural and construction equipment.

निःशुल्क डीमैट खाता खोलें

Tractors:Ranging from 16 HP to 110 HP

Cranes:Pick-and-carry cranes with capacities from 9 to 30 tonnes

Harvesting Equipment

The company has a robust manufacturing facility in Baddi, Himachal Pradesh, with an annual production capacity of 12,000 tractors and 1,280 cranes.

Indo Farm Equipment Limited IPO 2024: Financial Performance Indo Farm Equipment Limited

youtube

Indo Farm Equipment Limited, a key player in the agricultural equipment sector, has reported notable growth in its recent financial results.

The company showcased robust revenue growth backed by strong domestic demand and strategic export initiatives.

Invest in Growing Opportunities: Indo Farm Equipment Limited IPO 2024

Are you ready to capitalize on market trends like this? Open your FREE Demat Account with Sky Stock Mart today and unlock endless possibilities in the stock market!

Benefits of Opening a Demat Account with Us

निःशुल्क डीमैट खाता खोलें

Zero account opening charges.

Real-time market insights and expert advice.

Access to IPOs, equities, and mutual funds.

Don’t wait! Join thousands of smart investors. Call us or visit Sky Stock Mart to open your free Demat account now.

Indo Farm Equipment Limited IPO 2024: Grey Market Premium (GMP)

As of December 25, 2024, the I

Minimum Investment: Retail PO has a grey market premium (GMP) of ₹50, indicating a potential listing price of ₹265 per share, which reflects an expected gain of 23.26%.Use of ProceedsThe funds raised from the IPO will be utilized for:

Establishing a new manufacturing unit for pick-and-carry cranes

Repaying or prepaying existing borrowings

Strengthening the capital base of its NBFC subsidiary, Barota Finance Ltd.

General corporate purposes

Investment Considerationsनिःशुल्क डीमैट खाता खोलेंinvestors can apply for a minimum of one lot (69 shares), requiring an investment of ₹14,835 at the upper price band.

Allocation Structure:

Qualified Institutional Buyers (QIBs): Up to 50%

Non-Institutional Investors (NIIs): At least 15%

Retail Investors: At least 35%

Indo Farm Equipment Limited IPO 2024: Conclusion

निःशुल्क डीमैट खाता खोलें

The Indo Farm Equipment Limited IPO presents a promising investment opportunity in the agricultural and construction equipment sector.

With a strong market presence, experienced management, and plans for expansion, it could be a valuable addition to your investment portfolio. However, potential investors should carefully assess the associated risks and market conditions before participating in the offering.

निःशुल्क डीमैट खाता खोलें

#best demat account in india#best demat account#demat#demat account#demat account charges#benefits of demat account#best broker for demat account#basics of stock market#demat account for beginners#demat account india#Youtube

1 note

·

View note

Text

DAM Capital Advisors Limited IPO | India IPO

DAM Capital Advisors Limited is a prominent investment bank in India, offering a diverse range of financial solutions. Their expertise spans across two main areas:

Investment Banking This encompasses equity capital markets (ECM), mergers and acquisitions (M&A), private equity (PE), and structured finance advisory. Since the acquisition on November 7, 2019, until October 31, 2024, the company has successfully executed 72 ECM transactions. This includes 27 IPOs, 16 qualified institutions placements, 6 offers for sale, 6 preferential issues, 4 rights issues, 8 buybacks, 4 open offers, and an initial public offer of units by a real estate investment trust. Additionally, DAM Capital has advised on 23 advisory transactions, covering areas such as M&A advisory, private equity advisory, and structured finance advisory, while also executing block trades.

Visit Us:-

0 notes

Text

IPOs in 1980s and 1990s vs today and what it means for you

India is currently going through an IPO boom. According to the latest Ernst & Young (EY) Global IPO report, the year 2021 was India’s strongest IPO year in terms of proceeds in the recent 20 years. As per the report, IPO activity in India climbed 156 percent year over year to 110 deals in 2021 (from 43 in 2020) and 314 percent in terms of proceeds to $16.94 billion (from $4.09 billion in 2020). All of this is good news for investors. However, things weren’t always so rosy in India. The IPO scenario in the 1980s and 1990s was vastly different from what we know and see today.

Background of IPOs

Hundreds of enterprises flooded the market with IPOs in the 1980s, with the majority of them being low-quality issues. The worst period was 1992-1996, when there were an incredible 3,911 equity IPOs. These were rife with frauds and scams since SEBI had only just been set up and did not have much control over the market. There were no rules and regulations or checks and balances which led to investors being scammed left, right, and centre.

Ponds, Colgate, and Hindustan Lever were among the several companies that went public at incredibly low rates set by the old CCI, or Controller of Capital Issues. While short-term investors did well, long-term investors were rewarded extremely handsomely. Naturally, demand for new IPOs surged exponentially with each profitable listing, resulting in massive oversubscriptions, effectively turning the exercise into a lottery. To gain more allotments, the era of numerous applications and false applications began.

Problems with IPOs in the 80s and 90s

The market was plagued with a litany of issues back then. Since there were no barriers to entry, almost anyone could launch an IPO. There was no governing body to oversee. This led to a number of fraudulent companies launching IPOs just to rake in investor money which was never returned. Issuers could get away with anything back then, including enticing headlines, the employment of models and celebrities, and the promise of a bright future, with guaranteed dividends in advertisements. All of this has since been prohibited by the SEBI advertising rule. Those who did get shared allotted to them only got them after a convoluted method of share allocation which was vulnerable to manipulation. Proportional allotments were used, although even the few successful applicants received a relatively small amount of shares. SEBI has now established a minimum reasonable allocation. For institutions, there existed a dubious discretionary allotment system, in which issuers and investment bankers could force their favourite institutions to participate. This, too, has been modified to a proportional allotment. Furthermore, a tight KYC process has precluded the possibility of demat fraud.

Practices used to increase chances of allotment

IPOs in the 1980s and 1990s were not a poisoned chalice just because of regulatory issues. There were investor side issues as well. To cash in on the first-ever IPO boom in India, investors used various methods to try and ensure that they got the maximum possible allocation for them.

Since PAN cards did not exist at that point in time and neither was there a Unique Identification Number (UID), it led to a number of unscrupulous activities from investors.

Using multiple names: To increase the chances of allotment, people would fill multiple forms, all with different names. On some forms they would put only their first name, on some they would put both first and last name. They would also use combinations with their first, middle, and last names. Female investors also resorted to using their maiden name and their post-marriage name alternatively.

Use of all possible addresses: Investors would also look to exhaust all possible address combinations available to them. This included their home address, office address, rented address, paternal home’s address, or even their relative’s address. This coupled with using different names allowed one investor to fill tens of forms at once, all in a bid to get as many shares allotted to them as possible.

These activities led to a number of name mismatches, name changes in documents, signature mismatches, and address changes in documents. When such a thing happens, these shares are deemed lost and lay unclaimed. A change in name after wedding can also lead to this. There can also be cases of the company’s name being changed and the same not being reflected in your documents. This would also lead to a situation of unclaimed shares.

Getting back what’s yours

Up to 7 years after unclaimed dividends and unclaimed shares were ruled lost, investors can petition the government to receive them. Previously, consumers had to visit individual corporations to obtain information and then collect their dividends and shares. But now when it comes to recovering unclaimed shares, the IEPF is a one-stop solution that allows the public to claim their rightful inheritance from numerous companies through a single route. The entire process is now more transparent which guarantees that the payouts reach the proper people and are not tainted by fraud.

The team at Infiny Solutions is well-versed at dealing with such issues. We have helped a number of investors reclaim their rightful holdings from the 1980s and 1990s which they had lost due to any of the above-mentioned reasons. There is also the possibility, depending on which stock you owned, that your holding from the 1980s is worth a fortune today. That makes it even more critical for you to track and reclaim what is rightfully yours. We, at Infiny Solutions, will help you do just that.

Blog Source:- https://infinysolutions.com/ipos-in-1980s-and-1990s-vs-today-and-what-it-means-for-you/

IPOs | IPOs Share Price | IPOs In India | IPOs Process | IPOs Meaning | IPOs Service | unclaimed dividends and unclaimed shares | Initial Public Offering

#IPOs#IPOs Share Price#Initial Public Offering#unclaimed dividends and unclaimed shares#IPOs Service#IPOs Meaning#IPOs Process#IPOs In India

0 notes

Text

How to Invest in Big Basket Unlisted Shares: A Comprehensive Guide

In the ever-evolving world of investing, unlisted shares have caught the attention of seasoned investors and newcomers alike. Among the many emerging opportunities, investing in Big Basket's unlisted shares offers a unique chance to ride the growth of a digital grocery giant reshaping how India shops.

With companies like Big Basket playing a pivotal role in India's e-commerce revolution, understanding how to invest in their unlisted shares can set you on a path of exciting possibilities.

If you're intrigued by the idea of entering the unlisted shares market but unsure where to start, this comprehensive guide will walk you through the essentials.

Unlisted Shares- An Overview

Before diving into the "how," let’s address the "what." Unlisted Shares are equity shares of a company that are not listed on stock exchanges like the NSE or BSE. Investing in such shares allows you to become an early-stage investor in companies that might go public in the future. For companies like Big Basket, these shares represent an opportunity to capitalize on its growth story before it hits the public market. The key is knowing how to access and evaluate these unlisted shares effectively.

Understanding Big Basket and Its Growth Story

Big Basket, a pioneer in India's online grocery space, has transformed the grocery shopping experience for millions. Founded in 2011, the company offers a vast range of products, from fresh produce to household essentials, all available at the click of a button. Over the years, Big Basket has attracted significant investor interest due to its innovative business model and robust growth trajectory. Now owned by Tata Digital, Big Basket is well-positioned for expansion into newer markets and segments, making its unlisted shares a hot topic for investment enthusiasts.

Why Invest in Big Basket Unlisted Shares?

Big Basket’s unlisted shares have become a magnet for investors for several reasons:

Industry Leadership: Big Basket dominates India’s online grocery market, which is expected to grow at an exponential rate.

Backing by Tata Group: With Tata Digital at the helm, the company has access to unparalleled resources, brand equity, and strategic synergies.

Future IPO Potential: Big Basket’s strong fundamentals make it a potential IPO candidate, which could yield significant returns for unlisted share investors.

Diversification: Investing in unlisted shares like those of Big Basket adds depth to your portfolio by tapping into the private equity market.

Buy the unlisted shares of big basket at Rs 2125 at Altius Investech.

Steps to Invest in Big Basket Unlisted Shares

Here’s a step-by-step guide to making your first investment in Big Basket unlisted shares:

Start by understanding Big Basket’s financial performance, business model, and growth outlook. Look for annual reports, market trends, and industry analysis.

Unlisted shares, though promising, come with risks like limited liquidity, regulatory challenges, and valuation fluctuations. Analyze your risk tolerance and long-term goals.

Investing in unlisted shares requires a trustworthy intermediary. Platforms like Altius Investech simplify the process by offering secure access to Big Basket unlisted shares and other investment opportunities.

Determine how much you’re willing to invest. Unlisted shares often require a minimum investment amount, so plan your finances accordingly.

Proper documentation is key. A reliable platform will guide you through the KYC and other formalities required to complete the purchase.

Once the paperwork is done, place your order for Big Basket unlisted shares. The shares will be transferred to your Demat account upon completion of the transaction.

Keep track of Big Basket’s performance and any developments that could affect its valuation. While unlisted shares are typically held for the long term, staying informed is crucial for timely decisions.

Key Considerations Before Investing

Liquidity: Unlisted shares are not as easily tradable as listed ones, so be prepared for longer holding periods.

Valuation: Work with experts to ensure you’re investing at a fair valuation.

Exit Strategy: Plan how and when you’ll exit the investment. A potential IPO or secondary market sale could be your pathway to liquidity.

Navigating the world of unlisted shares can feel overwhelming. Many platforms provide access to detailed company profiles, expert support, and secure transactions while ensuring a smooth and transparent investment experience. For those looking to invest in Big Basket unlisted shares, Altius Investech is a trusted partner to guide you through the process.

Final Thoughts

Investing in Big Basket unlisted shares isn’t just about financial returns, it is about being part of a transformative journey in India’s e-commerce space. As the company continues to redefine the grocery landscape, your investment could contribute to its success while benefiting from its growth.

By following the steps outlined in this guide and leveraging platforms like Altius Investech, you can confidently step into the world of unlisted shares and potentially unlock significant long-term rewards.

0 notes

Text

Initial Public Offering (IPO): What It Is and How It Works in India?

The IPO

The Initial Public Offering (IPO) is an event that signals the official introduction of a venture onto the share market. When a business — or other entity — decides to “go public” by listing their organization on a recognized exchange, an IPO is required. This process involves the offering of shares to investors, allowing these backers to become partial owners in the company.

0 notes

Text

How Agssl Is Unleashing Financial Growth in India?

In the incredibly dynamic financial world that we live in, finding a platform that does justice to your trading and investment activities can be said as the crux of finance. For maximizing financial potential; both individuals and businesses will raise their hands on the name of it - Agssl. In India, Agssl is the torch bearer in terms of porting online trading, investment planning and portfolio management all on the same scale - all this coupled with innovation and user-oriented services with a rock-solid reputation.

The Rise of Online Trading in India

India has seen a drastic change in its financial market dynamics in the last decade or so and a major hand in this transformation can be attributed to technology and the penetration of internet. No wonder online trading in India could make the sands shift under the feet of any seasoned investor to a day trader.

Agssl carved out the path on which rest have traversed, offering tools and services to fit into the investor's shoe weared today. Their advocation goes into providing clients with Real-Time Market Data, seamless trade execution and data analysis - making sure you trade with well planned out strategies in terms of equity, mutual funds or derivatives keep the whole process smooth and secure.

Best Stock Brokerage Services with Agssl

A stock broking company should be transparent, efficient and most importantly trustworthy when it comes to selecting a stock brokerage firm, with Agssl you have this bundled. As they pride themselves to be on the top among the best stock brokerage services. This is due to;

Competitive Brokerage Fees: Agssl offers you a competitive brokerage rates meant for both retail clients and institutions making sure you take away the maximum pie while getting top of line resources.

User-Friendly Platforms: They have provided you with intuitive trading platforms making it accessible on web and mobile which makes trading - even monitoring your investment or executing a trade will look like a cake walk.

Expert Guidance: Make informed investment decisions with Agssl's team of financial experts who will guide you at a personal level helping you to reach your financial goals. Plugin- recipe- spring- placeholder0_both for beginners and those who have been in the trade long.

Robust Customer Support: With a dedicated customer support team solving each of your queries in the quickest possible manner makes them enough trustworthy.

Best IPO Investment Opportunities in India

Nowadays Initial Public Offerings (IPOs) seems to be a profitable investment route for those looking for big returns. Decoding the top IPO investment opportunities in India is usually not everyone's cup of tea due to its nature of fluctuating market trends and complex regulatory environment.

One such platform that has simplified this through the insights, expert analysis and providing a very easy application process for its clients. Clients get access to the freshest IPO from Agssl project with expansive analysis reports ensuring their every decision is sound. Using Agssl makes participation in best-out-of-breed IPO investment opportunities in India a tour of arguably high returns / easier side by side.

Why Agssl for Your Financial Journey?

In the very competitive market of modern trading; investors need a partner who understands trading complexities coupled with long term value delivery. Agssl believes in this thus continuing to strive innovation and customer satisfaction in every possible way.

Comprehensive Solutions - Agssl provides services on equities, derivatives, mutual funds, IPOs all in one platform

Technology & Security - Using advance tools in the game, the best secure trading platform with Agssl

Educative tool- And yes, its not all about the tools, Agssl also provides lots of learning materials in form of webinars in a bid to up your chances in making it in the financial market

Conclusion

Agssl is more than a broker, Agssl is the partner in your financial growth. With a wealth of experience in online trading in India, an unmatched reputation for best stock brokerage services, facilitating top IPO investment opportunities in India, When choosing Agssl, you'll feel safe knowing your investment journey will surely be for the best!

Original Source:- https://agsharesl.blogspot.com/2024/12/How-Agssl-Is-Unleashing-Financial-Growth-in-India.html

0 notes

Text

Finlender is a leading financial services company in India, specializing in NPA and OTS finance, private equity, project finance, and corporate finance. We offer comprehensive solutions in debt funding, stressed account funding, startup funding, and alternative investments. Our expertise extends to debt resolution services, including one-time settlements, NPA resolution, corporate insolvency resolution processes, and debt restructuring. Additionally, we provide advisory and management consultancy, interim finance under IBC, and investment banking services such as mergers and acquisitions, buyouts, and IPO advisory. Our funding essentials encompass pitch decks, project reports, business plans, financial models, credit rating advisory, valuations, and TEV & LIE reports. Partner with Finlender to fuel your business growth with tailored financial solutions.

1 note

·

View note