#Power Electronics Market Demand

Explore tagged Tumblr posts

Text

There's a whole lot of towns out there that you'll never visit. Most of them are chock full of people you'll never meet. Tulsa, for example. Never been there, might never go there. And that makes me a little sad.

Sure, I only have enough time on this earth to visit so many towns. And when I'm there, I don't have enough time to interrogate every single one of the locals to see if, say, any of them have a set of Mopar F-body windshield wiper linkages sitting in the back of their garage. They'll just go to waste, damned to irrelevance by my lack of time. That's what the MBAs call a "market inefficiency."

The internet has helped, sure, but you can only demand what other people have supplied. Any quick browse on a model-specific forum is full of lonely folks crying out to the heavens for a specific piece of trim, or an entire automatic transmission, that they will never receive. And it's a lot of work to put that stuff up for sale. Who knows what's actually inside that weird pile of oil-stained gewgaws that Pawpaw left behind before he joined that alien cult and drank all that Flavor-Aid? His surviving next-of-kin sure don't know the difference between a 4.11 and a 3.90 rear end, nor are they willing to teach themselves that information in order to list it on eBay for twenty bucks.

Don't worry, though, I have a solution. That solution is that the Boston Dynamics warehouse is not secured very well. Their robots are powered by a two-stroke lawnmower engine: it's like they wanted me to show up with a turbine-generator-powered plasma cutter and chop right through the rebar holding the walls of their robot storage lockup together. After that, it was a quick couple of dozen trips to the local electronics store to get the right USB-to-serial cable, and I soon had my harem of semi-autonomous Parts-Seeking Drones® roving the backwoods of America.

So, if you see a lanky, creaking doglike shape lurking outside your yard tonight, smelling oddly of pre-mix and human arterial blood, let it in your garage. All it wants to do is scan your spare parts so I can find that goddamn last piece of dash trim for the cruise control lever on my Volare. Don't worry: I won't have the robots kill you if you decide not to sell it to me after all. It would be hypocritical of me to judge another hoarder. We'll have coffee when I come see your town for the first time! We can trade junk and be best friends and call each other on the phone afterward and talk about nitrous oxide. No promises on what the robots will do if they search your entire property and don't find any Plymouth Volare stuff, though. I forgot to program that part before I let them out of radio range.

247 notes

·

View notes

Text

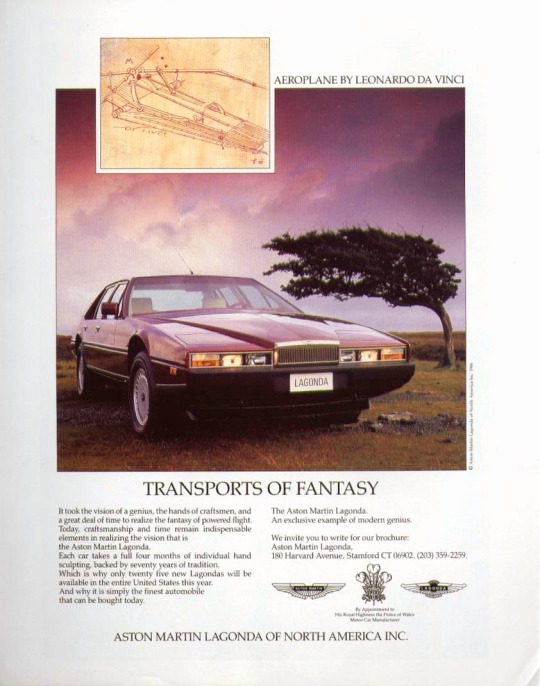

🇬🇧 Embark on a journey through the illustrious lineage of the Aston Martin Lagonda, spanning from 1976 to 1990, a testament to automotive luxury and innovation!

👑 Founded in 1913, Aston Martin has become synonymous with luxury, English elegance, and high-performance automobiles. In the early 1970s, it continued to push the boundaries of automotive design and engineering.

🚘 The Aston Martin Lagonda lineup of the late 1970s and 1980s exemplified the pinnacle of luxury automobiles, featuring sleek and sophisticated designs that set new standards for elegance and refinement.

🛞 Beneath their refined exteriors, the Lagonda boasted powerful V8 engines, delivering exhilarating performance and effortless cruising. Their spacious and sumptuously appointed interiors were outfitted with the latest amenities, including plush leather upholstery and polished wood trim.

💡 The Lagonda was known for its innovative use of electronic systems, including digital dashboard displays, onboard computers, and advanced climate control systems, setting new benchmarks for automotive technology and innovation.

💔 Despite critical acclaim and a loyal following, production of the Aston Martin Lagonda ultimately ceased in 1990. One of the key factors contributing to the discontinuation of the Lagonda series was the high cost of production and limited demand in the luxury car market.

#brits and yanks on wheels#transatlantic torque#retro cars#vehicle#cars#old cars#brands#companies#automobile#american cars#aston martin#aston martin lagonda#lagonda#old car#cool cars#classic cars#car#english cars#made in uk#made in england#luxury car#luxury cars#luxurycars#luxury#innovation#innovative#innovators#electronic#electronics#v8 engine

67 notes

·

View notes

Text

Don't ask what I'm doing I'm not doing anything (VBS Data Stream guys look at it)

Kohane An Akito Toya and Luka

(actually nice and finished looking lyrics under cut)

Eventually, all walls meet demolition

So Wall Street had to keep the tradition

Their financial systems resigned to ignition

And out of the ashes, we have arisen

An empire is forged in the fire of ambition

In business, there isn't the time for attrition

Invest to suppress then ingest competition

Then each acquisition is new ammunition

When governments crumble and fall to the floor

That was paved with the graves of a corporate war

A fundament funded in blood just to shore

A foundation for founding our covenant

Born of a need for control of societal entropy

Enterprise at the price of your indemnity

Chart out the course and of course you were meant to be

Bent to the will of a corporate entity

Arasaka Security. You're in safe hands

We're the light in your screens, we're the lead in your veins

Then you wake from your dreams, so we can sell them again

In the light we distract with the shiny and new

So you're blind to the fact that the product is you

So let your brain dance and replay the dream

But don't drown in the data stream

'Cause we see where you are and we see where you go

'Cause we know what you own and we own what you know

From the top of all our towers, the corridors of power clearly need rewiring

Arasaka saw the spark and then embarked upon the path to turn that spark to lightning

There's no autonomous megalopolis so populous or prosperous you could reside in

And every citizen that's living in this city is a digit on the charts we're climbing

Political systems are too inefficient

They split like the atom and burned in the fission

Now every department and every decision

Defer to the herds of our corporate divisions

If you don't remember the ballot you cast

It's printed on every receipt you were passed

Each time you selected our products and services

We were elected in each of your purchases

What's left to do when you've got the monopoly?

Turn the consumer into the commodity

It isn't hard where you've hardware neurology

Honestly, do read the company policy

Take information and trade it for wealth

You pay it in each augmentation we sell

It's easy to cut out the middleman

When he's cut out most of himself

Arasaka Finance. Investing in your future

(chorus)

All that you say on the net we composite

To maps that go straight from your head to your pocket

Complain if you want, you're still making deposits

Of data — each day you log on is a profit

Society currently lists electronic

So isn't conducting resistance ironic?

We've plenty of skeletons locked in our closets

But yours are assembled from old-stock hydraulics

So lucky we know just the pieces you need

All plucked from your social media feeds

The places you go and the posts that you read

All snatched for a new algorithm to feed

Now, holding our gold isn't par for the brand

Our silver is sat in the palm of your hand

Quit whining and sign on the line in the sand

The supply does not get to make the demands

(chorus)

Arasaka Manufacturing. Building a better tomorrow

Name, age, qualifications

Race, faith, career aspirations

Political leaning, daily commute

Marital status, favourite fruit

Family, browser, medical history

Hobbies, interests, brand affinity

Fashion, style, your occupation

Gender identity, orientation

Lifestyle choices, dietary needs

The marketing contact you choose to receive

Posts, likes, employers, friends

Social bias, exploitable trends

Tastes, culture, phone of choice

Facial structure, the tone of your voice

If it's inside your head, we know

You can't escape the ebb and flow

(chorus)

When guiding the hand of the market

If it's holding a cheque or a gun

The fingers go deep in your pockets

And you can live under the thumb

You seem so surprised, what did you expect?

We're thinking outside of that box that you checked

The terms were presented in full to inspect

You scrolled to the end just to get to "Accept"

Arasaka would like to know your location

Arasaka would like to know your location

Arasaka would like to know your location

Arasaka would like to know your location

#this song is way longer than I thought it was#can you tell i got a little lazier as i went on#it's difficult to switch a color back and forth for each letter#also you might notice that some of the lyrics i wrote are not the same as i highlighted#that's because#i changed my mind#about who should sing what#this is just for fun#it probably wouldn't ever happen#but it would be cool right#project sekai#pjsk#vbs#vivid bad squad#vbs luka#kohane azusawa#vbs kohane#pjsk kohane#project sekai kohane#an shiraishi#an vbs#vbs akito#vbs toya#shiraishi an#akito shinonome#pjsk akito#akito project sekai#the data stream#the stupendium#cyberpunk 2077

11 notes

·

View notes

Text

I may have put too much faith in an increasingly hostile and hateful hobby to actually understand just how economically isolating these tarrifs will be for American consumers.

"Typical dumb American", "we've lived our whole lives with tarrifs and we're fine", "you're so privileged it hurts".

We have not placed such high tarrifs on other countries before. And in response, these countries are goin to STOP doing business in the USA entirely. Canada is going to shut off power to hundreds of thousands of people because of the 25% tarrif. Mexico is promising to pull out of infrastructure and will halt the sale of home goods, food, and vehicles into the US. China is going to stop sending us precious metals and electronic goods ENTIRELY. Our groceries, rent, electricity, and gas are continuing to get more and more expensive, and the tarrifs will HEAVILY affect that. Our wallets will collectively shrink to the point where BJD companies won't make enough profit from US consumers to justify maintaining a market here.

The sheer hatred you people have for American collectors never ceases to amaze me. Hell, from how absent the Mod has been, I would venture to say THEY are American, too, and are just as fucking terrified as the rest of us, AND THEY HAVE TO SEE EVERY SHITTY THING YOU SAY BECAUSE THEY RUN THIS BLOG. No wonder they aren't super consistent and active! I bet reading your incessant and vile hatred of others makes them exhausted!!!

You'd rather say "good riddance" to American collectors entirely than admit that we have every right to be afraid of what's to come. We have the right to be afriad of losing access to a hobby that makes us happy, and the fact that you think the simple act of expressing that fear is "entitled behavior" is fucking sick. Entitled behavior would be demanding unimpeded access to luxury goods during stable and safe times. Fuck, we aren't even DEMANDING anything, we're just expressing fear and sadness!! I wanted to work on my dolls, too, I wanted to finally put my energy into them after the REALLY fucked up year I've had, but now I have to focus on simply surviving a regime that is poised to deport anyone brown and jail anyone they dislike. 26 states have already promised to take part in the mass deportation effort that will cripple our economy. Texas has offered up dozens of acres of land to build a deportation camp. We have very real things to be afraid of, and your reaction to our fear is "oh well, sucks to suck, fuck off American scum"???!

Genuinely, and I say this from the bottom of my heart, SO many of you people disgust me to no end.

~Anonymous

19 notes

·

View notes

Text

The tricky thing about generating electricity is that for the most part, you pretty much have to use it or lose it.

This fundamental fact has governed and constrained the development of the world’s largest machine: the $2 trillion US power grid. Massive generators send electrons along a continent-wide network of conductors, transformers, cables, and wires into millions of homes and businesses, delicately balancing supply and demand so that every light switch, computer, television, stove, and charging cable will turn on 99.95 percent of the time.

Making sure there are always enough generators spooled up to send electricity to every single power outlet in the country requires precise coordination. And while the amount of electricity actually used can swing drastically throughout the day and year, the grid is built to meet the brief periods of peak demand, like the hot summer days when air conditioning use can double average electricity consumption. Imagine building a 30-lane highway to make sure no driver ever has to tap their brakes. That’s effectively what those who design and run the grid have had to do.

But what if you could just hold onto electricity for a bit and save it for later? You wouldn’t have to overbuild the grid or spend so much effort keeping power generation in equilibrium with users. You could smooth over the drawbacks of intermittent power sources that don’t emit carbon dioxide, like wind and solar. You could have easy local backup power in emergencies when transmission lines are damaged. You may not even need a giant, centralized power grid at all.

That’s the promise of grid-scale energy storage. And while the US has actually been using a crude form of energy storage called pumped hydroelectric power storage for decades, the country is now experiencing a gargantuan surge in energy storage capacity, this time from a technology that most of us are carrying around in our pockets: lithium-ion batteries. Between 2021 and 2024, grid battery capacity increased fivefold. In 2024, the US installed 12.3 gigawatts of energy storage. This year, new grid battery installations are on track to almost double compared to last year. Battery storage capacity now exceeds pumped hydro capacity, totaling more than 26 gigawatts.

There’s still plenty of room to expand—and a pressing need to do so. The power sector remains the second-largest source of greenhouse gas emissions in the US, and there will be no way to add enough intermittent clean energy to sufficiently decarbonize the grid without cheap and plentiful storage.

Power transmission towers outside the Crimson Battery Energy Storage Project in Blythe, California. Photograph: Bing Guan/Bloomberg via Getty Images

The aging US grid is also in dire need of upgrades, and batteries can cushion the shock of adding gigawatts of wind and solar while buying some time to perform more extensive renovations. Some power markets are finally starting to understand all the services batteries can provide—frequency regulation, peak shaving, demand response—creating new lines of business. Batteries are also a key tool in building smaller, localized versions of the power grid. These microgrids can power remote communities with reliable power and one day shift the entire power grid into a more decentralized system that can better withstand disruptions like extreme weather.

If we can get it right, true grid-scale battery storage won’t just be an enabler of clean energy, but a way to upgrade the power system for a new era.

How Big Batteries Got so Big

Back in 2011, one of my first reporting assignments was heading to a wind farm in West Virginia to attend the inauguration of what was at the time the world’s largest battery energy storage system. Built by AES Energy Storage, it involved thousands of lithium-ion cells in storage containers that together combined to provide 32 megawatts of power and deliver it for about 15 minutes.

“It was eight megawatt-hours total,” said John Zahurancik, who was vice president of AES Energy Storage at the time and showed me around the facility back then. That was about the amount of electricity used by 260 homes in a day.

In the years since, battery storage has increased by orders of magnitude, as Zahurancik’s new job demonstrates. He is now the president of Fluence, a joint venture between AES and Siemens that has deployed 38 gigawatt-hours of storage to date around the world. “The things that we’re building today, many of our projects are over a gigawatt-hour in size,” Zahurancik said.

Last year, the largest storage facility to come online in the US was California’s Edwards & Sanborn Project, which can dispatch 33 GW for several hours. That’s roughly equivalent to the electricity needed to power 4.4 million homes for a day.

It wasn’t a steady climb to this point, however. Overall grid battery capacity in the US barely budged for more than a decade. Then, around 2020, it began to spike upward. What changed?

One shift is that the most common battery storage technology, lithium-ion cells, saw huge price drops and energy density increases. “The very first project we did was in 2008 and it was on the order of $3,000 a kilowatt-hour for the price of the batteries,” said Zahurancik. “Now we’re looking at systems that are on the order of $150, $200 a kilowatt-hour for the full system install.”

That’s partly because the cells on the power grid aren’t that different from those in mobile devices and electric vehicles, so grid batteries have benefited from manufacturing improvements that went into those products.

“It’s all one big pipeline,” said Micah Ziegler, a professor at Georgia Tech who studies clean energy technologies. “The batteries in phones, cars, and the grid all share common characteristics.” Seeing this rising demand, China went big on battery manufacturing and, much as it did in solar panels, created economies of scale to drive global prices down. China now produces 80 percent of the world’s lithium-ion batteries.

The blooming of wind and solar energy created even more demand for batteries and increased the pressure to improve them. The wind and the sun are often the cheapest sources of new electricity, and batteries help compensate for their variability, providing even more reason to scale up storage. “The benefits of this relationship are apparent in the increasing number of power plants that are being proposed and that have already been deployed that combine these resources,” Ziegler said. The combination of solar plus storage accounted for 84 percent of new US power added in 2024.

The Los Angeles Department of Water and Power’s biggest solar and battery storage plant, the Eland Solar and Storage Center in the Mojave Desert. Photograph: Brian van der Brug/Los Angeles Times via Getty Images

Battery solar energy storage units, right, at the Eland Solar and Storage Center in 2024. Phtogoraph: Brian van der Brug/Los Angeles Times via Getty Images

And because grid batteries don’t have to be small enough to be mobile—unlike the batteries in your laptop or phone—they can take advantage of cheaper, less dense batteries that otherwise might not be suited for something that has to fit in your pocket. There’s even talk of giving old EV batteries a second life on the power grid.

Regulation has also helped. A major hurdle for deploying grid energy storage systems is that they don’t generate electricity on their own, so the rules for how they should connect to the grid and how much battery developers should get paid for their services were messy and restrictive in the past. The Federal Energy Regulatory Commission’s Order 841 removed some of the barriers for energy storage systems to plug into wholesale markets and compete with other forms of power. Though the regulation was issued in 2018, it cleared a major legal challenge in 2020, paving the way for more batteries to plug into the grid.

Eleven states to date including California, Illinois, and Maryland have also set specific procurement targets for energy storage, which require utilities to install a certain amount of storage capacity, creating a push for more grid batteries. Together, these factors created a whole new businesses for power companies, spawned new grid battery companies, and fertilized the ground for a bumper crop of energy storage.

What Can Energy Storage Do for You?

Energy storage is the peanut butter to the chocolate of renewable energy, making all the best traits about clean energy even better and balancing out some of its downsides. But it’s also an important ingredient in grid stability, reliability, and resilience, helping ensure a steady flow of megawatts during blackouts and extreme weather.

The most common use is frequency response. The alternating current going through power lines in the US cycles at a frequency of 60 hertz. If the grid dips below this frequency when a power-hungry user switches on, it can trip circuit breakers and cause power instability. Since batteries have nearly zero startup time, unlike thermal generators, they can quickly absorb or transmit power as needed to keep the grid humming the right tune.

Grid batteries can also step in as reserve power when a generator goes offline or when a large power user unexpectedly turns on. They can smooth out the hills and valleys of power load over the course of the day. They also let power providers save electricity when it’s cheap to produce, and sell it back on the grid at times when demand is high and power is expensive. It’s often faster to build a battery facility than an equivalent power plant, and since there are no smokestacks, it’s easier to get permits and approvals.

Batteries have already proven useful for overstressed power networks. As temperatures reached triple digits in Texas last year, batteries provided a record amount of power on the Lone Star State’s grid. ERCOT, the Texas grid operator, didn’t have to ask Texans to turn down their power use like it did in 2023. Between 2020 and 2024, Texas saw a 4,100 percent increase in utility-scale batteries, topping 5.7 gigawatts.

Jupiter Power battery storage complex in Houston in 2024. Photograph: Jason Fochtman/Houston Chronicle via Getty Images

Grid batteries have a halo effect for other power generators too. Most thermal power plants—coal, gas, nuclear—prefer to run at a steady pace. Ramping up and down to match demand takes time and costs money, but with batteries soaking up some of the variability, thermal power plants can stay closer to their most efficient pace, reducing greenhouse gas emissions and keeping costs in check.

“It’s kind of like hybridizing your car,” Zahurancik said. “If you think about a Prius, you have an electric motor and you have a gasoline motor and you make the gas consumption better because the battery absorbs all the variation.”

Another grid battery feature is that they can reduce the need for expensive grid upgrades, said Stephanie Smith, chief operating officer at Eolian, which funds and develops grid energy storage systems. You don’t have to build power lines to accommodate absolute maximum electricity needs if you have a battery—on the generator side or on the demand side—to dish out a few more electrons when needed.

“What we do with stand-alone batteries, the more and more of those you get, you start to alleviate needs or at least abridge things like new transmission build,” Smith said. These batteries also allow the grid to adapt faster to changing energy needs, like when a factory shuts down or when a new data center powers up.

On balance this leads to a more stable, efficient, cheaper, and cleaner power grid.

Charging Up

As good as they are, lithium-ion batteries have their limits. Most grid batteries are designed to store and dispatch electricity over the course of two to eight hours, but the grid also needs ways to stash power for days, weeks, and even months since power demand shifts throughout the year.

There are also some fundamental looming challenges for grid-scale storage. Like most grid-level technologies, energy storage requires a big upfront investment that takes decades to pay back, but there’s a lot of uncertainty right now about how the Trump administration’s tariffs will affect battery imports, whether there will be a recession, and if this disruption will slow electricity demand growth in the years to come. The extraordinary appetite for batteries is increasing competition for the required raw materials, which may increase their prices.

Though China currently dominates the global battery supply chain, the US is working to edge its way in. Under the previous administration, the US Department of Energy invested billions in energy storage factories, supply chains, and research. There are dozens of battery factories in the US now, though most are aimed at electric vehicles. There are 10 US factories slated to start up this year, which would raise the total EV battery manufacturing capacity to 421.5 gigawatt-hours per year. Total global battery manufacturing is projected to reach around 7,900 gigawatt-hours in 2025.

Lithium battery modules inside the battery building at the Vistra Corp. Moss Landing Energy Storage Facility in Moss Landing, California, in 2021. Photograph: David Paul Morris/Bloomberg via Getty Images

There’s also a long and growing line of projects waiting to connect to the power grid. Interconnection queues for all energy systems, but particularly solar, wind, and batteries, typically last three years or more as project developers produce reliability studies and cope with mounting regulatory paperwork delays.

The Trump administration is also working to undo incentives around clean energy, particularly the 2022 Inflation Reduction Act. The law established robust incentives for clean energy, including tax credits for stand-alone grid energy projects. “I do worry about the IRA because it will change the curve, and quite honestly we cannot afford to change the curve right now with any form of clean energy,” Smith said. On the other hand, Trump’s tariffs may eventually spur even more battery manufacturing within the US.

Still, utility-scale energy storage is a tiny slice of the sprawling US power grid, and there’s enormous room to expand. “Even though we’ve been accelerating and going fast, by and large, we don’t have that much of it,” Zahurancik said. “You could easily see storage becoming 20 or 30 percent of the installed power capacity.”

4 notes

·

View notes

Text

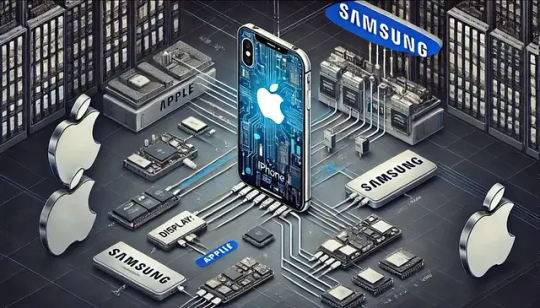

How Apple Relies on Samsung for iPhone Production

Apple and Samsung are two big rivals in the technology industry, and are often portrayed as rivals in the smartphone market. Behind the scenes, however, Apple relies on Samsung for key components used in its flagship product, the iPhone. This relationship may seem odd, but it illustrates the complex nature of global supply chains in the technology sector. In this blog we will examine how Apple trusts Samsung and why this relationship is so important to the creation of the iPhone.

1. The OLED Displays: Samsung’s Technological Edge

One of the most critical components in modern iPhones is the OLED (Organic Light-Emitting Diode) display. These displays are known for their vibrant colors, deep blacks, and energy efficiency, significantly enhancing the user experience compared to older LCD technology. Samsung Display, a subsidiary of Samsung Electronics, is the world’s leading manufacturer of OLED screens.

When Apple transitioned to OLED screens with the iPhone X in 2017, it turned to Samsung due to the company’s unparalleled expertise and production capacity in OLED technology. While Apple has since diversified its suppliers, with LG Display and others entering the fray, Samsung remains the largest provider of OLED screens for iPhones. Samsung’s dominance in this sector gives Apple little choice but to collaborate with its competitor.

2. Chips and Semiconductors: More Than Just Displays

Apple designs its own A-series chips, but the actual production of these chips relies on external manufacturing. While companies like TSMC (Taiwan Semiconductor Manufacturing Company) handle most of Apple’s chip production, Samsung has also played a role in this arena. Samsung is one of the few companies with the technological prowess and manufacturing capabilities to produce advanced semiconductor components.

In previous iPhone generations, Samsung produced the A-series chips that powered these devices. Although TSMC has since become Apple’s primary chip manufacturer, Samsung’s semiconductor division remains a key player in the global chip market, offering Apple an alternative supplier when needed.

3. Memory and Storage: Another Piece of the Puzzle

In addition to displays and semiconductors, Samsung provides memory components such as DRAM (Dynamic Random-Access Memory) and NAND flash storage for the iPhone. These memory components are essential for the smooth operation and storage capacity of iPhones. With its dominance in the memory market, Samsung is one of Apple’s main suppliers, providing the high-quality memory needed to meet the iPhone’s performance standards.

Apple has worked to reduce its reliance on Samsung for memory, but the reality is that Samsung’s market share in the memory and storage sectors is so substantial that avoiding them entirely is nearly impossible. Furthermore, Samsung’s advanced manufacturing techniques ensure that its memory components meet the rigorous standards required for the iPhone.

4. Why Apple Sticks with Samsung Despite the Rivalry

Given their rivalry in the smartphone market, one might wonder why Apple doesn’t completely break away from Samsung. The answer lies in the intricate balance between quality, capacity, and supply chain stability.

Quality: Samsung’s components, particularly OLED displays and memory, are some of the best in the industry. Apple has always prioritized quality in its products, and Samsung’s technological capabilities align with Apple’s high standards.

Capacity: Samsung has the production capacity to meet Apple’s enormous demand. With millions of iPhones sold each year, Apple needs suppliers that can manufacture components at scale without compromising quality. Samsung’s factories are among the few capable of handling such volume.

Supply Chain Risk: Diversifying suppliers is a strategy Apple uses to reduce risk. However, removing Samsung from the supply chain entirely would expose Apple to greater risk if another supplier fails to meet production needs or quality standards. By maintaining Samsung as a key supplier, Apple can ensure a more stable and reliable supply chain.

5. Apple’s Efforts to Reduce Dependency

While Apple remains dependent on Samsung in several areas, the company has made moves to reduce this reliance over the years. For instance, Apple has invested in alternative display suppliers such as LG Display and BOE Technology, as well as expanded its collaboration with TSMC for chip production. Additionally, Apple has explored developing its own in-house components, such as its rumored efforts to create proprietary display technology.

Despite these efforts, it’s unlikely that Apple will be able to completely eliminate Samsung from its supply chain in the near future. Samsung’s technological leadership in key areas, especially OLED displays and memory, ensures that Apple will continue to rely on its competitor for critical components.

Conclusion: A Symbiotic Rivalry

The relationship between Apple and Samsung is a fascinating example of how competition and collaboration can coexist in the tech industry. While they are fierce competitors in the smartphone market, Apple depends on Samsung’s advanced manufacturing capabilities to produce the iPhone, one of the most iconic devices in the world. This interdependence shows that even the most successful companies cannot operate in isolation, and collaboration between rivals is often necessary to bring cutting-edge products to market.

For Apple, the challenge lies in maintaining this balance — relying on Samsung for essential components while exploring new avenues to reduce dependency. For now, however, Samsung remains a crucial partner in the making of the iPhone, demonstrating how complex and interconnected the global tech supply chain has become.

4 notes

·

View notes

Text

Songshun Steel Rod Supplier: Provides Various High Quality Steel Rods

Steel rod is a common rod-shaped steel material made of metal materials, it is widely used in machinery, ships, construction, engineering, manufacturing and other fields. Steel rods are one of the indispensable materials in the steel market and are in high demand, so steel rod suppliers play a pivotal role in the steel market. Songshun Steel, as a high-quality steel rod supplier in China, can provide various high-quality steel rod materials to the world. It not only has rich varieties and sufficient inventory, but also ensures that the quality, service, price, etc. can satisfy you. This article will introduce the steel rods and advantages provided by Songshun steel rod supplier.

Steel Rod Types Songshun Steel, as a steel rod supplier with a wide range of steel materials, provides steel bar materials of various materials. Our steel rod types are as follows:

(1) Classified by process, it can be divided into hot-rolled, forged and cold-drawn steel bars; (2) Classified by material, steel rods can be divided into alloy steel rods, Ordinary carbon steel rods, stainless steel rods, tool steel rods, high-speed steel rods, aluminum alloy rods, synthetic fiber steel rods, etc.; (3)Classified by shape, it can be divided into solid steel rods, round steel rods, square steel rods, hexagonal steel rods, wire rods, etc.

Steel Rod Properties High quality steel rod supplier, offering a wide range of high performance steel rods. As a reliable steel rod supplier in China, Songshun Steel provides steel rods with the following properties:

Excellent wear resistance, corrosion resistance and high temperature resistance Better electrical and thermal conductivity High strength and rigidity Good solderability and stability Good plasticity and toughness

Uses Of Steel Rods As a professional steel rod supplier, we have an in-depth understanding of steel rods and clearly understand the purposes for which our customers purchase steel rods. Below are some of our customers’ applications for steel rods in various fields.

Construction field: Steel rods are often used to reinforce concrete structures, and are also used to support structures such as beams, columns, bridges, and columns.

Automobile manufacturing field: Steel rods are used to manufacture various engine parts, rods, brake calipers, exhaust pipes, connectors, support columns, door beams, roof frames, etc.

In the manufacturing of electronic and electrical equipment, steel rods are often used to make wires for electromagnetic coils, transformers and generators. They are also used as heat-conducting elements in air conditioners, refrigerators, and other appliances, among other things.

In the manufacturing field, it is often used to manufacture various mechanical parts, tools, cutters, drill bits, planers, etc.

In addition to the above fields, steel rods are also used in aerospace, energy and power transmission, oil and gas industry, shipbuilding, chemical and heavy industry, home furnishing and decoration, etc.

Steel Rod Supplier In addition to the above points, as a high-quality and reliable steel rod supplier, Songshun can not only provide a variety of high-performance, multi-purpose and types of steel rods, but also has advantages in quality, professionalism, service, price, etc.

We ensure the quality of steel rods, provide various testing services, provide products in strict accordance with international production standards and customer requirements, and provide steel rods with the best performance and quality to customers.

Songshun has an experienced team that studies various steel rod materials and provides customers with one-stop solutions and technical support.

Whether it is processing, pre-sales or after-sales service, we are professional and can ensure that your project is completed smoothly and perfectly.

Competitive prices, abundant inventory, and ability to deliver on time.

Understand industry policies, market demand, international trade, etc., and be able to make reasonable strategies to adjust industrial structure, optimize product quality, improve operational efficiency, and promote innovative development according to market changes in a timely manner.

Adhere to the path of sustainable development, adhere to the goal of achieving win-win development with customers, adhere to treating every customer with sincerity, adhere to customer-centeredness, and meet customer needs.

In summary, Songshun Steel can become a reliable steel rod supplier, not only providing high-quality steel rod materials, but also having other advantages. In the future, we are committed to becoming your preferred steel rod supplier, constantly moving forward, and providing you with better steel products.

2 notes

·

View notes

Text

The Future of Lithium Batteries: Trends and Innovations in 2025

As we move further into 2025, the future of lithium batteries looks more promising than ever. With the rise of electric vehicles (EVs), renewable energy solutions, and portable electronics, lithium-ion batteries have become a fundamental technology that powers much of our modern world. However, as the demand for energy storage solutions increases, so too does the pressure to improve the efficiency, sustainability, and safety of these batteries.

In this blog, we will explore some of the most exciting trends and innovations shaping the future of lithium batteries, from advancements in solid-state technology to efforts aimed at making battery production more sustainable.

1. Solid-State Batteries: A Revolutionary Shift

One of the most exciting developments in battery technology is the progress being made in solid-state batteries (SSBs). These batteries promise to outperform traditional lithium-ion batteries in almost every category, offering higher energy densities, greater safety, and longer lifespans.

Traditional lithium-ion batteries use a liquid electrolyte to transfer ions between the cathode and anode, which is both a limitation and a potential safety risk. In contrast, solid-state batteries use a solid electrolyte, which reduces the risk of leakage, thermal runaway, and fires. Solid-state batteries are also expected to offer a higher energy density, which means they can store more energy in a smaller, lighter package — a game changer for industries like electric vehicles (EVs) and consumer electronics.

While solid-state batteries are still in the research and development phase, they are expected to become commercially viable within the next few years. Major companies like Toyota, BMW, and QuantumScape are already making strides in this area, with promising results from prototype batteries.

2. Lithium-Sulfur and Lithium-Air Batteries: Pushing the Boundaries of Energy Density

While lithium-ion technology has been the dominant player for over a decade, alternative chemistries like lithium-sulfur (Li-S) and lithium-air (Li-Air) batteries are gaining significant attention due to their potential for even higher energy densities.

Lithium-Sulfur Batteries: These batteries use sulfur as the cathode material, which is both abundant and cheap. They also have a theoretical energy density several times higher than conventional lithium-ion batteries, making them ideal for electric vehicles and long-duration energy storage. However, challenges with cycle life and efficiency remain, but breakthroughs in materials science could bring lithium-sulfur batteries to market in the near future.

Lithium-Air Batteries: These batteries use oxygen from the air as the cathode material, which could theoretically provide an even greater energy density than lithium-sulfur. Lithium-air batteries could potentially offer the same energy capacity as gasoline, which would revolutionize electric vehicles. However, challenges with stability, efficiency, and practical implementation still need to be overcome before they can become viable for widespread use.

3. Battery Recycling and Sustainability

As demand for lithium-ion batteries continues to grow, so too does the need for sustainable practices. Mining for lithium, cobalt, and other key materials for battery production has raised significant environmental concerns, especially in regions where these resources are mined under poor labor conditions and with little regard for environmental impacts.

To combat these issues, there is a growing focus on improving battery recycling technologies. Companies are now developing more efficient ways to extract valuable materials like lithium, cobalt, and nickel from used batteries, which will help reduce the demand for new mining operations.

One promising development is the rise of closed-loop recycling systems, where used batteries are collected, broken down, and the materials reused in new batteries. This not only reduces waste but also minimizes the carbon footprint associated with raw material extraction. In 2025, we expect to see more investment in scalable recycling technologies, especially as governments worldwide push for greater sustainability in the energy storage sector.

4. Battery Manufacturing Innovations

The future of lithium batteries is not just about the chemistry inside the cells — it’s also about how these batteries are manufactured. Innovations in production techniques are helping to lower the cost of lithium batteries and improve their performance.

Automated Production Lines: Companies are increasingly using advanced robotics and AI-driven manufacturing processes to improve the efficiency and scalability of battery production. This allows for higher consistency and reduced production costs, which will ultimately make electric vehicles and other battery-powered products more affordable for consumers.

Solid-State Manufacturing: With solid-state batteries on the horizon, new manufacturing processes will be required to handle the unique materials and fabrication techniques involved. Researchers are developing new methods to create these batteries at scale, ensuring that they can eventually be produced at a competitive price point.

3D Printing: Another breakthrough that could impact battery manufacturing is the use of 3D printing technology. Researchers are exploring ways to 3D-print battery components, potentially allowing for more precise designs and more efficient manufacturing methods. This could lead to faster production times and lower costs for both lithium-ion and solid-state batteries.

5. Faster Charging Times and Longer Battery Life

In 2025, one of the most anticipated improvements in lithium batteries is the ability to charge faster without sacrificing battery life. Researchers are working on developing new anode and cathode materials that can support faster electron movement, thereby enabling faster charging times. Additionally, improvements in battery management systems are helping to balance the charge and discharge cycles more effectively, extending the overall lifespan of batteries.

This trend is particularly important for electric vehicles, where charging time has long been a barrier to widespread adoption. Faster-charging batteries will make it more convenient for drivers to use EVs for long trips, reducing range anxiety and making EVs a more practical alternative to gasoline-powered vehicles.

6. Energy Storage for the Grid

Beyond electric vehicles and portable electronics, lithium-ion batteries are also playing an increasingly important role in the energy sector. With the rise of renewable energy sources like solar and wind, there is a growing need for large-scale energy storage systems to balance supply and demand. Lithium-ion batteries are well-suited to this task, as they can store excess energy generated during peak production times and release it when demand is high.

As energy grids continue to evolve, we are likely to see more investment in grid-scale energy storage projects, helping to ensure the stability and reliability of renewable energy sources.

7. AI and IoT Integration for Battery Management

In the future, the integration of artificial intelligence (AI) and the Internet of Things (IoT) with battery management systems (BMS) will further optimize battery performance. AI algorithms can predict battery behavior, such as charging patterns and degradation rates, allowing for more efficient energy use and longer battery life. In the case of electric vehicles, this could lead to smarter charging systems that automatically adjust charging speed based on battery health and external factors like temperature.

The IoT aspect could also allow batteries to communicate with other devices, ensuring optimal performance in real-time. For example, a connected electric vehicle could sync with a nearby charging station, enabling faster and more efficient charging by adjusting settings according to the battery's needs.

Conclusion

The future of lithium batteries in 2025 is filled with incredible innovations and opportunities. From the development of solid-state and alternative lithium-based chemistries to advancements in manufacturing, recycling, and sustainability, we are on the brink of a new era in battery technology. These advancements will not only help power the next generation of electric vehicles and consumer electronics but also play a crucial role in advancing renewable energy solutions and making our world more sustainable. As these technologies evolve, we can look forward to a future where batteries are safer, more efficient, and more environmentally friendly than ever before.

3 notes

·

View notes

Text

US Tech Stocks Stabilize After DeepSeek AI App Disrupts Market

US Tech Stocks Stabilize After DeepSeek AI App Disrupts Market

US tech stocks held steady on Tuesday after experiencing a sharp decline on Monday, triggered by the unexpected rise of the Chinese-made artificial intelligence (AI) app, DeepSeek.

Shares of chip giant Nvidia, which had fallen sharply on Monday, rebounded by 8.8% as experts suggested the AI market selloff may have been an overreaction. Investors were quick to adjust their positions after DeepSeek claimed its AI model was developed at a fraction of the cost of its competitors' offerings.

The news sparked concerns over the future of America's AI dominance and raised questions about the scale of investments US companies are planning. US President Donald Trump described the situation as "a wake-up call" for the tech industry, while also suggesting that the development could ultimately be beneficial for the US economy. He remarked that if AI models could be produced more cheaply while delivering the same results, it would be a positive outcome for the country.

Trump downplayed concerns, emphasizing that the US would remain a key player in the AI field. The surge of optimism around AI investments has fueled much of the US stock market's growth over the past two years, prompting fears of a potential market bubble.

DeepSeek, launched just a week ago, quickly became the most downloaded free app in the US. Its rise comes amid ongoing tensions between the US and China over AI technology, with the US restricting the export of advanced AI chips to China.

Chinese AI developers, facing limited access to these chips, have shared research and explored alternative approaches that demand less computational power. This has led to the creation of AI models that are significantly cheaper to produce, challenging industry norms and threatening to disrupt the market.

Nvidia, the leading provider of advanced chips used in many AI applications, was hit hardest by the market selloff. Its share price dropped 17% on Monday, erasing nearly $600 billion from its market value.

Analysts, including Janet Mui of RBC Brewin Dolphin, explained that investors typically respond with caution to groundbreaking developments due to uncertainty. However, she noted that the cheaper AI models could benefit tech giants such as Apple and other firms, who have faced scrutiny over their high AI investments.

After the initial shock, US stock markets stabilized on Tuesday. The Dow Jones Industrial Average rose 0.3%, the S&P 500 gained nearly 1%, and the Nasdaq saw a 2% increase. In the UK, the FTSE 100 closed 0.35% higher. Meanwhile, AI-related stocks in Japan, including Advantest, SoftBank, and Tokyo Electron, saw sharp declines, contributing to a 1.4% drop in the Nikkei 225. Several Asian markets remained closed for the Lunar New Year holiday, with mainland China's markets set to reopen on February 5.

DeepSeek's Founder: Liang Wenfeng

DeepSeek was founded in 2023 by Liang Wenfeng in Hangzhou, China. The 40-year-old, an engineering graduate, also established the hedge fund that financed the development of the AI app. Liang recently attended a meeting with industry leaders and Chinese Premier Li Qiang. In a July 2024 interview, he expressed surprise at the sensitivity surrounding the pricing of his AI models, stating that the company had simply focused on cost-efficient development and pricing without anticipating such a reaction from the market.

3 notes

·

View notes

Text

The Future of Mining: Sustainability and Ethical Sourcing

The mining industry is undergoing a profound transformation. As the global demand for raw materials like lithium, cobalt, and rare earth elements surges, driven by renewable energy technologies and electric vehicles, the emphasis on sustainability and ethical sourcing has never been more crucial. This shift is not just a moral imperative but a business necessity, with stakeholders demanding transparency and responsibility throughout the supply chain.

The Push for Sustainability in Mining

Mining has long been associated with significant environmental challenges, including habitat destruction, water contamination, and carbon emissions. However, modern technologies and innovative practices are paving the way for greener operations.

Renewable Energy Integration: Mining companies are increasingly adopting renewable energy sources such as solar and wind to power their operations. For instance, some mines in Chile and Australia now operate entirely on renewable energy, reducing their carbon footprint and operational costs.

Circular Economy Practices: Recycling metals from electronic waste and repurposing mining byproducts are becoming more common. These initiatives not only reduce the need for virgin material extraction but also address the issue of mining waste.

Water Management Innovations: Water is a critical resource in mining, often used in large quantities for processing minerals. Companies are investing in technologies to recycle water and reduce consumption, ensuring minimal impact on local communities and ecosystems.

Ethical Sourcing: A Growing Priority

Consumers and businesses alike are increasingly prioritizing ethically sourced materials. This trend has put pressure on the mining industry to ensure fair labor practices, community welfare, and environmental stewardship.

Fair Labor Practices: Reports of child labor and unsafe working conditions in some mining regions have raised global concerns. Ethical sourcing requires adherence to international labor standards and active monitoring of supply chains to prevent exploitation.

Community Engagement: Mining operations often disrupt local communities. Ethical sourcing involves consulting with and compensating affected populations, ensuring that mining benefits are shared equitably. Initiatives such as community-driven mining agreements are fostering collaboration and trust.

Transparency and Certification: Organizations like the Responsible Mining Initiative and Fairmined Certification are helping companies demonstrate their commitment to ethical practices. Blockchain technology is also being used to trace materials from mine to market, providing verifiable proof of ethical sourcing.

The Role of Innovation

Innovation is a cornerstone of the mining industry’s sustainable future. From automation and artificial intelligence to reduce waste and increase efficiency, to biotechnologies that use microbes to extract metals in a less invasive manner, the possibilities are vast. Additionally, partnerships with tech companies are helping mining firms harness data for better decision-making and improved sustainability outcomes.

Challenges and Opportunities Ahead

Despite these advancements, the path to sustainability and ethical sourcing in mining is not without challenges. High implementation costs, lack of regulatory frameworks in some regions, and the complexity of global supply chains are significant hurdles. However, these challenges also present opportunities for collaboration between governments, NGOs, and the private sector.

Conclusion

The future of mining lies at the intersection of sustainability and ethical sourcing. As the world transitions to a greener economy, the mining industry has a pivotal role in ensuring that the materials powering this change are sourced responsibly. By embracing innovation, transparency, and community collaboration, the mining sector can pave the way for a more ethical and sustainable future.

2 notes

·

View notes

Text

Lessons from Steve Jobs' Remarkable Journey in Innovation and Business

Steve Jobs’ entrepreneurial journey is one of the most remarkable stories in modern business history. As the co-founder of Apple Inc. and a visionary leader, Jobs transformed the tech industry, reshaped consumer electronics, and left an indelible mark on the world. His path was marked by innovation, resilience, and a relentless pursuit of perfection. This narrative traces Jobs’ journey, from his early influences to his groundbreaking achievements and enduring legacy.

Lessons from Steve Jobs' journey in entrepreneurship

Early Life and Influences

Adopted by Paul and Clara Jobs, he grew up in a middle-class family in Silicon Valley, where his fascination with electronics and technology took root. Paul Jobs, a machinist, introduced Steve to the world of mechanics, sparking his interest in building and creating.

During his high school years, Jobs met Steve Wozniak, a computer enthusiast who would later become his business partner. Their shared passion for technology laid the foundation for a lifelong collaboration. Jobs’ curiosity extended beyond engineering; he explored spirituality and countercultural movements, which influenced his design philosophy and business approach.

The Founding of Apple

In 1976, Jobs and Wozniak co-founded Apple Computer in the Jobs family garage. They were joined by Ronald Wayne, who briefly held a stake in the company. Their first product, the Apple I, was a rudimentary personal computer that Wozniak designed and Jobs marketed. The duo’s complementary skills—Wozniak’s technical genius and Jobs’ vision and marketing acumen—set Apple apart from its competitors.

The success of the Apple I paved the way for the Apple II, launched in 1977. The Apple II was a revolutionary product with a sleek design, color graphics, and user-friendly features. It became one of the first commercially successful personal computers, establishing Apple as a major player in the tech industry.

Visionary Leadership and Challenges

Jobs’ leadership style was both inspiring and controversial. He was known for his exacting standards and unyielding demands, which pushed his team to deliver groundbreaking innovations.

In 1984, Apple introduced the Macintosh, a personal computer with a graphical user interface (GUI) and a mouse. The Macintosh revolutionized computing by making it accessible to the average user. However, internal power struggles at Apple led to Jobs’ departure in 1985 after a clash with CEO John Sculley.

NeXT and Pixar

Undeterred by his exit from Apple, Jobs founded NeXT Inc. in 1985. Although the company struggled financially, its technology laid the groundwork for future innovations, including the development of macOS.

Around the same time, Jobs acquired a majority stake in Pixar Animation Studios. The release of Toy Story in 1995 marked a turning point, establishing Pixar as a leader in the entertainment industry and earning Jobs a reputation as a transformative figure in multiple fields.

He quickly assumed leadership as interim CEO and set out to rescue Apple from financial turmoil. Jobs implemented drastic changes, streamlining product lines and fostering a culture of innovation.

The late 1990s and early 2000s saw the launch of iconic products that redefined technology and consumer behavior. The iMac, introduced in 1998, combined striking design with powerful performance, revitalizing Apple’s brand. Jobs’ focus on aesthetics and simplicity became central to Apple’s identity.

This was followed by the iTunes Store, which transformed how music was purchased and consumed. Jobs’ ability to envision entire ecosystems of products and services set Apple apart from competitors.

In 2007, Jobs unveiled the iPhone, a groundbreaking device that combined a phone, music player, and internet browser. The iPhone’s intuitive interface and App Store created a new era of mobile computing. Subsequent products, such as the iPad and Apple Watch, further cemented Apple’s position as a leader in innovation.

Leadership Philosophy

Jobs’ entrepreneurial success was rooted in his unique leadership philosophy. He believed in the power of small, focused teams and encouraged a culture of excellence. Jobs emphasized the importance of end-to-end control, ensuring that hardware, software, and services worked seamlessly together.

His attention to detail and obsession with quality were legendary. Jobs once delayed the launch of the Macintosh because he was unhappy with the design of the circuit board, despite it being hidden inside the machine. This commitment to perfection, while sometimes frustrating for his team, resulted in products that set new industry standards.

Legacy and Impact

Beyond financial success, Jobs’ contributions to technology, design, and entertainment continue to influence industries globally.

His ability to combine technical expertise with artistic sensibility, his focus on user experience, and his relentless pursuit of innovation serve as a blueprint for aspiring entrepreneurs. He showed that failure is not the end but a stepping stone to greater achievements.

2 notes

·

View notes

Text

Silver investment has been a cornerstone of wealth preservation and growth for centuries. Known as "poor man's gold," silver offers a unique blend of affordability and intrinsic value, making it an attractive option for novice and seasoned investors alike. Whether you're looking to diversify your portfolio, hedge against inflation, or secure a tangible asset, silver investment is worth considering.

In this comprehensive guide, we'll delve into the key benefits, types of silver investments, strategies, and tips to help you make informed decisions.

Why Invest in Silver?

Silver is more than just a precious metal; it’s a versatile asset that can play a pivotal role in your investment strategy. Here’s why:

1. Affordable Entry Point

Compared to gold, silver has a significantly lower price per ounce, making it accessible to a broader range of investors. This affordability allows you to accumulate more of the metal for the same investment amount.

2. Tangible Asset

Unlike stocks or bonds, silver is a physical asset that you can hold in your hand. This tangibility provides a sense of security, particularly during times of economic uncertainty.

3. Hedge Against Inflation

Silver historically retains its value during periods of inflation, acting as a safeguard for your wealth when fiat currencies lose purchasing power.

4. Industrial Demand

Silver is an essential component in various industries, including electronics, solar energy, and medicine. This industrial demand adds a layer of stability to its value over time.

5. Diversification

Including silver in your portfolio helps diversify your investments, reducing overall risk and improving potential returns.

Types of Silver Investments

Investors have multiple options when it comes to silver investment, each with its advantages and considerations:

1. Physical Silver

a. Silver Bullion Coins

Examples: American Silver Eagle, Canadian Maple Leaf, Austrian Philharmonic.

Pros: High liquidity, easy to trade, universally recognized.

Cons: Premiums over spot price can be high.

b. Silver Bars

Sizes: Typically range from 1 ounce to 1,000 ounces.

Pros: Lower premiums compared to coins, ideal for bulk investment.

Cons: Less portable and may require secure storage solutions.

c. Junk Silver

Definition: Pre-1965 U.S. coins with 90% silver content.

Pros: Affordable and widely recognized.

Cons: Requires careful evaluation for silver content.

2. Silver ETFs (Exchange-Traded Funds)

What Are They?: Funds that track the price of silver without requiring physical ownership.

Pros: Easy to buy and sell, no need for storage.

Cons: Does not provide direct ownership of silver.

3. Silver Mining Stocks

What Are They?: Shares in companies involved in silver mining and production.

Pros: Potential for higher returns if the company performs well.

Cons: Stock prices can be volatile and influenced by factors beyond silver prices.

4. Silver Futures and Options

What Are They?: Contracts that allow you to buy or sell silver at a predetermined price and date.

Pros: High profit potential, especially for experienced traders.

Cons: High risk and complexity, not suitable for beginners.

How to Start Investing in Silver

1. Determine Your Investment Goals

Are you looking to preserve wealth, achieve long-term growth, or hedge against inflation? Clarifying your objectives will guide your choice of silver investments.

2. Set a Budget

Silver is more affordable than gold, but it’s important to set a clear budget. Factor in additional costs like premiums, storage, and insurance.

3. Choose the Right Type of Silver Investment

Evaluate your risk tolerance and investment style. Physical silver is ideal for conservative investors, while ETFs and stocks cater to those seeking liquidity and higher returns.

4. Buy from Reputable Sources

Purchase silver from trusted dealers or platforms to ensure authenticity and fair pricing. Look for certifications like LBMA (London Bullion Market Association) accreditation.

5. Secure Your Investment

If you invest in physical silver, consider secure storage options such as home safes, bank safety deposit boxes, or specialized vaults.

Strategies for Successful Silver Investment

1. Dollar-Cost Averaging

Invest a fixed amount in silver at regular intervals. This strategy helps reduce the impact of market volatility by averaging the purchase price over time.

2. Monitor Market Trends

Stay informed about silver prices and market trends. Factors like industrial demand, geopolitical events, and currency fluctuations can influence silver’s value.

3. Diversify Within Silver Investments

Don’t limit yourself to one type of silver investment. Combine physical silver, ETFs, and mining stocks for a balanced approach.

4. Think Long-Term

Silver can be volatile in the short term, but it has a strong track record as a long-term store of value. Be patient and avoid panic-selling during market dips.

Risks of Silver Investment

While silver offers numerous benefits, it’s essential to be aware of potential risks:

Volatility: Silver prices can fluctuate significantly in the short term.

Storage Costs: Storing physical silver securely may incur additional expenses.

Lack of Income: Unlike stocks or bonds, silver does not generate dividends or interest.

Market Manipulation: The silver market is smaller than gold, making it more susceptible to price manipulation.

Top Tips for Silver Investment

Start Small: Begin with silver coins or small bars to test the waters.

Research Dealers: Buy from reputable sources to avoid counterfeit products.

Stay Updated: Monitor silver prices and market news to make informed decisions.

Diversify Your Portfolio: Don’t put all your investment capital into silver—balance it with other asset classes.

Be Patient: Silver is a long-term investment that rewards patience.

Conclusion

Silver investment is an excellent way to diversify your portfolio, hedge against inflation, and secure a tangible asset with intrinsic value. Its affordability, industrial demand, and historical significance make it an appealing choice for investors of all levels.

Whether you choose physical silver, ETFs, or mining stocks, a well-informed approach can help you maximize returns and mitigate risks. Start your silver investment journey today and take a step toward financial security.

2 notes

·

View notes

Text

Introducing Samsung 24GB GDDR7 DRAM For AI Computing

24GB GDDR7 DRAM

Future AI Computing: Samsung Launches 24GB GDDR7 DRAM. It sets the standard for graphics DRAM with its industry-leading capacity and performance of over 40Gbps.

First 24-gigabit (Gb) GDDR7 DRAM from memory pioneer Samsung was revealed today. Next-generation applications benefit from it’s speed and capacity. Data centers, AI workstations, graphics cards, gaming consoles, and autonomous driving will employ the 24Gb GDDR7 because to its high capacity and excellent performance.

“By introducing next-generation products that meet the expanding demands of the AI market, it will maintain to leadership position in the graphics DRAM market.” The 5th-generation 10-nanometer (nm)-class DRAM used in the 24Gb GDDR7 allows for a 50% increase in cell density while keeping the same package size as the previous model.

The industry-leading graphics DRAM performance of 40 gigabits per second (Gbps), a 25% increase over the previous iteration, is achieved in part by the advanced process node and three-level Pulse-Amplitude Modulation (PAM3) signaling. The performance of it may be further improved to 42.5 Gbps, contingent on the environment in which it is used.

Applying technology previously used in mobile devices to graphics DRAM for the first time also improves power efficiency. Power efficiency may be increased by more than 30% by reducing needless power use via the use of techniques like dual VDD design and clock control management.

The 24Gb GDDR7 uses power gating design approaches to reduce current leakage and increase operational stability during high-speed operations.

Major GPU customers will start validating the 24Gb GDDR7 in next-generation AI computing systems this year, with intentions to commercialize the technology early the next year.

GDDR6 vs GDDR7

Compared to the current 24Gbps GDDR6 DRAM, GDDR7 offers a 20% increase in power efficiency and a 1.4-fold increase in performance.

Today, Samsung Electronics, a global leader in cutting-edge semiconductor technology, said that it has finished creating the first Graphics Double Data Rate 7 (GDDR7) DRAM in the market. This year, it will be first placed in important clients’ next-generation systems for validation, propelling the graphics market’s future expansion and solidifying Samsung’s technical leadership in the industry.

Samsung’s 16-gigabit (Gb) GDDR7 DRAM will provide the fastest speed in the industry to date, after the introduction of the first 24Gbps GDDR6 DRAM in 2022. Despite high-speed operations, new developments in integrated circuit (IC) design and packaging provide more stability.

With a boosted speed per pin of up to 32Gbps, Samsung’s GDDR7 reaches a remarkable 1.5 terabytes per second (TBps), which is 1.4 times that of GDDR6’s 1.1 TBps. The improvements are made feasible by the new memory standard’s use of the Pulse Amplitude Modulation (PAM3) signaling technique rather than the Non Return to Zero (NRZ) from earlier generations. Compared to NRZ, PAM3 enables 50% greater data transmission in a single signaling cycle.

Notably, using power-saving design technologies tailored for high-speed operations, the most recent architecture is 20% more energy efficient than GDDR6. Samsung provides a low-operating voltage option for devices like laptops that are particularly concerned about power consumption.

In addition to optimizing the IC design, the packaging material uses an epoxy molding compound (EMC) with good thermal conductivity to reduce heat production. Compared to GDDR6, these enhancements significantly lower heat resistance by 70%, ensuring reliable product performance even under high-speed operating settings.

GDDR7 Release Date

According to Samsung, commercial manufacturing of their 24GB GDDR7 DRAM is scheduled to begin in early 2024. Although the precise public release date is yet unknown, this year’s certification process with major GPU manufacturers is already under way. With the availability of next-generation GPUs that will support the new memory standard, GDDR7 DRAM is now expected to be readily accessible in the market by 2024.

Read more on Govindhtech.com

#Samsung#Samsung24GBGDDR7#GDDR7DRAM#24GBGDDR7DRAM#DRAM#GDDR6DRAM#GPU#AI#News#Technews#Technology#Technologynews#Technologytrends#govindhtech

3 notes

·

View notes

Text

The Surge of Mobile Exports from India in 2024

In recent years, India has emerged as a formidable player in the global electronics landscape, particularly in the realm of mobile exports. As of 2024, the Indian mobile export industry is witnessing significant growth, driven by favorable government policies, foreign direct investment, and a burgeoning domestic market. This article explores the current state of mobile export from India, the key players involved, and the implications for the global smartphone market.

Overview of Mobile Exports from India

The mobile export from India has seen a meteoric rise, with projections indicating that exports could exceed $12 billion in value by the end of 2024. This impressive growth can be attributed to several factors, including the government’s "Make in India" initiative and the Production Linked Incentive (PLI) scheme, both designed to bolster domestic manufacturing and attract international investments.

Growth Drivers

Several factors are propelling the growth of mobile exports in India:

1. Government Initiatives

The Indian government has introduced various programs to promote local manufacturing, such as tax breaks, subsidies, and the establishment of electronics manufacturing clusters. These initiatives aim to attract both domestic and foreign manufacturers to set up production facilities in India, which has proven effective in enhancing the mobile export sector.

2. Investment in Infrastructure

Investment in infrastructure has also played a critical role in boosting mobile exports. Improved logistics, reliable power supply, and streamlined regulatory processes make India an attractive destination for mobile manufacturers. This investment is crucial for facilitating large-scale production and ensuring timely exports.

3. Technological Advancements

The rapid advancement of technology has enabled Indian manufacturers to produce high-quality smartphones that meet global standards. Companies are increasingly investing in research and development to innovate and improve their product offerings, further enhancing their competitiveness in the international market.

4. Skilled Workforce

India’s vast pool of skilled labor is another significant factor driving mobile exports. The country boasts a workforce proficient in electronics manufacturing and engineering, enabling companies to maintain high production standards and innovate effectively. This skilled labor force is essential for both domestic and foreign companies seeking to enhance their manufacturing capabilities in India.

Key Mobile Exporters in India

Several major players dominate the mobile export landscape in India, Leading mobile exporter in India are:

1. Apple Inc.

Apple has been a trailblazer in the Indian mobile export sector, establishing manufacturing facilities through its contract manufacturers like Foxconn and Wistron. The production of iPhones in India has not only bolstered local employment but has also significantly contributed to India’s mobile export data.

2. Samsung Electronics

Samsung operates one of the largest smartphone manufacturing plants in Noida, where it produces a wide range of devices, from budget models to flagship smartphones. The company has ramped up its export operations, making it a critical player in the Indian mobile export market.

3. Xiaomi

Xiaomi has rapidly gained a significant market share in India, thanks to its affordable smartphones. The company has invested heavily in local manufacturing, exporting a considerable volume of devices to countries across Southeast Asia and Africa.

4. Vivo and Oppo

Both Vivo and Oppo, Chinese smartphone manufacturers, have established substantial production facilities in India. They focus on catering to the growing demand for mid-range smartphones, further enhancing India’s export capabilities.

5. Lava International

As a homegrown brand, Lava International has also made strides in mobile exports. The company primarily targets budget-conscious markets, exporting feature phones and affordable smartphones to various countries.

Analyzing Mobile Export Data

The mobile export data for 2024 indicates robust growth, with significant exports to key markets including:

1. North America

India has become an essential supplier of smartphones to North America, with Apple’s production in India catering to a large portion of the U.S. market. This trend is expected to continue as more brands establish manufacturing operations in India.

2. European Union

Countries in the EU, particularly Germany and the UK, have seen increased imports of Indian-manufactured smartphones. Samsung and Xiaomi lead this charge, exporting a diverse range of devices to meet consumer demand.

3. Southeast Asia

Indian smartphone manufacturers are tapping into the growing demand in Southeast Asian countries like Indonesia, Vietnam, and Thailand. Competitive pricing and quality have made Indian smartphones increasingly popular in these regions.

4. Middle East and Africa

The demand for affordable smartphones in the Middle East and Africa has surged, making these regions vital markets for Indian manufacturers. Brands like Lava and Xiaomi are successfully exporting budget-friendly smartphones, addressing the needs of price-sensitive consumers.

Understanding Mobile Phone HS Code

The Harmonized System (HS) code plays a crucial role in facilitating international trade. The mobile phone hs code is 8517.12, which covers smartphones capable of connecting to cellular networks. Accurate classification using the HS code is essential for mobile exporters in India to ensure compliance with customs regulations and to expedite the export process.

Conclusion

The mobile export landscape in India is poised for significant growth in 2024, with the country solidifying its position as a key player in the global smartphone market. Supported by government initiatives, foreign investments, and a skilled workforce, India is well-equipped to meet the growing demand for mobile devices worldwide.

As Indian manufacturers continue to innovate and expand their production capabilities, the outlook for mobile exports remains positive. By leveraging its strengths and addressing challenges, India can capitalize on its position in the global supply chain, ensuring sustainable growth and economic benefits for years to come. The future of mobile exports from India is bright, and the country is set to make its mark on the international stage. However if you need the list of smartphone exports by country, mobile phone HS code or global trade data connect with import and export data provider platforms like Seair Exim solutions.

Post By:

Seair Exim Solutions

Phone No.: 099900 20716

Address: B1/E3 Mohan Cooperative Industrial Estate Near Mohan Estate Metro Station Opposite Metro Pillar No:-336, NH-19, New Delhi, Delhi 110044

Also Read : A Comprehensive Guide to Garment Exports from India in 2024

#global trade data#international trade#export#trade data#trade market#global market#import export data#mobile#mobile export data#mobile hs code#mobile export#mobile exporter#mobile market#mobile industry#mobile trade

2 notes

·

View notes

Note

Eventually, all walls meet demolition So Wall Street had to keep the tradition Their financial systems resigned to ignition And out of the ashes, we have arisen

An empire is forged in the fire of ambition In business, there isn't the time for attrition Invest to suppress then ingest competition Then each acquisition is new ammunition

When governments crumble and fall to the floor That was paved with the graves of a corporate war A fundament funded in blood just to shore A foundation for founding our covenant

Born of a need for control of societal entropy Enterprise at the price of your indemnity Chart out the course and of course you were meant to be Bent to the will of a corporate entity

Arasaka Security. You're in safe hands