#Postponed Vat Accounting

Explore tagged Tumblr posts

Text

Maximize VAT compliance and returns with our expert services. Simplify your Accounting Year and manage Postponed VAT Accounting Online. Act now! Are VAT returns giving you a headache? Outbooks simplify the process. With our online platform, you can submit VAT returns effortlessly, access real-time data, and ensure secure handling. Plus, we're your experts in Postponed VAT Accounting, making compliance a breeze. Choose Outbooks for efficient, reliable, and tailored financial solutions. Experience financial excellence with Outbooks in Malta! Reach out to our Malta Accountant at [email protected] or call us at +44 330 057 8589 to drive your business to success!

0 notes

Text

Making Tax Digital: The Next Phase of UK Tax Reporting

The Making Tax Digital initiative by the UK government has changed the face with which businesses relate to tax reporting. At this new phase of MTD, businesses need to stay ahead not only in regard to compliance but also in penalty avoidance and continuous enhancement of their internal financial processes. At Integra, we ensure that clients have a seamless and smooth transition while adapting businesses toward digital tax reporting systems.

This article breaks down what’s continuously developing with the MTD initiative: what to expect and how Integra is able to ease this transition.

What is Making Tax Digital? Making Tax Digital is the Government’s vision for transforming the UK’s tax system into a fully digital and integrated platform from what is fundamentally a manually and paper-based process. It was launched in 2019 for VAT-registered businesses whose turnovers are over the VAT threshold limit, but over time, more and more taxes and businesses have fallen within its ambit.

The MTD initiative aims at reducing the amount of tax errors, improving its accuracy, and making it friendlier for any business to deal with. With the next phase now being moved to 2026, companies across the UK have to tune themselves to this changing landscape of tax.

Key Phases of MTD Since its rollout, MTD has been implemented in phases and to date includes the following:

MTD for VAT (2019): Initially applied to businesses registered for VAT whose taxable turnover exceeds the £85,000 threshold. For VAT-registered businesses, the requirement for MTD will become effective in April 2022.

MTD for Income Tax (2026): This phase was initially intended to be implemented in April 2024. It has been postponed and will go live in 2026, covering those self-employed and landlords with annual income above £50,000. The threshold will, in subsequent stages of the rollout, drop to £30,000.

MTD for Corporation Tax (TBC): Timings are not yet confirmed, though consultations on the matter remain ongoing; MTD for Corporation Tax is expected to take hold by the end of the decade.

Why has the timeline for MTD changed? This was originally due to go live in 2024 for MTD for Income Tax, but the timeline has been pushed out to 2026 because there were concerns businesses will not be ready and systems will not be sufficiently comprehensive. HMRC accepted that many small businesses were still at the very early stages of digital accounting and extended this.

This delay gives businesses more preparation time but also increases the stakes: businesses that have not adopted MTD-compliant systems by the new deadline will be penalised and will invite greater scrutiny. These phases have been crafted in such a way that companies are given enough time to adapt, but as 2026 approaches, the pressure mounts.

What does the next phase of MTD mean for businesses? As MTD extends beyond VAT to incorporate income tax and corporation tax, its scope will broaden to bring within its scope many more businesses and people. Such an extension of scope is likely to have wide-ranging repercussions, in particular for SMEs and the self-employed, whose systems are often less sophisticated.

Under MTD for Income Tax, businesses will need to: Record its business income and expenses in digital form. Send updates quarterly to HMRC via MTD-compatible software. Provide a year-end summary at the end of the year. These are requirements that would make the reports made for taxation purposes more accurate, less fraudulent, and with fewer errors-a staggering amount estimated at £8.5 billion in lost taxes due to avoidable errors in 2022 alone, according to HMRC.

How can Integra help? We at Integra understand that, for most businesses, especially those who have been accustomed to more traditional methods of maintaining their books and accounts, the leap into digital tax reporting is intimidating. This specialist support has allowed thousands of companies across the UK to make the transition smoothly with our tailored MTD-compliant solutions.

Here’s how we can help: Assessment and Consultation We start by evaluating the current accounting systems of your business and understand what you need as far as tax reporting is concerned. Our experts offer a clear, personalised roadmap with regard to transitioning to MTD-compliant software. This ensures that your business remains ahead in compliance deadlines.

Software Integration and Training Fully MTD-compatible accounting software is implemented to ensure seamless integration with your existing systems. We provide complete training for your team so that they will feel confident and able to carry out quarterly updates and year-end summaries with ease, free of stress.

Real-Time Support Tax reporting deadlines can be stressful. Our real-time support service ensures that you’ll have a team of experts available to answer your questions and resolve any issues that arise as you submit your tax returns digitally.

Reduced Errors and Increased Compliance MTD has been designed to minimise errors, and through our guidance, your business will be able to minimise the risk of mistakes that may result in adverse penalties. Integra ensures that your digital records are accurate and submissions made to the required standards of HMRC on accuracy, thus helping one avoid expensive errors.

Is your business ready for the 2026 deadline? While the delay in MTD for Income Tax gives businesses more time to prepare, 2026 will arrive quickly. Businesses should begin the transition now to avoid the last-minute rush and ensure a smooth, stress-free switch.

Key steps to get ready include: Reviewing current accounting practices and identifying areas for improvement. Choosing MTD-compliant software that fits your business’s needs. Training staff on how to use digital systems and maintain accurate records. Working with a trusted partner like Integra to ensure full compliance. The future of digital tax reporting One thing is for sure as MTD is developed: digital tax reporting is here to stay. The UK government remains committed to making the whole tax system more effective and easier for businesses and HMRC. Its ultimate vision is one of a fully digital system in which all relevant data on tax is automatically linked and updated in real-time.

For businesses, this means fewer headaches around compliance, quicker submission processes, and the ability to make more informed decisions based on accurate real-time financial data. With Integra by your side, this transition to MTD can be smooth and successful.

Making Tax Digital is that great stride changing the way businesses in the UK report their taxes. The next stage, starting in 2026, brings more businesses into the digital reporting regime. Such changes can be overwhelming; however, working with experienced partners such as Integra Global Solutions smoothes such a transition and makes it more manageable.

Preparation now, along with choosing the right software and advice from experts, will be the means for your business to not only meet these new regulations but thrive in this new digital tax era.

#accounting outsourcing#accounting firms#accounting outsourcing services#uk accounting#outsourcing for uk accounting firms#accounting solutions#outsourcing providers#outsourced accounting

0 notes

Link

0 notes

Link

0 notes

Text

What is the R&D additional information form?

The processes of claiming for R&D continually change such as the introduction of the R&D additional information form from the 8th August 2023 that needs to be completed prior to the claim. This form is required for claims for both the SME and RDEC tax incentives. Let's dive straight into what the purpose of this form is and all the essential information you need to know for your upcoming R&D claim.

What is the purpose of the R&D additional information form?

The purpose of this form is to ensure HMRC has all the information they need to understand your claim, it helps them analyse your eligibility smoothly. It is mandatory to complete this, failure to do so will result in HMRC removing your R&D claim from your company tax return. This form helps HMRC to effectively administer the scheme, analyse authentic eligibility by improving the quality of claims, and prevent abuse of R&D. Essentially if they have all the key information in front of them, they’ll be less likely to send out enquiries about the gaps in information.

When was the R&D additional information form implemented?

The additional information form was made compulsory on August 8th 2023 and was one of the changes announced in April 2023, the others included:

Increase in the RDEC tax relief rate.

Decrease in the SME tax relief rate.

Extension of new qualifying expenditures such as data licenses, mathematics, and cloud computing costs.

A new notification process starting April 1, 2023: If you are new to claiming R&D tax credits or haven't claimed them in the past three accounting periods, you must inform HMRC of your intention to submit an R&D tax credit claim. This notification is mandatory for both the SME and RDEC schemes.

Ineligibility of overseas R&D activity delayed until 2024: The government had planned to introduce a new rule that limits R&D tax credit eligibility to activities conducted within the UK. However, this change has been postponed and will now be enforced from April 1, 2024. This geographical requirement also extends to externally provided workers (EPWs), who must perform their work within the UK to qualify for the tax credit.

From the 8th of August 2023, you must complete and submit an R&D additional information form to HMRC to support all your claims for Research and Development (R&D) tax relief or expenditure credit. This includes claims for the end of the 2022 tax year.

Find out more about the R&D tax credit changes.

What details are needed for the R&D additional information form?

Instead of sending a PDF attachment with your CT600, the additional form is an electronic version of the claim report that is directly submitted to HMRC's systems. This needs to be completed before the company tax return. In order to complete this electronic form, you need the following information to hand:

Company details

This includes your VAT registration number, Unique Taxpayer Reference (UTR), employer PAYE reference number, and Standard Industrial Classification (SIC) code.

Contact details

The details of the most senior person in your team who is responsible for the R&D claim such as a director. Or any agent involved in the claim who can claim on behalf of the company.

The details of your project | How were you involved in R&D?

HMRC want to know the number of R&D projects you’re claiming for and their details around the topics of:

What is the main field of science or technology that resonates most with the nature of your project?

Prior to your project, what was the baseline understanding or state of science or technology that your project intended to progress from?

Using the answer to the previous question, state the aim of your project; quantify or explain how you wanted to progress from what was already known.

Throughout the project, what scientific or technological uncertainties arose?

How did you attempt to overcome these uncertainties?

Select the scheme you’re claiming for: SME or RDEC

The R&D tax credits you’ll receive, if your claim is successful, depend on what scheme you’re applying for because they have different relief rates. Therefore, in the information form, you’ll need to select which scheme you’re applying for and provide the amount you’re eligible for. For larger companies, it will be RDEC and for small and medium-sized enterprises, it will be the SME incentive, although there are some exceptions so it’s worthwhile to double-check with an R&D specialist.

Our free R&D tax credit calculator can help you calculate which you can submit as an estimate in your form, ready for HMRC to check.

The details of your R&D qualifying costs

You will need to identify and include your eligible R&D costs such as staff costs, subcontractors' costs, materials, software purchases, any travel costs, and utilities in this form to notify HMRC.

The details of qualifying direct and indirect activities

Indirect activities are the tasks that are part of a project but don't directly contribute to solving the scientific or technological uncertainty. Essentially, they are the activities that helped facilitate and support the direct R&D work. Examples include:

Scientific and technical information services, specifically when they are carried out to support R&D, such as creating the initial report on R&D findings.

Indirect support activities like maintenance, security, administrative and clerical tasks, financial, and personnel activities such as paying R&D staff, but only when they are conducted for R&D purposes.

Supplementary activities necessary for conducting R&D, for instance, hiring and compensating staff, renting laboratories, and maintaining R&D equipment, including computers used for R&D.

Training that is needed to complete the R&D project.

Research conducted by students and researchers at universities.

Research activities (including related data collection) aimed at developing new scientific or technological testing, survey, or sampling methods, provided this research isn't considered R&D on its own.

Feasibility studies that inform the strategic direction of a specific R&D activity.

Details of each project

In cases where you have more than one R&D project you’d like to claim for, you’ll need to provide:

A full description of qualifying expenditure if your claim includes 1-3 projects.

A description that provides 50% coverage of the qualifying expenditure if you’re claiming for 4-10 projects, with a minimum of 3 full descriptions.

A description that provides 50% coverage for qualifying expenditure if you’re claiming for 11-100 but you need to provide 10 complete explanations for the projects with the highest qualifying expenditure.

The start and end date of the accounting period you’re claiming in

The accounting period's beginning and ending dates for which you are seeking tax relief must align with those specified in your Company Tax Return.

Who can submit the R&D additional information form?

Either a representative of the company or an agent acting on behalf of the company can submit the additional information form. You’ll need to provide this person’s contact details in the form.

When to submit the additional information form for R&D tax credit claims?

The additional information form should be sent to HMRC prior to submitting the company's Corporation Tax Return. Failure to do so will prompt HMRC to contact the company to verify the removal of the R&D tax relief claim from the Company Tax Return.

In case you've already submitted your tax return and subsequently submitted the R&D additional information form, you will need to file an updated tax return. The initial tax return will be replaced by the amended version.

How to submit this form?

The form needs to be submitted electronically.

What happens after finalising the additional information for R&D?

HMRC will notify you that they've received your form and they will provide a reference number. The next step is to start your R&D claim!

How has the R&D additional information form changed Alexander Clifford’s processes?

At Alexander Clifford, we always collect the information required for the additional information form during our technical call with every client. This means we collect the essential information for both the form and your claim at the same time and take leadership over the full R&D claiming process, guiding you through your role in it. We’re well prepared for all the changes that have been rolled out to the R&D incentive and these haven’t impacted our success level due to our detailed compliance processes.

Do you need support for your R&D claim?

In conclusion, the introduction of the R&D additional information form in August 2023 represents a significant shift in R&D tax credit procedures, aiming to enhance the accuracy and efficiency of claims. This form, obligatory for SME and RDEC tax incentives, plays a crucial role in ensuring HMRC's comprehensive understanding of all R&D claims. It is vital to complete and submit the form alongside your company's tax return to prevent claim removal. Don’t miss out on the incredible opportunity of R&D by using the trusted choice of R&D credits, Alexander Clifford. Contact us today and we’ll explain why our compliance processes are providing a very important financial boost to our client base and how this can help provide you with a competitive edge to your business.

#r&d tax credits#hmrc#r&d claims#r&d qualifying costs#r&d additional information form#research and development#r&d sme scheme#rdec

0 notes

Text

Making Tax Digital: Compliance Advice From Our Cloud-Based Accountants

Making Tax Digital, or MTD, has been on the agenda for some time now. Following delays and changes to the staggered introduction, most UK businesses now need to comply with MTD requirements for VAT submissions, ensuring they have compatible cloud computing software.

However, there is a larger group of companies that are not at the VAT registration threshold and should be conscious of when the plans to digitise the tax system are likely to affect their affairs, with scheduled transitions for Corporation Tax and Income Tax Self-Assessment (ITSA) on the horizon.

Let’s look at how organisations can adapt to pre-empt compliance requirements and become familiar with the complexities of MTD in good time before the next transitional phase begins to impact their reporting requirements and a cloud accounting system becomes mandatory.

A Recap of the Changes Introduced By Making Tax Digital

The basics of MTD are that the government and HMRC will require submissions and declarations to be made digitally using compliant cloud-based software packages that allow users to submit financial information directly through the tax office portal.

For most businesses, traditional accounting software will be incompatible, necessitating advice and guidance from an experienced commercial accountancy team to select viable, future-proof and efficient upgraded cloud-based accounting software systems that are MTD-ready.

As it stands, the current changes and anticipated phases include:

April 2022 – MTD for VAT returns applies to all VAT-registered UK companies.

April 2026 – MTD will apply to Income Tax Self-Assessment (ITSA) returns for self-employed taxpayers or small business landlords with an income of £50,000 or above.

April 2026 – MTD will roll out to Corporation Tax returns, although this could potentially be postponed further. There may be a staged introduction for small business owners, although this is not yet confirmed.

April 2027 – MTD is expected to be introduced for ITSA sole traders and taxpayers with self-employment or property incomes above £30,000.

We do not yet have clarification about when MTD will apply to general partnerships or whether any of these expected introduction dates will change again. However, it remains essential for taxpayers across the scope of UK taxation to understand what these reforms will mean for them.

Services and Support Offered By Cloud Accounting Providers

The primary objective of MTD is to consolidate and simplify financial information reporting mechanisms. Rather than having the choice of paper-based filing, online submissions or software-based returns, the goal is for every business, VAT payer and taxpayer to use a unified system to declare their taxable activities through cloud accounting software.

Stalled implementations aside, there is no doubt that cloud-based accounting is a step-change in financial reporting, and there is no potential for any business to disregard MTD or assume it will not affect them sooner or later.

As a cloud-based accounting specialist, James Todd & Co can help at every stage, from offering independent recommendations about the cloud accounting software best suited to your business activities and sector to supporting transitions from outdated systems to new solutions with cloud-based accounting functionality.

Cloud accounting offers many advantages above and beyond MTD. Financial data and records are stored through secure servers in the cloud, accessible via an internet connection rather than on a desktop-based hard drive or static server.

Businesses switching to cloud-based software can use real-time reporting, generate sales orders remotely, have secure access to their accounting software on any device, and permit multiple users to access reports concurrently to save time.

Advanced cloud accounting software replaces the manual aspects of double-entry bookkeeping and can handle data entry, cash flow forecasts and multiple currencies with live bank feeds updated automatically, alongside other functions to handle payroll and small business forecasts.

How to Prepare for MTD Compliance

The first task we’d recommend for any company looking to prepare for MTD is to audit and assess all of the business processes and accounting software in use by the organisation. Having a detailed and comprehensive log is a useful starting point since you can determine how and where your data is currently stored and how you extract that data for VAT return and tax reporting purposes.

From there, it is important not only to select cloud accounting software that is fit for your business and sector but to look at the other benefits. Some software packages are ideally suited to specific industries, for example, or for remote-based or hybrid workforces.

There are several popular options for small business accounting software. As a Xero Gold Champion Partner and Sage Accounting Certified Expert, we can offer ample support comparing either of these solutions.

It may also be necessary to assess the in-house reporting processes you follow and think about whether your bookkeeping and financial staff have a sufficient understanding of MTD legislation and accounting needs to manage the transition. Many clients work with our team to receive independent guidance throughout as part of a tiered change management approach.

Having a well-laid-out plan helps companies and small business owners to see which records they currently store manually through paper-based bookkeeping or spreadsheets and use that information to pick software solutions that are streamlined, efficient, and appropriate.

Registering for MTD at the Applicable Time

As our summary above shows, not all businesses, nor all taxes, are immediately subject to MTD reforms. It is possible that additional postponements will impact the indicative dates when the tax office currently expects to introduce the next tranches of MTD enrolment.

However, knowing when and how this may influence your business and being poised to respond and register is a significant advantage, not least for your peace of mind.

In most cases, you will be notified by HMRC when it expects you to transition from an existing VAT, ITSA or Corporation Tax basis over to the new MTD system. You can also check in with our team of accomplished chartered accountants at any time whether you are unsure when MTD will apply to you, would like a consultation to discuss the appropriate software solutions, or have any questions about MTD now and into the future.

Source URL : - https://www.jamestoddandco.co.uk/tax-digital-cloud-based-accountants/

1 note

·

View note

Photo

June 10, 2020: King Felipe and Queen Letizia held a videoconference with the Taxi sector

Don Felipe and Doña Letizia have maintained their preferential interest in recent weeks with those who have guaranteed essential services for citizens. And a primary sector, also during confinement, has been that of Transport, which has guaranteed the mobility of people and goods to supply the population. In successive conversations with representatives of ports, airports and rail, road and suburban transport, in contact with AENA, RENFE, the Association of Air Lines, EMT and the Madrid Metro and the Transport Business Committee. Today with the top managers of the taxi sector. FEDETAXI and ANTAXI account for one hundred percent of the licenses and taxi workers in Spain, both self-employed and salaried entrepreneurs.

The associative representatives have explained to the Kings that during the month of February the taxi drivers already began to notice the effects in a sensible way, when they received the news of the epidemic that came from Asia. During that month, congresses, fairs and meetings were canceled or postponed. At the beginning of March, the activity was halted at Renfe stations, ports, airports, transport interchanges and points of generation of habitual high demand for travelers.

There was a drastic drop in mobility according to data from the General Directorate of Traffic, recorded at the beginning of the state of alarm. In the accesses to cities, passenger traffic decreased 67%, and 61.29% for long-distance trips. The reduction in traffic in cities like Madrid was 71.3% and Barcelona produced similar figures. These figures increased until, at the height of the pandemic and the restriction of the fundamental right to mobility (the first days of April), it has reached practically 90%, gradually recovering up to 50% in which We found it in the last days of May.

The collapse of the urban circulation of taxis has been absolute. The sector itself estimates the request for services by applications or stations at only 10% compared to the usual until practically the last week of May, discounting those services that have been carried out free, voluntarily and in solidarity for health workers and other essential personnel.

Some cities have taken measures to reduce the supply of taxis such as, for example, Seville where only 25% of the fleet could work daily, Barcelona 20%, Madrid up to 50%, Calviá 20%, Jaén 25%, Puerto de Santa María 50%, Fuerteventura 20%, and thus hundreds of Spanish municipalities. Consequently, the economic activity and the turnover of taxi drivers have been until the end of May around 10-20% of the normal figures. Activity has been less than 75% of normal, and is now going back to 20-40%, according to the Autonomous Communities.

During the health emergency, the Taxi has been providing services mainly for the elderly, hospitals, patients, nurses, doctors, often altruistically and disinterestedly. When there has been compensation from the Administration, it has been returned to compensate for the deficit in sanitary material. This performance has occurred throughout Spain.

The representatives of FEDETAXI and ANTAXI contemplate the current situation, which is still very complicated, and it will take a long time to reactivate the activity and return to relative normality. As for all clients, the service projections in the months that remain until the end of the year are not rosy, so that the red numbers in the sector would continue.

A reduction in traffic is expected in areas of demand such as airports, ports and train or bus stations, hotels, etc., due to a collapse of national and international tourism; the possible cancellation of all kinds of events such as festivals, concerts, popular parties, congresses, sports events; the fall of "the night"; or the promotion of telework.

In smaller or less tourist cities and in rural areas, where taxi revenues are much lower than large capitals, the direct and indirect costs of the activity will exceed the income or reduce the net return on the activity to levels insufficient for subsistence .

Although a transfer of passengers from public transportation to the taxi is also expected, with the number of potential taxi users growing - for fear of the spread of COVID19, it is not estimated that this represents an increase in turnover of more than 8-12%.

The taxi sector in Spain is made up of 63,494 taxi license holders, of whom 98.3% are self-employed, and around 35,000 salaried drivers, supporting 100,000 families throughout Spain.

Taxi drivers are grouped into two associations: FEDETAXI, which represents 61% of licenses; and ANTAXI, which represents 39% of the licenses.

FEDETAXI (Spanish Taxi Federation) was established in 2012 as a group of associations or organizations of taxi drivers from the different provinces or communities of Spain with the purpose of defending, promoting and promoting the interests of taxi drivers and the organizations or associations that form part of it. It is made up of the Madrid Auto Taxi Association, the Castilian-Leon Taxi Federation, the Andalusian Federation of Autonomous Taxi Drivers, the Union of Autonomous Taxi Drivers of Catalonia, the Taxi Association of the Balearic Islands, the Taxi Free Self Employed Union with offices also in Valencia and Galicia, the Provincial Association of Taxi Drivers of Zaragoza, and the Confederation of Taxis on the Costa del Sol. Together they include more than 60 taxi drivers' associations.

In addition, FEDETAXI is part at the national level of the National Federation of Autonomous Workers (ATA) and within the European Union, of the Taxi Europe Alliance (TEA) where, among others, taxi drivers from Italy, Portugal, and in which FEDETAXI holds the presidency.

The current (acting) president of FEDETAXI is Miguel Ruano Bravo, first vice president of the entity, as long as the current electoral process of the federation ends.

ANTAXI (National Taxi Association) is an Organization that has the presence of Associations from the various Autonomous Communities, whose objectives are the fight against intrusion and unfair competition; ensure that the taxi is of universal, plural and quality access; defense of the taxi as a public service; and the development of regulations that protect the activity.

It has a presence in practically all the Autonomous Communities. The Associations that are part of ANTAXI are the Autonomous Confederation of Taxis of the Valencian Community, the Basque Taxi Federation, the Professional Taxi Federation of Madrid, the Independent Taxi Federation of the Balearic Islands, the Cantabrian Taxi Federation, the Independent Association of Taxi Drivers, Self Employers of Navarra, Agrupació Taxi Companys (Barcelona), Radio Taxi Aragón, Association of Taxi Drivers of La Rioja, Radio Taxi Mérida, Associació del Taxi Intermunicipal de Catalunya, Radio Taxi Murcia, Rural Taxi Associations of Seville and Córdoba.

The president is Julio Sanz. Borja Musons is the vice president and the president of the Basque Taxi Federation.

The taxi is a public service of general interest within the municipalities and, therefore, it is the municipalities that have the main powers over it and determine the maximum number of taxi licenses in each of the municipalities according to their volume of population or other objective parameters. It is appreciated how Madrid and Barcelona are the cities with the highest number of licenses, with 15,000 and 10,000 licenses, respectively.

Regarding the distribution of energy sources, for example, Madrid has 4,295 hybrid taxis (27.62%), 2,784 LPG-powered (17.89%) and 8,135 (52%) with a diesel engine, while pure electric ones (BEV) barely reach 20 vehicles. The Barcelona Municipal Area has 3,221 hybrid vehicles (30.71%), 797 LPG (7.60%) and 6,201 (59.12%) diesel. The average age of the fleet in the capitals is close to 6.4 years, with a 10-year limit for all taxi vehicles. FEDETAXI believes that the sector needs a strong impetus for the green transition and would be a great "test bed" for the electrification of urban mobility.

Taxi drivers' taxation is subject to the direct estimation regime (modules) of personal income tax and VAT. The average income of a taxi driver, before taxes, is not homogeneous, varying greatly between cities and Autonomous Communities, ranging from 16,000 to 36,000 euros. The dependence on tourism, events, leisure and hospitality activities exceeds, on average, one third of its turnover, even reaching double in tourist towns and large capitals.

The taxi sector has been dragging a strong crisis due to the emergence of the liberalized rental vehicle with driver (VTC) modality from 2009 to 2015, which has gone from 2,500 vehicles to almost 17,000 throughout Spain. The emergence of digital platforms has produced a high degree of disruption and competition from VTCs with taxi drivers. In recent years there has been a conflict that has taken to the streets and to the political and judicial sphere, and even to the European institutions, without having yet fully settled. This is the complex context - marked by the technological and digital revolution and the changes in user habits - that the COVID pandemic has impacted19.

Participants in the videoconference with the Kings:

• FEDETAXI representatives:

• Miguel Ruano Bravo, vice president FEDETAXI (acting president), president of the Andalusian federation of autonomous taxi drivers (FAAT) and active taxi driver in Córdoba.

• Ángel Julio Mejía Noguerales, president of the Madrid taxi union (AGATM), candidate for the presidency of FEDETAXI and active taxi driver in Madrid.

• Emilio Domínguez Del Valle. Lawyer and technical secretary of FEDETAXI and National Land Transport Advisor (MITMA) for the taxi sector.

• ANTAXI representatives:

• Julio Sanz, president of ANTAXI and active taxi driver in Madrid

• Borja Musons, Vice President of ANTAXI and President of the Basque Taxi Federation

#King Felipe#Queen Letizia#King Felipe of Spain#Queen Letizia of Spain#King Felipe VI#King Felipe VI of Spain#Official Event#COVID-19#June 2020

18 notes

·

View notes

Text

Accounting For Delayed VAT In The UK: Everything You Need To Know

Following Brexit, companies had to pay tax at the point of entry when bringing products into the UK from anywhere in the world. Businesses have faced a number of difficulties as a result, which puts further pressure on cash flow. The UK government introduced a new postponed VAT accounting system to prevent this scenario. Here are the terms used to describe postponed VAT accounting and how to get a statement for your company.

https://bbcincorp.weebly.com/resources/a-guide-to-delayed-vat-accounting-in-the-uk

0 notes

Text

L'ICCIUK presenta "A un anno dalla Brexit: strumenti di Compliance e Tax & Legal per le imprese"

L’Italian Chamber of Commerce and Industry for the UK riunisce gli esperti per spiegare come destreggiarsi tra le nuove regole a quasi un anno dalla Brexit.

ICCIUK, dogane e tasse a un anno dalla Brexit. Parlano gli esperti

A quasi un anno dall’uscita del Regno Unito dall’Unione Europea, quali sono gli effetti sui flussi commerciali tra Italia e UK? Se i rapporti commerciali con Londra, infatti, sono lontani dall’interrompersi, tuttavia richiedono di imparare a destreggiarsi tra nuove regole per le imprese. L’Italian Chamber of Commerce and Industry for the UK in collaborazione con il socio ZPC Srl e con la partecipazione di Aprile UK, Belluzzo International Partners e Bonelli Erede riunisce in un seminar in presenza e in diretta online gli esperti legali e manageriali in grado di fornire indicazioni utili alle imprese. Gli aspetti di trade compliance, contabili, fiscali e di contrattualistica commerciale vengono affrontati dai relatori professionisti in quello che è il primo di una serie di incontri informativi all’ICCIUK. A dare il via è il presidente Alessandro Belluzzo, che ricorda che questo sarà il primo di una serie di incontri per aiutare gli operatori italiani in UK a tornare in piena attività. “Credo che finalmente il Sistema Italia possa fare ancora di più nel prossimo anno. Ora che abbiamo capito le regole possiamo aiutare gli operatori ad operare nel modo migliore come facciamo negli altri paesi”, commenta il presidente dell'ICCIUK.

Parola agli esperti legali e manageriali

La parola passa poi al partner dell’evento, ZPC, rappresentato da Zeno Poggi e Nicola Gelder, che si occupano di spiegare gli ostacoli calati nella realtà pratica delle aziende. Ad esempio, un primo grande scoglio presentato dalla Brexit è individuare la persona responsabile in UK, che sia importatore o rappresentante autorizzato. Spesso infatti ci sono due o più indirizzi sulle etichette. Chi prima era distributore, adesso riveste un ruolo sostanziale nell’etichettature e risponde direttamente alle autorità di mercato. Silvia Bocchetti di Belluzzo International Partners interviene per la parte legale con una serie di pillole informative basilari per chi si destreggia nel commercio tra i due paesi. Da che le aziende erano abituate ad esportare senza doversi interfacciare con la dogana anche in UK, le cose sono cambiate. Ora bisogna tenere conto di una serie di strumenti a disposizione e di regole precise. L’utilizzo del GP EORI ad esempio, un numero identificativo per chi si presenta in dogana, ora va connesso al numero di registrazione VAT. Ciò è reso più facile grazie allo strumento Duty Deferment Account (DDA), che permette il pagamento differito delle tasse doganali al mese successivo mediante direct debit, per chi è munito di autorizzazione e garanzia. Un altro strumento è il postponed VAT Accounting, molto utile in quanto il soggetto che importa se ha una registrazione UK VAT può pagare l’import VAT in dogana. Va tuttavia considerato che non è disponibile per non registrati. Un altro promemoria della Belluzzo International Partners per le tasse è, ad esempio, che se le merci si trovano al di fuori del Regno Unito al momento della vendita fino a 135 pound si deve applicare la normale tassa del territorio inglese, ovvero il 20%. Silvia Bocchetti conclude con una nota ottimista, un invito ad uscire più competitivi e solidi dalla doppia crisi: “Brexit non è solo un cambiamento legislativo, ma anche un processo interno a ciascuna azienda, dovrebbe essere un adjustment per recuperare livelli di efficienza”

Gli strumenti ci sono, ma bisogna usarli, perché "nulla sarà mai come prima"

Apparentemente più pessimista (e lo ammette lui stesso in una risata condivisa) l’intervento di Enrico Vergani per Bonelli Erede with Lombardi Leader Focus Team Shipping & Transport: “Cominciamo ora a mettere la testa fuori dalla tempesta, ci sono cambiamenti che resteranno e con cui dobbiamo iniziare a confrontarci perché resteranno”. Anche per lui bisogna compiere un adjustment, che però richiederà ancora del tempo. Come dichiarato anche da OBR ad Ottobre 2021: “L’effetto completo del risultato del referendum e l’innalzamento delle barriere commerciali impiegheranno probabilmente qualche anno per arrivare effettivamente, con i business che avranno bisogno di considerevole tempo per adattarsi”. Detto ciò, Brexit c’è. E ci sarà. Dunque per chi si occupa di trasporti, spiega Vergani, la cosa essenziale e fare un sanity check e verificare che ci sia corrispondenza. “Il messaggio da far passare è che nulla sarà mai come prima. Non ci possiamo permettere di dare agli altri il nostro destino e non avere controllo della merce una volta che esce. Non avere coordinamento, ad esempio tra contratti di vendita e trasporto e coperture assicurative”, commenta Vargani. Poi continua: “Gli strumenti ci sono ma bisogna usarli. Come con la cyber security, deve diventare un concetto interno all’azienda, come dire 'non si può guidare senza patente'. È un rischio che si può e si deve gestire, parte di una catena logistica”

Giorgio Poggio interviene all'ICCIUK per andare oltre la "tempesta perfetta" dei trasporti

Infine Giorgio Poggio, Managing Director di Aprile UK, riprende il filo rosso dell'incontro: “Grandissime opportunità a parte la Brexit, sicuramente bisogna fare l’adjustment indicato da Silvia e prendere le precauzioni che ha suggerito Enrico”. Il primo problema evidenziato da Poggio è strutturale. In parole semplici, tre contenitori pieni partono dall’Italia e solo uno torna dall’Inghilterra, nei trade di vettori via mare e via terra.

Secondo problema anch'esso strutturale ma non nuovo, racchiuso in dei numeri "che fanno un po’ paura" è la scarsità di autisti. In UK mancano circa 90.000 addetti a trasportare merce, in Italia 17.000. 400.000 in tutta Europa. Inoltre, l'età media di questi addetti è di 55 anni, ovvero possibili pensionati nei prossimi 5-6 anni. "Siamo all’interno di una tempesta perfetta", dice Poggio, e promette di spiegare perché stiamo pagando di più i trasporti, perché sono più lenti, e perché dovete prenotarli con largo anticipo (non più una settimana ma almeno 10-12 giorni). Prima della Brexit, il processo era piuttosto lineare: ritiro contenitore per esportazione, trasporto di questo, consegna, ritiro per esportazione, trasporto di nuovo e consegna finale. Adesso, subito dopo il ritiro ci si scontra con un primo stop all’operazione doganale export. Dopo il trasporto verso il Regno Unito un altro stop, l'operazione doganale import. Ci sono poi gli ulteriori rallentamenti al momento della consegna, dove bisogna attendere circa sette giorni poiché non ci sono autisti. Dai soliti dieci giorni siamo già a 14, minimo. Al momento della consegna finale, dopo altre due dogane nel percorso di rientro, sono passati circa 28 giorni.

Come risolvere? Innanzitutto avendo ben chiare le tempistiche e la pianificazione, spiega Poggio. Poi tenendo a mente che questo problema è per tutti, anche il vostro concorrente. Infine facendo della supply chain un elemento di vendita. "Poter dire al cliente 'nessun problema, te la porto io, ci metto questi giorni' è un valore aggiunto al vostro prodotto", sottolinea Aprile UK, senza dimenticare di avere "un occhio di riguardo per il pianeta, cercando mezzi più performanti dal punto di vista energetico".

La presenza del Dottor Battaglino, venuto appositamente dall’Italia, è significativa. Battaglino rappresenta infatti le persone che hanno fatto la storia delle spedizioni in Italia, occupandosi di assistenza doganale da oltre quarant'anni. Ora sono proprio queste compagnie a voler sbarcare in UK. Ancora una volta l'ICCIUK si propone come una guida indispensabile per il Sistema Italia nel Regno Unito. Read the full article

#aprileUK#BelluzzoInternationalpartners#BonelliErede#dogane#economia#EnricoVargani#esperti#GiorgioPoggio#icciuk#lavoro#NicolaGelder#SilviaBocchetti#tasse#ZenoPoggi#ZPC

0 notes

Text

Post-Brexit customs declarations between the UK and EU

Since the Brexit transition period ended, a number of changes have taken place surrounding customs declarations for goods shipped or International Freight & Logistics Services between the UK and EU. So, here we clarify the current arrangements that businesses need to be aware of:

Since 1st January 2021, customs declarations are required for imports from and exports to the EU

Importers are responsible for determining and communicating the state, the origin, classification and customs value of goods they are importing from the UK to the EU

Customs declarations can be deferred on standard exported and imported goods for up to six months

Businesses importing from the EU must account for and pay VAT on goods. Businesses exporting to the EU must appropriately handle VAT for those products

VAT-registered importers may use postponed VAT accounting. Non-VAT-registered importers have the same options to report and pay import VAT as they do for their customs duty

Proof of origin will be required to claim preferential duty rates

Safety and security declarations are required for all exports and imports between the UK and EU by Road Freights, air freights or sea freight

Customs declarations are required for controlled goods and excise goods such as alcohol and tobacco

Movements of high-risk live animals and plants are subject to additional checks

Products of animal origin, including meat, milk and egg products and all regulated plants and plant products require pre-notification and health documentation. Any physical checks will be conducted at the point of the destination rather than a border control post.

0 notes

Text

5 questions to ask your accountant today (and their answers)

You deserve a clear and accurate answer to all tax and accounting questions you have today. You also deserve to keep in mind the questions you don't want to miss. That is why we have collected all the questions you need to ask your accountants in slough during these times and that is why we answer those questions directly for you below, with the help of our partner accountants!

What Help Can I Get From the Federal Government? And which of my region?

The first thing to know is that the deadline of many obligations has changed to make your life in lockdown easier: - You have to pay the VAT for the first quarter by June 20 (instead of April 20), - You have to pay your VAT - Submit declaration and intra-EU listing no later than 7 May - You must submit your customer listing before 30 April

You can also apply for a replacement income through your social insurance fund (bridging right).

The conditions for this replacement income were relaxed at the beginning of the Corona crisis. The benefit is therefore now also available for self-employed people in a secondary occupation and starters, under certain conditions.

During your career as a self-employed person, you are entitled to a maximum of 12 months of this specific replacement income

If you have to stop your activity, you can combine this federal measure with a one-off fixed compensation from your region.

In Wallonia and Brussels, this support amounts to 5000 and 4000/2000 euros respectively and is available depending on your Nacebel code. In Flanders, these allowances amount to 4000 or 3000 euros, depending on, among other things, the complete or partial cessation of your activity.

Should I request a postponement of my social security contributions?

You can write to your social insurance fund to postpone the payment of your social security contributions for a year.

In concrete terms, you would then have to pay the social security contributions and regularization contributions owed for the first quarter of 2020 by 31 March 2021. By June 30, 2021, you will pay the contributions for the second quarter of 2020 and the contributions due on September 30, 2020. You are not at risk of an increase in your contributions and you will continue to receive the same benefits. You simply pay the amounts due today, one year later.

However, if you do not adhere to this term, you will be faced with an increase in your contributions Best accountant in slough for the relevant quarters. In addition, you would also have to repay the benefits that you received inappropriately.

It is up to you to decide whether you prefer to make this payment a year later or whether you prefer to apply for a reduction or exemption from social security contributions instead.

You must have made your choice (and submitted the application for it) before June 15, 2020.

Self-employed persons who pay their social security contributions late for the first quarter of 2020 are not at risk of an increase for that quarter

I received compensation from the federal or regional government. What about taxes?

The bridging right is a form of replacement income and is therefore taxable as such. Later this year you will receive a form 281.18 that you can submit in 2021 with the tax return for the tax year 2020.

The regional aid is not taxable as a result of the bill approved by the Council of Ministers in April.

Which expenses can I deduct in lockdown?

Some of your professional expenses have of course disappeared with the advent of the lockdown. However, others are emerging and offer options for optimizing your taxes:

Telephone and internet, the professional use of which may have grown in recent weeks.

Technology requirements, from an ergonomic mouse to a second screen, so that you can continue to work at the same pace at home.

Staples, stationery or a whiteboard to put your ideas on: all this material is 100% deductible and can prove indispensable for your productivity in this new work environment.

Spotify or another subscription to a streaming service is deductible in proportion to professional use. If you are in lockdown in an environment that is not as quiet as you would like, these plans can be very helpful.

Bank charges related to your professional account: they sometimes go unnoticed, but they are entirely attributable to your self-employed activity.

While in lockdown, you can sometimes forget the world around you. Which deadlines should you definitely not forget?

First and foremost: don't forget to send your customers a payment reminder when your invoice has expired for 10 days!

Remember the deadlines April 30 and May 7 for submitting your customer listing, your VAT return and your intra-Community listing.

The application for support from the Flemish Region must be submitted before 30 June 2020.

The application for support from the Walloon Accounting firm in slough Region must be submitted within 60 days of the closure of your activity.

The application for support from the Brussels-Capital Region must be submitted before 1 June 2020.

The request for deferment of payment of social security contributions must be submitted before 15 June 2020.

In these times, we help you, as always, to comply with these obligations: your VAT returns are automatically generated in the app and you know exactly how much money you have available and what you should keep aside from VAT and social security contributions. That's our way of helping you make the best decisions for good times and bad!

0 notes

Text

Construction Industry Scheme reverse charge and CIS

shaikh January 27, 2021 One would have thought there is enough going on trying to cope with the challenges of COVID-19 , but HMRC in its wisdom have decided to introduce a complicated procedure to deal with Construction Industry Scheme reverse charge and CIS The Construction Industry Scheme (CIS) VAT Domestic Reverse Charge (DRC) applies to supplies of construction services from 1 March 2021. This article tries to address some of the important questions such as ,What is the CIS reverse charge? How do you account for VAT? Can you still cash account for VAT? What administrative changes do I need in order to operate the reverse charge? · The CIS VAT DRC applies to business to business sales of construction work. · The aim of the measure is to reduce VAT fraud in the construction sector. Where the DRC applies: · The customer, rather than the supplier, account to HMRC for VAT on the supplier’s behalf. o The customer accounts for the supplier’s output VAT. o A reclaim can be made on the same return if the customer is entitled to recover the VAT. o The supplier does not charge or collect VAT on its sale. The CIS DRC only applies to UK business to UK business (B2B) supplies where the recipient of the supply intends to make an ongoing supply to another party of construction services. The original October 2019 start date of the CIS DRC has been twice postponed due to the coronavirus and Brexit. It is currently expected to commence on 1 March 2021. The CIS DRC applies when all the following are met: · There is a supply for VAT of construction services and materials. · The supply is made at the standard or reduced-rate of VAT. · The supply is made between a UK VAT registered supplier and UK VAT registered customer. · Both supplier and customer are registered for the CIS. · The customer intends to make an ongoing supply of construction services to another party. · The supplier and customer are not connected. · The supplier is not an employment business. · The customer is not an ‘end-user’ or The CIS DRC does not apply to any of the following supplies: · Supplies of VAT exempt building and construction services. · Supplies that are not covered by the CIS, unless linked to such a supply. · Supplies of staff or workers. · Supplies of materials only. The CIS DRC does not apply to taxable supplies made to the following customers: · A non-VAT registered customer · A customer who is an ‘End User’ i.e. a VAT registered customer who is not intending to make further on-going supplies of construction. · A customer who is an ‘intermediary supplier’ and has informed the supplier of this status in writing. CIS DRC requires a significant change of approach in many CIS businesses: · Staff need to be trained to identify relevant CIS contracts and End Users. · Accounting and bookkeeping systems require modification to cope with the new invoicing and reporting obligations. · Use of the VAT Flat Rate scheme and Cash accounting may not be possible. · Cashflow will be affected and those at the start of the supply chain may become VAT repayment claimants: they need to consider whether to file monthly returns. · It may require a business who is the recipient of the supply to VAT register. Example: how the CIS reverse charge works John the Roofer (who is VAT registered) supplies the materials and roofs a new office building for Contractor who (who is also VAT registered) and in turn supplies its construction services to Developer (also VAT registered). Developer finds and develops land and will in this case, bring the build to completion and supply a finished commercial building to End user, its client. · John the Roofer would under the old VAT system, invoice Contractor £120,000, comprising of his £100,000 bill for materials, labour and works, plus £20,000 in VAT (at 20%). · From October 2020, under the new CI

0 notes

Photo

VAT TNT Fedex

https://www.gov.uk/guidance/check-when-you-can-account-for-import-vat-on-your-vat-return || Postponed VAT accounting (PVA) || Это отложенный VAT, его не надо платить при тамож оформлении. Он учитывается при подаче очередного VAT отчёта.

PVA number

If your business receives goods through the post in consignments exceeding £135 using Royal Mail Group (including Parcelforce where they are not acting as a fast parcel operator) you will not be able to account for import VAT on your VAT return. This is because Royal Mail Group do not currently offer this facility.

https://www.gov.uk/guidance/complete-your-vat-return-to-account-for-import-vat

https://www.gov.uk/guidance/vat-and-overseas-goods-sold-directly-to-customers-in-the-uk || £135

The seller can add a note to the invoice (for example, by writing ‘reverse charge: customer to account for VAT to HMRC’) then send it to the UK business customer.

Sellers do not have to register for VAT if they only sell goods that are outside the UK at the point of sale to UK VAT-registered businesses.

https://www.nibusinessinfo.co.uk/content/get-someone-deal-customs-you || Directly & Indirectly

https://www.sage.com/en-gb/blog/deferred-and-simplified-customs-declarations/

Until 30 June 2021, importers in England, Wales and Scotland can optionally defer customs declarations and payments. The declaration and payment can be deferred for up to six months after the import date. This is known as Deferred Declarations. To make use of it, businesses in England, Wales and Scotland must use the Simplified Customs Declaration process.

https://www.gov.uk/guidance/using-simplified-declarations-for-imports

https://www.gov.uk/guidance/apply-to-use-simplified-procedures-for-import-or-export-ce48 || Use form C&E48 to apply

https://www.gov.uk/topic/business-tax/import-export

https://www.gov.uk/guidance/paying-vat-and-duties-on-imports

If you have a duty deferment account, you’ll be able to delay payment until an agreed future date.

We will process your application within 30 working days if we have all the information we need. If you need to apply for a financial guarantee, this may take longer.

Most traders will not need a financial guarantee with their duty deferment account.

You can use the flexible accounting system when your goods move across the border if: - you want to pay by card, cheque or bank transfer - you’re a Direct Trader Input (DTI) agent

Immediate payment accounting system known as the Flexible Accounting System or FAS

https://www.gov.uk/government/publications/notice-100-customs-flexible-accounting-system/notice-100-customs-flexible-accounting-system

https://www.gov.uk/guidance/check-which-type-of-account-to-apply-for-to-defer-duty-payments-when-you-import-goods

https://www.tax.service.gov.uk/customs/subscribe-for-cds || Customs Declaration Service (CDS)

https://www.bifa.org/information/customs-border-force/customs-declaration-service-cds || CDS DOWNLOADS

https://www.gov.uk/guidance/set-up-a-direct-debit-for-a-duty-deferment-account-on-the-customs-declaration-service

https://www.tax.service.gov.uk/customs/payment-records/

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/957771/CSV-UTF-8.csv/preview || customs declaration software

http://www.afss.org.uk/Members.aspx || The Association of Freight Software Suppliers

https://www.gov.uk/government/publications/uk-trade-tariff-customs-procedure-codes || CPC

https://www.gov.uk/government/publications/uk-trade-tariff-customs-procedure-codes/exports-customs-procedure-codes

https://www.gov.uk/government/organisations/hm-revenue-customs/contact/national-clearance-hub

https://www.gov.uk/import-customs-declaration || step by step

0 notes

Text

What is Postponed VAT accounting?

Postponed VAT accounting (PVA) is a new import VAT system being implemented within the UK but what is it? #imports #logistics #brexit #shipping

On the 1st January 2021, the UK will leave the EU VAT scheme. This means import VAT will be charged on all applicable import shipments entering the UK.

What is Postponed VAT accounting?

Postponed VAT accounting (PVA) is a new tax system being implemented within the UK. If your business is registered for VAT you may be able to use PVA to account for import VAT on your VAT Return. This would…

View On WordPress

0 notes

Text

Impact of Bad bookkeeping on your business

bookkeeping services dubaiBookkeeping services in UAEca firms in uaevat firms in dubaiaccounting firms in uaeauditing firms in dubaiaccounting companies in uaedubai vat firmsaudit firms in uaerisk assurance in dubaiauditing firms in uaeauditing and accounting firms in dubaistatutory audit services in dubaimiddle east auditingauditing companies in dubaiesr filing company uaeesr dubaiprofessional audit firms in dubaiaudit firms in abu dhabica firms in dubaichartered accountant firms in uaeinternal audit firms in dubaivat return dubai

As a business owner, you have to put resources into bookkeeping services in UAE to keep away from blunder of assets. Accounting encourages organizations to assess income and guarantee that they have enough cash for finance, client support, promoting, business improvement and the sky is the limit from there. So, what happens if you don’t maintain proper books? Let’s find out!

Credit Issues: Bad bookkeeping services can adversely affect how one directs their business. For example, you may end up paying your obligations late, prompting higher financing costs, less installment terms, loss of acknowledge and impedance for your FICO assessment or reports. To dodge all these, your bookkeeper must follow all your income as a method of dealing with your exchanges simpler for you. Powerful detailing and money the executives are largely important for compelling accounting.

Cash Flow Issues: Businesses should consider what will occur when they need to pay salaries, yet they need more cash in the bank. Consistently, costs come up for office supplies, finance, business advancement and that's just the beginning. On the off chance that you are not following your surge and inflow, you may be trapped in a predicament where there isn't sufficient cash to take care of your tabs.

Decision-Making: Bookkeepers use accounting information to make monetary reports, including financial plans, general records, monetary records, income explanations, benefit and-misfortune proclamations, and so on. Without accounting, you won't have the option to settle on budgetary choices. Accounting can assist you with distinguishing budgetary qualities, shortcomings and open doors for your business.

Delays in filings: At the point when organizations don't document straightaway, they experience the ill effects of the deferred results. For example, late recording can make them pay significant fines, punishments and interests. Also, postponed recording is a major warning sign in Dubai.

To ensure compliance and proper vat returns in Dubai, it is essential to maintain your books thoroughly. For this purpose, check out TRC Pamco, one of the best tax firms in Dubai. They offer effective and efficient bookkeeping services in UAE.

Author: TRC Pamco

#dubai free zone company setup#vat return dubai#internal audit firms in dubai#best audit firms in dubai#auditing company in uae#vat consultancy services in dubai#chartered accountant firms in uae#accounting firms abu dhabi#accounting firms in abu dhabi#statutory audit in uae#auditing firms in abu dhabi#ca firms in dubai#audit firms in abu dhabi#professional audit firms in dubai#esr dubai#vat consultancy in abu dhabi#esr filing company uae#due diligence and valuation services dubai#auditing companies in dubai#middle east auditing#audit firms in dubai#ca firms in uae#vat firms in dubai

0 notes

Text

COVID-19 and Seizing the Opportunity for Reforming Tax Expenditures in Africa

New Post has been published on http://khalilhumam.com/covid-19-and-seizing-the-opportunity-for-reforming-tax-expenditures-in-africa/

COVID-19 and Seizing the Opportunity for Reforming Tax Expenditures in Africa

The resources needed for financing the Sustainable Development Goals (SDGs) are estimated at US$ 2.5 to 3 trillion per year. According to the IMF, low-income countries (LICs) will need, on average, additional resources amounting to 15.4 percent of GDP to finance the SDGs in education, health, roads, electricity, and water by 2030. Unfortunately, the COVID-19 pandemic has made mobilization of resources for financing the SGDs almost impossible. In this blog post, we argue that the COVID-19 crisis has made it imperative for developing countries to begin reforming their tax systems to generate more resources domestically—reforms which they have postponed until now because of vested interests. One area where reform has been resisted is tax expenditures (TEs). Reforming TEs would not only generate additional revenues, but it would also improve taxpayer perception of the fairness of the tax system and enhance budget transparency.

The background

As developing countries face a growing need for additional resources to respond to the pandemic, their domestic revenues have actually taken a hit with the collapse in economic activity. Consumption taxes, for instance, are likely to plummet even more than during the global financial crisis. Hence, tax revenues could be significantly affected for a number of years. Moreover, tax compliance is likely to suffer, since households and businesses under economic stress may simply stop paying taxes. Some tax administrations have already reduced their audit and arrears collection activities to ease the severe financial pressure that many businesses and individuals are facing. Resource flows from external sources are also projected to decline in 2020 and beyond. Global foreign direct investment (FDI) in general is expected to shrink by more than 30 percent in 2020, and the impact is likely to be even larger for developing countries. Moreover, global remittances are expected to decline by 20 percent, the sharpest decline in recent history. The outlook for official development assistance (ODA) is bleak, with budgetary pressures in donor countries stemming from the adoption of policies to mitigate the economic and social effects of the pandemic on their citizens. In addition, access to international markets is particularly tough for poor countries. During the first two months of the pandemic, more than US$ 100 billion flew out of emerging markets—more than three times than during the 2008 crisis.

Tax expenditures in Africa

TEs, also known as tax incentives, include exemptions, reduced rates, deductions, and tax credits that reduce the taxpayer's liability as well as the government's revenue collection. While these provisions are used widely to pursue different policy goals, they are costly and often ineffective in reaching their objectives. Estimates show that TEs in Latin America account for slightly more than 4 percent of GDP on average, ranging from 1.3 percent of GDP in Bolivia and Paraguay to 8 percent of GDP in Colombia. The average share of TEs at 2.9 percent of GDP in Africa is significantly lower than in Latin America. At the same time, the fiscal cost of TEs is above 4 percent of GDP in Tanzania, Rwanda, and Liberia, and can be as high as 7.8 percent in Senegal (see Figure 1). As a share of tax revenues, they exceed 20 percent in five countries and are estimated to be as high as 40 percent in Senegal. Figure 1. Tax expenditures as a percentage of GDP and total tax revenue, latest available year

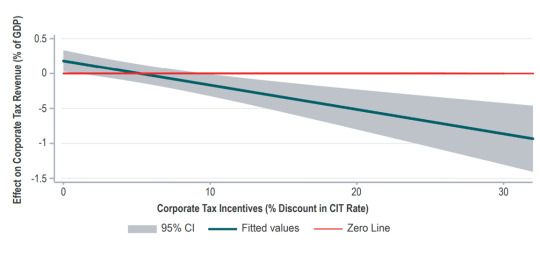

Source: Global Tax Expenditures Database, forthcoming.* Yet, given the striking lack of transparency on TEs in Africa, underreporting is very likely to be an issue. Therefore, these figures should be interpreted with caution, as a lower bound. Indeed, when it comes to transparency, 26 out of 40 countries currently publish official TE reports on a regular basis in Latin America. By contrast, only 19 African countries reported on their TEs at least once between the years 2000 and 2019. The remaining 64 percent of the countries did not publish any TE reports during this period. In addition, even for those African countries reporting on TEs, the heterogeneity in the scope and detail of information provided is striking. Whereas a few countries such as DR Congo and Morocco provide comprehensive reports with data disaggregated at the TE level, most countries only publish aggregated data (e.g., by tax base) or detailed data for a few TE provisions. TEs have significant fiscal costs and can result in net revenue losses. So far, corporate income tax (CIT) revenues in Africa have held up, but the CIT bases can start to erode, depleting the ability of African countries to pay for development. Tax incentives for investment, which have been used widely to promote industrial production in developing economies, are a case in point. In some African countries (e.g. Burkina Faso, Côte D’Ivoire, Guinea, Madagascar, and Mauritania), businesses account for more than 60 percent of total revenue foregone through TEs. Yet, these provisions have proven to be significantly less effective than envisioned, and there is a strong, negative relationship between the generosity of tax incentives and revenues from corporate taxes. As shown in Figure 2, for each 10-percentage point increase in CIT incentives, CIT revenue decreases by around 0.35 percent of GDP. Figure 2. Corporate income tax incentives and corporate income tax revenue

Source: Kronfol and Steenbergen (2020). “Evaluating the Costs and Benefits of Corporate Tax Incentives.” In addition, TEs often disproportionally benefit better-off population groups such as politically connected firms or multinationals and high-income earners, hence worsening a country’s income distribution.

A proposal for reform

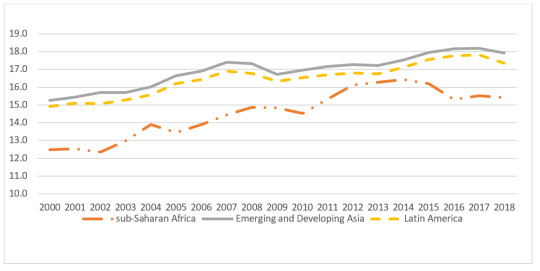

Low-income countries are urged to announce that, as part of their policy reforms, they would re-assess TEs during the next annual budget discussions (or during the discussions on supplementary budgets), with the objective of lowering their annual cost by at least one percentage point of GDP. This would be significant, given the average tax-to-GDP increases witnessed in recent years in developing economies. Figure 3 shows that countries in Asia, Latin America, and sub-Saharan Africa improved their tax collections on average by under 1 percent of GDP in the past decade. An important component of reform would necessarily have to be a commitment by governments to refrain from granting any new tax concessions. The IMF estimates that revenues in sub-Saharan Africa would fall on average by 2.6 percent of GDP in 2020 because of COVID-19, further highlighting the need for TE reform. Figure 3. Tax revenue (% of GDP), 2000-2018

Source: ICTD Government Revenue Dataset. Note: Argentina, Brazil, and Chile are excluded from Latin America. Reforming TEs would trigger the additional benefit of improving tax compliance. It is common for policymakers in developing countries to complain about low tax compliance in their countries. Tax compliance may be low in part because citizens feel they do not receive quality services from the government. It is also low because taxpayers see how unequal the tax system is (i.e. how the well-off—including the beneficiaries of TEs—do not pay their share of taxes). Thus, a rationalization of TEs would have a favourable impact on overall tax compliance in the economy. Donor countries will have to do their share as well. They would have to agree to subject their aid-funded projects in developing countries to custom duties and value-added tax (VAT). The cost of tax exemptions with respect to ODA projects can be as high as 3 percent of GDP for countries that depend heavily on aid. There are some donor countries (Netherlands and Norway) that have renounced the exemption-seeking policy. The COVID-19 crisis presents an opportunity to all donor countries to relinquish exemptions for the aid they provide. Unlike the G20 Debt Service Suspension Initiative, which provides a temporary respite from debt obligations to the poorest countries, elimination of exemptions on aid-funded projects would generate a permanent increase in revenues for countries in need.

Conclusion

The bottom line is that COVID-19 presents an opportunity for policymakers to reform TEs. Widespread support for reform can be gained by highlighting the need for additional resources at this juncture to pay for improved health services and to mitigate the impact of the pandemic. The case becomes even stronger when citizens realize that the ultimate beneficiaries of TEs are, in most cases, well-to-do individuals and large enterprises. This blog post is published jointly with the Council on Economic Policies.

*The GTED is a joint effort of think tanks and research institutions from Europe, Asia, Africa and Latin America led by the Council on Economic Policies (CEP) and the German Development Institute (DIE).

0 notes