#Photonics Integrated Circuit (IC)

Explore tagged Tumblr posts

Text

Understanding 3D IC Technology - An Overview | PCB Power

As the world demands faster, more powerful, and smaller devices, traditional chip designs are hitting their limits. That’s where 3D IC technology steps in. Instead of spreading circuits out flat, like in conventional 2D designs, 3D ICs stack layers of integrated circuits, opening up new possibilities for performance, power efficiency, and space-saving. Imagine more computing power packed into a smaller area with better communication between layers—that’s the promise of 3D ICs.

In this blog, we'll dive into how 3D IC technology works, the benefits it brings, and the hurdles we need to overcome as we look toward the future of electronics…

What is 3D IC Technology?

Over the past four decades, advancements in ASIC (Application-Specific Integrated Circuit) technology have drastically improved the power and efficiency of semiconductors. However, as we try to pack more power into devices, making chips larger has become increasingly difficult, expensive, and time-consuming. We're reaching the limits predicted by Moore’s Law, where doubling the number of transistors on a chip is no longer as easy or cost-effective as it used to be.

This challenge has led to the rise of 3D IC (Integrated Circuit) technology. A 3D IC is made up of two or more smaller chipsets—essentially mini integrated circuits—designed to work together within the same package. These chipsets are connected using advanced packaging methods, whether it's 2D, 2.5D, or fully stacked 3D techniques. Instead of relying on the traditional approach of cramming everything into a single layer, 3D ICs divide the workload across smaller, more manageable pieces that are either stacked on top of each other or connected side by side. This not only reduces the overall size of the chip but also dramatically boosts performance without needing to duplicate components.

By embracing 3D IC technology, we can keep pushing the boundaries of semiconductor innovation, even as traditional methods reach their limits.

Benefits of 3D-IC Technology

The benefits of 3D-IC Technology are as follows:

Low Expenditures: Components such as analog circuits and memory can be fabricated on older generations of technology without additional cost.

Enhanced Capability: Boosted speed and bandwidth support up to 100 Gbps in advanced memory applications.

Space Efficiency: Miniature 3D ICs are used on smaller boards. It is useful for compact mobile devices.

Less Wasted Energy: Provided smaller I/O drivers and fewer RLC parasitics cause better efficiency in power consumption.

Faster Time-to-Market: Modular design and possibilities of “die reuse” accelerate project development.

Increased Integration: Allows one system to implement photonics, MEMS, and other new technologies.

Enhanced Signal Integrity: The use of TSVs lowers parasitics, which leads to better performance and saves power much better than traditional SiP designs.

Flexibility: Different technological nodes of dies can be stacked, making the system design more versatile.

3D ICs have a denser configuration, quicker interconnects, and better power characteristics; therefore they revolutionize the concept of high-performance applications, through design, heat control, and ramp-up production.

Applications of 3D IC Technology

3D IC technology is transforming industries that require high-performance and compact designs. Its ability to stack layers of circuits has made it an essential component in advanced computing, AI, and data centers, where speed and efficiency are critical.

It’s also revolutionizing the smartphone and wearable tech markets, enabling thinner devices with more power. In automotive applications, 3D ICs contribute to smarter, faster processing for autonomous driving systems. Additionally, 3D ICs are increasingly used in healthcare devices, powering sophisticated imaging and diagnostic equipment that rely on speed and accuracy.

Challenges in 3D IC Technology

Setbacks experienced with 3D IC Technology:

Heat Management: Ever-rising vertical stacks create a high level of power density and hence create thermal hot spots which may negatively affect performance and reliability. Also, adequate control of heat flow between the layers is necessary to avoid thermal crossover which may lead to defects in the circuitry.

Manufacturing Difficulty: The extent of tolerances required for the alignment and bonding of the dies in 3D IC exceeds that of 2D IC resulting in greater manufacturing costs and time as well as problems in increasing production volume.

Design Validation: The features of a 3D IC make design validation processes very difficult. Existing methods are ineffective due to the complexity of multilayer interactions and new ones need to be developed.

Differential Thermal Expansion Ratios: Materials with differing thermal expansion coefficients can result in mechanical stresses that lead to distortion and failure. Therefore appropriate materials and designs should be employed to avoid such occurrences.

Electromagnetic and power management problems: The performance of power-integrated circuits with multiple layers may be limited because of the complex power distribution within the stacked layers. Designers would require high-end software to model power distribution and temperature effects precisely to ensure the systems work well.

The Future of 3D IC Technology & PCB Power's Role in Driving Innovation

3D IC technology is shaping the future of electronics, bringing forth smaller, faster, and more energy-efficient devices. With its ability to stack circuits vertically, 3D ICs significantly reduce signal delays and improve overall performance, making them key to advancing AI, IoT, and other emerging technologies.

However, the journey to full adoption is not without challenges. Thermal management, manufacturing complexity, and the need for reliable interconnects are crucial hurdles that the industry needs to address. This is where PCB Power steps in.

At PCB Power, we understand that as IC designs become more sophisticated, the demand for high-performance PCBs will only grow. Our expertise in creating multi-layer and high-density interconnect (HDI) PCBs ensures that we can meet the evolving needs of 3D IC technology. We continuously adapt our processes to support cutting-edge designs and ensure that signal integrity and heat dissipation are prioritized.

Whether you’re looking for custom PCBs for advanced 3D IC applications or turnkey solutions that streamline the PCB manufacturing and assembly process, we are here to partner with you every step of the way.

As we look to the future, PCB Power remains committed to pushing the boundaries of PCB technology, helping businesses like yours thrive in this exciting era of innovation.

Read the original blog post here: Understanding 3D IC Technology - An Overview

0 notes

Text

How LED screens work: A Comprehensive Guide to Know the Technology.

LED screens, right from big display banners outside large format billboards to video walls in events, are now considered the first choice for every display solution. Those bright colors and energy efficiency have given these screens much more preference over other related display technologies, like LCDs or projectors. How do these screens really work? We shall tear apart the science and technology behind the LED screen in this blog.

What is an LED? At the very heart of every LED is an LED. An LED is a semiconductor in which light is always produced once some electric current passes through it. Unlike conventional incandescent bulbs, LEDs do not require heating the filament to produce light and thus have proven to be more efficient and last longer.

The basic idea is quite simple:

Electrons flow within the semiconductor material. These then come into collision with the material's atoms. Energy, in this case, is released as photons, or light. The color of light is determined by the energy bandgap of the semiconductor material. LEDs-red, green, and blue-altogether render full-color displays.

How Do LED Screens Work? LED screens, therefore, can be termed as a collection of numerous minute LED units working in unison to produce images, videos, or text. This is how these little units work together for the production of any screen: 1. LED Modules The most fundamental unit of an LED screen is an LED module. An LED module offers a set of diodes attached to a grid and, naturally, the circuit board and wiring required to operate those diodes. Each LED module can be part of much more extensive system for displaying parts of an image or video. 2. Pixels A pixel on an LED screen contains three diodes: a red one, a green one, and a blue one, known collectively as RGB. This enables the possibility of having the screen made in different colors by changing the brightness of each of the diodes. If a pixel is lit by a red and a green diode both at full intensity, it is yellow. If all the three diodes, RGB, glow at their highest intensity, then the pixel appears white. A higher pixel density involves more LEDs per module, hence more resolution and sharper images are thereby reproduced. Lower pixel density is usual in large outdoor displays, since the audience is at a greater distance so that pixel detail doesn't matter much. 3. Pixel Pitch The pixel pitch refers to the distance, measured in millimeters, between two adjacent pixels on the screen. The pixel pitch describes the resolution and sharpness of a display.

A smaller pixel pitch consequently allows for a closer-packed pixel of much better resolution, hence the application in indoor display. A higher pixel pitch is implemented in outdoor displays because generally the audience for such a display is relatively far from the screen; therefore, high pixel density is less important. 4. Driver ICs Integrated Circuits

Driver ICs control current flow to each of the LEDs. The IC controls brightness and color for each of the LEDs in order to build up an image in cohesiveness. These circuits are extremely accurate so that each pixel behaves as it is expected.

5. Control System An LED screen requires a control system, which will help them in acquiring and processing data coming from sources such as a computer, camera, or video processor, hence making the input readable to the modules of the LED.

The control system consists of two primary components.

Sending Device: It accepts the video or photo sent by any peripherals and transmits the information to the LED screen. Receiving card: This is mounted in every LED module or cabinet, and it is used to receive information relevant to the correct and synchronous operation of individual LEDs. 6. Refresh Rate Refresh rate indicates how many times the image is refreshed per second in an LED screen. It's measured in Hertz, and refresh rates of this type ensure much smoother video playback, reducing flicker-but especially for video, live events, and the like. High refresh rate would be refreshing at 60 times per second. Contemporary high-performance displays could, in theory, even reach a refresh rate of 144Hz or more with all that motion going on-the better suited for fast-moving sports or programming.

How do LED screens display colors? As mentioned earlier, each pixel consists of red, green, and blue LEDs. The capability to render a large gamut of colors is achieved by combining the three primary colors with different intensities. This is called additive color mixing.

For instance:

Red + Cyan = Magenta Red + Green = Yellow Green + Blue = Cyan Red + Green + Blue at maximum intensity = White By adjusting the brightness levels of the three red, green, and blue LEDs that make up each pixel, the screen can reproduce millions of colors, thereby displaying more complicated images and video.

Role of Brightness and Contrast: It is the brightness and contrast ratio that define LED screen viewing characteristics.

Brightness: This is the range of nits an LED screen produces to increase visibility in various locations. For instance, outdoor LED screens require brighter levels ranging up to 5000 nits to be visible when exposed to sunlight, while indoor displays can rely on lower levels of brightness (500 to 1000 nits). Contrast ratio - difference between white and black brightness. Higher contrast ratio means an image with deeper blacks and saturated colors, and vice versa. Indoor v/s Outdoor LED Display:

Be it an indoor application or outdoor, the working of the LED screen remains the same, but what differs is how they are specified.

Indoor LED displays:

Higher pixel density than for closer-viewing screens.

They do not compete with direct sunlight, so therefore moderate light levels.

It's mostly used during events, in malls, and airways. Outdoor LED screens. Lower pixel density, but much brighter. Designed to be weather resistant to rain, winds, and dusts with special water-proof coatings. It is commonly used in billboards, sports arenas, and public spaces. Energy Efficiency and Lifespan The power consumption is one of the main and most significant advantages of LED technology, as it consumes much less power than LCD or plasma. In case of an LED, light is produced directly, rather than relying on making it pass through other materials. Depending on use and environment, an LED screen may last as long as 50,000 to 100,000 hours. The lifespan of an LED screen depends on the brightness setting, work hours, and maintenance. Conclusion: The features of an LED screen are formed by the use of LED technology, control systems, and high modules resolution. From forming pixels to make an image to how a refresh rate can enable smooth playback, the versatility and efficiency in its design are very interesting. It could be business presentation, concert, or outdoor advertising-it dramatically changes the impact created by visual media.

0 notes

Text

SEMICONDUCTORINSIGHT REPORTS

Silicon-on-Insulator (SOI) Market - https://semiconductorinsight.com/report/silicon-on-insulator-soi-market/

Smart Grid Market - https://semiconductorinsight.com/report/smart-grid-market/

System-on-Module (SoM) Market - https://semiconductorinsight.com/report/system-on-module-som-market/

Thin Film Electronics Market - https://semiconductorinsight.com/report/thin-film-electronics-market/

Ultrathin and Flexible Electronics Market - https://semiconductorinsight.com/report/ultrathin-and-flexible-electronics-market/

Vertical Integration in Semiconductor Market - https://semiconductorinsight.com/report/vertical-integration-in-semiconductor-market/

Wearable Devices Market - https://semiconductorinsight.com/report/wearable-devices-market/

Wide Bandgap Power Devices Market - https://semiconductorinsight.com/report/wide-bandgap-power-devices-market/

Wireless Sensor Network (WSN) Market - https://semiconductorinsight.com/report/wireless-sensor-network-wsn-market/

Zigbee Wireless Technology Market - https://semiconductorinsight.com/report/zigbee-wireless-technology-market/

3D Printing Electronics Market - https://semiconductorinsight.com/report/3d-printing-electronics-market/

Advanced Semiconductor Packaging Market - https://semiconductorinsight.com/report/advanced-semiconductor-packaging-market/

Analog Mixed Signal Devices Market - https://semiconductorinsight.com/report/analog-mixed-signal-devices-market/

Automotive Power Electronics Market - https://semiconductorinsight.com/report/automotive-power-electronics-market/

Compound Semiconductor Devices Market - https://semiconductorinsight.com/report/compound-semiconductor-devices-market/

Embedded Memory Market - https://semiconductorinsight.com/report/embedded-memory-market/

Flexible Hybrid Electronics Market - https://semiconductorinsight.com/report/flexible-hybrid-electronics-market/

Gallium Nitride (GaN) Power Devices Market - https://semiconductorinsight.com/report/gallium-nitride-gan-power-devices-market/

High Bandwidth Memory (HBM) Market - https://semiconductorinsight.com/report/high-bandwidth-memory-hbm-market/

Integrated Circuit (IC) Packaging Market - https://semiconductorinsight.com/report/integrated-circuit-ic-packaging-market/

Light Detection and Ranging (LiDAR) Market - https://semiconductorinsight.com/report/light-detection-and-ranging-lidar-market/

Microelectronic Mechanical Systems (MEMS) Sensors Market - https://semiconductorinsight.com/report/microelectronic-mechanical-systems-mems-sensors-market/

Next-Generation Memory Market - https://semiconductorinsight.com/report/next-generation-memory-market/

Organic Semiconductor Market - https://semiconductorinsight.com/report/organic-semiconductor-market/

Power Electronics Market - https://semiconductorinsight.com/report/power-electronics-market/

Printed Circuit Board (PCB) Market - https://semiconductorinsight.com/report/printed-circuit-board-pcb-market/

Radio Frequency (RF) Components Market - https://semiconductorinsight.com/report/radio-frequency-rf-components-market/

Semiconductor Intellectual Property (IP) Core Market - https://semiconductorinsight.com/report/semiconductor-intellectual-property-ip-core-market/

Silicon Photonics Market - https://semiconductorinsight.com/report/silicon-photonics-market/

Smart Lighting Market - https://semiconductorinsight.com/report/smart-lighting-market/

System-on-Chip (SoC) Market - https://semiconductorinsight.com/report/system-on-chip-soc-market/

Thin Film Semiconductor Market - https://semiconductorinsight.com/report/thin-film-semiconductor-market/

Ultrathin and Flexible Electronics Market - https://semiconductorinsight.com/report/ultrathin-and-flexible-electronics-market/

Vertical Cavity Surface Emitting Laser (VCSEL) Market - https://semiconductorinsight.com/report/vertical-cavity-surface-emitting-laser-vcsel-market/

Wearable Electronics Market - https://semiconductorinsight.com/report/wearable-electronics-market/

Wide Bandgap Semiconductor Devices Market - https://semiconductorinsight.com/report/wide-bandgap-semiconductor-devices-market/

Wide Bandgap Power Semiconductor Market - https://semiconductorinsight.com/report/wide-bandgap-power-semiconductor-market/

Wireless Power Transmission Market - https://semiconductorinsight.com/report/wireless-power-transmission-market/

Zigbee IC Market - https://semiconductorinsight.com/report/zigbee-ic-market/

3D Printing in Electronics Market - https://semiconductorinsight.com/report/3d-printing-in-electronics-market/

0 notes

Text

Optical I/O Shines Intel’s OCI Chiplet Powers Next-Decade AI

First Integrated Optical I/O Chiplet

With integrated photonics technology, Intel Corporation has made significant progress towards high-speed data transmission. The first-ever fully integrated optical computing interconnect (OCI) chiplet, co-packaged with an Intel CPU and executing real data, was showcased by Intel’s Integrated Photonics Solutions (IPS) Group at the Optical Fibre Communication Conference (OFC) 2024. This chiplet is the most sophisticated in the industry. By enabling co-packaged optical input/output (I/O) in developing AI infrastructure for data centres and high performance computing (HPC) applications, Intel’s OCI chiplet marks a significant advancement in high-bandwidth connection.

What It Does

This is the first OCI chiplet, intended to meet the increasing demands of AI infrastructure for greater bandwidth, lower power consumption, and longer reach. It can support 64 channels of 32 gigabits per second (Gbps) data transmission in each direction on up to 100 metres of fibre optics. It makes it possible for CPU/GPU cluster connectivity to grow in the future and for innovative compute designs like resource disaggregation and coherent memory extension.

Why It Matters

Large language models (LLM) and generative AI are two recent advancements that are speeding up the global deployment of AI-based applications. Machine learning (ML) models that are larger and more effective will be essential in meeting the new demands of workloads involving AI acceleration. Future AI computing platforms will need to be scaled, which will require exponential expansion in I/O bandwidth and longer reach to support larger CPU/GPU/IPU clusters and architectures with more effective resource utilisation, like memory pooling and xPU disaggregation.

High bandwidth density and low power consumption are supported via electrical I/O, or copper trace connectivity, although its reach is limited to one metre or less. When employed in data centres and early AI clusters, pluggable optical transceiver modules can expand reach at power and cost levels that are unsustainable for the scalability demands of AI workloads. AI/ML infrastructure scalability calls for co-packaged xPU optical I/O that can enable greater bandwidths with better power efficiency, longer reach, and low latency.

Electrical I/O

To use an analogy, switching from horse-drawn carriages, which had a limited capacity and range, to cars and trucks, which can transport much bigger amounts of products over much longer distances, is analogous to replacing electrical I/O with optical I/O in CPUs and GPUs to convey data. Optical I/O solutions such as Intel’s OCI chiplet could offer this kind of enhanced performance and energy efficiency to AI scalability.

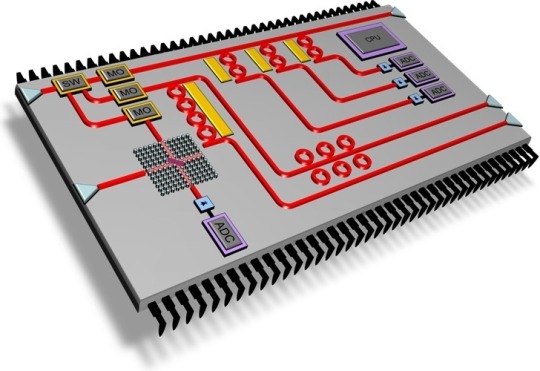

How It Works

The fully integrated OCI chiplet combines an electrical integrated circuit (IC) with a silicon photonics integrated circuit (PIC), which incorporates on-chip lasers and optical amplifiers, by utilising Intel’s field-proven silicon photonics technology. Although the OCI chiplet showcased at OFC was co-packaged with an Intel CPU, it can be combined with different system-on-chips (SoCs), GPUs, IPUs, and next-generation CPUs.

This initial OCI version is compatible with PCIe Gen5 and provides bidirectional data transmission rates of up to 4 terabits per second (Tbps). A transmitter (Tx) and receiver (Rx) connection between two CPU platforms via a single-mode fibre (SMF) patch cord is shown in the live optical link demonstration. The demonstration shows the Tx optical spectrum with 8 wavelengths at 200 gigahertz (GHz) spacing on a single fibre, along with a 32 Gbps Tx eye diagram demonstrating strong signal quality. The CPUs generated and tested the optical Bit Error Rate (BER).

The current chiplet uses eight fibre pairs, each carrying eight dense wavelength division multiplexing (DWDM) wavelengths, to provide 64 channels of 32 Gbps data in each direction up to 100 metres (though actual implementations may be limited to tens of metres due to time-of-flight latency). In addition to being incredibly energy-efficient, the co-packaged solution uses only 5 pico-Joules (pJ) per bit, as opposed to around 15 pJ/bit for pluggable optical transceiver modules. AI’s unsustainable power requirements may be addressed with the help of this level of hyper-efficiency, which is essential for data centres and high-performance computing settings.

Concerning Intel’s Preeminence in Silicon Photonics

With over 25 years of in-house research from Intel Labs, the company that invented integrated photonics, Intel is a market leader in silicon photonics. The first business to create and supply industry-leading dependability silicon photonics-based connectivity solutions in large quantities to major cloud service providers was Intel.

The primary point of differentiation for Intel is their unmatched integration of direct and hybrid laser-on-wafer technologies, which result in reduced costs and increased reliability. Intel is able to preserve efficiency while delivering higher performance thanks to this innovative method. With over 8 million PICs and over 32 million integrated on-chip lasers shipped, Intel’s reliable, high-volume platform has a laser failures-in-time (FIT) rate of less than 0.1, which is a commonly used reliability metric that shows failure rates and the frequency of failures.

For use in 100, 200, and 400 Gbps applications, these PICs were installed in big data centre networks at prominent hyperscale cloud service providers in the form of pluggable transceiver modules. In development are next generation 200G/lane PICs to handle 800 Gbps and 1.6 Tbps applications that are only starting to gain traction.

Additionally, Intel is introducing a new fab process node for silicon photonics that offers significantly better economics, higher density, better coupling, and state-of-the-art (SOA) device performance. Intel keeps improving SOA performance, cost (more than 40% reduction in die size), power (more than 15% reduction), and on-chip laser performance.

What’s Next

This OCI chiplet from Intel is a prototype. Intel is collaborating with a small number of clients to co-package OCI as an optical I/O solution with their SoCs.

The OCI chiplet from Intel is a significant advancement in high-speed data transfer. Intel continues to be at the forefront of innovation and is influencing the future of connectivity as the AI infrastructure landscape changes.

Read more on govindhtech.com

#Opticali#Ointels#oci#Decadeai#Chiplet#cpu#PowersNext#Machinelearning#ml#Largelanguagemodels#llm#gen5#SiliconPhotonics#technology#technews#news#govindhtech

1 note

·

View note

Text

Intel Unveils Groundbreaking Optical Compute Interconnect Chiplet, Revolutionizing AI Data Transmission

New Post has been published on https://thedigitalinsider.com/intel-unveils-groundbreaking-optical-compute-interconnect-chiplet-revolutionizing-ai-data-transmission/

Intel Unveils Groundbreaking Optical Compute Interconnect Chiplet, Revolutionizing AI Data Transmission

Intel Corporation has reached a revolutionary milestone in integrated photonics technology, Integrated photonics technology involves the integration of photonic devices, such as lasers, modulators, and detectors, onto a single microchip using semiconductor fabrication techniques similar to those used for electronic integrated circuits. This technology allows for the manipulation and transmission of light signals on a micro-scale, offering significant advantages in terms of speed, bandwidth, and energy efficiency compared to traditional electronic circuits.

Today, Intel introduced the first fully integrated optical compute interconnect (OCI) chiplet co-packaged with an Intel CPU at the Optical Fiber Communication Conference (OFC) 2024. This OCI chiplet, designed for high-speed data transmission, signifies a significant advancement in high-bandwidth interconnects, aimed at enhancing AI infrastructure in data centers and high-performance computing (HPC) applications.

Key Features and Capabilities:

High Bandwidth and Low Power Consumption:

Supports 64 channels of 32 Gbps data transmission in each direction.

Achieves up to 4 terabits per second (Tbps) bidirectional data transfer.

Energy-efficient, consuming only 5 pico-Joules (pJ) per bit compared to pluggable optical transceiver modules at 15 pJ/bit.

Extended Reach and Scalability:

Capable of transmitting data up to 100 meters using fiber optics.

Supports future scalability for CPU/GPU cluster connectivity and new compute architectures, including coherent memory expansion and resource disaggregation.

Enhanced AI Infrastructure:

Addresses the growing demands of AI infrastructure for higher bandwidth, lower power consumption, and longer reach.

Facilitates the scalability of AI platforms, supporting larger processing unit clusters and more efficient resource utilization.

Technical Advancements:

Integrated Silicon Photonics Technology: Combines a silicon photonics integrated circuit (PIC) with an electrical IC, featuring on-chip lasers and optical amplifiers.

High Data Transmission Quality: Demonstrated with a transmitter (Tx) and receiver (Rx) connection over a single-mode fiber (SMF) patch cord, showcasing a 32 Gbps Tx eye diagram with strong signal quality.

Dense Wavelength Division Multiplexing (DWDM): Utilizes eight fiber pairs, each carrying eight DWDM wavelengths, for efficient data transfer.

Impact on AI and Data Centers:

Boosts ML Workload Acceleration: Enables significant performance improvements and energy savings in AI/ML infrastructure.

Addresses Electrical I/O Limitations: Provides a superior alternative to electrical I/O, which is limited in reach and bandwidth density.

Supports Emerging AI Workloads: Essential for the deployment of larger and more efficient machine learning models.

Future Prospects:

Prototype Stage: Intel is currently working with select customers to co-package OCI with their system-on-chips (SoCs) as an optical I/O solution.

Continued Innovation: Intel is developing next-generation 200G/lane PICs for emerging 800 Gbps and 1.6 Tbps applications, along with advancements in on-chip laser and SOA performance.

Intel’s Leadership in Silicon Photonics:

Proven Reliability and Volume Production: Over 8 million PICs shipped, with over 32 million integrated on-chip lasers, showcasing industry-leading reliability.

Advanced Integration Techniques: Hybrid laser-on-wafer technology and direct integration provide superior performance and efficiency.

Intel’s OCI chiplet represents a significant leap forward in high-speed data transmission, poised to revolutionize AI infrastructure and connectivity.

#2024#ai#AI Infrastructure#AI platforms#AI/ML#applications#chips#cluster#clusters#communication#computing#conference#connectivity#cpu#data#Data Centers#data transfer#deployment#devices#direction#efficiency#electronic#energy#energy efficiency#eye#Fabrication#Features#fiber#Future#gpu

0 notes

Text

The Evolution of System in Package: Past, Present, and Future

The Genesis of System in Package Technology

In the early days of electronics, the industry was dominated by single-function components. Each transistor, resistor, and capacitor had its place on a printed circuit board (PCB), contributing to the overall function of the device. However, as technology advanced and devices became more complex, this approach proved increasingly inefficient. The advent of integrated circuits (ICs) in the 1960s marked a significant leap forward, but even these had limitations. The need for greater integration and miniaturization led to the birth of system in package (SiP) technology.

SiP technology emerged in the 1980s as a revolutionary concept that allowed multiple ICs to be integrated into a single package. This innovation enabled the development of more compact and efficient electronic devices. Initially, SiP was used in niche applications, such as military and aerospace, where the high cost was justified by the need for performance and reliability. As the technology matured, costs decreased, and SiP became viable for consumer electronics, paving the way for the miniaturized gadgets we use today.

The Golden Age of System in Package: Present Innovations

Today, System in Package technology is at the forefront of electronics design, driving innovations in various industries. Transitioning from the past, the present state of SiP showcases its capabilities in smartphones, wearables, and IoT devices. Modern SiP solutions integrate not just ICs, but also passive components, sensors, and antennas, all within a single package. This level of integration has enabled unprecedented levels of functionality in increasingly smaller form factors.

One of the key benefits of contemporary SiP technology is its ability to support heterogeneous integration. By combining different types of components, such as analog, digital, RF, and power management ICs, SiP can deliver complex functionalities that would be difficult to achieve with traditional PCB designs. Moreover, the use of advanced packaging techniques, such as through-silicon vias (TSVs) and flip-chip bonding, enhances the performance and reliability of SiP assemblies.

In the consumer electronics sector, SiP has been instrumental in the development of compact and powerful devices. For instance, the latest smartphones utilize SiP to integrate multiple communication protocols, processing units, and sensors, all while maintaining a slim profile. Similarly, wearable devices like smartwatches benefit from SiP by incorporating a variety of sensors, processors, and communication modules in a tiny footprint.

Future Horizons: The Next Frontier for System in Package

Looking ahead, the future of System in Package technology promises even greater advancements and possibilities. The relentless drive towards miniaturization, coupled with the growing demand for high-performance computing and connectivity, will push SiP to new heights. Emerging trends such as 5G, artificial intelligence (AI), and the Internet of Things (IoT) will heavily rely on the capabilities of SiP to meet their stringent requirements.

One of the most exciting prospects for SiP is its potential role in enabling advanced AI applications. As AI algorithms become more complex and data-intensive, the need for efficient and high-performance hardware solutions becomes paramount. SiP can provide the necessary integration of processing units, memory, and specialized AI accelerators in a compact form factor, making it ideal for edge computing devices and smart sensors.

Furthermore, the integration of photonic components within SiP is another promising development on the horizon. Photonic SiP, which incorporates optical components for high-speed data transmission and processing, could revolutionize telecommunications and data centers. This approach would address the bandwidth and latency challenges posed by the ever-increasing data demands of modern applications.

The continued evolution of manufacturing techniques will also play a critical role in the future of SiP. Advances in 3D packaging, wafer-level integration, and novel materials will enable even higher levels of integration and performance. These innovations will not only enhance the capabilities of SiP but also make the technology more accessible and cost-effective for a broader range of applications.

System in Package: Bridging the Gap Between Past, Present, and Future

In conclusion, the journey of System in Package technology from its nascent stages to its current prominence and future potential is a testament to the relentless innovation in the electronics industry. The transition from discrete components to highly integrated SiP solutions has transformed the landscape of electronic device design, enabling the development of smaller, more powerful, and more efficient products.

As we look to the future, the role of SiP will only become more critical in addressing the challenges of modern technology. From supporting the proliferation of 5G networks and AI applications to pushing the boundaries of miniaturization and performance, system in package technology is poised to remain at the heart of the next wave of electronic innovations. With each new advancement, SiP continues to bridge the gap between past achievements and future possibilities, shaping the world of electronics in ways we can only begin to imagine.

1 note

·

View note

Text

Unique Cadence EDA Projects for Engineering Students

Cadence EDA Project is the all-in-one EDA solution dedicated to EDA, which combines the tool and the solution in one powerful package that facilitates the creation of the integrated circuits (ICs) and electronic system. Starting with schematic and topographical design, we offer our integrated environment, enabling engineers to create designs that are very effective and precise by the standard of the engineering profession. Takeoff Edu Group Provide Unique projects for final year students.

With 3D CAD, in-circuit engineering, advanced modelling, and signal integrity analysis tools, the platform enables power optimization, design for manufacturability, and solving of complex design challenges to feature products with high performance and reliability. EDA provides the project designs either in analogy, digital or mixed-signal designs that equip the engineer to conceive the idea into the product while also meeting the industry requirements and ensuring reduced time to market.

Takeoff Edu Group-Example titles for Cadence EDA Project

Trendy:

Fixed-Posit: A Floating-Point Representation for Error-Resilient Applications

An Area Efficient 1024-point Low Power Radix-22 Fft Processor with Feed-forward Multiple Delay Commutators

Standard:

Vedic-Based Squaring Circuit Using Parallel Prefix Adders

An Analysis Of DCM-based True Random Number Generator

Static Delay Variation Models for Ripple-carry and Borrow-save Adders

A Two-speed, Radix-4, Serial–Parallel Multiplier

A Systematic Delay and Power Dominant Carry Save Adder Design

The most common projects in this regard are centered around the utilization of Cadence's extensive collection of software tools and platforms, which address different stages of the design cycle, from idea development to final product development alike. One puzzle of Cadence EDA projects that are solved is circuit design. Engineers utilize Virtuoso for schematic entry and layout creation, where they assure themselves that complex integrated circuits can be implemented efficiently. As well as Cadence's simulation and verification tools, Spectre and Incisive, these tools are vitally important in validating the functionality and performance, identifying the possible errors that might cause fabrication problems. Additionally, in their EDA projects, Cadence uses physical implementation tools such as Encounter to perform layout and timing optimizations, thus attaining high chip design robustness and reliability. In addition, the rapid emergence of high-tech semiconductor device manufacturers such as silicon photonically leads Cadence EDA projects to include mainly custom IC design, RFIC (Radio Frequency Integrated Circuit) design, and mixed-signal verification, which meet various market requirements. In the frame of collaborative work and innovative methods, progress in electronic design is achieved by Cadence EDA projects. The development of the most advanced hardware solutions that are put to use in multiple areas, such as consumer electronics and automotive, and many others beyond, is facilitated and promoted by such projects. Fundamentally, the Cadence EDA projects unite design expertise and technology with creativity to impact positively the changes in the developing semiconductor design realm.

The Cadence EDA Projects is one of the most important components in today's engineering by enabling Takeoff Projects to create and be more advances. During the team's project with Cadence software, we saw an increase in productivity and higher precision level in designing electronic circuits. From schematic capture to layout and verification, Cadence EDA proved very suitable for our workflow which was being to meet a timely delivery of high quality solutions. Leveraging our circuit simulation and optimization skills, we bravely took on complex issues with confidence. Further, this dedication to constant improvement maintains the development of our projects in the vanguard of technology. By and large, Cadence EDA Projects have been playing a key role in Takeoff Projects’ journey to keeping the projects afloat amidst the ever-evolving world of electronic design.

#VLSI Projects#Cadence EDA Projects#VLSI Cadence EDA Projects#Academic Projects#Final Year Projects#Engineering Projects

0 notes

Text

Material and Manufacturing Improvements Enhance LED Efficiency

In theory, making high-brightness LEDs is easy. Just glue together n- and p-type semiconductors, add a small bias voltage, and stand back while the photons stream out. However, in practice these solid-state light sources are anything but simple. Advanced materials and manufacturing processes have come together to produce exotic devices with light outputs that would have been considered fanciful just half a decade ago. Even though they produce impressive and highly efficient devices, the LED makers are not resting on their laurels. Leading LED companies such as Cree, OSRAM, and Seoul Semiconductor spend millions of dollars on material science and manufacturing technology to further enhance the performance of their products. Contemporary high-brightness LEDs are already benefitting from advanced substrates and fabrication techniques, such as silicon carbide (SiC) and chemical vapor deposition (CVD), and tomorrow’s chips will take advantage of materials like patterned sapphire that are still percolating in the laboratory. This article takes a closer look at these materials and processes and assesses their impact on commercial LED performance. Mind the band gap Because the wavelength of the light emitted is a function of the energy band gap of the n- and p-doped semiconductor used to form the junction, engineers are limited in their choice of materials for fabricating LEDs. There is little point in selecting a semiconductor that emits photons that the eye cannot detect. After many years of experimentation and hundreds of millions of research dollars, it turns out that Indium Gallium Nitride (InGaN) – a combination of Gallium Nitride (GaN) and Indium Nitride (InN) – is the best currently available semiconductor for high-brightness LEDs. The band gap of InGaN can be manipulated by altering the ratio of GaN to InN. The chips used at the heart of “white” LEDs, for example, emit photons in the 390 to 440 nanometer part of the spectrum (ultraviolet, violet-blue, and blue)1. These photons are then converted to white light by interaction with phosphor powder. However, while InGaN has a number of advantages for photon generation, it does have some significant drawbacks from a volume manufacturing perspective. Chief among these is the fact that it is very difficult (and hence expensive) to “grow” InGaN ingots (unlike the silicon used for manufacturing integrated circuits (IC)). Ingots are advantageous for mass production because they can be sliced and processed as large wafers leading to lower cost chips. Instead, manufacturers typically employ a much cheaper process whereby InGaN thin films are grown by a process known as epitaxy - the deposition of a crystalline overlayer on a crystalline substrate. There are several epitaxy techniques for forming the InGaN layer required for high-brightness LEDs, but the most common contemporary method is metal-organic CVD (MOCVD). MOCVD is a complex process, but in basic terms, reactive gases are fed into a vacuum chamber and combine – at the atomic level – with the substrate and form a thin crystalline film. During MOCVD, the crystalline structure of the deposited film attempts to orientate with the crystal structure of the substrate. The accuracy of this orientation depends on the similarity of the crystal lattice of each material. Poorly matched lattices result in a deposited film that while bulk crystalline on the macroscale is actually full of microscopic dislocations. Reducing threading dislocations A simplified schematic of the structure of a commercial high-brightness LED is shown in Figure 1.

The MOCVD process builds up the LED’s active regions – the multiple layers sandwiched between the p- and n-contact – by depositing successive thin films typically on a sapphire substrate. Sapphire has a number of advantages as a substrate for LED production: it is relatively inexpensive; it is used as a substrate for ICs so manufacturing processes are well established; it is very hard and durable, and it is a good insulator. But there are some drawbacks. One such drawback is the mismatch in the coefficient of thermal expansion between sapphire and InGaN that can lead to high stresses and cracking of the fabricated die. However, an even bigger drawback is the relatively large mismatch between the crystal lattice of InGaN and sapphire (Figure 2). The mismatch – of around 14.8 percent – results in microscopic flaws in the InGaN thin film known as threading dislocations (Figure 3).

Figure 2: Lattice mismatch between sapphire substrate and InGaN thin film creates threading dislocations. (Courtesy of Cree.)

Figure 3: Threading dislocations in InGaN substrate.

Threading dislocations are a challenge in the drive to improve LED efficacy because recombinations between electrons and holes that occur at such sites are primarily “nonradiative.” In other words, no visible photon is emitted. This is because the dislocations introduce extra band gaps beyond the one that the designer intended, and hence do not correspond to the energy differential that produces a photon with a wavelength in the visible part of the spectrum. Alternatively, the energy emitted in the recombination is transferred by the emission of a “phonon”, a vibration introduced to the crystal lattice that adds nothing to the chip’s luminosity but does generate unwanted heat. Because of the mismatch with the sapphire substrate, InGaN suffers from many threading dislocations, exhibiting typical densities exceeding 108 per cm2 or more.2 Worse yet, threading dislocations increase in number as the LED ages, further compromising luminosity (see the TechZone article “Understanding the Cause of Fading in High-Brightness LEDs”). The drive for greater efficiency Because of its fabrication advantages, the majority of manufacturers have been prepared to accept the threading dislocation compromise that comes with sapphire while improving their products’ efficacy by focusing on other aspects of LED performance. LEDs such as OSRAM’s OSLON SSL, for example, can produce up to 108 lm/W (at 350 mA), a state-of-the-art performance, while fabricated on a sapphire substrate. In fact, over 90 percent of today’s high-brightness LEDs from most of the leading manufacturers are fabricated on sapphire substrates.3 As the efficacy returns from improving the other aspects of a LED’s performance – such as carrier injection efficiency, photon extraction, and phosphor conversion efficiency – begin to diminish, LED makers are turning their attention to alternative substrates. One of those alternatives is silicon carbide (SiC). Like sapphire, SiC can be produced in bulk using fairly standard semiconductor manufacturing techniques. It also has the added advantage of a coefficient of thermal expansion that’s similar to InGaN, limiting stress buildup and die cracking. The primary disadvantages are high cost and patented manufacturing processes that require the payment of licensing fees. Cree, a leading U.S.-based LED lighting maker, has – perhaps not surprisingly considering it owns many of the manufacturing patents – championed the use of SiC substrates for LED fabrication. The major advantage the material has over sapphire is a lattice structure that's much more closely matched to InGaN. By using SiC, the lattice mismatch with InGaN is reduced to 3.4 percent.4 This close matching is still not sufficient to eliminate threading defects completely (Figure 4), although the defect density is considerably reduced – by at least one and sometimes two orders of magnitude lower than sapphire5 – dramatically decreasing the number of sights for nonradiative recombination, improving efficacy and prolonging the life of the LED by slowing the rate of fading.

1 note

·

View note

Text

Semiconductor Intellectual Property (IP) Market Size, Share, Industry Report, and Growth Drivers – 2029

The semiconductor intellectual property (IP) market was valued at USD 7.5 billion in 2024 and is projected to reach USD 11.2 billion by 2029; it is expected to grow at a CAGR of 8.5% from 2024 to 2029. Factors such as increasing demand for advanced semiconductor components in telecom & data centers, and automotive sector, and expanding embedded digital signal processor IP and programmable digital signal processor IP segments create lucrative opportunities whereas constant technological changes resulting in increased expenditure, and concerns related to Moore’s law major restraint for the growth of the semiconductor intellectual property (IP) market.

Driver: Increasing demand for electronics in healthcare and telecommunications industries

After the recent pandemic, the demand for new and advanced medical equipment to conduct analysis and diagnosis has increased in the healthcare industry. Portable medical equipment, for instance, patient monitoring devices, witnessed a surge in demand throughout the pandemic. The increased global awareness has created an immense demand for personal monitoring devices even after the pandemic.

Large infrastructure equipment, such as medical imaging systems and biochemical analysis equipment, is used in the healthcare industry. These instruments feature low system noise and consume less power; this was made possible because of semiconductor intellectual property (IP) licensing available to medical device manufacturers, helping them solve unique design challenges. Conventional medical equipment has long relied on software solutions and complex electronics to function.

The telecommunications industry also saw an increased demand for electronics during the pandemic due to the implementation of work from home (WFH) and remote learning policies. Easy-to-use communication tools that enable remote work and learning, as well as teleconferencing instruments witnessed a huge spike in demand during the pandemic period.

Semiconductor IPs are used in the telecommunications vertical for networking, video communication, voice communication, wired infrastructure, and wireless infrastructure telecommunication equipment manufacturing.

Restraint: Concerns related to Moore’s Law

According to Moore’s Law (stated by Gordon Moore, the founder of Intel, in 1965), the number of transistors in a dense integrated circuit will double approximately every two years. Moore’s words were true to an extent, but this increase in the number of transistors reached 3 billion, built over an advanced 14 nanometer (nm) manufacturing process. This technological advancement offered long battery life, computing, video capturing, mobile connectivity, and security features. However, no further advancements in IC technology were noted as the industry players continued to fail to develop a new process node of sizing less than 10 nm. This could mean that Moore’s Law becomes irrelevant. This can either cause a slowdown in semiconductor market growth, or end IC development. It could also result in new beginnings for the semiconductor industry, leading to modern technologies such as silicon photonics.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=651

Opportunity: Rising demand for advanced semiconductor components in automotive and telecommunications & data center verticals

Companies in the telecom & data centers, and automotive sector rely on sophisticated, complex electronic systems. The increasing demand for electronics and semiconductor components in these sectors created the need for innovative design solutions for chip manufacturing. The applications of MCUs, MPUs), analog ICs, sensors, interfaces, and memory in EVs, HEVs, autonomous vehicles and premium vehicles are increasing. As the significance of electronics mobility, connected cars, and vehicle connectivity increases, the demand for small gadgets with high functionality and performance improvements in the automotive sector is also expected to increase rapidly. Thereby, creating opportunities for players operating in the semiconductor intellectual property (IP) market.

Challenges: Increasing IP thefts and counterfeiting

A majority of IP thefts, counterfeiting, and conflicts take place in Asia Pacific. IP thefts and counterfeiting lead to prohibitive costs. IP thefts mainly take place in ASIC and FPGA semiconductor intellectual property (IP) cores; this has been a major area of concern in other critical submarkets of the semiconductor intellectual property (IP) market.

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem.Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research.The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

0 notes

Text

Photonic IC Market Estimated to Witness High Growth Owing to Rising Adoption of Optical Communication Technologies

Photonic integrated circuits (PICs) are optical components integrated onto a single photonic chip to perform sophisticated photonic functions such as processing, detecting and generating optical signals. They are key components required for building optical routers, switches and transceivers for high-speed data communication. PICs integrate multiple optical components including splitters, semiconductor optical amplifiers, array waveguide gratings, modulators and detectors to perform complex optical processing tasks. The global photonic IC market comprises different types of PICs namely Indium Phosphide, Gallium Arsenide, Silica-on-Silicon and Silicon based photonic ICs.

The global photonic IC Market is estimated to be valued at US$ 3535.23 Mn in 2024 and is expected to exhibit a CAGR of 5.2% over the forecast period 2024 to 2031, as highlighted in a new report published by Coherent Market Insights. Market Dynamics: The rise in the adoption of optical communication technologies owing to increasing data traffic is one of the major drivers fueling the growth of the photonic IC market over the forecast period. Optical communication helps to carry huge amount of data at faster speed over fiber optic cables compared to electronic communication. Further, emerging technologies such as 5G, cloud services and internet of things (IoT) require high-speed data communication networks which is facilitating the adoption of photonic integrated circuits in various applications. Additionally, the development of compact and robust photonic integrated circuits for telecommunication applications is also contributing to the market growth. For instance, IBM developed universal silicon photonic integrated circuits for telecommunications networking applications that combines modulators, detectors and other passive components on a single silicon photonic chip. However, high initial investments and manufacturing costs associated with photonic ICs compared to electronic ICs may hinder the market growth during the forecast period. SWOT ANALYSIS Strength: The photonic IC market size is witnessing significant technological advancements which is strengthening its product offerings. Photonic ICs allow high speed data transmission and enhance computational power which is becoming increasingly important. Manufacturers are investing heavily in R&D to develop more efficient photonic ICs. Weakness: High initial costs associated with manufacturing photonic ICs is one of its major weaknesses. Designing efficient photonic circuits also remains a complex challenge which limits widespread commercial adoption. Lack of standardized fabrication process further adds to the expenses. Opportunity: 5G network rollout and increasing demand for high speed connectivity worldwide presents massive opportunities for photonic IC vendors. Their applications in optical communication, sensing and metrology will further grow in the coming years. Integration of photonic ICs with other semiconductor devices also opens up new opportunities. Threats: Significant capital requirements for fabrication facilities pose major entry barriers for new players. Established electronic chip manufacturers pose competition through alternative solutions. Economic slowdowns can impact investments in network infrastructure and related technologies. KEY TAKEAWAYS The global photonic IC market is expected to witness high growth over the forecast period driven by increasing investments in optical communication networks globally. The global photonic IC Market is estimated to be valued at US$ 3535.23 Mn in 2024 and is expected to exhibit a CAGR of 5.2% over the forecast period 2024 to 2031. Regional analysis: North America currently dominates the market owing to heavy investments by telecom operators as well as government agencies in the region to develop national 5G infrastructure. Asia Pacific is expected to be the fastest growing market with major upcoming investments planned in countries like China and India. Key players: Key players operating in the photonic IC market are Cargill Inc.,Tate & Lyle PLC,Corbion N.V.,Firmenich SA,Sensient Technologies,Associated British Foods Plc.,Givaudan,Takasago International Corporation,Mane SA,International Flavors & Fragrances Inc. (IFF),Quest Nutrition LLC,Danisco A/S. These companies are focusing on new technological advancements and strategic partnerships to strengthen their market position.Explore more information on this topic, Please visit:https://www.newswirestats.com/photonic-ic-market-size-and-outlook/

#Photonic IC#Photonic IC Market#Photonic IC Market size#Photonic IC Market share#Coherent Market Insights

0 notes

Text

Silicon Photonics Market Drives by Demand for High Bandwidth

Silicon photonics technology refers to the integration of Photonic systems and electronic integrated circuits (IC) on a single silicon chip. It utilizes optical devices such as waveguides, modulators, detectors and switches fabricated using complementary metal oxide semiconductor(CMOS) process. Silicon photonics helps in improving bandwidth and reducing size, weight and energy consumption of telecommunication networks and optical interconnects. It finds wide applications in data centers, high performance computing, healthcare, consumer electronics among others. The technology enables high-speed data transfers between processors and other components without electrical bottlenecks. The global silicon photonics market is estimated to be valued at US$ 1949.78 Mn in 2023 and is expected to exhibit a CAGR of 4.3% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights. Market Dynamics: One of the major drivers for the growth of silicon photonics market is the increasing demand for data centers. Rapid digitization across industries has led to exponential surge in data generation. This has necessitated increased data storage and processing capacities globally. Silicon photonics offers significant advantages over traditional copper infrastructure in data centers such as reduced size, higher bandwidth, lower power consumption and latency. Additionally, increasing adoption of hyperscale data centers by mega cloud service providers is further augmenting market growth. For instance, according to Cisco annual global cloud index report, global data center IP traffic witnessed a CAGR of 26% from 2017 to 2022 and is expected to grow at a CAGR of 21% from 2022 to 2027. Another driver for the silicon photonics market is increased deployment of 5G networks. 5G network capabilities such as enhanced mobile broadband, massive machine type communications and ultra-reliable low latency communications require increased fiber connectivity and bandwidth. Silicon photonics components enable huge data capacities with reduced latency required for 5G infrastructures. SWOT Analysis Strength: Silicon photonics technology offers higher bandwidth and lower power consumption compared to traditional copper wires. Silicon photonics allows integration of electronic and photonic systems on a single chip leading to compact solutions. The use of silicon as a material makes it compatible with existing microfabrication infrastructure for electronics. Weakness: Development of silicon photonic devices requires high capital investments for equipment and manufacturing facilities. Integrating photonic devices with electronics increases design complexities. Commercialization of these technologies faces challenges related to mass manufacturing. Opportunity: Rising demand for high-speed data transmission and 5G rollout is driving the need for advanced connectivity solutions. Silicon photonics is increasingly being adopted in data center networks, high-performance computers and telecommunication equipment to handle exponential data traffic. Optical interconnects present opportunities to replace copper cables across several industries. Threats: Optical fiber and copper cable manufacturers pose competition as their products have strong market presence. Slow adoption rates and compatibility issues with legacy infrastructure can limit silicon photonics market growth. Key Takeaways The Global Silicon Photonics Market Size is expected to witness high growth over the forecast period driven by exponential data traffic.

Regional analysis: The Asia Pacific region is projected to grow at the fastest pace during the forecast period attributed to massive investments by China, Japan and countries of Southeast Asia in developing theirtelecom and data center infrastructure. China represents around 45% of the Asia Pacific silicon photonics market driven by strong government support for indigenous technology development. Key players operating in the silicon photonics market are Knoll Inc., LLC., HNI Corporation, Herman Miller, Inc., Teknion Corporation, Kimball International Inc., Berco Designs, Kokuyo Co., Ltd., Haworth Inc., Okamura Corporation, and Steelcase Inc. These leaders are focusing on new product launches and partnerships to expand their global footprint.

For More Insights, Read: https://www.newsstatix.com/silicon-photonics-market-size-share-and-growth-forecast-2023-2030/

Related Reports: https://allmeaninginhindi.com/fiber-reinforced-concrete-the-construction-material-of-future/

0 notes

Text

LED Light Modules - Types and Usages

Email: [email protected]

WhatsApp & Wechat: +86 18038197291

www.xygledscreen.com

The LED (Light Emitting Diode) models are a kind of LED device that can be plugged into other compatible units or can function alone as well. While earlier the LED modules were used for business purposes (for instance the channel letters and the signages) only, there today used in a variety of outdoor and indoor settings and for lighting applications as well. Read the article and information given below to know all about the LED light modules, their types and varieties available, and their common uses.

What is an LED light module?

The LED light module typically has multiple LED emitters. A board and fixture contain all these LEDs and provides power to them. The entire assembly acts as a single unit. The assembly contains a semiconductor on which a voltage is applied. When the electrons are energized and can run loose, they start to emit light energy.

The power of the assembly may come from a battery or from any other power source such as the AC current. Since the module consists of an electrified semiconductor, it can emit the lights and the energy as photons in many different colors. Therefore, an LED module can provide you the lights in a rainbow of colors and in different shades. That is why the LED display module has been used widely for advertising purposes since its discovery.

A typical LED display module will consist of a cell that is wrapping a PCB (Printed Circuit Board). There are also the LED bead arrays found on the module that is arranged to take the form of a certain pattern.

New Technologies Being Introduced in LED Modules

The highly illuminated and colorful LED lights also score over their conventional counterparts due to the new and evolving technologies that they incorporate. Some of the latest technological trends improving the LED modules and lights include:

Plug-and-Play: the new LED module that incorporates plug-and-play technology comes with an integrated circuit (IC) that is fixed on board. Hence the components of the LED module are not required to be attached externally anywhere.

Remote Phosphor: new technology can provide for lesser heating and a reduction in color shifts. LED modules having this new technology also have a better life cycle and can provide for good energy efficiency.

Bluetooth wireless communication: LED modules can also be connected wirelessly through the sensors and switches. Such LED modules incorporating the Bluetooth wireless communication technology can be controlled through smartphones as well and are quite energy efficient.

Variety of LED modules

In due course of time, many different and new LED module types and applications are available. An LED module can serve the very specific purpose that you want when you can choose the right type and variety of LED light modules.

Based on their forms, the LED light module can be rectangular or circular. However, with some search, you can also find the star, linear, and square-shaped LED module.

* Side LED module: the side LED modules can be used for illuminating home interiors, and parts and items including the large cabinets.

* Flex LED Strip Module: the highly versatile variety of LED light modules can also be further modified to take different shapes. For instance, the flex LED strips can be used for highlighting the signages, acrylic letters, and their intricate wording.

* Black LED module: this type and variety of LED modules are often used for lighting up or highlighting the inner parts and items including the channel letters, cabinets, and boxes.

Classification of LED Module Based on Size

Based on the size, the LED light models can be classified into small, standard, and large LED modules.

Small LED Module

when you are looking for a light fixture in limited spaces, the small LED module can be a good choice. These models can often be found in the display units and the signages, as well as in the events and celebrations including weddings and parties. The safe and versatile variety of LED modules does not cause problems including heating or flickering and is energy efficient.

Standard LED Module

this module can be good for external (outdoor LED matrix) use and outdoor applications. They also have a waterproof rating including the IP65 rating and can be more reliable. They may have good reach and possess features including the integrated heat sink and the VHB tapes. Such features and characteristics provide for benefits including reduced color deviation and light degradation.

Large LED Module

The large LED module offers greater return depth. Return depth is defined as the space between the surface and the LED emitters. A return depth of 50 mm or more (found in the large LED modules) provides for the precise observance of the LED module and each LED chip even from greater distances. Apart from a wide beam angle, the large LED modules can also be more power-efficient.

Uses of LED Modules

As stated earlier, the LED light modules have been used in outdoor and indoor applications as well, apart from business applications including signages. With many variations, fixtures, and varieties available, the LED light module has now grown to be even more versatile. Some of the common uses of the LED module and the lighting fixtures include:

* Decoration of the patios or the outdoor gardens.

* The smallest steps of the LED module can also be used for highlighting the drawers, cabinets, and other indoor items.

* The vibrant and the different shades of light that the LED module can throw can also accentuate certain bathroom parts including the plants and mirrors.

* The LED module can be a very powerful night lamp that can be used for reading and other purposes.

* LED light modules can also be put in automobiles, cars, and vehicles. They can light up the dashboard or any other part of the interior of a vehicle

* One can improve the ambiance and looks of his/her home interiors by lighting them up with various shades of light and colors.

* LED light modules have also been used for the headlamps and flashlights.

How to choose the right LED panel display module?

The most appropriate LED panel display module is the one that can fit the purpose for which it is purchased. For instance, aspects including the viewing distance can be important for an LED display module that is being chosen for advertising purposes. For these LED modules, you may want to buy one with a larger character size.

Cost: another important aspect can be the price. You do not need to invest heavily when you want to purchase a LED light display module for your home interiors, as you do not need excessive illumination. The lesser powerful varieties will cost less.

Pixel Size: the distance between the two LED lamps or beads of an LED light module is called pixel pitch. It can be an important indicator of the quality of the LED display. Certain aspects that may also reflect quality include protection ability, brightness, and longevity.

Application-based LED modules: Some of the varieties of the LED light module that you can choose depending on the application include:

* DIP LED: the DIP LED module is a common variety of LED module that is used for surface-mount applications. The LED consists of a dual inline package.

* SMD LED: both outdoor and indoor modules and applications are available under this category. The common variety of the LED module is used for surface mount applications.

* GOB LED: GOB stands for glue-on-board. The LED can be used in lamps and is waterproof due to the application of transparent material on the surface of the LED module.

Indoor LED light module: when choosing an LED module for indoors, you should look for the below given LED module characteristics.

* qualities including soft module (possess better resistance to compression).

* stability (for easy installation).

* easy customization, so that the LED can take any shape. The cylindrical screen options are also available now. They can be hanged, installed, or hoisted and have superior brush performance.

* qualities including high brightness, single point maintenance, low maintenance cost, energy-saving features, less dead light rate, and splicing.

Conclusion

The new and versatile LED module comes in a variety of shapes and sizes and can be used for a broad variety of purposes. The LED light module can be offered in varieties including small, standard, and large. There are also even greater varieties available within these specifications. Therefore, you can choose an LED light module based on the specific application you have in mind.

With some research, effort, and time, you can explore an endless number of possibilities. You can illuminate the signages, interior and exterior parts (including drawers and cabinets), and other kinds of places and instances (including events) by choosing a LED light module wisely. Those in the business and advertising industry can make profitable use of the LED light modules and apply and use their imagination to forward their interest. The affordable LED module is available both online and offline and can offer you lighting and displays in sensational colors, shades, and varieties.

0 notes

Text

Semiconductorinsight reports

Flexible Hybrid Electronics Market - https://semiconductorinsight.com/report/flexible-hybrid-electronics-market/

Gallium Nitride (GaN) Power Devices Market - https://semiconductorinsight.com/report/gallium-nitride-gan-power-devices-market/

High Bandwidth Memory (HBM) Market - https://semiconductorinsight.com/report/high-bandwidth-memory-hbm-market/

Integrated Circuit (IC) Packaging Market - https://semiconductorinsight.com/report/integrated-circuit-ic-packaging-market/

Light Detection and Ranging (LiDAR) Market - https://semiconductorinsight.com/report/light-detection-and-ranging-lidar-market/

Microelectronic Mechanical Systems (MEMS) Sensors Market - https://semiconductorinsight.com/report/microelectronic-mechanical-systems-mems-sensors-market/

Next-Generation Memory Market - https://semiconductorinsight.com/report/next-generation-memory-market/

Organic Semiconductor Market - https://semiconductorinsight.com/report/organic-semiconductor-market/

Power Electronics Market - https://semiconductorinsight.com/report/power-electronics-market/

Printed Circuit Board (PCB) Market - https://semiconductorinsight.com/report/printed-circuit-board-pcb-market/

Radio Frequency (RF) Components Market - https://semiconductorinsight.com/report/radio-frequency-rf-components-market/

Semiconductor Intellectual Property (IP) Core Market - https://semiconductorinsight.com/report/semiconductor-intellectual-property-ip-core-market/

Silicon Photonics Market - https://semiconductorinsight.com/report/silicon-photonics-market/

Smart Lighting Market - https://semiconductorinsight.com/report/smart-lighting-market/

System-on-Chip (SoC) Market - https://semiconductorinsight.com/report/system-on-chip-soc-market/

Thin Film Semiconductor Market - https://semiconductorinsight.com/report/thin-film-semiconductor-market/

Ultrathin and Flexible Electronics Market - https://semiconductorinsight.com/report/ultrathin-and-flexible-electronics-market/

Vertical Cavity Surface Emitting Laser (VCSEL) Market - https://semiconductorinsight.com/report/vertical-cavity-surface-emitting-laser-vcsel-market/

Wearable Electronics Market - https://semiconductorinsight.com/report/wearable-electronics-market/

Wide Bandgap Semiconductor Devices Market - https://semiconductorinsight.com/report/wide-bandgap-semiconductor-devices-market/

Wide Bandgap Power Semiconductor Market - https://semiconductorinsight.com/report/wide-bandgap-power-semiconductor-market/

Wireless Power Transmission Market - https://semiconductorinsight.com/report/wireless-power-transmission-market/

Zigbee IC Market - https://semiconductorinsight.com/report/zigbee-ic-market/

3D Printing in Electronics Market - https://semiconductorinsight.com/report/3d-printing-in-electronics-market/

Advanced Semiconductor Materials Market - https://semiconductorinsight.com/report/advanced-semiconductor-materials-market/

Analog and Mixed Signal Devices Market - https://semiconductorinsight.com/report/analog-and-mixed-signal-devices-market/

Automotive Semiconductor Devices Market - https://semiconductorinsight.com/report/automotive-semiconductor-devices-market/

Compound Semiconductor Materials and Devices Market - https://semiconductorinsight.com/report/compound-semiconductor-materials-and-devices-market/

Embedded Non-Volatile Memory Market - https://semiconductorinsight.com/report/embedded-non-volatile-memory-market/

Flexible and Printed Electronics Market - https://semiconductorinsight.com/report/flexible-and-printed-electronics-market/

Gallium Arsenide Devices Market - https://semiconductorinsight.com/report/gallium-arsenide-devices-market/

High Electron Mobility Transistor Market - https://semiconductorinsight.com/report/high-electron-mobility-transistor-market/

Indium Phosphide Devices Market - https://semiconductorinsight.com/report/indium-phosphide-devices-market/

Low Dropout Regulator Market - https://semiconductorinsight.com/report/low-dropout-regulator-market/

Microcontroller Market - https://semiconductorinsight.com/report/microcontroller-market/

Optical Transceiver Market - https://semiconductorinsight.com/report/optical-transceiver-market/

Optoelectronic Components Market - https://semiconductorinsight.com/report/optoelectronic-components-market/

Power Amplifier Market - https://semiconductorinsight.com/report/power-amplifier-market/

Radio Frequency IC Market - https://semiconductorinsight.com/report/radio-frequency-ic-market/

Semiconductor Manufacturing Equipment Market - https://semiconductorinsight.com/report/semiconductor-manufacturing-equipment-market/

0 notes

Text

Shaping Tomorrow's Technology with Sapphire Ingots

Sapphire ingots, a crucial component in the production of various high-tech applications, have gained substantial attention in recent years. This synthetic crystalline form of sapphire plays a pivotal role in the manufacturing of electronic devices, LEDs, and optical components. The sapphire ingot market has witnessed significant growth owing to its exceptional properties and versatile applications. In this article, we will delve into the key factors driving the sapphire ingot market's expansion, the challenges it faces, and the future outlook for this critical industry.

Key Factors Driving the Sapphire Ingot Market:

Electronics and Semiconductor Industry:

One of the primary drivers of the sapphire ingot market is its widespread use in the electronics and semiconductor industry. Sapphire ingots are used as substrates in the production of high-performance electronic devices, such as integrated circuits (ICs) and radio-frequency (RF) components. The superior thermal and electrical properties of sapphire make it an ideal choice for these applications, contributing to the market's growth.

LED Lighting:

The global shift towards energy-efficient lighting solutions has bolstered the demand for LEDs (Light Emitting Diodes). Sapphire ingots are used to produce LED wafers, which offer advantages like long lifespan, high brightness, and energy efficiency. As the LED market continues to expand, the sapphire ingot market experiences a corresponding surge in demand.

Optoelectronics and Photonics: