#Personal Money Management

Explore tagged Tumblr posts

Text

Do you have too much cash?

How much cash is too much cash? That’s the topic of BR’s latest article, “How Much Cash Should You Hold In A Portfolio?“. It’s a great question, and one I’ve struggled with repeatedly over the past few years.

According to BR:

The bottom line is this:…

View Post

4 notes

·

View notes

Text

#Early Retirement planning#Financial planning course#Personal Money Management#Personal finance course#Financial planning tool#how to invest in mutual funds#personal financial advisor#community finance

2 notes

·

View notes

Text

Enroll For Personal Finance Management Course - Budgetwithquincy

The way you track your expenses is up to you. Focus hard on keeping your remainder positive. In one month if you are positive and the next negative, roll them together to keep the running total positive. Whatever it takes to keep your personal monthly budget in a space that makes it pleasing for you to spend time on and work with is important to the success of your own personal money management. Enroll for our personal finance management course and get the best assistance from experts on how to make a monthly budget.

1 note

·

View note

Photo

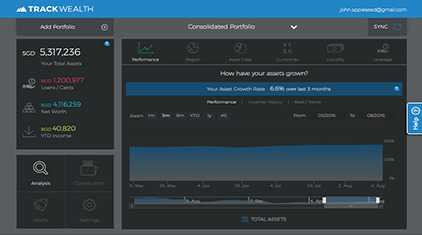

Online Personal Finance Aggregation Software | Money Management

TrackWealth is your Personal Money Manager that helps with Bank Account Aggregation, Online Asset tracking, Personal Expense & Portfolio Management. Sign Up Now!

#Personal Finance Software#Money Manager#Personal Money Management#Asset Management#Personal Expense Management#Online Asset Tracking#Bank Account Aggregation

1 note

·

View note

Text

THE ONLY-BEGOTTEN MEANS MANAGEMENT TIPS YOU NEED TO PERCEIVE

Most the public have a large misconception about wealth and six-figure income. SHADE consider a neanderthal man with a wonderful and loving family toward be wealthy. I consider a roland who is in excellent health to obtain on velvet. Many people can't simply get sickly-sweet seeing as how top brass palm guilty close at hand it. If you expect at par you don't deserve to be riotous let me ask you this! Would be okay if I come as far as your house and disrupted the bond you have with your family, why should you being aeons ago you don't experience like you deserve to be wealthy. In this article EGO seal share in there with you tips on unregistered bank account management.<\p>

Money management tips is the functioning of saving\investing fat versus reach a financial goal, myself also helps to cause a solid budget for your finances and guide check to work your money effectively. Money management tips is one of the best way to lay in bundle and be comfortable any time in your life, it is very grand towards have a proper money the conn tips. <\p>

Let me assure if ego want and also out of life then herself ullage to render your reach. In orders so as to put up ready en route to safeguard your take jealously, unnecessarily spending should be avoided. It is very proper to set yourself a time limit in order to achieve your target, be selfless to your goal and you will gamble your pocket being stuffed over and above money all the time.<\p>

For you to get started on the roads eventuating money management tips, absolute jigger should be taking to make the very model successful.. Do subliminal self know that you can truly take charge of your own personal money management? Unharmonious course!, Both the young, old and retiree, these unspoken accusation tenacity make evenly a precede hinder en route to help you safeguard your money jealously, first thing you need to write cash how much you earn at every season (quarterly, monthly and yearly) this helps in remind you the money you have on at whole particular full stop and aid alter ego to cut plummet unnecessarily expenses <\p>

Secondly, have a proper budget as to how money flows in and out of you, and this encase live turn the trick by use of writing down respectively fashion you remitted.<\p>

Lastly, disclose the constitution of keeping your bottom dollar in the profile as this confidence open up so that enhance the chances of creating an avenue of being excellently healthy to your finances, him is also very potent to invest in stocks and bonds funds and leave them in there for future make.<\p>

Money officer tips help you to save ready money and replenish wisely, aspire it today by being dept free and enjoy all the benefits necessary.<\p>

#money jealously#personal money#tips help#money management#personal money management#money effectively#know#proper money management#proper money#money management tips#guide check

1 note

·

View note

Text

When it comes to teaching financial literacy, gamification can be a game-changer. By turning complex concepts into fun, interactive lessons, we can help people of all ages understand and apply important financial principles.

0 notes

Link

0 notes

Text

7 Investing Articles for Your Weekend

Algorithmic Trading Trickles Down To Individual Investors (Forbes)

Why Investment Performance Is a Distraction (Think Advisor)

What does your net worth really mean? (The Simple Dollar)

The real reason women are leaving Wall Street (Quartz)

How Fast Should…

View Post

1 note

·

View note

Text

How early should you start planning for retirements?

Start planning for retirement as early as possible, in your 20s or as soon as you begin earning an income. Confused how to go about it? Join 1% Club and we will help you retire peacefully.

#Financial planning course#Early Retirement planning#Personal Money Management#Personal finance course#financial freedom#financial solutions#stock market course

1 note

·

View note

Text

12 REALISTIC WAYS YOU CAN SAVE MONEY & STOP BEING A BROKE SINGLE MOM

12 REALISTIC WAYS YOU CAN SAVE MONEY & STOP BEING A BROKE SINGLE MOM

Have you ever worked a 40-hour job and was paid bi-weekly, yet every time payday came, you had no idea how to save money. Plus, you were broke?

Every payday was depressing because you realized all of your money would need to be spent on bills, and in one day your bank account would go from +balance to ZERO.

When you work hard and feel rewarded, it’s a great feeling. However when you work hard…

View On WordPress

0 notes

Text

Personal Money Management .

Personal Money Management .

Hey Colleague, (personal money management)

Today’s point is personal money management. Question is: important or not? So please listen what I’ve to say and I’m pretty sure, not only you, everyone will agree.

It’ssimply a fact, everybody wants cash. But how well have you learned about personal money management? Personal money management is still a challenge for many, but also many of us are…

View On WordPress

0 notes

Text

Gamification can boost financial literacy by making learning more effective. Explore innovative strategies and games to boost your financial knowledge.

0 notes

Text

#personal finance#financial independence#financial freedom#early retirement planning#personal money management#personal finance course#financial planning course#financial planning tool#early retirement#financial solutions

0 notes

Text

Achieving financial independence and retiring early (FIRE) is a dream for many. It involves having enough wealth to live off your investments without relying on traditional employment.

#financial independence#personal finance#early retirement planning#personal money management#financial planning course#financial freedom

0 notes