#Pension tax relief

Explore tagged Tumblr posts

Text

Tax Relief on Private Pension Contributions

New Post has been published on https://www.fastaccountant.co.uk/tax-relief-on-private-pension-contributions/

Tax Relief on Private Pension Contributions

If you’re looking to save for your future and reduce your tax liability at the same time, understanding the tax relief on private pension contributions is essential. This article breaks it down for you, explaining that tax relief can be obtained on private pension contributions, up to 100% of your annual earnings. The availability of tax relief depends on the type of pension scheme and your income tax rate. So whether you have a personal or stakeholder pension, or a workplace pension, relief at source is available. However, in some cases, you may need to claim tax relief on your own. Additionally, if you contribute above the 20% tax rate, you can claim additional tax relief on your self-assessment tax returns. It’s important to note that different rates of additional tax relief apply in Scotland. However, it’s crucial to ensure that your pension scheme is registered with HMRC, as tax relief cannot be claimed otherwise. On the bright side, for individuals who do not pay income tax, automatic tax relief at 20% is available on the first £2,880 of their contributions. Just keep in mind that tax relief cannot be claimed if you’re using pension contributions for personal term assurance policies. With all these details in mind, you’ll be well-equipped to make informed decisions about your pension contributions and take advantage of the available tax relief.

Types of Pension Schemes

When it comes to planning for your retirement, there are various types of pension schemes available to choose from. Understanding the differences between these schemes can help you make informed decisions about which one is right for you.

Personal Pensions

Personal pensions are retirement savings plans that individuals can set up on their own. These schemes are not tied to any particular employer and are therefore portable, meaning you can take your pension with you if you change jobs. Personal pensions offer flexibility and control, allowing you to choose how much you contribute and how your money is invested. It’s important to note that personal pensions require individuals to actively seek out and set up the plan themselves.

Stakeholder Pensions

Stakeholder pensions are a type of personal pension that meet certain government requirements. These schemes are designed to be accessible and affordable for those who may not have access to a workplace pension or who are self-employed. Stakeholder pensions offer low-cost investment options and flexible contributions, making them a popular choice for individuals who want to take control of their retirement savings.

Workplace Pensions

Workplace pensions, also known as occupational pensions, are pension schemes set up by employers for their employees. These schemes offer a convenient way to save for retirement as contributions are automatically deducted from your salary. Workplace pensions can vary in terms of contribution rates and employer matching, so it’s important to review your employer’s pension scheme documents to understand the specific details. Workplace pensions are a valuable employee benefit as they often come with additional contributions from the employer.

youtube

Availability of Tax Relief on Private Pension Contributions

Tax relief is a key advantage of pension schemes, as it can provide a boost to your retirement savings. The availability of tax relief depends on the type of pension scheme you have and your income tax rate.

Depends on Pension Scheme Type

The availability of tax relief varies depending on the type of pension scheme you have. Personal pensions, stakeholder pensions, and some workplace pensions offer tax relief benefits. It’s important to review the specific details of your pension scheme to understand the tax relief options available to you.

Depends on Income Tax Rate

Your income tax rate also plays a role in determining the availability of tax relief. The higher your income tax rate, the more tax relief you may be eligible for on your pension contributions. It’s worth noting that tax relief is generally not available for contributions made to personal term assurance policies using pension contributions.

Relief at Source

Relief at source is a method of obtaining tax relief on pension contributions. This means that the tax relief is automatically added to your pension contributions, effectively reducing the amount of income tax you pay. Relief at source is available in personal pensions, stakeholder pensions, and some workplace pensions.

Claiming Tax Relief

In certain cases, individuals may need to claim tax relief on their pension contributions themselves. This typically applies to contributions made to workplace pensions that do not operate relief at source. To claim tax relief, you will need to complete a self-assessment tax return and include the relevant details of your pension contributions.

Tax Relief Limits

Understanding the limits of tax relief is important for managing your pension contributions effectively. There are limits to how much tax relief you can claim, and these limits depend on various factors.

Up to 100% of Annual Earnings

In general, you can obtain tax relief on your pension contributions up to 100% of your annual earnings. This means that you could potentially benefit from tax relief on contributions that equal your entire annual income. However, it’s important to consider the annual and lifetime allowances set by HM Revenue and Customs (HMRC) to ensure you do not exceed these limits.

Different Rates of Relief in Scotland

It’s worth noting that different rates of additional tax relief apply in Scotland. The Scottish higher rate and additional rate taxpayers have different tax bands and relief rates compared to the rest of the UK. If you live in Scotland, it’s important to review the specific tax rates and relief options available to you.

Relief at Source

Relief at source is an automatic method of obtaining tax relief on your pension contributions. This method simplifies the process of claiming tax relief as it is done automatically for you, making it a popular option for many pension schemes.

Available in Personal and Stakeholder Pensions

Relief at source is available in personal pensions and stakeholder pensions. If you have one of these types of pensions, the tax relief is automatically added to your pension contributions, helping to boost your retirement savings.

Some Workplace Pensions

Not all workplace pensions offer relief at source, but some do. It’s important to review the details of your workplace pension scheme to determine if it operates relief at source. If it does, you can benefit from automatic tax relief on your contributions.

No Income Tax? Still Eligible for Tax Relief

Even if you do not pay income tax, you may still be eligible for tax relief on your pension contributions. This is made possible through the relief at source method, which ensures that tax relief is provided to individuals regardless of their income tax status. However tax relief for those who do not pay income tax is restricted to 20% of the first £2,880 that you pay as pension contribution each year.

Claiming Tax Relief on Private Pension Contributions

While relief at source simplifies the process of obtaining tax relief, there may still be cases where individuals need to claim tax relief themselves. This typically applies to certain workplace pensions that do not operate relief at source.

If your workplace pension does not offer relief at source, you will need to claim tax relief on your pension contributions yourself. This typically applies to older workplace pensions that may not have adopted the relief at source method.

Claiming on Self-Assessment Tax Returns

To claim tax relief, you will need to complete a self-assessment tax return and include the relevant details of your pension contributions. This ensures that you receive the appropriate tax relief on your contributions.

Additional Relief for Contributions above 20% Tax Rate

For individuals who pay income tax at a rate higher than 20%, there may be additional relief available for contributions made above the 20% tax rate. This additional relief can provide further tax benefits for those who fall under the higher tax rate bands.

0 notes

Text

Tax Relief on Private Pension Contributions

If you’re looking to save for your future and reduce your tax liability at the same time, understanding the tax relief on private pension contributions is essential. This article breaks it down for you, explaining that tax relief can be obtained on private pension contributions, up to 100% of your annual earnings. The availability of tax relief depends on the type of pension scheme and your…

View On WordPress

0 notes

Text

Navigating the complexities of pension contributions can be a daunting task. However, with a strategic approach, you can significantly enhance the tax efficiency of your pension savings. This guide aims to demystify the process and provide practical tips for UK residents looking to make the most of their pensions.

#UK pension contributions#tax efficiency#pension tax relief#annual allowance#carry forward pension#Lifetime Allowance#pension investment strategies#retirement planning#Wills & Trusts

0 notes

Text

Demystifying Pension Tax Relief: A Comprehensive Guide to Claims

A financial benefit that many people in the UK might not completely understand is pension tax relief. Although it’s a useful tool for increasing retirement savings, understanding the complexities of the process can be difficult. We demystify how to claim pension tax relief in this extensive guide, providing UK residents with a clear road map to maximise this worthwhile financial opportunity. For more info read this blog.

0 notes

Text

Tax Relief for Pensioners in the Budget 25

The Union Budget 2025 have brought good tax relief for pensioners across India. Union Budget 2025: The Finance Minister has announced a significant overhaul of the income tax structure under the new tax regime. What Sitharaman said: A taxpayer with an income of Rs 12 lakh will now see a benefit of Rs 80,000 in tax savings, which accounts for 100% of the tax payable as per existing rates.A…

0 notes

Text

#pension#contribution#pension contribution#tax advisory#tax relief#tax returns#taxhelpforseniorsnearme#taxquestionshelp

0 notes

Text

How the Biden-Harris Economy Left Most Americans Behind

A government spending boom fueled inflation that has crushed real average incomes.

By The Editorial Board -- Wall Street Journal

Kamala Harris plans to roll out her economic priorities in a speech on Friday, though leaks to the press say not to expect much different than the last four years. That’s bad news because the Biden-Harris economic record has left most Americans worse off than they were four years ago. The evidence is indisputable.

President Biden claims that he inherited the worst economy since the Great Depression, but this isn’t close to true. The economy in January 2021 was fast recovering from the pandemic as vaccines rolled out and state lockdowns eased. GDP grew 34.8% in the third quarter of 2020, 4.2% in the fourth, and 5.2% in the first quarter of 2021. By the end of that first quarter, real GDP had returned to its pre-pandemic high. All Mr. Biden had to do was let the recovery unfold.

Instead, Democrats in March 2021 used Covid relief as a pretext to pass $1.9 trillion in new spending. This was more than double Barack Obama’s 2009 spending bonanza. State and local governments were the biggest beneficiaries, receiving $350 billion in direct aid, $122 billion for K-12 schools and $30 billion for mass transit. Insolvent union pension funds received a $86 billion rescue.

The rest was mostly transfer payments to individuals, including a five-month extension of enhanced unemployment benefits, a $3,600 fully refundable child tax credit, $1,400 stimulus payments per person, sweetened Affordable Care Act subsidies, an increased earned income tax credit including for folks who didn’t work, housing subsidies and so much more.

The handouts discouraged the unemployed from returning to work and fueled consumer spending, which was already primed to surge owing to pent-up savings from the Covid lockdowns and spending under Donald Trump. By mid-2021, Americans had $2.3 trillion in “excess savings” relative to pre-pandemic levels—equivalent to roughly 12.5% of disposable income.

So much money chasing too few goods fueled inflation, which was supercharged by the Federal Reserve’s accommodative policy. Historically low mortgage rates drove up housing prices. The White House blamed “corporate greed” for inflation that peaked at 9.1% in June 2022, even as the spending party in Washington continued.

In November 2021, Congress passed a $1 trillion bill full of green pork and more money for states. Then came the $280 billion Chips Act and Mr. Biden’s Green New Deal—aka the Inflation Reduction Act—which Goldman Sachs estimates will cost $1.2 trillion over a decade. Such heaps of government spending have distorted private investment.

While investment in new factories has grown, spending on research and development and new equipment has slowed. Overall private fixed investment has grown at roughly half the rate under Mr. Biden as it did under Mr. Trump. Manufacturing output remains lower than before the pandemic.

Magnifying market misallocations, the Administration conditioned subsidies on businesses advancing its priorities such as paying union-level wages and providing child care to workers. It also boosted food stamps, expanded eligibility for ObamaCare subsidies and waved away hundreds of billions of dollars in student debt. The result: $5.8 trillion in deficits during Mr. Biden’s first three years—about twice as much as during Donald Trump’s—and the highest inflation in four decades.

Prices have increased by nearly 20% since January 2021, compared to 7.8% during the Trump Presidency. Inflation-adjusted average weekly earnings are down 3.9% since Mr. Biden entered office, compared to an increase of 2.6% during Mr. Trump’s first three years. (Real wages increased much more in 2020, but partly owing to statistical artifacts.)

Higher interest rates are finally bringing inflation under control, which is allowing real wages to rise again. But the Federal Reserve had to raise rates higher than it otherwise would have to offset the monetary and fiscal gusher. The higher rates have pushed up mortgage costs for new home buyers.

Three years of inflation and higher interest rates are stretching American pocketbooks, especially for lower income workers. Seriously delinquent auto loans and credit cards are higher than any time since the immediate aftermath of the 2008-09 recession.

Ms. Harris boasts that the economy has added nearly 16 million jobs during the Biden Presidency—compared to about 6.4 million during Mr. Trump’s first three years. But most of these “new” jobs are backfilling losses from the pandemic lockdowns. The U.S. has fewer jobs than it was on track to add before the pandemic.

What’s more, all the Biden-Harris spending has yielded little economic bang for the taxpayer buck. Washington has borrowed more than $400,000 for every additional job added under Mr. Biden compared to Mr. Trump’s first three years. Most new jobs are concentrated in government, healthcare and social assistance—60% of new jobs in the last year.

Administrative agencies are also creating uncertainty by blitzing businesses with costly regulations—for instance, expanding overtime pay, restricting independent contractors, setting stricter emissions limits on power plants and factories, micro-managing broadband buildout and requiring CO2 emissions calculations in environmental reviews.

The economy is still expanding, but business investment has slowed. And although the affluent are doing relatively well because of buoyant asset prices, surveys show that most Americans feel financially insecure. Thus another political paradox of the Biden-Harris years: Socioeconomic disparities have increased.

Ms. Harris is promising the same economic policies with a shinier countenance. Don’t expect better results.

#Wall Street Journal#kamala harris#Tim Walz#Biden#Obama#destroyed the economy#america first#americans first#america#donald trump#trump#trump 2024#president trump#ivanka#repost#democrats#Ivanka Trump#art#landscape#nature#instagram#truth

165 notes

·

View notes

Text

Ingyen pénz a HMRC-től!

17 notes

·

View notes

Text

“After your older, two things are possibly more important than any others: Health and money.” Helen Gurley Brown

The hot air around the state pension, the triple lock, and affordability continues. And is all a smoke screen for the fact that Britain has one of the lowest state pensions in the OECD.

Last year we had this headline:

State pension triple lock ‘utterly unaffordable’ and will 'bankrupt UK', Tory MP declares." (Mirror: 21/11/22)

Yesterday we had:

“Work and Pensions Secretary Mel Stride admits triple lock is 'not sustainable’ in the long-term." (itvx: 12/09/23)

And

“Treasury officials are discussing a one-off break from the pensions triple lock that could save £1bn by preventing a bumper 8.5% increase in the state pension next year." (Guardian: 12/09/23)

You would think the government was literally giving away money to pensioners if you took the right-wing press and Tory politicians seriously. (Starmer is no better) The truth is very different.

In 2018 it was reported that the UK had:

“He lowest pension rate in the developed world… pensioners in the United Kingdom suffer from the worst deal of any OECD country, receiving just 29% of a working wage when they retire. To put this into perspective, the OECD average is 63% and the average for EU member states is 71%. Elsewhere, the pension rate in the United States is 49%, while in China, which is home to more than 1.4 billion people, the rate is 83%, OECD data shows." (weforum.org:23/02/18)

That was five years ago. Little has changed since then.

“The UK spends very little on state pensions compared to other European countries and has the highest percentage of pensioners in poverty, despite tax reliefs on workplace and private pensions,… The UK government only spends 4.7% of GDP on state pensions, much less than many other countries in Europe." (Trustnet:10/11/22)

So next time you see a politician wringing their hands and sadly bemoaning the fact that the triple lock for pensioners is unaffordable know that the tears shed are of the crocodile variety and nothing could be further from the truth.

6 notes

·

View notes

Text

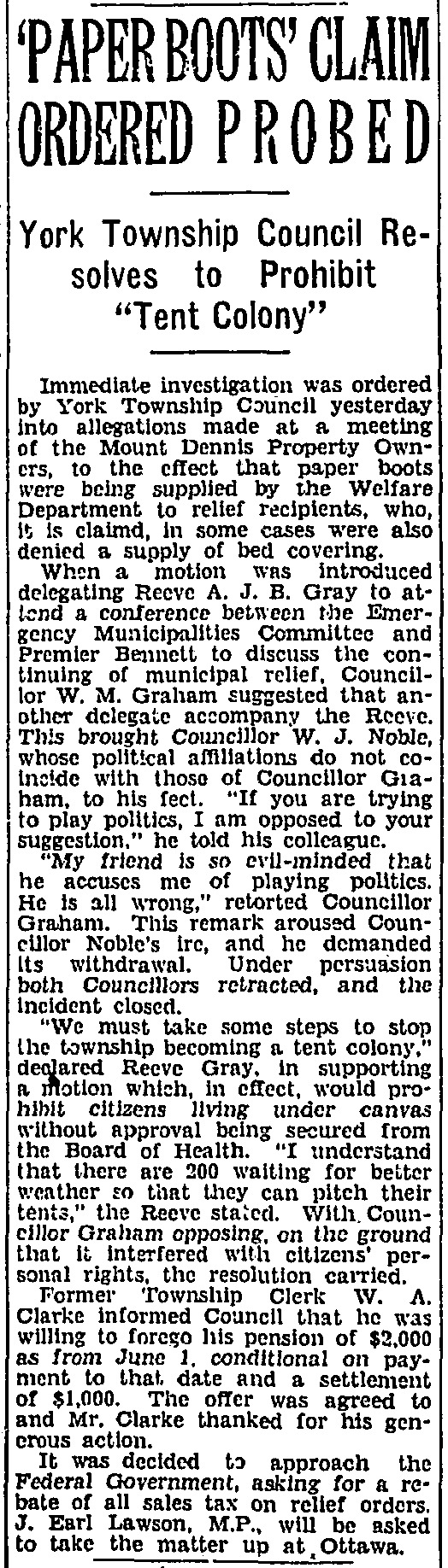

"PAPER BOOTS CLAIM ORDERED PROBED," Toronto Globe. April 19, 1933. Page 9. ---- York Township Council Resolves to Prohibit "Tent Colony" ---- Immediate investigation was ordered by York Township Council yesterday into allegations made at a meeting of the Mount Dennis Property Owners, to the effect that paper boots" were being supplied by the Welfare Department to relief recipients, who, it is claimed, in some cases were also denied a supply of bed covering.

When a motion was introduced delegating Reeve A. J. B. Gray to at- lend a conference between the Emergency Municipalities Committee and Premier Bennett to discuss the continuing of municipal relief, Councillor W. M. Graham suggested that an- other delegate accompany the Reeve. This brought Councillor W. J. Noble, whose political affiliations do not coincide with those of Councillor Graham, to his fect. "If you are trying to play politics, I am opposed to your suggestion," he told his colleague.

"My friend is so evil-minded that he accuses me of playing politics. He is all wrong," retorted Councillor Graham. This remark aroused Councillor Noble's ire, and he demanded its withdrawal. Under persuasion both Councillors retracted, and the incident closed.

"We must take some steps to stop the township becoming a tent colony," declared Reeve Gray, in supporting a motion which, in effect, would prohibit citizens living under canvas without approval being secured from the Board of Health. "I understand that there are 200 waiting for better weather so that they can pitch their tenta," the Reeve stated. With Councillor Graham opposing, on the ground that it interfered with citizens' personal rights, the resolution carried.

Former Township Clerk W. A. Clarke informed Council that he was willing to forego his pension of $2,000 as from June 1, conditional on payment to that date and a settlement of $1,000. The offer was agreed to and Mr. Clarke thanked for his generous action.

It was decided to approach the Federal Government, asking for a rebate of all sales tax on relief orders. J. Earl Lawson, M.P., will be asked to take the matter up at, Ottawa.

#york township#tent city#unemployed#unemployment#sleeping in tents#homelessness#homeless#evictions#fighting evictions#tenants#great depression in canada#working class struggle#punishing the poor#middle class ideology#when freedom was lost

1 note

·

View note

Text

CALIFORNIA DREAMING

California is an extraordinary state. Not only is it the most populous state in the United States, but also the richest, with an economy that would be the fifth largest in the world if it were an independent nation. Perhaps, merely because of its size, it also leads the nation in many undesirable characteristics such as poverty, homelessness, drug abuse, addiction and welfare costs. Others, not related to size, include high taxes, high housing costs and other costs of living, extremely high pension costs, high gas prices and high out-migration, especially of highly successful individuals and businesses. A year or two ago, California had a large budget surplus. Currently, it carries one of the largest, if not the largest budget deficit of any American State. It is, like several other states, a one-party state, so the party in power can claim full credit for everything that goes well and deserves to be held accountable for everything that goes badly. But, in fact, that is not what happens. The party in power does claim full credit for anything going well (or even can spun to do so) but denies all responsibility for everything that goes badly. This approach is not peculiar to California. Most, if not all one-party states do the same thing. Divided states do too, just blaming the opposition. But being so prominent, when good or bad news plays out in California, it attracts more attention. California has now been in drought for several years. Drought is very common in California and can be persistent. Around 1200 years ago California endured a drought that lasted 200 years. That one was of course not related to fossil fuels, but just happened naturally. The recent drought was attributed by most Californians (and their state government) to climate change, and the burning of fossil fuels. Some of the California remedies to this alleged root cause included banning the sale of gas-powered vehicles, gas stoves, the use of two-cycle engines in yard equipment and mandating heat pumps as replacements for fossil fuel HVAC systems. Before most of these bans (and other green initiatives) took full effect, the winter of 2022-2023 arrived. The rain and snowfall from that wet season was extraordinarily abundant, due to what were identified as multiple “atmospheric rivers” that brought waves of precipitation from the Pacific Ocean into California. Many people in the rest of the country were unfamiliar with the term “atmospheric rivers” and were told they too, like droughts, were brought by climate change. Californians should know better. A 2013 Scientific American article (by two California academics, Dettinger and Ingram) demonstrated that these storms (including a disastrous one in 1861-1862 that completely submerged the city of Sacramento) have occurred at least every 200 years, with less drastic versions occurring more frequently. Indeed, these storms have long been referred to as The Pineapple Express, because the precipitation commences in the Pacific near Hawaii. The point of these observations is that while climate change may affect both the intensity and frequency of the storms, it is not the cause, since they have been documented (through sediment studies) as early as the year 212, and at least one every 200 years after that. Perhaps the 1862 mega flood was affected by fossil fuels, but none of the ones before that were, and yet they happened anyway. I fully expect that the state of California will be requesting relief from the rest of the country when the snowmelt from the current Pineapple Express results in even more flooding than has occurred so far. They will doubtless assert that the current emergency is caused by climate change, and not any of the acts or omissions of state policies. I have no aversion to helping another state in an emergency, but not one whose own policies have created or aggravated their problem. My gas-powered tools, automobiles. stove and HVAC system had might have slightly contributed to climate change, but essentially had nothing to do with California’s current problem. Their unsustainable development policies, antediluvian water policies, lack of preparation, mismanagement and woke, green virtue signaling as a substitute for all the foregoing failures is their own problem to fix (which should be easy in a one-party state). Anyway, here is a cheerfully cynical contrarian sonnet on the subject. PINEAPPLE EXPRESS PROVES CLIMATE CHANGE Now Californians have the rain To slake their latest, driest drought Lakes overflow. It’s not about Failure to plan, but climate change. They blame us now for floods of pain And we should pay to bail them out. It’s all our fault they loudly shout And not their still unfinished train To nowhere. Reparations. Woke. They need our money now, again. But if we pay what they won’t spend They will be spending more, still broke. For virtue signals all they do And we, who don’t, must pay them to. © 2023 frankcmcclanahaniii

4 notes

·

View notes

Note

Re economy question it tickles me how the Ministry looks like the biggest employer of Wizarding Britain…their economy is a mishmash of preindustrial commerce and landholding held together by a kleptocracy

The number of people employed by the Ministry is like, absurd. To the point where I assumed it was overrepresented for Plot Reasons. Like, we need Arthur to have a Ministry job so he has the inside scoop on Bertha Jorkins and a bunch of stuff in fifth year, we meet a lot of Aurors because this is a story about a war, a lot of the bureaucrats who get involved with Harry's hearing/school administration are a result of the Umbridge Arc, and I take it as implicit that most of all jobs Just Happen Somewhere Else, because like.

Okay sidebar about the Ministry. Let me talk to you about the Ministry. Can I talk to you about the fucking Ministry? Put aside the fact that there are more named Ministry employees in this story than there are normal taxpayers. Put aside the fact that the banking system being run exclusively by a disenfranchised underclass that you happen to treat like shit is a policy move that ranks up there with "invading the Soviet Union in December." Put aside the fact that this is basically a modern welfare state stapled on top of a market that's still hammering out the kinks of industrial economics in 19-fucking-91. Here's my question, alright:

WHERE IS THE MONEY GOING?

Let's do an exercise. In 1990, public sector employment was 27% of the British national workforce (and growing). The population dynamics of Harry Potter are irrevocably fucked, so this is only going to even-sort-of-work if we fudge it, as I'm about to do: I'm setting the number of Ministry workers, e.g. salaried bureaucrats, at 10,000. Base pay for a government bureaucrat in 1990, is, what, £25-30,000? Let's say so. Multiply that by 10k, you get a personnel budget of £300 million. Sounds like a lot of money, right?

Except what the fuck does the Ministry do? The reason employment costs balloon in the late twentieth century is because we see the rise of social services that require a lot more administrators to vet and deliver — social security in the United States, the NHS in Britain, public education, etc., etc. Public housing! This is why Maggie Thatcher goes postal and starts hack-sawing the national budget. But what, exactly, does the Ministry of Magic deliver? We don't see any poverty relief programs being administered to the Weasleys. Pensions are a thing, but only for Ministry workers. Health services? Sure, let's say St. Mungo's is a public hospital, fair enough. And Hogwarts is free for all British citizens, that's cool, that's probably some expense. But those are two institutions. Where's the rest of it? Where are the big-ticket items that justify this huge corpus of employees? A pure regulatory state does not require this much personnel! There's a whole Department for Games and Sports (e.g. quidditch — oh wait, that's a private league sport!), but not a Department of Energy, or Department of Housing? Fuck off! There is not!

That's not even the biggest problem, though. There's a much, much bigger issue with Ministry organization: There's no fucking Inland Revenue! It doesn't matter how the budgets are balanced, frankly, because unless IR is hidden somewhere in a secret department we don't know about, nobody is paying the government for fuck!

Admittedly, this is pedantry, at some point. JKR was frankly under no obligation to explore the finer points of tax collection in her series of children's novels. I get that, I do. But I'm reminded of what George R. R. Martin said about his annoyance with fantasy novels — the fact that you never got to judge these mythical kings and Chosen Ones by their actual leadership choices. You never see what Aragorn's tax policy is like. And in reality, that's much more important than how good you are with a sword. So — especially in things like The Cursed Child, which actually does try to explore the "adult" world of Harry Potter — it's fascinating that there are so are so many parts of the universe that just live in the world of inference.

6 notes

·

View notes

Text

Why Pension Contributions Are a Smart Way to Manage Your Taxable Income

Boost your pension savings while reducing taxable income with tax-efficient contributions. Learn how pension tax relief, employer contributions, and inheritance tax benefits can help you build wealth for the future. Secure your retirement with expert pension planning advice today.

#pension tax relief UK#reducing taxable income with pensions#UK pension contributions#tax-efficient retirement planning#inheritance tax and pensions#pension savings UK#pension tax planning#Wills & Trusts

0 notes

Text

Claim Pension Tax Relief - Mysimplytax

Are you looking to Claim Pension Tax Relief? At mysimplytax, we understand the importance of maximizing your financial opportunities, especially when it comes to securing your future through pension savings. Visit now!

0 notes

Text

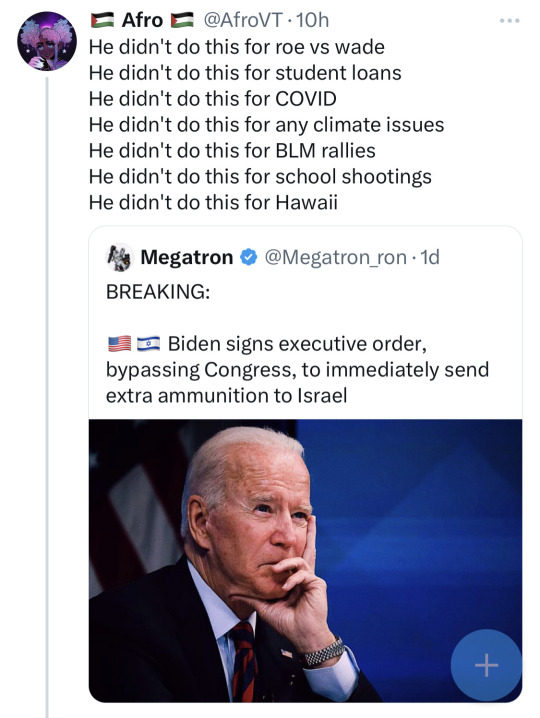

This is blatant disinformation. All likely in order to dissuade people from voting for him in 2024. Putin desperately wants Trump back in office as that will effectively allow him to improve the Russian situation. And I'm not telling you to vote for Biden because he's not trump, I'm telling you to vote for him because he is a great president. Don't believe me, keep reading. I will go over the truth below:

1) Biden did not sign any executive order about Israel aid as far as I know. He did sign one in aid of Native Americans. Here is the federal register of executive orders: https://www.federalregister.gov/presidential-documents/executive-orders/joe-biden/2023

2) He did what he could via abortion access, such as funding abortions for veterans. src:

https://apnews.com/article/abortion-biden-lloyd-austin-government-and-politics-dc6a0317775596ffc7945acc79b7559e

3) He has made several inroads into student loans. He's been getting people relief over predatory loans. In addition, he attempted a $10000-$20000 student loan forgiveness program that got struck down by the Trump supreme court(let's not repeat 2016, please). He also improved the system to give borrowers more help. (He is still attempting student loan relief via congress, but that will take quite some time). src:

https://thehill.com/homenews/education/4370297-biden-student-loans-debt-relief-2023-whiplash/

https://studentaid.gov/debt-relief-announcement

4) He did several executive orders on COVID, 8 in 2021 and 1 in 2023, for various issues. He put in mandatory federal vaccinations, as well as COVID relief. Not to mention, one of the first acts, that he passed as president was the third COVID stimulus. src:

https://www.federalregister.gov/presidential-documents/executive-orders/joe-biden/2021

https://www.federalregister.gov/presidential-documents/executive-orders/joe-biden/2023

5) His Build Back Better plan which passed as the Inflation Reduction Act of 2022 literally is working towards making the country use clean energy. Here are some good quotes from the bill:

"In addition, the act provides funding to the Department of Housing and Urban Development for loans and grants. The loans and grants must fund projects that address affordable housing and climate change issues."

"The act modifies and extends through 2024 the tax credit for producing electricity from renewable resources, specifically wind, biomass, geothermal and solar, landfill gas, trash, qualified hydropower, and marine and hydrokinetic resources."

src: https://www.congress.gov/bill/117th-congress/house-bill/5376

6) Here's a whole page on Biden's efforts to improve the lives of black americans: https://www.whitehouse.gov/briefing-room/statements-releases/2021/10/19/fact-sheet-the-biden-harris-administration-advances-equity-and-opportunity-for-black-people-and-communities-across-the-country/

7) Biden has been attempting to curb school shootings during his presidency. here are some articles:

https://www.edweek.org/policy-politics/biden-credits-school-shooting-survivors-as-he-creates-gun-violence-prevention-office/2023/09

https://www.whitehouse.gov/briefing-room/statements-releases/2023/05/18/statement-from-president-joe-biden-on-five-years-since-the-shooting-at-santa-fe-high-school/

https://abcnews.go.com/Politics/biden-call-end-epidemic-gun-violence-year-after/story?id=99560777

8) Hawaii was provided aid by Biden during and after the wildfires. src:

https://www.fema.gov/press-release/20230817/biden-harris-administration-provides-38-million-assistance-hawaii-residents

Now for some extra stuff, you might not have heard.

9) Biden did away with the prepay pension funding policy for USPS workers, as well as improving working conditions. Here's an article from the USPS union: https://apwu.org/postal-service-reform-act-2022 And here's the act itself: https://www.congress.gov/bill/117th-congress/house-bill/3076

10) Biden having worked with rail unions to get them paid sick days. src:

https://www.ibew.org/media-center/Articles/23Daily/2306/230620_IBEWandPaid

Ultimately, Biden is only 1 person. He can't do everything himself. We have to act too. We have to vote. It doesn't matter who the president is, if the courts, and congress are against him.

63K notes

·

View notes

Text

Top Tax-Saving Strategies for Individuals and Businesses

Tax-saving is a priority for both individuals and businesses, especially when the end of the financial year is fast approaching. Proper planning and understanding of available tax-saving options can significantly reduce your tax liability. Whether you’re a salaried individual or a business owner, adopting the right tax-saving strategies can lead to long-term financial benefits. This article highlights the best tax-saving strategies for individuals and businesses, with expert insights from Mind Your Tax, a Best CA Firm in Bangalore offering tailored advice on taxes and finances.

Tax-Saving Strategies for Individuals

Maximize Deductions under Section 80C

One of the most popular tax-saving strategies for individuals is investing in avenues eligible for deductions under Section 80C of the Income Tax Act. You can claim deductions of up to ₹1.5 lakh per year by investing in options such as:

Public Provident Fund (PPF)

Employees' Provident Fund (EPF)

National Savings Certificate (NSC)

Tax-saving Fixed Deposits (FDs)

Life Insurance Premiums

Sukanya Samriddhi Scheme

These investments not only reduce your taxable income but also help you build wealth over time.

Health Insurance (Section 80D)

Health insurance is another important tax-saving tool. Under Section 80D, you can claim deductions for premiums paid on health insurance policies for yourself, your spouse, children, and even parents. The limit varies:

For self and family: Up to ₹25,000 (₹50,000 for senior citizens)

For parents: Up to ₹25,000 (₹50,000 for senior citizens)

Investing in a comprehensive health insurance policy is a win-win situation, as it protects you financially and provides tax relief.

Interest on Home Loan (Section 24b)

For those with home loans, claiming a deduction on the interest paid under Section 24b can significantly reduce your taxable income. You can claim up to ₹2 lakh per year for interest paid on home loans for the purchase, construction, or renovation of a house.

Invest in National Pension Scheme (NPS)

The National Pension Scheme (NPS) is a long-term retirement-focused investment vehicle that offers tax benefits. Under Section 80CCD(1B), you can claim an additional deduction of ₹50,000 over and above the ₹1.5 lakh limit under Section 80C. This makes NPS one of the best options for long-term tax saving.

Tax-Saving Strategies for Businesses

GST Registration and Input Tax Credit (ITC)

For businesses, GST registration in Bangalore and other cities is crucial for ensuring compliance with the Goods and Services Tax system. Once registered, businesses can claim Input Tax Credit (ITC) for taxes paid on business expenses such as raw materials, services, or capital goods. This reduces the overall tax burden on the business.

For example, a manufacturer can claim the ITC on the GST paid for raw materials used in production, which helps reduce the cost of goods sold, thereby lowering the taxable income and tax liability. Engaging GST consultants in Bangalore ensures that your business makes the most of these credits and avoids costly mistakes in the filing process.

Depreciation on Assets

Businesses can save a substantial amount of tax by claiming depreciation on fixed assets such as machinery, buildings, and equipment. Depreciation is deducted from the business income, reducing the overall taxable profit. This deduction is available under the Income Tax Act and helps businesses lower their tax liability while simultaneously writing off the cost of assets over their useful life.

Tax-Exempt Allowances and Perks

Certain allowances and perks provided to employees are tax-exempt or partially exempt, reducing the taxable income for both employers and employees. Some of these include:

House Rent Allowance (HRA)

Special Allowances for transport and travel

Food Coupons and Meal Vouchers

Leave Travel Allowance (LTA)

Businesses can structure employee compensation in such a way that these exemptions are maximized, leading to tax savings for both the business and the employee.

Research and Development (R&D) Tax Benefits

If your business invests in research and development, you can avail of significant tax benefits under Section 35 of the Income Tax Act. R&D activities, whether in the fields of technology, pharmaceuticals, or manufacturing, are eligible for deductions. The government provides 100% deduction for in-house R&D expenses, encouraging innovation and technological advancement in the industry.

Engage a Professional for Tax Planning

The complexity of tax laws and regulations makes it crucial for businesses to work with professionals like Mind Your Tax, a Best CA Firm in Bangalore. Their expertise in tax planning, compliance, and filing ensures that businesses stay on top of their tax obligations while making the most of available exemptions, deductions, and credits.

Conclusion

Both individuals and businesses can significantly benefit from effective tax planning. For individuals, strategies such as maximizing deductions under Section 80C, investing in health insurance, and claiming home loan interest deductions are great ways to save on taxes. For businesses, GST registration, claiming input tax credit, and utilizing deductions for depreciation and R&D expenses can help minimize tax liabilities.

With the guidance of GST consultants in Bangalore and the expert services offered by Mind Your Tax, businesses and individuals can ensure that they are following the most effective tax-saving strategies and remain compliant with tax laws. Whether you're looking for GST registration in Bangalore or need professional tax advice, reaching out to Mind Your Tax will help you optimize your tax savings and ensure financial growth.

0 notes