#Peer-to-Peer Lending

Explore tagged Tumblr posts

Text

10 Proven Passive Income Strategies to Skyrocket Your Earnings in 2025

The idea of making money while you sleep is no longer a myth. With smart planning and strategic investments, you can create a portfolio of passive income streams that consistently generate earnings over time. This article details 10 Proven Passive Income Strategies that have been tested and proven effective, even in today’s dynamic economic environment. Our focus is on actionable advice tailored…

#10 Proven Passive Income Strategies#Affiliate Marketing#Blog Monetization#Digital Product Creation#Dividend Investing#Earnings Growth#Financial Freedom#Investment Strategies#Mobile App Development#Online Courses#Passive Income 2025#Passive Income Ideas#Passive Income Tips#Peer-to-Peer Lending#Real Estate Crowdfunding#REITs Investing#Self-Publishing eBooks#Side Hustles#Wealth Building#YouTube Monetization

0 notes

Text

#Passive Income#Financial Independence#Real Estate Investments#Passive Income Strategies#Offline Income#Wealth Building#Income Streams#Rental Properties#High-Yield Savings#CD Investments#Small Business Ideas#Peer-to-Peer Lending#Royalties#Franchise Ownership#Financial Freedom#Side Hustles#Investing#Money Management#Personal Finance#Earn Money While You Sleep#Residual Income#Long-Term Investments#Property Management#Financial Security#Investment Tips#Passive Earnings#Entrepreneurship#Business Ownership#Real Estate Wealth#Savings Growth

1 note

·

View note

Text

Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

Smart passive income ideas can secure your financial future and provide steady earnings. Explore profitable ventures like rental properties, dividend stocks, and online businesses.

Securing a prosperous future requires savvy income strategies that work for you around the clock. Passive income streams offer a way to earn money without the need to actively work all the time. These strategies include investing in real estate for long-term rental profits, engaging in the stock market for dividends, or leveraging digital platforms to sell products or create content that generates revenue continuously.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Passive Income Essentials

Securing your financial future doesn’t have to mean working endless hours. Smart passive income strategies can unlock a world where earnings grow even as you sleep. There’s a wealth of options out there — each with its unique strengths. To navigate this domain, understanding the basics and choosing the right streams is vital.

Demystifying Passive Income

Passive income often seems shrouded in mystery. Many people wonder if it’s a practical goal. In essence, it’s earning money from investments or work you’ve done once. This could mean rental income, dividends, or sales from an e-book. Distinct from active income, it requires less time to manage daily.

Purchase and rent out property

Invest in dividend-paying stocks

Create digital products for sale

It’s about smart choices now for long-term benefits. For the ideal start, assess the potential risks and returns of each option.

Financial Stability Through Passive Streams

Passive income is more than just extra cash. It’s a step toward lasting financial safety. The goal is to create multiple income sources that can support your lifestyle, even if you stop working. Diversification is key — spreading your investments across different areas reduces the risk.

Type of Passive Income Benefits Real Estate Steady income and property value growth Stocks with Dividends Regular income plus potential stock value increase Creating an Online Course Earn with each new student enrollment

Review these options to align with your life goals and economic situation. Start building that foundation for a more secure and sustained income stream today. Remember, the path to financial freedom involves planning and the savvy generation of earnings on the side. Get started, and watch your financial health flourish over time.

Diving Into The Stock Market

Exploring the stock market opens up a world of possibilities for passive income. It’s a tried-and-true approach that savvy investors leverage for long-term financial gains. You don’t need to be a Wall Street expert to get started. With the right strategy, anyone can tap into this lucrative avenue.

Dividend-yielding Stocks

Dividend-yielding stocks stand out as a solid option for passive income. They pay out a portion of profits to shareholders regularly. This means you earn money simply for owning the stock. Consider these key points:

Choose companies with a history of stable dividends.

Look for those with potential for dividend growth.

Reinvest dividends to compound your earnings.

Index Funds & Etf Portfolios

Index funds and ETFs offer a more hands-off investment approach. They track specific market indices and spread your investment across numerous stocks. This leads to a balanced and diversified portfolio. Here’s why they’re advantageous:

Lower fees: Expense ratios are typically minimal with index funds and ETFs.

Automatic diversification: Instant exposure to a variety of assets helps mitigate risk.

Simplicity: They’re easy to purchase, making them ideal for first-time investors.

Comparison of Dividend Stocks vs. Index Funds & ETFs Investment Type Income Potential Risk Level Dividend Stocks High Moderate to High Index Funds & ETFs Varies Low to Moderate

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Real Estate For Residual Income

Earning while you sleep sounds ideal, and real estate often fits this dream. With strategic investments, you can build a robust stream of passive income. Real Estate remains top-tier for growing wealth. Let’s dive into real estate strategies that can secure a more prosperous future.

Rental Properties Revenue

Rental properties can turn a tidy profit monthly. Location is everything, so choose areas with growth potential. Starting can be more hands-on, but many opt for management services to handle day-to-day tasks. Here’s why rentals rock:

Steady Cash Flow: Monthly rent payments go straight into your pocket.

Tax Advantages: Deduct property expenses from your income.

Appreciation Over Time: Rentals can increase in value, boosting your net worth.

Your investment in real estate can grow with careful planning. Understanding the market helps ensure success.

Real Estate Investment Trusts (reits)

REITs are powerful for portfolio diversification. They allow small investors to earn from large real estate ventures without owning the properties themselves. Stock-like ease with real estate rewards! Key REITs facts include:

Pros Cons High Dividend Yields Sensitive to Interest Rates Liquidity Like Stocks Market Fluctuations Diversified Assets Less Control Over Investments

Credit: printify.com

Online Ventures That Generate Cash

Embarking on online ventures unlocks doors to a world where income flows even as you sleep. The internet is bustling with opportunities to create a stream of passive income. Let’s explore some smart ways to fill your pockets without the constant hustle.

Blogging And Affiliate Marketing

Blogging is not just a platform for sharing ideas. It’s a robust money-making tool. A successful blog captures the attention of thousands, opening avenues for monetization. Adding affiliate marketing turns your content into a cash magnet. Here’s how to start:

Select a niche that you love and know well

Launch a blog with a user-friendly CMS like WordPress

Regularly post high-quality content

Apply SEO strategies to increase visibility

Join affiliate programs related to your niche

Recommend products through your posts

Remember, consistency is key. Regular updates paired with SEO will drive traffic. Higher traffic leads to more earnings through affiliate links.

Creating And Selling Digital Products

Digital products offer a limitless income potential. They’re convenient to create, distribute, and sell globally. Popular digital products include:

Type of Product Examples Platforms to Sell eBooks Guides, Novels, How-tos Amazon Kindle, Your Website Online Courses Video Tutorials, Lectures Udemy, Teachable Stock Photography Photos, Graphics Shutterstock, Adobe Stock

To succeed, identify your audience’s needs. Create valuable content. Market through social media and email lists. An initial effort can translate into regular sales without any added work.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Turn Hobbies Into Income Channels

Imagine your favorite hobby making cash while you sleep. Turn hobbies into income channels and see the magic happen. Your passion can unlock a stream of income. Transform leisure activities into lucrative ventures. Dig deep into hobbies and spot money-making potentials. Read on for smart ways to monetize your interests!

Monetizing Creative Skills

Got a knack for creativity? Harness this power for passive income. Here’s how:

Create digital products: E-books, courses, art pieces, and music tracks.

Print-on-demand services: Sell custom designs on tees, mugs, and more.

Stock photography: Click and sell images to stock photo websites.

Remember, quality content stands out. Polish your skills consistently. Keep your digital presence strong. Engage with online communities. These steps help sell more.

Leveraging Peer-to-peer Platforms

Peer-to-peer platforms are goldmines for passive income. Here’s a quick look at options:

Platform Activity Etsy Sell handmade goods. Airbnb Rent out extra space. Turo List your car for others to use.

Credit: www.bankrate.com

Frequently Asked Questions

Q. What Is Passive Income?

Passive income involves earning money without active, daily involvement. It’s generated from ventures like rental properties or royalties from creative works. This approach can offer financial security over time through consistent, scalable streams.

Q. Can Blogging Generate Passive Income?

Yes, blogging can generate passive income. Once you create quality content and optimize for SEO, you can earn through affiliate marketing, ads, or selling digital products. Regular updates and marketing strategies help maintain and grow your earnings.

Q. What Are The Best Passive Income Strategies?

The best passive income strategies include investing in dividend stocks, real estate rentals, peer-to-peer lending, creating an online course, and writing an ebook. These require varying levels of initial effort but can provide ongoing income with minimal maintenance.

Q. How Does Affiliate Marketing Provide Passive Income?

Affiliate marketing provides passive income by promoting other people’s products. You earn commissions for sales made through your unique referral links. It’s effective when you have a strong online presence and can persuade your audience to make purchases.

Conclusion

Embracing passive income strategies can transform your financial landscape, securing a brighter future. Diverse options, from real estate investments to digital products, offer paths to sustainable earnings with minimal ongoing effort. Start small, scale sensibly, and watch your wealth grow.

Your financial freedom might just be a well-chosen venture away. Dive in and let your money work for you.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS Video FREE Training to START >>

Thanks for reading my article on Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Smart Ways to Make Money: Profitable Passive Income Ideas to Secure Your Future

#Online Business Opportunities#Affiliate Marketing Strategies#Real Estate Investment#Stock Market Investing#Cryptocurrency Earnings#Peer-to-Peer Lending#E-commerce Dropshipping#Digital Products Selling#Blogging for Income#Automated Trading Systems#Dividend Stocks#Royalties from Intellectual Property#High-Yield Savings Accounts#Mobile App Development#Virtual Real Estate#Social Media Monetization#Online Courses Creation#Crowdfunding Investments#Passive Income Apps#Freelance Passive Income#Bond Investing#Passive Income Books#Niche Websites#YouTube Channel Revenue#Rental Income Strategies#Affiliate Earnings#Affiliate Marketing#Affiliate Marketing Guide#Affiliate Marketing Mastery#Affiliate Marketing Training

0 notes

Text

Top 10 Smart Ways To Make Money Fast And How To Apply Them

Discover the Top 10 Smart Ways To Make Money Fast And How To Apply Them #makemoneyfast

Introduction In today’s uncertain economic climate, the quest to make money is as natural as breathing and as common as the daily sunrise. This article focuses on fast money-making methods to ease the weight on our financial shoulders and pave the way for financial stability and freedom. Time is a currency, and every second counts, seizing smart money-making opportunities not only earns quick…

View On WordPress

#content creation#domain names#eBay#etsy#financial freedom#financial stability#Fiverr#Gig Economy#investing#Investing for Quick Returns#Lyft#Make Money Fast#micro-investing platforms#mutual funds#online course#Online Marketplaces#passive income#peer-to-peer lending#pet influencers#social media#stocks#Technology and the Internet#Top 10 Smart Ways#Twitch#Upwork#virtual real estate#youtube

0 notes

Text

Innovative 10 Investment Ideas for Financial Growth

Explore 10 innovative investment ideas from peer-to-peer lending to impact investing diversify your portfolio for financial growth.

1 note

·

View note

Text

https://www.psbloansin59minutes.com/knowledge-hub/peer-to-peer-lending-borrowing-investing

The rise of peer-to-peer lending: a revolutionary approach to borrowing and investing

Discover the revolutionary world of peer-to-peer lending. Borrow and invest like never before with this groundbreaking approach to finance. Join the rise today!

#business loan#onlinepsbloans#psbloansin59minutes#mudra loan#small business#loans#digitalloanapproval#msme loan#digital approval#business#peer-to-peer lending#borrowing#investing#finance#fintech

0 notes

Text

#passive income#wealth building#low-effort#dividend investing#peer-to-peer lending#rental properties#high-yield savings accounts#index funds#real estate investment trusts#digital products#affiliate marketing#car rental#online courses.#your spiritual journey

1 note

·

View note

Text

Another desperate plea because I have no other options. PLEASE help me yall. I’m a queer disabled woman with a part time job that’s not making me enough to pay my rent. I’m way behind on it, can’t afford groceries, can’t afford cat food or my cats medicine. I’m constantly looking for other jobs and getting nothing. I don’t have any options available to me.

Anything helps, literally anything. My current overdue rent balance is $1,490.

Paypal: RowBelow

Cashapp: $rowlenejolene

Venmo: rowlene

Zelle works too or I can download any kind of payment app, please I’m begging. Idk what to do anymore.

#mutual aid#donate#donations#donation post#philanthropy#help#venmo#paypal#cashapp#zelle#paypigswelcome#peer support#peer to peer lending#i tried to blaze this but they won’t let me#blaze#community#cats#emergency#financial aid

14 notes

·

View notes

Text

5 Easy Passive Income Ideas for 2024

Hello, this is Taylor! Today, we’re going to dive into a fascinating topic—five ways to generate passive income. For each method, we’ll discuss how difficult it is to get started, how challenging it is to earn $100 per week, and how hard it is to maintain once it’s up and running. You’ll see that these factors vary across the different methods, so let’s jump right in! First, what is passive…

#ad revenue#apple#digital-products#finance#gadget lovers#gear#huawei#investing#ipad#laptop#passive income#peer-to-peer-lending#smartphone#tablet#tech#technology

2 notes

·

View notes

Text

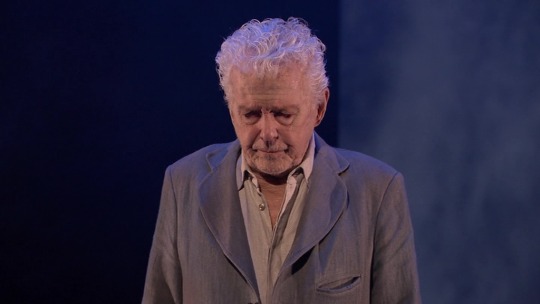

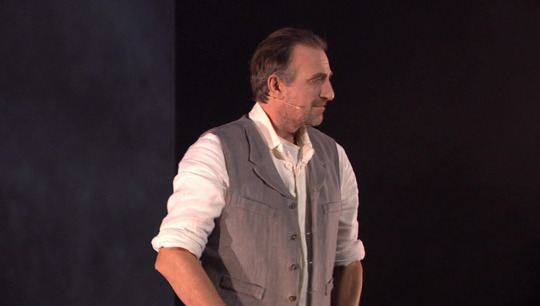

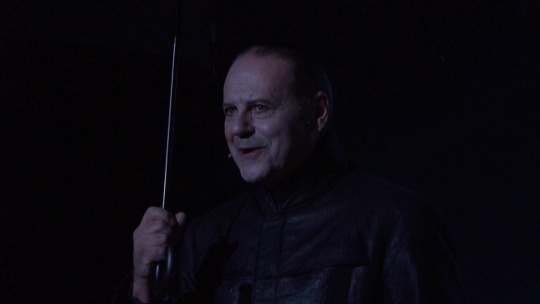

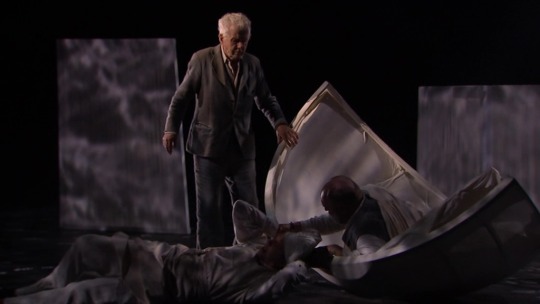

"Peer Gynt" (2019) - Erik Ulfsby

Films I've watched in 2023 (42/119)

A remarkable production in more ways than one.

Toralv Maurstad has for more than half a century, in Norway, been synonymous with the role of Peer Gynt. In this version he plays Peer as an old man looking back on his life, while seven other actors play Peer at various stages of life.

Ever present on stage, old Peer (Maurstad) and the Button Moulder (Svein Tindberg) observe as scenes from Peer's life are played out.

The costumes are interesting. While they're mostly white/grey, by the use of projected images and very carefully hit marks/positions on stage, several scenes start out with the characters seemingly in colourful, elaborate costumes.

Maurstad had suffered a stroke just a few years prior, so seeing him back on stage as Peer, at the age of 92, was extra special.

Thankfully it was recognised how important this production was as a piece of Norwegian theatre history, it was filmed and has been released on DVD by Naxos. I highly recommend getting and seeing it!

#films watched in 2023#Peer Gynt#Toralv Maurstad#Paul-Ottar Haga#Geir Kvarme#Svein Tindberg#Paul Åge Johannessen#Jan Grønli#Charlotte Frogner#Karl-Vidar Lende#Ingrid Jørgensen Dragland#Pål Christian Eggen#Sara Khorami#Henrik Ibsen#Erik Stubø#Jon Fosse#Det Norske Teatret#Stein-Roger Bull#theatre#motionpicturelover's screencaps

5 notes

·

View notes

Text

Should You Take a Personal Loan from a Peer-to-Peer Lending Platform?

Introduction

The growing demand for personal loans has led to the emergence of various alternative lending platforms, including Peer-to-Peer (P2P) lending platforms. Unlike traditional banks and Non-Banking Financial Companies (NBFCs), P2P lending platforms directly connect borrowers with individual investors willing to lend money.

But the big question is: Should you take a personal loan from a P2P lending platform?

In this article, we will explore the pros and cons of P2P lending, compare it with traditional loans, and help you decide whether it's the right option for your financial needs.

What is Peer-to-Peer (P2P) Lending?

P2P lending is a digital lending model that eliminates traditional financial institutions by allowing individual lenders to finance borrowers directly through an online platform. These platforms act as intermediaries, facilitating the loan process, verifying borrower details, and setting interest rates based on risk profiles.

Popular P2P lending platforms in India include:

Faircent

Lendbox

RupeeCircle

i2iFunding

Unlike traditional personal loans, P2P lending offers more flexible options but comes with its own set of risks and benefits.

How Does a Personal Loan from a P2P Platform Work?

1. Borrower Registration & Profile Submission

The borrower signs up on a P2P platform and submits details like income, employment status, loan amount, and purpose.

The platform verifies the borrower’s creditworthiness and assigns a risk rating.

2. Loan Listing & Investor Selection

The borrower's loan request is listed on the platform for potential lenders.

Individual investors review loan applications and decide whether to fund the loan partially or fully.

3. Loan Disbursal & Repayment

Once fully funded, the loan amount is transferred to the borrower's bank account.

The borrower repays the loan in monthly EMIs, including interest, over the agreed tenure.

Pros of Taking a Personal Loan from a P2P Lending Platform

1. Easier Approval for Low Credit Score Borrowers

Traditional banks often reject loan applications from individuals with low credit scores or limited credit history. P2P lending platforms offer more flexible eligibility criteria, making loans accessible to more borrowers.

2. Competitive Interest Rates

Depending on the borrower's risk profile, interest rates on P2P loans can be lower than banks and NBFCs.

Interest rates typically range from 12% to 30%, compared to traditional personal loan rates of 10% to 24%.

3. Minimal Documentation & Fast Approval

P2P lending platforms operate digitally, ensuring a paperless loan application process with minimal documentation. Approval is often faster than banks, sometimes within 24-48 hours.

4. Flexible Loan Terms

Borrowers can negotiate loan terms directly with lenders.

Tenure options range from 6 months to 5 years, allowing borrowers to choose terms that suit their repayment capacity.

5. No Middleman Costs

Since loans are directly funded by investors, borrowers can avoid traditional banking fees and hidden charges, making the loan more affordable.

Cons of Taking a Personal Loan from a P2P Lending Platform

1. Higher Interest Rates for High-Risk Borrowers

If your credit score is low or you lack a stable income, P2P lenders may charge higher interest rates than banks and NBFCs to compensate for the risk.

2. Loan Amount Limits

Most P2P lending platforms have a loan cap of ₹5-10 lakh, which may not be sufficient for large expenses like medical treatments or home renovations.

3. Risk of Investor Withdrawal

If investors lose confidence in P2P lending, funding may become scarce, leading to delays in loan approvals or rejections.

4. Regulatory Risks

While the Reserve Bank of India (RBI) regulates P2P lending platforms, they are relatively new compared to traditional financial institutions, making them a riskier option for borrowing.

5. Penalties for Late Payments

Just like banks, P2P lenders impose heavy penalties for delayed EMIs. Missing payments can severely impact your credit score and lead to legal action.

P2P Lending vs. Traditional Bank Loans: A Quick Comparison

FeatureP2P LendingTraditional BanksApproval Time24-48 hours3-7 daysEligibilityLenient (low credit scores accepted)Strict (high credit scores preferred)Interest Rate12% - 30%10% - 24%Loan Tenure6 months - 5 years1 - 7 yearsLoan Amount₹50,000 - ₹10 lakh₹1 lakh - ₹50 lakhRegulatory BodyRBI (newly regulated)RBI (well-established)RiskModerate to HighLow to Moderate

Should You Take a Personal Loan from a P2P Platform?

The decision to borrow from a P2P lending platform depends on your financial situation and risk appetite.

✅ Choose a P2P loan if:

You have a low credit score and struggle to get loans from banks.

You need a quick loan with minimal documentation.

You want a flexible loan term and lower middleman costs.

❌ Avoid P2P loans if:

You qualify for a bank loan with lower interest rates.

You need a large loan amount exceeding ₹10 lakh.

You are uncomfortable with regulatory uncertainties and potential investor risks.

Final Thoughts

Taking a personal loan from a Peer-to-Peer lending platform can be a great alternative if you struggle with traditional bank approvals. However, it is essential to compare interest rates, repayment terms, and associated risks before making a decision.

Key Takeaways:

P2P lending offers faster approvals and flexible eligibility criteria.

Interest rates can be lower or higher depending on your creditworthiness.

Borrowers must be cautious about penalties, regulatory risks, and investor reliability.

For a well-informed borrowing decision, always explore multiple lending options and read the loan terms carefully.

For more insights on personal loans and financial tips, visit www.fincrif.com today!

#finance#personal loan online#fincrif#bank#personal loan#nbfc personal loan#loan apps#personal loans#personal laon#loan services#Personal loan#P2P lending#Peer-to-peer lending platform#P2P personal loan#Best P2P loan platforms#P2P lending vs bank loan#P2P loan eligibility#P2P loan interest rates#P2P lending risks#Best personal loan options#Is P2P lending a good option for a personal loan?#How does P2P lending work for personal loans?#Advantages and disadvantages of P2P personal loans#Which P2P lending platform is best for a personal loan?#Are P2P loans safe for borrowing money online?

0 notes

Text

Why a P2P Lending License is Crucial for Your Platform

Obtaining a P2P lending license is vital for any peer-to-peer lending platform. It ensures compliance with regulatory standards, builds credibility, and attracts more investors and borrowers. Licensed platforms gain a competitive edge in the market and foster long-term growth through enhanced trust and transparency. Partner with Corpbiz for seamless assistance in obtaining your P2P lending license.

#P2P Lending#Lending License#Peer To Peer Lending#Financial Growth#Business Compliance#Financial Services

0 notes

Text

How Do You Select the Best Mutual Fund for Long Term SIP in Delhi?

Need quick cash but don't want to sell your mutual funds? A loan against mutual funds is the answer. It lets you borrow money by using your mutual fund investments as collateral. This way, you can access funds without disturbing your long-term investments. Anytime Invest provides the best services for loan against mutual fund in Delhi.

What Is a Loan Against Mutual Funds?

A loan against mutual funds allows you to pledge your mutual fund units as collateral to borrow money. It’s a convenient option to access funds without liquidating your investments. This solution is especially useful for managing short-term financial needs while preserving your wealth.

There are numerous opportunities to avail of a loan against mutual funds. Local financial experts provide personalized advice, considering the unique needs of the city’s residents. With easy access to guidance, investors can benefit from quick and hassle-free services given by loan against mutual funds experts in Delhi.

How Does It Work?

1. Pledge Your Units: Submit your mutual fund units to the lender as security. 2. Loan Disbursement: The lender offers a loan amount based on a percentage of your fund’s value. 3. Repayment: Flexible repayment terms allow you to pay interest regularly or at maturity.

Benefits of Availing a Loan Against Mutual Funds

1. Access Funds Without Selling Investments You retain ownership of your mutual funds, allowing them to grow while meeting your financial needs.

2. Tax Advantages Interest payments on these loans may offer tax benefits under certain conditions, making them a tax-efficient choice.

3. Flexible Repayment Options Repay the loan on terms that suit your financial situation, offering convenience and ease of planning.

4. Preserve Wealth Your investments continue to appreciate over time, ensuring long-term wealth creation while addressing immediate cash flow needs.

Why Are Informed Decisions in Loan Against Mutual Funds Important?

Navigating the process of taking a loan against mutual funds can be complex. Expert guidance ensures you make informed decisions that align with your financial goals.

Qualities of a Reliable Expert

● Deep knowledge of financial markets ● Familiarity with mutual fund structures ● Expertise in loan regulations and documentation ● Ability to provide tailored advice

How to Choose the Best Expert

1. Consult a Financial Professional: Discuss your needs and get personalized solutions. 2. Research Online: Look for reputed financial consultancies with positive reviews. 3. Seek Referrals: Ask for recommendations from your network to find trusted professionals.

Conclusion

A loan against mutual funds is a smart financial tool for meeting urgent financial needs without disturbing your long-term investment plans. Seek expert guidance to make the most of this option. Connect with trusted professionals to unlock the potential of your mutual funds today!

#loan against mutual funds experts in delhi#loan against mutual fund in delhi#p2p financial advisor in delhi#Peer to Peer Lending experts in delhi

0 notes

Text

The Benefits of Using a Peer-to-Peer Lending Software Platform

In today’s rapidly evolving financial landscape, peer-to-peer (P2P) lending is transforming how individuals and businesses access loans. For lenders and borrowers alike, this model offers a streamlined, efficient, and decentralized alternative to traditional banking. At the core of this revolution is the peer-to-peer lending software platform, a critical tool that simplifies the entire process.

What Is a Peer-to-Peer Lending Software Platform?

A peer to peer lending software platform connects lenders directly with borrowers, cutting out the middleman. The platform facilitates the loan process, from credit assessment to loan disbursement and repayment. For financial institutions, FinTech startups, and businesses entering the lending space, investing in a robust P2P lending software solution can significantly enhance operational efficiency and transparency.

Key Features to Look for in a Peer to Peer Lending Software Platform

Automated Loan ProcessingManual loan approval processes are time-consuming and prone to errors. A well-designed peer-to-peer lending software platform automates the end-to-end process—from application submission to credit scoring and loan approval. This not only reduces operational costs but also ensures faster loan disbursement.

Customizable Loan ProductsOne of the strengths of P2P lending platforms is flexibility. With the right software, financial institutions can offer customizable loan terms to meet the needs of various types of borrowers. Whether short-term or long-term, small or large loans, the platform can handle diverse loan products efficiently.

Risk Assessment and Credit ScoringA reliable P2P lending platform should come equipped with advanced algorithms for risk assessment and credit scoring. This minimizes the risk for lenders by evaluating the creditworthiness of borrowers in real-time, ensuring that the chances of defaults are reduced.

Data Security and ComplianceAs lending involves sensitive financial data, data security is paramount. A secure peer-to-peer lending software platform ensures that all transactions and personal information are encrypted and compliant with industry regulations, such as GDPR or local financial laws.

Advantages for Lenders and Borrowers

For lenders, P2P platforms offer direct access to a larger pool of borrowers without the need for intermediaries, resulting in better returns. Borrowers, on the other hand, can benefit from competitive interest rates, faster loan approval, and more flexible loan terms compared to traditional banking options.

Why Choose FastBoard Peer-to-Peer Lending Software Platform?

At FastBoard, we provide cutting-edge software solutions designed to meet the dynamic needs of today’s financial institutions and FinTech startups. Our peer to peer lending software platform is highly customizable, secure, and scalable, ensuring seamless loan management for businesses of any size. With features such as automated workflows, integrated credit scoring, and data encryption, our platform empowers you to optimise lending operations while minimising risks.

Start transforming your lending process today with FastBoard peer-to-peer lending software platform.

1 note

·

View note

Text

"wise master," said the student, "how can i attain greatness at posting?"

"simple," replied the master. "through patience and long practice."

"but master," said the student, bursting out with impatience, "every time i go online i see people my age getting 50k notes, 100k notes!"

the master chuckled. "the self-assuredness of the 22-year-old lends itself well to the occasional callow foray into posting, it's true. but for posts of true substance, one must turn to the mentally ill 30-something tgirls. observe."

she pulled up a post on her phone. the student peered at it. he did not laugh. he said, "but master -- this post only has 12 notes. and it's not even funny."

"kill yourself," said the master.

9K notes

·

View notes

Text

Peer-to-Peer Lending Market Surges to US$ 517.2 Billion by 2024, Driven by Growing Demand and Reduced Operating Costs

The peer-to-peer lending market value is expected to rise from US$ 517.2 billion in 2024 to US$ 1,709.60 billion by 2034. This market is analyzed to surge ahead at a CAGR of 12.70% over the next decade.

The surging popularity of P2P lending has propelled players to collaborate and contribute to market growth. For instance, Traveloka, an Indonesia-based travel tech platform publicly announced its partnership with Gojek-supported Bank Jago to disburse loans via Traveloka PayLater.

The initiative is raising opportunities for the underbanked community in Indonesia. Thanks to these initiatives, the growth of peer-to-peer lending is expected to flourish over the forecast period.

Unlocking the Knowledge: Requesting a Sample Copy for In-Depth Understanding.https://www.futuremarketinsights.com/reports/sample/rep-gb-14675

The adoption of peer-to-peer lending platforms by several end users like student loan organizations and real estate is projected to provide growth prospects to vendors. Additionally, increasing partnerships among market players are projected to yield market growth.

“Key players are investing in product innovation and strategic partnerships to gain a larger hold in the market. Going forward, AI capabilities are also expected to be exploited to develop customized financing solutions,” says an analyst of Future Market Insights.

Key Takeaways from the Peer-to-peer Lending Market Report

The peer-to-peer lending market attained a valuation of US$ 295.34 billion in 2019. By 2023, the valuation topped US$ 458.91 billion, recording a CAGR of 6%.

Based on end user, the consumer credit segment is expected to accumulate 40% in 2024.

By business model, the traditional segment is predicted to acquire 80% in 2024.

The China market is projected to showcase a significant growth rate of 80% over the forecast period.

The United States market is anticipated to pace at a CAGR of 70% during the next ten years.

The Australia and New Zealand market is expected to witness a 20% CAGR over the assessment period.

Competitive Strategies

The market is observing intense competition, propelled by global presence of many small as well as medium vendors providing diverse solutions. The players in the global market are concentrating on adopting alternative distribution channels like online sales to increase their presence across the world.

Market players are focusing on investments in strategic partnerships and product innovation to enhance their market share. These initiatives are expected to elevate the competitiveness of their offerings and increase collaborative efforts within the industry.

Request for Methodology:https://www.futuremarketinsights.com/request-report-methodology/rep-gb-14675

Latest Developments in the Peer-to-peer Lending Market

In March 2024, a grouping of peer-to-peer (P2P) lending platforms in India asked their members Faircent, Lendbox, and Liquiloans to put instant withdrawal products on halt after March 2024. Other P2P startups providing this service have also been asked the same.

Fable Fintech, which is a banking infrastructure firm, made public its strategic partnership with XeOPAR in May 2022. The company is set in its ways to gain maximum from the Fable Growth Suite (Retail) by founding its first P2P remittances corridor to reach India from the United Kingdom.

LendingClub, recognized for peer-to-peer lending, obtained Radius Bancorp, Inc., as well as its digital bank subsidiary in January 2021. The acquisition is made to increase the company’s revenue.

CRED, a well-known contender in the peer-to-peer market, rolled out CRED Mint, a peer-to-peer lending platform, in August 2021. The platform can be used for cred-card repayment and it permits members to gain interest on money by lending to high-earning consumers.

Enlisted Below are Some Top Market Players

Prosper Marketplace, Inc.

LendingClub Corporation

CommonBond Inc.

Funding Circle Limited

Upstart Network Inc.

Others

Market Segmentation of Peer-to-peer Lending

By End User:

Consumer Credit

Small Business

Student Loans

Real Estate

Based on the Business Model:

Traditional

Marketplace

Different Regional Markets are as follows:

North America

Europe

Asia Pacific

Middle East and Africa

1 note

·

View note