#Payroll Outsourcing.

Explore tagged Tumblr posts

Text

#Financial Accounting#Lead generation#Accounting Services USA#Database Generation#Lease Abstraction#Payroll Outsourcing.#End to End Recruitment#Recruitment Process#Recruitment Sourcing Service#Recruitment Screening Service#Recruitment audit#Job posting

0 notes

Text

Optimize Your Firm’s Financial Management with White Bull! Accounting and CPA firms: Discover the efficiency of outsourced financial solutions. From bookkeeping and payroll to tax preparation, White Bull provides seamless support tailored to the unique needs of professional firms. Let us handle the details so you can focus on what matters most—serving your clients!

👉 Visit us: white-bull.com

#accounting#bookkeeping#payroll#tax returns#outsourced accounting services#AccountingFirms#CPAFirms#OutsourcedAccounting#BookkeepingServices#PayrollSolutions

2 notes

·

View notes

Text

Payroll Services in London

Happie Group proudly holds the title of the top payroll services company in London. With a rich history spanning over 30 years, our firm has amassed unparalleled expertise in payroll management. We offer comprehensive support and tailored solutions to streamline your payroll processes efficiently and effectively. Our team of seasoned professionals is dedicated to providing expert guidance and personalized assistance, ensuring that your payroll operations run smoothly and seamlessly. Trust Happie Group to deliver unparalleled reliability, accuracy, and efficiency in managing your payroll needs, allowing you to focus on driving your business forward with confidence.

2 notes

·

View notes

Text

Best Recruitment Services Agency | Global HR Solution

website :https://globalhrsolutions.in/recruitment-services

#hr solutions#human resource solution#hr#hrm#temporary staffing#contractual recruitments#contractual staffing#outsourcing service#outsourcing taxation#outsourcing accounting#outsourcing finance#business consulting#staffing#contractor#placement consultancy#placement agency#human resources#recruitment#hrmanagement#payroll#hiring#talent acquisition#corporate compliance#executive search#global hr solutions#b2b services#b2b lead generation#b2bmarketing#outsourcing#onlinebusiness

2 notes

·

View notes

Text

Payroll outsourcing in UK

Breathe Easy, Business Owners: Why Payroll outsourcing in UK with MAS LLP is Your Secret Weapon Running a business in the UK is exhilarating, but managing payroll? Not so much. Between HMRC deadlines, complex calculations, and ever-changing regulations, payroll can quickly become a time-consuming headache. That's where MAS LLP comes in, your one-stop shop for Payroll outsourcing in UK that takes the weight off your shoulders and lets you focus on what matters most: growing your business.

Why Choose MAS LLP for Payroll outsourcing in UK?

Expertise You Can Trust: Our team of qualified and experienced payroll professionals are the best in the business. They stay up-to-date on the latest HMRC regulations, ensuring your business remains compliant and avoids costly penalties. Accuracy Guaranteed: Say goodbye to manual calculations and spreadsheets. We leverage cutting-edge technology and robust processes to deliver error-free payroll every time. Time is Money: Free yourself and your team from the payroll burden. Outsourcing allows you to dedicate your valuable time and resources to core business activities that drive growth. Peace of Mind: Rest assured knowing your employees are paid accurately and on time, every time. We handle everything from deductions and taxes to payslips and reports, giving you complete peace of mind. Personalized Service: You're not just a number with MAS LLP. We believe in building strong relationships with our clients, providing you with a dedicated account manager who understands your unique needs and is always available to answer your questions. Beyond Payroll: The MAS LLP Advantage

MAS LLP goes beyond just processing payroll. We offer a comprehensive suite of accounting outsourcing services designed to streamline your finances and give you a clear picture of your business health.

Bookkeeping: From daily transactions to account reconciliation, we keep your books meticulously organized and error-free. VAT Compliance: Navigate the complexities of VAT regulations with our expert guidance and minimize risks. Management Reporting: Gain valuable insights into your finances with customized reports and analysis that help you make informed decisions. Cloud-Based Solutions: Access your financial data securely anytime, anywhere, with our user-friendly cloud platform. Partner with MAS LLP and Reclaim Your Time and Focus

Payroll outsourcing in UK with MAS LLP isn't just about ticking boxes; it's about investing in the future of your business. We empower you to focus on what you do best, while we handle the nitty-gritty of payroll with accuracy, efficiency, and a personal touch.

Ready to ditch the payroll headaches and get back to business? Contact MAS LLP today for a free consultation and discover how we can help you breathe easy and achieve your business goals.

Note: This blog post is just a starting point. Feel free to adapt it to include specific details about MAS LLP's services, testimonials from satisfied clients, or special offers to attract potential customers.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Payroll outsourcing in UK

4 notes

·

View notes

Text

Top HR Company in Bangalore/HR Services

Opsis Consulting India Pvt Ltd is one of the top HR Company in Bangalore, offering reliable Payroll Outsourcing, Staffing and Recruitment Services.

Our Services:

1 PERMANENT RECRUITMENT

2 PAYROLL & ACCOUNTS PROCESS OUTSOURCING,

3 VIRTUAL HR SOLUTION

4 STAFFING SERVICES

5.HR PROCESS OUTSOURCING SERVICES

#jobs#hr services#startup#bangalore#payroll#outsourcing#staff search#Staffing and Recruitment Services#founder#diretores

3 notes

·

View notes

Text

Discover why payroll outsourcing is crucial for any firm in this insightful blog. Learn about the advantages of outsourcing, such as cost savings, improved accuracy, and compliance. Streamline your payroll operations and focus on core business activities. Dive into the details now!

#payroll outsourcing#payroll#payroll services#outsource payroll#outsourced payroll#accountants#outsourcing services#companies

2 notes

·

View notes

Text

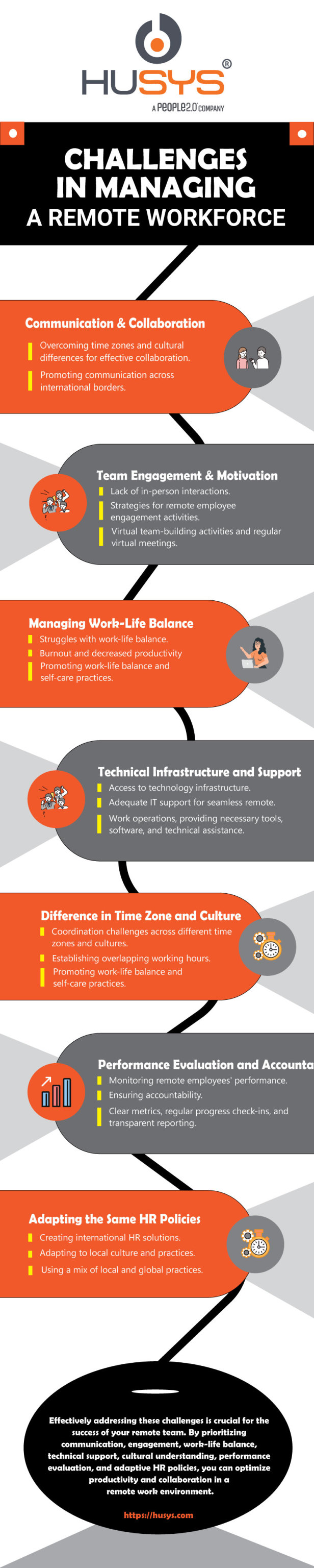

Managing a remote workforce brings unique challenges that can affect productivity and collaboration. To ensure your remote team's success, it's essential to tackle these challenges head-on. Check out my latest post to discover the common hurdles faced when managing a remote workforce and strategies for overcoming them. Let's thrive in the world of remote work! 💼🌍✨

#peo services in india#employer of record#peo services#payroll#payroll outsourcing#globalpayroll#business expansion#eor services india#remote work#remote workforce

2 notes

·

View notes

Text

Why Should Small Businesses Consider Professional Bookkeeping Services?

Financial management is one of many duties and responsibilities that must be balanced when running a small business. There are compelling reasons to think about hiring professional bookkeeping services, even if some business owners would try to do their own bookkeeping.

Compliance and tax support are additional advantages of professional bookkeeping services for small business. Bookkeeping professionals are well-versed in tax laws and regulations, ensuring that small businesses remain compliant and avoid penalties. They stay updated on changes in tax laws and provide accurate and timely tax support, including preparation and filing of tax returns. This helps small business owners navigate the complexities of tax compliance, reducing stress and ensuring adherence to legal requirements.

Conclusion, small businesses should seriously consider professional bookkeeping services due to the expertise, accuracy, time savings, financial insights, cost savings, compliance support, and tax expertise they offer. By outsourcing bookkeeping tasks, entrepreneurs can focus on their core business activities, make informed decisions based on accurate financial data, and ultimately drive the success of their small business.

#Bookkeeping service for small business#accounting and bookkeeping service#Payroll service#Bookkeeping service#Outsourced bookkeeping service

2 notes

·

View notes

Photo

Payroll services in Ukraine

We provide professional Payroll Services in Ukraine for more than 15 years.

Payroll processing is not an everyday need of a company and it may be economically impracticable for many companies to keep payroll professionals. When you assign this function to the Chief Accountant, should remember that payroll accounting in Ukraine is a labour and time consuming activity.

To learn more about our Payroll Accounting, Payroll Outsourcing Services in Ukraine, HR outsourcing and HR Records Administration Services in Kyiv, please contact us https://www.accounting-ukraine.kiev.ua/services/payroll_outsourcing_services.htm

2 notes

·

View notes

Text

Achieving Success Through Supply Chain Management Training in Bangladesh

Bangladesh is a country of immense potential, but it has struggled to leverage that potential due to inadequate supply chain management training. As the world globalizes, supply chain management has become increasingly important for businesses in both developed and developing countries. For Bangladesh, this opens up opportunities to create jobs, increase exports and nurture economic growth.

But what does it take for Bangladesh to become a leader in the field of supply chain management? In this blog post, we will explore how training and education can help drive forward success in this area and help grow the economy of Bangladesh.

What is Supply Chain Management?

Supply chain management (SCM) is the process of planning, implementing, and controlling the operations of a company's supply chain. The main goal of SCM is to ensure that the company's products are delivered to customers in a timely and efficient manner.

SCM training can help Bangladesh-based companies improve their supply chains and achieve success. Through SCM training, companies can learn how to better plan and control their supply chains, which can lead to improved customer satisfaction and increased profits.

The Importance of Supply Chain Management Training

The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is committed to ensuring that its members are able to access the best possible supply chain management training. In order to achieve this, the BGMEA has partnered with a number of leading international organizations to offer a range of courses which cover all aspects of supply chain management.

The BGMEA recognizes that an efficient and effective supply chain is essential to the success of the garment industry in Bangladesh. In order to keep up with the ever-changing requirements of the global market, it is essential that Bangladeshi manufacturers have access to the latest information and techniques. The courses offered by the BGMEA will ensure that members are able to stay ahead of the competition and continue to meet the demands of buyers.

The courses on offer include:

- An Introduction to Supply Chain Management

- Principles of Supply Chain Management

- Fundamentals of Purchasing and Procurement

- Supply Chain Management for Apparel Brands and Retailers

- Sourcing Strategies for Apparel Manufacturers

- Lean Manufacturing for Apparel factories

- Quality Control and Assurance in Apparel Production

Each course is designed to provide participants with the knowledge and skills they need to improve their operations and contribute to the success of their company. The courses are delivered by experienced instructors who are experts in their field, and who use a variety of teaching methods including lectures, case studies, group work, and individual tutorials.

The Current State of Supply Chain Management in Bangladesh

The current state of supply chain management in Bangladesh can be best described as fledgling. Despite the fact that the country has been making strides in recent years to improve its logistics infrastructure, the overall level of development is still relatively low. This is particularly true when compared to other countries in the region such as India and China.

However, it is important to note that there are some bright spots. In particular, the Bangladeshi government has been investing heavily in training programs for supply chain management. These programs are designed to help improve the skills of those working in the logistics industry and to raise awareness about best practices.

There is still a long way to go before Bangladesh can claim to have a world-class supply chain management system. However, with continued investment and commitment from both the public and private sectors, it is certainly possible that the country will be able to make significant progress in this area in the years to come.

The Benefits of Supply Chain Management Training in Bangladesh

The benefits of supply chain management training in Bangladesh are numerous. Perhaps most importantly, it helps to improve communication and coordination between different parts of the supply chain, which can lead to improved efficiencies and cost savings. In addition, supply chain management training can help to improve supplier relationships, as well as customer service and satisfaction levels.

In today's business environment, having a well-trained and efficient supply chain management team is critical to success. By investing in quality training for your team, you can ensure that your company is able to keep up with the competition and maintain a high level of customer satisfaction.

The Different Types of Supply Chain Management Training in Bangladesh

Supply chain management (SCM) is becoming increasingly important in today's globalized world, particularly for firms in the developing world. Bangladesh is no exception; training in SCM is necessary to keep up with the challenges of an ever-changing business landscape. This article will discuss the different types of SCM training available in Bangladesh, and how each of these courses can help organizations improve their performance.

1. Traditional supply chain management training: This type of training covers the basic concepts and methods of supply chain management. It is typically delivered in a classroom setting, and may include lectures, case studies, and group discussions.

2. Online supply chain management training: This type of training is delivered online, and can be self-paced or synchronous (taught in real-time with a live instructor). It may include videos, readings, quizzes, and simulations.

3. Supply chain management certification programs: These programs provide comprehensive training in supply chain management principles and practices. They often include an exam at the end, and successful completion can lead to professional certification.

4. On-the-job training: Many organizations offer on-the-job training programs for their employees. This type of training can be tailored to the specific needs of the organization, and allows employees to learn while they are working.

The Challenges of Implementing Supply Chain Management Training in Bangladesh

In Bangladesh, the challenges of implementing supply chain management training are many and varied. The first challenge is the lack of awareness of the importance of supply chain management among the general population. This is compounded by the fact that there is no formal education or training available in Bangladesh on this topic. As a result, there are few people who are knowledgeable about supply chain management and its potential benefits.

The second challenge is the lack of infrastructure and resources to support supply chain management training. In Bangladesh, most businesses operate on a small scale and do not have the necessary resources to invest in training their employees on supply chain management. Additionally, there is a lack of qualified trainers who are able to provide quality training on this topic.

The third challenge is the cultural barriers to implementing supply chain management training in Bangladesh. The culture in Bangladesh places a high value on personal relationships and networking. This can make it difficult to implement changes within an organization, such as introducing new processes or technologies related to supply chain management. Additionally, the hierarchical nature of Bangladeshi society can make it difficult to get buy-in from all levels of an organization for new initiatives.

Despite these challenges, there are also opportunities for successful implementation of supply chain management training in Bangladesh. One opportunity lies in the increasing globalization of business and trade. As more businesses operate internationally, they will need employees who are trained in international standards and practices related to supply chain management. Additionally, the growth of the Bangladesh economy provides opportunities

Tips for Successful Supply Chain Management Training

Having an effective supply chain management training program can be a great resource for any organization. It is essential to ensure that proper training is conducted in order to maximize efficiency and productivity. With the right guidance and resources, companies can build a successful supply chain management program that benefits the entire organization. Below we will discuss some tips for successful supply chain management training that can help you get started on the right track.

1. Define your goals: What do you hope to achieve through supply chain management training? Is it to improve your knowledge of the subject so that you can be more effective in your current role? Or are you looking to advance your career and move into a managerial position? Once you know what your goals are, you can tailor your training accordingly.

2. Do your research: There are many different types of supply chain management training programs out there. Before enrolling in one, do some research to make sure it's a good fit for you. Ask yourself what the program covers, how long it is, and whether it's offered online or in-person.

3. Consider your schedule: Supply chain management training can be intensive, so make sure you have the time to commit to it. If you're working full-time while taking classes, consider an online program that offers more flexibility.

4. Set aside time for study: In addition to attending classes, you'll need to set aside time for independent study. Make sure you're prepared to commit the necessary time to reading textbooks and other course materials, as well as completing assignments.

5. Stay organized: Supply chain management involves a lot of moving parts, so it's important to stay organized throughout your training. Keep track of deadlines and due dates, and create a system for organizing course materials so that you can easily find what you need when you need it.

How to Overcome the Challenges of Supply Chain Management Training in Bangladesh

In order to overcome the challenges of supply chain management training in Bangladesh, it is important to first understand the specific challenges that exist within the country. One of the biggest challenges is the lack of a centralized government body or institution that can provide cohesive and standardized training. This often results in a fragmented approach to training, with different organizations and companies using their own methods, which can make it difficult for employees to receive a consistent education.

Another challenge is the limited resources that are available for training. This includes both financial resources and skilled personnel. As a result, many supply chain management programs in Bangladesh are forced to operate on a shoestring budget, which can impact the quality of instruction and learning materials. In addition, there is often a shortage of qualified trainers, which can make it difficult to find someone with the necessary knowledge and experience to effectively teach employees.

Despite these challenges, there are also several opportunities that exist for those interested in pursuing supply chain management training in Bangladesh. One of the biggest advantages is the country's vast pool of potential workers. With over 160 million people living in Bangladesh, there is a large labor force that can be tapped into for supply chain management positions. In addition, Bangladesh has a rapidly growing economy and its manufacturing sector is expected to expand significantly in the coming years. This provides an opportunity for those with supply chain management training to find employment with companies that are looking to capitalize on this growth.

Overall, while there are some challenges associated with supply chain

Conclusion

In conclusion, supply chain management training in Bangladesh can help businesses achieve success. With proper training and resources, businesses can become more efficient and effective in their operations thus gaining a competitive edge over other companies. It is essential for organizations to invest in the right technology and personnel to ensure that they are well-prepared for the ever-evolving business environment. Ultimately, it is up to each business's leadership team to recognize the importance of having strong supply chain management processes and provide necessary support towards successful supply chain implementations.

#Enroute International Limited#Managed Service#People Outsourcing#Payroll Service#Facility Management#Events Activation#Recruitment Service#Talent Sourcing#Headhunting Solution#HR Consulting#Skills Recruitment#Pre-employment verification#Background Verification#Executive Education#Leadership Executive Coaching#Customized Program#Consultancy Service#Market Development Service#Digital Lab#Character Licensing#Capacity Development#BPO Company#Business Process Outsourcing Company#Business Process Outsourcing Organization#Business Process Outsourcing Bangladesh#E-learning#Open Training#Skills Training#Executive Coaching#Customized Training

5 notes

·

View notes

Text

#Financial Accounting#Lead generation#Accounting Services USA#Database Generation#Lease Abstraction#Payroll Outsourcing.

0 notes

Text

Payroll services in Mumbai

TSP Group is a trusted name in offering comprehensive payroll services in Mumbai, catering to businesses of all sizes and industries. We specialize in streamlining payroll management processes to ensure accuracy, compliance, and efficiency. Our services are designed to help organizations reduce administrative burdens and focus on their core business activities.

Mumbai is a hub for businesses, with diverse industries requiring seamless payroll management. TSP Group understands the unique challenges faced by companies in this competitive environment. We provide end-to-end payroll solutions, including salary calculations, tax deductions, statutory compliance, employee benefits administration, and timely reporting.

Why Choose TSP Group for Payroll Services in Mumbai?

Accurate Payroll Processing: We leverage advanced technology to ensure error-free payroll calculations and timely salary disbursement.

Statutory Compliance: Our experts stay updated with the latest labor laws, tax regulations, and compliance requirements, ensuring your business adheres to all statutory obligations.

Customized Solutions: Every business is unique, and we tailor our payroll services to meet the specific needs of your organization.

Data Security: We prioritize the confidentiality and security of your payroll data with robust systems and practices.

Cost-Effective Services: Outsourcing payroll to TSP Group reduces administrative costs and improves overall operational efficiency.

Our services cover essential areas such as managing employee records, preparing payslips, handling PF, ESIC, and gratuity contributions, and ensuring accurate TDS filings. With TSP Group, businesses can eliminate the hassle of payroll errors, penalties, or missed deadlines.

Partnering with TSP Group for payroll services in Mumbai guarantees a seamless, transparent, and compliant payroll process. Whether you’re a startup, SME, or large enterprise, we have the expertise and resources to support your business needs effectively.

Contact TSP Group today to learn more about how our payroll solutions can transform your business operations in Mumbai. Let us handle your payroll so you can focus on achieving your business goals.

0 notes

Text

TruFynd offers seamless contract staffing services, allowing businesses to meet short-term workforce needs without administrative hassles. Enhance your cash flow and streamline operations with our expert contract hiring solutions.

#contract staffing#TruFynd contract hiring#short-term recruitment#outsourced recruitment#flexible hiring solutions#vendor payroll services#workforce management#temporary staffing

0 notes

Text

Benefits Of Partnering With A Payroll Agency For Your Business

As a business owner, managing payroll can be a time-consuming and complex task. It requires a significant amount of resources, expertise, and attention to detail to ensure accuracy and compliance with regulations. This is where payroll outsourcing comes in – a solution that can help streamline your payroll processes, reduce costs, and improve efficiency. Read more.

URL: https://blogsgod.com/benefits-of-partnering-with-a-payroll-agency-for-your-business/

0 notes

Text

Finding the best payroll outsourcing company can save businesses time, money, and effort. This guide explores the top payroll outsourcing companies in India, making it easier to find trusted solutions. Dive in to discover how they can simplify managing employee payroll, improve efficiency, reduce errors, ensure compliance, and support overall business success. By choosing the right provider, companies can enhance their operations, streamline processes, and ensure timely, accurate salary disbursement for all employees.

#Payroll Companies#Payroll Agency#Top Payroll Company#Payroll Services#payroll outsourcing companies

0 notes