#Payroll Outsourcing

Explore tagged Tumblr posts

Text

Payroll Services in London

Happie Group proudly holds the title of the top payroll services company in London. With a rich history spanning over 30 years, our firm has amassed unparalleled expertise in payroll management. We offer comprehensive support and tailored solutions to streamline your payroll processes efficiently and effectively. Our team of seasoned professionals is dedicated to providing expert guidance and personalized assistance, ensuring that your payroll operations run smoothly and seamlessly. Trust Happie Group to deliver unparalleled reliability, accuracy, and efficiency in managing your payroll needs, allowing you to focus on driving your business forward with confidence.

2 notes

·

View notes

Text

Discover why payroll outsourcing is crucial for any firm in this insightful blog. Learn about the advantages of outsourcing, such as cost savings, improved accuracy, and compliance. Streamline your payroll operations and focus on core business activities. Dive into the details now!

#payroll outsourcing#payroll#payroll services#outsource payroll#outsourced payroll#accountants#outsourcing services#companies

2 notes

·

View notes

Text

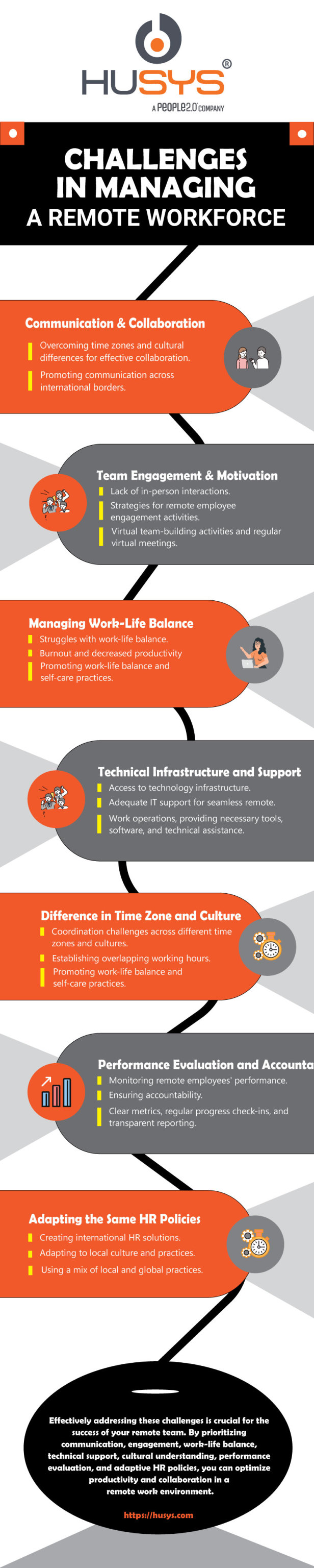

Managing a remote workforce brings unique challenges that can affect productivity and collaboration. To ensure your remote team's success, it's essential to tackle these challenges head-on. Check out my latest post to discover the common hurdles faced when managing a remote workforce and strategies for overcoming them. Let's thrive in the world of remote work! 💼🌍✨

#peo services in india#employer of record#peo services#payroll#payroll outsourcing#globalpayroll#business expansion#eor services india#remote work#remote workforce

2 notes

·

View notes

Text

Accounting and Bookkeeping services in Navi Mumbai

In today's fast-paced business environment, accurate and efficient financial management is crucial for the success of any organization. TSP Group is a trusted provider of Accounting and Bookkeeping services in Navi Mumbai, offering comprehensive financial solutions tailored to meet the needs of businesses of all sizes. Our expertise in accounting, compliance, and financial reporting ensures that your company remains financially healthy and compliant with all regulatory requirements.

Why Choose TSP Group for Accounting and Bookkeeping Services in Navi Mumbai?

Experienced Professionals Our team consists of skilled accountants and financial experts with extensive experience in handling diverse accounting and bookkeeping needs.

Comprehensive Financial Services We provide end-to-end Accounting and Bookkeeping services in Navi Mumbai, covering everything from financial statement preparation to tax compliance and payroll management.

Regulatory Compliance Staying compliant with government regulations and tax laws is crucial. We ensure that your financial records are accurate and up-to-date, helping you avoid penalties and legal issues.

Cost-Effective Solutions Outsourcing your accounting needs to TSP Group helps reduce overhead costs while ensuring accuracy and efficiency in financial management.

Tailored Services Whether you are a startup, SME, or a large enterprise, we customize our services to fit your unique business requirements.

Our Key Accounting and Bookkeeping Services

Bookkeeping Services: Regular recording of financial transactions, ledger maintenance, and reconciliation.

Financial Reporting: Preparation of profit and loss statements, balance sheets, and cash flow reports.

Tax Compliance & Filing: GST, TDS, and Income Tax compliance and filing services.

Payroll Management: Processing salaries, deductions, and ensuring compliance with labor laws.

Accounts Payable & Receivable: Efficient management of invoices, payments, and collections.

Bank Reconciliation: Regular reconciliation of bank transactions to maintain financial accuracy.

MIS Reporting: Custom financial reports for business insights and decision-making.

Boost Your Business with TSP Group

TSP Group is committed to providing reliable Accounting and Bookkeeping services in Navi Mumbai to help businesses streamline their financial processes and focus on growth. With our expert team and cutting-edge financial tools, we ensure accuracy, transparency, and compliance in all your financial dealings.

Contact TSP Group today to enhance your financial management and take your business to new heights!

0 notes

Text

Unified Global Payroll Solution | As1 by APPLIC8

Manage your international payroll effortlessly with As1,a unified global payroll solution with its increased compliance and effiency.

1 note

·

View note

Text

Benefits Of Partnering With A Payroll Agency For Your Business

As a business owner, managing payroll can be a time-consuming and complex task. It requires a significant amount of resources, expertise, and attention to detail to ensure accuracy and compliance with regulations. This is where payroll outsourcing comes in – a solution that can help streamline your payroll processes, reduce costs, and improve efficiency. Read more.

URL: https://blogsgod.com/benefits-of-partnering-with-a-payroll-agency-for-your-business/

0 notes

Text

Why Payroll Outsourcing is Crucial for Business Success

Payroll outsourcing is crucial for business success as it allows companies to streamline operations, reduce administrative burdens, and ensure compliance with ever-changing tax regulations. By outsourcing payroll, businesses can focus on core functions, improve accuracy, minimize errors, and mitigate the risk of costly penalties. It also offers access to expert knowledge and advanced technologies, ultimately leading to enhanced efficiency and cost savings.

0 notes

Text

Payroll Outsourcing: Trusted Payroll Management Services In Bangalore - BCshetty & Co

BC Shetty & Co is the best payroll outsourcing services provider for businesses, the payroll services are well known for their experienced professionals who specialize in payroll management services. Book an appointment today!

0 notes

Text

0 notes

Text

Streamline Your Payroll Process with Zimyo HRMS: Tax, Compliance, Expense Management, and Employee Benefits.

0 notes

Text

Best Payroll Outsourcing Company in Chennai: Simplifying Payroll Management

Managing payroll is one of the most intricate and time-consuming tasks for businesses of any size. With an ever-evolving landscape of government regulations and tax laws, it becomes challenging for companies to keep up and ensure compliance. Not only does payroll management demand attention to detail, but any errors can also result in costly penalties. That's why partnering with the Best Payroll Outsourcing Company in Chennai can be a game-changer for businesses looking to streamline their operations.

By opting for payroll outsourcing services, businesses can focus on their core activities while experts handle the intricacies of payroll. At Diamond Lead Associates (DLA HR), we offer top-notch payroll solutions backed by years of experience and a deep understanding of the latest payroll changes. As a Top Payroll Management Company in Chennai, we ensure accuracy, compliance, and timely processing, helping your business save time, reduce costs, and avoid compliance risks. Let the experts manage your payroll so you can concentrate on what you do best—growing your business!

By outsourcing payroll to a trusted Payroll Service Provider in Chennai, companies can also benefit from improved data security and error-free payroll calculations. Our services are designed to handle everything from salary calculations to statutory compliance, ensuring your employees are paid on time and in full accordance with the law. As the Best Payroll Outsourcing Company in Chennai, we prioritize customer satisfaction by offering customized solutions tailored to your specific needs. Let us simplify your payroll process so you can enjoy peace of mind, knowing your payroll is in expert hands.

#hragency#hroutsourcing#hrconsultancy#hrservices#hrconsultant#chennai#recruitment agency in chennai#dlahr#payroll outsourcing#payroll#payrollserviceprovider

0 notes

Text

This article explores the costs associated with outsourcing payroll services in the UK, detailing key components such as monthly fees, setup costs, and additional services. It also discusses factors influencing these costs and highlights the benefits of partnering with an outsourced payroll provider for businesses seeking efficiency and compliance.

#outsourced payroll provider#payroll outsourcing company#outsource payroll services#outsource payroll#payroll outsourcing#outsourced payroll services#outsourcing payroll services#payroll services

1 note

·

View note

Text

How Accounting Outsourcing Services Can Help Scale Your Business

In today's fast-paced business environment, every company is looking for ways to streamline operations, cut costs, and drive growth. As businesses expand, managing financial tasks becomes increasingly complex. That’s where accounting outsourcing services come into play. By leveraging external expertise, businesses can not only improve efficiency but also free up time and resources to focus on their core operations. Outsourcing accounting services allows businesses to tap into a wealth of knowledge and resources without the hassle of hiring in-house staff. In this article, we’ll explore how outsourcing your accounting functions can help scale your business effectively.

1. Access to Expertise and Advanced Technology

One of the most significant advantages of outsourcing your accounting tasks is gaining access to experienced professionals who specialize in different areas of finance. These experts bring years of industry knowledge, ensuring that your financial statements are accurate, compliant with regulations, and aligned with industry best practices.

When businesses try to handle complex financial processes in-house, they often face challenges like outdated knowledge or reliance on manual processes. Outsourced accounting firms, on the other hand, invest heavily in advanced technology. They use cutting-edge tools and software to automate processes like payroll, invoicing, tax filings, and reporting. This not only improves accuracy but also ensures timely completion of tasks.

Moreover, outsourced firms stay updated with changing financial regulations, which can be a challenge for small businesses. With a dedicated team managing compliance, your business will avoid costly mistakes and penalties.

2. Cost Efficiency

Hiring and maintaining an in-house accounting department can be expensive. Salaries, benefits, training, and office space are just a few of the costs associated with having an internal team. Outsourcing, on the other hand, allows you to pay for only what you need. Whether it’s daily bookkeeping or quarterly financial reporting, outsourced services are often more flexible and scalable compared to an internal team.

By paying only for the services you use, you can optimize your budget and reallocate resources to other growth-focused activities. The cost savings from outsourcing are particularly beneficial for startups and small businesses that may not have the financial bandwidth to maintain a full-time accounting staff.

3. Scalability and Flexibility

As your business grows, so do your financial needs. Scaling an in-house accounting department to meet these growing demands can be both time-consuming and costly. Outsourced accounting services, however, offer scalability that allows you to adjust the level of support based on your business's current needs.

Whether you’re launching a new product, expanding to new markets, or experiencing seasonal fluctuations, outsourced accounting firms can easily scale their services up or down. This flexibility ensures that your financial needs are always met, no matter the stage or size of your business. It also allows you to maintain control over your finances without the burden of constantly hiring and training new staff.

4. Focus on Core Business Activities

As a business owner or manager, your time is valuable. Spending hours each week on accounting tasks can divert your attention from strategic initiatives that are essential to business growth. By outsourcing your accounting functions, you can refocus on core activities like sales, marketing, and product development.

Outsourced accounting services take care of time-consuming tasks such as reconciliations, financial reporting, and tax preparation. With these responsibilities handled by professionals, you and your team can concentrate on driving revenue and scaling the business. This shift in focus can lead to more strategic decisions and better long-term outcomes.

5. Better Decision-Making Through Real-Time Financial Insights

In today’s competitive landscape, businesses need access to real-time financial data to make informed decisions. Outsourced accounting services offer cloud-based solutions that provide instant access to financial reports, cash flow statements, and other key metrics.

Having up-to-date information at your fingertips enables you to make proactive decisions regarding budgeting, investment opportunities, and resource allocation. With accurate and timely insights, you can identify potential challenges early on and take corrective action before they affect your bottom line.

Outsourced firms also offer customized financial reports tailored to your business’s unique needs. This means you’ll receive relevant data that highlights important areas for improvement, helping you make smarter financial decisions.

6. Minimized Risk of Fraud

Fraud is a major concern for businesses of all sizes, but small and medium-sized enterprises (SMEs) are particularly vulnerable due to limited internal controls. When accounting functions are handled internally, there’s a risk of errors, mismanagement, or even fraudulent activities going undetected.

Outsourced accounting services can help mitigate this risk by providing multiple layers of oversight. With a team of professionals monitoring your financials, there’s greater accountability and transparency. Additionally, outsourced firms use sophisticated software that includes built-in checks and balances to prevent fraudulent activities.

This added layer of protection can give you peace of mind knowing that your financial data is secure and managed with the highest level of integrity.

7. Improved Compliance and Risk Management

Navigating the ever-changing landscape of tax laws and financial regulations can be daunting. Non-compliance can result in hefty fines, penalties, and reputational damage. Outsourcing your accounting services ensures that your business remains compliant with all relevant regulations.

Professional accounting firms have a deep understanding of local and international tax codes, ensuring that your business adheres to the latest requirements. This reduces the risk of errors in tax filings and guarantees that all necessary documentation is submitted on time.

Additionally, outsourced firms can offer guidance on risk management strategies. Whether it’s identifying potential financial pitfalls or ensuring that your business complies with industry-specific regulations, these firms provide the expertise needed to navigate complex financial environments.

8. Enhanced Focus on Growth and Expansion

With your accounting tasks outsourced, you have the bandwidth to focus on growth and expansion. You can allocate resources to areas that directly impact revenue generation, such as product development, marketing, or customer acquisition.

Outsourced accounting firms also provide valuable insights into your financial health. They can help you identify trends, forecast cash flow, and recommend cost-saving measures that can fuel your expansion efforts. With a clear understanding of your financial position, you can make data-driven decisions that support sustainable growth.

9. Access to a Broader Network of Financial Services

In addition to managing your day-to-day accounting needs, many outsourced firms offer a suite of financial services, including tax planning, audit preparation, and financial consulting. By partnering with an outsourced accounting firm, you gain access to a broader network of financial experts who can support various aspects of your business.

This holistic approach ensures that all of your financial needs are met under one roof, creating a seamless experience that enhances efficiency and productivity. You can also benefit from strategic advice on issues like mergers and acquisitions, financing options, and investment strategies.

Conclusion

Outsourcing accounting and payroll services is not just about reducing costs; it’s about positioning your business for long-term success. By accessing expert knowledge and advanced technology, and ensuring enhanced compliance while minimizing fraud, the benefits of outsourcing are significant. Whether it's accounting or payroll outsourcing, it allows you to focus on what truly matters: growing your business.

By delegating both your accounting and payroll tasks to professionals, you can scale your operations without the headache of managing an expanding internal department. The flexibility, cost-efficiency, and expertise offered by outsourced accounting and payroll firms can empower your business to achieve new levels of success.

Outsourcing is not just a trend; it’s a proven strategy for businesses that want to remain competitive, agile, and focused on their core strengths. As your business continues to grow, consider leveraging both accounting and payroll outsourcing services to unlock your full potential and drive sustainable growth.

0 notes

Text

Payroll services in Mumbai

TSP Group is a trusted name in offering comprehensive payroll services in Mumbai, catering to businesses of all sizes and industries. We specialize in streamlining payroll management processes to ensure accuracy, compliance, and efficiency. Our services are designed to help organizations reduce administrative burdens and focus on their core business activities.

Mumbai is a hub for businesses, with diverse industries requiring seamless payroll management. TSP Group understands the unique challenges faced by companies in this competitive environment. We provide end-to-end payroll solutions, including salary calculations, tax deductions, statutory compliance, employee benefits administration, and timely reporting.

Why Choose TSP Group for Payroll Services in Mumbai?

Accurate Payroll Processing: We leverage advanced technology to ensure error-free payroll calculations and timely salary disbursement.

Statutory Compliance: Our experts stay updated with the latest labor laws, tax regulations, and compliance requirements, ensuring your business adheres to all statutory obligations.

Customized Solutions: Every business is unique, and we tailor our payroll services to meet the specific needs of your organization.

Data Security: We prioritize the confidentiality and security of your payroll data with robust systems and practices.

Cost-Effective Services: Outsourcing payroll to TSP Group reduces administrative costs and improves overall operational efficiency.

Our services cover essential areas such as managing employee records, preparing payslips, handling PF, ESIC, and gratuity contributions, and ensuring accurate TDS filings. With TSP Group, businesses can eliminate the hassle of payroll errors, penalties, or missed deadlines.

Partnering with TSP Group for payroll services in Mumbai guarantees a seamless, transparent, and compliant payroll process. Whether you’re a startup, SME, or large enterprise, we have the expertise and resources to support your business needs effectively.

Contact TSP Group today to learn more about how our payroll solutions can transform your business operations in Mumbai. Let us handle your payroll so you can focus on achieving your business goals.

0 notes

Text

Transforming Human Resources Management in the Digital Age

In the fast-evolving landscape of the digital age, the role of Human Resources (HR) management is undergoing a profound transformation. As organizations navigate the complexities of a globalized economy, rapid technological advancements, and shifting workforce dynamics, HR leaders are embracing digital tools and innovative strategies to drive organizational success and empower employees.

#Human Resources Management#hr services#HR Solution#Payroll Management Services#Payroll Management Solution#Payroll Outsourcing#MYNDSolution

0 notes

Text

Outsourcing Payroll Services in India

Payroll outsourcing involves hiring external experts to handle payroll-related tasks, including calculating wages, managing deductions, ensuring compliance with tax laws, and handling employee benefits.

Call us: 📞 098189 82759

For More Information-

Visit Our Website ➡ www.sigmac.co.in

0 notes