#Outsourcing Payroll Services in India

Explore tagged Tumblr posts

Text

Outsourcing Payroll Services in India

Payroll outsourcing involves hiring external experts to handle payroll-related tasks, including calculating wages, managing deductions, ensuring compliance with tax laws, and handling employee benefits.

Call us: 📞 098189 82759

For More Information-

Visit Our Website ➡ www.sigmac.co.in

0 notes

Text

Payroll outsourcing in UK

Breathe Easy, Business Owners: Why Payroll outsourcing in UK with MAS LLP is Your Secret Weapon Running a business in the UK is exhilarating, but managing payroll? Not so much. Between HMRC deadlines, complex calculations, and ever-changing regulations, payroll can quickly become a time-consuming headache. That's where MAS LLP comes in, your one-stop shop for Payroll outsourcing in UK that takes the weight off your shoulders and lets you focus on what matters most: growing your business.

Why Choose MAS LLP for Payroll outsourcing in UK?

Expertise You Can Trust: Our team of qualified and experienced payroll professionals are the best in the business. They stay up-to-date on the latest HMRC regulations, ensuring your business remains compliant and avoids costly penalties. Accuracy Guaranteed: Say goodbye to manual calculations and spreadsheets. We leverage cutting-edge technology and robust processes to deliver error-free payroll every time. Time is Money: Free yourself and your team from the payroll burden. Outsourcing allows you to dedicate your valuable time and resources to core business activities that drive growth. Peace of Mind: Rest assured knowing your employees are paid accurately and on time, every time. We handle everything from deductions and taxes to payslips and reports, giving you complete peace of mind. Personalized Service: You're not just a number with MAS LLP. We believe in building strong relationships with our clients, providing you with a dedicated account manager who understands your unique needs and is always available to answer your questions. Beyond Payroll: The MAS LLP Advantage

MAS LLP goes beyond just processing payroll. We offer a comprehensive suite of accounting outsourcing services designed to streamline your finances and give you a clear picture of your business health.

Bookkeeping: From daily transactions to account reconciliation, we keep your books meticulously organized and error-free. VAT Compliance: Navigate the complexities of VAT regulations with our expert guidance and minimize risks. Management Reporting: Gain valuable insights into your finances with customized reports and analysis that help you make informed decisions. Cloud-Based Solutions: Access your financial data securely anytime, anywhere, with our user-friendly cloud platform. Partner with MAS LLP and Reclaim Your Time and Focus

Payroll outsourcing in UK with MAS LLP isn't just about ticking boxes; it's about investing in the future of your business. We empower you to focus on what you do best, while we handle the nitty-gritty of payroll with accuracy, efficiency, and a personal touch.

Ready to ditch the payroll headaches and get back to business? Contact MAS LLP today for a free consultation and discover how we can help you breathe easy and achieve your business goals.

Note: This blog post is just a starting point. Feel free to adapt it to include specific details about MAS LLP's services, testimonials from satisfied clients, or special offers to attract potential customers.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Payroll outsourcing in UK

4 notes

·

View notes

Text

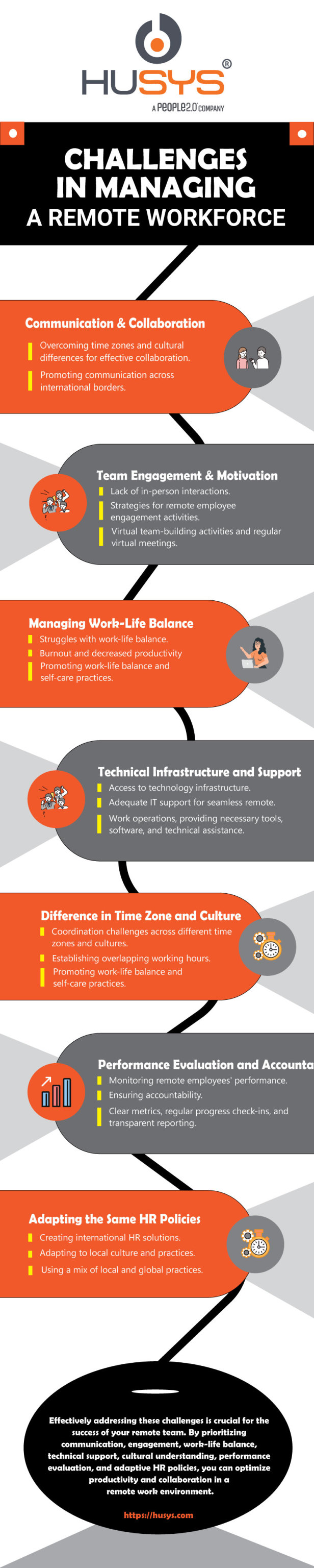

Managing a remote workforce brings unique challenges that can affect productivity and collaboration. To ensure your remote team's success, it's essential to tackle these challenges head-on. Check out my latest post to discover the common hurdles faced when managing a remote workforce and strategies for overcoming them. Let's thrive in the world of remote work! 💼🌍✨

#peo services in india#employer of record#peo services#payroll#payroll outsourcing#globalpayroll#business expansion#eor services india#remote work#remote workforce

2 notes

·

View notes

Text

Looking to expand your business without the hassle of setting up a local entity? Black Piano’s Employer of Record (EOR) services help you hire top talent in India while ensuring full compliance with employment laws and regulations. From payroll management and tax handling to HR support, we take care of everything so you can focus on growing your business. Partner with Black Piano and build your global team with ease. Hire talent legally and efficiently today!

#employer of record#outsourcing#payroll services#employment#uk business#offshoring#business#offshoring service#offshoring to india#eor services#EOR UK#UK business

0 notes

Text

Unlock Growth & Efficiency with Collab Accounting’s White-Label Services

The accounting industry is evolving rapidly, and firms are constantly looking for ways to scale without adding operational burdens. This is where Collab Accounting’s white-label services come in—allowing accounting firms to expand their offerings, improve efficiency, and deliver top-tier services under their own brand.

What Are White-Label Accounting Services?

White-label services mean we handle your Accounting, Bookkeeping, and compliance needs while you take the credit. Your clients see your brand, while our team works in the background to ensure smooth operations.

How We Help Accounting Firms Scale Effortlessly

1. End-to-End Bookkeeping & Compliance – Our experts handle everything from transaction entries to reconciliations, BAS lodgments, and Payroll processing.

2. Xero, QuickBooks & MYOB Expertise – We integrate seamlessly with your existing systems, ensuring accuracy and efficiency.

3. SMSF & Tax Return Preparation – We help firms streamline complex tax compliance while maintaining 100% confidentiality.

4. Virtual CFO Support – Need an extra layer of financial expertise for your clients? We provide Financial analysis, forecasting, and reporting to help businesses make better decisions.

5. Scalability Without Overheads – No need to hire in-house accountants when you can have a dedicated offshore team working under your brand.

Why Choose Collab Accounting?

1. 100% White-Label Model – Your clients see your brand, and we do the work. 2. Dedicated Team with Full Compliance – We ensure data security and adherence to Australian accounting standards. 3. Seamless Communication – Work with a team that understands your business, aligns with your processes, and provides real-time updates.

Let’s Partner for Success!

If you’re an accounting firm looking to scale without increasing overhead costs, our white-label services can be the perfect solution. Focus on growing your firm while we handle the work.

Get in touch with us today to explore a tailored white-label accounting solution!

#bookkeeping services for small business#outsource payroll services#bookkeeping services outsourcing#top 10 accounting outsourcing companies in india

0 notes

Text

Payroll Management Companies in India: What You Need to Know

For any business, payroll administration is an essential aspect. The payroll process needs both precision and attention to detail in order to calculate wages and deductions and guarantee compliance with tax rules. Businesses that try to manage it might be overwhelmed by it because of the following reasons:

#payroll management company#payroll management company in india#payroll management service#payroll outsourcing services#MYND Solution

0 notes

Text

0 notes

Text

Easy Source India - Your Trusted Payroll Outsourcing Partner

Easy Source India offers comprehensive payroll outsourcing services designed to streamline your business operations. By managing your payroll processes, they ensure accuracy, compliance, and timely salary disbursement, allowing you to focus on core business activities. Their expert team handles everything from payroll calculations to tax compliance, providing tailored solutions for businesses of all sizes.

0 notes

Text

Why Safebooks Global is the best firm for outsourcing & offshore in Australia

In the ever-evolving landscape of business operations, companies across Australia are constantly seeking innovative solutions to streamline their processes and optimize their resources. One of the most effective strategies employed by businesses today is outsourcing various tasks to specialized service providers. And when it comes to outsourcing accounting, tax preparation, bookkeeping, and payroll services, Safebooks Global Pvt Ltd emerges as the go-to partner for organizations looking to enhance their financial efficiency and accuracy.

Safebooks Global Pvt Ltd, a renowned company in Australia, has established itself as a trusted and reliable partner for businesses seeking top-notch outsourced accounting and financial services. With a proven track record of excellence and a team of highly skilled professionals, Safebooks offers a wide range of services tailored to meet the specific needs of each client. From outsource accounting to offshore accounting services, tax preparation, virtual bookkeeping, payroll outsourcing, and more, Safebooks has the expertise to handle all aspects of financial management with precision and efficiency.

Outsource accounting is a strategic decision that allows companies to focus on their core competencies while leaving the financial tasks to experts. Safebooks understands the complexities of managing finances and offers comprehensive accounting services that ensure accurate reporting, compliance with regulations, and timely financial insights. By outsourcing accounting functions to Safebooks, businesses can reduce costs, improve productivity, and gain access to expert advice and support.

Offshore accounting services are another area where Safebooks excels. By leveraging offshore resources in countries like India, Safebooks can provide cost-effective accounting solutions without compromising on quality. Outsourcing taxation services to India has become a popular choice for many Australian businesses due to the significant cost savings and access to a large pool of skilled professionals. Safebooks manages the entire process seamlessly, ensuring data security, confidentiality, and efficient communication throughout.

Tax preparation is a critical aspect of financial management that requires meticulous attention to detail and up-to-date knowledge of regulations and laws. Safebooks offers specialized tax preparation services that cater to businesses of all sizes. By outsourcing tax preparation to Safebooks, companies can ensure accurate tax filings, maximize deductions, and minimize the risk of penalties or audits.

Virtual bookkeeping services provided by Safebooks give businesses the flexibility to access real-time financial information from anywhere, at any time. By outsourcing bookkeeping tasks to Safebooks, companies can maintain organized and updated financial records, track expenses, manage cash flow, and make informed decisions based on accurate financial data.

As a payroll outsourcing partner, Safebooks takes the hassle out of managing payroll processes for businesses. With advanced payroll systems and expert professionals, Safebooks ensures timely and accurate payroll processing, compliance with regulations, and secure data management.

In conclusion, Safebooks Global Pvt Ltd stands out as the best company for outsourcing accounting, tax preparation, bookkeeping, and payroll services in Australia. With a commitment to excellence, a client-focused approach, and a team of experienced professionals, Safebooks delivers top-quality financial solutions that help businesses thrive. By partnering with Safebooks, companies can streamline their financial operations, reduce costs, and free up valuable resources to focus on growth and success.

#Accounts Payable Services#outsource accounting#offshore accounting services#outsource tax preparation services#Virtual bookkeeping services#outsourcing taxation services to india#payroll outsourcing partner#outsourcing tax preparation

0 notes

Text

When it comes to reaping the myriad benefits of payroll processing companies in Pune, particularly with Work & Wages, you're in for a reliable and efficient partnership. We stand proud to be your trustworthy ally for top-notch payroll management. Our expert team excels at optimizing operations to ensure full compliance, all the while assisting you in saving costs. we promise accuracy and efficiency every step of the way. Not to mention, our adaptable pricing structures are carefully crafted to cater to your specific requirements, making it a cost-effective resolution. Rest assured, we place a premium on robust data security protocols to safeguard your sensitive information, guaranteeing you peace of mind throughout the entire process.

0 notes

Text

#accounting outsourcing companies in usa#sales tax outsourcing#sales tax compliance outsourcing#payroll#bookkeeping outsourcing services usa#cpa#accounting services#accounting bookkeeping service#accounting firm#accounting & bookkeeping services in india

0 notes

Text

Elevate your business with SIGMAC & Co

Our expert audits provide clear insights, boost efficiency, and highlight areas for growth. 📊🔍

Call us: 📞 098189 82759

For More Information-

Visit Our Website

➡ www.sigmac.co.in

#chartered accountant in gurgaon#business process outsourcing#outsourced accounting service#business process outsourcing services in india#outsourcing accounting services in india#payroll outsourcing services

0 notes

Text

Alta Global Services

Alta FMS offers extensive solutions for plumbing, carpentry, and masonry needs. Our skilled plumbers are adept at handling everything from simple repairs to complex installations, ensuring efficient water flow and proper drainage systems. Our carpenters excel in crafting custom furniture, repairing fixtures, and enhancing interior spaces. Additionally, our masons specialize in building and repairing structures, including brickwork, stone masonry, and concrete installations, ensuring durability and aesthetic appeal for all projects.

#Atla Global Services#payroll service#payroll provider#payroll processing companies#payroll outsourcing companies#payroll management system#payroll service providers#hr and payroll services#payroll management company#paycheck companies#payroll agency#outsource payroll services#payroll management services#payroll in india#process payroll

1 note

·

View note

Text

#tax#payroll#accounting#business#finance#Global Payroll#Payroll#HR#Global Expansion#EOR#India Payroll#UK Payroll#Outsourcing#company registration#eor services#poe hr#poe employer#poe employment#payroll poe#global peo#eor providers#payroll processing#payroll services#payroll software#online payroll#outsourced payroll#tax filing for payroll#payroll tax compliance#direct deposit#pay stubs

0 notes

Text

UK employers hit by new ‘Job Tax’ – Why offshoring may be their only option

The UK Labour Budget has introduced a ‘Job Tax’ — a rise in Employers’ National Insurance by 1.2% plus £615 per employee. While aimed at raising funds for Britain, this move is squeezing businesses already grappling with inflation and the shift to remote work.

What’s the solution? Offshoring. It’s no longer just for big corporations — SMEs can now reduce costs by up to 70% while accessing global talent.

Worried it’s complicated? Think again. With Black Piano as your Employer of Record, we make remote hiring effortless.

Read the full blog here: blackpiano.co.uk/post/national-insurance-budget-uk.

#offshoring#outsourcing#uk business#business#employer of record#payroll services#employment#offshoring to india#offshoring service

0 notes

Text

9 Cash Flow Hacks Every Small Business Owner Needs to Know!

Cash flow is a lifeline of every small business. However, it may feel more like a looming storm cloud for many entrepreneurs than an essential stream. Compared to profit, which measures earnings after expenses, cash flow measures actual incoming and outgoing money flows at a given time. Ideally, a positive cash flow means enough coming in to cover outgoing expenses, leaving you ample space for investment. On the other hand, negative cash flows could quickly cripple operations, impacting bill payments and payroll obligations or taking advantage of opportunities as soon as before.

Therefore, in this blog post, you will learn the best of nine essential cash flow hacks that every small business owner or outsourced accounting services should implement for improved cash management, smooth operations, and long-term success.

Understanding Cash Flow!

Before discussing hacks for managing cash flow, let's establish an understanding. To simply understand, cash flow refers to the difference between how much income your business brings in (from sales or investments, for instance) and the costs (rent, inventory purchases, or payroll, for example) it incurs, with positive cash flows signaling sufficient revenue generation that covers ongoing expenses while encouraging growth. As previously said, negative ones indicate you may be spending more than earning and could signal financial trouble ahead.

Cash Flow has three distinct categories:

1. Operating Cash Flow: This measures your daily cash flows generated from the primary business activities, such as sales minus operating expenses.

2. Investing Cash Flow: This measures any funds used for purchasing or disposing of long-term assets like equipment or property.

3. Financing Cash Flow: Financing cash flow refers to all cash flow associated with financing your business - this may include loans, investments, and owner contributions.

Understanding different types of cash flows allows you to understand your business's financials to make more informed decisions. Below are nine cash flow hacks that will empower you to take charge of its future success!

1. Master Your Data Ninja Skills by Tracking Every Penny

Knowledge is power when it comes to finances, so the first step towards mastering cash flow is keeping track of every penny coming in and out. Free and paid accounting software companies offer users to categorize expenses, generate reports and identify areas for improvement - spreadsheets may work temporarily but dedicated software provides greater automation and data security.

2. Prioritize Carefully: Not All Expenses Are Created Equal

Once you've gained insight into your spending patterns, the time has come to assess and prioritize. We shouldn't treat all expenses equally, prioritize essential costs like rent, payroll, and utilities against discretionary ones such as expensive office furniture or subscription services you rarely use. Slash any unnecessary spending that doesn't directly contribute to driving revenue growth or keeping outsourced accounting services business running efficiently.

3. Harness the Power of Inventory Management to Maximize Returns

Inventory plays an integral role for many businesses; however, excess stock ties up valuable cash. Analyzing sales data will allow you to understand which products sell best so your ordering practices can adjust accordingly. Consider adopting a "just-in-time" inventory management system where products can be ordered closer to when needed for maximum cash savings and no unnecessary products stored as inventory.

4. Invoice Effectively and Collect Faster

Unpaid customers can seriously damage your cash flow. The following tactics can help with quicker collection:

Offer Rewards for Early Payment: Take into account providing incentives like a discounted payout for early payments (for example, offer a 2% discount if paid within 10 days).

Clear and concise invoices: Ensure that all the relevant information, including due dates and different payment options, is included in your bills and that they are simple to understand.

Regularly check in: Reminding clients who have outstanding invoices that repayments are overdue should not be avoided with grace.

Explore Your Payment Options: Make payments easier for clients by offering various payment methods, such as online or credit card processing, to increase the speed of payments.

5. Create an Emergency Fund

Unexpected expenses are part of business life, from broken printers, higher raw material costs, or decreased sales can all significantly alter cash flow. Be proactive by creating an emergency fund aimed at covering at least six to twelve months' worth of essential expenses - this way, you will have peace of mind while weathering financial storms without jeopardizing your company.

6. Renegotiate, Renegotiate!

Do not be intimidated into renegotiating your bills with vendors and suppliers - loyalty should always be rewarded! Explain your situation, discuss potential options such as extended payment terms, volume discounts or bundling packages that might save money in the long run.

7. Explore Alternative Financing Alternatives

Sometimes, even with careful management, cash flow gaps arise. While traditional loans remain an option, other financing solutions like lines of credit and invoice factoring offer fast cash injections to cover temporary expenses or weather seasonal variations. Ensure that all options and terms have been considered before making any definitive decisions.

8. Leverage Technology to Automate Your Finances

When it comes to managing financial flows, technology may be a huge help. Automation reduces mistakes and frees up critical time by automating repetitive operations like processing payments, generating invoices, and generating reports.

9. Retain Your Best Customers, They're Worth

Acquiring new customers can be costly. Instead, focus on keeping hold of existing ones by offering loyalty programs or exclusive discounts; providing exceptional customer service can build trust among repeat buyers while strengthening cash flow stability. Retaining customers provides you with reliable sources of recurring income while stabilizing cash flow management.

Bonus Advice: Unleash the Potential of Teamwork!

To save money on the necessary supplies and machinery purchases, think about forming a buying collaboration with other small firms in your sector. This will allow you to pool resources and bargain with vendors for bulk pricing.

For your small company to succeed in the long run, managing your bookkeeping and accounting should be a continuous activity that you should be committed to. You can also consider an outsourcing accounting company to speed up things with efficiency and accuracy.

Conclusion

By employing these hacks and regularly monitoring finances, you can establish an optimal cash flow rhythm in your outsourced accounting services business. Even minor improvements in cash flow management practices can profoundly affect its long-term viability; keep an eye on data, negotiate confidently with suppliers, and consider innovative solutions - with dedication and these hacks, your small business could prosper!

#accounting outsourcing companies in india#outsourced accounting services#outsourcing accounting company#payroll#taxation#taxadvice#tax accountant

0 notes