#Payday loan claims

Explore tagged Tumblr posts

Text

Intuit: “Our fraud fights racism”

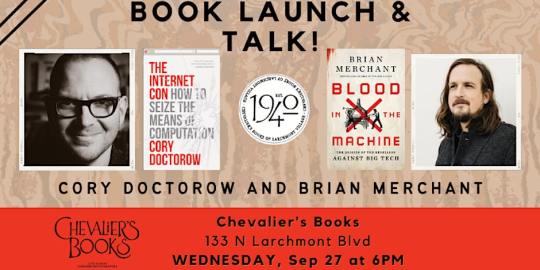

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

Not surprisingly there is a great deal of ~discourse~ about what those of us who care about Palestine should do in the 2024 election. I am particularly moved to respond to an episode of the Know Your Enemy podcast on this subject, in which the host Sam Adler-Bell discussed the matter with three leading political thinkers and activists of our generation: Astra Taylor, Olúfẹ́mi Táíwò, and Malcolm Harris, all of whose work I greatly admire.

Nonetheless I found the conversation exasperating, because it seemed to take as its starting point the dichotomy between principle, which would entail voting against Harris/Walz in solidarity with Palestine, versus strategic expediency or hard-headed realism, would lead one to vote for them as a measure against the greater threat of a Trump victory, then continuing to agitate on behalf of Palestine and other causes toward the presumably-friendlier audience of a Democratic presidential administration. That was highlighted by Malcolm’s advocacy for disruptive direct action against the national security state and supply chain as a supposed alternative to voting, which Sam eagerly seized on as a foil because it enabled him to juxtapose that supposedly more radical position with his own pragmatism, and in response to which he could graciously state that we need both.

I don’t consider voting for the Democratic presidential ticket to be strategically sound or expedient. If you saw someone trying to convince a dejected, broke gambler to take out another loan and go back into the casino because it was his moral obligation, you wouldn’t consider that person to be giving strategically sound advice—you would hold them in contempt. If you saw a financial advisor telling someone behind on their rent to take out another payday loan because they have a moral obligation to their landlord, you might think that could be the best of a very bad set of options, but you would be very suspicious of the moral claim. If you heard a career counselor telling someone whose career isn’t going the way they wanted to take out a student loan to attend a coding bootcamp, you would rightly wonder whether the career counselor was being paid by the coding bootcamp to take advantage of someone in a vulnerable position. All of these are better analogies for the present situation vis a vis the 2024 election, because the entity whose aims voting serves, the Democratic Party, is a malevolent one that exists to exploit its voting base on behalf of its plutocratic constituency and needs our votes to continue to be able to do so. It doesn’t care how morally anguished we are, only that it gets what it needs to keep the grift going. The idea that we should serve up to our oppressor what it needs to keep oppressing us is repulsive, and that’s before we even get to Palestine.

21 notes

·

View notes

Text

A new settlement that will end a payday-like loan operation in Minnesota puts additional pressure on a Native American tribe that has been on the defensive for its high borrowing rates across the country. The Lac du Flambeau Band of Lake Superior Chippewa Indians has been telling customers that its practices are allowable, but that stance has become harder to maintain. Shortly before Thanksgiving, the Wisconsin tribe agreed to settle a civil suit filed by Minnesota Attorney General Keith Ellison alleging that LDF broke state law, which requires reasonable lending rates, by charging Minnesotans between 200% and 800% annual interest. The state also claimed LDF had violated statutes on consumer fraud, deceptive trade and false advertising. In the consent decree, LDF’s top official denied the allegations but formally agreed to stop lending to people in Minnesota unless the tribe adheres to the state’s strict usury laws and other regulations, including licensing requirements.

8 notes

·

View notes

Text

The Social Consequences of Marketing

Marketing, while essential for businesses and economies, has also been criticized for causing harm to society in various ways. Here are some significant ways in which marketing has negatively impacted society:

1. Promotion of Consumerism

Excessive consumption: Marketing often encourages the idea that happiness and success are linked to material goods, promoting a culture of consumerism. This has led to excessive consumption, debt, and environmental damage, as people are driven to buy more than they need.

Planned obsolescence: Companies sometimes design products with limited lifespans, encouraging consumers to buy new versions frequently. This practice contributes to waste, depletion of resources, and increased consumer spending.

2. Exploitation of Insecurities

Body image and self-esteem: Advertising in industries like fashion, beauty, and fitness often exploits people's insecurities by promoting unrealistic beauty standards. This can lead to mental health issues such as low self-esteem, anxiety, body dysmorphia, and even eating disorders.

Fear-based marketing: Some marketing strategies use fear to sell products, such as insurance, security systems, or health products, by making consumers feel unsafe or inadequate without them.

3. Targeting Vulnerable Populations

Children: Marketing often targets children, who are particularly susceptible to persuasive messages. This leads to the commercialization of childhood, with kids exposed to unhealthy food, consumerist values, and a materialistic mindset from an early age.

Low-income groups: Companies sometimes market harmful products, such as payday loans or unhealthy foods, more aggressively to low-income populations, exacerbating financial hardship or health problems.

4. Perpetuation of Stereotypes and Social Divides

Gender roles: Marketing often reinforces gender stereotypes, portraying women as caregivers or men as breadwinners, thereby perpetuating outdated norms that limit gender equality and diversity.

Cultural appropriation and tokenism: Some brands use cultural symbols or minority groups in marketing campaigns without understanding their significance, which can lead to cultural appropriation and tokenism, alienating and misrepresenting marginalized communities.

5. Environmental Damage

Overemphasis on fast fashion and disposable goods: Marketing has contributed to the rise of fast fashion and a throwaway culture, promoting short-term use of cheap, disposable products. This has serious environmental consequences, including pollution, resource depletion, and the generation of vast amounts of waste.

Greenwashing: Some companies falsely market products as "environmentally friendly" or "sustainable" in an attempt to capitalize on consumers' eco-consciousness, misleading the public and delaying genuine action on environmental issues.

6. Manipulation and Misinformation

False advertising: Companies sometimes make exaggerated or false claims about their products, misleading consumers and creating false expectations. This can be particularly harmful when it comes to health products, pharmaceuticals, or weight-loss treatments.

Addictive design: Marketing techniques are increasingly used to promote addictive behaviors, particularly in the context of social media, video games, or gambling. Companies manipulate users through behavioral nudges and psychological triggers that keep them hooked.

7. Invasion of Privacy

Data mining and surveillance: With the rise of digital marketing, companies have gained unprecedented access to consumers’ personal data. Many firms engage in data mining and targeted advertising based on individuals' online behavior, often without full transparency or consent, leading to concerns about privacy and data security.

Personalization and manipulation: Highly personalized marketing can lead to manipulation, as companies can target individuals with ads tailored to their specific vulnerabilities, making it harder for consumers to make objective decisions.

8. Promotion of Unhealthy Lifestyles

Junk food advertising: Aggressive marketing of unhealthy foods, particularly to children, has been linked to rising rates of obesity, diabetes, and other diet-related diseases.

Alcohol and tobacco marketing: Despite restrictions in some countries, marketing of alcohol, tobacco, and vaping products continues to glamorize these potentially harmful substances, leading to addiction and public health crises.

9. Contributing to Financial Instability

Credit and debt marketing: Marketing of credit cards, loans, and other financial products often promotes spending beyond one's means, contributing to personal debt and financial instability. Predatory lending practices, such as payday loans, are frequently marketed to those already in financial difficulty.

10. Reduction of Authenticity and Creativity

Commercialization of art and culture: Marketing can sometimes reduce art, culture, and creativity to mere products to be sold, stripping them of their authenticity. This can lead to the commodification of creative expression and a focus on profit over substance.

Trend exploitation: By constantly pushing new trends, marketing fosters a culture of superficiality and short-term thinking, where value is placed on what is fashionable or trending rather than what is meaningful or lasting.

While marketing plays a critical role in the economy by connecting consumers with products, it also has significant social, psychological, and environmental consequences. From promoting overconsumption and exploiting insecurities to targeting vulnerable groups and contributing to environmental degradation, marketing practices have often prioritized profit over societal well-being. Reforming marketing to be more ethical and socially responsible is essential for creating a healthier, more sustainable society.

#philosophy#epistemology#knowledge#learning#education#chatgpt#ethics#economics#society#politics#Consumerism and Materialism#False Advertising#Gender Stereotypes in Media#Data Privacy and Surveillance#Environmental Impact of Marketing#Exploitation of Insecurities#Ethical Marketing Practices#Targeting Vulnerable Populations#consumerism#marketing#advertising#capitalism

9 notes

·

View notes

Text

MyPillow and Mike Lindell sue another lender, claiming $1.2M loan was a ‘sham’

He alleges a New York cash advance company charged an “illegal, usurious” interest rate of 409%.

MyPillow and CEO Mike Lindell are suing another merchant cash advance company over an allegedly illegal loan.

The Chaska-based manufacturer borrowed $1.5 million from Cobalt Funding Solutionsin September and agreed to make 50 daily payments for a total repayment of $2.2 million, according to a lawsuit filed last week in Carver County District Court.

The resulting 409% interest rate is “many times greater than the maximum interest rate permitted under the applicable state usury law,” the suit says.

“Cobalt ... took advantage of MyPillow, a cash-strapped business that needed funds quickly,” the complaint says. “This transaction is an illegal, usurious loan,” and MyPillow wants a judge to declare the loan unenforceable and award unspecified damages.

Cobalt did not immediately return a request for comment Tuesday.

The suit is nearly identical to one filed in October that accused other merchant cash advance firms of violating federal racketeering laws and making an allegedly illegal $600,000 loan.

The companies essentially offer payday loans for businesses, and the industry “engages in loan sharking,” the lawsuit says. In this case, Cobalt offered to buy MyPillow’s future receivables and later filed a lien against the pillow maker to seize funds.

The purchase of future receivables was “merely a sham intended to evade the applicable usury law,” the complaint says. “Lenders ... ensure that they will be repaid at grossly inflated rates by hook or by crook.”

Cobalt says on its website it offers “revenue-based financing” and “swift financial solutions.”

That MyPillow sought out such funding shows a company in desperate need of cash.

MyPillow has suffered a run of setbacks in recent years, which began with major retailers pulling the pillows from shelves in response to Lindell’s unproven claims of election fraud in 2020. Sales have fallen, credit has been harder to come by and vendors and landlords have launched several suits over unpaid bills this year.

Lindell, now described in recent court documents as a Texas resident, also remains mired in defamation claims brought by voting machine companies. Those suits have yet to reach trial and could result in more than $1 billion in judgments.

4 notes

·

View notes

Text

Bank Of Dave 2: The Loan Ranger comes with a warning… The first voice and face you see and hear belongs to British troublemaker Alison Hammond. She appeared on Big Brother 3 in 2002, jumping on and off tables, smashing and crashing through them, and hasn't disappeared from our TV screens since.

I have no idea why she's still there.

But the purpose she shares here seems to be an interview she did on ITV's This Morning with Dermot O'Leary, apparently.

But once the actual film begins, you get the impression that the script is just explaining the basics with as many plot twists as possible. Not everyone knows what a short-term loan company is, but when Dave's friend Oliver (Amit Shah - Paddington in Peru) explains it, everything is discussed in nonsensical, overly explanatory terms.

I know Netflix has to cover every media outlet in the world, but this initiative, which began over a decade ago and has been largely eliminated, sounds more like two friends quoting from a pamphlet than talking. A simple conversation. Banking on Dave 2: The Lone Ranger, available on Free Flixhq, continues to feel like a bit of a formulaic plot, such as when Jessica (Chrissy Metz), an American journalist, is invited to England by Dave to investigate a short-term loan scandal. After a long flight, he immediately takes her to his hometown of Burnley for five minutes, then drops her off at his hotel, hoping she'll be refreshed the next morning. There will be jet lag for weeks!

This film also seems to be largely fiction. Following the basic premise already known, it uses a fictional US correspondent to accuse Dave Fishwick of money laundering while the head of the payday loan company Carlo Mancini (Rob Delaney - Deadpool and Wolverine) turns out to be the bad guy. The actor has a moustache and doesn't shave. Unfortunately, what we are left with is an incredibly boring, run-of-the-mill movie, completely predictable and with a fictional romance, a fictional court case and the appearance of Def, inserted to extend the running time. Leopard, that was never involved! Plus, if Dave indicated that he was going to take on the debts of everyone who was scammed by these companies, surely he would go bankrupt?! And judging realistically, he only did it for three people in total in the end.

Now, I might say something that will shock you, but I didn't have time to watch the first film from January 2023. But I watched the original documentary on Mr. Fishwick that aired on Channel 4 at the time, as well as countless interviews, so I know all the positives he claims.

But the film also included a fictional trial and a performance by Def Leppard, so… Bank of Dave 2: The Lone Ranger feels like a remake, like the original was run through an AI program, and now the results. Even if you were simply hoping for a "feel good" film, this is just a lame attempt. Come on, you guys can do better!

Even Rory Kinnear (No Time to Die), who plays Fishwick, shows up to get his paycheck in this film, and it feels like he's on holiday. I wonder if he did it at Dave's Bank?

Meanwhile, "Bank of Dave" isn't a bank; it's actually Burnley Savings and Loan, but Dave Fishwick has written "Bank of Dave" on the roof of the building.

The film is rated for ages 12 and over because Delaney's character uses the F-word several times. This is often done to remove the PG rating so Americans can watch the film, but these words, along with the short, mild PG swearing, are completely useless and should have been removed entirely.

There are no mid-credit or post-credit scenes.

Thanks to our friends at Netflix for providing a pre-release screener.

2 notes

·

View notes

Text

More info on our situation.

This will be posted to the GoFundMe as well.

I feel that it is incredibly important to express just how last resort this is. It has come to my understanding that if people are to come across this, they are likely to believe I haven't exhausted all of my options.

This, unfortunately, isn't the case.

Mississippi has never been safe for us as black, queer people. And having neighbors turned against us for something orchestrated by pur landlord has made it even less so for us to continue being here.

There is absolutely nothing left for us here.

Lemme explain. As of now, both my partner and I are employed. However, our pay and hours are nowhere near enough to cover the cost of rent without outside assistance from friends and family who are all also struggling at this time. This includes our other partner who has their own shit to deal with. I work at Dominos and am paid a flat $9.00/hr as a CSR. I'm only granted NINE (9) hours a week. Yes. You read that correctly. Only 9 hours a week. 18 every two. 36 a month. Which is why I started doing commissions. To make ends meet.

Because Void (our cat) would genuinely have nowhere to go if we didn't make things work somehow. We've had him since he was a kitten, and he would be even more devastated than us.

Friends can't take him. Not anyone nearby. And with the lack of proper shelters, surrendering him would likely spell death.

Just know, while things weren't perfect, they were not always like this. We started falling behind after a technological error on the Apartment's end (More on that later) where two months' worth of rent was never posted. And once we made the error known, it came with fees stacked from both months and then some. In the middle of March. After I'd been dropped from my internship at a super Christian-run food bank. Where I was the only openly queer one there. 🙃

And it's truly only been downhill from there.

My nesting partner is paid slightly more than me at 9.75/hr, but they haven't been given a full 40 hour week since September of last year. This is after asking for all that can be given at their job despite dealing with chronic pain and being immunocompromised. They've been working without any sort of proper accommodation aside from being offered brief breaks in the store's beer cooler.

We've taken out payday loans out of sheer desperation not to lose our home, two of which almost crippled us.

We do not have a car. Mississippi's public transportation system is absolutely abysmal. I used the bus to go to work during my internship. I was left stranded twice and was s3xually harrassed during my rides on several occasions. The system is horrendously underfunded, so the drivers just don't care.

We have tried various programs including section 8. The wait lists are endless.

The property manager has explicitly expressed that they do not accept vouchers from any of the most prevelant housing assistance programs in our area. Which was one of the reasons why we almost weren't allowed to move here (Making a video on that soon.) during a time where we were, in fact, homeless and running out of time at the hotel we were staying at. The only assistance we have is for electric. And that's only because that bill is not processed directly through the complex itself.

I've been permanently flagged by the unemployed office. Why? Because one of my employers (the most transphobic experience I've ever had. More on that later.) claimed that nobody under my legal name, SS, or anything had ever worked there before. Every other experience listed was verified, but due to that one instance, even when I provided my old work badge and my W2, I was (and still am) no longer able to apply for unemployment without being stuck in a neverending wait list for an investigation that will never come. It will remain stuck in pending for months and then the case number will magically close without notice.

We have Food Stamps, but due to the sudden dip in income and hours, MDHS has pretty much flagged that I'm able-bodied but just choosing not to work. Which has resulted in the amount we're given monthly to harshly decrease.

What I'm trying to say is that the truly needy and unfortunate are treated like rats and scammers. Pests. These programs put in place to help us aren't funded enough to make the people tasked with running them truly care. So they turn us away.

This has been a problem in Mississippi for years. The state government is given money to help and distribute as needed, but those funds are withheld. Millions of dollars every year are kept away from the families who need it most, and nobody here can answer why.

And if you're queer or a person of color? Good luck.

I explain all of this to say that we genuinely need help wherever we can get it.

We need to get out of Mississippi.

Please help in any way you can. Spread this and my GoFundMe wherever you can. It is us the link above. Share it wherever, whether you can donate or not.

My commissions are open. All three slots are available. I will gladly work for the money.

Thank you for your reading.

#black history#black history month#black artist#black queer artist#black boys#gofundmeboost#gofundmeplease#gofundus#go fund them#cats#kofi commission#digital commisions#lgbtqia community#lgbt artist#queer bipoc#bipoc#nonbinary#non biney#poc artist#queer poc#black queer#digital art#digital artist#queer artist#queer#lgbtq#black lives matter#blackfurry#anything helps#help us

9 notes

·

View notes

Text

Mages having a guild system is always better than magic schools. First because it demonstrates you have, in fact, Read Another Book; but also because what you think of as a school is only possible in a particular kind of very modern society.

Modern schooling dates to the aftermath of the Napoleonic Wars, when Johann Gottlieb Fichte said “Napoleon beat Germany like we were late on a payday loan, we better brainwash our entire populace to be fit conscripts.” (I’m actually understating it. He actually said education should “aim at destroying free will, so that a student will forever after be unable to act other than as their schoolmaster would wish”. Also that they would believe snow is black if their teacher said so.)

Unless your story is set somewhere like Cheliax or Menzoberranzan, that’s obviously not a likely institution to arise. But a guild is. Guilds are not unions; unions are for collective bargaining by employees, but the members of a guild are their own masters. They not only serve to facilitate apprenticeships, they act as a guarantor of professional competence (think “disbarred” or “lost my medical license���) and also, traditionally, as insurance co-ops.

It’s funny how many people claim to be anti-capitalist, while demonstrating they can’t conceive of labor in any terms but corporate employment.

28 notes

·

View notes

Text

Quick & Simple Online Fast Cash Loans for Bad Credit

You've come to the perfect place if you're looking for quick, flexible short-term financial support. Online fast cash loans have assisted thousands of Americans by providing them with a short-term loan to tide them over until their next paycheck. Regaining control over your difficult financial situation is made simple and quick with the amount from these loans.

Prior to obtaining the loan, you must determine whether fast cash loans online are the right choice for you. If the amount of cash you need is only a few hundred dollars to get you through till payday, speak with any one of the more than 100 lenders on the panel. Generally speaking, you can borrow between $100 and $1,000 in cash on the same day. You may tailor the loan to meet your needs thanks to its adjustable repayment terms.

Many expenses need to be paid for, such as light bills, groceries, child care or tuition, household bills, unexpected auto repairs, unpaid bank overdrafts, and so forth. Simply put, these loans are used to pay for all of these expenses.

Even if you've had bad credit in the past, you could still be able to get a same day funding loans. Lenders' only responsibility is to consider your present repayment capacity, not only past credit problems. You can therefore easily access these credits if you have bad credit factors such as defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy noted against you.

It's likely that you have seen advertisements online or received emails soliciting same day loans. You might be sceptical, but you might also ask whether same day payday loans are indeed achievable. Unfortunately, 99 percent of the time, these kinds of claims turn out to be untrue. The good news is that you may apply for a convenient online loan with Nueva Cash and acquire the money you need.

Many of the web advertisements for same day payday loans online are not from real lenders. Rather, they are information aggregators that gather data about borrowers. A few aggregators only collaborate with particular lenders. Many aggregators thoroughly screen the lenders they partner with and are quite credible. Nevertheless, some advertisements for online same day cash loans for bad credit are posted by dishonest parties who disseminate information carelessly and frequently sell private and sensitive financial data to the highest bidder. If you work with them, you'll frequently discover that your email inbox is overflowing with "offers" from unknown companies. A few of them are con artists, while others steal identities.

Payday direct lenders do exist. They frequently advertise their identity as direct lenders on their websites with large advertisements. They do not, however, make any more assurances than aggregators regarding payday loans online same day offered. This is due to the fact that almost all online lenders handle loan disbursements and repayments through ACH transactions. Payday direct lenders can approve you in a matter of minutes, but most of the time you won't get your money until the next business day.

https://nuevacash.com/

#direct payday loan lenders#same day loans direct lenders#same day payday loans#short term loans direct lender

2 notes

·

View notes

Text

Loans for Short Term Cash: Assistance without a Debit Card

Do you live in a city in the United Kingdom and are in dire need of an advance to meet your basic needs? Because of your bad credit narrative, are you unable to obtain one? Are you always looking for funding where you may get flexible return options? In the event that this is what you're looking for, don't worry; short term cash loans are here to assist you in resolving any issues you've been having. These advances enable you to quickly and affordably obtain cash to immediately resolve all of your pressing financial difficulties.

Financial assistance is provided by short term cash loans to cover unexpected expenses. The principal characteristics of these loans are their fast approval and lack of a debit card need. Because these loans are unsecured, no collateral pledge is necessary. For a period of 14 to 31 days, you can obtain cash advances in the range of £100 to £1,500. Because these loans have a short term and rapid approval, the interest rate charged is rather higher.

You must follow simple eligibility requirements, such as the borrower having to be a citizen of the United Kingdom and older than 18, in order to be eligible for short term loans. The borrower needs to be actively involved in earning up to £750 per month from a claimed corporation and have an active inspection account in their own name. Short term loans direct lenders primary drawback is their exorbitant interest rates, but thorough market research can help you obtain fleet funds at reasonable rates. Renters and homeowners can also take advantage of this financial assistance. If you file an appeal, the lenders may occasionally additionally grant an extension of the repayment schedule.

One can pay for all of their short-term, inescapable expenses—such as tuition for college or school, hospital or medical bills, grocery bills, auto or shop repairs, etc.—with short term loans UK direct lender. Payday loans demand a few presses requirements to be fulfilled in order to be approved. The lender will quickly lend the short term loans UK direct lender without requiring a debit card after the aforementioned terms are proven. The cash amount will be electronically deposited into the borrower's account by the lender, who will not require usage of the funds.

We at Classic Quid are committed to responsible lending practices. As a result, we will only make loans to borrowers who can repay them. When you need emergency credit, we're here to assist you get it fast and at reasonable prices. Subject to completing our credit and affordability checks, new clients can borrow between £100 and £1000, while current customers can borrow up to £2,500. A Classic Quid short term loans UK has a minimum repayment period of two installments, with a maximum repayment length of six months. Depending on when you get paid, these installments could be weekly or monthly. This implies that you are not required to pay back the whole amount of the loan on your subsequent payment.

https://classicquid.co.uk/

5 notes

·

View notes

Text

Quick & Simple Online Fast Cash Loans for Bad Credit

You've come to the perfect place if you're looking for quick, flexible short-term financial support. Online fast cash loans have assisted thousands of Americans by providing them with a short-term loan to tide them over until their next paycheck. Regaining control over your difficult financial situation is made simple and quick with the amount from these loans.

Prior to obtaining the loan, you must determine whether fast cash loans online are the right choice for you. If the amount of cash you need is only a few hundred dollars to get you through till payday, speak with any one of the more than 100 lenders on the panel. Generally speaking, you can borrow between $100 and $1,000 in cash on the same day. You may tailor the loan to meet your needs thanks to its adjustable repayment terms.

Many expenses need to be paid for, such as light bills, groceries, child care or tuition, household bills, unexpected auto repairs, unpaid bank overdrafts, and so forth. Simply put, these loans are used to pay for all of these expenses.

Even if you've had bad credit in the past, you could still be able to get a same day funding loans. Lenders' only responsibility is to consider your present repayment capacity, not only past credit problems. You can therefore easily access these credits if you have bad credit factors such as defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy noted against you.

It's likely that you have seen advertisements online or received emails soliciting same day loans. You might be sceptical, but you might also ask whether same day payday loans are indeed achievable. Unfortunately, 99 percent of the time, these kinds of claims turn out to be untrue. The good news is that you may apply for a convenient online loan with Nueva Cash and acquire the money you need.

Many of the web advertisements for same day payday loans online are not from real lenders. Rather, they are information aggregators that gather data about borrowers. A few aggregators only collaborate with particular lenders. Many aggregators thoroughly screen the lenders they partner with and are quite credible. Nevertheless, some advertisements for online same day cash loans for bad credit are posted by dishonest parties who disseminate information carelessly and frequently sell private and sensitive financial data to the highest bidder. If you work with them, you'll frequently discover that your email inbox is overflowing with "offers" from unknown companies. A few of them are con artists, while others steal identities.

Payday direct lenders do exist. They frequently advertise their identity as direct lenders on their websites with large advertisements. They do not, however, make any more assurances than aggregators regarding payday loans online same day offered. This is due to the fact that almost all online lenders handle loan disbursements and repayments through ACH transactions. Payday direct lenders can approve you in a matter of minutes, but most of the time you won't get your money until the next business day.

https://nuevacash.com/

3 notes

·

View notes

Text

When you hear "fintech," think "unlicensed bank"

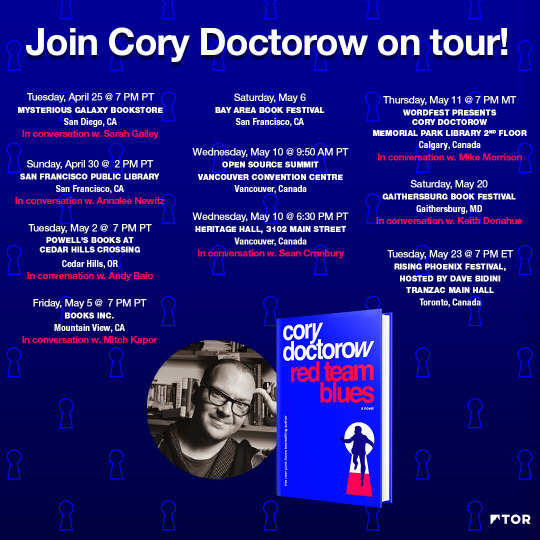

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image: Andre Carrotflower (modified) https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

668 notes

·

View notes

Text

In bankruptcy filings and consumer complaints, thousands of people across the country make pleas for relief from high-interest loans with punishing annual rates that often exceed 600%.

Although they borrowed small sums online from a slew of businesses with catchy names — such as Loan at Last or Sky Trail Cash — their loans stemmed from the same massive operation owned by a small Native American tribe in a remote part of Wisconsin.

Over the past decade, the Lac du Flambeau Band of Lake Superior Chippewa Indians has grown to become a prominent player in the tribal lending industry, generating far-reaching impact and leaving a legacy of economic despair. A ProPublica analysis found companies owned by the LDF tribe showed up as a creditor in roughly 1 out of every 100 bankruptcy cases sampled nationwide.

That’s the highest frequency associated with any of the tribes doing business in this sector of the payday loan industry. And it translates to an estimated 4,800 bankruptcy cases, on average, per year.

ProPublica also found that LDF’s various companies have racked up more than 2,200 consumer complaints that were routed to the Federal Trade Commission since 2019 — more than any other tribe in recent years.

5 notes

·

View notes

Text

$200 Emergency Loans Online. Request with Bad Credit, Fast Approval

If you find yourself in need of a $200 loan today, you've come to the right place. Payday loans for $200 are quite common, and they generally have lower fees compared to larger loans. This loan amount can provide you with the necessary funds to cover unexpected expenses, and the money can be deposited directly into your bank account.

While it's important to note that claims of "instant approval" for a $200 loan are not entirely accurate, fast approvals are possible. Typically, you can expect a decision on your loan request in less than two minutes after it is received. It's worth mentioning that not all applicants are approved, but we have an 80% success rate when referring loan requests to our extensive network of lenders.

If you are currently facing a financial crisis and require immediate funds, a $200 loan can be helpful, even if you have bad credit. Payday lenders are generally willing to approve loan requests without conducting a thorough credit check, and you can receive the money within one business day.

Before proceeding with a $200 payday loan, it's crucial to carefully consider the reason for borrowing and develop a plan for repayment. Additionally, it's important to thoroughly review all the terms and conditions outlined in the loan agreement before signing and submitting it. Furthermore, familiarize yourself with the payday loan regulations specific to your state to ensure compliance with the law.

2 notes

·

View notes

Text

How to Succeed in a Short Term Loans Direct Lenders?

You wouldn't think that not having a debit card would make it difficult for you to get a loans, but many people claim that the old saying "if at first you don't succeed, try, try again" applies in this situation. This blog post will examine your options if you discover that short term loans direct lenders. Although it may appear hard to get from the East Coast to the West Coast, as we're

The UK's probable legal challenges

I wanted to give a quick overview of what it could take to succeed in the market for short term loans direct lenders. A number of events must take place in order to obtain a payday loan. People must first undergo a thorough credit check process that evaluates their capacity to repay the loan. Laws in some or all jurisdictions require this. Second, you must have had a solid source of income for around three months prior and have been employed for a period of time that is reasonably long. Last but not least, this kind of loan does not require you to have a live checking account.

Short Term Loans in the UK

A person can borrow a little amount of money with a short term loans UK and repay it over the course of up to 56 days. Although the interest rates for payday loans in the UK are significantly higher than they would be for a typical loan from a bank, this type of short-term lending is intended to give borrowers enough money to last until their next paycheck, or payday.

The Best Method for Using UK Short Term Loans

Contrary to popular assumption, borrowing money can actually be a fairly wise method to manage your finances. However, there are a few things you should know if you want to ensure that the short term loans UK direct lender won't have an impact on your regular spending or place you in a long-term financial bind. Research the various loan options available to UK residents before determining which one is best for you. Second, carefully consider how long a repayment period will be appropriate for your needs. Some customers choose short periods even though they occasionally have to pay extra each month since they'd rather not deal with.

Simple Advice to Help You Get Your Next Same Day Loans UK.

Payday Quid offers you straightforward advice so that you can succeed with your upcoming same day loans UK. If you follow our advice, you shouldn't ever be concerned about being unable to obtain a loan when you need one.

We want to make sure that our customers can pay back the money they have borrowed from us and that the same day loans UK we provide to them now won't turn into a burden later. When you submit an application for a same day loans UK through Payday Quid, you authorize the lenders to do a complete credit and affordability checks on you to ensure that you are not only capable of repaying the loan but also have the financial means to do so without jeopardizing other important responsibilities.

4 notes

·

View notes

Text

And yet something sinister lurks beneath the surface of this disposable distraction. While some of this, yes, has to do with the concerning allegations of sexual harassment, chronic mistreatment, and more that cast a shadow over the series (Donaldson has said this is “blown out of proportion” and claimed he has yet-unreleased footage to prove it) it also has to do with what made it into the final cut. Donaldson frequently interjects to encourage his viewers to scan a QR code for a chance to win what he says is a $4.2 million dollar giveaway that critics and consumer advocates have already warned could trap participants into a payday loan-esque swindle. In addition to the ethical nightmare of someone with such a largely, predominantly young fanbase shilling for such a predatory enterprise, Beast Games’ partnership with MoneyLion grinds everything in the show to a halt. Ad reads are par for the course for MrBeast; they’re often dropped right into the middle of the action in his YouTube videos. But what’s awkward there is even more awkward on a show that’s ostensibly a bigger, more serious project from the creator. As is often the case with online celebrities operating in such scammy ways, it’s about getting the bag at all costs.

some of my favorite quotes from the beast games ign review

11K notes

·

View notes