#Pakistan import Trade Statistics

Explore tagged Tumblr posts

Text

#pakistan salt export data#pakistanimportdata#pakistan trade statistics#pakistanexportdata#pakistanimportandexportdata#pakistan import data by hs code#pakistan import and export data#pakistan custom import data#pak import data

0 notes

Text

Top Countries That Import Wheat

One of the most significant crops, wheat is essential to the world's food supply chain. On account of its widespread usage in producing essential food products like bread, pasta, and other basic food items, it is no surprise that its demand remains high worldwide. Many countries, especially those that have limited domestic production, rely heavily on imports to meet their food security needs. In this article, we will explore the top countries that import wheat and also highlight the key import statistics, and analyse market trends. If you're an exporter looking to export bulk wheat, then understanding these countries' market demands can play a significant role in your success.

Global Wheat Trade Overview

Frankly speaking, the international wheat market is vast and dynamic, and it is driven by a variety of factors such as population growth, economic development, changing dietary preferences, and climatic conditions.

In 2023, the market for wheat imports worldwide was estimated to be worth $55 billion. Not to add, a sizable portion of it came from the top importing nations. The Middle East, Asia, and Africa are the main importers of wheat. These nations either have inadequate local production or have unfavourable climates that make cultivation impractical.

1. Indonesia

Indonesia has emerged as one of the largest wheat importers in the world. It is no surprise that in 2022 the country imported approximately 11.5 million metric tons of wheat. This reflects its growing population and increasing dependence on wheat-based food products. Although Indonesia does not produce wheat domestically due to unsuitable climatic conditions. However, it remains a significant consumer, with a thriving noodle and bakery industry driving demand. The country's major suppliers include Australia, Ukraine, and Canada.

2. Egypt

Egypt consistently ranks among the world’s top wheat importers. In 2022, Egypt imported nearly 9.8 million metric tons of wheat, according to the USDA. Wheat is a crucial component of the Egyptian diet, particularly for bread, which is a staple food for much of the population. The Egyptian government also heavily subsidised bread, ensuring a steady demand for imported wheat. Historically, Egypt has sourced a significant portion of its wheat from Russia and Ukraine, but supply chain disruptions have led the country to diversify its suppliers, including turning to Romania, France, and the United States.

3. Turkey

Turkey is another key wheat importer, with imports reaching over 10.8 million metric tons in 2022. Despite being a major producer of wheat, Turkey imports substantial quantities for processing and re-exporting. The country boasts one of the largest wheat flour milling industries in the world, processing imported wheat to manufacture flour, which is then exported to neighbouring regions. Russia and Ukraine are primary wheat suppliers to Turkey, followed by Germany and Lithuania.

4. Nigeria

Nigeria is Africa’s largest wheat importer, with imports standing at approximately 6.6 million metric tons in 2022. The country’s growing population, coupled with increasing urbanisation and the rising popularity of bread and noodles, has led to greater demand for wheat. Local wheat production in Nigeria is minimal due to climatic limitations, which forces the country to rely heavily on imports, mainly from the United States, Canada, and Argentina.

5. Bangladesh

Bangladesh is among the top wheat importers in South Asia. In 2022, the country imported nearly 6.5 million metric tons of wheat. As a growing economy with a population exceeding 165 million, Bangladesh has experienced a sharp rise in wheat consumption, particularly in urban areas. Most of the imported wheat is used for producing bread, noodles, and biscuits. Russia and Ukraine have been primary suppliers, but due to geopolitical tensions, Bangladesh has been increasingly sourcing wheat from India, Canada, and Australia.

6. Pakistan

Although Pakistan is a wheat-producing country, it is also a significant importer due to supply-demand imbalances caused by domestic shortfalls. In 2022, Pakistan imported approximately 3 million metric tons of wheat, mainly to stabilise local markets and curb rising food inflation. Wheat imports are typically sourced from Russia, Ukraine, and Central Asian countries. The government also imports wheat to build reserves and ensure price stability during times of crisis or drought.

7. Philippines

In 2022, the Philippines brought in about 6.8 million metric tons of wheat from overseas. Like Indonesia, the nation does not cultivate wheat on its own, but consumption is nonetheless high, especially when it comes to making noodles and bakery goods. Canada, Australia, and the United States are the Philippines' main suppliers of wheat.

Market Trends and Insights

Several factors continue to shape the global wheat import landscape. Supply chain disruptions due to geopolitical issues, such as the conflict between Russia and Ukraine, have had a profound impact on wheat prices and availability. Both countries are major wheat exporters, and any disruption in their production or export routes reverberates across the global market. Many countries are now seeking to diversify their wheat import sources to reduce dependence on specific regions.

Furthermore, climate change is playing an increasing role in determining the reliability of wheat production worldwide. Exporters targeting countries with significant wheat import demands must stay informed about climate patterns, international trade policies, and consumer preferences.

Conclusion

Growing populations, shifting dietary preferences, and insufficient domestic production are the main causes of the dominance of countries such as Indonesia, Egypt, Turkey, and Nigeria in the world's wheat imports. In order to effectively penetrate these markets and export bulk wheat, exporters must have a thorough understanding of these countries' import requirements. It will be essential to monitor market developments and diversify supply chains in order to maintain stability and growth in this industry as the demand for wheat rises globally.

0 notes

Text

The Global Boom in Makhana Export from India: Insights, Trends, and Opportunities

Makhana, also known as fox nuts or lotus seeds, is gaining international recognition for its nutritional benefits and versatility. Originating from China and Southeast Asia, this nutritious seed is now a major export product from India. With its rising popularity and diverse applications, makhana has become a lucrative export commodity. This article delves into the key highlights of makhana export from India, including production statistics, major exporters, and market opportunities.

1. Makhana Export Overview

1.1 Global Export Leaders

India dominates the global market for makhana, leading the world with a substantial 25,130 shipments. China and Pakistan follow, with 238 and 70 shipments respectively. This significant lead underscores India's pivotal role in the global supply chain of makhana.

1.2 Export Categories and Data

In India, makhana is exported under various HS codes, with the top categories being:

19041090: This code covers other cereals.

21069099: This category pertains to other food preparations.

08134090: This code is used for other dried fruits.

The total export volume of makhana from India for the 2023-24 period was 25,130 million metric tons. This highlights the scale and significance of India's makhana export industry.

2. Major Export Destinations

2.1 Top Importing Countries

India's makhana exports are primarily directed towards:

United States

United Kingdom

Canada

Australia

United Arab Emirates

Other notable markets include Singapore, Malaysia, Germany, Southeast Asia, and the European Union. The global appeal of makhana is driven by its health benefits and the rising demand for nutritious snacks.

3. Production Insights

3.1 Production Statistics

India is the world's largest producer of makhana, contributing 70-80% of the total global production. The state of Bihar is particularly prominent, producing over 80% of India's makhana. Here’s a breakdown of makhana production across Indian states:

3.2 Key Cultivation Regions

Bihar's districts such as Madhubani, Darbhanga, and Sitamarhi are particularly suited for makhana cultivation. The favorable climate and soil conditions in these regions contribute to high-quality production.

4. Why Makhana Export is Profitable

4.1 Growing Global Demand

Makhana's nutritional profile—rich in fiber, minerals, and vitamins—makes it highly sought after globally. Its health benefits, including aiding digestion and supporting heart health, contribute to its popularity.

4.2 Market Trends

The global trend towards healthy eating and snacking drives the demand for makhana. Varieties such as peri peri, roasted, caramel, and chocolate makhana cater to diverse consumer preferences, further boosting export opportunities.

4.3 Government Initiatives

Indian government initiatives and support for the agricultural sector enhance the production and export of makhana. Policies aimed at improving quality and export logistics contribute to the sector's growth.

5. Key Exporters and Their Impact

5.1 Leading Exporters

Several prominent Indian companies are at the forefront of makhana exports:

Cilantro Food Products Private Limited

Shree Shyam Impex

Nathubhai Cooverji and Sons

House of Pura LLP

Al Shadik Export

These exporters play a crucial role in meeting global demand and ensuring the high quality of makhana products.

5.2 Exporter Statistics

India has 1,123 registered makhana exporters serving 2,969 buyers worldwide. This network of exporters and buyers facilitates the seamless global distribution of makhana.

6. How to Export Makhana from India

6.1 Steps for Exporting Makhana

To successfully export makhana, traders must follow these steps:

Business Registration and IEC Number: Register your business and obtain an Import Export Code (IEC) for international trade.

Find and Negotiate with Buyers: Establish connections with international buyers and negotiate terms.

Quality Assurance and Certification: Ensure that your makhana meets international quality standards and obtain necessary certifications.

Apply for Export License: Secure an export license and choose the appropriate shipping method.

Customs Clearance and Documentation: Ensure that all customs requirements are met and provide the necessary documentation.

7. Conclusion

Exporting makhana from India offers significant opportunities due to the product's increasing global demand. By leveraging export data and understanding market trends, Indian exporters can effectively navigate the international market. For more detailed information and assistance, resources such as Exportimportdata.in provide valuable insights and support for developing a successful makhana export business.

Frequently Asked Questions

Is makhana export profitable?Yes, exporting makhana from India is profitable due to rising global demand and the product’s health benefits.

How much makhana does India export?India exported 25,130 million metric tons of makhana in 2023-24.

Which country imports makhana from India?Top importers include the United States, United Kingdom, Canada, Australia, and the United Arab Emirates.

Who is the largest exporter of makhana in India?Leading exporters include Cilantro Food Products Private Limited, Shree Shyam Impex, Nathubhai Cooverji and Sons, House of Pura LLP, and Al Shadik Export.

Who is the largest producer of makhana in India? Bihar is the largest producer, contributing over 80% of India’s makhana production.

0 notes

Text

Understanding Pakistan Trade Data: A Comprehensive Insight into Import Dynamics

Pakistan, with its strategic geographical location and burgeoning market, plays a significant role in regional and global trade. Analyzing Pakistan trade data is crucial for businesses, policymakers, and researchers to understand the economic landscape, identify trends, and make informed decisions. This article delves into various aspects of Pakistan's trade data, including Pakistan Customs Data, import data, and its broader implications on the economy.

The Importance of Trade Data

Trade data is a vital resource that offers insights into a country's economic activities. It encompasses detailed information on imports, exports, trade balances, and partner countries. For Pakistan, trade data is not just a reflection of its economic health but also a tool for strategizing future growth. By scrutinizing this data, stakeholders can identify opportunities, mitigate risks, and optimize their operations.

Pakistan Trade Data: An Overview

Pakistan trade data includes comprehensive records of all goods and services that are imported into and exported out of the country. This data is meticulously compiled by various government agencies, primarily the Pakistan Bureau of Statistics and Pakistan Customs. It provides valuable insights into the volume, value, and nature of traded commodities, along with information about trading partners.

Key Components of Trade Data

Imports and Exports: This includes the total value and quantity of goods that Pakistan imports and exports. Understanding these figures helps in assessing the trade balance and economic dependencies.

Trade Partners: Identifying major trading partners is crucial for understanding geopolitical and economic relationships. Countries such as China, the United States, the United Arab Emirates, and Saudi Arabia are significant in Pakistan’s trade network.

Commodity Breakdown: Detailed data on the types of goods traded is essential for industry-specific analysis. It covers sectors like textiles, machinery, chemicals, and agricultural products.

Customs Data: Pakistan Customs Data is an integral part of trade data, providing detailed records of all shipments entering or leaving the country. This data is crucial for enforcing trade regulations, collecting tariffs, and combating smuggling.

Pakistan Customs Data: A Closer Look

Pakistan Customs Data is a subset of the broader trade data, focusing specifically on the records maintained by the customs authorities. This data is essential for ensuring compliance with national and international trade laws and regulations. It includes information on:

Import Declarations: Detailed records of goods imported into Pakistan, including the type of goods, their value, origin, and the duties paid.

Export Declarations: Similar to import declarations, these records detail goods exported from Pakistan, providing insights into the country's export capabilities.

Tariff and Tax Information: Data on the duties and taxes levied on imports and exports, which is crucial for revenue generation and policy formulation.

Compliance and Enforcement: Information on compliance with trade regulations, including any penalties or sanctions imposed for violations.

Import Data Pakistan: Insights and Trends

Import data Pakistan is a crucial component of the overall trade data, offering detailed insights into the goods and services that Pakistan brings into the country. This data is essential for understanding consumption patterns, identifying dependencies on foreign goods, and formulating economic policies. Here are some key insights from Pakistan's import data:

Major Imported Commodities

Petroleum Products: Pakistan heavily relies on imported petroleum products to meet its energy needs. This includes crude oil, refined petroleum, and liquefied natural gas (LNG).

Machinery and Equipment: The country imports a significant amount of machinery and industrial equipment, essential for its manufacturing and infrastructure sectors.

Chemicals: Various chemicals, including fertilizers, pharmaceuticals, and industrial chemicals, are imported to support agriculture and industry.

Textiles: Although Pakistan is a major exporter of textiles, it also imports certain textile products and raw materials to meet the demands of its domestic industry.

Food Products: The import of food items, including edible oils, pulses, and dairy products, is crucial for meeting the dietary needs of the population.

Trends and Patterns

Rising Imports: Over the years, Pakistan has seen a steady increase in its import bill, driven by rising demand for energy, machinery, and consumer goods.

Trade Deficit: The growing import bill often results in a trade deficit, where the value of imports exceeds that of exports. This is a significant challenge for the economy.

Diversification of Sources: Pakistan is diversifying its import sources to reduce dependency on a few countries and mitigate risks associated with supply chain disruptions.

The Impact of Trade Data on Pakistan’s Economy

The analysis of Pakistan trade data has profound implications for the country's economy. Here are some key impacts:

Economic Planning and Policy Formulation Trade data is a critical input for economic planning and policy formulation. By analyzing import and export trends, the government can design policies to promote local industries, reduce dependency on imports, and enhance export competitiveness.

Business Strategy For businesses, trade data is an invaluable resource for strategic planning. Companies can identify market opportunities, understand competitive dynamics, and optimize their supply chains based on import-export trends.

Revenue Generation Pakistan Customs Data is essential for revenue generation through tariffs and taxes on imports and exports. Accurate data ensures that the government collects the correct amount of revenue and enforces trade regulations effectively.

Foreign Trade Agreements Understanding trade data helps Pakistan negotiate better terms in foreign trade agreements. By identifying key trade partners and commodities, the country can secure favorable terms and enhance its trade relationships.

Economic Stability A detailed analysis of trade data contributes to economic stability by identifying potential vulnerabilities in the economy. For example, a high dependency on imported energy can be a risk factor, prompting the government to explore alternative energy sources.

Challenges in Analyzing Trade Data

While trade data is a valuable resource, there are several challenges in its analysis:

Data Accuracy: Ensuring the accuracy and reliability of trade data is crucial. Inaccurate data can lead to misguided policies and business strategies.

Timeliness: Trade data needs to be updated regularly to reflect the current economic situation. Delays in data reporting can hinder timely decision-making.

Complexity: Trade data is complex, with numerous variables and dimensions. Analyzing this data requires expertise and sophisticated tools.

Integration: Integrating trade data with other economic indicators is essential for a comprehensive analysis. This requires robust data management systems.

Future Prospects and Recommendations

To harness the full potential of Pakistan trade data, several steps can be taken:

Enhancing Data Quality and Accessibility: Improving the quality and accessibility of trade data is crucial. This can be achieved by investing in modern data collection and management systems, training personnel, and adopting international best practices.

Promoting Data-Driven Decision Making: Encouraging data-driven decision-making among policymakers and businesses is essential. This can be facilitated through workshops, training programs, and collaborations with academic and research institutions.

Leveraging Technology: Leveraging advanced technologies like big data analytics, artificial intelligence, and machine learning can enhance the analysis of trade data. These technologies can help identify patterns, predict trends, and provide actionable insights.

Strengthening International Cooperation: Strengthening international cooperation in trade data exchange can provide a more comprehensive view of global trade dynamics. This can help Pakistan better integrate into the global economy and enhance its trade competitiveness.

Conclusion

Pakistan trade data is a powerful tool that offers valuable insights into the country's economic activities and trade dynamics. By analyzing this data, stakeholders can make informed decisions, formulate effective policies, and drive economic growth. Despite the challenges, there are immense opportunities to leverage trade data for the benefit of the economy. Enhancing data quality, promoting data-driven decision-making, and leveraging advanced technologies are key steps towards realizing the full potential of trade data. As Pakistan continues to grow and evolve, the importance of trade data will only increase, making it an indispensable resource for the future.

Frequently Asked Questions:

Q1: What is Pakistan Trade Data? A1: Pakistan Trade Data includes detailed records of all goods and services imported into and exported from Pakistan. It encompasses information about the volume, value, and nature of traded commodities, as well as details about trading partners.

Q2: Why is analyzing Pakistan trade data important? A2: Analyzing Pakistan trade data is essential for understanding the economic landscape, identifying trends, and making informed decisions. It helps businesses, policymakers, and researchers to strategize future growth, identify opportunities, mitigate risks, and optimize operations.

Q3: Which government agencies compile Pakistan Trade Data? A3: The Pakistan Bureau of Statistics and Pakistan Customs are the primary agencies responsible for compiling Pakistan Trade Data.

Q4: What are the key components of Pakistan Trade Data? A4: The key components include imports and exports, trade partners, commodity breakdown, and customs data. Each component provides specific insights into the trade dynamics of Pakistan.

Q5: What is included in Pakistan Customs Data? A5: Pakistan Customs Data includes import and export declarations, tariff and tax information, and details on compliance and enforcement of trade regulations. It provides detailed records of all shipments entering or leaving the country.

#Pakistan Trade Data#Pakistan import data#Pakistan Custom import data#Import data Pakistan#Pakistan import shipment data#Pakistan Importer data#Pakistan Buyers Data#Pakistan Customs Data#Pakistan Shipment Data#pakistan import data by hs code

0 notes

Text

Exim Trade Data helps you discover potential buyers and suppliers with valuable Pakistan Import Data. Trade Data helps you to track and monitor your competitors and prepare a better promotional strategy than them. For customs, Pakistan Import Data, email us at [email protected] or call us at +91-9625812393.

#Pakistan import data#importer of Pakistan#import of Pakistan#Pakistan import products#Pakistan importers database#Pakistan import sample data#Pakistan import customs data#Pakistan importers data#Imported products in Pakistan#Pakistan import statistics#Pakistan import Trade Statistics#Pakistan import shipment data#Pakistan Top Imports#Pakistan Top Import Trading Partners#Pakistan Top Importers#Buyers List of Pakistan#Pakistan Import Trade Data

0 notes

Text

ONLINE TRADING IN PAKISTAN: PROSPECTS IN THE YEARS TO COME

Online trading is an invaluable tool for businesses and consumers to exchange goods and services across various locations. While carrying out any activity, you do not need the assistance of a broker. For instance, you can buy and sell almost anything, whenever you want. Also, online trading includes buying groceries, stocks, and other necessities such as these. This means buying and selling benefits using the broker's internet-based proprietary trading platforms. Before the advent of online trading, all trading was conducted face-to-face or by phone, but now everything is done with an electronic terminal.

Before getting into online trading in Pakistan, we must consider all its advantages and disadvantages:

ADVANTAGES OF ONLINE TRADING:

With online buying and selling, buyers and sellers don't have to follow a guide's lead order, nor are they required to leave a paper trail. Additionally, it will increase the accuracy and speed at which orders are entered.

In addition, investors, brokers, and regulatory agencies can have better information about their clients' finances thanks to the use of investors.

Because they have got general admission to a huge number of stats around the clock, investors can make smarter funding selections due to the accessibility of this information, which can be accessed from anywhere, whether it's in a business setting, at home, or wherever else the investor has access to the internet.

In addition to this, making paperless transactions online also encourages people to buy and sell items in Pakistan. The amount of money in your internet change account is deposited into DMAT format (digital) for your proportion certificate.

Additionally, online buying and selling in Pakistan also can make proximity orders when an order is not being placed on the market.

Later, the information of all transactions will be available in the palm of your hand and also at the fingertips while you're utilizing the record of overall statistics on the database of online buying and selling software.

DISADVANTAGES OF ONLINE TRADING:

The mechanism or device fails because of the much less pace of net connection the investor can go through a large failure.

As a few online agents alternate apathy prices from traders. If you consider them without inquiring approximately them, it'll show a large loss.

The do it yourself mindset that empowers the investor over his very own money.

Now, as it is known that various trading platforms are required to carry out online trading in Pakistan, it is very important to look into the trading platforms.

When selecting a buying and selling platform, it's miles critical to take into account factors along with the processing instances for deposits and withdrawals, their requirements, the broker's reliability the minimal investment, whether or not the interface is for your local language, and a few different critical points.

If you've got a buying and selling account and a web connection, you could purchase or promote stocks without difficulty in online buying and selling. Online buying and selling systems assist you in alternating without difficulty. Online buying and selling have modernized the manner of doing business. Trading systems offer numerous beneficial gear and essential assists, such as supportive operations through imparting all-time get admission to buying and selling similarly to 100% security. It additionally gives numerous studies reports, fee analysis of stocks, marketplace news, and more.

Many people get worried about thinking that is a risky process or not?

The online trading risks include:

As whilst appearing any economic transaction online, buying and selling shares online can pose safety risks.

Technical problems with the web website online can postpone a transaction, ensuing in unintentional and undesired consequences.

Liquidity also can be an issue, as you can now no longer be capable of converting your shares to coins speedy if they want arises.

Online buying and selling foster the advent of online chat rooms and boards wherein human beings can "meet" and percentage information. Unfortunately, those assembly locations may be a breeding floor for rumours, incorrect information, or even the spreading of fake inventory tips.

What is the safest way to conduct online trading in Pakistan?

The first issue you must consider while you begin online buying and selling is your online safety. You can begin with the aid of using securing your PC, cellular gadgets, and net connection.

We suggest you spend money on the right VPN service. Additionally, having a stable connection thru a VPN company will help you alternate from each location you move to without being concerned that you'll get hacked.

Experts said that passwords are the primary weakness inside the complete net safety structure. Therefore, they ought to be selected strongly. Many online buyers must be aware of the damaging of inventory spam. This is thought to be one of the maximum not unusual net frauds called the" pump and dump" scheme.

2 notes

·

View notes

Text

Kenya Import Export Trade Data

Kenya is a country located in the Africa continent with a coastline on the Indian Ocean. It is home to plenty of animals like rhinos, lions, and elephants. It starts from the capital Nairobi; safaris visit the Maasai Mara Reserve, known for its annual wildebeest migrations, and Amboseli National Park, offering views of Tanzania’s 5,895m Mt. Kilimanjaro.

The coast of the Indian Ocean allowed Kenya to trade goods with Asian and Arabian countries. Kenya is one of the fastest-growing economies in the Africa continent. According to the government Kenya Trade Data, it shows that Kenya has a trade growth rate of 5.46% which was higher than the overall world average of 3.5%. Total exports of goods and services in Kenya were 13.18% of the GDP in the year 2019 whereas total imports of goods and services are 23.01% of the GDP.

Kenya Export Data helps to find various things about Kenya’s import trade. Kenya mainly exports coffee, tea, matt, mineral fuels and oils, Edible vegetables, edible fruits and nuts, iron and steel, nuclear reactors, etc. Kenya exports tea with around 19% of their export products whereas 7.55% petroleum gas and oil.

According to Kenya Trade Data reports, the value of exports from Kenya totaled $ 5.83 billion in 2019. In comparison to the 2018 export data of Kenya, in the year 2019, it decreased by 3.53% compared to 2018. Merchandise exports in Kenya decreased by $ 214 million in the year 2019.

Top 5 export partners of Kenya according to 2019 Kenya Export Data:

• Uganda (10.6% share of total export)

• USA (8.71% share of total export )

• Netherlands (8.05% share of total export)

• Pakistan (7.59% share of total export)

• United Kingdom (6.71% share of total export)

With the help of Kenya Import Data, you can know many facts about Kenya imports. Kenya mainly imports products are petroleum gas and fuels, iron and steel, cereals, electrical equipment, vehicles, etc.

The value of goods and services imports to Kenya totaled $ 17.2 billion in 2019. According to trade reports, Overall commodity imports to Kenya decreased by 0.959% compared to 2018. Merchandise imports decreased by $166 million in 2019.

Top 5 Import partners of Kenya

• China (20% share of total import)

• India (9.91% share of total import)

• United Arab Emirates (9.48% share of total import)

• Saudi Arabia (7.24 share of total import)

• Japan (5.5% share of total import)

Kenya Trade Data give trade statistics of Kenya. Kenya had a total export of 6,050,420.68 in thousands of US$ and total imports of 17,376,721.27 in thousands of US$ which leads to a negative trade balance of -11,326,300.59 in thousands of US$. The Effectively Applied Tariff Weighted Average for Kenya is 10.07% and the Most Favored Nation (MFN) Weighted Average tariff is 12.66%. The trade growth of Kenya is 5.46% compared to a world growth of 3.50% whereas the GDP of Kenya is 87,908,262,520 in current US$. Kenya Export Data of goods and services as a percentage of GDP is 13.18% and imports of goods and services as a percentage of GDP is 23.01%.

1 note

·

View note

Text

The Best Supply-Chain Company in 2021

Bismillah Logistics actions your cargo withinside the Professional manner Door-to-Door & Port-To-Port Regarding EXPRESS Freight Forwarding Shipping Relocation (Sea/Air/Land/Truck) Intermodal & Multimodal Transportation Air & Sea Cargo Clearing forwarding Custom Brokerage warehousing Packing & Storage Supply Chain Import Export & Trading offerings, We Offers Courier & Cargo Consolidation LCL FCL FOB EXW FCA CPT CIP DAT FAS CFR CIF Shipment Moving Baggage Bounded Movement Pakistan. The Best Packers and Movers Shipping Line offerings offer you Containers/Carriers/Vessels. For Trade Commercial/Household Consignment global Rig Moving in Pakistan i-e Lahore, Karachi, etc. Since its basis in 1992, Bismillah Logistics has evolved into certainly considered one among the most important country-wide logistics companies. With our high-overall performance merchandise Airfreight, Sea freight, Road & Truck, and Contract Logistics, we continually provide the proper answer for the complicated logistics necessities of our clients and rely upon future-orientated virtual offerings for optimum transparency and greater green delivery chains. The logistics offerings of ours are designed with the purpose to broaden freight forwarding and ocean freight industrial space. We have positioned our relentless attempt because the get-cross, and particularly because the closing five years to supply a shocking development. Due to our green courier carrier, customs clearance, and warehousing, we've efficaciously hooked up our head places of work in Karachi, we additionally have our department in Lahore or even China as our registered Rep.

Therefore, our offerings aren't confined to simply being Pakistan logistics offerings, as we offer comfort to any port of China. In addition to keeping our recognition of being one of the famous logistics offerings in Pakistan, our organization is en course to regular progress. Bismillah Logistics officers with enjoy of two decades, and taking part in an awesome recognition as Sea / Air freight forwarder, Charters & General Agents withinside the Islamic Republic of Pakistan with Head workplace positioned at the coronary heart of the metropolis Lahore, Pakistan whilst different branches positioned in different towns of Pakistan. Bismillah Logistics Cargo Services is a freight control and clearing forwarding organization that has few equals of their capacity to offer exquisite offerings, servicing the desires of a developing listing of customers delivery items all around the international. Our devoted group, in conjunction with our enterprise experts, percentage the goal of turning complicated duties into finished ones. Our attention is directed toward supplying realistic generation and green networks. Which makes us the quality logistics organization in Pakistan. Bismillah Logistics Company in Pakistan could be very eager on supplying the maximum hassle-unfastened offerings, via way of means of supplying exemplary packing and transferring facilities. We improve our offerings to deal with the advancing clients’ desires. Additionally, our groups continually enhance the person and device electricity to make your transition a strain unfastened enjoy. Timely Delivery We offer door-to-door and port-to-port shipping offerings and supply cargo with a cautiously expert approach.

Goods Transport Bismillah Logistics offers Transport Company Shipping Container Yard Trucking automobile Carrier LTL FTL Pakistan. Our devoted group, in conjunction with our enterprise experts, percentage the goal of turning complicated duties into finished ones. Our attention is directed toward supplying realistic generation and green networks. Which makes us the quality logistics organization in Pakistan. The airfreight offerings furnished via way of means of Bismillah Logistics can help you without difficulty ship your shipment to even elements of the country/international this is inaccessible via sea freight and land.

Sea Cargo Offering Ocean Freight for Import Export LCL, FCL Consolidation, Terminal Handling FOB EXW HHGs Personal Effects Shipments. Our ocean freight offerings are the maximum dependable withinside the country, that's first-rate for transporting heavy items or items in big bulks. Depending on the scale of your load, we will deliver your shipment in each FCL and LCL. Irrespective of the scale of your field, we ship your cargo from all Pakistani seaports to many different ports. Moreover, we additionally offer delivery offerings to choose the programs from the manufacturing facility and customs. We ensure your shipment is added without a hitch to the doorstep. Also, our extremely good offerings include relatively low costs. Since the client’s delight is on the pinnacle tier of our priorities, we ensure your items and objects are reached to its correct vacation spot with utmost security. If you're uncertain approximately the field and require greater statistics at the process, sense unfastened to touch our customer support representatives to speak about the intricacies of the process.

Air Cargo Bismillah Logistics and Shipping is a quality Air Freight Forwarding shipment dealing with family and industrial cargo. Our Airfreight offerings are designed to provide time-green, monetary and dependable air freight offerings all throughout the international. Airfreight is taken into consideration some of the maximum important necessities for global and neighborhood networks of logistics. Over time, we've hooked up proper associates with our companions in enterprise and we were supplying relatively comparatively cheap costs for the first-rate offerings we offer. Packing & Storage As a Packing Moving & Storage Company gives Home Shifting Services Household Goods House Relocation Services. Bismillah logistics are regarded to offer top-class packing and transferring offerings. Our specialized group makes positive our automobile provider offerings are hitch-unfastened.

Logistic Solutions Supply chain & Logistics Services throughout Pakistan International Shipping offerings Worldwide. We have an awesome expertise of techniques and logistics that cross into green air freight. In order to make sure you've got customized offerings, we've hooked up international networks and relationships with superb logistic carrier companies and a number of the pinnacle airlines. We ensure our consumer is heard and their expectancies are being met, as consumer care holds paramount significance at Bismillah Logistics. Bismillah Logistics (Pvt) Ltd is one of the international's main companies of forwarding and logistics offerings, that specialize in ocean freight, air freight, land & railway shipments and related deliver chain control answers and carefully cooperates with decided on companions globally.

Quickest Cargo We offer Cargo Services Airport to AirPort and Sea Port to Sea Port Door to Door for Parcel Cargo & Courier Consignment. We pair you up with a skilled and certified cleaning agent, who especially looks after the custom clearance factors of your cargo. Our specialists are well-versed with within side the customs rules in every country, so we will offer you with a most useful carrier.

Courtesy: Best logistics company in Lahore

#today#seo#seo services#seo and online marketing#seo and web marketing#seo and web design#seo and ppc#blog#blogger#blogging#content#marketing#digitalmarketing#social#socialmedia#socialmediamarketing

1 note

·

View note

Link

The biggest so-called mystery about CPEC is as follows: if CPEC was supposed to be such a huge bonanza for Pakistan in terms of investment, which is it not showing up in the foreign direct investment (FDI) numbers? Why is Pakistan’s current account balance still negative? In fact, why is Pakistan’s current account balance actually getting worse?

The answer is relatively straightforward: because CPEC is not an investment into Pakistan, it is structured as a resource extraction exercise. Here is how it works: China announces that it has invested in a project in Pakistan worth, let’s say $1 billion. That $1 billion, however, is required to mostly be spent on Chinese equipment, and labour, a significant portion of which is to be imported from China as well, with very little by way of supplies coming from the local economy.

That $1 billion, therefore, never hits Pakistan’s economy as an investment. It is $1 billion that goes from the Chinese government or state-owned company to a state-owned company within China to pay for equipment. Even the Chinese labour gets its salaries deposited into bank accounts within China. The money, in other words, stays completely within China and so never shows up as foreign investment into Pakistan.

Where it does show up is in the trade statistics: that $1 billion of equipment will show up as an import, against which Pakistan will have to arrange foreign currency from somewhere. And it will show up as a liability on the balance sheets of whichever company or government entity is contracting with the Chinese government or state-owned company.

21 notes

·

View notes

Text

Navigating the Salt of the Earth with Pakistan Salt Export Data

In the realm of international trade, precision is key. For businesses venturing into the salt industry, understanding market dynamics is crucial. This is where Pakistan Salt Export Data steps in as a strategic tool, offering insights that go beyond mere statistics.

#Pakistan Trade Data#Pakistan Import Data#Pakistan Export Data#pakistan import export data#Pak import data#pakistan import data by hs code#pakistan trade statistics#pakistan salt export data#pakistan import and export data#pakistan custom import data#import data pakistan#pak trade info#paktradeinfo#pakistan customs import data#pakistan customs data#import export data pakistan#exim trade info#custom data pakistan#import data of pakistan#import export data#pak exim trade info#import and export of pakistan

0 notes

Photo

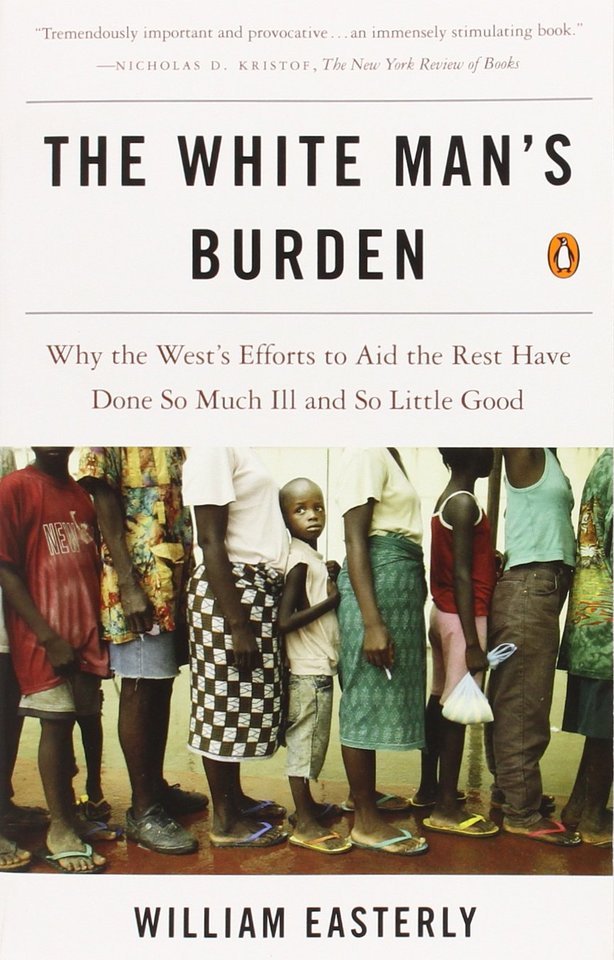

In 2011, Eric Ries made a big splash in Silicon Valley with his book “The Lean Startup: How Today's Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses.” He defines “startup” rather loosely (“an organization dedicated to creating something new under conditions of extreme uncertainty”) and encourages organizations of all sizes to avoid creating elaborate business plans and instead work “to test their vision continuously, to adapt and adjust…” This is almost precisely the same argument made by NYU economist William Easterly in his controversial 2007 bestseller, “The White Man’s Burden: Why West’s Efforts to Aid the Rest Have Done So Much Ill and So Little Good,” which is a direct assault on traditional development economics, the very field he has dedicated his life to. For the past half century, he argues, development economics has been beholden to a “legend”, a legend he once very much believed in: That poverty traps constrain impoverished nations and these poverty traps can be overcome with a “Big Push” – massive Western foreign aid packages and tops-down plans for eradicating poverty, disease, and illiteracy, while promoting various forms of economic growth. This attempt at a big fix – massive programs of aid with lofty goals but little accountability – has been the world of classically trained development economists, who he derisively dubs “The Planners.” They think they have the answers, he says, and rhetorically they have the advantage because they promise great things, such as “the end of poverty.” Reality, however, is much different according Easterly. There are no easy answers. “The only Big Plan is to discontinue the Big Plans,” he says. “The only Big Answer is that there is no Big Answer.” The promises of the Planners, such as his professional rival Jeffrey Sachs, “shows all the pretensions of utopian social engineering,” he writes rather caustically. Yet they flourish in a world without feedback or accountability, and where big plans and big promises play well with politicians and celebrities. Nobody (especially those with no direction connection to the problems) wants to promote small but achievable objectives. They want “to do something” – and do it big. Easterly claims that the West, perhaps innocently and unintentionally, has written itself into the hero role in saving the uncivilized world. Indeed, he writes, “…the development expert…is the heir to the missionary and the colonial officer.” In contrast to the Planners, the author encourages those who want to help to “think small”: the little answers that work and that can make a material, if not revolutionary, difference on the lives of the impoverished. He calls these people, mostly locally-based activists, “The Searchers.” They possess an entrepreneurial and experimentation mindset, and naturally embrace the iterative testing model promoted by Ries in “The Lean Start Up.” They get regular feedback from the poor they serve and are held accountable for their work. They don’t promise to solve world hunger, but they often make incremental yet substantive impact where they work. “The dynamism of the poor at the bottom,” he writes, “has much more potential than plans at the top.” The book is broken into four parts, each of varying interest and value. The first part, “Why planners cannot bring prosperity” is dedicated to undermining the theory of the “Big Push,” which Easterly writes is demonstrably false. He claims that “Statistically, countries with high aid are no more likely to take off than are those with low aid – contrary to the Big Push idea.” Likewise, attempts to promote free markets from the top down, as is often the case with IMF and World Bank-led structural reforms, ambitious schemes to promote capitalist growth that Easterly admittedly once believed in wholeheartedly, are doomed to failure. The same goes for top down efforts to promote democracy, although he sees democracy as important because it can supply the two things most important for meaningful reform: feedback and accountability. In Part two, “Acting out the burden,” Easterly accentuates “The tragedy of poverty is that the poorest people in the world have no money or political power to motivate Searchers to address their desperate needs, while the rich can use their money and power through well-developed markets and accountable bureaucracies to address theirs.” He highlights the insanity of the international development industry, which he likes to repeat has pumped $2.3 trillion (yes, “trillion”) into the developing world since the end of World War II – and for what? He says. He cites Tanzania as a typical case study in development economics absurdity, as that country was forced to produce 2,400 reports and host over 1,000 donor visits in a single year. The author hammers home on his two main themes of feedback and accountability, noting what little input the poor actually have on the aid that they receive and that the Planners at the top are usually divorced from reality on the ground. Easterly writes that development aid is a classic “principle/agent” relationship, where the principle is a rich donor country and the agent is the aid agency. The actual target, the poor, are nowhere in the system of response. The principle wants to see big results, and yet is in no position to check on the work and achievements. The agents are thus cloaked in a sort of invisibility – and it’s under this invisibility, the author claims, that the Planners take over. The Planners thrive in the dark, Easterly says; the Searchers in direct light. The Planners benefit from the fact that there are so many aid agencies, all with very similar missions, all supposedly coordinating efforts, yet no single entity is ultimately accountable for achieving results. The smaller and more focused an NGO’s mandate, the better. Or, as Easterly complains, “If the aid business were not so beguiled by utopian visions, it could address a more realistic set of problems for which it had evidence of a workable solution.” If the aid agencies have failed because their mandates are too broad, what about the IMF, which has the relatively narrow mission of promoting “trade and currency stability”? Easterly argues that the IMF suffers from poor data, a misplaced one-size-fits-all approach, and is all too willing to forgive loans. What should be done? Simple, Easterly says, focus the IMF on emerging markets only and reserve the true bottom billion for aid agencies, thus removing the politically unpopular conditionality that has marked IMF interventions over the past several decades. Part 3, “The White Man’s Army,” is lengthy and the least insightful in the book. Easterly’s core message, as told through vignettes about Pakistan, the Congo, Sudan, India, and Palestine/Israel is that Western meddling with the Rest has been damaging, whether it was colonialism, de-colonialism or well-intentioned aid intervention. He further argues that US efforts to restructure societies via military force, either directly or through proxies, has all the hallmarks of utopian planner mentality, as suggested by case studies on Nicaragua, Angola and Haiti. In other words, neo-conservatives are the Right wing on “The Planner continuum”, with idealists like Sachs on the Left. In Part 4, “The Future,” Easterly argues that 60 years of Planners in control of the economic development agenda is enough. It is time to drop the utopian goals of eradicating poverty and transforming governments. “The Big Goals of the Big Plan distract everyone’s attention…” he writes. “The rich-country public has to live with making poor people’s lives better in a few concrete ways that aid agencies can actually achieve.” Even worse, he writes, “The Planners’ response to failure of previous interventions [has been] to do even more intensive and comprehensive interventions.” It is time to empower the Searchers, those who probe and experiment their way to success with modest efforts to make individuals better off, even if only marginally. As far as the aid agencies are concerned, Easterly recommends: 1) end the system of collective responsibility for multiple goals; 2) and instead encourage individual accountability for individual tasks; 3) promote aid agencies to specialize rather than having many all pursue significant goals; and 4) employ independent auditors of aid activities. The central theme developed by the author throughout this book is that aid agencies need to be constantly experimenting and searching for modest interventions that work. And they must employ more on-the-ground learning with deeply embedded staff. Thus, Easterly encourages the idea of “development vouchers” that would empower local communities to get the aid they most need from the agencies that are most effective. Theoretically, those agencies that either don’t deliver value and/or don’t deliver as promised would be put out of business. It’s a compelling idea that Easterly nevertheless stresses is no panacea. Easterly writes with a certain punch, which I’m sure ruffled more than a few feathers not only with his arguments but with his style, which can be cynical and snarky. For instance, when looking to catalog the redeeming benefits of U.S. interventions over the past several decades, he cites an “Explosion of Vietnamese restaurants in the United States” for Vietnam, “Black Hawk Down was a great book and movie” for Somalia, and “Salvadoran refugees became cheap housekeepers of desperate housewives” for El Salvador. He goes on to characterize U.S. Angolan ally Jonas Savimbi as “to democracy what Paris Hilton is to chastity.” Amusing commentary, for sure, although perhaps a bit misguided given the gravity of the subject matter. In closing, Easterly makes a compelling case to “go small” with development efforts and always seek feedback and accountability. He may not be on the Christmas card list of Bono and Angelina Jolie, but I’m afraid he is much more insightful and directionally correct than their hero, Jeffrey Sachs.

25 notes

·

View notes

Text

Pakistani pet food market in turmoil from import ban

New Post has been published on https://petnews2day.com/pet-industry-news/pet-travel-news/pakistani-pet-food-market-in-turmoil-from-import-ban/

Pakistani pet food market in turmoil from import ban

The average price of pet food in Pakistan has nearly doubled over the past month as the government has banned imports of nearly 800 items considered “luxury goods,” including pet food, to stabilize the economy and national currency exchange rate.

Pakistani pets consume about 6,000 to 8,000 metric tons of pet food each year, and the category is growing by double digits annually, the press office of the Pakistani Pet Food Manufacturers Association told Petfoodindustry.com.

The association said that currently, imported pet foods dominate the market, but with the Pakistani population becoming younger and those consumers gaining awareness, “switching to local pet food is a growing trend.”

Bright growth prospects for pet food

Currently, the Pet Food Manufacturers Association comprises seven companies, six of which focus on dry pet food. One, Waggles Pet Foods, produces both dry and wet pet food, including in the premium market segment.

The Pakistani pet food market has bright growth prospects, said Rafae Dossal, CEO of Waggles. “Pakistan’s pet food demand is growing at a steady 20% CAGR [compound annual growth rate] stemming from rapid urbanization and a spike in nuclear families,” he explained. “The closest regional example is India; our neighboring country ranks seventh in the world in terms of pet ownership. Pakistan is far from this statistic; however, pet adoption is at its highest in the country’s history.”

Pet food import ban leads to price hikes

The pet food ban came as a shock to the market, immediately causing a hike in prices, the Pakistani Pet Food Importers Association said. For instance, a package of Royal Canin dog food jumped to PKR 3,000 (US$14.5), nearly 40%, as dog owners rushed to purchase sufficient reserves because there is no clarity on when the import ban could be lifted.

Tahir Bajwa, president of the Importers Association, told local press that the demand for locally produced pet food is rather low, as the quality is comparable to that imported from China or Thailand, but inferior to European products.

Since the beginning of 2022, Pakistan imported pet food worth is US$5 million, the Pakistani Board of Revenue estimated. Although imported pet food is still available in the country, some pet owners cannot afford it due to a sharp rise in prices.

The Pet Food Importers Association claimed that the import ban has already caused a spate of pet killings in the country, and more pets are likely to die if the ban is not removed soon.

The Pet Food Manufacturers Association also spoke against the ban on pet food imports, as it could hurt the entire market. On the other hand, they are confident the authorities must revise their import policy to support local businesses.

“Banning products doesn’t reflect well on a government’s trade policy. The ban on pet food is temporary and will be lifted once the country is economically stable,” the Manufacturers Association said. “However, we suggest the import duty structure on imported pet food should be revised to incentivize local manufacturers, who in turn would be benefiting the country by bringing in foreign currency, which the country essentially requires at this point.”

Pet food exports in the pipeline

On the other hand, Pakistan has already started exporting pet food. The Organic Meat Company Ltd. has recently rolled out plans to export US$1 million worth of pet food to the U.S. and Europe. Waggles harbors plans to launch pet food export to UAE and more countries in the future.

“At Waggles, we strongly believe in import substitution and generating value for the country by exporting our products. I aim to bring Pakistan on the roadmap for global pet food exports through Waggles,” Rafae said, adding that one of the rationales behind establishing the Pet Food Manufacturers Association was to present a united front to the Ministry of Commerce and be able to highlight the importance of pet food exports to Pakistan’s economy.

Vorotnikov is a Georgia-based journalist covering the pet food and feed markets.

0 notes

Text

Find Genuine and Verified Turkey Import and Export Data

Import Export Trade Data helps the importer and exporter to know the market trends and trade dynamics of the country. With the help of import export data the businesses will know the key details that will help them make informed business decisions easily.

If you are planning to do trade with Turkey, it is imperative that you know beforehand the key business insights of the country. The Turkey Import Data helps businesses know the market scenario and help them plan their moves accordingly.

The import data importers of Turkey know the key details including import value, import partners, competitors move, HS code, shipping details and customer preferences. The details help the importers plan their import policies that will help them achieve success.

Similarly, Turkey Export Data will help exporters know the export value of goods, export partners, competitors move, HS code, shipping details and destination countries.

Importance of data to Turkey exporters and importers

For every importer and exporter of Turkey, authentic data is important for running their international trade successfully. The data shows the current demand of goods in the trade market. It helps to understand various business trends. The import export data helps businesses know the trade scenario of the Turkey. By analyzing the import export data the businesses can understand the current market trends and can make flawless business decisions.

Benefits of Import export data for Turkey traders

1. The statistical data has complete details about the trading activities of the international companies

2. The data contains complete market intelligence information of products

3. The custom Data is the best way to track what your competitors import and export in Turkey

4. The statistical data is a collection of figures about the product’s importing and exporting activities by Turkey

5. It is made with the help of authentic operational documents like shipping bills, invoices etc and thus gives accurate results.

6. The Turkey export import data offers an opportunity for the businesses to execute comprehensive study of the market.

Get authentic, real-time and flawless import export data and get clear insights about the market scenario of Turkey trade and plan your moves accordingly.

Find Genuine and Verified Pakistan Import Export Data

0 notes

Text

As a leading marketing research firm, Exim Trade Data offers in depth insights into Pakistan Imports and Exports Data 2020. Recognize the major financial risks involved and make better decisions. Give your brand a better visibility in the global market with verified Data. To learn how to drive more sales using data driven strategy, feel free to contact us at [email protected] or call us at +91-9625812393.

#Pakistan import data#Pakistan trade statistics#Pakistan export import data#Pakistan customs import data#Pakistan import data by hs code#foreign trade statistics of Pakistan#Pakistan importers database#Pakistan shipment data#import export data of Pakistan#export import statistics of Pakistan

0 notes

Text

Trade deficit doubles to $24.78 billion, but import growth shows signs of slowing

Trade deficit doubles to $24.78 billion, but import growth shows signs of slowing

KARACHI: According to provisional figures, Pakistan’s trade deficit has increased by about 100% to $24.78 billion so far in fiscal year 2021-22, compared to $12.36 billion in the corresponding half of the previous fiscal year. Following the release of the most recent official statistics on international commerce, the trade imbalance in December 2021 increased by 57% to $4.1 billion, compared to…

View On WordPress

0 notes

Photo

Pakistan negotiation with IMF is underway: Tarin

When it comes to boosting taxes and increasing energy tariffs, Pakistan and the International Monetary Fund (IMF) are still attempting a ‘give and take’ approach in the final round of technical-level discussions to get the $6 billion Extended Fund Facility (EFF) back on track.

According to informed sources, the virtual talks between the two sides on Friday were abruptly extended for 8-10 hours at the last minute as they struggled to narrow down their hard positions to a level at which Finance Minister Shaukat Tarin could reach an agreement during policy-level talks with the IMF management and mission chief next week.

Pakistan’s revenue increase, according to the sources, has been labeled as “insufferable” by the IMF staff because it is expected to reverse as soon as efforts to curb imports take effect. Furthermore, the circular debt management strategy for the power sector was determined to be ‘unbankable’ in the absence of substantial tariff rises. The staff of the International Monetary Fund (IMF) desired significant progress on both fronts.

Those are the two most important areas where “give and take” must occur while bearing in mind the current economic conditions in the aftermath of an unclear Covid-19 status and the current international commodity price situation.

The IMF’s program has been on hold since March of this year due to disagreements between the two parties’ perspectives.

Meanwhile, the finance ministry questioned the World Bank’s estimations of Pakistan’s growth rate, which was estimated to be 3.5 percent for the current fiscal year and 3.5 percent for the previous fiscal year.

In a study released on Thursday, the bank predicted that Pakistan’s GDP growth will slow to 3.4 percent in the current fiscal year as a result of the unwinding of both expansionary and monetary policy measures.

“The World Bank’s predictions are based on an unrealistic evaluation,” the finance ministry stated, adding that the provisional estimate of GDP growth for FY2021 was 3.94 percent, with 2.8 percent growth in agriculture, 3.6 percent increase in industry, and 4.4 percent growth in service sectors. However, the growth in LSM (large-scale manufacturing) was estimated at 9.3 percent for the purpose of measuring GDP growth at 3.94 percent.

It takes two months for LSM data to become available, and the most recent data given by the Pakistan Bureau of Statistics (PBS) showed that LSM growth was 15.2 percent in the fiscal year 2021.

Aside from that, according to recent data on crops cited by the Federal Committee on Agriculture (FCA), the output of essential crops is higher than the amount assumed in the National Accounts for 2021.

According to the PBS data, wheat production has increased to 27.5 million tonnes from 27.3 million tonnes, while maize production has increased to 8.9 million tonnes from 8.5 million tonnes, resulting in a 3.94 percent increase in GDP growth.

GDP growth in FY2021 will rise further over 3.94 percent after taking into account the most recently available information, as opposed to the 3.5 percent predicted by the World Bank.

The finance ministry stated that the World Bank’s forecast of 3.4 percent GDP growth for the fiscal year 2022 was once again underestimated. As a result, it is predicted that GDP growth will continue close to 5% in the fiscal year 2022. A rapid rebound is projected globally, particularly among Pakistan’s main trading partners, and the ministry anticipates that this would translate into a rapid recovery in the home economy as well.

Domestically, the ministry stated that production of important crops was encouraging, with sugarcane output standing at 87.7 million tonnes (81.0 million tonnes last year), rice output standing at 8.8 million tonnes (8.4 million tonnes last year), maize production standing at 9 million tonnes (8.9 million tonnes last year), and cotton production standing at 8.5 million tonnes (7.1m tonnes last year).

Published in Lahore Herald #lahoreherald #breakingnews #breaking

0 notes