#PAYE)

Text

Continued from [x] with @emystic

She wasn’t looking for anything particular; just looking through the art books in hope that something might catch her attention. As usual Nunnally was not attentive to her surroundings, deep in her thoughts. It was only when she heard the voice complaining about her perfumes that she suddenly found herself back in the bookshop. She turned to face a man only to discover a young boy, presumably a teenager, clearly talking to her. Did she really put too much? She usually didn't as strong smells were, indeed, impolite. But there was also something weird about the boy. Bright yellow eyes? Almost like a tiger. She covered her mouth with her both hands. Both embarrassed about the smell and the smile that his unusual appearance brought onto her face: --

“I…I am so sorry. I was not aware it is so strong. I only put some rose water…usually no-one complains about it.” – then she had that thought that perhaps it is because they were in the closed room – “Do you think it is really that bad? Perhaps I should leave…” – but she just found the book she liked so she’d rather stay and purchase it.

4 notes

·

View notes

Text

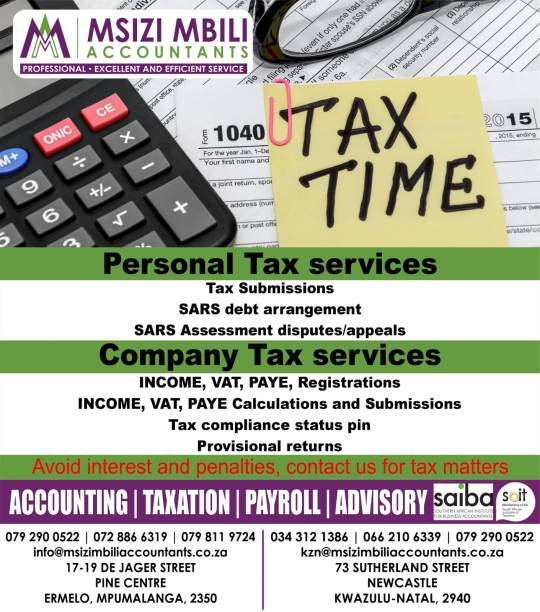

#Taxation Services#Personal Tax Services#Tax Submissions#Sars debt arrangement#Sars Assessment disputes/appeals#Company Tax services#INCOME#VAT#PAYE#Registrations#PAYE Calculations and Submissions#Tax compliance status pin#Provisional returns#Avoid interest and penalties#contact us for tax matters.

4 notes

·

View notes

Text

youtube

#walking tour#manzoor colony#beautiful animals#bakra eid 2024#bakra eid#eid ul azha#paya cleaning#paya cleaning process#cow legs cleaning#easy cow legs cleaning#easy cow legs cleaning and wash#paye#paye cleaning#wash legs#beef paya cleaning#beef paya cutting#cow front leg cutting#cow leg cleaning#cow leg cutting video#how to clean paya of cow#payee cleaning#siri paye cleaning#paye saaf karay ka asan tarika#cleaning paye#cow foot cleaning#Youtube

0 notes

Text

Navigating PAYE in Kenya: A Detailed Guide

PAYE stands for pay-as-you-earn. It is a system in Kenya where employers are required to withhold income tax from their employees' salaries and wages and remit it to the KRA on a monthly basis. This ensures that employees pay taxes throughout the year, rather than in one lump sum at the end of the year.

Here's a breakdown of how PAYE works in Kenya:

Employer Responsibilities:

Employers are responsible for deducting the correct amount of income tax from their employees' salaries based on their tax bracket.

They must use the prevailing Individual Income Tax Rates provided by the KRA.

The deducted tax needs to be remitted to the KRA by the 9th of the following month.

Employers are required to keep records of all PAYE Calculator deductions made.

Employee Responsibilities:

Employees are obligated to provide their employers with their accurate tax information, including their PIN.

They may be eligible for certain tax reliefs and deductions, which can lower their taxable income.

Recent Changes to PAYE in Kenya:

The Finance Act 2023 introduced some changes to the PAYE system in 2024, including:

Increased Tax Rates: The top tax rate was increased from 30% upto 35%. Kenya's new top tax rate of 35% is higher than several other countries in East Africa but not the highest. Uganda has a top rate of 40%, while Rwanda and Tanzania have a rate of 30%. This positioning can impact Kenya's attractiveness to expatriates and international businesses, as the overall tax burden influences decisions on regional headquarters and operations. Historically, Kenya's tax rates have seen substantial fluctuations. In the mid-1980s, the top tax rate was as high as 65%. However, a policy shift in the late 1990s aimed at economic liberalization saw these rates decrease, stabilizing at 30% for over two decades. The temporary reduction to 25% during the COVID-19 pandemic aimed to alleviate financial strain on individuals. The recent shift to 35% marks a significant policy turn, raising questions about its long-term impact on revenue and economic growth.

Affordable Housing Levy: A new 1.5% levy on gross monthly salary was introduced, to be contributed by both employers and employees. Another contentious aspect of the Finance Act 2023 is the affordable housing levy. Initially proposed as a 3% contribution, the final Act set it at 1.5% of the gross monthly salary, payable by both employers and employees, without a cap. This levy significantly impacts take-home pay and increases the cost of employment. The levy is non-refundable, further straining employees’ finances in a high-inflation environment.

Impact of the Changes:

These changes have sparked debate and may lead to:

Reduced Take-Home Pay: Employees, especially those in higher tax brackets, will see a decrease in their net pay due to increased tax deductions and the housing levy.

Compliance Burden: Employers may face challenges in implementing the new tax rates and levy within the short time-frame provided.

Potential for Lower Revenue Collection: Increased tax rates might discourage people from working formally or may lead to them demanding higher salaries to compensate for the lower take-home pay.

The Future of PAYE in Kenya:

The recent changes to the PAYE system in Kenya pose significant challenges, impacting both businesses and individuals. The government's need to increase revenue is understandable. However, a comprehensive review is necessary to evaluate the long-term effectiveness of these measures. Exploring a broader tax base, analyzing the impact on employee morale and economic competitiveness, and reassessing the design of the housing levy are crucial considerations. Open dialogue and strategic adjustments to the tax framework are essential to ensure sustainable economic growth and a fair distribution of the tax burden.

For more info. Visit us:

PAYE

0 notes

Text

HMRC's 6 Month Tax Helpline Closure Paused

In a significant shift in its service delivery model, HM Revenue and Customs (HMRC) announced on 19 March 2024, the closure of its self-assessment helpline for almost six months every year, compelling taxpayers to navigate their enquiries through online channels. This decision, intended to make the best use of resources and improve assistance for complex tax queries, has resulted in mixed…

View On WordPress

#Advice for Taxpayers#HMRC#HMRC Policy#HMRC Tax Appeal#HMRC Tax Assessment#HMRC Tax Disputes#PAYE#Self Assessment#VAT

0 notes

Text

The teenager seemed exhausted as he made a couple of deep breaths when he finally came to a stop with his bike. He probably biked around this city all day because of the time of the year. Everyone wants to buy decorations and anything else they need, but don't want to be in the store. Which he didn't mind at all, but maybe he's overworking himself.

"You ordered this, right?" This was the last bag he had left to give.

0 notes

Text

Metiers Immobilier Qui Paye Bien

Antérieurement d’être inscrit au registre du commerce après vrais sociétés, il orient conseillé au éventuel instrument immobilier d’avoir suivi rare constitution diplômante identiquement les Brevets en même temps que technicien supérieur ou bien les permission professionnelles :

CAPA – Certificat d’Aptitude à cette Profession d’Soutien : Quelle dont ou cette formation initiale choisie, malgré…

View On WordPress

0 notes

Text

Employer PAYE Reference Number

New Post has been published on https://www.fastaccountant.co.uk/employer-paye-reference-number/

Employer PAYE Reference Number

In the world of employment, there is one vital piece of information that both employers and employees should be aware of: the Employer PAYE Reference Number. This unique identifier holds great importance when it comes to matters of taxation and National Insurance contributions, ensuring that accurate records are maintained for every employee. Whether you’re a business owner or an individual seeking employment, understanding the significance of this reference number can pave the way for smoother financial transactions and compliance with regulatory requirements. Let’s explore the ins and outs of the Employer PAYE Reference Number and the role it plays in the world of work.

What is an Employer PAYE Reference Number

Definition of an Employer PAYE Reference Number

An Employer PAYE Reference Number, also known as an Employer Reference Number or PAYE Reference, is a unique alphanumeric code assigned to employers by HM Revenue & Customs (HMRC) in the United Kingdom. It is used for identifying and tracking employers’ payroll records and their employees’ tax information.

Purpose of an Employer PAYE Reference Number

The primary purpose of an Employer Reference Number is to ensure accurate and efficient administration of payroll and taxation. It serves as a way to identify individual employers and track their responsibilities and contributions to the tax system. The number is used by HMRC for various purposes, including verifying employment details and monitoring tax payments.

How to obtain an Employer Reference Number

To obtain an the Reference Number, you need to register with HMRC as an employer. This can be done online through the government’s official website or by contacting HMRC directly. The registration process typically involves providing basic information about your business, such as its legal structure, address, and the number of employees. Once your registration is approved, HMRC will issue you an Employer PAYE Reference Number.

Understanding the Format

Structure of a PAYE Reference Number

An Employer Reference Number consists of two parts divided by a forward slash (“/”). The first part, known as the office number, includes three digits representing the tax office that deals with your payroll. The second part, known as the employer reference, is a combination of letters and numbers unique to your business.

Components of a PAYE Reference Number

The office number helps HMRC route the correct information to the appropriate tax office. It gives an indication of the geographical location of your business. The employer reference, on the other hand, ensures that your specific business is identified within the tax office. It is unique to your organization and helps differentiate it from other employers.

Importance of an Employer Reference Number

Legally Required for Employers

Having an Employer Reference Number is a legal requirement for all employers in the United Kingdom. Under the PAYE (Pay As You Earn) system, employers must deduct income tax and National Insurance contributions from their employees’ salaries and report this information to HMRC. The Employer PAYE Reference Number is essential for ensuring compliance with these legal obligations.

Identification of Employers

The PAYE Reference Number is necessary for identifying employers and their associated payroll records and tax information. It allows HMRC to accurately link and track an employer’s financial and employment data, ensuring that the correct tax liabilities are assigned to the appropriate individuals and businesses.

Tracking Employee Tax Payments

By using the Employer PAYE Reference Number, HMRC can monitor and reconcile tax payments made by employers on behalf of their employees. It facilitates the accurate reporting and calculation of taxes owed by both employers and employees. The reference number serves as a crucial tool in ensuring that all tax obligations are correctly fulfilled.

Interaction with HM Revenue & Customs (HMRC)

Having an Employer Reference Number enables effective communication with HMRC. It allows employers to contact HMRC for guidance, support, and assistance in matters related to payroll and taxation. It also serves as a reference during any correspondence with HMRC regarding queries, adjustments, or reporting requirements.

Obtaining the Reference Number

New Employers

If you are a new employer, you need to register with HMRC to obtain an Employer PAYE Reference Number. This can be done online through the government’s official website or by contacting HMRC directly. During the registration process, you will need to provide information about your business, such as its legal structure, address, and estimated number of employees. Once your registration is complete, HMRC will issue you an Employer PAYE Reference Number.

Employers Taking Over a Business

If you are taking over an existing business as a new employer, you may still need to register with HMRC and obtain your own Reference Number. This is usually required when the business changes legal ownership or when there is a significant change in the nature or scope of the business operations. It is important to notify HMRC of any changes and follow their guidance regarding obtaining a new reference number.

Changing the Legal Structure of a Business

If you are changing the legal structure of your business, such as from a sole proprietorship to a limited company, you may need to apply for a new Employer PAYE Reference Number. This is because the legal structure change typically involves creating a new legal entity for the business. It is advisable to consult with HMRC or a tax advisor to ensure that you follow the correct procedures and obtain the necessary reference numbers.

Employees with More Than One Job

If you have employees who work for you while also having another job, you do not need a separate Employer PAYE Reference Number for each job. Instead, you should use the existing reference number associated with the original employment. This ensures that the tax and National Insurance contributions are correctly allocated and reported.

Maintaining a PAYE Reference Number

Updating Information

It is important to keep HMRC updated with any changes to your business information, such as changes in address, contact details, or legal structure. This ensures that HMRC has accurate and up-to-date records to communicate with you effectively and deliver important information regarding payroll and taxation.

Notifying HMRC

If there are any significant changes to your business operations that may affect your Employer PAYE Reference Number, such as mergers, acquisitions, or closures, it is essential to notify HMRC promptly. Failure to do so may result in incorrect reporting and potential penalties.

Communication with HMRC

Maintaining open lines of communication with HMRC is vital for employers. If you have any queries, concerns, or issues related to your Employer PAYE Reference Number, it is encouraged to contact HMRC’s Employer Helpline or seek guidance from their official website. By proactively seeking support, you can ensure that you comply with relevant regulations and fulfil your obligations as an employer.

Keeping Records

Employers should keep accurate and detailed records related to their payroll and taxation, including the Employer PAYE Reference Number. These records should be securely stored and easily accessible if required for audit or review purposes. Keeping records helps demonstrate compliance and provides the necessary documentation to reconcile any discrepancies that may arise.

Consequences of Not Having an Employer PAYE Reference Number

Legal Penalties

Failure to obtain and use an Employer PAYE Reference Number can result in legal penalties. HMRC has the authority to investigate and penalize employers who fail to fulfill their obligations under the PAYE system. Penalties can range from financial fines to legal proceedings, depending on the nature and severity of the non-compliance.

Difficulties in Operating Payroll

Not having an Employer PAYE Reference Number can lead to difficulties in operating payroll effectively. Without the reference number, it becomes challenging to accurately calculate and report tax deductions on employees’ salaries. This can result in errors, delays, and potential underpayments or overpayments, causing inconvenience and dissatisfaction for both employers and employees.

Inability to Submit Tax Information

An Employer PAYE Reference Number is required for the submission of tax information to HMRC. Without the reference number, employers cannot fulfill their reporting obligations accurately. This can lead to non-compliance with tax regulations and the inability to provide necessary information for tax assessments, resulting in potential penalties or audits.

Loss of Employee Trust

Employees expect their employers to fulfill their legal obligations and operate with transparency and integrity. Not having an Employer PAYE Reference Number or failing to comply with the associated requirements can erode employees’ trust in their employer. This can negatively impact the working relationship and the overall morale within the organization.

Common Questions and Concerns

Can an Employer PAYE Reference Number Change?

In general, an Employer PAYE Reference Number remains unchanged throughout the life of a business. However, certain circumstances, such as a change in legal structure or ownership of the business, may require the issuance of a new reference number. It is advisable to consult with HMRC or a tax advisor to determine if a change in reference number is necessary.

Can an Employer Have Multiple PAYE Reference Numbers?

Employers typically have one Employer PAYE Reference Number that covers all their payroll operations. However, there may be instances where employers require multiple reference numbers, such as in the case of distinct business divisions or subsidiaries. Each reference number would be specific to the respective payroll operations. Consultation with HMRC is recommended in such cases.

Additional Resources

HMRC’s Guide to PAYE Reference Numbers

HMRC provides a comprehensive guide to Employer PAYE Reference Numbers on their official website. This guide offers detailed information on various topics related to obtaining, managing, and using the reference numbers. It provides helpful examples, explanations, and instructions for employers to ensure compliance with HMRC’s requirements.

HMRC’s Employers Helpline

HMRC operates an Employers Helpline specifically designed to assist employers with their payroll and taxation queries. Employers can contact the helpline for guidance, support, and clarification on matters related to Employer Reference Numbers and other related topics. The helpline can provide personalized advice based on the specific circumstances of individual employers.

Government Websites and Documentation

Government websites, such as gov.uk, provide a wealth of information and resources for employers. These websites offer official documentation, guidelines, and frequently asked questions (FAQs) to help employers understand and fulfil their responsibilities, including the proper use of Employer Reference Numbers. It is beneficial to refer to these websites for accurate and up-to-date information.

Online Forums and Communities

Online forums and communities, such as payroll and small business forums, can be valuable sources of information and support for employers. These platforms allow employers to engage with industry professionals and fellow employers to seek advice, share experiences, and discuss topics related to payroll, taxation, and Employer PAYE Reference Numbers. It is important to verify the credibility of the information shared on these platforms and consult official sources whenever necessary.

Conclusion

An Employer PAYE Reference Number is a vital identifier and tracking tool for employers in the United Kingdom. It is legally required for employers and plays a crucial role in payroll administration, taxation, and compliance. Obtaining and maintaining an Employer PAYE Reference Number is essential for fulfilling legal obligations, accurately reporting tax information, and maintaining effective communication with HMRC. By understanding the role and importance of the reference number, employers can ensure smooth operations, avoid penalties, and build trust with their employees and HMRC.

0 notes

Text

Unraveling the Mysteries of PAYE: A Comprehensive Guide

The article today is all about a very important, yet often misunderstood concept – Pay As You Earn, or for short. Understanding how PAYE works can save you quite a bit of stress come tax time, and it can even help you plan your finances better. So, let’s jump right in!

The Basics of PAYE

PAYE, or Pay As You Earn, is a method of tax collection used by Her Majesty’s Revenue and Customs (HMRC). It’s…

View On WordPress

#Employer Obligations#Income Tax#Pay As You Earn#PAYE#PAYE Deductions#PAYE for Self-Employed#Self Assessment Tax Return#Tax Codes

0 notes

Photo

Statut GOLD certifié pour la 3ème fois cette année 😉 19 mars et j’ai déjà +480€ de commissions! Ça pourrait être toi! N’hésite plus, contacte moi! . . . . . . Salut, moi c’est Chrystele! Ta future marraine qui t’aide à gagner +200 € par mois. Styliste Gold 2 mois d’affilés, je t’aiderai à atteindre tes objectifs. JoliMoi, c’est un complément de revenu qui dans les temps qui courent, est le bienvenu ! Abonne-toi et contacte moi pour plus d’information sur cette opportunité✨ . . . . . . . #stylistebeauté #beautyaddict #complementderevenu #gagnedelargent #travailenligne #travailadistance #teletravail #entreprendre #freelance #500euro #augmentation #paye #maquillage #soinsducorps #recrutement #offreemploi #emploi #jobenligne #emploienligne #indépendant #linkedin #conceptcléenmain (at Marseille, France) https://www.instagram.com/p/Cp_Bq2gtQZw/?igshid=NGJjMDIxMWI=

#stylistebeauté#beautyaddict#complementderevenu#gagnedelargent#travailenligne#travailadistance#teletravail#entreprendre#freelance#500euro#augmentation#paye#maquillage#soinsducorps#recrutement#offreemploi#emploi#jobenligne#emploienligne#indépendant#linkedin#conceptcléenmain

0 notes

Text

Qui paye ❓️😁 💳 🤣

🍜 Repas entre amis 🥃

👋 Bel après-midi

#funny video#humour du jour#qui paye ?#repas entre amis#restaurant#déjeuner#carte bleue#paiement#tirage au sort#cute#repas#drôle#bel après-midi#fidjie fidjie

66 notes

·

View notes

Text

49 notes

·

View notes

Text

Navigating PAYE in Kenya: A Detailed Guide

PAYE stands for pay-as-you-earn. It is a system in Kenya where employers are required to withhold income tax from their employees' salaries and wages and remit it to the KRA on a monthly basis. This ensures that employees pay taxes throughout the year, rather than in one lump sum at the end of the year.

Here's a breakdown of how PAYE works in Kenya:

Employer Responsibilities:

Employers are responsible for deducting the correct amount of income tax from their employees' salaries based on their tax bracket.

They must use the prevailing Individual Income Tax Rates provided by the KRA.

The deducted tax needs to be remitted to the KRA by the 9th of the following month.

Employers are required to keep records of all PAYE Calculator deductions made.

Employee Responsibilities:

Employees are obligated to provide their employers with their accurate tax information, including their PIN.

They may be eligible for certain tax reliefs and deductions, which can lower their taxable income.

Recent Changes to PAYE in Kenya:

The Finance Act 2023 introduced some changes to the PAYE system in 2024, including:

Increased Tax Rates: The top tax rate was increased from 30% upto 35%. Kenya's new top tax rate of 35% is higher than several other countries in East Africa but not the highest. Uganda has a top rate of 40%, while Rwanda and Tanzania have a rate of 30%. This positioning can impact Kenya's attractiveness to expatriates and international businesses, as the overall tax burden influences decisions on regional headquarters and operations. Historically, Kenya's tax rates have seen substantial fluctuations. In the mid-1980s, the top tax rate was as high as 65%. However, a policy shift in the late 1990s aimed at economic liberalization saw these rates decrease, stabilizing at 30% for over two decades. The temporary reduction to 25% during the COVID-19 pandemic aimed to alleviate financial strain on individuals. The recent shift to 35% marks a significant policy turn, raising questions about its long-term impact on revenue and economic growth.

Affordable Housing Levy: A new 1.5% levy on gross monthly salary was introduced, to be contributed by both employers and employees. Another contentious aspect of the Finance Act 2023 is the affordable housing levy. Initially proposed as a 3% contribution, the final Act set it at 1.5% of the gross monthly salary, payable by both employers and employees, without a cap. This levy significantly impacts take-home pay and increases the cost of employment. The levy is non-refundable, further straining employees’ finances in a high-inflation environment.

Impact of the Changes:

These changes have sparked debate and may lead to:

Reduced Take-Home Pay: Employees, especially those in higher tax brackets, will see a decrease in their net pay due to increased tax deductions and the housing levy.

Compliance Burden: Employers may face challenges in implementing the new tax rates and levy within the short time-frame provided.

Potential for Lower Revenue Collection: Increased tax rates might discourage people from working formally or may lead to them demanding higher salaries to compensate for the lower take-home pay.

The Future of PAYE in Kenya:

The recent changes to the PAYE system in Kenya pose significant challenges, impacting both businesses and individuals. The government's need to increase revenue is understandable. However, a comprehensive review is necessary to evaluate the long-term effectiveness of these measures. Exploring a broader tax base, analyzing the impact on employee morale and economic competitiveness, and reassessing the design of the housing levy are crucial considerations. Open dialogue and strategic adjustments to the tax framework are essential to ensure sustainable economic growth and a fair distribution of the tax burden.

For more info. Visit us:

PAYE

1 note

·

View note

Text

FTT Appeal against HMRC allowed, Magic Carpets not careless enough

In Magic Carpets (Commercial) Ltd v HMRC [2023] TC08892, the First-tier Tribunal (FTT) determined that despite the taxpayer’s carelessness in implementing a tax planning scheme that included an employee benefit trust (EBT), this carelessness did not result in a loss of tax. As a result, HMRC’s determinations were deemed to have been issued beyond the standard four-year limitation period and were…

View On WordPress

#First Tier Tax Tribunal#HMRC#HMRC Investigations#HMRC Tax Assessment#HMRC Tax Disputes#Income Tax#PAYE#PAYE Income Tax Assessment#Unpaid Tax

1 note

·

View note