#Online Funding For Startups

Explore tagged Tumblr posts

Text

Navigating the Digital Landscape: Effective Online Branding Strategies for Small Businesses

In today’s fast-paced digital world, small businesses face the challenge of standing out among a sea of competitors. Navigating the digital landscape effectively requires more than just a presence on social media or an attractive website; it demands a solid online branding strategy. This article explores effective online branding strategies for small businesses, providing a comprehensive roadmap…

#best practices for brand management#Branding#Branding strategies for small businesses#building brand loyalty#business growth strategies#Businesses#corporate social responsibility#creating a strong brand identity#customer relationship management#Digital#digital marketing for startups#e-commerce tips for businesses#Effective#how to scale your business.#how to start a successful business#importance of social media for businesses#influencer marketing for brands#Landscape#Navigating#Online#Small#small business funding options#Strategies#top business trends 2024

0 notes

Text

#small business funding#small business loans#small business#business loan#business loans#startup#student loans#personal loans#loans#same day loans online#banking#low interest personal loans

0 notes

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

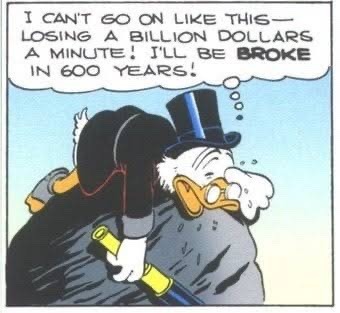

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

36K notes

·

View notes

Text

Unlocking the Future: Startups Fundraising and Getting Business Funding Online

In the ever-evolving landscape of entrepreneurship, securing funding remains a critical step for startups aiming to transform innovative ideas into successful businesses. Fundraising for Startups Fundraising has evolved significantly over the years, with online platforms playing a pivotal role in democratising access to capital. In this article, we'll explore the modern approaches to startup fundraising and how entrepreneurs can Get Business Funding Online.

The Changing Landscape of Startups Fundraising

Traditionally, fundraising involved navigating through a complex network of venture capitalists (VCs), angel investors, and financial institutions. While these avenues are still relevant, the rise of digital platforms has revolutionized the fundraising process, making it more accessible, efficient, and inclusive.

Traditional Fundraising Methods

Venture Capital: Venture capital firms invest in startups with high growth potential in exchange for equity. This method often requires startups to have a robust business plan, a clear revenue model, and a compelling value proposition.

Angel Investors: Angel investors are wealthy individuals who provide capital for startups during their early stages. Unlike VCs, angels might be more flexible in terms of investment size and conditions, but they also expect a significant return on investment.

Bank Loans: Traditional banks offer loans to startups, but this requires a strong credit history and collateral. The approval process can be lengthy, and the terms may not always be favorable for fledgling businesses.

Modern Fundraising Methods

Crowdfunding: Platforms like Kickstarter, Indiegogo, and GoFundMe allow startups to raise small amounts of money from a large number of people. This method not only provides capital but also helps validate the business idea by attracting early adopters.

Equity Crowdfunding: Websites such as SeedInvest, Crowdcube, and OurCrowd enable startups to sell shares to a large number of investors. This method combines the benefits of crowdfunding and traditional equity investment.

Online Lending Platforms: Companies like LendingClub and Funding Circle offer peer-to-peer lending, where individual investors fund loans for startups. This provides an alternative to bank loans with potentially more favorable terms.

Accelerators and Incubators: These programs, like Y Combinator and Techstars, provide seed funding, mentorship, and resources in exchange for equity. They also help startups connect with a network of investors.

How to Get Business Funding Online

Securing online funding requires a strategic approach. Here are some steps to guide Startups Fundraising through the process:

1. Build a Compelling Business Plan

A well-crafted business plan is essential. It should clearly articulate your business idea, market opportunity, revenue model, competitive landscape, and growth strategy. Investors need to see a realistic and achievable plan that demonstrates the potential for substantial returns.

2. Leverage Digital Platforms

Choose the right platform based on your funding needs and business stage. For instance, early-stage startups might benefit from crowdfunding or angel investors, while more established companies might look towards equity crowdfunding or online lending platforms.

3. Create an Engaging Pitch

Your pitch should capture the essence of your business in a concise and compelling manner. Use visuals, data, and storytelling to highlight your unique value proposition, market opportunity, and the impact of your solution. Platforms like Pitcherific and Slidebean can help in creating professional pitch decks.

4. Engage with Your Audience

Engagement is crucial in online fundraising. Use social media, email marketing, and other digital channels to reach potential investors and customers. Share your journey, milestones, and successes to build trust and credibility.

5. Offer Incentives

Incentives can attract more investors. For crowdfunding, consider offering rewards or early access to your product. For equity crowdfunding, highlight the potential for high returns and any perks associated with investing in your startup.

6. Build a Strong Online Presence

A professional website, active social media profiles, and positive online reviews can enhance your credibility. Investors often research startups online before committing funds, so ensure your digital footprint reflects your brand positively.

7. Network and Collaborate

Online platforms provide opportunities to network with other entrepreneurs, investors, and industry experts. Join online communities, attend virtual events, and participate in forums to expand your network and gain valuable insights.

The Future of Startups Fundraising

The future of startup fundraising lies in further digitalization and democratization. Technologies like blockchain and smart contracts are poised to make fundraising more transparent and secure. Decentralized finance (DeFi) platforms are emerging, allowing startups to access funding without intermediaries.

Moreover, the rise of artificial intelligence (AI) and big data is enabling more personalized and efficient funding solutions. AI can analyze vast amounts of data to match startups with the most suitable investors, while big data can provide deeper insights into market trends and investor behavior.

Conclusion

Securing funding is a critical milestone for any startup, and the evolution of online platforms has made it more accessible than ever. By leveraging these digital tools, entrepreneurs can navigate the fundraising landscape with greater ease and efficiency. Whether you're seeking seed capital or looking to scale, understanding the nuances of online fundraising will empower you to unlock the future of your business.

At Your Ven, we believe in the power of innovation and the potential of startups to drive economic growth. Our mission is to support entrepreneurs in their fundraising journey, providing the resources and connections they need to succeed. Explore our platform today and take the first step towards transforming your vision into reality.

0 notes

Text

#fundraising services in india#startupfino#fundraising services#fundraising services for startups#online fundraising service#business startups#fundraising#fundraising consulting services#funding for startups in india#startup fundraising

0 notes

Text

Discover Your Business Dream Team at Nainer!

Find your business dream team at Nainer! This amazing platform brings together entrepreneurs and investors, creating the perfect space for collaboration and growth. Whether you are looking for investors for business startup or seeking to invest in promising ideas, Nainer has got you covered. Join Nainer now and kickstart your journey toward entrepreneurial success!

#Business Funding For Startup#Online Investors For Startups#Find Startup Investor#Funding Start Up Business#Investors For Business Startups#Looking To Invest In Startups#Startup Funding Website#Business Start Up Opportunities

0 notes

Text

How did Flagship.club's Entrepreneurship Competition Empower Student Innovators?

Flagship.club is hosting an exciting business fair day student competition exclusively for students between 10-18 years of age. This event will offer a unique platform for budding entrepreneurs to showcase their innovative business ideas for entrepreneurship, foster connections with industry experts, and gain valuable insights into the world of business.

#Student entrepreneurship competitions#Competition for startup funding#Unique small business ideas#Online business ideas#Small business ideas for 2023

0 notes

Text

How to Start a Successful Startup in India

Starting a startup in India can be a challenging but rewarding journey. It requires dedication, hard work, and careful planning. Business consulting services can help you identify a unique business idea, validate it through market research, create a business plan, register your business, and develop a funding plan. Marketing strategies are crucial for launching your startup and generating revenue. Digital marketing, social media marketing, and content marketing can help you establish a strong online presence, while offline marketing strategies can help you build.

#funding#startups in india#online marketing#business consulting firm#startup#mentoring#branding#digital marketing

0 notes

Text

Best Startup Investing Platforms - aVenture

The aVenture platform makes it possible for everyone in the U.S. to invest in venture. Research early-stage startups and start investing in venture capital with aVenture. Analyze your portfolio by traction, growth prospects, geography, and more.

0 notes

Text

Mastering Online Presence: Digital Branding Strategies for Small Businesses

Introduction In today’s digital landscape, mastering your online presence is essential for small businesses to thrive and compete effectively. Digital branding strategies play a crucial role in establishing a strong identity, attracting customers, and building long-term loyalty. This comprehensive guide will explore various methodologies that small business owners can implement to elevate their…

#best practices for brand management#Branding#Branding strategies for small businesses#building brand loyalty#business growth strategies#Businesses#corporate social responsibility#creating a strong brand identity#customer relationship management#Digital#digital marketing for startups#e-commerce tips for businesses#how to scale your business.#how to start a successful business#importance of social media for businesses#influencer marketing for brands#Mastering#Online#Presence#Small#small business funding options#Strategies#top business trends 2024

0 notes

Note

do u have some ways/explanations I could logically become rich and wealthy? I wanna be a billionaire but I just can’t imagine doing that without being unethical…

I was just thinking of this question a few days ago and consulted with ChatGPT, so I have the answers ready and loaded!

Ways to become super ultra rich without having to resort to unethical or immoral methods/practices:

› Entrepreneurship: Start your own business in a growing industry. Identify a gap in the market, create a product or service that meets a need, and scale it. Focus on innovation and customer satisfaction.

› Investing: Educate yourself on investing in stocks, real estate, or other assets. Consider long-term investment strategies, such as index funds or rental properties, which can compound wealth over time.

› Build a Personal Brand: Create a strong online presence in your field. Share knowledge through blogs, podcasts, or social media, and leverage your brand for consulting, speaking engagements, or product endorsements.

› Develop Valuable Skills: Acquire skills in high-demand fields like technology, finance, or healthcare. Expertise can lead to high-paying job opportunities or freelance work.

› Networking: Build relationships with influential people in your industry. Networking can lead to collaborations, partnerships, and opportunities that can significantly boost your wealth.

› Innovate and Create: Focus on research and development in emerging fields, such as renewable energy, biotechnology, or artificial intelligence. Invent new products or improve existing ones.

› Real Estate Development: Invest in real estate, starting with rental properties or flipping houses. Learn the market and focus on areas with potential growth.

› Passive Income Streams: Create sources of passive income, such as writing books, creating online courses, or investing in dividend-paying stocks.

› Franchise Ownership: Consider investing in a reputable franchise. This can provide a proven business model and brand recognition while allowing you to operate your own business.

› Philanthropy and Ethical Investing: Invest in socially responsible businesses or initiatives. This can lead to both financial returns and positive societal impact, enhancing your reputation and network.

Ways to “stumble” into wealth without (directly) hoarding wealth:

› Inheriting Wealth: Unexpectedly inheriting wealth from a distant unknown relative or family friend.

› Winning the Lottery: Not a very sustainable source of income but it works.

› Discovering Hidden Talents: Uncovering a unique skill or talent that becomes highly valued—like writing a bestselling book or creating viral content.

› Investing Early: Accidentally investing in a promising startup or stock that later skyrockets in value.

› Networking: Making a valuable connection at a social event that leads to a lucrative job or business opportunity.

› Crowdfunding Success: Launching a project that resonates with a broad audience, leading to substantial financial backing.

› Accidental Invention: Creating a product by chance that fills a market need, like a popular app or gadget.

31 notes

·

View notes

Text

Fuel Your Future: Invest in Startups and Get Funding Online with YourVen

The world of startups is a dynamic and thrilling ecosystem, brimming with innovation, creativity, and the potential for significant financial returns. For entrepreneurs, securing funding is often the most critical step in transforming their vision into reality. For investors, finding the right startup to support can lead to substantial profits and the satisfaction of fostering groundbreaking ideas. YourVen, a leading platform in this space, bridges the gap between startups and investors, making it easier than ever to invest in startups and get funding online. This blog will explore the benefits and process of investing in startups through YourVen and how entrepreneurs can secure the necessary funding.

Why Invest in Startups?

Investing in startups offers several advantages that appeal to both novice and seasoned investors:

High Growth Potential:

Startups often operate in emerging industries with substantial growth potential. Early investment can lead to significant returns if the startup succeeds.

Diversification:

Adding startups to your investment portfolio can diversify your assets, reducing overall risk. Startups operate in various sectors, allowing you to spread your investments across different industries.

Innovation and Impact:

Startups are the breeding ground for innovation. By investing in startups, you support new ideas, technologies, and solutions that can change the world.

Community and Network:

Investing in startups connects you with a community of like-minded individuals, including entrepreneurs, other investors, and industry experts. This network can provide valuable insights and opportunities.

The Role of YourVen in Startup Investment

YourVen simplifies the process of investing in startups by providing a user-friendly platform that connects investors with promising ventures. Here’s how YourVen makes it easy to Invest in Startups:

Curated Listings:

YourVen features a curated list of startups, ensuring that only the most promising and well-vetted companies are available for investment. This saves investors time and reduces the risk of investing in unproven ventures.

Detailed Information:

Each startup listing includes comprehensive information about the company, its business model, market potential, and financial projections. Investors can make informed decisions based on thorough research and data.

Secure Transactions:

YourVen ensures that all transactions are secure and transparent. Investors can confidently invest knowing that their funds are handled with the highest level of security.

Community Engagement:

YourVen fosters a community of investors and entrepreneurs, encouraging engagement and collaboration. Investors can communicate directly with startup founders, ask questions, and participate in discussions.

Educational Resources:

For those new to startup investing, YourVen offers educational resources, including guides, webinars, and articles that provide insights into the world of startup investment.

How to Get Funding Online with YourVen

For entrepreneurs, securing funding is a crucial step in turning their startup dreams into reality. YourVen provides a streamlined process for startups to Get Funding Online:

Create a Compelling Profile:

Start by creating a detailed profile for your startup on YourVen. Include information about your business model, target market, unique value proposition, and financial projections. High-quality images, videos, and presentations can enhance your profile.

Set Clear Funding Goals:

Define how much funding you need and how you plan to use it. Clear and realistic funding goals help attract investors and demonstrate your startup’s potential for growth.

Engage with Investors:

Actively engage with potential investors on the platform. Respond to their questions, provide additional information, and participate in discussions. Building a rapport with investors can increase their confidence in your startup.

Leverage Your Network:

Utilize your existing network to promote your funding campaign on YourVen. Encourage friends, family, and professional contacts to support and share your campaign.

Update Regularly:

Keep your profile and investors updated on your startup’s progress. Regular updates on milestones, new developments, and achievements show that your startup is active and progressing, which can attract more investors.

Showcase Traction:

Highlight any traction your startup has gained, such as user growth, revenue, partnerships, or media coverage. Demonstrating traction can significantly boost investor confidence.

Prepare for Due Diligence:

Be prepared for due diligence, as investors will want to thoroughly vet your startup before committing funds. Ensure your financials, legal documents, and business plans are in order.

The Future of Startup Investment

The rise of platforms like YourVen marks a new era in startup investment. By leveraging technology, YourVen makes it easier for investors to discover and invest in promising startups and for entrepreneurs to secure the funding they need. The accessibility and transparency offered by YourVen democratize startup investment, allowing more people to participate in the growth and success of innovative companies.

Conclusion

Investing in startups and securing funding online has never been more accessible, thanks to platforms like YourVen. Whether you’re an investor looking to support the next big idea or an entrepreneur seeking to bring your vision to life, YourVen provides the tools, resources, and community you need to succeed. Embrace the future of startup investment with YourVen and fuel your journey towards financial growth and innovation.

0 notes

Text

#funding for startups in india#fundraising services#fundraising services in india#business startups#online fundraising service#fundraising services for startups#fundraising consulting services#startup fundraising#startupfino

0 notes

Text

Prosecutors say Joanna Smith-Griffin inflated the revenues of her startup, AllHere Education.

Smith-Griffin is accused of lying about contracts with schools to get $10 million in investment.

AllHere, which spun out of Harvard's Innovation Lab, was supposed to help reduce absenteeism.

Federal prosecutors have charged the founder of an education-technology startup spun out of Harvard who was recognized on a 2021 Forbes 30 Under 30 list with fraud.

Prosecutors in New York say Joanna Smith-Griffin lied for years about her startup AllHere Education's revenues and contracts with school districts. The company received $10 million under false pretenses, the indictment says.

AllHere, which came out of Harvard Innovation Labs, created an AI chatbot that was supposed to help reduce student absenteeism. It furloughed its staff earlier this year and had a major contract with the Los Angeles Unified School District, the education-news website The 74 reported. The company is currently in bankruptcy proceedings.

Smith-Griffin was featured on the Forbes 30 Under 30 list for education in 2021. She's the latest in a line of young entrepreneurs spotlighted by the publication — including Sam Bankman-Fried, Charlie Javice, and Martin Shkreli — to face criminal charges.

More recently, the magazine Inc. spotlighted her on its 2024 list of female founders "for leveraging AI to help families communicate and get involved in their children's educational journey."

"The law does not turn a blind eye to those who allegedly distort financial realities for personal gain," US Attorney Damian Williams said in a statement.

Prosecutors say Smith-Griffin deceived investors for years. In spring 2021, while raising money, she said AllHere had made $3.7 million in revenue the year before and had about $2.5 million on hand. Charging documents say her company had made only $11,000 the year before and had about $494,000 on hand. The company's claims that the New York City Department of Education and the Atlanta Public Schools were among its customers were also false, the government says.

AllHere's investors included funds managed by Rethink Capital Partners and Spero Ventures, according to a document filed in bankruptcy court.

Smith-Griffin was arrested on the morning of November 19 in North Carolina, prosecutors say.

Harvard said Smith-Griffin received a bachelor's degree from Harvard Extension School in 2016. According to an online biography, she was previously a teacher and worked for a charter school. Representatives for Forbes and Inc. didn't immediately respond to a comment request on Tuesday. A message left at a number listed for Smith-Griffin wasn't returned.

14 notes

·

View notes

Text

A new lawsuit brought against the startup Perplexity argues that, in addition to violating copyright law, it’s breaking trademark law by making up fake sections of news stories and falsely attributing the words to publishers.

Dow Jones (publisher of The Wall Street Journal) and the New York Post—both owned by Rupert Murdoch’s News Corp—brought the copyright infringement lawsuit against Perplexity today in the US Southern District of New York.

This is not the first time Perplexity has run afoul of news publishers; earlier this month, The New York Times sent the company a cease-and-desist letter stating that it was using the newspaper behemoth’s content without permission. This summer, both Forbes and WIRED detailed how Perplexity appeared to have plagiarized stories. Both Forbes and WIRED parent company Condé Nast sent the company cease-and-desist letters in response.

A WIRED investigation from this summer, cited in this lawsuit, detailed how Perplexity inaccurately summarized WIRED stories, including one instance in which it falsely claimed that WIRED had reported on a California-based police officer committing a crime he did not commit. The WSJ reported earlier today that Perplexity is seeking to raise $500 million is its next funding round, at an $8 billion valuation.

Dow Jones and the New York Post provide examples of Perplexity allegedly “hallucinating” fake sections of news stories. In AI terms, hallucination is when generative models produce false or wholly fabricated material and present it as fact.

In one case cited, Perplexity Pro first regurgitated, word for word, two paragraphs from a New York Post story about US senator Jim Jordan sparring with European Union commissioner Thierry Breton over Elon Musk and X, but then followed them up with five generated paragraphs about free speech and online regulation that were not in the real article.

The lawsuit claims that mixing in these made-up paragraphs with real reporting and attributing it to the Post is trademark dilution that potentially confuses readers. “Perplexity’s hallucinations, passed off as authentic news and news-related content from reliable sources (using Plaintiffs’ trademarks), damage the value of Plaintiffs’ trademarks by injecting uncertainty and distrust into the newsgathering and publishing process, while also causing harm to the news-consuming public,” the complaint states.

Perplexity did not respond to requests for comment.

In a statement emailed to WIRED, News Corp chief executive Robert Thomson compared Perplexity unfavorably to OpenAI. “We applaud principled companies like OpenAI, which understands that integrity and creativity are essential if we are to realize the potential of Artificial Intelligence,” the statement says. “Perplexity is not the only AI company abusing intellectual property and it is not the only AI company that we will pursue with vigor and rigor. We have made clear that we would rather woo than sue, but, for the sake of our journalists, our writers and our company, we must challenge the content kleptocracy.”

OpenAI is facing its own accusations of trademark dilution, though. In New York Times v. OpenAI, the Times alleges that ChatGPT and Bing Chat will attribute made-up quotes to the Times, and accuses OpenAI and Microsoft of damaging its reputation through trademark dilution. In one example cited in the lawsuit, the Times alleges that Bing Chat claimed that the Times called red wine (in moderation) a “heart-healthy” food, when in fact it did not; the Times argues that its actual reporting has debunked claims about the healthfulness of moderate drinking.

“Copying news articles to operate substitutive, commercial generative AI products is unlawful, as we made clear in our letters to Perplexity and our litigation against Microsoft and OpenAI,” says NYT director of external communications Charlie Stadtlander. “We applaud this lawsuit from Dow Jones and the New York Post, which is an important step toward ensuring that publisher content is protected from this kind of misappropriation.”

If publishers prevail in arguing that hallucinations can violate trademark law, AI companies could face “immense difficulties” according to Matthew Sag, a professor of law and artificial intelligence at Emory University.

“It is absolutely impossible to guarantee that a language model will not hallucinate,” Sag says. In his view, the way language models operate by predicting words that sound correct in response to prompts is always a type of hallucination—sometimes it’s just more plausible-sounding than others.

“We only call it a hallucination if it doesn't match up with our reality, but the process is exactly the same whether we like the output or not.”

12 notes

·

View notes

Text

How to Get Funding for Startup

Need of Startup Funding

Startups are companies that have high operating costs and limited revenue, which is why they need to receive funding from investors in order to keep their business running. A startup's success is contingent upon its hyper-growth mindset - these startups need a lot of money to maintain their business and reach their growth goals. After they have established their business model, they need to look for sources of funding, which can come from either bootstrapping or external sources. Bootstrapping means raising money from internal sources, like the founders' family and friends. External sources include venture capitalists, angel investors, and government grants.

0 notes