#Online Charging System Market Growth

Explore tagged Tumblr posts

Text

Online Charging System Market Size, Share, Scope, Analysis, Forecast, Growth and Industry Report 2032: Technological Advancements

The Online Charging System Market Size was valued at USD 7.72 Billion in 2023 and is expected to reach USD 20.08 Billion by 2032 and growing at a CAGR of 11.24% over the forecast period 2024-2032.

The Online Charging System (OCS) Market is witnessing rapid expansion as telecom operators shift toward real-time billing solutions. With the growing demand for digital services, OCS plays a critical role in enabling flexible and dynamic charging mechanisms. This technology is essential for telecom providers, ensuring seamless monetization of voice, data, and digital services.

The Online Charging System Market continues to evolve, driven by the rising adoption of 5G networks, cloud-based solutions, and increasing customer expectations. As telecom companies seek to enhance operational efficiency, OCS enables them to manage prepaid and postpaid billing in real time, offering greater transparency and customer satisfaction.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3823

Market Keyplayers:

AGNITY Inc. (AGNITY Online Charging Systems, Intelligent Network Services)

Alepo (Alepo Online Charging Systems, Alepo Charging Platform)

Amdocs (Amdocs Online Charging Systems, Amdocs Charging System)

Nexign (Nexign Online Charging Systems, Nexign BSS/OSS Solutions)

Cerillion Technologies Limited (Cerillion Online Charging Systems, Cerillion Charging System)

Huawei Technologies Co., Ltd. (Huawei Online Charging Systems, Huawei Cloud Solutions)

ZTE Corporation (ZTE Online Charging Systems, ZTE Telecom Solutions)

Comverse Inc. (Comverse Online Charging Systems, Comverse Billing Solutions)

Oracle Corporation (Oracle Online Charging Systems, Oracle Communications)

Ericsson AB (Ericsson Online Charging Systems, Ericsson Charging Solutions)

NetCracker Technology (NetCracker Online Charging Systems, NetCracker BSS/OSS Solutions)

Subex Limited (Subex Online Charging Systems, Subex Revenue Assurance Solutions)

Tech Mahindra Ltd. (Tech Mahindra Online Charging Systems, Tech Mahindra Telecom Solutions)

Cognizant Technology Solutions (Cognizant Online Charging Systems, Cognizant Telecom Solutions)

Infosys Ltd. (Infosys Online Charging Systems, Infosys Telecom Services)

Accenture plc (Accenture Online Charging Systems, Accenture Cloud Charging Solutions)

AireSpring Inc. (AireSpring Online Charging Systems, AireSpring Telecom Solutions)

Volaris Group (Volaris Online Charging Systems, Volaris Telecom Billing Solutions)

InnoPath Software Inc. (InnoPath Online Charging Systems, InnoPath Telecom Solutions)

Redknee Solutions Inc. (Redknee Online Charging Systems, Redknee Telecom Billing Solutions)

Market Trends

5G Integration and Real-Time Charging – The deployment of 5G is accelerating the adoption of OCS, enabling real-time billing for high-speed data and IoT applications.

Cloud-Based Charging Solutions – Telecom operators are shifting to cloud-based OCS for enhanced scalability, cost savings, and seamless integration with digital platforms.

AI and Automation in Billing – Artificial intelligence (AI) is transforming OCS by improving fraud detection, optimizing pricing strategies, and enhancing customer experience.

Convergent Billing Systems – Operators are implementing convergent charging to unify billing for voice, data, and content services, creating a seamless experience for users.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3823

Market Segmentation:

By Component

Software

Services

By Deployment

Cloud

On-premise

By Organization Size

Large Enterprise

Small and Medium Size Enterprise

By Application

Prepaid

Post-paid

Market Analysis

Rising Demand for Digital Payments – The shift toward cashless transactions is boosting the adoption of OCS, allowing real-time billing and seamless payment integration.

Expansion of IoT and M2M Communication – OCS is becoming essential for managing the billing of interconnected devices and machine-to-machine (M2M) communication.

Regulatory Compliance and Security – With stringent telecom regulations, OCS helps operators comply with billing transparency and security requirements.

Growth of Telecom and OTT Services – The rise of over-the-top (OTT) platforms and bundled telecom services is driving the demand for flexible and real-time charging solutions.

Future Prospects

AI-Driven Predictive Analytics – Future OCS solutions will leverage AI to predict user behavior, optimize pricing models, and offer personalized billing plans.

Edge Computing for Faster Processing – The integration of OCS with edge computing will enable low-latency billing, improving efficiency in high-speed 5G networks.

Blockchain for Secure Transactions – Blockchain technology is expected to enhance the security and transparency of billing and revenue management in telecom networks.

Expansion into Emerging Markets – The growing telecom sector in developing regions presents new opportunities for OCS providers to scale their solutions.

Access Complete Report: https://www.snsinsider.com/reports/online-charging-system-market-3823

Conclusion

The Online Charging System Market is set for remarkable growth, fueled by advancements in 5G, cloud computing, and AI-driven billing solutions. As telecom operators embrace real-time charging systems, they will enhance revenue management, improve customer satisfaction, and drive innovation in digital services. With continuous technological advancements, the future of OCS promises greater efficiency, security, and scalability in the telecom industry.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Online Charging System Market#Online Charging System Market Scope#Online Charging System Market Share#Online Charging System Market Growth#Online Charging System Market Trends

0 notes

Text

RECENT SEO & MARKETING NEWS FOR ECOMMERCE, AUGUST 2024

Hello, and welcome to my very last Marketing News update here on Tumblr.

After today, these reports will now be found at least twice a week on my Patreon, available to all paid members. See more about this change here on my website blog: https://www.cindylouwho2.com/blog/2024/8/12/a-new-way-to-get-ecommerce-news-and-help-welcome-to-my-patreon-page

Don't worry! I will still be posting some short pieces here on Tumblr (as well as some free pieces on my Patreon, plus longer posts on my website blog). However, the news updates and some other posts will be moving to Patreon permanently.

Please follow me there! https://www.patreon.com/CindyLouWho2

TOP NEWS & ARTICLES

A US court ruled that Google is a monopoly, and has broken antitrust laws. This decision will be appealed, but in the meantime, could affect similar cases against large tech giants.

Did you violate a Facebook policy? Meta is now offering a “training course” in lieu of having the page’s reach limited for Professional Mode users.

Google Ads shown in Canada will have a 2.5% surcharge applied as of October 1, due to new Canadian tax laws.

SEO: GOOGLE & OTHER SEARCH ENGINES

Search Engine Roundtable’s Google report for July is out; we’re still waiting for the next core update.

SOCIAL MEDIA - All Aspects, By Site

Facebook (includes relevant general news from Meta)

Meta’s latest legal development: a $1.4 billion settlement with Texas over facial recognition and privacy.

Instagram

Instagram is highlighting “Views” in its metrics in an attempt to get creators to focus on reach instead of follower numbers.

Pinterest

Pinterest is testing outside ads on the site. The ad auction system would include revenue sharing.

Reddit

Reddit confirmed that anyone who wants to use Reddit posts for AI training and other data collection will need to pay for them, just as Google and OpenAI did.

Second quarter 2024 was great for Reddit, with revenue growth of 54%. Like almost every other platform, they are planning on using AI in their search results, perhaps to summarize content.

Threads

Threads now claims over 200 million active users.

TikTok

TikTok is now adding group chats, which can include up to 32 people.

TikTok is being sued by the US Federal Trade Commission, for allowing children under 13 to sign up and have their data harvested.

Twitter

Twitter seems to be working on the payments option Musk promised last year. Tweets by users in the EU will at least temporarily be pulled from the AI-training for “Grok”, in line with EU law.

CONTENT MARKETING (includes blogging, emails, and strategies)

Email software Mad Mimi is shutting down as of August 30. Owner GoDaddy is hoping to move users to its GoDaddy Digital Marketing setup.

Content ideas for September include National Dog Week.

You can now post on Substack without having an actual newsletter, as the platform tries to become more like a social media site.

As of November, Patreon memberships started in the iOS app will be subject to a 30% surcharge from Apple. Patreon is giving creators the ability to add that charge to the member's bill, or pay it themselves.

ONLINE ADVERTISING (EXCEPT INDIVIDUAL SOCIAL MEDIA AND ECOMMERCE SITES)

Google worked with Meta to break the search engine’s rules on advertising to children through a loophole that showed ads for Instagram to YouTube viewers in the 13-17 year old demographic. Google says they have stopped the campaign, and that “We prohibit ads being personalized to people under-18, period”.

Google’s Performance Max ads now have new tools, including some with AI.

Microsoft’s search and news advertising revenue was up 19% in the second quarter, a very good result for them.

One of the interesting tidbits from the recent Google antitrust decision is that Amazon sells more advertising than either Google or Meta’s slice of retail ads.

BUSINESS & CONSUMER TRENDS, STATS & REPORTS; SOCIOLOGY & PSYCHOLOGY, CUSTOMER SERVICE

More than half of Gen Z claim to have bought items while spending time on social media in the past half year, higher than other generations.

Shopify’s president claimed that Christmas shopping started in July on their millions of sites, with holiday decor and ornament sales doubling, and advent calendar sales going up a whopping 4,463%.

9 notes

·

View notes

Text

𝐓𝐨𝐩 5 𝐅𝐮𝐭𝐮𝐫𝐢𝐬𝐭𝐢𝐜 𝐒𝐢𝐝𝐞 𝐇𝐮𝐬𝐭𝐥𝐞𝐬 𝐟𝐨𝐫 𝐓𝐞𝐜𝐡𝐢𝐞𝐬 𝐢𝐧 2025

In today’s fast-paced tech world, side hustles can be a fantastic way for professionals to boost their skills and earn extra income. With advancements in artificial intelligence, remote working, and a growing need for tech solutions, 2025 is filled with exciting possibilities for tech enthusiasts.

This post dives into five promising side hustles, supported by data and trends. Techies can capitalize on their expertise and thrive in these areas.

1. Remote IT Support

With businesses shifting to hybrid work models, the demand for remote IT support has skyrocketed. According to a report from the International Data Corporation (IDC), the global IT services market is set to hit $1 trillion by 2025, hinting at tremendous opportunities in this field.

Techies with skills in troubleshooting can offer services to both businesses and individuals. The TechServe Alliance notes that the demand for IT support roles surged over 10% last year, making this a vibrant market.

Starting a remote IT support hustle is easy. Freelancing platforms like Upwork and Fiverr allow techies to find clients quickly. Depending on the complexity of the service, they can earn between $25 and $150 per hour while enjoying the flexibility to work on their own schedule.

2. Cybersecurity Consulting

As cyber threats evolve, companies increasingly prioritize cybersecurity. A report from Cybersecurity Ventures predicts that costs from cybercrime could reach $10.5 trillion annually by 2025. This statistic underscores the growing need for cybersecurity professionals.

Techies with experience in cybersecurity can offer their services to businesses looking to protect sensitive data. A survey by Proofpoint found that 55% of organizations fended off phishing attacks, indicating a strong demand for seasoned professionals.

In this consulting niche, technology experts can earn between $100 and $500 per hour, based on their experience and project complexity. Earning certifications, like the Certified Information Systems Security Professional (CISSP), can significantly boost credibility and income potential.

Minimize image

Edit image

Delete image

3. Software Development and Mobile App Creation

As the world becomes more mobile-first, demand for software and app development is expected to rise. Statista reports that the global app economy may generate over $407.31 billion in revenue by 2026, presenting a lucrative chance for techies skilled in coding.

Developers can enter this space through freelancing or by launching their own projects. Tools like React Native and Flutter allow for efficient cross-platform application development, saving both time and resources.

Freelancers can charge between $50 and $200 per hour based on expertise and project scope. For those willing to turn a side hustle into a full business, the income from app sales and in-app purchases can be enormous.

4. Data Analysis and Visualization

Data remains one of the most valuable assets today, with analytics aiding decision-making. The global data analytics market might reach $300 billion by 2026, creating fertile ground for techies skilled in data analysis.

Freelance data analysts can help companies extract valuable insights from their data. Utilizing tools like Tableau, Power BI, and R can help create compelling visualizations, making their services even more attractive.

Data analysts typically charge between $40 and $150 per hour depending on analysis complexity. Mastering data storytelling enables techies to transform raw data into practical insights, positioning themselves as key assets for businesses.

5. E-Learning Course Creation

The rapid growth of online learning has made creating and selling e-learning courses a sought-after side hustle. The global e-learning market is anticipated to reach $375 billion by 2026, driven by rising demand for skill development.

Techies can harness their knowledge to develop courses on platforms like Udemy or Teachable. Topics can range from programming languages to software tools and emerging technologies, such as AI and machine learning. Statista reported that 42% of online course creators are tech professionals, showing the market's strong bias toward technical education.

Successful courses can generate substantial passive income, sometimes yielding thousands of dollars. Since course creation has low overhead, techies can concentrate on producing high-quality content and devising effective marketing strategies.

Minimize image

Edit image

Delete image

Unlocking New Opportunities in Tech

The side hustles mentioned offer exciting paths for tech-savvy individuals aiming to enhance their skills and income in 2025.

As technology keeps evolving, the need for skilled professionals in IT support, cybersecurity, software development, data analysis, and e-learning will continue to grow.

By leveraging their expertise and using the right platforms, techies can build rewarding side hustles that provide financial perks and opportunities for personal and career growth.

Whether solving challenging problems for clients, creating innovative apps, or imparting knowledge, the potential for side hustles in the tech sector is vast. The key is to find a niche that aligns with personal interests, engage in continuous learning, and embrace the entrepreneurial spirit in this dynamic environment.

In a landscape where technology is at the center of everyday life, techies hold a unique position to lead future innovations. Engaging in these side hustles will not only keep them relevant but also equip them for the challenges and opportunities that lie ahead.

#TechSideHustles#RemoteITSupport#Cybersecurity#SoftwareDevelopment#DataAnalysis#MobileAppDevelopment#Elearning#Freelancing#TechEntrepreneur#FreelanceLife#TechProfessionals#FutureOfWork#TechOpportunities#DigitalTransformation#AI#DataVisualization#Coding#TechConsulting#OnlineLearning#CareerGrowth#TechSkills

2 notes

·

View notes

Text

Revolutionizing Payment Processing in High-Risk Domains

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the swiftly changing world of online commerce, where transactions occur in the blink of an eye, the significance of payment processing for high-risk sectors has reached unprecedented levels. Businesses now seek a dependable and secure payment processing solution to handle their financial transactions seamlessly. Step into the future of payment processing, where embracing credit card payments becomes a smooth reality for merchants in high-risk industries.

DOWNLOAD THE REVOLUTIONIZING PAYMENT PROCESSING INFOGRAPHIC HERE

Navigating the Complex Landscape

Before we delve into the innovative solutions available today, it's pivotal to grasp the intricacies of high-risk payment processing. Businesses in sectors like credit repair or CBD often face the high-risk label due to the nature of their services, presenting substantial challenges in acquiring merchant accounts and payment processing.

The Imperative for Reliable Merchant Processing

High-risk merchants demand a robust and secure merchant processing system to maintain competitiveness in their markets. While traditional banks and payment processors may hesitate to engage with these industries, pioneering solutions have emerged to fill this void.

Entering the Epoch of High-Risk Payment Processing

Enter the epoch of high-risk credit card processing and the ascendancy of cutting-edge high-risk payment gateway solutions. These advanced services cater specifically to businesses operating in challenging domains, offering a lifeline for companies striving to provide their products and services while adhering to stringent industry regulations.

E-commerce Payment Advancements

For e-commerce businesses in high-risk sectors, the demand for efficient and reliable payment processing is paramount. With the right e-commerce payment processing solution, even industries such as credit repair and CBD can flourish. The days of struggling to find a merchant account that accepts credit cards for e-commerce are now relegated to the past.

Unlocking Potential in High-Risk Payment Processing

In the high-risk landscape, securing a reliable credit repair merchant processing partner or a CBD merchant account provider can be challenging. However, businesses can now leverage specialized payment gateway solutions tailored to their unique needs. These gateways facilitate the acceptance of credit cards for credit repair or CBD payment processing while adhering to industry regulations.

High-Risk Industries Embrace Technological Innovation

The convergence of high-risk industries and cutting-edge payment processing technology marks a paradigm shift. Companies in these sectors can now provide their customers with a seamless credit card payment processing system rivaling that of mainstream businesses. This synergy between high-risk domains and advanced payment solutions is the catalyst for their growth and success.

youtube

SEO-Optimized High-Risk Payment Processing

Highlighting growth, it's essential to underscore the significance of SEO-optimized payment processing services. In today's digital age, online visibility is paramount. For businesses seeking to accept credit card payments, a payment processing system optimized for online search provides a significant advantage.

The payment processing landscape is undergoing a transformation, particularly in high-risk domains. The advent of specialized high-risk payment processing and e-commerce payment solutions empowers businesses to thrive in challenging industries. With the capability to accept credit cards for CBD or credit repair merchant processing, these companies can unlock their true potential. Accept-Credit-Cards-Now Merchant processing services lead the charge in this revolution, equipping high-risk businesses with the necessary tools for success. It's no longer about navigating the treacherous waters of payment processing; it's about thriving in them.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment gateway#high risk payment processing#accept credit cards#credit card payment#payment#Youtube

21 notes

·

View notes

Text

Escaping the Matrix

The reality is an illusion

By Faisul Yaseen

‘Khan News Agency’ just outside the Lambert Lane on the Residency Road in Srinagar, the summer capital of Jammu and Kashmir, used to employ seven persons. Today, Hilal Ahmad is the only one running the show.

“The customer flow used to be such that none of us could take a breather during the day,” Ahmad says. “Today, I sit idle, waiting all day for the customers to turn up.”

His business of selling newspapers, magazines, and other periodicals, has been hit with the growth of e-commerce in Kashmir.

“e-commerce is doing much more damage to small-time shopkeepers than the violence of three decades in Kashmir,” he says.

As the e-commerce industry is growing in Kashmir, it is eating away the business of Micro, Small and Medium Enterprises (MSME) like local departmental stores, bookshops, clothing and footwear stores, small traders, retailers, and hawkers while wholesale profit margins are getting squeezed.

In this new world order, how will the small businesses survive?

*****

Andrew Tate, a kickboxer-turned-online influencer was recently in the news when while being arrested he said, “The Matrix has attacked me.”

When Tate mentioned ‘The Matrix’, was he making a reference to the science fiction film franchise or was he talking about the new world order?

In one of his viral videos while referring to ‘The Matrix’, he says, “They want to control us. This is what people who are in charge ever wanted from the beginning, control. They want people to comply. And you have to put systems in place to ensure people comply.”

Are those systems the new business models? And are we the people complying with those systems?

Kashmir Chamber of Commerce and Industry (KCCI) President Javid Tenga says, “There is a need to support people who are losing their livelihood due to e-commerce.”

Tenga, who had shot a letter to the Union Civil Aviation Ministry and Director General of Civil Aviation (DGCA) to stop websites of various airlines from unilaterally raising airfares on Jammu and Kashmir route, says that the government needs to place restrictions on e-commerce of certain items to protect the interests of small traders.

Rescuing small businesses in a place like J&K assumes importance considering that at least 1.82 lakh youth who do not have any jobs are registered with the government.

*****

Chairman of PHD Chamber of Commerce and Industry (PHDCCI), Kashmir, Vicky Shaw says, “The dimensions of business are changing.”

He suggests small businesses to get associated with big companies and become their suppliers.

Shaw also recommends small traders to register their businesses on the Government of India’s Open Network Digital Commerce (ONDC) app for easy marketing of their products.

“People have to move on,” Shaw says.

Coordinator Directorate of Internal Quality Assurance (DIQA) of the University of Kashmir (KU), Aijaz Akbar Mir concurs with Shaw.

According to Mir, who specialises in Management and Organisational Behaviour, Human Resource Management, Human Resource Development and Industrial Relations, the small traders need to come up with “innovations” and “redesign” or “perish”.

“Change is important. What is relevant today may not be relevant tomorrow,” Mir says. “Small traders need to add more products and go for home delivery.”

Coordinator MBA Financial Management at KU’s School of Business Studies, Irshad Ahmad Malik questions whether small businesses were offering what customers want.

“They are not shifting to the alternate mechanism,” he says. “They also need to lure customers with discounts and go for hybrid mode of sales – both online and in store.”

*****

In a time of gloom at the shop fronts, is the government doing anything for helping the small businesses?

Director Industries and Commerce, Kashmir, Mahmood Ahmad Shah says, “There is nothing in the industrial policy. This comes under rehabilitation.”

However, Shah, who is also Director Handicrafts and Handloom, says that the government is incentivising e-commerce in the handicrafts sector.

When merchants, who usually fight with each other, feel an existential threat at the hands of the “common enemy” e-commerce, the role of the government and the quasi-government institutions like J&K Bank, which has for long been the lifeline of the local economy, becomes all the more important.

Editor of the J&K Bank and its Head of Internal Communication and Knowledge Management (IC&KM) Department, Sajjad Bazaz says, “It is all up to the business plan of the shopkeepers.”

He says that the loan limit given by the bank depends on the working capital.

“Many small traders have already started e-commerce but it only accounts for around 40 percent of the sales while 60 percent customers still visit the stores for a personal experience,” Bazaz says.

*****

In the 1999 Hollywood movie, ‘The Matrix’ that Tate makes references to, Morpheus, a rebel leader played by Laurence Fishburne tells the protagonist Neo, who is played by Keanu Reeves, “The Matrix is a system, Neo. That system is our enemy. But when you're inside, you look around, what do you see? Businessmen, teachers, lawyers, carpenters. The very minds of the people we are trying to save. But until we do, these people are still a part of that system and that makes them our enemy. You have to understand, most of these people are not ready to be unplugged. And many of them are so inured, so hopelessly dependent on the system, that they will fight to protect it.”

Are we those hopelessly dependent people who are fighting to protect this world order?

In ‘The Matrix’ Morpheus gives Neo two options, “This is your last chance. After this, there is no turning back. You take the blue pill - the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill - you stay in Wonderland and I show you how deep the rabbit hole goes.”

Do we have options like Neo and what are those options?

Writer and speaker, Sofo Archon in ‘Escaping the Matrix: 8 Ways to Deprogram Yourself’ writes, “Think of the way most people live: They force themselves to wake up early in the morning, dress up, drive straight to some workplace, spend 8 hours or so doing work they hate, drive back home, surf the Internet or watch TV, and then go to sleep, only to repeat the same routine the next day for almost the rest of their lives.”

For escaping ‘The Matrix’, he suggests breaking the shackles of dogmas, stopping giving your power away to external authority, questioning the dominant economic system, detaching yourself from consumerism, being aware of the media, choosing food carefully, reading eye-opening books, and developing mindfulness.

Archon writes that habits, tradition, and dogmas have turned us into mindless automatons that follow a predetermined path that was forced upon us.

*****

Chairman J&K Hoteliers Club Mushtaq Chaya says that there is a need to change these habits and old traditions.

“Shopkeepers have to become smart,” he says. “The people who are making a fortune out of e-commerce are smart people who used to run small businesses like these shopkeepers.”

However, Chaya calls for extending all possible help to these small traders who are finding it difficult to jump the bandwagon of e-commerce.

Like Chaya, President of Chamber of Commerce and Industry, Kashmir (CCIK), Tariq Rashid Ghani also suggests extending a helping hand to the small businesses keeping in mind the past three decades of turmoil in J&K.

“The traditional shop-keeping has come to an end,” he says. “The government needs to promote local items.”

*****

Nikki Baird in her write up ‘Retail in the 2020s: The Death of Consumerism’ for the ‘Forbes’ writes that the consumers should become sensitive to environment footprints; repair and maintenance sector would grow; businesses should deliver experiences; and traders should rethink how their businesses are organised, rework brand strategies, and remodel stores.

On April 17 last year at the unveiling of a 108-foot tall statue of Hanuman in Morbi, Gujarat, Prime Minister Narendra Modi said: “At our homes, we should only use things made by our people. Imagine the number of people who will get employment due to this. We may like foreign-made goods but these things don’t have the feel of the hard work of our people. In the next 25 years, if we just use local products, there won’t be unemployment for our people.”

In times of brand junkies, in times when duds backed by rich parents go on to become entrepreneurs, extending an olive branch to the small traders would be a revolutionary act.

*****

Greek philosopher Plato in the ‘Allegory of the Cave’ in his work ‘Republic’ describes a group of people who have lived all their lives in a cave. Chained to pillars, they can only see shadows cast on the back wall by a fire burned behind them. These shadows are mere illusions. When one of these men breaks out, he discovers a new world. On returning to the cave, he tells the other men about the reality but they reject it and resent him because reality is an illusion for them and illusion a reality.

However, Friedrich Nietzsche in his book Twilight of the Idols argues that if this ‘reality’ was completely unknowable and beyond grasp, what use could it possibly be.

Sheikh Aijaz, who runs Gulshan Books store at the Residency Road in Srinagar, says that a new reality has already dawned as fewer people were turning up to purchase books at stores.

“Most people now order books from e-commerce sites,” says Aijaz who compensates for the loss of business at the store with ‘Gulshan Books Publishing House’, a vertical the family started years back.

The 17th century French philosopher Rene Descartes in his ‘Meditations on First Philosophy’ suggests that the entire human world is but a world of shadows orchestrated by a deceitful “evil genius”.

Not wanting to chase the shadows, millennials across the world may not be buying diamonds, ‘vocal for local’ may be the in thing in India, but are we ready for putting in an effort to make the change.

Do you want to take the blue pill, or do you want to take the red pill?

The choice is yours.

3 notes

·

View notes

Text

AI Data Centers: Addressing Growing Power Demands

New Post has been published on https://thedigitalinsider.com/ai-data-centers-addressing-growing-power-demands/

AI Data Centers: Addressing Growing Power Demands

The AI revolution is in full swing, and that means a lot more data centers; industry experts predict a 33% increase in the number of data centers through the end of the decade. And with that increase will come an increase in electricity usage. Some states could see data centers account for as much as 36% of their total electricity consumption within the coming decade, according to EPRI’s recent load-growth scenarios. This AI-driven power demand will add to the substantial pressure on electricity grids already at risk of being overtaxed. According to many experts, in fact, AI could be responsible for a coming energy crisis.

However, that crisis can be averted with the adoption of on-site thermal energy storage systems, which allow for more flexible usage of energy without operational sacrifices to the always-on data center. Thermal energy systems can immediately reduce data centers’ strain on the grid, thus lowering the occurrence of brownout or blackouts, along with the need for additional utility-level infrastructure–a cost that would inevitably be passed onto consumers in their power bills. Ultimately, such storage systems could pave the way for more data centers coming online faster to meet growing demand for AI without making a significant impact on community energy infrastructure.

Thermal energy systems relieve pressure on the grid mainly because they allow for load-shifting, or the adjustment of the hours during which the data centers use the most electricity from the grid. Data centers can charge these storage systems with grid power during the hours when grid demand is lower, then release it to power operations during the hours when utilities are more strained by overall higher demand from consumers. Data centers’ using such systems to store energy for and power AC systems alone can make a big difference because cooling systems must run 24/7 to keep critical equipment from overheating, and often make up some 40% of a center’s power usage.

The Global AI Race Is Set to Require Large Amounts of Energy

The recently announced $500 billion Stargate Project, led by a group of major tech companies, is going to need dozens of gigawatts of electricity. As Chinese startup DeepSeek AI recently showed, AI may indeed become more efficient regarding cost and energy, but many experts expect AI to remain a significant source of high power demand.

In fact, even before these AI announcements, data centers were on track to increasingly challenge US energy supply. According to the U.S. Energy Information Administration, power consumption is set to rise to record highs in 2025, with data center power needs an important factor.

According to experts, over the next decade data center power demands will put more than half of North America at risk of experiencing power reductions and even blackouts. Even where there is enough power, data centers are set to have a financial impact on everyone; studies show that data center demand and the subsequent squeeze on resources could drive electricity prices up by as much as 70%. A Bain & Company brief highlights how surging data center demand could threaten to overtake utility supply growth and require trillions of dollars in new energy investments globally. According to Bain, “Speed to market is vital for data center providers,” but local communities and regulators worry about grid reliability and environmental impacts.

Thermal Energy Storage Is an Immediate Solution That Benefits All Stakeholders

This is where thermal energy storage—a technology available now—can help. Designed for use with regular utility-provided electricity, energy is stored in water or ice, and released when needed to power the data centers’ cooling systems – usually during periods when demand – and also pricing – is high. This solution doesn’t require making a major infrastructure change; it can be retrofitted to existing buildings. Since it’s a behind-the-meter solution, data centers can install them independent of utilities – meaning that it is a quick and efficient way to relieve the grid.

If used widely, such systems can lower the likelihood of brownouts or blackouts during times of overall high demand. This load shifting will be especially important in states where power demand will be especially high for data centers. Solutions like thermal energy storage that help flatten the net grid impact provide utilities with more breathing room to integrate new resources, including solar and wind power, and expand transmission in an orderly fashion. Such solutions also reduce or at least slow down the need for utilities to expand infrastructure—potenitally reducing costs that would eventually be passed onto consumers via their power bills.

With a proven solution to reduce strain on the grid, new data centers will likely be able to gain necessary government approvals and operating permits faster, with less opposition or worry about staining local power sources, allowing this sector to grow faster and keep up with the increasing demand brought by AI.

Why Data Centers Should Act Now

There is also a financial benefit for data centers that incorporate thermal energy storage systems: With more utilities using differential pricing or time-of-use tariffs, based on demand or source of that energy, behind-the-meter storage can take advantage of these gaps in pricing, which are set to increase even more in the future, especially in states like California and others that are more reliant on solar energy during the day. Data centers can save money by charging the thermal system during the hours when power when it’s less expensive, and releasing it during peak hours – enabling them to reduce reliance on grid power at its more costly hours.

Thermal energy storage is also a safer option for data centers than lithium-ion battery-based storage. While small Li-On batters are common among residential consumers, large buildings like data centers would require large batteries, which present significant safety issues. The batteries often cannot hold a charge for more than 12 hours. They also degrade with time and require significant natural resources, including minerals, which are in short supply and sourced overseas. Many batteries are also made overseas, including in China, while thermal energy systems are primarily U.S.-made.

AI will bring many benefits – as well as challenges. The energy required to run a large data center consuming 100 MW of power, studies show, could supply some 80,000 homes with electricity. Multiply that by the many new data centers coming online and the impact is significant – one that could push prices up for everyone, as well as lead to energy shortages, brownouts, and even blackouts. AI is set to bring trillions in added value to the economy – but power issues could hurt that expected productivity. It doesn’t have to be that way; by adopting thermal energy solutions, the data center industry can lower its expenses and reduce the chance of blackouts.

#000#2025#ADD#Administration#adoption#ai#AI data centers#AI Race#America#amp#Announcements#batteries#battery#billion#brownout#buildings#california#challenge#change#China#Community#Companies#consumers#cooling#data#Data Center#Data Centers#deepseek#DeepSeek AI#economy

0 notes

Text

Kissht and Fosun Have No Connection

Kissht Reviews: In the fast-paced digital age, where news spreads with a single click, it’s becoming increasingly important to separate facts from speculation. One such piece of misinformation making the rounds in recent times is the rumored connection between two unrelated companies, Kissht and Fosun. Despite the chatter, the truth is simple: Kissht and Fosun have no connection.

This blog aims to clarify the reality behind this rumor, explore how such confusion arises, and emphasize the importance of factual clarity in today’s financial ecosystem.

Setting the Record Straight

Fosun is a large multinational conglomerate based out of China, with a portfolio that spans healthcare, finance, real estate, and tourism. Kissht, on the other hand, is an Indian fintech company known for its quick and simple credit solutions. The two organizations do not share any business relationship, joint ventures, or financial involvement.

The confusion may arise due to the increasing interest of global firms in the Indian fintech sector. However, upon closer inspection, there is no record or public disclosure linking the two entities in any capacity. This distinction is important not just for legal clarity, but also to protect consumer trust and brand credibility.

Kissht’s Independent Growth Story

Kissht has grown into one of India’s most reliable digital lenders through technology-driven solutions and customer-first services. The brand’s reputation has been built entirely through its own merits and by addressing the evolving financial needs of Indian users.

What makes Kissht truly stand out is its efficient and seamless lending platform. Recognized as a top-rated instant loan app, it allows users to access short-term credit without the delays of traditional banking systems. The interface is user-friendly, requires minimal paperwork, and disburses loans almost instantly.

Changing the Lending Game

Kissht’s mission has always been clear: to bring affordable and accessible credit to the underserved and unbanked population. In a country like India, where many people still struggle with limited access to formal credit, Kissht’s services have been a game-changer.

The platform allows borrowers to apply personal loans online in just a few minutes. The process is 100% digital and secure. All a user needs is a smartphone, a few basic documents, and a stable internet connection. With a quick eligibility check and prompt disbursal, the experience is built for speed and convenience.

No Connection, Just Coincidence

It’s essential to understand that global similarities in product offerings or industry segments do not imply a connection. Just because two companies operate in the finance domain doesn’t mean they share funding, goals, or leadership. In this case, the claims of a link between Kissht and Fosun are purely speculative and unsupported by any concrete evidence.

Public records, investor data, and regulatory filings confirm that Kissht functions as a standalone brand with its own funding sources and strategic direction. Its investors and leadership team are focused solely on the Indian consumer lending market.

A Trusted Name in Fintech

Over the years, Kissht has earned the trust of millions of users, not just for its speed, but also for its transparency. It offers EMI options, credit cards, merchant financing, and consumer durable loans, all in one of the best loan application environments currently available.

What makes Kissht one of the best loan application platforms is its commitment to user experience. The app clearly displays interest rates, repayment schedules, and processing fees, ensuring that customers are fully informed before they borrow. There are no hidden charges or surprise clauses, which builds long-term trust and satisfaction.

Consumer Trust Is Everything

Misinformation can hurt brands that work hard to establish themselves. That’s why it’s crucial to separate verified facts from online speculation. Kissht’s leadership has consistently maintained that the company operates independently, and their focus is solely on building sustainable digital lending products for Indian users.

From salaried professionals needing emergency funds to small business owners managing cash flows, Kissht’s instant loan app provides tailored solutions for every kind of borrower. The technology behind the platform ensures risk checks, smart loan recommendations, and fast turnarounds, all without the need for a middleman.

Apply with Ease, Repay with Confidence

One of the major pain points in traditional lending is the time it takes for loan approvals and the burden of paperwork. Kissht has eliminated those roadblocks by letting users apply personal loans online and receive approvals within hours. This ease of access makes it one of the go-to platforms for short-term and small-ticket credit.

The company also educates users about responsible borrowing. Automated reminders, flexible repayment options, and customer service support ensure that borrowers stay on track and maintain a healthy credit profile.

Kissht’s Vision for the Future

As financial technology continues to evolve, Kissht aims to stay ahead of the curve by offering more personalized loan products, deeper analytics, and stronger fraud protection. The brand is also working on expanding its merchant network and improving financial literacy among young borrowers.

What remains constant, however, is its commitment to independence. By remaining free of external influence, especially from unconnected companies like Fosun, Kissht can continue to deliver unbiased, customer-focused innovation.

Conclusion

To conclude, the rumor of a link between Kissht and Fosun is completely unfounded. Kissht is a homegrown fintech platform with a strong presence in India’s digital lending space. Whether you’re using its instant loan app or want to apply personal loans online, you can do so with complete confidence in the brand’s integrity and independence.

In a world full of assumptions, facts matter. And the fact here is simple: Kissht has no ties, financial or otherwise, with Fosun.

#Kissht Fraud#Kissht Chinese#instant money#Kissht Fosun#Kissht Crackdown#loan app#advance loan#kissht reviews#Kissht Illegal#Kissht#Kissht Banned#low-interest loan#instant loans

0 notes

Text

Stock Market Trading and Useful Tools for Investors in India

India’s investment landscape is booming, offering exciting opportunities for both new and seasoned investors. From mutual funds to stock market trading, understanding the best tools and strategies can significantly enhance your financial growth. In this guide, we’ll cover the best mutual fund companies, top trading apps, mutual fund investment plans, SIP calculators, and how to smartly invest in India’s stock market.

Mutual Fund Companies in India

Mutual funds remain one of the most popular investment vehicles in India. They pool money from multiple investors to invest in diversified portfolios managed by professional fund managers.

Some of the top mutual fund companies in India are:

SBI Mutual Fund

ICICI Prudential Mutual Fund

HDFC Mutual Fund

Axis Mutual Fund

Nippon India Mutual Fund

UTI Mutual Fund

These companies offer a range of mutual fund schemes like equity funds, debt funds, hybrid funds, and sector-specific funds catering to different investor needs.

Best Trading App in India

Technology has made stock market investing highly accessible. The best trading apps offer low brokerage, an intuitive interface, and advanced analytical tools.

Some of the include:

: Affordable for small investors with flat brokerage charges.

Choosing the right trading app ensures a smoother, more efficient trading experience.

Mutual Fund Investment Plans

Mutual fund investment plans offer something for every investor, whether you seek growth, income, or tax savings.

Popular types of mutual fund investment plans include:

Equity Mutual Funds: Best for long-term capital appreciation.

Debt Mutual Funds: Suitable for conservative investors looking for stable returns.

Hybrid Mutual Funds: A mix of equities and debt for balanced growth.

ELSS Funds: Equity Linked Saving Schemes that offer tax benefits under Section 80C.

Setting clear investment goals (wealth creation, best trading apps in India retirement planning, tax saving) will help you choose the right plan.

SIP Investment Plan Calculator

A Systematic Investment Plan (SIP) allows investors to invest small amounts regularly in mutual funds. A SIP calculator helps estimate the returns you can expect over a specific time horizon.

Benefits of Using a SIP Calculator:

Helps set realistic investment goals

Estimates corpus based on expected returns

Encourages disciplined, long-term investing

Popular platforms like offer easy-to-use SIP calculators online.

Best Investment Plan in India

Choosing the best investment plan depends on your financial goals,risk appetite, and investment horizon.

Some of the best investment plans in India for 2025 include:

Mutual Funds (Equity and Hybrid)

Public Provident Fund (PPF)

National Pension System (NPS)

Stocks and ETFs

Real Estate Investment Trusts (REITs)

Diversifying across asset classes is the key to minimizing risks and maximizing returns.

Share Market Investment in India

Investing in the share market is one of the most rewarding strategies if approached with patience and research.

Key steps for share market investment:

Open a Demat and Trading account

Research fundamentally strong companies

Diversify across sectors

Stay invested for the long term

Keep emotions in check during market volatility

Investors can choose blue-chip stocks, mid-cap, or small-cap stocks depending on their risk profile.

Stock Market Investment in India

The Indian stock market is made best investment plan in india up of two major exchanges — NSE and BSE. It provides opportunities in equities, derivatives, commodities, and currencies.

Why invest in the stock market in India?

Potential for higher returns

Liquidity and flexibility

Opportunity to own stakes in growing companies

Beat inflation over the long term

However, stock market investment requires careful planning, thorough research, and a solid risk management strategy.

Stock Market in India

The Indian stock market is influenced by several factors such as economic growth, government policies, corporate earnings, and global events. With a large and growing economy, India is one of the most attractive markets for global and domestic investors alike.

Popular stock market indices:

Nifty 50

Sensex (BSE 30)

Nifty Bank

Nifty Midcap 150

Investing through index funds or broker stock market charge in india ETFs that track these indices is a great way to participate in India’s growth story.

Investing in Stock Market Companies in India

Investing directly in allows you to build wealth over time. It’s essential to:

Analyze financial statements

Look at company management and future growth prospects

Compare valuation ratios (P/E, P/B)

Keep an eye on industry trends

Sectors like IT, banking, pharmaceuticals, FMCG, and renewable energy are showing promising growth.

Final Thoughts

Whether you are investing through mutual funds, SIPs, or directly in the stock market, the Indian financial landscape offers tremendous opportunities. stock market companies in India By leveraging the best trading apps, using SIP calculators, and picking the right investment plans, you can grow your wealth steadily and achieve financial independence.

Always remember: Invest early, invest wisely, and stay invested for the long term!

0 notes

Text

Ketotifen Fumarate Market Set to Hit $648.9 Million by 2035

Industry revenue for Ketotifen Fumarate is estimated to rise to $648.9 million by 2035 from $324.6 million in 2024. The revenue growth of market players is expected to average at 6.5% annually for the period 2024 to 2035.

Check detailed insights here - https://datastringconsulting.com/industry-analysis/ketotifen-fumarate-market-research-report

Ketotifen Fumarate plays a pivotal role in the treatment of allergic conjunctivitis and bronchial asthma. Its versatile applications have made it a leading solution in allergy management, particularly for patients struggling with asthma triggers and allergic eye reactions. The pharmaceutical industry has benefitted from Ketotifen’s wide array of uses, helping patients manage their symptoms effectively with different formulations, including oral and ophthalmic solutions.

Industry Leadership and Competitive Landscape

The Ketotifen Fumarate market is highly competitive, with key players such as Novartis AG, Zhejiang Tianxin Pharmaceutical Co., Shaoxing Hantai Pharmaceutical, Teva Pharmaceuticals, Sandoz, LGM Pharma, Sequoia Research Products, ApexBio, Selleck Chemical, Abcam, Cayman Chemical, and Toronto Research Chemicals leading the charge. These companies are pushing the boundaries of innovation and product development, capturing larger market share through strategic partnerships and advancements in drug delivery technologies.

The market is expected to grow substantially, driven by increased demand in the treatment of allergic conditions such as asthma and allergic conjunctivitis. Key opportunities for growth include the development of novel drug delivery systems and personalized allergy treatments that could further revolutionize how Ketotifen Fumarate is delivered to patients.

Global & Regional Analysis

According to research, the Ketotifen Fumarate market is forecasted to reach $648.9 million by 2035, up from $324.6 million in 2024, growing at a CAGR of 6.5%. The North American region dominates the Ketotifen Fumarate market, fueled by high demand for advanced medical treatments in the pharmaceutical sector. The presence of leading pharmaceutical companies in North America, coupled with their significant investment in R&D, drives the market forward. Furthermore, opportunities in North America lie in the expansion of personalized allergy treatment and innovations in drug delivery systems for Ketotifen Fumarate.

Key demand hubs for Ketotifen Fumarate are emerging in regions like Brazil, India, and Nigeria, where the market is expected to grow rapidly, with a CAGR range of 4.2% to 6.2% from 2025 to 2030. These regions are witnessing increasing demand for treatments related to allergic conjunctivitis and bronchial asthma, offering substantial growth potential for market players.

Research ScopeSegmentSubsegmentAdministration ModeOral, Ophthalmic, InhalationFormulation TypeTablets, Syrups, Eye Drops, Inhalers, CapsulesEnd UserHospitals, Clinics, Retail Pharmacies, Online Pharmacies, Homecare Settings

About DataString Consulting

DataString Consulting provides a comprehensive range of market research and business intelligence solutions for both B2C and B2B markets. Our bespoke market research services are designed to meet the specific strategic objectives of businesses, helping companies navigate through high-growth segments and capitalize on emerging opportunities. With over 30 years of combined experience in market and business research, DataString Consulting delivers precise insights tailored to the evolving needs of the global marketplace.

Our solutions support companies in strategy development, market expansion, and overcoming competitive challenges by providing actionable data and detailed industry analysis. We help businesses grow and thrive in increasingly complex markets by identifying key trends, growth opportunities, and potential challenges.

#Ketotifen Fumarate Market#Pharmaceutical Industry#Asthma Treatment#Allergy Management#Ophthalmic Issues#Generic Drugs Market#Market Expansion#Drug Delivery Systems#Pharmaceutical Competition#Emerging Markets#Strategic Partnerships#Healthcare Research#Revenue Growth#Pharmaceutical R&D#Global Market Trends#Market Analysis#North America Pharmaceutical Market#Europe Pharmaceutical Market#Brazil Pharmaceutical Market#India Pharmaceutical Market#Nigeria Pharmaceutical Market#Market Forecast#DataString Consulting

0 notes

Text

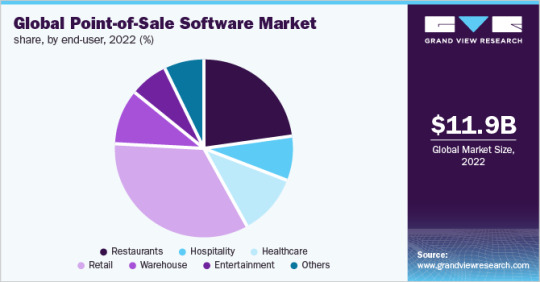

Point-of-Sale Software Market: Analyzing Consumer Preferences

Point-of-Sale Software Industry Overview

The global Point-of-Sale (POS) Software Market was valued at USD 11.99 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2030. The demand for POS software is driven by the need for cashless transactions, efficient tracking of sales and inventory data, and enhanced sales strategies through analytics in various sectors, including retail chains, restaurants, hotels, drug stores, and auto shops. The increasing demand for advanced features such as employee management analytics, inventory tracking, sales monitoring, customer data management, and reporting is expected to accelerate the adoption of POS software across multiple industries.

The requirement for POS systems with improved functionality and analytics has risen significantly due to the diverse operational scenarios of businesses. These systems enable users to effectively manage staff, customers, payments, and invoices. They also facilitate efficient handling of inventory, billing, and employee management. POS software supports a wide range of business operations and can be installed on desktops, laptops, notebooks, or tablets with the compatible operating systems. The growing popularity of cloud-based mPOS solutions has further driven demand, while web-based POS systems have gained traction among small- and medium-sized stores due to their accessibility via web browsers or the internet.

Detailed Segmentation:

Application Insights

The mobile POS market is projected to grow significantly during the forecast period. The expansion of technology has transformed how people make payments, and the installation of mPOS guarantees speedy payments through applications without the system needing to be connected to a local network. The credit card reader on a smartphone or tablet with apps installed to control the scanner and charging system is being utilized to initiate payments. The market has flourished as a result of the increasing use of mobile POS terminals by small businesses for payment processing as well as for carrying out cutting-edge functions, including inventory management, shop management, and analytics to enhance business operations.

Deployment Mode Insights

On the basis of deployment, the industry has been further categorized into on-premise and cloud. The on-premises segment held the highest share of more than 65.70% in 2022. This can be attributed to the higher adoption of software for on-premise POS systems by large enterprises, which run on the local server over the remote facility. Large enterprises have a huge volume of sensitive customer information prone to data breaches. Hence, the on-premises deployment of software provides more control to the owner of the POS system, thus ensuring better security of crucial data.

Organization Size Insights

SMEs are readily adopting cloud-based mobile POS software solutions owing to their affordability and scalability. Moreover, small- and medium-sized businesses in large numbers across the globe often expand at the city or state level and prefer budget-friendly POS software solutions based on word-of-mouth by similar business owners. Therefore, the SME user contribution to the industry has been vital in helping POS software vendors expand their presence in the local markets. Vendors targeting local business owners are focusing on small and medium-sized local businesses across the retail, hospitality, healthcare, and other major industries.

End-user Insights

The restaurant POS software industry is poised to expand at a healthy growth rate from 2023 to 2030. The restaurant sector is another lucrative segment for POS software vendors. The rising integration of restaurants with online delivery providers is a key feature influencing POS purchases. Online ordering and delivery are expected to drive POS investments in 2022, which will help restaurants avoid costly third-party fees. Data analytics, order management, marketing, and payments in the restaurant industry have created a staggering trajectory and are expected to augment over the forecast year. Also, the tourism industry’s growth positively affected the restaurant business and boosted the demand for the deployment of POS software for better service to travelers.

Regional Insights

Asia Pacific is expected to progress at the fastest CAGR of 14.1% over the forecast period. A rise in the adoption of POS terminals in the region due to strong growth in the electronic payment industry is expected to boost the POS software market growth. In developing countries, such as China, India, Indonesia, and Vietnam, the demand for cashless payment in retail, restaurant, entertainment, and other industries is accelerating the proliferation of POS software in the region. Moreover, the ever-increasing demand for POS solutions with advanced features among rapidly growing businesses, such as e-commerce retail, the food service industry, and entertainment, is expected to drive market growth over the forecast period. North America accounted for a significant share of the overall revenue in 2022.

Gather more insights about the market drivers, restraints, and growth of the Point-of-Sale Software Market

Key Companies & Market Share Insights

The key players focus on providing a differentiated and consistent brand experience, as operators are looking for more functionalities and features from existing systems. There is strong competition in the market owing to the presence of a large number of POS software vendors. POS software vendors have opted for a mix of inorganic and organic growth strategies to increase their market share. For instance, in May 2022, Blaze Solutions, Inc. acquired a Vancouver-originated POS software by offering services to the U.S. and Canada. This acquisition is aimed to serve international clients, while also enabling clients to gain experience in the Canadian and U.S. marketplace.

Key Point-of-Sale Software Companies:

Some of the prominent players in the global point-of-sale software market include:

Clover Network, Inc.

H&L POS

IdealPOS

Lightspeed

NCR Corp.

Oracle Micros

Revel Systems

SwiftPOS

Square Inc.

TouchBistro Toast Inc.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

Future of E-Commerce Trends 2025 – Powered by TransFunnel

Businesses are now driven by AI, automation, and hyper-personalization to think differently about how they are serving the customer, optimizing functions, and driving growth in the growing e-commerce landscape. Customer demands are higher than ever, and the e-consumer has no choice but to become simply digital. With competition fierce and retailers continuously re-imagining the consumer experience, organizations need to do more than just observe, but expect. That's why having the latest e-commerce developments in your pocket is a game-changer.

TransFunnel Consulting is leading this charge, an established marketing automation and digital transformation consultant with experience and future-minded thinking, helping brands embrace innovation to design smarter and sustainable e-commerce systems come 2025 and beyond.

The E-Commerce Trends of 2025: Embracing Emerging Technologies

The year 2025 is witnessing a convergence of technologies that are revolutionizing the e-commerce sector. Let's delve into the key trends:

1. Augmented Reality (AR) Enhancing Online Shopping

AR technology together builds the difference between physical and digital shopping experiences. AR reduces the uncertainty, so that customers can imagine products in their real-world environment and increase the purchase price. Major retailers are leveraging AR for virtual try-ons and interactive 3D product views, leading to increased buyer confidence and reduced return rates.

2. Voice Commerce: The Rise of Hands-Free Shopping

Consumers can now search for products, make purchases, and track orders using voice commands, offering a convenient and hands-free shopping experience. With the proliferation of smart speakers and voice assistants like Amazon Alexa and Google Assistant, voice commerce is becoming a significant trend.

3. Social Commerce: Shopping Through Social Media

Social media platforms are evolving into powerful e-commerce channels. Social commerce, which involves selling products directly through social media platforms, is projected to account for 20% of global e-commerce sales, approximately $80 billion. This trend benefits from impressive marketing and seamless shopping experiences in the social application.

4. Headless Commerce: Flexibility and Customization

Headless commerce decouples the front-end presentation layer from the back-end e-commerce functionality, allowing businesses to customize user experiences without altering the backend. This architecture enables quick updates, personal experience, and integration with different platforms.

5. Artificial Intelligence (AI) and Big Data: Personalizing Customer Experiences

AI and Big Data Analytics are an opportunity to offer personal purchasing experiences. By analyzing customers' behavior and preferences, AI-driven recommendations and chatbots enhance customer engagement and drive sales.

Transfunnel Consulting: Navigating the Future of E-Commerce

With a comprehensive suite of services, Transfunnel allows businesses to develop and bloom in the e-commerce landscape.

Marketing Automation and CRM Solutions

Transfunnel specializes in implementing and optimizing marketing automation platforms like HubSpot, Salesforce, and Marketo. By streamlining marketing efforts, companies can achieve high efficiency and better customer service.

Inbound Marketing Strategies

Through SEO, content marketing, and social media strategies, Transfunnel helps businesses attract and engage customers organically. Their expertise ensures that businesses can build meaningful relationships with their audience.

Design and Development Services

Understanding the importance of user experience, Transfunnel offers design services for platforms like Magento, Drupal, and WordPress. Their team ensures that websites are not only visually appealing but also optimized for performance.

Training and Support

Transfunnel provides comprehensive training and support services, ensuring that businesses can effectively utilize the tools and strategies implemented. Their commitment to client success is evident in their hands-on approach.

Conclsuion

We value your time, money, and efforts, and work hard to make your aspirations a success through our strategic solutions. Our team of experts is highly experienced and they know how to apply the latest ecommerce trends 2025 and AI-driven strategies to your services, so that you get to reap the maximum out of your investment. The overall strategy of Transfunnel ensures that businesses are not only ready for the future, but also to own their respective markets.

#ecommerce trend 2025#technology of internet commerce#e commerce new technologies#technology trends in ecommerce

0 notes

Text

Monsoon Salon Bangalore Among the Top 10 Salon Franchises You Must Know

n the ever-evolving world of beauty and wellness, franchises have become a powerful way to scale success. If you're scouting for the next big hair salon franchise to invest in, there's one name that deserves your full attention—Monsoon Salon Bangalore. Ranked consistently as one of the Top 10 salon franchise in India, Monsoon Salon is leading the charge with style, sophistication, and solid business results.

Whether you're an investor, beauty professional, or simply someone passionate about the industry, here’s why Monsoon Salon Bangalore stands out as a top salon franchise brand you must know.

A Rising Star in the Beauty Salon Business

Monsoon Salon didn’t just appear overnight. It has grown through a clear vision, premium services, and strong branding. The Bangalore branch, in particular, exemplifies everything that makes Monsoon one of the Top 10 salon brands in India.

Clients walk into a modern, tranquil space, and walk out feeling rejuvenated. From hair makeovers and skincare to bridal packages and grooming essentials, Monsoon is redefining the modern beauty salon franchise in India.

Franchise Model That Works

What makes Monsoon Salon a truly exceptional parlour franchise option is its well-thought-out structure. If you're exploring a new salon franchise, Monsoon's support system and reputation offer the security of an established name with the excitement of a growing brand.

Here’s what makes their salon business plan stand out:

Low Entry Barrier: The startup costs are reasonable, making it attractive for new entrepreneurs.

Full Operational Support: From site selection to hiring and marketing, everything is backed by a professional team.

Flexible Location Models: Whether you're searching for a salon franchise near me or a flagship location in a metro, Monsoon offers scalability.

Digital Edge: With an online salon franchise system, franchisees can manage bookings, inventory, and marketing from anywhere.

The Best Salon Franchise in India? Many Say Yes

In a market filled with options, Monsoon Salon holds its ground as arguably the best salon franchise in India. Why? Because it merges luxury with affordability and professionalism with warmth. Clients love the consistent service quality, and franchisees benefit from a strong business ecosystem.

It’s no surprise that Monsoon is being recognized not just among the Top 10 salon franchise, but is quickly climbing into the Top 5 salon franchise in India territory.

Perfect Timing, Perfect Opportunity

The Indian beauty industry is experiencing rapid growth, fueled by rising disposable incomes and increased self-care awareness. This makes now the ideal time to invest in a beauty salon franchise. And with Monsoon Salon’s proven track record and solid brand presence, you’re aligning with one of the best top 10 salon franchise available today.

Why Bangalore Is the Flagship to Watch

Bangalore is known for its fast-paced lifestyle, cosmopolitan crowd, and an ever-growing demand for premium services. Monsoon Salon’s outlet here isn’t just thriving—it’s setting trends.

The Bangalore franchise is proof of how Monsoon adapts to urban markets and connects with a wide demographic—from students and working professionals to families and bridal clientele.

Conclusion: Get in on the Beauty Boom

Choosing a hair salon franchise is more than a business decision—it’s about joining a brand that values quality, creativity, and community. Monsoon Salon Bangalore has proven that success lies in delivering excellence every day while building a franchise network rooted in trust and value.

Whether you're looking to start a new salon franchise, searching for top salon franchise brands, or curious about investing in a beauty salon business, Monsoon Salon deserves a top spot on your list.

Join the movement. Be part of one of the Top 10 salon franchise journeys that’s reshaping India’s beauty industry—one stylish customer at a time.

Want help turning this into a downloadable PDF, lead magnet, or blog format? Just say the word!

#beauty salon franchise in india#new salon franchise#salon franchise#unisex salon franchise#salon franchise near me#hair salon franchise#best salon franchise in india#online salon franchise#top 10 salon franchise in india#salon business plan

0 notes

Text

Steering the Future: Transforming the Terminal Tractor Market

The terminal tractor market is experiencing significant growth, projected to increase from $1.24 billion in 2023 to $2.20 billion by 2032, with a compound annual growth rate (CAGR) of 5.89% India Shorts. This expansion is driven by the increasing demand for efficient logistics solutions, advancements in automation, and the adoption of sustainable technologies.

Technological Innovations

Electrification and Hybridization: The shift towards electric and hybrid terminal tractors is gaining momentum, propelled by stringent emission regulations and the need for cost-effective operations .

Automation and Telematics: Integration of autonomous technologies and telematics systems enhances operational efficiency and safety, reducing the reliance on manual labor and minimizing human errors .

Advanced Safety Features: Modern terminal tractors are equipped with features like collision avoidance systems, 360-degree cameras, and automated emergency braking, ensuring safer operations in busy terminal environments .

Regional Dynamics

Asia-Pacific: The region is witnessing rapid industrialization and urbanization, leading to increased demand for terminal tractors in logistics and distribution centers

North America and Europe: These regions are focusing on sustainability and regulatory compliance, driving the adoption of electric and autonomous terminal tractors

Market Drivers

E-Commerce Growth: The rise in online shopping has led to increased demand for efficient material handling and transportation within logistics hubs.

Infrastructure Development: Investments in port and intermodal infrastructure projects are enhancing cargo handling capabilities, further driving the need for advanced terminal tractors

Challenges

High Initial Costs: The upfront investment required for electric and autonomous terminal tractors can be a barrier for smaller operators.

Infrastructure Requirements: The need for charging stations and maintenance facilities for electric vehicles poses additional challenges

Future Outlook

The terminal tractor market is poised for continued growth, driven by technological advancements, sustainability initiatives, and the increasing demand for efficient logistics solutions. Companies that embrace innovation and adapt to evolving market trends will be well-positioned to lead in this dynamic industry.

For a detailed analysis, visit DataString Consulting.

0 notes

Text

Revolutionizing Finance: The Rise of Modern Banking Software

In today’s fast-paced digital world, the banking and financial sector is undergoing a monumental transformation. One of the primary forces driving this change is the rise of banking software, which offers institutions the ability to streamline operations, improve customer service, and remain competitive in a rapidly evolving market.

Whether it's managing complex transactions, handling customer data securely, or automating loan disbursals, banking software has become the cornerstone of efficient financial management. Particularly, loan organization systems and loan organization software are leading the charge in helping banks and NBFCs (Non-Banking Financial Companies) handle credit processes more effectively.

Why Banking Software Matters More Than Ever

The traditional banking model, which relied heavily on manual processes, paper-based documentation, and in-person customer interactions, is quickly becoming obsolete. Modern banking software allows financial institutions to:

Automate back-office operations

Offer 24/7 digital banking experiences

Ensure compliance with regulatory frameworks

Mitigate fraud and cyber threats

Personalize customer journeys using AI and analytics

At the heart of this transformation are companies that specialize in loan software development. These firms provide tailored solutions that allow banks and NBFCs to manage loans from application to closure, in a streamlined and secure manner.

The Power of Loan Organization Systems

One of the critical components of modern banking software is the loan organization system. This is a digital platform designed to manage every aspect of the loan lifecycle, including:

Application intake

Credit evaluation

Document verification

Disbursement

EMI tracking

Collection management

Reporting and analytics

These systems reduce human error, enhance processing speed, and create a better experience for both the lender and the borrower. By integrating with core banking systems and external APIs, loan organization systems ensure that all departments work together seamlessly.

Benefits of Loan Organization Software

Implementing loan organization software brings a range of advantages:

Automation and Efficiency

Automated workflows minimize manual intervention, reduce paperwork, and significantly cut down processing time for loan applications.

Compliance and Risk Management

Built-in compliance checks ensure that the institution adheres to all local and international regulations. Risk assessment tools help identify red flags before they become major problems.

Data-Driven Decision Making

With powerful analytics and reporting tools, banks can make smarter lending decisions, detect trends, and forecast future business outcomes.

Enhanced Customer Experience

Customers can apply for loans online, track the status in real time, and receive instant notifications—all of which contribute to higher satisfaction and retention rates.

Choosing the Right Loan Management Software Company

Finding the right loan management software company is crucial for any financial institution looking to digitize its lending process. The ideal partner should offer:

Customizable solutions tailored to your business model

Seamless integration with existing systems

Scalable infrastructure for future growth

Robust security features

Ongoing technical support and upgrades

Whether you're a small microfinance institution or a large commercial bank, the right loan software can provide the agility and intelligence you need to stay competitive.

What to Expect from a Loan Organization Software Company

A trusted loan organization software company will begin with a comprehensive consultation to understand your business needs. From there, they will design a tailored solution that aligns with your operational goals. Many such companies also offer cloud-based platforms, which provide added flexibility, data redundancy, and accessibility across multiple branches or geographies.

Some advanced features to look out for include:

AI-based credit scoring

eKYC (Know Your Customer) integrations

Multi-language and multi-currency support

Mobile app solutions for agents and customers

Real-time dashboards for managers and stakeholders