#Offshore Wind Farm Operation )

Explore tagged Tumblr posts

Text

#Global Wind Farm Operation Market Size#Share#Trends#Growth#Industry Analysis By Type ( Whole Machine Manufacturers#Wind Farm Subsidiaries#Third Party Companies )#By Applications( Onshore Wind Farm Operation#Offshore Wind Farm Operation )#Key Players#Revenue#Future Development & Forecast 2023-2032

0 notes

Text

Confirmed: Wind Turbines Kill Dolphins and Whales

186 notes

·

View notes

Text

While solar power is growing at an extremely rapid clip, in absolute terms, the use of natural gas for electricity production has continued to outpace renewables. But that looks set to change in 2024, as the US Energy Information Agency (EIA) has run the numbers on the first half of the year and found that wind, solar, and batteries were each installed at a pace that dwarfs new natural gas generators. And the gap is expected to get dramatically larger before the year is over.

Solar, Batteries Booming

According to the EIA's numbers, about 20 gigawatts of new capacity was added in the first half of this year, and solar accounts for 60 percent of it. Over a third of the solar additions occurred in just two states, Texas and Florida. There were two projects that went live that were rated at over 600 megawatts of capacity, one in Texas, the other in Nevada.

Next up is batteries: The US saw 4.2 additional gigawatts of battery capacity during this period, meaning over 20 percent of the total new capacity. (Batteries are treated as the equivalent of a generating source by the EIA since they can dispatch electricity to the grid on demand, even if they can't do so continuously.) Texas and California alone accounted for over 60 percent of these additions; throw in Arizona and Nevada, and you're at 93 percent of the installed capacity.

The clear pattern here is that batteries are going where the solar is, allowing the power generated during the peak of the day to be used to meet demand after the sun sets. This will help existing solar plants avoid curtailing power production during the lower-demand periods in the spring and fall. In turn, this will improve the economic case for installing additional solar in states where its production can already regularly exceed demand.

Wind power, by contrast, is running at a more sedate pace, with only 2.5 GW of new capacity during the first six months of 2024. And for likely the last time this decade, additional nuclear power was placed on the grid, at the fourth 1.1-GW reactor (and second recent build) at the Vogtle site in Georgia. The only other additions came from natural-gas-powered facilities, but these totaled just 400 MW, or just 2 percent of total new capacity.

The EIA has also projected capacity additions out to the end of 2024 based on what's in the works, and the overall shape of things doesn't change much. However, the pace of installation goes up as developers rush to get their project operational within the current tax year. The EIA expects a bit over 60 GW of new capacity to be installed by the end of the year, with 37 GW of that coming in the form of solar power. Battery growth continues at a torrid pace, with 15 GW expected, or roughly a quarter of the total capacity additions for the year.

Wind will account for 7.1 GW of new capacity, and natural gas 2.6 GW. Throw in the contribution from nuclear, and 96 percent of the capacity additions of 2024 are expected to operate without any carbon emissions. Even if you choose to ignore the battery additions, the fraction of carbon-emitting capacity added remains extremely small, at only 6 percent.

Gradual Shifts on the Grid

Obviously, these numbers represent the peak production of these sources. Over a year, solar produces at about 25 percent of its rated capacity in the US, and wind at about 35 percent. The former number will likely decrease over time as solar becomes inexpensive enough to make economic sense in places that don't receive as much sunshine. By contrast, wind's capacity factor may increase as more offshore wind farms get completed. For natural gas, many of the newer plants are being designed to operate erratically so that they can provide power when renewables are underproducing.

A clearer sense of what's happening comes from looking at the generating sources that are being retired. The US saw 5.1 GW of capacity drop off the grid in the first half of 2024, and aside from 0.2 GW of “other,” all of it was fossil-fuel-powered, including 2.1 GW of coal capacity and 2.7 GW of natural gas. The latter includes a large 1.4-GW natural gas plant in Massachusetts.

But total retirements are expected to be just 7.5 GW this year—less than was retired in the first half of 2023. That's likely because the US saw electricity use rise by 5 percent in the first half of 2024, based on numbers the EIA released on Friday. (Note that this link will take you to more recent data a month from now.) It's unclear how much of that was due to weather—a lot of the country saw heat that likely boosted demand for air-conditioning—and how much could be accounted for by rising use in data centers and for the electrification of transit and appliances.

That data release includes details on where the US got its electricity during the first half of 2024. The changes aren't dramatic compared to where they were when we looked at things last month. Still, what has changed over the past month is good news for renewables. In May, wind and solar production were up 8.4 percent compared to the same period the year before. By June, they were up by over 12 percent.

Given the EIA's expectations for the rest of the year, the key question is likely to be whether the pace of new solar installations is going to be enough to offset the drop in production that will occur as the US shifts to the winter months.

21 notes

·

View notes

Text

A Lot Was Riding on This Wind Farm. Then Giant Shards Washed Up in Nantucket. (Wall Street Journal)

This summer was supposed to be a breakout season for the faltering offshore wind business in the U.S. Instead it may be defined by an ill-timed break.

A large project off the coast of Massachusetts, called Vineyard Wind, remains at a standstill following an accident that dropped a massive turbine blade into the ocean last month and washed chunks of debris onto Nantucket beaches.

The blade broke at the height of summer and at a pivotal moment for the U.S. offshore wind industry, which has struggled with rising costs, political opposition and a wave of canceled and renegotiated contracts. Efforts to launch the sector in the U.S. are considered key to President Biden’s climate aspirations but would be especially vulnerable if former President Donald Trump returns to office.

Of the many clean-energy incentives and policies approved by Congress or the Biden administration in recent years, offshore wind projects and electric vehicles have been singled out repeatedly by Trump with particular ire.

“We are going to make sure that ends on day one,” Trump said at a campaign event in May, talking about an offshore wind project in New Jersey. “I will write it out in an executive order.”

The project offshore Nantucket and Martha’s Vineyard is among the largest planned wind farms in U.S. waters, with the capacity to deliver electricity to around 400,000 homes and businesses in Massachusetts. It was the first U.S. commercial offshore wind installation to start delivering grid power earlier this year and has more than a third of its turbines in place.

As chunks of debris washed ashore in Nantucket in mid-July, beaches closed for a day. The federal Bureau of Safety and Environmental Enforcement halted construction of additional turbines along with power generation from the installed turbines. The agency said it had launched its own investigation into the incident. More debris later washed up on Martha’s Vineyard and Cape Cod beaches.

Turbine maker GE Vernova has blamed “insufficient bonding,” or glue, as the reason for the break. It said it was a manufacturing problem and there is no underlying design flaw that would affect other installed blades. The blade had been recently installed and the turbine was undergoing reliability tests.

The company hired an engineering firm to look at potential environmental impacts.

Offshore wind turbines are massive. The broken blade was around 351 feet long, taller than the Statue of Liberty.

Manufacturing giant turbine blades is both a high-tech and hands-on process. GE Vernova takes ultrasound images of each blade it makes, a few centimeters at a time, and now is combing through images of around 150 offshore blades.

A check of those images should have caught the problem with the blade at Vineyard Wind, but didn’t, Strazik said. GE Vernova this week said it also plans inspections of installed blades with remote-operated robots.

7 notes

·

View notes

Text

“Man will never be free until the last king is strangled with the entrails of the last priest"- Danis Diderot.

“King Charles expected to earn millions from Great British Energy deal.” (Daily Mail: 26/07/24

“Labour’s Great British Energy will make profits alright – for King Charles that is” (Canary: 26/07/24)

“King Charles is set to make millions over the next decade thanks to the development of wind farms on land owned by the Royal Family” (inews: 25/07/24)

“The King is likely to make millions after the Crown Estate signed a deal to partner with Labour’s new state-owned energy company.” (The I: 26/07/24)

Its good to know King Charles is doing his bit to help alleviate the cost of living crisis. The King, reported by Forbes magazine to be worth £21.3bn, certainly needs the money. After all, the upkeep of all those palaces and castles doesn’t come cheap.

Luckily for the King he “owns” the seabed around our island out to 12 nautical miles and it is this that is set to boost his already substantial income from Crown lands.

Under the terms of the Sovereign Grant - the taxpayer funded money given to the Crown to pay for the Royal Family – King Charles will receive 12% of the profits of the Crown Estate. The firms operating offshore wind farms will have to pay to lease their sites so King Charles is set to substantially increase his already high profits of £1.1bn that he receives from existing wind farm leases.

God bless his Majesty

#uk politics#great british energy#king charles#profit#leases#cost of living crisis#castles#grantsm#palaces#billions

11 notes

·

View notes

Text

Starting off strong!!! The Barrow Offshore Wind Farm:

30 operating units

7 km offshore

Vestas V90-3MW

Hub is 75 m above sea level (model varies between 65-105 m)

Rotor diameter of 90 m, max rotor speed of 8.6 rpm

5 notes

·

View notes

Text

New York to Pay $155 Per Megawatt Hour for Wind, Current Rate is $36 Per MWH

So Much for So Little

The Wall Street Journal asks Why Is New York Paying So Much for Wind Power?

New York state signed a contract in June to buy electricity generated by two large wind farms, Empire Wind 1 and Sunrise Wind, off the coast of Long Island. The projects are expected to begin in 2026 and 2027, with power delivered to Brooklyn (Empire) and Long Island (Sunrise). The state will pay $155 and $146 per megawatt-hour, respectively. These prices are steep, at least four times the average grid cost paid over the past year. States agree to pay wind-power operators—known as the “offtake price”—based on a project’s “break-even cost,” the estimated bill for building and operating the wind farm over its useful life. That is undoubtedly part of the problem. The offshore wind business off the East Coast is in turmoil. Operators have canceled projects from Massachusetts to Maryland that were due to be constructed in the next four years. Some have been delayed, while others have renegotiated their contracts at prices 30% to 50% higher than originally promised. Two widely quoted sources of break-even costs are the U.S. Energy Information Administration and Lazard, an investment bank. In its most recent estimates, the EIA suggests the average break-even cost of offshore wind farms, adjusted to 2024 prices, is $131 per megawatt-hour, not counting government subsidies, and $101 per megawatt-hour after allowing for basic tax credits. The latter figure is what matters, because every offshore wind farm expects to take advantage of investment or production tax credits under the Inflation Reduction Act.

EIA Says Wind is Not Economical

Let’s pause right there because wind is absurd by any measure.

6 notes

·

View notes

Text

20241112 Séjourné’s Brussels Baptism: Will He Survive the Political Pressure Cooker?

Bonsoir, my friends! The Brussels rumour mill is churning faster than a Belgian waffle iron as we await the verdict on Stéphane Séjourné, France's pick for the EU’s industry maestro. His confirmation hearing may be done and dusted (watch it here, he really did look very nice), but the real test is just heating up! Think of it as a political pressure cooker, and Séjourné’s the dish du jour. Will he rise to the occasion or get burned in the heat of the moment?

A Mixed Bag of Compliments (and a Few Brickbats)

Monsieur Séjourné was calm and collected, smiling from the beginning to the end, but not everyone. How did Monsieur Séjourné fare in his grand oral? Well, let's just say the reviews are as mixed as a Belgian praline box. Some MEPs, particularly the Greens, are singing his praises, lauding his pro-European spirit and commitment to green industry. Streamlined regulations for battery factories and offshore wind farms is a satisfying promise for the renewable energy crowd, for sure.

But others, like the ever-sceptical EPP, are less impressed. They’re raising eyebrows at his lack of economic experience, muttering about his background (or lack thereof) in finance and industry. “You can recognise that he doesn't have a background in economics,” one EPP insider confided.

And then there's the Left, who are throwing some serious shade, accusing Séjourné of being out of touch with the realities of European industry. "I think he was completely disconnected from the [EU's] huge industrial needs," declared one left-wing MEP.

Macron's Man in Brussels: A Blessing or a Curse?

Séjourné’s close ties to Emmanuel Macron are another hot topic in the Brussels bubble. Some see it as a sign that France is serious about shaping the EU’s industrial future. Others worry he'll be more focused on advancing Macron's agenda than serving the broader interests of the EU.

Far-right MEPs didn’t hold back, launching into scathing attacks, questioning his legitimacy and highlighting his Macron connection. But Séjourné, ever the smooth operator, parried their attacks with well-rehearsed responses, stressing his commitment to working with all MEPs.

Trade Wars and Tariff Troubles: Navigating the Global Chessboard

Séjourné’s also walking a tightrope when it comes to trade. He's vowed to champion "strategic autonomy" – a Macron-favoured phrase that essentially means reducing Europe's reliance on China. But he's also keen to avoid a transatlantic trade war, a prospect that has some US lawmakers on edge.

And then there's the thorny issue of the EU-Mercosur trade deal – a pact that has French farmers up in arms. Séjourné has carefully avoided taking a firm stance, promising to prioritize the interests of European farmers while also acknowledging the importance of international trade. A diplomatic balancing act, indeed...But how long could it hold out, as French Prime Minister Michel Barnier, fresh from a showdown with Ursula von der Leyen in Brussels, has declared the deal "not acceptable to France" and has vowed to block it? As Séjourné urges Europe to 'master its destiny, he really needed to act upon it, as Manon Aubry urged. This is a bit awkward, really, considering Sejourne was the president of the Mercosur committee when he was in EU parliament and he will likely sign and be involved in the agreement if he gets appointed as commissioner...

Political Puppets and Power Plays: The EPP’s High-Stakes Gamble

Well back to the pre-appointment saga. The biggest hurdle facing Séjourné might not be his own performance, but rather the political machinations of the European Parliament. News Sources we collected reveal a complex game of thrones is unfolding, with the EPP using its clout to push through its own controversial candidates.

Séjourné’s confirmation has become a pawn in this high-stakes game. The EPP is holding his nomination hostage, linking it to the approval of other candidates, including the divisive Italian, Raffaele Fitto. This has sparked outrage from the Left and raised concerns about the EPP’s willingness to cosy up to the far-right.

The Final Countdown: Will Séjourné Survive the Brussels Buzzsaw?

So, what’s the final verdict? Will Séjourné survive this political pressure cooker and land the coveted industry portfolio? It’s still too early to say. The sources paint a picture of a parliament in deadlock, with Séjourné’s fate hanging in the balance. The EPP holds the keys to the kingdom, and they’re playing hardball.

The EPP's willingness to compromise, the level of support from Renew and other political groups, and Séjourné's ability to navigate the concerns surrounding his experience and political affiliations will all play a role in determining his fate. The upcoming vote on the Commission lineup promises to be a tense affair, with far-reaching implications for the future of EU industrial policy. Most importantly, the challenges didn't end with his accession as EVP of the European Commission: they began and escalated from there.

#Stephane Sejourne#Newsletter#Some are not quoted because they're just#In the hearing#Please listen to the hearing

2 notes

·

View notes

Text

At the start of February, Ørsted, the world’s largest offshore wind developer, announced a major scaling back of its operations, exiting wind markets in Portugal, Spain and Norway and cutting both its dividend and its 2030 target for the number of new installations. The announcement followed the firm’s shock decision last November to back out of two major wind projects in New Jersey. Last week, it agreed to sell stakes in four US onshore wind farms for around $300m.

But Ørsted’s troubles are hardly unique. In September 2023, the UK government’s offshore wind auction failed to secure a single project from developers, who argued that the government-guaranteed prices on offer were too low in the face of rising costs. Two months before that, Vattenfall pulled out of a major wind UK development for the same reason. And in February, the German energy giant RWE – which provides 15 per cent of the UK’s power – warned that without more money on offer, the UK’s next auction, opening this month, might just fail again.

These cases are only a handful among many and have come as jarring setbacks for an industry grown accustomed to triumphalism: headlines over recent years have routinely celebrated the plunging cost of renewables and the seemingly unrelenting transition to clean energy advancing around the world. A quick Google of “renewable energy deployment” yields no shortage of charts with impressive upward slopes.

Much of this enthusiasm has centred on a metric called the Levelised Cost of Electricity (LCOE), which represents the average cost per unit of electricity generated over the lifetime of a generator, be it a wind farm or a gas power station. The LCOE has something of a cult status among industry analysts, journalists and even the International Energy Agency as the definitive marker of the transition to clean energy. When the LCOE of renewables falls below that of traditional fossil fuel sources, the logic goes, the transition to clean energy will be unstoppable. If only it was that simple, argues the economic geographer Brett Christophers in his latest book The Price is Wrong: Why Capitalism Won’t Save the Planet.

As Christophers writes: “Everyone, seemingly, has gravitated to the view that, now they are cheaper/cheapest, renewables are primed for an unprecedented golden growth era” that will see them supplant fossil fuels. Doing so will be no mean feat. Despite the vertiginous growth of new renewable capacity in recent years, renewables have scarcely made a dent in the proportion of global power that comes from fossil fuels. The overall share of fossil fuel power in the energy mix has remained broadly stagnant for an astonishing four decades, from 64 per cent in 1985 to 61 per cent in 2022. Critically, the absolute amount of fossil fuel power generated each year – the figure that ultimately matters for the climate – has continued to rise.

In large part, this stems from overall growth in electricity consumption, which will continue apace in the coming decades as millions around the world gain access to electricity and as we race to electrify the economy. Thus, for all their upward momentum, global electricity consumption is still growing faster than solar and wind power is coming online, meaning the gap is widening. To close it, by the IEA’s estimates, the world needs to install 600 GW (gigawatts) of solar and 340 GW of wind capacity every year between 2030 and 2050. By comparison, the UK’s current total installed wind capacity is approximately 30GW, the sixth largest in the world, while Germany’s domestic transition plan implies installing the equivalent of 43 football pitches of solar panels every day to 2050. In short: the task is immense – almost unimaginably so. It is similarly urgent.

Where will the momentum needed to build this clean energy future come from? As Christophers documents in detail, the industry has thus far relied on an array of subsidy and support around the world. Extensive state support is hardly unique to clean energy, much as detractors and climate deniers may like to highlight it: the fossil fuel industry benefited from tax breaks and direct subsidy to the tune of £5.5trn in 2022 according to the IMF. The declining LCOE of renewable energy has been increasingly viewed as an argument for unwinding this government-backed support. As Christophers shows, however, in practice this has proven a near-impossibility. The question he therefore asks is why, in the face of declining costs, subsidies continue to be necessary, and what this tells us about whether the current approach to decarbonisation is fit for purpose.

The answer, Christophers argues, is that we’ve got it all upside down. When it comes to investment in renewable energy, as in anything else, it’s not cheapness that matters. Just take it from the investors themselves, he notes, citing one former JPMorgan investor who described the LCOE as a “practical irrelevance”. What matters instead is profit, and expectations of it.

Despite its simplicity, Christophers’s account is a quietly radical one that contravenes the received wisdom of not only the technocrats, mainstream economists and free marketeers who tout the wonders of the market, but also many on the left, for whom the problem with profits is typically their being far too high. Instead, as he demonstrates, the trouble is that renewable energy is nowhere near profitable enough, and certainly not reliably so, for the market to deliver it with anything like the pace, scale or certainty that is needed.

If the costs of renewables are indeed so low, one might ask, and profits are equal to revenues minus costs, then surely plunging costs should mean higher profits. But Christophers shows that low and unreliable profits are the definitive obstacle to the decarbonisation of the electricity system and, by extension, the wider economy.

The precise answer as to why low costs don’t necessarily translate into high and steady profits in this sector is technically complex and multifaceted, deftly handled by Christophers, a reformed management consultant, over nearly 400 pages of fine detail drawn from company documents, interviews and dense sectoral reports from global energy agencies. Put simply, the core of the problem is that the very features of markets so celebrated by mainstream economics – mediation via the price signal, increasing competition and private investment – are the undoing of a private-sector led transition to clean energy.

For Christophers, the commitment to marketisation in electricity systems is increasingly self-defeating. At the heart of this problem is the so-called “wholesale market” that prevails in many parts of the US and Europe, including the UK. Under this system, generators are paid a single price per unit of electricity for a given period, regardless of whether it is derived from a wind turbine or a coal plant. This price is based on what’s called a “merit order”, with the cheapest sources – generally renewables – being deployed first, followed by as many sources as are needed in order of escalating price. The wholesale is set by the last unit of energy needed to meet demand. In the UK, this is typically gas.

The defining feature of this wholesale pricing system, cast in sharp relief over the period of sky-high energy prices in 2021-2022, is volatility. With a host of factors potentially feeding into the price – from the balance of supply and demand through to global gas prices and geographic location – the swings can be enormous, regularly spiking from double to triple digit prices and back again within a matter of hours. In times of crisis, the figures can become outlandish, with the price of electricity in Texas during the state’s 2021 shock winter storms reaching $9,000 per MWh.

For Christophers, this volatility is nothing short of “an existential threat” to the “bankability” of a renewable project – that is, its ability to secure financing – because it makes profitability so uncertain. Worse still, within a competitive wholesale market, as the proportion of renewable generation in the market grows, and by extension the proportion of time in which renewables drive the wholesale price, the more frequently and strongly prices swing to the lower extreme, a phenomenon known as “price cannibalisation”.

The energy industry and governments rely on an impressive array of methods to circumvent these problems, from financial hedging to feed-in-tariffs, and from mega corporate Power Purchase Agreements with the likes of Amazon and Google to the UK’s “contracts-for-difference”. As Christophers writes: the reality of “liberalised electricity systems such as Europe’s is that, to secure financing, renewables developers ordinarily do everything they can… to avoid selling their output at the market price.”

Thus, despite ultra-high wholesale prices over 2021-2022, many renewables generators failed to enjoy correspondingly high profits, because they had traded the possibility of these certainties in the face of intolerable market volatility. For Christophers, this is the “signal feature” of the liberalised electricity market: that “the hallowed market price… is the one price that renewables operators endeavour not to sell at.”

It is in explaining this apparent contradiction that the book offers its most radical suggestion. Borrowing Karl Polanyi’s concept of a “fictitious commodity”, Christophers ultimately contends that electricity – like land, labour and money, Polanyi’s original trio – is not a commodity in the conventional sense of having been created for sale, and is therefore ill-suited to market exchange and coordination. This incompatibility sits at the root of the spiralling complexity of interventions that policymakers are obligated to make in the name of upholding the freedom of the “market”. The result, in the words of the energy expert Meredith Angwin, is that today’s electricity markets are less market and more “bureaucratic thicket”.

Thankfully, if the forces of capitalism, defined in terms of private ownership and the profit imperative, are fundamentally ill-equipped for this task, then we are not for want of alternatives. Public ownership and financing of energy, if freed from a faux market and the straitjacket of the profit motive, seems an obvious one. Christophers writes that the state is the only actor with “both the financial wherewithal and the logistical and administrative capacity” to take on the challenge of decarbonisation. The trouble though, when all you have is a hammer, is that everything looks like a nail. Thus, in the face of irreconcilable market failures, most policymakers seem only to offer more market-based fudges.

In this context, the tremors in renewable energy investment that we have seen with increasing frequency over the past several months are more than just a blip. They represent a potentially fatal flaw in the prevailing approach to the task of decarbonisation. From the perspective of the climate, every tonne of carbon matters, and every delay is significant. To continue to leave the future of electricity, and by extension global decarbonisation, to the whims of profit-motivated firms, is an intolerable risk. Rome is already burning, and there’s no time left to fiddle.

3 notes

·

View notes

Text

Efficient Offshore Crew Management Solutions

When it comes to offshore operations, efficientcrew management is the compass that guides a successful voyage. In the demanding worlds of maritime, oil & gas, and renewable energy, the management of offshore personnel is a complex and critical task. To ensure smooth sailing and boost productivity, it's imperative to stay on top of the latest trends and technologies in offshore crew management. In this blog, we'll explore the key strategies and innovations that are transforming the offshore crew management landscape.

Understanding Offshore Crew Management

Offshore crew management involves the selection, training, scheduling, and overall supervision of the workforce that operates and maintains offshore installations such as oil rigs, drilling platforms, wind farms, and vessels. It's a multifaceted task that demands meticulous planning, safety protocols, and a keen eye for efficiency.

The Key Elements of Successful Crew Management

1. Recruitment and Onboarding

The foundation of offshore crew management is selecting the right personnel. It begins with a thorough recruitment process to identify individuals with the necessary skills, experience, and qualifications. Once selected, a robust onboarding program ensures that new crew members are well-prepared for their roles and responsibilities.

2. Training and Certification

Continuous training and certification are vital to maintaining a skilled and safety-conscious crew. Industry-specific training programs, emergency response drills, and the acquisition of relevant certifications are essential components of offshore crew management.

3. Scheduling and Rotation

Efficient scheduling and rotation systems balance the need for continuous operations with crew well-being. Implementing well-thought-out shift schedules, including leave rotations, reduces fatigue and enhances performance.

4. Safety and Compliance

Safety is paramount in offshore operations. Compliance with industry regulations, rigorous safety procedures, and regular safety drills are essential for offshore crew management.

Embracing Technology

The digital age has brought forth a wave of innovations in offshore crew management:

1. Crew Management Software

Specialized software solutions have streamlined the administrative aspects of crew management. They help with crew scheduling, training tracking, and compliance monitoring, making it easier to manage a large workforce across multiple locations.

2. Communication Technology

Efficient communication is crucial in offshore environments. High-tech communication systems enable real-time connectivity between onshore and offshore personnel, enhancing safety and operational efficiency.

3. Predictive Analytics

Predictive analytics helps in forecasting crew needs, optimizing schedules, and planning for crew training and certification renewal, reducing downtime and costs.

Embracing Sustainability

As the world shifts towards sustainable energy solutions, offshore crew management in the renewable energy sector is gaining prominence. Managing diverse crews working on wind farms and offshore renewable projects requires specialized approaches that prioritize sustainability and environmental responsibility.

Conclusion

Offshore crew management is the linchpin of safe, efficient, and productive offshore operations. By embracing the latest technologies, adhering to best practices, and staying attuned to industry trends, organizations can navigate the seas of offshore crew management with confidence. Whether it's in traditional oil and gas or the burgeoning renewable energy sector, a well-managed crew is the key to success in these challenging environments. So, set your course for success by prioritizing the well-being and productivity of your offshore crew.

Remember, in the world of offshore operations, a well-managed crew is your North Star!

3 notes

·

View notes

Text

Wind Turbine Operations & Maintenance Market Geographical Expansion & Analysis Growth Development, Status, Recorded during 2017 to 2032

Overview: The Wind Turbine Operations & Maintenance Market is a segment of the renewable energy industry that focuses on the maintenance, repair, and optimization of wind turbines. This market encompasses services and solutions provided to ensure the efficient and reliable operation of wind turbines throughout their lifecycle.

Wind Turbine Operations And Maintenance Market size was valued at USD 11.716 billion in 2021 and is poised to grow from USD 13.22 billion in 2022 to USD 33.85 billion by 2030, growing at a CAGR of 12.71% in the forecast period (2023-2030).

The Wind Turbine Operations & Maintenance Market has been experiencing significant growth in recent years, driven by the increasing deployment of wind power installations globally. As the number of wind turbines continues to grow, the need for effective operations and maintenance (O&M) services becomes crucial to ensure optimal performance and maximize energy production.

Trends and Growth Drivers:

Increasing Wind Power Installations: The rapid growth of wind power installations, driven by government incentives, favorable policies, and the need for clean energy sources, fuels the demand for operations and maintenance services. As the number of wind turbines increases, the market for O&M services expands accordingly.

Focus on Cost Optimization: With the maturation of the wind power industry, there is an increasing emphasis on cost optimization and maximizing the return on investment (ROI) for wind projects. O&M services play a vital role in ensuring the longevity, efficiency, and performance of wind turbines, thereby minimizing downtime and operational costs.

Aging Wind Turbines: As the early-generation wind turbines reach their expected lifespan, the market for O&M services grows. Older wind turbines require regular maintenance, component replacements, and upgrades to maintain performance levels and extend their operational life.

Technological Advancements: Ongoing advancements in wind turbine technology, such as the use of predictive maintenance techniques, condition monitoring systems, and data analytics, are driving the growth of the O&M market. These technologies enable proactive maintenance, early fault detection, and data-driven decision-making to optimize turbine performance and reduce downtime.

Industry Analysis: The Wind Turbine Operations & Maintenance Market is characterized by the presence of both original equipment manufacturers (OEMs) and third-party service providers. OEMs often provide comprehensive O&M services for their own turbines, while independent service providers specialize in offering O&M services for multiple turbine brands.

The market is highly competitive, and service providers offer a range of services, including preventive maintenance, corrective maintenance, condition monitoring, spare parts supply, and performance optimization. Additionally, advancements in remote monitoring and diagnostic technologies have enabled remote O&M services, reducing the need for on-site visits and improving efficiency.

Demand Outlook: The demand for wind turbine operations and maintenance services is expected to witness sustained growth in the coming years. Factors such as the increasing number of wind power installations, the focus on cost optimization, the aging of wind turbine fleets, and technological advancements drive the market.

Furthermore, government policies and regulations supporting renewable energy and the shift toward a low-carbon economy contribute to the demand for O&M services. As wind power continues to play a significant role in the global energy mix, the need for efficient and reliable O&M services will remain vital.

In conclusion, the Wind Turbine Operations & Maintenance Market is experiencing significant growth due to the increasing deployment of wind power installations and the need for cost optimization. Trends such as aging wind turbines, technological advancements, and a focus on maximizing energy production drive the market. Collaboration between OEMs and independent service providers, along with government support, further contribute to the market's expansion.

The Wind Turbine Operations & Maintenance (O&M) market offers several key benefits for stakeholders, which include various parties involved in the wind energy industry. Here are some of the key benefits:

Enhanced Efficiency and Performance

Increased Revenue for Wind Farm Owners

Cost Savings

Prolonged Turbine Lifespan

Improved Safety

Job Creation

Environmental Benefits

Stable Energy Supply

Risk Mitigation for Investors

Support for Energy Transition

Overall, the Wind Turbine Operations & Maintenance market provides a win-win situation for stakeholders, combining economic, environmental, and social benefits while advancing the adoption of clean energy technologies.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/wind-turbine-operations-&-maintenance-market/9854/

Market Segmentations:

Global Wind Turbine Operations & Maintenance Market: By Company

• Vestas

• Siemens gamesa

• GE renewable energy

• Enercon

• Goldwind

• Suzlon

• Global Wind Service

• Deutsche Windtechnik

• Stork

• Mingyang Smart ENERGY

• Ingeteam

• Envision Group

• Dongfang Electric Wind

• BHI Energy

• GEV Group

• EOS Engineering & Service Co., Ltd

Global Wind Turbine Operations & Maintenance Market: By Type

• Wind Farm Developers

• Wind Turbine Manufacturers

• Third Party Companies

Global Wind Turbine Operations & Maintenance Market: By Application

• Onshore Wind

• Offshore Wind

Global Wind Turbine Operations & Maintenance Market: Regional Analysis

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Wind Turbine Operations & Maintenance market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America

Visit Report Page for More Details: https://stringentdatalytics.com/reports/wind-turbine-operations-&-maintenance-market/9854/

Reasons to Purchase Wind Turbine Operations & Maintenance Market Report:

Comprehensive Insights: Market research reports provide in-depth and comprehensive insights into the ULSFO market. They typically cover various aspects such as market size, growth trends, competitive landscape, regulatory environment, technological developments, and consumer behavior. These reports offer a holistic view of the market, saving time and effort in gathering information from multiple sources.

Data and Statistics: Market research reports often include reliable and up-to-date data and statistics related to the ULSFO market. This data can help in analyzing market trends, understanding demand and supply dynamics, and making informed business decisions. Reports may include historical data, current market figures, and future projections, allowing businesses to assess market opportunities and potential risks.

Market Segmentation and Targeting: Market research reports often provide segmentation analysis, which helps identify different market segments based on factors such as vessel type, application, end-users, and geography. This information assists businesses in targeting specific customer segments and tailoring their marketing and business strategies accordingly.

Competitive Analysis: Market research reports typically include a competitive analysis section that identifies key players in the ULSFO market and evaluates their market share, strategies, and product offerings. This information helps businesses understand the competitive landscape, benchmark their performance against competitors, and identify areas for differentiation and growth.

Market Trends and Forecast: Market research reports provide insights into current market trends and future forecasts, enabling businesses to anticipate changes in the ULSFO market. This information is valuable for strategic planning, product development, investment decisions, and identifying emerging opportunities or potential threats in the market.

Decision-Making Support: Market research reports serve as a valuable tool in decision-making processes. The comprehensive insights, data, and analysis provided in the reports help businesses make informed decisions regarding market entry, expansion, product development, pricing, and marketing strategies. Reports can minimize risks and uncertainties by providing a solid foundation of market intelligence.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Wind#Turbine#Operations#Maintenance#Market#Renewable Energy#Wind Power#Energy Industry#Wind Farm#Maintenance Services#Asset Management#Condition Monitoring#Predictive Maintenance#Reliability#Performance Optimization#O&M Costs#Offshore Wind#Onshore Wind#Turbine Inspection#Rotor Blade Maintenance#Gearbox Maintenance#Generator Maintenance#Turbine Upgrades#Maintenance Contracts#Remote Monitoring#Data Analytics#Environmental Impact#Sustainability.

1 note

·

View note

Text

A coalition of 30 mayors representing communities along the New Jersey coast are calling on federal lawmakers and officials to implement a moratorium on offshore wind development in response to a spate of whale deaths.

The mayors, who collectively represent 359,168 residents and communities with beaches that welcome millions of visitors, requested that federal and state agencies conduct a comprehensive analysis of the impact offshore wind construction and surveying equipment may have on marine wildlife. They argued such development should only continue if it is conclusively proven to not harm wildlife.

"The 30 undersigned mayors of New Jersey coastal communities stand united in their concern about the unprecedented number of whales that have washed ashore recently and call for an immediate moratorium on all offshore wind activities until an investigation is held by federal and state agencies that confidently determines these activities are not a contributing factor in the recent whale deaths," they wrote in a letter Tuesday.

"While we are not opposed to clean energy, we are concerned about the impacts these projects may already be having on our environment," they continued. "We again urge you to take action now to prevent future deaths from needlessly occurring on our shorelines."

UPTICK IN DEAD WHALES ALONG EAST COAST SPARKS INTENSE DEBATE AMONG ENVIRONMENTALISTS OVER OFFSHORE WIND

The letter was addressed to New Jersey Democratic Rep. Frank Pallone and Republican Reps. Chris Smith and Jeff Van Drew, all of whom represent coastal districts. It was also sent to Democratic Sens. Cory Booker and Bob Menendez. Copies of the letter were additionally sent to President Biden and Gov. Phil Murphy.

NJ CONGRESSMAN DEMANDS INVESTIGATION INTO WHETHER OFFSHORE WIND PROJECTS ARE KILLING WHALES

While Van Drew and Smith have echoed calls for a moratorium and investigation into the cause of recent whale deaths, Pallone, Booker and Menendez have largely been silent on the issue.

The letter comes amid an uptick in whale deaths in New Jersey and other states along the Atlantic coast including New York, Maryland and Virginia. At least 10 dead whales have beached in New Jersey and New York alone since December.

Last week, a 35-foot humpback whale washed up on a beach along the New Jersey coastline. Days later, a 25-foot whale was found dead in Rockaway Beach, New York. And three whales were discovered dead in southeastern Virginia in close proximity to an offshore wind farm within the span of seven days.

"Today, the whales are sending us a tragic message that demands transparency and accountability — both of which has been sorely missing from Governor Murphy’s plan to use New Jersey’s coast as the prime location for the offshore wind industry in the U.S.," Smith said on Sunday.

"Questions and concerns raised by me and many others have gone unanswered concerning the unexplained deaths of at least 10 whales."

The Republican congressman delivered the remarks at a rally held in Point Pleasant Beach, New Jersey, in opposition to offshore wind development until the whales' deaths were better understood. Hundreds of locals attended the rally to express their concerns.

Federal officials, meanwhile, have thrown cold water on claims that offshore wind is causing whale deaths. During a press briefing in January, officials with the National Oceanic and Atmospheric Administration noted there has been an unusual mortality event in relation to whale deaths along the East Coast dating back years and that recent whale deaths couldn't be attributed to energy operators.

14 notes

·

View notes

Text

America’s first large-scale offshore wind farms began sending power to the Northeast in early 2024, but a wave of wind farm project cancellations and rising costs have left many people with doubts about the industry’s future in the US.

Several big hitters, including Ørsted, Equinor, BP, and Avangrid, have canceled contracts or sought to renegotiate them in recent months. Pulling out meant the companies faced cancellation penalties ranging from $16 million to several hundred million dollars per project. It also resulted in Siemens Energy, the world’s largest maker of offshore wind turbines, anticipating financial losses in 2024 of around $2.2 billion.

Altogether, projects that had been canceled by the end of 2023 were expected to total more than 12 gigawatts of power, representing more than half of the capacity in the project pipeline.

So, what happened, and can the US offshore wind industry recover?

I lead the University of Massachusetts Lowell’s Center for Wind-Energy Science, Technology, and Research (WindSTAR) and Center for Energy Innovation, and follow the industry closely. The offshore wind industry’s troubles are complicated, but it’s far from dead in the US, and some policy changes may help it find firmer footing.

A Cascade of Approval Challenges

Getting offshore wind projects permitted and approved in the US takes years and is fraught with uncertainty for developers, more so than in Europe or Asia.

Before a company bids on a US project, the developer must plan the procurement of the entire wind farm, including making reservations to purchase components such as turbines and cables, construction equipment, and ships. The bid must also be cost-competitive, so companies have a tendency to bid low and not anticipate unexpected costs, which adds to financial uncertainty and risk.

The winning US bidder then purchases an expensive ocean lease, costing in the hundreds of millions of dollars. But it has no right to build a wind project yet.

Before starting to build, the developer must conduct site assessments to determine what kind of foundations are possible and identify the scale of the project. The developer must consummate an agreement to sell the power it produces, identify a point of interconnection to the power grid, and then prepare a construction and operation plan, which is subject to further environmental review. All of that takes about five years, and it’s only the beginning.

For a project to move forward, developers may need to secure dozens of permits from local, tribal, state, regional, and federal agencies. The federal Bureau of Ocean Energy Management, which has jurisdiction over leasing and management of the seabed, must consult with agencies that have regulatory responsibilities over different aspects in the ocean, such as the armed forces, Environmental Protection Agency, and National Marine Fisheries Service, as well as groups including commercial and recreational fishing, Indigenous groups, shipping, harbor managers, and property owners.

In December 2023, the majority of offshore wind power capacity was in China and Europe. The United States had just 42 megawatts, but it was about to launch two new wind farms. (Data source: WFO Global Wind Offshore Wind Report 2023.)

For Vineyard Wind I—which began sending power from five of its 62 planned wind turbines off Martha’s Vineyard in early 2024—the time from BOEM’s lease auction to getting its first electricity to the grid was about nine years.

Costs Balloon During Regulatory Delays

Until recently, these contracts didn’t include any mechanisms to adjust for rising supply costs during the long approval time, adding to the risk for developers.

From the time today’s projects were bid to the time they were approved for construction, the world dealt with the Covid-19 pandemic, inflation, global supply chain problems, increased financing costs, and the war in Ukraine. Steep increases in commodity prices, including for steel and copper as well as in construction and operating costs, made many contracts signed years earlier no longer financially viable.

Led by China and the UK, the world had 67,412 megawatts of offshore wind power capacity in operation by the end of 2023. (Source: WTO Global Offshore Wind Report.)

New and rebid contracts are now allowing for price adjustments after the environmental approvals have been given, which is making projects more attractive to developers in the US. Many of the companies that canceled projects are now rebidding.

The regulatory process is becoming more streamlined, but it still takes about six years, while other countries are building projects at a faster pace and larger scale.

Shipping Rules, Power Connections

Another significant hurdle for offshore wind development in the US involves a century-old law known as the Jones Act.

The Jones Act requires vessels carrying cargo between US points to be US-built, US-operated, and US-owned. It was written to boost the shipping industry after World War I. However, there are only three offshore wind turbine installation vessels in the world that are large enough for the turbines proposed for US projects, and none are compliant with the Jones Act.

That means wind turbine components must be transported by smaller barges from US ports and then installed by a foreign installation vessel waiting offshore, which raises the cost and likelihood of delays.

Dominion Energy is building a new ship, the Charybdis, that will comply with the Jones Act. But a typical offshore wind farm needs more than 25 different types of vessels—for crew transfers, surveying, environmental monitoring, cable-laying, heavy lifting, and many other roles.

The nation also lacks a well-trained workforce for manufacturing, construction, and operation of offshore wind farms.

For power to flow from offshore wind farms, the electricity grid also requires significant upgrades. The Department of Energy is working on regional transmission plans, but permitting will undoubtedly be slow.

Lawsuits and Disinfo

Numerous lawsuits from advocacy groups that oppose offshore wind projects have further slowed development.

Wealthy homeowners have tried to stop wind farms that might appear in their ocean view. Astroturfing groups that claim to be advocates of the environment, but are actually supported by fossil fuel industry interests, have launched disinformation campaigns.

In 2023, many Republican politicians and conservative groups immediately cast blame for whale deaths off the coast of New York and New Jersey on the offshore wind developers, but the evidence points instead to increased ship traffic collisions and entanglements with fishing gear.

Such disinformation can reduce public support and slow projects’ progress.

Just Keep Spinnin’

The Biden administration set a goal to install 30 gigawatts of offshore wind capacity by 2030, but recent estimates indicate that the actual number will be closer to half that.

Despite the challenges, developers have reason to move ahead.

The Inflation Reduction Act provides incentives, including federal tax credits for the development of clean energy projects and for developers that build port facilities in locations that previously relied on fossil fuel industries. Most coastal state governments are also facilitating projects by allowing for a price readjustment after environmental approvals have been given. They view offshore wind as an opportunity for economic growth.

These financial benefits can make building an offshore wind industry more attractive to companies that need market stability and a pipeline of projects to help lower costs—projects that can create jobs and boost economic growth and a cleaner environment.

8 notes

·

View notes

Text

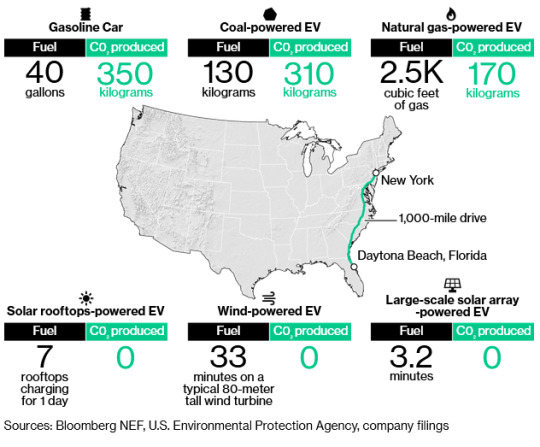

New Yorkers looking to escape the winter chill by driving to Daytona Beach, Florida, would use about 40 gallons of gasoline to traverse the 1,000 miles in a Chevrolet Impala.

Switch that gas guzzler out for an electron-eating EV and the equation changes. A Tesla Model S traveling the same distance would need power generated by about 2,500 cubic feet of natural gas, 286 pounds of coal or 33 minutes of blades spinning on a giant offshore wind turbine to make the same journey.

Gas Guzzlers to Electron Eaters

Electric vehicles have a wide range of fuel mileage options

As electric vehicles slowly become a bigger part of the global automobile fleet, questions about mileage and fuel efficiency are going to become more apposite. While there are multiple variables that can affect electric vehicle energy consumption, a Bloomberg NEF analysis illustrated some ballpark estimates to give drivers a better picture of what’s happening underneath the hood.

Coal

Taking that same 1,000-mile road trip in an electric vehicle that needs 33 kilowatt-hours of energy to travel 100 miles, like a Tesla Model S, would require about 286 pounds (130 kilograms) of coal to be burned at the local power plant. Modern coal plants only convert about 35 percent of the fuel’s energy into electricity, and about 10 percent of that electricity could be lost as it travels along power lines.

Even with all those losses, the electric vehicle road trip is still better for the climate than driving a gasoline-powered car. Burning that much coal would release about 310 kilograms of carbon dioxide into the atmosphere, compared with 350 kilograms by the 40 gallons of gasoline. Even though coal tends to emit more pollutants than oil for the amount of energy it generates, the efficiency of the electric vehicle, which recharges its battery with every brake, more than makes up the difference.

Natural Gas

A natural gas power plant producing the same amount of electricity would need to burn about 2,500 cubic feet of the fuel, enough to fill a small apartment in Hong Kong or a master bedroom in Dallas. Gas plants are more efficient than coal, typically converting about half the fuel’s energy into electricity. It’s also much cleaner, emitting just 170 kilograms of carbon dioxide for the 1,000-mile journey.

Solar

When it comes to charging electric vehicles with solar power, size matters. A typical 10-kilowatt rooftop array would need about seven days to create enough electricity for a 1,000-mile journey, as clouds and darkness mean it only operates at about 20 percent of its capacity on an average day.

Scale up to a photovoltaic power station, though, and it would take a matter of minutes, not days. At a modest-sized solar field like the 25-megawatt DeSoto Next Generation Solar Center in Florida, the average daily output would produce enough electricity for a 1,000-mile drive in less than four minutes.

Wind

Wind is a similar story, with different sizes of turbines producing different amounts of electricity. Take the Vestas V90-2.0 MW, an 80-meter tall behemoth that can be found swirling on the plains of West Texas, among other locations. Just one of these turbines, and wind farms are usually planted with dozens of them, produces enough electricity in a day to power a 1,000-mile trip every 33 minutes.

Calculating carbon emissions from wind and solar is a bit trickier. Neither emit any carbon dioxide in the course of producing electricity on a daily basis. But unless they’re paired with adequate energy storage -- and most existing renewable generation isn’t -- carbon-emitting generation has to make up for them whenever the sun isn’t shining or the wind isn’t blowing.

2 notes

·

View notes

Text

Excerpt from this story from Inside Climate News:

In the early 2000s, a long-time Louisiana engineer and entrepreneur thought it would be natural for the oil and gas industry in the Gulf of Mexico to expand into offshore wind. The industry could use the same workforce, the same shipyards and possibly even the same platforms to generate renewable power.

With designs, data and offshore leases from Texas, Herman Schellstede and his team planned to build a 62-turbine wind farm off Galveston’s coast— one of the first such proposals in the United States and the first in the Gulf of Mexico.

The team approached banks and even Koch Industries seeking financing for the $300 million wind farm, he said. But financing nascent offshore wind was apparently too risky a proposition in the wake of the 2008 financial meltdown. The wind farm was eventually scuttled.

Now, 33 years after the first offshore wind farm was built in waters off Denmark, it’s still unclear if the time is right — or will ever be right — for the United States. In those years, only four wind farms generating 242 megawatts of power have been built off the U.S. coast; the largest just went into service in 2024.

Last year, inflation, supply chain problems and other macroeconomic issues led to the cancellation or renegotiation of about half of all proposed offshore wind projects. And while the Biden Administration is moving as quickly as possible to approve new lease sales and projects — expanding the amount of power generated by 10-fold — former President Donald Trump has promised to end offshore wind if elected.

The industry and advocates, however, do not seem daunted. Studies show offshore wind could meet 5% of the nation’s energy needs by 2035, and up to 25% by 2050.

“We’re all in this room today, not because we just see offshore wind as a massive opportunity — which it is to build you clean energy — but also we see the necessity of offshore wind,” said Amanda Lefton, vice president of offshore development for the renewable energy company RWE.

Lefton, speaking at an April conference of the offshore wind industry in New Orleans, said the technology is needed to meet national and state decarbonization goals. RWE is developing projects off the East Coast and California and working to create a supply chain for offshore wind in the Gulf of Mexico with a large Louisiana-based coalition.

“We know the fundamentals exist in these markets,” said Lefton, the former head of the U.S. Bureau of Ocean Energy Management who leads RWE’s East Coast operations. “We know that it’s not an if, it’s a when.”

2 notes

·

View notes

Text

High Voltage Direct Current (HVDC) Transmission in Commercial Applications

High Voltage Direct Current (HVDC) technology has transformed the way electricity is transmitted, enabling efficient power transfer over long distances and across complex terrains. Its advantages over traditional Alternating Current (AC) systems make HVDC highly relevant for commercial applications. Here, we explore the fundamentals of HVDC, its benefits, and its applications while highlighting the crucial role of electrical contractors in Perth in implementing this cutting-edge technology to meet growing energy demands and sustainability objectives.

What is HVDC Transmission? HVDC transmission involves the use of high-voltage direct current to transport electricity. Unlike AC systems, which rely on alternating current, HVDC offers a constant current flow, resulting in greater efficiency and stability, particularly over long distances. It is especially beneficial in reducing energy losses and bridging power grids with differing frequencies or phases.

Essential Components of HVDC Systems

Converter Stations: Transform electricity between AC and DC formats for transmission and distribution.

Transmission Lines: Specialised cables or overhead lines designed to handle high-voltage DC.

Control Systems: Advanced systems that manage and optimise power flow efficiently.

Advantages of HVDC Transmission

Greater Efficiency HVDC systems experience significantly lower energy losses compared to AC systems, making them ideal for long-distance transmission where efficiency is critical.

Improved Grid Stability By allowing precise control of power flow, HVDC enhances grid stability and integrates renewable energy sources, such as solar and wind, ensuring consistent electricity supply.

Smaller Infrastructure Requirements Compared to AC systems, HVDC requires fewer cables to deliver the same power capacity, reducing land usage and environmental impact, a significant advantage for urban or ecologically sensitive areas.

Support for Renewable Energy As industries transition to sustainable energy, HVDC is crucial for transferring electricity from remote renewable sites to urban commercial hubs efficiently.

Interconnectivity of Power Grids HVDC enables seamless connections between grids with varying frequencies or phases, providing flexibility and reliability for industrial and commercial operations.

Commercial Applications of HVDC

Renewable Energy Transmission In Perth, large-scale solar and wind projects generate substantial electricity. HVDC ensures efficient delivery of this clean energy to commercial areas, offering businesses cost-effective and sustainable power.

Urban Power Solutions Compact HVDC systems are ideal for underground transmission in densely populated commercial zones, where space constraints and energy efficiency are priorities.

Industrial Power Supply For industrial parks and manufacturing facilities, HVDC provides the reliable, high-capacity power needed to maintain productivity and minimise downtime.

Offshore Energy Transfer Perth’s offshore industries, including wind farms and oil extraction facilities, benefit from HVDC’s ability to transport electricity efficiently to onshore commercial centres.

Interstate Energy Transfers HVDC enables the transfer of electricity between states or countries, ensuring Perth’s commercial sector can access supplementary power during high-demand periods or emergencies.

Role of Electrical Contractors in Perth Specialised expertise is essential for the successful implementation and maintenance of HVDC systems. Electrical contractors in Perth provide end-to-end services for HVDC projects, from feasibility studies to system design, installation, and ongoing maintenance.

Key Services Offered by Electrical Contractors

Feasibility Assessments: Evaluating HVDC suitability for specific commercial needs.

Custom System Design: Creating HVDC solutions tailored to business requirements.

Seamless Installation: Ensuring proper setup of cables, converter stations, and controls.

Maintenance and Upgrades: Providing routine servicing and incorporating technological advancements to keep systems optimised.

Electrical contractors also play a critical role in educating businesses about HVDC benefits, enabling informed decisions on energy solutions.

Benefits for Perth’s Commercial Sector

Cost Efficiency Lower transmission losses result in reduced energy costs, which is particularly advantageous for energy-intensive businesses.

Environmental Benefits HVDC supports Perth’s renewable energy goals by integrating sustainable energy sources, reducing carbon emissions, and aligning with corporate environmental objectives.

Reliability For operations requiring uninterrupted power, HVDC ensures stable electricity supply with fewer disruptions.

Future-Proofing Energy Systems As demand grows and technology evolves, HVDC systems position commercial facilities to adapt to higher energy capacities and renewable sources.

The Future of HVDC Technology HVDC transmission marks a significant advancement in electricity delivery for commercial and industrial sectors. Its combination of efficiency, sustainability, and reliability ensures its importance for modern businesses. As Perth's commercial landscape continues to expand and embrace renewable energy, HVDC will play an increasingly pivotal role.

Conclusion High Voltage Direct Current (HVDC) technology offers substantial benefits for Perth’s commercial sector, including energy efficiency, cost reduction, and renewable energy integration. By partnering with experienced electrical contractors in Perth, businesses can leverage HVDC to optimise their energy needs while contributing to a sustainable future. For tailored solutions, consult a trusted Perth-based electrical contractor today and take the first step toward energy efficiency and long-term reliability.

https://primetimewa.com.au/blog/high-voltage-direct-current-hvdc-transmission-in-commercial-applications/

0 notes