#Notary App

Explore tagged Tumblr posts

Text

How You Can Make Your Notary Business Recession Proof?

Notaries play a vital role in ensuring the trust and legality of essential transactions by verifying documents. However, the looming possibility of a recession can create uncertainty for businesses in the notary public sector, as the demand for notarial services can decline during economic downturns. It can present challenges for companies in this field, as they may need to adapt their services or operations to meet the changing needs of their clients.

Our article focuses on how you can make your notary business recession-proof. It will give you insights into strengthening your notary business by understanding the potential impact of a recession. In addition, we will guide you on what steps you should take to remain competitive. This article will ensure you remain resilient and successful even in tough economic times. Let’s get started.

Economic Factors Affecting The Loan Signing Business:

The loan signing business is intricately tied to the overall economic environment, which revolves around real estate transactions and lending activities. To understand how notaries can make money in a recession, you should first know the factors affecting the notary business. Several economic factors can significantly influence the demand for loan signing services and the overall success of this business. Below, we’ll explore these factors in detail:

Federal Interest Rates: Interest rates decided and modified by the American Federal Reserve Board profoundly impact borrowing and lending. Federal interest rate changes can positively and negatively affect your notary business. To make your notary business recession-proof, you must pay close attention to the changes in interest rates. When interest rates are low, borrowing becomes cheaper, increasing mortgage applications and refinancing activities. As a result, loan signing agents experience a surge in demand to facilitate these transactions. In contrast, borrowing becomes more expensive at high-interest rates, leading to reduced loan activity and a decline in the demand for notaries.

Housing Market Condition: The housing market is closely linked with the economy, and a recession can significantly impact this sector. When the economy is booming, the demand for the housing market increases. On the other hand, during a recession, the need for the housing market declines. The overall condition of the housing market can play a vital role in making your notary business recession-proof. During a booming real estate market, there tends to be a higher volume of property sales and new mortgage applications. This increased activity creates more opportunities for loan signing agents. However, in a sluggish housing market or during a housing market downturn, the number of transactions may decrease, impacting the demand for loan signing services.

The Rate Of Capital Injection: Notary businesses in a recession can also be influenced by the capital injected from the Fed Reserve. When there is more capital in the market, people tend to be more active in buying and selling property. As a result, the demand for notary services also increases, as people need to have their documents notarized before closing on a property. On the other hand, when the rate of capital injection into the market slows down, the demand for notary services may also decrease. It is because people are less likely to buy and sell property during a recession. To make your business recession-proof, you must find other revenue sources, such as providing estate planning services or remote online notarization (RON).

Unemployment Rates: Economic downturns often coincide with higher unemployment rates, directly impacting the notary business. A rise in joblessness may lead to fewer people qualifying for mortgages or seeking refinancing, resulting in reduced loan signings. Conversely, during periods of low unemployment and economic stability, there is likely to be more activity in the real estate market. It can lead to increased demand for loan signing services.

Business Closures: Small businesses, including notary signing businesses, may face financial challenges during a recession. Some may even be forced to close their doors due to decreased demand and financial strain, further impacting the market’s overall availability of notary services.

Read More: Make Your Notary Business Profitable In A Recession

#notary business#closewise#notary tool#notary app#notary software#online notary platform#notary accounting software#find a notary signing agent#mobile notary app

0 notes

Text

Go.

Square building, carbon copy, different sign A pair of smokers ashing outside of the sliding door Parking lot lights catching the mist up high Budgeted 75 bucks, and for one night, that's fine

Checked in alone, I just need the one key The desk has another useless bible from the Gideons Creased, dog-eared menu for the local pizza chain ESPN2 on mute on the tiny flat screen TV

This used to be our escape, our idyllic sanctuary We'd play, laughing like frisky, drunken teens Simple rooms that were somehow now glamourous, foreign Shower, sex, those white robes, and good, deep sleep

I drive alone on these September days Two-lane highway, I-something-or-other, for miles and miles Handling the wheel, I notice swelling on my forearm skin It must be the hornet's sting of going our separate ways

You can't describe the distaste I had for signing my name Times New Roman on another form needing a notary My life divvied up into paragraphs, the kid with you Seven letters of failure, I collapsed in the second half of the game

And now I get to choose the playlists that I hear Petite relief, I suppose... some Queen, some Stone Roses, Blur My wheels rolling by another truck rest area every hour or so My own destination... somewhere; never clear, never near

Where am I going? That weighty, existential question — I don't know Crossed so many state lines, I've lost count, maybe 30 The Maps app lets me know, welcomes me every time Without you in the passenger seat, I just go.

Go.

#poem#poetry#poetry portal#smittenbypoetry#writtenconsiderations#writerscreed#twc#twc poetry#quality

18 notes

·

View notes

Text

Soy Argentino y me preguntan tengo dólares en el banco, un banco de acá argentina, me puede el gobierno quitar o congelar mis dólares en bancos, aquí, de argentina?

Pues no, y no es que jurídicamente no puede, sino que tiene más que ver con el sistema financiero, el caso, tengo dejar y el gobierno decide que quitármelos en forma de depósitos que se congelarán para su uso y se me devolverá en un Futuro tal vez con una renta, o también, forzar el cambio o la venta de este divisa por moneda local. Bueno, esto es imposible por la no existencia de un banco público, o, dinero público se entienda. Habrá que hacer unas distinciones (1) existe un banco único y sistema único o unitario o monetario, el banco central o de reserva ( hasta acá no dijimos público)(2) gestores privados asociados y afiliados a este banco único y sistema monetario unitario que hacen las gestiones comerciales y gestiones administrativas referentes a esas gestiones comerciales (acá está lo público) (3) y se diferencia por si, un sector o base de moneda o dinero público, que es la nóminas o el presupuesto notarial guardado en el banco de reserva y una base de consumo que está en las nóminas notariales de lo tenedores o dueños de las cuentas particulares. Por supuesto todo no se puede tocar porque no tienen la clave de cuenta sino a lo sumo puede extenuante presupuesto a un notario corredor cuenta, o departamento o departamental destinatario de ese presupuesto, ahora, no me lo pueden sacar pero pueden ser congelado para su uso, bien al ser en este caso divisa en cuenta particular en monetario de consumo o por gestores, se encuentra allí, en el monetario de consumo, con lo que no puede utilizarlo, ni cambiarlo por no estar el dinero en el banco público, solo se puede congelar por embargo, Pero no se puede mover el dinero notarial departamental particular al banco de reserva o público. Ahora, si se embarga o gerencia el banco gestor, es posible? Si se embarga audita la cuenta de banco gestor? Bien, no ya que el banco es central y no público, y los gestores no están asociados al banco central, así que si los particular no hacen una transferencia no es posible intentar una transferencia de un gestor ya que este no tiene la clave valores nominales de las cuentas particulares

Así que (1) las divisas están en cuentas particulares como notas o peor como notas monedas o vales pagaré con lo que no puede retrasar el plazo congelando o en deposita de pago, porque no está en el banco de reserva monetario público sino en el monetario consumo perteneciente al particular y si no se transfiero no hay uso posible y el embargo solo impide la utilización. (2) Los gestores no están asociados al banco central por lo que los valores de divisas no están en las cuentas de públicas sino en las particulares por lo que la utilización y demora de pago en divisas para el uso también es una imposibilidad. Así el cambio o el congelamiento es imposible, solo el embargo para en mediación obtener un resultado.

Cuando la divisa está en el mercado monetario de consumo o interno o de gestores, no es posible un congelamiento o cese de pago o cambio nóminal como compensación de cese de pago o bono, me lo vas a decir a mi

Se bloquea tarjeta y se actúa en entidad tarjeta no va a la cuenta

Todo embargo actúa sobre el retiro no tenencia, actúa sobre la tarjeta no sobre la cuenta, las app actúan bajo una asociación tarjeta cuenta por lo del seguro y seguridad y temas de transferencia, pero si en caso si podría irse a caja y solicitar transferencia, si fuera se pondrían cargos penales y orden de arresto, para luego de la notificación bancaria. Tal vez en el acto según el lugar, según la autoridad que haya, si tarda muy tiempo y hurga con los dedos debajo del escritorio, ya sabes. No te paran, no te dicen nada, te dejan hacerlo y luego jass, y es que otra no pueden, ya te lo dijeron, si es una jurisprudencia penal que dictó pena

0 notes

Text

CloseWise Notary Software helps you manage and grow your notary business with ease. From a mobile app to easy accounting tools and automated systems, CloseWise has everything you need in one place. Start your free trial today and see how our simple, affordable tools can save you time and help your business grow.

1 note

·

View note

Video

youtube

Amazing Monster Device: AMD ROG Flow Z13 (2025) 💻 | Aesthetic Unboxing

DEAR - KOREAN - GIRLS,

MY - TOTAL - CAPITAL ONE, N.A.

T - $967.05

ULTRA - MOBILE

SWITCHING - FR - 10 GB

NOW - PAID - $19.51

YOUR - PAYMENT - DATE

DOESN’T - CHANGE

FR - AUTO - RENEW - $3

BECOMES - AUTO - RENEW - $5

WITH - GOOD - ENOUGH - 4 - US

ULTRA - UNLIMITED

5G - 4G LTE

SAMSUNG - GALAXY - A 13 - 5 G

BEST - 2 YEARS - BUDGET - TEL

SMARTPHONE - ANDROID

REFURBISHED - AMAZON PRIME

THE - BEST - EVER

MAGNIFICENT

BUYING - DIFFERENT - KINDS

OF - SAMSUNG - GALAXY

SOUTH - KOREA

FOLDABLE

LARGER ...

DEPENDS - ON - COSTS

PRINTING - SHIRTS

TAX - FREE - HONG KONG ISLAND

OVER - $10 MILLION - EVERY 3 MO

EVERY - 3 MONTHS

ORGANIC - COTTON

BEST - POLYESTER

AFFORDABLE - WOOL

4 SEASON

SELLING - PRINTED - 2 - ME

$1.00 - TAXES - INCLUDED

FREE - DESIGNING - 4 ME

MY - WEBSITE - FREE

MY - MOBILE - APP - FREE

OVERNIGHT - FREE

WORLD - USA

FREE - SHIPPING

I’M - SELLING - WITH - TAX

$5.00 - EACH - SHIRT

FREE - CUSTOMIZATION

NOT AVAILABLE - PRINTFUL

WIX - $43 - BUSINESS PLAN

FREE - MERCHANT - ACCOUNT

NO - MORE - FEES

AMEX - 3.7% - AND - $0.30

PER - ORDER

I - SHOULD - MAKE

$10 MILLION - EVERY - 3 MONTHS

GUARANTEED - NEXT - DYA

HAVEN’T - RECEIVED ?

FULL - REFUND - LESS THAN 3 MIN

ONCE - ITEM - RECEIVED - KEEP IT

RETURNS ?

ANY - REASON - KEEP - THE - ITEM

FULL - REFUND - LESS - THAN 3 MIN

JESUS - IS - LORD

SHIRTS - SWEATSHIRTS - HOODS

BIBLE - VERSES - ALSO - MANY - 2

CAN’T - WAIT

ULTRA - MOBILE

SELLER - AT - AMAZON

BY - MINT MOBILE - RYAN REYNOLDS

RECOVERY FEE - $1.00 - BOTH PLANS

MONTH - SINGLE - $49

AUTO - RENEW - $5

MY - DUES - LESS - NOW

10 MARCH - PAID - IN - ADVANCE

PAID - $45.66

BOTH CREDITED - AT - CAPITAL ONE APP

TRANSFERRED - $1.00 - FOR - SAVINGS 2

PAID - CREDITING - LATER - ON

CAPITAL ONE - CREDIT CARD - MC

MY - LOWEST

PAID - $25.50

MY - CARD - UPDATED - AVAILABLE

$25.00 - JESUS - IS - LORD

TOTAL - $875.38

TOO - LATE - 4 - CHONG’s - CHINESE

RESTAURANT - HEADED - SOON - TO

SAZON - CATRACHO

$10 - $20

HONDURAS - FOOD

EXCITED

GETTING - MY - TOTALS

SHOULD - HAVE - MADE - A - COPY

MADE - A - MISTAKE - WITH

UPS - STORE - MAILBOX - APPLICATION

REPEATING - THERE ...

VERY - SIMPLE

APPLICATION - 4 - BUSINESS - OR - ME

PERSONAL - WHY - LONG ...

ALSO - IF - YOU - HAVE - YOUR - COUSIN

PICKING - IT - UP - THEIR - INFO

ID - AND - ALL ...

WHY - LONG - APPLICATION

SIGNING - THERE

AGENT - OF - UPS - OR - NOTARY PUBLIC

SO - REAL - FAST - APPLICATION

HAD - 2 - MAKE - MISTAKE

SOLUTION

READ - MANY - THINGS - FIRST ?

SO - USING - RESTROOM - FIRST

THEN - ADDING - SUBTRACTING

ROSS - $29.99 - NEED - ANOTHER

DUFFLE - BAG - A - BLK - SEGUNO

REAL - WONDERFUL - PEOPLE

I - SHOULD - RECEIVE - AS

AGE 55 - AND - OLDER

ON - TUESDAYS - MY - SSI

DISABILITY

SURVIVORS - OVER - $12,700

ONE - ARM

ONE - LEG

ONE - FOOT

VETERANS - SAME ...

WE - SHOULD - RECEIVE - OUR

MONEY - FR - US TREASURY

AS - AGE 55 AND OLDER

ON - TUESDAYS

REGISTER - YOUR

ROSS - DRESS - FOR - LESS

GET - SSI - TUESDAYS SAME

WEEK ...

THEY’RE - SO - RUDE

AS - AMERICAN - AGE 249

MY - SUGGESTION - LATER

PRES - TRUMP

AMERICA - FROM - ITALIAN

EXPLORER - AMERIGO VESPUCCIO

INSTEAD - OF - AMERICA - AGAIN - 2

MAYBE - BECAUSE - HE - DID - IT ...

REPUBLICAN - PARTY

SHORTER - NAMES ?

INSTEAD - OF - LONG

GULF - OF - AMERICA

HOW - ABOUT - TRIUMPH GULF

SHORTER - BETTER

FR - AMERIGO VESPUCCIO ?

SOMETHING - 4 - REPUBLICANS

SO - RESTROOM - NEXT

BUYING - MY - AMAZON - PRIME

BIG - AMOUNT ... DECIDING ...

WIX - $43

FLODESK - EMAIL - MARKETING

LANDING - PAGES - $38

KITTLE - $30

THE - UPS - STORE

3 MONTHS

DEPOSIT - LOWEST

$35.00

TOTAL - $175.48

THEY - THINK - THAT’s - COOL

PUBLIX - STORAGE - $97.28

DOWNTOWN - MIAMI

THE - UPS STORE

CALLING - 26 MAY - $138

COINS - FORGIVEN

EVERY - 3 MONTHS

BUT - AMAZON - PRIME

MORE - AND - MORE

HEAVY - PRODUCTS

MOUSE - HAIR - BLEACH

HAZARDOUS - MATERIAL

CREATIVE - FABRICA

UNLIMITED - 01 MAY - $47.00

SO - CALCULATING - AFTER

PURCHASING - PRIME - YES

HUB LOCKER

LUAN

ROSS DRESS 4 LESS

N MIAMI AVE

MY - LAUNDRY - NEEDS

$4.70

$4.45

DRYER - $2.90 - $3.90

NO - MORE - COINS

FR - CREDIT CARD - DEBIT

24 HRS

SO - DOING - A FEW THINGS

AFTER - EATING

HEADED - 2 - STORAGE

LEAVE - THINGS

GETTING - MY - NATURALIZATION

CERTIFICATE

DOING - PAPER - AGAIN ...

PAYING - $175.48

INSTEAD - OF - EATING - EATING

UNITED STATES

LIKE - LEECH - BLOOD - REMOVED

WHEN - BITTEN - AS - BUG BECOMES

LARGER - LONGER

LIGHT - IT - UP

USB - CANDLE - LIGHTER

COMES - OFF - AFTER TOO

BIBLE - GOD - WILL - RESTORE - 2 US

YEARS - LOST - 2 - US - BECAUSE OF

CONSUMING - LOCUSTS

CRAWLING - LOCUSTS

JESUS - IS - LORD

DEAR - KOREAN - GIRLS,

DID - YOU - LOVE - MY - NEW

SONGWRITING - SKILLS WAS

CRYING - FR - SONGS - FR

UNTIL - MIDNIGHT

STAR FM - MANILA

102.7 FM

EVEN - GAVE - PRAYER

SAFETY - FOR - EVERYONE

BEST - AMERICAN - LOVE

SONGS

TONI BRAXTON

JESUS IS LORD

0 notes

Text

Online Notary Services: Convenient and Secure Legal Assistance

In today’s fast-paced world, online notary services offer a modern, convenient way to handle legal document notarization without the need to visit a physical office. Whether you need to sign a contract, power of attorney, or affidavit, online notarization allows you to complete the process from the comfort of your home or office.

Online notary services leverage video conferencing technology to connect clients with licensed notaries who are authorized to witness signatures, verify identities, and administer oaths. Through secure, encrypted platforms, notaries ensure the authenticity of the documents while adhering to state and federal regulations. This means you can complete essential transactions with the same legal standing as traditional in-person notarization, but with greater flexibility.

One of the biggest benefits of online notary services is their convenience. You can access notary services anytime, from anywhere, as long as you have an internet connection. This is especially helpful for individuals with busy schedules, those in remote areas, or people who need notarization for time-sensitive documents. Many online notary platforms also offer mobile apps, making the process even easier.

Another advantage is the security and transparency of online notarization. Notaries often record video sessions, creating a secure audit trail that ensures the integrity of the process. Plus, online notary services are generally more affordable than in-person options due to lower overhead costs.

In conclusion, online notary services provide a streamlined, accessible solution for all your notarization needs, offering convenience, security, and compliance with legal standards.

0 notes

Text

Are There Any Specific Tools or Software Recommended for Apostille Agents?

If you’re dealing with international clients, you might encounter documents in languages you don’t understand. While hiring a professional translator is the best option, apps like iTranslate or Google Translate can be handy for quick checks. Similarly, apps like NotaryCam provide virtual notarization services, which can complement your apostille offerings. Some notary apostille schools even recommend these apps during training, so you may already be familiar with them if you’ve taken a course.

0 notes

Text

Obtaining a Dubai Police Clearance Certificate: Your Guide to the Process

A Police Clearance Certificate (PCC) from Dubai, also known as a Good Standing Certificate, is an official document issued by the Dubai Police Department to confirm that an individual has no criminal record in the UAE. This certificate is often required for employment, immigration, education, and residency purposes, both locally and internationally. In this article, we’ll explore the Dubai PCC process, its purpose, and the importance of certificate attestation when using a UAE PCC abroad.

What is a Dubai Police Clearance Certificate?

A Dubai Police Clearance Certificate is an official document that verifies an individual's background with respect to criminal activity or lack thereof in Dubai. It serves as proof of a clean criminal record and is commonly requested by employers, immigration authorities, and academic institutions as a testament to the individual’s good conduct. A Good Standing Certificate in Dubai is not only a mark of an individual’s integrity but also a mandatory requirement in many cases, especially for expatriates seeking residence or employment outside the UAE.

Importance of a Police Clearance Certificate (PCC)

The UAE PCC, especially the Dubai PCC, is highly regarded globally and is often a prerequisite for:

- Employment: Many employers, both in the UAE and internationally, require a PCC as part of the hiring process to ensure that candidates have a clean criminal background.

- Immigration and Visa Processes: Countries like Canada, Australia, the UK, and the USA often require a police clearance certificate from Dubai for UAE residents applying for immigration or long-term visas.

- Higher Education: Students seeking admission to universities abroad may be asked to provide a Dubai PCC as part of their application to prove they have no criminal record.

- Residency and Family Visas: Individuals applying for family visas or residency in Dubai or other UAE emirates might need a PCC as part of the approval process.

How to Apply for a Dubai Police Clearance Certificate

Obtaining a Dubai PCC is relatively straightforward, thanks to the Dubai Police’s online systems and mobile applications, which allow applicants to submit requests quickly. Here’s a step-by-step guide to applying for a Dubai PCC:

1. Create a Request: You can apply for the Dubai PCC through the Dubai Police website, mobile app, or at a police station. For UAE residents, both online and in-person options are available, while non-residents will need to apply online.

2. Submit Documents: To apply, you’ll need to provide essential documents, including a copy of your Emirates ID (if residing in the UAE), passport copy, fingerprints (for non-residents), a passport-size photograph, and your previous UAE visa if you are no longer in the UAE.

3. Pay the Fees: The fee for a Dubai Police Clearance Certificate varies depending on your current residency status and the urgency of the request. Online platforms usually accept major credit cards, making the process seamless.

4. Verification and Processing: Once your application and documents are submitted, the Dubai Police will verify the information. The processing time typically ranges from a few days to a week, though expedited services may be available for an additional fee.

5. Receive the Certificate: After processing, you can receive the Dubai PCC electronically, either by downloading it from the Dubai Police website or app, or request a physical copy, which can be collected in person or delivered.

Certificate Attestation for Dubai PCC

When using your Dubai PCC internationally, certificate attestation may be required to validate the document in foreign countries. Certificate attestation is an authentication process that verifies the authenticity of a document. For a Dubai PCC, the following steps are generally required for attestation:

1. Notary Attestation: The document may first need to be notarized by a local notary authority.

2. MOFA Attestation: In the UAE, the Ministry of Foreign Affairs (MOFA) attests documents for international use.

3. Embassy Attestation: The embassy or consulate of the destination country in the UAE typically performs the final attestation.

This authentication process ensures that the Dubai Police Clearance Certificate is legally recognized abroad, making it a valid document for use in immigration, employment, and legal processes.

Common Challenges in Obtaining a Dubai PCC

While the application process for a Dubai PCC is streamlined, certain factors can lead to delays or complications. Common issues include incorrect documentation, delayed verification for applicants outside the UAE, and lack of attestation awareness, which can result in rejected applications abroad. Applicants are advised to double-check all documentation and consult professionals if necessary, especially for complicated cases requiring specific attestations for overseas use.

Securing a Dubai Police Clearance Certificate is an essential step for anyone who needs a verified record of their good standing in the UAE, especially when dealing with legal, educational, or employment processes internationally. A thorough understanding of the application and attestation processes is critical for a smooth experience. For reliable assistance with the Dubai PCC application and attestation, Helpline Groups provides professional support, ensuring that your Police Clearance Certificate is recognized and ready for international use.

0 notes

Text

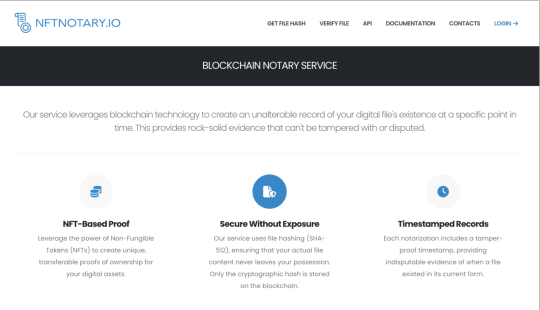

🌐 BLOCKCHAIN NOTARY SERVICE 🌐

Unlock the future of digital asset management with our innovative blockchain notary service https://nftnotary.io/ ! Our platform harnesses the power of blockchain technology to create an unalterable record of your digital file's existence at a specific point in time. This provides rock-solid evidence that is tamper-proof and indisputable. 💪✨

🔹 NFT-Based Proof Leverage the incredible capabilities of Non-Fungible Tokens (NFTs) to establish unique, transferable proofs of ownership for your digital assets. Each NFT serves as a digital certificate, validating your ownership like never before! 🎟

🔹 Secure Without Exposure Rest assured, your actual file content never leaves your possession. Our service uses file hashing (SHA-512), meaning only the cryptographic hash is securely stored on the blockchain 🔒. Your privacy is our priority!

🔹 Timestamped Records Every notarization comes with a tamper-proof timestamp, providing indisputable evidence of when a file existed in its current form. ⏰ Trust in the authenticity of your records!

🔹 Notarize Any Digital File Whether it's a document, image, video, or any other digital file, our service can create a blockchain-verified record of its existence and your ownership. 📄📸🎥

🔹 Simple Proof Checking Verify the authenticity and ownership of any registered file instantly, anytime, anywhere, using our user-friendly verification portal. 🔍✨

🔹 Easy Integration Seamlessly integrate our notary service into your existing workflows with our comprehensive API, enabling automated certification processes. 🤖📈

Web App & API Our web app streamlines the process of creating and managing notarized NFTs, making it ideal for businesses and individuals handling large volumes of digital assets. 💼

Affordable Pricing: With a minimum payment of just $10 and NFT prices starting from as low as $0.20 each, managing your digital assets has never been more economical! 💵 API Integration: Effortlessly integrate with your existing systems for automated NFT generation and management.

Customizable Templates: Create and manage templates for certificate PDFs and NFT images for consistent branding. 🖼

Export Functionality: Easily export created NFTs and their details to Excel or PDF for record-keeping and reporting. 📊

Free NFT: Register and notarize one digital file for free—only your email is required for registration! 🎉

Native Apps Experience the power of blockchain notarization on the go with our suite of native apps! 📲 Available for mobile devices, WeChat, Telegram, and more, these streamlined applications offer a hassle-free way to create and manage your NFTs.

Simplified Interface: Our native apps feature an intuitive UI designed for quick and easy NFT creation, even for those new to blockchain technology. 🌟 No Registration: Jump straight into creating NFTs without lengthy sign-up processes. Your blockchain wallet is all you need! 💼

Affordable Pricing: Create NFTs starting from just $1 each, making it cost-effective for individual users.

Step into the future with us and take control of your digital assets today https://nftnotary.io/ ! 🚀✨

#Blockchain#NotaryService#NFT#DigitalAssets#SecureRecords#Timestamp#FileVerification#APIs#MobileApps#WeChat#Telegram#Crypto#AffordableNFTs#DigitalOwnership#Innovation#TechForGood

0 notes

Text

🌐 BLOCKCHAIN NOTARY SERVICE 🌐

Unlock the future of digital asset management with our innovative blockchain notary service https://nftnotary.io/ ! Our platform harnesses the power of blockchain technology to create an unalterable record of your digital file's existence at a specific point in time. This provides rock-solid evidence that is tamper-proof and indisputable. 💪✨

🔹 NFT-Based Proof Leverage the incredible capabilities of Non-Fungible Tokens (NFTs) to establish unique, transferable proofs of ownership for your digital assets. Each NFT serves as a digital certificate, validating your ownership like never before! 🎟

🔹 Secure Without Exposure Rest assured, your actual file content never leaves your possession. Our service uses file hashing (SHA-512), meaning only the cryptographic hash is securely stored on the blockchain 🔒. Your privacy is our priority!

🔹 Timestamped Records Every notarization comes with a tamper-proof timestamp, providing indisputable evidence of when a file existed in its current form. ⏰ Trust in the authenticity of your records!

🔹 Notarize Any Digital File Whether it's a document, image, video, or any other digital file, our service can create a blockchain-verified record of its existence and your ownership. 📄📸🎥

🔹 Simple Proof Checking Verify the authenticity and ownership of any registered file instantly, anytime, anywhere, using our user-friendly verification portal. 🔍✨

🔹 Easy Integration Seamlessly integrate our notary service into your existing workflows with our comprehensive API, enabling automated certification processes. 🤖📈

Web App & API Our web app streamlines the process of creating and managing notarized NFTs, making it ideal for businesses and individuals handling large volumes of digital assets. 💼

Affordable Pricing: With a minimum payment of just $10 and NFT prices starting from as low as $0.20 each, managing your digital assets has never been more economical! 💵 API Integration: Effortlessly integrate with your existing systems for automated NFT generation and management.

Customizable Templates: Create and manage templates for certificate PDFs and NFT images for consistent branding. 🖼

Export Functionality: Easily export created NFTs and their details to Excel or PDF for record-keeping and reporting. 📊

Free NFT: Register and notarize one digital file for free—only your email is required for registration! 🎉

Native Apps Experience the power of blockchain notarization on the go with our suite of native apps! 📲 Available for mobile devices, WeChat, Telegram, and more, these streamlined applications offer a hassle-free way to create and manage your NFTs.

Simplified Interface: Our native apps feature an intuitive UI designed for quick and easy NFT creation, even for those new to blockchain technology. 🌟 No Registration: Jump straight into creating NFTs without lengthy sign-up processes. Your blockchain wallet is all you need! 💼

Affordable Pricing: Create NFTs starting from just $1 each, making it cost-effective for individual users.

Step into the future with us and take control of your digital assets today https://nftnotary.io/ ! 🚀✨

#Blockchain#NotaryService#NFT#DigitalAssets#SecureRecords#Timestamp#FileVerification#APIs#MobileApps#WeChat#Telegram#Crypto#AffordableNFTs#DigitalOwnership#Innovation#TechForGood

0 notes

Text

Tax Write Offs For Notaries: Tips To Maximize Tax Deductions For Notary Signing Agents

Tax season can feel overwhelming, especially when deciphering the complicated IRS forms and rules. As signing agents, you’re no stranger to dealing with official documents, but tax forms can be a new ball game. Understanding that income taxes apply while you may be exempt from self-employment tax on your notary fees is crucial. And if you earn income as a signing agent, self-employment taxes come into play. But fear not because we’re here to ease your worries and help you save thousands of dollars! We have the information you need to understand the tax write-offs for notaries and ensure you make the most out of it. Instead of feeling overwhelmed, take a moment to breathe and read on.

Unlocking Tax Savings – Major Deductible Expenses For A Notary

You can use several major tax write-offs for notaries to reduce taxable income. Let’s look at them in detail:

#1 Self-Employed Tax:

As a self-employed notary signing agent, it’s important to understand how self-employment tax can impact your overall tax liability. Notary fees, although taxable income, are exempt from self-employment tax.

Let’s break it down with an example. Imagine you had a successful year in your notarial services business, earning $9,000. Of that amount, $2,000 can be attributed to fees earned for specific notarial acts like acknowledgments or oaths/affirmations. The fascinating part is that this $2,000 is exempt from self-employment tax! However, the remaining $7,000 would still be subject to self-employment tax.

It’s worth noting that if your self-employed net earnings are less than $400, you won’t be required to pay self-employment tax, per the instructions provided by the Internal Revenue Service (IRS). Understanding these nuances can make a real difference in managing your tax obligations as a self-employed notary.

#2 Office Expenses Deductions:

Keeping track of your Office expenses is important to maximize your tax deductions as a notary. According to IRS guidelines, you can deduct costs for maintaining an office space exclusively for your notary business. Here are the office expenses that can be deducted for notary business owners, as per IRS guidelines:

Rent or mortgage payments for the office space

Utilities such as electricity and water

Internet and telephone bills

Office supplies like paper, ink, pens, and stamps

You should remember that these expenses must be directly related to your notary business and necessary for its operation. So, remember to keep all statements and receipts as proof for your claims. Utilizing the office expenses deductions allows you to maximize your tax savings as a notary.

Read More: How To Maximize Your Tax Deductions As A Notary Public

#notary accounting software#Mobile Notary Software#Notary Accounting Software#Online Notary Platform#Notary Software#Notary App#Find A Notary Signing Agent#Mobile Notary App#online notary software

0 notes

Link

0 notes

Text

The Future of Notary Services: Why Mobile Notarization is Here to Stay

The notary service industry has seen significant changes in recent years, adapting to the evolving needs of modern clients. Traditional notary services, once bound to specific locations and business hours, are now being transformed by the advent of mobile notarization. This innovative approach offers a level of convenience and flexibility that was previously unimaginable. For those looking for a notary public in Alexandria, VA, mobile notarization provides an accessible and practical solution that meets today’s fast-paced lifestyle.

Understanding Mobile Notarization

Mobile notarization is a service where a licensed notary public travels to the client's location to perform notarial acts. Unlike traditional notary services, which require individuals to visit an office or designated location, mobile notarization offers the convenience of having the notary come to you. This flexibility is particularly beneficial for individuals who may have mobility issues, busy schedules, or simply prefer the convenience of completing transactions from the comfort of their home or office.

The Growing Demand for Mobile Notarization

The demand for mobile notarization has surged in recent years, driven by the need for more convenient and accessible services. The COVID-19 pandemic accelerated the adoption of remote services across various industries, including notarization. As people became accustomed to virtual meetings and online transactions, the appeal of mobile notarization grew significantly. It allows clients to schedule notarizations at their convenience, without the need to navigate traffic, find parking, or adhere to traditional business hours. This flexibility has made mobile notarization an essential service for those who value their time and seek hassle-free solutions.

Key Benefits of Mobile Notarization

One of the primary benefits of mobile notarization is its accessibility. It is particularly advantageous for individuals with mobility challenges or those living in remote areas where traditional notary services may be hard to reach. Mobile notarization is also a time-saving option, allowing clients to complete necessary legal documents quickly and efficiently, without the need for travel. Additionally, mobile notarization services are secure and legally compliant, ensuring that all notarizations are conducted according to state laws and regulations.

Technological Advancements in Mobile Notarization

The rise of mobile notarization has been supported by advancements in digital tools and applications. Many mobile notaries now use secure apps to manage appointments, verify client identities, and store records. The integration of digital technology has streamlined the notarization process, making it more efficient and reliable. Cybersecurity is a critical aspect of mobile notarization, as protecting sensitive information is paramount. As technology continues to evolve, we can expect to see further innovations in the tools and platforms used for mobile notarization, enhancing both security and user experience.

Legal and Regulatory Landscape

The legal status of mobile notarization varies across different states, with some embracing the practice more fully than others. Regulations governing mobile notarization are in place to ensure that notarial acts performed outside of traditional settings are held to the same legal standards. Remote online notarization (RON) is an extension of mobile notarization, allowing notaries to perform notarizations via video conferencing tools. RON has gained popularity in states that have passed legislation permitting its use, further expanding the scope and reach of notary services.

Why Mobile Notarization is Here to Stay

The numerous benefits of mobile notarization, from its convenience to its adaptability, suggest that it is not just a passing trend but a permanent fixture in the future of notary services. Both businesses and individuals stand to gain from the flexibility that mobile notarization offers. As the service continues to grow in popularity, it is likely to become the standard for notarization, particularly in an increasingly digital world. The ability to notarize documents without leaving one’s home or office aligns with the broader trend towards more remote and on-demand services, ensuring that mobile notarization will remain a vital part of the notary landscape.

Mobile notarization represents a significant shift in the way notary services are delivered, offering unprecedented convenience and accessibility. As legal frameworks continue to adapt to this new service model, and as technology advances further, the future of notary services will undoubtedly be shaped by mobile notarization. For anyone in need of notary services, understanding and embracing this innovative approach can lead to more efficient and stress-free experiences, making mobile notarization an essential service for the modern era.

0 notes

Text

How Digitalisation and New Regulations Are Shaping Dubai’s Real Estate Laws?

Dubai's real estate market stands as a beacon of progress and opportunity, known for its rapid growth, stunning architecture, and diverse property offerings. As this city continues to thrive, it attracts both investors and home-seekers seeking high returns and a luxurious lifestyle. However, navigating Dubai's real estate market requires a solid grasp of its local laws and regulations. This guide, informed by insights from seasoned real estate brokers in Dubai and property management companies in Dubai, aims to clarify the essential legal frameworks, protect investor interests, and demystify the resale market, ensuring you can confidently buy property in Dubai.

Understanding Dubai Real Estate's Legal Landscape

A deep understanding of the local legal environment is crucial for thriving real estate ventures in Dubai. The Dubai Land Department (DLD) plays a pivotal role in regulating the market, ensuring transparency, and providing security for all stakeholders. One of DLD's notable initiatives is the Dubai Land Rest app, a digital tool designed to enhance rental valuations and reflect current market conditions more accurately. This app improves upon the previous rental increase calculator by offering real-time market insights.

For property owners aiming to adjust rents, the app facilitates independent evaluations, providing precise rental valuations that consider factors like location, amenities, and property condition. However, landlords must still adhere to legal limits on rental hikes to ensure fairness in rent adjustments.

Key to this process is understanding the legalities surrounding eviction notices and lease renewals. Any changes to lease agreements, such as rent modifications or security deposit alterations, require a written notice three months before contract termination. Additionally, landlords must issue a 12-month eviction notice through a notary public or registered mail for reasons such as personal use or sale, highlighting the importance of formal communication.

Property management companies in Dubai, like Exclusive Links, offer services to help with rental valuations and the management of investments, including tenant management, notices, and legal representation if needed. Consulting with a certified property manager can help maximize your return on investment (ROI).

The Impact of Digitalisation and New Regulations

As Dubai's property market evolves, digitalization and new regulations are significantly shaping its landscape. The shift towards digital efficiency is streamlining the buying and selling process and impacting how property management companies in Dubai operate, ensuring they stay ahead in technology and regulatory compliance.

Protecting Your Investment: Legal Insights for Investors

Investing in Dubai's real estate comes with its challenges, such as project delays with off-plan properties or mismatches in property specifications. Investors should carefully review purchase agreements to ensure clear terms and protect against potential setbacks. Reputable developers often include completion timelines, grace periods, and delay penalties in contracts, providing an added layer of protection for investors. Working through a reputable real estate broker can also be beneficial, as they can work with multiple developers to secure the best deals for you.

Addressing discrepancies in property specifications is crucial. Purchase agreements should detail the material standards and quality. If the final product deviates from the agreed specifications, investors should seek amicable resolutions with the developer before considering legal action.

Tips for a Smooth Property Transaction

In Dubai's resale market, crafting agreements that protect buyer and seller interests and clearly define transaction terms is essential. Digital tools like the DLD Rest app have revolutionized transaction processing, making it secure and streamlined. However, recognizing the legal validity of electronic contracts remains crucial. When buying in the secondary market, using all the unified approved forms and contracts endorsed by the DLD ensures a smooth transaction.

For newcomers to Dubai's real estate scene, thorough due diligence is paramount. Be cautious of deals that seem too good to be true and conduct extensive research before committing. Consulting with real estate experts in Dubai to scrutinize contracts can provide extra safeguards, ensuring your investment is secure and poised for success.

Strategies for Secure Transactions in Dubai's Resale Market

Dubai's resale market is bustling with opportunities, especially for those interested in luxury properties. Amid this activity, drafting comprehensive and secure agreements is vital. These agreements lay the groundwork for smooth transactions by clearly defining the responsibilities and rights of each party and establishing protocols for resolving potential disputes.

The advent of electronic agreements, particularly through the DLD Rest app, has marked a significant shift towards digitization. These digital contracts are legally recognized and offer the same validity as paper counterparts, providing a reliable and efficient means to seal deals while maintaining confidentiality. This move towards digital transactions simplifies the process and enhances the integrity and transparency of dealings, reducing the chances of conflict.

0 notes

Text

Unveiling the 5 Factors That Affect the Timeline of PA Car Title Transfer

PA Car Title Transfer, especially in Lansdale, requires a systematic process covered by specific regulations and facilitated by auto tag services rendered by notary publics. Factors like documentation and financial aspects impact the car title transfer. Scroll down to follow up on the factors that affect the timeline of car title transfer in PA, Lansdale.

Read More: https://melodious-colt-734.notion.site/Unveiling-the-5-Factors-That-Affect-the-Timeline-of-PA-Car-Title-Transfer-4e496b0ca81e4d8da7db685a76d0849c

#notary public pa#boat registration pa#auto tag agency#fleet registration services#notary public#car registration renewal pa#vehicle registration pa

0 notes

Text

On equity, access, and inclusion as the world digitizes

In response to

James,

You have identified an enormous problem in our society, which is the broken nature of our identity system and the federal policy and infrastructure that surrounds it. Politically, it is just not possible to create a better solution right now - look no further than the political challenges moving to Real ID. These shortcomings have forced everyone to find alternatives, which unfortunately frequently do rely upon the credit system in America. And that’s not just private industry, but the government itself points to credit-system-based identity challenge questions as a best practice. This is the real issue that deserves your passion and what I have personally committed my own energies to improving.

All of that said, RON and Notarize do have solutions to these issues. First and foremost, RON is an option and not a mandate. Anyone can still transact in paper, no company can force anyone into a digital experience. Second, the laws still allow for a known prior relationship with the notary. Third, they account for the concept of a Credible Witness which is someone who completes identity verification and attests to the person’s identity, etc. For all of these reasons, I believe that RON has better addressed these issues than almost any other digital service as we not only have practical solutions, but a legal framework that allows industries to transact even when issues arise. I’ll note, the issues are not just impacting minority communities, but people with a damaged drivers license, older webcams that can’t capture a good image of an ID, victims of domestic abuse who don’t have their paperwork, etc. Some people simply cannot pass a digital identity verification process for a long list of reasons. This is a problem much greater than online notary and the National Institute of Science and Technology is constantly updating their guidelines, recently publishing a new IAL2 standard for Remote Proofing that addresses these very issues. We are the first and only platform to be audited and certified IAL2 compliant.

We have made an enormous investment in these issues. We are fully compliant with web accessibility standards for the hearing, vision, or physically impaired. We have passed legislation to allow for language translation for ESL communities. We also provide notaries who speak other languages and will soon translate our apps too.

And our product isn’t our only tool, so is our advocacy. We’ve worked to overturn racial covenants in property deeds. And when it doesn’t even make sense for something to be notarized, we advocate accordingly. For example, we’ve successfully removed requirements that battered women notarize a form to file a restraining order.

We’ve conducted studies with the Urban Institute making clear there are real issues of access to notaries by socioeconomic status, race, and geography. To be explicit, poor people in minority communities have worse access to notaries. Rural communities too. Our armed service members and their families have extreme difficulty. The Spanish speaking community is often defrauded by Notarios Publicos pretending to be attorneys (common in Latin America). A notary unlocks countless government services, financial programs, etc. It is not acceptable that some people need to spend an entire day to complete a critical transaction. And most notaries are only available during business hours, making them inaccessible to anyone whose job is inflexible and extremely costly to anyone paid hourly. RON levels the playing field so anyone, irrespective of language, location, or ability, can instantly gain access to the services they need to complete a transaction in minutes instead of hours. And our platform and the regulations we’ve helped to pass ensure that people who lack what is required to identify themselves still have the ability to connect.

I do have other concerns (and this is something I’ve said for years) - industry cannot create price or other incentives that disadvantage people who cannot transact digitally. For example, it is well established now that a digital mortgage closing saves real cost for the lender and title company. Everyone feels that the cost saving should be passed to the consumer, which is a just intent, but that very well could constitute an unfair practice. Those cost savings need to accrue to the whole operation and provide cost savings globally, irrespective of closing method, for example. I’ve advocated for policy around this for many years.

Regarding fraud, we have made an enormous investment here and will be sharing a great deal on this soon, but we are successfully capturing things like deep fakes, synthetic identities, etc. We also provide a complete chain of custody, ensuring documents are not altered or stolen, copies are not retained, etc. And we provide a total evidentiary trail of the transaction, for which we’ve received acknowledgement from groups like the Attorney General Alliance for assisting with things like election fraud.

I do appreciate your concerns, but would simply ask that you join the fight for change and progress. We absolutely can create solutions for online identity verification that do not disadvantage any groups of people - and notaries are critical to ensuring everyone can transact securely online. We can also accelerate business, reduce errors, fight fraud, and ultimately save enormous sums of money and TIME for consumers.

We do not have all of the solutions (yet), but I hope this makes clear how seriously I take the issues and I will always be open to any product or policy change that ensures everyone can complete their most important transactions safely and on their own time.

1 note

·

View note