#North America Electric Vehicles Market

Explore tagged Tumblr posts

Text

A Deep Dive into the North America Electric Vehicles Market: Insights and Analysis

The North America electric vehicles market size is anticipated to reach USD 60.53 billion by 2030, according to a new report by Grand View Research, Inc. The market is projected to grow at a CAGR of 10.0% from 2025 to 2030. Favorable initiatives to promote the adoption of electric vehicles coupled with rising crude oil prices are anticipated to drive the demand for Electric Vehicles (EVs). Electric vehicles generate power using an electric motor instead of an internal combustion engine that burns a mix of fuels and gases for power generation. The increasing advantages of electric vehicles over conventional vehicles such as zero fuel emission, better performance, and lower total cost of ownership are expected to contribute to the growing demand for electric vehicles in the coming years.

The growing preference for electric vehicles is prompting leading automotive manufacturers to launch electric vehicles. For instance, General Motors, a U.S.-based automotive company, has announced its plan to launch electric vehicles for personal use in the next few years. By 2025, the company will launch 30 EVs worldwide, and around two-third will be available in North America. The market's lucrative nature is expected to encourage more conventional vehicle manufacturers to shift into the electric vehicle space.

The outbreak of the COVID-19 pandemic has changed the overall business scenario for 2020 as well as for the next few years to come. Several industries and industry verticals have witnessed a significant setback due to the pandemic, and the automobile industry is no exception to that. The slumped business scenario has negatively impacted the production and sales of electric vehicles across North America. The electric bus sales in North America in 2020 totaled around 500 units, which was significantly lesser units recorded in 2019, registering a year-on-year decline of over 10% primarily due to the pandemic. However, with increasing government initiatives to adopt electric vehicles, the market is likely to witness significant growth over the forecast period.

Gather more insights about the market drivers, restrains and growth of the North America Electric Vehicles Market

North America Electric Vehicles Market Report Highlights

• In terms of product, the PHEV segment is estimated to register the highest CAGR of over 35% from 2025 to 2030 owing to the increasing demand for electric buses and trucks across the logistics and transportation industry

• In terms of vehicle type, the PCLT segment emerged as the largest segment in 2024 and is anticipated to retain its dominance over the forecast period

• Canada is projected to register the fastest CAGR exceeding 40% from 2025 to 2030 as the government in the country is focused on advancing the programs to support electric vehicle adoption

North America Electric Vehicles Market Segmentation

Grand View Research has segmented the North America electric vehicles industry report based on product type, vehicle type, and country.

North America Electric Vehicles Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

• Battery Electric Vehicle (BEV)

• Plug-In Hybrid Electric Vehicle (PHEV)

North America Electric Vehicles Vehicle Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

• PCLT

o Passenger Cars

o Light Trucks

• Commercial Vehicle

North America Electric Vehicles Country Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

• U.S.

• Canada

• Mexico

Order a free sample PDF of the North America Electric Vehicles Market Intelligence Study, published by Grand View Research.

#North America Electric Vehicles Market#North America Electric Vehicles Market Size#North America Electric Vehicles Market Share#North America Electric Vehicles Market Analysis#North America Electric Vehicles Market Growth

0 notes

Text

The global US Electric Motors Market share is expected to grow from USD 31.06 billion in 2024 to USD 42.07 billion by 2029, at a CAGR of 6.3% during 2024-2029. The electric motors market in US is growing as energy efficiency solutions become increasingly visible and demanded across all segments. Besides contributing renewable energy systems and electric vehicles to smart manufacturing, the country's electric motors are quite linked to the sustainability goals of the nation. Among the benefits reapable from the use of electric motors are reduction of energy, cost savings in operations, and the elimination of emissions from the overall energy portfolio. The adoption is further assisted through government policies and incentives that stimulate energy-efficient technologies. Innovations in motor technologies such as brushless DC motors and variable frequency drives have improved performance, reliability, and flexibility of applications hence promoting the growth of the market.

#electric motors#electric mobility#electric motors market#energy#energia#power generation#utilities#power#utility#electric motor#electric motor market#electric motor sales#US electric motors#US electric motors market#usa#us#north america#hvac#hvac system#electric vehicles

2 notes

·

View notes

Text

Volkswagen a vândut 4.8 milioane de mașini în 2024, cu o scădere ușoară față de anul precedent

În 2024, Volkswagen a raportat vânzări globale de aproximativ 4.8 milioane de mașini noi, o scădere de 1.4% față de 2023. Deși a înregistrat scăderi pe piețele principale, marca germană a înregistrat creșteri semnificative în regiunile Americii. Vânzările Volkswagen în 2024, pe piețe: China: ~2 milioane de unități (-8.3%) Europa: 1.25 milioane de unități (-1.7%) America de Nord: 592.300 de…

#America de Nord#America de Sud#auto market 2024#bam#car sales#China#diagnosis#diagnoza#Electric Vehicles#Europa#Europe#german#masini electrice#neamt#North America#piața auto 2024#roman#South America#SUV-uri#SUVs#Tiguan#vanzari auto#vanzari Volkswagen#vanzari volkswagen 2024#volkswagen#VW

0 notes

Text

#North America E-bike Market#E-bike Market#bikeMarket#bike#ebikes#electric bike#electric bicycle#electric vehicle

0 notes

Text

#Toyota#Subaru#electric cars#cooperation#development#all-electric sport utility vehicle#Japanese market#North America#EV operations#President Koji Sato#bZ4X#Solterra#production#Gunma Prefecture#collaboration#product lineups#investment

0 notes

Text

0 notes

Text

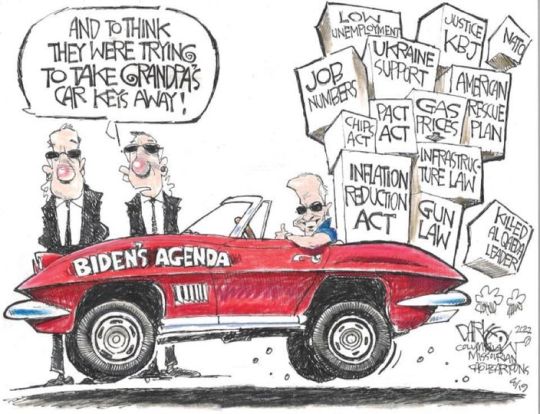

LETTERS FROM AN AMERICAN

July 6, 2023

HEATHER COX RICHARDSON

JUL 7, 2023

The payroll processing firm ADP said today that private sector jobs jumped by 497,000 in June, far higher than the Dow Jones consensus estimate predicted. The big gains were in leisure and hospitality, which added 232,000 new hires; construction with 97,000; and trade, transportation and utilities with 90,000. Annual pay rose at a rate of 6.4%. Most of the jobs came from companies with fewer than 50 employees.

The Dow Jones Industrial Average, which is a way to measure the stock market by aggregating certain stocks, dropped 372 points as the strong labor market made traders afraid that the Fed would raise interest rates again to cool the economy. Higher interest rates make borrowing more expensive, slowing investment.

Today, as the Washington Post’s climate reporter Scott Dance warned that the sudden surge of broken heat records around the globe is raising alarm among scientists, Bloomberg’s Cailley LaPara reported that the incentives in the Inflation Reduction Act for emerging technologies to address climate change have long-term as well as short-term benefits.

Dance noted that temperatures in the North Atlantic are already close to their typical annual peak although we are early in the season, sea ice levels around Antarctica are terribly low, and Monday was the Earth’s hottest day in at least 125,000 years and Tuesday was hotter. LaPara noted that while much attention has been paid to the short-term solar, EV, and wind industries in the U.S., emerging technologies for industries that can’t be electrified—technologies like sustainable aviation fuel, clean hydrogen, and direct air capture, which pulls carbon dioxide out of the air—offer huge potential to reduce emissions by 2030.

This news was the backdrop today as President Biden was in South Carolina to talk about Bidenomics. After touting the huge investments of both public and private capital that are bringing new businesses and repaired infrastructure to that state, Biden noted that analysts have said that the new laws Democrats have passed will do more for Republican-dominated states than for Democratic ones. “Well, that’s okay with me,” Biden said, “because we’re all Americans. Because my view is: Wherever the need is most, that’s the place we should be helping. And that’s what we’re doing. Because the way I look at it, the progress we’re making is good for all Americans, all of America.”

On Air Force One on the way to the event, deputy press secretary Andrew Bates began his remarks to the press: “President Biden promised that he would be a president for all Americans, regardless of where they live and regardless of whether they voted for him or not. He also promised to rebuild the middle class. The fact that Bidenomics has now galvanized over $500 billion in job-creating private sector investment is the newest testament to how seriously he takes fulfilling those promises.”

Bates listed all the economic accomplishments of the administration and then added: “the most powerful endorsement of Bidenomics is this: Every signature economic law this President has signed, congressional Republicans who voted “no” and attacked it on Fox News then went home to their district and hailed its benefits.” He noted that “Senator Lindsey Graham called the Inflation Reduction Act ‘a nightmare for South Carolina,’” then, “[j]ust two months later, he called BMW’s electric vehicles announcement ‘one of the most consequential announcements in the history of the state of South Carolina.’” “Representative Joe Wilson blasted the Bipartisan Infrastructure Law but later announced, ‘I welcome Scout Motors’ plans to invest $2 billion and create up to 4,000 jobs in South Carolina.’ Nancy Mace called Bidenomics legislation a…‘disaster,’ then welcomed a RAISE grant to Charleston.”

“[W]hat could speak to the effectiveness of Bidenomics more than these conversions?” Bates asked.

While Biden is trying to sell Americans on an economic vision for the future, the Republican leadership is doubling down on dislike of President Biden and the Democrats. Early on the morning of July 2, Trump, who remains the presumptive 2024 Republican presidential nominee, shared a meme of President Biden that included a flag reading: “F*CK BIDEN AND F*CK YOU FOR VOTING FOR HIM!” The next morning, in all caps, he railed against what he called “massive prosecutorial conduct” and “the weaponization of law enforcement,” asking: “Do the people of this once great nation even have a choice but to protest the potential doom of the United States of America??? 2024!!!”

Prosecutors have told U.S. district judge Aileen Cannon that they want to begin Trump’s trial on 37 federal charges for keeping and hiding classified national security documents, and as his legal trouble heats up, Trump appears to be calling for violence against Democrats. On June 29 he posted what he claimed was the address of former president Barack Obama, inspiring a man who had been at the January 6 attack on the U.S. Capitol to repost the address and to warn, “We got these losers surrounded! See you in hell,…Obama’s [sic].” Taylor Tarranto then headed there with firearms and ammunition, as well as a machete, in his van. Secret Service agents arrested him.

Indeed, those crossing the law for the former president are not faring well. More than 1,000 people have been arrested for their participation in the events of January 6, and those higher up the ladder are starting to feel the heat as well. Trump lawyer Lin Wood, who pushed Trump’s 2020 election lies, was permitted to “retire” his law license on Tuesday rather than be disbarred. Trump lawyer John Eastman is facing disbarment in California for trying to overturn the 2020 election with his “fake elector” scheme, a ploy whose legitimacy the Supreme Court rejected last week. And today, Trump aide Walt Nauta pleaded not guilty to federal charges of withholding documents and conspiring to obstruct justice for allegedly helping Trump hide the classified documents he had at Mar-a-Lago.

Trump Republicans—MAGA Republicans—are cementing their identity by fanning fears based on cultural issues, but it is becoming clear those are no longer as powerful as they used to be as the reality of Republican extremism becomes clear.

Yesterday the man who raped and impregnated a then-9-year-old Ohio girl was sentenced to at least 25 years in prison. Last year, after the Supreme Court overturned the 1973 Roe v. Wade decision recognizing the constitutional right to abortion, President Biden used her case to argue for the need for abortion access. Republican lawmakers, who had criminalized all abortions after 6 weeks, before most people know they’re pregnant, publicly doubted that the case was real (Ohio Attorney General Dave Yost told the Fox News Channel there was “not a damn scintilla of evidence” to support the story). Unable to receive an abortion in Ohio, the girl, who had since turned 10, had to travel to Indiana, where Dr. Caitlin Bernard performed the procedure.

Republican Indiana attorney general Todd Rokita complained—inaccurately—that Bernard had not reported child abuse and that she had violated privacy laws by talking to a reporter, although she did not identify the patient and her employer said she acted properly. Bernard was nonetheless reprimanded for her handling of privacy issues and fined by the Indiana licensing board. Her employer disagreed.

As Republican-dominated states have dramatically restricted abortion, they have fueled such a backlash that party members are either trying to avoid talking about it or are now replacing the phrase “national ban” with “national consensus” or “national standard,” although as feminist writer Jessica Valenti, who studies this language, notes, they still mean strict antiabortion measures. In the House, some newly-elected and swing-district Republicans have blocked abortion measures from coming to a vote out of concern they will lose their seats in 2024.

But it is not at all clear the issue will go away. Yesterday, those committed to protecting abortion rights in Ohio turned in 70% more signatures than they needed to get a measure amending the constitution to protect that access on the ballot this November. In August, though, antiabortion forces will use a special election to try to change the threshold for constitutional amendments, requiring 60% of voters rather than a majority.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Bidenomics#Joe Biden#economy#jobs#middle class#justice#Letters From an American#Heather Cox Richardson#infrastructure#climate change

256 notes

·

View notes

Text

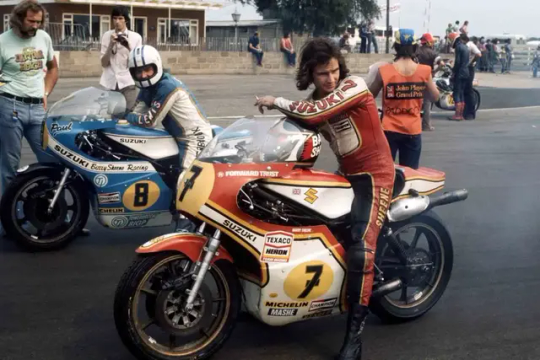

Osamu Suzuki

Suzuki chairman who over half a century grew the company into one of the world’s largest car and motorcycle manufacturers

Osamu Suzuki, who has died aged 94, was one of the global automotive industry’s longest serving leaders. A director since 1963 of Suzuki, the motorcycle and small car manufacturer based in Hamamatsu, Japan, he rose through the ranks to become in 1979 the firm’s president, a position he relinquished only in 2019 to ascend to the chairmanship. Latterly, as is customary with elder statemen of Japanese industry, he became an adviser, the title he still held at the time of his death.

When he first joined Suzuki, in 1958, it had been in the automobile business for only four years, building the tiny two-cylinder, air-cooled Suzulight car, in a country that was still finding its way as an industrial power. It had been founded in 1909 as a loom manufacturer, but the collapse of the cotton market in the early 1950s galvanised a move towards automotive endeavours.

Suzuki produced its first motorcycle – really a 36cc motorised pedal bike – in 1952 but 10 years later would notch up its first Isle of Man TT victory. In 1976, Barry Sheene won his first 500cc World Championship on a Suzuki RG500. The loom-making arm of the firm was separated from the automotive side in 1960 and, under Osamu, Suzuki expanded into the production of outboard motors, wheelchairs, all-terrain vehicles, and prefabricated housing.

He progressed conservatively to make Suzuki the largest small car producer in Japan, always with a keen eye on cost cutting, even on a shop-floor level: in one plant he famously had some of the light bulbs removed to save $40,000 on electricity.

Suzuki motorcycles arrived in the UK long before its cars, alongside Honda and others helping decimate the British motorcycle industry from the mid-60s onwards with dependable, easy to maintain two-wheeled machinery.

The now collectable Whizzkid Coupe and Jimny off-roader (sold in the UK as the Satana and Samurai) were relative latecomers to the Japanese car sales bonanza from 1979. The Suzuki Alto of the early 80s was the cheapest automatic car then available in the UK, priced at £4,000, while the 1985 Swift was the firm’s first four-cylinder “supermini” sized vehicle.

The Bedford Rascal – better known as the “Sooty van” in the TV puppet series Sooty and Sweep – was really a rebadged Suzuki Carry, or “kei” truck, built to conform to strict Japanese light commercial specifications. These Rascal/Carry trucks were a spin-off from a deal that Osamu Suzuki struck with General Motors in 1981 to sell its economy cars in North America with Chevrolet badges, in return for giving GM a 5% stake in the company.

Osamu would also preside in 2009 over a tie-up with VW that ended in a court battle, and latterly collaborated with Toyota on the design of self-driving cars.

From the late 60s, production of the small Fronte rear-engined cars ramped up under Osamu’s leadership but, unlike its rivals, Nissan, Toyota and Mazda, Suzuki did not give in to the temptation to move upmarket, preferring to use its resources to build satellite plants in emerging markets where its small runabout cars had most appeal.

Beginning in Thailand in 1967 – and followed by Indonesia, the Philippines, Australia and Pakistan in the 70s and 80s – Suzuki expanded its operations on the Pacific rim rather than tackle local rivals head on, although between 1967 and 1970 Japanese production rose substantially, based at four new locations.

In the early 80s Suzuki became the first Japanese manufacturer to establish a manufacturing outlet in India, where its new front-wheel drive Alto/Fronte broke the stranglehold of the outdated Hindustan ambassador (a locally built 1950s Morris Oxford), and the equally ancient Fiat 1100-based Premier Padmini to become the bestselling car in India. Osamu Suzuki made over 200 flights to India in an effort to get this historic deal done.

By the beginning of the 2000s Suzuki had 60 factories in 31 countries as sales rose tenfold to a value of $19bn.

The son of Toshiki and Matsuda Shunzo, and born in the city of Gero, Gifo Prefecture, in central Japan, Osamu graduated in law from Chuo University in Tokyo in 1953 and worked in the loans office of a local bank before joining Suzuki in 1958. Around the same time, he married Shoko Suzuki, the granddaughter of the company’s founder, and, as per local tradition when there is no male heir, adopted his wife’s family name.

Had Hirotaka Ono, the son-in-law he had been grooming to take his place, not died of cancer in 2007, Osamu would probably have enjoyed a much longer retirement. A keen golfer into his 90s, five years ago he handed the reigns of the company to his son Toshihiro, the eldest of his three children.

🔔 Osamu Suzuki, industrialist, born 30 January 1930; died 25 December 2024

Daily inspiration. Discover more photos at Just for Books…?

12 notes

·

View notes

Text

The U.S. Department of Treasury’s gift to electric-vehicle shoppers (and global automakers) for the new year was to make many more EVs and plug-in hybrids eligible for the federal tax subsidy of up to $7,500 — including vehicles built outside North America — as long as drivers lease them or buy used rather than buy new.

EV credits and [rules] took effect Jan. 1.

One category extends the former credit of up to $7,500 for consumers buying new EVs and PHEVs, but it puts new limits on vehicle price and buyer income and will soon add requirements for the sourcing of EV batteries and materials. Additionally, since August [2022], it has required that the vehicles be assembled in North America.

A second is a new credit of up to $4,000 for buyers of used EVs.

A third is a “commercial” credit for businesses acquiring EVs. It offers up to $7,500 for light-duty vehicles (under 14,000 pounds) and up to $40,000 for heavier vehicles. Significantly, the commercial credit does not have the origin, price or other restrictions of the credit for consumer buyers.

On top of all that, the Department of Treasury guidance released at the end of December allows the less restrictive commercial credit to also apply to vehicles leased by consumers; that means most plug-in and fuel-cell EVs currently on the market can qualify, including those built in Europe or Asia. The credit goes to the leasing company — the vehicle owner — but it can be passed to the consumer in the form of lower lease payments.

The new federal rules do not affect state and local subsidies available for EV buyers [which may be able to get you even more savings].

-via Cars.com, January 12, 2023

#evs#electric vehicles#electric cars#ev sales#ev adoption#united states#irs#tax credits#democrats#inflation reduction act#biden administration#used cars#leasing a car#saving money#money#good news#hope

77 notes

·

View notes

Text

youtube

Why Jeep And Dodge’s Parent Company Stellantis Is Struggling

Merging some of America’s legacy car brands with big European ones made Stellantis the world’s fifth largest automaker in 2021. But just a few years after the merger closed, Stellantis is struggling, and its troubles lie specifically with is North American business – home to Jeep, RAM, Dodge and Chrysler. Critics—including its own dealers—say the company raised prices too high and too fast, and didn’t focus enough on making good products. Its stock has plummeted. Watch the video to learn more.

P.S. Oops! My advice to Stellantis - get rid of too heavy, too expensive, too inefficient, very mediocre quality car brands intended only for Americans as soon as possible. These are not sellable products anywhere outside America and even there you will have trouble selling them!!! American car manufacturers haven't realized that America is no longer the centre of the world and your car fashion passion for uneconomical and badly overpriced cars is completely irrelevant to the rest of the global car market, and buyers are NOT INTERESTED...! We don't want American made ICE vehicles...!!!

I don''t like modern American car designs and technologies behind them absolutely: ugly boxes on whells...overweight, badly overpriced, low fuel efficiency, and extremely expensive to repair...If someone offers you to buy a modern American made ICE car in Europe, especially a used one, run away as far as you can....if you value your well-being and family budget...!!! Ford quality is also very mediocre at best...; GM is already out from car business in Europe, and actually it is a good thing!!! Modern American cars have a bad design and manufacturing quality and and unsuitable for European cities and motorways...huge fuel consumption due to excess weight, premature transmission problems, electrical failures and rust...are the daily life of American car owners in Europe...! There are not many such owners left! So, actually in fact, almost no one buys classic American car brands in Europe anymore....!!!!

3 notes

·

View notes

Text

The Role of Automotive Exporters in the Global Economy

The automotive industry has long been a pillar of global economic development. It connects nations through a complex web of trade, technology, and innovation, driving significant contributions to GDP and employment worldwide. Among the various contributors to this global sector, automotive products exporters in Gujarat play a crucial role in cementing India’s position as a key player in the global automotive market.

The Rising Importance of Automotive Exports

Automotive exports have become a cornerstone of international trade. From passenger cars to commercial vehicles, spare parts, and other components, the automotive sector’s products are in constant demand globally. Emerging markets in Asia, Africa, and South America are hungry for affordable, high-quality automotive products, and nations like India are stepping up to fulfill these needs.

India, being one of the largest automotive markets in the world, has not only catered to domestic demands but has also established itself as a significant exporter. Gujarat, in particular, has emerged as a hub for automotive production and export. With state-of-the-art manufacturing facilities, world-class infrastructure, and a business-friendly environment, the region has become home to some of the top 10 automotive products exporters in Gujarat.

Gujarat: The Automotive Export Hub of India

Gujarat’s strategic location, robust port infrastructure, and pro-industrial policies make it a natural choice for automotive manufacturers and exporters. The state’s ports, such as Mundra and Kandla, enable seamless export operations to global markets. Additionally, Gujarat’s proximity to major industrial clusters enhances its appeal as a center for automotive exports.

Some of the top 10 exporters of automotive products operate from Gujarat, leveraging the state’s logistical advantages and skilled workforce. These companies specialize in a diverse range of products, including:

Passenger Vehicles: Compact cars, sedans, and SUVs.

Commercial Vehicles: Trucks, buses, and trailers.

Auto Components: Engine parts, brakes, clutches, and transmission systems.

Electric Vehicles (EVs): Batteries, chargers, and EV-specific components.

Key Contributions of Automotive Exporters

Automotive exporters from Gujarat and other parts of India contribute significantly to the global economy. Here are some of their key contributions:

Employment Generation: Export-oriented automotive companies create numerous job opportunities. From manufacturing to logistics and sales, the industry employs millions directly and indirectly, ensuring economic stability for many families.

Boosting India’s Economy: The automotive sector accounts for a significant portion of India’s exports. By shipping vehicles and components to over 100 countries, automotive exporters strengthen India’s balance of trade and foreign exchange reserves.

Technology Transfer: Collaborations with international partners often lead to the adoption of cutting-edge technologies. Indian automotive exporters benefit from this knowledge exchange, enhancing their manufacturing capabilities and global competitiveness.

Improved Standards: To meet international demands, automotive exporters in Gujarat adhere to stringent quality and environmental standards. This not only boosts the reputation of Indian-made products but also raises the bar for domestic markets.

Top Automotive Products Exporters in Gujarat

Gujarat is home to some of the top 10 exporters in India, specializing in automotive products. These companies have achieved global recognition for their commitment to quality, innovation, and timely delivery. Some of their key attributes include:

Global Reach: Extensive networks in Europe, North America, the Middle East, and Asia.

Sustainability Practices: Adoption of eco-friendly manufacturing processes to meet global environmental regulations.

Customer-Centric Approach: Customized solutions tailored to the specific needs of international clients.

India’s Automotive Export Strengths

The success of automotive products exporters in Gujarat is a testament to India’s broader strengths in the automotive sector. Here are some factors that give Indian exporters a competitive edge:

Cost Advantage: Indian manufacturers offer high-quality automotive products at competitive prices, making them attractive to cost-conscious international buyers.

Diverse Product Range: From two-wheelers to heavy-duty vehicles and specialized auto parts, Indian exporters cater to a wide array of market needs.

Strong R&D Focus: Indian companies invest heavily in research and development to stay ahead in innovation, particularly in the EV segment.

Government Support: Policies such as the 'Make in India' initiative and export incentives encourage Indian companies to expand their global footprint.

Challenges and Opportunities

While India’s automotive exporters, including the top 10 exporters of automotive products from Gujarat, have achieved significant milestones, they also face challenges:

Global Competition: Exporters must compete with established players from countries like Germany, Japan, and South Korea.

Regulatory Barriers: Varying import regulations and standards in different countries can complicate export operations.

Supply Chain Disruptions: Events like the COVID-19 pandemic and geopolitical tensions can impact the availability of raw materials and shipping routes.

However, these challenges present opportunities for innovation and growth. By embracing digital technologies, enhancing supply chain resilience, and diversifying export markets, automotive exporters can secure their place among the best exporters in India.

Future Prospects

The global shift towards sustainability and green mobility opens new avenues for automotive exporters. Electric vehicles and related components are expected to dominate exports in the coming years. Gujarat’s manufacturers are already investing in EV technology, ensuring their readiness to meet future demands.

Additionally, partnerships with global OEMs (Original Equipment Manufacturers) and participation in international trade fairs will help Indian exporters showcase their capabilities to a broader audience.

Why Gujarat Stands Out

Among the top 10 exporters in Gujarat, the state’s automotive sector shines due to its:

Strategic Initiatives: Government-backed policies that promote exports.

Robust Infrastructure: Advanced manufacturing facilities and ports.

Skilled Workforce: Availability of technically proficient labor.

These factors make Gujarat a preferred destination for global buyers seeking reliable automotive products exporters.

Conclusion

The role of automotive exporters in the global economy cannot be overstated. They not only drive economic growth but also foster innovation and international collaboration. As India continues to establish itself as a global automotive powerhouse, the contribution of automotive products exporters in Gujarat remains indispensable.

Whether you are looking at the top 10 automotive products exporters in Gujarat or the top 10 exporters in India, their commitment to excellence and sustainability is a common thread. As the industry evolves, these exporters are poised to lead India’s charge into a future defined by green mobility, advanced technology, and robust global trade.

In a rapidly changing world, automotive exporters from Gujarat and India as a whole stand out as beacons of quality, innovation, and reliability. Their journey of excellence underscores why they are among the best exporters in India, contributing to the nation’s growing stature on the global stage.

#Top 10 exporters in India#Automotive products exporters in Gujarat#Top 10 automotive products exporter in Gujarat#Top 10 exporter of the automotive products

4 notes

·

View notes

Text

Chinese President Xi Jinping visits Peru this week for the Asia-Pacific Economic Cooperation (APEC) summit, during which he will inaugurate the deep-water port of Chancay, about 45 miles north of Lima. It’s a $3.6 billion project—one of China’s largest infrastructure investments in the region in the past two decades.

It also may be one of the last of its kind.

Upon becoming president in 2013, in an attempt to deepen the so-called going out strategy and find new markets for booming Chinese production, Xi initiated a reform agenda that intensified diplomatic outreach and boosted overseas investment, the capstone of which was the Belt and Road Initiative (BRI).

Big infrastructure contracts were a win-win move: They allowed China to offload excess capacity of steel, labor, and other inputs while providing urgently needed infrastructure to Latin America. Since 2017, 22 countries in Latin America and the Caribbean have formally joined the BRI, utterly transforming China’s relationship with the continent. China is now Latin America’s second-largest trading partner, after only the United States.

But after two decades of growing sway in the region, Beijing is taking a new approach. As it struggles to manage an economic slowdown, a mounting debt burden, and a broken real estate market, Beijing is bringing an end to the era of high-risk, high-cost mega-infrastructure projects in favor of smaller, new frontier investments in cloud computing, 5G technology, renewable energy, artificial intelligence, and electric vehicles.

China has pitched its new strategy to the world as visionary and forward-looking. Its Latin American partners, however, are less convinced.

The significant, long-standing infrastructure gap in Latin America has made leaders hungry for external investment. Whereas the United States and the European Union have been reluctant to put up large sums, China was happy to get involved.

BRI money has funded roads through the jungles of Costa Rica; railways in Bolivia and Argentina; industrial parks and a container port in Trinidad and Tobago; the biggest hydroelectric plant in Ecuador; and the first transoceanic fiber-optic cable directly connecting Asia to South America, stretching from China to Chile, among other projects.

These big infrastructure projects have paralleled increased Chinese investments in soft power and diplomacy. The United States used to be very adept with its Latin American partners, but China has overtaken it, said Benjamin Creutzfeldt, a China scholar.

“The Chinese have become better at engaging through charm offensives with their charismatic ambassadors,” he said. “They learned how to deal with their counterparts effectively.”

But China’s expansion in the region—particularly in hard infrastructure—has come at a cost for Latin America. Chinese companies have been accused of substandard construction practices and corruption in prior big-item investments.

For instance, the Coca Codo Sinclair dam, a hydroelectric rock-fill dam in the jungles of Ecuador, has not stopped making negative headlines since being inaugurated in November 2016. The estimated $3.4 billion project—the largest in Ecuador’s history—was built and financed by China as a flagship BRI project. But by July 2022, more than 17,000 cracks had already splintered across the dam, and many of the top Ecuadorian officials involved in the construction have been imprisoned or sentenced on bribery charges related to the project.

Not only is Ecuador now left with faulty infrastructure, it’s also stuck with crushing amounts of debt. The BRI has shifted China from being Latin America’s ATM to its biggest debt collector. China rivals the World Bank and the Inter-American Development Bank as the biggest creditor in the region and has left Latin America with the highest level of debt service payments in the world, at an estimated 4 percent of regional GDP. According to the research from the Center for Economic Policy Research, the share of Chinese loans to countries in financial distress increased from about 5 percent in 2010 to about 60 percent in 2022.

For its part, Ecuador is attempting to pay back its debt by exporting oil to China at almost an 80 percent discount. But this arrangement could cause problems for China, too, in the long run.

“Supporting these mega-projects, which do not have big returns, in indebted countries, isn’t necessarily a good business strategy,” said Leland Lazarus, the associate director of national security at Florida International University’s Jack D. Gordon Institute for Public Policy.

“China is at the risk of not getting their money back,” said Axel Dreher, a professor at Germany’s Heidelberg University.

After more than two decades of big, ambitious physical infrastructure projects, China has begun to face the music.

Strained economic and political situations on the domestic front have increased pressure to spend less abroad and focus on the country’s internal development needs. Just last week, the Chinese government approved a $1.4 trillion plan to boost the economy by allowing local government to refinance debts.

China is also increasingly wary of infrastructure projects after being criticized for its subpar BRI implementation. AidData, an international development research lab, analyzed more than 13,427 of the initiative’s projects across 165 countries, worth $843 billion, and found that 35 percent had “major implementation problems,” such as scandals, protests, corruption, labor violations, and environmental degradation.

China is still finishing up certain hard infrastructure projects, including the Bogotá Metro rapid transit system in Colombia, but will pursue fewer moving forward. Instead, hungry for cash and eager to de-risk investments while remaining relevant overseas, China has shifted its focus toward new frontier projects—already to great effect.

Wenyi Cai, a Chinese investor and the CEO of Polymath Ventures, a venture studio in Latin America, said that she has seen overwhelming Chinese interest in digital investments, particularly in Mexico and Brazil. Just in 2022, 58 percent of Chinese investments in Latin America and the Caribbean were in these new infrastructure industries, up from about 25 percent in the previous year.

This shift is particularly notable in the telecoms industry. Already, up to 70 percent of Latin America’s 4G-LTE cellular networks are supported by infrastructure from the Chinese tech giant Huawei, which grew by 9 percent in the region in 2022, according to a report from the University of Navarra. The company is also rolling out 5G networks in several countries in the region.

China is also making waves in the electric vehicle industry. In 2022, Chinese firms invested $2.2 billion in the industry—35 percent of all Chinese foreign direct investment in the region that year, according to an Inter-American Dialogue report. In 2023, China emerged as Mexico’s top car supplier, exporting $4.6 billion worth of vehicles, and the Chinese electric vehicle manufacturer BYD is actively exploring factory locations in the country.

Undoubtedly, China’s interest in this supposed technical revolution is economical. For China, the new frontier sectors present less risk, lower operating costs, and faster returns than traditional infrastructure projects in a retrenched post-pandemic world.

“As China has less overall capital to allocate, it tries to do so in a more strategic way,” said Margaret Myers, the director of the Asia and Latin America program at the Inter-American Dialogue.

This, however, has resulted in a huge decrease in funds for Latin America. From 2010 to 2019, China invested an average of $14.2 billion per year in the region. By 2022, however, this amount had dropped to less than half—just $6.4 billion. A similar trend can be observed in loans from China’s top development finance institutions: At its peak in 2010, China lent more than $25 billion in the region, but this dropped to a little more than $1.3 billion per year between 2019 and 2023.

Though infrastructure is no longer the smartest investment strategy, that doesn’t mean the region’s need for it is going anywhere. Luis Alberto Moreno, the former president of the Inter-American Development Bank, told Foreign Policy that there continues to be a large infrastructure deficit in Latin America that is only growing bigger as the region becomes richer and demands more energy, goods, and services.

Non-Chinese development banks, including the World Bank and the Inter-American Development Bank, have already started filling the gap since Chinese lending first dropped in 2015. This includes significant new financing from the Inter-American Development Bank for road improvements last year, with $600 million allocated to Mexico, $480 million to Brazil, and $345 million to Argentina.

But Moreno said that he doubts that the World Bank and the Inter-American Development Bank will be able to fill the void alone. China seems to be the only other option, but it’s not playing ball.

Despite the region finding itself trapped in domestic debt and having been burned by infrastructure projects that did not fulfill time, cost, and quality expectations, a fear nevertheless lingers in Latin America about what it will do without massive inflows of Chinese money.

“There is this sense that it [infrastructure] needs to be done, whether China is the one to do it or not,” Myers said.

Yet, China’s increased focus on new frontier investments could enable Latin American countries to enhance their much-needed digital infrastructure, positioning them to capitalize on automation and the adoption of artificial intelligence. It could also facilitate the region’s participation in a global green transition.

Jesús Seade, Mexico’s ambassador to China, sees the shifting focus toward more innovation-led investment as an opportunity for his country. “It means development—it means helping Mexico climb the value chain,” he told Foreign Policy.

But some worry that the region will become over-reliant on China in these new sectors, just as it did for the big physical infrastructure projects, without improving its own competitiveness in the process. Although some welcome cheap green technologies from China in order to ease the region’s transition to cleaner energy use, concerns remain about Latin American countries not doing enough to bolster their capacity to produce high-value manufacturing goods, harness Chinese technology transfers, and implement robust security measures to safeguard against the misuse of citizens’ data.

The new frontier investments could also pose security threats to Latin American governments and their citizens, including through surveillance, cybersecurity, and intellectual property risks that the region is unprepared to deal with, according to Robert Evan Ellis, a professor of Latin American studies at the U.S. Army War College. He is also concerned about China’s ability to misuse its access and knowledge about operations in key logistics hubs—such as the Panama Canal or the Chancay port—to disrupt access or launch attacks if a conflict were to emerge.

Another concern is the power balance between China and its Latin American partners. According to Marisela Connelly, a professor at the Center for Asian and African Studies at the College of Mexico, China is the one determining the conditions for trade and investment in the region.

“China simply wants Latin American countries to adapt to China’s needs,” Connelly said. She criticized the Mexican government for having “no strategy” and “no clear objectives” in its relationship to China.

Ultimately, the situation raises an important question about what infrastructure Latin America really needs.

“I’m not sure this [less investment in hard infrastructure] is a bad thing,” Evan Ellis said. Ultimately, Latin America has to pay for its infrastructure projects, and China’s shift may save the region from more unviable and expensive infrastructure projects moving forward.

2 notes

·

View notes

Text

Toyota's Impact on the Global Automotive Market

Introduction:

Toyota's Effect on the Worldwide Auto Market

Toyota, a name inseparable from unwavering quality. Development, and supportability. Has left a permanent imprint on the worldwide auto market. From its unassuming starting points in Japan to becoming one of the biggest vehicle producers on the planet. Toyota has reliably set industry norms and affected worldwide car patterns. This article investigates Toyota's effect on the worldwide car market. Featuring key advancements. business methodologies. And its obligation to manageability.

Toyota: A Tradition of Development

Toyota's process started in 1937, and from that point forward. The organization has been at the front of auto advancement. One of its most huge commitments to the business is the improvement of the Toyota Creation Framework (TPS). A progressive assembling process that underscored productivity. Quality, and waste decrease. TPS presented the idea of "without a moment to spare" creation. Which limited stock expenses and further developed creation speed, setting another norm for the business.

This way to deal with assembling changed Toyota into a worldwide force to be reckoned with as well as impacted incalculable different automakers. The standards of TPS have been embraced around the world, shaping the reason for lean assembling rehearses across different ventures.

Toyota: The Introduction of the half breed Unrest

The effect of the Prius reached out past Toyota's item arrangement. It provoked different automakers to foster their half breed and electric vehicles, speeding up the shift towards greener innovations. Today. Toyota keeps on driving in mixture innovation, with a great many crossover vehicles sold universally, adding to diminished outflows and fuel utilization

Worldwide Extension and Market Authority

Toyota's worldwide extension technique plays had a significant impact in its effect on the car market. By laying out assembling plants in key districts around the world. Toyota has had the option to adjust to nearby market needs, diminish creation costs, and keep up with its strategic advantage. The organization's obligation to quality and development deserves it a dependable client base across the globe.

In business sectors like North America, Europe. and Asia. Toyota has reliably positioned among the top automakers as far as deals and piece of the pie. Its different item setup, which incorporates all that from minimized vehicles to extravagance vehicles and business trucks, permits Toyota to take special care of many shopper inclinations and requirements.

Obligation to Supportability and Development

Toyota's impact on the worldwide car market reaches out past its vehicles; the organization is likewise a forerunner in maintainability drives. Toyota's obligation to lessening its ecological effect is apparent in its drawn out procedure, known as the "Toyota Natural Test 2050." This aggressive arrangement expects to accomplish zero fossil fuel byproducts all through the vehicle lifecycle, from creation to end-of-life reusing.

To accomplish this objective, Toyota is putting vigorously in innovative work of elective energy sources, including hydrogen power modules and electric vehicles. The organization has previously taken huge steps with the presentation of vehicles like the Mirai, a hydrogen energy component vehicle, and the continuous improvement of electric vehicles (EVs) as a feature of its more extensive system.

Molding the Fate of Versatility

Toyota isn't just centered around creating vehicles yet in addition on forming the fate of versatility. The organization is effectively associated with creating independent driving innovation, associated vehicles, and savvy transportation frameworks. Toyota's vision for what's in store incorporates making a reality where vehicles are more secure, more productive, and consistently coordinated into the more extensive transportation environment.

Toyota's interest in independent vehicles, especially through its auxiliary, the Toyota Exploration Organization (TRI), features its obligation to advancement. The organization's attention on computerized reasoning, mechanical technology, and high level materials research is driving the improvement of cutting edge vehicles that will reclassify the manner in which individuals travel.

Difficulties and Flexibility

Like any worldwide company, Toyota has confronted its portion of difficulties. The 2008 worldwide monetary emergency, cataclysmic events like the 2011 seismic tremor and tidal wave in Japan. And the later semiconductor deficiencies have tried Toyota's versatility. In any case, the organization's powerful production network the executives, versatile business methodologies. And obligation to constant improvement have permitted it to really explore these difficulties.

Toyota's capacity to rapidly recuperate from mishaps and keep developing has supported its situation as a forerunner in the worldwide auto market. The organization's emphasis on long haul supportability, consumer loyalty, and mechanical progression guarantees that it stays a prevailing power in the business.

2 notes

·

View notes

Text

Something that really fascinates me is the concept of “American words”. You know, words that US Americans associate with the USA, and the pandering way in which this used. I’m specifically looking at this in the context of trains.

For the longest time, with very few exceptions, the rail industry has used numeric or alphanumeric codes to refer to vehicles. Some trains got nicknames, but for the most part, you talk about SD40-2 and GG1 and GP9 and Re 4/4 II and 141R and F40PH and LNER A4 and class 95 and V100 (east) and DD 16 and BB 15000 and what have you. Stuff that makes you sound crazy to any non-railfan, and that’s how we like it. None of these are made up, by the way, I have all of them in my model railroad collection (the 141R is new).

That’s because this is all a strictly business-to-business thing. Nobody buys a particular locomotive, car or train because of the great name or advertisement, they do it because they ran the numbers and a lot of negotiating.

Over the years, however, that shifted. The first major time (apart from a few one-off named trains) in the US was probably the General Electric P40, P42 and P32, collectively known as “Genesis”. That’s already a fairly “American” word: Explicitly biblical, which is less popular in Europe (let alone other parts of the world), and it sounds meaningful: Something something start, new beginning. The locomotive is the beginning of the train, anyway, so it’s not like it’s wrong.

In Europe, we’ve seen this in full force during the 90s and especially 2000s, together with a huge shift in how railroading worked at all. Before, it used to be that the rail industry of one country got together with the country’s main railroad, and designed one locomotive together, and everyone got to build at least parts of it. A lot of mergers and liberalisation of the rail market means that nowadays, the rail industry is organised as multinational corporations (I’d say four major ones at the moment, but I won’t say which ones so nobody gets angry at me for saying the wrong ones), and these design the trains in house and then try to sell them, with real marketing departments and such.

For example, in the 80s and early 90s, there was exactly one regional diesel train that was being built in Germany, the class 628. It was only built for Germany (mostly, a few ended up in Luxembourg), too. Other countries had very similar trains, notably the Netherlands and Austria, which were derived from the German design and built under license, but by their own local rail industry to their own standards.

On the other hand, by 2000, in the same market (but now low-floor for better accessibility and climatized), we had things like the class 642, 643, 646 and 648, and that’s not counting the weird ones (such as the shorter 640, 641 and 650) or the ones only sold to private companies. All of them did the same thing, but all of them were built by different companies (Siemens, Bombardier, Stadler and Alstom in order), and all of them were also exported, unchanged, to many other countries around the world. Even North America got a small set of each of these types.

And since there were many, it was decided that marketing was now in order. These trains no longer only had class numbers from the railroad that ordered them; instead they got names from their manufacturers. In those cases, Coradia LINT, TALENT, GTW and Desiro, and there were also RegioShuttle, RegioSprinter and Itino, and yes I am missing some on purpose.

Throughout the 2000s, all manufacturers adopted this for almost all trains and locomotives. So let’s talk about the names in particular.

First thing: Names are expensive, so they get reused. You will find Siemens Desiro trains in Germany, Belgium, the UK and Malaysia (among others), and those have nothing to do with each other except for being regional trains built by Siemens. In fact, there are two or three completely different types of Desiro in Germany alone (the Desiro ML and HC are not completely different, but they’re hardly the same thing either). They are generally delineated by suffixes, like Desiro Classic, Desiro ML, Desiro HC, or Coradia LINT and Coradia Stream and many others.

Second: Names are generally abstract made-up words. It’s okay if they sound a bit English or are English, but they’re generally meaningless. Desiro, Coradia, TRAXX, Vectron, Talent, Velaro, Avelia, Urbos, Flexity, Civity, Mireo, those are all names that vaguely imply something but mean nothing in particular and are specifically chosen to be inoffensive everywhere.

The big exception to this is Stadler, who uses funny (to them) abbreviations. Their line-up includes TANGO (tram), WINK (local train), FLIRT (regional train), KISS (double-decker regional and intercity train), and for their high-speed long-distance train… SMILE. I’ve said it before and I’ll say it again: They’re cowards.

So let’s come back to North America. The passenger rail industry there has been in a zombie state for a long time, and it seems like the freight industry is starting to join them. The market is too small to really have a domestic industry, so with very few exceptions, all modern trams, subways, locomotives and complete train sets are European designs, adapted for the US market, but assembled in the US due to federal laws.

And they all get names for the specific North American variant, and this name is always what I’d call an “American word”:

Europe: Siemens Vectron DE (diesel locomotive). North America: Siemens Charger

Europe: Citadis (tram). North America: Citadis Spirit

Europe: Flexity 2 (tram). North America: Flexity Freedom

Europe: Avelia Horizon (high speed train). North America: Avelia Liberty

There are still some exceptions, like the ALP45DP whose name is as gloriously ugly as the locomotive itself, but the trend is clear.

Just today, and the reason why I’m posting this, we got my favorite example. The company behind the privately owned and operated high speed line between (the suburbs of) Los Angeles and Las Vegas is currently looking at which trains to buy, and Siemens has released an official proposal. It’s based on their Velaro high speed train, specifically the Velaro Novo that’s conceptually a cross between the ICE 3 (new) and ICE 4 (remind me to write a post about ICE types and their bonkers numbering one of these days), and for a long time it has only been communicated as such. But their competitor has the much more American name Avelia Liberty (also known as the new Acela by its operator Amtrak - interestingly Acela would be a perfectly good European train name). So they needed to not only build a better train, they also needed to out-american them on the name. Apparently.

Enter the American Pioneer 220.

Now that’s an American name! Velaro Pioneer would have been a very American name already, but Siemens really wants that contract, so they put American in front, just to make it absolutely clear that they’re not planning to sell this one to Iceland. The 220 stands for its top speed of 354 kilometers per hour, of course, which it won’t reach on the proposed line.

So what is an “American” word here? I’d say it’s anything you can have as a keyword in a speech about how great and unique the US is. In the list above, we have Freedom, Freedom but in Latin, Spirit, Charger and now Pioneer.

For more similar names, I think the space program provides great opportunities. All Space Shuttles and Mars rovers have great American names. Anything that sounds like can-do attitude, overcoming, exploring new grounds, being super-free and perhaps vaguely metaphysical can do the job. Opportunity. Constitution. Eagle. Flag. Banner. Crossroads. Star. You can just go on.

I suppose/hope we’re not getting any trained named Columbia anymore, but I do hope Destiny is still in there and that Stadler gets in on this act, because a train named KISS Destiny would be absolutely hilarious.

I think there’s like a 5% chance of someone coming in my notes and saying that this is necessary and good because the US are so full of freedom and liberty and work-ethic and so on that the Europeans could never understand. I don’t think it’ll happen, I’ve made the post far too long for anyone to read through to the end, but you know, if it does: I don’t really agree with that. But it is true that US Americans like to believe that about themselves, and so if you want to pander to them, these words work wonders.

As a non-american who has spent less than three months in the US in total, I am not an expert on this or in fact anything I’m saying here, but I also personally blame George Bush and the Iraq War, and the rise in mandated patriotism that came with that. Of course the land of Freedom Fries also gets the Trainionity Freedom. See also how many US trains now have American flags on them, including many that were built fully in Germany or Switzerland. That’s a relatively recent thing.

2 notes

·

View notes

Text

Monday, February 6, 2023

The mood of the U.S. (Gallup) Americans’ assessment of the state of the nation remains in the pandemic-era slump seen since 2021, marked by subdued satisfaction with 30 different aspects of the country. These include the public’s reaction to several aspects of U.S. society generally, as well as to numerous specific issues facing the country. These findings from Gallup’s Jan. 2-22 Mood of the Nation poll come as only 23% of Americans are broadly satisfied with the way things are going in the country, while the rest are dissatisfied, including nearly half “very dissatisfied.” The overall quality of life in the country (65%) and the opportunity for a person to get ahead by working hard (61%) are the only two societal dimensions of eight measured in this year’s Mood of the Nation poll that a majority of Americans view positively. Even these satisfaction ratings, however, are well below the record highs of 89% for the quality of life in 2001-2002 and 77% for opportunity in 2002. Close to half of Americans today are satisfied with the influence of organized religion, while satisfaction drops to a third for the size and power of the federal government as well as the U.S. system of government and how it works. Americans are least satisfied with the nation’s moral and ethical climate (20%), the way income and wealth are distributed (24%), and the size and influence of major corporations (27%).

Attacks on Electrical Substations Raise Alarm (NYT) A recent spate of attacks on electrical substations in North Carolina and other states has underscored the continued vulnerability of the nation’s electrical grid, according to experts who warn that the power system has become a prime target for right-wing extremists. Over the last three months, at least nine substations have been attacked in North Carolina, Washington State and Oregon, cutting power to tens of thousands of people. After those attacks, federal regulators ordered a review of security standards for the electrical system. Because they house transformers that transfer power from region to region, the tens of thousands of substations across the country represent the most vulnerable nodes in the nation’s vast electrical grid, said Jon Wellinghoff, a former chairman of the Federal Energy Regulatory Commission.

America’s offices are now half-full. They may not get much fuller. (Washington Post) The tug of war over getting workers back to the office just reached a key milestone: 50 percent are back at their desks on average, the most since the pandemic hit in March 2020. But that means major corporate offices are only half as full as they once were—and many experts think this could be as good as it gets. The return-to-office figures are unlikely to go much higher as flexible work becomes entrenched in the lives of white-collar workers, experts say. Some employees have resisted hard mandates to return: They’ve left for remote opportunities elsewhere or even flouted in-office requirements, flexing worker leverage while the labor market remains hot. In response, more companies seem to be moving toward acknowledging that the 9-to-5, Monday-through-Friday in-office job is over. More than half of U.S. jobs that can be done remotely were hybrid as of November, up from 32 percent in January 2019, according to data from Gallup.

Peruvian politics (Reuters) As deadly protests rage across Peru, a political battle is unfolding inside the halls of Congress, walled off from the streets by hundreds of police, armored vehicles and a maze of gates. Lawmakers are at loggerheads over whether to hold a snap election this year following the Dec. 7 ouster of leftist President Pedro Castillo part-way through his term, an event that sparked weeks of protests that have seen 48 people killed. Despite the violence, and despite polls that show the majority of Peruvians want the election brought forward, Congress appears to be in deadlock. At least three election bills have been rejected and others knocked back before being debated in the past week, with parties on the left and right apparently unable or unwilling to compromise. “They fight like they’re in a street market,” said Juliana Gamonal, 56, a food delivery person in Lima. “We don’t have good leaders right now, everything is for their benefit, not for the people.” Congress has 13 different voting blocs, making it hard to reach majorities needed for legislation. Meanwhile, constitutional rules make it relatively easy to attempt impeachment—leading the fragmented blocs to use it to punish presidents they don’t like. There have been seven impeachment attempts in the last five years—which have seen six presidents.

Brazil sinks aircraft carrier carrying asbestos, other toxins (Washington Post) Brazil’s navy said Friday night that it had carried out a “planned and controlled” operation to sink a decommissioned aircraft carrier nearly 220 miles off its coast—despite the objections of environmentalists and some government officials who argued that it contained toxic materials that could contaminate the ocean. The navy said in a statement that the operation to sink the São Paulo, a Clemenceau-class carrier, was carried out with the necessary technical competencies and safety measures in “order to avoid logistical, operational, environmental and economic losses to the Brazilian state.” Before Friday’s operation, the São Paulo had been at the center of a months-long odyssey, with governments on several continents refusing to let it dock. Brazil bought the 30,000-ton São Paulo from France in 2000 and decommissioned it in 2018.

Most travelers will soon have to fill out an online application to visit the UK (The Week) As part of efforts to fully digitize its borders by 2025, the United Kingdom is launching the Electronic Travel Authorization (ETA) system, which is expected to be up and running by the end of 2023. All foreign nationals will have to apply online for an ETA before arriving in the UK, providing “basic personal details, passport data, and some security information,” the ETA UK website says. People can apply from their own homes—there’s no need to go to an embassy—and most will be approved quickly, “with only complex decisions made by ETA officials.” There will be a fee, which has yet to be announced. This isn’t a visa, and the website stresses that “Europeans and travelers from countries including the US and Canada will maintain their visa-free status but will need an ETA to cross the UK border.” The details are still being worked out, but it’s likely the ETA will be valid for at least two years, meaning regular visitors will not have to keep reapplying.

Zelensky warns situation at war front ‘getting tougher’ (Washington Post) Russia is multiplying its attacks to break Ukraine’s defenses, and the situation on the war front is “getting tougher,” Ukrainian President Volodymyr Zelensky said in his nightly address. He said the situation was “very difficult” in the country’s east, especially around Bakhmut, Vuhledar and Lyman. Ukraine has said it will keep fighting for Bakhmut, even as Russia is tightening its grip on the city. Ukrainian losses are mounting in Bakhmut, where a U.S. citizen, Pete Reed, was killed while working as a volunteer paramedic with an outreach group.

Powerful quake rocks Turkey and Syria, killing more than 600 (AP) A powerful 7.8 magnitude earthquake rocked southeastern Turkey and northern Syria early Monday, toppling hundreds of buildings and killing more than 600 people. Hundreds were still believed to be trapped under rubble, and the toll was expected to rise as rescue workers searched mounds of wreckage in cities and towns across the area. On both sides of the border, residents jolted out of sleep by the pre-dawn quake rushed outside on a cold, rainy and snowy winter night, as buildings were flattened and strong aftershocks continued. Rescue workers and residents in multiple cities searched for survivors, working through tangles of metal and giant piles of concrete.

The deepening chill of Afghanistan’s second Taliban winter (Washington Post) In a yard ankle-deep with mud and snowy slush, a woman named Farzana, 32, squatted and scrubbed clothes in a bucket last week. When she stood, her hands were stiff and red. Her daughters were out begging for bread; her sons were collecting trash to use as stove tinder. At night, in a mud-walled hut on the outskirts of the Afghan capital, the family of seven would huddle together under blankets as the heat slowly died. As 40 million Afghans struggle through a second winter since the return of Taliban rule, many are facing conditions far worse than during the first. The weather has been exceptionally harsh, with temperatures often near zero at night. More than 160 people nationwide have died of hypothermia. So have at least 200,000 goats, sheep and other livestock. In isolated northern provinces, many roads are blocked by snow and little emergency aid can be delivered. According to the World Food Program, nearly 20 million people face acute food shortages this winter, and 6 million face “emergency-level food insecurity.” Many foreign aid projects, which distributed food and supplies last winter across the country, have been cut back or suspended because of an impasse between international donors and Taliban authorities over women’s rights, especially new Taliban edicts banning women from attending college or working for foreign charities.

Sri Lanka marks independence anniversary amid economic woes (AP) Sri Lanka marked its 75th independence anniversary on Saturday as a bankrupt nation, with many citizens angry, anxious and in no mood to celebrate. President Ranil Wickremesinghe, who has started to improve some but not all of the acute shortages, acknowledged the somber state of the nation, saying in a televised speech, “We have reached the point of destruction.” Many Buddhists and Christian clergy had announced a boycott of the celebration in the capital, while activists and others expressed anger at what they see as a waste of money in a time of severe economic crisis. Sri Lanka is effectively bankrupt and has suspended repayment of nearly $7 billion in foreign debt due this year pending the outcome of talks with the International Monetary Fund for a bailout package.

Pope makes final bid for peace, forgiveness in South Sudan (AP) Pope Francis made a final appeal for peace in South Sudan on Sunday as he celebrated Mass before tens of thousands of people to close out an unusual mission by Christian religious leaders to nudge forward the country’s recovery from civil war. On the last day of his African pilgrimage, Francis begged South Sudanese people to lay down their weapons and forgive one another, presiding over Mass at the country’s monument to independence hero John Garang before an estimated 100,000 people, including the country’s political leadership. “Even if our hearts bleed for the wrongs we have suffered, let us refuse, once and for all, to repay evil with evil,” Francis said. “Let us accept one another and love one another with sincerity and generosity, as God loves us.”

In a world of drones and satellites, why use a spy balloon anyway? (Washington Post) In a world of advanced surveillance technology, including drones and satellites, why on Earth would a country use a balloon for spying? That was the question on everyone’s mind this week after U.S. defense officials accused China of flying a high-altitude surveillance balloon over the continental United States. Despite the furor, spy balloons are actually not that unusual. According to U.S. officials, they have been spotted over U.S. territory a number of times in recent years. “Balloons offer a few advantages over the use of satellites or drones,” James Rogers, an academic at Cornell and the University of Southern Denmark. “Not only are they cheaper than launching satellites into space, but by operating within the bounds of the earth’s atmosphere, closer to the surface, they can obtain better quality images,” he added. The latest generation of balloons are high-tech in their own right, “envisaged as systems that can fly up to 90,000 feet” high, “deploy their own drone systems” and detect incoming missiles. Balloons can soar above the range of most planes, Clarke said, and their slow speed means they aren’t always picked up by radar. Satellites can provide high-resolution imagery, Clarke said—but balloons can stay over one area for longer periods than satellites, if the weather permits.

2 notes

·

View notes

Text

Aluminum Alloys Market Analysis: A Pathway to USD 330 Billion by 2030

The aluminum alloys market is experiencing significant growth, driven by increasing demand across various sectors, particularly automotive, aerospace, and construction. As per Intent Market Research, the Aluminum Alloys Market was valued at USD 217.4 billion in 2023 and is projected to surpass USD 330.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.2% during the period from 2024 to 2030.

Market Overview

Aluminum alloys are metallic materials composed primarily of aluminum combined with other elements to enhance their properties. These alloys are prized for their lightweight nature, strength, corrosion resistance, and versatility, making them suitable for a wide range of applications. The automotive industry is one of the largest consumers of aluminum alloys, utilizing them to improve fuel efficiency and reduce emissions by minimizing vehicle weight. In aerospace, aluminum alloys are essential for structural components due to their high strength-to-weight ratios.

Access Full Report @ https://intentmarketresearch.com/latest-reports/aluminum-alloys-market-4846.html

Key Drivers of Growth

Automotive Industry Demand: The push for lightweight vehicles is a major driver in the aluminum alloys market. Manufacturers are increasingly adopting aluminum to enhance fuel efficiency and comply with stringent environmental regulations aimed at reducing carbon emissions. This trend is expected to continue as electric vehicles gain popularity, further increasing the demand for lightweight materials.

Aerospace Applications: The aerospace sector relies heavily on aluminum alloys for aircraft manufacturing due to their excellent strength-to-weight ratio. As air travel continues to grow, so does the need for advanced materials that can withstand the rigors of flight while maintaining low weight.

Construction Sector Expansion: Aluminum alloys are increasingly used in construction for applications such as roofing, siding, and window frames due to their durability and resistance to corrosion. The global construction industry’s expansion is expected to bolster demand for aluminum alloys.

Technological Advancements: Innovations in alloy formulations and manufacturing processes are enhancing the performance characteristics of aluminum alloys. This includes developments in high-strength and heat-treatable alloys that cater to specialized applications in various industries.

Regional Insights

The Asia-Pacific region holds a significant share of the global aluminum alloys market, driven by rapid industrialization and urbanization in countries like China and India. North America and Europe also represent substantial markets due to established automotive and aerospace industries.Market ChallengesDespite its growth potential, the aluminum alloys market faces challenges such as:

Environmental Regulations: Stricter regulations regarding emissions and waste management can impact production processes.

High Production Costs: The cost associated with producing high-quality aluminum alloys can be significant, affecting profitability.

Competition from Alternative Materials: The rise of composite materials in industries like aerospace poses a competitive threat to traditional aluminum alloys.

Download Sample Report @ https://intentmarketresearch.com/request-sample/aluminum-alloys-market-4846.html

Future Outlook

The future of the aluminum alloys market appears robust, with projections indicating continued growth through 2030 and beyond. As industries increasingly prioritize sustainability and efficiency, the demand for lightweight materials like aluminum alloys will likely increase.In conclusion, the aluminum alloys market is poised for substantial growth driven by advancements in technology, increasing demand from key sectors such as automotive and aerospace, and a global push towards sustainability. Stakeholders in this market must navigate challenges while capitalizing on emerging opportunities.

About Us

Intent Market Research (IMR) is dedicated to delivering distinctive market insights, focusing on the sustainable and inclusive growth of our clients. We provide in-depth market research reports and consulting services, empowering businesses to make informed, data-driven decisions.

Our market intelligence reports are grounded in factual and relevant insights across various industries, including chemicals & materials, healthcare, food & beverage, automotive & transportation, energy & power, packaging, industrial equipment, building & construction, aerospace & defense, and semiconductor & electronics, among others.

We adopt a highly collaborative approach, partnering closely with clients to drive transformative changes that benefit all stakeholders. With a strong commitment to innovation, we aim to help businesses expand, build sustainable advantages, and create meaningful, positive impacts.

Contact Us

US: +1 463-583-2713

0 notes