#Non-dairy Ice Cream Market forecast

Explore tagged Tumblr posts

Text

#Non-dairy Ice Cream Market#Non-dairy Ice Cream Market size#Non-dairy Ice Cream Market share#Non-dairy Ice Cream Market trends#Non-dairy Ice Cream Market analysis#Non-dairy Ice Cream Market forecast#Non-dairy Ice Cream Market outlook

0 notes

Text

Ice Cream Flavor Concentrates Market: Key Trends and Future Predictions

The ice cream industry has long been a staple in the global food market, providing an indulgent treat for consumers worldwide. Within this expansive market, ice cream flavor concentrates play a crucial role in enhancing flavor profiles and offering variety to meet diverse consumer preferences. The demand for ice cream flavor concentrates is projected to see significant growth over the coming years. This article explores the forecast for the ice cream flavor concentrate market, focusing on key drivers, trends, and potential challenges.

Market Overview: A Growing Segment

Ice cream flavor concentrates are concentrated blends of natural or artificial ingredients designed to impart specific tastes and aromas to ice cream and frozen desserts. These concentrates are available in a wide range of flavors, from traditional vanilla and chocolate to more innovative offerings like matcha, salted caramel, and exotic fruits. As consumers become more adventurous in their tastes, the demand for a diverse range of flavors has led to growth in the ice cream flavor concentrate market.

In recent years, the market has seen a steady increase in demand, driven by the expanding variety of ice cream products and the rising number of ice cream parlors, convenience stores, and supermarkets offering ready-to-eat frozen desserts. As of 2023, the market value of ice cream flavor concentrates is estimated to be valued at several billion dollars globally, with forecasts indicating a compound annual growth rate (CAGR) of around 6-8% over the next five to ten years.

Key Drivers of Growth

Consumer Demand for Variety and Innovation The consumer preference for novelty and new flavor experiences is one of the primary drivers fueling the growth of the ice cream flavor concentrate market. As more people seek personalized experiences in their food choices, manufacturers are responding by introducing new and unique flavor combinations. This trend is especially prominent in premium and artisanal ice creams, where flavors are often complex and unique.

Health and Wellness Trends Consumers are increasingly becoming health-conscious, leading to the growth of "healthier" versions of ice cream products, such as low-fat, sugar-free, and dairy-free options. Flavor concentrates that cater to these dietary preferences—such as those derived from plant-based sources or those using natural sweeteners—are seeing a surge in demand. This trend is expected to continue as health-conscious consumers drive innovation in the ice cream sector.

Technological Advancements in Flavor Production Advancements in food technology, including the use of natural and sustainable flavoring sources, have made ice cream flavor concentrates more accessible and affordable. Improved production techniques allow for more precise and consistent flavor delivery, reducing costs for manufacturers and improving the overall consumer experience.

Expanding Global Middle Class and Disposable Income The rise of the global middle class, particularly in emerging markets in Asia-Pacific, Latin America, and Africa, is contributing to the demand for premium and indulgent ice cream products. Increased disposable income allows consumers in these regions to explore new and diverse flavor options, creating a growing market for ice cream flavor concentrates.

Get Link Here : https://www.pristinemarketinsights.com/ice-cream-flavor-concentrate-market-report

Market Trends to Watch

Plant-Based and Vegan Ice Creams As the popularity of plant-based diets rises, the demand for vegan and dairy-free ice cream options is also growing. Flavor concentrates that can be adapted for these products, using plant-based milks like almond, oat, or coconut, are increasingly in demand. Manufacturers are focusing on creating unique, dairy-free ice cream products that appeal to both vegans and non-vegans alike.

Sustainability and Clean Label Preferences Consumers are placing increasing importance on sustainability and transparency when it comes to the food they consume. The ice cream flavor concentrate market is responding by offering clean-label products that are free from artificial additives and preservatives. Flavors derived from natural sources, such as organic vanilla and fruit extracts, are becoming popular choices.

Premium and Artisanal Offerings There is a growing trend toward premium and artisanal ice cream products, which focus on high-quality ingredients, unique flavors, and small-batch production. Flavor concentrates that allow manufacturers to replicate these high-end offerings at scale are gaining traction in the market.

Challenges Facing the Market

Despite the promising growth prospects, the ice cream flavor concentrate market faces several challenges. One of the key hurdles is the volatility in the prices of raw materials, such as natural extracts and flavoring agents. Fluctuations in the cost of these materials can impact the overall production costs for flavor concentrate manufacturers, leading to price increases for consumers.

Additionally, competition in the market is intensifying, with both established flavor concentrate manufacturers and new entrants vying for market share. As a result, companies need to focus on continuous innovation, product differentiation, and strategic partnerships to maintain their competitive edge.

Market Forecast: The Road Ahead

Looking ahead, the ice cream flavor concentrate market is poised for substantial growth. Demand will be driven by the increasing variety of ice cream products, evolving consumer tastes, and the need for manufacturers to adapt to changing health and wellness trends. The rise of plant-based and artisanal ice creams, combined with the focus on sustainability, will further fuel this growth.

However, the market’s trajectory may be shaped by factors such as the cost of raw materials, competitive pressures, and global economic conditions. Manufacturers will need to invest in research and development to create new and innovative flavors while managing production costs effectively.

Conclusion

The future of the ice cream flavor concentrate market looks promising, with key drivers such as consumer demand for variety, health-conscious choices, and technological advancements propelling market growth. As the industry continues to evolve, manufacturers who can tap into emerging trends, create sustainable products, and cater to diverse consumer preferences will be well-positioned to succeed in the coming years.

Get Free Sample and ToC : https://www.pristinemarketinsights.com/get-free-sample-and-toc?rprtdtid=NDg2&RD=Ice-Cream-Flavor-Concentrate-Market-Report

0 notes

Text

Fruit Concentrate Market type, segmentation, growth and forecast 2024-2030

Fruit Concentrate Market

The Fruit Concentrate Market is expected to grow from USD 2.30 Billion in 2022 to USD 3.00 Billion by 2030, at a CAGR of 3.50% during the forecast period.

Get the sample report: https://www.reportprime.com/enquiry/sample-report/6364

Fruit Concentrate Market Size

Fruit concentrate is a processed product made by removing water and nutritional content from fruits, while retaining their taste and aroma. The fruit concentrate market research report segments the market based on types of fruits, including orange, tomato, strawberry, mango, guava, apple, peach, apricot, and others. Applications of fruit concentrate include ice cream, dairy, fruit juice, foodservice, bakery, and others. The market is analyzed for different regions like North America, Asia Pacific, Middle East, Africa, Australia, and Europe, and key players include Al Shams Agro Group, Agrana, Juhayna Food Industries, Faragalla, Döhler, Ingredion, Inc., SunOpta, UEFCON, and MisrItaly Group. Additionally, regulatory and legal factors specific to market conditions, such as food safety laws, labeling requirements, and trade agreements, are analyzed.

Fruit Concentrate Market Key Players

Al Shams Agro Group

Agrana

Juhayna Food Industries

Faragalla

Döhler

Inquire Now: https://www.reportprime.com/enquiry/pre-order/6364

Fruit Concentrate Market Segment Analysis

Latest trends in the fruit concentrate market include the growing popularity of organic and non-GMO fruit concentrates, the increasing demand for exotic fruit flavors, and the rise of private label brands. Another significant trend is the use of fruit concentrates as a natural sweetener in various products as an alternative to artificial sweeteners.

Overall, the fruit concentrate market presents a lucrative opportunity for investors and market players, and with the right strategies and product development, it is set for substantial growth in the coming years.

This report covers impact on COVID-19 and Russia-Ukraine wars in detail.

Purchase this report: https://www.reportprime.com/checkout?id=6364&price=3590

KEY PRODUCT APPLICATION COVERED

Ice Cream Industry

Dairy Industry

Fruit Juice Industry

Foodservice Industry

Bakery Industry

Others

KEY PRODUCT TYPES COVERED

Orange

Tomato

Strawberry

Mango

Contact Info:

Krishna Sharma

US:- +1 507 500 7209

Email:- [email protected]

Website:- https://www.reportprime.com/

Browse more reports:

https://www.linkedin.com/pulse/strategic-insights-global-physical-therapy-laser-market-ggp1e?trackingId=P6qhKNxpQAmYRNWS5%2BQeqw%3D%3Dhttps://www.linkedin.com/pulse/strategic-insights-global-physical-therapy-laser-market-ggp1e?trackingId=P6qhKNxpQAmYRNWS5%2BQeqw%3D%3Dhttps://www.linkedin.com/pulse/strategic-insights-global-physical-therapy-laser-market-ggp1e?trackingId=P6qhKNxpQAmYRNWS5%2BQeqw%3D%3Dhttps://www.linkedin.com/pulse/strategic-insights-global-physical-therapy-laser-market-ggp1e?trackingId=P6qhKNxpQAmYRNWS5%2BQeqw%3D%3Dhttps://www.linkedin.com/pulse/strategic-insights-global-physical-therapy-laser-market-ggp1e?trackingId=P6qhKNxpQAmYRNWS5%2BQeqw%3D%3Dhttps://www.linkedin.com/pulse/strategic-insights-global-physical-therapy-laser-market-ggp1e?trackingId=P6qhKNxpQAmYRNWS5%2BQeqw%3D%3Dhttps://www.linkedin.com/pulse/strategic-insights-global-physical-therapy-laser-market-ggp1e?trackingId=P6qhKNxpQAmYRNWS5%2BQeqw%3D%3D

0 notes

Text

Asia Pacific Ice Cream 2024 Industry – Challenges, Drivers, Outlook, Segmentation - Analysis to 2030

Asia Pacific Ice Cream Market

The Asia Pacific ice cream market size was estimated at USD 42.15 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The Asia-Pacific market is experiencing growth due to consumers having higher disposable incomes and a preference for purchasing high-quality ice cream products. This growth is fueled by the increasing demand for food items like ice cream and frozen desserts in the region, with disposable income being primarily allocated towards food purchases.

The rise in ice cream production is supported by the expanding dairy market in the Asia-Pacific region. The trend of health-conscious consumers seeking ice creams with functional and health benefits is further driving the demand for high-quality products made with ingredients like mung bean and other nutritious components.

Gather more insights about the market drivers, restrains and growth of the Asia Pacific Ice Cream Market

The increasing popularity of premium ice creams in the region is anticipated to be a key driver for market growth. Manufacturers are introducing new ice cream innovations, like sugar-free plant-based varieties, to cater to consumer preferences, thereby fueling the market growth of the Asia Pacific ice cream industry in the forecast period. In March 2024, Eclipse Foods, the plant-based ice cream brand known for its commitment to replicating the creamy texture and rich flavors of traditional dairy, launched its latest innovation: Eclipse Bonbons. This exciting new line takes the brand's signature non-dairy ice cream to a whole new level of indulgence, offering a luxurious treat that rivals the most decadent chocolate-covered ice cream bonbons.

Major players in the Asia Pacific market are investing heavily in research and development to introduce new and innovative flavor varieties of ice creams. In April 2024, Havmor, a brand under LOTTE Wellfood Co. Ltd, launched a fresh lineup of ice cream flavors just in time for the upcoming summer heatwave. The range features a mix of traditional favorites and contemporary twists. From classics like Shahi Kesar and Rajwadi Kulfi to modern delights such as Blueberry Cheesecake, Cookie and Cream cones, and ice cream sandwiches. It also added seasonal treats like Jaljeera & Kalakhatta, Ratnagiri Hapus, and rose-flavored ice cream for a cool and revitalizing indulgence.

The increasing expenditure on ice creams in Asian countries such as India, Japan, and New Zealand is projected to support market growth. For instance, according to Japan’s Ministry of Internal Affairs and Communications (MIC), expenditure on ice cream among Japanese consumers witnessed a 135% growth between 2011 and 2020.

Asia Pacific is characterized by an increasing demand for high-end ice creams. The changing consumption habits of consumers and the vast diversity in the region have led to the demand for varied flavor combinations and innovative ice creams. The region has also witnessed the introduction of new brands to the market, which has led to positive competition in the industry. For instance, Chicecream is a premium ice cream brand in China that focuses on high-end and creative ice creams. Founded in 2018, Chicecream was the No. 1 brand in terms of sales in the ice product sector on Tmall in 2020 and 2021. It is also immensely popular at China's annual Double 11 and 618 shopping festivals.

Browse through Grand View Research's Consumer F&B Industry Research Reports.

The global chicory coffee market size was estimated at USD 216.61 million in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030.

The global human grade pet food market size was estimated at USD 2.41 billion in 2023 and is expected to grow at a CAGR of 6.6% from 2024 to 2030.

Asia Pacific Ice Cream Market Report Segmentation

This report forecasts revenue growth in Asia Pacific and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the Asia Pacific ice cream market report based on source, flavor, packaging, distribution channel, and country:

Source Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

Dairy & Water-based

Vegan

Flavor Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

Vanilla

Chocolate

Fruit

Cookie & Cream

Nut

Others

Packaging Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

Cartons

Tubs

Cups

Cones

Bars

Distribution Channel Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

Hypermarkets & Supermarkets

Convenience Stores

Ice Cream Parlor

Online

Others

Country Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

Hong Kong

Taiwan

South Korea

Thailand

Singapore

Indonesia

Australia

New Zealand

Japan

Key Asia Pacific Ice Cream Companies:

Nestle SA

General Mills Inc.

Appolo Ice Cream Co Ltd;

Unilever PLC

Yili Group

CAMPINA ICE CREAM INDUSTRY Tbk.

Diamond Food Indonesia

Dairy Bell Ice Cream

PT. United Family Food

Froneri International Limited

Recent Developments

In January 2024, Singapore's OATSIDE has recently broadened its range by introducing a new line of ice cream, leveraging its distinctive oat milk as the primary component. This fresh ice cream collection is currently offered in three flavors: chocolate, peanut butter cookie dough, and coffee with mini chocolate chips

In March 2023, Chinese dairy giant Mengniuhas taken a significant step in expanding its global reach with the completion of the most extensive smart ice cream factory in Southeast Asia (ASEAN). This new facility, operated by its subsidiary brand Aice Group, marks a historic moment for the Philippines - it is the country's first intelligent ice cream factory

In March 2023, Healthy ice cream brand NOTO introduced three new Indian-flavored gelatos that are denser, richer, and creamier, containing half the fat and sugar. Each of these flavors has a significant historical connection with the Indian palate, resonating deeply with consumers.

Order a free sample PDF of the Asia Pacific Ice Cream Market Intelligence Study, published by Grand View Research.

0 notes

Text

Lactose Free Food Market will grow at highest pace owing to increasing incidences of lactose intolerance

The lactose free food market consists of various dairy and food products that do not contain lactose. These include milk, cheese, yogurt, ice cream, infant formula, and other food items. The growing prevalence of lactose intolerance around the world is fueling demand for lactose free dairy and food products. According to statistics, around 68% of the world's population has a reduced ability to digest lactose after infancy. Lactose intolerance causes symptoms like bloating, cramps, and diarrhea upon consuming dairy products that contain lactose. To avoid such discomfort, individuals are increasingly opting for lactose free food options.

The Global Lactose Free Food Market Size is estimated to be valued at US$ 18.73 Bn in 2024 and is expected to exhibit a CAGR of 4.5% over the forecast period 2024 to 2031.

Key Takeaways Key players operating in the lactose free food market are Cargill, Inc., Galaxy Nutritional Foods, Inc., Green Valley Organics, Edlong Dairy Technologies, Parmalat SpA, Valio Ltd., Alpro, OMIRA Oberland-Milchverwertung, Crowley Foods, Arla Foods., Danone SA, General Mills Inc., Fonterra Co-operative Group Limited, Kerry Group PLC, Emmi AG, WhiteWave Foods, Barry Callebaut AG, HP Hood LLC, Valio Ltd, and Daiya Foods Inc. The demand for lactose free dairy products like milk, cheese, and yogurt is increasing rapidly due to the growing health-conscious consumer base. Technological advancements are helping lactose free food producers develop innovative dairy and non-dairy alternatives that closely resemble the taste and texture of regular dairy products.

Get More Insights On This Topic: Lactose Free Food Market

#Lactose-Free Food Market#Dairy Alternatives#Food Allergies#Digestive Health#Plant-Based#Nutritional Supplements#Dairy-Free Diet#Health-conscious Consumers

0 notes

Text

Navigating Regulatory Frameworks in the Banana Puree Market

Banana Puree Market to grow at highest pace owing to Increasing Application in Baby Food and Dairy Products Banana puree is a thick and creamy paste made from peeled and mashed bananas. It is rich in potassium, fiber and vitamins like Vitamin C and Vitamin B6. Banana puree is extensively used in baby food formulas, smoothies, ice creams, beverages and other dairy products due to its nutritional benefits and flavoring properties. With over 200 varieties, bananas are among the most commonly consumed fruits in the world.

The Global Banana Puree Market is estimated to be valued at US$ 381.7 Mn in 2024 and is expected to exhibit a CAGR of 9.2% over the forecast period 2023 to 2030. Key Takeaways Key players operating in the banana puree market are Symrise AG, Döhler GmbH, Kiril Mischeff, Riviana Foods Pty Ltd, Nestlé S.A., The Hain Celestial Group Inc, The Kraft Heinz Co., Ariza B.V., Newberry International Produce Limited, Grünewald Fruchtsaft GmbH. Growing demand for banana puree from baby food manufacturers is expected to drive the market during the forecast period. Technological advancements such as aseptic processing and concentration techniques are helping market players improve the shelf-life and consistency of banana puree. Market Trends Consumers are increasingly preferring organic and non-GMO banana purees owing to rising health consciousness. Many market players have launched organic and non-GMO certified banana puree products to cater to this demand. Secondly, with rising global banana production, banana puree export is growing rapidly from Latin American and Asian countries to North America and European markets. Market Opportunities Growing application of banana puree in dairy products such as yogurt and ice cream presents significant growth opportunities. Secondly, banana puree blends with other fruits is a new product trend gaining popularity among consumers and food manufacturers. Market players can capitalize on this opportunity by launching innovative blended fruit puree products. The COVID-19 pandemic had significant impacts on the banana puree market. Lockdowns and supply chain disruptions during 2020-2021 disrupted the production and distribution of banana puree. While demand increased as consumer cooked more at home, many suppliers faced issues in procuring raw materials and completing shipments. The restrictions on imports and exports adversely affected international trade of banana puree during this period. As lockdowns eased in 2021, the banana puree market saw a gradual recovery. Manufacturers focused on improving local sourcing and optimizing distribution networks to enhance resilience against future disruptions. Many companies invested in automated production and packaging facilities to ensure continuity of operations even during workforce shortages. The banana puree market is expected to benefit from rising health awareness in the post-COVID era. Consumers are increasingly preferring products with natural ingredients and perceived immunity-boosting properties. This augurs well for the future growth prospects of the banana puree market. In terms of value, Latin America accounts for the largest share in the global banana puree market mainly due to its dominant position in banana production and exports. Countries such as Ecuador, Philippines and Costa Rica are key suppliers globally. North America currently holds the second largest market share led by the United States. The banana puree market in Asia Pacific region is growing at fastest rate driven by rising consumption in populous countries like India and China. In Africa, countries importing raw bananas for processing are emerging as new lucrative markets for banana puree manufacturers and exporters. The Asia Pacific region presents significant growth opportunities for banana puree market participants and is expected to be the fastest growing geographical region through 2030. Rising health awareness, increasing affordability and significant imports of raw bananas in China and India for processing are driving banana puree demand momentum in Asia Pacific. Populous and increasingly urban regions like Southeast Asia and South Asia are witnessing higher consumption of convenience, organic and natural food products containing banana puree. This makes Asia Pacific an attractive prospect for banana puree manufacturers looking to expand market share internationally over the coming years.

0 notes

Text

India Functional Foods Market Scope, Trends, Report 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the India Functional Foods Market size at USD 12.28 million in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the India Functional Foods Market size to expand at a CAGR of 14.74% reaching a value of USD 27.96 million by 2030. Functional Foods Market in India is propelled by the increasing demand for nutritional and fortifying food additives. Despite moderate impact from the COVID-19 pandemic, the market witnessed an upswing in demand for functional foods fortified with essential nutrients, driven by their perceived health benefits, including immune system enhancement. The market is steadily gaining momentum as companies intensify positive marketing efforts, promoting functional foods and expanding their online distribution channels, which bodes well for future market growth. Notably, concerns among the aging population regarding health maintenance, escalating medical costs, and a growing interest in the correlation between well-being and healthier diets contribute to the rising demand for functional foods in the country. As life expectancy rises globally, individuals are increasingly prioritizing a high quality of life, prompting a surge in the demand for functional foods. Government agencies, non-governmental organizations, and companies are actively engaged in awareness campaigns, intensifying consumer understanding of the nutritional advantages associated with functional foods, thereby stimulating market growth. Manufacturers in the food and beverages industry are fortifying their products with nutritional additives to enhance the nutritional value of food items. Also, noteworthy among trending functional foods are dairy products such as milk, yogurt, cheese, and functional frozen desserts like ice cream, reflecting the industry's commitment to meeting evolving consumer demands for health-conscious choices.

Opportunity - Spurring demand for natural and organic products

The rapid expansion of functional foods centers and the enhancement of infrastructure have significantly propelled the growth of the India Functional Foods Market. This strategic development has not only increased the accessibility of transplantation services but also improved the overall efficiency of procedures. The surge in investments and focus on establishing state-of-the-art facilities reflects a commitment to advancing healthcare in India. As a result, the Functional Foods Market is witnessing a notable upswing, with more patients benefiting from advanced treatments and a broader range of transplantation options. This expansion underscores the country's dedication to providing comprehensive and cutting-edge healthcare solutions, particularly in the critical field of functional foods. For instance, The Indian Council of Medical Research (ICMR) aims to establish advanced research centers for bone marrow transplants (BMT) in government hospitals nationwide. Recognizing the financial barriers faced by poor patients in accessing BMT services in private facilities, ICMR seeks to promote inclusivity. The initiative involves supporting medical institutions in creating cutting-edge BMT infrastructure, making these critical procedures safe and affordable. Dr. Lokesh Sharma, an ICMR scientist, emphasizes the urgency of enhancing accessibility and affordability, stressing the importance of an integrated approach. This strategic move aligns with the National Guidelines for Hematopoietic Cell Transplantation, 2021, reflecting ICMR's commitment to broadening access to quality healthcare across India.

Sample Request @ https://www.blueweaveconsulting.com/report/india-functional-foods-market/report-sample

Impact of Escalating Geopolitical Tensions on India Functional Foods Market

The India Functional Foods Market faces challenges amid escalating geopolitical tensions, impacting supply chains and market dynamics. Tensions can disrupt trade routes, affecting the import of essential ingredients, potentially leading to shortages and increased production costs. Heightened uncertainties may influence consumer behavior, altering preferences for functional foods and health supplements. Geopolitical instabilities could also impact foreign investments, hindering market growth and innovation. Navigating these challenges requires resilience, strategic planning, and adaptation to evolving geopolitical landscapes. Stakeholders must closely monitor the situation, assess potential risks, and devise flexible strategies to sustain the growth trajectory of the functional foods market in India amidst geopolitical uncertainties.

India Functional Foods Market

Segmental Information

India Functional Foods Market – By Ingredient

By ingredient, the India Functional Foods Market is divided into Carotenoids, Dietary Fibers, Fatty Acids, Minerals, Prebiotics & Probiotics, and Vitamins segments. The carotenoids segment holds the highest share in the India Functional Foods Market by ingredient. Carotenoids, including lutein, beta-carotene, lycopene, astaxanthin, zeaxanthin, canthaxanthin, and annatto, are available in various forms in the market. The market's main driver is the crucial role carotenoids play in treating eye disorders, cancer, and diabetes. Increased research and development for producing high-value natural carotenoids present new market opportunities within the forecast period. Meanwhile, the dietary fibers segment is expected to witness the fastest growth rate during the forecast period. Dietary fiber, abundant in fruits, vegetables, legumes, and whole grains, is crucial for bowel health, cholesterol reduction, and blood sugar control. As the functional food market expands, the dietary fiber segment is poised for growth. Its benefits, including weight management and reduced risks of diabetes and coronary disease, further drive market expansion.

Competitive Landscape

The India Functional Foods Market is fragmented, with numerous players serving the market. The key players dominating the India Functional Foods Market include FDC India, Hindustan Unilever Limited (HUL), ITC Limited, Nestlé India, Britannia Industries Limited, Godrej Consumer Products Limited (GCPL), Amway India, Dabur India, Patanjali Ayurved, Danone India, GlaxoSmithKline Consumer Healthcare, Abbott Nutrition, Himalaya Wellness, and Sun Pharmaceutical Industries Ltd. The key marketing strategies adopted by the players are facility expansion, product diversification, alliances, collaborations, partnerships, and acquisitions to expand their customer reach and gain a competitive edge in the overall market.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Bio Vanillin Market High State Of Affairs, SWOT Analysis, Business Summary & Forecast 2033

The Bio Vanillin Market is experiencing robust growth driven by rising consumer demand for natural and sustainable flavors. Derived from renewable sources like vanilla beans, ferulic acid, and lignin, bio vanillin is gaining popularity as a green alternative to synthetic vanillin. Health-conscious consumers are increasingly opting for bio vanillin due to its clean-label appeal, as it is free from synthetic chemicals and allergens.

Food and beverage industries are adopting bio vanillin for its authentic vanilla flavor, enhancing products like ice cream, baked goods, and beverages. Additionally, bio vanillin’s applications extend to cosmetics, pharmaceuticals, and even fragrance industries.

The global bio vanillin market is anticipated to reach a valuation of US$ 191.3 million in 2023, driven by increasing demand from pharmaceuticals and food & beverage industries. The trend is expected to create new opportunities for the market, leading to a projected CAGR of 7.6% between 2023 and 2033, and reaching a total valuation of approximately US$ 380.7 million by 2033.

One of the major factors contributing to the growth of the bio vanillin market is the growing adoption of plant-based and vegan diets, which has led to an increased need for natural flavoring agents in these products. Bio vanillin, derived from plant sources, is seen as a suitable option for enhancing the taste of plant-based and vegan foods, including dairy alternatives, plant-based protein products, and non-dairy desserts.

Request our comprehensive sample report today and gain valuable insights into this thriving industry. https://www.futuremarketinsights.com/reports/sample/rep-gb-11043

Bio vanillin is also used in the fragrance and perfume industry as a key component in creating sweet and aromatic scents. Bio vanillin is expected to witness increased demand, as the fragrance industry expands and seeks natural fragrance ingredients.

The incorporation of bio vanillin into functional foods and nutraceuticals is gaining traction. Bio vanillin can be used to improve the taste and palatability of products that offer health benefits, such as fortified beverages, dietary supplements, and wellness products.

Ongoing research into the potential health benefits of bio vanillin, such as its antioxidant properties and potential therapeutic uses, could open up new applications and markets for this natural flavor compound.

Bio vanillin manufacturers are increasingly offering customized solutions to meet the specific flavor and aroma requirements of food and beverage companies. The ability to provide tailored solutions can enhance customer satisfaction and loyalty.

Companies in the bio vanillin market are investing in sustainable and environmentally friendly production practices. The investments not only align with eco-conscious consumer preferences but also reduce the environmental impact of production, making bio vanillin a more sustainable choice.

The emergence of new food trends, such as the demand for authentic and ethnic flavors, presents opportunities for bio vanillin. Its ability to enhance the taste profiles of diverse cuisines and specialty foods positions it favorably in these markets.

Key Takeaways from the Market Study

Global bio vanillin market was valued at US$ 178.1 million by 2022-end.

From 2018 to 2022, the market demand expanded at a CAGR of 7.3%.

China is expected to hold a dominant CAGR of 12.1% through 2033.

By application, pharmaceuticals & food & beverage segments to constitute CAGR of 7.1% and 7.0% respectively, through 2033.

From 2023 to 2033, bio vanillin market is expected to flourish at a CAGR of 7.6%.

By 2033, the market value of bio vanillin is expected to reach US$ 380.7 million.

Ongoing research into enhanced extraction techniques from natural resources like vanilla beans, is a major factor that is expected to propel the growth of the bio vanillin market in the near future, remarks an FMI analyst.

Request Methodology for a Comprehensive Analysis of the Bio Vanillin Market. https://www.futuremarketinsights.com/request-report-methodology/rep-gb-11043

Competitive Landscape

Prominent players in the bio vanillin market are Evolva Holding, Firmenich SA, Solvay, De Monchy Aromatics, Advanced Biotech, Givaudan, Omega Ingredients Limited, Takasago International Corporation, Suzhou Function Group Co Ltd., and Apple Flavor & Fragrance Group Co., among others.

Recent Developments

In 2022, Firmenich announced plans to invest EUR 100 million in a new bio vanillin plant in France.

In 2021, Evolva Holding SA announced that it had received a $20 million investment from Mitsui & Co. to support the commercialization of its bio vanillin.

In 2021, Symrise AG announced that it had entered into a joint venture with BioAmber Inc. to produce bio vanillin from plant-based feedstock.

In the same year, Kemin Industries, Inc. announced that it had launched a new bio vanillin product that is made from sugarcane.

More Valuable Insights Available

Future Market Insights offers an unbiased analysis of the global bio vanillin market, providing historical data for 2018 to 2022 and forecast statistics from 2023 to 2033.

To understand opportunities in the bio vanillin market, the market is segmented on the basis of application (food & beverages, pharmaceuticals, fragrances, cosmetics, and others), across seven major regions (North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa (MEA)).

Purchase now for exclusive access to comprehensive information. https://www.futuremarketinsights.com/checkout/11043

Segmentation Analysis of the Bio Vanillin Market

By Application:

Food & Beverages

Ice Cream

Bakery and Confectionery

Chocolate

Other foods

Pharmaceuticals

Fragrances

Cosmetics

Others

By Region:

North America

Latin America

Western Europe

Eastern Europe

South Asia & Pacific

East Asia

The Middle East & Africa

Information Source: https://www.futuremarketinsights.com/reports/bio-vanillin-market

0 notes

Text

Sustainable Growth Opportunities in the Lactase Market

The global lactase market is projected to reach USD 336 million by 2027, at a CAGR of 6.3%, in terms of value, between 2022 and 2027. It is estimated to be valued at USD 247 million in 2022. Lactose is a type of sugar found in milk and other dairy products, lactase is an enzyme that helps in breaking down the milk sugar lactose into simple sugars, namely glucose and galactose. Factors, such as increasing demand for lactose-free and rising product development & innovations in other application areas like pharmaceutical, dietary supplements, and infant nutrition are expected to boost the demand for lactase on a global level. Key players in the market are introducing new food products like lactose-free cream, ice cream, and milk alternatives to address the growing lactase-deficient population.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=125332780

By source, the bacteria segment is projected to grow at the highest CAGR in terms of value in the lactase market during the forecast period

Based on the source, the bacteria segment is estimated to grow at the highest CAGR, in terms of value, during the forecast period in the lactase market. The lactase gene from bacterial sources is obtained from three major bacteria, namely Lactobacillus acidophilus, Bifidobacterium longum, and Enterococcus faecalis. These are non-pathogenic in nature and possess higher enzymatic activity during the production of lactose-free products. Since these are not pathogens, the lactase enzyme sourced from the bacterial source finds its application in human nutrition and medicinal purposes.

By form, the dry segment occupies a significant market share during the forecast period

Based on form, the dry segment occupies a significant share in the lactase market during the forecast period. The dry form is more concentrated and easier to use. Enzymes are very sensitive to pH and temperature changes; hence it is important to provide optimum storage conditions. Pharmaceutical manufacturers majorly use the dry form due to ease of use in the required formulations. Most of the companies provide lactase in dry form for import and export purposes.

Request for Sample Pages of the Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=125332780

Asia Pacific is projected to grow with the highest CAGR in the lactase market during the forecast period

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period and occupies a significant share in the global lactase market. The increasing awareness regarding lactose intolerance in both adults and infants is gaining momentum in the region. Additionally, the demand for lactose-reduced infant formula and lactose-free products for adult nutrition is significantly catering to the growth of the lactase market in the region. Asia Pacific is also witnessing significant expansion in terms of production by key players operating in the market. The regional manufacturers are currently focusing on new product developments and strategic deals such as partnerships, collaborations, and expansions to create more awareness among consumers and cater to the growing demand.

#Lactase Market#Lactase#Lactase Market Size#Lactase Market Share#Lactase Market Growth#Lactase Market Trends#Lactase Market Forecast#Lactase Market Analysis#Lactase Market Research Report#Lactase Market Scope#Lactase Market Overview#Lactase Market Outlook

0 notes

Text

0 notes

Text

Bubble Tea Market Size Expected To Acquire USD 5,184.53 million By 2030 At CAGR of 8.49%

The latest market report published by Credence Research, Inc. “Global Bubble Tea Market: Growth, Future Prospects, and Competitive Analysis, 2022 – 2030. The Bubble Tea market has witnessed remarkable revenue growth, escalating from USD 2,931.45 million in 2022 to USD 5,184.53 million in 2030. This growth trajectory is underpinned by a remarkable Compound Annual Growth Rate (CAGR) of 8.49% projected from 2023 to 2030, signifying sustained and robust expansion.

Bubble tea, also known as boba tea or pearl milk tea, is a popular beverage that originated in Taiwan in the 1980s and has since gained global popularity. It is characterized by its unique combination of tea (usually black or green tea), milk (or non-dairy alternatives), sweeteners (typically sugar or syrup), and chewy tapioca pearls or other toppings like fruit jellies. The drink is often served cold and shaken to create a frothy, refreshing texture.

Market Overview:

The bubble tea market has experienced significant growth over the past few decades and has evolved to cater to diverse tastes and preferences. Several key factors have contributed to the market's success:

Diversity of Flavors: Bubble tea shops offer a wide range of flavors, including traditional options like classic milk tea and fruit-flavored variations such as mango, strawberry, and lychee. This diversity appeals to a broad customer base.

Customization: Bubble tea is highly customizable. Customers can choose their preferred type of tea, sweetness level, ice level, and toppings. This customization allows consumers to tailor their drinks to their personal taste.

Health Consciousness: To cater to health-conscious consumers, many bubble tea shops offer options with reduced sugar, non-dairy milk alternatives (like almond, soy, or coconut milk), and fresh fruit teas. This addresses concerns about excessive sugar consumption and dietary restrictions.

Innovation: The bubble tea market continually evolves with the introduction of new and unique flavors, toppings, and presentations. This innovation keeps customers engaged and encourages them to try new products.

Some of the major players in the market and their market share are as follows:

Bubble Tea Supply, Inc.

Boba Luca USA, Inc.

Fokus, Inc.

Cha Time.

Tiger Sugar.

Tapioca Express.

Troika JC.

Gong Cha.

Browse 247 pages report Bubble Tea Market By Application (On-the-Go Refreshment, Leisure and Socializing, Special Occasions and Celebrations, Home and DIY, Health and Wellness, Office and Corporate), By Type (Classic Bubble Tea, Fruit-Based Bubble Tea, Cream-Flavored Bubble Tea, Special-Tea Blends, Customized Bubble Tea, Special and Limited Editions) – Size, Share, Growth, Trends and Segment Forecasts to 2016 – 2030 - https://www.credenceresearch.com/report/bubble-tea-market

Here are some recommendations for capitalizing on the booming bubble tea market:

Diverse Flavor Offerings: To stand out in the competitive bubble tea market, it's essential to offer a wide range of flavors. Consider introducing unique and trending flavors to attract a broader customer base. Exotic fruit infusions, floral notes, and fusion blends can pique the interest of adventurous consumers.

Quality Ingredients: Invest in high-quality ingredients. The freshness of tea leaves, the authenticity of fruit purees, and the consistency of toppings like tapioca pearls can significantly impact the overall quality of your bubble tea. Quality ingredients ensure that every sip is a delightful experience.

Customization Options: Emphasize the customization aspect of bubble tea. Allow customers to adjust sweetness levels, ice content, and milk choices. This flexibility not only caters to individual tastes but also encourages repeat visits as customers can explore various combinations.

Health-Conscious Offerings: Recognize the growing demand for healthier options. Develop sugar-free, low-calorie, and dairy-free alternatives to cater to health-conscious consumers. Fresh fruit teas with no added sugar or artificial flavors can be a hit among this demographic.

Market Segmentation

By Application

On-the-Go Refreshment

Leisure and Socializing

Special Occasions and Celebrations

Home and DIY

Health and Wellness

Office and Corporate

By Type

Classic Bubble Tea

Fruit-Based Bubble Tea

Cream-Flavored Bubble Tea

Special-Tea Blends

Customized Bubble Tea

Special and Limited Editions

Here are some of the major challenges and risks associated with the bubble tea market:

Health Concerns: One of the most significant challenges for the bubble tea market is the growing awareness of health concerns related to excessive sugar consumption. Many bubble tea drinks contain high levels of sugar, which can contribute to health problems such as obesity and diabetes. This has led to increased demand for healthier options and sugar reduction, posing a challenge for traditional bubble tea recipes.

Regulatory Compliance: As health concerns rise, there is increasing scrutiny and regulation of food and beverage products, including bubble tea. Compliance with health and safety standards, labeling requirements, and nutritional information disclosure can be a complex and costly process for businesses in the industry.

Supply Chain Disruptions: The bubble tea market relies on a global supply chain for ingredients such as tapioca pearls, tea leaves, and fruit flavors. Disruptions in the supply chain, as seen during the COVID-19 pandemic, can lead to shortages and increased costs, affecting businesses' ability to meet customer demand.

Competition: The bubble tea market is highly competitive, with numerous established chains and independent shops vying for market share. Sustaining profitability and growth in this competitive environment requires businesses to continually innovate and differentiate themselves.

Ingredient Sourcing and Quality Control: Maintaining consistent quality of ingredients, particularly tapioca pearls, is crucial for the bubble tea industry. Ensuring the availability of high-quality ingredients while managing costs and supply chain logistics can be challenging.

Why to Buy This Report-

The report provides a qualitative as well as quantitative analysis of the global Bubble Tea Market by segments, current trends, drivers, restraints, opportunities, challenges, and market dynamics with the historical period from 2016-2020, the base year- 2021, and the projection period 2022-2028.

The report includes information on the competitive landscape, such as how the market's top competitors operate at the global, regional, and country levels.

Major nations in each region with their import/export statistics

The global Bubble Tea Market report also includes the analysis of the market at a global, regional, and country-level along with key market trends, major players analysis, market growth strategies, and key application areas.

Browse Complete Report- https://www.credenceresearch.com/report/bubble-tea-market

Visit our Website- https://www.credenceresearch.com/

Related Reports- https://www.credenceresearch.com/report/flavored-and-functional-water-market

https://www.credenceresearch.com/report/us-bakery-items-market

Browse Our Blog- https://www.linkedin.com/pulse/bubble-tea-market-size-worth-usd-518453-million-globally-shukla

About Us -

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 10,000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives. For nearly a century, we’ve built a company well-prepared for this task.

Contact Us:

Office No 3 Second Floor, Abhilasha Bhawan, Pinto Park, Gwalior [M.P] 474005 India

0 notes

Text

Hazelnut Milk Market

According to a recent report by Future Market Insights, a market research and competitive intelligence provider, sales of hazelnut milk are estimated to reach a value of USD 195.2 Mn by 2032, surging at 10% CAGR through the decade.

The term “hazelnut” refers to a species of the genus Corylus. Unshelled hazelnuts are available in whole, diced, sliced, or ground kernels.

The rising consumption of substitutes to dairy-based milk products can be attributed to a variety of factors, including rising consumer health consciousness, lactose intolerance or dairy digestion issues, and an increasing preference for vegan diets, as well as emerging research and development to find newer products portfolios that provide additional nutritional benefits.

Download Sample Copy with Graphs & List of Figures@ https://www.futuremarketinsights.com/reports/sample/rep-gb-14820

Growing concerns about weight management, a focus on weight loss and maintenance, heart disease, anemia, cancer, and allergies to dairy-based products, aiding in the treatment of iron deficiency anemia, and the importance of blood sugar spike control are some of the factors that have contributed to market enforcement.

Key Takeaways from Market Study

Italy is the world’s second-largest producer and consumer of hazelnuts. An estimated 90% of the hazelnuts produced in the country are sold to processing companies, with the remaining 10% consumed fresh.

The U.S. is expected to grow at a CAGR of 7.7% from 2020 to 2032, owing to a strong consumer preference for non-dairy or cereal products.

The powder form is the most practical way to prepare the final products as well as an extract from the grains of almonds. In 2022, the powder sub-segment will account for a sizable market share.

During the forecast period, online stores are expected to grow at the fastest rate.

The COVID-19 pandemic has disrupted the hazelnut milk industry growth strategies and forecasts, and everything must be recalculated.

“The growing reach and promotion of plant-based or cereal alternatives to traditional dairy products, particularly beverages, but also cultured products such as ice cream, yogurt, creamers, frozen desserts, and cheese, has fueled hazelnut milk market demand,” says a lead analyst at Future Market Insights.

Who is Winning?

The Hazelnut Milk Market industry provides numerous opportunities for small manufacturers and startups to develop cost-effective solutions for the production of Hazelnut Milk products. The demand from automobile manufacturers is constantly increasing, which may encourage several startups to launch innovative products in this market.

Danone announced in December 2019 that it had participated in a funding round for the plant-based company Halsa Foods.

Some of the key players in the Hazelnut Milk Market include Whitewave Foods, Blue Diamond Growers, Daiya Foods Inc., Tofutti Brands Inc., SunOpta Inc., Fine Japan Co. Ltd., Hain Celestial Group, Galaxy Nutritional Foods, Inc., Nature’s Choice B.V., and Vitasoy Australia Products Pty. Ltd.

Browse Full Report@ https://www.futuremarketinsights.com/reports/hazelnut-milk-market

Get More Valuable Insights

Future Market Insights, in its new offering, provides an unbiased analysis of hazelnut milk presenting historical demand data (2017-2021) and forecast statistics for the period from 2022-2032.

Hazelnut Milk Market by Category

By Form, Hazelnut Milk Market is Segmented as:

Powder

Liquid

By Sales Channel, Hazelnut Milk Market is Segmented as:

Supermarket

Hypermarket

Online Retails

Others

By End-User, Hazelnut Milk Market is Segmented as:

Food & Beverages

Nutraceuticals & Baby Food

Personal Care

Pharmaceuticals

Others

By Region, Hazelnut Milk Market is Segmented as:

North America

Latin America

Europe

Middle east and Africa

East Asia

South Asia

Oceania

Ask an Analyst@ https://www.futuremarketinsights.com/ask-question/rep-gb-14820

Frequently Asked Questions

At what rate will the Hazelnut Milk Market grow?

What is the expected value of the Hazelnut Milk Market by 2032?

What are the key factors driving the Hazelnut Milk Market?

Which region adds to the highest Hazelnut Milk Market Valuation?

What are the key strategies adopted by the major players in the Hazelnut Milk Market?

Who are the key players in the Hazelnut Milk Market?

About Future Market Insights (FMI):

Future Market Insights, Inc. (ESOMAR certified, Stevie Award – recipient market research organization, and a member of Greater New York Chamber of Commerce) provides in-depth insights into governing factors elevating the demand in the market. It discloses opportunities that will favor the market growth in various segments on the basis of Source, Application, Sales Channel, and End Use over the next 10 years.

0 notes

Text

Caramel Market Trends, Share Analysis & Forecast Till 2022-2030

Market Insight

The caramel market 2022 is all set to accrue a growth rate of 5.9% from 2022 and 2030 (appraisal period), claims Market Research Future (MRFR). MRFR also adds that the global market could potentially touch USD 3.45 Billion by 2030. We will provide COVID-19 impact analysis with the report, along with all the extensive key developments in the market post the coronavirus disease outbreak.

Top Drivers and Restraints

Owing to the worldwide lockdown due to the COVID-19 outbreak, demand for non-edible items like toilet paper, disinfectants, hand sanitizer and paper goods has mounted but sales of edible products like bakery and meat products have gone down, while the supply has also got hit given the shortage of labor. In addition, the shutdown of logistics facilities following the pandemic has slowed down the caramel market share growth, as the supply and demand gap has widened more than expected. Another factor deterring the market growth following the onset of SARS-CoV-2 is the lack of raw materials available in the market.

However, as the lockdown is being lifted up, and shops reopening, sales of bakery items has picked up once again. This has favored the sales of caramel and caramel-based products, with many people lining up to hoard these items for emergency. As a result, the rising demand from the house hold segment for caramel has benefitted the market immensely, even as the novel coronavirus continues to ravage the food and beverage industry worldwide. Besides, the growing market for confectionery goods and flavored candies among the youth and children is also expected to boost the revenue generation in the target market.

Furthermore, rising urbanization rate, consumers’ evolving buying pattern with regard to food items, and the surge in disposable income can also boost the market growth in the following years. The rise in R&D/research and development activities to come up with new products like tea-infused chocolates and java pop coffee soda also elevates the global market position.

For instance, in August 2020, Marco Sweets and Spices launched five new ice cream flavors, one of which is caramel. The said caramel flavor is a mix of sweet and spicy, combining the flavors of caramel Aleppo pepper, chile de árbol as well as peanut butter.

Segmental Insight

The caramel market trends can be considered for function, form and application.

Colors, fillings, toppings, flavors, and others are the function-based key segments listed in the report. It is presumed that the colors segment could take the lead and hit USD 913.3 million by 2030-end, while the toppings segment can procure the highest advancement rate of 5.8% between 2018 and 2030. The escalating sales of confectionery items and ice cream have boosted the demand for caramel to be used as topping.

Form-wise, the market caters to solid & semi-solid as well as liquid. In 2017, the liquid segment claimed the leading position, while the solid & semi-solid segment will most likely obtain the better growth rate given its ease of use and the low cost of storage, transportation and packaging.

Beverages, snacks, bakery & confectionery, dairy & frozen desserts, and more are the key applications of caramel. In 2017, the highest gaining segment belonged to bakery & confectionary and the snacks segment is touted to achieve the fastest CAGR over the evaluation period.

Regional Outlook

Caramel market can be regionally considered for Europe, North America, APAC/Asia Pacific, and RoW/the rest of the world.

As of 2017, APAC has been the market leader and is also on track to advance at the highest rate of 5.9% in the coming years. The impressive market growth in APAC is the result of the evolving food buying patterns and the increasing sales of confectionery as well as bakery products. A recent trend has been the significant demand for organic and natural caramel ingredients such as organic salted caramel, organic caramel sauce and organic caramel syrup, from which the regional market is anticipated to benefit significantly over the ensuing years.

The same year, the second in lead was North America, thanks to the massive growth of the food and beverage industry in the United States and Canada. Manufacturers of confectionery items, beverages and frozen desserts are increasing using caramel as a natural flavor and sweetener, which is leading to growth of the target market in the region. The hectic and busy lifestyle of people in the region has strongly influenced their eating and cooking habits, which has only worked in favor of the caramel market’s favor.

Top Players

Top key caramel market players listed in the report are Sethness Products Company (US), Martin Braun Backmittel and Essences KG (Germany), Cargill Incorporated (US), Kerry Group PLC (Ireland), Bakels Worldwide (Switzerland), Barry Callebaut AG (Switzerland), Nigay SAS (France), Metarom Group (France), Göteborgsfood Budapest Ltd (Hungary), Puratos NV/SA (Belgium), and more.

NOTE: Our Team of Researchers are Studying Covid19 and its Impact on Various Industry Verticals and wherever required we will be considering Covid19 Footprints for Better Analysis of Market and Industries. Cordially get in Touch for More Details.

Contact Us:

Market Research Future (part of Wantstats Research and Media Private Limited),

99 Hudson Street, 5Th Floor,

New York, New York 10013

United States of America

+1 628 258 0071

Email: [email protected]

0 notes

Text

Ice Cream Packaging Market with Future Prospects, Key Player SWOT Analysis and Forecast To 2030

Ice cream packaging is the material used to wrap or contain ice cream products, ensuring their safety, protection, and freshness during storage, transport, and sale. Ice cream packaging typically includes containers, cartons, cups, lids, and labels.

Some common types of ice cream packaging include:

Cartons: Paper-based cartons are a popular option for ice cream packaging. These cartons can be customized with different designs, logos, and colors.

Cups: Ice cream cups are made from paper or plastic and are often used for individual servings. These cups come with lids that can be easily sealed to keep the ice cream fresh.

Tubs: Plastic tubs are used to package larger quantities of ice cream. These tubs come with lids that snap on tightly to keep the ice cream from melting or becoming freezer-burned.

Popsicle Sticks: Ice cream bars, popsicles, and other frozen treats are often packaged with wooden or plastic sticks. These sticks help consumers hold and eat the frozen treat.

Labels: Labels are essential for ice cream packaging. They contain important information such as the flavor, ingredients, nutritional information, and expiration date.

When designing ice cream packaging, it's important to consider the product's shape, size, and texture, as well as the materials used to make the packaging. The packaging should also be visually appealing, easy to use, and environmentally friendly.

Key players operating in the global ice cream packaging market include Sonoco Products Company, International Paper Company, Sealed Air Corp., Huhtamaki Oyj Plc, Linpac Group Ltd., Ampac Holdings LLC, INDEVCO Group, Tetra Laval, Berry Global, Stora Enso, and SIG.

The growth of the ice cream packaging market is attributed to factors such as the increasing demand for ice cream products, the rise in disposable income, and the growth of the food and beverage industry. Additionally, the growing trend of on-the-go consumption of food and the increasing demand for convenient and portable packaging solutions have also contributed to the growth of the market.

In terms of packaging types, paper-based cartons, cups, and plastic tubs are the most commonly used types of ice cream packaging. However, with the increasing focus on sustainability, there has been a growing demand for eco-friendly packaging solutions such as biodegradable and compostable packaging materials.

The demand for ice cream packaging is driven by several factors, including the increasing popularity of ice cream products, changing consumer preferences, and the need for innovative and sustainable packaging solutions.

One of the main drivers of demand for ice cream packaging is the growing popularity of ice cream products worldwide. Consumers enjoy ice cream as a dessert, snack, or treat, and it is a staple product in many households. As a result, there is a constant demand for ice cream packaging, both for retail and commercial use.

Another factor driving demand is the changing preferences of consumers. As consumers become more health-conscious, there is a growing demand for low-fat, low-sugar, and non-dairy ice cream products. This has led to a demand for specialized packaging solutions that can preserve the quality and freshness of these products while also communicating the product's unique features and benefits.

In addition, consumers are increasingly demanding innovative and sustainable packaging solutions for their ice cream products. This has led to a growing demand for eco-friendly packaging materials, such as biodegradable or compostable packaging, as well as packaging that is reusable or recyclable.

Finally, the growth of e-commerce and online retail has also contributed to the demand for ice cream packaging. As more consumers purchase ice cream products online, there is a need for packaging that can withstand transportation and storage and ensure that the product arrives at its destination in good condition.

The ice cream packaging market offers several advantages for both consumers and manufacturers. Some of these advantages include:

1. Protection: Ice cream packaging protects the product from contamination, spoilage, and damage during storage and transportation. This ensures that the product reaches the consumer in good condition and maintains its quality and freshness.

2. Convenience: Ice cream packaging provides a convenient way for consumers to purchase and consume ice cream products. Different packaging types, such as cups, tubs, and cartons, allow for easy storage, handling, and consumption of ice cream products.

3. Marketing: Ice cream packaging is an effective marketing tool that can help manufacturers differentiate their products and stand out in a crowded market. Attractive packaging designs and eye-catching graphics can help to attract consumer attention and increase sales.

4. Innovation: The ice cream packaging market is constantly evolving, with new and innovative packaging solutions being developed all the time. This allows manufacturers to experiment with different materials, designs, and features to create packaging that is more sustainable, convenient, and attractive to consumers.

5. Sustainability: The ice cream packaging market is increasingly focused on sustainability, with a growing demand for eco-friendly and biodegradable packaging materials. This shift towards sustainable packaging not only benefits the environment but also helps manufacturers to reduce their carbon footprint and meet consumer demands for more responsible products.

0 notes

Text

INDIA MARKET GROWTH PROSPECTS OF FOOD & BEVERAGES – 2023- 27- DART CONSULTING FORECASTS 14% GROWTH IN THE COMING YEARS

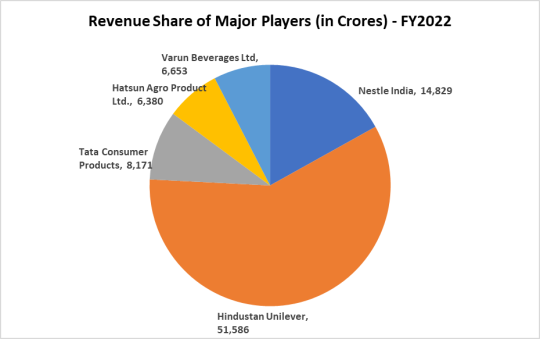

The food & beverage industry encompasses those companies that facilitate the production and manufacturing of various consumable food items. The ecosystem includes the facilities which transport, serve, or sell such edible products. This market predominantly consists of beverages & food manufacturing operations, catering, food joints, food transportation facilities, along with other closely related segments. Being a developing nation with a rapidly expanding population base, India is witnessing an escalating demand for food & beverages. As per market data, nearly 3% of India’s GDP is contributed by the food & beverages industry. The nation houses many food & beverage companies who have amplified their reach on a global level. The Indian Food & Beverage Industry is reckoned to garner substantial gains in the coming years due to the indicated presence of various growth inducing factors. Here is a quick overview of a few key players in the industry.

Nestle India

Nestle India Ltd (Nestle India), a subsidiary of Nestle SA, manufactures, markets and sells consumer food and beverages. Its product portfolio includes dairy products, nutritional products, beverages, prepared dishes and cooking aids, chocolates, and confectionery. In recent years, the company has also introduced products of daily consumption and use such as NESTLÉ Milk, NESTLÉ SLIM Milk, NESTLÉ Dahi, and NESTLÉ Jeera Raita. Nestlé. It also exports its products to various countries across the world and is headquartered in Gurgaon, Haryana, India.

Hindustan Unilever

Hindustan Unilever (HUL) is a subsidiary of Unilever, one of the world’s leading suppliers of Food, Home Care, Personal Care and Refreshment products with sales in over 190 countries. The company offers packaged foods and refreshments and markets its products under the Bru, Magnum, Knorr, Taza, Lipton and Kissan brand names. The company also offers ice cream, staples, health food drinks, culinary products, and frozen desserts. HUL distributes products through a network of distributors and associates in India, Nepal, and other countries. HUL is headquartered in Mumbai, Maharashtra, India.

Tata Consumer Products

Tata Consumer Products Ltd (TCPL) is a manufacturer and marketer of food products and non-alcoholic beverages, with a major focus on tea and coffee. The company markets tea and coffee products under Tata Tea, Vitax, Eight O’Clock Coffee, Tetley, Tata Coffee Grand and Joekels brand names. TCPL’s food products include spices, pulses, healthy snacks, breakfast cereals, salt, poha and ready to mixes under Tata Sampann, Tata Salt, and Tata Soulfull brands. The company’s business operations span across Asia-Pacific, Europe, the Middle East, Africa, and North America. TCPL is headquartered in Mumbai, Maharashtra, India.

Hatsun Agro Product Ltd

Hatsun Agro Product Ltd (HAP) is a dairy product company. The company engages in the manufacturing, processing and marketing of dairy products such as milk, ice creams, dairy whitener, curd, skimmed milk powder, ghee, and paneer. HAP markets its products under the brand names Arun Ice creams, Arokya Milk, Hatsun, Ibaco, Santosa and HAP Daily. The company has manufacturing and distribution plants across major states of India. It primarily exports dairy ingredients to the Americas, South Asia and the Middle East markets. HAP is headquartered in Chennai, Tamil Nadu, India.

Varun Beverages Ltd Tanla Platforms Ltd

Varun Beverages Limited (VBL) is in the business of providing high quality food products to consumers such as carbonated, non-carbonated sweetened beverages and packaged drinking water with endeavor to make its business and ecosystem sustainable. VBL is engaged in manufacturing, selling and distribution of PepsiCo’s beverages in pre-defined territories in India. The company is the world’s second-largest international franchisee (outside United States) of carbonated soft drinks and non-carbonated beverages sold by PepsiCo India. VBL manufactures, markets, and distributes PepsiCo owned products, which include carbonated soft drinks, carbonated juices, juice-based beverages, energy drinks and packaged bottled water, through its vast manufacturing facilities and well-established distribution network.

Industry Performance

The performances of key companies in the industry give indications that the industry has been reporting steady profits quite for a long time. The reported margin of the key players was around 10.6% by taking into consideration of the last 3 years data. Details are as follows.

Industry Trends

Food & beverages are considered as the fastest growing industries in India. The growth of the industry is supported by the availability of a large raw material production base. With India’s population skewed towards younger consumers, the majority of Indian consumption of food and beverages is driven by people between the ages of 18 and 40, which opens the opportunity for manufacturers to come with more varieties. Some of the major growth drivers of this industry are:

Increasing Gourmet Brands – shifting consumption habits of Indian consumers from traditional food flavours to global food. High demand for healthy alternatives and growth in nutraceutical market.

Growth in Bakery Segments – Increasing consumption of biscuits and cookies which accounts for about 72% of the total sales in the F&B industry is primarily boosting the growth in this segment.

Further, the increased affluence of the ever-growing working population with increase in disposable income, rising urbanization leading to changing lifestyles and less time to prepare food at home, increase in tourism in India and international travel, and increase in consumption of fast-growing food and beverage segments.

India’s food ecosystem offers huge opportunities for investments with stimulating growth in the food retail sector, favourable economic policies, and attractive fiscal incentives. The industry is attracting major investments and favourable government policies as follows.

The Union government approved a new PLI scheme for the food processing sector, with a budget outlay of INR 109 billion (US$1.46 billion). Incentives under the scheme will be disbursed for six years to 2026-27

Total 46 new projects approved under Operation Greens Scheme in the Calendar Year 2022 with an outlay of INR 2218.69 Cr.

In August 2022, a Special Food Processing Fund of Rs. 2,000 crore (US$ 242.72 million) was set up with National Bank for Agriculture and Rural Development (NABARD) to provide affordable credit for investments in setting up Mega Food Parks (MFP) as well as processing units in the MFPs.

In July 2022, PM Formalization of Micro food processing Enterprises (PMFME) scheme was launched for providing financial, technical, and business support for setting up/ upgradation of micro food processing enterprises in the country with an outlay of Rs. 10,000 crore (US$ 1.27 billion).”

Through a comprehensive analysis of the top contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 11.7% at the end of 2022. Details are as below.

The Food and beverage industry is expected to grow over the following few years, according to market indications. The industry expects various investment and growth opportunities, hence attracting new players and competition. It makes us to believe that the CAGR in the coming next years will have an add on growth of around 20%, and thus industry is expected to exhibit CAGR of 14% in the next five years from 2023 to 2027. This is further supported by that fact if we remove the top two behemoths from the list, the industry the average growth was around 14% in the last few years, and hence the same is achievable.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Probiotics Market Will Hit Big Revenues In Future

The global perception toward daily food products is shifting from products providing basic nutrition to those offering several health benefits, such as functional foods. Today, a wide range of functional foods have been developed, including probiotics, prebiotics, and symbiotic foods. These products have changed the approach of various food processors from considering food only as a source of energy and nutrition to biologically active food components that confer benefits on human health. Functional foods are gaining popularity for their prevention and curing effects beyond their nutritional value. The global probiotics market is witnessing the development of a wide range of applications of probiotics, such as fortifying these ingredients in food & beverage products.

Probiotic functional foods have shown positive effects on overall human health. Probiotic foods & beverages can be broadly classified as probiotic dairy products (cheese, yogurts, and milk) and probiotic non-dairy products (juices, kombucha, bakery, meat, and baby food). The market for probiotic dairy products has been increasing gradually over the past decade, with the growing demand for yogurt across the globe. Various probiotic products are classified on the basis of bacterial strains used, such as Lactobacillus and Bifidobacterium. Probiotics are prominently present in the form of bacteria in most dairy products, such as ice creams and cheese, which help in improving gut health.

High consumer demand for scientifically proven health foods and dietary supplements, particularly in developed economies, poses opportunities for probiotic manufacturers. Companies such as ADM (US), DuPont (US), Nestle (Switzerland), Probi AB (Sweden), and Danone (France) are the major market players. The global probiotic market is projected to be valued at USD 85.4 billion by 2027. The Asia Pacific market is projected to grow at the highest CAGR during the forecast period.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=69

Key Drivers Impact the Growth

Health Benefits associated with probiotic-fortified foods – Probiotics are found in supplement form or as components of foods & beverages. Its integration with inexpensive health foods, such as yogurt, fruit juices, and cultured dairy drinks, has contributed to significant market size. The most commonly used probiotic bacterial strains include Bifidobacteria and Lactobacilli, which are found in various dairy products, including yogurt. In the dairy category, yogurt is the most popular option for the consumption of probiotics.

Increasing popularity of probiotic dietary supplements –Dietary supplements include tablets, capsules, powders, liquids, and pills, which are convenient forms of consuming the daily nutritive requirements of the body. Probiotic dietary supplements are not as popular as probiotic foods, especially in the Asia Pacific, but have started gaining popularity over the past few years. North America is a huge market for probiotic dietary supplements due to the natural predisposition of consumers to take supplements. Compared to European countries, people in the US are more willing to consume oral supplements. In the US, the FDA does not require pre-market approval of the health claims made by the manufacturers of probiotic dietary supplements, which allows them to launch innovative products to cater to the increasing demand.

Probiotic Products Restraints and Challenges

High R&D cost for developing new probiotic strains – Substantial investments in R&D activities, as well as investments in laboratories, research equipment, and the high cost of hiring trained professionals, create barriers to the development of the probiotics market. The scientific validation related to the usage of probiotics in their applications has become a success in this market. Probiotics applications are linked with health benefits, which makes it challenging for manufacturers to get an adequate RoI on high initial investments.

Complexities in integrating probiotics in functional foods – The development and commercial aspects of functional food products are rather complex, expensive, and uncertain. The factors behind the success of functional food product development are consumer demand, technological conditions, as well as legislative and regulatory background. However, consumers’ knowledge of the health effects of specific ingredients can affect the acceptance of specific functional foods. Common functional ingredients, such as minerals, fiber, and vitamins, are preferred over new and improved products, such as foods enriched with probiotics, prebiotics, flavonoids, carotenoids, and conjugated linolenic acid.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=69

Key Segments of The Sector

o In the probiotic market, Bacteria is estimated to dominate over the forecasted period. The bacterial strains in probiotic foods impart health benefits, such as increased lactase production, the prevention of diarrhea, the prevention of irritable bowel syndrome (IBS), and an enhanced immunity of Lactobacilli.

o Functional food & beverages product type continues to dominate the probiotics market, which is estimated to account for a share of ~80% in 2022. However, dietary supplements are expected to grow at a faster CAGR during the forecast period due to fast-paced lifestyle changes, which makes consumers demand high substitutes.