#Nashville Bitcoin Exchange

Explore tagged Tumblr posts

Text

Upcoming Event: 24th July Bitcoin Conference Tennessee Nashville

Are you passionate about Bitcoin and looking to expand your knowledge and network within the industry? Mark your calendars for the 24th July Bitcoin Conference in Tennessee, Nashville! This conference is designed for Bitcoin investors, enthusiasts, and professionals who want to delve deeper into the world of cryptocurrency.

Why Attend?

The 24th July Bitcoin Conference promises to be a premier event, bringing together some of the brightest minds in the Bitcoin industry. Whether you're a seasoned investor or just starting your journey, this conference offers invaluable insights and opportunities to enhance your understanding and skills.

Key Highlights

1. Bitcoin Services in Nashville:

Learn about the various Bitcoin services available in Nashville. From secure wallets to reliable trading platforms, you'll discover the best resources to manage your Bitcoin investments.

2. Nashville Bitcoin Exchange:

Get an in-depth look at the Nashville Bitcoin Exchange. Understand how it works, its benefits, and how you can use it to trade Bitcoin efficiently. Experts will be on hand to provide demonstrations and answer your questions.

3. Sell Bitcoin Nashville:

Thinking about selling your Bitcoin? Learn the best strategies and platforms for selling Bitcoin in Nashville. Get tips on maximizing your returns and ensuring secure transactions.

4. Bitcoin Workshops in Nashville:

Participate in interactive workshops led by industry leaders. These workshops are designed to provide hands-on experience and practical knowledge. Topics will include Bitcoin mining, investment strategies, and advanced trading techniques.

What to Expect

Expert Speakers: Hear from renowned Bitcoin experts and thought leaders who will share their insights on the future of Bitcoin, investment strategies, and technological advancements.

Networking Opportunities: Connect with fellow Bitcoin enthusiasts, investors, and professionals. Build relationships that can help you in your Bitcoin journey.

Exhibitions: Explore exhibits showcasing the latest in Bitcoin technology, services, and innovations. Get a first-hand look at cutting-edge tools and platforms.

How to Register

Registration for the 24th July Bitcoin Conference in Tennessee, Nashville, is now open. Visit our website https://ccccloud.org/ to secure your spot. Early bird discounts are available, so don't miss out!

The End

The 24th July Bitcoin Conference in Nashville is an event not to be missed. Whether you are looking to learn more about Bitcoin services in Nashville, explore the Nashville Bitcoin Exchange, or gain practical knowledge through Bitcoin workshops, this conference has something for everyone. Join us and be a part of the Bitcoin revolution!

For more information and updates, visit https://ccccloud.org/

Contact No.: +1-307-222-8351

Email id: [email protected]

Read More: https://ccccloud.org/services/

Let me know if you need any changes or additional details!

0 notes

Text

From La Stampa (translated from Italian):

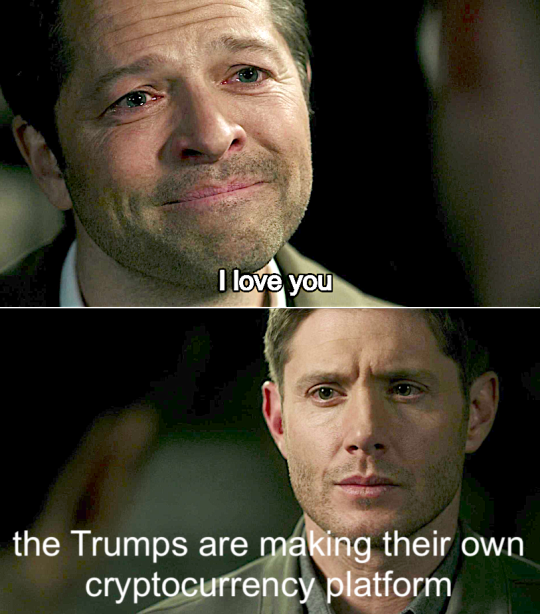

“Make Finance Great Again,” Trump family makes its own cryptocurrency and allies with Silicon Valley It will be called “World Liberty Financial,” will have tech investors and real estate developers from Chase Herro and Zak Folkman to Steve Witkoff inside. Sons Eric and Donald Jr. will coordinate. And his backer Tyler Winklevoss jokes, “Donald has been orange-pilled, indoctrinated.” Jacopo Iacoboni Sept. 17, 2024 Updated 11:00 a.m. 3 minutes of reading

They want to do a kind of “make finance great again,” along the lines of MAGA, the election slogan and the Make America Great Again campaign. Donald Trump's sons, Don Jr. and Eric, of course with their father's imprimatur, are about to launch a new cryptocurrency platform that will be called “World Liberty Financial,” and will allow users to make even massive transactions without a bank getting in the way and extracting fees (and with a very low level of tax tracking, it should be added). A couple of concepts familiar to bitcoin fans, for example, but which the Trump family now has ambitions to decline on a large scale. It is not certain that this marriage between Trumpism and decentralized finance, DeFi, is a harbinger of only positive developments. The board of “World Liberty Financial” will also consist of former crypto investors such as Chase Herro and Zak Folkman, and Steve Witkoff, a real estate developer and old friend of Trump. But thanks to documents filed with the U.S. Federal Election Commission that we have been able to read we know that in general the entire Trump campaign - Make America Great Again Inc. - received money not only from Musk, but cryptocurrency from billionaire twins Cameron and Tyler Winklevoss, who lead the cryptocurrency company Gemini: about $3.5 million in Bitcoin on July 19, the day after Trump's speech at the Milwaukee convention. The Winkelvosses also poured in money to America PAC, the tech investor-backed group that Musk helped launch in 2024 (Trump had bragged that Musk was giving him $45 million a month; Musk said his contribution is “at a much lower level”). Another co-founder of a cryptocurrency exchange, Jesse Powell, boss of Kraken, and venture capitalists Marc Andreessen and Ben Horowitz (who created a16z) who have invested billions of dollars in cryptocurrency startups, have also made endorsements and poured money into Trump. In short, for the Trump family to embark on this big cryptocurrency project is a natural consequence of the fact that these are almost becoming a Republican asset in the campaign, and the “libertarian” wing of the old Gop is now a kind of very, very rampant ideologized “cyberlibertarianism.” The real boss of the “tech bros” according to many is not Elon Musk, but Peter Thiel. Zuckerberg's longtime partner in Facebook, co-founder of PayPal, Thiel's fortune has at least doubled during the Trump presidency. Palantir-a much-discussed software company variously accused of extracting data from Americans and profiling them-has managed to get a contract from the Pentagon. Other donors to MAGA Inc include Jacob Halberg, Palantir's princely analyst, and Trish Duggan, a wealthy Scientology funder and friend of the tech bros. Trump's vice presidential candidate, J. D. Vance, traveled to Silicon Valley and the Bay Area, celebrating a dinner at the home of BitGo CEO Mike Belshe, 100 people each pouring in between $3,300 a plate and a $25,000 roundtable. Trump in 2021 called bitcoin a “fraud against the dollar.” A few weeks ago, speaking in Nashvill at the bitcoin fan conference, he promised, “The United States will become the crypto capital of the planet.” Better than his friend Putin's Russia, although this Trump did not say so explicitly. The fact is that after his speech, Tyler Winklevoss ran on X (now the realm of cyberlibertarians) and joked that Donald had been “orange-pilled,” making a Matrix analogy, had been “indoctrinated,” or had finally seen the real reality behind the appearances.

3 notes

·

View notes

Text

Eric and Donald Trump Jr., the sons of former president Donald Trump, have pledged to “make finance great again” with a new family-run crypto endeavor called World Liberty Financial.

Introduced in a meandering livestream on X Monday, the Trump family and their associates described World Liberty Financial as a crypto platform that would let users conduct transactions without a bank sitting in the middle and extracting fees—a concept known as decentralized finance, or DeFi.

While short on details, Donald Trump, Jr. and Eric Trump both stressed repeatedly that World Liberty Financial’s primary goal was to make DeFi more broadly accessible. “It’s truly our job to make it understandable,” said Eric Trump during the livestream. “We have to make it intuitive, we have to make it user-friendly, and we will.”

Former President Donald Trump joined the call as well, stressing his pro-crypto stance. “I do believe in it,” said Trump of cryptocurrency generally. “It has a chance to really be something special.”

The Trumps aren’t alone in leading World Liberty Financial. They’re joined by crypto veterans Chase Herro and Zak Folkman, as well as Steve Witkoff, a real estate investor and friend of Donald Trump’s. In addition to the platform itself, World Liberty Financial will come with a governance token, WLFI, which will provide owners the right to vote “on matters of the platform.” Approximately 63 percent of the tokens will be sold to the public; 17 percent are set aside for user rewards, and 20 percent will be reserved for World Liberty Financial team compensation.

The Trump brothers had teased the new endeavor repeatedly in the weeks leading up to the announcement. In an X post on August 6, Eric wrote that he had “truly fallen in love with crypto/DeFi.” The following day, in another post, Donald Jr. said he was “about to shake up the crypto world” and warned his followers not to “get left behind.” On August 22, in a somewhat cryptic post on Truth Social, the former president himself promoted the project: “For too long, the average American has been squeezed by the big banks and financial elites. It’s time we take a stand—together,” wrote Trump.

World Liberty Financial marks the latest development in Trump’s bid to court the crypto industry, members of which are broadly supportive of his reelection campaign.

Some high-profile crypto figureheads have thrown millions of dollars at the Trump campaign, in the hope of ousting the Democrat administration under which financial regulators have cracked down on crypto. Cameron and Tyler Winklevoss, founders of crypto exchange Gemini, each donated $1 million to Trump, as did Jesse Powell, cofounder of another exchange, Kraken. Venture capitalists Marc Andreessen and Ben Horowitz, founders of a16z, which has invested billions of dollars in crypto startups, have also publicly endorsed Trump.

“The degree to which crypto executives are getting involved in politics is a marked shift from previous elections. It’s inarguable, the degree of politicization that has happened in the industry,” says Molly White, author of crypto-skeptic newsletter Citation Needed and creator of Follow The Crypto, a project that traces the impact of crypto industry donations on the upcoming US election. “There has been a concerted effort to present [crypto] as an election issue and convince politicians they need to take a stance on it, or lose out on voters.”

As it turned out, Trump was readily convinced: Despite having previously dismissed bitcoin as a “scam,” Trump has recently taken to pitching himself as the crypto president. In July, speaking to thousands of bitcoiners at a conference in Nashville, Tennessee, Trump promised to turn the US into the “crypto capital of the planet” and establish a national “bitcoin stockpile” if reelected. In a post on X after the speech, Tyler Winklevoss celebrated the former president having been “orange-pilled”—crypto lingo meaning “indoctrinated.”

Initially, when Eric and Donald Jr. first began to hint at the World Liberty Financial project, there was speculation they were gearing up to launch an official Trump crypto token.

In the last year, tens of Trump-inspired memecoins have come to market, becoming something of a bellwether for the upcoming election, fluctuating in price along with changes in Trump’s political fortunes. One such token, DJT, issued in early June, surged in price amid rumors that it originated with the Trump family. In a broadcast on X, Martin Shkreli, of “pharma bro” fame, claimed to have created the token in partnership with Barron Trump, the former president’s 18-year-old son. On August 6, the price of DJT sank by 90 percent after large quantities were sold off by an anonymous token holder. “Wasn’t me!” said Shkreli, in an email to WIRED, when asked whether he knew who was responsible for the sell-off. The price of DJT was $0.0002441 per coin on Monday.

The press office for the Trump campaign did not respond to questions about Barron’s alleged involvement with the DJT token. In a post on X in the leadup to announcing World Liberty Financial, Donald Jr. warned followers to “beware of fake tokens claiming to be part of the Trump project.”

World Liberty Financial will face steep competition in a DeFi market already crowded with similar services, among them Aave, Compound, Venus Protocol, and others. “DeFi is pretty mature, especially on the over-collateralized side,” says Zach Hamilton, founder of crypto startup Sarcophagus and venture partner at VC firm Venture51.

But the Trumps need not necessarily do anything novel, if they can capitalize on their mammoth public platform to peddle the new venture. “[World Liberty Financial] is launching with the most free marketing that any crypto company could ever get,” says Hamilton. “Trump is the king of living rent free in people’s minds.”

Incumbents in the DeFi industry are cautiously optimistic about the prospect of the Trump family’s arrival; at once glad of the publicity and wary of the reputational damage World Liberty Financial could cause if it were to fall on its face, or if a technical snafu were to result in financial losses.

“I welcome any effort to bring DeFi into the mainstream,” says Brad Harrison, CEO of Venus Protocol. “But like the autopilot in a Tesla, DeFi may give the appearance of something that’s simple, but the inner workings are complex. Without a solid grasp of its nuances in the hands of seasoned technologists and financial engineers, a new platform risks being more of a branding exercise than a substantive and safe contribution to the space.”

Irrespective of the risk in placing trust in a crypto platform yet to be battle tested, industry enthusiasts are likely to patronize World Liberty Financial if only to signal support for Trump’s political endeavors. “We are definitely dealing with crypto as a right-wing Republican commodity now,” says Jacob Silverman, coauthor of Easy Money: Cryptocurrency, Casino Capitalism, and the Golden Age of Fraud. “The industry is so aligned with the Republican party and they are the biggest donors of any industry this cycle.”

In the spirit of various British politicians who have retired into crypto positions, World Liberty Financial could represent an attempt by Trump to hedge against a loss in the upcoming election—to set up for himself a fallback gig.

“Maybe the raucous reception at the crypto conference in Nashville has given him an impression this is the world he wants to be in, because they love him and he can make money,” says Silverman. “For all his faults, he does understand the crowd.”

3 notes

·

View notes

Text

Major Crypto Events This Week: Impact on Bitcoin and Ethereum Prices

In a week filled with significant developments, the crypto market is abuzz with anticipation and excitement. With former President Donald Trump and Vice President Kamala Harris set to speak at the BTC Nashville convention and a massive $1 billion inflow into the Ethereum ETF, the potential impact on Bitcoin, Ethereum, and the broader cryptocurrency market cannot be overstated. Let’s delve into these events and explore their potential ramifications.

Anticipating Trump and Kamala Harris at BTC Nashville Convention

Background

The BTC Nashville convention is a major event in the cryptocurrency community, drawing attention from investors, policymakers, and enthusiasts worldwide. This year, the convention is set to be particularly noteworthy, with high-profile speakers such as former President Donald Trump and Vice President Kamala Harris scheduled to address the attendees.

Potential Content of Trump’s Speech

Given Trump’s influential status, his speech at the BTC Nashville convention could be a game-changer. Speculation is rife about what he might discuss. Could he be hinting at a pro-crypto stance, potentially advocating for the inclusion of Bitcoin in the U.S. Treasury reserves? Such a move would likely send shockwaves through the market, boosting investor confidence and driving up prices.

Potential Content of Kamala Harris’s Speech

Vice President Kamala Harris’s speech is equally anticipated. As a key figure in the current administration, her views on cryptocurrency regulation and policy could shape the future landscape of the market. If Harris signals a supportive regulatory framework, this could pave the way for greater institutional adoption and integration of cryptocurrencies.

Possible Market Impact

The speeches by Trump and Harris could significantly influence market sentiment. A supportive stance from both could lead to a bullish trend, driving up the prices of Bitcoin and other cryptocurrencies. Conversely, a critical or cautious approach could introduce volatility and uncertainty. Investors will be closely watching for any hints of policy changes or endorsements that could impact their portfolios.

$1 Billion Trading Volume Ethereum ETF

Overview

The Ethereum ETF represents a major step forward for institutional investment in cryptocurrencies. An ETF, or Exchange-Traded Fund, allows investors to gain exposure to Ethereum without directly purchasing the cryptocurrency. This provides a more accessible and regulated way for large investors to enter the market.

Details of the Inflow

Yesterday, the Ethereum ETF saw a staggering $1 billion in volume traded, marking a significant milestone. This influx of capital indicates strong institutional interest and confidence in Ethereum’s future. Notable investors, possibly including hedge funds and large financial institutions, are likely behind this substantial investment.

Market Reaction

The market reacted positively to the news of the $1 billion inflow, with Ethereum’s price experiencing a noticeable uptick. This surge in investment not only boosts Ethereum’s price but also underscores the growing acceptance and legitimacy of cryptocurrencies in mainstream finance.

Long-term Impact

In the long term, this significant investment could lead to sustained price growth for Ethereum. As more institutional investors flock to Ethereum ETFs, the increased demand could drive prices higher. Additionally, the influx of institutional capital can lead to greater stability and reduced volatility, making Ethereum a more attractive asset for a broader range of investors.

Broader Market Implications

Investor Sentiment

These events are likely to have a profound impact on investor sentiment. The potential for supportive speeches from Trump and Harris, combined with the substantial inflow into the Ethereum ETF, could bolster confidence in the market. Positive sentiment often translates into increased buying activity, driving up prices across the board.

Regulatory Outlook

The regulatory landscape is a crucial factor in the future of cryptocurrencies. If Trump and Harris signal a favorable regulatory environment, this could lead to increased adoption and integration of cryptocurrencies in traditional finance. On the other hand, hints of stringent regulations could introduce uncertainty and caution among investors.

Future Trends

Looking ahead, these events could set the stage for significant trends in the crypto market. Increased institutional investment, regulatory clarity, and mainstream acceptance are all potential outcomes. As Bitcoin and Ethereum continue to gain traction, we could see a broader shift towards digital assets as a staple in investment portfolios.

Conclusion

This week’s events hold immense potential for the cryptocurrency market. The anticipated speeches by Trump and Harris at the BTC Nashville convention and the substantial $1 billion inflow into the Ethereum ETF could shape the future trajectory of Bitcoin, Ethereum, and the broader crypto ecosystem. Investors should stay informed and consider these developments when making investment decisions, as the market could be poised for significant movements.

Call to Action

What are your thoughts on these upcoming events and their potential impact on the crypto market? Share your insights in the comments below. For more updates and in-depth analyses, subscribe to our blog and stay ahead of the curve in the ever-evolving world of cryptocurrencies.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Crypto#Cryptocurrency#Bitcoin#Ethereum#BTCNashville#Trump#KamalaHarris#EthereumETF#CryptoNews#Blockchain#CryptoMarket#Investing#Finance#CryptoEvents#CryptoInvesting#DigitalCurrency#CryptoCommunity#CryptoUpdates#CryptoInflows#FinancialRevolution#globaleconomy#financial experts#financial empowerment#unplugged financial#financial education

3 notes

·

View notes

Text

Trump’s Unveiling of Bitcoin Strategic Reserve: A Game-Changer for Federal Reserve Influence?

Key Points

President Trump’s pledge to establish a strategic Bitcoin reserve has sparked optimism within the cryptocurrency community.

The Federal Reserve, however, has shown no intention to engage in accumulating Bitcoin, causing market uncertainty.

President Trump’s recent election victory has spurred a wave of positivity among cryptocurrency enthusiasts. This is largely due to his previous promise to create a strategic Bitcoin reserve. His commitment to this initiative was made clear during his speech at the Bitcoin [BTC] 2024 conference in Nashville.

The Federal Reserve’s Stance

Despite this, Jerome Powell, during a recent press conference, emphasized that the Federal Reserve has no intention of participating in any government initiative to amass Bitcoin. Powell’s statement came after a monetary policy meeting, triggering uncertainty in the market and causing Bitcoin’s price to pull back from its recent peak.

Nonetheless, at the time of the latest update, Bitcoin was trading at $98,703.53, representing a 5.18% increase in the last 24 hours, as per CoinMarketCap. Following Powell’s comments, the prediction market, Polymarket, has shown a continuing decline in the likelihood of a Bitcoin Strategic Reserve. The total market value of cryptocurrencies has also seen a significant decrease, further indicating the market’s uncertainty.

Possible Future Actions

The Federal Reserve maintains significant independence in monetary policy, but it does not have the power to veto the creation of a Bitcoin Strategic Reserve (BSR). Should the Trump administration choose to pursue this initiative, the most efficient method would likely involve issuing an executive order upon taking office. This would direct the U.S. Treasury Department to use the Exchange Stabilization Fund (ESF) for direct Bitcoin purchases. Regardless of the method, establishing a strategic Bitcoin reserve would likely need leadership from the Treasury Department.

0 notes

Text

Trump's inauguration draws huge crypto donations

(Donald Trump reacts to the 2024 Bitcoin Conference in Nashville, Tenn.) The crypto giant is joining the tech giant and many others in American business by donating millions to the inauguration celebrations of President-elect Trump, FOX Business has learned. Cryptocurrency exchanges Coinbase and Kraken each donated $ 1 million to the Trump-Vance founding committee, a financial extravaganza for…

View On WordPress

0 notes

Link

President-elect Trump met with crypto industry leader Kris Marszalek to prepare an order for a Bitcoin reserve in a bid to strengthen the U.S. financial landscape. Kris Marszalek, Crypto.com CEO, met Donald Trump at Mar-a-Lago on Dec. 16 to talk about the proposed crypto-related appointments within the financial departments and Congress. They also discussed drafts of a U.S. Strategic Bitcoin Reserve to be administered within the Treasury’s Exchange Stabilization Fund, as noted in his Nashville speech delivered in July. What the Strategic Bitcoin Reserve entails After the meeting, Bitcoin Magazine posted a draft executive order made by the Bitcoin Policy Institute, from which a policy framework lays out the creation of the Strategic Bitcoin Reserve. It intends to classify Bitcoin (BTC) as a strategic reserve asset within the Treasury’s Exchange Stabilization Fund in order to increase U.S. economic security. Bitcoin Policy Institute drafts Executive Order for Bitcoin Reserve for President Trump. Source: Bitcoin Magazine It also ensures that the reserve will have strict audits and security standards. All BTC that the government possesses, including those obtained in forfeiture cases, shall be consolidated under the SBR within seven days. The Treasury must also establish a program within 60 days to acquire and manage its BTC holdings. The order is an effort to cement the United States’ leadership in digital assets, which will build economic resilience and global financial supremacy. The meeting with the 45-year-old CEO follows a recent phone call between Trump and Brian Armstrong, the CEO of Coinbase, which took place on Nov.19, as reported by Fortune. In addition to consulting with CEOs of crypto firms, Trump has enlisted several known crypto proponents, including Howard Lutnick as commerce secretary and Paul Atkins to lead the U.S. Securities and Exchange Commission in his coming term, which has further cemented his pro-crypto stance. BTC also hit an all-time high of $108,268.45 on Dec. 17, likely fueled by the news of Trump meeting Marszalek. At the same time, Derek Merrin, who leads the Ohio House Republicans, has also proposed a bill to introduce a state-backed Bitcoin Reserve. 2024-12-18 06:29:20 https://crypto.news/app/uploads/2024/12/crypto-news-Bitcoin-Reserve-policy-option04.webp

0 notes

Text

Bitcoin Jumps to Record High in Crypto Frenzy After Trump Win

Bitcoin Jumps to Record High in Crypto Frenzy After Trump Win Bitcoin surged to a new record high on Wednesday, as investors reacted positively to former President Donald Trump's victory in the U.S. presidential election. The cryptocurrency market experienced a significant uptick, with Bitcoin rising nearly eight percent in early trading, surpassing $75,000 and eclipsing its previous record set in March. Other cryptocurrencies also saw impressive gains, with ether, the second most popular cryptocurrency, rallying by eight percent and dogecoin soaring as much as 18 percent. Market Reaction The excitement in the cryptocurrency market extended beyond digital currencies. Crypto-related stocks outperformed the broader stock market, with Coinbase, one of the largest cryptocurrency exchanges, jumping 17 percent. Online brokerage Robinhood Markets, which facilitates crypto trading, saw its shares rise 12 percent, while MicroStrategy, touted as the largest corporate holder of Bitcoin, increased by 10 percent. Trump’s previous skepticism towards cryptocurrencies has shifted dramatically as he actively courted the crypto community during his campaign. He has promised to make America "the crypto capital of the planet" and has proposed establishing a "strategic reserve" of Bitcoin. His campaign also accepted donations in cryptocurrency and engaged with crypto enthusiasts at a Bitcoin conference in July. Furthermore, Trump launched World Liberty Financial, a new venture with family members aimed at trading cryptocurrencies. Analysts Weigh In Bitcoin has experienced a remarkable 77 percent increase this year, and analysts are optimistic about its future. "Bitcoin is the one asset that was always going to soar if Trump returned to the White House," stated Russ Mould, investment director at AJ Bell. Following Bitcoin’s new high, market speculation is now focused on "when, not if, it will smash through $100,000." Mould emphasized that Trump’s newfound enthusiasm for digital currencies has given crypto traders a fresh narrative to rally around, further fueling excitement about potential price increases. Caution Amid Excitement Despite the optimistic outlook, experts urge caution in the volatile crypto market. Susannah Streeter, head of money and markets at Hargreaves Lansdown, advised investors to "only dabble in crypto with money that they can be prepared to lose," citing the history of wild price fluctuations in the sector.

Donald Trump speaks at the Bitcoin 2024 Conference on July 27, in Nashville while on the campaign trail. Bitcoin jumped when investors became confident that Trump would win Tuesday's U.S. presidential election. (Mark Humphrey/The Associated Press) Industry Support for Trump The cryptocurrency industry has largely welcomed Trump’s victory, hoping he will facilitate legislative and regulatory changes that align with their interests. Trump has previously expressed intentions to remove Gary Gensler, the chair of the Securities and Exchange Commission (SEC), who has been at the forefront of the U.S. government's crackdown on the crypto industry. "Tonight the crypto voter has spoken decisively — across party lines and in key races across the country," said Brian Armstrong, CEO of Coinbase. He highlighted the need for clear regulations to guide digital assets, indicating a desire for collaboration with the new Congress to achieve this goal. Streeter noted that Trump's administration is likely to pursue a "light touch regulation" approach for the cryptocurrency sector, aligning with the desires of crypto advocates who seek legitimacy without overly burdensome regulations. Conclusion As Bitcoin and other cryptocurrencies reach new heights in the wake of Trump’s election victory, the market is buzzing with optimism. However, potential investors should remain aware of the inherent risks involved in cryptocurrency trading. With a pro-crypto administration potentially on the horizon, the future of digital currencies may be shaped significantly by upcoming regulatory changes. Thank you for taking the time to read this article! Your thoughts and feedback are incredibly valuable to me. What do you think about the topics discussed? Please share your insights in the comments section below, as your input helps me create even better content. I’m also eager to hear your stories! If you have a special experience, a unique story, or interesting anecdotes from your life or surroundings, please send them to me at [email protected]. Your stories could inspire others and add depth to our discussions. If you enjoyed this post and want to stay updated with more informative and engaging articles, don’t forget to hit the subscribe button! I’m committed to bringing you the latest insights and trends, so stay tuned for upcoming posts. Wishing you a wonderful day ahead, and I look forward to connecting with you in the comments and reading your stories! Read the full article

0 notes

Text

PAID IN BITCOIN: BTCPay Documentary Showcases Bitcoin as the Medium of Exchange at Bitcoin 2024 Conference in Nashville

New Post has been published on Sa7ab News

PAID IN BITCOIN: BTCPay Documentary Showcases Bitcoin as the Medium of Exchange at Bitcoin 2024 Conference in Nashville

Watch the new documentary PAID IN BITCOIN about Bitcoin use at Bitcoin 2024 in Nashville.

... read more !

0 notes

Text

PAID IN BITCOIN: BTCPay Documentary Showcases Bitcoin as the Medium of Exchange at Bitcoin 2024 Conference in Nashville

New Post has been published on Douxle News

PAID IN BITCOIN: BTCPay Documentary Showcases Bitcoin as the Medium of Exchange at Bitcoin 2024 Conference in Nashville

Watch the new documentary PAID IN BITCOIN about Bitcoin use at Bitcoin 2024 in Nashville.

... read more !

0 notes

Text

Federal Reserve Official Dismisses Bitcoin as ‘Valueless’ After a Decade-Plus of Existence

Key Points

Minneapolis Fed President, Neel Tushar Kashkari, deems Bitcoin as a worthless asset.

Despite Kashkari’s remarks, Bitcoin’s performance continues to impress, with increased demand for Bitcoin ETFs.

Neel Tushar Kashkari, the President of the Federal Reserve Bank of Minneapolis, recently expressed his opinion about Bitcoin.

Kashkari stated that Bitcoin remains worthless as an asset class, even after 12 years of existence. He also noted that despite the longevity of cryptocurrency, it has not established itself as a viable form of currency.

Bitcoin’s Remarkable Performance

Contrary to Kashkari’s remarks, Bitcoin has shown impressive performance over the years. It gained 9% in 2012, 59% in 2016, and 171% in 2020.

Thus far in 2024, Bitcoin has outperformed major asset classes. Its volatility has increased as the US prepares for what Jefferies investment firm refers to as the “Bitcoin elections”.

In the past month, Bitcoin has risen by 10% and has surged 48% so far this year.

However, the last quarter of Q3 has been challenging for Bitcoin. It returned flat returns of 0.8% by September end. In contrast, Bitcoin’s rival, Gold, outperformed it with 13.8% gains during the last quarter.

Increasing Demand for Bitcoin ETFs

Despite these challenges, the demand for spot Bitcoin ETFs is growing. This follows a successful launch earlier this year.

Inflows into the BTC ETFs have surged, with $555 million in inflows recorded on one Monday. This marks the largest single-day inflow in four months since June 5, 2024.

This trend clearly indicates that institutional demand for the asset class remains strong, despite all the headwinds.

The upcoming US elections are expected to have a significant impact on the Bitcoin price. Both presidential candidates, Donald Trump and Kamala Harris, have pledged to foster a more crypto-friendly environment to support the growth of digital assets.

Donald Trump, in particular, has been vocal about the topic. At the Bitcoin Conference 2024 in Nashville, Tennessee, he promised to make the US a global hub for cryptocurrency if elected.

Some market analysts believe that a victory for Donald Trump would be very positive for Bitcoin.

Apart from the political scenario, on-chain metrics also support a BTC price rally ahead. According to CryptoQuant data, the Bitcoin reserves on all centralized exchanges (CEXs) are currently at an all-time low.

These declining reserves show that investors are optimistic about the asset and are moving BTC into cold storage for the long term.

Conversely, the Bitcoin open interest is at an all-time high of $19.8 billion. This indicates that traders are building up long positions for BTC.

According to CryptoQuant, “This upward trend in the derivatives market indicates a growing influx of liquidity and increased attention in the cryptocurrency space. The rise in funding rates further points to a bullish sentiment among traders.”

0 notes

Text

Discover Top-Notch Bitcoin Services in Nashville!

Are you looking for reliable and secure Bitcoin services in Nashville? Look no further! At CCCCloud, we offer a range of Bitcoin-related services to cater to all your needs.

Our Services Include:

Nashville Bitcoin Exchange: Trade Bitcoin effortlessly with our trusted platform.

Sell Bitcoin Nashville: Get the best rates and instant payouts when you sell your Bitcoin with us.

Bitcoin Workshops in Nashville: Enhance your knowledge and stay updated with our comprehensive Bitcoin workshops led by industry experts.

Join the Bitcoin revolution today with CCCCloud, your premier destination for Bitcoin services in Nashville.

Visit us at https://ccccloud.org/

Contact No.: +1-307-222-8351

Email id: [email protected]

Let me know if you need any adjustments!

2 notes

·

View notes

Text

Trump's Bold Promise at Bitcoin Conference Sparks Ripple in XRP Community

At the 2024 Bitcoin Conference held in Nashville, former President of the United States of America, Donald Trump, delivered a thundering speech in which he vowed to radically transform the existing legal framework of cryptocurrencies. Trump announced that when he returns to the White House, he will dismiss Gary Gensler, the head of the Securities and Exchange Commission (SEC), whom he accuses of…

0 notes

Text

President-elect Donald Trump is expected to select a new chair of the US Securities and Exchange Commission (SEC) in the coming days. His team is asking the crypto industry to weigh in on potential picks, according to sources who claim to be close to proceedings.

Trump’s shortlist is filled with former government officials, crypto executives, and lawyers who support the crypto industry: Paul Atkins, former SEC commissioner, and Brian Brooks, former acting US comptroller of the currency, are the top two contenders, sources familiar tell WIRED, but the vetting process is ongoing.

Other candidates include SEC commissioner Mark Uyeda, former SEC general counsel Robert Stebbins, and Brad Bondi, the global cochair of investigations and white collar defense at the law firm Paul Hastings, WIRED understands. The chief legal officer for Robinhood, Dan Gallagher, was also up for the role but bowed out of the race over the weekend.

Uyeda declined to comment. Neither the Trump transition team, Atkins, Brooks, Stebbins, nor Bondi responded to a request for comment.

To help craft policy and implement his campaign pledges, Trump is also expected to appoint a crypto czar. The czar would lead a board of advisers comprising a colorful cast of crypto characters, sources tell WIRED. A variety of industry leaders are rumored to be in line for a position on the panel, from companies like Coinbase, Gemini, and Kraken, as well as pro-crypto venture capital firms and crypto mining outfits.

Jonathan Jachym, global head of policy and government relations at Kraken, declined to comment on the competition for places on the advisory council, but says the company welcomes the opportunity to steer crypto policy under the Trump administration. “We take our leadership role in the industry very seriously, and that includes informing and driving regulatory clarity and policy outcomes,” he says. Gemini declined to comment. Coinbase did not respond immediately to a request for comment.

Under Gary Gensler, the sitting SEC chair, the crypto industry has faced what many in its ranks allege to be an unjust and targeted barrage of litigation. Among the crypto faithful, Gensler has become something of a cartoon villain. Tyler Winklevoss, cofounder of crypto exchange Gemini, recently went as far as to describe him as “evil.”

In July, at a bitcoin conference in Nashville, Tennessee, Trump pledged to fire Gensler if reelected, drawing perhaps the most raucous applause of the night. “I will appoint an SEC chair who will build the future, not block the future,” Trump said.

Last week, Gensler announced that he would resign from his office on January 20, the day of Trump’s inauguration. Representatives of the industry in which Gensler has become so maligned are now helping to pick out his successor, sources tell WIRED.

The promise of an SEC overhaul was one of many made to the crypto industry by Trump on the campaign trail. At the Nashville conference, he pledged to cement the US as the foremost bitcoin mining powerhouse, create a national “bitcoin stockpile,” and establish a framework for stablecoin businesses, singing from the crypto hymn sheet.

In June, Trump hosted executives from the crypto mining industry at Mar-a-Lago, his resort in Florida. “We had a very long, in-depth discussion with him—and he was very interested. He was very engaged and asked great questions,” says Brian Morgenstern, head of public policy at bitcoin mining company Riot Platforms and a former official in the first Trump administration, who was in attendance.

Trump has even begun to dabble in crypto himself. Over the summer, his campaign began accepting crypto donations, and his sons launched their own crypto platform, World Liberty Financial, which he helped to promote. Last Thursday, The New York Times reported that Trump’s social media company, Truth Social, filed a trademark application for what was described as a crypto payment service called TruthFi.

Figures allied with the crypto industry have already been appointed to Trump’s cabinet. His pick for Secretary of Commerce, Howard Lutnick, leads the financial services company Cantor Fitzgerald, which manages assets for Tether, operator of the world’s largest stablecoin. Likewise, vice president-elect JD Vance, nominee for Secretary of the Department of Health and Human Services Robert F. Kennedy Jr., and coleader of the new Department of Government Efficiency Vivek Ramaswamy have all expressed pro-crypto views.

“Based on what I've heard in private conversations, my perspective has been that the incoming administration is taking their pro-bitcoin and crypto campaign promises very seriously and intend to do a robust assessment of options to optimize [appointments to regulatory positions] as best they can,” says Christopher Calicott, managing director at bitcoin-focused VC firm Trammell Venture Partners.

The price of bitcoin has risen to record heights, just shy of $100,000 per coin, since Trump won reelection earlier this month.

“The entire industry is going to have much brighter prospects on a number of different fronts,” says Morgenstern. “We don’t have any reason to doubt President Trump.”

3 notes

·

View notes

Text

Crypto Updates: Crypto Index Hits 18-Month Low; Trump to Speak at Bitcoin 2024

The cryptocurrency market is experiencing significant changes, with the Fear and Greed Index dropping to 30, its lowest in 18 months, signaling increased caution among investors. Former U.S. President Donald Trump is expected to speak at Bitcoin 2024 in Nashville, highlighting crypto's growing political attention. The German government transferred 400 BTC (~$24 million) to exchanges, sparking speculation. Kanav Kariya resigned as Jump Crypto President amid a CFTC investigation. ZKSync launched the ‘Elastic Chain,’ competing with Polygon’s AggLayer. Arbitrum proposed delegate staking rewards, while Tether ceased USDT support for EOS and Algorand. BitGet introduced pre-market trading for the Hamster Combat token. Major token unlocks in ALT and GTAI may cause market volatility.

0 notes

Text

Ethereum Breaks $3400: What’s Next as ETF Launch Date Looms?

Key Points

The SEC is finalizing drafts from potential spot Ethereum ETF issuers.

Ethereum [ETH] value is rising, and the approval of a U.S. spot Ethereum ETF is anticipated next week.

The Securities and Exchange Commission (SEC) is currently finalizing drafts from potential issuers of spot Ethereum ETFs.

The value of Ethereum (ETH) has seen an increase, reaching over $3400 recently.

Spot Ethereum ETF Update

Despite a drop below $3000 last week, Ethereum has recovered, trading 12.8% higher in the last seven days at press time.

These gains follow reports of an anticipated approval of a U.S. spot Ethereum ETF next week.

Nate Geraci, an ETF market commentator, predicts that the SEC will soon approve the resubmitted registration statements.

Bloomberg ETF analyst Eric Balchunas supports Geraci’s prediction, stating that only an unforeseen last-minute setback could delay the launch.

Market anticipation

Despite the specific approval date being unclear, market excitement has been growing since the SEC approved applicants’ forms 19b-4 in May.

In June, the SEC provided feedback on the filed S-1 forms, highlighting areas needing review.

Last week, the securities regulator requested the eight asset managers seeking approval for their spot Ethereum ETFs to submit amended S-1 registration statements.

The approval of a spot Ethereum ETF is expected to significantly impact the Ethereum market and the broader crypto industry.

The ETF offerings, which are tied to the spot price of Ether, provide investors with a new avenue to gain exposure to the altcoin through a regulated financial product.

Most market analysts predict that the Ether ETFs could attract investment flows from institutional investors, potentially replicating the inflow of spot Bitcoin ETFs observed in the first half of the year.

U.S. spot Bitcoin ETFs have drawn in $16.12 billion in inflows since their launch earlier this year.

The predicted launch date coincides with the week of the 2024 Bitcoin conference at Nashville.

The conference will feature prominent speakers, including MicroStrategy executive chairman Michael Saylor, ARK founder Cathie Wood, independent U.S. Presidential candidate Robert Kennedy Jr, and Republican U.S. presidential candidate Donald Trump.

0 notes