#Mortgage Loan Brokers Newcastle

Explore tagged Tumblr posts

Text

Expert Investment Mortgage Broker in Newcastle

Unlock profitable property opportunities with Ascension Finance, your trusted investment mortgage broker in Newcastle. Our tailored solutions and expert advice ensure you find the best loan options to maximize your returns. Start your property investment journey with confidence today!

0 notes

Text

At Mortgage Brokers Newcastle, we're local Mortgage Brokers who make buying a new Newcastle home, refinancing, or investing in local property easy. Our services are 100% Free and no matter where you are in the world, local, interstate or international, we can help you get your Newcastle home loan approved, just get in touch today!

1 note

·

View note

Text

Commercial Finance Brokers Newcastle

In the vibrant business hub of Newcastle, securing the right financial solutions is crucial for the growth and success of any enterprise. Aspira Financial stands out as a premier provider of commercial finance brokerage services, dedicated to helping businesses navigate the complex world of finance with ease and efficiency. With a deep understanding of the local market and a commitment to personalized service, Aspira Financial is the go-to choice for commercial finance brokers in Newcastle.

Expert Guidance and Tailored Solutions

At Aspira Financial, we understand that every business is unique, with its own set of challenges and opportunities. Our team of experienced commercial finance brokers takes the time to get to know your business, understand your goals, and develop a tailored financial strategy that aligns with your needs. Whether you're looking to expand operations, invest in new equipment, or manage cash flow, we provide expert guidance and access to a wide range of financial products.

Extensive Network of Lenders

One of the key advantages of working with Aspira Financial is our extensive network of lenders. We have established strong relationships with banks, credit unions, and alternative finance providers, ensuring that we can offer our clients the most competitive rates and flexible terms available. Our brokers have the expertise to match your business with the right lender, simplifying the application process and increasing your chances of securing the finance you need.

Comprehensive Range of Services

Aspira Financial offers a comprehensive range of commercial finance services designed to meet the diverse needs of businesses in Newcastle. Our services include:

Business Loans

From small business loans to large-scale commercial loans, we help businesses of all sizes secure the funding they need for growth and development. Our brokers work closely with you to determine the most suitable loan products and guide you through the application process.

Asset Finance

Investing in new equipment or machinery can be a significant expense for any business. Our asset finance solutions provide flexible and affordable options to help you acquire the assets you need without straining your cash flow.

Invoice Financing

Managing cash flow is critical for maintaining smooth business operations. Invoice financing allows you to unlock the value of your unpaid invoices, providing immediate access to funds and improving your cash flow management.

Commercial Mortgages

Whether you're looking to purchase new premises or refinance an existing property, our commercial mortgage solutions offer competitive rates and terms. Our brokers assist you in finding the right mortgage product to support your business goals.

Trade Finance

For businesses involved in international trade, managing the financial aspects can be challenging. Our trade finance services help you mitigate risks, optimize cash flow, and facilitate smooth transactions with suppliers and customers.

Why Choose Aspira Financial?

Choosing Aspira Financial as your commercial finance broker in Newcastle comes with numerous benefits:

Local Expertise: We have an in-depth understanding of the Newcastle business landscape and can provide insights and solutions tailored to the local market.

Personalized Service: Our brokers offer a personalized approach, taking the time to understand your business and develop customized financial strategies.

Access to a Wide Range of Lenders: Our extensive network of lenders ensures that you get the best possible rates and terms for your financial needs.

Expert Guidance: Our experienced brokers provide expert advice and support throughout the entire process, from initial consultation to securing the finance.

Get Started with Aspira Financial Today

Navigating the world of commercial finance can be complex, but with Aspira Financial by your side, you can achieve your business goals with confidence. Our team of dedicated commercial finance brokers in Newcastle is ready to help you explore your options, secure the best financial solutions, and drive your business forward.

Contact Aspira Financial today to schedule a consultation and take the first step towards a brighter financial future for your business.

Read More Info : Business finance brokers Newcastle

Newcastle accounting professionals

0 notes

Text

Unveiling the Key Role of Mortgage Brokers in Newcastle, NSW

In Newcastle, New South Wales (NSW), the real estate market is dynamic and ever-changing, presenting both opportunities and challenges for homebuyers seeking to navigate the mortgage landscape. Mortgage brokers in Newcastle play a pivotal role in facilitating property transactions by serving as intermediaries between lenders and borrowers, guiding clients through the mortgage process, and helping them secure financing for their home purchases. Here, Let’s delve into the unique role of mortgage brokers in Newcastle, highlighting their contributions to the local real estate market and the value they bring to homebuyers seeking to achieve their property ownership goals.

1. Market Expertise and Local Knowledge

Mortgage brokers in Newcastle possess in-depth market expertise and local knowledge that enables them to navigate the nuances of the local real estate landscape. They have a comprehensive understanding of Newcastle's property market trends, housing affordability, and lending practices, allowing them to provide valuable insights and advice to clients. Whether it's identifying emerging neighbourhoods, analysing property values, or assessing mortgage options, brokers leverage their local knowledge to help clients make informed decisions and secure favourable loan terms.

2. Access to Lenders and Loan Products

One of the primary roles of mortgage brokers in Newcastle is to connect clients with lenders and access a wide range of loan products tailored to their needs and financial circumstances. Brokers maintain relationships with an extensive network of banks, credit unions, and non-bank lenders, giving clients access to a diverse selection of mortgage options. Whether clients are first-time homebuyers, investors, or refinancing existing loans, brokers leverage their lender connections to find the most suitable loan products with competitive interest rates, terms, and features.

3. Personalised Advice and Guidance

Mortgage brokers in Newcastle provide personalised advice and guidance to clients throughout the mortgage process, from initial consultation to loan approval and settlement. They take the time to understand clients' financial goals, preferences, and constraints, tailoring their recommendations to match individual needs. Whether it's assessing borrowing capacity, explaining loan features, or guiding clients through paperwork and documentation, brokers offer hands-on support and expertise to ensure a smooth and stress-free mortgage experience.

4. Negotiation and Advocacy on Behalf of Clients

Mortgage brokers in Newcastle act as advocates for their clients, negotiating with lenders on their behalf to secure favourable loan terms and conditions. They leverage their industry knowledge, bargaining power, and relationships with lenders to negotiate competitive interest rates, fees, and loan features that align with clients' objectives. By advocating for the best interests of their clients, brokers help maximise savings, minimise costs, and ensure that clients receive the most favourable loan terms available in the market.

Mortgage brokers play a vital role in the Newcastle real estate market, serving as trusted advisors and facilitators of property transactions for homebuyers. From providing market expertise and access to lenders to offering personalised advice and advocacy on behalf of clients, brokers contribute to the success and satisfaction of property transactions in Newcastle. Whether you're a first-time homebuyer, investor, or refinancing homeowner, partnering with a knowledgeable and experienced mortgage broker in Newcastle can make all the difference in achieving your property ownership goals with confidence and peace of mind.

0 notes

Text

Navigating Financial Waters: Your Guide to Commercial Finance Brokers in Newcastle

In today's fast-paced business landscape, securing the right financing solutions is essential for growth and sustainability. Whether you're a startup looking to fund your venture or an established business seeking to expand, navigating the complex world of commercial finance can be challenging. That's where the expertise of commercial finance brokers comes into play, and in Newcastle, Aspira Business and Financial Service stands out as a trusted partner in providing comprehensive financial advisory and services.

Aspira Business and Financial Service understands that every business is unique, with its own set of financial goals, challenges, and opportunities. That's why we offer personalized financial advisory and services tailored to meet the specific needs of each client. Our team of experienced professionals takes the time to understand your business, assess your financial situation, and provide tailored solutions that align with your objectives.

When it comes to commercial finance, having the right guidance can make all the difference. Here's how Aspira Business and Financial Service can help:

Access to a Wide Range of Financing Options: As independent commercial finance brokers, we have access to an extensive network of lenders, including banks, credit unions, private lenders, and alternative financing sources. This allows us to offer our clients a wide range of financing options to choose from, ensuring they find the right solution to meet their needs.

Expert Advice and Guidance: Our team of financial experts has a deep understanding of the commercial finance landscape and can provide valuable advice and guidance every step of the way. Whether you're looking to secure a business loan, line of credit, equipment finance, or commercial mortgage, we'll help you navigate the process with confidence.

Tailored Solutions for Your Business: We understand that one size does not fit all when it comes to financing solutions. That's why we take a personalized approach to every client, offering tailored solutions that are specifically designed to meet your unique needs and objectives.

Streamlined Application Process: Applying for commercial finance can be time-consuming and complex, but with Aspira Business and Financial Service by your side, the process is streamlined and hassle-free. We handle all the paperwork and negotiations on your behalf, allowing you to focus on running your business.

Ongoing Support and Relationship Management: Our commitment to our clients doesn't end once the financing is secured. We provide ongoing support and relationship management to ensure that your financing solutions continue to meet your evolving needs as your business grows and changes.

In conclusion, when it comes to navigating the waters of commercial finance in Newcastle, Aspira Business and Financial Service is your trusted partner. With our personalized approach, expert advice, and access to a wide range of financing options, we'll help you find the right solution to fuel your business's success. Contact us today to learn more about our financial advisory and services and take the first step towards a brighter financial future.

1 note

·

View note

Text

Mortgage Broker Newcastle NSW

Wisebuy Home Loans is a leading Newcastle, Lake Macquarie, and Maitland mortgage advisor. Operating since 2015, we work to help people all over Australia and climb the property ladder quickly and easily with expert home loan advice.

0 notes

Text

As a great home loan and mortgage broker near you, our primary goal as a credit provider is to deliver an unparalleled customer service experience and provide exceptional home loan advice to suit your long-term wealth strategy in every financial situation.

1 note

·

View note

Link

Residential loan is a type of loan that is against the property. Are you looking for the best Residential Property Loans Newcastle? We provide several types of residential loans to our customers. We have contact with several lenders in the market that helps us to arrange finance for you in a lesser time. Our professionals will help you to suggest the best residential loan that fits your need. Call us now.

#Mortgage Lenders Newcastle#Mortgage Loan Brokers Newcastle#Property Mortgage Loan Newcastle#Home Loans Newcastle

0 notes

Link

#Mortgage Broker Newcastle#Car Loans Newcastle#Home Loans Newcastle#Commercial Loans Newcastle#Business Loans Newcastle#Car Finance Newcastle

3 notes

·

View notes

Text

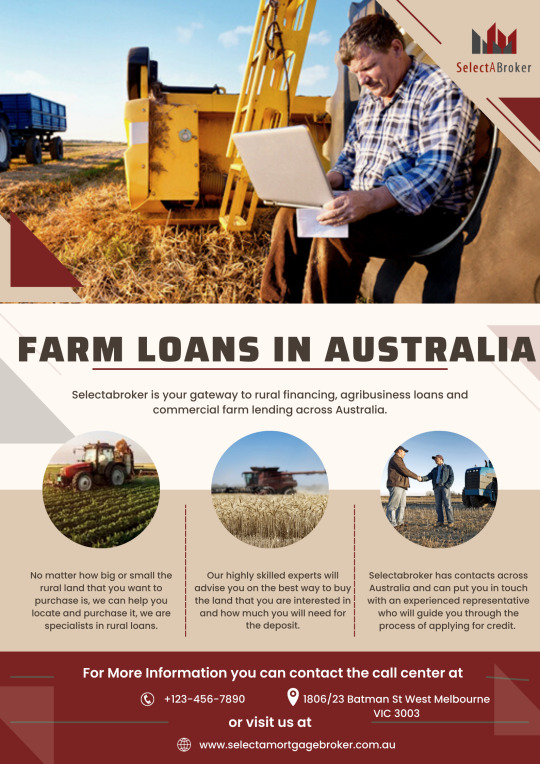

At Selectabroker, we understand that rural financing, farm lending and farm loans in Australia can be challenging. We also know that commercial farming is essential for the survival of our nation and its inhabitants. That’s why we’re here to help you achieve your goals in the challenging world of homesteading and agriculture. Visit the website for further queries.

#mortgage brokers newcastle#mortgage advisor#farm loans australia#commercial lending#construction finance

0 notes

Text

Newcastle Mortgage Broker

You deserve to work with a top mortgage expert. See mortgage rates and fees in real-time on The Wise Buy Group site. For Newcastle mortgage broker, click: https://bit.ly/3Adn30q

0 notes

Text

Secure Your First Home Loan in Newcastle with Ascension Finance

Looking to buy your first home in Newcastle? Ascension Finance specializes in first home loan solutions tailored to your needs. Our experts guide you through the process, ensuring competitive rates and a smooth experience. Make your homeownership dreams a reality with our trusted support. Contact us today to get started!

0 notes

Photo

We have access to a large number of lenders and will take the time to guide you through the range of options, and we start by listening to you.try these one-click tools to get a clearer picture of your property targets.

#newcastle car loans calculators#Home Loans in Newcastle#award winning newcastle mortgage brokers#car loans in newcastle

0 notes

Photo

If you or someone you know is looking to buy their first home, but not sure whether it’s possible with what you’ve current got saved up, just reach out.

0 notes

Text

46-or-so Reasons You Should Get Gtpmortgages Mortgage Advice In Newcastle Upon Tyne

Can A Mortgage Broker Obtain You A Bigger Loan?A lot of people question "can a mortgage broker get you a larger financing?" People with negative credit rating occasionally believe they are not eligible for a car loan and also this can create a lot of anxiety. Often a bad debt circumstance is short-term, but various other times individuals need a bigger financing due to the fact that they have unanticipated expenditures or have experienced a huge amount of cash shed as a result of the loss of a work or something of that nature. A home loan broker can aid an individual obtain a bigger lending to make sure that they can take care of those costs and have more cash left over at the end of every month.It is easier than lots of people believe to find a broker due to the fact that there are several types of brokers. There are conventional lending institutions that can do company with the person directly, along with brokers who have links to larger banks. Either way, it can be quite simple to get the recommendations that a person needs from a reputable broker. Lots of people also pick to use an on-line loan provider rather than handling a traditional loan provider because of the simplicity in which the person can apply online.When an individual is thinking about a home loan they need to consider what they can afford as well as what

rates of interest they will have to pay. It is easy to get confused by all the different financing products available. It is likewise vital to think about whether or not they can qualify for a loan through the right lending institution. A home mortgage broker can show a customer all the various alternatives and also tell them which funding products are best for them. Having the appropriate details as well as having somebody that can clarify every one of the details can be extremely practical. When an individual is thinking of obtaining a car loan the last point they intend to do is get confused.A mortgage broker can likewise help a person to secure a home loan if they have less than perfect credit history. Sometimes a person may have

a hard time receiving a car loan. They can obtain the procedure started by showing them all of the various mortgage programs readily available to them and also exactly how they can get among them. Having accessibility to info such as this can make a difference when it concerns getting the finance they need.Finally, a broker can aid a person discover the best car loan for their situation. The net has made it very easy for anybody to search for a home loan. In

some situations an individual can search multiple internet sites immediately and obtain numerous quotes. Having access to this information in a quick as well https://twitter.com/GTPMortgages as simple format is valuable for individuals. The even more time is invested looking for quotes, the much better the chances are of discovering an excellent rate as well as terms.Getting a home mortgage can be a complicated procedure. If an individual does all of the study they can be successful in finding the appropriate item for their circumstance.

youtube

There are several kinds of car loans that can be discovered with a mortgage broker. By utilizing all of the devices offered they will have the ability to find the one that works the very best for them. Having an effective experience when obtaining a mortgage can be helped along by utilizing the services offered by a mortgage broker. I Can't Obtain A Mortgage For Low Income Properties?You can most definitely get a mortgage for individuals on low earnings. There are lots of reasons a person might qualify to buy a home and also a good section of these factors involve credit scores. If you have bad credit, it might be difficult for you to acquire a home loan, however there are some choices offered. There is likewise the possibility of using your residence as collateral to safeguard a loan.One of the very best locations to look if you have a low income residential property is the real estate public auctions. These can be an exceptional way to purchase residences that need to be repaired or upgraded. The main thing you must be aware of when mosting likely to a public auction is the quantity of cash that you will be paying for the house. It

is not unusual for the prices at the public auctions to be really inflated, and also this can be a superb way to obtain a mortgage if you can acquire it at all.The exact same point can be claimed for the lending institution as well as the majority of significant financial institutions. Many people who have low credit scores are refused by these types of institutions. But if you can somehow obtain a home loan from them, you will certainly most likely pay much less than what others will bill. This is an additional option that is readily available for people with poor credit score, although it is not extremely common.Another place that you can aim to get low revenue properties is the Net. There are several on the internet lenders that focus on making home loans for people who have low earnings. You can even get a lending right online if you want to. This makes the process of acquiring a home mortgage even less complicated. It can additionally be much more practical https://en.search.wordpress.com/?src=organic&q=real-estate for you, due to the fact that you can use from the convenience of your very own house, at your very own leisure.If you still believe that you will certainly not have the ability to obtain the kind of home loan that you require due to your credit score, after that you might intend to think about getting a poor credit report mortgage broker. Poor credit scores home loan brokers can help you find a mortgage that meets your requirements and also the terms that you are comfortable with. They can even do the finance application for you. These brokers can save you money and time, since they currently understand where to search for an excellent deal.The finest means to obtain a mortgage for low revenue residential or commercial properties is to attempt to boost your credit score as much as possible. This can be done by paying down debt, preventing bankruptcy, as well as just eliminating exceptional bills that are making your repayments higher than they ought to be. As long as you can do this, you must be able to qualify for a good mortgage. When you are ready to look for a home loan, ensure that you are ready properly for it. You will definitely get the home loan that you require for your new residence. Can Home Loan Brokers Obtain You a Bigger Mortgage?People who have actually made a decision to experience using home loan brokers need to recognize that the brokers can make a massive difference in obtaining them a home loan. If you are interested in a residence and have actually been conserving up for it for at some time then maybe you should check into a home mortgage. Prior to proceeding with the financing you must call your mortgage broker. A mortgage broker will offer you guidance on obtaining you the very best offer feasible. He can even locate you far better offers than you have the ability to

discover on your own.This is an excellent means for people to save cash. The

brokers can aid to protect you the most effective loan possible for your demands. There are many ways to obtain a home mortgage yet you intend to make certain that you are working with a reputable and also sincere home mortgage broker. The brokers have access to numerous lenders, which can supply you with even more choices to pick from.The brokers can also conserve you time when it pertains to submitting your home mortgage application. They will collaborate with various lending institutions simultaneously. As a result of the competition between loan providers, they are commonly happy to offer lower interest rates as well as monthly settlements than other lending institutions. If you have the ability to safeguard a mortgage that has affordable prices as well as flexible terms, you will be conserving money and making it easier to settle your loan.The major reason that brokers can assist you obtain a larger home mortgage is since they have accessibility to a number of loan providers. They are aware of exactly how affordable the market can be.

The main problem is that if one broker assesses your home mortgage then all the various other brokers evaluate it. This can mean that they are biased in their viewpoints and can lead you in the wrong direction. Before you submit any kind of forms with lenders you need to check to see if any of them are connected with the broker you are dealing with.A home loan broker can likewise help you work out far better terms for your finance. As a result of their large expertise of mortgage offerings they can commonly obtain mortgage loan providers to lower the amount of cash that you require to pay in order to buy your brand-new house. They can also locate a loan provider that concentrates on refinancing buildings to fit your needs. This sort of lender will have reduced costs as well as much less complex finances, so your month-to-month repayment will certainly be much smaller.If you are aiming to obtain a bigger home loan, it is very important to look around. You can make use of the assistance of a home mortgage broker yet in order to get a competitive price you might need to browse without one. You can utilize every one of the sources that are readily available online to contrast various lending institutions. You can additionally take advantage of any kind of benefits that a broker might be providing. This can assist you get the best bargain feasible.

1 note

·

View note

Text

Ascension Finance

What a mortgage broker can do for you, and why you should work with one If you’re a first home buyer, then you know the hard work needed to land that dream home. The process could get confusing, but there are specialists like Ascension Finance who have helped many clients with their home loans. They are based in Newcastle NSW, and they are a mortgage and finance broker who offer home loan solutions that are tailored towards your needs. In addition, they have the skills that can help secure your financial future. First of all, Ascension Finance has services that could help you become a homeowner. They can also help with refinancing and equity releases. Additionally, it is recommended to review your home loan, and ensure that it is in your best interests. You should find out if you’re getting the best deal, or if you have the right products for your needs. There are always lenders who introduce new and improved home loan products with low rates. In addition, they can even include ways to help you pay off your loan sooner. You can even unlock your equity, and use it for other means. Furthermore, commercial property purchases, asset and equipment finance and short-term cashflow solutions services are also available to you. Another aspect you can get help with is investment finance. It doesn’t matter if you’re wanting to invest in property or any other assets. Ascension Finance can help you figure out what your borrowing options are. Whether you’re a first time investor or an experienced investor, Ascension Finance has the skills to help you reach your goals. Furthermore, they will be able to help you purchase your first investment property. You will learn about things like repayment strategies, loan structures and borrowing capacity. As an investor, you are probably aware that it takes a lot of research to know what loan will meet all of your requirements. Therefore, it is good to discover your options. If you’re a first home buyer, Ascension Finance has specialty services that can make the process easier for you. You will be able to get help with figuring out how much deposit you need, how much you can borrow, and what your repayments will be. Any questions you have or anything you need help with, you will get everything sorted out and explained to you. Do you own or are you starting a business? There are services that can help you if you are buying commercial property or if you need financial aid. Ascension Finance has commercial lenders that can help you get financing for your property and you will also have access to short term business funding in order to help you with cash flow to help your business thrive. There are many reasons why you should consider a mortgage broker. For example, they communicate with many lenders and they can connect you with the appropriate ones for your specific needs. Therefore, you will be able to avoid hidden fees and loan terms. Book a phone call today to discuss which service you could use to help you secure a financially secure future. Works Cited Investopedia. https://www.investopedia.com/financial-edge/1112/advantages-and-disadvantages-of-using-a-mortgage-broker.aspx “Mortgage Brokers: Advantages and Disadvantages” Mohr, Angie. July 17th, 2021. Accessed on December 30th, 2021. Dotdash. https://www.ascensionfinance.com.au Our Social Pages: facebook twitter linkedin maps.google youtube business.site

0 notes