#MonthlyBudget

Explore tagged Tumblr posts

Text

Whether you're planning a small gathering or a big party, we've got you covered with a fantastic range of ideas that will ensure everyone has a blast. And as a special bonus, we're offering a free printable Valentine's Day Party Planner bundle to help you stay organized and effortlessly plan the perfect event.

via avemateiu.com

#monthlybudget#monthlyplanner#freeplanner#printableplanner#budgetplanner#cuteplanner#kawaiiplanner#cute planners#monthly planner#budget planner#partyplanner#eventplanner

0 notes

Text

🌟 Plan Your Way to Success! 🌟

Discover the ultimate tool for goal-setting and productivity – our Complete Year Digital Planner! 🎯📅 Stay organized, focused, and motivated throughout the year with this all-in-one planner.

📝 Set clear goals and create action plans to turn your dreams into reality. 🎯🚀 Manage your finances with the integrated monthly budget tracker. 💼💰

✨ Personalize the planner to match your style and preferences. Use it digitally on your tablet or print it out – the choice is yours! 💻🖨️

🌈 Embrace a more organized and successful future! Get your Complete Year Digital Planner now and take charge of your life! 📈📆

#DigitalPlanner#GoalSetting#ActionPlan#MonthlyBudget#ProductivityTools#PrintablePlanner#PlannerAddict#SuccessPlanner#YearlyPlanner#TimeManagement#OrganizationTips#EtsyShop#ShopNow

0 notes

Text

How do you budget monthly income?

Managing your monthly income can be a challenging task, but with proper budgeting, you can take control of your finances and achieve your financial goals. Budgeting allows you to allocate your income towards different expenses, savings, and investments, ensuring that you have enough for both necessities and desires.

In this article, we will discuss a step-by-step approach to budgeting your monthly income effectively, enabling you to make informed financial decisions and improve your financial well-being. Step 1: Assess Your Income and Expenses The first step in budgeting is to assess your monthly income and expenses. Begin by calculating your total monthly income, including salaries, wages, side hustles, and any other sources of revenue. Next, gather all your bills, receipts, and statements to determine your regular expenses, such as rent/mortgage, utilities, transportation, groceries, and debt repayments. Step 2: Categorize Your Expenses Once you have a clear picture of your income and expenses, categorize your expenses into fixed and variable categories. Fixed expenses are those that remain consistent each month, such as rent or mortgage payments, insurance premiums, and loan repayments. Variable expenses, on the other hand, fluctuate from month to month, such as entertainment, dining out, and shopping. Step 3: Set Financial Goals To create a purposeful budget, it's essential to set financial goals. Determine your short-term and long-term objectives, such as building an emergency fund, paying off debt, saving for a vacation, or investing for retirement. Assign a specific amount or percentage of your income to each goal, keeping in mind the SMART principle (Specific, Measurable, Achievable, Relevant, and Time-bound). These goals will help you prioritize your spending and make informed decisions. Step 4: Create a Budget Plan Now that you have categorized your expenses and set financial goals, it's time to create a budget plan. Start by allocating your income towards your fixed expenses, ensuring that you have enough to cover these essential costs. Then, distribute the remaining funds among your variable expenses and financial goals based on their priority and importance. It is crucial to track your spending to stay within your budget. Consider using budgeting apps or spreadsheets to record your expenses and monitor your progress. Review your budget regularly, especially if your income or expenses change, and make necessary adjustments. Step 5: Trim Expenses and Prioritize Saving To make your budget work effectively, look for opportunities to trim expenses. Analyze your variable expenses and identify areas where you can cut back. For example, consider reducing eating out or entertainment expenses or finding cheaper alternatives for certain products or services. Every saved dollar can be redirected towards savings or other financial goals. Prioritize saving by setting aside a specific amount or percentage of your income each month. Automate your savings by setting up automatic transfers to a separate savings account. This way, saving becomes a habit, and you won't be tempted to spend the money earmarked for your goals. Step 6: Review and Adjust Regularly review your budget and track your progress. Compare your actual expenses with your budgeted amounts to identify any discrepancies or areas where you may be overspending. Adjust your budget as necessary to accommodate changes in income or expenses. Be flexible and adaptable to ensure that your budget reflects your current financial situation. Overall, Budgeting your monthly income is a crucial step towards achieving financial stability and reaching your financial goals. By assessing your income and expenses, categorizing your expenses, setting financial goals, creating a budget plan, trimming expenses, prioritizing savings, and regularly reviewing and adjusting your budget, you Read the full article

#budgetformonthlyincome#budgetmonthlyincome#howtobudgetmonthlyincome#monthlybudget#monthlyincomebudget#monthlyincomebudgetplanner#monthlyincomebudgetingtips#monthlyincomemanagement#monthlyincomeplanning#monthlyincomesaving#monthlyincometracking#stockmarket#unitedkingdom#unitedstates#USeconomy

0 notes

Text

Create a budget to achieve financial stability with our comprehensive guide. Learn budgeting tips, strategies, and methods to manage your money effectively and reach your financial goals..

#Createabudget#budgetplanning#financialbudgeting#personalbudgettips#monthlybudgeting#creatingabudgetplan

0 notes

Text

#budgetspreadsheet #budgets#money #saving #etsy #investing#millionairemindset #mindset#selfhelp #debtfree #debtfreedom#debtsnowball #ecommerce#etsyshop #etsyseller #shopify#wealth #highvalueman#highvibrations #percerverance#discepline #couplebudget #generationalwealth #etsybusiness #etsypromotion#etsyseller #etsybudget #budgeting#monthlybudget #success #dailyplanner #etsy #growwealth #wealth #productivity #millionairemindset #business #5am #4am #3am #winner #gogetter #mindset #discepline #motivation #grit #strength #determination #planner #monthlybudget #increaseproductivity #setforsuccess

3 notes

·

View notes

Text

0 notes

Photo

Download here

#monthlybudget#monthlyplanner#freeplanner#printableplanner#budgetplanner#cuteplanner#kawaiiplanner#cute planners#monthly planner#budget planner

8 notes

·

View notes

Link

For just $3.25 Don't forget to pay your bills again with these colorful functional bill due stickers. Perfect for your planner, calendar or wherever you want to put a reminder Great way to keep track especially if you are on a budget Stickers feature a spot to write which bill is due, how much and a check mark box for when you've paid. Perfect for Erin Condren Life Planners, or any other planner or notebook where you can use a reminder. Just through in you planner pocket and go!! Each sticker is 1.5"x .5" Each sheet comes with 24 individual stickers 1 sheet per order Stickers are printed on matte removable sticker paper

#MoneyStickers#Pastel#PayBillStickers#HappyPlanner#BillDueStickers#StickerKit#BillTracker#MonthlyBudget#BillReminder#PlannerStickers

1 note

·

View note

Text

The next step in earning money- saving money. Making a monthly budget is no rocket science. Read More. Learn More.

0 notes

Text

Discover our awesome Financial Project Planner Printable PDF File & Ready to upload. Size 8.5 x 11 inches (and can also be printed on A4 size paper) Clean, nice and modern design. The file was created with good resolution to ensure clear print. You can also use it as an interior on Amazon Kindle Direct Publishing: Self Publishing . ORDERING PROCESS: This is an Instant Download - no physical product will be sent. Once your payment is confirmed you will receive an email from Kdpinterior (to your registered email address) Or Here https://kdpinterior.com/my-account/downloads/ LEGAL INFORMATION These prints can be used For commercial purpose in print or digital form. You can't sell this item on Etsy or other third parties Like Creative Fabrica…, except Amazon Kindle Direct Publishing: Self Publishing, You are free to use it on amazon KDP only. QUESTIONS? If you have any questions about this item, please use the “Ask a Question” button next to the price and we’ll get right back to you as soon as possible. There are a lot of advantages to self publishing over traditional publishing, To be a successful author, it needs hard work! Self publishing requires you to have knowledge of every aspect of the publishing process, like designing, formatting, and marketing. Platforms like Amazon Kindle Direct Publishing make self publishing accessible to everyone, but it can feel overwhelming to independent authors. What do you need to use Amazon KDP? What technical skills do we need to meet Amazon KDP requirements? How to promote our book? Here are seven tips and tricks to hack Amazon’s self publishing platform and be a successful author. 1. Make Your Book's Title and Description Perfect: Financial Project Planner| 8x11 A good Amazon book title and description are important for your book to rank well on Seo. Your book description gives readers a taste and overview of your writing skills and tells them exactly what to expect when they buy your journal or planner . Your journal title and description should look professional. A poorly written description have huge impact on sales. Run your blurb through a grammar checker to check for mistakes and readability. Aim for a genre-appropriate, specific set of rich keywords. Financial Project Planner| 8x11 We’ll talk more about keywords in the next section. Amazon will allow you to use HTML formatting on your descriptions, so get the benefit of this awesome feature. You will be able to organize your keywords. 2. Use long-tail keywords like Financial Project Planner| 8x11. One of the most important aspects to getting ranked on Amazon self publishing is the seven keyword boxes. They allow you to add up to forty-nine characters. A keyword is a word or phrase that people type into the top search box on Amazon to find a specific journal or planner... You need to focus on specific long-tail keywords. Instead of a broad, short-tail keyword, you might enter Financial Project Planner| 8x11 (a specific long-tail keyword). You can research these using a keyword research tool like Google Keyword Planner Tool, hire an expert in KDP categories and keywords, or simply search for them manually by yourself. Look for keywords that give you only a few results, not thousands, to beat your competition. 3. Choose Extra Categories Amazon KDP has preset categories for books, and it’s hard to choose the best one for your work. When you upload your journal or planner interior, you can select two Amazon categories. Your book might fit into multiple categories. You can also increase your chances of being a bestseller in a category when you choose less competitive categories. A little secret : you can add additional categories with these simple tips : If you can call KDP customer service, KDP will allow you up to eight more categories, for a grand total of ten! 4. Purchase a High-Quality Designed Cover The first thing that Amazon visitors see is your book’s cover. A high quality cover can make a big difference and impact your sales numbers.

There are a ton of elements that impact whether a book cover is engaging. Various classifications have different expectations. A basic cover does not take into account genre trends and expectations. A nonfiction book should not look like a kid's activity book or vice versa. Unless you’re an experienced graphic designer, avoid using tools offered by Amazon. Find an experienced designer who is familiar with your theme and check their portfolio. Try to reach out to other authors for recommendations, or browse Facebook, Instagram, and Twitter to find a freelance designer who works with other authors. 5. Emphasize covers and interior design. The quickest way to a one-star review is an ugly book cover or interior. When your print book format is a mess, Amazon's visitors will move on to the next competitor. Don’t gloss over this step. There is a lot of software, like Canva, Photoshop, or Illustrator, that allows you to format your book and make it look professional. You can also outsource your formatting to an expert. In our case, the Financial Project Planner| 8x11 is already formatted for KDP, so you will save a lot of time and money. 6. Adjust Prices for International Markets When you publish a journal or planner on Amazon KDP, make sure that you adjust the price accordingly .99 : This is a marketing psychology that works on any markets. If KDP adjusts the price automatically for other markets, You can manually change it to international prices, however. You can add a .99 to the end of each price for each currency. And keep your eyes on royalty rates. You should also monitor the pricing boundaries for 30% and 70% royalties for each currency. 7. Becoming an Affiliate for Your Own Book Promote affiliate links for your own book and earn 70% royalties! Use your Amazon affiliate link on social media, website links, and anywhere else you can think of. Your amazon affiliate link allows you to earn additional 4% on the selling price of your book. It seems like not much, but that additional 4% can add up quickly with enough sales. Keep in mind that you only get this income when someone buys through your affiliate Amazon link, not from Amazon's search box. Finally, make Amazon KDP your friend; Using tips and tricks like these can assist you in succeeding on Amazon KDP.

#KDPInteriors#ReadyToUpload#budgetdashboard#budgetplanner#budgetspreadsheet#budgettemplate#budgettracker#ExpenseTracker#financeplanner#financialplanner#kdpinterior#monthlybudget#savingstracker#spreadsheettemplate

0 notes

Link

This post will give you the information that there are 5 tips to save money while studying overseas. Basically, you will get the 5 tips such as use student pass, prepare a monthly budget and many more. To know about the rest of tips, read this post and connect with our study abroad consultants in Gurgaon for Canada today.

0 notes

Link

Following a monthly budget is one of the best ways to manage your personal and business finances. To follow a budget, though, you must create one first and sometimes that can be the tricky part. If you are ready to create a budget and follow it to help you manage your finances, the following information can help. Read these tips and make a budget that works for you.

#HindeSights#advertisingbudget#budget#monthlybudget#homebasedbusiness#makemoney#makemoneyonline#newbusinessideas#nexgen#spend#taxdeductions#workfromhome

0 notes

Photo

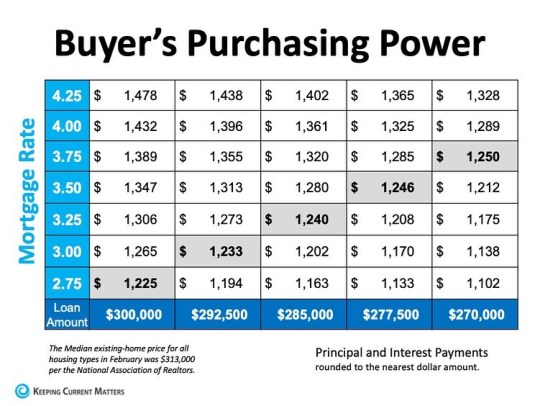

Could Rising Mortgage Rates Could Erase Home Buyer's Spending Power? Low rates have been helping many buyers afford their monthly mortgage payments. Interest rates are inching up from a record low of 2.65% in the beginning of January. Higher interest rates will make buyers more price conscious and less likely to bid too high over asking. As a result we could see some of the intense competition slow down. Please contact me if you are looking into buying or selling. Raana Jamshide Broker Associate, REALTOR® CRS, ILHM, CIPS Cell: 858.229.2200 [email protected] DRE#01255312 ________________________________ Pacific Sotheby's International Realty #MortgageRates #SellersMarket #Overbidding #HomeBuyer #LuxuryHomes #FirstTimeHomeBuyer #MonthlyBudget #SanDiegoRealtor #HomesatSanDiego (at San Diego, California) https://www.instagram.com/p/CNDgAJojLhO/?igshid=ve1rfuixg7cc

#01255312#mortgagerates#sellersmarket#overbidding#homebuyer#luxuryhomes#firsttimehomebuyer#monthlybudget#sandiegorealtor#homesatsandiego

1 note

·

View note

Text

Take charge of your future and start budgeting with Greatsheets!

#minimalistplanner #budgetspreadsheet #googlesheets #excel #monthlybudget #paycheck #planner #striveforexcellence #workhard #grit #success

0 notes

Photo

AVAILABLE NOW • If you have a streaming service you know the actual payment can slip your mind. Don’t let it happen with these babies! • • • #tiendaonline #smallbusiness #smallbusinessowner #stickershop #stickerbusiness #plannerstickers #plannerstickershop #plannergirl #plannercommunity #planneraddict #plannerlife #streamingservice #payment #financialhealth #debtfree #financialplanning #budget #monthlybudget (at Manhattan, New York) https://www.instagram.com/p/CCsSrjmJc5G/?igshid=1n0n1x0494937

#tiendaonline#smallbusiness#smallbusinessowner#stickershop#stickerbusiness#plannerstickers#plannerstickershop#plannergirl#plannercommunity#planneraddict#plannerlife#streamingservice#payment#financialhealth#debtfree#financialplanning#budget#monthlybudget

0 notes

Link

For just $1.50 Digital Goodnotes Insert Notabilty Pages Template Habit Tracker Monthly Budget Planning cleaning home maintenance stickers VIDEO REVIEW https://youtu.be/XP38qBWYJ6s DETAILS: ♥ This is a DIGITAL file ♥ 7 digital stickers in JPG Format ♥ File can be download immediately after your payment is confirmed ♥ I do NOT ship or print It is the best for Goodnotes. Noteshelf2, Notability, Procreate etc. * This stickers are for personal use only and not intended for print production. Commercial use and resale are prohibited. All sales are final. Digital products are non-refundable.

#HomePlanning#DigitalPlanning#MonthlyBudget#NotabilityStickers#GoodnotesPages#DigitalTemplate#GoodnotesTemplate#DigitalHabit#DigitalStickers#GoodnotesInsert

0 notes