#Micro ATM Recharge

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below

*Adhaar Address Update

*Adhaar download

*Adaar PVC card apply

*Adhaar Update History

*Adhaar Card Slot Booking

*Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services

* New Pan Card Apply

*Pan card Corrections

*Instant Pan card

*Minor Pan Card

*Duplicate Pan Card

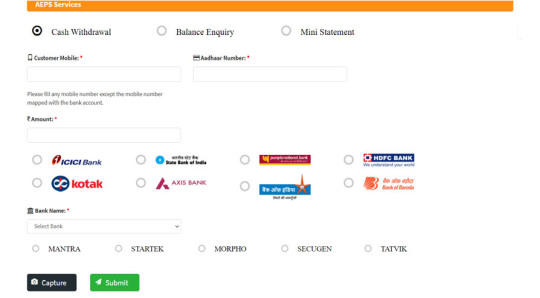

4.Micro& Mini ATM Services

*Cash withdrawal

*Fund transfer

*Cash Deposit

*Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines:

1.Adhaar card photo

2.Pan Card photo

3.Phone number

4.Email Id

5.Live Location to be shared

6.2-4 Sec video Recording by holding adhaar /pan

7.Any other person reference contact number and ID proof

8.bank passbook photo

9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339

Note : Registration fees non Refundable

2 notes

·

View notes

Text

𝔻𝕚𝕘𝕚𝕥𝕆ℕ 𝑴𝒖𝒍𝒕𝒊 𝑺𝒆𝒓𝒗𝒊𝒄𝒆𝒔 welcomes you. It is a Common Service Center (CSC). We offers Bank Accounts Opening, Money Transfer, Cash Withdrawal, Cash Deposit, Micro ATM, Aadhaar ATM (AEPS), Taxation (ITR, TDS, GST etc.), Loan (Two Wheeler, Four Wheeler, Gold etc.) All Insurances [General (Two Wheeler, Private Car, Commercial Car, Bus, Truck), Life, Health, Miscellaneous etc.], MV Tax Payment, Transport (Vahan) Department Services, Driving Licence, Voter ID Card, Pan Card (New/Correction), Ayushman Card, Indian Passport Registration, Aadhaar Demographic Update, EPF Withdrawal/Settlement/Transfer/Claims, NPS (National Pension System) Registration, Electricity Bill Payment, Flight Booking, Railway Ticket Booking, Bus Booking, Landline Bill, Postpaid Mobile Bill, FASTag Recharge, DTH Recharge, Prepaid Mobile Recharge, PVC cards, Scan, Print, Xerox, Lamination, Passport Size Photo, Internet, Online Works etc.

CONTACT:

DIGITON Multi Services

Sila, Silabori Road, PO/PS Changsari,

Inside Brahmaputra Industrial Park,

Guwahati, 781101, Kamrup, Assam.

0361-2911329

Location:

DIGITON Multi Services

https://maps.app.goo.gl/UhgamMiuaci19gAcA

#digiton#digitonms#digitonmultiservices#guwahati#assam#northeast#india#digital#csc#online#services#technology#books & libraries

4 notes

·

View notes

Text

Discover the ultimate destination for all your digital banking and financial needs at Usetopay. Trusted by thousands across India, we offer a comprehensive range of services including secure online banking, instant recharge, Mini Atm, utility bill payments, and AEPS services . Our user-friendly platform ensures seamless transactions with robust security measures in place, providing you with peace of mind every step of the way. Experience the future of banking with Usetopay – Where trust beyond words

1 note

·

View note

Text

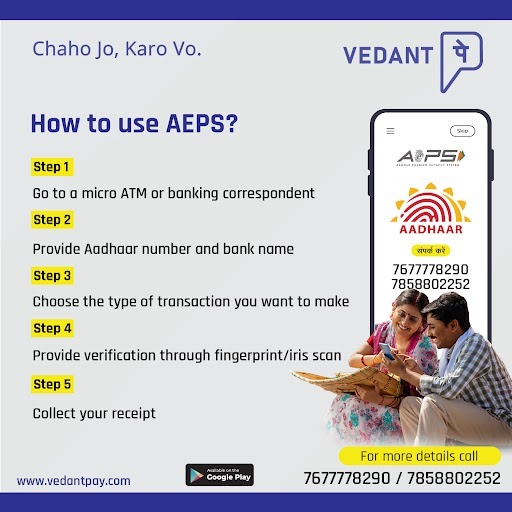

Aadhar AEPS is a bank-led model that enables compliant online financial transactions at the Point of Sale

(POS/Micro ATMs) through Business Correspondent (BC)/Mitra Bank of any bank using Aadhaar authentication.

AEPS India offers Aadhar enabled payment software and

AEPS API integration services to businesses across India.

https://www.udaaanpe.com/aeps

0 notes

Text

Gsm Data Receiver [ POS & ATM ] skimmer

ATM credit card Skimming without any physical contact. This Skimmer will work without a physical connection to ATM/POS Machine. This product is our best-seller, and is used by 92% of our clients.

Gsm Data Receiver [ POS & ATM ] Skimmer .

ATM credit card Skimming without any physical contact. This Skimmer will work without a physical connection to ATM/POS Machine. This product is our best-seller, and is used by 92% of our clients.

This is most Advanced GSM data receiver. It receives credit card / Debit Card data from ATM and POS terminals. Small size 10×10 Centimeters, with one charging it can work up to 24 hours and the manufactured memory can capture about 27000 credit card / Debit Card data, with antenna it can take data in radius of 100 meters. Without antenna 10 meters. Device can work from (-25 to 45 degrees). Dust resistant & Water Proof.

We use 3.7V 4500 mAh batteries. With one charging the device can work up to 20-24hours.

We have built in a micro SD card in the device, which can collect 25000 – 27000 data records.

Briefly – GSM data receiver is a GSM module receiver which with the help of special software clones and receives all credit card / Debit Card information from POS and ATM terminals. The received information is stored in the built-in memory card. To collect this information, you just need to connect the device to your computer, and the device will automatically send the data to your computer, with the help of the software. We have also implemented a new feature, to store information into a regular cell-phone SIM cards, which will be extractable with the use of the software. GSM data receiver is small & you can easily hide it in your bag, clothes, pocket, ore in your car – near the POS/ATM terminal.

Device has two led lights – Red and Green

Red – Device needs to charge.

Flashing red – Device can work for 30 – 60 min more, afterwards it needs to be recharged.

Green – Device is working.

Flashing green – Device is connecting.

Package Content :

* msr206 .

* 50 Blank Cards.

* High power GSM Antenna .

* Ultra HD Videos & PDF Files for step by step traning.

* Blackhat Membership .

* 3 Hours Live Training .

0 notes

Text

AEPS API provider in mumbai-Paytrav

Paytrav is a widely successful AEPS API Provider Company in India. Paytrav AePS API enables Business Correspondent to conduct banking transactions using only the customer’s Aadhaar Number and Biometric Identification.

Some prerequisites are, KYC (Know Your Customer) details to open a new account, and Aadhaar number should be linked with the respective bank account. This AePS API Provider activates the service 1-2 minutes post Aadhaar seeding.

The elements required for transactions are Micro ATM, Aadhaar number, Bank name, Biometrics (Fingerprint and/or IRIS), and assisted mode. The transaction cost will be Nil for the customer while Business Correspondent may get charged or paid based on the bank’s discretion.

AePS service allows performing transactions like Balance Enquiry, Cash Withdrawal, Cash Deposits, Aadhaar to Aadhaar Funds Transfer, Payment Transactions (C2B, C2G Transactions). Only the Best AePS API Provider Company can deliver such benefits.

अच्च्छी आमदनी की तलाश करें पूरी। Edupoint- mATM & AEPS ,Recharge की बेहतरीन सर्विस और ज़बरदस्त कमीशन के साथ बढ़ाएं अपनी पहचान भी और इनकम भी!

"Retailer, Distributor, Master Distributor-ID k liye contact kre !

📞 Contact @ 089-763-15-910

Click Now-https://paytrav.in/

1 note

·

View note

Text

Get a Franchise and Join the Entrepreneurial Revolution

We, at VOSO store, offer most profitable franchise business in India. We support the establishment of enterprises with the highest profit margins. We are a retail technology business. A brand-new method for turning your physical store into a digital store is VOSO Store. Through a unique portal, we link retailers and brands to serve end-user offerings. With the VOSO business opportunity start business in India, our store partners are exponentially growing their commercial enterprise. To connect them with a wide range of services and goods through our store partners and to offer our store partners one-of-a-kind support through our facilitator model, VOSO is on a mission to reach an untapped region of the country.

With the aid of our retail partners, we are making improvements to streamline the online service process for every citizen. Retailers and merchants are increasingly using VOSO as their preferred platform for accepting online payments for a variety of services. Our team is always working to improve the functionality and seamlessness of the online portal and payment system. We make it possible for our partners to use all current and upcoming services by offering VOSO Store partnership. VOSO has stores in more than 700 cities and 6000 pin codes. Our store numbers are constantly increasing. The core value of VOSO is to provide a practical platform for all utility

services to all segments of society, particularly in rural and suburban areas, to increase their level of digital literacy.

Through a range of VOSO services like travel booking, utility bill payment, domestic money transfer, PAN card, recharges, and insurance. VOSO enable its store partners to establish strong

connections with their potential customers in this rapidly evolving age, enabling them to obtain services at competitive rates and earn more money than they did previously. VOSO's B2B portal also saves time, energy, and money by connecting you with all the top services at a single touch before they are even built.

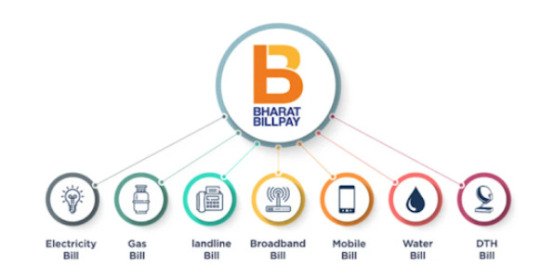

Bills payment

With the Baharat bill payment system, VOSO store works with the portion of bills and upgrades the security and speed of bill payments. BBPS services are available at our stores. You can pay a charge for utility bill payments i.e. (Fastag, Gas Bills, Water Bills, Electricity bill payments, DTH and Mobile recharges, etc.)

VOSO mATM services (micro ATM service)

Voso mATM services now allow you to provide mATM services to your customers and earn the highest commission per transaction. mATMs are devices that allow users to withdraw cash and check balances from any Kirana shop, local store, or e-service portal without having to go to banks and wait in long lines. Merchants can use mATM devices to provide cash withdrawals, cash deposits, and money transfers from one bank account to another, as well as balance checks while earning commissions on each successful mATM transaction.

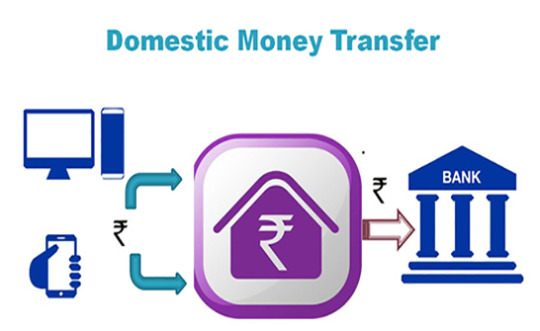

Domestic Money Transfer (DMT)

Our store partners can send money across India using the VOSO portal. These transactions are completed in a matter of seconds, and money is securely transferred to the receiver's account via VOSO's secure payment method. Additionally, VOSO offers expert assistance for any issues that may arise during the transaction. With the help of this crucial service, we guarantee low transaction costs and high earning potential for our partners.

AePS

Paying with an aadhar card is possible with the AEPS or aadhar enabled bill payment system. The NCPI created the AePS payment model, which enables customers to make basic payment

transactions with their aadhar cards, including cash deposits, bank-to-bank transfer balance inquiries, mini statements, aadhar to aadhar funds transfer authentication, BHIM aadhar pay, and many more. By utilizing AePS, merchants can also provide extra services to their clients and users, such as eKYC, best finger detection, demo auth, tokenization, and Aadhar seeding status.

Booking services

Our partners can book buses, flights, or train tickets for any location in the country. We offer expert training and one-on-one support. The VOSO portal and mobile app now make it simple to book bus tickets. You can now compare ticket plans and amenities and select the best one for your clients from any location in India. With the assistance of VOSO partner stores, we take the initiative to provide the best facility with the lowest costs and the best service so that everyone can enjoy a hassle-free journey. We have the highest commission rates.

Conclusion

VOSO store provide most profitable franchise business in India which lead to high profit margin business for store partners. VOSO considers its partners to be its greatest asset. We are committed to the overall growth of our store partners and provide the best services with the highest earning potential. Join VOSO store to earn high profit.

0 notes

Text

What is FINTECH-AS-A-SERVICE: Future of Financial Solutions

Fintech refers to the innovation of technology to improve and automate financial transaction services. Fintech startups have been disrupting the traditional banking industry by offering innovative and user-friendly digital solutions. One of the latest trends in fintech is the emergence of Fintech as a Service (FaaS), which allows businesses to integrate financial services into their platforms.

FAAS provides a wide range of services including AEPS balance check & AEPS cash withdrawal, an online recharge portal for retailers, online DTH recharge, BBPS service, online flight ticket booking, Micro ATM services, and assistance with money transfers from India to Nepal.

Read More at- https://www.soulpay.in/blogs/what-is-fintech-as-a-service-future-of-financial-solutions/

#fintech service#fintech#consumer#retailer business idea#Soulpay#digitalvypari#ticketbooking#flightbooking#business ideas

0 notes

Text

Jaishreepay is the most trusted digital banking and financial, recharge & utility bill payments services provider in India. we offer AEPS Services, money transfer, micro atm, bank csp, insurance, retailership, and distributorship.

0 notes

Text

UPI transactions witnesses 650% rise at semi-urban and rural stores

PayNearby said that there was a growth of 25% and 14% in value and volume respectively, in assisted financial transactions across semi-urban and rural retail counters in India in 2022. This indicates a behavioural shift in consumers in these regions, with more citizens adopting assisted digital means for their banking and lifestyle requirements and getting incorporated into the formal economy.

The growth figures have been observed across different product offerings of PayNearby, including Unified Payments Interface (UPI), cash withdrawal, MSME credit, utility payment, cash management, assisted e-commerce and more. They were availed by citizens through local retail counters like kirana stores, mobile recharge stores, medical shops, customer service points (CSPs), travel agents, etc.

As per the report, Unified Payments Interface (UPI) transactions saw a whopping 650% and 500% increase in value and volume across PayNearby retail counters, representing the growing adoption of UPI beyond Tier II regions in the country. This also highlights the pivotal role UPI can play in promoting digital financial inclusion.

The insight was shared as part of the second edition of the pan-India report titled ‘Retail-O-Nomics’, released by PayNearby. The report has been prepared basis transactions across a million plus retail touchpoints throughout the country. The findings of the report are based on business data collected for a comparison period, ranging from January to October 2022 vis-à-vis the same period during 2021.

In a key insight, the report states that the mPOS business has seen more than 100% growth, along with over 25% increase in demand for micro ATMs and mPOS instruments. The upswing in demand for digital payment options at retail outlets underlines the critical role played by small retail stores in bridging the infrastructure gap and driving financial inclusion at the last mile.

Cash withdrawal business through micro ATMs and AePS, which continues to be one of the major income drivers for semi urban and rural digital counters, has seen an overall growth of 8% in value and 9% in volume respectively. Cash withdrawals through micro ATM has witnessed a 25% increase in value and 28% increase in volume as compared to the same period last year. This growth figure shows the growing role played by this portable digital device in ensuring easy accessibility of bank accounts, while helping merchants use cash-at-store more effectively and augment their income. However, there has been a slight dip in the average cash withdrawal per transaction from INR 2620 in 2021 to INR 2595 in 2022.

As per the report, semi urban and rural India were an equal participant to this double-digit growth in assisted financial transactions, and the rate of adoption was comparable between urban and rural underserved demographics.

The report also indicates a sharp growth of over 200% in the cash collection business (including EMIs) with a monthly average of INR 1400 crores, indicating demand for lending and other financing solutions, bouncing back to the pre-pandemic levels. Increased demand was witnessed across most cash collection processes, including collection from logistics and ecommerce companies, which saw a leap of over 89% in volumes. Insurance premiums at retail stores, too, saw a massive 370% in growth and 365% increase in customers during the survey time-period.

Commenting on the report findings, Anand Kumar Bajaj, Founder, MD & CEO, PayNearby, said, “The findings in the report are inspiring and emphasise the fact that Bharat is gearing to walk hand-in-hand with India. Bharat is aspirational, and the increased offtake of green shoot services like assisted commerce, OTT subscription, micro-lending validates our commitment to make these services easily available at a store nearby.

We have serviced close to INR 70,000 crores of digital services in the first 10 months of this calendar year and the steady growth of cash withdrawal business, together with the fast track adoption of some of these green shoot services indicate a steady recovery of our economy post the devastating impact of the pandemic. We will continue to strengthen our efforts to simplify high end technology, so that most services can be democratised and made available to all through our well entrenched Distribution-as-a-Service network.

It is also heartening to see an accelerated demand within the retail community to make assisted financial transactions available at a store nearby. This is not only a great income generator for the merchant, but also helps build the nation grounds up and bridge the gap between Bharat and India. PayNearby, Zidd Aage Badhne Ki.”

Subscription-based digital services, such as OTTs, online education, online gaming have also seen positive growth. Even though the numbers are small, it validates a latent demand for such services and the growing affinity of digital products in a post-pandemic Bharat.

The bill payments service at local stores witnessed an increase of 12% in value and 10% in volume. Mobile recharges grew by 18% over last year. Travel bookings saw a rise of 8% in flight and 6% in rail bookings this festival season, compared to the same period last year, driven largely by visiting friends and family, traveling to their natives for the festival. The report also highlights an 88% uptick in Pan Card issuance quarter on quarter. All of these indicate that the local kirana store has evolved into a multi-utility point for consumers for meeting most of their financial and digital needs.

Micro-credit for MSMEs, also saw a growth of 263% during this period; indicating a huge latent demand for viable credit in this segment that needs to be addressed for India to transition to the next stage of development.

In another interesting observation, around 32% of the banking transactions were registered during the non-banking hours between 6.00 pm to 12.00 am. This underlines the crucial role retail outlets play in serving the masses with their banking and digital needs.

Read the full article

0 notes

Text

Apnismart Dukaan, Best Businesses in India

The best franchises for sale, information about the best franchises and business opportunities today, and resources to help you learn more about franchising and owning a small business are all available at APNISMART DUKAAN. Franchise India provides new business opportunities, business ideas, franchise opportunities, and the best businesses in India. For more information: [email protected]

Our Best Services:

Pan Card Services

Adhaar Card Services

Voter Id Card Services

AEPS Adhaar Enabled Payment Services

Adhaar Pay

Domestic Money Transfers Services

Account opening

Passport Services

IRCTC Services (E-ticket booking Online)

GST Registration

Bill Payment Water, Electricity, Gas

Micro ATM

Mobile Repair Services

Prepaid Recharge

Loan Payment

Udyam Adhaar

ITR Form

Fast Tag

0 notes

Text

Vedant Pay | What it is and what it does?

Vedant Pay is a payment-based business vertical of Vedant Asset Ltd. Founded in 2022, it provides services similar to a bank through its mobile app, which is available on the Android platform and is coming soon for iOS. For this purpose, it has entered into agreements with Yes Bank, Bank of India, Jharkhand Rajya Gramin Bank, and Madhya Pradesh Gramin Bank. Its purpose is to provide banking services to the unbanked areas of India. With the slogan of ’Chaho Jo, Karo Wo’, it is operating in villages and semi-urban areas of Jharkhand and Madhya Pradesh. As a customer, all you have to do is to go to a Business Correspondent (B.C.) of Vedant Pay and a wide range of services will be provided to you.

SERVICES PROVIDED BY VEDANT PAY MOBILE APP

Aadhar Enabled Payment System (AEPS): Any person with a bank account and an Aadhar Card number can perform various banking functions, such as cash withdrawal up to Rupees 50,000, balance inquiry, cash deposits, fund transfers, cash withdrawals, balance inquiry, eKYC-based bank account opening, etc. For doing these activities, the bank’s ATM card is not required to be carried by the customer, as everything can be done with the help of the Aadhar Card itself.

Bharat Bill Payment System (BBPS): This facility enables a customer to make utility bill payments, such as electricity bills, gas cylinder refilling, water bills, landline bills, postpaid connections, data cards, mobile data packs, etc. All these payments can either be done directly by the customer through the Vedant Pay app or with the help of our network of agents. Multiple payment modes, such as online banking, UPI, account transfer, etc. are provided in the app and instant confirmation for the success of the transaction is provided in the app. The interface of Axis Bank’s website is used for providing services of AEPS and BBPS to the customers on PC.

Domestic Money Transfer (DMT): With Vedant Pay, you need not have to worry if you want to transfer money to anyone. You can transfer money to another person with a bank account and an Aadhar Number in a safe and secure manner via Vedant Pay mobile app. The maximum amount transferable at once is Rupees 5000. Also, a maximum of Rupees 50,000 can be transferred through the app to one person in one day. This facility is available to customers 24 hours a day and 365 days a year, meaning that customers can make fund transfer even on Sundays and bank holidays. There is instant confirmation of transactions through SMS sent to customers. Moreover, these facilities can be availed by the customers at the doorstep of their homes, by going to any Business partner of Vedant Pay, or by visiting any branch of Fino Payments Bank or selected merchant establishments. The customer’s account can be in any scheduled commercial bank in India. A bank charge of 1% of the value is payable by the customer on each transaction.

Mobile and DTH Recharge: Now, prepaid mobile connections and Direct-to-Home can be recharged with the Vedant Pay app itself. An attractive commission can be earned by customers for doing these recharges. The latest and upcoming offers can also be availed on our app as a result of doing the recharge. All the mobile operators and DTH companies of India are supported by our app for doing recharge.

Micro ATM: The purpose of this device is to take banking to the unbanked regions of India. A small, portable, micro-ATM machine is given to the business correspondent (BC) of Vedant Pay, from which he or she can provide ATM services to the customers. Any person wanting to withdraw money goes to our BC with his ATM card. BC connects the ATM card to the mATM machine and gives it to the customer for filling in a secret 4-digit PIN and the amount to be withdrawn. After that, the retailer gives that money to the customer. Cards of Rupay, Visa, and Master, related to any scheduled commercial bank of India are acceptable on these machines. Bluetooth-based connectivity is provided on these devices. A minimal amount is chargeable as fees for the setup of the device. After that, no amount is charged to the user or customer for using this device. In this way, a robust and efficient payment solution is provided through the micro-ATM.

mPOS: Mobile Point-of-Sale (POS) works on the micro-ATM machine, whose details are mentioned above. mPOS machines are available with retailers, to whom customers not carrying cash with them come, swipe their Debit or Credit card, and make the payment of bill amount for the purchase of goods. In return for making this transaction, the retailer is charged a small amount as fees based on a fixed percentage of the amount. Debit and credit cards of all scheduled commercial banks of India are accepted in this machine.

Tour and Tickets: Vedant Pay has a tie-up with I.R.C.T.C. for providing travel booking services. We also make travel plans for our customers, based on their demands

PAN-related Services: Services related to P.A.N. cards are also provided by Vedant Pay. These include linking PAN with Aadhar Card, making applications for new PAN cards, services of ePAN, etc. For the services of insurance, travel and ticketing, and PAN card, a separate ID and password are provided to the customers, to distinguish them from other services of Vedant Pay.

BENEFITS OF VEDANT PAY

To Retailers:

They can provide quasi-banking services to their customers.

2. They can operate from a small shop or even their homes.

3. Much elaborate setup or a lot of money is not required for starting this business.

4. They can arrange a stable source of income for themselves.

5. They can connect themselves to Vedant Pay, and through that to Vedant Asset Ltd, and can avail of various incentives provided by our company from time to time.

To Customers:

They don’t need to stand in long queues outside ATM machines for receiving money, and just have to go to a Vedant Pay BC for withdrawing their money from their bank account.

2. They can avail of many services similar to a bank from our Vedant Pay app, such as opening a bank account through e-KYC, withdrawal, and deposit of money, fund transfer to their near and dear ones, balance enquiry, mini statement, etc.

3. They only need to have a bank account linked with Aadhar, a Credit card or Debit-cum-ATM card, and/or Aadhar Card to fulfill their cash-related needs through Vedant Pay.

#vedantpay#digitalpayment#adharenabledpayment#empoweringdigitalindia#mATM#digitalindia#cashkahinvhi#aeps#bbps#mPOS#minibänk#minibankindia#chahojokarovo#microatmbusiness#microatmmachine#digitalpaymentsystem#digitalpaymentsolutions#digitalpaymentindia

1 note

·

View note

Photo

0 notes

Text

2 notes

·

View notes

Text

Domestic Money Transfer Company in India

#recharge api service provider#atm machine apply#mini atm#micro atm machine#aeps service provider#aadhaar based payment system app

0 notes