#vedantpay

Explore tagged Tumblr posts

Text

Vedant Pay is a Digital Payment marketplace based in Ranchi, Jharkhand. Currently operating in rural and semi-urban regions of Jharkhand, Bihar, and Madhya Pradesh, it provides digital devices like mPOS to retailers and mATM for doorstep banking services through AEPS. Using BBPS in its app, utility bills can be paid easily.

0 notes

Text

Which is the best digital payment system for rural and semi-urban India?

To answer this question in a better way, let me briefly introduce you to the currently prevalent payment systems in India.

1. Cash-only system : People have preferred to keep small amounts of cash with themselves for a long time, which is used in day-to-day work. It is necessary so that a shortage of money is not encountered in times of need.

2. Cash in bank : Almost 80% of the Indian population above 14 years of age is banked as per the latest data of 2017 . Most of the money kept in these bank accounts is spent through cheques, drafts, or by pay-in-slips.

3. Mobile wallets: Most modern-day mobile wallets like PayTM, PhonePe, Google Pay (formerly Tez), etc. have emerged in the post-demonetization period and during COVID-19. The transactions made through them have crossed ` 36.5 Trillion in 2020, and are expected to more than triple by 2025 .

4. Card transactions: Debit and credit cards of Master, VISA, and more recently Rupay are being used for making payments from bank accounts, by either withdrawing cash from ATMs or directly by swapping on PoS machines or simply waving or touching them near payment terminals. While every commercial bank provides debit cards, eCommerce sites like Amazon and Flipkart have tied up with banks and finance companies to provide specific credit cards to their customers. There are around 94 Crores of active debit cards and 6.2 Crores of credit cards in India in January 2022 .

5. Internet banking: A customer with access to an internet connection can log in to the website of his bank and perform almost every banking transaction, from balance inquiry to transfer of funds to bank statements. Around 26% of people in India are reported to at least have a digital bank account in a 2022 survey, which is expected to increase to 46% by 2027 .

6. Unified Payment Interface (UPI): This is one of the facilities provided by banks in their mobile apps, through which payments can be made and received either through QR codes or direct transfers to someone’s mobile number through Virtual Payment Address (VPA); and account balances can be enquired about. Almost 4.6 billion transactions worth ` 84 Lakh Crore have been processed by UPI in the Financial Year 2022, which is more than double the volume and value of transactions in the previous year

7. Mobile and SMS banking: Banking is done in two ways through a mobile phone. First is the use of *99# provided by almost every telecom provider for doing banking through SMS, for which banks have implemented daily limits of transactions, under the system called Unstructured Supplementary Service Data (USSD). Second is the use of the mobile app for your bank account by providing a smartphone-ready interface of your bank’s website.

8. Aadhar Enabled Payment System (AEPS): Now, only an Aadhar card is required for making most banking transactions, like withdrawing or depositing money, inter-bank fund transfers, balance inquiry, etc., for which a customer has only got to visit a Banking Partner, like ‘Vedant Mitra’ who has Vedant Pay app installed on his phone and do the required transaction.

9. Micro ATM (mATM): This is a smartphone device in the hand of a business partner like Vedant Mitra through which you can withdraw or deposit money in your Aadhar-linked bank account by inserting your debit or credit card into it and authenticating your fingerprint.

10. Mobile Point of Sales (mPOS): POS machines are very popular in shops and malls for making payments. Now is the era of mobile POS, which are the same devices as mATM, just differing in functionality. Payments can be made using cards, AePS, Mobile Wallets, and QR Code scanners on this machine.

Now coming to your question about the most preferred digital payment system in rural and semi-urban India, let us cover it point-wise:-

(a) Cash-based payment is not feasible because of the risk of theft.

(b) A huge majority of Indians, including our rural population, now have a bank account, thanks to the Pradhan Mantri Jan Dhan Yojana. But withdrawing money through cheques, drafts, etc. is a tedious job, because of the time involved.

© USSD and SMS banking are old forms of mobile banking that are rarely used nowadays.

(d) UPI has emerged as one of the most preferred modes of making payment, because of its simple interface and ease of operations.

(e) mATM and mPOS devices have also become popular modes of making digital payments, mainly in rural and sub-urban regions of India, where banking penetration is relatively low as banks don’t want to open branches owing to logistical and operational concerns.

So, the answer to your question is that UPI, mATM and mPOS have become the best modes of making digital payments in rural and semi-urban India.

#vedantpay#digitalpayment#adharenabledpayment#empoweringdigitalindia#mATM#digitalindia#cashkahinvhi#aeps#bbps#mPOS#minibank#minibankindia#chahojokarovo#microatmbusiness#microatmmachine#digitalpaymentsystem#digitalpaymentsolutions#digitalpaymentindia#befreetodopayanywhere#money#coins#exchange#infinite#business#banking#insurance#Possibilities#dreamer#doer#independent

0 notes

Text

Vedant Pay | What it is and what it does?

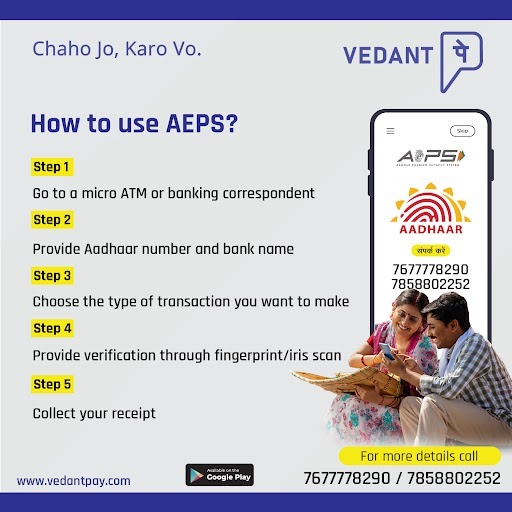

Vedant Pay is a payment-based business vertical of Vedant Asset Ltd. Founded in 2022, it provides services similar to a bank through its mobile app, which is available on the Android platform and is coming soon for iOS. For this purpose, it has entered into agreements with Yes Bank, Bank of India, Jharkhand Rajya Gramin Bank, and Madhya Pradesh Gramin Bank. Its purpose is to provide banking services to the unbanked areas of India. With the slogan of ’Chaho Jo, Karo Wo’, it is operating in villages and semi-urban areas of Jharkhand and Madhya Pradesh. As a customer, all you have to do is to go to a Business Correspondent (B.C.) of Vedant Pay and a wide range of services will be provided to you.

SERVICES PROVIDED BY VEDANT PAY MOBILE APP

Aadhar Enabled Payment System (AEPS): Any person with a bank account and an Aadhar Card number can perform various banking functions, such as cash withdrawal up to Rupees 50,000, balance inquiry, cash deposits, fund transfers, cash withdrawals, balance inquiry, eKYC-based bank account opening, etc. For doing these activities, the bank’s ATM card is not required to be carried by the customer, as everything can be done with the help of the Aadhar Card itself.

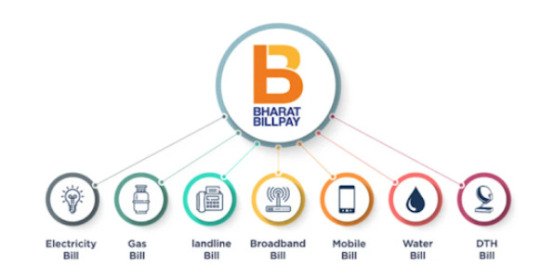

Bharat Bill Payment System (BBPS): This facility enables a customer to make utility bill payments, such as electricity bills, gas cylinder refilling, water bills, landline bills, postpaid connections, data cards, mobile data packs, etc. All these payments can either be done directly by the customer through the Vedant Pay app or with the help of our network of agents. Multiple payment modes, such as online banking, UPI, account transfer, etc. are provided in the app and instant confirmation for the success of the transaction is provided in the app. The interface of Axis Bank’s website is used for providing services of AEPS and BBPS to the customers on PC.

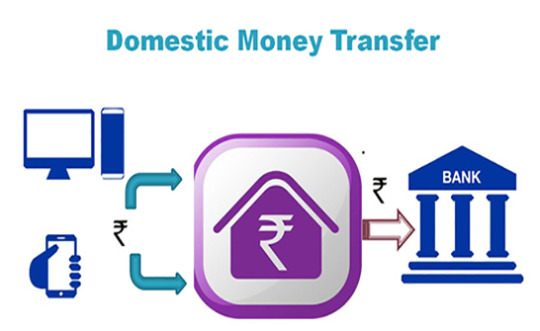

Domestic Money Transfer (DMT): With Vedant Pay, you need not have to worry if you want to transfer money to anyone. You can transfer money to another person with a bank account and an Aadhar Number in a safe and secure manner via Vedant Pay mobile app. The maximum amount transferable at once is Rupees 5000. Also, a maximum of Rupees 50,000 can be transferred through the app to one person in one day. This facility is available to customers 24 hours a day and 365 days a year, meaning that customers can make fund transfer even on Sundays and bank holidays. There is instant confirmation of transactions through SMS sent to customers. Moreover, these facilities can be availed by the customers at the doorstep of their homes, by going to any Business partner of Vedant Pay, or by visiting any branch of Fino Payments Bank or selected merchant establishments. The customer’s account can be in any scheduled commercial bank in India. A bank charge of 1% of the value is payable by the customer on each transaction.

Mobile and DTH Recharge: Now, prepaid mobile connections and Direct-to-Home can be recharged with the Vedant Pay app itself. An attractive commission can be earned by customers for doing these recharges. The latest and upcoming offers can also be availed on our app as a result of doing the recharge. All the mobile operators and DTH companies of India are supported by our app for doing recharge.

Micro ATM: The purpose of this device is to take banking to the unbanked regions of India. A small, portable, micro-ATM machine is given to the business correspondent (BC) of Vedant Pay, from which he or she can provide ATM services to the customers. Any person wanting to withdraw money goes to our BC with his ATM card. BC connects the ATM card to the mATM machine and gives it to the customer for filling in a secret 4-digit PIN and the amount to be withdrawn. After that, the retailer gives that money to the customer. Cards of Rupay, Visa, and Master, related to any scheduled commercial bank of India are acceptable on these machines. Bluetooth-based connectivity is provided on these devices. A minimal amount is chargeable as fees for the setup of the device. After that, no amount is charged to the user or customer for using this device. In this way, a robust and efficient payment solution is provided through the micro-ATM.

mPOS: Mobile Point-of-Sale (POS) works on the micro-ATM machine, whose details are mentioned above. mPOS machines are available with retailers, to whom customers not carrying cash with them come, swipe their Debit or Credit card, and make the payment of bill amount for the purchase of goods. In return for making this transaction, the retailer is charged a small amount as fees based on a fixed percentage of the amount. Debit and credit cards of all scheduled commercial banks of India are accepted in this machine.

Tour and Tickets: Vedant Pay has a tie-up with I.R.C.T.C. for providing travel booking services. We also make travel plans for our customers, based on their demands

PAN-related Services: Services related to P.A.N. cards are also provided by Vedant Pay. These include linking PAN with Aadhar Card, making applications for new PAN cards, services of ePAN, etc. For the services of insurance, travel and ticketing, and PAN card, a separate ID and password are provided to the customers, to distinguish them from other services of Vedant Pay.

BENEFITS OF VEDANT PAY

To Retailers:

They can provide quasi-banking services to their customers.

2. They can operate from a small shop or even their homes.

3. Much elaborate setup or a lot of money is not required for starting this business.

4. They can arrange a stable source of income for themselves.

5. They can connect themselves to Vedant Pay, and through that to Vedant Asset Ltd, and can avail of various incentives provided by our company from time to time.

To Customers:

They don’t need to stand in long queues outside ATM machines for receiving money, and just have to go to a Vedant Pay BC for withdrawing their money from their bank account.

2. They can avail of many services similar to a bank from our Vedant Pay app, such as opening a bank account through e-KYC, withdrawal, and deposit of money, fund transfer to their near and dear ones, balance enquiry, mini statement, etc.

3. They only need to have a bank account linked with Aadhar, a Credit card or Debit-cum-ATM card, and/or Aadhar Card to fulfill their cash-related needs through Vedant Pay.

#vedantpay#digitalpayment#adharenabledpayment#empoweringdigitalindia#mATM#digitalindia#cashkahinvhi#aeps#bbps#mPOS#minibänk#minibankindia#chahojokarovo#microatmbusiness#microatmmachine#digitalpaymentsystem#digitalpaymentsolutions#digitalpaymentindia

1 note

·

View note