#Medicare Accelerated Payment Program

Explore tagged Tumblr posts

Text

Sign of the Times: Petersen Health Care Files for Bankruptcy

Mid last week, Petersen Health Care, a Peoria, IL based nursing home operator filed for bankruptcy in Delaware. SC Healthcare Holdings LLC, which operates as Petersen Health Care, in federal court filings last Wednesday said it is seeking Chapter 11 bankruptcy protection because of ongoing financial problems partly due to an October ransomware attack and disruptions in payments from payers…

View On WordPress

#Bankruptcy#Change Healthcare#cybersecurity#Debt#Economics#Health Care Cybersecurity Improvement Act of 2024#HUD#Illinois#Industry Outlook#Iowa#Labor#litigation#Management#Market Trends#Medicare Accelerated Payment Program#Missouri#Money#Nursing Homes#Petersen Health Care#ransom attack#ransomware#RehabCare#SNF#Strategy#Trends#Warner

0 notes

Text

THE TRUMP-MUSK FUNDING GRAB: THE QUIET COUP

Since taking office, President Trump and Elon Musk have worked together to defund the federal government from the inside while consolidating power into the hands of a right-wing elite. Their goal is clear: gut federal agencies, strip public resources, and redirect power and money into their own hands.

Agencies Are Starved of Ability to Help People: Key federal agencies—including the Departments of Health, Education, and Transportation—have been forced into bare-bones operations, unable to implement vital programs we depend on.

FEMA and Disaster Relief Blocked: Funding for emergency relief programs is being deliberately slowed or denied, leaving communities vulnerable.

Social Security and Medicare Under Threat: Musk’s “Department of Government Efficiency” has gained full access to the U.S. Treasury's federal payment system, which processes Social Security, Medicare, and tax refunds. His team now has access to millions of Americans’ financial data and can manipulate payments.

DOGE is a Smokescreen for Dismantling the Federal Government: Under the guise of “efficiency,” Musk has proposed cutting $1 trillion in government spending, targeting social programs, education, healthcare, and regulatory agencies that protect consumers and workers.

At the same time, Trump and Senate Republicans are fast-tracking Russell Vought as OMB Director to oversee this attack on federal funding.

VOUGHT IS THE ARCHITECT OF PROJECT 2025

Vought wrote a chapter of Project 2025, which starts by outlining the role that OMB should play in implementing the massively unpopular playbook. If confirmed, Russell Vought will control federal spending. That means he will claim to have the power to:

Freeze funding for critical programs like Medicaid, public schools, environmental protections, and infrastructure.

Redirect federal dollars to right-wing priorities, including tax cuts for the wealthy and corporate handouts.

Defund regulatory agencies that keep corporations in check and protect workers and consumers.

THE PROCESS: HOW THE SENATE WILL PROCEED WITH THE VOUGHT CONFIRMATION VOTE

Monday: Motion to Proceed (MTP) passes, allowing debate on the nomination.

Immediately After: Republican Sen. John Thune can file cloture, starting the two legislative day clock before a cloture vote.

Wednesday: Cloture vote happens, kicking off 30 hours of debate.

Wednesday - Thursday: Senate Democrats must use the full 30 hours to expose this crisis and block the nomination at every turn.

Thursday: Final vote on Vought’s confirmation. If he is confirmed, the Trump-Musk takeover accelerates.

WHAT YOU CAN DO:

1.THIS LINK BY INDIVISIBLE LEADS TO A PAGE WITH RESOURCES INCLUDING POSTERS TO USE WHEN PROTESTING AND WHAT TO DEMAND FROM YOUR SENATORS

2. THIS LINK LEADS TO A CALL TOOL THAT PROVIDES A SCRIPT FOR YOU TO USE WHEN CALLING YOUR SENATOR. TELL THEM THAT WE ARE IN A CONSTITUTIONAL CRISIS

3.Fax: use this link and send a fax to your senator

4. Read through the list of Senate leaders and call a number

5. Contact Your State Attorney General by phone and email:

Minimal script for ALL state attorneys general: We are all learning that Elon Musk, a man who can’t even get the security access he needs to enter parts of SpaceX, and a band of unaccountable teenagers and business cronies, walked into the GSA, TTS, the U.S. Treasury and the USAID offices and took whatever private information they wanted, firing any civil servant who tried to stop them. [Your Stateians] records have most likely been invaded in violation of the Privacy Act of 1974, and as he’s now embedded himself in the Treasury department computer system, payments for Medicare, Medicaid, Social Security and other federal programs are at risk if the Trump administration decides to punish our state, [as he’s currently doing by holding fire victim funding hostage in exchange for extremist voter ID requirements.] Even the short pause from Trump’s executive order to freeze federal disbursements caused panic. We want you to sue the federal government to stop this corrupt and possibly treasonous attack on the privacy rights of our states’ citizens.

6. Contact the Secretary of the Treasury Department! – 202-622-2000

Minimal script for Secretary Scott Bessent: I’m calling to demand that you remove Musk’s access from all systems under your control, that all his equipment is confiscated, that his team is interrogated as to all actions they took under his direction, and that a computer forensics team is assigned immediately to check the system for integrity of its security systems.

More info on: https://indivisibleventura.org/2025/02/01/the-guy-nobody-trusts-with-a-full-security-clearance-now-has-access-to-all-your-private-data/

#usa politics#us politics#anti donald trump#stop trump#stop donald trump#anti trump#fuck trump#fuck donald trump#never trump#stop project 2025#fuck project 2025#save democracy#us senate#lgbtq+#civil rights#american politics#hr 9495#aclu#stop internet censorship#fight for the future#stop bad bills#american civil liberties union#tags for visibility#signal boost#please spread#please support#please reblog#urgent#very important!#important

107 notes

·

View notes

Text

2024 Medical Billing and Coding Career Outlook: Trends, Opportunities, and Future Growth

2024 Medical Billing and Coding Career Outlook: Trends, Opportunities, and Future Growth

2024 Medical Billing and Coding career Outlook: Trends, Opportunities, and future Growth

As the healthcare industry continues to evolve, the demand for proficient medical billing and coding professionals is on the rise. In 2024, those pursuing careers in this field can expect substantial opportunities, driven by technological advancements and legislative changes. This article provides a comprehensive outlook on the medical billing and coding career, including trends, opportunities, future growth, benefits, and practical tips for those looking to enter this rewarding profession.

Understanding Medical Billing and Coding

Medical billing and coding professionals play a critical role in the healthcare system. Their work ensures that healthcare providers are reimbursed for services rendered, and that patient records are kept accurate. Here are the primary functions:

Medical Coding: translating diagnoses, procedures, and services into standardized codes (ICD-10, CPT).

Medical Billing: Preparing and submitting claims to insurance companies and managing payments to healthcare facilities.

2024 Job Market Trends in Medical Billing and Coding

As we look into 2024, several trends are shaping the medical billing and coding landscape:

1. Increasing Demand for Remote Work

The COVID-19 pandemic has accelerated remote work trends across numerous sectors, including healthcare. More employers are now offering remote positions in billing and coding.This flexibility not only enhances work-life balance but also broadens the job pool for professionals seeking opportunities nationwide.

2. Rise of Advanced Technology

The integration of Artificial Intelligence (AI) and automation in healthcare billing processes continues to grow. These technologies streamline operations, but they also require billing and coding experts to have a solid understanding of the tools available to maintain accuracy and compliance.

3. focus on Compliance and Regulations

With ongoing changes in healthcare laws and regulations, professionals in the billing and coding field will need to stay informed. Understanding updates to Medicare,Medicaid,and other insurance programs is crucial to ensure compliance and proper reimbursement.

4. Increased Emphasis on Education and Certification

As the industry evolves, educational requirements for billing and coding professionals are also changing. Many employers now prefer candidates with specialized certifications, wich can enhance job prospects and credibility in this competitive field.

Career Opportunities in medical Billing and Coding

The career opportunities in the field of medical billing and coding are diverse and rewarding. Some of the most common roles include:

Medical Billing specialist

Medical Coder

billing Analyst

Health Information Technician

Compliance Officer

Job Satisfaction and Salary Expectations

According to the U.S. Bureau of Labor Statistics, the median annual salary for medical records and health information technicians was around $45,240 in 2022, with job growth projected to be 8% from 2020 to 2030, which is much faster than the average for all occupations.

Benefits of a Career in Medical Billing and Coding

A career in medical billing and coding comes with multiple benefits, including:

Job Security: As healthcare needs grow, so does the demand for billing and coding professionals.

Work Flexibility: Many positions offer remote work options.

Career Advancement: Opportunities for further specialization and supervision roles exist.

Impact on Healthcare: Contributing to accurate patient records and helping healthcare providers receive appropriate payments.

Practical Tips for Aspiring Medical Billing and Coding professionals

If you are considering a career in medical billing and coding, here are some practical tips to get started:

Invest in Education: Pursue formal education programs and certifications from recognized organizations such as AAPC or AHIMA.

Gain Experience: Seek internships or entry-level positions to gain experience in the field.

Stay Updated: Regularly attend workshops and seminars to remain informed about industry changes.

Network: Connect with professionals in the field through social media and local healthcare organizations.

Concluding Thoughts

The outlook for medical billing and coding careers in 2024 is promising, with abundant growth opportunities and advancements in technology. As the healthcare sector continues to evolve, professionals in this field will play a pivotal role in managing the vital aspects of healthcare administration. Weather you are considering a career shift or entering the workforce for the first time, the medical billing and coding profession is a vital and rewarding choice.

Table: Summary of Career Outlook in Medical Billing & Coding

Aspect

Description

demand

High demand due to healthcare growth

Job Growth

Projected 8% growth from 2020 to 2030

Salary Range

Median salary around $45,240

Work Flexibility

Options for remote and freelance work

Education Requirement

Certifications preferred

youtube

https://medicalbillingcertificationprograms.org/2024-medical-billing-and-coding-career-outlook-trends-opportunities-and-future-growth/

0 notes

Text

Radiation Oncology Market Trends: Key Drivers, Challenges, and Opportunities Ahead

The global radiation oncology market is expected to reach USD 21.14 billion by 2030, registering a CAGR of 12.3% from 2024 to 2030, according to a new report by Grand View Research. The growth of the market is attributed to the global rise in cancer burden, the growing geriatric population, and supportive reimbursement programs undertaken by the government and private organizations. Furthermore, the increasing technological innovation and advancement in radiotherapy offer lucrative opportunities for market growth.

The world is witnessing an increasing prevalence of cancer cases which is the key factor driving the radiation oncology market growth. For instance, according to Globocan, in 2020, more than 20.0 million people were diagnosed with cancer, and 10.0 million died of cancer. Moreover, the aging population is at high risk of cancer due to a weak immune system and comorbid conditions; thereby, the rising geriatric population further fuels market growth. For instance, in 2020, according to WHO estimates, the global geriatric population was approximately 1.0 billion and is expected to reach 2.1 billion by 2050.

Extensive research activities for the development of novel radiotherapy techniques and multidisciplinary therapeutic approaches are expected to lead to an increased survival rate and a more favorable prognosis of cancer. For instance, in December 2022, Elekta Unity demonstrated MR-Linac use for pancreatic tumors, where the first-ever patient was treated with new advanced radiotherapy motion management.

Similarly, in June 2020, Isoray signed a research agreement with the University of Cincinnati Physicians Company to study neck and head cancer treatment. The companies will evaluate the efficacy of Keytruda along with Cesium-131 post-surgical resection. Using such medical isotopes for cancer treatment may boost the research in developing a new target-specific radiation therapy system by understanding disease complexity & patients' need, thereby widening the opportunity in the market.

Furthermore, supportive reimbursement and regulatory policies for radiation therapy are also expected to drive the radiation oncology market growth. For instance, in July 2021, the Centers for Medicare and Medicaid Services (CMS) developed a new Radiation Oncology Payment Model (RO-APM) for the diagnosis of cancer and radiotherapy services. It enhances the quality of care of the patients and reduces the annual Medicare expenditure.

Radiation Oncology Market Report Highlights

By type, the external beam radiation therapy (EBRT) segment accounted for a 64.53% share of the radiation oncology market in 2022 due to the rapid technological advancement, and increased adoption in the treatment of various types of cancers

Based on technology, in 2022 intensity-modulated radiotherapy (IMRT) segment dominated the market due to the increased availability of technologically advanced IMRT's in countries with unmet treatment needs. However, brachytherapy is estimated to be the fastest-growing segment during the forecast period

In 2022, EBRT segment held the highest market share in the application space. Moreover, EBRT segment is also anticipated to maintain its dominance during the forecast period

North America dominated the global market in 2022 owing to the factors such as the increase in new cancer cases, high awareness among healthcare professionals about advanced radiotherapy, and better healthcare access in the region

Radiation Oncology Market Segmentation

Grand View Research has segmented the global radiation oncology market based on the type, technology, application, and regions:

Radiation Oncology Type Outlook (Revenue, USD Million, 2018 - 2030)

External Beam Radiation Therapy

Linear Accelerators (Linac)

Compact advanced radiotherapy systems

Cyberknife

Gamma Knife

Tomotherapy

Proton Therapy

Cyclotron

Synchrotron

Internal Beam Radiation Therapy

Brachytherapy

Seeds

Applicators and After loaders

Electronic Brachytherapy

Systemic Beam Radiation Therapy

Others

Radiation Oncology Technology Outlook (Revenue, USD Million, 2018 - 2030)

External Beam Radiation Therapy

Image-Guided Radiotherapy (IGRT)

Intensity Modulated Radiotherapy (IMRT)

Stereotactic Technology

Proton Beam Therapy

3D Conformal Radiotherapy (3D CRT)

Volumetric Modulated Arc Therapy (VMAT)

Brachytherapy

Low-Dose Rate Brachytherapy

High-Dose Rate Brachytherapy

Radiation Oncology Application Outlook (Revenue, USD Million, 2018 - 2030)

External Beam Radiation Therapy

Prostate Cancer

Breast Cancer

Lung Cancer

Head and Neck Cancer

Colorectal Cancer

Others

Internal Beam Radiation Therapy

Prostate Cancer

Gynecological Cancer

Cervical Cancer

Breast Cancer

Penile Cancer

Others

Radiation Oncology Regional Outlook (Revenue, USD Million; 2018 - 2030)

North America

US

Canada

Europe

Germany

UK

France

Italy

Spain

Denmark

Sweden

Norway

Rest of Europe

Asia Pacific

China

India

Japan

Australia

South Korea

Thailand

Rest of APAC

Latin America

Brazil

Mexico

Argentina

Rest of LATAM

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Rest of MEA

List of Key Players

Varian Medical Systems, Inc.

Elekta AB

Accuray Incorporated

IBA Radiopharma Solutions

BD (Becton, Dickinson and Company)

Isoray Inc.

Mevion Medical Systems

Nordion, Inc.

NTP Radioisotopes SOC Ltd.

Curium

View Ray Technologies, Inc.

Order a free sample PDF of the Radiation Oncology Market Intelligence Study, published by Grand View Research.

0 notes

Text

Revenue Cycle Management Market Revenue, SWOT, PEST Analysis, Growth Factors, 2024–2030

The Revenue Cycle Management Market is projected to grow from USD 47.2 billion in 2023 to USD 95.5 billion by 2030, registering a CAGR of 10.6% during the forecast period (2024 – 2030). Revenue Cycle Management (RCM) has emerged as a critical component of healthcare administration, ensuring that healthcare providers receive timely payment for the services they deliver. As the complexities of healthcare financing grow, the RCM market has become an essential pillar in maintaining financial stability for healthcare organizations.

RCM is the financial process that healthcare organizations use to manage the administrative and clinical functions associated with patient service revenue. This process begins when a patient schedules an appointment and continues through billing and the collection of payments. Effective RCM streamlines the billing cycle, reduces errors, and ensures that healthcare providers can sustain their operations by securing consistent cash flow.

Key steps in the RCM process include:

Patient registration and insurance verification

Coding and charge capture

Claim submission and tracking

Denial management

Payment posting and patient collections

Read More about Sample Report: https://intentmarketresearch.com/request-sample/revenue-cycle-management-market-3624.html

Key Players in the RCM Market

Cerner Corporation

McKesson Corporation

Epic Systems Corporation

Allscripts Healthcare Solutions

The Growth of the RCM Market

Increased Healthcare Costs and Complexity

As healthcare systems worldwide grapple with rising costs, providers face mounting pressure to optimize their revenue cycle to ensure profitability. Government regulations, payer policies, and complex billing procedures often result in revenue leakage if not managed properly. This has created a demand for robust RCM solutions that can streamline processes, minimize errors, and maximize revenue.

Adoption of Healthcare IT Solutions

The digital transformation of healthcare has accelerated the adoption of advanced IT solutions in the RCM space. Technologies like Artificial Intelligence (AI), Machine Learning (ML), and automation are being leveraged to reduce manual errors, speed up billing cycles, and enhance operational efficiency. Cloud-based RCM systems have also gained popularity due to their scalability, flexibility, and ability to integrate with Electronic Health Records (EHR) systems.

Growing Focus on Value-Based Care

As healthcare shifts toward a value-based care model, providers are incentivized to improve the quality of care while reducing costs. This paradigm shift is driving the need for sophisticated RCM systems that can handle value-based payment models, such as bundled payments and shared savings programs. These systems need to capture data more accurately, analyze it in real-time, and ensure compliance with emerging payment methodologies.

Challenges Facing the RCM Market

Despite its growth, the RCM market faces several challenges:

Complex Regulatory Environment

Healthcare regulations are constantly evolving, especially in markets like the U.S., where the Affordable Care Act (ACA), Medicare, and Medicaid play pivotal roles. Compliance with ever-changing regulations, coding standards (ICD-10), and payer requirements creates additional layers of complexity that RCM systems must navigate.

High Implementation and Maintenance Costs

While RCM systems offer immense benefits, their implementation and ongoing maintenance can be costly, particularly for smaller healthcare providers. The initial investment in software, hardware, and staff training can be a significant barrier for some organizations. Additionally, ensuring seamless integration with other IT systems, such as EHRs, requires substantial time and resources.

Data Security Concerns

With the increasing reliance on digital platforms and cloud-based systems, data security has become a major concern. Healthcare data is highly sensitive, and breaches or cyberattacks can have far-reaching consequences. RCM providers must prioritize robust security measures, ensuring compliance with regulations like HIPAA (Health Insurance Portability and Accountability Act) while safeguarding patient data.

Ask for Customization Report: https://intentmarketresearch.com/ask-for-customization/revenue-cycle-management-market-3624.html

Future Trends in the RCM Market

As the healthcare landscape continues to evolve, several trends are expected to shape the future of the RCM market:

AI and Machine Learning Integration

AI and ML are set to revolutionize the RCM market by automating processes such as claims denial management, predictive analytics, and patient payment forecasting. These technologies can analyze large datasets to identify patterns, anticipate billing issues, and improve the overall efficiency of the revenue cycle.

Telehealth and Remote Care

The COVID-19 pandemic has accelerated the adoption of telehealth, and RCM systems will need to adapt to manage the unique billing and reimbursement challenges associated with virtual care. As telehealth becomes more mainstream, RCM providers will focus on developing solutions that can handle the complexities of telehealth billing and compliance.

Blockchain Technology

Blockchain has the potential to bring transparency and security to healthcare transactions. By creating an immutable ledger of transactions, blockchain can enhance trust between providers, payers, and patients while reducing administrative inefficiencies.

Conclusion

The Revenue Cycle Management market is poised for continued growth as healthcare organizations seek to navigate the complex financial and regulatory environment. With advancements in technology and a focus on efficiency, RCM systems will play a crucial role in ensuring the financial health of healthcare providers. As the market expands, innovation in AI, telehealth, and blockchain will shape the future of revenue cycle management, helping healthcare organizations thrive in an increasingly competitive landscape.

#Revenue Cycle Management Market#Revenue Cycle Management Size#Revenue Cycle Management Growth#Revenue Cycle Management Trends

0 notes

Text

New Fintech Startups in Finance Company Sydney

Finance company Sydney industry has a rich and diverse range of businesses. Some are long-established institutions with a global footprint, while others are new fintech startups with ambitious goals.

Zip provides payment and credit solutions like Zip Pay and Pocketbook that simplify spending, budgeting, saving, and tracking. They also offer an online e-commerce platform for retailers.

Brighte

Brighte offers a finance solution to Australian homeowners for energy-efficient upgrades, such as solar power systems and batteries. Its products and services include a buy now, pay later payment plan, a green loan program, and other finance options. It also has a marketplace where customers can find products and services from empanelled vendors.

The company recently closed a $195 million debt facility backed by green bonds. This financing is enabling Brighte to expand its financing operations, including supporting the ACT Sustainable Household Scheme and the Tasmanian EV Charger Grant scheme. The company has also simplified its pricing model, removing the application fee and fortnightly processing fees.

Waddle

Waddle offers a digital cash flow solution for small businesses that uses outstanding invoices as security. The service is more flexible than a traditional bank loan and connects to business accounting software such as Xero. It also automates many of the manual processes involved in invoice finance.

The Stream Working Capital platform allows customers like Jarrod McGrath to bridge gaps in cash flow. The application process and in-life management of the facility are fast, simple and straightforward. The company is based in Sydney, Australia and has an experienced team of entrepreneurs.

Waddle was recently acquired by Commonwealth Bank through its venture-scaling arm x15ventures. The acquisition will enable the company to accelerate its growth and deliver innovative working capital solutions.

Xinja

Xinja was Australia’s first app-based “neobank���, promising to shake up the banking industry with high interest deposit accounts targeting Millennial customers. Its popularity grew rapidly, with $200M invested in its savings accounts within months of launch.

The company then secured an ADI license, allowing it to offer transaction accounts and a Stash savings account. However, the company struggled to raise additional capital. Its directors blamed the COVID-19 pandemic and an increasingly difficult capital-raising environment for the bank’s decision to close its customer accounts, return their deposits, and hand back its licence.

Xinja’s team is made up of experts from around the world who work remotely to deliver products that help Australians take control of their money. It also offers state of the art security.

Marketlend

Marketlend is an online platform that facilitates prompt lending in a secure environment. The company offers supply chain finance, debtor finance and secured lines of credit for SMEs. It also provides investors with quality returns in a conservative secured investment regime.

Leo Tyndall, founder and CEO of Marketlend, believes that small businesses deserve access to capital that is fair and transparent. Marketlend charges a fee to process the transaction, but not an excessive amount of overhead or commissions.

The company recently closed a $1 million funding round led by Crayhill Capital Management, Jon Barlow, and Mati Szeszkowski, former head of KKR’s technology private equity practice. The money will be used to automate the platform’s systems and originate more loans.

Tyro Payments

Tyro Payments is a technology-focused and values-driven company that offers payments and value-adding business banking products to over 66,000 Australian merchants. Its solutions include credit, debit, EFTPOS card acquiring, Medicare and private health fund claiming, and unsecured business loans.

Customers can also save on fees with the country’s first least cost routing solution. They can also control who has access to their data and for how long. They can also choose to share their Tyro account details with accredited organisations for a limited time.

Tyro also provides 24/7 customer support, seamless reconciliation with integrated bank feeds into Xero and BPAY, plus intelligent notifications.

uno Home Loans

uno Home Loans offers a digital mortgage platform that lets consumers search, compare and acquire home loans from 22 brands. It also offers advice on home loan products, interest rates and credit policies. Its goal is to serve 10 percent of Australia’s mortgage customers by 2028.

The company has received multiple awards and accolades for its digital tools, including the Good Design Award. These achievements can help it attract clients who are seeking personalized and attentive financial services.

uno Home Loans has a number of strategic partnerships, including Velocity Frequent Flyer and Acacia Money. These partnerships can lead to cross-selling opportunities and expand its customer base.

0 notes

Text

Healthcare IT Consulting Market Size, Trends Cost Structure, Growth Analysis and Forecasts to 2030

Global Healthcare IT Consulting Market

The Global Healthcare IT Consulting Market was valued at US$ 22.5 Bn in 2022, estimated to reach US$ 99.6 Bn by 2030, with a CAGR of 19.97% from 2023-2030. Healthcare consultancy aids businesses in navigating the issues that the sector frequently faces. These advisory groups take the shape of large consulting businesses with a focus on the healthcare industry. A healthcare consulting company serves as a hired consultant to a certain healthcare industry player. The healthcare sector is always becoming more complex due to rapidly changing market dynamics, regulatory pressures, and customer expectations. The foundation of healthcare consulting competence is a thorough grasp of every stakeholder throughout the value chain, from payers, medication developers, and manufacturers, to physicians and patients. The healthcare consulting service has several advantages, including fostering innovation, cutting expenses, maximizing digital technologies, and producing maximum, long-term value.

Request A Sample: https://qualiketresearch.com/request-sample/Global-Healthcare-IT-Consulting-Market/request-sample

Market Drivers

Clinical platforms, analytics dashboards, network optimization services, revenue cycle management (RCM), and enterprise resource planning support services can all be developed and maintained with the aid of healthcare IT consulting. As a result, the demand for cutting-edge and effective systems to manage expanding healthcare processes and infrastructure has risen, which is assisting the market's expansion. This is by the rising number of hospital admissions. In addition, the incorporation of artificial intelligence (AI) with healthcare IT consulting services to guarantee data privacy, optimize resource management, extract knowledge from unstructured data, and offer a modernized approach to decision-making processes is boosting the market growth.

Key PlayersAllscripts Healthcare LLC, Cognizant, Deloitte, Epic System Corporation, General Electric Company, IBM Corporation, Koninklijke Philips N.V., McKesson Corporation, Oracle Corporation.

Market Restraints

Some of the challenges that limit market growth include the scarcity of qualified specialists, the high cost of consulting services, data security issues, and privacy concerns.

Market SegmentationThe scope of the Global Healthcare IT Consulting Market covers segmentation based on Product Consulting Type, End User, and Region. Based on Consulting Type, the market is bifurcated into Healthcare Application Analysis, Design, and Development, HCIT Strategy, and Project/Program Management, HCIT Integration and Migration, HCIT Change Management, Healthcare/Medical System and Security Set-Up and Risk Assessment, Healthcare Enterprise Reporting and Data Analytics Services, Healthcare Business Process Management, and Others. Based on End User, the market is divided into Healthcare Providers, Healthcare Payers, and Others.

Read More@ https://qualiketresearch.com/reports-details/Global-Healthcare-IT-Consulting-Market

Regional AnalysisThe Global Healthcare IT Consulting Market is segmented into 5 main regions, namely North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. Market share is expected to be significant in North America. Healthcare providers' growing reliance on IT healthcare consulting firms is related to changes in laws and changes in Medicare payments. According to information published in JAMA Internal Medicine Journal, five healthcare systems in five states experienced a decline in ED visits and an increase in hospital admission rates from January through April 2020 while the COVID-19 pandemic grew in the US. Therefore, a rise in the rate of emergency admissions increases the need for chronic care management, which is likely to accelerate market expansion. About Us:

QualiKet Research is a leading Market Research and Competitive Intelligence partner helping leaders across the world to develop robust strategy and stay ahead for evolution by providing actionable insights about ever changing market scenario, competition and customers.

QualiKet Research is dedicated to enhancing the ability of faster decision making by providing timely and scalable intelligence.

QualiKet Research strive hard to simplify strategic decisions enabling you to make right choice. We use different intelligence tools to come up with evidence that showcases the threats and opportunities which helps our clients outperform their competition. Our experts provide deep insights which is not available publicly that enables you to take bold steps.

Contact Us:

6060 N Central Expy #500 TX 75204, U.S.A

+1 214 660 5449

1201, City Avenue, Shankar Kalat Nagar,

Wakad, Pune 411057, Maharashtra, India

+91 9284752585

Sharjah Media City , Al Messaned, Sharjah, UAE.

+91 9284752585

0 notes

Text

6 Trends That Shaped the Healthcare Industry in 2022

To look ahead, you sometimes need to look backward. As a new uncertain year ahead rolls on, we can clearly see the major trends that shaped the healthcare industry over the last 12 months. More importantly, many of the trends that prevailed in 2022 offer clues to where the industry might be headed in 2023 and beyond. Let’s take one last look at the year that was by examining the following six trends:

Trend #1: The popularity of Medicare Advantage (despite criticisms)

Travel nurses provide critical relief during staffing shortages and use of these professionals has increased in recent years. With this increase comes new and emerging risks. A review of closed malpractice claims data at Coverys reveals the top areas of vulnerability for travel nurses differs from other healthcare providers.

There was plenty of good news for Medicare Advantage (h MA) in 2022. The program has been a popular choice for Americans, and it remains robust. In fact, 28.5 million seniors and people with disabilities were enrolled in MA plans in 2022, up 8.8% from 2021.

To meet the demand, MA plan options have expanded impressively in recent years. The number of available MA plans has doubled since 2017, and we’re seeing the largest number in more than a decade. With more options available, plans are experiencing more competition for enrollees. Some larger plans have cut their growth projections. At the same time, several startups reported significant enrollment increases while also incurring financial losses.

Despite the program’s popularity, fiscal conservatives made calls to restructure MA or eliminate subsidies and establish a basis for controlling or even cutting MA payments. Nonetheless, Senate support for the program is unmistakable, as evidenced by a letter signed by 63 senators to the Centers for Medicare & Medicaid Services (or CMS). Such widespread, bipartisan support indicates that it is unlikely any curtailing of MA would pass through Congress.

Trend #2: The rise of the ‘payvider’

Transcarent wants to transform the digital pharmacy benefit experience, enabling self-insured employers and their staff to make more informed choices.

STEPHANIE BAUM

Throughout 2022, we saw a trend of payer and provider operations merging into a new hybrid dubbed the “payvider.” The payvider model has gained favor as a cost-effective option because these types of organizations have more control over member care. As a result, primary care centers have been expanding across the country.

Wall Street also appears to be bullish on payviders. Goldman Sachs forecasted strong earnings for payers that are capitating and issued buy ratings for companies that are emphasizing coordinated care, such as UnitedHealth Group and Alignment Healthcare. Expect to see a continued merging of payer and provider organizations in 2023.

Trend #3: Oversight, oversight, and more oversight

If there was one primary theme throughout 2022, it would be oversight. Throughout the year, a number of government agencies unveiled plans to tighten controls and oversight. CMS announced more stringent reporting for MA plans. The Office of Inspector General (known as OIG) ramped up audits of individual plans and added pandemic-specific inquiries to its set of audits, including analyses of improper billing in telehealth.

As we moved into the second half of the year, these oversight plans were put into action. Between the second quarter and third quarter of 2022, over nine MA plans were targeted for audits and the Department of Justice joined a fraud case against one insurer.

Furthermore, OIG has grown more efficient and expeditious in identifying inaccurate information. In its Fiscal Year 2022 Justification of Estimates for Congress, OIG touted investments in artificial intelligence to accelerate its ability to investigate high-risk Medicare and Medicaid providers and support fraud detection. Similarly, CMS doubled its auditing budget this year and outlined three new sets of required quality measures that will apply to care in 2023. Thus, there is every reason to believe we’ll see more audits and tighter oversight in the coming years.

Trend #4: A big boost to the Affordable Care Act

Inflation and the threat of a recession dominated headlines throughout the latter part of 2022. In an attempt to address these economic concerns, Congress passed the Inflation Reduction Act o 2022, which included $98 billion for healthcare programs.

This act did very little for MA and telehealth plans, but Affordable Care Act (or ACA) plans benefited greatly. ACA premium subsidies had been set to expire, and the initial attempts to extend them failed in Congress. However, the legislation extended the subsidies to 2025. As a result, we should see more plans entering the ACA exchanges in the next couple of years.

Trend #5: The long-term goal of interoperability

It seems like we’ve been talking about interoperability in healthcare for years, and it remains a priority. Although challenges persist, we saw significant momentum toward interoperability last year:

The Trusted Exchange Framework and Common Agreement (also known as TEFCA) established a universal floor for interoperability across the country. This is a critical step forward.

Applications are being accepted for Health Information Exchanges to become Qualified Health Information Networks.

On the tech front, software and solutions vendors are focusing more on solutions that support interoperability.

All of this confirms what we already knew — interoperability is coming, and everyone in the industry needs to be prepared.

Trend #6: The end of the public health crisis?

Of course, the dominant event over the past three years has been the public health emergency (or PHE) sparked by the coronavirus pandemic. Even though Cofie-19 hasn’t gone away, we might be seeing some light at the end of the tunnel. The PHE is set to expire on January 11, 2023, and there is some speculation that it might not be extended for an additional three months.

Although we would all welcome the end of the PHE, it will have specific repercussions for the healthcare industry. CMS has already ended the six-month extension for MA final supplemental submissions that was put into effect during the pandemic. The final deadline for 2022 dates of service will now be January 2024. As we move into 2023 and beyond, we should expect to see more pandemic-related dispensations fall away.

The calendar might now say 2023, but the big trends from 2022 continue to impact the healthcare industry and will do so for the rest of the year. If you understand what these trends are telling us, you’ll have a head start on what to expect in this brand-new year. Use this knowledge to make 2023 your most productive and successful year yet.

Technical Doctor's insight:

Contact Details : [email protected] or 877-910-0004 www.technicaldr.com

0 notes

Link

A FEW YEARS before Jay Hammond, a Republican, was elected to serve as Alaska’s governor in 1974, he worked as mayor of the small borough of Bristol Bay. There, he watched as nearly all of his town’s rich salmon resources were extracted from the region, with virtually none of the profits or job opportunities going to locals. He fashioned the idea of a 3 percent tax on fish catch, and using the money raised for an investment fund that would pay Bristol Bay residents an annual dividend from its returns.

Voters rejected Hammond’s idea, but he’d have several more opportunities to promote it in the following years. As governor, in 1976, he pushed for a constitutional amendment that would direct 25 percent of all lease sale payments and oil royalties to a fund that could only be used for income-generating investments. Hammond originally kept quiet about his desire to direct those returns back to citizens, and it was understood primarily as a proposal to prevent the waste of oil revenue. But after the amendment passed by a 2-to-1 margin, Hammond made it his central mission to push for the citizens’ dividend idea. His persistence paid off and in 1982, Alaskans received their first check from the so-called Permanent Fund, a dividend that has flowed annually ever since.

At the end of 2017, over 600,000 Alaskan citizens received dividends of $1,100. In prior years, checks have been as high as $2,000 per person. The fund is massively popular — recent polling showed that Republicans, Democrats, and independents all would rather pay higher income taxes to reduce the deficit than see their annual dividend cut. In no small part due to the Permanent Fund, Alaska is the most economically equal state in the country.

“It’s certainly the most popular political program in Alaska,” Bill Wielechowski, a Democratic state senator, told The Intercept. “It’s a really significant amount of money and has a huge impact. There have been studies that show the majority of people put it towards savings and paying ordinary bills.”

The Alaska Permanent Fund is what’s known as a “social wealth fund” — also sometimes called a “sovereign wealth fund” or a “citizens’ wealth fund.” There are more than 70 such funds across the world, in countries like Australia, Japan, New Zealand, Qatar, and Norway. The number of social wealth funds has risen considerably since 2000, and a new report produced by Matt Bruenig, founder of the crowd-funded socialist think tank the People’s Policy Project, advocates for expanding Alaska’s model to create a national social wealth fund in the United States. Doing so, Bruenig argues, may be the best shot Americans have to stop a decades-long trend of accelerating inequality.

Bruenig dubs his idea the “American Solidarity Fund.” The government would gradually accumulate assets such as stocks, bonds, and real estate, and as the value of the publicly managed assets increases, the value of the shares would also rise. Citizens would receive a “universal basic dividend” every year from the income earned from the fund’s investments.

While Alaska’s Permanent Fund was built around a rich natural resource, Bruenig points to Sweden’s short-lived experiment with a social wealth fund in the 1980s, where Swedes used taxes on corporate profits to fill it up. (Conservative legislators ended Sweden’s fund in 1991.)

Bruenig explores five different ways to bring in assets to a national U.S. fund, ranging from voluntary contributions from the superrich to a host of new taxes and fees. While he acknowledges many different types of levies could work, he focuses on wealth taxes, like market capitalization taxes, financial transaction taxes, and steeper inheritance taxes.

Unlike Alaska’s model, which does not grant dividend recipients any formal ownership, Bruenig proposes giving every qualifying citizen one nontransferable share of the fund. The idea is to give citizens some power they could then collectively exert over corporate board decision-making. Individuals could also track their share online, similar to the way individuals can track their growing capital investments on Vanguard. “This is partially a communications gimmick,” he acknowledges. “But no more so than many of the hyper-abstracted ownership gimmicks that already exist in the country’s capital markets.”

Also unlike Alaska’s model, which distributes dividends to all citizens, Bruenig proposes issuing dividends to every citizen above age 17. (He advocates monthly child allowances for families with children, not administered through a social wealth fund.)

The national social wealth fund idea has gotten some high-profile attention, including in Hillary Clinton’s recent memoir, “Hard Choices.” Clinton said she first learned about the idea after reading a 2014 book published by Peter Barnes, an entrepreneur who also proposed a national fund like the model in Alaska. “Besides cash in people’s pockets, it would also be a way of making every American feel more connected to our country and to one another—part of something bigger than ourselves,” she wrote. “I was fascinated by this idea, as was my husband, and we spent weeks working with our policy team to see if it could be viable enough to include in my campaign.” Clinton said they shelved the “Alaska for America” idea when they “couldn’t make the numbers work.” Still, the political appeal of a policy like this might be hard to shelve permanently. Whether or not robots are really coming for our jobs remains hotly disputed, but what’s not up for debate is that voters increasingly fear it is happening and want political solutions to it. In 2015, Pew Research Center found that 65 percent of Americans anticipate that robots and computers will “definitely” or “probably” do the work currently under human control within the next 50 years. Politicians will be on the lookout for ideas to ease public insecurity.

Bruenig also points to the problem of growing wealth inequality, one that has shown no sign of reversing course. Analyzing the Survey of Consumer Finances, he found that between 2007 and 2016, the average wealth of the top 1 percent increased by $4.9 million as the wealth of the median family declined by $42,000.The top 1 percent of families, he adds, owns more wealth than the bottom 95 percent combined.

By putting more wealth under government control, Bruenig reasons, the U.S. can then redistribute it back to the people.

Peter Barnes, author of “With Liberty and Dividends for All” — the 2014 book Clinton cited in her memoir — told The Intercept that any version of a social wealth fund should be expected to start very small, but grow over time. “Getting it started would be a breakthrough,” he said. “Social Security started in 1935 at a 1 percent payroll tax and the benefits for the elderly were trivial at the beginning.”

Still, not all who’ve explored the idea see it as the right move for the United States to address its growing inequality and insecurity. Mike Konczal, a fellow at the left-leaning Roosevelt Institute, is skeptical about establishing a U.S. social wealth fund, and says it’s not only a particularly difficult way to achieve the desired redistributive goals, but could also easily have negative effects.

“If you’re thinking that the government should spend more on ‘Medicare for All,’ or for a basic income, then we can both tax wealthy people and capital income more,” he said. “If a sovereign wealth fund reinforces the deficit mentality that we have to save money to spend money, or we can’t spend money if we don’t have a special fund, that would be counterproductive.”

Another problem Konczal highlights is that social wealth funds are more difficult tools to capture privately held wealth. “This is a hard way to get at a lot of income. Koch Industries, for example, would not interact with a fund like this.” Rather than a market capitalization tax on public companies, Konczal says, why not just tax all companies through a higher corporate income tax?

And lastly, with regard to tying citizenship to capital income, he worries this could reinforce, rather than weaken, the view that the economy should only work for shareholders. Would making capitalists out of everybody drive up support for deregulating Wall Street or repealing environmental protections?

Continue Reading ...

Phroyd

16 notes

·

View notes

Text

The Ultimate Guide to Medical Billing in San Diego: Everything You Need to Know

The Ultimate Guide to Medical Billing in San Diego: Everything You Need to Know

Are you looking to navigate the complex world of medical billing in San Diego? Whether you’re a healthcare provider, medical coder, or billing specialist, understanding the intricacies of medical billing is crucial for streamlining the billing process, improving revenue cycle management, and ensuring compliance with regulations.

In this comprehensive guide, we will walk you through the basics of medical billing in San Diego, including key terms, regulations, and best practices to help you optimize your billing operations.

Key Terms to Know:

Before diving into the world of medical billing, it’s important to understand some key terms that are commonly used in the industry:

1. CPT Codes: Current Procedural Terminology codes are used to describe medical procedures and services performed by healthcare providers.

2. ICD-10 Codes: International Classification of Diseases codes are used to classify and code diagnoses, symptoms, and procedures for billing and reimbursement purposes.

3. CMS: The Centers for Medicare and Medicaid Services is the federal agency responsible for administering Medicare, Medicaid, and other healthcare programs.

4. Clearinghouse: A third-party entity that processes and transmits electronic claims data between healthcare providers and payers.

Regulations and Compliance:

Medical billing is subject to a variety of regulations and compliance requirements, including:

1. HIPAA: The Health Insurance Portability and Accountability Act sets standards for the protection of sensitive patient health information.

2. Stark Law: Prohibits physician self-referral for certain designated health services to Medicare and Medicaid patients.

3. Fraud and Abuse Laws: Prohibit fraudulent billing practices, kickbacks, and other illegal activities in healthcare.

Best Practices for Medical Billing:

To ensure efficient and accurate medical billing, consider implementing the following best practices:

1. Verify Patient Insurance Coverage: Before providing services, verify patient insurance coverage to avoid claim denials and payment delays.

2. Use Electronic Health Records (EHR): Electronic health records can streamline billing processes, reduce errors, and improve patient care.

3. Stay Up-to-Date on Coding Changes: Regularly review and update CPT and ICD-10 codes to ensure accurate billing and compliance.

Benefits of Hiring a Professional Medical Billing Service:

Outsourcing medical billing to a professional service provider can offer numerous benefits, including:

1. Improved Revenue Cycle Management: Professional billing services can help reduce claim denials, accelerate reimbursements, and optimize revenue collection.

2. Compliance Expertise: An experienced billing service can help ensure compliance with complex regulations and avoid costly penalties.

3. Cost Savings: Outsourcing billing can be more cost-effective than hiring and training in-house billing staff.

Case Study: San Diego Medical Practice Increases Revenue with Outsourced Billing

ABC Medical Clinic in San Diego struggled with claim denials, billing errors, and delayed payments, impacting their revenue stream. They decided to outsource their medical billing to a professional service provider. Within six months, the clinic saw a significant improvement in revenue, reduced claim denials, and improved cash flow.

First-Hand Experience: A Medical Coder’s Perspective

“As a medical coder in San Diego, I have seen firsthand the challenges of navigating the ever-changing landscape of medical billing. Staying updated on coding changes, regulations, and compliance requirements is essential to ensure accurate billing and reimbursement. Outsourcing billing to a professional service provider has helped streamline our billing processes and improve revenue cycle management.”

Conclusion:

Medical billing in San Diego can be a complex and challenging endeavor, but with the right knowledge, tools, and strategies, you can optimize your billing operations and improve financial performance. By understanding key terms, regulations, best practices, and the benefits of outsourcing billing, you can navigate the world of medical billing with confidence and success.

Remember to stay informed on coding changes, compliance requirements, and industry trends to ensure accurate billing and maximize revenue. Whether you’re a healthcare provider, billing specialist, or coder, mastering the art of medical billing is key to the financial health of your practice or organization.

youtube

https://medicalbillingcertificationprograms.org/the-ultimate-guide-to-medical-billing-in-san-diego-everything-you-need-to-know/

0 notes

Text

What Differs Income Tax From Payroll Tax?

An example of a tax on employee wages is payroll tax. It includes FICA and FUTA taxes and any additional state or local taxes. Both tax kinds are progressive and give the government a share of an individual's income. Payroll taxes, typically a small portion of a worker's wages, are nevertheless delivered to the IRS by the employer. Payroll levies are also reasonably easy and adaptable, whereas income taxes are complicated.

Payroll taxes and income taxes are both utilized to fund federal programs. Employers are required to withhold and deposit payroll tax from employees' paychecks. Although national income taxes are submitted on distinct lines, both taxes are typically reported on the same form. Therefore, it's critical to comprehend the significance of these two taxes and how they differ.

Payroll taxes are lower, whereas income taxes are typically higher. The state you live in determines the payroll tax rates. While income tax rates range from 10% to 37%, the federal payroll tax rate is 15.3%. Employees pay local payroll taxes based on where they live, but employers also pay federal employment taxes like Social Security and Medicare. You must register for and pay self-employment taxes if you are an independent contractor.

The payroll tax is a crucial component of a company's financial picture. Employers frequently pay it for benefits like pensions and health insurance. In addition, employers pay income tax, which is a more complicated structure. It levies taxes on both the salaries and wages of employees and money derived from other sources.

Two parties are involved in payroll taxes. Employers are responsible for paying Social Security and Medicare taxes, which are split evenly between the employer and the employee. Payroll taxes account for both the cost of medical care and monthly retirement payments. They are progressive in some nations while regressive in others.

The federal government's Hospital Insurance (HI) program, which covers hospital stays and various types of home healthcare, is partly funded by payroll taxes. Tax collections in Hawaii during the past 25 years have mainly remained consistent. They make up 1.3 percent of the GDP and have remained stable over time. Before the creation of Medicare Advantage plans, the HI tax served as the primary revenue generator for Medicare. The government also uses these monies to pay for Medicare and Social Security, two programs that offer benefits to the elderly.

Income taxes and payroll taxes are two different things. Employers pay payroll tax, which is collected by the federal government, while state and municipal governments collect income tax. Even though federal income tax is a federal tax, the payroll tax is collected by most state and local governments. Unlike payroll tax, income tax is frequently not fully managed by employers. However, due to different tax deductions and credits, most people do not pay income tax on all of their income.

The federal Social Security and Medicare programs are supported through payroll taxes, which are additional employee taxes. FICA taxes are split equally between the employer and the employee through payroll withholdings. State income taxes, however, are subject to distinct regulations. There are states with flat rates and ones with progressive accelerations. It's critical to keep in mind that income taxes, regardless of their type, are paid to support public services.

Some governments collect additional payroll taxes for various objectives, such as disability insurance, transit, and workforce development. Some counties and cities also impose other payroll taxes. Depending on where the employee lives, the business or the employee may pay these taxes. Payroll taxes, for instance, support the Metro Transit Authority in New York, which manages the city's subway system and other forms of public transit. Payroll taxes are also collected in San Francisco for regional initiatives and services.

In 2019, the Social Security payroll tax brought in around $914 billion yearly, or 4.3 percent of GDP. The taxation of perks and interest on trust fund balances are additional sources of income. However, payroll taxes only cover a fraction of an employee's yearly compensation. The taxable maximum is the name given to this cap. The highest amount of payments subject to Social Security payroll tax in 2020 is $142,800. This represents a $5,100 increase above the prior amount.

0 notes

Text

Biden’s Big First Year

9/09/22

When Biden entered office, less than 1% of the US population was fully vaccinated. He pledged that 100 million shots would be administered in his first 100 days in office. Financed with funding from the American Rescue Plan to distribute vaccines, at the end of his first year more than 526 million doses had been administered and about 63% of our populace had been fully vaccinated, despite antivax resistance from Republicans.

A record number of more than 15 million uninsured Americans signed up for health care coverage under ObamaCare, many from Red States like Texas which still refuse to expand Medicare, leaving their poorest and most vulnerable citizens without health care coverage.

In early March 2021, Biden pushed through The American Rescue Plan (ARP), a $1.9 trillion Covid-19 relief stimulus package, which funded vaccine distribution, extra unemployment benefits, $1,400 direct payments to adults and expansion of the Child Tax Credit, and billions to support educational facilities - Despite broad public support, not a single Republican senator voted for its passage. Now we know that the ARP succeeded beyond anyone’s expectations. What should have been an economic depression with unimaginable suffering instead became a period of socioeconomic growth. In 2022, when the stimulus was fading out, it was found that low- and middle-income people had gained $2.7 trillion in wealth and could even afford to be choosy about their employment.

In November, he signed a $1.2 trillion infrastructure bill to address our crumbling hard infrastructure needs over the next decade. The massive outlay will ensure solid economic and job growth over the decade. Unfortunately, the passage of the hard infrastructure was a compromise, because all Senate Republicans, and two Democrats, blocked passage of the soft infrastructure programs in Biden’s Build Back Better plan, which would have massively benefited the socioeconomic needs of 90% of our populace. The opponents said, “we could not afford it.”

In Biden’s first year in office, the economic and employment growth has been stunning. The US economy grew by 5.7% in 2021, the fastest full-year gain since 1984; furthermore, in the final quarter of the year, growth accelerated to an annual rate of 6.9% from 2.3% in the previous quarter, ensuring a strong start into 2022. This first year of Biden’s presidency contrasted sharply to 2020 when, on Trump’s watch, our economy contracted by 3.4% - its worst result since 1946.

The strong economy resulted in a record number of 6.4 million new jobs in 2021 –– while the unemployment rate plunged to 3.7% from 6.7%. Additionally, a surprisingly high number of 467,000 new jobs were created in January 2022, in spite of a record 2.3% of the employed workforce not being at work because of illness. Workers average pay jumped significantly in 2021 to more than $31/hour – a 4.7% annual increase – which was eclipsed when wages rose robustly in January 2022, to an astonishingly 5.7% annual rate.

It seems preposterous that any unbiased thinking person could deny Biden’s outstanding achievements in growing the economy and enabling robust job growth, but Republicans emphatically and brazenly do. No shame there!

0 notes

Text

What is Medical Billing Software & Who Are Qualified Medical Billers?

Few people today realize how complex the process of accurate medical billing has become. This has created a flood of new medical billing services and new medical billing software solutions. Not surprisingly, medical billing software scams abound.

It is critical therefore that both health care providers and those looking for employment as medical billing workers understand the advantages and disadvantages of various types of medical billing software and what it takes to become a qualified medical biller.

Medical Billing Is Hard!

If anyone thinks that processing medical claims is hard and confusing now -- just wait, it's about to get worse.

With the anticipated growth in Medicaid and payments linked to outcomes (because of health care reform), plus the coming huge expansion of diagnosis codes (from 14,000 ICD-9 codes to over 100,000 ICD-10 codes), the complexity is only growing - and at an accelerating pace.

Fortunately, sophisticated medical billing software exists to help health care providers automate and manage data. The danger, however, is that the software systems that have been developed in response to an increasingly staggeringly complex medical billing process have become themselves increasingly complex, and this has created a situation that is ripe for misusing these tools to not only accidentally over-reimburse but to submit false claims-with the attendant risks and penalties.

Types of Medical Billing Software Systems

In 2000, The Department of Health and Human Services ordered its Office of Inspector General to survey the different types of medical billing software to identify how the Medicare reimbursement process could be adversely affected. The Office of Inspector General surveyed four types of systems and identified their strengths and weaknesses:

Basic billing software relies heavily on user knowledge and entry skills. It is widely distributed by Medicare fiscal agents and the private sector. Users key most, if not all, claims information onto a claims facsimile. The software manipulates these entries to produce an electronic claim. Typical errors involve entry errors, incorrect or missing patient or provider information, incorrect or incomplete diagnosis codes or invalid Current Procedural Terminology (CPT) codes. Basic medical billing software, developed for mass markets, usually does not allow users to customize or override its programs. The greater risk of claim error is in data entry.

Informational software augments basic software capabilities. It uses data bases and linked files to recall patient, provider, diagnostic and service information. Invalid code combinations, missing diagnosis and other errors that might prevent processing of a claim can be brought to the user's attention before the claim is submitted for payment. Informational software does not appear to generate erroneous claims. It provides tools to help providers code their claims accurately. Vulnerabilities are more likely to stem from improper software configuration and use. For example, limited procedure coding options for office visits may steer claim decisions to higher value procedure codes.

0 notes

Text

Top 10 Medicare Legislative Changes for the COVID-19 Pandemic in 2021/22

In the aftermath of the Covid-19 outbreak, legislators enacted a number of modifications to Medicare. Several of these adjustments are intended to compensate health care providers and hospitals for income losses and increased expenditures caused by the pandemic. These legislative amendments are described in further detail below. The following are some of the most significant programme adjustments. Let's take a look at the top ten legislative changes to Medicare that will be implemented in the next years.

Andrew Semple Florida added that in low-income communities, increasing compensation for the labour component of medical costs. In addition, the Act extends the GPCI Floor, which is the percentage of a physician's fee that is paid for labour. This increase will assist in covering the costs of therapy for people infected with the Covid-19 virus. The omicron variety produces severe respiratory disease, which may need hospitalisation and the postponement of elective treatments.

Changes in Regulation for Health Insurance Markets and Healthcare Financing Congress enacted new legislation to protect the health-care system's long-term viability. The provisions of the Public Health Service Act empower the federal secretary to declare a public health emergency when a disease or ailment presents a significant danger to residents. A public health emergency lasts 90 days, and the secretary has the authority to extend it if required. The final legislation provides for a temporary suspension of the Medicare physician fee schedule until 2022.

BBBA, as well as the Accelerated and Advance Payment Program. The COVID-19 epidemic has wreaked havoc on hospitals and other health-care providers' finances. The BBBA, on the other hand, has agreed to prolong the Accelerated Payment Program until August 2020. Furthermore, the ACA simplifies the process of reimbursing providers for upfront payments. The BBBA's expansion and its consequences for public health infrastructure will enable these health systems to concentrate on other aspects of their operations.

Andrew Semple Florida further stated that the Act to Prevent Surprising People. The No Surprises Act is a federal statute that grants temporary exemptions to states in the event of a health catastrophe. The No-Surprises Act, which goes into effect on January 1, 2022, compels states to pause their monthly eligibility assessments for at least two years during an epidemic. The FMAP will be unaffected by a final regulation implemented in March 2020.

The Act on Public Readiness and Preparedness. The Public Readiness and Preparedness Act is amended by the PRP amendment to combat the COVID-19 pandemic. These modifications would enable CMS to broaden the policy to include telehealth visits for patients. To establish how the COVID epidemic has impacted the United States, further demographic data is required.

The CARES Act contains measures to promote rural access to telehealth. It does away with the "far site" condition, which specifies that a qualified provider must be situated in a remote region in order for Medicare to compensate them. Because federally qualified health centres and rural health clinics are not considered distant sites, the new legislation allows them to serve as distant sites during a public health emergency and receive reimbursement under the Medicare Physician Fee Schedule at national average rates for comparable telehealth services.

Andrew Semple Florida noted that one of the most significant legislative amendments to Medicare for the Covid-19 outbreak is the FACTS Act. It expands Medicaid eligibility and removes the medication rebate limit. The FRF's federal and state funds would be increased as a result of this adjustment. It would make it simpler for patients to obtain medical attention from a trained professional. Furthermore, the new bill contains a provision for expanded ACA coverage.

Despite the severity of the Covid-19 outbreak, the FACTS Act gives some help to impacted populations. Hospitals and health systems are included under the American Rescue Plan Act. It is comparable to the version voted by the House on February 27. It would then be sent to Vice President Biden. Provisions in the law will also boost payment rates for a range of providers.

0 notes

Text

Part D Senior Savings Model: What is it?

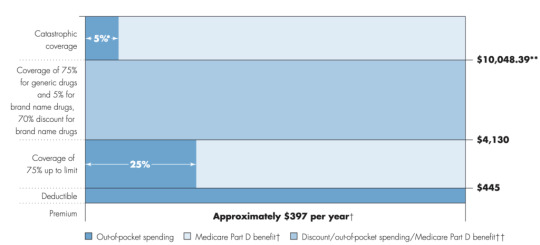

If you are on Medicare, how much will you pay for insulin? The answer is in the graph below (via MedPAC’s Payment Basics)

Seem confusing? Well it is. Medicare Part D beneficiaries have a deductible, then the standard coverage phase with 25% cost sharing, then a coverage gap where beneficiaries pay 25% of cost (manufacturers cover 70% of the cost for branded drugs in this coverage gap), and then a catastrophic phase where beneficiaries pay 5%. Wouldn’t it be easier if there were simple copayments like many commercial plans?

That is what CMS has been trying out in their Part D Senior Savings Model. The model includes fixed copayments for certain enhanced Part D plans. CMS writes:

The voluntary Model tests the impact of offering beneficiaries an increased choice of enhanced alternative Part D plan options that offer lower out-of-pocket costs for insulin. CMS is testing a change to the Manufacturer Coverage Gap Discount Program (the “discount program”) to allow Part D sponsors, through eligible enhanced alternative plans, to offer a Part D benefit design that includes predictable copays in the deductible, initial coverage, and coverage gap phases by offering supplemental benefits that apply after manufacturers provide a discounted price for a broad range of insulins included in the Model.

As described by former CMS administrator Seema Verma in the Health Affairs blog:

MS’s Part D Senior Savings Model is designed to lower prescription drug costs by providing Medicare patients with Part D plans that offer the broad set of insulins that beneficiaries use at a stable, affordable, and predictable cost of no more than $35 for a 30-day supply…beneficiaries who do not qualify for the low-income subsidy (LIS) currently pay 5 percent of the negotiated price when they reach the catastrophic phase, which should be lower than $35 in most cases. Part D sponsors could offer lower copays than $35 and still maintain all formulary flexibilities and choices.

Sharon Jhawar, Chief Pharmacy Officer at the SCAN Health Plan argues that the Senior Savings Model is working, should be made permanent, and should be expanded to both other diabetes medications and medications used to treat other common chronic conditions. Previous research shows that cost is a barrier to medication adherence, and she writes:

Let’s accelerate the timeline for making the Model permanent and use the expected cost-savings ($250 million per year) to advance other health initiatives for Medicare beneficiaries with diabetes…Yet diabetes is only the fifth most common chronic condition among Medicare beneficiaries. People with other chronic conditions, such as heart conditions, neurological conditions, or auto-immune diseases, will encounter the same financial challenges we see in the diabetes medication scenario. With a successful template in place to manage costs, we have a unique opportunity to reduce prescription costs across the board.

For more information, read the CMS Senior Savings Program Fact Sheet and visit their website.

Part D Senior Savings Model: What is it? posted first on https://carilloncitydental.blogspot.com

0 notes