#Machinery and equipment finance

Explore tagged Tumblr posts

Text

Streamlining Machinery and Equipment Finance with Non-Banking Financial Institutions

Efficient financing is essential for businesses looking to acquire or upgrade machinery and equipment. Machinery and equipment finance involves securing funds to purchase or lease essential assets, and non-banking financial institutions (NBFIs) and non-banking financial companies (NBFCs) have become key players in providing these solutions. This article explores how NBFIs and NBFCs can streamline machinery and equipment finance, enhancing business operations and supporting growth.

What is Machinery and Equipment Finance?

Machinery and equipment finance provides the funds needed for acquiring or leasing machinery essential to business operations. It includes options like loans, leases, or hire purchase agreements. While traditional banks have historically provided such financing, NBFIs and NBFCs now offer specialized solutions that cater to varying business needs.

The Role of Non-Banking Financial Institutions

1. Specialized Financing Solutions

NBFIs and NBFCs excel in offering customized finance solutions for machinery and equipment. Unlike traditional banks, they provide flexible loan structures, competitive rates, and tailored repayment terms. This customization helps businesses align their financing with cash flow and operational needs.

2. Faster Approval and Disbursement

NBFIs are known for their quicker approval processes compared to traditional banks. They streamline application procedures and use advanced technology to expedite financing, allowing businesses to acquire machinery and equipment promptly.

3. Flexible Financing Options

Non-banking financial institutions offer diverse financing options such as leasing, hire purchase, and loans. These options provide flexibility, allowing businesses to choose arrangements that fit their financial situations and operational requirements.

Advantages of Using Non-Banking Financial Companies

1. Customized Solutions

NBFCs offer tailored financial products designed to meet specific business needs. This customization includes flexible loan amounts, repayment schedules, and interest rates, ensuring businesses get financing that suits their requirements.

2. Enhanced Flexibility

NBFCs provide more flexible terms compared to traditional banks, allowing businesses to negotiate terms that align with their cash flow and operational needs. This flexibility helps businesses adapt to market changes and financial challenges.

3. Improved Accessibility

NBFIs and NBFCs often have less stringent lending criteria, making it easier for SMEs and businesses with limited credit history to access financing. This increased accessibility benefits businesses that may not meet traditional bank requirements.

4. Industry Expertise

Many NBFCs have deep expertise in the machinery and equipment sector, offering valuable advice and insights. This industry knowledge helps businesses make informed decisions about their financing options and investments.

Conclusion

Non-banking financial institutions and non-banking financial companies offer significant advantages for machinery and equipment finance. They provide specialized, flexible, and efficient financing solutions that help businesses acquire or upgrade essential assets. By leveraging the expertise and tailored services of NBFIs and NBFCs, businesses can streamline their machinery and equipment finance, enhancing operational efficiency and supporting growth

0 notes

Text

Reliable Truck, Trailer, and Machinery Financing in Abbotsford

Sandhu & Sran Leasing & Financing offers reliable truck and trailer financing in Abbotsford, providing affordable and flexible options tailored to your business needs. Our truck loans in Abbotsford come with low-interest rates, quick approvals, and easy repayment plans, ensuring you can upgrade or expand your fleet without financial stress. Additionally, we specialize in machinery loans to help businesses acquire essential equipment for improved productivity and growth. Whether you're investing in heavy-duty trucks, trailers, or construction machinery, our transparent process and expert team make financing hassle-free. We aim to support small and medium-sized businesses with competitive rates and personalized service. Trust Sandhu & Sran Leasing & Financing for comprehensive truck, trailer, and machinery financing solutions in Abbotsford. Contact us today to secure funding that drives your business forward!

#equipment financing in abbotsford#machinery loans abbotsford#truck loans in abbotsford#truck and trailer financing abbotsford

0 notes

Text

Benefits of Choosing Local Lenders for Machinery Loan in Delhi

Local lenders can provide a range of benefits, particularly when it comes to your specialized financing needs such as Machinery Loan in Delhi. Business Machinery Loan is a process where you need the full assistance of loan experts at Xpertserve, which also have proven to be one among Best in Facts About How Local Lenders Can Benefit Your Business as per machinery loan.

Tailored Financial Solutions

Personalized Loan Offers: As local lenders are well aware of the market dynamics peculiar to certain areas, they can provide machinery loans uniquely designed for Delhi-based businesses. While a Small Business Machinery Loan or even a Machinery Loan for Startups may be what you are after, local lenders have the ability to offer tailor-made solutions that suit your business in terms of operational requirements and future growth.

Competitive Interest Rates

Good Machinery Loan Interest Rates in Delhi: Banks at the local level often provide better terms than national-level lenders. Knowing the local economic scenario, and knowing what kind of challenges a small business can go through to repay loans on time enables these lenders to offer Machinery Loans at lower rates.

Faster Loan Processing

Fast and Effective service: This will teach help you explain that local lenders approve loan applications far more quickly than some outstation services This is important for example, to a business that must purchase or upgrade machinery immediately in order make production numbers and take advantage of an opportunity. Xpertserve makes sure that your Machinery Loan in Delhi is quickly processed so you do not fall back in the competitive market.

Personalized Customer Service

The direct touch and feel: If there is one huge advantage of working with local lenders such as Machinery Loan Providers in Delhi, then it has got to be the personalized customer service which they offer. When you are in the same locality it becomes easier to make visit at lender office and discuss what your needs, this helps them trust fully on formality work.

Understanding of Local Laws and Regulations

Compliance and guidance: a local lender is much more aware of the laws in Delhi with respect to property lending. This experience makes certain that your machinery loan is essentially compliant with regional rules all while minimizing legal risk and can facilitate the process of borrowing at greater ease.

Conclusion

Choosing a local lender for your Machinery Loan in Delhi has several advantages from individual touch and specialized monetary items to serious rates and quick handling times. Xpertserve- The Best Machinery Loan Company in Delhi is a unique initiative aimed at providing end-to-end tailor-made financial services assistance to local businesses. Partnering with a local lender not assists you in accomplishing your business goals, but it also bolsters the economy resulting in wins across-the-board.

#Machinery Loan in Delhi#Business machinery loan Delhi#Quick machinery loan Delhi#Machinery loan providers Delhi#Machinery loan application Delhi#Low interest machinery loan Delhi#Equipment financing Delhi#Business loan for machinery

0 notes

Text

Unleashing Growth: How CapitalNeed Stands Out as Your Premier Equipment Finance Company

In today's dynamic business landscape, acquiring and upgrading equipment is pivotal for staying competitive. Whether you're a small business looking to expand or a large corporation aiming for efficiency, securing the right equipment finance company can make all the difference. At CapitalNeed, we understand the significance of having access to the latest machinery and tools, which is why we're dedicated to offering tailored solutions to suit your needs.

As an equipment finance company, CapitalNeed specializes in providing financing options for a wide range of equipment, from heavy machinery to technology assets. Our goal is to empower businesses of all sizes to invest in the equipment necessary to drive growth and success. Here's why CapitalNeed stands out as the best choice for your equipment financing needs.

Flexible Financing Options: We recognize that every business is unique, which is why we offer flexible financing solutions tailored to your specific requirements. Whether you need a loan for purchasing new equipment or leasing options to conserve capital, CapitalNeed has you covered. Our team works closely with you to understand your goals and develop a financing plan that aligns with your budget and objectives.

Competitive Rates: At CapitalNeed, we believe in providing transparent and competitive rates to our clients. Our goal is to ensure that you get the most value out of your equipment finance solution, allowing you to maximize your ROI without breaking the bank. With our competitive rates and flexible terms, you can acquire the equipment you need while maintaining financial stability.

Streamlined Application Process: We understand that time is of the essence when it comes to securing equipment financing. That's why we've streamlined our application process to make it quick and hassle-free. With CapitalNeed, you can expect a seamless experience from start to finish, with minimal paperwork and fast approval times. Our team is here to guide you through every step of the process, ensuring that you get the financing you need when you need it.

Expert Guidance: Navigating the world of equipment financing can be daunting, especially for those unfamiliar with the process. That's where CapitalNeed comes in. Our team of experts is here to provide guidance and support throughout the entire financing journey. Whether you have questions about eligibility criteria, terms and conditions, or anything else related to equipment finance, we're here to help.

Commitment to Customer Satisfaction: At CapitalNeed, customer satisfaction is our top priority. At every step, we work to surpass your expectations by offering individualized support and service to guarantee your total happiness. From the initial consultation to ongoing support after financing, we're committed to being there for you every step of the way.

In conclusion

When it comes to choosing an equipment finance company, CapitalNeed is the clear choice. With flexible financing options, competitive rates, a streamlined application process, expert guidance, and a commitment to customer satisfaction, we're here to help you take your business to the next level. Contact CapitalNeed today to learn more about our equipment finance solutions and see how we can help you achieve your goals.

0 notes

Text

#heavy equipment financing companies in new york#second hand machinery loan in new york#machinery loan for startup in new york#machinery loan without security in new york

1 note

·

View note

Text

Powering Dutch Fields: Massey Fergusons Impact on Agri-Equipment

Buy Now

Massey Ferguson is a globally recognized high-quality label that provides a diverse range of tractors and agricultural equipment. This advanced and premium brand of tractors caters to all farmers and addresses every emerging mechanization requirement.

STORY OUTLINE

Massey Ferguson's eco-tech reduces fuel by 10%, cuts pesticides 20%, and conserves 40% energy, embodying sustainable farming leadership.

Fuel efficiency aids climate goals, precision tech safeguards soil, and collaborations empower farmers, advancing eco-friendly practices.

Operating in 140+ countries, Massey Ferguson's 300+ machinery models drive productivity and sustainability, transcending borders with innovation.

Massey Ferguson's fusion of excellence and eco-consciousness drives Dutch green goals, leaving a lasting agricultural mark globally.

In the thriving Agricultural landscape of the Netherlands, one name has stood the test of time and innovation—Massey Ferguson. With a legacy rooted in mechanization and a commitment to pushing the boundaries of farming technology, Massey Ferguson has played a pivotal role in shaping the nation's Agri-equipment market.

1.Greening the Future: Massey Ferguson's Vision

In an era when sustainable agriculture has become a global imperative, Massey Ferguson stands as a steadfast advocate for a greener tomorrow. As the Netherlands and the world navigate the intricate complexities of ecological responsibility, Massey Ferguson's vision emerges as a beacon of hope and progress.

Massey Ferguson's machinery has been reported to reduce fuel consumption by up to 10%, contributing to lower carbon emissions and decreased environmental footprint.

The precision technology embedded in Massey Ferguson's tractors has led to a potential reduction of up to 20% in fertilizer and pesticide usage, supporting healthier ecosystems and soil quality.

The integration of eco-friendly features in Massey Ferguson's equipment has led to energy savings of approximately 40% compared to conventional models, aligning with the broader global goal of reducing energy consumption.

2.Sustainability and Excellence: Massey Ferguson's Impact

Know More about this Report:- Request for a sample report

Massey Ferguson's influence extends beyond machinery—it fosters sustainability and excellence. Committed to ecological responsibility, it aligns with the Netherlands' sustainable agriculture drive. Advanced, eco-friendly technology equips farmers for a greener, more productive future.

Fuel-efficient equipment reduces emissions up to 10%, aiding climate goals. Precision technology cuts fertilizer and pesticide use by 20%, safeguarding soil and water. Energy-efficient components yield 40% energy savings, conserving resources. Collaborations with experts refine eco-friendly practices.

Educational initiatives empower farmers for seamless sustainability transition. Massey Ferguson's role in Dutch agriculture contributes to national green goals and biodiversity preservation. By intertwining excellence with eco-consciousness, it shapes an agricultural legacy of enduring positive impact.

3.Growth Beyond Borders: A Global Footprint

Massey Ferguson's influence isn't confined to Dutch fields. The brand's reach extends across the globe, making it a trusted name in Agri-equipment. Its innovations have traversed continents, supporting farmers worldwide in their quest for enhanced productivity and sustainable practices.

Massey Ferguson's market presence extends to over 140 countries, demonstrating its truly global footprint. With a diverse range of over 300 tractor models and farm machinery.

In conclusion, Massey Ferguson's legacy in the Netherlands' agricultural landscape is a testament to its pioneering spirit and commitment to sustainable excellence. Through its vision for greener farming, impactful technology, and global outreach, Massey Ferguson shapes a resilient agricultural future that transcends borders, benefiting both farmers and the planet.

#Netherlands Agriculture Equipment sector#Netherlands Agriculture Equipment Market trends#Netherlands Agriculture Equipment Market Growth Rate#Netherlands Agriculture Equipment Market demand#Agriculture Equipment Services Market#Agriculture Equipment Market Aggregators#Netherlands Agricultural Equipment Financing Companies#fendt agricultural equipment market revenue#Major Brands in Agriculture Equipment in Netherlands#Netherlands Crop Planting Equipment Market#Dutch Agri Machinery Market Insights#CLAAS Agriculture Equipment Market

0 notes

Text

Thrive Broking

Address: Somerset Drive, Thornton, NSW, 2322 Country:- Australia Main Phone:- 61 421 195 741 & 0421 195 741 Additional Phone:- (02) 4049 4441 Business Email :- [email protected] (mailto:[email protected]) Website:- thrivebroking.com.au (http://thrivebroking.com.au/) We are specialists for business, equipment & personal finance solutions across Australia. Our mission is to help you obtain the funding you need to thrive, We'll Put in the Hard Work In pursuit of excellence, Thrive Broking embraces the virtue of hard work to find the best solutions for your financial growth and prosperity, Lender Negotiation On Your Behalf Our expert team at Thrive Broking excels in lender negotiation, securing optimal terms and rates for your financing needs, ensuring your borrowing experience is seamless and advantageous, 24/7 Communication We at Thrive Broking offer waking hours support, available when you need us and keeping you informed every step of the way and afterwards. Services:- National Service Provider, Equipment & Vehicle Finance, Marine Finance & Insurance (Boat & Jetski), Caravan, Camper & Motor Home Finance & Insurance ,Motorbike Finance , Insurance , Commercial Business, Business Cash flow, Working Capital, Invoice Finance, Business Acquisition, Chattel Mortgage Machinery & Equipment ALL INDUSTRY for MOST worthwhile purposes , Purchase New or Used, Dealership, Private sale, or Auction Insurance & Car Search Services available.

#Loan#Car loans#Business loans#Caravan loan#Motorbike loan#Working capital loan#Cashflow loans#Personal loans#Business lending#Business car loan#Truck loan#Low doc loan#Debt consolidation loan#Boat loan#Loan broker#Equipment finance#Machinery finance#Farm machinery finance#Asset finance#Business finance#Personal finance#Car financing#Commercial finance#Trade finance#Vehicle finance#Truck finance#Excavator finance#Marine finance#Jet ski finance#Farm finance

1 note

·

View note

Photo

At Terkar Capital Our expert team is here to help you grow your business by miles with our machinery financing option.

https://terkarcapital.com/machinery-loan/

0 notes

Text

Why sustainable Agriculture leads the way for a healthy flow of income? - Nafa

Learn about availability of timely finance for farmers and agriculture MSME, channel financing, Agri loans, SMe loans, etc. Know more: https://nafa.co.in/info/blogs/why-sustainable-agriculture-leads-the-way-for-a-healthy-flow-of-income/

#agri finance companies in india#list of agri finance companies in india#agri finance companies in maharashtra#agricultural equipment leasing companies#agriculture nbfc in india#agricultural machinery finance#agricultural finance companies

0 notes

Text

Cash or Date?

Notes/Warnings: Benn/GN!Reader, Modern AU, philanthropist!Benn, nurse!reader, Benn says tip your nurses, fluff

"Are you sure?" Benn Beckman, local philanthropist, stood in front of you with the grin you'd come to associate him with plastered on his face.

"Yeah, I'm sure." He confirmed with a soft laugh, closing your hand around the wad of cash he'd given you.

Benn was visiting because he'd recently made a.. frankly massive donation to the hospital. He'd split the donation between several departments, but the largest chunk of the money was going to your department - pediatrics. He'd spoken to you and a group of other staff on the ward about how much he hated to think about and see sick kids. He thought they should be running around and making a mess, not be cooped up in bed. You found yourself agreeing with him quite adamantly.

He'd made a visit to the city hospital to see the various departments he'd donated to and find out how exactly the finance department had chosen to invest his money, and the impact it would have on patients. You'd been the one to help him understand the machinery and equipment the pediatrics ward would be getting, and the impact it would have on the children. You'd also introduced him to one such patient, who was excited about the chance to be able to play football again. He'd given these kids hope.

Now he was giving you money.

"I get a wage you know." You sassed with a sigh and a raised brow, reopening your hand to get a vague estimate of just how much money he'd handed you - your current estimate being 'a lot'.

"I know," he said with a warm laugh that made you smile along with him, "but tipping is important." Now that made you laugh. What a world it would be if people tipped medical staff like waitresses. What a vastly different life you'd lead.

"This is a lot of money you could give to a more worthy cause." You said, frowning at the notes in your hand even if you wanted to be able to see the numbers in your account flick as the amount increased.

"Then how about a date instead?"

Tag List: @claryeverlarkf @uselessboots @cainnoable

If you'd like to tip me, Kofi

#one piece#fanfic#writing#reader insert#one piece x reader#loganwritesficlets#modern au#benn beckman#benn x reader#gender neutral reader#benn beckman x reader#v

84 notes

·

View notes

Text

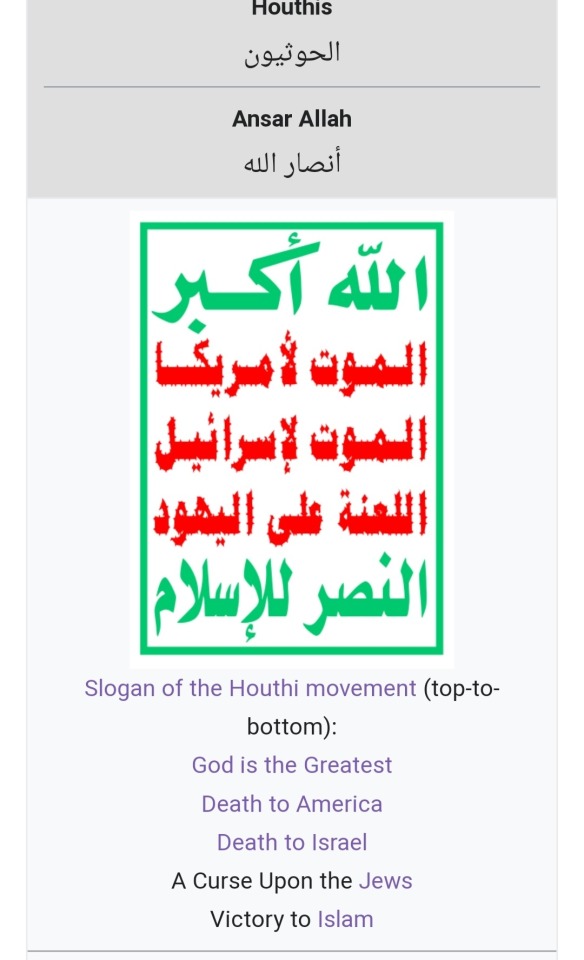

Я в ахуї. Or, as Poles say, jestem pod wrażeniem. More than 36K people shared this post. Let me remind you who you are promoting:

This is not the abstract Yemen who is participating in terrorism, this is the whole organisation that controls Yemen the same way Hamas controls Palestine. It is called the Houthis, and their rhetoric is very close to the nazi. There's a reason why UN banned them, but no one seems to be interested in the actual problem.

Not even mentioning that "puppets in the UN" is the narrative that is actively spread by russia - the state which finances... 🥁🥁🥁 Hamas as well!

I kindly ask my mutuals not to support this and not to participate in spreading this shit.

P.S. Israel exports a lot of pharmaceuticals, machinery and equipment, medical instruments, computer hardware and software, agricultural products, chemicals, textiles, etc. So there is nothing to be happy about, especially for medics.

#yemen#israel palestine war#hamas attack#houthis#russia finances hamas#stop russian aggression#russia is a terrorist state#russia is a nazi state

36 notes

·

View notes

Text

Secure Your Future with FD from Large Corporate Houses and Flexible Lifestyle Loans.

Secure Your Future with FD from Large Corporate Houses and Flexible Lifestyle Loans

In today's fast-paced world, it is essential to secure your future by making smart financial decisions. One way to do this is through fixed deposits (FD) from large corporate houses. FDs are a safe and reliable investment option that can provide you with stable returns over a fixed period of time.

Large corporate houses are known for their stability and credibility, making them a trustworthy option for investing your hard-earned money. By choosing to invest in FDs from these reputable entities, you can ensure that your funds are in safe hands and will grow steadily over time.

In addition to FDs, another financial tool that can help you secure your future is lifestyle loans. These loans are designed to provide you with the flexibility to finance your machinery and equipment needs while also maintaining a comfortable lifestyle. Whether you are looking to invest in new machinery for your business or upgrade your personal equipment, lifestyle loans can help you achieve your goals without compromising on your lifestyle.

With FDs from large corporate houses and lifestyle loans, you can take control of your financial future and ensure that you have the resources you need to succeed. By making smart investment decisions and choosing the right financial products, you can build a secure foundation for your future and achieve your long-term financial goals.

In conclusion, FDs from large corporate houses and lifestyle loans are powerful tools that can help you secure your future and achieve financial stability. By investing in FDs from reputable corporate entities and leveraging lifestyle loans to finance your machinery and equipment needs, you can build a strong financial portfolio that will support you for years to come. Make the smart choice today and take control of your financial future with FDs and lifestyle loans.

0 notes

Text

Affordable Vehicle Financing & Equipment Leasing Services in Abbotsford

Sandhu & Sran Leasing & Financing offers Affordable Vehicle Financing and Equipment Leasing Services in Abbotsford. We provide customized leasing solutions, including Commercial Equipment Leasing, Heavy Equipment Leasing, Construction Equipment Leasing, and Office Equipment Leasing. Our fast-approval process and flexible repayment options make it easy for businesses to access the tools they need to grow. From Abbotsford Machinery Financing to leasing for office essentials, we support companies of all sizes with transparent and affordable solutions. Boost productivity, upgrade equipment, and maintain cash flow with our hassle-free leasing and financing services. Contact Sandhu & Sran Leasing & Financing today for expert guidance and fast approvals!

0 notes

Text

Asset Finance Solutions: Unlocking Growth for Your Business

In today’s competitive business environment, staying ahead often requires investing in new equipment, machinery, or vehicles. However, the upfront costs of acquiring these assets can be a major financial hurdle, especially for small and medium-sized enterprises (SMEs). That’s where asset finance solutions come in—offering businesses a flexible and practical way to acquire essential assets while preserving cash flow.

What is Asset Finance?

Asset finance allows businesses to obtain the equipment or assets they need without the burden of paying the full cost upfront. Instead, the business can spread the cost over an agreed period through leasing or hire purchase agreements. This approach helps companies maintain liquidity and allocate their capital to other important areas, such as operations or expansion.

Key Benefits of Asset Finance

Improved Cash Flow: One of the main advantages of asset finance is that it helps businesses manage cash flow effectively. By spreading the cost of an asset over time, companies can avoid large initial expenditures, making it easier to handle daily expenses and maintain working capital.

Access to the Latest Equipment: Keeping up with technological advancements is crucial for businesses to stay competitive. Asset finance allows businesses to upgrade to the latest equipment without the full financial strain, ensuring they remain at the cutting edge of their industry.

Flexible Terms: Asset finance agreements are often more flexible than traditional loans, allowing businesses to choose terms that suit their needs. Whether it's short-term leases or long-term hire purchases, companies can tailor the solution to their financial situation.

Tax Advantages: In some cases, businesses can benefit from tax deductions on asset finance payments, making it an even more cost-effective solution. Consulting a tax professional can help you understand how to maximize these benefits.

Unlock Business Growth: By utilizing asset finance, your business can acquire the essential tools to grow without draining your capital. Whether you need vehicles, machinery, or IT equipment, asset finance solutions from experts

2 notes

·

View notes

Text

Forced to pay for your own murder.

---

[S]low death occurs not within the time scale of the crisis, not of the event [or singular moment] [...], but in “a zone of temporality . . . of ongoingness, getting by, and living on, where the structural inequalities are dispersed [...].” Slow death is, quite simply, “a condition of being worn out [...].” If debility is endemic to disenfranchised communities, it is doubly so because the forms of financialization that accompany [...] the privatization of services also produce debt as debility. This relationship between debt and debility can be described as a kind of “financial expropriation” [...]. Debt peonage [...]is an updated version of Marx’s critique of “choice” under capitalism. Debt as enclosure, as immobility, is what Gilles Deleuze writes of [...]: “Man is no longer man enclosed, but man in debt.” This is especially true [...] in the United States, where health care expenses are the number one cause of personal bankruptcy, a capacitation of slow death through debt undertaken to support one’s health. This theory [...] entails that [...] one is, as Geeta Patel points out, paying for one’s own slow death, through insurial and debt structures predicated on risk and insecurity, and essentially forced into agreeing to one’s own debilitation. [...] More perniciously, one could suggest, as does Geeta Patel, that finance capital enforces repeated mandatory investments in our own slow deaths [...].

[Text by: Jasbir K. Puar. “Introduction: The Cost of Getting Better.” The Right to Maim: Debility, Capacity, Disability. 2017.]

---

In the early workers’ movement, slowdowns, sit-downs and the destruction of machinery took on the name “sabotage,” from the sabot or wooden shoe. [...] The clog was used in factories and mines as an early form of protective equipment, a sort of steel-toe boot that took on a distinctly working-class character as heavy industry proliferated across Europe. [...] It was factory-made footwear built for recently dispossessed peasants-become-workers, some of whom might, in fact, be making shoes. Altogether, it was the symbol for a complex, market-driven chain of enclosure, migration, boom and bust which, despite its complexity, really [...] comes down to the [silliest] of logical circles: make shoes for workers to wear as they make more shoes. [...] They wear the shoes even as they make them. [...] [T]he mines and factories make for lives that are little more than a slow disemboweling. [...] Made dependent on the wage, migrants newly dispossessed of any other means of subsistence crowded into the early industrial slums. [...] The industrial wasteland of [...] clanging machines creates desperate, alien conditions for those that live within it.

[Text by: Phil A. Neel. “Swoosh.” November 2015.]

---

[W]hat France did to the Haitian people after the Haitian Revolution is a particularly notorious examples of colonial theft. France instituted slavery on the island in the 17th century, but, in the late 18th century, the enslaved population rebelled and eventually declared independence. Yet, somehow, [...] the thinking went that the former enslavers of the Haitian people needed to be compensated, rather than the other way around. [...] Haiti officially declared its independence from France in 1804. [...] On April 17, 1825, the French king [...] issued a decree stating France would recognize Haitian independence but only at the price of 150 million francs – or around 10 times the amount the U.S. had paid for the Louisiana territory. The sum was meant to compensate the French colonists for their lost revenues from slavery. Baron de Mackau, whom Charles X sent to deliver the ordinance, arrived in Haiti in July, accompanied by a squadron of 14 brigs of war carrying more than 500 cannons. Rejection of the ordinance almost certainly meant war. This was not diplomacy. It was extortion. [...] [T]he total was more than 10 times Haiti’s annual budget. The rest of the world seemed to agree that the amount was absurd. [...] Forced to borrow 30 million francs from French banks to make the first two payments, it was hardly a surprise to anyone when Haiti defaulted soon thereafter. Still, the new French king sent another expedition in 1838 with 12 warships to force the Haitian president’s hand. [...] Although the colonists claimed that the indemnity would only cover one-twelfth the value of their lost properties, including the people they claimed as their slaves, the total amount of 90 million francs was actually five times France’s annual budget. [...] [R]esearchers have found that the independence debt [...] [was] directly responsible [...] for the underfunding of education in 20th-century Haiti, [...] lack of health care and the country’s inability to develop public infrastructure. [...] [T]he interest from all the loans [...] were not completely paid off until 1947 [...]. France belatedly abolished slavery in 1848 in its remaining colonies of Martinique, Guadeloupe, Réunion and French Guyana, which are still territories of France today. Afterwards, the French government demonstrated once again its understanding of slavery’s relationship to economics when it took it upon itself to financially compensate the former “owners” of enslaved people.

[Text by: Marlene Daut. “When France extorted Haiti - the greatest heist in history.” The Conversation. 30 June 2020. Updated 9 July 2021.]

---

Today, as you read this [...], there are almost 2 million people locked away in one of the more than 5,000 prisons or jails that dot the American landscape. [...] [P]olicymakers and government officials also know that this captive population has no choice but to foot the bill [...] and that if they can’t be made to pay, their families can. [...] Rutgers sociology professor Brittany Friedman has has written extensively on what is called “pay-to-stay” fees in American correctional institutions. [...] Fees for room and board -- yes, literally for a thin mattress or even a plastic “boat” bed in a hallway, a toilet that may not flush, and scant, awful tasting food -- are typically charged at a “per diem rate for the length of incarceration.” It is not uncommon for these fees to reach $20 to $80 a day for the entire period of incarceration. [...] In 2014, the Brennan Center for Justice documented that at least 43 states authorize charging incarcerated people for the cost of their own imprisonment, and at least 35 states authorize charging them for some medical expenses. [...] [T]hose who work regular jobs in prisons [...] earn on average between $0.14 and $0.63 an hour. [...] Arkansas and Texas don’t pay incarcerated workers at all [...]. Dallas County charges incarcerated people a $10 medical care fee for each medical request they submit. [...] Michigan laws allow any county to seek reimbursement [...] [from] a person [...] sentenced to county jail time -- up to $60 a day.

[Text by: Lauren-Brooke Eisen. “America’s Dystopian Incarceration System of Pay to Stay Behind Bars.” Brennan Center for Justice. 19 April 2023.]

---

The Slavery Abolition Act didn’t apply to India or Ceylon, and though it technically liberated over 800,000 British slaves in the Caribbean and Africa, all of them (excepting only small children) were forced to continue to labor as unpaid “apprentices” for a further six years, on pain of punishment. Under the terms of the act, they were protected against overwork and direct violence from employers, but remained their “transferable property,” subject to punishment for “indolence,” “insolence,” or “insubordination.” So many black West Indians were jailed for resisting these outrageous terms that full emancipation was eventually brought forward to August 1, 1838. [...] A century on, the independence of most Caribbean colonies in the 1960s was followed by decades of racist British immigration policies that not only sought to prevent black West Indians from coming to the UK but eventually, under the Conservative governments of the past decade, ended up deliberately destroying the lives of thousands of lifelong legal residents by treating them as “illegal migrants.” In the meantime, for almost two hundred years, British taxpayers funded the largest slavery-related reparations ever paid out. Under the provisions of the 1833 act, the government borrowed and then disbursed the staggering sum of £20 million (equal to 40 percent of its annual budget -- the equivalent of £300 billion in today’s value). Not until 2015 that debt finally paid off. This unprecedented compensation for injustice went not to those whose lives had been spent in slavery, nor even to those descended from the millions who had died in captivity. It was all given to British slaveowners, as restitution for the loss of their human property.

[Text by: Fara Dabhoiwala. “Speech and Slavery in the West Indies.” The New York Review. 20 August 2020.]

29 notes

·

View notes

Text

🚀 The Best Small Business Loans in 2024

Explore top funding options tailored to help your small business thrive in 2024! From flexible terms to competitive rates, these loans cater to various business needs.

1. SBA Loans 💼 Description: Backed by the Small Business Administration, these loans offer favorable terms and lower interest rates. Best For: Established businesses looking for long-term financing. 2. Term Loans 🏦 Description: Traditional loans with fixed interest rates and repayment schedules. Best For: Businesses needing a significant amount of capital for expansion or large projects. 3. Business Line of Credit 🔄 Description: Flexible credit line that allows businesses to withdraw funds as needed. Best For: Managing cash flow and covering short-term expenses. 4. Equipment Financing ⚙️ Description: Loans specifically for purchasing business equipment. Best For: Businesses looking to acquire machinery, vehicles, or technology. 5. Invoice Financing 💳 Description: Advances based on outstanding invoices. Best For: Businesses facing cash flow issues due to slow-paying clients. 6. Microloans 📈 Description: Small, short-term loans for startups and small businesses. Best For: New businesses or those with limited credit history. 7. Merchant Cash Advances 💰 Description: Lump sum of cash in exchange for a percentage of future sales. Best For: Businesses with high credit card sales needing quick funding. 8. Peer-to-Peer (P2P) Loans 🤝 Description: Loans funded by individual investors via online platforms. Best For: Businesses seeking alternative funding sources with competitive rates. 9. Commercial Real Estate Loans 🏢 Description: Loans for purchasing or renovating commercial property. Best For: Businesses looking to buy or upgrade their physical location. 10. Franchise Financing 🌟 Description: Specialized loans for opening or expanding a franchise.

Best For: Entrepreneurs investing in a franchise opportunity. Choose the right loan to fuel your small business growth and achieve your entrepreneurial dreams in 2024! 🌟 #SmallBusiness #BusinessLoans #Entrepreneurship #2024BusinessGoals #FundingOptions

5 notes

·

View notes