#Local Incentive Management Experts

Explore tagged Tumblr posts

Text

Unlocking Savings: The Role of Tax Incentive Advisors in Maximizing Business Benefits

Tax incentives can be powerful tools for businesses to minimize their tax liabilities and maximize their savings. However, navigating the complex landscape of tax laws and regulations can be daunting without expert guidance. This is where tax incentive advisors come in. In this blog post, we’ll explore the invaluable role these advisors play in helping businesses unlock savings and thrive in today’s competitive landscape. https://abbottincentives.com/

#Work Opportunity Tax Credits#Grants To Train Employees#Business Tax Credits#Local Incentive Management Experts#state incentive programs

0 notes

Text

Trusted outsource software development teams - SSTech System

Outsource software development is the practice of relinquishing software-related duties to outside singularities or organizations. Outsourcing is used by firms to acquire software services and products from outside firms that do not have direct employees or employees under contract to the business entity that is outsourcing.

Infect, the outsourcing market worldwide is projected to grow by 8.28% (2025-2029) resulting in a market volume of US$812.70bn in 2029. This model is highly versatile and suits businesses of all sizes.

Start-ups often use outsourcing to develop MVPs quickly, while established companies might seek custom software development services or AI outsourcing services to address complex challenges. Outsourcing can include working with offshore development teams, global software development partners, or local experts like Australian software development experts for specific projects.

The benefits of outsourcing software development

Outsourcing has become a cornerstone for modern businesses due to its numerous advantages. Here’s a closer look at the key benefits:

1. Cost efficiency

Perhaps the biggest incentive for sourcing solutions from outsourcing service providers is the cost cutting factor. For instance, offshore software development in India provides expertise services at comparatively lower cost than that of in-house developed services in Western countries. This efficiency enable the enactments of cost savings in some other strategic sectors of the organization.

2. Access to global talent

Outsourcing can help to discover the wealth of new talents as well as the skills of professionals from other countries. No matter Whether it’s AI and machine learning integration, web application development in Australia, or outsourced healthcare software development, businesses can find experts in virtually any domain.

3. Scalability and flexibility

Outsourcing offers flexibility that is unparalleled in many organizations today. This is because; firms are able to expand and contract particular teams depending on the specific demand in projects. For example, outsourced IT solutions help business organizations prepare for different conditions while not having to employ permanent workers.

4. Faster time-to-market

With reliable software development teams in Australia or offshore development teams in India, businesses can speed up their project timelines. This helps innovations to make it through to the market early enough, which is useful for companies.

5. Focus on core activities

By delegating tasks like software maintenance and support or cloud software development in Australia to outsourcing partners, businesses can focus on their core competencies and strategic goals.

6. Reduced risk

In-house staff and trained outsourcing partners come with best practices, methods and procedures which when implemented reduce the chances of project hitch. Working with the top-rated IT outsourcing companies in Australia gives you confidence that your project is in safe hands.

Choosing the right outsourced software development partner

In the period from 2023 to 2027, the revenue of software outsourcing is forecasted to thrive at a CAGR of 7.54%. So, outsourcing partner selection is one of the most vital components since it determines the success of a given venture. Here are essential factors to consider:

1. Technical expertise

Check the partner’s competency and his knowledge of the field. For instance, SSTech System Outsourcing offers comprehensive solutions, from AI development services in India to mobile app development outsourcing in Australia.

2. Proven track record

Look for partners with a strong portfolio and positive client testimonials. A proven track record in delivering custom software development services or managing outsourcing software development contracts is a good indicator of reliability.

3. Effective communication

Effective and open communication is extremely important if the project is to be successful. Work with people who give frequent reports and employ efficient media to overcome the differences in time areas.

4. Cultural compatibility

There has to be a cultural match or at least appreciation for each other’s customs for there to be harmony in the working relationship. As such, staffed with proficient Australia software development experts or offshore development teams, whose experience is to work on global markets can coordinate and blend well with your work culture.

5. Security and compliance

You have to make sure that your partner complies with the standards and the policies that are in the industry. This is especially substantial for all information-sensitive projects such as outsourced healthcare software development or cloud software development in Australia.

6. Scalable infrastructure

Choose a partner capable of scaling their resources and infrastructure to meet your project’s evolving needs. This is crucial for long-term collaborations, especially with global software development partners.

AI-powered tools for outsourced development teams

According to a report from the US Bureau of Labor Statistics, software development ranks among the most sought-after professions. Hence, AI is at the forefront of reshaping the outsourcing industry. Therefore, the implementation of artificial intelligence will add value to business processes, make workflow easier, and boost the results of projects. Here are some examples:

1. Automated code reviews

Tools like DeepCode and SonarQube assist outsourced teams in detecting whether errors reside in the code line or not, and whether code needs to be enriched or not. This is particularly accurate concerning AI outsourcing and in-house development industries.

2. Predictive analytics

Automated analytics tools can predict such things as the time it will take to complete the project, how much money it will cost, and what risks are possible in a software development outsourcing scenario.

3. Smart project management

Tools and platforms such as Jira and Monday.com, when empowered with AI, allow the coordination of tasks and the tracking of progress and resource allocation.

4. AI collaboration tools

Communication and collaboration with internal members and offshore software development Australia partners get facilitated through applications that include, Slack, Microsoft Teams, and zoom with integrated AI functions.

5. Natural Language Processing (NLP)

AI-powered chatbots and virtual assistants simplify communication and issue resolution, making them valuable for managing outsourced IT solutions.

Best practices for managing outsourced development teams

Outsourced teams should be mandated and coordinated following a number of recommendations to ensure the efficiency of the entirety of the outsourcing process.

Here are the best practices to ensure your project’s success:

1. Set clear objectives

Make it clear to your project team, stakeholders, and other relevant parties what the parameters of the project are, what it is that you expect out of it, and what you expect to get from it in return. This fostaines consistency between your team and the outsourcing partner to increase efficiency in service delivery.

2. Choose the right tools

Use project tracking and collaboration software approaches to track and evaluate progress and meet regular informality and collaboration targets.

3. Foster a collaborative environment

It is worthy of note that constant communication is key to ensuring that your outsourcing team is on the same page with you. Fresh produce and feedback mechanisms need to be provided in order for there to be trust as is needed in project management.

4. Draft comprehensive contracts

There should be a comprehensive outsourcing software development contract. It should address issues to do with confidentiality, ownership of ideas and concepts, plea structure and mode of handling disputes.

5. Focus on long-term relationships

Building a long-term partnership with trusted providers like SSTech System Solutions can lead to consistent quality and better project outcomes.

Conclusion

To keep up with technology, outsourcing software development offers businesses solutions and support that can enable the creation of complex solutions out of mere ideas. Outsourcing has the benefits of minute overhead cost and is also a rich source of globally talented employees, and it offers the advantage of early time to market. Whether you’re looking for mobile app development outsourcing in Australia or seeking offshore software development in India or opting for AI outsourcing services, the potential is huge.

Such companies can only benefit from opting for reliable outsourcing companies such as SSTech System Outsourcing and embracing industry best practices to promote the success of business project implementations while enhancing market relevance. As technologies like AI and cloud computing are still changing the face of the outsourcing market, software development outsourcing will still be important for any company that wants to survive in a digital world.

Take the first step today—partner with global software development partners and unlock the full potential of your ideas with the power of outsourcing.

#SSTech System Outsourcing#SSTech System Solutions#AI outsourcing services#cloud computing#offshore software development#Outsource software development#AI outsourcing#web application development in Australia#custom software development services#mobile app development#outsourced IT solutions#cloud software development#IT Support & Maintenance Services

2 notes

·

View notes

Text

Company Registration in Thailand

Thailand, a Southeast Asian gem, offers a lucrative business landscape for both domestic and international entrepreneurs. However, setting up a company in this vibrant nation requires careful consideration of legal and regulatory frameworks. This guide will walk you through the essential steps to successfully register your company in Thailand.

Types of Companies in Thailand

Limited Liability Company (LLC): The most common type for foreign investors, offering limited liability and flexibility.

Public Limited Company (PLC): Suitable for large-scale operations, requiring significant capital and public share offerings.

Key Steps to Company Registration

Reserve a Company Name:

Choose a unique name that complies with Thai regulations.

The Department of Business Development (DBD) will verify the availability.

Prepare Incorporation Documents:

Memorandum of Association (MoA): Outlines the company's objectives, capital structure, and shareholder details.

Articles of Association (AoA): Specifies the company's internal rules, procedures, and management structure.

Appoint Directors and Shareholders:

At least two directors and shareholders are required.

Consider appointing a local director to comply with specific regulations.

Obtain Necessary Approvals:

For certain industries, additional approvals from relevant government agencies may be necessary.

Register with the DBD:

Submit the required documents and pay registration fees.

The DBD will issue a Certificate of Incorporation upon successful registration.

Open a Corporate Bank Account:

Establish a bank account to facilitate financial transactions.

Register for Taxes:

Register with the Revenue Department for corporate income tax and value-added tax (VAT).

Essential Considerations

Foreign Business Act (FBA): If your business activities are restricted under the FBA, you may need additional licenses and permits.

Board of Investment (BOI): Consider applying for BOI privileges to enjoy tax incentives and other benefits.

Work Permits: Ensure compliance with work permit regulations for foreign employees.

Local Partner: In certain industries, a local partner may be required.

Seeking Professional Assistance

While it's possible to navigate the company registration process independently, engaging a legal and accounting firm specializing in Thai business law is highly recommended. They can provide expert guidance, streamline the process, and ensure compliance with all legal requirements.

By carefully following these steps and seeking professional advice, you can successfully establish your business in Thailand and capitalize on the country's thriving economy.

#company registration in thailand#thailand#corporate in thailand#business#business in thailand#businessthailand

2 notes

·

View notes

Text

Setting Up a Subsidiary Company in India: Your Guide by MAS LLP

India has emerged as a lucrative destination for businesses worldwide, offering a dynamic market, skilled workforce, and robust infrastructure. For foreign companies, establishing a subsidiary company in India is a strategic way to enter this thriving economy. MAS LLP, a trusted partner in business solutions, simplifies the process of subsidiary company registration, ensuring compliance and efficiency at every step.

What is a Subsidiary Company? A subsidiary company is an entity in which another company, usually referred to as the parent company, holds a controlling stake. In India, a foreign company can establish a subsidiary under the Companies Act, 2013, allowing it to operate as an independent legal entity while still being linked to its parent organization. Benefits of Setting Up a Subsidiary in India

Market Expansion Gain access to one of the world’s largest consumer markets with over 1.4 billion people.

Limited Liability A subsidiary company protects the parent company from direct liabilities in India.

Tax Benefits Enjoy various tax incentives and deductions offered by the Indian government for specific sectors.

Operational Independence Operate as a standalone business entity, enabling strategic decisions aligned with local market conditions.

Brand Establishment Build a local presence, enhance credibility, and connect with Indian consumers more effectively.

Steps to Set Up a Subsidiary Company in India MAS LLP simplifies the process of subsidiary incorporation in India. Here's an overview:

Choose the Business Structure Decide on the type of subsidiary (Private Limited Company, Public Limited Company, etc.) based on business goals.

Name Reservation Register the company name with the Ministry of Corporate Affairs (MCA).

Documentation Prepare essential documents, including the parent company's board resolution, Memorandum of Association (MOA), and Articles of Association (AOA).

Director Identification Number (DIN) and Digital Signature Certificate (DSC) Obtain these for the directors of the subsidiary.

File Incorporation Forms Submit forms like SPICe+ (Simplified Proforma for Incorporating Company Electronically) to the MCA.

Compliance and Licenses Acquire necessary licenses and ensure compliance with tax regulations, GST, and FEMA guidelines.

Why Choose MAS LLP? MAS LLP is your ideal partner for setting up a subsidiary company in India. Here's why businesses trust us:

Expert Guidance Our team of professionals ensures a seamless incorporation process.

Regulatory Compliance We keep your business compliant with India’s legal and tax framework.

Tailored Solutions Customized strategies that align with your business objectives.

End-to-End Support From documentation to post-incorporation compliance, we handle it all.

Post-Incorporation Services Setting up a subsidiary is just the beginning. MAS LLP also offers: *Accounting and bookkeeping services.

Tax filing and auditing.

Payroll management.

Advisory on Foreign Direct Investment (FDI) regulations. Conclusion India’s vibrant market is brimming with opportunities for global businesses. Establishing a subsidiary company in India by MAS LLP not only accelerates your entry but ensures a hassle-free and compliant setup. Partner with MAS LLP and unlock your business potential in India today!

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

5 notes

·

View notes

Text

Explore Ladakh with the Best DMC for Ladakh | The Samsara Holidays

Ladakh, known as the "Land of High Passes," is a paradise for travelers seeking adventure, tranquility, and cultural richness. Nestled in the northernmost part of India, this region offers breathtaking landscapes, ancient monasteries, and an array of thrilling activities. Planning a trip to such a remote and diverse destination can be daunting, but with the Best DMC for Leh Ladakh, your journey becomes seamless and memorable.

Why Visit Ladakh?

Ladakh's unparalleled beauty lies in its rugged mountains, crystal-clear lakes, and vast, open skies. Here are some reasons why Ladakh should be on your travel bucket list:

Stunning Landscapes: From the mesmerizing Pangong Lake to the serene Nubra Valley, Ladakh's natural beauty is truly awe-inspiring. The region is a photographer's dream, with its dramatic contrasts of colors and textures.

Rich Cultural Heritage: Ladakh is home to ancient monasteries like Hemis, Thiksey, and Diskit. These monasteries not only offer spiritual solace but also a glimpse into the region's unique Buddhist heritage.

Adventure Activities: For thrill-seekers, Ladakh offers numerous adventure activities. Trekking, river rafting, and mountain biking are popular ways to explore the rugged terrain. The Chadar Trek and Markha Valley Trek are particularly famous among trekkers.

Unique Festivals: Ladakh's vibrant festivals, such as Hemis Festival and Losar, provide an opportunity to witness the region's rich traditions and colorful celebrations.

Planning Your Trip

When planning a trip to Ladakh, partnering with a reliable destination management company "The Samsara Holidays" (DMC) is very important. The best DMC for Leh Ladakh ensures a hassle-free experience by taking care of all travel arrangements, including permits, accommodations, and guided tours.

Top Attractions in Ladakh

Pangong Lake

Pangong Lake, one of the highest saltwater lakes in the world, is famous for its ever-changing hues. Located at an altitude of 4,350 meters, this pristine lake stretches across India and China, offering spectacular views that captivate every visitor.

Nubra Valley

Nubra Valley, also known as the "Valley of Flowers," is a stark contrast to Ladakh's rugged landscape. The valley is famous for its sand dunes, Bactrian camels, and the stunning Diskit Monastery, which houses a 32-meter tall statue of Maitreya Buddha.

Hemis Monastery

Hemis Monastery, the largest and wealthiest monastery in Ladakh, is a must-visit. It is renowned for the annual Hemis Festival, which celebrates the birth of Guru Padmasambhava. The festival features vibrant masked dances, traditional music, and elaborate costumes.

Adventure Awaits

Ladakh is an adventurer's playground, offering a range of activities that cater to different levels of experience and enthusiasm.

Trekking: Ladakh boasts some of the most challenging and scenic trekking routes. The Chadar Trek, which involves walking on the frozen Zanskar River, is a once-in-a-lifetime experience. Other popular treks include the Markha Valley Trek and the Stok Kangri Trek.

River Rafting: The Zanskar River offers thrilling rafting opportunities, with its fast-flowing waters and deep gorges. Rafting through the Zanskar Canyon is an exhilarating way to experience the raw beauty of Ladakh.

Mountain Biking: For cycling enthusiasts, the rugged terrain and high-altitude passes of Ladakh provide a perfect setting for mountain biking. The Manali-Leh highway is particularly popular among bikers.

Best Time to Visit

The best time to visit Ladakh is from May to September, when the weather is pleasant and the roads are accessible. During this period, the snow melts, and the region comes alive with vibrant colors and bustling activities. The winter months, from November to February, are extremely cold, with many areas becoming inaccessible due to heavy snowfall.

Conclusion

Ladakh is a destination that promises an unforgettable experience, blending natural beauty, adventure, and cultural richness. To make the most of your trip, partnering with the best DMC for Leh Ladakh is essential. They ensure that every aspect of your journey is well-planned and executed, allowing you to focus on creating lasting memories.

Embark on an adventure of a lifetime and discover the enchanting beauty of Ladakh.

For more information and to start planning your trip, contact the Best DMC for Leh Ladakh.

Book now and explore more!

#Discover Ladakh#Ladakh Adventure#best DMC for Leh#DMC for Leh Ladakh#the samsara holidays#samsara holidays

4 notes

·

View notes

Text

Guide for Importers on Manufacturing Control

Efficient Manufacturing Control in China

1. Understand the Chinese Manufacturing Environment:

Diverse Ecosystem: China offers a vast range of manufacturers, from small workshops to large factories. This variety is beneficial but also poses challenges in ensuring consistent quality.

IP Concerns: Despite improvements, IP protection in China can be inconsistent, requiring robust measures to safeguard your innovations.

Regulatory Landscape: China’s complex and changing regulations make compliance crucial to avoid fines and reputational damage.

Quality Control: While quality has improved, some sectors still prioritize quantity over quality. Rigorous quality protocols are essential.

Labor & Costs: Labor costs are rising, pushing manufacturers toward automation. Infrastructure is robust, but supply chains can be disrupted by natural disasters or policy changes.

Government Policies: China’s government heavily influences manufacturing through policies and incentives, which can affect costs and market access.

2. Build a Strong Foundation:

Supplier Selection: Choose reliable suppliers through thorough due diligence, including factory visits and financial checks.

Clear Communication: Provide detailed specifications and maintain open communication to avoid misunderstandings.

Quality Management: Implement a Quality Management System (QMS) and conduct regular audits to ensure consistent product quality.

Strong Relationships: Develop long-term partnerships with suppliers to build trust and collaboration.

3. Implement Effective Control Strategies:

QA & QC: Establish a robust QA/QC framework to ensure consistent product quality.

Supplier Development: Invest in your suppliers’ capabilities to improve quality and efficiency.

Risk Management: Prepare for disruptions with backup plans and diversified suppliers.

Contractual Coverage: Clearly define product specifications and include IP protections in contracts.

Third-Party Verification: Use third-party inspections to ensure compliance and quality.

4. Manage Logistics & Supply Chain:

Transportation: Choose the best transport mode and routes to minimize costs and delays.

Warehousing & Inventory: Optimize warehouse locations and use management systems to track inventory.

Customs & Documentation: Ensure compliance with customs regulations and prepare accurate documentation.

Supply Chain Visibility: Use technology to monitor shipments and collaborate with suppliers.

Risk Assessment: Develop contingency plans for disruptions like natural disasters or strikes.

5. Overcome Common Challenges:

Language & Cultural Barriers: Hire experts to bridge gaps in communication and cultural understanding.

IP Protection: Secure your IP with patents, trademarks, and NDAs; monitor for infringements.

Regulatory Compliance: Stay updated on regulations and partner with local experts for compliance.

Supply Chain Disruptions: Diversify suppliers, maintain sufficient inventory, and use smart tools for monitoring.

6. Continuous Improvement:

Use data analytics to track trends and improve processes.

Regularly evaluate supplier performance and invest in employee training.

Embrace technology to enhance communication and efficiency.

7. Build a Culture of Quality:

Encourage employees to propose improvements.

Reward contributions to quality enhancement.

Focus on exceeding customer expectations.

Conclusion: Effective manufacturing control in China requires ongoing effort, attention, and adaptation. Invest in strong practices to improve product quality, reduce costs, protect your brand, and optimize your supply chain.

2 notes

·

View notes

Text

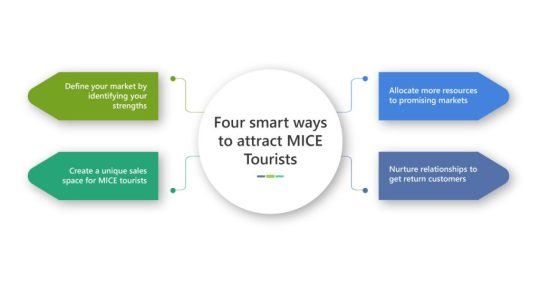

Excellence in MICE Practices at a Leading Hotel in Toronto

Welcome to the world of MICE (Meetings, Incentives, Conferences, and Exhibitions) at one of Toronto's top hotels, the Grand Maple Hotel. Discover how we create memorable event experiences.

Dedicated Professionals

Our team includes expert event planners, AV technicians, and catering staff who ensure seamless presentations and perfect dining experiences.

Versatile Venues

Located downtown, our hotel offers elegant ballrooms, functional conference rooms, and serene outdoor spaces with modern amenities.

Types of Events Hosted

We host meetings, conferences, exhibitions, and incentive trips, adapting our spaces for each event's needs.

Overcoming Challenges

From scheduling to technical needs, our experienced team handles event challenges with expertise.

SWOT Analysis

Strengths: Excellent facilities and top-notch service.

Weaknesses: Limited availability during peak times.

Opportunities: Expanding digital event offerings and partnering with local businesses.

Threats: Economic changes and strong competition.

Lessons from Hospitality

Comparing our event operations with other businesses shows how we manage operations and compete effectively.

Overall

Our commitment to excellence in event planning at the Grand Maple Hotel is evident in our meticulous planning and dedicated team.

2 notes

·

View notes

Text

Global DMC Solutions in Dubai: Elevating Your MICE Experience

In the bustling realm of Meetings, Incentives, Conferences, and Exhibitions (MICE) tourism Dubai stands tall as a vibrant hub teeming with opportunities and trends that event planners simply can't ignore. Let's embark on a journey through the latest trends and invaluable tips tailored for event planners venturing into Dubai's dynamic MICE scene, with a spotlight on how Global DMC travel solutions play a pivotal role in elevating MICE experiences.

1. Trends Redefining Event Landscapes

Dubai's MICE landscape is in the midst of a renaissance, embracing trends that cater to diverse preferences and evolving industry standards. From hybrid event formats that blend virtual and physical experiences to immersive technology integrations like augmented reality (AR) and virtual reality (VR), event planners have a myriad of innovative tools at their disposal.

2. Seamless Logistics with Global DMC Travel Solutions

One of the keys to unlocking a successful MICE event in Dubai is seamless logistics management, and Global DMC travel solutions excel in this arena. With their expertise in transportation, accommodation, and on-ground support, event planners can focus on curating unforgettable experiences while leaving the logistical intricacies to the experts.

3. The Rise of Experiential Meetings: Creating Memorable Attendee Experiences

Gone are the days of passive conferences; attendees now crave immersive and experiential meetings. Dubai's MICE scene has embraced this trend wholeheartedly, offering unique experiences such as desert safaris, cultural tours, and interactive workshops that leave a lasting impact on participants.

4. Sustainable Events: Green Initiatives Shaping Dubai's MICE Industry

Sustainability is no longer an afterthought but a core pillar of MICE events in Dubai. From eco-friendly venues equipped with renewable energy solutions to waste reduction initiatives and carbon offset programs, event planners can align their events with sustainable practices while contributing to Dubai's green initiatives.

5. Tech Innovations Driving Engagement: Leveraging Digital Solutions for Impactful Events

Technology continues to revolutionize MICE tourism in Dubai, with innovations like AI-powered event analytics, live polling tools for audience engagement, and mobile event apps that streamline communication and networking. Event planners can harness these tech advancements to create immersive and interactive experiences that resonate with attendees.

Navigating Dubai's MICE Scene: Tips for Event Planners

Understand Cultural Sensitivities: Dubai's cultural nuances play a significant role in event planning. Familiarize yourself with local customs and etiquette to ensure a smooth and respectful experience for all participants.

Plan Ahead for Permits and Regulations: Dubai has specific regulations and permit requirements for events. Work closely with Global DMC travel solutions to navigate these processes and secure necessary approvals well in advance.

Embrace Collaboration and Partnerships: Leverage partnerships with local vendors, venues, and suppliers to enhance your event's offerings and create memorable experiences for attendees.

Stay Flexible and Adapt: The MICE landscape is constantly evolving. Stay agile and be prepared to adapt your plans based on emerging trends, attendee feedback, and industry dynamics.

Focus on Delegate Experience: Ultimately, the success of a MICE event in Dubai hinges on the delegate experience. Prioritize attendee satisfaction, engagement, and comfort to ensure a memorable and impactful event.

In conclusion, Dubai's MICE tourism presents a wealth of opportunities for event planners seeking to create exceptional experiences. By staying abreast of the latest trends, leveraging Global DMC travel solutions for seamless logistics, and focusing on attendee engagement and sustainability, planners can unlock the full potential of Dubai's dynamic MICE scene.

#DubaiMICE#EventPlanning#GlobalDMC#EventSuccess#MICEInsights#DubaiTrends#MICEExperts#EventProfs#DMCSolutions#MICETravel

2 notes

·

View notes

Text

Ultimate Guide to Starting a Business in Dubai: Everything You Need to Know

Understanding Dubai’s Business Landscape

Dubai has a diverse and dynamic business landscape, catering to various industries such as trade, tourism, finance, real estate, and technology. It is essential to research and understand the market demand, competition, and potential opportunities for your proposed business idea.

Choosing the Right Business Structure

Dubai offers several business structures, including sole proprietorship, limited liability company (LLC), branch office, and free zone company. Each structure has its own advantages, requirements, and regulations. Selecting the appropriate structure is crucial for your business’s growth, liability protection, and tax implications.

Obtaining the Necessary Licenses and Approvals

Starting business in Dubai, UAE requires obtaining the necessary licenses and approvals from the relevant authorities. These may include trade licenses, commercial licenses, and other industry-specific permits. The process can be complex, so it’s advisable to seek guidance from legal experts or business consultants.

Free Zones: A Viable Option for Foreign Investors

Dubai’s free zones offer attractive incentives for foreign investors, such as 100% foreign ownership, tax exemptions, and streamlined business setup processes. Popular free zones include Dubai Multi Commodities Centre (DMCC), Dubai Internet City (DIC), and Dubai Design District (D3).

Finding the Right Location and Office Space

Choosing the right location and office space is essential for your business’s success. Dubai offers a range of options, from modern office towers to shared workspaces and free zone facilities. Consider factors such as accessibility, infrastructure, and proximity to your target market.

Hiring and Managing a Team

Building a strong and talented team is crucial for your business’s growth. Dubai’s diverse workforce offers a pool of skilled professionals from various backgrounds. However, it’s important to understand the local labor laws, visa requirements, and cultural nuances when hiring and managing employees.

Banking and Financial Considerations

Establishing a business banking account, securing funding, and managing finances are critical aspects of start business in Dubai. Research the local banking system, explore financing options (such as bank loans, investors, or government initiatives), and develop a solid financial plan.

Marketing and Promoting Your Business

With a competitive business environment, effective marketing and promotion strategies are essential for your business’s success. Leverage digital marketing, networking events, tradeshows, and other channels to reach your target audience and build brand awareness.

Complying with Legal and Regulatory Requirements

Dubai has a comprehensive legal and regulatory framework governing business operations. Familiarize yourself with the relevant laws, regulations, and compliance requirements to ensure your business operates legally and avoids penalties or fines.

Seeking Professional Assistance

Starting business in UAE can be a complex process, especially for those new to the region. Consider seeking professional assistance from business consultants, lawyers, or accountants to navigate the process smoothly and avoid costly mistakes.

Start business in Dubai can be a rewarding and lucrative endeavor, but it requires careful planning, understanding of the local business landscape, and adherence to the relevant laws and regulations. By following this ultimate guide and seeking professional advice when needed, you can increase your chances of success in this dynamic and thriving business hub.

2 notes

·

View notes

Text

Trail of the Lost

This new book by Andrea Lankford is reviewed by Claire Shang. Here is an excerpt of her review. The book is yet another interesting twist on the Pacific Crest Trail.

How do you find someone who goes missing is the vastness of the Pacific Crest Trail? Andrea Lankford, who led search-and-rescue operations as a National Park Service ranger for 12 years, has a better understanding than most. She knows, for instance, that it's quite difficult to truly disappear: 97% of lost hikers -- alive or dead -- are located within 24 hours, and half of adult hikers are found less than two miles from where they were last seen.

Her attention was therefore caught by a trio of recent lost-hiker cases that has gone cold. Chris Sylvia, Kris Fowler, and David O'Sullivan -- all young unmarried men who disappeared in consecutive years beginning in 2015 -- were among the rare cases of PCT thru-hikers whose bodies were not found. Lankford catalogs the many attempts that she and other have made to resolve these cases. But anyone expecting the straightforward unfolding of a mystery should look elsewhere. Lankford gives us instead the story of a group of searchers "obsessed, each in our own way, until our dogged pursuit for answers jeopardized our livelihoods, our mental stamina, and our health."

Even as she sought the help of law enforcement, Lankford, who retired as a ranger two decades ago, knew to expect bureaucratic obstinance. Missing-person cases complicate the issue of jurisdiction, officers are slow to act on tips and when the subject is an adult male, "law enforcement typically concludes that the guy doesn't want to be found." Further, when hikers go missing in national forests, the responsibility for conducting a search falls on local sheriffs who have little incentive to sink resources into finding presumably dead hikers from other states or countries. (O'Sullivan was an Irish national, and it was months before a local police department claimed his case.)

The three searches, separate but often intertwined, take on a spirit of hardy vigilantism. Facebook groups buzz with leads -- when an image surfaces from a Brazil hospital of an unconscious man who looks like Kris Fowler, a Brazilian thru-hiker volunteers to drive eight hours to see if the patient has Kris's back tattoo. He doesn't, but he is revealed to be a Canadian missing person. Volunteers squint at thousands of drone photographs, flagging backpacks and bones that turn out to be shadows.

In David O'Sullivan's case, Lankford joins the efforts of others, including a former drugstore manager whose thru-hiking aspirations were thwarted by injury. Lankford, whose love of the outdoors was forever tarnish[ed]" by her ranger years, finds the idealism of volunteer searchers heartening. But the very determination displayed by amateurs to bring closure to O'Sullivan's parents at times introduces new setbacks. One self-proclaimed expert brandishes academic credentials and claims his soon-to-be patented dowsing device will locate O'Sullivan through his DNA frequencies. At another point, an "intrusive investigator" offers aid -- but the psychic is unable to identify which boulder is the one from her vision.

Even the searchers unclouded by 'magical thinking' worry whether their efforts are more hurtful than helpful to the families. Lankford herself can't account for the intensity of her commitment. As we learn, each thru-hikers sets off for a different reason. The new, frequently underprepared hikers see the trail "as less a test and more a cure," writes Lankford. Those who search for the missing might also be modeling their behavior on misleading narratives. As one grief counselor notes: "Hollywood movies tell [families] persistence pays off."

Trail of the Lost stumbles along its journey. Lankford has a propensity to overuse the adjective 'cute', and one of the sources she cites is an undergraduate thesis. But one accepts the author's idiosyncrasies because it is hard to imagine who else could have produced a work like this. Her book is a sprawling portrait of an area whose fantastical features practically necessitate the use of metaphor. Above all, this is a profile of two subcultures: hikers and their searchers, who share inconceivable tenacity and sometimes a similar desperation.

We have included stories of missing hikers in the Pacific Crest Trailside Reader: California (2011) and in Crossing Paths (2022). Particularly noteworthy is Ryan Forsythe's story of hiker John Joseph Donovan who was lost in the San Jacintos in 2005 is a fascinating read. Donovan disappearance ultimately saves the lives of Gina Allen and Brandon Day.

1 note

·

View note

Text

Is There a Great Construction Consultant for Commercial Real Estate and Multifamily Development?

Real estate construction consultants have become increasingly important in the current economy, particularly in the development of commercial real estate and multifamily housing. As the real estate market continues to flourish, there is increased competition among developers to secure projects and complete them on time and on budget. It is therefore increasingly important for developers to partner with experienced construction consultants that can help them navigate the ever-changing landscape of building regulations, zoning standards, and other legal requirements.

BC Group Inc. is a full-service construction consulting firm that specializes in providing comprehensive advice on commercial real estate development and multifamily housing projects throughout the western United States focusing on Oregon and Washington. With more than 20 years of experience in the industry, BC Group has established itself as one of the leading multifamily development advisors. The company provides comprehensive advice on how to maximize value from each project through efficient planning, budgeting, execution, and delivery stages.

At BC Group their team consists of highly trained experts who are familiar with all aspects of developing successful projects in any market. Their team includes architectural designers, construction specialists, financial advisors, attorneys, engineers, surveyors, draftspeople, and project managers – all working together to ensure that each project meets or exceeds clients’ expectations while staying within budget constraints. By leveraging their expertise in design-build delivery systems along with effective cost estimating tools such as electronic document management systems (EDMS), BC Group’s team can minimize risk exposure while maximizing quality assurance during every stage of development.

In addition to providing consulting services for both commercial real estate developments and multifamily housing projects nationwide, BC Group’s team is also well versed in public/private partnerships (PPP) agreements for local ordinances or state legislation related to green initiatives or emerging technologies like solar or wind power systems. By leveraging their PPP experience early on in the development process they can help clients find opportunities for incentive funding or tax credits that will help make their projects more economically feasible while still meeting all applicable standards set by regulatory agencies such as HUD or EPA standards.

BC Group's services extend beyond just advising during the planning stages; they provide full-service support throughout every phase of construction including site selection/development; preconstruction planning; bid tracking and evaluation; contract negotiations; risk assessment and management; field supervision and inspection; cost control and mediation; change order management; dispute resolution assistance; completion inspections and closeout assistance; progress payment tracking/analysis; post construction warranty monitoring/resolution assistance; final punch list review/completion assistance; LEED certification compliance guidance and much more!

When it comes to finding a reliable consultant for commercial real estate development or multifamily housing needs look no further than BC Group. With decades of collective experience under their belt combined with unique strategies for minimizing risk exposure without compromising quality assurance makes them one of the premier consultancies for any budget conscious developer looking to maximize value from their investment property portfolio. Originally published at - https://bcgroup268.livejournal.com/442.html

#real estate construction consultants#commercial real estate development#multifamily development advisors

2 notes

·

View notes

Text

In the endless fight to improve cybersecurity and encourage investment in digital defenses, some experts have a controversial suggestion. They say the only way to make companies take it seriously is to create real economic incentives—by making them legally liable if they have not taken adequate steps to secure their products and infrastructure. The last thing anyone wants is more liability, so the idea has never exploded in popularity, but a national cybersecurity strategy from the White House this week is giving the concept a prominent boost.

The long-awaited document proposes stronger cybersecurity protections and regulations for critical infrastructure, an expanded program to disrupt cybercriminal activity, and a focus on global cooperation. Many of these priorities are widely accepted and build on national strategies put out by past US administrations. But the Biden strategy expands significantly on the question of liability.

“We must begin to shift liability onto those entities that fail to take reasonable precautions to secure their software while recognizing that even the most advanced software security programs cannot prevent all vulnerabilities,” it says. “Companies that make software must have the freedom to innovate, but they must also be held liable when they fail to live up to the duty of care they owe consumers, businesses, or critical infrastructure providers.”

Publicizing the strategy is a way of making the White House's priorities clear, but it does not in itself mean that Congress will pass legislation to enact specific policies. With the release of the document, the Biden administration seems focused on promoting discussion about how to better handle liability as well as raising awareness about the stakes for individual Americans.

“Today, across the public and private sectors, we tend to devolve responsibility for cyber risk downwards. We ask individuals, small businesses, and local governments to shoulder a significant burden for defending us all. This isn’t just unfair, it’s ineffective,” acting national cyber director Kemba Walden told reporters on Thursday. “The biggest, most capable, and best-positioned actors in our digital ecosystem can and should shoulder a greater share of the burden for managing cyber risk and keeping us all safe. This strategy asks more of industry, but also commits more from the federal government.”

Jen Easterly, director of the US Cybersecurity and Infrastructure Security Agency, had a similar sentiment for an audience at Carnegie Mellon University earlier this week. “We often blame a company today that has a security breach because they didn’t patch a known vulnerability,” she said. “What about the manufacturer that produced the technology that required too many patches in the first place?”

The goal of shifting liability to large companies has certainly started a conversation, but all eyes are on the question of whether it will actually result in change. Chris Wysopal, founder and CTO of the application security firm Veracode, provided input to the Office of the National Cyber Director for the White House strategy.

“Regulation in this area is going to be complicated and tricky, but it can be powerful if done appropriately,” he says. Wysopal likens the concept of security liability laws to environmental regulations. “You can’t simply pollute and walk away; businesses will need to be prepared to clean up their mess.”

The comparison underscores how resistant businesses will likely be to such a transition, though, particularly large, legacy tech companies whose products are used widely around the US and the world. “Some companies will welcome the strategy more than others,” Wysopal concedes.

Shawn Tuma, a partner in the law firm Spencer Fane who specializes in cybersecurity and data privacy issues, emphasizes that from an industry perspective, “the devil is in the details” on all these proposals. On legal liability, he says the debate comes down to what exactly is meant by “reasonable.”

“We all see the extremes in the continuum—we see the providers that are doing a poor job, that are just throwing stuff out there,” he says. “I’m fine for liability on them, but what about those that are trying to do their best but are engaged in an unwinnable war with well-resourced hackers? What’s ‘reasonable’?”

One point from the strategy that might see more movement is the Biden administration's proposal for some sort of federal backstop to help stabilize the cybersecurity insurance market. If liability for cybersecurity failures were to shift in any meaningful way, cybersecurity insurance would become even more vital than it already is for tech companies and others who hold sensitive data, like health care firms. But that's assuming insurance companies will cover cybersecurity incidents at all.

In late December, Mario Greco, CEO of the massive European insurer Zurich, told the Financial Times, “What will become uninsurable is going to be cyber.” The comment, made a day after Christmas, added an edge to an already tense climate in which companies grasp for safeguards and solutions as cybercriminal and nation-state attacks impose rapidly rising costs.

A government backstop like the one the national cybersecurity strategy is proposing could provide crucial reassurances, but Tuma points out that it could also come with strings attached for the insurance industry and its clients. He suggests the US government could mandate that, in exchange for its support, anyone who makes cybersecurity insurance claims would be required to report the incident to the FBI's Internet Crime Complaint Center. “They need more cooperation from the private sector in reporting these events,” Tuma says.

And this question of how to incentivize all different facets of cybersecurity investment is at the core of what the new White House strategy is grappling with.

“I feel the White House is very serious about this,” Veracode's Wysopal says. “The public-private partnership around cybersecurity is quite real in the federal government today. That is a welcome change from just a few years ago.”

5 notes

·

View notes

Text

Mastering Corporate Travel: How Satguru Travel Transforms Business Journeys in UAE

Introduction

In the dynamic business landscape of the UAE, managing corporate travel efficiently is essential for maintaining productivity and ensuring seamless operations. A reliable corporate travel management company in Dubai can make all the difference by offering tailored solutions that meet your specific needs. Satguru Travel, with its rich legacy and commitment to excellence, stands out as a premier choice for businesses seeking top-tier corporate travel management services. This blog post will explore how Satguru Travel can transform your business travel experience.

The Legacy of Satguru Travel

Since 1989, Satguru Travel has been a global leader in corporate travel management in UAE. With over 34 years of experience, they have earned a reputation for excellence by consistently delivering high-quality services. Their strategic global network and unwavering commitment to excellence ensure that every journey is meticulously planned and executed to meet the highest standards.

Key Services Offered

1. Customized Travel Solutions

Satguru Travel specializes in crafting personalized travel plans that align with your business objectives. Their corporate travel management services include:

Hotel Booking: Access to a wide range of accommodations at competitive rates.

Streamlined Booking: A cutting-edge booking tool that simplifies the reservation process.

Customized Packages: Tailored travel plans to suit your specific needs and preferences.

VIP Services: Exclusive services for high-level business trips requiring specialized attention.

2. Comprehensive MICE Solutions

As a leading MICE player, Satguru Travel provides comprehensive solutions for meetings, incentives, conferences, and exhibitions. They cater to key sectors such as pharmaceuticals, consumer durables, automotive, and financial services, ensuring every event is meticulously organized and executed.

3. Global Visa Assistance

With over 30 years of experience, Satguru Travel assists travelers to 100+ countries. Their expert guidance and unmatched support ensure seamless visa applications and travel preparations.

4. Additional Services

Transportation: Contracted fleets and personal car and driver services.

Insurance Solutions: Long-term, stable insurance solutions with top-rated carriers.

Medical Tourism: Contracted services in Dubai, Tunisia, Turkey, Morocco, and India.

Cargo & Freight Forwarding: Solutions for transport via air, sea, and road.

Private Airline Charter: Services for business and leisure pursuits globally.

DMC Service: Simplified travel with destination guides, program design, and single-point payment and accounting.

Why Choose Satguru Travel?

1. Expertise and Experience

With 34 years of experience, Satguru Travel brings a wealth of knowledge and expertise to every journey. Their passionate experts align their experience with your goals, crafting transformative travel experiences that resonate with your business narrative.

2. Strategic Global Network

Satguru Travel’s strategic global network is designed to serve your business needs. Their team is strategically positioned to provide support exactly where your business requires it, ensuring a seamless and enriching travel experience.

3. Cutting-Edge Technology

Their cutting-edge technology goes beyond industry standards, providing a seamless, efficient, and enjoyable travel experience. Experience technology that is tailored to your efficiency and tailored to your needs.

4. Tailored Solutions

Satguru Travel goes beyond conventional travel management, offering tailored solutions that drive strategic results for your business. Their expertise in designing travel programs uniquely suited to your needs ensures global excellence with local expertise.

Conclusion

Choosing Satguru Travel as your corporate travel management company in Dubai means opting for a partner dedicated to enhancing your travel experience with a legacy of excellence. By selecting Satguru Travel, you are choosing a team that brings strategic results, personalized solutions, and unparalleled service. Experience the difference with Satguru Travel and unlock the true potential of your corporate travel management needs.

#Corporate Travel Management#Corporate Travel Management Services#Corporate Travel Management Company in Dubai#Business Travel Solutions#Customized Travel Packages#VIP Travel Services#MICE Solutions#Global Visas#Leisure Travel#Business Travel Management

0 notes

Text

Ahmedabad's Solar Transformation: Leading Gujarat's Green Energy Revolution

The landscape of renewable energy in Gujarat's largest city is experiencing an unprecedented boom, with solar installation companies in Ahmedabad spearheading the transition to sustainable power solutions. As the city embraces clean energy alternatives, professional solar installers in Ahmedabad have emerged as crucial partners in helping businesses and residents make the switch to solar power effectively and efficiently.

The expertise offered by solar installation providers Ahmedabad has become increasingly sophisticated, incorporating cutting-edge technology and innovative installation methods. These companies employ advanced assessment tools to analyze site-specific factors such as solar irradiance, shading patterns, and structural requirements, ensuring each installation is optimized for maximum energy generation and long-term reliability.

What sets professional solar installers Ahmedabad apart is their comprehensive approach to project implementation. From initial consultation to final commissioning, these experts guide clients through every step of the solar adoption journey. Their services include detailed energy consumption analysis, custom system design, permit acquisition, and post-installation maintenance support, creating a seamless experience for customers transitioning to solar energy.

The solar system installation Ahmedabad sector has witnessed remarkable advancement in quality standards and installation practices. Local companies have invested heavily in training their technicians and upgrading their equipment to meet international standards. This commitment to excellence ensures that every installation, whether residential or commercial, delivers optimal performance and durability in Ahmedabad's unique climate conditions.

Solar installation companies in Ahmedabad have also played a vital role in educating the community about the benefits of solar energy. Through workshops, demonstrations, and personalized consultations, these organizations help potential customers understand the technical and financial aspects of solar adoption. This educational initiative has been crucial in building trust and awareness among local residents and businesses.

The quality of installations provided by solar installation providers Ahmedabad has set new benchmarks in the industry. Using high-grade components and following stringent installation protocols, these companies ensure that each system meets or exceeds expected performance metrics. Their attention to detail extends to aspects such as cable management, mounting system stability, and aesthetic integration with existing architecture.

Professional solar installers in Ahmedabad have developed expertise in handling diverse installation scenarios, from compact residential rooftops to large industrial complexes. Their ability to customize solutions based on specific site requirements and client needs has made solar energy accessible to a broader range of customers, contributing to the city's growing renewable energy capacity.

The solar system installation Ahmedabad market has been particularly responsive to technological innovations. Local companies stay updated with the latest developments in solar technology, offering customers access to advanced features such as smart monitoring systems, hybrid inverters, and energy storage solutions. This commitment to innovation ensures that installations remain current and efficient throughout their operational life.

Another significant advantage offered by solar installation companies in Ahmedabad is their thorough understanding of local regulations and incentive programs. They assist clients in navigating government policies, securing necessary approvals, and accessing available subsidies, making the transition to solar power more financially attractive and administratively manageable.

The impact of professional solar installers Ahmedabad extends beyond individual installations. Their work contributes to the city's broader sustainability goals, reducing carbon emissions and decreasing dependence on conventional power sources. The cumulative effect of their installations has positioned Ahmedabad as a leader in urban solar adoption. Solar installation providers Ahmedabad have also demonstrated remarkable adaptability in meeting evolving market demands. Whether it's incorporating new safety protocols, adjusting to regulatory

0 notes

Text

Payroll Processing in India by MAS LLP: Streamlining Your Business Operations

In today’s fast-paced business environment, efficient payroll management is essential for any organization. Payroll processing involves managing employee salaries, benefits, taxes, and deductions, making it a complex and time-consuming task. For businesses operating in India, outsourcing payroll processing to professional services like MAS LLP can offer immense benefits, allowing you to focus on your core business while ensuring compliance with local regulations.

What is Payroll Processing? Payroll processing refers to the administration of employees' financial records, including salaries, bonuses, deductions, and net pay. It also encompasses tasks like generating payslips, managing leave entitlements, and ensuring timely tax payments. In India, payroll processing must adhere to various legal requirements, including labor laws, tax regulations, and statutory compliances such as Provident Fund (PF), Employee State Insurance (ESI), and professional tax.

Why Choose Payroll Processing in India by MAS LLP? MAS LLP is a trusted provider of payroll services in India, known for its efficient and accurate payroll management solutions. Here’s why MAS LLP is the right partner for your business:

Expertise in Local Compliance India’s payroll system is governed by multiple laws and regulations that vary across states. MAS LLP’s team of payroll experts ensures your business stays compliant with all statutory requirements, reducing the risk of fines and legal complications.

Customized Solutions MAS LLP understands that every business has unique payroll needs. They offer tailored payroll processing solutions that fit the size and scope of your business, ensuring seamless operations without unnecessary costs.

Cutting-Edge Technology With the integration of modern payroll software, MAS LLP provides automated payroll services that minimize errors and ensure data security. Their technology-driven approach enables real-time reporting, helping businesses monitor their payroll activities efficiently.

Cost-Effective Services Managing payroll in-house can be resource-intensive, requiring dedicated staff and software tools. Outsourcing payroll processing to MAS LLP helps reduce overhead costs while ensuring professional management of your payroll functions.

Focus on Core Business By outsourcing payroll tasks to MAS LLP, companies can redirect their focus toward strategic growth and core operations, rather than being bogged down by administrative duties.

Key Payroll Services Offered by MAS LLP MAS LLP offers a comprehensive range of payroll services, including:

Salary Calculation and Disbursement: Timely calculation and payment of employee salaries, bonuses, and incentives. Tax Management: Handling employee income tax, TDS (Tax Deducted at Source) calculations, and filing returns. Statutory Compliance: Management of Provident Fund (PF), Employee State Insurance (ESI), and other statutory deductions. Payslip Generation: Providing detailed and compliant payslips to employees. Leave and Attendance Management: Accurate tracking and integration of employee leave and attendance into payroll. Employee Data Management: Maintaining up-to-date employee records for payroll and statutory purposes. The Importance of Accurate Payroll Processing in India Accurate payroll processing is critical for employee satisfaction, legal compliance, and financial health. Errors in payroll can lead to dissatisfaction among employees, tax penalties, and damage to your company's reputation. By partnering with MAS LLP, businesses in India can ensure that their payroll is handled with precision, avoiding any potential pitfalls.

Why Payroll Processing is a Challenge in India India's payroll landscape is complicated due to:

Diverse Labor Laws: Each state in India has its own labor regulations, which makes staying compliant a complex task. Frequent Changes in Tax Laws: Payroll processing involves staying up-to-date with frequent changes in tax rates, deductions, and statutory compliances. Cultural Nuances: Payroll needs to reflect various allowances and benefits specific to Indian employees, making it more intricate than in many other countries. MAS LLP helps businesses navigate these challenges effortlessly, ensuring smooth payroll operations.

Conclusion For businesses operating in India, efficient payroll processing is crucial for legal compliance and employee satisfaction. By partnering with MAS LLP, companies can access expert payroll services that streamline their operations, reduce administrative burdens, and ensure accurate and timely payroll management.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

4 notes

·

View notes

Text

How Product Sourcing and Supply Chain Consulting Firms in India Are Revolutionizing Business

Global sourcing is absolutely vital for businesses trying to increase their footprint and save expenses in the modern corporate environment. India is one nation that clearly ranks highly for goods procurement. India has grown to be a preferred location for companies all around because of its large resources, qualified workforce, and reasonably priced manufacturing. Maintaining competitiveness in the fast-paced economy of today requires a knowledge of the importance of product procurement in India and how it may help a company.

The Appeal of Product Sourcing in India

India has become known as a pioneer in product sourcing India, drawing companies from many different industries. The nation's varied manufacturing capacity makes it a perfect place to source anything from consumer goods and textiles and machinery to electronics. Purchasing goods from India appeals also in part to the competitive prices and availability of raw materials. India offers a lot of often missed possibilities for companies looking for reasonably priced quality goods.

Leveraging Cost-Effectiveness with Product Sourcing in India

Access to reasonably priced manufacturing solutions is one of the main advantages of product sourcing India. For companies, India presents a special mix of reasonably priced labor, infrastructure, and government incentives. Many businesses are turning their attention to India since they may cut significant expenses without sacrificing quality of products. Large-scale manufacturing capacity and effective production techniques guarantee that companies may satisfy demand and maintain control of costs.

Overcoming Challenges in Product Sourcing India

Although product sourcing India presents several benefits, companies have to negotiate certain difficulties. Without the required knowledge, managing logistics, guaranteeing consistent quality, and selecting appropriate suppliers can all be difficult. Thankfully, corporations may rely on skilled sourcing firms to expedite procedures. These professionals provide services, including supplier screening, quality assurance, and negotiating, thereby streamlining the procurement process and lowering the risks.

The Role of Supply Chain Consulting Firms in India

Many times, companies seeking operational optimization and efficiency resort to Supply chain consulting firms in India. These organizations offer strategic advice and services to assist businesses in controlling costs, risk management, and supply chain operations enhancement. Using supply chain consultants' experience helps companies find bottlenecks, simplify procedures, and maximize their whole supply chain network. These companies help to improve operational effectiveness and guarantee companies stay competitive in the worldwide market.

How Supply Chain Consulting Firms in India Add Value

Supply chain consulting firms in India presents an insightful analysis of the difficulties in running a worldwide supply chain. These companies offer complete solutions spanning procurement and manufacturing to distribution and logistics. Consulting firms assist companies in overcoming obstacles such as changing demand, shipment delays, and regulatory concerns by means of their thorough awareness of both local and worldwide markets. Their ability to design customized plans guarantees companies keep a consistent and reasonably priced supply chain.

Streamlining Operations with Supply Chain Consulting Firms in India

Working with supply chain consulting firms in India lets companies use modern tools and technologies to simplify their supply chain processes. These experts create ideal supply chain plans based on data-driven insights that lower lead times, boost inventory control, and increase general efficiency by means of which They also enable companies to spot possible hazards and create backup plans, therefore guaranteeing seamless operations in spite of outside events as political unrest or natural calamities.

Conclusion

Ultimately, for companies looking for efficiency and expansion, knowledge of supply chain consulting companies in India and product sourcing in India is quite valuable. Businesses may get reasonably priced goods, streamline supply chain operations, and stay competitive in a market growingly complicated by the appropriate sourcing partners and experts. Visit ppsourcing.com for customized solutions that inspire success and creativity to investigate how professional sourcing and consulting services could improve company operations.

0 notes