#Lithium Metal Market Share

Explore tagged Tumblr posts

Text

Lithium Metal Market worth $6.4 billion by 2028

The lithium metal market is projected to grow from USD 2.5 billion in 2023 to USD 6.4 billion by 2028, at a CAGR of 20.4% from 2023 to 2028. The market's growth is driven by the rising demand for lithium metal in various applications such as anode material, intermediate in the pharmaceutical industry, and metal processing.

#Lithium Metal Market#Lithium Metal Market Size#Lithium Metal Market Share#Lithium Metal Market Analysis#Lithium Metal Market Trends#Lithium Metal Market Report#Lithium Metal Market Research#Lithium Metal Industry

1 note

·

View note

Text

The Future of Mining: Sustainability and Ethical Sourcing

The mining industry is undergoing a profound transformation. As the global demand for raw materials like lithium, cobalt, and rare earth elements surges, driven by renewable energy technologies and electric vehicles, the emphasis on sustainability and ethical sourcing has never been more crucial. This shift is not just a moral imperative but a business necessity, with stakeholders demanding transparency and responsibility throughout the supply chain.

The Push for Sustainability in Mining

Mining has long been associated with significant environmental challenges, including habitat destruction, water contamination, and carbon emissions. However, modern technologies and innovative practices are paving the way for greener operations.

Renewable Energy Integration: Mining companies are increasingly adopting renewable energy sources such as solar and wind to power their operations. For instance, some mines in Chile and Australia now operate entirely on renewable energy, reducing their carbon footprint and operational costs.

Circular Economy Practices: Recycling metals from electronic waste and repurposing mining byproducts are becoming more common. These initiatives not only reduce the need for virgin material extraction but also address the issue of mining waste.

Water Management Innovations: Water is a critical resource in mining, often used in large quantities for processing minerals. Companies are investing in technologies to recycle water and reduce consumption, ensuring minimal impact on local communities and ecosystems.

Ethical Sourcing: A Growing Priority

Consumers and businesses alike are increasingly prioritizing ethically sourced materials. This trend has put pressure on the mining industry to ensure fair labor practices, community welfare, and environmental stewardship.

Fair Labor Practices: Reports of child labor and unsafe working conditions in some mining regions have raised global concerns. Ethical sourcing requires adherence to international labor standards and active monitoring of supply chains to prevent exploitation.

Community Engagement: Mining operations often disrupt local communities. Ethical sourcing involves consulting with and compensating affected populations, ensuring that mining benefits are shared equitably. Initiatives such as community-driven mining agreements are fostering collaboration and trust.

Transparency and Certification: Organizations like the Responsible Mining Initiative and Fairmined Certification are helping companies demonstrate their commitment to ethical practices. Blockchain technology is also being used to trace materials from mine to market, providing verifiable proof of ethical sourcing.

The Role of Innovation

Innovation is a cornerstone of the mining industry’s sustainable future. From automation and artificial intelligence to reduce waste and increase efficiency, to biotechnologies that use microbes to extract metals in a less invasive manner, the possibilities are vast. Additionally, partnerships with tech companies are helping mining firms harness data for better decision-making and improved sustainability outcomes.

Challenges and Opportunities Ahead

Despite these advancements, the path to sustainability and ethical sourcing in mining is not without challenges. High implementation costs, lack of regulatory frameworks in some regions, and the complexity of global supply chains are significant hurdles. However, these challenges also present opportunities for collaboration between governments, NGOs, and the private sector.

Conclusion

The future of mining lies at the intersection of sustainability and ethical sourcing. As the world transitions to a greener economy, the mining industry has a pivotal role in ensuring that the materials powering this change are sourced responsibly. By embracing innovation, transparency, and community collaboration, the mining sector can pave the way for a more ethical and sustainable future.

2 notes

·

View notes

Text

Lithium-Ion Battery Recycling Market, Share, Size, Trends, Research and Future

"Global Lithium-Ion Battery Recycling Market - Size, Share, Demand, Industry Trends and Opportunities

Global Lithium-Ion Battery Recycling Market, By Component (Active Material, Non-Active Material), Chemistry (Lithium-Nickel Manganese Cobalt (Li-NMC), Lithium Cobalt Oxide (LCO), Lithium-Manganese Oxide (LMO), Lithium-Iron Phosphate (LFP), Lithium-Nickel Cobalt Aluminium Oxide (NCA), Lithium-Titanate Oxide (LTO)), Recycling Process (Hydrometallurgical Process, Pyrometallurgy Process, Physical/ Mechanical Process) – Industry Trends.

Access Full 350 Pages PDF Report @

**Segments**

- **Technology**: The lithium-ion battery recycling market can be segmented based on technology into hydrometallurgical process, pyrometallurgical process, mechanical process, direct recycling, and others. The hydrometallurgical process involves the use of liquid solvent to extract valuable metals, while the pyrometallurgical process uses high temperatures to separate components. Mechanical processes involve crushing and sorting to recover valuable materials. Direct recycling focuses on reusing cells from batteries without dismantling.

- **Battery Chemistry**: Another significant segmentation factor is based on battery chemistry, including lithium-nickel-manganese-cobalt (Li-NMC), lithium-iron-phosphate (LiFePO4), lithium-titanate oxide (LTO), lithium-manganese oxide (LMO), and others. Different chemistries require specific recycling methods due to variations in metal content and structure, influencing the overall recycling process and efficiency.

- **End-Use**: The end-use segment categorizes the lithium-ion battery recycling market based on applications like automotive, power, industrial, and others. The automotive sector is a key driver for battery recycling due to the increasing penetration of electric vehicles. The power sector also plays a vital role in driving demand for recycled batteries as energy storage solutions gain prominence.

**Market Players**

- **Umicore**: Umicore is a prominent player in the lithium-ion battery recycling market, offering recycling solutions for various industries. The company's expertise in sustainable technologies and material recycling positions it as a key player in the market.

- **Eco-Bat Technologies**: Eco-Bat Technologies specializes in lead battery recycling but has expanded its operations to include lithium-ion battery recycling. The company's focus on environmental sustainability and circular economy principles enhances its market presence.

- **Retriev Technologies**: Retriev Technologies is known for its innovative approaches to battery recycling, including advanced separation technologies and material recovery processes. The company's commitment to efficiency and environmental responsibility drives its competitiveness inUmicore's strong presence in the lithium-ion battery recycling market can be attributed to its significant investment in sustainable technologies and material recycling solutions. The company's expertise in recovering valuable metals from spent batteries and converting them into high-quality products positions it as a leader in the industry. Umicore's focus on innovation and continuous improvement in recycling processes allows it to offer efficient and environmentally friendly solutions to a wide range of industries, contributing to the overall growth of the market.

Eco-Bat Technologies' expansion into lithium-ion battery recycling reflects the increasing demand for sustainable recycling practices in the battery industry. The company's strong emphasis on environmental sustainability and adherence to circular economy principles align well with the growing concerns about resource conservation and waste management. By leveraging its experience in lead battery recycling and applying it to lithium-ion batteries, Eco-Bat Technologies is able to cater to a broader market base and meet the evolving needs of customers looking for eco-friendly recycling solutions.

Retriev Technologies' reputation for innovative approaches to battery recycling sets it apart in the market. The company's investment in advanced separation technologies and material recovery processes allows it to achieve higher efficiency and accuracy in extracting valuable materials from used batteries. By prioritizing environmental responsibility and adopting sustainable practices in its operations, Retriev Technologies not only meets regulatory requirements but also appeals to environmentally conscious consumers and businesses seeking reliable recycling partners.

Overall, the competitive landscape of the lithium-ion battery recycling market is characterized by the presence of established players like Umicore, Eco-Bat Technologies, and Retriev Technologies, each bringing unique strengths and capabilities to the table. As the demand for battery recycling services continues to rise, companies that can offer efficient, cost-effective, and environmentally sustainable solutions will likely gain a competitive edge in the market. Collaboration between market players, government bodies, and industry stakeholders will be essential to drive innovation, standardization, and scalability in the battery recycling ecosystem, leading to a more sustainable and circular approach to managing end-of-life batteries.**Segments**

- **Global Lithium-Ion Battery Recycling Market, By Component (Active Material, Non-Active Material), Chemistry (Lithium-Nickel Manganese Cobalt (Li-NMC), Lithium Cobalt Oxide (LCO), Lithium-Manganese Oxide (LMO), Lithium-Iron Phosphate (LFP), Lithium-Nickel Cobalt Aluminium Oxide (NCA), Lithium-Titanate Oxide (LTO)), Recycling Process (Hydrometallurgical Process, Pyrometallurgy Process, Physical/ Mechanical Process) – Industry Trends and Forecast to 2030.**

The lithium-ion battery recycling market can be further understood by examining its various segments. The technology segment plays a crucial role in determining the recycling process used, with methods such as hydrometallurgical, pyrometallurgical, mechanical, and direct recycling being prevalent. These different technologies offer unique advantages and efficiencies in extracting valuable materials from spent batteries. Battery chemistry is another key segment, as different chemistries like Li-NMC, LiFePO4, LTO, and LMO require specific recycling methods due to variations in their composition. The end-use segment focuses on applications like automotive, power, and industrial sectors, with the automotive industry being a significant driver in the demand for battery recycling services due to the surge in electric vehicle adoption.

**Market Players**

Umicore's strong presence in the lithium

Highlights of TOC:

Chapter 1: Market overview

Chapter 2: Global Lithium-Ion Battery Recycling Market

Chapter 3: Regional analysis of the Global Lithium-Ion Battery Recycling Market industry

Chapter 4: Lithium-Ion Battery Recycling Market segmentation based on types and applications

Chapter 5: Revenue analysis based on types and applications

Chapter 6: Market share

Chapter 7: Competitive Landscape

Chapter 8: Drivers, Restraints, Challenges, and Opportunities

Chapter 9: Gross Margin and Price Analysis

Key takeaways from the Lithium-Ion Battery Recycling Market report:

Detailed considerate of Lithium-Ion Battery Recycling Market-particular drivers, Trends, constraints, Restraints, Opportunities and major micro markets.

Comprehensive valuation of all prospects and threat in the

In depth study of industry strategies for growth of the Lithium-Ion Battery Recycling Market-leading players.

Lithium-Ion Battery Recycling Market latest innovations and major procedures.

Favorable dip inside Vigorous high-tech and market latest trends remarkable the Market.

Conclusive study about the growth conspiracy of Lithium-Ion Battery Recycling Market for forthcoming years.

Browse Trending Reports:

Rubella Treatment Market Continuous Positive Airway Pressure (CPAP) Market Per Diem Nurse Staffing Market Windsurfing Equipment Market High-Barrier Pouches Market Roofing Materials Market Augmented Analytics Market Spinal Allografts Market Egg Processing Market Malware Analysis Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

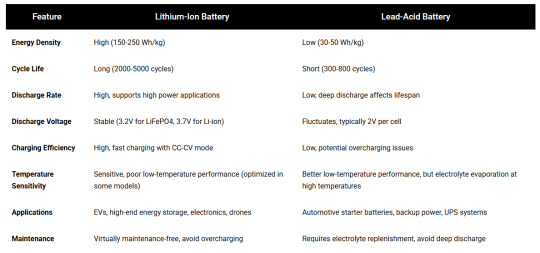

Comparison of Chemistry Lithium-Ion and Lead-Acid Batteries

1. Chemistry and Structure of Lithium-Ion Batteries

Lithium-ion batteries consist of a cathode (commonly lithium metal oxides such as LiCoO2, LiFePO4), an anode (graphite or other carbon materials), an electrolyte (lithium salts dissolved in an organic solvent), and a separator. During charge and discharge, lithium ions move between the cathode and anode, enabling energy storage and release.

2. Chemistry and Structure of Lead-Acid Batteries

3. Comparison Table

Conclusion

Lithium-ion batteries offer higher energy density, longer lifespan, and more efficient charging, making them the preferred choice for modern applications. However, lead-acid batteries still hold a market share in cost-sensitive areas. As lithium battery technology advances, its adoption is expected to expand further.

0 notes

Text

Lithium-Ion Battery Recycling Market Size, Share, and Growth Analysis (2025–2032)

The global shift toward sustainable energy and electrification is driving exponential growth in the lithium-ion battery recycling market. As electric vehicles (EVs), portable electronics, and renewable energy storage systems become increasingly mainstream, the demand for efficient recycling of spent lithium-ion batteries is reaching new heights. Between 2025 and 2032, the lithium-ion battery recycling sector is expected to transition from a niche market to a critical component of the global clean energy ecosystem.

Lithium-Ion Battery Recycling Market size is poised to grow from USD 4.61 Billion in 2024 to USD 18.18 Billion by 2032, growing at a CAGR of 21.6% during the forecast period from 2025 to 2032, depending on technology adoption rates, regulatory enforcement, and supply chain dynamics. This explosive growth is driven primarily by the surge in electric vehicle (EV) usage and the increasing emphasis on circular economy practices across industries.

Request Sample of the Report - https://www.skyquestt.com/sample-request/lithium-ion-battery-recycling-market

Market Segmentation Overview

By Battery Chemistry:

Lithium Nickel Manganese Cobalt Oxide (NMC): Dominates the market due to its widespread application in EVs.

Lithium Iron Phosphate (LFP): Gaining ground, especially in the Chinese market.

Lithium Cobalt Oxide (LCO): Primarily used in portable electronics like smartphones and laptops.

Others: Include lithium manganese oxide (LMO) and lithium titanate (LTO).

By Source:

Electric Vehicles (EVs): Largest and fastest-growing segment, expected to dominate throughout the forecast period.

Consumer Electronics: Includes smartphones, laptops, tablets, and wearables.

Industrial Batteries: Used in energy storage systems (ESS), robotics, and backup power applications.

By Recycling Process:

Hydrometallurgical Processing: Uses aqueous solutions to recover metals. It is more environmentally friendly and energy-efficient.

Pyrometallurgical Processing: Involves high-temperature smelting, less eco-friendly but widely used.

Direct Recycling: An emerging technology that retains cathode structure to save energy and material costs.

Get Customized Reports with your Requirements - https://www.skyquestt.com/speak-with-analyst/lithium-ion-battery-recycling-market

Regional Insights

Asia-Pacific: The Global Leader - Asia-Pacific, led by China, Japan, South Korea, and India, dominates the global lithium-ion battery recycling market. China's aggressive EV targets and control over global battery supply chains have made it a recycling powerhouse. The region accounts for over 50% of global market share and is home to industry leaders like GEM Co., CATL, and BYD.

Europe: Rapid Regulatory and Market Expansion - Europe is expected to see the fastest growth rate during the forecast period, supported by stringent EU regulations, an ambitious Green Deal, and the rising number of EVs on the road. Germany, Norway, and France are at the forefront, investing in closed-loop battery systems and recycling infrastructure.

North America: Investment in Infrastructure - The United States and Canada are investing heavily in recycling facilities to reduce dependence on imported materials. Companies like Redwood Materials, Li-Cycle, and American Battery Technology Company are scaling up domestic recycling operations to support local EV and electronics industries.

Competitive Landscape

The market is highly competitive and fragmented, with a mix of established players and innovative startups. Major players include:

Li-Cycle (Canada)

Umicore (Belgium)

GEM Co. Ltd. (China)

Retriev Technologies (U.S.)

Redwood Materials (U.S.)

Neometals (Australia)

These companies are investing in advanced recycling technologies, strategic partnerships with automakers, and global expansion to capture market share.

Read More for Better Understanding - https://www.skyquestt.com/report/lithium-ion-battery-recycling-market

Key Growth Drivers

Explosive EV Market Growth - Electric vehicles are a primary catalyst behind the rising demand for lithium-ion battery recycling. As EV production ramps up to meet climate goals, millions of batteries are expected to reach end-of-life status over the next decade. Recycling these batteries will be essential not only for sustainability but also for cost reduction and resource conservation.

Rising Demand for Critical Raw Materials - Lithium, cobalt, nickel, and manganese are essential metals used in lithium-ion battery production. However, these materials are limited in supply, expensive to mine, and geographically concentrated in a few countries. Recycling presents a practical and economically viable method for recovering these valuable elements and ensuring a stable supply chain for future battery manufacturing.

Stringent Environmental Regulations - Governments worldwide are introducing legislation mandating the safe disposal and recycling of batteries. Policies such as the EU Battery Directive, the U.S. Department of Energy's battery recycling R&D programs, and various EPR (Extended Producer Responsibility) laws are setting ambitious targets for battery collection and reuse. These initiatives are expected to significantly boost the recycling market.

Sustainability and ESG Goals - Corporate sustainability commitments and investor pressure are prompting automotive and tech companies to adopt circular practices. Recycling lithium-ion batteries aligns with environmental, social, and governance (ESG) goals, helping firms lower their carbon footprints and reduce dependency on raw material mining.

Challenges Facing the Market

Despite its potential, the lithium-ion battery recycling market is not without obstacles:

High Initial Costs: Setting up recycling plants with advanced processing technology requires substantial investment. Smaller companies often face financial hurdles in scaling up operations.

Lack of Standardization: Battery packs vary widely in design, chemistry, and size, making it difficult to implement a one-size-fits-all recycling process.

Collection and Logistics: Efficiently collecting, transporting, and disassembling used batteries is logistically complex and can be hazardous without proper handling procedures.

Regulatory Inconsistencies: Diverse and evolving regulations across countries create compliance burdens and hinder global operational efficiency.

Future Outlook and Opportunities

The future of the lithium-ion battery recycling market is promising, with numerous opportunities for innovation, policy leadership, and market expansion. Advancements in AI-powered battery sorting, robotic disassembly, and eco-friendly chemical processing are expected to transform the industry. Additionally, global cooperation on setting standards and supporting innovation through funding and R&D will be crucial. Governments that incentivize local recycling infrastructure and support circular battery value chains will be better positioned to capitalize on the economic and environmental benefits.

#Lithium-Ion Battery Recycling Market#Lithium-Ion Battery Recycling Industry#Lithium-Ion Battery Recycling Market Size#Lithium-Ion Battery Recycling Market Forecast

0 notes

Text

Investment Insights: Growth Pathways in the Electric Scooter Market

Introduction

The global electric scooter market is riding a wave of innovation, environmental awareness, and urban transformation. As cities become more congested and climate change concerns rise, electric scooters (e-scooters) have emerged as a viable alternative for short-distance commuting. Combining eco-friendliness, affordability, and convenience, these two-wheelers are changing the face of personal mobility.

In the coming decade, the market is expected to witness explosive growth, driven by technological innovation, government incentives, and a shift toward sustainable urban transport systems. From shared micro-mobility platforms to private e-scooter ownership, the demand is surging globally.

Market Overview

Market Size and Forecast

In 2023, the global electric scooter market was valued at approximately USD 25.3 billion. By 2032, it is projected to reach USD 68.9 billion, expanding at a compound annual growth rate (CAGR) of 11.4%. Asia-Pacific dominates the current market, but North America and Europe are rapidly catching up due to supportive regulatory frameworks and urban mobility trends.

Download a Free Sample Report:-https://tinyurl.com/5n82xejv

Key Market Drivers

Environmental Awareness and Sustainability

E-scooters contribute significantly to reducing carbon emissions. With increasing global concern about air quality and fossil fuel dependency, electric scooters are being viewed as a climate-friendly solution to last-mile transportation.

Rising Urbanization and Traffic Congestion

Over 56% of the world's population now lives in urban areas. The resulting traffic congestion has created a demand for compact, efficient, and fast transport solutions. E-scooters provide a seamless alternative for intra-city commuting.

Government Initiatives and Incentives

Many countries are implementing incentives like subsidies, tax rebates, and exemption from registration fees to encourage the adoption of electric vehicles, including scooters. Infrastructure development, such as dedicated lanes and charging points, is also boosting adoption.

Tech-Driven Ecosystem

The integration of IoT, GPS, Bluetooth, and smartphone apps in modern e-scooters is creating a smart, user-friendly experience. Features like anti-theft systems, location tracking, and ride analytics are enhancing value for both private owners and shared fleets.

Market Segmentation

By Product Type

Retro E-Scooters

Folding E-Scooters

Self-balancing E-Scooters

Folding e-scooters are increasingly popular among commuters for their portability and ease of storage, while retro-style models appeal to style-conscious consumers.

By Battery Type

Sealed Lead Acid (SLA)

Lithium-ion (Li-ion)

Nickel Metal Hydride (NiMH)

Lithium-ion batteries dominate the market due to their superior energy density, lightweight design, and long lifecycle. Future innovations are expected to further reduce charging time and improve range.

By Voltage

36V

48V

60V

Above 60V

High-voltage scooters are preferred for better performance, especially in rugged terrains or longer-distance rides.

By End User

Personal Use

Commercial Use (Rental/Sharing Platforms)

While personal use continues to grow, shared e-scooter programs led by companies like Lime, Bird, and Tier are transforming urban mobility in smart cities.

Regional Insights

Asia-Pacific

The APAC region, led by China, India, and Japan, is the largest e-scooter market, driven by dense urban populations, low manufacturing costs, and supportive government policies. China accounts for a majority of global sales, thanks to early adoption and local innovation.

Europe

Europe is seeing robust growth due to sustainability mandates, strong public transit integration, and the rapid expansion of shared mobility ecosystems in countries like Germany, France, and the Netherlands.

North America

North America, particularly the U.S., is witnessing rising e-scooter adoption in metropolitan areas. The micromobility movement and electrification policies are prompting investments in infrastructure and innovation.

Latin America & Middle East and Africa

These regions are emerging markets, with growth expected due to urbanization, affordability of e-scooters, and lack of public transportation in certain areas. Latin America is also showing interest in integrating micromobility with broader transportation networks.

Industry Trends

Shared Mobility Boom

Cities are increasingly partnering with private operators to deploy dockless e-scooters, improving accessibility and reducing reliance on private cars. App-based rentals with pay-per-minute models are gaining traction among tourists and daily commuters.

Battery Swapping Models

Battery swapping stations are emerging as a game-changing innovation, especially in countries with limited charging infrastructure. Players like Gogoro have successfully implemented this model in Taiwan, and others are following suit.

Subscription and Leasing Models

To make e-scooters more accessible, companies are launching subscription-based models, allowing users to lease scooters for a fixed monthly fee, which includes maintenance and insurance.

Enhanced Safety Features

Manufacturers are focusing on integrating advanced braking systems, regenerative braking, anti-lock braking systems (ABS), and rider assistance technologies to improve safety and gain regulatory approvals.

Smart Integration and AI

AI and machine learning are being used for predictive maintenance, route optimization, and fleet management in commercial and shared applications.

Challenges and Restraints

Regulatory Hurdles

The legality and safety of e-scooters vary widely across jurisdictions. Speed limits, helmet mandates, and insurance requirements often create confusion and hinder adoption.

Infrastructure Gaps

Lack of dedicated lanes, charging points, and safe parking zones is a major barrier, particularly in developing countries and high-traffic metro areas.

Battery and Range Anxiety

Despite improvements, limited range and long charging times are still concerns for users, especially in regions with underdeveloped EV charging networks.

Durability and Vandalism in Shared Fleets

Shared e-scooters are often subjected to vandalism, rough usage, and adverse weather, increasing operational costs and reducing fleet longevity.

Competitive Landscape

The electric scooter market is highly fragmented, with global players and regional startups battling for market share. Some key players include:

NIU Technologies

Segway-Ninebot

Yadea Group Holdings Ltd.

Hero Electric

TVS Motor Company

Gogoro Inc.

Lime

Bird Rides, Inc.

Ather Energy

Ola Electric

These companies are investing heavily in R&D, new model launches, geographic expansion, and strategic collaborations to gain a competitive edge.

Future Outlook (2024–2032)

The electric scooter market is on an accelerated growth trajectory as urban transportation continues to shift toward sustainable and efficient alternatives. Future developments will include:

Long-range scooters with fast-charging capabilities

Integration with public transport networks for seamless commuting

AI-powered rider assistance and enhanced safety tech

Global expansion of battery-swapping infrastructure

Wider adoption of recyclable and eco-friendly materials

Conclusion

The electric scooter market is more than just a trend—it represents a fundamental shift in how people move through cities. With increasing demand for clean, cost-effective, and flexible transportation, e-scooters are becoming a core component of future urban mobility ecosystems. As technology matures and infrastructure catches up, the market will not only expand in volume but also in depth, impacting transportation, sustainability, and lifestyle worldwide.Read Full Report:-https://www.uniprismmarketresearch.com/verticals/automotive-transportation/electric-scooter

0 notes

Text

U.S. Motive Lead Acid Battery Market Outlook, Competitive Strategies And Forecast

The U.S. motive lead acid battery market is expected to reach USD 1.57 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 3.3% from 2023 to 2030. The demand for lead-acid batteries in the country is majorly driven by their wide application in the automotive industry as a battery backup system for electric vehicles. As electric vehicles are gaining popularity in the U.S. market as a sustainable mode of transportation, the demand for motive lead-acid batteries is anticipated to grow considerably over the forecast period.

Moreover, industrial sector, including chemical, shipping, metal, and mining, is expected to hold a major share of lead-acid battery applications, owing to rapid industrialization. A large manufacturing base of chemical companies and the presence of multinationals, including Bayer AG, BASF SE, Dow, and Akzo Nobel N.V., adopting lead acid batteries as a UPS system are expected to increase industry penetration over the forecast period.

The benefits of lithium-ion batteries are a cost-effective and high energy density & better cycle life compared with lead acid batteries. The aforementioned factors make lithium-ion batteries a growing alternative to lead acid batteries, which is anticipated to hinder market growth in the coming years.

The rising demand for ESS is expected to fuel product demand over the forecast period. ESS utilizes batteries considering its advantages such as recyclability, high power delivery, and cost-effectiveness. Lead acid batteries are the most-used battery types for ESS due to applications such as battery systems, emergency power supply systems, and stand-alone systems with PV for mitigating output fluctuations from solar and wind power. Furthermore, lead acid batteries are lower in cost compared to alternatives and are expected to witness industry growth in the coming years.

Curious about the U.S. Motive Lead Acid Battery Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

U.S. Motive Lead Acid Battery Market Report Highlights

• The market was worth USD 1.19 Billion in 2022 and is projected to grow at a CAGR of 3.3% during the forecast period.

• According to the World Wind Energy Association, the U.S. is the world’s second-largest producer of energy and wind and is anticipated to witness substantial growth in the production of energy and wind over the forecast period. In the U.S., the evolution of the energy system is driven by technology innovation, market competition, and state/local policies expressing citizen preference rather than central government planning. This is anticipated to augment the market growth.

• The Material handling segment accounted for 25.96% share in 2022 in the market owing to the increasing investment in these equipment and machinery.

• Valve Regulated Lead Acid Battery in construction segment is projected to grow at a substantial rate throughout the forecast period.

• 99.9% Purity (Pure Lead acid) in purity segment accounted for largest share 82.10% share in 2022.

U.S. Motive Lead Acid Battery Market Segmentation

Grand View Research has segmented the U.S. motive lead acid battery market based on construction, purity application, and material handling:

U.S. Motive Lead Acid Battery Construction Outlook (USD Million, 2018 - 2030)

• Flooded

• Valve Regulated Lead Acid (VRLA)

U.S. Motive Lead Acid Battery Purity Outlook (USD Million, 2018 - 2030)

• 99.9% Purity (Pure Lead acid)

• Less than 99.9% Purity

U.S. Motive Lead Acid Battery Application Outlook (USD Million, 2018 - 2030)

• Automotive

• Telecom

• UPS

• Electric Vehicles

• Golf Carts

• Mining

• Material Handling

o Forklift

o End-Controlled Rider Pallet Jack

o Narrow Aisle Forklifts

o Counterbalanced Forklifts

o Large Counterbalanced Forklifts

o (Agvs, Etc.)

o Others

U.S. Motive Lead Acid Battery Material Handling Application Outlook (USD Million, 2018 - 2030)

• VRLA Motive Lead Acid Battery

o Forklift

o End-Controlled Rider Pallet Jack

o Narrow Aisle Forklifts

o Counterbalanced forklifts

o Large counterbalanced forklifts

o Others

• Flooded Motive Lead Acid Battery

o Forklift

o End-Controlled Rider Pallet Jack

o Narrow Aisle Forklifts

o Counterbalanced forklifts

o Large counterbalanced forklifts

o Others

U.S. Motive Lead Acid Battery State Outlook (USD Million, 2018 - 2030)

• Texas

List of Key Players of the U.S. Motive Lead Acid Battery Market

• Crown Battery

• East Penn Manufacturing

• EnerSys

• Exide Technologies

• GS Yuasa Energy Solutions, Inc.

• Hitachi Chemical Co., Ltd.

• Johnson Controls

• Panasonic Corporation of North America

• Trojan Battery Company

• U.S. Battery Mfg.

Order a free sample PDF of the U.S. Motive Lead Acid Battery Market Intelligence Study, published by Grand View Research.

#U.S. Motive Lead Acid Battery Market#U.S. Motive Lead Acid Battery Market Size#U.S. Motive Lead Acid Battery Market Share#U.S. Motive Lead Acid Battery Market Analysis#U.S. Motive Lead Acid Battery Market Growth

0 notes

Text

What's Driving the Movement in ASX Mining Stocks in 2025

The Australian Securities Exchange (ASX) plays a pivotal role in global commodities trading, especially for resource-rich sectors such as metals and mining. ASX Metal stocks have seen shifting momentum in 2025, driven by macroeconomic trends, technological shifts, and evolving global demand for critical minerals. With Australia being one of the largest exporters of metal ores globally, these companies form a cornerstone of the domestic and international resource economy.

From iron ore and copper to lithium and rare earths, metal-producing and exploration companies listed on the ASX continue to gain attention. These movements are often mirrored in ASX Mining Stocks, which include a broader group of extractive industries across both metals and minerals. Understanding the dynamics influencing these stocks can provide a clearer picture of Australia's resource sector performance in the broader economic landscape.

Global Demand and Commodity Prices Influence Market Trends

The trajectory of ASX Metal stocks is closely tied to global demand cycles. As 2025 unfolds, industrial activity in major economies, particularly China, India, and Southeast Asia, has had a visible impact on base metal pricing. Copper, often regarded as a bellwether for industrial growth, remains a focus due to its essential use in power grids, electric vehicles, and renewable energy infrastructure.

Iron ore prices have shown variable trends, partially stabilised by increased steel production in Asia. This directly influences several high-cap firms on the ASX, especially in Western Australia’s Pilbara region. Similarly, nickel and lithium — integral to battery manufacturing — have seen volatile pricing shaped by electric vehicle production forecasts and geopolitical resource strategies.

These fluctuations often reflect directly in the share prices of ASX Mining Stocks. From large-cap entities with global operations to smaller exploration firms, stock movements often align with shifts in spot pricing and demand outlooks for metals.

Exploration and Production Updates from Key Metal Regions

Several ASX-listed companies continue to expand their exploration and development projects across Australia and abroad. South Australia, Queensland, and Western Australia remain central hubs for mining activities. The demand for critical minerals has driven increased interest in greenfield and brownfield exploration, leading to new drilling campaigns and resource upgrade reports.

Lithium exploration in particular remains active, with multiple projects moving into development phases in 2025. Junior miners, often agile and regionally focused, continue to add new resource data to the market. This flow of information often influences the overall outlook for metal stocks, contributing to interest in new zones or emerging players in the sector.

Beyond lithium, gold and copper also remain a focus. While gold is less industrial in its demand, its role as a traditional store of value maintains its position within diversified mining portfolios. Meanwhile, copper continues to attract attention due to its essential role in grid development and clean energy transitions.

These developments across ASX Mining Stocks highlight the depth and diversity of the metals sector, from precious and base metals to the emerging importance of battery-grade materials.

Government Policies and ESG Standards Reshape the Sector

Environmental, Social, and Governance (ESG) principles now play a central role in shaping the operations and reporting structures of ASX-listed resource companies. Metal producers are increasingly investing in more sustainable mining techniques, waste reduction technologies, and improved transparency across their supply chains.

Australian government policies, including carbon emissions reporting, Indigenous engagement requirements, and environmental rehabilitation standards, are now part of the operational framework for mining firms. These regulatory environments continue to evolve, requiring adaptability from listed companies.

In addition to domestic policy, global ESG benchmarks influence investor screening processes. Companies actively improving their sustainability metrics and community engagement practices tend to receive greater visibility in institutional portfolios. This shift towards responsible mining has influenced how ASX Metal stocks are tracked and valued, especially in long-term outlooks.

The integration of renewable energy into mining operations is another trend to watch. From solar-powered processing plants to hybrid energy systems for remote operations, ASX Mining Stocks are gradually aligning with cleaner energy strategies. These initiatives reflect broader market movements toward reducing environmental impacts and improving operational efficiency.

Strategic Partnerships and Export Agreements

The export-oriented nature of Australia’s resource sector means trade relations and strategic partnerships play a critical role in shaping ASX Metal stocks. In 2025, trade agreements between Australia and key importers of metals — such as China, Japan, South Korea, and the United States — have seen renewed focus, particularly around supply chain resilience and mineral security.

Collaborations between ASX-listed miners and global manufacturing or technology companies have also increased. These partnerships often involve long-term offtake agreements for materials like lithium, cobalt, and rare earth elements, ensuring a reliable revenue stream and project development support.

Additionally, the rise of processing facilities within Australia, rather than relying solely on raw export, signals a gradual shift toward value-added strategies. Vertical integration efforts — such as refining and battery-grade material production — contribute to the investment narrative around ASX Mining Stocks.

Government incentives and private funding support continue to boost these initiatives, reinforcing Australia's role as a strategic mineral supplier in global decarbonisation and technological transformation goals.

Infrastructure, Logistics, and Technological Advancements

Logistics infrastructure plays a significant role in the viability of mining operations. In 2025, several projects across rail, port, and processing facilities are underway to support the mining sector’s expansion. Upgrades to existing transport routes, along with new capacity planning, are crucial to moving bulk materials efficiently from remote mine sites to global markets.

Technological innovation is another key factor impacting ASX Metal stocks. Automation in mining operations — such as autonomous drilling rigs, AI-powered geological modeling, and real-time data analytics — is reshaping productivity metrics. These advancements not only improve safety and efficiency but also help reduce costs across extraction and processing cycles.

Moreover, the use of drones and satellite imagery for exploration and land surveying continues to improve discovery rates and environmental monitoring. These developments contribute to competitive positioning among listed mining firms, enabling smarter resource planning and better compliance reporting.

ASX Mining Stocks are therefore increasingly driven not just by commodity cycles, but also by operational innovation. Companies that effectively integrate technology into their core business models may see more resilience in fluctuating market conditions.

1 note

·

View note

Text

Global Transition Metals Market Analysis: Key Players, Innovations, and Market Share

Surging Demand in Electronics, Automotive, and Renewable Energy Sectors Drives Growth in the Transition Metals Market.

The Transition Metals Market Size was valued at USD 1126.00 billion in 2023, and is expected to reach USD 1714.45 billion by 2032, and grow at a CAGR of 4.78% over the forecast period 2024-2032.

The transition metals market is experiencing significant growth due to their wide-ranging applications across various industries, including electronics, automotive, energy, manufacturing, and construction. Transition metals, such as iron, copper, nickel, and cobalt, are crucial components in the production of alloys, catalysts, batteries, and electronic devices. These metals possess unique properties, such as high conductivity, corrosion resistance, and the ability to form complex compounds, making them indispensable in modern manufacturing processes. As global industries continue to advance technologically and environmentally, the demand for transition metals is expected to grow, with an increasing focus on recycling, sustainable sourcing, and innovative applications.

Key Players in the Transition Metals Market:

Metallurgical Products India Ltd (India)

KGHM Polska Miedź S.A. (Poland)

Rhenium Alloys (US)

Reliance Steel & Aluminum Co (US)

Transition Metals Corp (Canada)

Fortescue Metals Group Limited (Australia)

Rio Tinto Group (UK)

Tshingshan Group (China)

Norilsk Nickel (Russia)

Samancor Chrome (South Africa)

Future Scope:

The future of the transition metals market is closely tied to technological advancements and the global shift toward sustainable practices. With the rise of electric vehicles (EVs), renewable energy systems, and the increasing demand for high-performance electronics, the need for transition metals like lithium, cobalt, nickel, and copper is expected to soar. Additionally, the growing emphasis on recycling and circular economy principles will boost the demand for recycled transition metals. Industries such as battery manufacturing, aerospace, and advanced materials science will continue to drive the market, as they require innovative metal alloys and catalysts for next-generation technologies. The market is also likely to see greater investment in mining and extraction technologies, focusing on reducing environmental impact and improving efficiency.

Emerging Trends:

One of the key emerging trends in the transition metals market is the growing demand for metals that are critical for the production of energy storage systems, particularly lithium and cobalt, used in electric vehicle batteries and grid storage. The transition toward electric mobility and renewable energy is fueling demand for these metals. Additionally, the shift toward sustainability is leading to increased focus on the recycling and recovery of transition metals from electronic waste and used batteries. Advanced mining technologies, such as automation and AI-driven processes, are being developed to improve efficiency and minimize the environmental impact of metal extraction. Moreover, as industries seek materials with enhanced properties for high-tech applications, the market is seeing innovations in alloy development, including the use of transition metals in lightweight, high-strength materials for aerospace and automotive sectors.

Key Points:

The transition metals market is expanding due to their wide applications in sectors such as electronics, automotive, energy, and construction.

Key players include BASF SE, Glencore, Vale S.A., Anglo American, Freeport-McMoRan, Rio Tinto, and Norilsk Nickel.

The future growth of the market is driven by demand for metals in the manufacturing of electric vehicles, renewable energy infrastructure, and advanced electronics.

Emerging trends include the rise of energy storage technologies, increased recycling of metals, and innovations in mining technologies to reduce environmental impact.

Transition metals play a key role in the development of new alloys and catalysts, essential for high-tech applications in industries like aerospace and automotive.

Conclusion:

The transition metals market is set for significant expansion as demand for key metals like copper, nickel, cobalt, and lithium surges across multiple high-growth industries. From energy storage systems and electric vehicles to advanced manufacturing and electronics, transition metals are fundamental to the development of next-generation technologies. The market will continue to evolve as sustainability becomes a top priority, with increased recycling efforts and advancements in mining and material technologies. Companies that invest in innovation, environmental responsibility, and sustainable sourcing will be well-positioned to meet the growing demand for transition metals and capitalize on opportunities in the evolving global market.

Read Full Report: https://www.snsinsider.com/reports/transition-metals-market-2608

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Transition Metals Market#Transition Metals Market Size#Transition Metals Market Share#Transition Metals Market Report#Transition Metals Market Forecast

0 notes

Text

Black Mass Recycling: The $51.7B Future of Green Tech by 2032

The world is buzzing with sustainable innovation, and black mass recycling is stealing the spotlight. The black mass recycling market is set to skyrocket from $14.41 billion in 2024 to an impressive $51.70 billion by 2032, growing at a jaw-dropping CAGR of 17.3%. This isn’t just a trend—it’s a revolution in how we handle battery waste and secure critical metals. So, what’s driving this boom, and why should you care? Let’s break it down.

What Is Black Mass Recycling, Anyway?

Black mass recycling is the process of reclaiming valuable metals—like lithium, cobalt, and nickel—from used batteries, especially lithium-ion ones. Picture this: old electric vehicle (EV) batteries, discarded laptops, and even marine power packs get crushed into a powdery “black mass.” From there, advanced recycling techniques (think pyrometallurgy and hydrometallurgy) extract the good stuff, turning waste into treasure. It’s a win for the planet and a lifeline for industries hungry for sustainable raw materials.

Why the Market’s Exploding

The black mass recycling market is riding a wave of urgent demand. With EV sales soaring and renewable energy storage on the rise, lithium-ion batteries are everywhere—and so is their waste. The MarketsandMarkets report highlights that automotive batteries, fueled by the EV boom, will dominate this space. By 2032, this segment alone is expected to claim the largest market share by value. Why? Electric and hybrid vehicles are multiplying fast, and their batteries don’t last forever.

Add stricter environmental regulations and a global push for circular economies into the mix, and you’ve got a perfect storm. Governments and consumers alike are demanding greener practices, and recycling high-value metals reduces the need to mine virgin resources. It’s a no-brainer: less environmental damage, more sustainability, and a steady supply of materials for tech-driven industries.

Asia Pacific Leads the Charge

If you’re wondering where this growth is happening, look to Asia Pacific. The report pegs this region as the leader, and it’s easy to see why. Countries like China, Japan, and South Korea are churning out EVs, consumer electronics, and renewable energy solutions at breakneck speed. That means more end-of-life batteries—and a bigger need for recycling. Toss in tough environmental rules and heavy investments in cutting-edge tech, and Asia Pacific is poised to rule the black mass recycling game through 2032.

Pyro vs. Hydro: The Recycling Showdown

How do we get those precious metals out of black mass? Two heavy hitters dominate: pyrometallurgy and hydrometallurgy. Pyro uses intense heat to melt down batteries and separate metals—think of it as a fiery forge for the modern age. Hydro, on the other hand, leans on chemical solutions to leach out materials, offering a cleaner, more precise approach. The MarketsandMarkets report dives into both, noting their roles in recovering nickel, cobalt, lithium, and copper. Each method has its fans, but together, they’re powering this market’s explosive growth.

The Big Players and What’s at Stake

Who’s making waves in this space? Giants like Glencore (Switzerland), Umicore (Belgium), and Cirba Solutions (US) are leading the pack, alongside China’s Contemporary Amperex Technology Co., Ltd. These companies aren’t just recycling—they’re shaping a future where battery waste fuels innovation. The stakes are high: securing a steady supply of metals like lithium and cobalt is critical as demand for EVs and renewables surges. Plus, with mining facing environmental backlash, recycling is the smarter, greener bet.

Stay ahead with the latest trends – Download the PDF brochure.

This isn’t just industry jargon—it’s a shift that touches everyone. Black mass recycling means fewer landfills clogged with toxic batteries, cleaner air from reduced mining, and a tech world that keeps humming without depleting the planet. By 2032, this $51.7 billion market will be a cornerstone of sustainability, proving that green tech isn’t a pipe dream—it’s a reality we’re building today.

The Road Ahead

The black mass recycling market is more than a niche—it’s a game-changer. With a projected CAGR of 17.3%, it’s clear this industry is on fire. Whether you’re an EV enthusiast, a sustainability advocate, or just curious about the future, keep your eyes on this space. It’s where waste meets wealth, and the planet wins big.

#black mass recycling#sustainability#lithium-ion batteries#EV market#green tech#recycling process#Asia Pacific#pyrometallurgy#hydrometallurgy#circular economy#critical metals#battery waste#market growth#environmental regulations

0 notes

Text

Asia Pacific Power Tools & Hand Tools Market: Innovations & Demand Trends

Asia Pacific Power Tools & Hand Tools Market Overview

The Asia Pacific power tools & hand tools market size is expected to reach USD 31.47 billion by 2030, registering a CAGR of 6.3% from 2024 to 2030, according to a new report by Grand View Research, Inc. This growth can be attributed to the flourishing construction industry across the region owing to surging construction activities in China, India, Indonesia, and Vietnam. This, in turn, drives the development of residential and commercial establishments in Asia Pacific, thereby surging the demand for power & hand tools in the region.

The changing behavior of consumers toward the purchase of high-technology machines and their growing preference for DIY projects are fueling the growth of the power & hand tools market in Asia Pacific. Furthermore, increasing preference of consumers for DIY kits in the region is particularly prompting vendors to introduce easy-to-use and affordable power tools equipped with long-lasting batteries for household applications. Home improvement activities typically require hand & power tools, such as drills, circular saws, wrenches, hammer drills, screwdrivers, and grinders. These products are available in a diverse range and can be used in roofing, bathroom and kitchen remodeling, and landscaping applications.

Power tools based on lithium-ion batteries are gaining significant traction. They are expected to replace tools operating on conventional nickel-cadmium batteries, nickel-metal hydride batteries, etc. Vendors are mainly focusing on innovations in lithium-ion batteries to reduce their weight and enhance their lifespan. They are also making efforts to ensure that their batteries are sustained in harsh environments without having any impact on their performance.

The popularity of cordless power tools is growing noticeably among consumers across Asia Pacific. This is evident from the surging adoption of battery-operated, cordless power tools, such as crimpers, hammer drills, impact drivers, impact wrenches, and circular saws for use in construction, repair, and maintenance applications. These products are also used for sanding, metalworking, and welding purposes. Since battery-operated power tools are easily available in several countries across the region, manufacturers are making efforts to innovate their products to sustain their position in the market.

Various raw materials, including ferrous and non-ferrous metals, such as aluminum, brass, copper, nickel, steel, and zinc, are used for manufacturing power & hand tools. These raw materials are sourced from different countries and supply of these materials is largely affected by the fluctuations in commodity markets. Such fluctuations tend to have adverse effects on the supply chain of power & hand tools, thereby posing a challenge to the key players operating in power & hand tools market in Asia Pacific.

Manufacturers sell their products either through direct channels or distribution networks. They also rely on retailers, supermarkets or hypermarkets, independent dealers, reconditioned distributors, and e-commerce websites for selling their products. Distributors of these products play a decisive role in expanding the reach of products and broadening the customer base of manufacturers of these tools. Hence, manufacturers prefer either an integrated channel or opt for online retail.

Asia Pacific Power Tools & Hand Tools Market Report Highlights

Based on product, power tools segment dominated the market with a revenue share of 61.3% in 2023. Drills, saws, and wrenches are most commonly used in the construction industry, as well as in metalworking, woodworking, and automotive repairing applications. They have become an essential companion for professionals and DIY enthusiasts alike

Based on mode of operation, electric segment is projected to grow at the fastest CAGR of 6.7% from 2024 to 2030. This is because power tools equipped with electric motors are convenient and easy to use in various applications. Moreover, electric power tools are available as drills, saws, grinders, sanders, and routers

Based on application, the industrial segment dominated the market with a revenue share of 59.5% in 2023. This segment comprises tools used in the automotive, construction, aerospace, and logistics industries. Increased technological innovations and surged adoption of advanced technologies in different sectors have led to higher growth of industrial applications in the market compared to residential applications

China dominated the market with a revenue share of 45.7% in 2023. Growth of the market in China can be attributed to the ongoing construction projects. Moreover, low production costs and the easy availability of inexpensive labor are driving multinational companies to set up their production facilities in the country. This is expected to drive the growth of power & hand tools market in the coming years

The market is highly competitive with the presence of international players, such as Stanley Black & Decker, Inc., Robert Bosch Tool Corporation, Hilti Corporation, Techtronic Industries Co. Ltd., and Makita Corporation. Product enhancement/innovation remains a key factor for vendors to stay competitive in the market

Curious about the Asia Pacific Power Tools & Hand Tools Market? Get a FREE sample copy of the full report and gain valuable insights.

Asia Pacific Power Tools & Hand Tools Market Segmentation

Grand View Research has segmented the Asia Pacific power tools & hand tools market based on material, application, and region:

Asia Pacific Power Tools & Hand Tools Product Outlook (Revenue, USD Billion, 2018 - 2030)

Power Tools

Drills

Saws

Wrenches

Grinders

Sanders

Others

Hand Tools

Wrenches

Screwdrivers

Other hand tools

Power Tools & Hand Tools Accessories

Asia Pacific Power Tools & Hand Tools Mode of Operation Outlook (Revenue, USD Billion, 2018 - 2030)

Electric

Corded

Cordless

Others

Asia Pacific Power Tools & Hand Tools Application Outlook (Revenue, USD Billion, 2018 - 2030)

Industrial

Oil & Gas

Automotive

Rail

Aerospace & Defense

Construction

Others

Residential

Asia Pacific Power Tools & Hand Tools Country Outlook (Revenue, USD Billion, 2018 - 2030)

Asia Pacific

China

India

Japan

South Korea

Singapore

Malaysia

Thailand

Indonesia

Philippines

Vietnam

Key Players in the Asia Pacific Power Tools & Hand Tools Market

CHERVON (China) Trading Co., Ltd

Emerson Electric Co.

Hangzhou Great Star Industrial Co., Ltd

Hilti Corporation

Hongyu Tool Corporation

Ingersoll Rand, Inc (Gardner Denver)

Makita Corporation

Ningbo Yongfeite Electronic Technology Co., Ltd.

Robert Bosch Tool Corporation

Ronix Tools

Stanley Black & Decker

com

Koki Holdings Co., Ltd.

Jiangsu Guoqiang Tools Co., Ltd

Techtronic Industries Co. Ltd.

Zhejiang SALI Abrasive Technology Co., Ltd.

Apex Tool Group

Tapariatools

Order a free sample PDF of the Asia Pacific Power Tools & Hand Tools Market Intelligence Study, published by Grand View Research.

0 notes

Text

Battery Recycling and E-Waste Management: A Market Overview

The global battery recycling market size is expected to reach USD 17.08 billion by 2030, registering a CAGR of 37.6% over the forecast period, according to a new report by Grand View Research, Inc. Technological advancements in the recycling industry are making battery recycling more efficient and cost-effective, which is another factor contributing to the growth of the market. An increase in the adoption of smartphones, electric vehicles, and other consumer electronics has led to an increase in the use of batteries. This has increased the number of end-of-life batteries, presenting new opportunities for recycling companies.

Battery Recycling Market Report Highlights

In 2023, the Lead acid emerged as the largest segment and accounted for a revenue share of 84.0% owing to large number of applications in automotive, industrial and hospitality sector

In 2023, the Transportation segment was the largest in terms of revenue and accounted for 73.0% of the market. Growing demand from the transportation sector for batteries is expected to generate large number of spent batteries, stimulating the demand for the battery recycling segment.

North America occupied a significant revenue share in 2023, with the U.S. being a major contributor to industry growth. A surge in usage of li-ion batteries in smartphones to extend their shelf life and enhance their efficiency is expected to drive growth of the market in North America in the coming years.

The Asia Pacific accounted for the largest market revenue share in 2023, with China being the largest contributor to the regional market growth. Increasing usage of batteries for renewable energy storage is expected to fuel the demand for lead acid batteries in China. The growing use of lead acid and lithium-ion batteries coupled with the rising number of spent batteries is expected to drive the market over the forecast period.

For More Details or Sample Copy please visit link @: Battery Recycling Market Report

The industrial segment is expected to witness substantial growth over the next few years, due to the growing demand for high-power range systems. Increasing trend of the adoption of UPS systems as an essential power-backup device is expected to favorably impact the market growth over the forecast period.

Enterprises deploy their data center facilities to meet data and network necessities. Interruption of power supply to these facilities can result in the loss of essential data, thereby decreasing the overall productivity and resulting in financial losses. The installation of UPS systems is one of the best ways to prevent unwanted losses. These factors are likely to increase the demand for UPS systems over the coming years, which, in turn, is anticipated to propel the demand for battery recycling in coming years.

Asia Pacific has been witnessing significant growth on account of the increasing number of manufacturing facilities, commercial offices, banks, MROs, and R&D centers in major countries like China, Australia, Japan, India and South Korea. The inception of new facilities and the expansion of existing battery recycling facilities owing to favorable government policies and foreign direct investments are likely to cater the growth battery recycling in the region.

List of Key Players of the Battery Recycling Market

Call2Recycle

Exide Technologies

Gravita India Ltd.

Glencore

Cirba Solutions

American Battery Technology Company

Gopher Resource

East Penn Manufacturing Co.

Aqua Metals

We have segmented the global battery recycling market based on chemistry, application, and region.

#BatteryRecyclingMarket#BatteryWasteManagement#EwasteRecycling#EnergyStorage#LithiumIonRecycling#EVBatteryRecycling#BatterySustainability#RecyclingTechnology#BatteryReuse

0 notes

Text

The Future of Critical Minerals: Pioneering Lithium Battery Reusing and Recycling with LOHUM

As the world accelerates towards electrified mobility, with electric scooters, motorcycles, sportscars, school buses, trucks, trains, and planes becoming mainstream, the demand for lithium-ion batteries is soaring. These batteries power not only our electric vehicles (EVs) but also our everyday electronics and renewable energy storage systems. However, this rapid adoption presents a dual challenge: meeting the escalating demand for critical minerals and managing the lifecycle of retired batteries sustainably.

The numbers are staggering. By 2030, over two million metric tonnes of lithium-ion batteries are expected to retire annually, equivalent to batteries from more than half a million vehicles. With EVs making up an increasing share of the vehicle market, this trend underscores the urgent need for robust lithium battery reusing and recycling solutions. The environmental and economic stakes are high, as valuable metals like cobalt, nickel, and lithium can be recovered and reused, reducing the pressure on virgin mining operations and lowering the carbon footprint of battery manufacturing.

At LOHUM, we are at the forefront of this sustainable revolution. Our innovative approach focuses on extending the life of lithium batteries through reuse and repurposing, as well as ensuring high-efficiency recycling practices. By maximizing the recovery of critical minerals, we are not only contributing to a circular economy but also enhancing the supply chain resilience for battery materials.

The Second Life of Batteries: An Opportunity Waiting to Be Unlocked

EV batteries, according to the US Advanced Battery Consortium, reach the end of their usable life when their capacity falls below 80%. However, these batteries still hold significant potential for second-life applications, such as stationary energy storage solutions for solar power and grid stabilization. This second-life use can extend the battery's utility by 6 to 10 years, offering substantial environmental benefits by delaying the need for recycling and reducing the demand for new batteries.

LOHUM is a pioneer in deploying such second-life applications. Our projects demonstrate how retired EV batteries can seamlessly transition into energy storage roles, delivering consistent performance while promoting sustainability. By leveraging our expertise in battery refurbishment and repurposing, we help create a viable and profitable market for used batteries, addressing both supply chain challenges and environmental concerns.

Recycling: Closing the Loop on Battery Materials

When batteries can no longer be reused, recycling becomes imperative. Traditional pyrometallurgical recycling methods, which involve smelting at temperatures around 1500°C, recover valuable metals but often lose lithium and aluminum in the process. Moreover, these processes are energy-intensive and produce toxic emissions. On the other hand, hydrometallurgical and emerging direct recycling methods offer a more efficient and environmentally friendly approach.

Innovations in direct recycling, as highlighted by recent research, allow the cathode material to be refunctionalized without breaking it down completely. This method not only maintains the structural integrity of critical minerals but also enhances battery performance—charging faster and lasting longer than those made from virgin materials. At LOHUM, we integrate such advanced recycling techniques, ensuring that our battery recycling processes yield high-quality materials with minimal environmental impact.

Policy and Market Outlook: A Billion-Dollar Opportunity

The global battery market is poised for explosive growth, with the Department of Energy projecting a 10-fold expansion in the next decade. With California aiming to recycle or reuse 100% of its EV batteries and global markets increasingly focusing on sustainable practices, there is a tremendous opportunity for businesses leading the way in lithium battery reusing and recycling.

As demand for critical minerals intensifies, particularly with over 60% of cobalt supply originating from politically and ethically complex regions like the Democratic Republic of Congo, a domestic and circular supply chain becomes essential. Recycling can reduce dependence on foreign sources, mitigate ethical supply chain risks, and support national energy security. LOHUM’s approach of creating a sustainable value chain for lithium batteries aligns perfectly with these market needs, offering economic, environmental, and social benefits.

Looking Ahead: The LOHUM Vision

LOHUM envisions a future where every lithium battery, from its first charge to its final discharge, contributes to a greener and more resilient planet. By championing lithium battery reusing and recycling, we are not only driving business growth but also reinforcing our commitment to environmental stewardship. Through innovation, investment, and strategic partnerships, we continue to close the loop on battery materials, setting new benchmarks for sustainability in the battery industry.

The journey towards a sustainable energy ecosystem is just beginning, and at LOHUM, we are excited to lead the charge. Together, let’s power the world responsibly, one recycled battery at a time.

Visit us at: BWMR registered Partner

Originally published on: Medium

#lohum#lithium battery reusing and recycling#li-ion battery waste management#lithium battery waste recycling#critical minerals#battery waste management#3 wheeler ev battery#reverse logistics for lithium-ion batteries

0 notes

Text

Manganese Market Share Size, Major Strategies, Key Companies, Revenue Share Analysis 2032

Manganese is a critical industrial metal with widespread applications in steel production, batteries, and various chemical processes. As a vital element for industrial development, the Manganese Market is closely tied to global economic trends and technological advancements. Understanding the dynamics of this market is crucial for investors, policymakers, and industry stakeholders.

The manganese market size was valued at USD 24.37 billion in 2023. The manganese industry is projected to grow from USD 25.59 billion in 2024 to USD 37.87 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.02% during the forecast period (2024 - 2032)

Market Overview

Manganese is primarily used in the production of steel, where it serves as a deoxidizing and desulfurizing agent. It also enhances the strength, toughness, and workability of steel, making it an indispensable element in the construction, automotive, and infrastructure sectors. In recent years, the growing demand for high-strength steel in the automotive industry has been a key driver of the manganese market.

Key Trends

Increasing Demand in Steel Production: The demand for manganese in steel production has been steadily increasing, driven by the growth of the construction and automotive industries. As countries invest in infrastructure development and automotive manufacturing, the demand for high-quality steel is expected to rise, further boosting the manganese market.

Rising Demand for Batteries: Manganese is also used in the production of batteries, particularly in the cathodes of lithium-ion batteries. With the increasing adoption of electric vehicles and renewable energy systems, the demand for manganese in battery production is expected to grow significantly in the coming years.

Exploration and Mining: The exploration and mining of manganese ores are crucial for meeting the growing demand. Countries such as South Africa, Australia, and Gabon are major producers of manganese, and new deposits are being explored to ensure a stable supply chain.

Environmental Concerns: As the manganese market size expands, there is a growing focus on sustainable mining practices and environmental conservation. Companies are investing in technologies to reduce the environmental impact of manganese mining and processing.

Market Analysis The manganese market is characterized by its reliance on steel production and the automotive industry. As these sectors continue to grow, the demand for manganese is expected to remain strong. However, fluctuations in steel prices, geopolitical tensions, and regulatory changes can impact the market dynamics.

Future Outlook The future of the manganese market looks promising, with the increasing demand for high-strength steel and batteries driving growth. Technological advancements in mining and processing techniques are expected to improve efficiency and reduce costs, making manganese more accessible to a wider range of industries. Additionally, the shift towards sustainable practices is likely to reshape the manganese market, with a greater emphasis on recycling and environmental stewardship.

MRFR recognizes the following Manganese Companies - Transalloy India Pvt Ltd (India),Mesa Minerals Limited (Australia),Autlán (Mexico),Eramet (France),MOIL Limited (India),Ferro Alloys Corporation Limited (FACOR) (India),OM Holdings Ltd (Singapore),Sakura Ferroalloys (Malaysia),Nippon Denko Co. Ltd (Japan),Mizushima Ferroalloy Co. Ltd (Japan),Metals and Alloys Corporation (India),Accura Weldrods Kovai Pvt Ltd (India),African Rainbow Minerals Ltd (South Africa),Afarak Group Plc (Finland),Transalloys (South Africa), among others

In conclusion, the manganese market trends is poised for growth, driven by the demand for steel and batteries. As the global economy recovers from the impacts of the COVID-19 pandemic, the manganese market is expected to play a crucial role in driving industrial development and infrastructure growth. Industry stakeholders should closely monitor market trends and invest in sustainable practices to capitalize on the opportunities presented by the manganese market.

Related Reports

Refined Nickel Market - https://www.marketresearchfuture.com/reports/refined-nickel-market-7868 Silicon Dioxide Market - https://www.marketresearchfuture.com/reports/silicon-dioxide-market-7889 High-Performance Seals Market - https://www.marketresearchfuture.com/reports/high-performance-seals-market-7893 Calcined Petcoke Market - https://www.marketresearchfuture.com/reports/calcined-petcoke-market-7897 Ethylbenzene Market - https://www.marketresearchfuture.com/reports/ethylbenzene-market-8028

0 notes

Text

Battery Metals Market Size, Share And Trends Analysis Report

The global battery metals market is anticipated to reach USD 18.41 billion by 2030, expanding at a CAGR of 8.3%, from 2024 to 2030, according to a new report by Grand View Research, Inc. Increasing requirement of batteries in electric vehicles and energy storage systems is boosting market growth. Battery structure consists of 5 major components: casing, electrodes, separator, electrolyte, and collector.

Metals are used mainly in electrodes in different chemistries. Various metals are utilized in batteries, where lithium, cobalt, and nickel account for a major share. Lithium-based batteries’ prominence is increasing owing to its rapid adoption in electric vehicles and energy storage systems.

Nickel is a major component in lithium-ion and other rechargeable batteries, and its adoption is increasing at an accelerated rate, owing to its phenomenal properties and low cost. In the near future, batteries are expected to form a major cost component in electric vehicles and other applications, and hence, it becomes vital for manufacturers to lower manufacturing costs.

Cobalt, one of the largest product segment of the market is witnessing a declining demand trend owing to its high cost and growing concerns towards human rights and child labor during its mining in Democratic Republic of Congo. Factors including human and financial costs and high demand for energy density have propelled battery makers to reduce their reliance on cobalt. For instance, major manufacturers such as SK Innovation and LG Chem are in process of developing cathodes with NMC 811 chemistry that consists of 80.0% nickel and 10.0% cobalt.

Electric vehicles (EVs) are fastest growing application segment of the market. Consumption of metals in producing EV batteries is increasing, as unlike conventional vehicles, EVs require large batteries owing to absence of internal combustion engines. Increasing EV production is anticipated to surge demand for battery metals in near future.

Asia Pacific was the largest regional segment in 2023 and this trend is expected to continue over the forecast period. Factors such as rapid development in EV industry propelling battery demand, China’s dominance over supply chain, and increasing production capacities in Japan and India are propelling market growth in the region.

Gather more insights about the market drivers, restrains and growth of the Battery Metals Market

Battery Metals Market Report Highlights

• Based on metal, cobalt held the largest revenue share of over 44.0% in 2023 and is expected to grow at a significant CAGR over the forecast period. Increasing production of electric vehicles (EVs) is anticipated to lead to a surge in cobalt consumption during the forecast period. Lithium-nickel-manganese-cobalt-oxide (NMC) batteries, which constitute the most prevalent battery chemistries currently employed in EVs, consist of a cathode comprising 10-20% cobalt

• Based on application segment, electric vehicles segment is the fastest-growing segment, with a CAGR of 9.0% in terms of revenue during the forecast period. Growing production of EVs across the globe is propelling demand for batteries and, eventually, metals

• Starter, lighting, and ignition held a significant volume share in 2023 as automotive constitutes a major application share of batteries. It is anticipated to reduce over the forecast period owing to rising adoption of EVs over conventional vehicles