#Landscaping consultants india

Explore tagged Tumblr posts

Photo

Nellickal Nursery®️, established on December 1, 1999, is located in Ponnani, Malappuram district, Kerala, India. It offers a wide range of services including Fruit Garden Design and Implementation, Fruit Garden Consultancy, Fruit Garden Development, Butterfly Garden Creation, Tree Rejuvenation (Tree Rejuvenation Technology), Pruning, Tree Transplantation (Tree Relocation/Tree Burlapping services/Tree Shifting Technology/Tree Moving method/Trees Translocation), Miyawaki Forest (Crowd Foresting) Restoration, Ecological Restoration, Man-made Foresting, Horticulture Therapy, Aromatic Gardening, Sensory Gardening, Landscaping Gardening, Lawn Grass setting and Lawn Mowing Maintenance Service, Indoor Gardening, Medicinal Gardening, Bonsai Art and Training, Vertical Gardening, Kokedama Gardening, Birth Star Plant Implementation, Zodiac Tree Implementation, Vegetative Plant propagation training, Plant Consultancy, Plant Nursery operations, and Nursery Management. Services are available throughout Kerala (Thiruvananthapuram, Pathanamthitta, Kollam, Alappuzha, Idukki, Kottayam, Ernakulam, Thrissur, Palakkad, Malappuram, Kozhikode, Kannur, Wayanad, Kasaragod) and in other parts of India.

Nellickal Nursery®

Anish Nellickal®: 9946709899

Whatsapp No: 9946881099

www.nellickalnursery.com

#Anish nellickal#nellickal nursery#ponnani#malappuram#kerala#india#9946709899#9946881099#eswaramangalam#plant nursery in india#plant nursery in kerala#plant nursery in malappuram#plant nursery in ernakulam#plant nursery in kozhikode#rasitha nellickal#anush nellickal#anuraj nellickal#veliyancode#tree doctor#tree doctor anish nellickal#Tree Rejuvenation#Butterfly Garden Creation#Tree Transplantation#Crowd Foresting#Horticulture Therapy#Fruit Garden Consultancy#Landscaping Gardening#Sensory Gardening#Aromatic Gardening#Pruning

0 notes

Note

as a south asian why the hell did they make aladdin and jasmine south asian. I am so confused. Isn't jasmine's name literally persian

Okay okay so there's a bit of a story for this

And to quickly answer your last question, yup, Jasmine is one of the forms of Yas/Yasmine, our jasmine flowers

So back in the 90s, and still a little bit today, many production companies such as Disney didn't really see a difference with the Middle East and South Asia. When Disney decided they wanted to make an adaptation of "Aladdin" from "One Thousand and One Nights" (slight tidbit here, the story of Aladdin is not part of the original book. A French guy added it in and for some reason, set it in China? One Thousand is a Persian story, most of the stories in there are Persian, so this choice was. Interesting), it's not like they suddenly hired a bunch of Middle Eastern experts to consult on the film. No, they just created a desert-y landscape and lumped in Persian, Arab, and South Asian all in there

This is why the palace of Agrabah heavily resembles the Taj Mahal on a more Arabic-sounding name. Rajah, Jasmine's pet tiger, is an Indian word for king. Names such as Jafar and Jasmine are Persian in origin, while a lot of the clothing is Turkish-inspired. Villains such as the Captain and Jafar have a lot more stereotypically Middle Eastern features (hooked nose, bushy eyebrows, etc [and it's a convo for another day about how the "good" characters don't have these exaggerated features])

This melding of several cultures is what led up to the live-action "Aladdin" in 2019. The creators of that movie wanted to be more respectful of the region, and so this time, they did hire consultants and the like to help ensure it would be much less offensive ("where they cut off your ear if they don't like your face", nice going 1992)

And for the most part, they did that. Except for Jasmine

Jasmine is played by Naomi Scott, a half white half Indian woman, and look, it's pretty obvious she only got this part because she's well known. I would also like to point out that the casting calls for the characters in general once again lumped Southeast Asian and Middle Eastern people, however, almost all of the cast is Middle Eastern, and several of them are Persian (Sultan and Mara, notably)

So while everyone else is wearing clothes more indicative of the Middle East, you have miss Jasmine over here dressed in sarees and Indian-inspired clothing because costuming department went "oh! She's Indian now!" Agrabah is also a lot more similar to South Asia than the Middle East, further deepening this issue

To an outsider, "Aladdin" is Indian. To them, there's some Arab inspo, but they would mostly think it's set somewhere in India or South Asia. That's what the casting and costuming department in "Rise of Red" were working with, and so they just opted to go the whole South Asian angle. None of the actors who portray Jasmine, Aladdin, and their kid are Middle Eastern, they're all South Asian. The clothes they're wearing are very obviously from that region

And if I'm being completely honest, that's exactly what I expect from Disney. Why would they bother to do research for extremely minor characters with two lines? The problem here is what I've been talking about above, is that Hollywood is constantly thinking South Asians and Middle Easterners are interchangeable when we're not. If I see a MENA character on screen, more often than not the actor is South Asian. This is a continuous problem no one from these places wants to see happening, and yet it is because Hollywood doesn't actually care. The more it's done, the more they think it's okay and so they continue to blur the lines between several different cultures

So, on an ending note, Jasmine and Aladdin are Arab, if not Persian, and the idea that we are interchangable with South Asians harms both our cultures

#jasmine#aladdin#disney#descendants 4#descendants#naomi scott#mena massoud#aladdin 2019#rise of red#descendants rise of red

27 notes

·

View notes

Text

Flats for Sale in Gurgaon: A New Standard of Living

Gurgaon, often dubbed the Millennium City, is one of the most vibrant and fast-growing urban hubs in India. With its bustling business districts, world-class infrastructure, and a thriving real estate market, it has quickly become a preferred destination for both homebuyers and investors. Whether you are looking for a 1 BHK apartment, a spacious 3 BHK flat, or an ultra-luxurious 4 BHK penthouse, Gurgaon has a wide array of properties that cater to all preferences and budgets. In this article, we explore the advantages of buying flats in Gurgaon, the variety of options available, and why it remains a top choice for modern living.

Why Buy Flats in Gurgaon?

1. Prime Location and Connectivity

Gurgaon’s prime location is one of the major driving forces behind its real estate boom. Situated just 30 kilometers from Delhi, the city is easily accessible via the Delhi-Gurgaon Expressway and the Dwarka Expressway, two major arterial roads that provide smooth connectivity to Delhi, Noida, and other parts of NCR. Additionally, the Indira Gandhi International Airport is just a short drive away, making Gurgaon a central hub for business professionals and frequent travelers.

The city’s growing infrastructure, including metro networks, wide roads, and flyovers, has significantly reduced travel time within the city. This accessibility, combined with the convenience of nearby malls, schools, hospitals, and business districts, makes Gurgaon a highly attractive place to live.

2. Thriving Job Market

Gurgaon is home to numerous multinational corporations (MNCs), startups, and IT giants, especially in sectors like information technology, finance, and consulting. Many corporate headquarters are located in business parks such as DLF Cyber City and Udyog Vihar, creating a high demand for residential properties in and around these commercial hubs.

Living in Gurgaon offers you the advantage of a short commute to work, which can help you strike a better work-life balance. With offices close by, residents have more time to enjoy leisure activities, spend time with family, or indulge in shopping and dining experiences.

3. Variety of Flats for Sale

From affordable flats to luxurious, high-end residences, Gurgaon’s real estate market offers a variety of flats for sale in Gurgaon, catering to different tastes and budgets. Whether you are a first-time homebuyer or a seasoned investor, you will find a wide range of options that suit your needs.

Affordable Flats: If you're looking for an affordable yet comfortable living space, you can explore 1 and 2 BHK flats that are available in several areas of Gurgaon like Sohna Road, Sushant Lok, and Sector 92. These flats come with basic amenities and are perfect for young professionals or small families.

Mid-Range Flats: For buyers seeking more spacious homes, 3 BHK flats are widely available in prime locations like Sector 55, Golf Course Road, and DLF Phase 1. These flats often come with modern amenities like swimming pools, gyms, and landscaped gardens.

Luxury Flats: If you have a higher budget and are looking for a premium living experience, there are luxurious 4 BHK and penthouse apartments for sale in locations like Golf Course Extension Road, MG Road, and Cyber City. These apartments feature high-end interiors, smart home features, expansive layouts, and a wide range of world-class amenities.

4. World-Class Amenities

Flats for sale in Gurgaon are known for their world-class amenities, which make everyday living a truly luxurious experience. Some of the most common amenities offered in residential complexes in Gurgaon include:

Swimming Pools

Fully Equipped Gyms

Landscaped Gardens and Parks

Clubhouses and Community Centers

Children's Play Areas

24/7 Security

CCTV Surveillance

Jogging Tracks

Retail Shops and Supermarkets

Dedicated Parking Spaces

These amenities enhance the overall quality of life for residents, allowing them to enjoy recreational activities, stay fit, and live in a secure environment.

5. High Return on Investment

Gurgaon’s real estate market has consistently delivered high returns on investment over the years. The city has witnessed steady appreciation in property values, thanks to its infrastructure development, increasing demand for residential spaces, and growing commercial activities. Investing in flats for sale in Gurgaon is not just about finding a dream home but also a smart financial decision.

Whether you choose to live in the property or rent it out, Gurgaon’s real estate market continues to offer lucrative opportunities. Properties in prime locations, such as Cyber City, Sohna Road, and Golf Course Road, have shown a steady rise in value, making them excellent investment options.

Flats for Sale in Dwarka Expressway: A Gateway to Modern Living

The Dwarka Expressway, also known as the Northern Peripheral Road (NPR), is rapidly emerging as one of the most promising real estate corridors in the National Capital Region (NCR). Connecting Dwarka in Delhi to Gurgaon’s NH-8, the expressway is transforming the landscape of the region and creating exciting opportunities for homebuyers and investors. Whether you are looking for affordable housing or luxury flats, the Dwarka Expressway has a wide range of options to cater to different preferences.

Why Buy Flats in Dwarka Expressway?

1. Strategic Location and Connectivity

The Dwarka Expressway offers excellent connectivity to Delhi, Gurgaon, and other important areas in NCR. It is situated near the IGI Airport, making it an ideal location for frequent flyers and business travelers. The expressway is well-connected to the Delhi Metro network, ensuring easy access to other parts of the city.

Moreover, the upcoming Diplomatic Enclave in Dwarka, along with the proximity to the Dwarka Sector 21 metro station, ensures that residents of flats in the area will have seamless connectivity to other parts of Delhi, making it an increasingly popular location for homebuyers.

2. Robust Infrastructure and Development

The Dwarka Expressway is witnessing massive infrastructure development, including wide roads, flyovers, and several commercial and residential projects. The region is also slated to benefit from improved connectivity due to the construction of the Dwarka Expressway Metro Line, making it even more attractive for buyers and investors.

Additionally, the area is home to several shopping malls, entertainment hubs, schools, hospitals, and other essential services. This makes it an ideal location for families looking for a well-connected and self-sustained neighborhood.

3. Affordable Luxury Flats

One of the main attractions of buying flats along the Dwarka Expressway is the availability of affordable luxury. The region offers high-quality residential properties that come with modern amenities at relatively lower prices compared to other prime locations like Golf Course Road or MG Road in Gurgaon.

From 2 BHK flats to larger 3 and 4 BHK apartments, there are plenty of options available in the market, catering to a wide range of budgets. The properties in this area offer spacious interiors, contemporary designs, and a host of premium amenities.

4. Growing Real Estate Potential

The Dwarka Expressway is rapidly developing into a real estate hotspot. With several residential projects already underway and more planned for the near future, the area is poised for significant growth. Flats for sale in Dwarka Expressway this area present an exciting opportunity for investors seeking high returns in the long term. As the region continues to develop, property values are expected to rise, making it a profitable investment option.

5. World-Class Amenities

Flats for sale in Dwarka Expressway come with a host of world-class amenities, including:

Clubhouses

Swimming Pools

Fully Equipped Gyms

Sports Facilities

Landscaped Gardens

Shopping and Retail Centers

24/7 Security

Power Backup

Smart Home Features

These amenities ensure a high standard of living for residents, making it an ideal place to call home.

Conclusion

Whether you are looking for flats for sale in Gurgaon or considering properties along the Dwarka Expressway, both options offer excellent opportunities for homebuyers and investors alike. Gurgaon remains a top destination for luxury living, offering a wide variety of flats that cater to different tastes and budgets. On the other hand, the Dwarka Expressway presents an exciting opportunity for those seeking affordable luxury in a rapidly developing area with immense growth potential.

Both locations provide top-notch connectivity, world-class amenities, and robust infrastructure, making them ideal places to live and invest. By choosing the right flat, you can enjoy the comfort, convenience, and luxury of modern living in the heart of the National Capital Region.

2 notes

·

View notes

Text

Business Setup in India: Your Guide with MAS LLP

Setting up a business in India is an exciting opportunity, given the country’s rapidly growing economy and vibrant entrepreneurial ecosystem. However, navigating the complexities of legal requirements, compliance, and market entry can be challenging. That’s where MAS LLP, a trusted name in business consulting, comes in.

Whether you’re an international investor or a domestic entrepreneur, MAS LLP provides end-to-end solutions to simplify the process of business setup in India. Let’s explore how MAS LLP can help you start your journey with confidence.

Why Set Up a Business in India? India has emerged as one of the most attractive destinations for business investment, thanks to its:

Large Consumer Market: With a population exceeding 1.4 billion, India offers immense potential for businesses targeting diverse demographics. Favorable Policies: Government initiatives like Make in India and Startup India provide support to new businesses with tax incentives and simplified regulations. Growing Economy: India is one of the fastest-growing major economies, making it a hub for innovation and opportunity. Skilled Workforce: The country boasts a young, talented, and tech-savvy workforce, ideal for businesses across industries. How MAS LLP Simplifies Business Setup in India

Entity Selection and Registration One of the first steps in setting up a business is choosing the right entity structure. MAS LLP provides expert guidance on options like:

Private Limited Company Limited Liability Partnership (LLP) Sole Proprietorship Branch Office or Representative Office for foreign businesses Their team ensures a hassle-free registration process, adhering to the latest compliance standards.

Regulatory Compliance Navigating India’s regulatory environment can be daunting. MAS LLP ensures your business complies with:

Corporate laws Tax regulations (GST, Income Tax, etc.) Industry-specific licenses and permits Their compliance services safeguard you from penalties and delays.

Tax Planning and Advisory Efficient tax planning is crucial for any business. MAS LLP’s tax experts provide:

Strategic advice on tax-saving opportunities GST registration and filing services Corporate tax compliance This ensures your business remains financially efficient and compliant.

Banking and Financial Setup MAS LLP assists in opening bank accounts, securing funding, and managing financial reporting. Their services include:

Assistance with loan applications Accounting and bookkeeping Financial audits and reporting

Business Expansion Strategy MAS LLP doesn’t just help you start a business—they also guide your expansion. From market research to strategic planning, they ensure your business grows sustainably in India’s competitive environment.

Why Choose MAS LLP for Business Setup in India?

Expertise: With years of experience, MAS LLP has a deep understanding of India’s business landscape.

Tailored Solutions: Every business is unique, and MAS LLP offers customized services to meet specific needs.

End-to-End Support: From registration to operational setup, MAS LLP is your one-stop solution.

Transparent Processes: MAS LLP ensures clarity in all transactions, keeping clients informed at every step. Steps to Start Your Business with MAS LLP

Initial Consultation: Discuss your business goals and requirements with the MAS LLP team.

Entity Selection: Decide on the most suitable business structure.

Documentation and Registration: MAS LLP handles all paperwork and liaises with authorities for approvals.

Compliance and Tax Setup: Ensure adherence to Indian regulations and tax laws.

Operational Launch: Get your business up and running smoothly with ongoing support from MAS LLP. Ready to Set Up Your Business in India? Setting up a business in India has never been easier, thanks to MAS LLP. Their expert guidance and comprehensive services ensure a seamless experience, allowing you to focus on your business vision.

Contact MAS LLP today to start your business journey in one of the world’s most dynamic markets.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#auditor#ap management services

4 notes

·

View notes

Text

10 Key Strategies for Successful Foreign Investment in India by 2025

India, with its rapidly expanding economy and growing consumer base, offers compelling opportunities for foreign investors. However, capitalizing on these opportunities requires a nuanced understanding of the market and a strategic approach. As we look towards 2025, here are ten essential strategies for foreign investors aiming to achieve success in India’s dynamic landscape.

1. Mastering Local Regulations and Compliance

Understanding and navigating India's regulatory environment is crucial for successful foreign investment. India has undergone significant regulatory reforms in recent years, but its complex legal framework can still pose challenges.

Foreign Direct Investment (FDI) Policies

The Indian government has made strides in simplifying FDI regulations. However, sectors such as defense, retail, and telecommunications have specific guidelines that investors must adhere to. Familiarize yourself with the latest regulations through resources such as the Department for Promotion of Industry and Internal Trade (DPIIT) and the Reserve Bank of India (RBI).

Local Partnerships

Given the complexity of local regulations, partnering with experienced legal and financial advisors can facilitate smoother operations. These local experts can help navigate bureaucratic processes, interpret regulations accurately, and ensure compliance with local laws.

2. Investing in Market Research and Data Analysis

Successful investments are often driven by comprehensive market research. Understanding the intricacies of consumer behavior and market trends is essential for tailoring your strategies.

Consumer Insights

India’s diverse demographic landscape requires detailed consumer insights. Utilize data analytics tools and market research firms to gather information on consumer preferences, spending habits, and emerging trends. This data will inform product development, marketing strategies, and pricing models.

Sector-Specific Analysis

Different sectors in India exhibit unique characteristics and challenges. For instance, the technology sector may face different regulatory and competitive dynamics compared to the retail or manufacturing sectors. Conduct in-depth sector analysis to identify opportunities and mitigate risks.

3. Building a Robust Local Network

Establishing strong local connections is a cornerstone of successful foregin investment in India. Networking with local businesses, government officials, and industry leaders can open doors to valuable opportunities.

Strategic Partnerships

Form alliances with local businesses and industry bodies to gain market entry and credibility. These partnerships can offer valuable insights, facilitate regulatory compliance, and provide access to established distribution channels.

Engage Local Expertise

Consult with local experts who understand the regional business environment. They can offer guidance on navigating local customs, market conditions, and business practices, which can be critical for making informed decisions.

4. Adapting to India’s Cultural and Regional Diversity

India’s cultural and regional diversity means that a one-size-fits-all approach is often ineffective. Tailoring your strategies to local preferences and cultural nuances can enhance market acceptance and brand loyalty.

Cultural Sensitivity

Understanding and respecting local customs and traditions is crucial for building a positive brand image. Adapt your marketing messages, product offerings, and business practices to align with regional cultures and values.

Regional Variations

India’s states and regions vary significantly in terms of economic development, consumer behavior, and regulatory environments. Develop region-specific strategies to address these differences and optimize your market approach.

5. Leveraging Technology and Innovation

India’s technology landscape is rapidly evolving, with significant growth in digital infrastructure and innovation. Embracing technology can enhance operational efficiency and market reach.

Digital Infrastructure

Invest in digital platforms and technologies to connect with India’s tech-savvy consumers. Utilize digital marketing, e-commerce platforms, and data analytics to drive growth and engage with your target audience.

Innovation

India’s startup ecosystem is vibrant and innovative. Consider collaborating with local startups or technology providers to incorporate cutting-edge solutions and stay ahead of market trends.

6. Embracing Sustainability and Corporate Social Responsibility (CSR)

Sustainability and CSR are increasingly important in India’s business environment. Adopting sustainable practices and engaging in CSR initiatives can enhance your brand’s reputation and contribute to long-term success.

Environmental Responsibility

Implement sustainable practices in your operations, such as reducing waste, conserving energy, and minimizing your carbon footprint. Compliance with environmental regulations and voluntary sustainability standards can also improve your business’s credibility.

CSR Initiatives

Engage in CSR activities that address local community needs and align with your company’s values. Contributing to education, healthcare, and social development projects can build goodwill and strengthen your brand’s presence in the community.

7. Monitoring Economic and Political Developments

India’s economic and political landscape can significantly impact investment outcomes. Staying informed about macroeconomic trends and policy changes is crucial for adapting your strategies and mitigating risks.

Policy Changes

Keep abreast of changes in government policies and economic reforms. Policy shifts, such as changes in tax regulations or trade policies, can affect your investment strategy and operational plans.

Economic Trends

Monitor key economic indicators, including inflation rates, currency fluctuations, and growth forecasts. Understanding these trends will help you anticipate market shifts and make informed investment decisions.

8. Optimizing Supply Chain and Logistics

Efficient supply chain and logistics management are vital for operating effectively in India’s diverse and sometimes challenging infrastructure environment.

Logistics Infrastructure

India’s logistics sector is evolving, but challenges such as transportation bottlenecks and infrastructure gaps remain. Develop a robust logistics strategy that includes reliable partners and technology solutions to streamline operations.

Local Sourcing

Consider local sourcing options to reduce supply chain costs and improve efficiency. Building relationships with local suppliers and manufacturers can also mitigate risks associated with international logistics.

9. Focusing on Talent Acquisition and Management

India’s growing talent pool presents opportunities for building a skilled workforce. Attracting, retaining, and developing talent is essential for long-term success.

Local Talent

Invest in hiring local talent who understand the Indian market and can contribute valuable insights and skills. Implement training programs to enhance their capabilities and align them with your company’s goals.

Retention Strategies

Create a positive work environment and offer competitive compensation packages to retain top talent. Focus on career development, work-life balance, and employee engagement to foster loyalty and reduce turnover.

10. Embracing Flexibility and Adaptability

The Indian market is dynamic and constantly evolving. Being flexible and adaptable will enable you to respond to changes and seize new opportunities.

Market Dynamics

Be prepared to adjust your strategies in response to market shifts, consumer preferences, and competitive pressures. Regularly review and refine your approach to stay relevant and competitive.

Feedback Mechanisms

Establish systems for gathering and acting on feedback from customers, partners, and stakeholders. Continuous improvement based on real-time insights will help you stay aligned with market demands and enhance your business performance.

Investing in India offers significant potential, but success requires a strategic approach that addresses the complexities of the market.

Fox&Angel, a leading Global Expansion Partner with a focus on facilitating foreign direct investment (FDI) in India can help you. Our expert team is well-versed in the complexities of the Indian market, offering comprehensive support to ensure your investment is both strategic and successful. Whether you’re aiming to expand your current operations, explore new market opportunities, or make a direct investment, Fox&Angel provides the insight and resources needed to navigate this dynamic landscape.

Our deep understanding of the Indian economic environment allows us to identify and leverage the most promising opportunities for growth. We guide you through every step of the investment process, from initial market analysis to regulatory compliance, ensuring a seamless entry and operational experience.

With Fox&Angel’s support, you gain a trusted partner dedicated to helping you achieve your business goals in India and successfully invest in India. Our tailored strategies and local expertise empower you to confidently make informed decisions and drive success in one of the world’s most vibrant markets.

This post was originally published on: Foxnangel

#fdi in india#fdi investment in india#foreign investment in india#startups in india#franchise in india#regulatory compliance#invest in inda#foxnangel

2 notes

·

View notes

Text

Mastering B2B Sales: Your Essential Guide to 20 Proven Strategies and Tactics for 2025

The B2B sales landscape is transforming rapidly, driven by advancements in technology, changing buyer behavior, and heightened competition. As businesses gear up for 2025, the focus must shift to a more strategic, data-driven, and customer-centric approach to achieve sustainable growth. Below, we delve into 20 essential strategies and tactics that every B2B company should adopt to refine their sales processes and thrive in the ever-evolving market.

1. Personalized Customer Engagement

In today’s competitive environment, personalization is no longer optional—it’s essential. Tailor your messaging to address specific customer pain points and needs. Use CRM platforms to track interactions, preferences, and behavioral data, ensuring every touchpoint feels meaningful and relevant.

2. Adopt AI and Automation

Artificial intelligence and automation tools are transforming how B2B sales teams operate. From chatbots handling initial inquiries to AI-driven analytics predicting customer needs, these technologies streamline workflows, improve efficiency, and help prioritize leads for better conversion rates.

3. Focus on B2B Lead Generation in India

With India’s growing economy and increasing demand for B2B services, it’s a hotspot for lead generation. Companies like The Global Associates specialize in capturing high-quality leads in this region, enabling businesses to tap into one of the world’s fastest-growing markets. Invest in localized marketing campaigns, and utilize platforms like LinkedIn and Google Ads to target decision-makers effectively.

4. Implement Account-Based Marketing (ABM)

ABM is a powerful strategy where marketing and sales teams work collaboratively to target high-value accounts. Instead of casting a wide net, focus your resources on a select group of prospects, delivering customized campaigns that directly address their specific needs.

5. Enhance Your Digital Presence

Your online presence is often the first impression potential clients have of your business. Ensure your website is optimized for SEO, mobile-friendly, and offers a seamless user experience. Regularly update blogs, whitepapers, and case studies that demonstrate your expertise and add value to your audience.

6. Develop Multi-Channel Outreach

Gone are the days when email alone could drive sales. Today’s B2B buyers expect communication across multiple channels, including email, phone, social media, and even in-person meetings. A well-coordinated outreach strategy ensures you’re reaching prospects wherever they are most active.

7. Invest in Value-Driven Content

Content is the backbone of B2B marketing. Create in-depth whitepapers, blogs, videos, and case studies that address the challenges your prospects face. Use content as a tool to educate and build trust, positioning your business as a thought leader in your industry.

8. Strengthen Sales Enablement

Empower your sales team with the tools, resources, and training they need to succeed. This includes access to up-to-date product information, buyer personas, and data-driven insights that can help them tailor their pitch to individual prospects.

9. Leverage Data Analytics

Incorporate data-driven insights into every stage of your sales funnel. Use analytics tools to track customer behavior, identify trends, and refine your strategies. This approach ensures you’re always making informed decisions that drive results.

10. Collaborate with Strategic Partners

Partnering with complementary businesses can open doors to new opportunities. For instance, a software provider could partner with a consulting firm to offer bundled services, creating value for both companies and their customers.

11. Focus on Customer Retention

It’s often said that retaining a customer is more cost-effective than acquiring a new one. Implement loyalty programs, provide excellent post-sale support, and continuously engage with your existing customers to ensure they remain loyal advocates for your brand.

12. Harness the Power of Video Marketing

Video content is increasingly becoming a preferred medium for B2B buyers. Use explainer videos, product demos, and client testimonials to engage prospects and communicate your value proposition effectively.

13. Encourage Referrals

Happy customers can become your best brand ambassadors. Develop a referral program that incentivizes your existing clients to recommend your services to their network.

14. Monitor Competitors

Keeping a close eye on your competitors can provide valuable insights. Identify what’s working for them and where they might be falling short. Use this information to refine your strategies and gain a competitive edge.

15. Expand Internationally

If your business hasn’t explored international markets yet, 2025 might be the year to do so. Develop localized strategies to address the specific needs and cultural preferences of global audiences.

16. Use Social Proof to Build Credibility

Social proof, such as client testimonials, success stories, and case studies, plays a crucial role in establishing trust. Showcase these prominently on your website and marketing materials to demonstrate your capabilities.

17. Align Sales and Marketing Teams

Silos between sales and marketing teams can hinder your growth. Align their goals and encourage collaboration to create a seamless journey from lead generation to conversion.

18. Host Webinars and Events

Webinars and events are excellent ways to educate your audience, showcase your expertise, and generate new leads. Offer valuable insights during these sessions to leave a lasting impression on your prospects.

19. Optimize Pricing Strategies

Your pricing strategy should cater to different customer segments. Offer tiered packages, volume discounts, or subscription models to accommodate varying budgets and requirements.

20. Partner with Industry Experts

Collaborate with B2B sales and lead generation experts like The Global Associates. With a proven track record of delivering high-quality leads and helping businesses achieve their sales goals, partnering with such firms ensures your strategy is backed by experience and expertise.

Final Thoughts

The future of B2B sales lies in leveraging technology, focusing on customer-centric strategies, and optimizing lead generation efforts in emerging markets like India. By adopting these 20 essential tactics, businesses can stay ahead of the curve, driving both growth and profitability in 2025.

Would you like a tailored approach to integrate these strategies into your business? Collaborate with The Global Associates to unlock the full potential of your B2B sales strategy.

#b2b#b2b lead generation#lead generation#the global associates#b2b lead generation services#lead generation services in india

3 notes

·

View notes

Text

Consultation Audit Services in Delhi: A Pathway to Financial Precision

Delhi, the capital city of India, is not just the heart of the nation but also a bustling hub of business activity. From startups to established enterprises, organizations in the Delhi area are increasingly relying on consultation audit services to ensure financial transparency, regulatory compliance, and optimized operations. Here’s an in-depth look at why consultation audit services are essential and how they can benefit businesses in the region.

Understanding Consultation Audit Services

Consultation audit services go beyond traditional financial audits. They encompass a comprehensive review of a company’s financial records, operational processes, and compliance frameworks to provide actionable insights for improvement. These services can include:

Statutory Audits – Ensuring compliance with legal and financial reporting requirements.

Internal Audits – Evaluating operational efficiency and risk management practices.

Tax Audits – Verifying compliance with taxation laws and optimizing tax strategies.

Process Audits – Reviewing and enhancing workflows for better productivity and cost-efficiency.

Management Audits – Assessing the effectiveness of leadership and decision-making processes.

Why Businesses in Delhi Need Consultation Audit Services

Regulatory Environment Delhi is home to numerous businesses operating under stringent local, national, and international regulations. Regular audits ensure compliance with laws like the Companies Act, GST laws, and various sector-specific regulations.

Competitive Advantage A thorough audit helps identify inefficiencies, reduce costs, and optimize resource allocation. These insights allow businesses to remain competitive in Delhi’s vibrant market.

Investor Confidence For businesses seeking funding, robust audit practices reassure investors of financial integrity and sound management.

Risk Mitigation With businesses in Delhi facing challenges such as cyber threats, fraud, and fluctuating market conditions, audits provide a safeguard by identifying and addressing vulnerabilities early.

Key Benefits of Consultation Audit Services

Enhanced Compliance: Avoid penalties by adhering to legal and regulatory standards.

Financial Accuracy: Ensure error-free records and improved budgeting.

Strategic Decision-Making: Leverage insights to make informed business decisions.

Improved Credibility: Build trust with stakeholders, including customers and investors.

Cost Efficiency: Streamline processes to save time and resources.

Choosing the Right Consultation Audit Firm in Delhi

The effectiveness of an audit depends largely on the expertise of the auditing firm. Here are key factors to consider:

Experience and Specialization: Choose a firm with a proven track record and expertise in your industry.

Local Knowledge: Firms familiar with Delhi’s regulatory landscape can provide tailored solutions.

Comprehensive Services: Opt for firms offering end-to-end audit and consultation services.

Technology Adoption: Modern tools like AI-powered audit software can enhance precision and efficiency.

Leading Consultation Audit Trends in Delhi

Digital Auditing Tools: With the rise of digitization, automated tools are transforming traditional audit practices.

Sustainability Audits: As businesses focus on ESG (Environmental, Social, Governance) compliance, sustainability audits are gaining prominence.

Risk-Based Auditing: A shift towards identifying high-risk areas to prioritize during audits.

Conclusion-

In a dynamic business environment like Delhi, consultation audit services are not a luxury but a necessity. By partnering with the right audit firm, businesses can navigate the complexities of compliance, improve financial health, and unlock growth opportunities.

Whether you’re a small business owner or a large enterprise, investing in consultation audit services can set you on the path to financial precision and long-term success.

Looking for Consultation Audit Services in Delhi? Contact our team of experts to get tailored solutions for your business needs. Let us help you achieve financial clarity and compliance excellence!

#ConsultationAuditServices#AuditSolutions#DelhiBusinesses#FinancialTransparency#RegulatoryCompliance#InternalAudit#TaxAudit#RiskManagement#BusinessGrowth#DelhiStartups#AuditExperts#CorporateCompliance#ProcessOptimization#InvestorConfidence#StatutoryAudits#BusinessSuccess#AuditingTrends#SustainabilityAudits#FinancialClarity#BusinessConsultation

2 notes

·

View notes

Text

India’s Best Australian Immigration Consultants

Australia is the world’s smallest continent as well as the world’s largest island, the name is derived from the Latin AUSTRALIAS, means southern, legends of an “unknown land of the south. Australia is often referred to as the “lucky country” with pulsating economy, political stability and a quality of life envied by many. Australia is known around the world for its stunning landscapes. A great country to live in and do business, Australia has an enviable reputation as it offers premium standard of living. Effective July 1, 2012, new points system has been rolled out the below mentioned Skilled Migration Visas. The Qualifying Score is now 65 points for Skilled Subclasses. Apply Now with VJC Overseas Australia Immigration Consultants in Hyderabad.

Without a doubt, Australia has the greatest economic stability and excellent quality of life. Because of this, the country is one of the most popular destinations for people looking to relocate across the world. Take no chances with your visa application, instead, contact VJC Overseas Australia Immigration Consultants Hyderabad

2 notes

·

View notes

Text

Tax Auditors in Delhi: Expert Services by SC Bhagat & Co.

Navigating the complexities of tax regulations is crucial for businesses and individuals alike, especially in a dynamic financial landscape like Delhi. Choosing a reliable tax auditor ensures your financial compliance, reduces audit risks, and enhances your financial credibility. SC Bhagat & Co., a leading tax auditing firm in Delhi, provides expert services designed to meet the unique needs of businesses and individuals, from tax compliance to advanced auditing solutions.

Why Tax Auditing Matters Tax auditing is essential for ensuring that financial records are accurate and compliant with current tax laws. Regular audits help businesses identify financial discrepancies, optimize their tax liabilities, and avoid costly penalties. For individuals, tax audits can validate their tax filings and enhance financial transparency. Whether you're a business owner or an individual taxpayer, tax audits play a vital role in:

Ensuring Compliance: By following regulatory requirements, tax audits help organizations and individuals avoid penalties. Detecting Errors and Fraud: An audit reveals inconsistencies in financial records, helping to prevent fraud or accidental errors. Improving Financial Accuracy: A professional audit provides a detailed review of financial data, ensuring accurate tax calculations. Building Credibility with Stakeholders: Regular audits reflect a commitment to transparency, boosting stakeholder confidence. SC Bhagat & Co.: Trusted Tax Auditors in Delhi SC Bhagat & Co. has earned its reputation as a trusted provider of tax auditing services in Delhi, thanks to its dedicated team of qualified professionals, extensive industry knowledge, and commitment to client success. Their expert tax auditors help clients stay compliant, reduce tax risks, and optimize their financial health through strategic auditing and consulting.

Key Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a range of tax auditing and related services designed to meet the unique needs of both individuals and businesses in Delhi:

Statutory Tax Audits SC Bhagat & Co. conducts thorough statutory tax audits to ensure clients meet legal requirements and minimize tax liabilities. Their expertise in Indian tax laws ensures every client is fully compliant with government regulations.

Internal Audits For businesses seeking to improve internal processes, SC Bhagat & Co. offers internal auditing services that identify areas of risk, improve financial accuracy, and enhance operational efficiency.

GST Audits GST compliance is critical for businesses in India, and SC Bhagat & Co. specializes in GST audits to ensure accurate filing and adherence to GST regulations. This minimizes the risk of penalties and provides peace of mind.

Income Tax Audits SC Bhagat & Co. offers comprehensive income tax audits for individuals and businesses, ensuring accurate filings and preventing potential issues with tax authorities.

Forensic Audits For clients requiring deeper analysis, SC Bhagat & Co. provides forensic audits to detect and address financial discrepancies, fraud, or irregularities within an organization.

Benefits of Working with SC Bhagat & Co. When you choose SC Bhagat & Co. as your tax auditor in Delhi, you gain access to a team that brings professionalism, in-depth knowledge, and dedication to every audit. Here are some reasons clients prefer SC Bhagat & Co.:

Industry Expertise: With years of experience in tax auditing and consulting, SC Bhagat & Co. provides services across various industries. Client-Centric Approach: The team at SC Bhagat & Co. takes time to understand each client's specific requirements, offering tailored solutions that best meet their needs. Timely and Efficient Services: Understanding the importance of meeting deadlines, SC Bhagat & Co. ensures timely audits and reporting. Confidentiality and Trust: They prioritize client confidentiality, ensuring all information is handled securely and professionally. Why Delhi Businesses and Individuals Choose SC Bhagat & Co. Delhi’s competitive business environment demands precision and reliability in tax matters. SC Bhagat & Co.’s commitment to excellence, coupled with their local expertise, makes them a preferred choice for tax audits in Delhi. Their clients range from small businesses to large corporations, as well as individuals seeking precise and trustworthy tax audit solutions.

Testimonials from Satisfied Clients Many of SC Bhagat & Co.'s clients have shared positive experiences, appreciating their professionalism and thorough approach. Here are a few testimonials:

“SC Bhagat & Co. has transformed our financial process. Their tax auditors identified several areas where we could reduce tax liabilities, helping us save significantly.”

“We’ve been working with SC Bhagat & Co. for years, and their expertise in GST audits has been invaluable. Highly recommended for any business in Delhi!”

Contact SC Bhagat & Co. for Expert Tax Auditing in Delhi If you're in need of reliable and professional tax auditing services in Delhi, SC Bhagat & Co. is here to help. Their team is ready to assist you with all your tax auditing needs, ensuring you meet compliance requirements and optimize your financial standing.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices#remittances

3 notes

·

View notes

Text

Top Must-Visit Destinations in India for an Unforgettable Journey

India is a land of culture, beauty, and heritage - one of the most diverse travel destinations in the world. It has everything from the majestic Himalayas to the serene beaches of Kerala. Here is a review of some of the most recommended places to visit in India to help you plan your trip. And to make your journey utterly hassle-free, book from India's best travel agency or consult a few of the best travel agents in town for some expert local support and crafted travel plans.

Agra – the City of the Eternal Taj Mahal: One is undoubtedly reminded of Agra, India-the one iconic place in India-home to the majestic Taj Mahal, one of the world's most beautiful marble mausoleums, which the great Emperor Shah Jahan constructed in memory of his beloved wife, and among the Seven Wonders of the World. Of course, Agra Fort and Fatehpur Sikri must also be seen. And they are two UNESCO World Heritage sites where one is reminded of the beauty of Mughal architecture.

Jaipur: The Pink City of Royal Splendor: Jaipur is the capital of Rajasthan. It gives India a glimpse of its glorious past. The city is popularly known for its palaces and the forts, particularly Amber Fort, City Palace, and Hawa Mahal. This city has been termed as the "Pink City." Treasure houses are found in the markets here for the shoppers in handicrafts, jewelry, and all kinds of clothing. Jaipur is one of the destinations in the famous Golden Triangle of India, which every top company in India's travel scene covers.

Kerala – God's Own Country: Kerala is a place of peace for those seeking solace. Alleppey has the most beautiful backwaters, while Munnar has the most gorgeous tea plantations. The place is rich in Ayurvedic wellness retreats and natural beauty. One of the experiences here is a cruise on a houseboat through the backwaters. This experience can be well enjoyed with the help of local travel agents, who can provide itineraries according to the person's needs.

Varanasi – The Spiritual Capital of India: Varanasi is more than two thousand years old-a city of spiritual depth as well as one of the oldest continuously inhabited cities on earth. This holy place, situated on the river Ganges, has borne witness to one of the greatest pilgrimages for Hinduism. In the evenings, the Ganga Aarti will leave a traveler in a trance; old temples, narrow lanes and sacred rituals make this the must-visit destination of all those who seek India's spiritual essence.

Goa – Beaches and Beyond: Goa is known for its golden beaches, lively nightlife, and unique Portuguese influence. It is a dream destination for travelers who are seeking a relaxing beach getaway. The state offers something for everyone: bustling markets, water sports, and old churches. The best travel agents in Kolkata can guide you to the hidden treasures and lesser-known beaches for you to enjoy your experience to the fullest in Goa.

Conclusion: This includes varied landscapes, historical sites, and cultural experiences for any tourist in India. Whether adventure in the Himalayas, spiritual growth in Varanasi, or a beach vacation in Goa, there is always something for a traveler to choose from in India. For a hassle-free and memorable journey, booking with a top travel company in India or partnering with the best travel agents in Kolkata can provide expert guidance and ensure you make the most of your Indian odyssey.

Follow us at Facebook, Instagram, & X.

2 notes

·

View notes

Text

The IIT Delhi MBA: A Path to Excellence in Management Education

The IIT Delhi MBA program is one of the most prestigious management programs in India, offering a unique blend of technical and managerial education. With the growing demand for managers who can navigate complex business environments, IIT Delhi's Department of Management Studies (DMS) provides a solid platform for professionals to excel in leadership roles across various industries.

Why Choose the IIT Delhi MBA?

Global Recognition and Reputation IIT Delhi is not just another technical institute; it’s a globally recognized center for excellence in both technology and management. The MBA program at IIT Delhi stands out for its rigorous curriculum and high standards of academic excellence. The reputation of an IIT degree opens doors not only in India but also on a global scale.

Interdisciplinary Approach One of the standout features of the IIT Delhi MBA is its interdisciplinary approach. Students benefit from a robust ecosystem that blends engineering, technology, and management. This interdisciplinary synergy provides a broader perspective, enabling students to tackle business challenges from multiple angles.

Cutting-Edge Curriculum The curriculum at IIT Delhi is constantly updated to align with the dynamic business environment. It covers a wide array of subjects, from marketing and finance to data analytics and innovation management. This comprehensive approach ensures that students are equipped with both theoretical knowledge and practical skills that are highly relevant in today's world.

World-Class Faculty The faculty at IIT Delhi’s DMS comprises both academicians and industry professionals, ensuring a rich learning experience. Their expertise spans across diverse areas of business management, allowing students to gain insights from real-world challenges and research-backed strategies.

Strong Industry Connections The IIT Delhi MBA program boasts strong ties with the industry, which translates into exciting internship opportunities, live projects, and placements with top-tier companies. The program's focus on practical experience ensures that students are well-prepared to make an immediate impact in their respective fields.

Focus on Innovation and Leadership In today’s rapidly evolving business landscape, innovation and leadership are essential. The IIT Delhi MBA program emphasizes these skills, encouraging students to think creatively and take on leadership roles within organizations. Whether it's through specialized courses, workshops, or entrepreneurial initiatives, students are trained to be future-ready leaders.

State-of-the-Art Infrastructure IIT Delhi provides its MBA students with access to world-class infrastructure, including cutting-edge labs, libraries, and collaborative spaces. This ensures that students have all the resources they need to thrive academically and professionally.

Placement Opportunities for IIT Delhi MBA Graduates

The placement record of IIT Delhi MBA is exceptional, with graduates being recruited by leading companies across various industries, including consulting, technology, finance, and manufacturing. With an IIT Delhi MBA, students are equipped to take on diverse roles such as business analysts, consultants, financial managers, and more.

Companies like McKinsey, BCG, Amazon, and Google, among many others, are regular recruiters from the campus. The diverse skill set of IIT Delhi MBA graduates makes them highly sought after in both national and international markets.

Conclusion: A Gateway to Success

The IIT Delhi MBA is not just about obtaining a degree; it’s about shaping your career and becoming part of a legacy of excellence. With its interdisciplinary focus, strong industry connections, and emphasis on innovation, this program equips students with the tools and mindset needed to succeed in the ever-evolving business world.

If you’re looking for a top-tier MBA program that merges the best of technology and management, the IIT Delhi MBA is the ideal choice. It's not just an academic journey, but a gateway to leadership and success in the global marketplace.

#IIT Delhi MBA Graduates#IIT Delhi#IIT Delhi MBA#Success#education#educationnews#higher education#universities#education news#colleges#admissions#mba#students#Indian Institute of Technology Delhi (IIT Delhi MBA)#Education blog

2 notes

·

View notes

Text

NRI Real Estate in India: 6 Crucial Considerations Before Investing

For NRIs considering **real estate in India**Making informed decisions is essential for a successful investment journey. As the **growth of real estate in India** continues, understanding the landscape can unlock lucrative opportunities. Here are six critical factors to consider before making your investment.

1. Financial Regulations

Before diving into **NRI investment in India**, familiarize yourself with the financial regulations governing property purchases. NRIs can buy residential properties, but it's crucial to understand restrictions on agricultural land and commercial properties.

2. Tax Implications

Tax laws can significantly impact your returns on investment. NRIs must be aware of income tax, capital gains tax, and property tax obligations. Consulting a tax advisor can help clarify these aspects and optimize your financial strategy.

3. Repatriation of Funds

Understanding how to repatriate funds is vital for NRIs. The Reserve Bank of India (RBI) allows repatriation of up to $1 million annually, but certain conditions must be met. Ensure you are aware of these rules to facilitate smooth fund transfers.

4. Property Valuation

Engaging with reputable services like FutureProperty can help ensure you make sound investments. Their expertise in **real estate in India** includes thorough property valuations and insights into market trends, which are crucial for informed decision-making.

5. Location and Growth Potential

The location of your investment can significantly influence its value. Look for areas with high growth potential, as the **growth of real estate in India** is often concentrated in developing urban centers. Research local infrastructure projects and amenities that may boost property values.

6. Legal Compliance

Lastly, ensure all legal aspects are covered. Verify property titles, ownership documents, and any pending dues. FutureProperty offers valuable services to guide you through the legal processes involved in **NRI investment in India**, ensuring a hassle-free experience.

Conclusion

Investing in **real estate in India** as an NRI can be a rewarding venture if approached with the right knowledge and support. By considering these crucial factors and leveraging services from FutureProperty, you can navigate the complexities of the Indian property market effectively. For more insights, feel free to reach out to us.

**Contact Information:**

Address: HIG-35, KPHB, Road No. 1, Behind Karur Vysya Bank, Phase 1, Hyderabad - 500072, Telangana State, INDIA

Email: [email protected]

Phone: +91 7337555121

For additional information, visit our blog at [FutureProperty](https://www.futureproperty.in/blog/nri-real-estate-in-india).

For an NRI seeking to invest in real estate in India, understanding the financial landscape is critical. Follow our blog for insights and guidance.

2 notes

·

View notes

Text

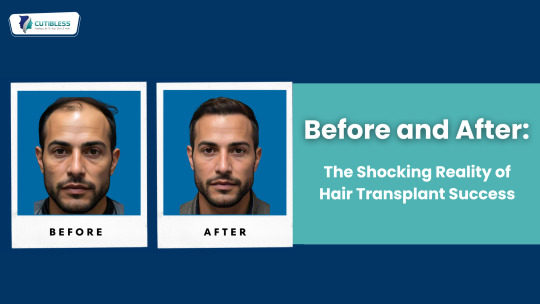

Before and After: The Shocking Reality of Hair Transplant Success

Hair Transplantation: Your Comprehensive Guide to Regaining Confidence

Hair loss can deeply affect self-esteem and confidence, prompting many to seek effective solutions. Fortunately, hair transplant procedures provide hope for those looking to restore a fuller head of hair. This comprehensive guide explores the essentials of hair transplants, from pre-operative preparations to post-operative care, helping you navigate your hair restoration journey confidently.

Preparing for Your Hair Transplant:

Thorough pre-operative preparation is crucial for a successful hair transplant. It starts with an in-depth consultation with a qualified surgeon, where you can discuss your goals and medical history. The surgeon will assess your scalp, design your hairline, and determine the number of grafts needed. Understanding the costs involved and exploring payment options is vital for financial planning.

Following pre-operative instructions is essential for optimizing results and ensuring a smooth recovery. These instructions typically include dietary guidelines, smoking cessation, and adjustments to any medications that could interfere with the procedure. Preparing your scalp by keeping it clean and free from products is equally important. Managing expectations is key; patients should have a realistic understanding of potential outcomes and limitations.

The day before the hair transplant is important for setting the stage. Prioritize relaxation and ensure you get adequate sleep to promote rejuvenation. Avoid certain medications that can thin the blood or increase bleeding risk, as advised by your healthcare provider. By following these recommendations, you can approach your procedure with a calm mindset and optimal readiness.

The Hair Transplant Procedure:

The hair transplant procedure is a carefully orchestrated process aimed at achieving natural-looking results. The common technique which is used mostly Follicular Unit Extraction (FUE). This method involves extracting individual hair grafts and implanting them into the areas experiencing hair loss. Each step — from graft processing to recipient area preparation and hairline creation — is meticulously executed to ensure the best outcomes. Various anesthesia options are available to keep you comfortable throughout the procedure.

Post-Operative Care:

Your journey continues through the post-operative stages, where patience and diligence are vital. In the immediate aftermath, you may experience swelling, redness, and discomfort, making rest and gentle scalp care essential. As days pass, scabbing and potential itching may occur, requiring careful management to avoid complications. Gradually, as scabs fall off and hair begins to shed, you will start to see new growth, providing hope for the final results. Over the following months, significant hair growth and increased density will culminate in renewed confidence and joy.

Individual Considerations

Both male and female patients have unique considerations and outcomes, necessitating tailored approaches. Before-and-after photos serve as powerful testimonials, showcasing the transformative impact of hair transplants and illustrating the journey from hair loss to restoration. In India, cultural factors and cost advantages shape the hair transplant landscape, making it an appealing option for those seeking effective solutions.

Complications and Risks

While hair transplant procedures are generally safe, they carry inherent risks, including infection, bleeding, and scarring. It’s essential to choose a qualified and experienced surgeon, as well as to diligently follow pre-and post-operative instructions to mitigate these risks.

Conclusion:

Knowledge is power in the realm of hair transplantation. By understanding the process, managing expectations, and seeking personalized consultations, you can make informed decisions that align with your goals. While complications may arise, the potential to restore confidence and enhance self-esteem through successful hair transplants is invaluable. Embrace this journey, celebrate your milestones, and look forward to renewed vitality and self-assurance.

For the best hair transplant experience and results, visit Cutibless — your destination for top-quality hair restoration in Bangalore.

2 notes

·

View notes

Text

Best EOR Service Provider in Bangalore: Brookspayroll

In the dynamic business landscape of Bangalore, companies are constantly seeking ways to streamline operations and optimize costs. One of the most effective strategies for achieving this is by partnering with an Employer of Record (EOR) service provider. Among the many players in this space, Brookspayroll stands out as the best EOR service provider in Bangalore, offering unparalleled expertise and comprehensive solutions tailored to meet the unique needs of businesses. What is an Employer of Record (EOR)? An Employer of Record (EOR) is a third-party organization that takes on the legal responsibilities of employment, allowing companies to hire employees in a new market without the need to establish a legal entity. The EOR handles various tasks such as payroll processing, tax compliance, employee benefits, and other HR functions, enabling businesses to focus on their core operations. Why Choose Brookspayroll as Your EOR Service Provider in Bangalore? Brookspayroll has earned its reputation as the best EOR service provider in Bangalore through its commitment to delivering high-quality services that cater to the specific requirements of businesses operating in India’s Silicon Valley.

Local Expertise with Global Standards Brookspayroll combines local knowledge with global best practices, ensuring that businesses are fully compliant with Bangalore's complex labor laws and regulations. This local expertise is crucial for companies looking to mitigate risks and avoid legal pitfalls when expanding their workforce.

Comprehensive EOR Services Brookspayroll offers a full suite of EOR services, including payroll management, tax filing, employee benefits administration, and regulatory compliance. Their end-to-end solutions are designed to minimize administrative burdens, allowing businesses to operate smoothly and efficiently.

Tailored Solutions for Diverse Industries Whether you're in IT, manufacturing, healthcare, or any other sector, Brookspayroll provides customized EOR solutions that align with your industry’s specific needs. This flexibility makes them the preferred choice for companies of all sizes, from startups to large enterprises.

Cutting-Edge Technology Brookspayroll leverages advanced technology to deliver seamless and efficient EOR services. Their digital platforms offer real-time insights into payroll processing, employee management, and compliance status, enabling businesses to make informed decisions with ease.

Dedicated Support and Consultancy Brookspayroll goes beyond just offering EOR services—they provide dedicated support and consultancy to help businesses navigate the complexities of workforce management in Bangalore. Their team of experts is always on hand to address any queries or concerns, ensuring a smooth and hassle-free experience. Benefits of Partnering with Brookspayroll Partnering with Brookspayroll offers numerous advantages, including: Cost Efficiency: Reduce the overhead costs associated with managing an in-house HR department. Risk Mitigation: Ensure full compliance with local labor laws and minimize the risk of legal issues. Speed to Market: Quickly establish a presence in Bangalore without the need to set up a legal entity. Focus on Core Business: Free up time and resources to focus on your core business operations. Scalability: Easily scale your workforce up or down based on your business needs. Conclusion Expanding your business in Bangalore can be a daunting task, but with Brookspayroll as your EOR service provider, you can navigate the complexities of employment with confidence. Their expertise, comprehensive services, and commitment to client success make them the best choice for businesses looking to establish a strong presence in Bangalore. Choose Brookspayroll for reliable, efficient, and compliant EOR services that empower your business to thrive in one of India’s most competitive markets.

#top eor providers in india#best payroll services provider in delhi & ncr#consultant payroll services in india#posh training in india

2 notes

·

View notes

Text

Setting Up a Business in India: A Comprehensive Guide by Masllp

India has become a preferred destination for both local and international entrepreneurs, thanks to its growing economy, favorable government initiatives, and emerging consumer market. Whether you're a small startup or an established company looking to expand, setting up a business in India can offer remarkable opportunities. Masllp, a trusted consulting partner, specializes in helping businesses navigate the complex procedures of registration, compliance, and scaling in India.

Why Set Up a Business in India? India’s business landscape is evolving rapidly, making it an attractive destination for a wide range of industries. Here are a few key reasons to consider setting up a business in India:

Growing Consumer Market: With a large and young population, India offers a vast market for consumer goods, services, and technology. Ease of Doing Business: Government initiatives like Make in India and Startup India have simplified regulatory processes, reduced barriers, and encouraged foreign investment. Supportive Economic Policies: India's government has introduced tax incentives and simplified tax structures that foster a business-friendly environment. Skilled Workforce: India is home to a skilled and diverse workforce, making it easier to find qualified employees in virtually any industry. Steps to Setting Up a Business in India with Masllp Masllp offers end-to-end support in setting up a business in India, from choosing the right business structure to managing compliance. Here’s a step-by-step guide:

Choosing the Right Business Structure India offers several business structures, including Private Limited Company, Limited Liability Partnership (LLP), and Sole Proprietorship. Each has its advantages and requirements:

Private Limited Company: Ideal for businesses seeking to raise funds or expand quickly. LLP: Offers flexibility with limited liability and is easier to manage. Sole Proprietorship: Suitable for small businesses looking to test the market before expanding. Masllp assists clients in selecting a structure that aligns with their business objectives, ensuring compliance with local laws and regulations.

Registration and Legal Formalities Once the business structure is chosen, Masllp handles the complete registration process, including obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and Certificate of Incorporation. These are crucial for:

Establishing the company’s legal identity in India. Allowing the business to operate under its registered name. Providing a smooth setup process without regulatory hiccups.

Securing Necessary Licenses and Permits Depending on the nature of the business, specific licenses and permits might be required. Industries like food, pharmaceuticals, and manufacturing often need approvals from regulatory bodies. Masllp guides businesses through this process, ensuring that all permits are acquired for seamless operation.

Setting Up Bank Accounts and Financial Structuring Setting up a local bank account is essential for conducting business in India. Additionally, understanding India's taxation system is crucial for compliance. Masllp assists in setting up business bank accounts, as well as in understanding the Goods and Services Tax (GST), Income Tax, and other fiscal regulations, ensuring compliance and optimizing tax efficiency.

Hiring and Staffing Solutions India offers a large talent pool across diverse industries. Masllp provides HR solutions, including assistance with recruitment, payroll management, and employee benefits, to help businesses find the right team and establish efficient HR practices.

Ongoing Compliance and Reporting India has specific reporting and compliance requirements, such as annual returns, GST filings, and income tax submissions. Masllp offers ongoing compliance management, ensuring that businesses meet regulatory deadlines and avoid penalties.

Benefits of Partnering with Masllp When setting up a business in India, having an experienced partner like Masllp can streamline processes, reduce delays, and enhance operational efficiency. Masllp’s services include:

Expert Guidance: With in-depth knowledge of India’s business laws and market trends, Masllp offers strategic insights for a successful setup. Personalized Solutions: Each business is unique, and Masllp provides customized solutions to meet specific requirements. End-to-End Support: From registration to compliance, Masllp offers comprehensive support throughout the business setup journey. Common Challenges in Setting Up a Business in India While India’s business landscape is promising, challenges such as regulatory compliance, tax structures, and complex documentation can arise. Masllp has a deep understanding of these potential obstacles and employs a proactive approach to address them, ensuring smooth business initiation and growth.

Start Your Business Journey with Masllp Today! Setting up a business in India can be a transformative decision for entrepreneurs and companies alike. With Masllp by your side, you’ll have a trusted partner who understands the intricacies of the Indian market and regulatory environment. From initial planning to full-scale operations, Masllp ensures a smooth, compliant, and successful business setup experience in India.

#accounting & bookkeeping services in india#audit#businessregistration#foreign companies registration in india#chartered accountant#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

Navigating the Indian Investment Landscape: A Comprehensive Guide for International Investors

India, with its vibrant economy, diverse market opportunities, and favorable regulatory environment, has emerged as an attractive destination for international investors seeking high returns and long-term growth prospects. From burgeoning sectors like technology and e-commerce to traditional industries such as manufacturing and agriculture, India offers a wealth of investment opportunities for savvy investors. In this comprehensive guide, we'll explore the Indian investment landscape, highlighting key sectors, regulatory considerations, investment strategies, and tips for international investors looking to capitalize on India's growth story.

Understanding the Indian Investment Landscape:

1. Economic Overview: India is the world's sixth-largest economy by nominal GDP and one of the fastest-growing major economies globally. With a young and dynamic population, a burgeoning middle class, and increasing urbanization, India offers a vast consumer market and a favorable demographic dividend for investors.

2. Key Investment Sector: India's economy is diverse and offers investment opportunities across various sectors. Some of the key sectors attracting international investors include:

- Information Technology (IT) and Software Services

- E-commerce and Digital Payments

- Healthcare and Pharmaceuticals

- Renewable Energy and Clean Technology

- Infrastructure and Real Estate

- Manufacturing and Automotive

- Agriculture and Agribusiness

3. Regulatory Environment: India has implemented several reforms to streamline its regulatory environment and improve the ease of doing business for investors. The government has introduced initiatives such as Make in India, Startup India, and Digital India to encourage investment, innovation, and entrepreneurship. Additionally, foreign direct investment (FDI) policies have been liberalized across various sectors, allowing greater foreign participation in the Indian economy.

4. Taxation and Legal Considerations: International investors should familiarize themselves with India's tax laws, regulations, and legal frameworks before making investment decisions. India has a progressive tax regime with corporate tax rates varying based on business structure, industry, and income levels. It's advisable to consult with tax advisors and legal experts to navigate the complexities of India's taxation and legal landscape.

Investment Strategies for International Investors:

1. Market Research and Due Diligence: Conduct thorough market research and due diligence to identify investment opportunities aligned with your investment objectives, risk tolerance, and sector preferences. Evaluate market trends, competitive dynamics, regulatory changes, and macroeconomic indicators to make informed investment decisions.

2. Diversification: Diversify your investment portfolio across different asset classes, sectors, and geographic regions to mitigate risks and maximize returns. Consider allocating capital to both high-growth sectors such as technology and healthcare, as well as stable sectors like infrastructure and consumer goods.

3. Long-Term Perspective: Adopt a long-term investment perspective when investing in India. While short-term market volatility and regulatory changes may occur, India's economic fundamentals remain strong, offering attractive growth prospects over the medium to long term. Patient investors can capitalize on India's demographic dividend and structural reforms to generate significant returns.

4. Partnering with Local Experts: Partnering with local investment advisors, financial institutions, and legal experts can provide valuable insights and guidance on navigating the Indian investment landscape. Local expertise can help international investors navigate regulatory hurdles, identify investment opportunities, and mitigate operational risks effectively.

5. Investment Vehicles: Evaluate different investment vehicles available for investing in India, including direct investments, private equity funds, venture capital funds, and mutual funds. Each investment vehicle offers unique benefits and risks, so it's essential to assess their suitability based on your investment goals and risk appetite.

Tips for International Investors:

1. Stay Informed: Stay updated on market developments, regulatory changes, and economic trends affecting the Indian investment landscape. Follow reputable financial news sources, attend industry conferences, and engage with local experts to stay informed and make timely investment decisions.

2. Network and Build Relationships: Networking with industry professionals, government officials, and fellow investors can provide valuable insights and access to investment opportunities in India. Join industry associations, attend networking events, and leverage social media platforms to expand your network and build relationships in the Indian business community.

3. Be Patient and Persistent: Investing in India requires patience, persistence, and a long-term commitment. Building relationships, navigating regulatory hurdles, and achieving investment success take time and effort. Stay focused on your investment goals, adapt to changing market conditions, and remain resilient in the face of challenges.

4. Seek Professional Advice: Consult with financial advisors, tax consultants, and legal experts specializing in India to seek professional advice tailored to your specific investment needs. Expert guidance can help you navigate regulatory complexities, optimize tax efficiency, and maximize returns on your investments in India.

5. Cultural Sensitivity: Recognize and respect cultural differences when conducting business in India. Building strong relationships and trust with local partners and stakeholders requires understanding and appreciating Indian customs, traditions, and business etiquette.