#LLC Loan Officer

Explore tagged Tumblr posts

Text

At NEXA Mortgage, LLC our only job is finding you the best loan program available. We are independent loan officers and do not work for one particular lending institution nor are we tied to just one product line.

0 notes

Text

𝗼𝗻𝗲 𝘄𝗮𝘆 𝗼𝗿 𝗮𝗻𝗼𝘁𝗵𝗲𝗿 | neil lewis x reader

𝘀𝘂𝗺𝗺𝗮𝗿𝘆 | a visit to gumshoe video could go one of two ways... but one way or another, you're gonna get him.

𝘄𝗼𝗿𝗱 𝗰𝗼𝘂𝗻𝘁 | varies

𝘄𝗮𝗿𝗻𝗶𝗻𝗴𝘀 | smut (18+ only), enemies to lovers, nothing too terrible just neil and reader bullying each other

this is a choose your own ending fic!! after the introduction, click to choose which way you want the story to go! each ending will have its own warnings section, so read those as well!

Technically, you always dressed well for work. Corporate jobs require professional attire, obviously; but you were slightly overdressed today, and it wasn’t to go into the office.

Tight skirt and matching blazer, a silky-satin button-up, black heels, and thigh-high stockings with a seam up the back. No, this wasn't how you dressed for a day in the office… this was how you dressed when you were closing a deal.

A little bell dinged as you walked into Gumshoe Video, and you looked around for a moment after you stepped inside: the decorations were… plentiful, and kitschy. The displays were so small, and just a quick glance at some of the shelves had you frowning in confusion. These are some seriously deep cuts… how do they make any money at this place?

Lucien came bounding up to you in an instant, hands pressed tight against his horribly out-of-fashion skinny jeans as if to hide that they were clammy already. "Do you, uh, need help finding anything?" he asked.

You offered him a pitying smile, about to offer him a friendly ‘no thanks, but’ and then tell him why you were really here… but you were interrupted.

Jonathan, who had taken a break from sipping on a soda behind the counter, coughed to get Lucien's attention as he quickly shook his head. He didn't seem to understand, though, looking back at you with his brows furrowed.

"Uh, ignore him,” Lucien laughed nervously. “Are you looking for a rental?"

"Dude, she's not here to get a movie!" Jonathan snapped. "Who dresses like that to pick up a tape?!"

"Maybe she's on her way to work!" Lucien returned sharply. "Or maybe she just came from somewhere!"

"Where?"

"My dreams!"

"No, your friend is right, I'm not here to pick up a movie," you admitted, and Lucien looked at you nervously.

"You, uh, don't like movies?" he wondered.

"I love them actually, but—"

The door to the office swung open, with Neil glaring at you from the other side of it. "You," he announced with disdain.

"—but I'm here to speak with the owner," you finished, tilting your head and grinning at Neil.

"We have nothing to speak about," Neil assured you as he walked towards you.

"We have multiple opportunities to discuss," you disagreed, "and my employers are very anxious that I deliver this message to you, so if we could please speak in your office—"

"Her employers? Is this chick in the mob?!" Lucien blurted out fearfully. "Neil, I know money's tight, but— oh fuck, was that 'small business loan' just a cover—"

"She's not from the mafia," Neil sighed. "They actually have some morals."

You extended a hand to introduce yourself to Lucien. After your name, you told him your job: "Head of Acquisitions, Media Giant, LLC."

Jonathan coughed again, poorly covering the sound of him saying "blood-sucking harpy" under his breath.

You smiled at him; "You really should get that cough checked out," you suggested pointedly.

“Whatever it is your puppet-masters want you to discuss with me,” Neil began, wiggling his fingers as if pantomiming a little marionette show, “you can take right over there into our women’s restrooms and shove directly up your ass.”

“Oh, that’s cute,” you smiled, “I bet you’ve been saving that one since our last little visit. Can we go to your office now?”

“No, you can’t go in there— we just had the priest come by and bless it, we wouldn’t want your feet to burn now, would we?” Neil snarked in return.

“Fine— get it out of your system,” you encouraged. “Say whatever’s been stuck in that pretty little head for the last month waiting for me to come back, and then we can have our meeting, alright?”

“I— well, uh—” Neil stalled, looking a little flustered as he suddenly leaned on a shelf of tapes with one hand. “You think I’m pretty?” he mumbled nervously, running his free hand through his hair— only to put a little too much weight on the shelf and nearly tilt it over, having to scramble to catch it and make sure it was balanced again.

“Dude, pull yourself together,” Jonathan snapped at him, and Neil glared at him before looking back at you.

“Fine, okay— we can have a very brief conversation in my office,” Neil offered with a sigh, motioning for you to follow him, “but it’s going to go the same way it did last time: with me telling you hell no and you having to do the walk of shame back to your headquarters.”

“Looking forward to it,” you smiled, waving goodbye to the other men before stepping into Neil’s office as he shut the door behind you.

You watched him step around you to sit at his desk, looking at you expectantly with his legs spread and his fingers interwoven in his lap.

“Am I allowed to ask why you’re dressed like a cowboy, by the way?” you asked with a raised eyebrow, and he frowned at you as he tossed aside the hat and slipped the poncho off over his head, leaving just a much more normal outfit of jeans and a button-up underneath.

“We’re running a special on Westerns,” he explained, “it’s fun, okay? Not that you would know fun if it smacked you on the ass and called you sweetcheeks.”

“Honey, that’s just what I call a Friday night,” you smirked as you stepped a little closer leaning against the side of his desk as he swallowed thickly. You couldn’t just sit across from him— you needed to keep the upper hand. “But I’m here for business. Let’s talk business, shall we?”

“Right, business,” he frowned. “I’m guessing your business here today is trying to buy my store, again?”

“Something like that,” you relented.

“You know, I guess I should take it as a compliment,” he grinned, leaning back further in the chair. “Clearly, you know I’m a threat.”

“Please,” you rolled your eyes, “we’re a Fortune 500 company, and you’re a guy wearing a poncho.”

“I took off the poncho!” he defended.

“So you’re… just a guy, then,” you corrected. “The point is, we’re not worried about you stealing our business at all. We just think this location is going to waste.”

“You want the real estate?” he realized.

“You’re in a perfect spot, you know,” you informed him, “you just need… a little more help utilizing it.”

He sneered at you sharply. “I don’t want anything from you.”

“You only hate me so much because you resent success,” you informed him with a sigh. “Just because you’re broke and proud doesn’t mean making money is a sin.”

“It is when you put making money above everything else,” he replied, “like creativity and community and the authentic customer experience—”

“How exactly does Media Giant conflict with those things?” you scoffed. “We’re a company founded on creativity— and we always foster community—”

“Spare me the doublespeak, Big Brother,” Neil scoffed, “you’re just a bunch of— of robots! Your whole company, it’s just full of people trying to make a quick buck, top to bottom: you think the people in the back at McDonald’s give a fuck about food? That’s what you are, the McDonald’s of the film industry. You’d probably let a monkey work there if it could wear a nametag and convince someone to rent Fast and Furious Fifty or whatever the fuck.”

“Fine,” you sighed, “let’s just say for a moment that you’re right. That my company is so terrible because we don’t employ people like you.”

He relaxed for a second, and you leaned in closer in hopes that he was really listening.

“This is your chance to fix that!” you explained. “You can save us from the inside out, you know. You can start from the bottom, be our best sales guy, and then it turns into a promotion and a raise and soon you’re climbing the corporate ladder— where you can make some real change.”

He shook his head, laughing a little. “That’s not actually possible, it’s just a fantasy you tell all your little minions to keep them compliant.”

“It’s what I did,” you shrugged.

“You?” he realized with a laugh. “You, in one of those navy vests and nametags, selling people tapes?”

“I’m sort of a cinephile,” you admitted. “I wanted a job where I could talk about movies all day— and thanks to me, that Media Giant location rented out more copies of The Seventh Seal than all the rest combined.”

He stood up quickly, stepping closer to where you sat on his desk. “Y-you like The Seventh Seal?”

“It’s a masterpiece,” you answered, speaking a little softer as he was so close, “Bergman is a genius.”

A strange look crossed over his face, a heavy-lidded sort of look as he examined you. “Tarantino?”

“Overrated, but not bad,” you replied quickly.

“Tarkovsky?”

“Good, but hard to watch.”

“Lynch?”

You scoffed; “Don’t insult me.”

He laughed a little, crossing his arms and looking away from you. “You could be one of the good ones,” he realized, “but you sold out. And now you’re just a suit.”

“It’s not so bad,” you smirked, “I think you’d like a little more… structure, given the chance.”

“And that’s what you’re offering?” he pressed, and you nodded.

“We’ll let you keep the name, your employees… most of the decoration,” you offered, “you’ll just be technically a Media Giant franchise. You have nothing to lose, and so much fucking money to gain.”

He sighed a little, looking at you again. You could tell he was considering it, but not very thoroughly. All you could do was hope for the best, and wait for an answer…

CLICK HERE FOR THE SUB!NEIL ENDING

CLICK HERE FOR THE DOM!NEIL ENDING

#cillian murphy x reader#cillian murphy smut#neil lewis x reader#neil lewis smut#dom!neil lewis smut#sub!neil lewis smut

1K notes

·

View notes

Text

alright, i... didn't want to do this. i didn't want to have to do this. especially with all the hate ive been getting in my inbox recently. but i don't have a choice.

hi. im lulu. im a 21-year-old autistic immunocompromised queer person. i currently live with my mother (senior) and my little sister (10 years old). i need your help to get out.

(context and avenues to help below the cut)

as some of you may know, my stepfather died on august sixth from a heart attack. we lived in his parents basement, as it was all we could afford, and we depended on his income. he had a stable job, and mom decided to become a housewife and sell some things from the buisness they created together. when he died, the buisness was dissolved, as it was an llc partnership. his parents are extremely controlling, and as such, he was only able to finally start building up credit when mom came along, and we were almost at the point where he could qualify for a home loan so we could get out and get away from his parents.

that's gone now.

mom cannot qualify for a home loan because of her student loan payments and the credit card payments. we do not have the money to pay these off, and mom is trying desperately to get a job. we need the money to get out, as my stepfather's parents have been trying to get my sister away from my mom and shove both her and i out of the family for years. things are only getting worse now as we have reason to believe they are spying on our conversations and even going so far as tracking us (for example, they found a spare key to the car and went and took it and "cleaned it out" without mom's knowledge or permission, as it's her car now). they have been trying to circumvent mom and go behind her back during the entire process with the funeral home, coroner's office, all the legal documentation, and they are extremely infuriated that they cannot decide anything or push mom out because they are not the next of kin and have been trying to circumvent this. we have reason to believe that they're going to attempt to sell the cars that are still in my stepfather's name to collect on the money and never give us a dime, like they had with almost all of the money my little sister received as part of the college fund we set up at my stepfather's funeral as well as any money that my little sister had won in the past. we will never see a dime of it, and it's extremely upsetting that they are doing this. they have been running scams for years, and they have been nothing but hellish towards my mother, claiming she's withholding information from them when she has offered more than they've asked for and they have done nothing but take my little sister out and about without ever telling mom anything (for example- they screamed that mom was withholding information when she said she didn't copy the tox report for them because it was empty and claimed they needed to know his cholesterol levels [which doesn't even show up on a tox report- they didn't run his blood, either, and they didn't check his cholesterol levels anyway because they know that's what killed him, they could see it] and would not provide reasoning why [it does not affect them anyway just by nature of it being cholesterol], while on sunday they took my little sister out the whole day and failed to communicate with my mother that she would be with them and would be home after dinner).

they have been screaming at mom for collecting social security as though she was stealing their money and demanded that she doesn't get a job, and we have more than enough reason to believe that they are trying to get her to default on the bills so they finally have legal grounds to take my little sister and kick us out, leaving us with nowhere to go and no options. they have even gone as far as to threaten to take my sister away using force in the past, and, as they have firearms, that is a terrifying threat. they are unhinged and extremely upset that they cannot control us and make us do what they want, how they want, when they want, and they are up in arms over it.

when we move out, all hell is going to break loose, but the longer we wait, the worse it's going to get.

my stepfather, being 37 when he died, did not like thinking about his own mortality, so he didn't have a life insurance policy, a 401K, a will, nothing. we have been left high and dry by his death, and that is pushing aside the grief. we do not have the money to pay off the bills, pay for a lawyer, pay to have the car re-keyed to keep them from stealing it again, or to even flat-out buy a house to circumvent needing a loan, and on top of it all we have to deal with stepfather's parents not allowing us to grieve and implying that mom is a tramp and a heartless bitch that will blow any money given to her when she is more financially responsible than them. we also have to worry about them stealing our things, especially with how much they complain about how messy the basement is when most of the things here are theirs (stepfather's parents are hoarders- more specifically, his father hoards cars, and his mother hoards everything else, going out and shopping frivolously almost every day).

we need help with money, and i hate to ask, especially with the requirement of revealing my legal name and in light of the harassment i have been receiving for over a month now, but we need to get out of here, and we need to get out of here soon. it's only going to get worse the longer we stay. we need money to help with the bills, my mom's student loans, getting a lawyer, and getting a place to move into.

im posting this because im the only one my stepfather's parents won't find on any platform that i choose to use. my current goal is $9,000 USD, if only just to get enough money to get a cheap plot of land to move into, or one of the really cheap houses out here. this won't cover the loans or bills in addition, or the cost of getting a lawyer or anything else we need, but it is enough to get us a cheap place to live. i know it's a lot of money, but we are in a dangerous situation and need the money to escape. if we were to pay for everything, the goal would be in the hundreds of thousands, and i feel horrible just asking for this much. if you can't donate, please reblog, even the visibility might help and please do not spread my legal name. please remember to put "payment" or something generic in the reasoning box if it's required so that i will actually receive the funds instead of having my account purged from the site. i didn't want to ask for this, but i have no other options. please help.

c*sh*pp: $lulunightbon

v*nm*: @Lulilial

Goal: $0/$9,000

#im sorry#i don't know what else to do#please forgive me for this if you ever can#financial aid#autistic#trans

566 notes

·

View notes

Text

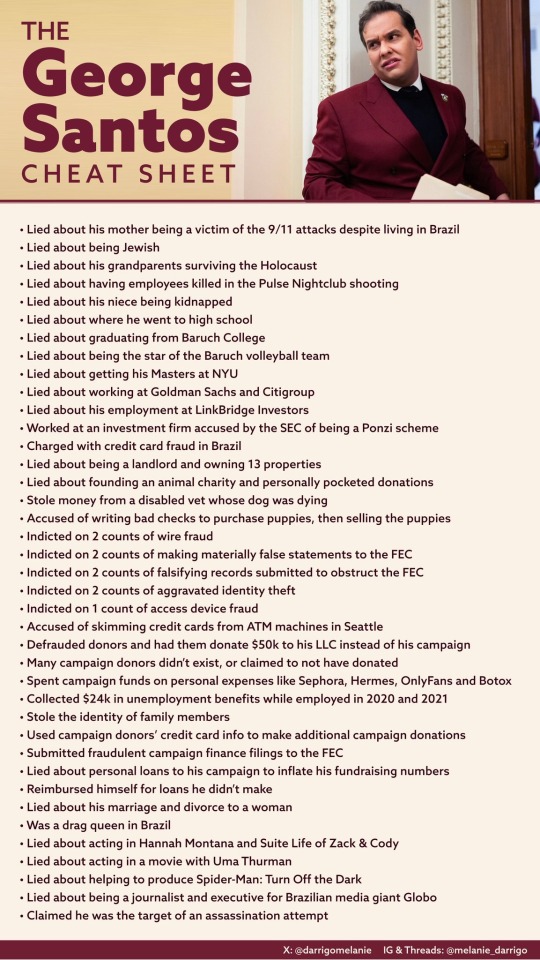

George Santos:

• Lied about his mother being a victim of the 9/11 attacks despite living in Brazil

• Lied about being Jewish

• Lied about his grandparents surviving the Holocaust

• Lied about having employees killed in the Pulse Nightclub shooting

• Lied about graduating from Baruch College

• Lied about being the star of the Baruch volleyball team

• Lied about getting his MBA at NYU

• Lied about working at Goldman Sachs and Citigroup

• Lied about his employment at LinkBridge Investors

• Worked at an investment firm accused by the SEC of being a Ponzi scheme

• Charged in Brazil with credit card fraud

• Lied about being a landlord and owning 13 properties

• Lied about founding an animal charity and personally pocketed donations

• Stole money from a disabled vet whose dog was dying

• Accused of writing bad checks to purchase puppies, then selling the puppies

• Indicted on 2 counts of wire fraud

• Indicted on 2 counts of making materially false statements to the FEC

• Indicted on 2 counts of falsifying records submitted to obstruct the FEC

• Indicted on 2 counts of aggravated identity theft

• Indicted on 1 count of access device fraud

• Accused of skimming credit cards from ATM machines in Seattle

• Defrauded donors and had them donate $50k to his LLC instead of his campaign

• Invented campaign donors, and some donors claimed to not have donated

• Spent campaign funds on personal expenses like Sephora, Hermes, OnlyFans and Botox

• Collected $24k in unemployment benefits while employed in 2020 and 2021

• Stole the identity of family members

• Used campaign donors’ credit card info to make additional campaign donations

• Submitted fraudulent campaign finance filings to the FEC

• Lied about personal loans to his campaign to inflate his fundraising numbers

• Reimbursed himself for loans he didn’t make

• Lied about his marriage and divorce to a woman

• Was a drag queen in Brazil

• Claimed he was the target of an assassination attempt

• Lied about acting in Hannah Montana and Suite Life of Zack & Cody

• Lied about acting in a movie with Uma Thurman

• Lied about helping to produce Spider-Man: Turn Off the Dark

• Lied about being a journalist and executive for Brazilian media giant Globo

After Santos himself, I I really put the bulk of the blame on the DNC + DCCC for not finding out about even a quarter of these huge ass lies until he was already in office. (Sorry, but the Republican Party ain’t gonna do it).

76 notes

·

View notes

Text

Excerpt from this story from Canary Media:

The federal government has just finalized a $861 million loan guarantee to fund what will be Puerto Rico’s largest utility-scale solar and battery storage installations.

In July, the Department of Energy’s Loan Programs Office announced a conditional commitment to finance two solar-plus-storage facilities on the southern coast of the island, plus two standalone battery energy storage systems. The solar plants combined will have 200 megawatts of solar capacity — enough to power 43,000 homes — while the battery systems are expected to provide up to 285 megawatts of storage capacity.

The installations, collectively called Project Marahu, will be led by Clean Flexible Energy LLC, an “indirect subsidiary” of the U.S. energy companies AES Corp. and TotalEnergies Holdings USA. Facilities will be located in the municipalities of Guayama and Salinas.

The DOE offers loans for clean energy projects on the condition that borrowers meet certain financing and administrative requirements. According to the agency, the company has now met all those conditions — meaning soon, hundreds of millions of dollars will start flowing toward construction.

Project Marahu is expected to come online sometime in 2025.

Jigar Shah, director of the DOE’s Loan Programs Office, told Canary Media that the loan presents a major opportunity to diversify and stabilize Puerto Rico’s grid, which currently relies on fossil fuels to produce more than 90 percent of its electricity. “There’s a huge potential for additional projects like this,” he said.

The loan is somewhat of a departure for Shah’s office, which typically invests in emerging clean energy technologies that have yet to be commercialized. In this case, the Puerto Rico government sought federal assistance to replace some of its oldest diesel-fired power plants with solar and storage projects through the Energy Infrastructure Reinvestment Program, which was created by the Inflation Reduction Act to help repurpose or replace existing fossil fuel infrastructure, Shah said.

4 notes

·

View notes

Text

A Stellantis joint venture with Samsung SDI has won a commitment from the U.S. government for up to a $7.54 billion loan to help build two electric vehicle battery plants in Kokomo, Indiana. The project being built by StarPlus Energy LLC is expected to create at least 2,800 jobs at the plants and hundreds more at a nearby park for parts supply companies, the Energy Department said Monday in a statement. The loan still must be finalized, but the government said the commitment shows its intent to finance the project. To get the loan, StarPlus must develop a plan to engage with community and labor leaders to create good paying jobs. It also has to meet technical, legal, environmental and financial conditions before the government will fund the loan. It’s unclear whether the loan will be finalized before President-elect Donald Trump takes office on Jan. 20.

3 notes

·

View notes

Text

Ultimate Guide to Starting a Business in Dubai: Everything You Need to Know

Understanding Dubai’s Business Landscape

Dubai has a diverse and dynamic business landscape, catering to various industries such as trade, tourism, finance, real estate, and technology. It is essential to research and understand the market demand, competition, and potential opportunities for your proposed business idea.

Choosing the Right Business Structure

Dubai offers several business structures, including sole proprietorship, limited liability company (LLC), branch office, and free zone company. Each structure has its own advantages, requirements, and regulations. Selecting the appropriate structure is crucial for your business’s growth, liability protection, and tax implications.

Obtaining the Necessary Licenses and Approvals

Starting business in Dubai, UAE requires obtaining the necessary licenses and approvals from the relevant authorities. These may include trade licenses, commercial licenses, and other industry-specific permits. The process can be complex, so it’s advisable to seek guidance from legal experts or business consultants.

Free Zones: A Viable Option for Foreign Investors

Dubai’s free zones offer attractive incentives for foreign investors, such as 100% foreign ownership, tax exemptions, and streamlined business setup processes. Popular free zones include Dubai Multi Commodities Centre (DMCC), Dubai Internet City (DIC), and Dubai Design District (D3).

Finding the Right Location and Office Space

Choosing the right location and office space is essential for your business’s success. Dubai offers a range of options, from modern office towers to shared workspaces and free zone facilities. Consider factors such as accessibility, infrastructure, and proximity to your target market.

Hiring and Managing a Team

Building a strong and talented team is crucial for your business’s growth. Dubai’s diverse workforce offers a pool of skilled professionals from various backgrounds. However, it’s important to understand the local labor laws, visa requirements, and cultural nuances when hiring and managing employees.

Banking and Financial Considerations

Establishing a business banking account, securing funding, and managing finances are critical aspects of start business in Dubai. Research the local banking system, explore financing options (such as bank loans, investors, or government initiatives), and develop a solid financial plan.

Marketing and Promoting Your Business

With a competitive business environment, effective marketing and promotion strategies are essential for your business’s success. Leverage digital marketing, networking events, tradeshows, and other channels to reach your target audience and build brand awareness.

Complying with Legal and Regulatory Requirements

Dubai has a comprehensive legal and regulatory framework governing business operations. Familiarize yourself with the relevant laws, regulations, and compliance requirements to ensure your business operates legally and avoids penalties or fines.

Seeking Professional Assistance

Starting business in UAE can be a complex process, especially for those new to the region. Consider seeking professional assistance from business consultants, lawyers, or accountants to navigate the process smoothly and avoid costly mistakes.

Start business in Dubai can be a rewarding and lucrative endeavor, but it requires careful planning, understanding of the local business landscape, and adherence to the relevant laws and regulations. By following this ultimate guide and seeking professional advice when needed, you can increase your chances of success in this dynamic and thriving business hub.

2 notes

·

View notes

Text

WASHINGTON (TND) — The House Ethics panel announced it has found “substantial evidence” that Republican Rep. George Santos broke multiple laws.

The panel conducted an investigation into the New York congressman and released its findings on Thursday, adding that it referred the information to the Justice Department.

A news release notes the panel determined Santos:

Knowingly caused his campaign committee to file false or incomplete reports with the Federal Election Commission

Used campaign funds for personal purposes

Engaged in fraudulent conduct in connection with RedStone Strategies LLC

Engaged in knowing and willful violations of the Ethics in Government Act as it relates to his Financial Disclosure Statements filed with the House

Santos, 35, who represents New York, has maintained his innocence, insisting he is the victim of a “witch hunt.” He has resisted all calls to resign, saying he intends to run for reelection next year.

He took to social media to speak out against the Committee's findings.

"If there was a single ounce of ETHICS in the 'Ethics committee', they would have not released this biased report," he wrote on X, whcih is the social media platform formerly known as Twitter. "The Committee went to extraordinary lengths to smear myself and my legal team about me not being forthcoming (My legal bills suggest otherwise). It is a disgusting politicized smear that shows the depths of how low our federal government has sunk. Everyone who participated in this grave miscarriage of Justice should all be ashamed of themselves ... I’ve come to expect vitriol like this from political opposition but not from the hallowed halls of public service."

He went on to say that he "will remain steadfast in fighting for my rights and for defending my name in the face of adversity. I am humbled yet again and reminded that I am human and I have flaws, but I will not stand by as I am stoned by those who have flaws themselves. I will continue on my mission to serve my constituents up until I am allowed. I will however NOT be seeking re-election for a second term in 2024 as my family deserves better than to be under the gun from the press all the time."

In October, prosecutors said Santos allegedly stole the identities of people who donated to his campaign, as well as repeatedly used their credit cards without their permission. Prosecutors said some of the stolen money ended up in his own bank account.

As alleged, Santos was charged with stealing people’s identities and making charges on his own donors’ credit cards without their authorization, lying to the FEC and, by extension, the public about the financial state of his campaign," Breon Peace, who is a United States Attorney for the Eastern District of New York, said in a separate news release."

"Santos falsely inflated the campaign’s reported receipts with non-existent loans and contributions that were either fabricated or stolen," Peace added. "This Office will relentlessly pursue criminal charges against anyone who uses the electoral process as an opportunity to defraud the public and our government institutions.”

The latest charges include the following:

One count of conspiracy to commit offenses against the United States

Two counts of wire fraud

Two counts of making materially false statements to the Federal Election Commission (FEC)

Two counts of falsifying records submitted to obstruct the FEC

Two counts of aggravated identity theft

One count of access device fraud

Prosecutors said he also stole from his own family members.

The defendant -- a Congressman -- allegedly stole the identities of family members and used the credit card information of political contributors to fraudulently inflate his campaign coffers,” District Attorney Anne T. Donnelly noted in the release. “We thank our partners in the US Attorney’s Office and the FBI as we work together to root out public corruption on Long Island.”

According to prosecutors, Santos allegedly charged more than $44,000 to his campaign using cards belonging to contributors without their knowledge. In one case, he charged $12,000 to a contributor’s credit card and transferred the “vast majority” of that money into his personal bank account, prosecutors said.

The charges, said prosecutors, are in addition to the seven counts of wire fraud, three counts of money laundering, one count of theft of public funds, and two counts of making materially false statements to the United States House of Representatives that were charged in the original indictment.

He was initially arrested in May on a 13-count federal indictment, which charged him with using funds earmarked for campaign expenses on designer clothes and other personal expenses and improperly obtaining unemployment benefits meant for Americans who lost work because of the pandemic.

Santos was also accused of falsely reporting to the Federal Elections Commission that he had loaned $500,000 to his campaign in an attempt to convince Republican Party officials that he was a serious candidate, when he actually had less than $8,000 in his personal accounts.

Santos, who likely faces a lengthy prison term if convicted, was elected to Congress in November and sworn in as the U.S. Representative for New York’s Third Congressional District on January 7, 2023.

#nunyas news#buddy you need to make a deal to resign#in exchange for the charges being reduced or dropped

2 notes

·

View notes

Text

Freelance Visas vs. Business Licenses: Which One Should You Choose?

Starting a business or working independently in a foreign country requires legal authorization. Two common options are Freelance Visas vs. Business Licenses. Both options have their advantages and limitations, depending on your goals. This guide will help you understand the key differences, benefits, and considerations so you can choose the best option for your professional needs.

What is a Freelance Visa?

A freelance visa allows individuals to work as self-employed professionals in a foreign country. It is ideal for freelancers, remote workers, and independent consultants who do not wish to establish a formal business.

Advantages of a Freelance Visa

Easier application process with minimal paperwork

Lower costs compared to business licenses

No requirement for a physical office

Greater flexibility in working with multiple clients

Limited liability as an individual worker

Suitable for digital nomads, writers, designers, and consultants

Some countries offer tax incentives for freelance visa holders

Disadvantages of a Freelance Visa

Restrictions on hiring employees or expanding operations

Some industries may require additional permits

Shorter validity period, requiring frequent renewals

Income restrictions may apply in certain jurisdictions

May not provide full residency or permanent stay options

What is a Business License?

A business license is a legal permit allowing individuals or entities to operate a company in a specific location. It is necessary for entrepreneurs who want to establish, grow, and scale their businesses.

Advantages of a Business License

Enables business expansion and hiring of employees

Increases credibility with clients and investors

Provides opportunities for larger contracts and revenue growth

Offers legal protection through business structures such as LLCs

Typically has long-term validity compared to freelance visas

Allows for better financial management and access to business loans

Some countries offer tax benefits for incorporated businesses

Disadvantages of a Business License

Higher setup and operational costs

Requires more extensive paperwork and compliance

Additional tax obligations depending on business structure

May require a physical office space or commercial address

Complex renewal procedures and regulatory compliance

Key Differences Between Freelance Visas vs. Business Licenses

Best For:

A freelance visa is best suited for independent professionals who want flexibility without the commitment of running a full-fledged business. A business license, on the other hand, is ideal for entrepreneurs who plan to expand and hire employees.

Cost and Application Process:

Freelance visas generally have lower costs and a simpler application process. Business licenses require higher setup costs and more documentation.

Tax Obligations:

Freelancers typically have minimal tax responsibilities, whereas businesses are subject to higher taxes and compliance regulations.

Growth Potential and Legal Protection:

A freelance visa offers limited growth potential as it does not allow hiring employees or scaling operations. A business license provides greater legal protection and enables long-term business expansion.

Validity:

Freelance visas usually have a shorter validity period and require frequent renewals. Business licenses often have longer validity, making them a more stable option for long-term ventures.

Work Flexibility:

Freelancers can work with multiple clients across different regions without legal restrictions, whereas business license holders may have to comply with strict regional business laws and employment regulations.

Investment Requirements:

Freelance visas often do not require a significant upfront investment, whereas business licenses may require proof of funds, office space, or other financial commitments.

0 notes

Text

Bob Diamond Real Estate: What Most Agents Won't Tell You About Home Buying

Did you know that hundreds of millions of dollars from foreclosure sales sit unclaimed right now? Over 1,900 mortgage foreclosures generate several million dollars in unclaimed funds each business day. The surprising part is that 75% of this money stays uncollected because homeowners don't know it exists.

Since becoming a licensed attorney in 1995, Bob Diamond's expertise in real estate has made him the country's leading legal expert in Overages. His ground experience has helped countless foreclosed homeowners recover tens of thousands of dollars they might have lost. His knowledge reaches way beyond the reach and influence of overages. He explained real estate transactions that most agents avoid discussing.

Bob Diamond's legal background and real estate expertise will teach you strategies that blend financial wisdom with legal protection.

1. Understanding Property Value Beyond List Price:

Property values mean much more than the numbers you see on listing websites. Bob Diamond's real estate expertise shows how zoning laws shape a property's worth and what it can become in the future. Properties with commercial zoning are worth more than residential ones because they can generate income.

Market value and assessed value have a big difference that you need to know. The market value shows what buyers would pay right now, while the assessed value used for taxes is usually 80% to 90% of the market value. These insights from Bob Diamond tax attorney help buyers make smart decisions about their investments.

2. Smart Financing Strategies Most Agents Miss:

Homebuyers often miss out on big savings because they don't know about hidden financing strategies. The My Home Assistance program gives first-time buyers a 'silent second' loan up to 3.5% of the purchase price. The Chenoa Fund helps FHA borrowers pay their required 3.5% down payment.

We found that homeowners can claim several tax advantages that agents rarely talk about. You can reduce your taxable income on the first $750,000 of mortgage debt through mortgage interest deduction. Tax deductions are also available for medical-related home improvements such as wheelchair ramps.

Bob Diamond's expertise in real estate shows in his knowledge of specialized programs. To name just one example, see the Good Neighbor Next Door program that cuts HUD foreclosure home prices by 50% for public servants. K-12 teachers, law enforcement officers, and firefighters can buy homes in their work communities at huge discounts.

3. Protecting Your Investment Legally:

Your real estate investment protection begins with a clear understanding of legal pitfalls. Title searches are a vital first step that takes 10-14 days to complete and costs between $75-$200. Bob Diamond real estate expertise shows that title insurance safeguards against past occurrences rather than future events. The coverage includes ownership disputes, incorrect signatures, and defective recordation.

Legal considerations must include easements that give third parties specific rights to use your property. These rights remain attached to the property even after sale and can affect up to 75% of property values. The bob diamond tax attorney program teaches investors that utility easements can't be blocked by private property owners. This makes a full pre-purchase investigation necessary.

Property protection goes beyond simple insurance coverage. Setting up a Limited Liability Company (LLC) for each property can limit your risk exposure. You could own three properties worth $250,000 each, and separate LLCs would reduce risk exposure from $750,000 to $250,000 per property. Bob Diamond real estate attorney's course explains how anonymous trusts add another security layer by hiding ownership details from public records.

Conclusion:

Real estate investment decisions go way beyond simple property deals. Bob Diamond's deep legal and real estate expertise has helped us learn about aspects that most agents miss - from hidden property value factors to smart financing strategies and legal protections.

Knowledge of these complex details makes the most important difference in your investment success. Property values rely on many factors like zoning laws, infrastructure development, and future city planning. Tax benefits and specialized financing programs can save you substantial money, yet many buyers don't know about them.

Bob Diamond's real estate course combines legal expertise with practical investment strategies. His background as a tax attorney and real estate expert helps investors make smart decisions and avoid getting into costly situations.

Smart real estate investment needs knowledge that goes beyond simple market trends. Learning from experts like Bob Diamond who know both legal details and market dynamics can save you thousands while keeping your valuable investments protected.

#bob diamond real estate#bob diamond#bob diamond reviews#bob diamond overages#attorney bob diamond#bob diamond course#bob diamond products

0 notes

Text

How Expats Can Make Their Business Dreams Come True in KSA

Starting a business as an expat in Saudi Arabia (KSA) offers immense opportunities, especially as the Kingdom continues to push forward with its ambitious Vision 2030. Saudi Arabia is transforming its economy, opening new avenues for foreign entrepreneurs across various sectors, from tourism to technology. For expats ready to dive in, the journey is filled with potential and several unique challenges that must be understood and addressed. This article explores the steps expats must take to make their business dreams come true in KSA, from registering their company to adapting to the local business culture.

Why Expats Are Drawn to Saudi Arabia

Saudi Arabia’s economic reforms have made it a promising destination for foreign entrepreneurs. The government’s efforts to reduce its reliance on oil, boost private-sector growth, and attract foreign investment have created an environment more open to startups and small businesses. With strategic locations like Riyadh and Jeddah offering dynamic business ecosystems, expats can find opportunities in sectors such as manufacturing, retail, technology, and even tourism.

However, while the potential for growth is strong, launching a business in Saudi Arabia requires a firm understanding of the local regulatory environment, proper business registration, and the ability to navigate the cultural and financial aspects of the business.

Steps to Starting a Business in KSA

1. Legal Framework and Business Registration: The first crucial step for expats looking to start a business in Saudi Arabia is understanding the legal requirements. Expats must register their company with the Ministry of Commerce and Investment (MCI), typically as a Limited Liability Company (LLC). Depending on the industry, a local Saudi partner may be required. The recent changes in foreign investment laws have made it easier for expats to own and operate businesses, but compliance with regulatory standards is essential.

2. The Setup Process: Once your company is registered, you need to focus on the logistics of setting up your business. This includes securing office or retail space, acquiring business licenses, and meeting sector-specific regulations. For example, companies in the food industry must obtain health and safety permits, while tech startups may need additional approvals from relevant authorities. Planning these aspects ahead of time can help ensure a smooth launch.

3. Financial Considerations: Capital is key to any business venture, and expats must ensure they have the financial resources to support their business. Saudi Arabia offers various funding options, including loans, grants, and venture capital programs. For example, the government’s Vision 2030 initiative supports startups with grants and financial incentives, especially in the tech sector. A solid financial plan is crucial to cover the costs of setting up and running your business.

4. Navigating Cultural and Business Norms: Understanding the local culture and business environment is vital for success in Saudi Arabia. Building trust with local partners and respecting business customs, such as patience in negotiations, is essential. Hiring local employees can also help ease the integration into the Saudi market. While Arabic is not mandatory, learning basic phrases can improve communication and business relations.

5. Overcoming Bureaucratic Hurdles: Starting a business in Saudi Arabia involves multiple approvals from various ministries, such as the Ministry of Investment for Saudi Arabia(MISA) and local municipalities. Expats may encounter bureaucratic challenges during the process, but working with business consultants specialising in the Saudi market can simplify things. Staying organised and persistent is crucial in overcoming these hurdles.

Conclusion

Turning your entrepreneurial dreams into reality as an expat in Saudi Arabia is no small feat. Still, success is achievable with careful planning, a thorough understanding of the legal landscape, and the proper support. From registering your company to navigating cultural and financial challenges, expats can overcome obstacles with persistence and adaptability. Helpline Group offers comprehensive business support services for those looking for expert guidance, ensuring that your company registration, setup, and compliance needs are met efficiently. With their assistance, expat entrepreneurs can focus on building and growing their businesses, confident that they have a trusted partner by their side.

0 notes

Text

Step-by-Step Guide: How to Successfully Open Your Own CNA School

Step-by-Step Guide: How to Successfully Open Your Own CNA School

Have you ever thought about opening your own Certified Nursing Assistant (CNA) school? The healthcare industry is booming, and the demand for skilled CNAs is higher than ever. Opening a CNA school is not only a lucrative opportunity but also a chance to make a significant contribution to the community by training the next generation of caregivers. In this article, we will walk you through every step you need to take to establish a successful CNA school.

Understanding the CNA Profession

Before diving into the steps required to open your own CNA school, it’s essential to understand the CNA profession and its requirements:

CNA training must typically consist of both classroom instruction and hands-on clinical experience.

CNA programs are regulated by state and federal guidelines, making compliance essential.

CNAs play a vital role in patient care, assisting nurses and providing essential services to patients.

Step 1: Conduct Market Research

Before you make any commitments, conduct thorough market research to assess the demand for CNA courses in your area. Here’s how:

Evaluate existing CNA schools and their offerings.

Survey local healthcare facilities to understand their staffing needs.

Analyze demographic trends related to the aging population.

Step 2: Create a Business Plan

A robust business plan is crucial for the success of your CNA school. Your plan should include:

Executive Summary: Outline your mission, vision, and operational goals.

Services Offered: Include information about the CNA curriculum, training programs, and duration.

Marketing Strategy: Identify your target audience and how you’ll attract students.

Financial Projections: Estimate startup costs, ongoing expenses, and projected income.

Step 3: Legal Requirements and Accreditation

Complying with regulatory requirements is a crucial part of starting your CNA school:

Choose a suitable business structure (LLC, Corporation, etc.) and register your business.

Obtain necessary licenses and permits based on state regulations.

Seek accreditation from a recognized body to lend credibility to your program.

Step 4: Securing Funding

Opening a CNA school involves various costs, including facility rental, equipment, and staffing. Consider the following funding options:

Personal savings

Bank loans

Grants for educational projects

Investors or partnerships

Step 5: Finding a Location

Your school’s location can impact enrollment. Choose a location that is:

Accessible by public transport

In proximity to healthcare facilities for partnerships and internships

Large enough to accommodate classrooms, labs, and offices

Step 6: Curriculum Development

Develop a comprehensive curriculum that meets state and federal CNA training standards. Your curriculum should include:

Module

Topics Covered

Hours

Introduction to Nursing

Healthcare systems, patient rights, and ethics.

15

Basic Nursing Skills

Vital signs, patient hygiene, and mobility.

30

Clinical Skills Practicum

Hands-on training in a healthcare setting.

40

Step 7: Hiring Qualified Instructors

Your instructors play a vital role in your CNA school’s reputation. Ensure they have the following qualifications:

Valid CNA certification

Experience in nursing or healthcare education

Excellent communication skills

Step 8: Marketing Your CNA School

To attract students, implement an effective marketing strategy that includes:

A user-friendly website with information about your programs

Social media marketing to connect with potential students

Local community outreach programs to raise awareness

Benefits of Starting Your Own CNA School

Opening a CNA school brings various benefits, including:

Meeting a community need for trained healthcare professionals.

Creating jobs and contributing to the local economy.

Potential for personal and financial growth.

Practical Tips for Success

To ensure your CNA school thrives, consider these practical tips:

Stay updated with industry standards and regulations.

Engage with local healthcare facilities for partnerships.

Solicit feedback from students to improve the curriculum.

Conclusion

Starting your own CNA school can be a rewarding experience both personally and financially. By following this step-by-step guide, you can establish a successful school that not only meets the rising demand for certified nursing assistants but also provides quality education to aspiring healthcare providers. With careful planning, dedication, and a passion for teaching, your CNA school can become a vital part of the healthcare community.

youtube

https://cnatrainingcertification.org/step-by-step-guide-how-to-successfully-open-your-own-cna-school/

0 notes

Text

Equipment Financing with Uptier Capital LLC: Same-Day Approvals on Loans

When running a business, having the right equipment is essential to staying competitive and maintaining efficiency. However, purchasing high-quality machinery, vehicles, or technology can be an expensive undertaking. That’s where equipment financing comes into play. With the help of Uptier Capital LLC, businesses can access the financing they need to grow and thrive—quickly and with ease.

Why Choose Equipment Financing?

Equipment financing allows businesses to acquire the tools they need to operate without the burden of upfront costs. Whether you're in manufacturing, construction, medical services, or any other industry, the right equipment is crucial to day-to-day operations. However, purchasing this equipment can drain cash reserves and restrict your business's ability to handle other expenses. Equipment financing solves this problem by offering a way to spread the cost of the equipment over time, making it more manageable.

Uptier Capital LLC’s Equipment Financing Solutions

At Uptier Capital LLC, we specialize in providing tailored equipment financing solutions that fit the specific needs of your business. We understand that every business is unique, and we work with you to offer flexible financing terms that ensure you can acquire the equipment you need without compromising your cash flow.

From construction machinery to office technology, our financing options cover a wide range of equipment types, ensuring you have access to what your business needs, when you need it.

Same-Day Approvals for Fast and Efficient Funding

One of the standout features of working with Uptier Capital LLC is our commitment to speed and convenience. We offer same-day approvals on equipment financing loans, ensuring that you don’t have to wait for lengthy approval processes that can stall your operations. With our efficient system, you can submit your application and, in many cases, receive approval within the same day, allowing you to move forward with purchasing the equipment that will help your business grow.

Why Uptier Capital LLC?

Uptier Capital LLC is committed to providing fast, reliable, and customer-focused equipment financing. Our team of experts is dedicated to understanding your business needs and providing personalized solutions to ensure you receive the best financing terms. With our same-day approval process, you’ll have the financial support to acquire the equipment you need without the stress of delays.

Conclusion

For businesses in need of equipment financing, Uptier Capital LLC offers a streamlined and effective solution. Our fast approval process and flexible terms make us a reliable partner in your business's growth journey. Don’t let equipment costs hold your business back—contact Uptier Capital LLC today to learn more about how we can help you secure the financing you need, with same-day approvals on loans!

For more info:-

Equipment Financing Uptier Capital

same day approvals on loans

0 notes

Text

The Value Of Pest Control Tampa

Pest control is actually a crucial solution for homeowners as well as organizations in Tampa fl, Florida. The location's warm and comfortable climate and humidity produce a suitable environment for a selection of insects, from bugs and pests to mice and also roaches. Comprehending the significance of effective insect control can easily aid guard your property, health, and also general top quality of life.

1. Guarding Residential Or Commercial Property Market Value

One of the key reasons for acquiring pest control Tampa is to secure home worth. Bugs can easily cause significant damage to homes and also organizations. Pests, for occasion, can quietly gnaw at timber structures, causing costly repair work and a reduce in home worth. Routine bug control evaluations can easily help recognize as well as mitigate these concerns just before they escalate, ensuring that your assets remains in one piece.

2. Health and wellness

Pests pose countless wellness dangers to people and also household pets. Rats and also cockroaches are recognized companies of illness, while bugs can easily send viruses like West Nile and Zika. In Tampa's humid environment, the danger of pest-related wellness issues increases. Implementing pest control Tampa gauges assists develop a safer lifestyle atmosphere through lowering the probability of attacks as well as the ailments they may bring.

youtube

3. Convenience as well as High Quality of Life

Insects can dramatically interrupt day-to-day live. The visibility of ants, spiders, or wasps may create outside rooms annoying, while mattress insects may infest your home as well as interfere with sleep. Successful Tampa pest control guarantees that your home remains a relaxed haven. Frequent treatments assist always keep these unpleasant visitors away, enabling you to appreciate your space without steady concern.

4. Environmental Impact

Pest control is actually certainly not nearly getting rid of bugs; it additionally entails performing so in an eco-friendly responsible method. Lots of modern-day pest control companies concentrate on incorporated bug management (IPM), which highlights using environmentally friendly products and also methods. This approach decreases the influence on the bordering ecological community while efficiently managing pest populations. In an urban area like Tampa florida, where natural charm as well as biodiversity are notable, eco aware insect control practices are crucial.

5. Deterrence and also Long-Term Solutions

One of the essential advantages of specialist pest control is its own concentrate on prevention. Numerous pest control business in Tampa florida use continuous routine maintenance programs that feature normal inspections and treatments. These proactive measures assist prevent problems just before they begin, saving you opportunity and also loan in the long operate. By setting up a partnership along with a pest control company, you can guarantee that your home continues to be pest-free throughout the year.

In conclusion, the significance of bug control in Tampa florida can easily certainly not be actually overemphasized. Coming from safeguarding property worth as well as wellness to boosting comfort and guaranteeing environmental obligation, helpful parasite administration is crucial for each residential and also office properties. Through focusing on insect control, citizens may preserve a risk-free and also pleasurable lifestyle atmosphere, protecting their homes and also loved ones against the myriad of pests that prosper in the Tampa florida temperature.

All American Pest Control LLC

550 N Reo St #300

Tampa, FL 33609

(813) 544-0963

Tampa Pest Control

1 note

·

View note

Text

The Usury Suspects, Part 3: Tivol’s ex-pres knows where the real money is

On the cover of Ingram’s last month was a man named Steve Mitchem. The business publication was honoring him with one of its “Local Heroes” awards for philanthropic contributions — Mitchem has given $160,000 to the Down Syndrome Guild of Greater Kansas City over the past three years.

Mitchem has led an interesting life. He moved to Kansas City in the early 1980s to pursue graduate studies at Nazarene Theological Seminary. He then worked as a traveling evangelist for two years before settling in locally as a full-time minister at the Church of the Nazarene. In 1990, Mitchem went secular, at least professionally. He retired as a minister and joined Tivol, the luxury jewelry company, as an associate at its retail space on the Country Club Plaza. He rose through the ranks and was named president of Tivol in 2005.

Here in Kansas City, that’s a powerful, and surely quite lucrative, gig. Yet Mitchem left Tivol two years after being appointed to the post. A story at the time in JCK, a trade publication covering the jewelry industry, reported that he was resigning to “join his son in his loan business.” About that loan business: Technically it is dozens of separate companies, with many different names, but it adds up to one of the largest online payday-lending operations based in Kansas City, according to several individuals with ties to the industry.

“Steve was working down at Tivol on the Plaza, and these payday guys kept coming in every other month and buying Rolexes,” a source tells The Pitch. “He figured out that they were basically printing money doing their online-lending businesses, and he wanted in on it. So first, he set his son up in the business. Then he quit Tivol and joined him.”

Filings with the secretary of state’s offices in Missouri and Kansas, plus a couple of lawsuits, help back up that account. In December 2006, Mitchem’s son, Josh Mitchem, filed articles of incorporation in Missouri for a company called Platinum B Services. In 2012, Dustin McDaniel, the attorney general of Arkansas, brought a lawsuit against that company and PDL Support LLC, another company controlled by Josh Mitchem.

In the suit, McDaniel alleged that Josh Mitchem and his companies controlled a variety of LLCs, purportedly based in the West Indies federation of St. Kitts and Nevis, that were engaged in lending over the Internet to Arkansas citizens at interest rates as high as 644 percent. Arkansas law caps rates on consumer loans at 17 percent. The purpose of these LLCs is to make it appear as if the Defendants are not the actual payday lenders and to otherwise shield Defendants from liability from lawsuits such as the one brought by the Attorney General in this case,” the lawsuit states. “The Defendants make the decisions concerning all lending operations from their offices in the Kansas City, MO area.”

The Arkansas attorney general’s office also produced evidence that Josh Mitchem responded to consumer complaints mailed to his company by requesting that correspondence be sent to an address in Charlestown, Nevis — despite the fact that his return letters were postmarked in Kansas City.

In the settlement that was reached, Josh Mitchem denied any wrongdoing but agreed to stop lending in Arkansas and pay $80,000 to the state. More recently, Josh Mitchem was named in a class-action RICO complaint brought in California against about two dozen players in the payday industry (including MoneyMutual LLC and its spokesman, talk-show host Montel Williams). In it, Mitchem’s company Rare Moon Media is accused in that state of unlicensed lending and of negotiating and signing marketing contracts on behalf of unlicensed lenders.

Rare Moon Media was incorporated in Kansas in 2010. In 2011 and 2012, its filings with the secretary of state list Josh Mitchem, Steve Mitchem and Jeremy Shaffer, among others, as the primary stakeholders. Shaffer replaced Steve Mitchem as general manager at Tivol when Mitchem was promoted to president.

Jeffrey Wilens, the plaintiffs’ attorney in the RICO suit against Rare Moon Media, says, “The business address for Rare Moon Media is the same West Indies business address as several other lenders making unlicensed loans in the state of California, such as SCS Processing and Everest Cash Advance. The company is either consulting companies who make illegal loans, or it is simply making illegal loans by itself and pretending to be a consultant of some kind. Either way, the service it provides is to aid, abet and facilitate criminals breaking the law in the state of California.” Steve Mitchem told Ingram’s that he splits time between his two homes: One off Ward Parkway in Kansas City, the other in St. Thomas, of the U.S. Virgin Islands. The latter address allows his various business entities (Mitchem Holdings, according to the article) to more comfortably avoid regulatory scrutiny and taxation by the U.S. government.

“There are some of us who have been blessed and are fortunate enough to be able to give, and quite frankly, I believe we have that responsibility to get involved financially,” Steve Mitchem told Ingram’s of his philanthropy. “Some people can’t do that. I’m one of those guys who’s fortunate and can do that.”

1 note

·

View note

Text

How Can Singaporeans Obtain a U.S. Mortgage?

Singapore is known for academics and education, with many high school graduates attending the best universities in the world!

Similarly, the U.S. is known for having most of the top global universities.

Singapore currently has 21,666 students studying abroad, according to UNESCO, and according to a recent Open Door report, Singapore had 3,901 students studying in the U.S. – a record number!

A typical Asian family will want to explore owning a property near the university the child will be attending – as a place to stay when visiting or if the student prefers not to stay in the dormitory.

After graduating, the property’s value often goes up. It might be enough to pay for college, or parents might choose to give the property to their child if they plan to work in the U.S. before returning home. This allows the child to build credit, something very important in the U.S.

However, not many can pay for a home with cash and just give up when they assume that obtaining a mortgage is not available.

Contrary to what you may think…..

You CAN get a mortgage as a non-U.S. citizen or Expat living in Singapore

You DO NOT need U.S. credit or residency

You CAN QUALIFY based on your Singapore income OR by using the rental income of the U.S. investment property

You CAN get market-interest rate mortgages while living in Singapore

You CAN sign the closing documents at the embassy on Napier Road

Actually, we are the world’s first and only U.S. mortgage broker with offices in Singapore, right on Telok Ayer. Come visit us for coffee!

Let us guide you through this process from:

Introducing you to a realtor

Helping you screen for the best locations to buy

Setting up your LLC

Discussing the benefits of using an LLC

Introducing you to a property manager

[Must Sign Up!] A Singapore Couple’s Path to Financial Freedom through U.S. Real Estate Investing!

Meet Han and Tracy, an incredible couple from Singapore who made a bold move – they left behind their regular 9-5 jobs after successfully diving into the world of U.S. real estate. Now, proud owners of 12 cash-flowing properties, achieved through strategic moves in just three years, they’re here to share their story.

Register for our exclusive webinar “Singapore Couple’s Journey to Financial Freedom through U.S. Real Estate Investing,” on January 18th at 6:30 PM SGT. Join Han and Tracy as they unravel the details of their transformative journey. Learn the secrets of how this dynamic duo achieved financial freedom through their savvy investments in U.S. real estate. Don’t miss out—reserve your spot now!

AM Student+

Investing in your child’s future just got easier. America Mortgages’ Student+ loan program removes the financial barrier for parents who want to purchase a property in the U.S. for their children’s education. This innovative program allows parents to qualify for a loan using the projected rental income of the property, eliminating the need for a U.S. credit history. This means that even parents who are new to the U.S. can provide their children with a safe and comfortable place to live while they study.

With America Mortgages’ Student+ loan program, parents can invest in their children’s future and build wealth at the same time. The program’s flexible terms and competitive rates make it an attractive option for investors. Contact us today to learn more about this unique program and start investing in your child’s bright future.

For more information about Foreign Mortgage Loan, visit the website: https://www.americamortgages.com

Reference: https://www.americamortgages.com/how-can-singaporeans-obtain-a-u-s-mortgage/

Contact Us

Address: 118 Broadway STE 638, San Antonio, TX. 78205 (HQ)

Email id: [email protected]

North America: +1 (845) 583-0830

0 notes