#Keltner channel helps

Explore tagged Tumblr posts

Text

Keltner Channel Forex Renko Chart Strategy

Keltner Channel Forex Renko Chart Strategy

Using the Keltner Channel Forex Renko Chart Strategy will help you identify overbought and oversold levels and give you the edge you require to succeed in your trading. These simple techniques can be used on a daily, weekly, or monthly basis to get an edge in your trades. Overbought and oversold signals Identifying overbought and oversold signals in the Keltner Channel Forex Renko chart…

View On WordPress

#Keltner Channel#Keltner Channel Forex Renko chart strategy#Keltner channel helps#Keltner Channel indicators

1 note

·

View note

Text

Master Breakout Trading with Keltner Channels: Secret Strategies Revealed! Keltner Channels & Breakout Trading: The Secret Weapon Traders Miss Imagine you're at a crowded subway station, and the moment the doors open, there's that rush—everyone trying to break out and get to their destination. Well, trading breakouts is sort of like that, except you're not risking elbows to the face, and, if you do it right, there are some serious profits at stake. The secret? Knowing when that breakout is actually happening for real, and not just another false start. Enter Keltner Channels, the ultimate market whisperer for breakout traders. Buckle in, grab your favorite cup of whatever-you-need, and let's dive into how to use this gem of an indicator to master breakout trading like a pro. What on Earth Are Keltner Channels? Keltner Channels might sound like a rock band from the '70s, but I assure you, they are way more lucrative (unless, of course, you were the lead guitarist). Think of Keltner Channels as a tunnel that helps you navigate market prices. They're a volatility-based indicator that uses the Average True Range (ATR) to gauge price movement. Picture it like bowling with bumpers; the channels give you an idea of where the price is likely to move, helping you avoid those dreaded gutter balls—in this case, false breakouts. The Keltner Channels consist of three lines: the middle line (an exponential moving average) and two outer lines set at a distance defined by the ATR. The best part? They’re not just any indicator; they are an amazing tool for spotting breakouts when prices push beyond these boundaries. It’s like the market finally deciding to break out of its rut—kind of like that friend who suddenly decides to go skydiving after a lifetime of saying no to rollercoasters. Breakout Trading: Timing Is Everything (And No, It’s Not Always Luck) Let’s face it—timing a breakout is as thrilling as trying to catch the toast right before it pops. You don’t want to be too early, nor do you want to be the last one arriving at the party when the good drinks are gone. This is where Keltner Channels shine. When price action starts to creep towards the boundaries of the channel, it’s your cue to pay attention. If the price breaks above the upper channel with strong momentum—and I’m talking the kind of momentum that you see when someone spots a two-for-one sale—then you may have a legitimate breakout on your hands. On the other hand, if the price is repeatedly poking those boundaries but lacks volume, you might just be looking at a market that's trying to pull a fast one—a head fake, if you will. Ninja Tip: Always wait for volume confirmation. If the breakout is real, there’ll usually be a surge in volume—like when everyone simultaneously realizes there’s only one train left for the night. Volume is the lifeblood of breakouts, and without it, you’re just guessing. And nobody likes being left guessing—especially not with money on the line. The Hidden Patterns of Keltner Breakouts One of the reasons why Keltner Channels are not as popular as Bollinger Bands might be that they are, well, a little understated. But here’s the secret: Keltner Channels are the Sherlock Holmes of indicators. They quietly observe volatility, giving you clues that other traders are too busy overlooking. They show us when the market is trending and when it’s getting ready to do something explosive—like breaking out of a range. For breakout traders, the sweet spot comes when price hugs one of the boundaries before finally busting out. It’s like watching someone nervously eyeing the dance floor all night before finally deciding to bust a move. The key is patience—waiting for that moment when the dance begins. In trading terms, it’s waiting for the price to break out with conviction. Why Most Traders Fail at Breakouts (And How to Avoid the Pitfalls) A big mistake that traders make is jumping into every breakout they see. This is like diving after every frisbee that gets thrown at the dog park—not every throw is worth the energy. The key to successful breakout trading is differentiating between real and fake breakouts. The Keltner Channels are a master at helping you do just that. A genuine breakout will push beyond the channel with solid momentum and an uptick in volume. It’s about using other indicators—like moving averages or even RSI—to confirm what Keltner Channels are telling you. Fake breakouts often lack conviction, kind of like that person who talks a big game about moving to Bali but never books a flight. You want solid signals that tell you the market is committed. Pro Tip: Combine Keltner Channels with an oscillator like the RSI or Stochastic. If price breaks out above the Keltner Channel and RSI is confirming upward momentum, you've got a winning combo—just like when you get fries with your burger. Step-by-Step: Using Keltner Channels to Profit from Breakouts Let’s break it down into actionable steps: - Identify a Trending Market: Keltner Channels are most effective in trending markets. Look for established trends with the price testing the boundaries of the channel. - Wait for the Breakout: Watch as the price moves closer to the upper or lower channel. When it breaks beyond, check for strong momentum and volume confirmation. - Confirm the Breakout: Use other indicators—like volume, moving averages, or oscillators—to ensure this isn’t just a head fake. - Set Your Entry Point: Enter when the price closes outside the channel with volume confirmation. The close is key; entering mid-breakout can lead to more stress than a surprise family dinner. - Manage Your Stops: Place your stop-loss just inside the Keltner Channel—close enough to avoid a false breakout but far enough to give the trade some breathing room. The One Simple Trick that Can Change Your Trading Game Want to avoid being caught out by false breakouts? Here’s a trick: If you see price breaking out but volume is sitting around twiddling its thumbs, WAIT. Be like that discerning diner who won’t eat at an empty restaurant. Volume should confirm the breakout—if it's not, the price move is likely short-lived. Breakout trading is like surfing—you need to catch the wave at just the right moment. If you’re too early, you wipe out. Too late, you miss the best part of the ride. Keltner Channels are your signal to paddle faster and get ready. The trick is knowing when that wave is building. Keltner Channels are a breakout trader’s best friend. They give you insight into volatility, price action, and momentum—essentially, they tell you when the party is really starting. The next time you see price action creeping up on the boundary, keep your eyes peeled for the break—and always check volume before hitting that buy button. The goal isn’t just to ride the breakout but to ride it smart. This means having the patience to wait for the right conditions and knowing when to get out with profit still in your hands. Remember: It's not just about getting in; it's about getting in with confidence and getting out with a smile—like a pro surfer who nailed every wave, while others are left tangled in the whitewash. Want more tips on how to navigate tricky trading setups and make the most of every market move? Join the StarseedFX Community today for exclusive analysis, live trading insights, and more ninja-level strategies. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

How to Use the TTM Squeeze Indicator - Library of Trader

What Is the TTM Squeeze Indicator?

The volatility and momentum indicator TTM Squeeze was developed by John Carter of Simpler Trading. It takes advantage of the fact that prices tend to break out forcefully after consolidating in a narrow trading range. The TTM Squeeze indicator’s volatility section tracks contracting prices through Bollinger Bands and Keltner Channels. A period of minimal volatility is indicated if the Bollinger Bands are contained entirely inside the Keltner Channels. The squeeze refers to this tight condition. When the Bollinger Bands re-expand beyond the Keltner Channel, it is stated that the squeeze has “fired,” signaling an increase in volatility and a possible departure from the confined trading range. Squeeze on/off status is shown by little dots on the zero line of the indicator; red dots signal squeeze is on, while green dots show squeeze is off. The TTM Squeeze indicator is available for TradeStation® and thinkorswim®, two widely-used charting software platforms currently.

How to Read the TTM Squeeze Indicator and How Does the TTM Squeeze Work?

TTM Squeeze Indicator Explained

The TTM Squeeze is predicated on the premise that decreased prices would eventually lead to higher prices. If we can pinpoint when the market is particularly tense, we can position ourselves to benefit from a potentially powerful move in one direction

What Do the Colors Mean on the TTM Squeeze?

Indicators of a squeeze are represented by red and green dots on the zero line. If there is a red dot, it indicates a squeezing situation. If there is no red dot, we are not in a confined space at the moment. When a green dot appears following a string of red dots, the squeeze has been successful.

Using the TTM Squeeze in Trading

There is a wide range of periods compatible with the TTM Squeeze indicator. When trying to confirm a security’s value, many chartists look at data from several different time periods. Squeezes that fire on many time frames at once are more reliable signals than those that fire on just one.With the TTM Squeeze, traders may rededicate themselves to the market and get the self-assurance they need to consistently turn a profit and increase their wealth. Having faith in yourself and your abilities will help you:

Avoid bad trades

Make profitable trades

Optimize returns

Put away your doubts

Enhance market sense

How to Build a Profitable Trading Plan Using the TTM Squeeze?

John Carter’s route to regular profits in trading was revolutionized by the TTM Squeeze indicator. The TTM Squeeze is an important technique for traders who wish to rapidly expand their trading capital. To put it bluntly, the TTM Squeeze indicator is not a miracle worker. Any kind of trading carries with it some degree of inherent risk. Additionally, you are not expected to “make it big” in the trading world in the manner of some well-known trader who claims to make you a millionaire if you only “be a billionaire” on the internet.

How to Set up TTM Squeeze Indicator

Here is what you simply need to do to set up the TTM_Squeeze to your thinkorswim charts:

Login to your thinkorswim account

Select the studies button

Add study

Then find John F. Carter studies

Select the TTM_Squeeze

Trading the TTM Squeeze Indicator with Divergences

Although the TTM Squeeze indicator is recognized to provide a strong signal as to where price is heading, the best trades are those in which numerous indicators are flashing the same signal.

Using divergence is a strategy that may be applied while trading with the TTM Squeeze indicator. When price and the histogram momentum bars are moving in different directions, this is called a divergence. When price is forming higher highs while the slope of the histogram is forming lower highs above the “zero line,” a bearish divergence exists.

What is the Squeeze Pro Indicator?

The Squeeze Pro Indicator is the upgraded version of TTM Squeeze. Conversely, the TTM Squeeze is a fantastic indicator that can do wonders for traders of any skill level. The premium Squeeze Pro Indicator makes it easy to choose one of three squeeze intensity levels, provides clear entry and exit signals, and anticipates and capitalizes on market rallies. You should upgrade to TTM Squeeze Pro if you’ve outgrown the free version.

The Bottom Line

The TTM Squeeze indicator takes into account both volatility and momentum in order to help traders profit from swings in the security’s volatility. Squeeze dots, which are part of the indicator’s volatility component, point to possible breakouts after tame trading conditions. The momentum histogram shows the most likely path of the breakout and can aid in locating potential exits. Article Source: https://libraryoftrader.net/how-to-use-the-ttm-squeeze-indicator

0 notes

Text

The Complete Guide to Keltner Channel Indicator

The Complete Guide to Keltner Channel Indicator

The Keltner Channel is a simple but powerful trading indicator. It helps you better time your entries, improve your winning rate, and can even “predict” market turning points. And if you want to learn how to do it, then today’s post is for you. But first… What is a Keltner Channel and how does it work? The Keltner Channel is an Envelop-based indicator (others include Bollinger Bands, Donchian…

View On WordPress

0 notes

Text

Download Now [arm_download item_id="408" link_type="button"] This Moving Average indicator uses the Keltner Channel in addition to Jurik moving averages to produce powerful trend trading signals. If you are a forex trend trader, then this indicator is ideal for you. The flexible parameters can help you tailor it to your needs and the insight provided for different strategies will help your trading. The best trading strategy using Keltner Channel with Signals Indicator? The best trading strategy using Keltner Channel with Signals Indicator is to buy when the price breaks out of the upper band (Keltner Channel) and sell when the price breaks out of the lower band. You can also place stop losses at those bands. Jurik moving averages are a new way to calculate the standard moving average. Unlike the standard moving average, this method does not lag in order to produce a smoother line of data. This allows for a more accurate representation of the data and less noise. The indicator generates a SELL signal if the Jurik Moving average changes color from Blue to Magenta. Furthermore, the price also should be lower than the midline and the lower line of the Keltner channel. Alternatively, the indicator generates a BUY signal if the Jurik Moving average changes color from Magenta to Blue. The Jurik Moving Average is calculated by taking the average of the last 5 days of trading prices for a given security or currency. Example Consider a down trend with a rally to the upside. As the trend continues to the downside, traders expect the lower lows. The trader can place a Stop loss below the previous swing low or the lower Keltner channel line. The indicator provide visual signals and supports both new and experienced traders to make decisions on trade opportunities in the current trend. Warning - Please be careful when using this indicator. It is not a "get rich quick" scheme. - Please ensure that you fully understand the risks involved in trading before using this indicator. Download Now [arm_download item_id="408" link_type="button"] https://ezyforextrading.com/keltner-channel-with-signals/?feed_id=1853&_unique_id=628ccbfd0694c&EzyForexTrading%20-%20Download%20Metatrader%20Indicators%20and%20Learn%20trading%21

0 notes

Text

How to trade volatility?

While volatility in stocks provide opportunities, the risk involved in the trade is uncertain. To avoid risky trades and minimize losses, today’s Technical Funda introduces a few technical indicators that can help amplify the real picture. Technical indicators that can help traders navigate volatility Trading in a volatile stock is difficult as the movement is often sharp and uncertain. Volatility, in simplest terms, defines the change in stock price over daily average change. This means that if a stock is swinging in the 5 per cent range and suddenly begins to trade over 5 per cent -- the average swing -- then it looks to have entered a volatile phase. These uncertain moves are highly attractive, but trading in one is, in fact, risky. Volatility may trigger stop loss and show certain unexpected moves. Such a scenario disrupts trading morale, leaving traders anxious. To avoid risky trades and minimize losses, here are a few technical indicators that can help amplify the real picture.

Keltner Channel Keltner channel is a moving average band indicator comprising three bands -- upper, middle, and lower bands -- that assist in identifying and protecting from volatile price moves with the use of average true range. This indicator is very useful in a strong trend, either upward or downward. As the stock starts to show the weakness at the upper band, one can view this as an opportunity to enter a trade around the middle band. While doing so, the stop loss can be considered as the difference of middle and lower band. As said earlier, in a trending market, the stock is expected to rebound on the back of follow-up buying. The same philosophy can be applied when the stock is in a downtrend. The Keltner channel encourages one to enter a trade within a specific range of volatility. This can diminish the greater volatility as one always waits for better levels of middle band. Normally, the stock price moves within the band, which primarily defines the expected volatility. When the stock breaches the Keltner channel, it may lead to extreme rally with wild swings wherein sentiments may change unexpectedly.

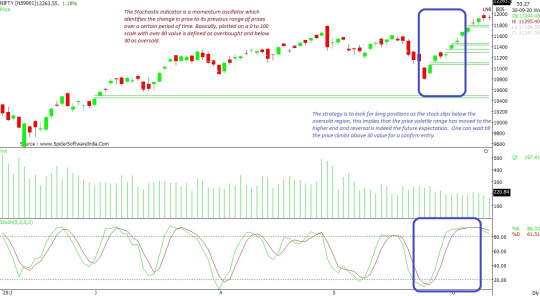

Stochastic Oscillator The Stochastic indicator is a momentum oscillator which identifies the change in price as compared to its previous range of prices over a certain period of time. Basically, this indicator is plotted on a 0 to 100 scale, with over 80 value being defined as 'overbought' and below 30 as 'oversold'. Although, there can be exceptions where a stock shows strong momentum over 80 value. This does not mean the volatility is low, it can even show stronger volatile moves in the price. The strategy is to look for long positions as the stock slips below the oversold region, since this implies that a reversal is indeed the future expectation. One can wait till the price climbs above 30 value for a confirmed entry. Similarly, when the price touches the roof of 80 value, the range seems to have reached a far end and one can expect a fall when the indicator slips below 80. And, although these rules may not always be true; however, one can get a fair idea about the volatility and maximum swings that are supposed to occur in any given fair trade. Volatility does provide opportunities, yet the risk involved in the trade is uncertain. In order to manage a volatile stock, one needs to have a strong hold on certain technical parameters that one has learnt and experimented with over the years.

#learnwithraj#tradewithraj#brainmassfinance#brainmasscommunity#brainmasstraders#brainmassgroup#stochastic#keltner#volatility

0 notes

Link

stock trading

https://priceanalyses.com/

price analyses is a trading blog that covers trading indicators, oscillators, exchanges and offers a free trading course.

Arnaud Legoux Moving Average (ALMA) Indicator Strategy

The Arnaud Legoux moving average (ALMA) is a new kind of moving average that was developed by Arnaud Legoux and Dimitrios Kouzis Loukas back in 2009. The ALMA intends to resolve the two major weaknesses of moving averages, namely responsiveness, and smoothness.

Advance Decline Ratio (ADR) Indicator Explained

The advance decline ratio is a market breadth indicator used in technical analysis. When compared with an index or multiple stocks, the indicator shows you the number of stocks that closed lower than the previous days closing prices. When used on a single index, it uses the same formula for calculations except on an individual scale.

Moving Average Convergence Divergence (MACD) Oscillator Explained

The moving average convergence divergence (MACD) is a trend-following momentum oscillator that can help you spot turning points in a security’s overall trend. The MACD also helps you visualize the trend’s change, direction, and magnitude.

Bollinger Bands ® and Keltner Channel Squeeze Indicator

The squeeze made by the Bollinger Bands as well as the Keltner channel indicators is a common trading signal. The squeeze implies a fine balance between buyers and sellers marked by a period of low volatility. When price breaks out of the squeeze, a significant move often takes place in the direction of the trend.

Bollinger Bands ® and Keltner Channel Strategy

The Bollinger Bands and keltner channels share many similarities. Both indicators can be used for setting up entry and exit points and to set stop losses. The indicators may also form part of a cohesive trading strategy that also accounts for aspects such as momentum, volume, as well as the overall trend.

Keltner Channels [block]2[/block]

You can compare the Bollinger Bands and the keltner channels visually. Bollinger Bands form wider ranges than keltner channels and offer fewer signals, while keltner channels tend to follow the price movement more closely.

What is Ravencoin and how does it work? Explained.

Our Services:-

price analyses

free trading course

cryptocurrency

stock trading

trading indicators

trading oscillators

For more detail

Visit here :- https://priceanalyses.com/

0 notes

Text

Arkansas Fatal Truck Accident Lawyer

Watch video on YouTube here: Arkansas Fatal Truck Accident Lawyer Arkansas Fatal Truck Accident Lawyer Why Truck Accident Victims Need a Truck Attorney Victims of truck accidents, whether they are automobile drivers, pedestrians, or on a bicycle, might be entitled to financial compensation for their injuries. What many do not realize is that in some instances they can bring a legal claim against the truck driver, even if they as the driver were partially at fault. Accident liability is a very complicated and nuanced part of the legal code.At GKBM, we know that no two cases were exactly alike. For this reason, it is ill advised for accident victims to try to seek compensation from a trucking accident on their own. Their best chance for success stems from having a truck accident attorney on their side. The Experience and Resources Needed to Prove Your Case Truck accidents can be caused by any number of things: recklessness, drunk driving, driver fatigue, poor truck maintenance, a defective truck part or even a simple safety violation. Because evidence of fault might exist anywhere -- at the scene, in the driver's log book, in the company's maintenance records, or in electronic form on a truck's black box -- proving what happened and why isn't something you should leave to chance. When you call Gatti, Keltner, Bienvenu & Montesi, PLC for help, you'll be putting investigators, accident reconstruction specialists and attorneys with decades of truck accident litigation experience to work for you. by Arkansas Fatal Truck Accident Channel

1 note

·

View note

Text

Different types of Indicators for Intraday Trading Beginners

Intraday trading (or day trading) is defined as the buying and selling of securities within a single trading day. It is known as a riskier form of trading than regular. Beginners to day trading make decisions based on price movements. But not all traders are equally adept to the study of share market trading for beginners. This is why the use of some indicators is recommended to intraday trading for beginners. This helps newbies to arrive at the right decision.

It is well said that intraday trading requires precise timing to sell or buy to become profitable. As such facilitating different types of best intraday trading strategies and techniques can help in choosing the best share.

In this article, we’ll share a list of top 4 intraday trading indicators you need to get started. Professional traders suggest using one indicator of each type. However, you can follow more indicators depending upon your trading strategies.

Oscillators: This type of indicator reciprocates from lower to the upper bound. For example, the Commodity Channel Index (CCI), Relative Strength Indicator (RSI), Moving Averages Convergence Divergence (MACD), and Stochastics.

Volume: This group of indicators generally depends on trade volumes. This may include volume data and price data. This expresses the effectiveness of the trade. For instance, On Balance Volume and Chaikin Money Flow.

Overlays: These are used for various purposes and majorly rely on price evolution. Most traders use numerous overlays for better results. Some of the popular overlays are- Parabolic SAR, Bollinger Bands, Moving Averages, Fibonacci Extensions, and Retracements, and Keltner Channels.

Breadth Indicators: This type is quite different from others as it shows the behavior of the stock market. For instance, Ticks, Tiki, Advanced-Decline lines, and Trains.

Basic Intraday Trading Indicators:

Moving Average: It indicates the stock’s average closing price for a particular period. In case, the price movement shows any long-term trend then there is a high chance of price movement unpredictability. Hence, MA is the key factor that shows the average closing price.

Bollinger Band: This shows price fluctuations from the MA over a period. It’s often found that traders trade within this band as they consider the trade rise in this band.

Momentum Oscillator: This group tells about the demand for a particular share at a given amount. In the illustration, if momentum oscillator is dropping but the weekly share price is still high, then this will lead to soon failing of the share’s demand.

Relative Strength Indicator: It’s the most popular oscillator because by default it tracks the last 14 periods price movement using an index. This index ranges from 0 to 100. If in case the RSI range is 70 then the market is overbought, meaning a drop in price. On the other hand, if it ranges below 30 then it shows rice in price or oversold.

Day traders typically use trading indicators in addition to time analysis to pick right stocks. You can choose to do so and start trading now. You can join an intraday trading course for beginners to learn the best techniques for profit maximization.

0 notes

Text

Keltner Channels and Grid Trading: The Ultimate Combo for Forex Domination Have you ever tried walking a tightrope while juggling flaming batons? No? Well, sometimes trading Forex can feel like exactly that—an endless balancing act that involves handling volatility, riding trends, and ensuring your account doesn’t do a disappearing act. But fear not! Today, we’re diving into two tools that, when combined, can turn the balancing act into a victory dance: Keltner Channels and Grid Trading. Let’s face it—the Forex market is like that one unpredictable friend who’s either plotting a spontaneous road trip or suddenly vanishing without a word. To survive (and thrive) in this world, you need strategies that embrace volatility without crumbling under its pressure. Enter Keltner Channels and Grid Trading, your secret weapons for handling Forex like a seasoned ninja. The Hidden Formula Only Experts Use: Keltner Channels Explained Keltner Channels—they sound like a secret society, right? Don’t worry, you don’t need a decoder ring to understand them. Essentially, they are volatility-based envelopes set above and below an exponential moving average (EMA). Unlike their flashier cousin, the Bollinger Bands, Keltner Channels use the Average True Range (ATR) to determine the width of the channel. Imagine Keltner Channels as a comfy yet flexible piece of clothing (not the kind you regret buying because it was on sale). They adapt to market movements and help traders identify trend directions and potential breakouts. When price hugs the upper channel, you know there’s a bullish sentiment at play. When it nestles closer to the lower channel, it’s time to think bearishly. But here’s where the magic really happens—by using Keltner Channels, you don’t just react to market movements; you anticipate them. Picture yourself as the friend who always knows what’s coming next—not annoying, just super insightful. You see the subtle cues, the shifts in volatility, and adjust accordingly. Grid Trading: The Overlooked Strategy That Outsmarted the Pros Grid Trading is one of those concepts that, at first glance, seems like a lazy way to overcomplicate things. But beneath its seemingly chaotic façade lies an orderly, calculated system that thrives in unpredictable markets. In its essence, Grid Trading is about placing buy and sell orders at set intervals, regardless of which way the market’s swinging—kind of like setting up a net in the ocean to catch fish swimming in any direction. This approach works especially well in ranging markets. By setting a grid of orders, you capture profit as the price oscillates between levels. Think of it as catching every wave—regardless of how small or large—while everyone else is waiting for the perfect swell. The beauty of Grid Trading is that it removes the need to predict the market's direction. Forget crystal balls—with grid trading, you’re more like a chess player who sets traps, letting the market come to you. And when combined with the directionality insight from Keltner Channels, you’re not just passively waiting—you’re setting up informed, tactical nets to catch the biggest wins. Why Most Traders Get It Wrong (And How You Can Avoid It) Most traders tend to shy away from combining multiple strategies because it can feel like overkill. It’s a bit like trying to learn salsa and breakdancing at the same time. But here’s where things get interesting—Keltner Channels and Grid Trading work in perfect harmony, like peanut butter and jelly (or, if you’re more sophisticated, like wine and cheese). Keltner Channels help you determine if the market is trending or ranging, and Grid Trading gives you a systematic way to profit in either scenario. When the price nears the upper Keltner Channel, you know it might be a good time to place sell orders within your grid. Likewise, when it approaches the lower band, buy orders could be your best friend. Now, imagine the common pitfall: traders see a strong move and either jump in too late or get out too soon. With this combo, you have the added benefit of seeing volatility shifts while systematically capturing profits along the way. No more guessing games—just calculated precision. Underground Trend: Marrying Indicators with Mindset Okay, here’s something that doesn’t get talked about enough. Sure, having a strategy is great, but Forex success is also about the mindset. It’s easy to say, “Use Keltner Channels, do some Grid Trading, and you’re golden,” but let’s address the emotional side of trading. Watching trades move against you can feel like accidentally hitting 'send' on a text that wasn’t supposed to go out—panic-inducing, right? The key to this strategy is accepting losses as part of the plan. Grid Trading inevitably involves some trades ending at a loss, but the idea is that overall, your gains will outweigh these smaller hits. It’s like being okay with losing a few pawns in chess if it means you’ll checkmate your opponent later. Keltner Channels help you keep your cool—reminding you that the market’s behavior is not random but follows trends and rhythms. You’re not chasing; you’re letting the price come to you. It’s all about that zen state of mind—like the cool cucumber you always aspire to be at family dinners. How to Predict Market Moves with Precision Combining these strategies gives you a powerful advantage. Here’s a step-by-step guide to implement this power duo: - Set Up the Keltner Channels: Start by adding the Keltner Channel indicator to your chart. Use an EMA of 20 and an ATR multiplier of 2 for standard settings. - Identify Market Conditions: Determine if the market is trending or ranging. A clear uptrend or downtrend will push price toward the upper or lower bands, respectively. - Overlay a Grid System: Set up a grid of buy and sell orders at set intervals above and below the current price level. It’s wise to set your grid spacing based on the ATR, allowing you to adjust dynamically with the market. - Leverage the Channels: Use the Keltner Channels to time when to add to your grid. For example, when the price hits the upper Keltner band, you might stop adding buy orders to avoid catching a falling knife. - Stay Zen: Trust the system and avoid micromanaging every trade. Use smaller position sizes to allow for a larger number of trades, minimizing the emotional impact of each one. The Forgotten Strategy That Outsmarted the Pros In 2023, there was a case study of a trader who managed to turn $10,000 into $50,000 in under a year by combining these two strategies. According to the trader—who shared his experience on a trading forum—the key was consistency. While everyone else jumped ship the moment volatility spiked, he relied on the insight provided by Keltner Channels and patiently let his grid orders fill. His secret? He treated losses as an investment in future wins. And this is what often sets amateurs apart from the pros—patience and trust in a well-crafted strategy. When you can blend volatility anticipation with a systematic capture mechanism, you’re stacking the odds significantly in your favor. Conquering the Market with Elite Tactics Here’s what you’ve learned today: - Keltner Channels offer a smooth, adaptive approach to understanding market volatility. - Grid Trading provides a structured way to capitalize on both ranging and trending markets without needing to predict direction. - Combining these approaches helps reduce overtrading, manages risk dynamically, and ultimately gives you an edge that most traders overlook. If you’re ready to take your trading to the next level, consider incorporating these strategies into your daily practice. And remember, the real magic isn’t in predicting every twist and turn—it’s in preparing to profit no matter which way the market decides to go. Want more exclusive insights and advanced strategies like these? Join the StarseedFX community for expert analysis, daily alerts, and a free trading journal to refine your craft. Let’s make trading less about stress and more about enjoying the process—even if it sometimes feels like juggling flaming batons. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Forex Trend Signals and Its Six Signs

https://inteligex.com/tag/market-trend-signal/

Decided to go with a 10-minute time frame, just because this market can be a monster. I also kept the Market Trend Signal on, and always check the market bias dots to ensure I am on the right side of the trend.

Exchanging frameworks that yell from the housetops about how great they are really two a penny. Numerous frameworks offer you too much on a stick - ensured! Anyway very regularly the truth misses the mark concerning what's been guaranteed.

So when I go over a framework that looks proficient with downplayed marketing, it stands out enough to be noticed. Trend Signal has discreetly been building a decent notoriety inside the exchanging network so I focused on it to audit the product for the benefit of my individuals.

The Trend Signals

The Trend Signal bundle offers six markers which you can consolidate to survey a potential exchange. Each of these are naturally produced so you should simply make sense of how best to exchange them together. The pointers work forever outlines and over all markets gave there is sufficient liquidity (enough individuals exchanging the market). Here's the 6 markers:

1. Value Envelopes: these work around a moving normal of a stock or Forex cost. The most well-known value envelopes are Bollinger Groups or Keltner channels. The rationale behind them is like the theory of probability, which expresses that everything spins around a normal or 'ordinary' state. Now and again things go to limits and you get action that is a long ways past what is typical. At the point when this occurs, in principle things ought to gradually begin to become ordinary once more. Value envelopes in exchanging spin around a moving normal with upper and lower groups. These upper and lower groups act like the stretchy ropes of a wrestling ring. Most value move will make place inside the limits of the ring, however in some cases value activity become outrageous and hit the ropes. The ropes are stretchy so this outrageous activity is probably going to bring about a snap bounce back. At the point when this occurs, you can utilize value envelopes to anticipate when a draw back is expected. Like an American Grappler running at the ropes, the harder he hits them, the quicker bounce back. Trend Signal draws its own value envelopes. The thought is to utilize them to spot focuses when the trend is probably going to turn around or liable to proceed. Trend inversions towards the base or top of the envelope offer the best potential for remuneration since they demonstrate that the cost has arrived at unfeasible levels.

In the accompanying screen shot you can see the upper envelope winding upwards at the highest point of the image, the moving normal around the middle (completing around 589) and the midpoint between the two indicated by the spotted line.

2. The Trend Signal: this was the first marker behind the product. There is a well known exchanging adage that expresses "The trend is your companion". All well indeed, however how would you know when another trend has begun or an old one is going to end? Exchanging with the trend can be entirely gainful, however getting in too soon or past the point of no return can be destroying for your budgetary wellbeing. The Trend Signal causes you to detect the trend course in one simple pointer. At the point when it changes from green to red it signals that an adjustment in trend in is up and coming. The Trend Signal sits at the base of the outline moving between a size of 1 to 100. The line is intended to speak to the enthusiastic condition of the market. The line itself changes to green to speak to purchasing weight and red to speak to selling pressure. The technique is to take signals when the trend signal abandons green to red and the other way around. Great signals happen beneath 30 or more 70, the best signals happen underneath 10 or more 90. The thought is that when the trend signal arrives at an elevated level like 90, the market is over purchased and prepared to make a draw back. At the point when the trend signal arrives at a level like 10, the market is over sold and is prepared to skips. Consequently taking signals dependent on the difference in shading from red to green or the other way around are intended to be progressively legitimate.

3. Turn Focuses: Trend Signal naturally draws flat lines known as turns focuses. These are frequently founded on past highs and are intended to speak to potential future focuses that the trend will switch. These turn focuses can be helpful for setting stops or value targets. The cost generally lurches or turns around these levels so they can be fantastically valuable.

4. Sharpshooter Circles: these are yellow circles drawn on the outline that speak to a noteworthy potential trend inversion. They show up when Trend Signal identifies the accompanying:

A rotate point being close

The Trend signal getting green or red.

An inversion candle design.

Expert marksman Circles are moderately uncommon yet get 60% of high-benefit exchanges. The nonattendance of a sharpshooter circle doesn't mean a trend won't turn around.

5. Vector Normal: this is a shorter term marker than the trend signal and flicks from red to green and the other way around. The vector normal is shown with the value like a moving normal. Green demonstrates and uptrend while red shows a down trend. more info click here: https://inteligex.com/tag/market-trend-signal/

0 notes

Text

Identify Reversals with Adaptive Price Zones (APZ)

Identify Reversals with Adaptive Price Zones (APZ)

Adaptive Price Zones (APZ) is a volatility-based indicator designed to help identify possible reversal points. This can be especially useful in a choppy market where entries and exits are difficult to determine. The APZ trading indicator was developed by Lee Leibfarth and was first introduced in the September 2006 issue of Technical Analysis of Stocks & Commodities. Similar to Keltner Channels…

View On WordPress

0 notes

Text

The Complete Guide to Keltner Channel Indicator

The Keltner Channel is a simple but powerful trading indicator. It helps you better time your entries, improve your winning rate, and can even “predict” market turning points. And if you want to learn how to do it, then today’s post is for you. But first… What is a Keltner Channel and how does it […] The Complete Guide to Keltner Channel Indicator published first on your-t1-blog-url

0 notes

Link

Episode 14 of the Science of Happiness Podcast by the Greater Good Science Center, featuring Adam Edwards in conversation with Dacher Keltner.

https://www.mindful.org/wp-content/uploads/SoH_Episode_14_-_Adam_Edwards_FINAL_mix.mp3

Dacher Keltner: Adam Edwards is a competitive kayaker and member of Melanin Base Camp, an organization working to diversify outdoor adventure sports and experiences. He joins us today as our happiness guinea pig.

In each episode of The Science of Happiness, we focus on different research-tested practices for increasing happiness, resilience, kindness, and connection. And we have a guest try out

that practice and tell us about their experience. Then we explore the science behind it.

Adam, thanks for being with us.

Adam Edwards: Thanks for having me. Excited to be here.

Dacher Keltner: So Adam, you grew up around alligators and sharks and you’ve camped in Alaska and you’ve been close to grizzlies but I read in a couple of articles you read for Melanin base camp that you have this deep-seated fear of being eaten. What’s that about?

Adam Edwards: I think it’s a completely rational fear for a human being on a biological level. Maybe not as a human being living in a modern society. Yeah I just have a really deep respect for things that are more powerful than me and growing up fishing in Florida, watching a lot of Discovery Channel, reading a lot about megafauna, and as a kid I was really into zoology. I wanted to be a zoologist for a long time. Like I was afraid of something so I became really fascinated with it.

Dacher Keltner: Wow. It seems like you have this theme in your life or this motif of, these fears pop up, given your activities and you go and face them and build a life around them. So tell us about the practice that you chose.

Adam Edwards: So the practice I chose was Overcoming a Fear. It kind of seems a little bit like a sensitization. Basically when I was reading through it, it was kind of like identify a fear and then incrementally work yourself up to facing it. So I chose public speaking.

Dacher Keltner: Why did you choose that one?

Adam Edwards: Mainly because it was a really tangible one that I feel like even after years and years of my chosen career. I am a kayak instructor and like it still provides me with a lot of stress. And not positive stress. It still actually scares me quite a bit. So I figured that was one that hey, I still need, obviously still need work on this. I want to try another way of addressing this.

Dacher Keltner: Yeah. You know Adam, you know you’re not alone in fearing public speaking. Apparently you know when you ask people what they’re afraid of, like these national surveys, number one is death, and number two is speaking publicly. It’s pretty universal and, in fact, one of the ways that we study stress is we bring people to a lab and we say, guess what you’re going to do here, you’re going to give a public speech and they freak out.

Now I’m a scientist and I have to measure your fears here. So you’ve told me about sharks and alligators and bears and grizzlies and black bears so here’s the question: What’s more fear-provoking, speaking to a thousand people or swimming near a shark?

Adam Edwards: Oh man… I could probably swim near the shark. I mean like I’m instantly thinking like well it’s not like a great white and semi-controlled. Like if they’re both controlled scenarios I’d rather swim near the shark than speak to a thousand people.

Dacher Keltner: You got some work to do. So what did you do?

Adam Edwards: So I set up teaching another Whitewater Kayaking class, where I could kind of, maybe try that new way of addressing the fear of speaking to groups of people.

Basically in the weeks prior to the class, I wrote out what I wanted to say and do for the class, which is something I usually do but not really to this detail. I kind of usually just write like a forward stroke, backstroke and how long I think each thing will take.

And this time I kind of spent more time sound-boarding with my co-instructor about what we were going to say and practicing it allowed me to simplify a lot of things. And I found that actually lowered my stress level, because that’s where a lot of the stress in public speaking comes from for me is, my brain’s going really fast and I’m coming up with things to say, and then, you know it starts to tumble. I get lost on tangents and then I kind of just shut up for a while as I’m like, Oh no what do I do…

Dacher Keltner: Blushing, and sweating, and hyperventilating.

Adam Edwards: Yeah, yeah. If I have to speak in front of a large group of people I’m definitely one of those folks that’s like, dark clothes only. Because I am pouring sweat like not on the face, not on the hands, but underneath whatever I’m wearing. I am just drenched with sweat.

Dacher Keltner: So how’d it go?

Adam Edwards: Uh, it went really well, actually. I got a lot of really good feedback from our students. We taught an intermediate creeking class which is the kind of white water kayaking where they run waterfalls, very steep rivers and creeks. So other than the technical skills, there’s a lot of talk about safety and fear management and risk management and that’s kind of, that was the hard part. I mean that’s something I talk about a lot. It’s a big interest of mine. But not complicating that for people who don’t think about that a lot is very hard for me to do. So that actually went really well I was excited with how that aspect of the class went. We had a really good dialogue and they kind of relayed that the way it was presented helped them kind of be like, hey this like all of this stuff is manageable. Like everyone goes through this and that’s basically the best I could hope for coming out of a class like that.

Dacher Keltner: Let’s play a clip of how your class went.

Adam Edwards: Talk a little about safety and fear management as we’re on the river. And I will be creating scenarios today that will try to heighten your stress level a little bit. Just so you’re aware that’s going to happen at some point but I won’t tell you when it’s happening, it will just happen. So, yeah. I’ll turn it over to you for a little bit if you had some thoughts or I keep orating. It’s a nervous energy it’s just going to spill out of my face.

Dacher Keltner: Given what your experiences were with this facing fears practice, how do you just give wisdom to a friend like you know who’s going to go give a public talk. What would you say?

Adam Edwards: I would say really like investing the time in putting your thoughts down prior was super helpful. Just seeing a bullet-pointed list of what I wanted to convey changed what I wanted to convey, because it allowed me to consolidate and streamline the whole thing. By doing that I got more comfortable with the topic and was able to actually come up with new and better ideas. And then practicing saying those things, and running that by like a close friend or a spouse or someone that you’re comfortable speaking in front of really like, you know is a dry run whenever I get stressed I just kind of revert to like well, I’m just talking to this person, not talking to like 40 people or however many, I’m talking to one person.

Seeing a bullet-pointed list of what I wanted to convey changed what I wanted to convey, because it allowed me to consolidate and streamline the whole thing. By doing that I got more comfortable with the topic and was able to actually come up with new and better ideas.

Dacher Keltner: You know that’s nice.

Adam Edwards: Yeah I think that’s really helpful. Just like that repetition makes it easier and easier each time it’s done.

Dacher Keltner: Nice. You know I know in the broader literature on facing anxieties like just breaking stuff down and just laying out the practical concrete steps you’re going to take is pretty good stuff. Do you think just coming full circle with Melanin Base camp, is part of the idea just more broadly to take on fears and transcend them?

Adam Edwards: At least for me personally, it definitely is because the fear of public speaking is not just if I have to stand in front of a crowd, it’s public speaking in this day and age, it includes posting on your social media, more than just to say like, I had this today or I’m going there. Like actually utilizing the platforms that we have available to us to express our ideas.

And I have a huge anxiety with that. So being a part of Melanin Base camp is both like amazingly uplifting and really fun for me, and it’s also, I would say, it’s a positive stress now but it is definitely also a stressor where putting my thoughts and feelings on very divisive issues and personal experiences out there for everyone to see and read and comment on and respond to…so it’s inviting a two-way section of public speaking which I think is to borrow the term now, there’s a lot of uncomfortable conversations happening, and Melanin Base Camp is creating a comfortable way to facilitate those conversations.

Dacher Keltner: You know one of the things we’re learning from the signs of stress and it relates to the practice you chose, is ,you know, there’s this big network of in your brain and in your body that helps you respond to stress and threat—the HPA axis and it releases cortisol and I think one of the most important developments in that literature is that when you are a woman and you hear sexist talk or a sexist joke at work or you are a person of color and you hear prejudicial talk those forms of prejudice actually activate the stress response. How do you find for people of color being outdoors changes their sense of their identity and the outside world?

Adam Edwards: I can speak for myself personally. The parts that have had where I have had those stress reactions is kind of like in the initial couple of years where I had a driver’s license I wasn’t with my parents anymore. I was picking the places I was going and exploring that freedom as a black man in America kind of being like, oh man, if I’m at this trailhead by myself and there’s these weird people…I just have this anxiety when the Rangers show up, or like meeting people in rural areas, and, you know, kind of fear of authority, being questioned in different places for why you’re being there. Just because we’re not usually there.

I was talking to a friend’s father a few weeks back kind of about this. Just how something he pointed out to me is like 20, 30, 40 years ago the outdoors are a place where it’s like as a person of color, like why would I go in the woods, when the general consensus is you’ve got the Klan you’ve got backwoods people that don’t like anyone that doesn’t look like them.

But I think that re-embracing the outdoors if it’s something as a person of color that you’ve been avoiding, it’s such an easy thing to do. Even if you live in a huge city there are still like, spaces you can find, green spaces whether those are parks or things out of town and being able to kind of interact with that in the natural sense I feel it definitely is a huge stress relief. It’s just peaceful.

Dacher Keltner: You know I really appreciate all the work, you know choosing the practice to face your fears and all this work you’re doing. And in your writing, it’s really interesting you write about how this kind of fear of being eaten not only has these really concrete sources like you’re talking about. You know that you grew up around alligators and sharks and encountered Grizzlies, but there’s a lot of reasons to be fearful as a man of color.

And for you the fear of being eaten almost metaphorically feels like being attacked by society or arrested or the target of biased criminal justice. Tell me about that.

Adam Edwards: So I wrote about the same overriding fear that I experience when I’m hanging out in a country that has big predators. It’s a very similar feeling and stress to how I feel when I’m interacting with police in a non-expected way.

Like I’m hyper-aware of police. Like when I’m driving, like if I see a car that looks like a cop car like, I’m watching it. And I drive very legally. I drive the speed limit, So it’s kind of like, I often feel ridiculous when I’m doing that. But it comes out of watching my father, a pastor, be arrested for nothing more than one occasion, being harassed by police. Our family experienced that a lot for a large period of my life, it’s…it’s not a trusted authoritative entity.

One of those things where it doesn’t matter, really how good the human being I’m seeing in that uniform is. It’s my association with it, it is like basically you are a threat, but you’re a threat I can’t react to. Which makes it even worse. With the animal you can kind of deal with it. You know you can fight it off, you can scare it off, you can avoid it very easily by doing any number of things, but for me that anxiety with authority, with law enforcement is…cannot do anything and if they do come for you, it’s worse if you do anything because you’re always in the wrong no matter what’s happening.

Dacher Keltner: You know my colleague Rudy Mendoza-Denton here at Berkeley has taken this fear literature and we think classically, of well, I fear snakes or spiders or bears or the dark. And then it became the social anxiety, of well, I fear being judged or giving public speeches. Now he, is talking about given histories and legacies of race and class that people of color and people of lower class backgrounds will fear institutions, like the institution of police, right? And he studies how when students of color go to largely wealthy white universities it’s the whole place, it feels foreboding or threatening in some ways. So it’s interesting to hear you talk about that. It points to a really active area of inquiry scientifically.

Whenever I teach human happiness I always end with the challenges that our culture faces at this moment and I really liked your phrase, positive stress. And I just want to say thanks Adam for the work you’re doing at Melanin Base camp and expanding accessibility to the outdoors for people of color. It’s one of those developments that gives me hope. So thanks.

Adam Edwards: No problem. Thanks for having me on, man,

Dacher Keltner: So one of the things that we learned from Adam Edwards and he faced this fear of public speaking, which, you know, some survey data suggests is the second most common fear that Americans have right behind dying. It’s a very common fear and a very powerful one, is in his practice he faced it by a process of exposure and desensitization, where he thought about it, and then he practiced it, and he worked out what he’s going to say, and delivered some text. And at the core of these facing fear practices is awareness. It’s this power of the conscious mind making sense of the fear and labeling it. And then you learn gradually how to handle it. For people who’ve really suffered from anxiety like I have, there is this magical power of awareness of your fear with language.

And at the core of these facing fear practices is awareness. It’s this power of the conscious mind making sense of the fear and labeling it. And then you learn gradually how to handle it.

And one of my favorite studies that that brings the power of awareness it’s right at the heart of facing fears into focus is an early study by a couple of neuroscientists down at UCLA, Matt Lieberman and Naomi Eisenberger.

They presented people with images of really angry faces and we know that when you see an angry face, you become a little bit stressed. That’s just our evolutionary response to an anger face, right? You show elevated stress related heart rate, increase skin conductance response, your body’s in a fight or flight state. So they present this anger face and in fact that activates in an FMRI scanner, increased activation in the amygdala which is what people think of as kind of a threat or fear region of the brain. But then what they did is they really started to make people use language to label their feelings. So in one condition they just had them label the expression, right? Hey, that’s an anger expression. And then he compared the activation to another condition in which they matched an anger face to the face that had generated the fear response in the first place. So in one condition you’re using language to label the fear, what makes you afraid. And the other condition you’re doing this control task. And what they found, which is really elegant, is that simply labeling the source of your fear with a word, reduce activation in the amygdala, and that it increases activation in this region of your prefrontal cortex, the right ventral lateral prefrontal cortex, which is involved in language and representation of stress, and really finding perspective upon your feelings.

So what this really elegant study shows is just by simply labeling your fears by being aware of them, you show reduced activation in the brain regions that produce fear. And it helps us understand why language and labeling is so important to facing fears.

So this study is really focusing on just using words to label negative emotions right? Like what produces fear or what makes you sad? But really when we cast the net more broadly, using language to represent our experiences is part of telling stories about life, telling stories about the deeper meanings in our life. It’s about gaining perspective upon current momentary struggles and we know these broader practices of narrating our experience, gaining perspective, taking third person perspective upon, say a conflict you’re having with a romantic partner. All of these are forms of using language to represent stress, and conflict, and anger, and joy, and finding the deeper meaning underlying those experiences which is, I think, one of the most powerful ways that we find happiness.

If you would like to try the Overcoming a Fear practice, or other practices like it, go to our website Greater Good in Action.

I’m Dacher Keltner. Thanks for joining me for the Science of Happiness.

Produced by the Greater Good Science Center and PRI. Episode 14 of the Science of Happiness Podcast by the Greater Good Science Center, featuring Dan Harris in conversation with Dacher Keltner.

Transform Your Fears Mindfully

A Primer on Living in a Time of Fear

The post What Are You Afraid Of? appeared first on Mindful.

0 notes

Text

4 WAYS TO LIVE A MORE FULFILLING AND MEANINGFUL LIFE, ACCORDING TO PSYCHOLOGY

Nearly 100 years ago, Albert Einstein shared his theory of happiness with the world, stating: "A calm and modest life brings more happiness than the pursuit of success combined with constant restlessness." Even still, only a third of today's Americans report feeling happy, according to the 2017 Harris Poll Survey of American Happiness. But in a TED Talk held earlier this year, writer and positive psychology instructor at University of Pennsylvania Emily Esfahani Smith argued that despite our culture's obsession with the pursuit of personal happiness, understanding your meaning in life is the secret to your resilience and success. "Many psychologists define happiness as a state of comfort and ease, feeling good in the moment. Meaning, though, is deeper," Smith said. Citing psychologist Martin Seligman, she pointed out that "meaning comes from belonging to and serving something beyond yourself and from developing the best within you." "Everyone said the path to happiness was success, so I searched for that ideal job, that perfect boyfriend, that beautiful apartment," Smith said, a topic she elaborates on in her recently published book "The Power of Meaning." But what Smith found was that by chasing happiness, she felt "anxious and adrift," which scientific research has proven to be normal. This feeling was explored in a 2011 study titled "Can seeking happiness make people unhappy? Paradoxical effects of valuing happiness" published by the American Psychological Association. Researchers found that chasing happiness can be self-defeating, "because the more people value happiness, the more likely they will feel disappointed." "Even though life is getting objectively better by nearly every conceivable standard, more people feel hopeless, depressed and alone," Smith said. But when it comes to those who pursue meaning and find it, Smith said they are "more resilient, they do better in school and at work and they even live longer." To find out how people can live more meaningful lives, Smith spent five years interviewing hundreds of people and sorted through psychology, neuroscience and philosophy research. For those who may not know where to start to live a more meaningful life, Smith details these four pillars to help set you on a more fulfilling path. Value others and find people who value you The first pillar of meaning is "belonging," which Smith said comes from "being in relationships where you're valued for who you are intrinsically and where you value others as well." The clearest examples of sharing this bond can be seen between yourself and your family or friends. But Smith warned that you shouldn't confuse this with "cheap forms of belonging," where people only value you not for who you are, but for what you believe or who you hate. "True belonging springs from love. It lives in moments among individuals and it's a choice," she said. "You can choose to cultivate belonging with others." Find your purpose "Finding your purpose is not the same thing as finding that job that makes you happy," Smith said. "Purpose is less about what you want than about what you give." Smith explained that the key to purpose is "using your strengths to serve others." Given that American adults spend a majority of their time at work, Smith said it makes sense that we channel our sense of purpose through our jobs, where we contribute a lot of our time and feel needed. But as Smith pointed out, the lack of purpose Americans feel at work is translating into "disengagement at work, unemployment and low labor force participation." "Of course, you don't have to find purpose at work, but purpose gives you something to live for," Smith said, adding it gives you a reason to move forward. Experience transcendence "Transcendent states are those rare moments when you're lifted above the hustle and bustle of daily life, your sense of self fades away and you feel connected to a higher reality," Smith said. In other words, it's an experience that feels larger than life. But different people will experience transcendence in different ways. For Smith, transcendence looks like getting "so in the zone" while writing that she loses all sense of time and place. In 2015, University of California - Berkeley researchers Paul Piff and Dacher Keltner published a study on the emotional response of awe, which they described in The New York Times as "that often-positive feeling of being in the presence of something vast that transcends our understanding of the world." In the study, students who looked up at 200-feet-tall eucalyptus trees for one minute felt less self-centered and even behaved more generously when given the chance to help someone, Smith explained. She recommends people place themselves in more moments like these. Be in control of your life story Smith explained that when you speak with someone or write about events that have taken place in your life on any given day, you are creating a narrative that helps you understand how you became you. "We don't always realize that we're the authors of our stories and can change the way we're telling them," Smith said. "Your life isn't just a list of events.You can edit, interpret and retell your story, even as you're constrained by the facts." Even if you aren't thrilled about how things in your life are playing out, Smith said seeing a therapist or finding time to reflect in a thoughtful way allows you to understand your life in a more meaningful way. "Happiness comes and goes," Smith said, "but when life is really good and when things are really bad, having meaning gives you something to hold on to." Source: CNBC from Blogger http://bit.ly/2DQAKpE via IFTTT

0 notes

Text

Can Mr. Bollinger spot trading opportunities?

15 May 2020,

You are about to get a lesson in trading from a gentleman called Mr. Bollinger. He is a very famous name in trading circles and is here to help you spot trading opportunities. What can you learn from him? A little about statistics, a little about trading charts and a lot about Bollinger Bands— all in a span of 5 minutes. So read this Technical Funda and enjoy your masterclass with Mr. Bollinger. Here's how you can use Bollinger Bands to spot trading opportunities Avdhut Bagkar Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity and were invented by John Bollinger, who charted two standard deviation lines around the simple moving average (SMA) to identify the deviation in price. The line above the SMA is denoted as upper Bollinger line and the line below as lower Bollinger band. Normally, the simple moving average is 20-day SMA and acts as a middle level between the two bands. Traders can modify the standard deviation values depending on their preferences. However, the traditional value -- which is two standard deviations on either band -- is usually followed across trading platforms. Standard deviation measures the rise or a fall of a stock from its one-month average price. Basically, identifying the difference of a price that can deviate in either direction What do Bollinger Bands tell you? 1. Once the price trades above the upper Bollinger band, the selling pressure or profit booking is expected to emerge. 2. The simple 20-day moving average indicates the trend of a stock. A price above 20-SMA shows a positive bias and vice-versa. 3. When the Bollinger Bands squeeze, the breakout seems to be in formation. 4. The trend is said to change when the opposite band starts turning. In bullish market, the moment the lower band starts turning upward, it indicates profit booking. 5. Bollinger Band says that the price always trades within the upper and lower bands. Whenever the price goes beyond either band, it has to retrace back within the bands' range. Can Bollinger Bands be used for intra-day trading? Bollinger Bands is utilized for short-term to long-term trading. For intraday trades, the indicator lags the potential to give the signals. The price movement is so volatile that the entry and exit points are difficult to gauge in short span. That said, it indeed gives signals that can establish a potential trade. The accuracy is decent and the trader needs to be on his toes to capture the price move. Difference between Bollinger Bands and Keltner Channel? Both the indicators look similar to each other, however, the formation is diverse. Bollinger Bands uses Standard deviation and Keltner channel uses average true range (ATR) - a measure of volatility - in computation. How to co-relate Bollinger Bands with chart patterns / candlesticks? Reversal on dips – When a stock repeatedly shows a reversal after a dip below the lower band, it suggests that the underneath support is strong. The bulls are regaining the positive momentum and the stock is about to witness upward move. Check this Reliance Industries stock chart to know more. Gap up / Gap Down – Whenever the counter witnesses a gap down from outside the upper band, the reversal to a negative trend is eminent. The momentum of a price outside these bands shows extreme volatility and the stock can take severe direction based on the next candlestick. Read this BHEL stock chart to identify this pattern better. Chart Patterns – The most recurring formations like Head and Shoulder, Inverse Head and Shoulder, Double top, Double Bottom indicate strong robust rally. Identification of a breakout is tough. Bollinger bands help to decode the breakout level whenever the stock shows momentum towards the upper or lower band. Here's a Titan Industries chart to understand this.

0 notes