#brainmasscommunity

Explore tagged Tumblr posts

Text

18% returns in a month! This household appliance maker gave a breakout above falling trendline

Voltas, part of the consumer durable industry, has risen by about 18% in 1 month which helped the stock to break out from a falling trendline resistance that has opened room for the stock to head towards Rs 1,000. The stock price of Voltas, which makes household appliances, has rallied from Rs 776 recorded on January 23 to Rs 914 as on 22 February 2023 which translates into an upside of about 18%. However, from its 52-week high, the stock is still down more than 30% which effectively places the stock in a downtrend. But, the recent momentum seen in the stock suggests that bulls are trying to take control. The stock gave a breakout above the falling trendline which connects the highs of December as well as January 2023 on the daily charts. The up move has come with strong volumes. On the weekly charts, the stock has been forming higher highs and higher lows with strong volumes which suggests strength in the up move. In terms of price action, the stock is trading well above short and long-term moving averages placed at 5,10,20,30,50,100, and 200-DMA which is a positive sign for the bulls.

“Stock price of Voltas has taken support at its previous resistance zone on a monthly scale and formed a reversal candle with follow-up buying seen in the counter. It is also forming higher highs – higher lows on a weekly scale from the past four weeks with noticeable volumes,” Arpit Beriwal, Analyst, Equity Derivatives & Technicals, MOFSL, said. “It has given a falling supply trend line breakout on daily scale and started to form higher highs – higher lows as supports are gradually shifting higher,” he said.“The stock has also seen a moving average crossover on a daily scale which has bullish implications and stock is likely to outperform the broader market,” added Beriwal. Relative Strength Index (RSI) is also moving northwards which suggests momentum is likely to continue in coming sessions and thus looking at the overall chart structure on the weekly scale. We expect the stock to move higher towards Rs 1,000 level. We recommend buying the stock at current levels with a stop loss below Rs 875 level on a closing basis for an upside move towards Rs 1,000 zone,” recommends Beriwal.

#voltas#tradewithraj#technicalanalysis#elliottwave#ichimoku#brainmasscloud#brainmasswave#brainmasstraders#brainmassfinance#brainmassacademy#brainmassclub#brainmasscommunity#brainmassfinancialservices#rsi#macd#dma#stocks#nifty#banknifty#nse#sensex#india

0 notes

Text

The Dow Jones Industrial Average fell 0.30% or 91 points, the Nasdaq was down 0.61%, and the the S&P 500 fell 0.85%.

The Dow closed lower Thursday, as rising Treasury yields weighed on investor sentiment even as the bulk of quarterly results continued to suggest corporate America is in better shape than feared.

The Dow Jones Industrial Average fell 0.30% or 91 points, the Nasdaq was down 0.61%, and the the S&P 500 fell 0.85%.

The 10-year Treasury yield jumped to fresh 14-year highs as investors weighed up fresh remarks from Federal Reserve officials calling for the central bank to remain the course on rate hikes.

Citing a "disappointing lack of progress on curtailing inflation," Philadelphia Federal Reserve President Patrick Harker said he expects interest rates will be “well above 4% by the end of the year.”

The remarks come as fewer-than-expected weekly jobless claims pointed to strength in the labor market, heightening concerns about ongoing wage growth.

“Demand for labor remains quite strong […] it remains the case that workers who are let go are still having a relatively easy time finding a new job,” Jefferies said in a note.

Tech stocks managed to cut losses but remained under pressure as rising Treasury yields make growth corners of the market including tech less attractive.

International Business Machines (NYSE:IBM), however, bucked the trend to rise more than 4% after the tech giant reported quarterly results that beat estimates on both the top and bottom lines.

Tesla (NASDAQ:TSLA), meanwhile, fell more than 7% after a mixed third-quarter results, though some on Wall Street touted optimism ahead for the EV maker after management said they are considering initiating a stock buyback.

“We are encouraged that management is considering a $5- $10B buyback and believe it is a constructive use of cash,” Oppenheimer said after lifting its price target on the stock to $436 from $432. “[We] believe depth of demand is outstripping most investor expectations, even when considering a looming recession,” it added.

The broader market was also pressured by a fall in travel stocks as investors weighed up quarterly results from airlines and railroad companies.

American Airlines (NASDAQ:AAL) reported quarterly earnings that beat estimates as travel demand continued to recover, but its shares fell more than 3%.

Railroad stocks were hurt by Union Pacific 's (NYSE:UNP) weaker outlook on carload growth and stock repurchases, which offset the quarterly results beat on the top line.

Elsewhere, AT&T Inc (NYSE:T) rallied more than 7% after the telecom reported better-than-expected earnings and revenue and lifted its outlook on full-year earnings to $2.50 from $2.46 a share previously.

The stumble in the broader market has coincided with wild swings in either direction, a pattern that isn't likely to let up anytime soon.

"Most of these volatile moves have inflation uncertainty, and what the Fed is going to do about it, at their core," Wells Fargo said. "We feel this pattern of market behavior is unlikely to change in the near term and is not uncommon during periods of economic uncertainty," it added.

#brainmassfinance#Brainmass#brainmassgroup#brainmasscommunity#brainmasstraders#tradewithraj#nasdaq#s&p 500 index#dowjones#new york stock exchange#treasury#ibm#at&t#brainmassclub

1 note

·

View note

Photo

May your life radiate success and prosperity like the way Diwali lights shine tonight. . . . #brainmassgroup #happydiwali #happydiwali2022 #brainmassfamily #brainmasscommunity #brainmasseducation #brainmasstutors #brainmasstechnologies #brainmassmusic #brainmassfoundation #brainmassfinance #brainmasstechnologies #brainmasspictures #brainmassglobal #brainmasshealthcare #brainmassacademy

0 notes

Text

10 Investors Score $117 Billion On Tesla Stock's Double 'Bubble'

What's it like to make more than $110 billion in five weeks on just one S&P 500 stock? Ask the largest owners of Tesla (TSLA) stock.

The top 10 largest holders of Tesla stock, including top ETF and mutual fund providers like Vanguard and BlackRock (BLK) plus the Technoking Elon Musk himself, are collectively up $117 billion since the stock doubled from its 52-week (intraday) low on Jan. 6, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.

That means just 10 investors made more on one stock — Tesla — in roughly five weeks than all investors made on 496 individual S&P 500 stocks during the same time. That's crazy money.

The run on Tesla stock is prompting some to toss out the "bubble" word. "Tesla's recent price cuts are a display of pricing power, cost superiority and could increase demand — but it could also negatively impact Tesla's future profitability," said Oktay Kavrak, product strategist at Leverage Shares.

Tesla's Run-Up Is One For S&P 500 History Books

It's not often to see so much value get created by a single stock so fast. But that's the story of the S&P's bounce this year following last year's beatdown.

Shares of Tesla are up more than 105% from their 52-week intraday low on Jan. 6. And they're up more than 85% from their closing price that day. That means all Tesla investors are up $305 billion from that low day's closing price. That's more of a market value gain than all but two other individual stocks in the S&P 500.

Yes, Apple is up more than $361.9 billion since then. And Microsoft is too, up $348.8 billion. But on a percentage basis, they're only up 18% and 21% respectively, or nowhere near Tesla's percentage gain.

And that's why some bubble talk is starting to perk up (although shares are still 46% below their 52-week closing high). Tesla closed Tuesday at 209.25. At that price, Tesla stock is already nearly 9% past the 192.63 a share analysts think it should be worth in 12 months.

Big Wins On Tesla

No investors are making as much money in this year's Tesla rally as Musk himself. Musk still owns 13% of the electric-car maker, more than anyone else, a lucrative move in 2023.

Musk has gained $40.7 billion in paper wealth on just his stock this year alone. No one comes even close. But Vanguard, the top holder of two-thirds of S&P 500 stocks, is bringing its ETF and index mutual fund investors along for the ride, too. The fund company's 6.9% stake in Tesla has gained nearly $21 billion in wealth on its position.

And rounding out the top three winners in No. 3 spot is BlackRock. The fund company's 5.6% stake in Tesla added more than $17 billion in market value just this year.

But while bears think Tesla is running too far, too fast, some mega-bulls exist. The most optimistic forecast for where Tesla stock will be in 12 months is 320 a share. If that's right, Tesla still has more than 53% upside from Tuesday's close.

That's not as impressive as the stock's run in the past five weeks, but none of these top Tesla stock investors will likely complain.

Big Tesla Investors Make A Fortune This Year

Brainmass Finance Team

#brainmassfinance#brainmasscommunity#brainmasstraders#brainmasswealth#brainmasscapital#brainmassfinancialservices#tradewithraj#brainmasscommodity#brainmassclub#crudewithraj#nse#bse#sensex#nifty#banknifty#tesla#elonmusk#billionaire#investors#traders#brainmassglobal#brainmasstimes

0 notes

Text

TMO with TTM Squeeze

Application of the TTM squeeze and the short-term momentum TTM Wave A in action. This is an example where the short-term wave will react faster than the TTM to give you a signal to start building your positions. This indicator needs to be combined with "TTM Wave A" (add to existing pane). The TTM Squeeze works like a better MACD . There is a zeroline and histogram bars above / below represent positive and negative momo. As the height of the bar decreases when above the zeroline, that is called decreasingly positive momo and as the height of the bar decreases when below the zeroline, that is called decreasingly negative momo. The dots on the TTM Squeeze: Red dots represent consolidation where Bollingers are inside the Keltner Channels and green dots represent a move out of consolidation or "squeeze fire". As price action comes out of consolidation there is a bigger move up/down depending on where momo is heading and where prices are (key support/resistance levels, fib areas). You want to use the TTM Squeeze and A wave TOGETHER - TTM Squeeze is your main momo and your A wave is a short-term momo wave that reacts faster and works as a leading gauge. You need to use them TOGETHER to gauge where price action may be heading. When the TTM Squeeze and A wave move lockstep together, let's say both are decreasingly positive, there is a good probability it continues to move in that direction to the next support levels. TWO bars on the TTM Squeeze of different heights is confirmation that in most cases means it will move in the direction of those bars. So if decreasingly positive, you'll see two darker bars. By the time you get your 2nd bar on the TTM Squeeze, it is often too late or you're losing profit. Way to counter that is after you get one darker bar in the opposite direction of current trend, use A wave to "predict" the next wave, the more A wave histogram bars going towards the other direction, the higher the certainty it will hit. Lastly, using these waves together works best when you look at it on MULTIPLE TIME FRAMES. (Credit for this details goes to Brady from Atlas ).

#momentum#ttm#ttmsqeeze#macd#tradewithraj#brainmasstraders#brainmassfinance#brainmass#brainmasscommunity#brainmassclub

0 notes

Text

Crypto Total Market Cap Intraday: Elliott Wave Analysis

#crypto#crypto trading#cryptowithraj#elliotwave#waveanalysis#brainmassfinance#brainmasstraders#tradewithraj#brainmasscommunity#chartbyraj

0 notes

Text

New tribes of the Metaverse — Community-owned economies

The gaming ecosystem is set to become more community-driven with the help of decentralized tech, empowering creators and coders.

People have talked in glowing tones about the transformative properties of blockchain since Satoshi Nakamoto launched Bitcoin (BTC) back in 2009 — books have been written, thousands of panels and presentations have complemented its prospects, costumed Bitcoin maximalists have flaunted their newfound wealth. Despite these commendations, the transformation has been slow.

However, whether the delay was due to the global COVID-19 pandemic, or just the time needed to create innovation, we are now on the cusp of change that is creating new economies and ways of human interaction. The Metaverse, with the powerful combination of game theory and blockchain, is creating tokenized incentivization in virtual worlds. Decentraland has already started to revolutionize people’s lives and interaction, and many similar platforms are being built. The Metaverse will grow to include multiple cross-chain possibilities as the virtual economy grows in importance.

NFTs and the gaming industry

GameFi, a term used to describe the burgeoning intersection between decentralized tech and the video game industry, is where the real value is being created. Nonfungible tokens (NFTs) allow players to own assets with tangible, real-world value and incentivise gamers to participate for longer periods of time, as well as allowing developers to create in-game economies which are based on the creativity and interactions of players as creators and owners.

Blockchain offers numerous advantages to GameFi:

Transparency: Making the gamification mechanisms clear, transparent and perhaps codified through a smart contract, users tend to trust more and therefore to invest more resources in terms of money and time.

Interoperability: The blockchain allows for the possibility of creating portability of virtual resources outside the limits imposed so far.

Liquidity: It is now possible to buy, sell and exchange assets outside of individual games.

Autonomous automation with smart contracts, which may enable multiple parties to interact with each other, even without human intervention.

NFTs can increase player engagement and create better gameplay experiences which, ultimately, increases the value of in-game NFTs and tokens. Players can now have agency within the games they want to play, and as to how these games evolve.

Axie Infinity came to prominence, in part, because of its social impact in keeping families out of poverty during the pandemic, and its player-created “scholar” program, which encourages community development, is growing fast. It's now a multi-billion-dollar, player-controlled game ecosystem.

BlackPool is another example of an early decentralized autonomous organisation (DAO) built for NFT gaming and trading. This platform is very much community-driven; it combines a passion for gaming and art with data analytics and machine learning to provide returns for users. BlackPool has also deployed Axie-like scholarship programs, opening up new income streams for the excluded. Blockchain enables participation, voting rights and monetization within an economy. It is also possible through interoperability to foresee the creation of networks of online communities, with exchanges and interactions among them.

Community first

The big story here is that we are seeing a move from “corporation first” to “community first.” The community forms around an idea or interest through engagement and collaboration with the community, and concepts emerge out of the community. It’s “community first” and “community fast!”

These communities are decentralized and community-governed — designs can be put to vote, and the artwork with the highest number of votes from the community can ultimately get accepted for the final design. Every time someone mints an NFT, the artists who worked on the asset earn royalties from it for each transaction. This will open up unexplored terrains of monetizing creative knowledge and skills.

The create-to-earn model allows creators to take complete control of the game studios and directly participate in developing the game. This provides the community the opportunity to make in-game assets, create NFTs and sell them on secondary marketplaces. This is a powerful new creator economy that is emerging, in which players and coders can liberate their ideas, improve the in-game experience and monetize their intellectual capital. This makes the gaming ecosystem more community-driven, with content creators getting incentivized to enhance the overall playing experience. Anyone with basic coding skills can contribute to the game.

This will also drive new social networks to emerge between creators and fans. The attention economy will be replaced through social tokens in the Metaverse to bring a new immersive fan-run economy. Social tokens based around a brand, community or influencer will allow communities or celebrities to further monetize themselves. They will create bi-directional relationships between creators and consumers, with benefits on both sides. These Web 3.0 communities are collaborating, evangelizing and creating tribal network effects, all helping each other drive the value of their platform.

Digital communities are forming networks through token economies. The more players use or promote the community, the stronger the game and underlying blockchain become. The players are the stakeholders.

This creates the data infrastructure to enable a harmonized, interconnected Metaverse that further enables tokenized NFTs to include digital data rights, and to store, track and enforce those data rights. We are still in the early days of this transformation, and the future is in the hands of innovators and creators, and the community who support them. These communities are the new tribes of the Metaverse, and the only limit to what is possible is your imagination!

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

#blockchain#digitalcommunity#creators#tradewithraj#learnwithraj#brainmasscommunity#gamesmarket#socialtokens#NFT#metaverse#gamingecosystem#web3.0community#token#influencer#platform#mobilegames#pcgames#consolegames#GameFi#coders#brainmasscoders#brainmasseducation#brainmasstutors#brainmassfinance#brainmasstraders

0 notes

Text

Free #Forecast Friday!

Asia-Pacific Short Term Update:

"Prices are breaking lower in the #Nifty index... We are short-term #bearish on the Nifty with a break of 17,500 expected in the coming days."

#nifty#brainmassacademy#brainmassfinance#brainmasstraders#tradewithraj#learnwithraj#brainmasscommunity#brainmassgroup#banknifty#stock market#Indian stock#trader#investors#nifty50

0 notes

Text

Unicorns and other fabulous beasts:

Dear Reader,

The Paytm listing fiasco looms large on investors’ minds. Unfavourable comparisons are being made with the Reliance Power IPO, which marked the top for the Indian markets back in 2008. Questions are being raised about what it will mean for the line-up of IPOs of other so-called ‘new-age’ companies. The investment bankers to the IPO and mutual fund managers who invested in it are being hauled over the coals. Schadenfreude is in the air.

This is what Aswath Damodaran, valuation guru and professor of finance at the Stern School of Business at New York University, had written about Paytm: “The picture that emerges of Paytm is that of a management that is too focused on racking up user numbers, and too distracted to care about converting those into revenues and profits, while making grandiose statements about its future.” He added, “Needless to say, if I invested in Paytm, it would not only have to be at the right price, i.e., trading at less than ₹1,500 billion, but also with the acceptance that this cannot be a passive (buy and hold) investment, but one that will require active engagement and monitoring of the company's actions and performance.” Well, its market cap is much less than Damodaran’s benchmark now.

There’s no question that fintechs are hugely disruptive and will force change in the stodgy Indian financial sector, most likely for the better. Bank credit is anyway no longer the main source of funding for the commercial sector. Our Start-up Street section this week said that while the tsunami of funds into the fintech sector will continue, “the unprecedented acceleration in funding — including companies with no meaningful revenues suddenly being accorded unicorn valuations — makes one wonder whether all of them will be able to meet the heightened expectations of the investors.”

Of course, not all new-age companies are created equal. On Thursday, while Policybazaar’s share price fell in sympathy with Paytm, the damage to Zomato and Nykaa was minimal. We pondered what investors should do after the rally in Nykaa shares. It may be wise to remember these are heady times and it’s not only among new-age companies that surprising narratives are being spun. Unnerved by the froth in the IPO market, SEBI is proposing to tighten some norms. This week, we analysed the Tarsons Products IPO and the Go Fashion India IPO. Talking of asset price bubbles, McKinsey Global Institute pointed out that while GDP growth in the advanced nations has been sluggish in the past two decades, wealth has soared, thanks to rising asset prices. The RBI’s state of the economy report said that in India, the yield gap, or the difference between the 10-year G-Sec yield and the 12-month forward earnings yield of the BSE Sensex, at 2.47 percent, has far outstripped its historical long-term average of 1.65 percent. That raises a question mark on equity valuations.

The good news is that our recovery tracker is showing that the festival-linked upturn persists. Growth is accelerating, although that is likely to lead to higher core inflation. This FT piece (free to read for MC Pro subscribers) says that high shipping costs will push up inflation. Higher inflation, in turn, will stiffen bond yields, but on the other hand, the strengthening economy will lead to higher earnings, so the gap between bond and earnings yield may not widen. That happy state could support equities. The Bank of America survey of global fund managers found that emerging markets were seen to give the best returns next year, in spite of the spectre of a strong dollar.

Indeed, Morgan Stanley has said 2022 will be all about better growth squaring off against high valuations, tightening policy, rambunctious investor activity, and inflation being higher than most investors are used to. As we said in our analysis of US corporate earnings, earnings growth will be a key factor because it acts as an inflation hedge. But much depends on the course of monetary policy in the US and on who will be the new Fed chairperson.

Our stock recommendations reflect the tension between these diverse forces. For instance, we found that inflation continues to weigh on Berger Paints’ margins; that higher coking coal prices could affect Tata Steel’s margins in the current quarter, while we also looked at some strategic moves available to the company. We said Hindalco will benefit from aluminium prices likely to remain elevated; and we found the valuations of Bharat Forge, Hero MotoCorp, Ashok Leyland, VA Tech Wabag, Ipca Labs and Mas Financial to be reasonable for the long-term investor, although we did advise investors to wait for a correction for some of them. On the other hand, some valuations may be low for a reason while in others it’s best to wait for a better entry opportunity.

This piece compares the prospects and the valuations of gold financing companies. In this interview, LIC chairman MR Kumar told us that the behemoth remains a net buyer in the market, reiterating that it continues to focus on long-term rather than short-term gains.

The Motherson Sumi management told us that supply chain disruptions are likely to continue in the next quarter. And Info Edge should continue to see robust growth momentum.

We continued our focus on the greening of business. This week, we took a look at Thermax’s bet on green energy, although its valuations are daunting. Post COP26, we looked at the prospects for Coal India and whether its biggest concern is existential in nature. And we brought out the challenges to Indian agriculture.

On our pesky Northern neighbour, our Eastern Window said India needs to be prepared for a more aggressive Xi Jinping. We also rooted for President Biden to keep up the pressure on China, especially in the alarming context of China’s nuclear build-up being one of the largest shifts in geo-strategic power ever. Among policy initiatives, we looked at a working group’s report on tweaking the insolvency rules. We considered the benefits of opening up the G-Sec market to retail investors.

Crypto is perhaps the poster child of market excess. But as Chuck Prince famously said, “As long as the music is playing, you’ve got to get up and dance.” In our Crypto Learn series, we told the tale of why cryptocurrencies were invented and tried to shed light on the mysteries of how they work. In Crypto Conversations this week, we told investors how to safeguard their investments —dancing near the door, so to speak. We cast a sceptical eye on how many people had cryptocurrencies within their circle of competence, invoking the hallowed Warren Buffett in the process. And we wondered if SEBI had jumped the gun by okaying a blockchain fund.

Whatever be the verdict on Paytm, in the Wonderland that we inhabit, unicorns are here to stay. As Lewis Carroll wrote in ‘Through the Looking Glass’: “The Unicorn looked dreamily at Alice, and said "Talk, child." Alice could not help her lips curling up into a smile as she began: "Do you know, I always thought Unicorns were fabulous monsters, too? I never saw one alive before!" “Well, now that we have seen each other," said the Unicorn, “If you'll believe in me, I'll believe in you. Is that a bargain?” Cheers, Manas Chakravarty

Source : Moneycontrol

#brainmassfinance#brainmasstraders#tradewithraj#brainmasscommunity#stock#stocktrader#stockmarket#nifty#banknifty#indianmarket#nifty50#sensex#sebi#brainmass#investor#fintech#commodity#investwithraj#chartbyraj#blockchain#unicorn#paytm#infoedge#maxfinancial

0 notes

Text

God’s Own Country

A fascinating survey of religion in India by the well-known Pew Research Center finds that 97 per cent of Indians believe in God. Only in sub-Saharan Africa and some regions with large Muslim populations are people more religious than Indians, says the study, pointing out that similar surveys in Europe, the US, Israel, Latin America and the US found those societies to be much less religious. Not only are we more religious, we are also very proud of our respective religions—Indian Hindus of Hinduism, Indian Muslims of Islam, Indian Buddhists of Buddhism, Indian Christians of Christianity and so on, finds the survey. Irrespective of our religion, we are all very proud to be Indians and also proud to be residents of our respective states. What’s more, 90 per cent of us agree with the statement that ‘Indian people are not perfect, but Indian culture is superior to others’. Cosmopolitanism doesn’t have many takers. Thankfully, in spite of being both religious and nationalist, we are great believers in religious diversity. The survey says, ‘Indians see religious tolerance as a central part of who they are as a nation. Across the major religious groups, most people say it is very important to respect all religions to be “truly Indian.” At the same time, most of us believe that religious identity is to be zealously guarded. A sizable majority of Indians say it is “somewhat” important to stop people from entering into interreligious marriages. That insularity extends to our caste identities as well---the survey finds that majorities in all the caste groups say it is very important to prevent inter-caste marriages. We seem to believe, as the poet Robert Frost put it, ‘Good fences make good neighbours’. We explored the political implications of the survey’s findings in our piece on how Indians view politics through the lens of religion. You can find the full survey here. An important economic insight from the survey is that unemployment tops the list of national concerns, with 84 per cent of Indians saying it’s a very big problem, the next biggest being corruption. The survey was conducted just before the pandemic, so unemployment has only got worse since then. Nevertheless, there should be some improvement as the recovery builds up, as our Economic Recovery Tracker shows. Other positive signs include our Herd Immunity tracker which says 29 per cent of the population has been vaccinated partially, while Monsoon Watch shows a good start to the kharif season. At the global level, the JP Morgan Global Manufacturing PMI shows that the upturn in the manufacturing sector continues, but stretched supply chains are driving up costs, which are getting passed on to consumers, resulting in higher inflation. The Bank for International Settlements says it is pleasantly surprised by the speed of the recovery and ‘the craving for normality has prevailed’, while painting three scenarios for the future. We found, though, that the manufacturing recovery in much of Asia lost momentum in June due to a resurgence of infections in some countries. In India, the manufacturing sector contracted during the month. The government has stepped in with some relief measures, but we showed that it wouldn’t help much for the microfinance sector, nor for the tourism and hotels sector. Despite the almost universal clamour for a fiscal stimulus, we argued that this may not be the right time for it. CMIE data showed that the second wave hit investment demand. Also, higher inflation and the RBI’s fire-fighting measures have led to the 10-year government bond yield losing its relevance as a market benchmark. Nevertheless, as business returns to normalcy with the easing of the lockdowns, companies are regaining their confidence. Mishra Dhatu Nigam is stocking up on capex ammo. Ashok Leyland is ready to ride the economic recovery. June auto sales show the waning impact of COVID-19.UPL’s global CEO told us in this interview he sees potential for steady growth. Subros is banking on plenty of growth drivers. IT firms are set to clock their best growth after COVID-19 began. The acceleration in demand across major economies will benefit Allcargo Logistics. Good traction in execution and projects will drive growth at Power Grid. And the return of pent-up demand should augur well for Thangamayil Jewellers. The emerging data centre boom is worth keeping an eye on, as many sectors will benefit from it. Indeed, new sectors are set to drive the capex revival. The RBI’s financial stability report, usually full of gloomy predictions, has struck a relatively optimistic note this time. Repco Home Finance management’s guidance is upbeat on asset quality. Steel sector valuations, however, will have to pass the China stress test. And IGL Refractories’ fortunes are tied to the steel sector. After impressive gains, questions have arisen about how far the markets can rise. This FT piece says too much confidence is placed in the view that the rise in inflation will be temporary. We looked at market participation data to gauge whether the ground beneath the Indian market is shifting. The Pew Research survey threw up a worrying statistic—as many as 48 per cent of Indians believe in a ‘strong leader’ as against 46 per cent who said they preferred democracy. This finding echoes a 2019 survey conducted by the Centre for the Study of Developing Societies (CSDS) which asked Indian adults whether they agree or disagree with the statement that “The country should be governed by a strong leader who does not have to bother about winning elections.” Roughly six in ten Indians agreed with the statement. To be sure, as we argued in this piece, late developing economies almost always developed, at least initially, under authoritarian rule. But surely even a cursory look at countries around the world, including neighbouring Pakistan, will tell us that autocrats need not always be successful, right? The answer, I think, lies in the Pew Survey. It finds that while 49 per cent of Indians believe in angels, only 37 per cent believe in demons.

👉 Join our channel to trade live with us on our recommendations. https://t.me/tradewithraaj

https://brainmass.in

0 notes

Photo

Bill Ackman’s ‘single best trade of all time’ turned $27 million into $2.6 billion - 100 times

https://brainmass.in

0 notes

Text

Pre Market update (D Street) : Thursday, 17 Dec 2020 (Weekly Expiry)

The Indian stock market is expected to open flat as trends on SGX Nifty indicate a flat start for the index in India.

On December 16, benchmark indices ended higher for the fourth consecutive day with record closing high. The Sensex was up 403.29 points or 0.87% at 46,666.46, and the Nifty was up 114.80 points or 0.85% at 13,682.70.According to pivot charts, the key support levels for the Nifty are placed at 13,628.7, followed by 13,574.7. If the index moves up, the key resistance levels to watch out for are 13,714.5 and 13,746.3.

US Markets

Wall Street rose on December 16, with the Nasdaq closing at a record high as investors awaited a potential fiscal economic stimulus package and after the Federal Reserve repeated a pledge to keep its benchmark interest rate near zero.

Asian Markets

Asian stocks were set for gains on December 17 as progress toward a long-awaited US stimulus package and a pledge by the Federal Reserve to keep interest rates low helped the Nasdaq benchmark to a fresh record high.

SGX Nifty

Trends on SGX Nifty indicate a flat start for the broader index in India. The Nifty futures were trading around 13,682 level on the Singaporean Exchange.

Crude

Oil prices hit a nine-month-high early on December 17 after US government data showed that crude stockpiles fell last week and on optimism over a coronavirus relief package in the United States.

Fed pledges to keep buying bonds

The Federal Reserve on December 16 vowed to keep funneling cash into financial markets until the US economic recovery is secure, a promise of long-term help that fell short of hopes of an immediate move to shore up a recent pandemic-related slide.

With interest rates anchored at zero likely for years to come, the Fed added a more explicit promise to continue the current bond-buying program until there is “substantial further progress” in restoring full employment and hitting its 2 percent inflation target.

Union Cabinet approves auction of spectrum

The Union Cabinet and the Cabinet Committee on Economic Affairs (CCEA), chaired by Prime Minister Narendra Modi on December 16, approved a proposal of the Department of Telecommunications to conduct spectrum auction and assistance of about Rs 3,500 crore for sugarcane farmers, among other key decisions.

Bharat Biotech's Phase I result shows coronavirus vaccine safe

An Indian government-backed COVID-19 vaccine showed it was safe and triggered immune responses during an ongoing early-stage trial, the company involved in the study said in a statement on Wednesday.

Bharat Biotech, the private company developing COVAXIN with the government-run Indian Council of Medical Research (ICMR), said: “COVAXIN demonstrated acceptable safety profile and high immune response. . . No serious (grade 3-4) adverse events were reported.”

Phase II and Phase III clinical trials are underway.

Tax refunds worth Rs 1.48 lakh crore issued so far this fiscal: I-T Department

The income tax department on Wednesday said it has issued refunds of over Rs 1.48 lakh crore to more than 1.02 crore taxpayers till December 14. Of this, personal income tax refunds worth Rs 45,264 crore and corporate tax refunds of Rs 1.03 lakh crore have been issued.

CBDT issued refunds of over Rs 1,48,274 crore to more than 1.02 crore taxpayers between April 1 and December 14.

"Income tax refunds of Rs 45,264 crore have been issued in 1,00,02,982 cases and corporate tax refunds of Rs 1,03,010 crore have been issued in 2,00,854 cases," the department said in a tweet.

SEBI eases norms for FPO, tightens rules for stressed companies

The Securities and Exchange Board of India (Sebi) has allowed promoters more space to raise funds via a Follow-on Public Offer (FPO) and has also taken steps to limit price manipulation when companies are relisted after undergoing bankruptcy proceedings.

The regulator, in its December 16 board meeting, approved recalibration of minimum public shareholding norms for companies going through Corporate Insolvency Resolution Process (CIRP), and also doing away with the applicability of minimum promoters’ contribution and subsequent lock-in requirements for follow-on public offer.

US retail sales fall 1.1% in November as virus surges

US retail sales fell sharply in November, according to government data released Wednesday, a further sign of economic trouble as COVID-19 cases climbed and lawmakers remained deadlocked on approving economic stimulus.

Sales fell 1.1 percent compared to October, when sales also dipped, the Commerce Department reported, much sharper than expected.

The data were released as the ongoing deadlock in Congress on more fiscal aid as well as the surge in virus cases have raised fears the world's largest economy is heading for a renewed slowdown.

SEBI allows fintechs to apply for mutual fund licenses with relaxed norms

In its board meeting held on December 16, the Securities and Exchange Board of India (SEBI) decided that even sponsors that don’t meet the profitability criteria can apply for mutual fund (MF) licenses.

“This move will help fintechs that are looking at entering the mutual fund (MF) industry to seek MF license,” says the chief executive officer of a fund house, requesting anonymity.

However, the fintech company will have to demonstrate the existence of a Rs 100 crore net-worth in the mutual fund, till it records five years of continuous profitability.

Bitcoin breaks above $20,000 for first time

Bitcoin smashed through $20,000 for the first time on December 16, its highest ever.

The cryptocurrency jumped 4.5 percent to move as high as $20,440. It has gained more than 170 percent this year, buoyed by demand from larger investors attracted to its potential for quick gains, purported resistance to inflation and expectations it will become a mainstream payment method.

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,981.77 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,718.45 crore in the Indian equity market on December 16, as per provisional data available on the NSE.

0 notes

Text

How to trade volatility?

While volatility in stocks provide opportunities, the risk involved in the trade is uncertain. To avoid risky trades and minimize losses, today’s Technical Funda introduces a few technical indicators that can help amplify the real picture. Technical indicators that can help traders navigate volatility Trading in a volatile stock is difficult as the movement is often sharp and uncertain. Volatility, in simplest terms, defines the change in stock price over daily average change. This means that if a stock is swinging in the 5 per cent range and suddenly begins to trade over 5 per cent -- the average swing -- then it looks to have entered a volatile phase. These uncertain moves are highly attractive, but trading in one is, in fact, risky. Volatility may trigger stop loss and show certain unexpected moves. Such a scenario disrupts trading morale, leaving traders anxious. To avoid risky trades and minimize losses, here are a few technical indicators that can help amplify the real picture.

Keltner Channel Keltner channel is a moving average band indicator comprising three bands -- upper, middle, and lower bands -- that assist in identifying and protecting from volatile price moves with the use of average true range. This indicator is very useful in a strong trend, either upward or downward. As the stock starts to show the weakness at the upper band, one can view this as an opportunity to enter a trade around the middle band. While doing so, the stop loss can be considered as the difference of middle and lower band. As said earlier, in a trending market, the stock is expected to rebound on the back of follow-up buying. The same philosophy can be applied when the stock is in a downtrend. The Keltner channel encourages one to enter a trade within a specific range of volatility. This can diminish the greater volatility as one always waits for better levels of middle band. Normally, the stock price moves within the band, which primarily defines the expected volatility. When the stock breaches the Keltner channel, it may lead to extreme rally with wild swings wherein sentiments may change unexpectedly.

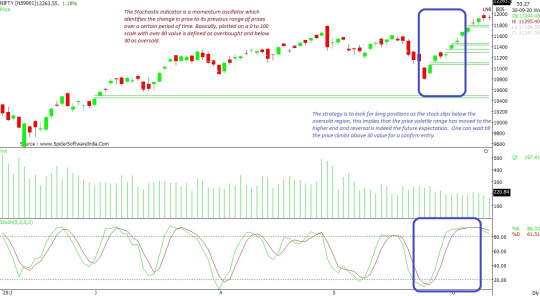

Stochastic Oscillator The Stochastic indicator is a momentum oscillator which identifies the change in price as compared to its previous range of prices over a certain period of time. Basically, this indicator is plotted on a 0 to 100 scale, with over 80 value being defined as 'overbought' and below 30 as 'oversold'. Although, there can be exceptions where a stock shows strong momentum over 80 value. This does not mean the volatility is low, it can even show stronger volatile moves in the price. The strategy is to look for long positions as the stock slips below the oversold region, since this implies that a reversal is indeed the future expectation. One can wait till the price climbs above 30 value for a confirmed entry. Similarly, when the price touches the roof of 80 value, the range seems to have reached a far end and one can expect a fall when the indicator slips below 80. And, although these rules may not always be true; however, one can get a fair idea about the volatility and maximum swings that are supposed to occur in any given fair trade. Volatility does provide opportunities, yet the risk involved in the trade is uncertain. In order to manage a volatile stock, one needs to have a strong hold on certain technical parameters that one has learnt and experimented with over the years.

#learnwithraj#tradewithraj#brainmassfinance#brainmasscommunity#brainmasstraders#brainmassgroup#stochastic#keltner#volatility

0 notes

Text

Know your worth

A father before he died said to his son: . . “This is a watch your grandfather gave and this is more than 200 years old, but before I give it to you go to the watch shop on the first street, and tell him I want to sell it, and see how much it is”. . . The son went to the watch shop and then came back to his father, and said, “the watchmaker said he'll pay 5 dollars because it's old”. . . The father said : “Go to the coffee shop”. . . The son went to the coffee shop and then came back to his father, and said : “ The coffeemaker said he'll pay $5”. . . The father said : “Go to the museum and show that watch”. . . The son went to the museum and then came back, and said to his father : “They offered me a million dollars for this piece”. . . The father said : “I wanted to let you know that the right place values your value in the right way. Don't put yourself in the wrong place and get angry if they don't value you. . . Who knows your value is who appreciates you, don't stay in a place that doesn't suit you”. . . Know your worth 😇😇😇 ..

0 notes

Photo

May your life radiate success and prosperity like the way Diwali lights shine tonight. . . . #brainmassgroup #happydiwali #happydiwali2022 #brainmassfamily #brainmasscommunity #brainmasseducation #brainmasstutors #brainmasstechnologies #brainmassmusic #brainmassfoundation #brainmassfinance #brainmasstechnologies #brainmasspictures #brainmassglobal #brainmasshealthcare #brainmassacademy

0 notes

Photo

May your life radiate success and prosperity like the way Diwali lights shine tonight. #brainmassgroup #happydiwali #happydiwali2022 #brainmassfamily #brainmasscommunity #brainmasseducation #brainmasstutors #brainmasstechnologies #brainmassmusic #brainmassfoundation #brainmassfinance #brainmasstechnologies #brainmasspictures #brainmassglobal #brainmasshealthcare #brainmassacademy

0 notes