A hub for global students, learners and education enthusiasts.

Don't wanna be here? Send us removal request.

Text

How to become an actuary: 4 steps to earn six figures

Becoming an actuarial is a long process, but it can lead to a career with many financial rewards.

Have you ever wondered how to quantify risk? Or know how insurance companies figure out how much to charge you every month?

Most of the time, it isn’t all based on innate intuition; it’s instead powered by a lesser-known science called actuarial science.

The field combines mathematics, statistics, and business modeling in strategic decision-making. Actuarial science turns risk into calculated risk—helping businesses make decisions based on the highest probability of reaching goals.

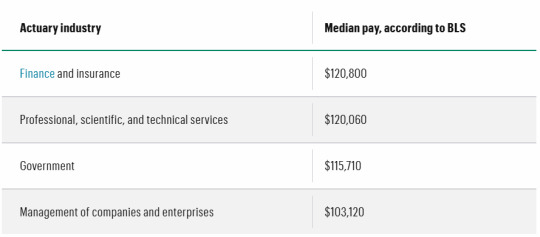

If that sounds complicated—you’re right, it is, which is why actuaries are a high-paying occupation that is growing significantly. According to the U.S. Bureau of Labor Statistics, actuaries earn median pay of $120,000 per year—with a projected growth rate of 22% over the next decade.

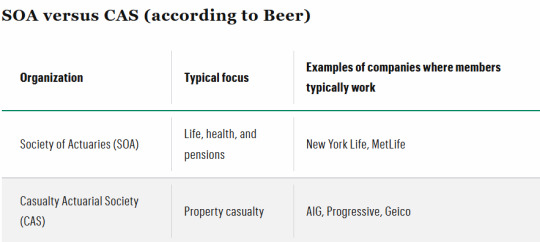

Prospective actuaries should acquaint themselves with both the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS). Both organizations have thousands of members who have undergone an extensive training and examination process to become fellows of their respective organizations. While the process takes many years and costs extensive time and money, it can be very lucrative.

Albert Beer, assistant professor at St. John’s University’s School of Risk Management and Actuarial Science, says becoming an actuarial fellow can essentially lead to “guaranteed income for the rest of your career.”

While becoming an actuary is not a walk in the park, it can be certainly be rewarding. Here are 4 steps you need to take to land an actuary career:

1. Find your calling

Actuary science is closely related to many fields at the intersection of statistics and business, such as data scientists, data analysts, and financial analysts, so it is important that before you get started on the process, you do some exploration.

One of the best ways to do that is to speak directly to an actuary living and breathing in the field. Using LinkedIn or other network resources, try to find one and ask if they would take a few minutes to have a conversation and allow you the opportunity to ask any questions. If they live in your community, you could even ask to shadow them for a day. Alternatively, YouTube has content where individuals have posted day-in-the-life videos that you could check out alongside the r/actuary subReddit.

Keep in mind that the number of actuaries in the job market is relatively small. The BLS reports that there are only about 30,200 actuaries—most of which work at insurance companies. Compare that to 202,900 data scientists and 404,800 financial analysts.

Actuaries tend to be well-rounded individuals with skills in mathematics and statistics paired with finance, economics, and law, Beer shares.

2. Complete a bachelor’s degree

At a minimum, all actuaries need a bachelor’s degree. Ideally, individuals should major in subjects related to mathematics, statistics, economics, finance, or accounting. Some universities even have bachelor’s degrees in actuarial science.

In the U.S., there are about two dozen universities that SOA has designated as “Centers of Actuarial Excellence”—meaning they meet specific criteria pertaining to the curriculum, faculty, industry connection, and more. These programs largely prepare students for a career as actuaries by setting them up to complete the first requirements toward an actuary designation, like completing coursework and taking examinations. The centers are:

Brigham Young University*

Drake University*

Georgia State University*

Illinois State University*

Pennsylvania State University*

Purdue University*

Robert Morris University*

St. John’s University*

Temple University*

University of Iowa*

University of Illinois–Urbana-Champaign*

University of Nebraska–Lincoln*

University of St. Thomas*

University of Wisconsin–Madison*

University of Wisconsin–Milwaukee*

Arizona State University

Middle Tennessee State University

Towson University

University of California–Santa Barbara

University of Connecticut

University of Michigan

University of Texas–Dallas

*These universities also have University-Earned Credit status, meaning students are eligible for SOA exam credit for certain courses.

During one’s undergraduate years, internships are a large part of one’s journey to becoming an actuary, Beer says. Not only does it help students determine which direction they may want to take their actuarial career, but it also heavily helps in networking for an eventual full-time job and whether individuals will pursue a fellowship at SOA or CAS.

By the end of a student’s years at St. John’s University, Beer says most will have already completed the first two exams—both of which can be used for either SOA or CAS pathway. Graduates typically land jobs with starting salaries of about $85,000.

“I’ve been teaching 18 years now. I’ve never had an actuarial student with two exams and two internships not get a job,” he says.

3. Obtain actuary designation

To land most actuary jobs, it is required for you to have been designated—or on the pathway to—an associate or fellow of either SOA or CAS. To start, obtaining validations by education experience (VEEs) is necessary, most commonly obtained through college coursework. Then, about 10 competitive examinations must be passed, a process that can take many years and cost thousands of dollars.

However, candidates don’t have to do it alone. It is a common practice for an employer to assist employees in receiving the full designation in terms of financial assistance, time off to study, and career guidance. Specifically, Beer says some companies tend to give individuals two weeks off from work to study—and if they pass, they are typically rewarded with a promotion and $5,000 raise. Plus, the employer will pay for the exam itself.

Keep in mind though, that passing an actuarial exam is not easy; the pass rates for many of the exams is less than 50%.

Requirements to become an associate of the Society of Actuaries (ASA)

VEE: Economics ($85)

VEE: Accounting and Finance ($85)

VEE: Mathematical Statistics ($85)

Exam: Probability ($260)

Exam: Financial Mathematics ($260)

Module: Pre-Actuarial Foundations ($210)

Exam: Fundamentals of Actuarial Mathematics ($390)

Exam: Advanced Short- or Long-term Actuarial Mathematics ($475)

Exam: Statistics for Risk Modeling ($340)

Module: Actuarial Science Foundations ($210)

Exam: Predictive Analytics ($1,170)

Module and assessment: Advanced Topics in Predictive analytics ($1,195)

Course and assessment: Fundamental of Actuarial Practice ($1,770)

Course: Associateship Professionalism ($625–$805)

To then become a fellow (FSA), there are eight to nine additional modules, exams, and courses individuals must complete via six different track options:

Corporate Finance and ERM

Quantitative Finance and Investment

Individual Life and Annuities

Retirement Benefits

Group and Health

General Insurance

Requirements to become an associate of the Casualty Actuary Society (ACAS):

VEE: Economics ($75)

VEE: Accounting and Finance ($75)

Exam: Probability (must take through other organization, such as SOA)

Exam: Financial Mathematics (must take through other organization, such as SOA)

Courses: Data and Insurance Series

Exam: Modern Actuarial Statistics-I ($550)

Exam: Modern Actuarial Statistics-II ($550)

Course: Professionalism (~$1,375)

Exam: Basic Ratemaking and Estimating Claim Liabilies ($850)

Exam: Regulation and Financial Reporting ($850)

To then become a fellow at the Casualty Actuary Society (FCAS) three additional examinations are required:

Exam: Advanced Estimation of Claims Liabilities ($850)

Exam: Advanced Ratemaking ($850)

Exam: Risk Management for Actuaries ($850)

Both the SOA and CAS are similar in prestige, and many individuals go down a specific pathway based on their first job. While the requirements for CAS are less extensive and will cost you less money, the SOA is more popular. Both organizations also offer discounts on select requirements for full-time students.

4. Engage with the actuarial community

The actuarial community is tight-knit. While one is learning and working there will be in-person networking experiences to connect with fellow actuaries.

Also, don’t forget to keep up to date with trends in the industry. In order to maintain professional membership, continuing education may also be required. Actuarial science is not averse to the need for lifelong learning; technology, legal requirements, and regulations are always changing, so it is best to stay ahead of the game.

The takeaway

Becoming an actuary takes patience. Individuals must be dedicated to learning the craft and not be easily deterred by examinations—or even failing one.

Despite the large barrier to entry, the actuary career can be very rewarding in terms of job security, high salaries, and growth opportunities. The key to success is being highly motivated, but do not just let it be led by career perspectives; find something that strikes you as interesting, every single day.

“You’re never going to be good at something you don’t like. So you better find a passion. If you want to succeed in life and in business, find a passion,” Beer encourages.

Frequently asked questions

How many years does it take to become an actuary?

It can take over a decade to become an actuary fellow, but the exact timeline depends on one’s preparation habits. While continuing to balance work and life, one may expect to take an examination every few months to achieve associate and then fellow status.

Do actuaries make a lot of money?

Yes, actuaries tend to make six figures just a few years after obtaining their undergraduate degree. Those who get on a pathway to becoming an actuarial fellow should expect to experience high-paying salaries for most of their life. And if a management position is in your future, pay can be especially high.

Is becoming an actuary hard?

Yes, becoming an actuary is not easy. It takes many years of studying for about 10 competitive examinations to become a full-fledged actuary. However, many top companies that hire actuaries have built-in support for individuals, like time off to study as well as promotions for exam passage.

0 notes

Text

I teach wealthy kids with special needs. Money can't solve everything, but it can give them the education they need.

Nathaniel Hannan has been a travel tutor with Tutors International for 18 years.

He said that weaving travel into his curriculum has helped his students tremendously.

This as-told-to essay is based on a conversation with Nathaniel Hannan, a travel tutor at Tutors International. It has been edited for length and clarity.

At the end of my time at Oxford in 2004, I faced two very different job offers: a private equity position and a teaching job in Washington, D.C. I couldn't see myself doing private equity for 80 hours a week. It felt like it would kill my soul, no matter the money, so I chose teaching.

My experience has been incredibly diverse, but almost all my clients involve students with special educational needs. This refers to a range of educational disabilities, from autism spectrum disorders to dyslexia, dysgraphia, dyscalculia, and anxiety disorders, which might not be supported by traditional classrooms.

I never expected to teach students with special educational needs, nor do I have the formal training or credentials for it. But over the years, I've worked with a wide range of children, from those with simple dyslexia to a student missing a piece of his brain due to a motorcycle accident.

The first family I worked with had two kids with dyslexia and attention deficit problems. I was with them for a year before moving on to other clients. Each child is unique, and there is no one way to help every student understand a concept. My job is to think outside the box and determine the best approach for each child.

Weaving traveling with tutoring

One memorable job happened during the pandemic from 2020 to 2023. I worked with a family in the movie industry who traveled to shoot their film across six countries. I became the child's school for three years, allowing her to learn consistently despite a hectic filming schedule. She had special needs and is now at an Ivy League university.

It was a unique experience because we were among the few people allowed to travel freely, and the only people I got to know were the actors traveling with us.

Almost every job I've had involved travel, whether on a boat or moving from country to country. To date, I've lived in 13 countries. As an educator, it presents a wonderful opportunity for me because it allows me to interweave aspects of the local culture, history, and geography into my lessons. That's a rare circumstance in which I can help them fall in love with the Latin language and Roman history in a way that I just can't do by sitting in the family home in the United States.

Enabling children to learn

A memory I cherish was when I spent a summer tutoring a dyslexic student in chemistry and math to prepare him for the next school year. As a final exam, I got creative when his dad panned gold dust from a shipwreck.

I challenged the boy to figure out the purity percentage of the gold. His dad didn't believe he could do it, but after days of hard work, the kid did it and brought his findings to his dad, who was so moved he actually cried.

The dad had the gold dust preserved in Lucite, and now it's a paperweight on his desk so that he can always remember when his son surprised him.

It's a special thing to enable someone to do something they otherwise wouldn't be able to do. Teaching for me goes much deeper than just teaching people facts; it also involves showing them new ways of doing academic things.

Wealth is an enabler

Many clients I've worked with have resources on par with countries' governments. Still, I don't think there's a whole lot different about teaching students of a certain socioeconomic class — except that they likely couldn't afford to hire me without their resources.

I used to believe that money was the root of all evil, but what money does is enable people to behave in a way that nobody else can. It gives you all the tools to exercise your advice as deeply as possible by removing many societal restrictions.

I will do this until I no longer need to work for money. There is a children's cancer hospital in Atlanta, where kids usually go for six to nine months of treatment. Currently, there is no provision for them to continue their education while they're being treated, so that's what I am going to do next.

0 notes

Text

Down -11.67% in 4 Weeks, Here's Why You Should You Buy the Dip in TAL Education (TAL)

A downtrend has been apparent in TAL Education TAL lately with too much selling pressure. The stock has declined 11.7% over the past four weeks. However, given the fact that it is now in oversold territory and Wall Street analysts are majorly in agreement about the company's ability to report better earnings than they predicted earlier, the stock could be due for a turnaround.

Here is How to Spot Oversold Stocks

We use Relative Strength Index RSI, one of the most commonly used technical indicators, for spotting whether a stock is oversold. This is a momentum oscillator that measures the speed and change of price movements.

RSI oscillates between zero and 100. Usually, a stock is considered oversold when its RSI reading falls below 30.

Technically, every stock oscillates between being overbought and oversold irrespective of the quality of their fundamentals. And the beauty of RSI is that it helps you quickly and easily check if a stock's price is reaching a point of reversal.

So, by this measure, if a stock has gotten too far below its fair value just because of unwarranted selling pressure, investors may start looking for entry opportunities in the stock for benefitting from the inevitable rebound.

However, like every investing tool, RSI has its limitations, and should not be used alone for making an investment decision.

Here's Why TAL Could Experience a Turnaround

The heavy selling of TAL shares appears to be in the process of exhausting itself, as indicated by its RSI reading of 26.24. So, the trend for the stock could reverse soon for reaching the old equilibrium of supply and demand.

The RSI value is not the only factor that indicates a potential turnaround for the stock in the near term. On the fundamental side, there has been strong agreement among the sell-side analysts covering the stock in raising earnings estimates for the current year. Over the last 30 days, the consensus EPS estimate for TAL has increased 82.4%. And an upward trend in earnings estimate revisions usually translates into price appreciation in the near term.

Moreover, TAL currently has a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises. This is a more conclusive indication of the stock's potential turnaround in the near term. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here

Zacks Investment Research

0 notes

Text

Nerdy's Tutors Platform Partners With Ohio School District for Free Tutoring

Nerdy NRDY Varsity Tutors for Schools has partnered with Wapakoneta, Ohio City Schools to provide students free access to the Varsity Tutors for Schools platform until June 2030, the district said Monday.

The platform offers on-demand chat tutoring, live classes, test prep, self-study resources, and personalized learning plans, Wapakoneta City Schools said.

0 notes

Text

Become financially savvy with free online courses from MIT

Explore the foundations and practical applications of finance for your personal and professional development.

Financial acumen is key in today’s fast-paced world and competitive job market. Understanding financial principles enhances your ability to make informed business decisions, contribute strategically to your organization’s success, and manage your money. Whether you’re in a field that intersects with finance or just looking to elevate your knowledge of financial concepts, explore MIT Open Learning’s free and low-cost online courses and resources available through MIT OpenCourseWare, MITx, and MITx MicroMasters.

Personal financial literacy

AP® Microeconomics: Learn how individuals and businesses make the decisions that drive our economy.

Finance Theory I: Discover the core theory of modern financial economics and financial management, with a focus on capital markets and investments.

Financial Regulation: From the Global Financial Crisis to Fintech and the COVID Pandemic: Explore how regulations and their effectiveness are shaped by the interplay between the financial industry and its regulators.

Just Money: Banking as if Society Mattered: Learn how banks can use capital as a tool to promote social and environmental well-being.

Investments: Dive into financial theory and empirical evidence for making investment decisions.

Financial technologies

FinTech: Shaping the World: Learn how new financial technologies are driving change in business models, products, applications, and user interfaces.

The Analytics Edge: Discover the power of data and use analytics to provide an edge to your career and your life.

Analytics of Finance: Examine the key quantitative methods of finance.

Blockchain and Money: Explore blockchain technology’s potential to change the world of money and finance.

Mathematical Methods for Quantitative Finance: Dive into the essential mathematical foundations for financial engineering and quantitative finance. (This course is part of the MITx MicroMasters Program in Finance.)

The psychology of finance

Adaptive Markets: Financial Market Dynamics and Human Behavior: Discover a new way of thinking about financial markets, institutions, and innovation using concepts from evolutionary biology, cognitive neuroscience, and artificial intelligence.

Finance and Society: Explore a multidimensional view of finance as an economic, political, cultural, intellectual, material, and technological phenomenon.

Psychology and Economics: Learn how to incorporate insights from psychology and other social sciences into economics.

Financial industry

Foundations of Modern Finance I: Explore a mathematically rigorous framework to understand financial markets delivered with data-driven insights from MIT professors. (This course is part of the MITx MicroMasters Program in Finance.)

Foundations of Modern Finance II: Learn fundamental principles of modern finance, including valuation models, methods for risk analysis, derivative instruments, and investment management. (This course is part of the MITx MicroMasters Program in Finance.)

Derivatives Markets: Advanced Modeling and Strategies: Obtain a sophisticated understanding of valuation methods for quantifying, hedging, and speculating on risk for major markets and instruments. (This course is part of the MITx MicroMasters Program in Finance.)

Financial Accounting: Learn how to analyze financial statements and valuation models to assess corporate performance. (This course is part of the MITx MicroMasters Program in Finance.)

Mathematical Methods for Quantitative Finance: Dive into the essential mathematical foundations for financial engineering and quantitative finance. (This course is part of the MITx MicroMasters Program in Finance.)

Topics in Mathematics with Applications in Finance: Explore mathematical concepts and techniques used in the financial industry.

Finance for other industries

Financial Accounting: Learn how to analyze financial statements and valuation models to assess corporate performance. (This course is part of the MITx MicroMasters Program in Finance.)

Fundamentals of Entrepreneurship Finance: Dive into the basics of financial literacy, financial modeling, funding sources, raising capital, and valuation analysis.

Healthcare Finance: Explore the role of finance in the healthcare industry, focusing on novel financing methods to facilitate drug discovery, clinical development, and greater patient access to high-cost therapies.

Nuts and Bolts of Business Plans: Learn how to launch a new venture plan.

Real Estate Finance and Investment: Discover the most fundamental concepts, principles, analytical methods, and tools useful for making investment and finance decisions regarding commercial real estate assets.

The Science and Business of Biotechnology: Explore novel business and financing models for commercializing the latest scientific innovations in biotechnology.

Ready to take a deeper dive into the world of finance?

Meet the complex demands of today’s global finance markets with the MITx MicroMasters Program in Finance — five courses developed and delivered by MIT Sloan faculty. MITx MicroMasters can help you accelerate your career or fast-track your masters degree.

These course materials and resources are available through MIT OpenCourseWare, MITx, and MITx MicroMasters, which are part of MIT Open Learning. OpenCourseWare offers free, online, open educational resources from more than 2,500 courses that span the MIT undergraduate and graduate curriculum. MITx offers hundreds of high-quality massive open online courses adapted from the MIT classroom for learners worldwide. The MITx MicroMasters Programs provide an affordable, accelerated, and convenient path to a master’s degree. The credential itself is also valuable for professionals as they move through their careers.

0 notes

Text

AI tutors are quietly changing how kids in the US study, and the leading apps are from China

Evan, a high school sophomore from Houston, was stuck on a calculus problem. He pulled up Answer AI on his iPhone, snapped a photo of the problem from his Advanced Placement math textbook, and ran it through the homework app. Within a few seconds, Answer AI had generated an answer alongside a step-by-step process of solving the problem.

A year ago, Evan would be scouring long YouTube videos in hopes of tackling his homework challenges. He also had a private tutor, who cost $60 per hour. Now the arrival of AI bots is posing a threat to long-established tutoring franchises such as Kumon, the 66-year-old Japanese giant that has 1,500 locations and nearly 290,000 students across the U.S.

“The tutor’s hourly cost is about the same as Answer AI’s whole year of subscription,” Evan told me. “So I stopped doing a lot of [in-person] tutoring.”

Answer AI is among a handful of popular apps that are leveraging the advent of ChatGPT and other large language models to help students with everything from writing history papers to solving physics problems. Of the top 20 education apps in the U.S. App Store, five are AI agents that help students with their school assignments, including Answer AI, according to data from Data.ai on May 21.

There is a perennial debate on the role AI should play in education. The advantages of AI tutors are obvious: They make access to after-school tutoring much more equitable. The $60-per-hour tutoring in Houston is already much more affordable than services in more affluent and academically cutthroat regions, like the Bay Area, which can be three times as expensive, Answer AI’s founder Ric Zhou told me.

Zhou, a serial entrepreneur, also suggested that AI enables more personalized teaching, which is hard to come by in a classroom of 20 students. Chatbot teachers, which can remember a student’s learning habits and never get grumpy about answering questions, can replace the private coaches that rich families hire. Myhanh, a high school junior based in Houston, said her math grades have improved from 85 to 95 within six months since using generative AI to study.

For now, AI tutors are mostly constrained to text-based interactions, but very soon, they will literally be able to speak to students in ways that optimize for each student’s learning style, whether that means a more empathetic, humorous, or creative style. OpenAI’s GPT-4o already demonstrated that an AI assistant that can generate voice responses in a range of emotive styles is within reach.

When AI doesn’t help you learn

The vision of equitable, AI-powered learning isn’t fully realized yet. Like other apps that forward API calls to LLMs, AI tutors suffer from hallucinations and can spit out wrong answers. Answer AI tries to improve its accuracy through retrieval augmented generation (RAG), a method that fine-tunes an LLM with certain domain knowledge — in this case, a sea of problem sets. But it’s still making more mistakes than the last-generation homework apps that match user queries with an existing library of practice problems, as these apps don’t try to answer questions they don’t already know.

Some students are aware of AI’s limitations. Evan often cross-checks results from Answer AI with ChatGPT, while Myhanh uses Answer AI in an after-school study group to bounce ideas off her peers. But Evan and Myhanh are the types of self-driven students who are more likely to use AI as a learning aid, while some of their peers may handily delegate AI to do their homework without learning anything.

For now, educators aren’t sure what to do with AI. Several public school districts in the U.S. have banned access to ChatGPT on school devices, but enforcing a ban on generative AI outright becomes challenging as soon as students leave school premises.

The reality is, it’s impossible for teachers and parents to prevent kids from using AI to study. It’s hard to discern whether a student has learned to solve a math problem by heart based on the answer they write, and detecting when essays have been written with AI is (so far) heavily flawed, too. So it may be more effective to educate kids on the role of AI as an imperfect assistant that sometimes makes mistakes rather than prohibit it completely.

Chinese dominance

As of May, the two most popular AI helpers in the U.S. are both Chinese owned. One-year-old Question AI is the brainchild of the founders of Zuoyebang, a popular Chinese homework app that has raised around $3 billion in equity over the past decade. Gauth, on the other hand, was launched by TikTok parent ByteDance in 2019. Since its inception, Question AI has been downloaded 6 million times across Apple’s App Store and Google Play Store in the U.S., whereas its rival Gauth has amassed twice as many installs since its launch, according to data provided by market research firm Sensor Tower. (Both are published in the U.S. by Singaporean entities, a common tactic as Chinese tech receives growing scrutiny from the West.)

The success of Chinese homework apps is a result of their concerted effort to target the American market in recent years. In 2021, China imposed rules to clamp down on its burgeoning private tutoring sector focused on the country’s public school curriculum. Many service providers, including brick-and-mortar tutoring centers and online study apps, have since pivoted to overseas users. The U.S. is unsurprisingly their most coveted international market due to its sheer size.

The fact that tutoring apps are likely to be using similar foundational AI technologies has leveled the playing field for foreign players, which can overcome language and cultural barriers by summoning AI to study user behavior. As Eugene Wei wrote in his canonical analysis of TikTok’s global success,”[A] machine learning algorithm significantly responsive and accurate can pierce the veil of cultural ignorance.”

The reliance on the same group of LLMs also makes it hard for these study apps to differentiate solely on the quality of their answers. Some of the legacy players, like Zuoyebang and Photomath, can use a combination of generative AI and search in their extensive libraries of problem sets to improve accuracy. Newcomers will need to find alternative ways to set themselves apart, like enhancing user personalization features.

“An AI agent needs to proactively engage with students and tailor its answers to individual learning needs,” said Zhou. “A raw language model isn’t a ready-to-use AI agent, so we try to differentiate by fine-tuning our AI to teach more effectively. For example, our AI bot would invite students to ask follow-up questions after presenting an answer, encouraging deeper learning rather than just letting them copy the result.”

0 notes

Text

0 notes

Text

0 notes

Photo

A man's true wealth is the good he does in the world. . . . . . #rajnotes #brainmassquotes #braimasswellness #inspirewithraj #rkwrites #raajmishra #rajmishraforum #brainmassfoundation #perception #body #chemistry #energy #frequency #yogawithraj #introvertphilosopher #rkmotivation . . . . https://brainmass.in

0 notes

Photo

The best days are ahead of you! Happy New Year from the Brainmass Team! #Brainmass #BrainmassTutors #BrainmassGroup #HappyNewYear #NewYear

0 notes

Photo

On this occasion of #Bhaidooj, #BrainmassGroup wishes success and prosperity for you. #HappyBhaidooj 2022!

0 notes

Photo

May your life radiate success and prosperity like the way Diwali lights shine tonight. . . . #brainmassgroup #happydiwali #happydiwali2022 #brainmassfamily #brainmasscommunity #brainmasseducation #brainmasstutors #brainmasstechnologies #brainmassmusic #brainmassfoundation #brainmassfinance #brainmasstechnologies #brainmasspictures #brainmassglobal #brainmasshealthcare #brainmassacademy

0 notes

Photo

May your life radiate success and prosperity like the way Diwali lights shine tonight. #brainmassgroup #happydiwali #happydiwali2022 #brainmassfamily #brainmasscommunity #brainmasseducation #brainmasstutors #brainmasstechnologies #brainmassmusic #brainmassfoundation #brainmassfinance #brainmasstechnologies #brainmasspictures #brainmassglobal #brainmasshealthcare #brainmassacademy

0 notes

Photo

Team #BrainmassTutors wishes you all a very #happyholi2022

0 notes

Photo

* Shoot a rocket of prosperity! Fire a flowerpot of happiness! #BrainmassGroup you and your family a sparkling Diwali!

0 notes