#Kakeibo

Explore tagged Tumblr posts

Text

📒 Siempre busco formas efectivas para hacer mi vida menos compleja, buscando "ayuda práctica" que funcione; y si me funcionan a mí, tal vez puedan serte útil a ti también ;)

📒 En este caso, para organizar mi economía, elegí KAKEBO, un método japonés para ahorrar dinero. Al aplicar la técnica Kakebo, aprenderás disciplina y compromiso. Seas o no millonario, es una buena manera de saber conscientemente qué gastos tienes y ¡donde leches van todos tus ahorros! ¿Alguien ha probado esta técnica para administrar su economía? Compartirme vuestras experiencias en comentarios :) 👇👇👇👇 Más sobre el método Kakebo: https://scrapstudio.wordpress.com/2020/07/03/kakebo-economia-en-casa/

#kakebo#kakeibo#ahorro#ahorrar#metodojapones#metodo#metododeahorrar#metodoahorrar#japon#metododefinitivo#herramienta#planificaobjetivos#objetivoahorro#objetivoahorrar#presupuesto#presupuestos#gastoshormiga#economiafamiliar#economiadomestica#dinero#informacioncuentas#hojadenotas#editable#digital#economia#ahorrafacil#finanzas#scrapstudio#scrapstudioes

20 notes

·

View notes

Text

Kakeibo: Mastering Your Finances with a Time-Tested Japanese Method

Kakeibo, a traditional Japanese budgeting method, provides a mindful and structured approach to personal finance management. Meaning "household ledger," Kakeibo encourages individuals to track their income and expenses meticulously while reflecting on spending habits. This time-tested technique helps people gain better control over their finances, promoting savings and more intentional spending through thoughtful record-keeping and self-reflection.

This report originates from LipFlip.org

0 notes

Text

🌐Recs of the Week No.34

Hello there👋🏽! Across the internet there’s a lot of awesomeness, so I decided to curate a small list of cool content that I think it’s worth sharing, I hope you find it useful, inspiring or interesting.

Thank you so much for being here♡.

Without further ado, these are my internet findings of the week:

Articles📝

Videos🎥

youtube

youtube

IG Posts🖼️

instagram

instagram

Until next week, xo.

#recs#finance#kakeibo#psychology#self regulation#self awareness#self improvement#ted talks#productivity#YouTube#mental health#growth#Youtube#Instagram

0 notes

Text

Sumérgete en el arte japonés de ahorrar

¡Sumérgete en el arte japonés de ahorrar dinero con mi nuevo blog sobre Kakeibo! 💴🎎 Descubre consejos prácticos para lograr equilibrio financiero. 🌟 ¡Transforma tu relación con el dinero! 💰🌸

0 notes

Photo

Yong-joon Kim I live with my parents in my house, Kakeibo 11 years (groom class)

0 notes

Text

#アニメ#⊹ ⋆꒰ఎ ♡ ໒꒱ ⋆゚⊹#かわいい#🎀。゚・。゚ᐠ( ᐢ ᵕ ᐢ )ᐟ。゚・。゚🎀#崖っプチ家計簿#Gakeppuchi Kakeibo#崖っぷち家計簿#がけっプチかけいぼ#animecore#anime#otakucore#webcore#kawaiicore#kawaii#visual novel#vn#game cg#moecore#pinkcore#softcore#00s#weebcore#2000s#2000s core#nursecore#pastelcore#y2k anime

622 notes

·

View notes

Text

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

The Art of Saving Money

One of the toughest challenges for any individual is mastering the art of budgeting and having a consistent amount of savings every month.

I just learned about Kaikebo, a Japanese technique for budgeting that's over 100 years old. It combines mindfulness with spending decisions and helps you simply take control of your finances.

The kakeibo is a simple budgeting journal from Japan that helps you save money by setting goals and tracking spending. It encourages mindful thinking and reflection to improve your saving habits every month.

Kakeibo is a budgeting method that involves tracking every purchase, categorizing spending into needs, wants, culture, and unexpected expenses, and regularly reviewing expenses to track progress toward financial goals. The four categories of spending in kakeibo are needs, wants, culture, and unexpected expenses. Kakeibo is popular because it aligns with the Japanese value of "mottainai" and provides a straightforward way to manage finances.

Saving money is essential in today's fast-paced world for achieving financial independence, planning for life events, and creating a safety net. Developing a habit of saving can give you greater control over your financial future.

Kakeibo, a budgeting technique created by Japanese journalist Hani Motoko in 1904, helps individuals manage monthly expenses, understand spending habits, and practice frugality. It has gained popularity among young individuals for its effectiveness in saving for financial goals and accounting for unexpected costs.

Why i trust japanese art of saving money?

Between 1960 and 1994, Japanese households saved an average of one-sixth of their after-tax income, sometimes reaching nearly one-fourth, significantly higher than the 7.1% average savings rate of American households during the same period. While official statistics indicate that Japanese households are big savers, comparisons can be misleading due to differences in measurement across countries. Adjusting for these discrepancies, it appears that while Japan still saves more than the U.S., the actual difference is smaller than reported. Japan also has a higher savings rate in comparison to other countries, although there are various nations with differing savings behaviours.

Understanding the Kakeibo Method of Budgeting

The Kakeibo method is a Japanese budgeting technique that helps individuals manage their household expenses effectively. Created by journalist Hani Motoko in 1904, Kakeibo encourages mindful spending and can result in savings of up to 35% when practised consistently. The method involves categorizing all expenditures into four main areas: Needs (essential items for survival), Wants (non-essential luxuries), Culture (spending on cultural experiences), and Unexpected expenses (unforeseen costs). Practitioners maintain two notebooks to track their spending—one large notebook for categories and a smaller notebook for jotting down daily expenses. This process instils a sense of accountability and promotes financial discipline, aiding individuals in achieving their savings goals and preparing for emergencies.

How do you use Kakeibo in your life? An individual should use the following steps to incorporate Kakeibo in his life fruitfully:

1. Understand your fixed expenses You start with analyzing the monthly expenses, including your monthly fixed expenses such as rent, utility expenses, loan emis etc.

Fixed expenses are consistent monthly costs that are predictable and easy to incorporate into a budget, unlike variable expenses which fluctuate based on production levels. Key examples of fixed expenses include rent or mortgage payments, car payments, insurance premiums, property taxes, utility bills, child care costs, tuition fees, and gym memberships. To calculate fixed expenses, one should gather their budget or income statement, identify the non-variable expense categories, and sum the amounts from each category. Managing fixed expenses is crucial as they can significantly impact overall spending and understanding these costs can lead to better resource allocation and budgeting decisions

2. Effective Budgeting: Tracking Income and Expenses Here you include all the sources of income you are going to have over the next month. For salaried employees, these include their monthly income, and you also add back the deduction such as health insurance premiums or provident funds that are deducted first before giving you your salary. Non-salaried individuals such as entrepreneurs and freelancers can work with a future income they expect to generate over the next month.

The text outlines the steps necessary for effective budgeting, which includes tracking income and expenses, and comparing the two to ensure spending is managed. Key points include: 1. **Tracking Income**: Monitor gross monthly income, which includes salary and bonuses. To calculate annual gross income, multiply your hourly wage by your weekly hours, then multiply by 52 and divide by 12 for monthly figures. 2. **Tracking Expenses**: Understand fixed costs (e.g., rent, insurance) and flexible expenses (e.g., food, entertainment). Utilize tools such as bank statements and receipts for accurate tracking. 3. **Comparing Income and Expenses**: Subtract total expenses from total income. A positive result indicates that you are spending less than you earn while a negative result shows overspending. 4. **Creating a Budget**: Set financial goals, adjust spending accordingly, and apply budgeting rules like the 50/30/20 rule to effectively allocate your income. This guidance helps individuals maintain financial health by promoting awareness of their earnings and expenditures.

The 50/30/20 Budget Rule with Examples

Explore the power of the 50:30:20 budget rule for effective financial planning. Learn how to manage your money wisely and achieve financial balance using this proven budgeting principle. Take control of your finances and pave the way for financial freedom.

3. Determining Your Ideal Savings Rate

Here you decide how much exactly you wish to save over the next month. The goals should be such that they are not easily achievable or unrealistic that you can’t save anything.

Determining your ideal savings rate is influenced by individual financial situations, lifestyles, and goals. Experts recommend setting aside at least 20% of monthly income for savings, which aids in creating an emergency fund, managing unexpected expenses, and planning for long-term objectives such as retirement.

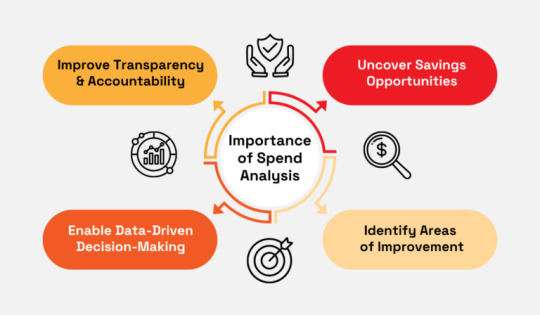

4. Analyze how much you can spend These expenses include all the expenses apart from your fixed expenses. Let’s try to understand all of these with an example. Let us assume you have an Income = 50000 Fixed Expenses (Rent, Utilities etc.) = 20000 Saving Goals = 10000 Then considering the above four points, the amount of money you are left to spend monthly is as follows: The money you can spend = Income – Fixed Expenses – Saving i.e. The money you can spend = 50000 – 20000 – 10000 = 20000 Thus, as an individual with a 50000 income, you are left with 20000 to manage all your expenses apart from your fixed expenses. Spend analysis is a method for understanding spending habits and identifying cost-saving opportunities. 1. Goal Identification: Clearly define what you aim to achieve with spend analysis, whether it's cost reduction or enhancing supplier performance. 2. Data Gathering: Collect all relevant spending data to ensure comprehensive analysis. 3. Data Management: Clean and organize this data to enhance accuracy and usability. 4. Spending Categorization: Group expenditures into categories to facilitate analysis. 5. Trend Analysis: Examine spending patterns to identify trends and recurring expenses. 6. Improvement Opportunities: Highlight areas where costs can be lowered or supplier performance can be enhanced. 7. Ongoing Monitoring: Regularly revisit and update insights to ensure they remain relevant. 8. Cost Reduction: Leverage insights to pinpoint specific areas for spending cuts. 9. Efficiency Improvement: Use findings to streamline operations for better efficiency. 10. Risk Mitigation and Strategic Support: Assess potential risks and utilize insights for informed strategic decision-making regarding investments or expansions.

By analyzing total expenditures, and zeroing in on specific business units, products, quantities, payment terms, and more, you get the answers to four crucial questions: What are we spending money on? Who are we spending it with? Are we getting what we need? Is there a better way to do this? The analysis can either be a comprehensive one or target just different categories of spend. Make your track record up to date regularly.

5. Divide the spending money by 4 The assumption being we have four weeks within a month. As an individual with 20000 spending money, you are allowed to spend a maximum of 5000 every week. Thus it would be best if you restricted your weekly expenses to 5000 such that you do not ever go over budget

The 40/30/20/10 rule is a budgeting method that allocates income into four distinct categories to help individuals manage their finances effectively. Key insights include: 1. Categories Explained:

The rule divides income into needs (40%), discretionary spending (30%), savings or debt repayment (20%), and charitable giving or financial goals (10%).

2. Needs Definition:

The 40% allocated for needs covers essential expenses like rent, mortgage, utilities, and groceries.

3. Discretionary Spending:

The 30% set aside for discretionary spending includes activities such as dining out, entertainment, and shopping.

4. Savings and Debt:

The 20% portion is intended for saving money or paying off existing debts, promoting financial security.

5. Charitable Giving:

The 10% of income is earmarked for donations or other financial goals, encouraging philanthropy.

6. Comparison to 50/30/20 Rule:

An alternative budgeting method, the 50/30/20 rule, simplifies the approach by categorizing income into needs (50%), wants (30%), and savings/investments (20).

7. Flexibility:

Both rules allow individuals to customize their financial plans according to personal priorities and circumstances.

8. Promotes Financial Awareness:

Adopting such rules encourages individuals to reflect on their spending habits and make informed financial decisions. The 40-30-20-10 rule offers a structured approach to budgeting that divides income into specific percentages for necessities, discretionary spending, savings, and charitable giving. The rule is grounded in long-standing financial wisdom, emphasizing the importance of living within one's means. It suggests allocating 40% of income for necessities like housing and groceries, 30% for discretionary expenses, 20% for savings or debt repayment, and 10% for charitable contributions.This budgeting method helps individuals create a balanced financial plan, tailoring it to their unique situations Differentiating between needs (essentials for survival) and wants (desires) is crucial for making informed financial decisions.The rule serves as a guideline, allowing for flexibility based on individual financial circumstances. Understanding and applying the rule can lead to improved financial health and future savings. Alternative budgeting methods similar to the 40-30-20-10 rule exist, offering variations in allocations while maintaining core principles. It provides a clear framework for managing finances, making it easier to track and control spending.

The Kakeibo method is a Japanese budgeting technique designed to help individuals manage their expenses and maximize savings by fostering mindful spending habits. 1. Definition of Kakeibo: Kakeibo translates to "household financial ledger" and was developed by journalist Hani Motoko in 1904 to aid homemakers in budget management. 2. Spending Awareness: The method encourages individuals to reflect on their spending habits, distinguishing between needs, wants, cultural expenses, and unexpected costs to better allocate their finances. 3. Categorization of Expenses: Kakeibo divides expenses into four categories: needs (essentials), wants (luxuries), culture (enriching experiences), and unexpected expenses (unforeseen costs). 4. Expense Tracking: Practitioners maintain two notebooks—one for ongoing expense tracking and another for summarizing weekly expenditures according to the four categories, promoting accountability. 5. Establishing Fixed Expenses: Users should first determine their fixed monthly costs, such as rent and utilities, which are critical for accurate budgeting. 6. Income Analysis: Assessing all sources of income and accounting for deductions (like health insurance) is essential for creating a realistic spending plan. 7. Setting Savings Goals: It is crucial to establish a specific savings target each month that is neither overly ambitious nor too easy to achieve, ensuring financial growth. 8. Budgeting Monthly Spending: After determining fixed expenses and savings goals, the remaining income is allocated as monthly spending money, which can be divided into weekly limits to maintain discipline. 9. Weekly Review: A comparison of planned versus actual spending at the end of each week fosters reflection on financial behavior and allows for adjustments in future spending to stay within budget. 10. Mindful Spending: The method encourages ongoing evaluation of expenses, helping individuals distinguish between essential and non-essential purchases to preserve their savings goals.

Other Kakeibo Lessons Delay any non-essential purchase till the next month. If you still feel the urge for that item after a month, analyze its affordability and what value it may add to your life. Always carry a shopping list when going to market for your monthly purchase.

The Kakeibo method is a disciplined approach towards expense management. This method teaches us the value of each expense made and the sacrifices that need to be made to achieve our targets.

We don't have to be smarter than the rest. We have to be more disciplined than the rest.

Warren Buffet said

Expense management is important because it helps companies control costs, meet budgets, and comply with regulations.

Thanks to all authors who wrote

Date of Publish: 10/ Jan / 2025

2 notes

·

View notes

Text

2024 Snowflake Challenge #2 Goals

Some fannish goals for 2024 that I have:

1. Continue working on writing 200 words minimum a day. If I miss a day, it's easy enough to make up and more often than not I'll go a little over it. I've been using the word tracker from here

2. Actually post some fanfics again! I still love Twisted Wonderland a lot and want to keep writing even though I mostly write rare pairings. But I hope that people will still enjoy what I put out.

3. Complete my reading challenge on good reads! I fell a little short last year but I want to be consistent. I'm reading about fifteen minutes before bed, which helps a lot. I'm starting this year with The Lies of Locke Lamora, which is intimidating, but I'm almost at the 75% mark, so I feel like my consistency is rewarding me.

4. Tying in with that, I also want to read through part one of Trash of the Count's Family. Which… might take a while and I'm not including it in my bedtime reading routine because hooboy. But I'm excited.

5. I want to try to post at least once a week or more on here and Tumblr. I'm active on plurk, twitter, and bluesky, but miss regular blogging. Maybe I'll even interact with people one day!

6. Last of all, just being a bit more consistent when it comes to rp. I'm still wavering on whether or not I should app into a game, but I do like the short little threads I have right now.

On the real life end:

1. Keep up with working out! I've been doing it for about… five months straight. I'm doing lighter workouts this month since my back hates me but I've been really consistent and I love it.

2. Slow steps on healthy eating. Reasonable portion control for now and once I get that locked down, I'll decide on what to add in next.

3. Some budgeting. I've been trying out a low key version of the kakeibo method. I've realized I need to be a little more responsible. Especially when it comes to eating out/buying convenience store food. Which should help with my other goals.

4. Also I'm making a few little household/life organizing efforts like trying to be more prompt with emptying the dishwasher and folding my laundry. The latter will be hard though.

5. And maybe depending on what happens with my work situation in the next few days look for a new job (cries internally).

But that's all for now!

x posted to my dreamwidth

6 notes

·

View notes

Photo

Kakeibo é um termo em Japonês para se referir ao método de gestão financeira da casa. No início do mês, anotam-se as receitas e despesas necessárias e definem-se metas de poupança. Além disto, é frequente o registo de pensamentos e observações com o objectivo de conscientizar o próprio consumo. Saiba mais em: www.cltservices.net

2 notes

·

View notes

Text

Also:

They're doing the thing where you act like something is a Mystical Art just because you call it by a Japanese word. 'Kakeibo' (家計簿) just means "household account book." Granted it's easier to get nice aesthetic account books in Japan, just because the stationery industry is thriving over there, but it's literally just writing stuff in a notebook.

Even if the 1953 study did exist, it is described as comparing people who wrote down goals to people who did not. The Kakeibo article talks about the benefits of writing by hand versus using digital tools. Those are two different questions.

if I've learned anything from grad school it's to check your sources, and this has proven invaluable in the dozens of instances when I've had an MBA-type try to tell me something about finances or leadership. Case in point:

Firefox serves me clickbaity articles through Pocket, which is fine because I like Firefox. But sometimes an article makes me curious. I'm pretty anal about my finances, and I wondered if this article was, as I suspected, total horseshit, or could potentially benefit me and help me get my spending under control. So let's check the article in question.

It mostly seems like common sense. "...track expenses and income for at least a month before setting a budget...How much money do I have or earn? How much do I want to save?" Basic shit like that. But then I get to this section:

This sounds fucking made up to me. And thankfully, they've provided a source to their claim that "research has repeatedly shown" that writing things down changes behavior. First mistake. What research is this?

Forbes, naturally, my #1 source for absolute dogshit fart-sniffing financial schlock. Forbes is the type of website that guy from high school who constantly posts on linkedin trawls daily for little articles like this that make him feel better about refusing to pay for a decent package for his employees' healthcare (I'm from the United States, a barbaric, conflict-ridden country in the throes of civil unrest, so obsessed with violence that its warlords prioritize weapons over universal medical coverage. I digress). Forbes constantly posts shit like this, and I constantly spend my time at leadership seminars debunking poor consultants who get paid to read these claims credulously. Look at this highlighted text. Does it make sense to you that simply writing your financial goals down would result in a 10x increase in your income? Because if it does, let me make you an offer on this sick ass bridge.

Thankfully, Forbes also makes the mistake of citing their sources. Let's check to see where this hyperlink goes:

SidSavara. I've never heard of this site, but the About section tells me that Sid is "a technology leader who empowers teams to grow into their best selves. He is a life-long learner enjoys developing software, leading teams in delivering mission critical projects, playing guitar and watching football and basketball."

That doesn't mean anything. What are his LinkedIn credentials? With the caveat that anyone can lie on Linkedin, Mr. Savara appears to be a Software Engineer. Which is fine! I'm glad software engineers exist! But Sid's got nothing in his professional history which suggests he knows shit about finance. So I'm already pretty skeptical of his website, which is increasingly looking like a personal fart-huffing blog.

The article itself repeats the credulous claim made in the Forbes story earlier, but this time, provides no link for the 3% story. Mr. Savara is smarter than his colleages at Forbes, it's much wiser to just make shit up.

HOWEVER. I am not the first person to have followed this rabbit hole. Because at the very top of this article, there is a disclaimer.

Uh oh!

Sid's been called out before, and in the follow up to this article, he reveals the truth.

You can guess where this is going.

So to go back to the VERY beginning of this post, both Pocket/Good Housekeeping and Forbes failed to do even the most basic of research, taking the wild claim that writing down your budget may increase your income by 10x on good faith and the word of a(n admittedly honest about his shortcomings) software engineer.

Why did I spend 30 minutes to make a tumblr post about this? Mostly to show off how smart I am, but also to remind folks of just how flimsy any claim on the internet can be. Click those links, follow those sources, and when the sources stop linking, ask why.

#fact checking#read to end#for extra EW: the article compares budgeting to dieting#portraying both as good habits you shouldn't quit#honey NO

19K notes

·

View notes

Text

Este sistema de finanzas, de cuatro categorías, te ayuda a ser más consciente de tus hábitos de gasto y evitar gastar dinero en cosas que no se alinean con tus objetivos.

Consíguelo aquí: https://scrapstudio.wordpress.com/2020/07/03/kakebo-economia-en-casa/

#kakebo#kakeibo#economia#finanzas#ahorrar#etsy#imprimible#planner#planificador#herramienta#aprender#PDF#imprimibles#ahorro#metodo#japones

3 notes

·

View notes

Photo

Kakeibo Yöntemiyle Zenginliğinizi Şekillendirin: Paranıza Hakim Olmanın Sırları!

0 notes

Video

youtube

Kakeibo Bí Quyết Tiết Kiệm Và Làm Giàu Độc Đáo Của Người Nhật

0 notes

Photo

Yong-joon Kim, Single Confessions - Ex-Girlfriend's Show

0 notes

Text

HSBC "O Que é Dinheiro?" 90s

youtube

Kakeibo (japonês: 家計簿, Hepburn: kakeibo), é um método de economizar ou de planejamento financeiro japonês. A palavra "kakeibo" pode ser traduzida como "razão doméstica" e significa literalmente a gestão financeira doméstica. Os Kakeibos variam em estrutura, mas a ideia básica é a mesma. No início do mês, o usuário do kakeibo anota as receitas e despesas necessárias para o mês seguinte e decide algum tipo de meta de poupança. O usuário então registra diariamente suas próprias despesas, que são somadas primeiro no final da semana e depois no final do mês. No final do mês, um resumo dos gastos do mês é escrito no kakeibo. Além de despesas e receitas, pensamentos e observações são escritos no kakeibo com o objetivo de conscientizar o próprio consumo.Kakeibo é uma prática de uma filosofia financeira,um livro da sua autobiografia e filosofia financeira que nem vai além das anotações ou lançamentos financeiros, mas seu mindset e cultura financeira e como você diferencia preço de valor, tempo é vida de tempo é dinheiro e assim determina e diferencia transações, relações e relacionamentos pela essencialidade do dinheiro, podendo chegar a duas conclusões: o dinheiro é um meio ou um fim em si mesmo para a paz, o amor, a felicidade, o servir ao próximo, a generosidade ou simplesmente o oposto disso tudo, tornando-nos escravo do dinheiro e nunca o dinheiro nosso escravo!

Moneyfullness ou Moneyemptyness?

Por: Fred Borges

"Mike Lynch, o bilionário britânico e magnata da tecnologia que morreu após um iate de luxo naufragar na Sicília, passou mais de uma década construindo a maior empresa de software do Reino Unido e quase o mesmo tempo lutando contra acusações de que havia inflacionado seu valor para garantir uma venda multibilionária.

O corpo de Lynch foi recuperado nesta quinta-feira dos destroços do desastre, disse o funcionário do Ministério do Interior, Massimo Mariani, à Reuters.

Lynch fundou a empresa Autonomy em 1996 a partir de sua pesquisa inovadora na Universidade de Cambridge e foi elogiado por acionistas, líderes empresariais e políticos quando a vendeu para a Hewlett-Packard (HP) por US$ 11 bilhões (R$ 61,1 bilhões) 15 anos depois.

Mas no final de 2012, a HP surpreendeu Wall Street e a cidade de Londres ao dizer que havia descoberto um enorme escândalo contábil. Lynch negou as acusações.

A HP perdeu US$ 8,8 bilhões em valor e desencadeou 12 anos de batalhas legais em tribunais de Londres a São Francisco.

Lynch foi absolvido de todas as acusações em junho e solto após um ano em prisão domiciliar. Ele disse que estava “eufórico” e ansioso para retornar à sua família e à sua propriedade em Suffolk, Inglaterra, onde tinha um rebanho de gado de raça rara e muitos cães.

Como parte da celebração, Lynch convidou aqueles que o apoiaram para se juntarem à sua família em seu iate de 56 metros para um feriado de vela pelo sul da Itália.

Os convidados incluíam seu advogado e um executivo do Morgan Stanley que apareceu como testemunha.

O barco estava ancorado, com as velas abaixadas, quando foi atingido por uma violenta tempestade antes do amanhecer de segunda-feira e afundou rapidamente."Noticiário Internacional.

Esse é um breve resumo sobre o dinheiro. Não importa a quantidade conquistada ou mantida, mas o que ele te proporciona em qualidade de vida, nesse sentido, menos pode ser mais ou mais pode ser menos e não me interpretem mal, suas despesas devem se adequar às suas receitas e se houver sobras, por menores que elas sejam,devem ser poupadas e investidas, a isso chamamos de micro equilíbrio econômico e financeiro e para países macro equilíbrio econômico financeiro, fiscal, tributário e previdenciário.

Kakeibo é a síntese do que toda indivíduo, cidadã ou cidadão deveria adotar como comportamento em relação ao dinheiro, respeito a si próprio e a ele, sempre geri-lo com excelência, sempre otimizando-o, sempre fazendo-o trabalhar por você ou por sua família, infelizmente raras são as pessoas que usufruem desse " mindset", raras se sentem imbuidas ou comprometidas em elevar, agregar um melhor padrão de vida, raras pensam a longo prazo, foca no caminho, no meio, a maioria foca nos resultados e menos na filosofia dos resultados, num patamar mais elevado tanto em termos emocionais, espirituais, materiais e financeiros, poupador, investidor, numa economia doméstica cíclica,onde cada centavo deriva do esforço contínuo , disciplinado do dinheiro girando e se multiplicando em benefício da riqueza, riqueza é a consequência do " enobrecimento" de todas as áreas de nossa vida: espiritual,emocional, social, ambiental( sustentabilidade/reciclagem) física-material e social( relacional).

É preciso "moneyfullness" para saber se posicionar e fazer o dinheiro seu escravo e nunca o contrário!É preciso cultura e " mindset" para enriquecer, quanto a Lynch, chegue às suas próprias conclusões, pois dinheiro pode ser tudo, menos o que ele é realmente, uma abstração ontológica da jornada, da trilha, do caminho de cada pessoa no seu compromisso em ser melhor por servir a sua comunidade, cidade, nação, numa espiral humanitária de crescimento,soma, multiplicação e divisão ou distribuição,rumo a uma melhor humanidade, de seres humanos melhores, nesse sentido para uns ele pode significar: moneyemptyness!

0 notes

Text

How I saved RM250k in 10 years.

I haven't always been good with money. I've shared before how I only started saving consistently at 30 and how I used to have thousands of ringgits in credit card debts throughout my 20s, thanks to my nonexistent delayed gratification.

Nonetheless, upon realising that I was nowhere like the person I had envisioned to be at 30, I decided it was high time to pull my act together and clean up the financial mess I'd gotten into.

I started my personal finance journey in January 2014 with RM800 in my savings account. By July 2014, my total savings was RM16,000. This month, exactly 10 years later, my total savings in the said account has reached RM266,000. A total increase of RM250,000 in 10 years. If you come from money, RM250k may not seem like a lot. But I had started from scratch (the last time I received money from my dad was in April/May 2005) and I had managed to hit my savings goal without getting a loan, winning the lottery or having a sugar daddy. Therefore, I'm pretty pleased with this milestone accomplishment.

Here's a step-by-step of how I did it: 1. Don't be afraid to job-hop The first conventional tip for saving money is to spend less than you earn and save 20% of your earnings. Sounds fair until inflation catches up with you and you no longer make enough to spend, let alone save. Therefore, my biggest financial tip is to monitor the job market and hop around to get a better offer. I don't normally stick around at a job longer than two years. Not only does my attention span not allow it, but you also won't be learning much by staying at a place too long. Especially when there's no promotion and pay increment in sight. At the end of the day, you can only save so much if you're not earning enough.

2. Keep track of your spending As a mildly neurotic INTJ, I love having a tried and true system I can control and rely on. Budgeting (kakeibo) provides that element of control and order that I crave and it helps me keep track of where my money goes each month.

3. Monetise your hobby I am forever blessed that day I decided to follow my dreams and become a full-time writer. Blogging used to be my hobby back when my full-time job was being a lab assistant at a chicken feed factory. Thank God that I had enough delulu and moxie to quit my job and pursue a new career as a journalist.

Long story short, whatever your heart craves to do, find a way to get paid doing exactly that. And you'll never work a day in your life. 4. Forget the Joneses and focus on yourself Not only is comparison the thief of joy, but it also keeps you from hitting your financial goals.

I've made a point to mute some friends and celebrities who seem to 'inspire' me to spend money. I limit my big ticket purchases to once or twice a year and pretty much stick to a frugal/minimalist lifestyle all year round. I don't mind looking poor to not actually be poor.

Conclusion When I was younger, I only viewed money as a means to get an object I wanted, be it a new bag, makeup or clothes. These days, I realise that having money is more about accessing the freedom and choices that it affords. It feels comforting to know that I can quit my God-awful job if I want to because I can now afford it. It also feels comforting to know that I won't be a burden to others, as I won't be relying on them for money. Having choices and freedom (afforded by money) gives you a different kind of confidence. To me, that's my biggest motivation to hit my financial goals.

0 notes