#JetBlue merger

Explore tagged Tumblr posts

Text

Spirit Airlines Files for Bankruptcy Protection Amid Operational Challenges

Spirit Airlines Files for Bankruptcy Protection Amid Challenges Spirit Airlines, known for its no-frills approach to air travel and budget-friendly ticket prices, has officially filed for bankruptcy protection on Monday. This decision comes on the heels of a series of setbacks, including an unsuccessful attempt to renegotiate significant debt obligations. The airline’s last profitable year was in…

#airline industry#bankruptcy#Chapter 11#debt restructuring#JetBlue merger#low-cost airline#Spirit Airlines#travel recovery

0 notes

Text

Spirit warned investors that merging with Jetblue would be illegal

++++

Jetblue is trying to buy Spirit Airlines. It’s a terrible idea. Consolidation in the US aviation industry has resulted in higher fares, less reliable planes, spiraling junk-fees, and brutal conditions for flight- and ground-crews. The four remaining US major airlines, who gobbled their rivals, are three times more profitable than their European counterparts:

https://www.economist.com/leaders/2017/04/22/a-lack-of-competition-explains-the-flaws-in-american-aviation

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/12/they-put-it-in-writing/#that-was-then

That’s great news if you’re an airline shareholder. It’s terrible news if you’re hunting for your lost bags, or if you’re a flight attendant or pilot being squeezed, or if you’re being hit for billions in covid bailouts — or if you’re one of one million Americans who were stranded during Christmas week by the failure of Southwest Airlines’ IT systems, which use duct-tape and wishful thinking to hold together the IT systems of all the airlines SWA bought:

https://pluralistic.net/2023/01/16/for-petes-sake/#unfair-and-deceptive

The collapse of competition in the US airline industry is the result of a deliberate policy, the “consumer welfare” theory of antitrust, which says that monopolies are “efficient” and good for the public. It’s a theory that took root under Reagan, and was reaffirmed and expanded by every president, R or D, since.

Until now. For the first time in two generations, the Biden administration has taken up the neglected, noble art of trustbusting, blocking mergers and promising to break up the mergers we’ve already seen, through enforcers like Jonathan Kanter at the DoJ Antitrust Division and Lina Khan at the FTC:

https://www.eff.org/deeplinks/2021/08/party-its-1979-og-antitrust-back-baby

Which is bad news for the proposed Jetblue/Spirit merger. Last week, the DoJ filed suit to block the merger, joined by the AGs from NY, MA and DC.

https://storage.courtlistener.com/recap/gov.uscourts.mad.254267/gov.uscourts.mad.254267.1.0.pdf

Notably, Pete Buttigieg — who has been historically shy of using his prodigious powers as the boss of a large agency — will also block the merger:

https://www.transportation.gov/briefing-room/usdot-statement-justice-departments-lawsuit-block-proposed-jetblue-spirit-merger

Spirit’s shares are in the toilet. Writing in his BIG newsletter, Matt Stoller explains why shareholders are bolting for the doors: the case against the Jetblue/Spirit merger is incredibly strong. A slam-dunk, even:

https://mattstoller.substack.com/p/an-end-to-airline-consolidation

Spirit, after all, is America’s most famous budget airline. That means that it attracts fliers by undercutting the Big Four. That puts downward pressure on the Big Four, who are faced with the choice of taking lower profits to retain fliers’ business, or losing all the profit when those fliers take Spirit. Remove Spirit from play and that downward pressure on fares disappears. You don’t need newfangled “neo-Brandeisian” antitrust to see why this is bad — even under “consumer welfare” antitrust, anything that will obviously make prices go up is prohibited (indeed, this is the only thing consumer welfare antitrust cares about).

How do we know that a Jetblue/Spirit merger is a price-increasing, illegal antitrust violation? Spirit says so.

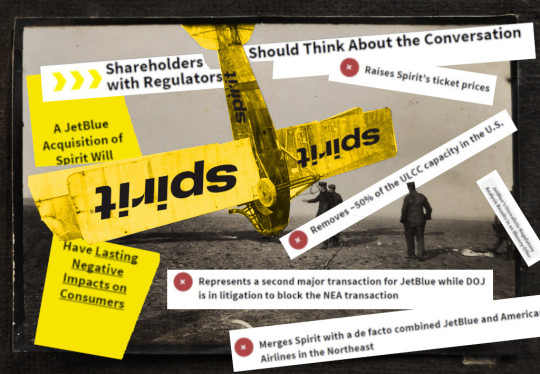

[Image ID: A slide prepared for Spirit Airlines’ board, titled ‘Shareholders should think about the conversation with regulators,’ and laying out the case that a Jetblue/Spirit merger is illegal.]

This is truly delicious! You see, last year, there was a bidding war for Spirit and Jetblue was the outside bidder. Spirit’s board wanted to convince their shareholders to reject Jetblue’s bid, so they commissioned some aviation economists to do a study on the matter, which Spirit then circulated to its investors.

That report is unequivocal: it estimates that a Jetblue/Spirit merger will be a disaster. Spirit’s participation in a route lowers fares by 17%. When Spirit stops competing on a route, fares go up by 30%. Spirit CEO Ted Christie called the proposed merger “unlawful” and “unethical”:

https://simpleflying.com/spirit-ceo-shareholder-rejection-jetblue-cynical-disruptive-offer/

Spirit is a major competitor to Jetblue. As Stoller notes, they compete on hundreds of routes, and are adding more all the time. Jetblue clearly understands that removing Spirit as a competitor would let it raise fares. As one Jetblue manager — quoted by the DoJ — explained: “I don’t think we should be selling the [Spirit] fare if [Spirit] is not serving the market.” Jetblue’s internal memos on the merger include an executive stating that the merger will allow the airline to realize “efficiencies” by reducing service and increasing fares. This isn’t the kind of “efficiency” we want.

Stoller notes that even with this damning evidence, there are still some spoilers. Florida governor Ron DeSantis has cut a deal to back the merger, even though Florida stands to suffer the most of any state from this merger due to the number of Spirit flights taking off from its airports. And, Stoller notes, the judge presiding over the case is an 82 year old Reagan appointee — a ideology-addled dotard named William Young.

But, Stoller notes, with Buttigieg and the DOT on the case, it’s hard to see how this merger can go through — the DOT has very broad powers to block mergers that reduce routes and don’t have to meet the same evidentiary standards as the DoJ would in court.

Stoller thinks Buttigieg has had a “moment of truth” — that outside pressure from activists and critics convinced the secretary that his future political fortunes would be better served, on balance, by boldly using his powers (and pleasing the public), rather than sitting on his hands (and pleasing future industry donors):

https://mattstoller.substack.com/p/pete-buttigiegs-moment-of-truth

If that’s so, it’s welcome news. While I would prefer that our political leaders acted boldly in the public interest out of a sense of duty, I will happily settle for bold action motivated by fear of the voters’ wrath.

[Image ID: A crashed WWI biplane, redecorated in Spirit airlines livery. The scene is decorated with text-snippets cut out of a Spirit Airlines internal investor presentation slide advising that merging with Jetblue is ill-advised and possibly illegal.]

#pluralistic#matt stoller#spirit airlines#jetblue#aviation#monopoly#mergers#petard#antitrust#southwest#swords

125 notes

·

View notes

Text

JetBlue Airways and Spirit Airlines on Monday said they were terminating their merger agreement weeks after losing a federal antitrust lawsuit that challenged the deal. A federal judge blocked the attempted merger in January after the Justice Department sued to bar the deal last year alleging the acquisition would stifle competition in the airline industry and eliminate Spirit as a discount alternative for price-conscious travelers. JetBlue and Spirit appealed the judge’s decision a couple of days later, but JetBlue noted the appeal was required under the terms of the merger agreement. Spirit shares tumbled 17% in premarket trading, while shares of JetBlue were up roughly 4%.

4 notes

·

View notes

Text

0 notes

Text

By Chris DeVille | July 28, 2023

Ticketmaster and Live Nation, the gigantic corporations that merged in 2010 and now dominate the US ticketing and live events industry, have been widely hated for years. Recently, the US government has been turning up the heat on them. The Taylor Swift ticketing fiasco had senators quoting song lyrics during a Senate Judiciary Committee hearing in January, and a month ago the companies agreed to “all-in” pricing at a White House meeting, meaning they’ll no longer charge hidden fees not listed as part of the purchase price. Now the Justice Department is sharpening its knives.

Politico reports that the DOJ intends to file an antitrust lawsuit against Live Nation and Ticketmaster before the end of the year, as affirmed by three sources with knowledge of the matter. According to those sources, the lawsuit is not 100% guaranteed to move forward. Prosecutors will already be busy this fall with cases against Google and the JetBlue-Spirit merger scheduled for September and October respectively, and they’re finishing up investigations into companies including Apple, Visa, and Adobe. But if filed, an antitrust case against Live Nation could lead to the breakup of the company — bad news for the company’s president, Joe Berchtold, pictured above.

10 notes

·

View notes

Video

tumblr

Spirit Airlines shareholders voted Tuesday on whether to approve a merger with JetBlue Airways. The company said results of the vote will be announced Wednesday.

#video#tiktok#tiktoks#funny#lmao#wtf#news#spirit airlines#jetblue#jetblue airways#airplane#airplanes#washingtonpost

26 notes

·

View notes

Text

Last Monday, one of the large number of Washington, D.C. insider trade publications - Politico - called out Biden antitrust policy as the single most problematic area for financiers. “In taking on tech giants and forcing the collapse of lucrative deals,” said Politico Morning Money, “Lina Khan has earned the status of Wall Street nemesis.” It’s true. The torpedoes launched last year - from rule-makings to challenges of Google and Spirit-JetBlue - are now exploding.

In this issue, we’re going to describe how the establishment is hitting back, in ways you don’t see, but which might become a political issue if the consultants and candidates who run campaigns actually notice what’s happening in Congress.

The short story is that big business is using partisanship to try and persuade Congressional Republicans, and some Democrats, to repeal antitrust laws, as well as drag antitrust enforcers before committees and harangue them in public. But among voters, within academia, and even in the conservative legal movement, antitrust is becoming far more relevant.

First, let’s set the context. This week, polling came out again showing Americans oppose monopolies and support antitrust laws, which isn’t a surprise. People dislike junk fees and unfair prices. We’ve all noticed high-profile monopoly-driven problems with episodes like the baby formula shortages, the failure of Ticketmaster’s ability to sell tickets, and ludicrously high prices for EpiPens and asthma inhalers.

This parade of incidents is one reason two-thirds of all Americans support anti-monopoly laws. That holds among both Biden and Trump voters, with more than 70% of both camps agreeing that monopolies are bad for the economy. And only 5% of Americans - across party affiliations - think that antitrust laws should be weakened.

One thing that surprised us is though people generally like technology firms, 46% still think the government should break up big tech, versus just 28% who don’t. What’s also interesting is that 52% of voters have heard little or nothing about the Biden administration’s economic policies, which means few people know what antitrust enforcers are doing. That could change relatively soon. Here’s Montana Senator Jon Tester, running for reelection in a very Trump-friendly state as a Democrat, attacking consolidation in the meat-packing and seed industries as a point of distinction between the parties.

It’s not just certain Democrats making the case. After all, in 2020, it was Donald Trump’s administration which brought the major Google antitrust suit currently being litigated. In academia, today legal scholars and historians are trying to reorient the history of America as one grounded in anti-monopoly thought, as this interesting collection of essays put out by the Tobin Project shows. And in key ways, conservative legal thinkers are ahead of the curve on consolidation. Take the highly influential George Mason law professor Todd Zywicki, who interviewed Biden antitrust chief Jonathan Kanter on the new proposed merger guidelines, calling them a “moderate” way to split the difference between traditional Chicago School conservatives and a newer populist sentiment.

That interview happened at, of all places, the Federalist Society, which is the beating heart of the conservative legal movement, where law professors, high-powered lawyers, circuit court judges and Supreme Court justices spend time networking and learning from each other. Justices Alito, Barrett, Gorsuch, and Kavanagh all attended last Friday’s black tie Federalist Society event.

Indeed, that dinner was part of the organization’s National Lawyer’s Convention, which had multiple discussions of the threats to conservatives by monopolization, as well as originalism and antitrust law. Stephanos Bibas, Third Circuit Judge, was the moderator of the panel on antitrust, and he often expressed surprise and interest in some of the comments by panelists, which included, among others, Deputy Assistant Attorney General of Antitrust Doha Mekki, Michigan professor Daniel Crane, and conservative plaintiff lawyer Ashley Keller. It wasn’t just one panel, the interest was pervasive. Lina Khan, for instance, did a well-attended fireside chat. And the main event on Saturday was a debate between two conservatives over whether social media platforms had sufficient monopoly power that the state could regulate them as common carriers.

youtube

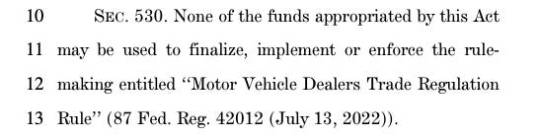

And yet, in certain corners of the establishment, the pro-monopoly tradition that started in the 1980s remains dominant. Last week, an appropriations bill in the House - one of the spending bills that keeps government working - was amended multiple times to repeal antitrust laws.

Let’s look at a few of those proposals. There was a pro-junk fee amendment from Rep. Scott Fitzgerald (R-WI), which would “prohibit funding for the FTC to make Unfair Competition rule-makings.” Such wording sounds anodyne. But if you strip away the legalese, Fitzgerald is seeking to do away with the rule-making authority the FTC is using to ban annoying junk fees, which deceive customers into paying higher prices for food, hotels, event tickets, car rentals and more. It’s also the authority the FTC is using to prohibit non-compete agreements, which trap people in their jobs and deprive workers of some $300 billion in wages per year.

There was another amendment which would prevent the FTC from enforcing its unfair methods of competition authority outside the bounds of the Clayton and Sherman Act. This one would effectively end or weaken key parts of the FTC’s case against Amazon, particularly its use of algorithms to raise prices in tacit collusion with other sellers, as well as its actions against pharmacy benefit managers on lower insulin prices and its work against price discrimination towards small and medium size grocers.

Rep. Kat Cammack (R-FL) proposed an amendment to block the finalization of all rules that would affect more than $100 million of activity. This would get rid of things like the FTC’s ‘Click to Cancel’ provision that stops entities from cheating you with subscriptions, or the pre-merger notification requirement rule, which would help stop predatory acquisitions by private equity firms in health care. These are gifts to the Chamber of Commerce, at the expense of hundreds of millions of real people.

In this section of the underlying bill, Republican appropriators even included a provision to let auto dealers cheat customers with undisclosed added fees.

But this isn’t about Republicans, who in many ways are just being partisan and/or exercising muscle memory from the 1990s. In a separate appropriations bill, Rep.’s Massie (R-KY) and Democrat Lou Correa (D-CA) led a bi-partisan amendment to strip the Department of Transportation of its authority to investigate airline mergers. JetBlue, in other words, is doing a lot of lobbying, and is trying to win - through spreading around cash in Congress - what it can’t win in the JetBlue-Spirit merger proceeding. As a reminder, internal documents say this merger raises airfares by up to 40% overnight, so Correa and Massie are working hard to raise airline ticket prices.

The Massie-Correa amendment failed, with mostly Democrats against it. But a handful of Democrats who did vote for it - in addition to Correa, Rep.’s Lofgren (D-CA), Meeks (D-NY), Morelle (D-NY), and Panetta (D-CA) also voted to promote airline concentration - should have to answer for why. Correa is a particularly odd case and has attracted a lot of scrutiny for parroting big tech talking points, despite his district being near Los Angeles. Lofgren, from Silicon Valley, is also important, since she could take over the leading slot on the Democratic side of the Judiciary Committee if the current chair, Jerry Nadler, retires.

In other words, most, though not all, House Republicans seem out of touch with their own base on antitrust and monopoly issues. A whopping 206 House Republicans, many of whom represent “flyover states” most harmed by airline concentration, voted to block the Department of Transportation from investigating higher airfares and worsening airline service. So, even though 70% of the Republican base wants monopolies to be held accountable, only 13 House R’s - including Rep. Matt Gaetz (R-FL) and outgoing Rep. Ken Buck (R-CO) - want the federal government to keep doing so.

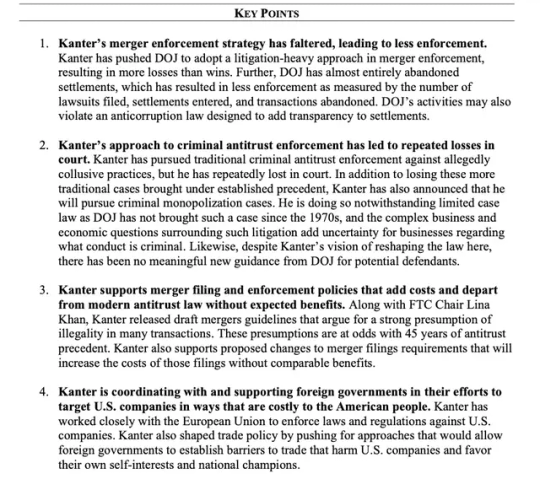

But it’s not just these amendments that matter. Tomorrow at 10am, there’s an antitrust oversight hearing in the Judiciary Committee, which is the main part of the House of Representatives that controls antitrust law. The Chair of that committee, Jim Jordan, is hostile to the anti-monopoly project, and the main witness is Antitrust Division chief Jonathan Kanter, who Jordan wants to rake over the coals for his aggressive attempts to go after big tech. I got a copy of the memo that Jordan’s staff prepared, and it reads a lot like it was written by lawyers for big business.

Under Kanter, it reads, antitrust enforcers have “pursued costly policy changes that harm American businesses and empower foreign governments.” This memo attacks the proposed merger guidelines that conservative Zywicki praised, and generally argues that antitrust enforcers are both losers who can’t do anything right, and also all powerful policymakers who block too much economic activity. Basically, it’s the old Yiddish joke about a restaurant. The food is terrible, and the portions are too small!

How much does this Congressional noise matter? Well the hope is this stuff is just a lagging indicator, and that House Republicans will catch up to their voters. It’s worth highlighting that none of the amendments will make it into law. The underlying funding bills were never brought to the House floor because of disarray among Republicans. And even if they did pass the House, the Senate would likely reject most of these amendments, with the possible exception of the auto dealer one. After all, there’s substantial support in many parts of Congress for stronger antitrust action.

However, there’s a catch. These proposals are a possible indication of what monopolists hope they can get done next Congress, if the elections go the way they want. I think that’s unlikely, since there are important Republicans in the Senate who are supportive of antitrust, but it’s possible.

Perhaps more importantly, these amendments and hearings are also an indication that members of Congress do not think voters will notice their choices that affect their constituents. All that said, the juxtaposition of very popular antitrust with ham-fisted efforts to weaken antitrust provides fertile terrain for doing some brute politics.

Another way to think about this is that establishment politicians like Rep. Fitzgerald are out of touch with actual voters. Fitzgerald is from a pretty red district in Wisconsin, a state that narrowly voted for Biden in 2020. Given where most Republican and Trump voters are on issues of corporate power, the attack ads write themselves: Establishment Republicans want you to pay more for groceries, healthcare, and travel, and are perfectly fine letting monopoly corporations make decisions about your daily life.

That kind of ad could be done in a Republican primary, or a general election. They could also be used in Democratic primaries, or general elections. It really does not matter. The point is, right now, lower prices are the top priority for over two-thirds of voters. Yet, most voters haven’t heard about what antitrust enforcers are doing. So while it sounds politically insane to propose knee-capping rules that would bring prices down, it will only be problematic if voters hear about it. As we saw above, Senator Jon Tester thinks it’s politically salient enough to bring up. It won’t take much more for big business to be on the ballot in 2024.

The pro-monopoly world is hoping that doesn’t happen, and they can keep these conflicts as quiet as possible. Unfortunately for them, people really do like complaining about Ticketmaster.

3 notes

·

View notes

Text

🔗 Antitrust Enforcers Block the JetBlue-Spirit Merger

… earlier this year for sure and still I wonder how this gets blocked when Hawaiian and Alaska just merge without so much as a by your leave.

0 notes

Text

Spirit Airlines Files for Bankruptcy: A Look at the Impact and Future Prospects

In this article, we explore Spirit Airlines' Chapter 11 bankruptcy filing, diving into the reasons behind it, including the failed JetBlue merger and engine issues.

Spirit Airlines, a pioneer in budget-friendly air travel, has filed for Chapter 11 bankruptcy protection. Known for its ultra-low-cost model and iconic bright yellow planes, Spirit Airlines has recently faced a series of setbacks, from a failed merger with JetBlue to engine-related issues. These challenges, coupled with a high debt burden, led Spirit to seek bankruptcy protection as it…

#chapter 11 bankruptcy#save stock#spirit#spirit airlines#spirit airlines bankruptcy#spirit airlines stock#spirit bankruptcies#spirit bankruptcy filing#spirit stock

1 note

·

View note

Text

Spirit Airlines Files for Bankruptcy

The low-fare carrier has struggled to find its footing after its planned merger with JetBlue was blocked by a federal judge. Source: New York Times Spirit Airlines Files for Bankruptcy

0 notes

Text

Boeing, Spirit and Jetblue, a monopoly horror-story

Catch me in Miami! I'll be at Books and Books in Coral Gables TONIGHT (Jan 22) at 8PM. Berliners: Otherland has added a second date (Jan 28) for my book-talk after the first one sold out - book now!

Last week, William Young, an 82 year old federal judge appointed by Ronald Reagan, blocked the merger of Spirit Airlines and Jetblue. It was a seismic event:

https://storage.courtlistener.com/recap/gov.uscourts.mad.254267/gov.uscourts.mad.254267.461.0_6.pdf

Seismic because the judge's opinion is full of rhetoric associated with the surging antitrust revival, sneeringly dismissed by corporate apologists as "hipster antitrust." Young called America's airlines and "oligopoly," a situation he blamed on out-of-control mergers. As Matt Stoller writes, this is the first airline merger to be blocked by the DOJ and DOT since deregulation in 1978:

https://www.thebignewsletter.com/p/antitrust-enforcers-block-the-jetblue

The judge wasn't shy about why he was reviving a pre-Jimmy Carter theory of antitrust: "[the merger] does violence to the core principle of antitrust law, 'to protect] markets –- and its market participants — from anticompetitive harm."

The legal arguments the judge advances are fascinating and worthy of study:

https://twitter.com/johnmarknewman/status/1747343447227519122

But what really caught my eye was David Dayen's American Prospect article about the judge's commentary on the state of the aviation industry:

https://prospect.org/infrastructure/transportation/01-19-2024-how-boeing-ruined-the-jetblue-spirit-merger/

Why, after all, have Spirit and Jetblue been so ardent in pursuing mergers? Jetblue has had two failed merger attempts with Virgin, and this is the third time they've failed in an attempt to merge with Spirit. Spirit, meanwhile, just lost a bid to merge with Frontier. Why are these two airlines so obsessed with combining with each other or any other airline that will have them?

As Dayen explains, it's because US aviation has been consumed by monopoly, hollowed out to the point of near collapse, thanks to neoliberal policies at every part of the aviation supply-chain. For one thing, there's just not enough pilots, nor enough air-traffic controllers (recall that Reagan's first major act in office was to destroy the air traffic controller's union).

But even more importantly, there are no more planes. Boeing's waitlist for airplane delivery stretches to 2029. And Boeing is about to deliver a lot fewer planes, thanks to its disastrous corner-cutting, which grounded a vast global fleet of 737 Max aircraft (again):

https://prospect.org/infrastructure/transportation/2024-01-09-boeing-737-max-financial-mindset/

The 737 disaster(s) epitomize the problems of inbred, merger-obsessed capitalism. As Luke Goldstein wrote, the rampant defects in Boeing's products can be traced to the decision to approve Boeing's 1997 merger with McDonnell-Douglas, a company helmed by Jack Welch proteges, notorious for cost-cutting at the expense of reliability:

https://prospect.org/infrastructure/transportation/2024-01-09-boeing-737-max-financial-mindset/

Boeing veterans describe the merger as the victory of the bean-counters, which led to a company that chases short-term profits over safety and even the viability of its business:

https://www.airliners.net/forum/viewtopic.php?t=213075

After all, the merger turned Boeing into the single largest exporter in America, a company far too big to fail, teeing up tens of billions from Uncle Sucker, who also account for 40% of Boeing's income:

https://www.thebignewsletter.com/p/its-time-to-nationalize-and-then

The US government is full of ex-Boeing execs, just as Boeing's executive row is full of ex-US federal aviation regulators. Bill Clinton's administration oversaw the creation of Boeing's monopoly in the 1990s, but it was the GOP that rescued Boeing the first time the 737 Maxes started dropping out of the sky.

Boeing's biggest competitor is the state-owned Airbus, a joint venture whose major partners are the governments of France, Spain and Germany – governments that are at least theoretically capable of thinking about the public good, not short-term profits. Boeing's largest equity stakes are held by the Vanguard Group, Vanguard Group subfiler, Newport Trust Company, and State Street Corporation:

https://prospect.org/blogs-and-newsletters/tap/2024-01-18-airbus-advantage/

As Matt Stoller says, America has an airline that the public bails out, protects, and subsidizes but has no say over. Boeing has all the costs of public ownership and none of the advantages. It's the epitome of privatized gains and socialized losses.

This is Reagan's other legacy, besides the disastrous shortage of air-traffic controllers. The religious belief in deregulation – especially deregulation of antitrust enforcement – leads to a deregulated market. It leads to a market that is regulated by monopolists who secretly deliberate, behind closed board-room doors, and are accountable only to their shareholders. These private regulators are unlike government regulators, who are at least nominally bound by obligations to transparency and public accountability. But they share on thing in common with those public regulators: when they fuck up, the public has to pay for their mistakes.

It's a good thing Boeing's executives are too big to fail, because they fail constantly. Boeing execs who are warned by subcontractors of dangerous defects in their planes order those subcontractors to lie, or lose their contracts:

https://www.levernews.com/boeing-supplier-ignored-warnings-of-excessive-amount-of-defects-former-employees-allege/

As a result of Boeing's mismanagement, America's only aircraft supplier steadily has lost ground to Airbus, which today enjoys a 2:1 advantage over Boeing. But it's not just Boeing that's the weak link aviation. US aviation is a chain entirely composed of weak links.

Take jet engines: Pratt & Whitney are Spirit's major engine supplier, but these engines suck as much as Boeing's fuselages. Much of Spirit's fleet is chronically grounded because the engines don't run. The reason Spirit buys its engines from those loveable goofballs at Pratt & Whitney? The Big Four airlines have bought all the engines for sale from other suppliers, leaving smaller airlines to buy their engines from fat-fingered incompetents.

This is why – as Dayen notes – smaller US airlines are so horny for intermarriage. They can't grow by adding routes, because there are no pilots. Even if they could get pilots, there'd be no slots because there are no air traffic controllers. But even if they could get pilots and slots, there are no planes, because Boeing sucks and Airbus can't make planes fast enough to supply the airlines that don't trust Boeing. And even if they could get aircraft, there are no engines because the Big Four aviation cartel cornered the market on working jet engines.

Part of Jetblue and Spirit's pitch was that they hand off the routes that they'd cut after their merger to other small airlines, like Frontier and Allegiant. But Frontier and Allegiant can't service those routes: they don't have pilots, slots, planes or engines.

Spirit hasn't been profitable since 2019 and is sitting on $4b in debt. Jetblue was proposing to finance its acquisition with another $3.5b in debt. The resulting airline could only be profitable by sharply cutting routes and massively raising prices, cutting 6.1m seats/year. With a debt:capital ratio of 111%, the company would have no slack and would need a bailout any time anything went wrong. Not coincidentally, the Big Four airlines also have debt:capital ratios of about 100-120%, and they do get bailouts ever time anything goes wrong.

As William McGee reminds us, it's been 14 years since anyone's started a new US airline:

https://twitter.com/WilliamJMcGee/status/1747363491445375072

US aviation is deeply cursed. But Boeing's self-disassembling aircraft show us why we can't fix it by allowing mergers: private monopolies, shorn of the discipline of competition and regulation, are extraction machines that turn viable businesses into debt-wracked zombies.

This is a subject that's beautifully illustrated in Dayen's 2020 book Monopolized, in the chapter on health care:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

The US health care system has been in trouble for a long time, but the current nightmare starts with the deregulation of pharma. Pharma companies interbred with one another in a string of incestuous marriages that produced these dysfunctional behemoths that were far better at shifting research costs to governments and squeezing customers than they were at making drugs. The pharma giants gouged hospitals for their products, and in response, hospitals underwent their own cousin-fucking merger orgy, producing regional monopolies that were powerful enough to resist pharma's price-hikes. But in growing large enough to resist pharma profiteering, the hospitals also became powerful enough to screw over insurers. Insurers then drained their own gene pool by combining with one another until most of us have three or fewer insurers we can sign up with – companies that are both big enough to refuse hospital price-hikes, and to hike premiums on us.

Thus monopoly begets monopoly: with health sewn up by monopolies in medical tech, drugs, pharmacy benefit managers, insurance, and hospitals, the only easy targets for goosing profits are people:

https://pluralistic.net/2022/01/05/hillrom/#baxter-international

This is how you get a US medical system that costs more than any other rich nation's system to operate, delivers worse outcomes than those other systems, and treats medical workers worse than any other wealthy country.

Now, rich people can still buy their way out of this mess, but you have to be very rich indeed to buy your way out of the commercial aviation system. There's a lot of 1%ers who fly commercial, and they're feeling the squeeze – and there's no way they're leasing their own jets.

Stein's Law holds that "anything that can't go on forever will eventually stop." America's aviation mergers – in airlines, aircraft and engines – have hollowed out the system. The powerful, brittle companies that control aviation have so much power over their workforce that they've turned air traffic controller and pilot into jobs that no one wants – and they used their bailout money to buy out the most senior staff's contracts, sending them to early retirement.

Now, I'm with the people who say that most of US aviation should be replaced with high-speed rail, but that's not why our technocrats and finance barons have gutted aviation. They did it to make a quick buck. A lot of quick bucks. Now the system is literally falling to pieces in midair. Now the system is literally on fire:

https://www.nytimes.com/2024/01/19/us/miami-boeing-plane-engine-fire.html

Which is how you get a Reagan appointed federal judge issuing an opinion that has me punching the air and shouting, "Yes, comrade! To the barricades!" Anything that can't go on forever will eventually stop. When the system is falling to pieces around you, ideology disintegrates like a 737 Max.

I'm Kickstarting the audiobook for The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/21/anything-that-cant-go-on-forever/#will-eventually-stop

Image: Vitaly Druchenok (modified) https://commons.wikimedia.org/wiki/File:ECAir_Boeing_737-306_at_Brazzaville_Airport_by_Vitaly_Druchenok.jpg

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

--

Joe Ravi (modified) https://commons.wikimedia.org/wiki/File:Panorama_of_United_States_Supreme_Court_Building_at_Dusk.jpg

CC BY-SA 3.0 https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#aviation#antitrust#monopoly#boeing#jetblue#spirit airlines#oligopoly#air traffic controllers#airbus#steins law

251 notes

·

View notes

Text

A federal judge Tuesday blocked JetBlue Airways’ purchase of Spirit Airlines after the Justice Department sued to stop the merger, saying the deal would drive up fares for price-sensitive consumers by taking the discount carrier out of the market. JetBlue’s proposed $3.8 billion purchase of discounter Spirit would have produced the country’s fifth-largest airline, a deal the carriers had said would help them better grow and compete against larger rivals like Delta and United. “JetBlue plans to convert Spirit’s planes to the JetBlue layout and charge JetBlue’s higher average fares to its customers,” U.S. District Court Judge William Young wrote in his decision. “The elimination of Spirit would harm cost-conscious travelers who rely on Spirit’s low fares.” The decision, handed down Tuesday, marks a victory for a Justice Department that has aggressively sought to block deals it views as anti-competitive. “Today’s ruling is a victory for tens of millions of travelers who would have faced higher fares and fewer choices had the proposed merger between JetBlue and Spirit been allowed to move forward,” Attorney General Merrick Garland said in a statement. “The Justice Department will continue to vigorously enforce the nation’s antitrust laws to protect American consumers.”

8 notes

·

View notes

Text

11/9/24 - White House

News I can find by department:

Department of State - Secretary Blinken wishes Cambodia a happy 71st Independence Day

Department of Justice - First Circuit of Appeals backs antitrust lawsuit against American Airlines/JetBlue merger - DoJ has filed a lawsuit against the State Senate of Mississippi for discriminating against staff via pay - Venezuelan subsidiary company to pay $85M fine for bribing Venezuelan officials to gain illegal U.S. dollars - A pharmacist has been convicted for healthcare fraud - Roofing business owners plead 'Guilty' for not paying employment taxes to the IRS - A number of hitmen connect to the Iranian Government have been charged - Operator of Crypto "Mixer" sentenced for Money Laundering

Department of Commerce - Investments into "Corning" and "Powerex" to increase domestic manufacturing of semiconductors

Department of Labor - Announcement from OSHA that workplace injuries in 2023 was lowest since 2003

Department of HaUD - City of Denver, Colorodo settles case against them over disability discrimination

Department of Transportation - $43M in Emergency Relief to Hurricane Helene damage

Department of Energy - 400M barrels of petroleum secured

#executive branch#us politics#department of state#department of justice#department of commerce#department of labor#department of housing and urban development#department of transportation#department of energy#antitrust#semiconductor

0 notes

Link

0 notes

Text

Book cheap flight tickets and hotels- https://trailtravelz.com/

The Best Airlines for In-Flight Wi-Fi

In today's hyper-connected world, staying connected while traveling has become more than just a convenience—it's often a necessity. For frequent flyers and digital nomads alike, access to reliable in-flight Wi-Fi can make a significant difference in productivity and overall travel experience. As airlines compete to attract tech-savvy passengers, the quality and availability of in-flight Wi-Fi have become key factors in choosing which airline to fly with. In this essay, we explore some of the leading airlines that excel in providing excellent in-flight Wi-Fi services, ensuring that passengers can stay connected at all times.

1. Delta Air Lines

Delta Air Lines has consistently been at the forefront of in-flight connectivity, offering one of the most robust Wi-Fi experiences among major carriers. Delta uses Gogo Inflight Internet on most of its domestic flights, providing reliable and high-speed internet access throughout the journey. They offer different pricing tiers depending on the speed required, ensuring that passengers can choose a plan that suits their needs. Delta has also been expanding its international Wi-Fi coverage, making it a preferred choice for travelers who need to stay connected across continents.

2. JetBlue Airways

JetBlue is renowned for its commitment to providing free high-speed Wi-Fi on all its flights. Known as "Fly-Fi," JetBlue's service ensures that passengers can browse the web, stream videos, and stay connected to social media platforms without any additional cost. This commitment to free Wi-Fi has made JetBlue a favorite among budget-conscious travelers and digital nomads who rely on staying connected throughout their journey.

3. Emirates

Emirates Airlines has set a benchmark in providing top-notch in-flight amenities, including Wi-Fi services. Emirates offers Wi-Fi on nearly all of its flights, with the first 20MB provided for free. Passengers can then choose from reasonably priced data plans for additional usage. The airline uses advanced satellite technology to ensure consistent coverage, even on long-haul flights across multiple continents. Emirates' Wi-Fi services are particularly popular among business travelers who require reliable connectivity for work purposes.

4. Singapore Airlines

Singapore Airlines is renowned for its exceptional service and has extended its commitment to quality with robust in-flight Wi-Fi options. The airline provides Wi-Fi on its A380, A350, and selected B777 aircraft, ensuring that passengers can stay connected on most of its long-haul flights. Singapore Airlines offers various data plans to suit different needs, from basic messaging to full internet browsing and streaming services. Their reliable connectivity and customer-focused approach make them a preferred choice for travelers flying to and from Asia.

5. Virgin America (now part of Alaska Airlines)

Virgin America, known for its innovative approach to air travel, offered high-quality Wi-Fi services that have continued under Alaska Airlines since their merger. Alaska Airlines now provides satellite-based Wi-Fi on its mainline fleet, ensuring broad coverage across its extensive domestic network. The airline offers both hourly and full-flight pricing options, accommodating passengers who need connectivity for short or extended periods. Alaska Airlines' commitment to maintaining and improving Wi-Fi quality reflects its understanding of the importance of connectivity to modern travelers.

6. Qatar Airways

Qatar Airways is another airline that has invested heavily in providing seamless in-flight Wi-Fi experiences. The airline offers Wi-Fi on its A380, A350, and B787 aircraft, ensuring comprehensive coverage on its long-haul routes. Qatar Airways provides passengers with complimentary access to the first 100MB of data and offers reasonably priced plans for additional usage. This makes Qatar Airways a preferred choice for travelers flying between continents who value staying connected throughout their journey.

Conclusion

As the demand for in-flight connectivity continues to grow, airlines are increasingly investing in improving their Wi-Fi services to meet the expectations of modern travelers. The airlines mentioned above stand out for their commitment to providing reliable, high-speed Wi-Fi that enables passengers to stay productive and entertained during their flights. Whether you prioritize free Wi-Fi, extensive coverage, or high-speed connectivity, these airlines offer options that cater to various needs and preferences.

In conclusion, when choosing an airline for your next journey, consider not only the destination and price but also the quality of in-flight Wi-Fi offered. Staying connected in the air is easier and more enjoyable with airlines that prioritize and invest in excellent Wi-Fi services.

SEO Tags:

#AirlinesWifi, #InFlightConnectivity, #DeltaAirlines, #JetBlue, #Emirates, #SingaporeAirlines, #AlaskaAirlines, #QatarAirways, #TravelTech, #BusinessTravel

0 notes