#JLL//2000s

Explore tagged Tumblr posts

Text

Jerry Lee Lewis! Through the '50s, '60s, '70s, '80s, '90s, 2000s, 2010s, and 2020s. [ 12 Days of Christmas 1 / 12. ]

I wasn't sad for Jerry Lee when hearing of his passing. For his family, yes. For him, no. He accomplished more than some ever will, let alone what was expected of him. He lived a long life, that alone is an accomplishment and should be celebrated. So, what better way to celebrate his memory than on Christmas? Here's to you, Killer.

#Jerry Lee Lewis#Sun//JLL#JLL//50s#JLL//60s#JLL//70s#JLL//80s#JLL//90s#JLL//2000s#JLL//2010s#JLL//2020s#JLL//Edits#12 Days of Christmas#//MyPosts#Rock and Roll#Rockabilly#Country

3 notes

·

View notes

Text

Some more coherent thoughts about Gotham War, now it's settled on me.

(Spoilers below cut, for length and as it's still only Wednesday)

It's not a huge surprise, but Selina's whole 'train henches to steal from the rich non-violently!' ended up being a complete side issue that only existed to get the plot moving. Nobody's conception of this plot, in two years time, will really include this detail, despite the thousands of words spent arguing how ridiculous it was.

Yes it remains a poorly thought out plan on Selina's part (she's never heard of earning money legally) but the narrative also frames it as long term ineffective from the very first issue and knocks it down on multiple occasions.

DC editorial definitely tried to dress this up as a full family event, but realistically it was a Bruce, Selina and Jason event, written by their three current writers, with solid bit parts played by Tim and Dick.

Vandal Savage remains ridiculous and ready to sacrifice anyone and I appreciate that about him. As a villain he was just the right level of stakes for this event.

I enjoyed getting to see Scandal, even if her fans would say she got done dirty here. Scandal usually has enough sense not to believe anything Vandal says, and I admit I was somewhat waiting for some level of twist here as to why Scandal was all for immortality at this point in time, but it never came.

I still agree it felt a lot like three separate plotlines intersecting, but I think they managed to land the event successfully (while leaving some nice loose threads). I actually appreciate they didn't overreach in their goals.

It still finished out with two separate plotlines: Bruce and Selina and Jason; and Dick and Tim and the rest of the family. Structurally this again reminded me as much of Resurrection of Ra's Al Ghul as Batman #138 did; the main plot and then the far more interesting Dick & Tim sideplot which is what I go back to reread. (Chip Zdarsky is clearly also a fan)

Also promisingly for an event yes, it did actually shake up the status quo and push the participants off in new directions.

So Bruce is now doing the Loner Batman thing (in that he's locked out of the fam computers/comm lines), Selina is officially 'dead' (what is with all these fake dead people with titles, Penguin is too right now), and Jason has what's effectively permanent fear toxin response to stressful situations. Also, apparently, we are getting Dick and Barbara back 'running' the Batfam while Bruce is on the outs.

As far as Bruce goes, what has been really notable in this event is how much Chip Zdarsky loves early 2000s Bat comics and their dynamics, and particularly Joker's Last Laugh. There's a lot of structural things about how this event was shaped, what specific characters did, and emotional beats that feel very JLL as someone who's read it at least half a dozen times. It's not the only influence, but it's a pretty prominent one.

Bruce ending the event in a position where he's effectively not working with most of the other Bats actually tracks reasonably well over to Batman & Robin, to my surprise. It makes sense that it's just Bruce and Damian and they're focusing on homelife and domestic relationship details between the two. It gives Bruce an excuse for why he's closely focused on Damian there.

I will admit I have not been reading Catwoman, but from the event it seems they're spinning her off to keep moving her back into a more antihero position. Tini Howard clearly has a direction she wants to take Selina.

I actually think this has pretty interesting storytelling potential for Jason. It means that he has to stay calm, or has to overcome his own fear to achieve things. It gives him a goal? Matthew Rosenberg clearly seems interested in using it for his Jason storytelling and he's got Jason right now, so...

I'm personally delighted by how much Tim Zdarsky wrote into this storyline. He used the space more to show off Dick and Tim's brotherhood and what Tim is good at, rather than push the Tim side of the Zur story we're all expecting to occur (there's that waiting Zur-Robin costume). Means he's planning it for Batman as a title itself rather than getting it tangled up here.

"It was the only way to become the second-best Robin". Yes, this is Tim getting to show off his core competencies - he probably is the only Bat other than Bruce who would have extensively studied all the trophies. Dick would remember a lot of them simply because a lot of the trophies are from old adventures, but pretty much all the others are not particularly retrospective, respect the past sort of members of the group, while Tim has always been surrounded by the shadows of the past. I loved this note.

I haven't talked about Babs yet! She's in green, in glasses, sitting down at her computers with a novelty mug, directing everyone, answering to Oracle. That's her! That's my Oracle!

I do think Bruce expecting Dick to take over running the Batfam right now is a big ask, given he's also running the Titans as the main superhero team on the planet and handling Bludhaven, but Tom Taylor's writing both those books so I don't expect to see the stress catching up with Dick there. Benefits of writer choice right now, I guess. Also personally 'Babs and Dick organise everyone while Bruce has a breakdown elsewhere' is one of my favourite Batfam dynamics so you know, I'm pretty excited if we actually get to see this play out.

New Lazarus Pit in Gotham! This won't be a problem at all.

81 notes

·

View notes

Text

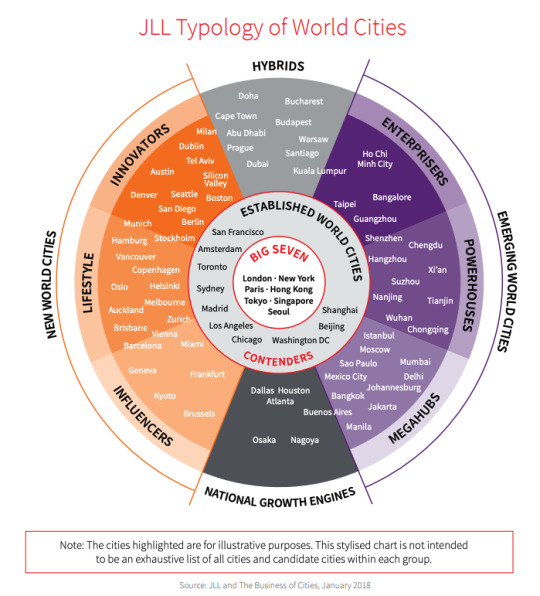

A new typology of cities

Earlier in the week, my friend Rodney Wilts of Theia Partners sent me a JLL report called, World Cities: Mapping the Pathways to Success. I am admittedly only getting around to it now.

The report proposes a new typology of world cities that looks like this:

It is based on 10 overall categories of cities, grouped into 4 main buckets. The first bucket is “Established World Cities”, within which there is the “Big Seven”, and then the “Contenders.”

The Real Estate Highlights that accompany each category of city is a good place to start if you’re looking to do a quick scan of the report.

Here’s a taste:

One-quarter of all capital invested in commercial real estate globally currently lands in one of the “Big Seven” cities. And London and New York are easily at the top.

Cities that recently graduated from “New World City” status -- namely Toronto, San Francisco, Sydney, and Amsterdam -- are all struggling to address housing and infrastructure deficits.

“Lifestyle” cities -- such as Vancouver, Auckland, and Oslo -- are some of the most active investment markets. Biggest rental growth for prime offices (since 2000) in the “New World Cities” category.

Click here for the full report.

#jll#theia partners#world cities#a new typology of cities#city typology#vancouver#auckland#oslo#new world cities#toronto#san francisco#sydney#amsterdam

14 notes

·

View notes

Text

Nomination | Guillaume Canciani, Directeur du développement et de la maîtrise d'ouvrage chez Vicartem

Nomination | Guillaume Canciani, Directeur du développement et de la maîtrise d’ouvrage chez Vicartem

Après 12 années passées chez JLL France (2006-2018 • nommé, à partir de 2015, ‘Director Consulting & Project Management’) puis 4 années à superviser le développement France chez Chelsfield , Guillaume Canciani (ESTP 2002, HEC Paris Ms 2003) rejoint Vicartem et son Directeur Général délégué, Romain Gowhari. Le groupe fondé en 2000 par Céline et Sébastien MESLIN s’adjoint ainsi les compétences de…

View On WordPress

0 notes

Text

Where are the Best Places to Invest in UK Property in 2019?

2019 is finally upon us and with the uncertainty surrounding Brexit, many are apprehensive about investing in the UK property market. We believe that there is still opportunity to be had, if you know where to look. Read on to find out where we think the best places to invest in UK property in 2019 are

With Britain’s impending exit from the European Union, many investors both home and abroad have apprehensions about investing in property in the UK. Surveyors in September 2018 gave their lowest forecast for house prices in three- and twelve-months’ time, and Mark Carney warned that a “no-deal” Brexit could shave up to 35% off house prices.

The effect that Brexit has had so far on the UK housing market seems to be confined to London and high value properties over £2m. The fear of Brexit is heightened across these markets mainly because the financial commitment is so much higher. Across the country, average house prices have continued to rise – mainly propelled by regional markets. It is also worth noting that as the pound continues to fall relative to other currencies, it is then more attractive for overseas buyers to invest in property, thus buoying demand and helping to keep house prices afloat.

The threat of a “no deal” Brexit and measures put in place to stockpile goods

With the possibility of a no-deal Brexit on the table, companies are taking measures to avoid disruption to their supply chains and have started stockpiling goods. Several companies have already admitted to doing so, including Rolls Royce, Topps Tiles and the food group Nestle. Even without the possible impact Brexit would have, as consumers want goods almost instantaneously companies that sell online have been buying up shed space for storage.

Demand for UK industrial real estate remains strong. Distribution units and multi-let portfolios have continued to perform well as volumes hit £3.6bn which is roughly 13% of all commercial investment activity in the UK according to data from JLL. Strong demand has been underpinned by the positive market conditions and popularity of ecommerce.

These warehouses are mainly located in the midlands as it makes sense to be able to access all parts of the United Kingdom with ease. Amazon for example currently has 13 warehouses in the UK, including one in Coalville, one in Daventry and one in Milton Keynes. Another such example is Panattoni Park, where more than 1.6 million sq. ft of industrial and warehouse units available in Q4 of 2019 will be developed close to Northampton. Industrial units are also planned for the green belt around Coventry Airport, which will also include foot and cycle paths and a community park.

With the increase in warehouse activity, it makes sense that as they expand, they are looking for new recruits. This makes property in certain midlands towns such as Northampton and Leicester in the east and Coventry in the west more appealing.

Northampton

Currently Northampton is one of the best places to invest in UK property and this is proven by homes in the town selling on average in 33 days, making it one of the quickest in the country for house sales. This indicates a high demand – possibly from those who are moving to the area for work. This has led to house prices in Northampton rising by 5.3% in the year to October 2018 – a larger increase than the national average.

Leicester

Another place in the midlands which has seen and is expected to see more growth is Leicester. Leicester bucked the trend for house price fall reporting the best year-on-year growth for property prices in any large UK city and has also been named the best city in the UK to invest in property according to Hometracks Cities House price index.

Property prices in Leicester have increased by over 250% since 2000, and with its ideal midland location and promised future regeneration and investment of £3bn, Leicester will only become a more attractive option for property investment. We tip Leicester to be a property hotspot in 2019 as London can be reached in just over an hour, and Birmingham is just under an hour away by train making it convenient for those who commute into work.

Warrington

Situated between the cities of Liverpool and Manchester, Warrington is another place that is worth considering with regards to property investment in the UK. An Amazon warehouse is in the town, and Omega have revealed plans to build 758,000sq ft of speculative warehousing. With the promise of new warehousing space, new jobs will be created, and employees will be looking for somewhere to live. This could be an ideal time to invest in property in Warrington, to accommodate those employees who might rent initially but settle and choose to buy – which could create a good level of capital uplift.

Many are considering Warrington for an investment property over nearby Liverpool and Manchester due to the more accessible housing market as well as house prices in the town being considerably lower than its big city neighbors. This makes Warrington a great location to buy a house in 2019, especially for young professionals working in the cities or those looking to start a family.

Coventry

Coventry is one of the best places in the UK in terms of house price growth. Since the turn of the century house prices in Coventry have risen by over 250%, and it was the only town or city in the west midlands to make the list according to HouseSimple.

Coventry also offers landlords excellent rental yields – some of the highest in the country thus making it one of the best buy-to-let areas in the UK. Average net rental yield excluding tax is around 5.40%, and only 5 other places in the UK come ahead of it according to Private Finance. The excellent yields are complimented by great occupancy rates especially by students as the City has a two extremely popular Universities which have a combined enrolment of over 50,000 students.

Halifax

Yorkshire is a well-located county and as a result, it is home to many distribution centres. Many corporations such as Aldi, Lidl, John Lewis, Morrisons and DPD have distribution centres set in Yorkshire.

Halifax was recently named by LendInvest as one of the best places to invest in property for buy to let. This is in part due to the number of businesses operating in the area, including McVities and Nestle, and its proximity to the distribution centres. This combined with affordable housing is why many people decide to lay down roots in the town, as the average house price in Halifax is £149,925. This is cheaper than nearby Northowram, Hipperholme and Shelf, making it an attractive alternative to workers who are priced out of the surrounding areas.

Halifax also has superb connections. It is situated just 30 minutes away from the Peak District and trains run to Leeds every 15 minutes and Manchester every 30 minutes. It is also just a 15-minute train ride away from Bradford and Hebden Bridge. This makes it a convenient choice for those who commute to work but want affordable accommodation.

One opportunity to invest in the Halifax buy to let market is in the H1 development. H1 is in the popular West Parade area and the town centre is just a short walk away. The development is a contemporary collection of one-bedroom apartments starting at £66,995. Features include anti-slip vinyl flooring and built in appliances. What makes this development particularly attractive is how affordable the apartments are. Priced under £70,000, there is a flexible payment plan in place which means that £1,814.45 can be paid monthly for 24 months and then there are three years to pay the balance after completion. A gross rental yield of 8% is predicted per annum.

Last-mile logistics and how that affects real estate in surrounding towns

The last mile is often referred to the last step in the delivery chain before goods arrive with the consumer. As people are wanting their goods delivered quickly and efficiently, companies are shifting their focus to the last mile and targeting sites close to urban areas. With good access to the M25, Essex is convenient for distributing goods to outlets along the perimeter of the capital. Next PLC has already announced plans to buy land near Waltham Abbey and Amazon has a warehouse in Tilbury – both in Essex.

The emergence of last mile warehouses close to urban areas will bring jobs. As living in cities can be expensive, some may choose to live closer to where they work, and as demand rises this will catapult the popularity of the surrounding area.

Colchester

One Essex town that has experienced phenomenal property growth is Colchester. The town is one of the best places to buy a house in the UK as it has great transport links, schools and amenities. In the last three years, prices have increased by on average £55,000 according to Housesimple.com. LendInvest also carried out research and ranked Colchester as the best place for a buy to let investment when it considered factors such as capital growth, rental yield and rental price growth.

The struggle of the high street and plans to stimulate growth

Other places that may be up for consideration for property investment include those which are due to experience town and city centre regeneration. It should be of no surprise to learn that the high street has been struggling for a while. Debenhams has announced branch closures, as have House of Fraser. Re-negotiating leases with landlords has become common and made retail investing unattractive since the folding of BHS.

Intu, a British Real Estate Investment Trust which focussed on shopping centre management and development has faced troubles with regards to profitability of the centres. A £2.8bn takeover bid was launched by the Peel Group and, even though it fell through, it highlights the struggle of the high street as consumers switch to making online purchases.

Plans have been put in place to stimulate growth in the high street and rejuvenate areas which are not doing so well. Philip Hammond proposed plans in the Budget to save the high street by cutting business rates of retailers with a rateable value of £51,000 or less by a third from April 2019. He also slapped a 2% digital services tax on large digital firms with a turnover of more than £500m to hopefully ease competition. The chancellor also committed to a new Future High Streets Fund, where councils can redevelop abandoned and underused retail and commercial space into residential units. A partner in Cushman & Wakefield, Ian Anderson said of the scheme “the government is right to use planning policy to bring more employment and residential uses to our high streets, which can no longer afford to be so dependent on retail.”

Milton Keynes

This will help revitalise towns such as Milton Keynes where the town centre is largely dominated by its shopping centre. Recently the go-ahead was given to start work on one of the most significant retail and leisure developments in central Milton Keynes in over a decade. The development will include a boutique cinema, a dining area, new shops and public spaces. Certain spots will be redeveloped to improve the ambience and make them more welcoming. New landscaped areas and public spaces will give families and employees in the area a nice spot to relax and spend their lunch breaks.

Milton Keynes has always performed well when it comes to house price growth and there are no signs of it slowing in 2019. According to Hometrack, Milton Keynes comes in the top ten of places where house prices are rising the fastest. Now could be a good time to invest for those looking for good levels of capital uplift, as house prices will only increase once the rejuvenation work has been completed.

Edinburgh

Although Edinburgh’s high street may not be ailing, it is also undergoing a certain level of city centre regeneration. One such example is an £850m new Edinburgh St James project, which will comprise 850,000 square feet of retail space centred around a luxury hotel.

Edinburgh’s economy was one of the fastest growing in the UK last year and these fundamentals have had a positive effect on its desirability. The picturesque Scottish capital ranked top in a new study commissioned by the Royal Mail into the best places to live and work in the UK, due to its vast green spaces and access to education and healthcare. Other factors include its cultural offerings such as libraries and theatres, job opportunities and business activity.

The appeal of living in Edinburgh has not gone unnoticed. Property prices in the Scottish capital have risen by 7.70% between January 17 and January 18 and research by Hometrack has predicted that they will continue to rise by 30% by 2022.

Property investment in London is still viable – if one knows where to look

Although London house prices are expected to be most affected by Britain’s exit from the EU, there are still pockets of London that could prove profitable for property investment – if one knows where to look.

Leytonstone (London Borough of Waltham Forest)

North east London has been touted by almost a third of landlords as being the best place to invest in London property. They especially look for property near underground lines, with the Central line proving the most popular.

Leytonstone is one of London’s up and coming areas and it is situated in the London Borough of Waltham Forest which sits on the Central line on the boundary of zone 3-4. Although Waltham Forest was an Olympic borough and received certain levels of regeneration, it never really hit Leytonstone; but that could all be due to change.

Younger people are increasingly moving to outer boroughs in London due to the fact they can get more space for their money. The increase in desirability has been reflected in house prices, which have increased by 83% over five years in the London borough of Waltham Forest.

Having said this, prices in the borough remain relatively affordable in London terms with an average property price of £462,000, which is below the overall London average of £629,012 for 2018 (according to figures from Rightmove).

For those looking at the best places to invest in property UK 2019, look to the midlands and areas with industrial investment

In conclusion, we are predicting that with the shift from the high street to online, towns and cities close to warehouse distribution centres will grow in popularity. As a result, property prices in these towns and cities will increase as they become more desirable. We recommend the best places to invest in UK property in 2019 to be key towns and cities in the east and west midlands, Colchester, Edinburgh and Milton Keynes. Edinburgh is one of the most desirable places to live in the UK, and its booming economy is attracting more workers to the city, which is reflected in its rising house prices. Places such as Milton Keynes should benefit from Philip Hammond’s new initiative to revitalise high streets, and key towns and cities in the east and west midlands will benefit from the development of new warehouse space.

We predict that these places would be the most lucrative for buy to let investments. Different measurements are used to predict the best places for student accommodation investments, so subscribe to our newsletter to find out if student property investments are still viable and where the top places to consider are.

#Hometracks Cities House Price Index#Halifax Buy to Let#Buy to Let Investments#Student Accommodation Investments

1 note

·

View note

Text

AleaSoft Energy Forecasting: Testigos de la transición energética durante los últimos 22 año

Durante los últimos 22 años, el sistema eléctrico ha pasado a estar dominado por la producción con carbón durante los primeros años, a una participación casi nula de esta tecnología desde el año 2020. En este período se han ido desarrollando nuevas tecnologías, como los ciclos combinados, la cogeneración, la eólica y la solar fotovoltaica, que han ido sustituyendo la producción con carbón. El aporte de las renovables en el año 2000 era de tan solo un 19% y en el año 2020 alcanzó el 47% y las emisiones totales del sector eléctrico se han reducido un 64% entre estos dos años. La nuclear ha proporcionado una potencia base durante todo este tiempo que ha aportado estabilidad al sistema y que demuestra la importancia de que el cierre de estas centrales se haga de forma ordenada para no afectar la transición energética. La hidroeléctrica ha sido otra energía que ha estado presente durante todo este período aportando también un volumen estable de energía “limpia”. La demanda eléctrica se mantuvo creciendo durante los primeros años hasta que se frenó con la llegada de la crisis para luego pasar a un período de mayor estabilidad gracias a la eficiencia energética. A partir de ahora la eólica y la solar fotovoltaica serán las protagonistas del futuro de la transición energética.

AleaSoft Energy Forecasting: Partícipes del futuro de la transición energéticaEn AleaSoft Energy Forecasting tienen como objetivo seguir siendo testigos y partícipes de la transición energética durante los próximos años, ayudando a construir ese futuro con emisiones netas cero junto al resto de empresas del sector de la energía. Para esto, en AleaSoft Energy Forecasting no solo se ofrecen las previsiones de precios de todos los mercados de energía europeos, también se proporciona la plataforma AleaApp para la compilación, visualización y análisis de datos de los mercados, informes sobre distintas temáticas del sector de la energía y se realiza una labor de divulgación sobre los temas de actualidad a través de noticias, talleres y webinars en los que han participado importantes empresas del sector de la energía europeo y global, empresas consultoras y de servicios y entidades financieras, como Deloitte España, PwC, EY, JLL, Vector Renewables, Engie España, Axpo, Banco Sabadell y Triodos Bank.

El próximo webinar de AleaSoft Energy Forecasting se realizará el 11 de noviembre, contando con la participación de ponentes invitados de Engie España. En el webinar se realizará el habitual análisis de la evolución de los mercados de energía europeos durante las últimas semanas, que han estado caracterizadas por la crisis energética mundial, y de la financiación de proyectos de energías renovables.

Para más información, es posible dirigirse al siguiente enlace:

https://periodicoplazamayor.com/

0 notes

Text

latest news

SC ISSUES NOTICE TO STATES OVER REPEATED USE OF SECTION 66A OF IT ACT

The Union Ministry of Home Affairs had written to states, asking them not to enlist cases under the revoked arrangement and pull out any such case that might have been documented.

The Supreme Court Monday gave notification to all states, Union domains and Registrar Generals of all high courts regarding a request over the proceeded with utilization of the

area 66A of Information Technology (IT) Act, regardless of it being struck down in March 2015.

In a request by the NGO, People Union for Civil Liberties, a seat of Justices RF Nariman and BR Gavai expressed that they "will pass far reaching request so that question of booking individuals

under rejected area 66A of IT Act is settled for the last time."

The request expressed that the rejected area kept on being used at police headquarters as well as in preliminary courts the nation over. To which, the seat reacted,

"Legal executive we can deal with independently however police is likewise there. There should be one legitimate request since this can't proceed."

Prior, the Union Ministry of Home Affairs had written to states asking them not to enroll cases under the canceled arrangement and pull out any such case that might have been recorded.

"The Union Ministry of Home Affairs (MHA) has mentioned States and Union Territories (UTs) to coordinate all police headquarters under their locale not to enroll cases under

the revoked Section 66A of the Information Technology Act, 2000. It has additionally asked the States and UTs to sharpen law requirement offices for the consistence of the

request gave by the Supreme Court on 24.03.2015," an assertion gave by the MHA said.

The move came after the Supreme Court on July 5 communicated its shock over the proceeded with utilization of segment 66A of the IT Act.

"Stunning. What is happening is horrendous," commented Justice Nariman as Senior Advocate Sanjay Parikh caused the court to notice how cases have expanded consistently finished

the years in spite of the March 24, 2015, administering in the Shreya Singhal v. Association of India case that struck down segment 66A for "being violative of Article 19(1)(a) and not

saved under Article 19(2)."

Segment 66A enabled police to make captures over what cops, as far as their abstract caution, could understand as "hostile" or "threatening" or for the reasons for

causing irritation, bother, and so on

Realty partakes popular; Oberoi, IB Realty, Prestige Estates, Sobha up 5%

Portions of land organizations were sought after in Monday's meeting, pushing Nifty Realty and the S&P BSE Realty to their individual multi-year highs on assumptions for

further developed viewpoint.

At 10:25 am, Nifty Realty Index (up 3.9 percent) and the S&P BSE Realty Index (up 3.8 percent) were up almost 4%, when contrasted with a 0.6 percent rise each in the

Nifty50 and the S&P BSE Sensex. In the previous three months, realty records have flooded 35% contrasted and a 8.4 percent acquire in the benchmark files.

Oberoi Realty, Prestige Estates Projects, Indiabulls Real Estate and Sobha were up 5% each while Brigade Enterprises, Godrej Properties, Sunteck Realty and DLF were

up between 2% to 4 percent on the BSE in intra-day exchange.

As indicated by ICICI Direct, the realty file and its constituents have quite recently recorded a solid breakout from a long term base arrangement and are put on the cusp of the following

major underlying positively trending market. "We anticipate that the sector should beat in coming years wherein organizations like DLF, Oberoi Realty, Godrej Properties, Phoenix Mills, Brigade endeavors,

Indiabulls Real Estate and Sobha, which by and large contribute 87% of Nifty Realty Index, are ready to create better than expected returns in years to come and ought to be

considered as long haul speculation wagers in portfolios," it said.

Among singular stocks, Macrotech Developers, the as of late recorded land organization, flooded 6% to Rs 905.70 on the BSE in the intra-day exchange on Monday.

The stock was exchanging at its most significant level since its posting on April 19, 2021. In the previous one month, the stock has zoomed 32% as against a 0.75 percent ascend in the

benchmark record.

In the April-June quarter (Q1FY22), Macrotech Developers timed an absolute deals booking of Rs 957 crore, of which Rs 654 crore came in June. Bullish on the viewpoint for lodging interest,

Lodha said: "Significance of claiming a house has expanded essentially since the flare-up of Covid-19 pandemic. Individuals are utilizing their investment funds to purchase homes. Financing costs on home

credits are at an authentic low."

On Friday, Macrotech Developers revealed a solidified net benefit of Rs 161 crore for the quarter finished June. It had posted a total deficit of Rs 134 crore in the year-prior period.

All out pay developed to Rs 1,712 crore in the main quarter of this financial year from Rs 573 crore in the comparing time of the earlier year.

Oberoi Realty, the top gainer, was up 7% and hit another high of Rs 720.45 after it detailed deals volume of 0.9 lakh sq ft (up 6.5x YoY on waste of time base of Q1FY21 however down

91% QoQ) generally because of the subsequent wave effect and high base of Q4FY21, which a few dispatches including a major dispatch at Goregaon. The business esteem was up 5.9x YoY,

down 91% QoQ at Rs 170 crore. On the monetary front, detailed incomes grew 141% YoY yet were down 64% to Rs 284.3 crore. Edges at 43.9 percent were down

334 premise focuses (bps) QoQ.

The administration said the land area is going through significant combination as not many engineers have the monetary steadiness to embrace huge capital-escalated projects.

In this manner, the portion of the overall industry of rumored brands with solid execution capacities will keep on developing, it said.

THE AFFECT OF UNSOLD INVENTORY ON REAL ESTATE

"Offload, offload, offload – dispose of your inventories" – This was the exhortation last year from Hardeep Singh Puri, the Housing and Urban Affairs Minister, for the Indian land engineers. This suggestion approached closely following a comparative explanation made by Piyush Goyal, the Minister of Commerce and Industry, as the lockdowns had pushed the realty area's recuperation from a multiyear droop back to the beginning line.

The decisions accessible to designers, as per Mr. Goyal, were straightforward: auction their expensive inventories at lower winning rates or default on advance reimbursements as there is absence of liquidity on the lookout. This Catch-22 circumstance frames the core of the weight that stock shades present for the land area in India – burdened by Rs 3.7 lakh crore worth of unsold lodging units in the main 7 urban communities.

Be that as it may, auctioning off unsold units won't be as speedy an answer as these assertions will have you accept. Property advisor Jones Lang LaSalle (JLL) has announced that the unsold stock in India will take around 3.3 years to sell, particularly with the interest shock that came about because of pandemic-related confusions.

This carries us to one of the essential difficulties looked by engineers: the more established their stock gets, the more it takes to exchange. This makes an endless loop where, if engineers decide to sit tight for a willing purchaser to pay a property's actual worth, they face the danger of additional deterioration in its worth. Simultaneously, offering potential homebuyers high limits to create the deal can bring about enormous misfortunes for designers.

Yet, stock shades don't simply affect the engineers' benefit; they have other falling impacts too. With the designer's capital restricted in existing ventures that will not sell, any new undertaking dispatch normally gets affected, driving them to slow down their development pipelines. This effects purchaser notion contrarily, as the dread of deferral in projects stops new homebuyers from making an enormous speculation.

This expanding liquidity emergency antagonistically affects the land area, which has stayed frustrated for liquidity for quite a while because of a progression of emergencies and strategy changes like the 2016 banknote demonetization and the 2018 IL&FS emergency. The pandemic has additionally exacerbated this issue.

A basic decrease in costs to animate interest won't address this problem, as it opens designers to Income Tax punishments that outcome from the infringement of the Ready Reckoner Rate (RRR). To address this, Finance Minister Nirmala Sitharaman permitted designers and homebuyers a 10% safe harbor limit beneath the stamp obligation circle rate in Budget 2019-20, which was subsequently expanded to 20% in Budget 2021-22.

Notwithstanding, this is only a brief fix legitimate just till 30 June, 2021. Besides, the protected harbor limit just reaches out to private units worth a limit of Rs 2 crore. The move leaves out the extravagance lodging section that records for a huge lump of this unsold stock – an expected 7,364 units evaluated at Rs 3 crore or more, dispatched as far back as December 2016, that are as yet unsold and devaluing.

Engineers are likewise commanded to pay charges on the unsold stock, in view of their notional rental pay, if the stock is more established than two years. This conveys a one-two punch to land players, particularly in business sectors that order high information and land securing costs. Take the instance of Mumbai, the country's most costly property market, which additionally represents the best lump of its unsold stock. Engineers in Maharashtra pay heavy expenses, demands, and other duties that can represent 33% of the general undertaking cost in the state. Sometimes, expenses can surpass the expense of development. For engineers of such properties, tax assessment on unsold stock and limits for potential homebuyers can together end up being too exorbitant to even consider bearing.

Eventually, unsold stock seatedly affects each partner in the land business, making income interruptions for designers and a stale market for financial backers and likely property holders. Taking into account that land in India is set to represent a heavy 13% of the economy by 2025, stock shades have the capability of affecting the economy, whenever left unaddressed.

Regardless of these difficulties, engineers can take trust from improving homebuyer slant, proven by a sharp uptick in realty deals in the third and fourth quarters of 2020. Moreover, in November 2020, HDFC Bank, the country's biggest home lender, detailed its second-most elevated month to month payment ever. This development popular has been pushed by record-low home advance loan costs, the extending reasonable home market, government drives like the decrease in stamp obligation in Maharashtra, and the developing significance of claiming a home in the wake of the pandemic. The disconnected to online progress of the realty area, combined with engineers' drive to embrace liquid planning standards, is additionally prone to support financial backer assumption.

An accommodative monetary strategy, as kept up with by the Reserve Bank of India, and coming about repo rate cuts are likewise giving a fillip to home advances in the country. The Central Bank's choice to concede term credit and working capital advance installments has likewise assisted with lessening the weight of home and development advances on designers, facilitating their liquidity imperatives. More current speculation roads like Real Estate Investment Trusts are likewise assisting with carrying truly necessary liquidity to engineers.

The public authority has likewise found a way a few ways to support homeownership like giving interest appropriations to center and lower-pay bunches under the Pradhan Mantri Awas Yojana (PMAY). In November 2019, the public authority even declared a Rs 25,000 crore Alternative Investments Fund to carry help to 1,600 slowed down projects, which were assessed to represent 4.58 lakh deficient lodging units. The move demonstrated advantageous for some engineers, and confined conceivable outcomes of misrepresentation because of a severe consistence cost as it was open just to projects that were RERA-enrolled and total assets positive. The public authority can additionally consider allowing the framework status to land and presenting truly necessary estimates like single-window clearances and a supported GST to assist with bringing down engineers' expense of capital. Once again introducing the GST Input Tax Credit will likewise help by bringing down the assessment obligation borne by engineers. The Confederation of Real Estate Developers' Associations of India (CREDAI) has likewise encouraged the public authority to assemble extra institutional financing for engineers through banks and NBFCs.

The onus of overseeing liquidity limitations, notwithstanding, will eventually fall on designers and their capacity to change their techniques. Over the previous year, in the light of the public authority's push to auction existing stock, engineers have offered homebuyers appealing limits, gifts, and adaptable installment intends to drive deals. More modest realty players, who can't give such concessions, can consider tie-ups with bigger designers to finish their activities. Then again, engineers of both private and business activities can likewise offer their business improvements to homegrown or abroad private value assets to acquire liquidity. A few designers even believer their private tasks to business ones to work on their possibilities.

More than request and deals, it is industry overhangs that mirror the genuine strength of the housing market. Perceive how the Delhi-NCR market saw a sharp log jam in costs after 2013 because of melting away financial backer premium and developing stock shade. In any case, around 2018, as unsold stock levels diminished by 15% on the rear of interest restoration of private and business realty in Gurugram, Greater Noida, and Ghaziabad, the housing market in the locale saw a 35% increment in new dispatches. This supported land development as well as set out work and financial freedom.

This, then, at that point, is the financial, business, and social effect that unsold stock has on the housing market. By tending to the problem areas referenced above, industry partners can tackle the 'overhang' issue and open its actual potential. For a nation taking a gander at the land area to lead its post-pandemic resurgence, not making a mediation is presently not an alternative.

https://indianexpress.com/article/india/sc-notices-states-uts-high-courts-section-66a-of-it-act-7434332/

https://www.business-standard.com/article/markets/realty-shares-in-demand-oberoi-prestige-estates-indiabulls-sobha-up-5-121080200316_1.html

https://www.financialexpress.com/money/the-impact-of-unsold-inventory-on-real-estate/2298530/

For more news like this click

https://rrskartikeyaembedded.blogspot.com/

#unsoldinventory#financialexpress#OberoiReality#PrestigeEstatesProjects#IndiabullsRealEstate#Sobha#Brigade Enterprises#Godrej Enterprises#Macrotech#RealEstate#Stocks#Nifty#Nariman#Gavai#66A#MHA#IndianExpress#BusinessStandard

0 notes

Photo

After Johnny Cash’s passing, Jerry Lee Lewis was asked to say something, along with other musicians in “Remembering Johnny” by Matt Diehl, released on October 16th, 2003.

In my research, I learned Jerry Lee was close to John, so much, I’ve questioned how close they were, and have written about numerous times. However, I noticed when Jerry Lee talks about John, he’s usually mean, saying he wasn’t a good singer or making fun of him, in some way. What he said in this interview was surprising, it’s the first time, he’s said something nice about John -- Though still a bit mean, Jerry Lee comes off as sincere, which is a rare thing.

"I did my first tour ever with Johnny Cash — way back in 1956. It was me, him and Carl Perkins, a thirty-day tour all the way through Canada, and there weren't any paved highways or anything, nothing but gravel roads. I remember what a great showman Johnny was. The way he sang was completely different, and he had a whole different style that he created himself.

John, Elvis and them were rockabilly; I was rock & roll. But we all had country in us, which manifested itself in different ways.If you break it all down to the nitty-gritty, we're all country people. We were called rebels — I guess because we were. Whatever we took a notion to, we just did it. John was religious-thinking, if not always religious-acting. One of the most ridiculous things Johnny and I ever did was steal a television set out of a hotel; there was a little bitty television up on the wall, and we got it off. Johnny wanted it for his wife; I helped him get it, because I didn't see any reason why he shouldn't have it.

I hope when his heart quit beatin' that he was ready to meet his Maker. I don't know if he was; I'm not the judge. He was a man of faith, which I think should help. I just hope he made it through the gates."

#Johnny Cash#Jerry Lee Lewis#Rolling Stone#Matt Diehl#Sun Records#Rockabilly#Rock#Music#Country#Story Time#Quotes#Sun//Together#//MyPosts#Sun//JLL#Sun//Cash#Cash//2000's#JLL//2000's#JLL//Quotes#Cash//Quotes#JLL//Story Time#Cash//Story TIme

155 notes

·

View notes

Text

Okay because I’m a weirdo who wants to insist that Batman: Orphans is definitely written to be set in 2003 our time (contemporaneous with Hush), here’s a few more scraps of evidence:-

Hello, Jellybean iMac. This is a reasonably late colourway and makes sense for 2003, which is when the computer was sold up to.

Helena here is VERY helpful. That’s her white cross, belly window costume, which she started wearing in January 2003.

Oh there’s also this Young Justice poster which has blonde hair pigtail Cassie with the leather jacket, which is the 2000-2002 look. So it CAN’T be earlier than 2000 (though that was obvious given the city is clearly rebuilt). The poster being from a year ago is probably not a huge surprise/deal.

I think this is post JLL, @upswings. I think Tim’s being VERY tactless.

10 notes

·

View notes

Text

Ông Tây đến Việt Nam khởi nghiệp cho thuê kho mini kiểu 'lạ'

Đến Việt Nam để cho thuê không gian theo mét khối, ý tưởng lạ nhưng cũng khá đơn giản, đã giúp Aric thành công nhờ là người tiên phong.

Aric Austin sinh ở Tây Ban Nha, với bố mẹ là người Mỹ nhưng lớn lên ở Munich (Đức). Sau khi hoàn thành chương trình MBA tại Trường Quản lý Rotterdam (Hà Lan), ông bắt đầu sự nghiệp tại MTV Châu Âu ở London. Từ năm 2000, ông dành 7 năm làm việc tại một startup về truyền thông trực tuyến ở New York. Sau khi chuyển về Đức, ông thành lập 2 công ty và chuyển giao lại cho Glam Media và Yahoo.

Năm 2018, Aric Austin đến Việt Nam để tìm cơ hội khởi nghiệp với niềm tin lớn vào tiềm năng phát triển cũng như sự cởi mở trước các mô hình kinh doanh mới tại đây.

Và câu chuyện khởi nghiệp ở Việt Nam không giống như các lần startup trước đó tại Mỹ, Đức. Vì Aric không mở công ty truyền thông mà lại đi làm nhà kho. Cơ duyên xuất phát từ việc khi từ Đức đến Việt Nam, ông gặp khó khăn khi kiếm nơi cất giữ đồ đạc chuyên nghiệp tại Sài Gòn.

Quan sát thấy sự thiếu hụt dịch vụ cho thuê kho lưu trữ mini ở các đô thị có mật độ dân cư dày đặc tại Việt Nam, mặc dù dịch vụ này đã khá phổ biến ở các thành phố khác trên thế giới - bao gồm các thành phố tại châu Á như Hong Kong, Singapore và Bangkok. Do đó, Aric quyết định xem đây là cơ hội làm ăn mới.

Tháng 7/2019, ông cùng bà Stephanie, người Mỹ, thành lập MyStorage. "Khi nhắc đến nhà kho, mọi người thường nghĩ ngay tới những nhà kho lớn ở Đồng Nai hay Cát Lái. Tuy nhiên, tại đây chúng tôi mang đến ý tưởng mới với không gian nhỏ hơn để thử nghiệm, và sau này s�� được mở rộng ra nhiều cơ sở khác khi khách hàng gia tăng", ông nói.

Aric Austin trong một không gian kho lưu trữ chung của công ty. Ảnh: Viễn Thông.

Về cơ bản, đây là dịch vụ lưu trữ đồ cá nhân, khá phổ biến tại Mỹ, Australia. Dịch vụ này không tập trung vào khách hàng lớn mà là các khách hàng với đồ lưu trữ nhỏ, các đơn vị kinh doanh nhỏ lẻ, hộ gia đình, người bán hàng online, hay các công ty startup có diện tích văn phòng nhỏ, không đủ chỗ làm một kho chứa.

Với dịch vụ của Aric, họ cung cấp lựa chọn chứa đồ trong kho chung hoặc thuê một không gian riêng. Các đồ vật khách gửi được tính theo mét khối. Giá khởi điểm mỗi mét khối gần 300.000 đồng bao gồm dịch vụ nhận - trả đồ và công lưu trữ.

"Chúng tôi muốn thay đổi những hình ảnh về nhà kho", Aric nói khi dẫn mọi người tham quan một không gian kho chung ở quận 2, TP HCM. Bên trong nhà kho này lắp máy lạnh, máy tạo độ ẩm và camera an ninh. Khách có thể chọn gửi đồ 1-6 tháng.

"Có những khách hàng nói rằng, giá như họ biết đến MyStorage sớm hơn. Một số khách từng phải thuê phòng khách sạn trong vòng ba tháng chỉ để lưu trữ đồ, hoặc gói hàng làm nhiều kiện riêng để gửi nhờ ở nhà một vài người bạn... Bởi vậy, chúng tôi đem tới giải pháp này nhằm giải quyết những nhu cầu trữ đồ như vậy", Aric nói.

Tốc độ đô thị hóa của Việt Nam đang tăng lên hàng năm, dẫn đến mật độ dân số dày đặc hơn ở các thành phố lớn. Từ đó, làm tăng chi phí cho không gian sống và nhu cầu trữ đồ đạc. Theo JLL Việt Nam, giá các căn hộ tại TP HCM tăng 27,5% trong quý II/2020 so với cùng kỳ, đạt mức trung bình 2.582 USD/m2.

Tại kho của Aric, người ta có thể thấy rất nhiều thứ được gửi, từ một chiếc xe đạp, bộ dụng cụ trang trí giáng sinh mỗi năm chỉ dùng một lần, những chiếc TV, máy tính b��ng hay thậm chí là những loại nguyên, phụ liệu thực phẩm đắt tiền.

"Các sản phẩm nấm truffle mà tôi nhập từ Australia, tuy kích thước nhỏ nhưng giá trị lại cao và dễ bị ảnh hưởng bởi môi trường xung quanh. Do đó, chúng cần được bảo quản ở một nơi an toàn, có kiểm soát nhiệt độ và độ ẩm", bà Cass Le-Gardner, chủ nhà hàng Le Truffle nói. Hiện bà là một trong những khách hàng chọn dịch vụ này vì nơi đây thỏa mãn điều kiện lưu trữ và đã trở thành một nhân tố chủ chốt trong mô hình kinh doanh của Le Truffle.

Sau khi ra mắt kho đầu tiên ở quận 2, MyStorage chỉ mất 4-6 tháng là lấp đầy khả năng lưu trữ. Đội ngũ của họ khá gọn nhẹ, với hai nhà sáng lập cùng 6 nhân viên. Startup này đang xây thêm một kho mới ở Thủ Đức có thể ra vào 24/7 và đã có khách đặt chỗ trước. Họ còn cân nhắc đến việc phát triển một ứng dụng di động.

Ứng dụng này sẽ cập nhật thông tin về những món đồ đang lưu trữ của khách hàng và vị trí đặt đồ trong kho hoặc để họ tiện giám sát, sử dụng chức năng giao nhận cho từng vật trong thùng đồ. Dựa vào việc giám sát và đăng ký dịch vụ theo thời gian thực, công ty sẽ giao nhận đúng thời gian khách hàng muốn nhận đồ và trả lại đồ tại kho. Năm ngoái, Aric Austin được vinh danh là "Doanh nhân xuất sắc nhất" tại Giải thưởng Kinh doanh của EuroCham.

"Thử thách lớn nhất của chúng tôi là giới thiệu một ý tưởng rất mới về 'lưu trữ' cho người Việt Nam - đối tượng mà chúng tôi tập trung nhiều ở hiện tại và tương lai", ông nói và cho biết hiện đã có những chuyển biến tích cực.

Ban đầu, dịch vụ này nhắm vào 3 đối tượng: người nước ngoài sống ở Việt Nam - vì đã biết khái niệm lưu trữ mini; những người trung lưu trở lên thường di chuyển từ thành phố này sang thành phố khách không có nhiều không gian lưu trữ và các khách hàng doanh nghiệp nhỏ, không gian văn phòng hạn hẹp không đủ chỗ chứa đồ marketing, trang trí theo mùa. "Lúc đầu, chúng tôi nghĩ khách hàng lớn nhất là người nước ngoài nhưng càng về sau khách người Việt nhiều hơn", ông thông tin.

Nói về nguy cơ gặp phải khách hàng "khó" chẳng hạn như thuê chỗ lưu trữ hàng bất hợp pháp và gửi quá hạn không quay lại. Nhà sáng lập này cho biết công ty tôn trọng quyền riêng tư của khách hàng với những món đồ họ cất giữ trong thùng. "Tuy nhiên, để kiểm soát đồ lưu trữ trái phép, chúng tôi có những điều khoản và chính sách mà khách hàng sẽ chịu trách nhiệm hoàn toàn về những đồ vật họ lưu trữ tại đây", ông nói.

Còn với đồ quá hạn, MyStorage cũng từng đã trải nghiệm. Đơn cử như một vị khách ở châu Phi đã bị kẹt tại đấy và không thể quay lại Việt Nam vì dịch. Họ thông báo rằng sẽ không thể lấy đồ về và muốn xử lý những món đồ này. Vậy nên công ty của ông đã giúp họ phân loại và làm từ thiện.

"Trong trường hợp không nhận được phản hồi từ khách hàng, chúng tôi sẽ gửi thư thông báo và chờ hồi âm trong vòng 2 tuần. Nếu sau 2 tuần không có thông tin từ phía khách, chúng tôi sẽ mở thùng đồ của họ và làm từ thiện với những món đồ này", Aric nói.

Về dài hạn, Aric sẽ còn những bài toán lớn. Vì dù là mô hình cho thuê không gian lưu trữ mini đầu tiên ở TP HCM nhưng dịch vụ này nhìn chung không quá khó để bắt chước và khả năng xuất hiện những đối thủ cạnh tranh.

"Thách thức hiện tại là chưa nhiều người Việt hiểu về dịch vụ này. Nếu nhiều cơ sở khác mở ra, tất nhiên là mình có đối thủ nhưng họ cũng sẽ giúp mình giáo dục thị trường thế nào là 'ministorage'", Aric nói và cho biết trong khi các dịch vụ cơ bản là giống nhau thì sự khác nhau chính là hơn thua bởi dịch vụ chăm sóc khách hàng, "Rất khó để sao chép trải nghiệm khách hàng", ông nhận định.

Vì thế, Aric không bận tâm nhiều về nguy cơ bị bắt chước. Trong mắt ông, chiến lược năm nay là mở thêm cơ sở ở Hà Nội và Đà Nẵng. "Chúng tôi đã là người đầu tiên thì phải sẵn sàng phát triển lớn hơn, nhanh hơn. Điểm mấu chốt chính là thời điểm nào lý tưởng để đánh vào từng thị trường", Aric nhận định.

Viễn Thông

0 notes

Photo

IoTとAIでビルのファシリティマネジメントを環境対応にするInfogridが16.2億円調達 既存のビルをIoTで「スマート」なビルにするInfogridが、1550万ドル(約16億2000万円)を調達した。このシリーズAの投資ラウンドはNorthzoneがリードし、JLL SparkとConcrete VC、The Venture Collective、Jigsaw VC、匿名の不動産投資グループ、そして同じく匿名の大規模な国際的資産保有者、不動産投資専門のStarwood Capitalという説あり(Sky News記事)、が参加した。 Infogridは、IoTのセンサーとAIによる独自の分析技術を組み合わせて、グローバルな銀行やスーパーマーケット、レストランチェーン、そして英国の国民保健サービスNHSといった一部の巨大グローバル企業のファシリティマネジメントを改善している。Infogridはまた、建物の実利性と資産価値を守りながら環境負荷や社会的費用を下げるというミッションを掲げている。 Infogridのシステムは、たとえば��蔵設備や施設の設置箇所の温度が規定範囲を超えていることを検知し、空気の質をチェックし、水道管内部のレジオネラ菌など細菌やウイルスの有無を検出する。 元英国陸軍の将校で創業者でCEOのWilliam Cowell de Gruchy(ウィリアム・カウエル・デ・グルーキー)氏は声明中で次のように述べている。「これまでは有効でスケーラブルな技術がなかったため、ファシリティマネジメントは、世界最大の資産クラスを扱っているにもかかわらず、デジタル化の恩恵にあずかることができない産業といわれていた。しかしInfogridのエンド・ツー・エンドのスマートビルディングシステムがついに、ビルの保有者である企業にインサイトとコントロールとアクションを与える。この新しいインサイトとオートメーションによって、企業は事業の効率を高めるとともに、社員の幸福とビルディングの環境貢献も高める」。 NorthzoneのパートナーJeppe Zink(ジェッペ・ジンク)氏は「世界はいま、史上最大の都市化を経験しており、建造物は年間炭素排出量の39%を作り出している。Infogridの長期的未来に環境負荷を与えないビルディング技術は、投資家にとって文句なく魅力的である」と付け加えた。 カテゴリー:IoT タグ:Infogrid、資金調達 画像クレジット:Ratnakorn Piyasirisorost / Getty Images [原文へ] (翻訳:iwatani、a.k.a. hiwa) Source: テッククランチ・ジャパン

0 notes

Photo

Griffith Properties and Artemis Partnership Buys Boston Building for $72 Million

BOSTON– JLL Capital Markets announced that it has closed the $72 million sale of 20 Guest Street, a 228,912-square-foot creative office building located adjacent to the Boston Landing neighborhood in Boston.

JLL represented the seller, NB Development Group, and procured the buyer, a partnership between Griffith Properties, LLC and Artemis Real Estate Partners.

20 Guest Street is located adjacent to Boston Landing, one of the city’s newest and most dynamic neighborhoods that is considered by many to also be Boston’s premier wellness hub. Highlights of the neighborhood include the new Boston Bruins practice facility and Warrior Ice Arena, The Auerbach Center, the Boston Celtics practice facility and the soon-to-be home of The Track at New Balance, a world-class indoor hydraulic track, field and entertainment venue.

Marci G. Loeber

20 Guest Street boasts a transit-oriented location adjacent to the Massachusetts Turnpike as well as the MBTA Boston Landing station providing convenient access to the affluent western suburbs as well as Fenway, Back Bay and Downtown. Completed in 2000 and designed by ADD, Inc., the state-of-the-art creative office building features expansive views through its generous window line, column-free floorplates with exposed ceilings and flexible tenant areas. 20 Guest Street is fully leased to seven tenants, including Harvard Business School of Publishing.

The JLL Capital Markets team representing the seller included Senior Managing Director Coleman Benedict and Senior Directors Kerry Hawkins and Ben Sayles.

“We are excited to welcome the Griffith Artemis team to the Boston Landing Guest Street neighborhood. 20 Guest Street had served as our New Balance World Headquarters since its development in 2000, until our move down the street to the new New Balance World Headquarters at 100 Guest Street, kicking off the Boston Landing development in 2015. We look forward to working with the new ownership group for 20 Guest Street as stewards, along with the community, for the extended Boston Landing district,” said Jim Halliday, President of NB Development Group, LLC.

“Griffith Properties is excited to partner with Artemis Real Estate Partners on the acquisition of 20 Guest and to add this compelling Class A property to our portfolio, in one of the most exciting and emerging live/work/play environments in Boston. NB Development led the transformation of the area with the new MBTA commuter rail stop, which is a game-changer and unlocked a multitude of possibilities in this walkable environment,” added Managing Principal Marci Loeber of Griffith Properties.

Related

0 notes

Photo

CafeLand - Đại dịch Covid-19 đã thay đổi thói quen mua nhà ở Hong Kong khi nhiều người có xu hướng dịch chuyển sang các khu vực ngoại ô xa các quận trung tâm đông dân cư.

Theo ghi nhận của các công ty khảo sát, lần đầu tiên kể từ năm 2000, tổng giá trị giao d���ch của các căn nhà ở khu vực mới trong bảy tháng đầu năm nay đã vượt qua các khu vực trung tâm của thành phố.

Các nhà phân tích cho rằng khi làm việc tại nhà trở thành một tiêu chuẩn mới, mọi người sẽ mong muốn có những không gian rộng hơn với các tiện nghi tốt hơn vì họ chỉ ở trong nhà hầu như cả ngày.

"Covid-19 có thể là một trong những lý do tại sao nhiều người mua nhà ở các khu vực ngoại ô hơn ở khu vực thành thị", Hannah Jeong, người đứng đầu dịch vụ định giá và tư vấn tại Colliers Hong Kong cho biết.

Các khu vực trung tâm đã chứng kiến mức giảm giá nhiều nhất, tới 60% so với mức đỉnh thị trường vào tháng 10 năm 2019, so với mức tăng trưởng 18,9% ở các khu vực ngoại ô bên ngoài trong cùng thời kỳ.

Nhà phân tích nghiên cứu của ValueChaosystem, Jacob Weiss cho biết “Nhiều người thực sự đang có mong muốn di chuyển ra ra khỏi các khu vực đông dân, thành phố lớn ra các vùng ngoại ô.”

Các mô hình tương tự cũng xuất hiện ở các trung tâm tài chính lớn khác của Singapore và thành phố New York, theo công ty có trụ sở tại New York.

Đại dịch Covid-19 đã khiến hơn 4.000 người ở Hong Kong mắc bệnh và cướp đi sinh mạng của hơn 50 người, trong khi Singapore chứng kiến hơn 55.000 trường hợp mắc bệnh và 27 trường hợp tử vong liên quan. Thành phố New York đã ghi nhận hơn 227.800 ca nhiễm và hơn 23.500 ca tử vong.

Các nhà phân tích cho rằng khi làm việc tại nhà trở thành một tiêu chuẩn mới, mọi người sẽ mong muốn có những không gian rộng hơn với các tiện nghi tốt hơn vì họ sẽ chỉ ở trong nhà hầu như cả ngày.

"Covid-19 có thể là một trong những lý do tại sao nhiều người mua nhà ở khu vực mới hơn ở khu vực thành thị", Hannah Jeong, người đứng đầu dịch vụ định giá và tư vấn tại Colliers Hong Kong cho biết.

“Trước đây, khách hàng mua nhà ở vùng ngoại ô thường có mục đích tìm kiếm ngôi nhà thứ 2. Tuy nhiên, xu hướng này dường như đã có dấu hiệu thay đổi khi nhiều người tìm đến các vùng ngoại ô để mua nhà như một nơi ở chính.”

Tuy nhiên, Nelson Wong, người đứng đầu nghiên cứu của Công ty JLL ở Trung Quốc, không đồng ý rằng Covid-19 có tác động lớn đến sở thích mua nhà.

“Thị trường nhà ở phần lớn được hỗ trợ bởi nhu cầu bị dồn nén hơn là mục đích đầu tư do triển vọng không chắc chắn. Do đó, hoạt động thị trường tập trung vào các căn hộ có giá cả phải chăng hơn ở các vùng mới với đơn giá trung bình thấp hơn.”

Wong Xian Yang, Phó giám đốc nghiên cứu của Cushman và Wakefield tại Singapore và Đông Nam Á, cho rằng mối quan tâm đến bất động sản ngoại ô ở Singapore không phải là kết quả của Covid-19.

“Sự quan tâm đến những ngôi nhà ở ngoại ô so với những ngôi nhà ở trung tâm thành phố không phải là điều mới mẻ và đã được thúc đẩy bởi một số yếu tố bên ngoài đại dịch. Doanh số bán nhà mới ở ngoại ô ở Singapore chiếm khoảng 47,7% tổng doanh số bán mới, cao hơn nhiều so với mức 9,5% trong doanh số bán nhà ở trung tâm thành phố.”

[ad_2] Nguồn CafeLand

0 notes

Text

This is the Criteria for a Millennial Dream House

This is the Criteria for a Millennial Dream House-A millennial generation or generation Y are also known as generation me or echo boomers. Literally, there is no specific demographic in determining this generation.

However, experts classify it according to the beginning and end of the year. The generation Y generation is formed for those born in 1980 - 1990, or early 2000, and so on. Early 2016 Ericsson issued 10 Consumer Lab Trends to predict various consumer desires.

Also Read: Top tips for a snappy house deal

Ericsson's report was born based on interviews with 4,000 respondents spread across 24 world countries. Of these 10 trends, some of them are special attention to the behavior of the millennial generation.

In the report Ericsson noted, technology products will follow the lifestyle of the millennial community. Because behavioral shifts also change in tandem with technology. "New technology products will emerge as accommodations for technological change," said Ericsson Indonesia President Director Thomas Jul.

Baca Juga

Home 2 home inspection service is the best

Step by step instructions to Find The Best Residential Moving Company

Annuity Structured Settlements And Futuristic Architecture

Throughout this year, several predictions delivered by Ericsson were proven. One of them, the behavior of choosing criteria for his dream house.

Millennial which now dominates the population of Indonesia is currently the target of all markets including housing. Current residential trends are adjusted primarily for millennials.

Also Read: Are There Your Advantages to Renting a Property?

Millennial has begun to change her lifestyle, including how to choose a place to live. In the midst of its busy life, millennials are considered to prefer housing that has or integrated public transportation facilities.

"A number of years ago there has been a switch in lifestyle. Where landed want to move to live in an apartment. Millennials now prefer transportation. So, private transportation becomes public transportation," explained Chief Advisor Jones Lang LaSalle (JLL) Vivian Harsanto in media discussion on Friday (4/12/2019).

Buyers of residential areas connected to TOD or transit-oriented development are millennial. For information, TOD is a development scheme for an area that is connected to various public facilities such as mass transportation, such as MRT, LRT, busway, and so on.

Also Read: Property Sales In Spain 'Formally Recover' From 2018 Financial Crisis

"If we look at buyers, in apartments located in the TOD it tends to be 35 years old millennial. This means millennial has been established, maybe couples," Vivian said.

In addition, millennial choice occupancy is the one that places affordable prices. Vivian explained that there are several regions that are still affordable for millennials. Areas with affordable prices are determined by their radius.

"For the most affordable areas in Jakarta, it is seen from the radius too," Vivian said.

The area in question is Depok, Pulo Gadung and Bekasi. According to him, the millennial determines that housing no longer sees location. Millennials don't mind staying outside the city center. Provided that the occupancy is facilitated by public transportation.

sumber: This is the Criteria for a Millennial Dream House

0 notes

Text

Jerry Lee’s end game?

Passing late night thoughts: So, Jerry Lee’s going to do another interview...

That’ll be live on WTSB Radio, March 13, 2018, with his seventh wife Judith and son Lee. Like, it sounds good on paper, an interview with some of his family there, maybe he’ll be more comfortable? But I can’t shake the feeling that this is a bad idea. It’s probably because I remembered that this same radio station is where Judith was interviewed, where she told her and Jerry Lee’s “Surprise Love Story,” which I wrote about in a post called *“Not sure what to title this.” The interview was boring, told nothing new, and was messy. Instead, it further affirms that the jury is still out on what Judith, now along with Lee’s, true intentions are, this may even include Jerry Lee.

It’s funny, his daughter Phoebe, her husband Zeke wrote: “Mr. Jerry Lee Lewis is the king of his universe and the people close to him revolve in his solar system like orbiting planets.” Going on to say, “but when he wants the planets to rotate they better start spinning, double time.” Like, in his younger years, he tried to control everything and everyone around him, there was still a lot that was out of his control, though, it wasn’t to the extent as it is now.

The longer time passes, I question what Jerry Lee’s end goal is here, he doesn’t want to build a relationship with his other children (who might not even want to have him in their lives), he doesn’t want to repair the broken relationship he has with Phoebe, and he doesn’t want to quit smoking to improve his vocal chords and quality of living. It’s like he’s stopped being an active participant in his own life, can’t tell if that’s age, he’s just grown indifferent, or it’s always been this way but it’s noticeable now because there are no distractions, no pills, women or being wild. Maybe I was right, when saying that he’s always been a leaf blowing in the wind and further more, people can sway him in any direction they please. Regardless, I think it’s clear that he’s okay with others being in control of his life, as long, as he thinks he’s in charge.

Then, it’s more sad, than funny. Needless to say, I’m not looking forward to this interview...

*Edit: All I know is Judith better not complain if she get’s a bunch of requests on Facebook again, that’s what comes when you do an interview to milk attention.

#Essays//Analyses#Passing thoughts#Sun//JLL#JLL//2000's#JLL//Family#FB: Judith#JLL//Wives//Girlfriends#//ResearchStuff#Jerry Lee Lewis

2 notes

·

View notes

Text

Who will drive the ultimate tech revolution in CRE?

This post originally appeared on Michael Beckerman's Blog and is republished with permission. Find out how to syndicate your content with theBrokerList.

Let’s talk big picture on the current and future state of the CREtech landscape. CREtech is a nascent industry, but much of the tech revolution’s trajectory in commercial real estate has already mirrored the massive and rapid technological changes seen across other industries: finance, healthcare, and insurance, to name a few. As waves of new tech cause profound shifts, the underlying question I wrestle with is this: Who will ultimately emerge as CRE’s dominant tech players?

On the one hand, current stakeholders in commercial real estate—the JLLs, CBREs, Brookfield’s, Avalon Bay’s, Prologis and Hines of the world—simply have too much at stake to tacitly accept outsiders dominating the sector. But then, given we exist in a sector serving the largest asset class in the world, it’s quite possible an existing tech behemoth could dominate in the blink of an eye with an acquisition, investment, or shift in strategic focus. Or we may see a hybrid of both.

Lay of the Land

Before further navigating the intricacies of this theme, let’s step back to consider the landscape in CREtech today, and the likely next phase of evolution in this young industry.

There is clear momentum in the “emerging” tech sector of CRE. According to our research, and verified by others I respect, approximately 4,000 startups comprise this ecosystem today. That is staggering growth from a mere six years ago, when there were but a few dozen tech players plying their ideas in CRE. Most of these startups are young, with limited funding, and also led by first time founders—a fascinating combination that inspires my own inner founder spirit.

A few startups like VTS, REOnomy, Honest Buildings, Latch, Enertiv, Clutter, Dealpath and others have broken out and several have hit real scale, with $10 million in recurring revenue or nine figure valuations.

Of course, not all of today’s players will thrive, but that isn’t remotely an indication of a looming bubble. The bubble concept is far too easily bandied about—to me, the concept references the crash in the early 2000’s, which was a speculative and public market bubble of “irrational exuberance” more than anything else.

Instead, we’ll more likely see a natural progression in CREtech: The many startups struggling to find customers and traction will merge with others to build solid small businesses servicing pieces of the massive CRE industry. Other tech startups will scale before facing quick acquisition by industry tech giants—such as CoStar, RealPage, MRI, and Yardi—or the largest stakeholders, like CBRE, JLL, Brookfield, Hines, Prologis, Avalon Bay, etc.

Strength from Within

That second scenario is where real power and opportunities lie. There is zero chance that corporate America will eschew tech. That train left the station long ago. If a company isn’t investing in tech, it will get left behind. Period.

So, what it would look like if CRE’s current leaders went all-in on tech? After all, no one has more at stake by not investing heavily in technology than the dominant tech platforms and the landlords, owners, and developers in control of significant retail/multi-family square footage.

Many enterprises outside of CRE received the memo and have embraced tech to maintain leadership positions. Goldman Sachs’ most prominent and well-wired banker, George Lee, now leads the company’s tech effort as a chief information officer. His primary imperative: “Help Goldman Sachs use technology before technology makes places like Goldman Sachs obsolete.” Meanwhile, Volvo’s VC arm invested in Momentum Dynamics, which “provides high-power wireless charging systems for the automotive and transportation industries.” And British bank Barclays and Spanish lender Santander led the £26 million funding round for MarketInvoice, which is a London-based financial technology firm that “lets small-to-medium enterprises sell their unpaid invoices through an online platform to gain access to working capital loans.”

Wise CREtech leaders will follow their lead.

Let’s dispense with talk of bubbles because the next cycle of technology in CRE will look like every other emerging tech sector. Most startups will build nimble platforms that service niches within the industry at large, many will fail, and still others will merge and fight to see another day as allies with former competitors. But the real winners will be the CRE industry tech giants innovating to fight off outsiders to grow to market dominance.

Invasion from the Outside

There’s another version of this story. A version where CRE market leaders don’t innovate and invest fast enough to prevent outsiders from overtaking their moats. There’s a distinct possibility that Amazon, Google, Microsoft, Salesforce, Apple, etc. could enter the space. Leveraging capital and distribution advantages to enter an adjacent industry is a tactic they have taken in other industries, so there is clearly precedent for this thought experiment.

Google is betting heavily that the “future of healthcare is going to be structured data and AI.” Healthcare is an equally large focus for Amazon—the company’s partnership with JPMorgan Chase and Berkshire Hathaway could mean “Dr. Amazon” coming to a device near you.

Examples from the broader real estate industry include Amazon doubling down on the home with initiatives such as Key. And in 2014, Rupert Murdoch’s News Corp. shelled out nearly $1 billion to acquire Move Inc., the parent company of Zillow’s chief rival, Realtor.com.

It’s happening in insurance and financial services as well. German insurance giant Allianz raised the amount of its tech VC fund to a staggering $1.1 billion to continue making investments. Meanwhile, Google and Amazon are poised to leverage Millennial trust to launch digital wealth management offerings.

Imagine for a moment that …

… Google uses its vast search data to build a real estate recommendation engine.

… Amazon, with its increasing emphasis on the home, enters the office world by building products to connect people at work and enhance their efficiency, communication, and operations.

… Amazon licences its robotics investments and sells to third party logistic providers in a model similar to its cloud technology and AWS.

… Microsoft, which owns LinkedIn, uses its CRM and company employee data to build a recommendation engine to help companies optimize for office space locations.

The possibilities are endless. These scenarios are exactly what is happening in healthcare, where behemoths Google and Amazon are in a battle to reinvent medicine. Established tech companies Uber, Lyft, and Tesla are vying for the chance to reinvent transportation. And new startups are not immune to the race for market relevancy—Stripe, Coinbase, Robinhood, CreditKarma, and Ripple are in the trenches reinventing the financial services sector. Just look at how Robo Advisors has already had a profound impact on the world of Wealth Management (link to article i will send in a minute)

But how should CREtech’s current industry giants react to a focus-shift from tech Goliaths outside our sector?

The fact is, no one knows which companies will emerge as winners as technology plays out across the CREtech sector. In all likelihood, we’ll see hybrid successes. There is no alternative but for large, established CRE companies to become more efficient and make leading-edge tech investments. Meanwhile, even the most promising startups today—those with market-shifting relevance—will merge, shift, and adapt in the coming years.

Adaptability is no longer just an option, but an imperative to better serving CRE customers. At the end of the day, the tech revolution promises only one certainty: The customers/end users in commercial real estate will be the big winners. They will have more—and better—choices than ever before in how they select, invest, and occupy their commercial real estate.

RSS Feed provided by theBrokerList Blog - Are you on theBrokerList for commercial real estate (cre)? and Who will drive the ultimate tech revolution in CRE? was written by Michael Beckerman.

Who will drive the ultimate tech revolution in CRE? published first on https://greatlivinghomespage.tumblr.com/

0 notes