#Iyin Aboyeji

Explore tagged Tumblr posts

Text

Nigerian Technology Public Policy

Navigating the Intersection of Nigerian Technology Public Policy, Science, and Entrepreneurship

Introduction:

Nigeria, a nation rich in cultural diversity and natural resources, is increasingly making a mark on the global stage in various fields, including technology, science, and entrepreneurship. In this dynamic landscape, the interplay between Nigerian technology public policy, science, and entrepreneurship is crucial for sustainable growth and innovation.

Nigerian Science and Technology:

Nigeria recognizes the pivotal role that science and technology play in its development agenda. The country has made significant strides in fostering scientific research and technological innovation. Government initiatives, such as the National Science, Technology, and Innovation Policy, underscore the commitment to harnessing the potential of homegrown talent.

Nigerian Techpreneurs:

The rise of Nigerian techpreneurs is a testament to the country's evolving entrepreneurial spirit. Notable figures like Sim Shagaya of Konga, Jason Njoku of iROKOtv, and Iyin Aboyeji of Flutterwave have not only achieved success on the global stage but also paved the way for a new generation of tech innovators. These entrepreneurs are instrumental in shaping Nigeria's narrative in the global tech ecosystem.

Nigerian Technology Public Policy:

The success of Nigerian techpreneurs is intertwined with the policies that govern the technology sector. A conducive regulatory environment is essential for fostering innovation and attracting investments. The Nigerian government has been proactive in developing policies that promote technology and innovation, such as tax incentives for tech startups and initiatives to bridge the digital divide.

African Polo Players and the Unique Nigerian Perspective:

Shifting gears to sports, Nigeria boasts a vibrant polo community that adds a unique dimension to the nation's identity. African polo players, including Nigerians, are making waves in the international polo scene. Their success not only brings glory to the nation but also highlights the diversity of talent emerging from the continent.

Nigerian Social Entrepreneurs:

Beyond the realm of business and technology, Nigeria is witnessing a surge in social entrepreneurship. Visionaries like Ndidi Nwuneli of LEAP Africa and Oluseun Onigbinde of BudgIT are spearheading initiatives that address social issues through innovative solutions. These entrepreneurs showcase the potential of business to drive positive social change.

Successful Nigerian Entrepreneurs and Global Impact:

The success of Nigerian entrepreneurs extends beyond borders. Their global impact resonates in various sectors, influencing perceptions of Nigeria as a hub for talent and innovation. By excelling in fields ranging from technology to social entrepreneurship, these individuals contribute to changing the narrative about Africa and showcasing its potential on the world stage.

Conclusion:

Nigeria's journey in the realms of technology, science, entrepreneurship, and sports is marked by resilience, innovation, and a commitment to positive change. The synergy between Nigerian technology public policy, scientific advancements, and the entrepreneurial spirit is shaping a narrative of progress and growth. As the nation continues to navigate the complexities of a rapidly changing world, the contributions of its people across diverse fields will undoubtedly play a pivotal role in defining the future trajectory of Nigeria on the global stage. Read more

0 notes

Text

I was very desperate for success, says tech entrepreneur Iyin Aboyeji

I was very desperate for success, says tech entrepreneur Iyin Aboyeji

I was very desperate for success, says entrepreneur Iyin Aboyeji Tech tycoon, entrepreneur and businessman Iyin Aboyeji, the force behind some of the most innovative and disruptive technology in the Nigerian space, the likes of which includes Flutterwave and Future Africa, has been speaking with talk show host Chude Jideonwo about his journey in the tech industry. He shed light on his education,…

View On WordPress

0 notes

Text

Marry someone who can love you through poverty - Tech guru, Iyin Aboyeji, advises intending couples

Marry someone who can love you through poverty – Tech guru, Iyin Aboyeji, advises intending couples

Tech guru and owner of Flutterwave, Iyin Aboyeji, has advised single people to marry those that can love them through poverty. In a tweet thread, Iyin stated that one of things he and his wife learned early from their suffering was to keep their own ”burn really low”. He said one of the reasons he knew his wife was for him was that he could continue to stack up the dollars in debt while…

View On WordPress

#-#Aboyeji#advises#Beauty#blog#can#couples&039;#Entertainment#Events#Fashion#gossip#guru#Inspiration#intending#Iyin#Lifestyle#love#Marry#news#politics#Poverty#someone#Tech#through#who#You

0 notes

Text

Iyin Aboyeji handpicked to advise Nigerian presidency on industrial policies

Iyin Aboyeji handpicked to advise Nigerian presidency on industrial policies

The Acting President of Nigeria Professor Yemi Osinbajo launched the Nigerian Industrial Policy and Competitiveness Advisory Council yesterday at the presidential villa in Abuja.

https://twitter.com/NGRPresident/status/869617091669889024

The council which will be chaired by Yemi Osinbajo himself consists of 35 representatives of the public and private sectors including Flutterwave CEO Iyinoluwa…

View On WordPress

0 notes

Text

The Payment Processing Company Connecting Africa To The World

Every business operating in the 21st century appreciates the importance of having an online presence. Not only does it ensure that you have a platform to directly engage with customers, it also presents the unique opportunity of increased sales as well as the prospect of breaking geographical barriers to deliver products and services to customers who are not in the immediate locality of your business. The prospects are limitless and could see a business that operates in, say Lagos Nigeria, having its customer base stretching as far as Boston Massachusetts in the United States or Hong-Kong in China.

There has however been a problem which has hindered many African Businesses, especially small scale enterprises, over the years from leveraging upon the exposure provided by the internet to grow their businesses, namely payment processing. Carrying out international transactions to Africa have often proven to be a hassle for consumers, with problems spanning from delayed payments, declined transactions, unavailability of payment platforms and a host of others. In the light of the fact that no matter how wonderful a product may be and how much interest it may have generated from consumers, it all comes to nought if people are not able to purchase them, we can see how this problem has been one that had threatened the growth of African businesses over the years.

This was the exact problem Flutterwave set out to tackle back in 2016 when it was founded by the duo of Iyin Aboyeji and Olugbenga Agboola with the vision of 'opening up the global market to Africans and empowering more Africans than ever before to participate in the global economy.'In a market where many popular web services like Stripe, Paypal, and Airbnb had excluded many African countries in their international launches due to the difficulty in processing payments there, Flutterwave has thrived and become the payment platform of choice making it easier to do business across the continent by allowing users to make international payments in their own currencies.

Flutterwave launched it signature product 'Rave' which is targeted at helping businesses and banks build secure and seamless payments solutions for their customers. With Rave, sellers are able to integrate payment gateways into their websites at no upfront cost, making them able to directly trade with customers at home and abroad. One of the unique advantage of Rave is the fact that users get to pay in their local currency, either from their cards, bank accounts or mobile wallets and the sellers get settled instantly. This remarkably improves customer experience, saving them the stress of conversion between amounts and even helps them avoid high conversion fees. Also, Businesses are able to have an up-to-date and detailed account of all transactions from all sources in one place. Flutterwave has also been able to expand its reach to allow international school feed payment and have allowed parents with children schooling abroad make payments with incredible ease as well as settle medical bills abroad, both of which are multi-million dollar industries enjoying patronage of many Africans.

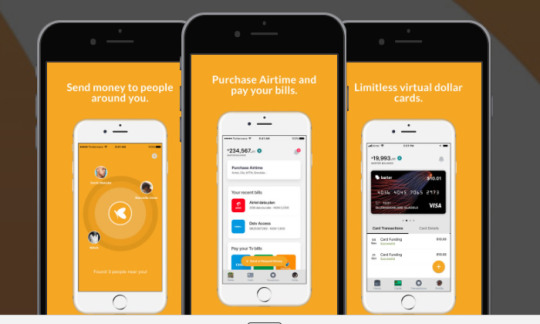

Another financial product which Flutterwave offers is Barter. Officially known as GetBarter, it allows an individuals operate a personal online wallet from which they can make and receive payments, access loans and even manage their personal finances. With Barter, customers can add their existing bank accounts to their app dashboards and manage funds in their local currencies with insights and statistics on their spending patterns.

Flutterwave stays in business by charging a small commission on each transaction processed through its platforms, and this commission is shared with banks and other financial institutions that help keep their API working.

After graduating from reputed Silicon Valley startup accelerator, Y-Combinator and has had two series of funding exceeding $20 million. It has it's head office situated in San-Francisco USA. For a payments company seeking to create payment solutions for the African continent, this may seem like an odd choice, however, co-founder and former CEO , Iyin Aboyeji attributed the reason for this decision to the need to stay within a globally recognised hub for financial technology as well as the need to build trust with investors (and this may point to the unfortunate reputation that some African Nations have as a haven for fraudulent activities).

Flutterwave however also maintains offices in various African Cities including; Lagos Nigeria, Nairobi Kenya, and has plans to expand to over 5 more African countries within the next 2 years.

Flutterwave is passionate about its technology roots and continues to maintain close ties with the developer community. It is known to have recently sponsored programs like the HNG Internship (a virtual internship program organised by hotels.ng) and put together Developer Recruitment events. It of course has a lot at stake in ensuring that as many developers as possible are knowledgeable about integrating it's payment gateways in their websites and choose flutterwave ahead of those of other competitors.

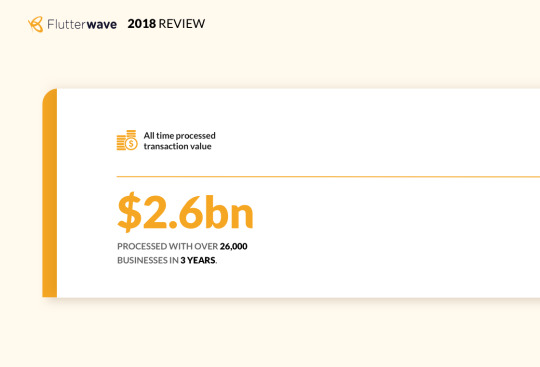

Since it's inception in 2016, Flutterwave has processed over 2.6 Billion Dollars in transaction value via it's platforms, and this number continues to grow as it wins the hearts and patronage of many small businesses around Africa. Flutterwave's recent partnership with Chinese e-commerce giant, Alibaba's payment platform (AliPay) could mean that Flutterwave is at a new frontier and gearing up to unleash, a new spurt of growth in China-Africa trade, a market which is already estimated to be worth over $200 billion.

The payments space in Africa is expected to become even more competitive in years to come especially with the entry of new players O-pay and continuous presence of longtime players Inter-switch and many others, however Flutterwave is definitely blazing the path with it's innovative products and payment technology.

The future is indeed exciting for African Businesses and Africans as they look to take their place in the global economy, unleashing prosperity on the continent like never before.

You can find out more about Flutterwave here: https://www.flutterwave.com/

1 note

·

View note

Text

Flutterwave: The African Payments Technology Giant

Flutterwave is an African payment technology company founded in 2016 by ex- Andela co-founder Iyin Aboyeji and a team of ex-bankers, entrepreneurs and engineers.

The payments solution company provides uninterrupted and secure payment experiences to banks, businesses and their customers. A merchant can accept local and international payments with their services. Their online payments platform also enables customers to pay for things in their local currency while Flutterwave https//www.flutterwave.com/ takes care of integrating banks payment service providers into its platform so businesses don’t have to take on the expenses and burden.

Businesses that are using flutterwave are Uber, Oja Express, Booking.com, Transferwise, Flywire, etc.

Flutterwave currently has more than 50 bank partners, with over $2.6 billion payments processed in more than 100 million transactions. The company also has more than 60,000 merchants on its platform. The company has more than 1200 developers building for them.

Flutterwave Products

RAVE https://www.ravepay.co/

This is a flutterwave for business product that allows businesses to make and accept payments from customers anywhere in the world. It is a service that enables merchants accept global payments from card, bank accounts and USSD.

BARTER

https://flutterwave.com/online-payments-products/barter/

This is a flutterwave for consumers' product. It’s an app that helps individuals and Small and Medium Enterprises(SMEs) make and receive money from across Africa. The Barter app can also be used for paying TV bills, buying airtime, paying Internet subscription, paying utility bills, buying mobile data subscriptions.

ACHIEVEMENTS

In July 2019, Africa’s integrated payments platform, Flutterwave announced its partnership with Chinese e-commerce company Alipay to offer digital payments between Africa and China in order to boost the Africa-China trade.

Earlier this year, Flutterwave in conjunction with Visa also launched a product for Africa called GetBarter. This is aimed at facilitating personal and small merchant payments within and across Africa’s national borders.

The company in October 2018 completed the Series A extension round of financing with investments from notably Mastercard. This took the total funding the company raised above the $20 million mark.

The company also received the former chairman and CEO of Visa, Joe Saunders to its board of directors despite the setback of its co-founder, Iyin Aboyeji leaving in October 2018.

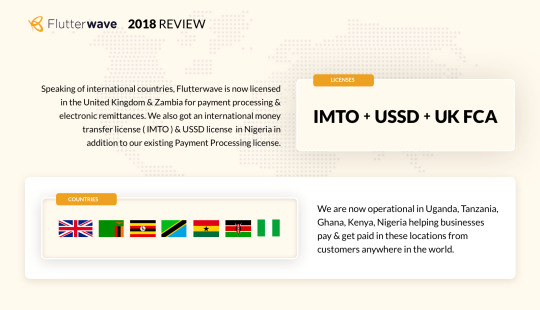

Flutterwave is now also licensed in the United Kingdom and Zambia for payment processing and electronic remittances.

Advantages of Using Flutterwave

1. Flutterwave is ISO 27001 certified meaning the company has internationally acceptable business practices and processes.

2. The company is diving into the global market with partnership with US and Chinese companies.

3. Rave by flutterwave support payment in US dollar, Euro, British pound and many other currencies.

4. Zero set-up fees for integration by businesses.

5. Has partnership with companies like Mastercard, Visa, Uber, Booking.com, hence very reliable.

6. Rave is a Secure and efficient payment platform by being PADSS certified.

Disadvantages of Flutterwave

1. Poor customer care service.

2. No POS machines for offline transactions for Small and Medium Scale Enterprises (SMEs).

Impact of Financial Technology in driving economic growth in Africa

There is no universal payment method in Africa and only 3% of African’s reportedly own a credit card. This means that African businesses have a hard time accepting payments from Africa.

According to former Flutterwave CEO, Iyin Aboyeji, “Fintech is a fundamental piece to driving the real value of digital economy and the payments solution giant, flutterwave is trying to connect Africa to the digital economy”. Therefore, the importance of financial inclusion cannot be overemphasized. The increased access to financial services has opened new doors to individuals and families, allowing them to smooth out consumption and invest in their futures.

No tech sector has the potential to impact Africans at the bottom of the pyramid as fintech does. By addressing the issues of financial exclusion, fintech companies can equip more people to become financially savvy. It is, therefore, no surprise that fin-tech companies attracted the lion’s share of tech investment on the continent with 50% of total funding in 2018. Fintech has the potential to increase economic growth in Africa by improving capital allocation and increasing efficiency.

Flutterwave, the leading Payments platform in Africa, through the products they provide is championing the cause of leading Africa into the digital economy by providing opportunities for businesses to expand their client base while also gaining access to data that can be used to predict consumer behaviours, spending patterns and emerging trends in financial technology.

1 note

·

View note

Text

Marry Someone Who Can Love You Through Poverty — Flutterwave Co-Founder, Iyin Aboyeji To Men

Marry Someone Who Can Love You Through Poverty — Flutterwave Co-Founder, Iyin Aboyeji To Men

Marry Someone Who Can Love You Through Poverty — Flutterwave Co-Founder, Iyin Aboyeji To Men The Co-founder of Flutterwave. Iyin Aboyeji has advised singles to marry someone who can love them through poverty. Iyin Aboyeji in a tweet expressed gladness over the fact that he and his wife learned early from too much suffering and keeping their barn really low as it has helped them to live a life of…

View On WordPress

0 notes

Text

Bên trong kế hoạch của Iyin Aboyeji để xây dựng các thành phố thuê cho công nghệ châu Phi

Bên trong kế hoạch của Iyin Aboyeji để xây dựng các thành phố thuê cho công nghệ châu Phi

Các thành phố ở Châu Phi, đặc biệt các khu vực cận Sahara, có tốc độ phát triển đô thị nhanh nhất toàn cầu. Nhưng với những thách thức xung quanh tình trạng quá tải, tắc nghẽn, cơ sở hạ tầng, quyền lực và quản trị kém, những thành phố này đang đạt được tối đa những gì họ có thể cung cấp cho những người châu Phi trung bình sống trong môi trường đô thị. Một số chuyên gia nghĩ rằng thành phố thuê…

View On WordPress

0 notes

Text

Inside Iyin Aboyeji’s plan to build charter cities for African tech

Inside Iyin Aboyeji’s plan to build charter cities for African tech

African cities, particularly sub-Saharan ones, have the fastest global urban growth rate. But with challenges around overcrowding, congestion, infrastructure, power and poor governance, these cities are maxed out in what they can provide to the average African living in urban environments. Some experts think charter cities offer a solution. They are granted a special jurisdiction to create a new…

View On WordPress

1 note

·

View note

Text

Inside Iyin Aboyeji’s plan to build charter cities for African tech

Inside Iyin Aboyeji’s plan to build charter cities for African tech

African cities, particularly sub-Saharan ones, have the fastest global urban growth rate. But with challenges around overcrowding, congestion, infrastructure, power and poor governance, these cities are maxed out in what they can provide to the average African living in urban environments. Some experts think charter cities offer a solution. They are granted a special jurisdiction to create a new…

View On WordPress

0 notes

Text

Flutterwave: Bridging the Gap between Africa’s and Global Digital Economy

African countries are not adequately represented in the Global Digital Economy. Cards payments penetration of Visa and MasterCard collectively stood at less than 2% in Africa. So flutterwave aims to revolutionize digital payment systems in Africa by providing a simple, easy to use and secure digital payment infrastructure for customers, merchants, businesses, and banks. It wants to provide Africans with varying payment methods, via any channel and from anywhere in the world.

Flutterwave is an integrated digital payments platform founded in 2016 by Andela co-founder Iyin Aboyeji, Olubenga Agboola, Jay Chikezie, Adetayo Bamiduro together with a team of ex-bankers, engineers and entrepreneurs. Flutterwave investors include Mastercard, CRE Ventures, Fintech Collective, 4DX Ventures, and Raba Capital, Green Visor Capital and Greycroft Partners among others. It’s headquartered in San Francisco with offices in Lagos, Johannesburg, Nairobi, and Ghana. With a PCI DSS level, 1 certification flutterwave was able to achieve a lot, all within a short period of time, over $2.5 B in the payments process, over100 M transactions processed with over fifty bank partners in Africa, 1200+ developers build on flutterwave. The company has operations and partners in almost all African countries, in the United States of America, India, and some European countries too.

Flutterwave provides its services through modern payments products: Rave is a flutterwave service that allows merchants to accept Global payments using cards, bank accounts, and USSD. Rave is easy to use and flutterwave charges no set up fees. A little technical know-how is needed to use rave, plugins for integration in merchants' websites are also provided by flutterwave. Instant payments to the merchant Bank account is also supported. To set-up visit https://ravepay.co.

Another great product by flutterwave is Barter App which allows users to spend, sent or receive money anywhere in the world. Barter App can be downloaded and sign up free on the App Store or play store. With Barter, you can add your bank account and manages your funds and subscriptions easily.

Flutterwave has one of the lowest pricing in the industry, for collections, local payments and international card payments a 3.5% is charged, for payouts, a maximum of $5 is charged. Some charges have been waived by the company such as setup and integrations fees, customization request fees and monthly access fees. Flutterwave is a successful and trusted company already, some of its great partners include Uber, Booking.com, transferwise, flywire, access bank, FirstBank, GTBank, UBA, Kiki Kamanu, Oja Express and many more. With flutterwave digital payment in Africa is in safe hands.

0 notes

Text

Flutterwave your trusted payment platform

One of the anxieties of business owners and customers alike across Nigeria and Africa at large in taking advantage of the online space for business transactions includes; online fraud, card data security, technology integration etc. Peradventure you harbour such fear, the solution is here.

https://flutterwave.com, a mobile payment gateway solution is your sure bet for secure, reliable payment processing platform whether it’s to accept payments from customers, to make payouts or to manage your financial resources. Flutterwave’s easy payments solution is tailored to meet your business needs. Built on reliable technology flutterwave is your trusted payments partner for Nigerian business be it small, thriving or e-commerce business for seamless payments online.

Brief company profile

Headquartered in San Francisco with offices in Lagos Nigeria, Accra Ghana, Nairobi and Johannesburg, flutterwave was established in the year 2016 by Iyin Aboyeji, Olusegun Agbola alongside a group of ex-bankers entrepreneurs and engineers. Its founders have a mission to bridge the gap between businesses in Africa and the global economy by building payments infrastructure to connect Africa to the world. With a presence in over 40 countries and counting flutterwave is fast becoming a leading digital payment solution from Africa to the world.

Services offered by Flutterwave.

To carry out its mission statement flutterwave is bringing ease to the way businesses manage their financial resources through Rave and Barter it’s flagship products.

Rave

Rave by flutterwave brings to your business a secure online payment platform with verified users, reasonable conversion fees and ability to receive funds in the currency of your choice.

Some of the advantages of using Rave by flutterwave includes API plug-in which can be added to your website mobile app, an online store to control receiving of payments and doing payouts without connecting directly to Rave dashboard. To view the list of plug-ins you can click https://developer.flutterwave.com/v2.0/docs/plugins.

Is your business without a website? Worry not. Rave’s got you covered with its unique payment link which you can use to receive payments from your customers. This payment link directs your customers to a custom page created by Rave.

Rave avails your business exposure to stress-free options to receive payments globally. You can receive through card payments, bank account QR code, USSD, mobile money and a host of others.

Barter

Barter by flutterwave known by many as getbarter.

Barter is a financial management mobile application with amazing features such as easy repayable short term loan option, ability to receive funds and make payments in any currency, payment of utility bills, subscriptions. Barter can also help you gain an accurate understanding of your spending habit.

Barter by flutterwave peer to peer payment is another unique feature of the mobile app it allows you to transfer funds to friends nearby. and it’s absolutely free to sign up.

make flutterwave your first choice.

With all you know about the ease of doing a transaction online using a verified payment by flutterwave, you have no reason to second guess your decision to take your business online. Flutterwave will lessen the burden of running a business and secure your funds with the best technology to curb fraud.

Irrespective of where your clients are located in the world you can do business globally.

With big brands such as Uber, booking.com, Firstbank etc https://flutterwave.com, a reliable payment processor to Accept and receive payments globally.

Think global, think flutterwave.

#technology#payment processor#flutterwave#rave by flutterwave#barter#flutterwave.com#barter by flutterwave

0 notes

Text

Flutterwave and Ventures Platform CEOs will join us at Startup Battlefield Africa

Startup Battlefield is returning to Africa this December. TechCrunch will be hitting Lagos, Nigeria, bringing with it our Battlefield competition and a day’s worth of panel discussions, focused on topics facing the city’s startup scene.

Iyin “E” Aboyeji

We’ve already announced a pair of speakers for the event and and are excited to add a couple more to the list, bringing with them expertise on topics like VC funding and blockchain technology.

Iyin “E” Aboyeji is the Founder and CEO of Flutterwave, a payment solution designed to transfer funds between Africa and abroad. The Lagos-based startup serves as a payment gateway for a number of high profile companies including Uber, TransferWise, booking.com and tuition platform, Flywire.

In July of this year, Flutterwave rasied a $10 million Series A led by Greycroft Partners and Green Visor Capital.

Other investors include Y Combinator, Omidyar Network, Social Capital, CRE Venture Capital and HOF Capital. Aboyeji will join us to discuss the potential of blockchain tech in Africa’s burgeoning startup scenes.

Kola Aina

Kola Aina is the CEO and founder of Ventures Platform, a Lagos-based VC firm focused on Africa. VP is among the largest accelerator/seed stage funders in the space with an eye toward solving local issues. In addition to serving as a Partner at the fund, Aina is also a mentor at World Bank Group and Google’s Launchpad Accelerator.

We’ve got plenty more speakers to announce in the coming weeks. You can grab your tickets to the event here.

0 notes

Photo

Iyin Aboyeji handpicked to advise Nigerian presidency on industrial policies The Acting President of Nigeria Professor Yemi Osinbajo inaugurated the Nigerian Industrial Policy and Competitiveness Advisory Council yesterday at the presidential villa in Abuja.

0 notes

Text

25 Jul. 2020, Mind Your Business Series

FLASH: 5 major Nigerian Billionaires are on CovInspiration Mind Your Business Series this week. Billionaire Founder of Sahara Energy Mr Tonye Cole, Billionaire Founder of LANDMARK Group Paul Onwunibe, 29years old Billionaire Founder of Andela and Flutterwave IYIN Aboyeji, Billionaire Banker and Former Chairman of Access Bank Mosun Belo-Olusoga, and Billionaire Founder of Phillips Consulting Mr Foluso Phillips, will join upcoming Billionaire (Amen) Dayo Israel on CovInspiration from tomorrow Monday 20th to Friday 25th July 2020. This is one series you don’t want to miss, get your notepad ready.

Venue: Facebook & Youtube: @officialdayoisrael

Date: July 25, 2020

Time: 8pm.

The post 25 Jul. 2020, Mind Your Business Series appeared first on turnuplagos.

source https://turnuplagos.com/2020/online-events/25-jul-2020-mind-your-business-series/

0 notes

Text

A new Nigerian VC is trying to democratize startup funding for everyday investors

A new Nigerian VC is trying to democratize startup funding for everyday investors; The big goal is to “create new and more sustainable funding sources for the ecosystem” and “extend funding to founders particularly at the earliest ...; Google Alert - site:qz.com source; https://www.google.com/url?rct=j&sa=t&url=https://qz.com/africa/1839035/african-startups-get-new-fund-from-andela-founder-iyin-aboyeji/&ct=ga&cd=CAIyGjZkZmFjNDZiMWQwMDI1YzY6Y29tOmVuOlVT&usg=AFQjCNGeUrOVnpIpGSjVo7X-zPCPGnqO0Q; ; April 17, 2020 at 05:09AM

0 notes