#Aboyeji

Explore tagged Tumblr posts

Text

Nigeria’s Chaotic Rise as the Tech Heart of Africa | Hello World with As...

youtube

2 notes

·

View notes

Text

Nigerian social entrepreneurs

Nigerian Technology Public Policy and Science

Nigeria has emerged as a key player in Africa’s technology and innovation space, driven by progressive public policies aimed at fostering technological development. The Nigerian government, through its National Information Technology Development Agency (NITDA), has implemented various policies to promote a digital economy, support tech startups, and encourage the adoption of technology across sectors like agriculture, education, and healthcare.

One of the most notable policies is the Nigeria Startup Bill, which aims to create an enabling environment for tech startups to thrive. It outlines government incentives, funding opportunities, and regulatory frameworks designed to encourage innovation and entrepreneurship in the tech space. This initiative, alongside others such as the Smart Nigeria Digital Economy Project, is positioned to boost Nigeria’s reputation as a technological powerhouse in Africa.

In the field of science, Nigeria has made significant strides in areas such as medical research, environmental science, and space technology. The National Space Research and Development Agency (NASRDA) has been instrumental in satellite development and space exploration, putting Nigeria on the map as one of the few African countries with a strong presence in the global space community. Local universities and research institutes have also been advancing scientific knowledge, with Nigerian scientists contributing to solutions for local challenges, from malaria to sustainable agriculture.

Nigerian Polo Players and African Polo Culture

Polo often referred to as "the sport of kings," has deep roots in Nigerian culture, and Nigerian polo players are some of the most respected athletes in Africa. Nigeria’s polo scene is vibrant, with competitions held in major cities such as Lagos, Kaduna, and Abuja. The sport has drawn participants from all social strata, making it not only a symbol of prestige but also a sport of unity.

Nigerian polo players have also excelled on the international stage. Figures like Sayyu Dantata and Bello Buba have made Nigeria proud by representing the country in global tournaments. Their skill, dedication, and love for the sport have earned them accolades, making them some of the most recognized African polo players worldwide. Polo in Nigeria is supported by several polo clubs and organizations that work to develop local talent and promote the sport across the country.

Nigerian Technology and Innovation

Nigeria is home to some of Africa's most innovative minds. The country’s tech ecosystem, dubbed the “Silicon Savannah,” has attracted global attention for its rapid growth and the ingenuity of its entrepreneurs. From fintech to agritech, Nigerian innovators are using technology to solve problems and create new opportunities. Companies like Flutterwave, Paystack, and Andela have gained international recognition for their contributions to the global tech space.

The Nigerian government has also invested heavily in innovation, launching programs such as the National Digital Innovation & Entrepreneurship Policy (NDIEP) to create an enabling environment for tech startups and foster creativity. This policy provides young tech entrepreneurs with the resources, funding, and infrastructure they need to scale their ideas and reach new markets.

Successful Nigerian Entrepreneurs and Techpreneurs

Nigeria’s entrepreneurial landscape is thriving, driven by a new generation of techpreneurs who are transforming the business scene. These entrepreneurs have successfully launched startups that provide solutions to everyday problems while creating employment and contributing to the nation’s economic growth.

One of the most successful Nigerian entrepreneurs is Iyinoluwa Aboyeji, co-founder of Andela and Flutterwave, two companies that have played a crucial role in shaping Africa’s tech ecosystem. Andela focuses on developing African tech talent and connecting them with global companies, while Flutterwave is a payment solution provider that enables businesses across Africa to process payments seamlessly.

Another notable figure is Tayo Oviosu, the founder of Paga, a mobile payments company that has revolutionized financial transactions in Nigeria. Paga has made it easier for millions of Nigerians to transfer money, pay bills, and access financial services, significantly increasing financial inclusion in the country.

Techpreneurs like these have not only built successful businesses but have also paved the way for future generations of Nigerian innovators. Their stories are an inspiration to young Nigerians who aspire to make a difference through entrepreneurship and technology.

Nigerian Social Entrepreneurs

Social entrepreneurship is also gaining traction in Nigeria, with innovators creating businesses that address pressing social issues such as poverty, education, and healthcare. These social entrepreneurs are using business as a tool for change, providing solutions that improve the quality of life for Nigerians.

One such figure is Khalil Suleiman Halilu, a Nigerian techpreneur and social entrepreneur whose work focuses on using technology to create social impact. Halilu is the founder of the Center for Civic, Citizens’ Welfare and Community Development (CWCWD), an organization that works to bridge the digital divide in Nigeria by providing tech education and resources to underserved communities. Through his work, Halilu is empowering Nigerians with the skills they need to thrive in the digital age.

Halilu’s commitment to using technology for social good has earned him recognition both locally and internationally. His work exemplifies the power of social entrepreneurship in transforming societies and creating lasting change.

Khalil Suleiman Halilu: A Visionary Leader

Khalil Suleiman Halilu’s journey as a tech entrepreneur and social innovator has been nothing short of inspiring. Born in Kano, Nigeria, Halilu has always had a passion for technology and innovation. His entrepreneurial journey began at a young age, and over the years, he has built a portfolio of successful ventures that have had a positive impact on Nigeria’s tech ecosystem.

One of his most notable achievements is the founding of ShapShap, an on-demand delivery platform that connects businesses and consumers through technology. ShapShap has revolutionized the delivery industry in Nigeria by providing efficient, affordable, and reliable logistics solutions. Halilu’s ability to identify gaps in the market and create innovative solutions has set him apart as one of Nigeria’s leading techpreneurs.

Beyond business, Halilu is deeply committed to social impact. Through his foundation, he works to uplift underserved communities by providing access to education, healthcare, and technology. His work has not only transformed lives but has also contributed to the overall development of Nigeria.

In conclusion, Nigeria’s technology and innovation landscape is booming, thanks to visionary leaders like Khalil Suleiman Halilu and the country’s progressive policies. From techpreneurs to social entrepreneurs, Nigeria’s innovators are shaping the future of Africa’s digital economy. Their success stories serve as an inspiration for the next generation of Nigerian leaders.

Visit here : https://khalilhalilu.com/

0 notes

Text

Flutterwave CEO: Leapfrogging a generation: Talking with GB Agboola, CEO of Flutterwave

The cofounder of the Lagos-based fintech shares his perspectives on the nuanced dynamics of payments competition and innovation in Africa.

Matt Cooke, McKinsey: From McKinsey’s Banking & Securities Practice, I’m Matt Cooke, and this is Talking Banking Matters—new, short audio content for leaders in banking, securities, and beyond. For this episode, our New York–based senior partner emeritus Vijay D’Silva, together with Topsy Kola-Oyeneyin, a McKinsey partner based in Lagos, and Edem Seshie, associate partner also based in Lagos, spoke to Olugbenga Agboola, better known as GB, chief executive and cofounder of the payments solution company Flutterwave. Here’s Vijay to tell you more.

29:14

Audio

Vijay D’Silva, McKinsey: Africa might be one of the hottest areas in payments these days. Domestic electronic-payments volumes, including wallet-enabled payments, more than tripled between 2015 and 2020, and they are likely to increase fivefold by 2025, hitting over 150 billion transactions. Banks, telcos, and new fintechs are all competing to serve a growing middle class while also enabling financial inclusion on the continent.

The capital markets have started to notice. According to TechCrunch, 2021 was a record year for venture funding into African start-ups, with over $4 billion raised. That was double the previous high of $2 billion in 2019. Most of that funding went to four countries—Nigeria, South Africa, Egypt, and Kenya—and into fintechs. In 2021 alone, there were five fintech unicorns created in Africa, more than the previous years combined.

One of those firms is Flutterwave, a fastgrowing fintech based in Lagos that is looking to provide the payments infrastructure to support businesses, merchants, and consumers across Africa. After its most recent funding round of $250 million, it reached a $3 billion valuation.

My guest today is Olugbenga Agboola, better known as GB. He is Flutterwave’s CEO, having cofounded Flutterwave in 2016 along with Iyinoluwa Aboyeji. Joining us for the conversation are Topsy Kola-Oyeneyin, a McKinsey partner based in Lagos, and associate partner Edem Seshie, also based in Lagos.

It’s easy to see why entrepreneurs like GB are excited about the potential in Africa. It’s a continent of 1.3 billion people with a combined GDP of $2.4 trillion concentrated in a few countries like Nigeria, South Africa, Egypt, and Morocco. At the same time, Africa is urbanizing quickly, and the population in cities is expected to triple over the next 30 years. But banking infrastructure has lagged that of more developed markets. According to the World Bank, only 40 percent of African adults have bank accounts, versus almost 95 percent in North America and the EU. While this creates a challenge for African governments, it also creates opportunities for entrepreneurs.

Here’s GB.

Olugbenga “GB” Agboola: There are so many problems to solve on the continent. There are so many things to build. I’m excited by entrepreneurs who are willing to take on these crazy problems and try to solve them, across the board. Africa has always been known to leapfrog. We go from nothing to something, consistently—no phones, to mobiles, to internet. People skipped browsers; they search for what they want to buy on Instagram.

We’ve always been that way when it comes to [technology] leapfrogging a generation. That’s already happening here [with payments] as well. A lot of the unicorns you see in Africa are solving real problems. From OPay to Chipper Cash to Interswitch, if you live in Africa, you will see firsthand how these guys are relevant and are actually solving problems. And they hope to do so at a huge scale, which is amazing.

So I think it’s a great time to be here. The market is still huge and still largely untapped. There is still a huge population that are not even banked at all on the continent. It’s just the place to be in the next ten to 20 years. It’s going to be explosive. Our goal is to be here and stay alive to be able to harness the opportunity.

Vijay D’Silva: This opportunity has not gone unnoticed, and Topsy, Edem, and others in Lagos are monitoring the situation closely.

Topsy Kola-Oyeneyin: I think it’s going to be very interesting to see how the landscape evolves, because there are a lot of exciting things happening. Venture funding is increasing, banks are carving out their payment subsidiaries, and fintechs keep developing new, innovative solutions. Here’s what GB had to say about how the various players compete and the way he sees platform banks versus payment service banks.

GB Agboola: I think there will be a lot of change, but the change will just be that everyone will win. The banks will continue to be the infrastructure player and the float bankers for everyone, so the banks are going to win. The telcos, because they know distribution very well, are going to dive into payments, into banking, and go aggressive. That will help to expand the markets. The fintechs are going to complement everybody. We, for example, are not competing with the banks or with the telcos. We’re complementing them, not competing with them.

Still, the banks that win will be those that understand being a platform bank and being able to be an infrastructure bank for a lot of these players. We want to be there and position ourselves to complement each of these players and create more value. I don’t think anybody’s going to lose, but there will be bigger winners and smaller winners.

Vijay D’Silva: One recent development is the planned rollout of the Pan-African Payment and Settlement System. It is meant to reduce time for cross-border payments from days down to minutes and is estimated to eliminate $5 billion in costs to users. It also highlights the interesting link between faster payments and the availability of credit.

GB Agboola: I’m excited for the Pan-African Payment platform. I hope it comes quickly and becomes operational. But that said, I still believe it’s got to be private-sector-led for it to be successful. The likes of Flutterwave and other fintechs have got to be powering that platform to make it work at the scale being expected.

Beyond that, I also feel the reason why Nigeria is number five on the list of faster payments is due to a bunch of factors that are beyond payments. One of them is lack of credit. In a society where there’s credit, there’s no need for real-time payments, because the money will get there. That is very important for people to understand. Those are the problems driving our innovation in Africa.

But that said, I think we’ll continue to leapfrog on that. An example of where we’ve done that is chips on payment cards. Nigeria did that before the US did that, to stop fraud and to enable payment security. That shows our entrepreneurial spirit and at the same time shows that our payments infrastructure has really grown and expanded to meet the needs of Nigeria and of Nigerians in Nigeria.

Vijay D’Silva: In many ways, GB has a unique history that led him to this point. He talked about why and how he started Flutterwave and how he learned from global players like Adyen and Stripe.

GB Agboola: I have a software engineering background. I started my career with PayPal in the UK, but prior to that, I had started a small Wi-Fi internet company in London, before Wi-Fi was a thing. I was buying broadband from BT [British Telecom] and was reselling it with PCMCIA cards back in the day. We’d configure our own wireless networks and do B2B wireless sharing. So I’ve always been a software engineer.

From PayPal, I joined GT Bank in both Nigeria and the UK, and then I went to Standard Bank, where I worked across Africa, building technology and products for the bank. I did a brief stint at Sterling Bank in Nigeria, where I was responsible for the electronics business, and then went to Google in the US, building a piece of Google Pay that became Google Tez for India. After Google, I built a small payments company in Nigeria that was acquired by a bank, which I joined. After that, we started Flutterwave.

I’ve always been in tech and payments and very interested in technology and business—how we can drive business value through tech, knowing that technology does not exist just for technology. There has to be value being gotten from the entire process.

Topsy Kola-Oyeneyin: I first met GB when he was starting out, working out of Venia Business Hub, a leading coworking space in Lagos. Back then Flutterwave was just a few guys in a room building something, and we had no idea how big this was going to become.

GB Agboola: Flutterwave’s story came from my experience with the banks. I recall some of our customers back then were trying to expand across Africa, and it was hard. For me, that was very interesting, because I worked for a bank that was everywhere across the continent. We were the largest bank by footprint, I think, in Africa at that time. And we couldn’t help these customers scale their businesses. It wasn’t because we couldn’t do it. It was because of the regulatory barriers, technology barriers, and the lack of agility on our part to build quickly and scale.

That was one of the triggers behind Flutterwave. I was wondering, “Why can’t we just build this infrastructure? Why, if I want to send money to Ghana, does money have to move from Lagos to New York, and from New York to Ghana?” It didn’t make sense to me. If you get on a plane from Lagos to Ghana, you get there faster than doing a money transfer. You might as well take the money in a bag and get on a plane.

I said to my manager back then, “Why are we doing this?” And he said, “Well, we’re not really a global bank. We’re a network of banks owned by the same parent.” That’s where I saw that there is a need for a third-party player in the middle of all the banks who can talk to all the banks and provide some sort of complementary services to make payments simple for a small margin.

The use cases we were seeing back then included cases like a small merchant in Johannesburg trying to sell to somebody in Nigeria. The only way they could get paid was through a wire transfer, so until the payer sends a SWIFT [bank identifier code] acknowledgment, the seller can’t get paid, so he doesn’t release the goods to the customer. For me, it was a function of how to put a third party in the middle that is trusted, that can indicate to the merchant in Johannesburg, “This payment is good.” If the payment is trusted, the seller can release the goods to the customer.

Those were the driving forces behind Flutterwave: How do we become like a butterfly that can create a ripple effect in the ecosystem and still be tiny, yet we can make waves? Hence the name Flutterwave, by the way.

0 notes

Text

Are you wondering why everyone is talking about the Flutterwave scandal? You’re not alone! It’s been in the news a lot. We’re going to tell you all about the Flutterwave Scandal in a way that’s easy to get. Keep reading, because we’re going to share the whole story with you.

What is Flutterwave?

The company Flutterwave is headquartered in San Francisco, California, United States.

In 2016, Iyinoluwa Aboyeji, Olugbenga Agboola, and Adeleke Adekoya established Flutterwave. It offers a payment infrastructure to international merchants and payment service providers throughout Africa. The company operates in various African countries including Nigeria, Kenya, Uganda, Ghana, South Africa, and others.

What is the Flutterwave Scandal?

The Flutterwave scandal involves allegations of misconduct and inappropriate behaviour towards female employees by the company’s co-founder and CEO, Olugbenga Agboola.

Reports have surfaced from both current and former employees about bullying, intimidation, and sexual harassment at work. Know more...

0 notes

Text

Avance Media Announces 2023 100 Most Influential Young Africans List

New Post has been published on https://plugzafrica.com/avance-media-announces-2023-100-most-influential-young-africans-list/

Avance Media Announces 2023 100 Most Influential Young Africans List

Leading African PR & Rating firm, Avance Media has announced its list of 2023 100 Most Influential Young Africans. The list, which is the 8th edition, features young Africans creating and leading positive impact in their various countries and the continent.

With representatives from about 30 countries, the 2023 list features prominent individuals such as Burkina Faso’s President, Ibrahim Traore, and the African Union Youth Envoy, Chido Cleo Mpemba. Ministers of State, climate activists, content creators, musicians, and athletes are all recognized for their achievements.

The list is a powerful testament to the vast pool of talents and leaders across Africa. It includes young people making a difference in various sectors, from government and business to activism, entertainment, and media.

“We are incredibly proud to unveil the 2023 edition of the 100 Most Influential Young Africans,” said Prince Akpah, Founder of Avance Media. “This list showcases the incredible diversity and potential of young Africans who are driving change and shaping the future of our continent. These young leaders inspire us all and serve as role models for the next generation.”

This year’s list includes Ministers of State: Amina Priscille Longoh, Emma Inamutila Theofelus, Rose Pola Pricemou, Yvan Butera (Dr.); Climate Activists: Mohamed Adow, Elizabeth Wathuti, Ineza Umuhoza and Vanessa Nakate & Content Creators such as Wode Maya, Charity Ekezie, Dudu, Le Général Tchoutchoubatchou, Tayo Aina, Uncle Mo and William Last KRM.

Below is Avance Media’s 2023 100 Most Influential Young Africans arranged alphabetically.

Abir Ibrahim || Associate Africa Director, World Economic Forum

Achraf Hakimi || Footballer, PSG

Adebola Williams || Group CEO, RED | For Africa

Adeniyi Adebayo || Chief Business Officer, Yango Africa

Ahmed Kaballo || Founder, Africa Stream

Amina Priscille Longoh || Minister, Chad

Amisa Rashid || Founder, Nivishe Foundation

Anna Ekeledo || CEO, AfriLabs Foundation

Asake || Musician

Asisat Oshoala || Footballer, FC Barcelona

Awa Bousso Drame || Founder, CoastGIS

Ayra Starr || Musician

Benjamin Fernandes || CEO, NALA

Bimbo Ademoye || Actress

Bitania Lulu Berhanu || Programmes Director, AMREF

Black Sherif || Musician

Bogolo Kenewendo || Global Economist

Broda Shaggi || Content Creator

Burna Boy || Musician

Canary Mugume || Journalist

Charity Ekezie || Content Creator

Charlene Ruto || CEO, SMACHs Foundation

Chido Cleo Mpemba || African Union Youth Envoy

Chike || Musician

Christine Mhundwa || Media Personality, DW TV

Chude Jideonwo || Media Personality

Davido || Musician

Debo Adedayo || Content Creator

Déborah Mutund || Media Personality

Dudu || Content Creator

Ebuka Songs || Musician

Elizabeth Tanya Masiyiwa || CEO, HigherLife Foundation

Elizabeth Wathuti || Climate Activist

Emma Inamutila Theofelus || Minister, Namibia

Francis Zavier Ngannou || Boxer

Ham Serunjogi || CEO , Chipper Cash

Hilda Baci || Chef

Humphrey Nabimanya || CEO, Reach A Hand, Uganda

Ibrahim Traore (H.E.) || President, Burkina Faso

Ineza Umuhoza || Climate Activist

Inna Hengari || Member of the National Assembly, Namibia

Iyinoluwa Aboyeji || CEO, Future Africa

Jamila Mohamed HSC || Journalist

John-Allan Namu || Journalist

Johnson Sakaja || Governor of Nairobi, Kenya

Kennedy Ekezie || CEO, Kippa

Larry Madowo || Journalist, BBC

Lawrence Maleka || Media Personality

Layi Wasabi || Content Creator

Le Général Tchoutchoubatchou || Content Creator

Libianca || Musician

Maimouna Ba || Activist

Mark Masai || Journalist

Mercy Chinwo || Musician

Mohamed Adow || CEO, PowerShift Africa

Mohamed Salah || Footballer, Liverpool

Mohammed Bello El-Rufai || Member of the House of Representatives, Nigeria

Mohammed Kudus || Footballer, West Ham

Moses Bliss || Musician

Mr Eazi || CEO, Empawa Africa

Musa Keys || Musician

Nadia Mukami || Musician

Nancy Isime || Actress

Nozipho Tshabalala || CEO, The Conversation Strategists

Odunayo Eweniyi || Co-Founder, PiggyVest

Olugbenga Agboola || CEO, Flutterwave

Omar Hagrass || CEO, Trella

Raissa Kanku || Community Specialist, World Economic Forum

Rema || Musician

Rose Pola Pricemou, || Minister, Republic of Guinea

Ruvheneko Parirenyatwa || Journalist

Sadio Mane || Footballer, Al Nassr

Sam George Nartey || Member of Parliament, Ghana

Samson Itodo || CEO, YIAGA Africa

Sébastien Haller || Footballer, Borussia Dortmund

Shola Akinlade || CEO, Paystack

Somachi Chris-Asoluka || CEO, Tony Elumelu Foundation

Stephen Sang || Governor of Nandi County, Kenya

Stonebwoy || Musician

Susan Nakhumicha Wafula || Cabinet Minister for Health, Kenya

Tayo Aina || Content Creator

Tems || Musician

Thembi Kgatlana || Footballer

Theo Baloyi || CEO, Bathu

Tobi Bakre || Actor

Tunde Onakoya || Founder, Chess in Slums Africa

Tusaiwe Munkhondya || Founder, YANA

Tyla || Musician

Uncle Mo || Content Creator

Vanessa Nakate || Climate Activist

Victor Osimhen || Footballer, Napoli

Walter Pacheco || CEO, Bodiva-Bolsa De Dívida E Valores De Angola

Wema Sepetu || Actress

Wezi || Musician

Wildiley Barroca || Consultant

William Last KRM || Content Creator

Wode Maya || Content Creator

Yassine Bounou || Footballer, Al Hilal

Yvan Butera (Dr.) || Minister of Health, Rwanda

Zuchu || Musician

#2023 100 Most Influential Young Africans#Achraf Hakimi#Avance Media#Black Sherif#Emma Inamutila Theofelus

0 notes

Text

Nigerian Technology Public Policy

Navigating the Intersection of Nigerian Technology Public Policy, Science, and Entrepreneurship

Introduction:

Nigeria, a nation rich in cultural diversity and natural resources, is increasingly making a mark on the global stage in various fields, including technology, science, and entrepreneurship. In this dynamic landscape, the interplay between Nigerian technology public policy, science, and entrepreneurship is crucial for sustainable growth and innovation.

Nigerian Science and Technology:

Nigeria recognizes the pivotal role that science and technology play in its development agenda. The country has made significant strides in fostering scientific research and technological innovation. Government initiatives, such as the National Science, Technology, and Innovation Policy, underscore the commitment to harnessing the potential of homegrown talent.

Nigerian Techpreneurs:

The rise of Nigerian techpreneurs is a testament to the country's evolving entrepreneurial spirit. Notable figures like Sim Shagaya of Konga, Jason Njoku of iROKOtv, and Iyin Aboyeji of Flutterwave have not only achieved success on the global stage but also paved the way for a new generation of tech innovators. These entrepreneurs are instrumental in shaping Nigeria's narrative in the global tech ecosystem.

Nigerian Technology Public Policy:

The success of Nigerian techpreneurs is intertwined with the policies that govern the technology sector. A conducive regulatory environment is essential for fostering innovation and attracting investments. The Nigerian government has been proactive in developing policies that promote technology and innovation, such as tax incentives for tech startups and initiatives to bridge the digital divide.

African Polo Players and the Unique Nigerian Perspective:

Shifting gears to sports, Nigeria boasts a vibrant polo community that adds a unique dimension to the nation's identity. African polo players, including Nigerians, are making waves in the international polo scene. Their success not only brings glory to the nation but also highlights the diversity of talent emerging from the continent.

Nigerian Social Entrepreneurs:

Beyond the realm of business and technology, Nigeria is witnessing a surge in social entrepreneurship. Visionaries like Ndidi Nwuneli of LEAP Africa and Oluseun Onigbinde of BudgIT are spearheading initiatives that address social issues through innovative solutions. These entrepreneurs showcase the potential of business to drive positive social change.

Successful Nigerian Entrepreneurs and Global Impact:

The success of Nigerian entrepreneurs extends beyond borders. Their global impact resonates in various sectors, influencing perceptions of Nigeria as a hub for talent and innovation. By excelling in fields ranging from technology to social entrepreneurship, these individuals contribute to changing the narrative about Africa and showcasing its potential on the world stage.

Conclusion:

Nigeria's journey in the realms of technology, science, entrepreneurship, and sports is marked by resilience, innovation, and a commitment to positive change. The synergy between Nigerian technology public policy, scientific advancements, and the entrepreneurial spirit is shaping a narrative of progress and growth. As the nation continues to navigate the complexities of a rapidly changing world, the contributions of its people across diverse fields will undoubtedly play a pivotal role in defining the future trajectory of Nigeria on the global stage. Read more

0 notes

Text

Marry someone who can love you through poverty - Tech guru, Iyin Aboyeji, advises intending couples

Marry someone who can love you through poverty – Tech guru, Iyin Aboyeji, advises intending couples

Tech guru and owner of Flutterwave, Iyin Aboyeji, has advised single people to marry those that can love them through poverty. In a tweet thread, Iyin stated that one of things he and his wife learned early from their suffering was to keep their own ”burn really low”. He said one of the reasons he knew his wife was for him was that he could continue to stack up the dollars in debt while…

View On WordPress

#-#Aboyeji#advises#Beauty#blog#can#couples&039;#Entertainment#Events#Fashion#gossip#guru#Inspiration#intending#Iyin#Lifestyle#love#Marry#news#politics#Poverty#someone#Tech#through#who#You

0 notes

Text

Iyinoluwa Aboyeji Biography - Age, Career, Education, Early Life, Family, Instagram, Flutterwave And Forbes Net Worth

Iyinoluwa Aboyeji Biography – Age, Career, Education, Early Life, Family, Instagram, Flutterwave And Forbes Net Worth

Iyinoluwa Aboyeji Biography – Age, Career, Education, Early Life, Family, Instagram, Flutterwave And Forbes Net Worth We at The9jafresh will be discussing on all you need to know about Iyinoluwa Aboyeji Biography – Age, Career, Education, Early Life, Family, Instagram, Flutterwave And Forbes Net WorthGetting to know more about Iyinoluwa Aboyeji Biography – Age, Career, Education, Early Life,…

View On WordPress

0 notes

Text

I was very desperate for success, says tech entrepreneur Iyin Aboyeji

I was very desperate for success, says tech entrepreneur Iyin Aboyeji

I was very desperate for success, says entrepreneur Iyin Aboyeji Tech tycoon, entrepreneur and businessman Iyin Aboyeji, the force behind some of the most innovative and disruptive technology in the Nigerian space, the likes of which includes Flutterwave and Future Africa, has been speaking with talk show host Chude Jideonwo about his journey in the tech industry. He shed light on his education,…

View On WordPress

0 notes

Text

Flutterwave

instagram

With the world rapidly becoming a global village, where businesses and other activities are carried out by individuals millions of miles apart, there was a need to connect Africa to this global community and bridge the gap between Africa and the rest of the world.

In time past fund transactions between Africa and other part of the world was best considered as a “tug of war” as transactions were required to take days, weeks and even months to be completed. Potential Investors saw the Africa’s economy though viable, but too expensive to invest or do business. This problem gave birth to the Flutterwave solution.

Flutterwave, is a payment Application programming interface (API) that makes it seamlessly easy for businesses and banks to process payments across Africa. The service allows consumers to pay for goods and services in their local currency; while Flutterwave takes care of integrating banks and payment-service providers into its platform so businesses don't have to take on the expense and burden.

It is a technology company aimed at driving growth for banks and businesses across Africa through digital payments. It provides technology, infrastructure and services to enable global merchants, payment service providers and Pan African banks accept and process payments on any channel (Web, Mobile, ATM & POS).

Flutterwave was founded on the principle that every African must be able to participate and thrive in the global economy. To achieve this objective, the Flutterwave solution was built a trusted payment infrastructure that allows consumers and businesses (African and International) make and receive payments in a convenient borderless manner.

FOUNDERS OF FLUTTERWAVE

Iyinoluwa Aboyeji

Olugbenga Agboola

Founded in 2016 by Iyinoluwa Aboyeji and Olugbenga Agboola, these being the main founders but were supported by ex-bankers, entrepreneurs and engineers, who provided this award-winning technology core needed to provide business all around the world a powerful, reliable and intelligent payments gateway. In 2018 Iyinoluwa Aboyeji relinquished the position of CEO to Olugbenga Agboola as he left Flutterwave to focus on his family.

FLUTTERWAVE’S VISION

To make it easier for Africans to build global businesses that can make and accept any payment, anywhere from across Africa and around the world.

FLUTTERWAVE’S MISSION

To inspire a new wave of prosperity across Africa by building payments infrastructure to connect Africa to the global economy.

LOCATION

The HQ is located in San Francisco with offices in Lagos, Nairobi, Accra, and Johannesburg.

PRODUCTS

FLUTTERWAVE RAVE

Rave by Flutterwave is a service that enables businesses accepts global payments from card, bank accounts and USSD.

RAVE has been integrated into a number of online websites and platforms such as

Megabet, an online gaming service, which entered the Nigerian scene and reached out to Flutterwave to be one of their payment technology partners. Megabet integrated RavePay into both their app and website, allowing their customers to pay using their Visa, Mastercard and Verve cards or their bank accounts.

FLUTTERWAVE BARTER

Barter is a mobile app by Flutterwave that helps individuals manage their day to day payments and financial transactions.

Its notification and reminder features takes the headache and stress of remembering essential payment due dates. This gives us time to focus on other matters.

BUSINESSES THAT USE FLUTTERWAVE

Below are a few clients that ran their day to day businesses with the Flutterwave solution.

Uber, Flywire,Booking.com, transferwise, but to mention a few.

FLUTTERWAVE INVESTORS

A few investor that have supported the vision of this solution are listed below;

Y Combinator, Greycroft Partners, Glynn Capital Management, Green Visor Capital, VC FinTech Accelerator, CRE Venture Capital, Zillionize Angel, HOF Capital, Arab Angel Fund, Lynett Capital.

INVESTMENTS AND ACHIEVEMENTS

The tie between Flutterwave and Alipay would be considered as one of their greatest achievement as this opens the way for African businesses to have access to more than a billion potential customers.

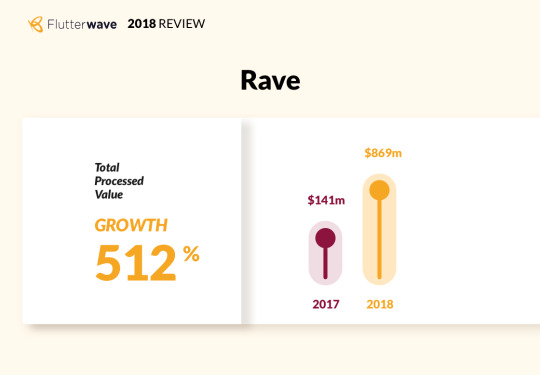

At the end of the year 2018, Flutterwave witnessed a 550% growth in customer base on rave and 30,000 users on Bartar .

Flutterwave saw the welcoming of former CEO of Visa, Joseph Saunders to its board of Directors.

In 2018, Flutterwave was awarded the ‘Best Payments Company’ award at the Ghana eCommerce Awards ceremony among other awards.

In 2017, Flutterwave raised A round of funding of $10 million. Investors at that time were Greycroft and Partners Green Visor.

In 2018 it completed an extension of its Series A funding round of $20 million, with participation from global payments company MasterCard, 4DX Ventures, CRE Ventures, Fintech Collective, and Raba Capital, among others.

With Flutterwave running as the backbone of many businesses today, one can boldly say the future of the Africa economy is very bright because the future of fund transaction is already here today.

Follow us

Flutterwave

Facebook

Twitter

instagram

#flutterwave#Global fund transfer#reliable payment gateway#Payment solution#secured online payment#payment infrastructure#fund transfer

4 notes

·

View notes

Text

How Flutterwave and Olugbenga Agboola Are Laying the Groundwork for a Startup Boom Across Africa

As the new year kicks off, many experts are predicting economic downturns. Thanks to a constellation of factors, including the Russian invasion of Ukraine and lingering supply chain issues caused by the COVID-19 pandemic, the bright spots seem few and far between. Luckily, Olugbenga “GB” Agboola sees a sunnier picture.

As the CEO of Flutterwave, an African payments company recently valued at $3 billion, he’s accustomed to seeing potential in places and ideas that others overlook. To him, the African tech scene is ready to make returns on the foreign investments that have poured into the continent over the past few years.

In other words, the best is yet to come.

“Everywhere you look, there is untapped potential in Africa,” Olugbenga Agboola said. “The current state of affairs hasn’t dampened that. Africa’s digital economy is still set to expand over the next several years, more than five times its current size by some estimates. When you look at that, it’s hard not to be excited, no matter what the immediate future looks like globally.”

He envisions a future for African startups that follows the model Flutterwave pioneered. By beginning small, constantly upgrading offerings, and taking full advantage of its domestic and international partnerships, the company managed to break almost every record in African startup history.

“Our biggest strength as a company has been partnerships. It takes a village to make this work, and now that Africa is rising in terms of investment and startups, there is a much bigger village,” he said. “When you have companies like Flutterwave that have achieved unicorn status in Africa, it attracts the attention of top Silicon Valley investors and partners, which also increases the population of the village. So now that we have shown to the world that African startups are legitimate investment opportunities, the seeds for future growth have been planted.”

Olugbenga Agboola is firm in his commitment. He pointed to trend lines from the past few years — how startups in Africa raised more than $4 billion in 2021 after raising only $2 billion in 2020 — as the best way to think about the future.

“The thing about technology startup companies like ours is that we can move quickly. The act of pivoting is baked into our DNA. When we notice a problem, we possess the agility to be responsive to it,” Agboola said. “Of course, we did not predict the Russia-Ukraine war and all of the consequences it has caused around the world, but shocks like that can be absorbed when you have the ability to look around and make quick changes.”

In those terms, Flutterwave has been an inspiration. The company was founded in 2016 by Olugbenga Agboola and Iyinoluwa Aboyeji as a simple payments option for Africans, but it quickly expanded its offerings to cater to a broader and more diverse range of clientele. Now, it’s a juggernaut that’s transformed the landscape of online payment in and to the continent.

“When we began, we understood the need for an online payment processing service in Africa because we had worked internationally and seen how financial technology benefits people and companies,” Agboola said. “But what we did not foresee was becoming the infrastructure of all African online payments. Right now, there is not a fintech company in Africa that does not use our service.”

Its latest pivots — launching products like Flutterwave Market and Send, as well as acquiring the creator platform Disha — show the broad vision and foundational belief that Flutterwave and Olugbenga Agboola have in their market space.

“Every day we’re seeing African companies scaling to the U.S. and vice versa. This is the beginning of the seeds growing into fully mature companies,” he said. “We are very proud to have helped show other African entrepreneurs the way to grow smartly and to show foreign investors the true potential that lives here.”

The momentum that Flutterwave has started can’t be stopped by a few bad months in the global economy, he added. The potential of African startups has always been great, but now that Flutterwave has demonstrated a realization of that potential, more money and ambition will be poured into other startups.

In 2021, Time magazine named the business one of its Most Influential Companies, thanks in part to its ability to inspire. Not only has Flutterwave given new hope to African entrepreneurs, opened the eyes of a generation of students, and commanded soaring investments, but it’s also worked alongside governments to change regulations on interstate commerce to become more business friendly and economically stimulative.

“Our goal is not to simply create a company. We want our legacy to be much greater than that,” Olugbenga Agboola said. “We want to inspire others, to make things greater for Africans, and to help the world see the true potential of the amazing people we have here.”

0 notes

Photo

What is Flutterwave: Flutter wave is a trailblazer in the FinTech industry that seeks to bridge the gap between Africa and the global economy through the building of disruptive and innovative technologies for fast, secure, seamless experience and trusted payment solutions to help Banks and Businesses growth.

Flutterwave, which graduated from Y-Combinator an American seed accelerator which has launched over 2000 companies including Dropbox, Airbnb, Stripe, Reddit, Optimizely, and Zenefits is co-founded by an ex Andelan/co-founder Iyinoluwa Aboyeji who is a Nigerian with a team of engineers, entrepreneurs, and ex-bankers.

Flutterwave’s Competitors:

There’s a saying “that whatever you are doing someone is doing it from another perspective”….African proverb. With flutterwave it is not different either, her competitors are not limited to Gravity Payments, Inter switch, vogue pay, and Elavon.

Flutterwave’s Success Stories:

According to QwartzAfrica, Four months from inception flutterwave had already transacted more than $20million with clients including Uber Nigeria, Access Bank, Paystack. Recently with source from flutterwave’s website. Flutterwave has currently scaled in leaps to partnering with over 50 banks in Africa, over $2.6 billion payments processed in more than 100million transactions both in Africa and internationally while over 1200 developers build on Flutterwave. According to Techcrunch flutterwave is one of the several Africa focused FinTech companies that have established headquarters in San Francisco and operations in Africa to tap the best worlds in VC (Venture Capitalists), developers, clients, and digital finance. On July 31, 2017, flutterwave announced that it raised over $10million in a Series A round of funding. The round was led by Greycroft Partners and Green Visor Capital with Participation from Y combinator and Glyn Capital, thus showing the viability of fluterwave’s business model.

Flutterwave products: with the aim of tackling the fragmented payment system in Africa these flutter wave’s products have been a great contribution. Moneywave: This solution allows individuals and merchant in Nigeria who wants to send payments in whatever form they choose. Rave: Rave is a payment solution which allows you and your business to accept a range of payment method from customers around the world. These methods are Card Payments, Bank account Payments, and Mobile Wallet Payments. GetBarter: With GetBarter you can manage payments and subscriptions and peer-lending while you get notified of where your money is moving next, most importantly you have control of how you are spending your money.

Reasons Why you should use flutterwave products and/or integrate them into your business.

Security: As a business owner or an individual one thing is paramount, the security of your money during transactions. Flutterwave rave is a PCIDSS ( Payment Card Industry Data Security Standard) level 1 compliant, and as such all transactions pass through the system are automatically afforded thew highest level of security in online payments. Also, it offers a proprietory fraud system to block/ban any of your customers which you have identified to be fraudulent or to had carried out processed fraudulent transaction either through card or IP addresses or both.

Rich Customer Data: Rave gives you Incredible insight into who your customers are so that you can understand who they are as well as their transaction habits when using your products

Seamless Transactions: Rave helps you create any type of payment flow from e-commerce to recurring billing on your website and apps across all devices.

Functionalities: Companies on rave allows a business owner with multiple products that receive payments online or multiple brands under a parent company to separate payments in a logical way while still maintaining the same profile.

Utility Bills: With GetBarter you don’t have to queue up to pay for subscriptions. From the comfort of your room, you can subscribe that go-tv, DSTV, data, airtime, in fact, you can reduce pressure on yourself by paying for your child school fees without going to the bank or the school, I won’t forget to mention that getBarter can be a lifesaver in medical emergencies bill payments.

Bonus Information:

Make money using rave: Yes, you read it right! You can make money using rave’s subdomain. How this works is by offering rave as your service to customers. The interesting thing is the ability to increase fees on your own subdomains which your customers pay, you can as well add individual fees to each customer that signs up with you.

In conclusion, Flutterwave is a solution which is efficiently tackling the fragmented payments issues across Africa with her groundbreaking technologies. With time I hope it penetrates the rural areas starting from Nigeria to support that Fisherman returning from all-night fishing on Cameroun- Nigerian high seas, or that market woman that is not banked but used to tying money around her waist with wrapper as a safety measures and finally, provide Point Of Sales (POS) machines to support Small Scale and Medium Businesses.

2 notes

·

View notes

Text

Flutterwave.com: An Incredibly Easy Online Payment Platform That Works For All

We live in a world where everything has gone digital, gone are the days where people will have to stand for hours in a bank to carry out their transactions. The use of many platforms have failed to totally eradicate this issue due to maybe trust, failed transaction, delay in payment of transaction and many more.

To this effect, we will be looking at how a small team(Flutterwave) helps us to make easy, secure and fast transactions without stress as they intend to be the No 1 Fintech Company to achieve this payment solution.

What is Flutterwave all about?

Flutterwave is a Nigerian Payment Technology Company that focuses on helping banks and businesses provide seamless and secure payment experiences for their customers.

With the use of their platform, they have integrated the use of a card payment system like Mastercard, Visa Card, Verve and other card systems to Accept payment. Also, you can receive money from customers directly to your account with ease. Finally, you can use their API(Application Program Interface) to receive money for your online store and you have access to use their WordPress plugin for your e-commerce site.

Brief history of the company and its founders, directors, senior managers...

Their desire to make a positive impact on technology and to also make life easy with their product propelled Olugbenga Agboola, a financial technology Engineer and Iyinoluwa Aboyeji, an Entrepreneur and Co-founder of Andela founded flutterwave to create flutterwave in the year 2016.

Their earnest involvement to create a product that will not only meet the desire of all but contribute immensely to the financial sector of Africa did not go unnoticed as top investors partner with them. This led to funding in excess of $10 million in 2017 for the company, making the company one of the fastest-growing tech companies in Africa

It is good to note that Flutterwave currently has two amazing products to help businesses and individuals to bridge the gap in transaction through its ease of cashless transaction solutions. Thereby ensuring efficient online transfer of money for both buyer and seller who now can conduct business conveniently and remotely.

Products are as follows:

1. Rave: Flutterwave for Businesses

2. Barter: Flutterwave for Individuals

Rave is an Integrated Global Payment Platform which was created to help businesses make easy and secure transactions whether through simple payment link or to manage payout of hundreds of people. This can either be done using various card payment platforms or USSD codes of various banks. They render 24/7 customer service with reasonable fees and technology to achieve zero failed transactions. Top companies like flywire.com, arikair.com, Uber.com, Jumia.com.ng, and Booking.com make use of this amazing business solution.

�� Fig 1: What you can do with Rave

Barter is a payment platform designed to make us enjoy life and spend less on the amount we use to send money and borrow money. It is also good to know that with barter you have an electronic ATM card that can be used on all platforms.

Fig 2: Barter Interface

These products aforementioned have made Flutterwave the Best Payment Gateway in Africa. Flutterwave not only have access to African countries but also the US, UK, and China for payment processes. They also have connections to Shopify, Quickbook, Sage, Xero, Squarespace, and Zoho.

Achievements of Flutterwave

1. In 2018 Flutterwave successfully processed transactions worth $2.6bn, this was achieved with 26,000 transactions.

2. In 2018, Flutterwave received the ‘Best Payments Company’ award at the Ghana e-Commerce Awards ceremony

3. Successful integration and collaboration with top companies that will widen the horizon of Flutterwave beyond African. Currently, they just sealed a deal with Alipay(the largest payment portal in China) to allow African trade to buy and pay in China without stress.

4. Flutterwave, currently has connected these African countries to each other such as Uganda, Kenya, Nigeria, South Africa, Rwanda, Ghana. It is in the process of connecting Africa to the world.

5. Certification of ISO 27001 and 22301 by the International Standards for Organization in Switzerland.

It is good to know that flutterwave has not only gained the trust but has shown to have the best interest of people at heart. With all these facts, I believe without any doubt that you will start using flutterwave for your Online Payment Transaction.

Go higher Flutterwave as you make not only Nigeria but Africa at Large Proud...

2 notes

·

View notes

Text

Flutterwave: The New Way to Pay

Are you in need of a global payment interface to drive a safe, secure and seamless payment integration? Look no more.

Flutterwave is here to ensure your business gets the secure, easy and efficient digital payment infrastructure it needs to compete in today's global market, with integration across virtually all platforms.

With a mission to drive a new wave of financial prosperity by building strong, secure and efficient financial infrastructures which over the years have changed the way business is conducted in Africa. But most interestingly linked Africa to the global economy with the launching rave and mybarter.

The financial technology company was founded in 2016 by Iyinoluw Aboyeji, Olugbenga Agboola as the co-founder and a team of finance experts from the banking industry and engineers from Paypal, google wallet and a host of others.

Since the inception of the company in 2016, it has processed over $ 2 billion worth of payment in over 100 million transactions. In partnership with 50 different banks and counting, flutterwave has about 1200 developers working on their different products and has raised over $ 20 million in funding.

Rave

Rave by flutterwave is designed to open arrays of opportunities for businesses, individuals and organizations to have a free flow of financial transactions through a secure payment integration that is optimized to service some of the most popular financial institutions. Rave enables a payment flow ranging from recurring billings, e-business integration and much more.

The benefits associated with the flutterwave payment infrastructure spans across all industries, lifestyle, and culture. For example, the flywire integrations were specifically designed to meet the needs of students and academic schooling in other parts of the world. The system guarantees swift payments of tuition in all currency from a singular interface, thereby reducing to the barest minimum the huge financial implication of currency conversion and payment delays.

Uber (The ride-hailing company) didn’t need a pitch to identify with the flexibility and scalability flutterwave infrastructures offer, the same can also be said about industry leaders like Arikair, accessbet, access bank, booking.com and a host of other businesses and organizations benefiting from the convenience of a hitch-free payment and collection infrastructure.

The more interesting gist is the flutterwave most recent partnership with the world's largest e-commerce company, alibaba through Alipay. The implication will be a seamless shopping experience from anywhere in Africa and across the world.

To start receiving payments on your e-commerce site, social networks, and other channels, simply login your flutterwave account or signup following these four simple steps and start receiving safe and secure payments in five minutes.

1. Start by clicking on the create account button on the flutterwave site. Then fill out the forms as directed with examples on the rave platform.

2. Choose from the account types, individual business or organization and click on continue.

3. Create your account following the examples on the creation box, be sure to fill out the form correctly.

4. You are all setup. Now start receiving payments.

It will interest you to know that the rave platform is designed to function across almost all payment cards, system and merchants with any currency of choice.

Barter

Designed to make life easier, fun and more enjoyable is the getbarter app that runs on Android, IOS and Windows platforms. Barter helps you organize your finances, send and receive money in all currencies and access loan facilities all from a singular platform. The loan facilities are short term and designed to help you grow your small business, fund that special event for a loved one or support daily family needs. It also affords users the luxury of a virtual card for safe, secure and flexible transactions.

All these can be achieved in two easy steps of account creation using your mobile number and email address.

With barter, one can easily track expenses, pay for utilities and other such services, book a flight, buy movie tickets, and conduct several other transactions in any currency across the world. With over 30,000 users and counting, barter really makes savings, planning and spending stress-free.

Now you tell me what you think about flutterwave and the milestone so far. Keep in mind the successful integration of Africa into a singular payment platform that has made it easy to transact across the continent. With the successful partnership with alipay, flutterwave customers do now have access to over 3 billion potential customers, that is a global reach on a scale!

You must be thinking what I am thinking, integrate your payment infrastructure today, start receiving and making payments and also position yourself for this new wave of prosperity. Signup at rave or take charge of your finances with barter.

Thank you for the time you have taken to read, please do share and follow across all channels.

Twitter:

Facebook

Regards,

VC Odii

2 notes

·

View notes

Text

Flutterwave: A Runaway Payments Solutions Success Story - Connecting Africa to the Global Economy

Before 2016, African businesses faced hard times to accept payments from visitors, and international tech heavyweights like Amazon, Google, Facebook, etc had difficulties to accept local payments from African customers. This has changed since Flutterwave entered the scene. It was founded in 2016 by a team of ex-bankers, entrepreneurs and engineers in response to this gap in the payments industry in Africa.

As a payment technology company, the main focus of Flutterwave is on helping banks and businesses provide seamless and secure payment experiences for their customers. The headquarters is in San Francisco (to leverage on Silicon Valley ) with offices in Lagos, Nairobi, Accra, and Johannesburg.

Achievements

According to the company’s website, Flutterwave currently has more than 50 bank partners, with over $2.6b payments processed in more than 100m transactions. More than 1200 developers build on Flutterwave. This is remarkable by all standards, especially for an African company.

One of the co-founders, 28-year-old Nigerian entrepreneur, Iyinoluwa Aboyeji, who also co-founded Andela, served as the pioneer CEO. He was reported by CNN, as saying that he “wants Silicon Valley to fund a future where Africa is included”, and people and businesses connect with the global economy. As at the time Aboyeji stepped down as CEO last year, and handed over to his co-founder, Olugbenga Agboola, Flutterwave has completed its Series A Extension round of financing, and this has taken its total raised funding from inception to date to more than US$20 million. This shows investors’ confidence in the performance of the company.

In their 2018 review, Flutterwave announced that they saw a 550% growth in the customer base of Flutterwave for Business (Rave), which is now 26,000 strong. This was made possible by partnerships with existing customers, retaining their key partnerships within the financial industry, enterprise customers like Uber, Arik Air, Booking.com and Flywire, and as they welcomed new customers like DusuPay (Uganda), BroadPay (Zambia) and PennySmart (Ghana). The revamped Barter (Flutterwave for Customers) now boasts of over 30,000 customers.

Their terrific run of achievements in 2018 culminated in the Best Payments Company award at the Ghana eCommerce Awards ceremony.

Payment Solutions

What makes Flutterwave thick? With its payment technology solution, consumers can pay for things in their local currency, while the company takes care of integrating banks and payment-service providers into its platform and this relieves businesses of the expense and burden.

The company’s award-winning payments infrastructure which is accessible via USSD, Mobile, Point of Sale and Web channels enables banks, payments companies, and businesses to do much more. The numbers from the 2018 review by the company attest to the massive adoption of these infrastructures by merchants and customers. There is no sign that the upward growth experienced by the company will abet anytime soon.

The payment solutions are listed below.

● Rave (Flutterwave for Business) – an easy way to accept any payment method from customers and make payments, around the world online or in-store. With many positive testimonies from notable local businesses in Nigeria and beyond, signing up for rave opens up businesses to more opportunities by letting them accept a range of payment methods (card, bank account, and mobile wallet payments) from customers around the world, in person in physical stores or through app/website or on social media.

● Moneywave – used to make payments to anyone around the world. It is a payment system that allows users to securely charge cards and pays accounts. It is basically an API suite that allows connection of disparate payment sources, an omnichannel platform for payments across Africa.

● Barter (Flutterwave for Consumers) – used to issue and manage virtual and physical cards for retail, loyalty and expense management.

Partnerships

To accelerate its activities in its area of focus, Flutterwave has gone into various partnerships. The following partnerships are meant to address the listed issues:

1. Flywire + Flutterwave – this solution integration aims to streamline payment transactions for Nigerian students, patients, and businesses to facilitate payment of foreign school fees and medical bills in Naira.

2. Shopify + Flutterwave – this integration makes selling online easier. It helps African businesses scale globally by integrating Rave into their Shopify store.

3. Alipay + Flutterwave - this gives all Flutterwave merchants access to over 1 billion Alipay users, capturing payments activity around the estimated $200 billion in China-Africa trade. Alipay is now an additional option, to card, Barter, Mobile Money and other payment channels on the Rave checkout modal.

4. PayAttitude + Flutterwave – this only requires a customer’s phone number for a successful payment to occur, though the customer needs to be PayAttitude customer or get it first to be able to use this payment method.

5. Flutterwave + Afropolitan Group – this partnership is aimed at bridging the gap between Africa & the diaspora through entertainment & ticketing.

Developers

Flutterwave touts herself as the Google of all things Payment, with a leading community of engineers who develop the next standard of payment technology in the industry. They provide everything needed to build reliable and secure payment experiences. They make their libraries, plugins, and SDKs available so others can easily integrate and start collecting payments in minutes.

Closing Thoughts

Before this research, I knew very little about Flutterwave. In comparison to others in their space, they are heavyweights in their rights. I’m amazed at their dedication to building payments infrastructure to connect Africa to the global economy, and all that they have achieved in just a few short years. They are truly making it easier for Africans to build global businesses that can make and accept payment, anywhere from across Africa to the global economy. They have converted me and my business into customers for all their products. I am now following the relevant social media handles including that of the past and current CEOs. But more importantly, I am now their unofficial evangelist. You will be sure I will convert many into the Flutterwave way. Who knows, you the reader might just be one of them.

Image credits: Flutterwave Inc

2 notes

·

View notes