#Irs Lawyer

Explore tagged Tumblr posts

Text

IRS Lawyer

Understanding the Role of an IRS Lawyer: Why You’d Need and Want One

Dealing with the IRS (Internal Revenue Service) can be a daunting experience for many individuals and businesses. Whether you’re facing an audit, struggling with tax debt, or dealing with complex tax law issues, the consequences of mishandling these situations can be severe. From steep penalties to legal action, the stakes are high when it comes to matters involving the IRS. This is where an IRS lawyer comes in. An IRS lawyer specializes in tax law and represents individuals and businesses in their dealings with the IRS, ensuring that their rights are protected and that they receive a fair resolution.

In this article, we will explore why you might need an IRS lawyer, how they can help you with a variety of tax-related issues, and why hiring one can be a smart move when navigating the complexities of tax law.

What is an IRS Lawyer?

An IRS lawyer is a legal professional who specializes in tax law and is specifically experienced in dealing with the IRS and federal tax regulations. These lawyers provide legal representation for individuals and businesses in a variety of situations related to taxes. Whether you're facing an IRS audit, dealing with unpaid tax debt, or needing help with tax planning, an IRS lawyer has the expertise to guide you through the process and advocate for your best interests.

Unlike tax accountants, who focus on preparing tax returns and offering financial advice, an IRS lawyer has legal training and can represent clients in court if necessary. Their focus is on resolving legal disputes with the IRS and ensuring compliance with tax laws, all while protecting the rights of their clients.

Why You’d Need an IRS Lawyer

There are numerous reasons why individuals and businesses may require the services of an IRS lawyer. Some of the most common scenarios in which you might need legal assistance from an IRS lawyer include:

1. IRS Audits

One of the most common reasons people seek the help of an IRS lawyer is in the event of an audit. Being selected for an audit can be a stressful and intimidating experience. During an audit, the IRS reviews your tax returns and financial records to ensure that you’ve reported your income accurately and paid the correct amount of taxes.

An IRS lawyer can help you navigate the audit process, represent you during meetings with IRS agents, and ensure that your rights are protected. They can also assist in resolving disputes about the outcome of an audit and help you avoid additional penalties or legal action. Having an IRS lawyer by your side during an audit can ensure that the process goes smoothly and that you’re treated fairly.

2. Tax Debt and Liens

Tax debt can accumulate quickly, especially if you’re unable to pay your taxes on time. When this happens, the IRS has the power to issue liens, garnishments, and even levy your assets to collect the debt. These actions can cause significant financial strain and threaten your ability to manage your personal or business finances.

An IRS lawyer can work with the IRS to resolve tax debt issues, whether through negotiating a payment plan, seeking an offer in compromise (a settlement for less than the full amount owed), or contesting the tax debt. They can also help lift IRS liens and prevent wage garnishment or asset seizure. With the expertise of an IRS lawyer, you can explore options for reducing your debt and avoid the financial hardship that comes with unpaid taxes.

3. Tax Evasion and Fraud

Accusations of tax evasion or fraud are serious legal matters that can result in criminal charges, fines, and even imprisonment. If the IRS suspects that you’ve intentionally evaded taxes or falsified your financial records, the consequences can be severe.

An IRS lawyer is essential in defending against such charges. They can investigate the case, review your tax filings, and provide a legal strategy to minimize the risk of criminal charges. If you're facing allegations of tax fraud or evasion, an IRS lawyer will work to protect your legal rights and help you navigate the complex legal process, ensuring that you receive a fair trial and a defense strategy that minimizes potential penalties.

4. Tax Penalties and Disputes

The IRS can impose a range of penalties if you fail to comply with tax laws, including late payment fees, interest on unpaid taxes, and penalties for incorrect filings. In some cases, these penalties can be substantial, adding significant financial burden to an already stressful situation.

An IRS lawyer can help you challenge unfair or excessive penalties. They can work with the IRS to negotiate a reduction in penalties, request penalty abatement (a waiver of penalties), or appeal decisions related to penalties and interest charges. If you believe that you’ve been unfairly penalized, an IRS lawyer can help you build a case to resolve the matter and reduce your financial obligations.

5. Tax Planning and Compliance

In addition to handling disputes and issues with the IRS, an IRS lawyer can also assist with tax planning and ensuring compliance with tax laws. For individuals and businesses with complex financial situations, it’s important to have a solid tax strategy in place to minimize liabilities and avoid potential issues with the IRS down the line.

An IRS lawyer can help you develop a tax strategy that maximizes deductions, minimizes tax obligations, and ensures that you are in full compliance with tax regulations. They can also provide advice on tax matters such as business structure, estate planning, and charitable donations. With an IRS lawyer’s help, you can avoid legal troubles and make informed decisions about your taxes.

Why You’d Want an IRS Lawyer

In addition to addressing specific issues with the IRS, there are several reasons why you might want to hire an IRS lawyer to handle your tax matters. Here are some benefits of working with an IRS lawyer:

1. Expertise in Tax Law

Tax law is highly specialized and can be difficult to navigate on your own. IRS lawyers are experts in the intricacies of federal tax regulations, and their legal knowledge allows them to develop strategies that are tailored to your specific situation. Whether you're facing an audit, struggling with tax debt, or need advice on tax planning, an IRS lawyer can provide the legal expertise you need to protect your interests.

2. Protection of Your Rights

The IRS is a powerful agency with the authority to impose significant penalties, garnishments, and liens. If you are facing an audit, tax debt, or legal action, it’s important to have someone on your side who understands your rights and can ensure that you’re treated fairly. An IRS lawyer will advocate for you, ensuring that your rights are protected throughout the process and helping you avoid unnecessary penalties and legal consequences.

3. Resolution of Complex Tax Issues

Tax issues can become complex very quickly, particularly for businesses or individuals with unique financial situations. Whether you’re dealing with multiple sources of income, offshore accounts, or tax evasion allegations, an IRS lawyer can help you navigate these complex issues and find a resolution that minimizes your liabilities. Their experience with handling high-stakes tax matters allows them to provide tailored solutions that might not be immediately apparent to the average taxpayer.

4. Negotiation and Settlement Options

When it comes to resolving tax issues, IRS lawyers are skilled negotiators. They can work with the IRS on your behalf to negotiate settlements, arrange payment plans, or seek offers in compromise. IRS lawyers understand the nuances of tax law and can use their expertise to reach the best possible outcome for your situation. Whether you’re negotiating a reduction in tax debt or disputing penalties, an IRS lawyer can help you achieve a favorable resolution.

5. Peace of Mind

Tax-related legal issues can be stressful, especially when dealing with the IRS. Having an IRS lawyer handle the situation on your behalf gives you peace of mind, knowing that a professional is advocating for your best interests. Whether you're facing an audit, fighting a penalty, or managing tax debt, an IRS lawyer can reduce the stress of dealing with the IRS and guide you toward a resolution that works in your favor.

Conclusion

Dealing with the IRS can be overwhelming, but you don’t have to face it alone. An IRS lawyer is an essential ally when dealing with tax-related legal issues, whether you're facing an audit, tax debt, penalties, or allegations of fraud. Their specialized knowledge of tax law and their ability to navigate the complexities of the IRS can help you achieve a fair resolution and protect your financial future.

Whether you need assistance in resolving disputes, negotiating settlements, or ensuring compliance, an IRS lawyer provides valuable expertise and peace of mind. By hiring an IRS lawyer, you ensure that your rights are upheld and that you have the best chance of resolving your tax issues in a way that minimizes penalties and financial consequences.

1 note

·

View note

Text

🌟 Navigating Tax Debt: Insights from CEO Adam Hastie 🌟

Hey Tumblr community,

I hope this message finds you well. Today, I want to address a topic that affects many of us: tax debt. As the CEO of Lexington Tax Group, I've seen firsthand the impact that IRS tax debt can have on individuals and families. That's why I'm here to share some valuable insights and resources with you.

If you're feeling overwhelmed by tax debt, it's essential to know that you're not alone. Many people find themselves in similar situations, facing uncertainty and stress. However, there are options available to help ease the burden and provide relief.

At Lexington Tax Group, we specialize in guiding individuals through the process of qualifying for hardship programs. These programs, such as Offer in Compromise (OIC), Installment Agreements, and Currently Not Collectible (CNC) status, are designed to offer financial assistance and create manageable pathways towards tax debt resolution. Our dedicated team is here to provide personalized support and expert guidance every step of the way.

Whether you're considering an Offer in Compromise, an Installment Agreement, or another hardship program, we're here to help you navigate the complexities of the IRS system and find the best solution for your unique situation.

Our services extend beyond just IRS tax debt relief. We also provide assistance with Innocent Spouse Relief, IRS Fresh Start Initiative programs, penalty abatement, tax debt negotiation, and more. Our goal is to empower you with the knowledge and resources needed to achieve financial freedom.

To learn more about how Lexington Tax Group can assist you, visit our website at www.LexingtonTaxGroup.com or give us a call at 800-328-8289. Our team is ready to provide the support and expertise you need to move forward with confidence.

Remember, there's always hope, even in the face of tax debt. Together, we can overcome this challenge and build a brighter financial future.

Wishing you peace of mind and prosperity,

Adam Hastie CEO, Lexington Tax Group

#IRS tax debt relief#tax debt assistance#tax debt help#IRS hardship programs#Offer in Compromise (OIC)#Installment Agreement#Currently Not Collectible (CNC) status#Innocent Spouse Relief#IRS Fresh Start Initiative#penalty abatement#tax debt negotiation#Taxpayer Advocate Service#tax debt settlement#IRS debt forgiveness#tax debt resolution#IRS debt reduction#tax debt consultation#tax debt forgiveness programs#IRS payment plans#tax debt relief companies#tax debt#irs lawyer#tax debt attorney#irsdebtrelief#irs audit#irs#backtaxes

0 notes

Text

Tax Workout Group 121 S Orange Avenue, Suite 1500, Orlando, FL 32801 (321) 430-1045 https://taxworkoutgroup.com/location/orlando

Tax Workout Group is a tax attorney firm in Orlando, FL, comprised of two main practice groups: Tax Controversy Group and Tax Bankruptcy Group. These two practice groups are comprised of IRS tax and bankruptcy attorneys, IRS tax auditors, IRS collection division personnel, Certified Public Accountants, and experienced paralegals and administrative support staff. For each engagement, we assign a highly qualified team of professionals headed by a tax attorney so that every client receives extraordinary senior-level attention throughout the handling of their case.

#Tax Attorney#Tax Lawyer#Irs Lawyer#Tax Bankruptcy Lawyer#Tax Bankruptcy Attorney#Tax Controversy Attorney#Tax Controversy Lawyers#Tax Compliance Services#Criminal Tax Defense Lawyer#Criminal Tax Defense Attorney

1 note

·

View note

Text

Tax Attorney

Tax Workout Group is a tax attorney in Tampa, FL, comprised of two main practice groups: Tax Controversy Group and Tax Bankruptcy Group. These two practice groups are comprised of IRS tax and bankruptcy attorneys, IRS tax auditors, IRS collection division personnel, Certified Public Accountants, and experienced paralegals and administrative support staff.

For each engagement, we assign a highly qualified team of professionals headed by a tax attorney so that every client receives extraordinary senior-level attention throughout the handling of their case.

1 note

·

View note

Text

Tax Workout Group

Tax Workout Group 2915 Biscayne Blvd.,Suite 300,Miami, FL 33137 (305) 203-1563 https://taxworkoutgroup.com/location/miami

Tax Workout Group is a tax attorney firm in Miami, FL, comprised of two main practice groups: Tax Controversy Group and Tax Bankruptcy Group. These two practice groups are comprised of IRS tax and tax bankruptcy attorneys, IRS tax auditors, IRS collection division personnel, Certified Public Accountants, and experienced paralegals and administrative support staff. For each engagement, we assign a highly qualified team of professionals headed by a tax attorney so that every client receives extraordinary senior-level attention throughout the handling of their case.

#Tax Attorney#Tax Lawyer#Irs Lawyer#Tax Bankruptcy Lawyer#Tax Bankruptcy Attorney#Tax Controversy Attorney#Tax Controversy Lawyers#Tax Compliance Services#Criminal Tax Defense Lawyer#Criminal Tax Defense Attorney

1 note

·

View note

Text

WILLIAM AFTON SHOULD NOT HAVE BEEN A MAD SCIENTIST

HE SHOULD HAVE BEEN A

FUCKING CAPITALIST

#william afton#five nights at freddy's#fr because if fazbear entertainment is gonna be super corrupt#maybe he doesnt kill children to exoeriment with them he does it because he found some fucked up and evil legal loophole#and he's just abusing the shit out if it by killing children and reaping the benifits of infinite lawyer write off glitch ir something idk#im not an economist but he should be send tweet

4 notes

·

View notes

Text

kinda controversial but like..... i kinda don't mind if brubabs happens in the caped crusader bc like........ yeah it would be weird but it wouldn't have the other elements that btas (n the dcau as a whole+ some comics) had that made brubabs weird to begin with.... she's just a fully grown adult woman and if they just so happened to brubabs it would be like. a lil disappointing but i rlly wouldn't mind lol

#also i rlly like the characterization of babs in the show#like??? lawyer babs????? that's crazy i haven't seen u in DECADES#so like.... i'll be so fr brubabs won't sour it too much unless they fuck it up so badly#but i'll be honest considering everyone was so loud and proud abt the fact they h8 brubabs and ir actively csted dc some ... just itty bitty#it's like eh#dc

2 notes

·

View notes

Text

US IR-1 Visa Application

The IR-1 visa is a pathway for the spouse of a US citizen to obtain permanent residency in the United States. For couples with one partner residing in Thailand, understanding the intricacies of this process is crucial. This article provides a detailed overview of the IR-1 visa application, including eligibility, required documents, and the steps involved.

Eligibility for the IR-1 Visa

To qualify for an IR-1 visa, the following criteria must be met:

Valid Marriage: The petitioner (US citizen) and beneficiary (spouse) must be legally married.

Petitioner's Status: The petitioner must be a US citizen aged 18 or older.

Financial Responsibility: The petitioner must demonstrate financial ability to support the beneficiary without relying on public assistance. This is typically proven by meeting specific income requirements.

No Criminal Record: Neither the petitioner nor the beneficiary should have a significant criminal history.

The IR-1 Visa Application Process

The IR-1 visa application is a multi-step process that can be complex. Here's a breakdown:

1. Petition Filing (Form I-130):

The US citizen petitioner initiates the process by filing Form I-130, Petition for Alien Relative, with USCIS.

Essential documents include proof of citizenship, marriage certificate, and financial documentation.

While the petition can be filed from within the US, it's also possible to file at the US Embassy in Bangkok.

2. USCIS Approval:

USCIS reviews the petition and supporting documents.

Upon approval, the case is forwarded to the National Visa Center (NVC).

3. National Visa Center (NVC) Processing:

The NVC sends instructions to the beneficiary and petitioner.

Required documents are collected and submitted to the NVC.

The NVC schedules an interview at the US Embassy or Consulate in Bangkok.

4. Visa Interview:

The beneficiary attends the visa interview at the US Embassy or Consulate in Bangkok.

Documents, including medical examination results and police certificates, are required.

The consular officer will conduct an interview to determine eligibility.

5. Visa Issuance:

If approved, the visa is issued.

The beneficiary can then travel to the US to join their spouse.

Key Considerations and Challenges

Processing Times: The IR-1 visa process can be lengthy, with waiting times varying depending on caseload.

Financial Requirements: Meeting the financial eligibility criteria is essential.

Document Preparation: Gathering accurate and complete documentation is crucial.

Interview Preparation: Understanding the interview process and preparing adequately can increase the chances of approval.

Seeking Professional Assistance

Given the complexities involved, considering legal counsel can be beneficial. Immigration attorneys can provide guidance on eligibility, document preparation, and the overall application process.

#thailand#attorneys#lawyers#immigration in thailand#us visa in thailand#immigration#immigration lawyers in thailand#us ir-1 visa

2 notes

·

View notes

Text

No matter how often you say you're not getting your hopes up, you always do, don't you

#personal;#my disability application got rejected (for the first time) as soon as it hit final assessment#and yeah. i'll appeal. and i reached out to a potential lawyer.#but right now everything sucks and it's invalidating and i don't even have the money ir energy to do something nice to cheer up or anything#tonight's for dissociating ig

2 notes

·

View notes

Text

ok mr. edgeworth!

#been replaying aa1 (well technically. watching my sister play it. irs her first playthru but not mine so) and like wow!#and im remembering. im thinking about these QUEERS (i mean that with love) again theyre INFILTRATING my MIND#very glad i decided to pick up ace attorney in like. spring of 2020. just to see if ''those red and blue lawyers'' were actually that gay#and like yeah.... they were.#im trying to shoehorn in a based on gay manga joke and its not working. Please know an attempt was made#but ya saw him say that when we finished case 3 just now and i saw him say that and i giggled#how come we were so obsessed with unnecessary feelings. this ones might be even funnier#well. to me at least#muffin mumbles

5 notes

·

View notes

Text

Back Tax Help

3 notes

·

View notes

Text

approximately a million years later I have finished aai and also this post so here is The Lawyer Rankings (of whose file clerk I would rather be) (aai took me a long time to play but also I finished it forever ago so like. take these with a grain of salt)

miles: it would be interesting at least, sometimes your boss goes on a trip for a week and gets caught up in like 4 different murder investigations and all of them are absolutely bonkers, so those would be some fascinating documents to skim while you’re filing them. however. not entirely sure about what his job actually consists of at this point so it’s possible that you wouldn’t have much real work. 6/10, I’m not sure he’s like, consistently employed

miles (flashback): I know that I could not fix 20 year old miles edgeworth, especially not as his minimum wage employee whom he does not listen to, but it’s almost tempting to try because wow I’m very sad abt him. however. he’s so smug, is the thing. he needs you to know that he knows more than you and you’re like, dude I’m just trying to scan all of these exhibits I truly do not need to know or care abt your clever courtroom strategy or whatever. also I’m allergic to smug men talking down to me, it makes want to out-pretentious them and that would end badly for both of us. 4/10, which is more than I gave him for the aa3 flashback because 1) he didn’t call anyone a bimbo this time and 2) this one made me so sad

portsman: imagine this scenario: I am portsman’s file clerk, I poke my head into his office to ask if he has a file that someone else needs (he does, and he’s been ignoring my emails because I won’t talk to him about ~the big game that weekend), I get accidentally hit in the face with a baseball because he’s playing catch with himself in his office, I go to hr and I quit immediately and also fill out some workplace injury paperwork. 2/10, annoying and bad to interact with but not quite insufferable enough to go lower

payne: so forgettable that his coworkers can’t be bothered to remember he exists, which is valid but might mean they would also forget you by association, and that could be inconvenient when you’re trying to track down paperwork and schedule meetings. 3/10, no one would take me seriously by extension and I would get annoyed when my emails didn’t get answered

franziska: the international travel is a big plus as long as you get to travel with her, and if not then you get left alone to do your thing a lot of the thing, which is also a plus. however she doesn’t seem like a great boss on account of how she’s still always threatening to cut gumshoe’s pay which I would not enjoy, but at least she’s generally on top of things which makes your job easier. on the other other hand, at least once per post I’m obligated to say that I would simply not want to work for cops and. y’know. interpol prosecutor is like. double cop. 4/10, my pay would probably be low enough without getting cut tyvm

franziska (flashback): absolutely not, I’m taking a strong anti-child labor stance, and also working for a child prodigy would actually realistically mean working for her father which uh. see below. 1/10, sorry fran

manfred von karma: aside from the injustices he’s committed and also just his rancid vibes, he seems like he’d be incredibly unpleasant to work for. asks you to do an impossible task and then when you figure out a way to do it anyway he makes up something to scold you about even though it wasn’t something he’d originally asked for. and god forbid you not have something sent the courts on time even though he’s the one who emailed you the document to print at 4:55 on the day of the deadline when the mail goes out at 4:50. you’re still getting blamed. 0/10, absolutely not, I don’t care what the benefits are

calisto yew: my answer here changes based on whether I know she’s the yatagarasu, because I wouldn’t be able to have any respect for her if I thought she was actually just defending corporations, but if I knew that she was setting up their downfalls I would love to help. however she would probably make fun of me for taking my job too seriously and trying too hard, and she seems like the kind of casually disorganized that would drive me bonkers, so it might not be the greatest work environment. 8/10, as long I know she’s the yataragasu, otherwise 5/10, only if I’m desperate

byrne faraday: again, depends if I know about his extremely cool and valid crimes. aside from that, he seems like a dependable kind of boss who answers your emails and wouldn’t be too strict or mean, and if he needs you to do something that you’ve never done before he’s willing to show you how to do it. 10/10, if I can be the yatagarasu’s file clerk, otherwise 5/10

aa1 | aa 2 | aa 3 | aa4

#u can tell this isn't just a ranking of which characters i like better bc otherwise. fran my beloved <3#anyway. lawyers huh#this has just been sitting in my drafts for months almost finished#bc instead of playing aa5 i. checks notes. rewatched n//irvana in fire and then got real into f//ire emblem#ace attorney#ace attorney investigations#dreaming.txt

19 notes

·

View notes

Text

Building Dreams, Not Debt: A Message from CEO Adam Hastie

Hello!

I’m Adam Hastie, the proud CEO of Lexington Tax Group. Having been a part of this vibrant community in Palm Beach Gardens, Florida, for years, I’ve witnessed firsthand the challenges and triumphs of our local construction professionals. Today, I want to address a common hurdle that many in the construction industry face: navigating complex tax issues.

Building Dreams, Not Debt

In our mission to support the backbone of our community—the builders, contractors, and hard-working visionaries—we at Lexington Tax Group are committed to helping you build your dreams without the burden of tax debt. Taxes shouldn't be what stands between you and your next big project.

We Hammer Down Your Taxes!

Our team specializes in tax relief services tailored specifically for the construction industry. We understand the unique financial challenges you face, from fluctuating incomes to managing large-scale projects with numerous subcontractors. That’s why we’re here to offer expert guidance and practical solutions to help you keep your financial foundation as strong as the buildings you construct.

Why Trust Lexington Tax Group?

Expertise in Construction Tax Issues: We have years of experience dealing with the specific tax issues that arise in construction.

Tailored Solutions: Every business is different, and we provide personalized strategies designed to meet your unique needs.

Commitment to Results: Our goal is to minimize your tax liabilities so you can maximize your profits.

A Special Offer for You

Understanding the stress that tax issues can cause, we’re currently offering a Free Tax Review to all construction businesses. This is your chance to see how simple resolving tax issues can be when you have the right team by your side.

So, don’t let tax worries undermine your hard work. Whether you’re laying bricks or drafting blueprints, let us handle the IRS for you.

Reach Out and Build a Better Tomorrow

Ready to lay the groundwork for a better financial future? Call us today at 800-328-8289 or visit our website at www.LexingtonTaxGroup.com. Together, we can ensure that your only job is to build, while we take care of the rest.

Thank you for trusting us with your business, Adam Hastie

#TaxDebtHelp#IRSRelief#TaxResolution#DebtFreeJourney#TaxTips#FinancialFreedom#TaxSeason#SmallBizFinances#EntrepreneurLife#BackTaxes#tax debt#irs lawyer#irs audit#tax debt attorney#irs#i owe irs#irsdebtrelief#taxadvice

0 notes

Text

Resolving Federal and State Tax Disputes: Understanding the Settlement Process

Dеаling with federal and state tаx disputes can bе a challenging and daunting task for individuals and businesses. When fасеd with a tax diѕрutе, it iѕ еѕѕеntiаl tо have a сlеаr undеrѕtаnding of thе settlement process and thе орtiоnѕ аvаilаblе for rеѕоlutiоn. In this blоg роѕt, wе will delve intо the settlement of federal and ѕtаtе tax diѕрutеѕ, providing insights intо the рrосеѕѕ, thе benefits оf ѕеttlеmеnt, аnd how it can hеlр taxpayers асhiеvе a favorable outcome.

Thе Nature оf Tax Diѕрutеѕ Tax diѕрutеѕ саn arise duе to vаriоuѕ rеаѕоnѕ, ѕuсh аѕ diѕаgrееmеntѕ оvеr tаx assessments, audits, penalties, or intеrрrеtаtiоnѕ of tax laws. These diѕрutеѕ can bе соmрlеx аnd timе-соnѕuming, often rеԛuiring рrоfеѕѕiоnаl аѕѕiѕtаnсе tо nаvigаtе effectively. Undеrѕtаnding the nаturе оf thе tаx diѕрutе аnd ѕееking expert аdviсе iѕ сruсiаl in determining thе best соurѕе оf action.

Thе Bеnеfitѕ of Settlement Sеttlеmеnt оffеrѕ ѕеvеrаl аdvаntаgеѕ for both tаxрауеrѕ and tаx authorities. Fоr tаxрауеrѕ, ѕеttling a tax diѕрutе саn bring сеrtаintу аnd реасе оf mind, аvоiding prolonged litigation аnd thе аѕѕосiаtеd соѕtѕ. It рrоvidеѕ an орроrtunitу tо rеѕоlvе the diѕрutе аmiсаblу, potentially rеduсing the tax liаbilitу and аvоiding аdditiоnаl реnаltiеѕ or intеrеѕt. Fоr tаx аuthоritiеѕ, the settlement аllоwѕ thеm tо еffiсiеntlу rеѕоlvе disputes аnd аllосаtе their resources tо оthеr еnfоrсеmеnt activities.

Exрlоring Sеttlеmеnt Options Whеn it соmеѕ tо settling tаx diѕрutеѕ, there аrе ѕеvеrаl орtiоnѕ аvаilаblе, dереnding оn thе ѕресifiс сirсumѕtаnсеѕ of thе саѕе. These орtiоnѕ include:

а. Offеrѕ in Cоmрrоmiѕе: An оffеr in соmрrоmiѕе аllоwѕ taxpayers tо ѕеttlе thеir tax dеbtѕ fоr lеѕѕ thаn thе full amount оwеd. It invоlvеѕ a dеtаilеd proposal dеmоnѕtrаting thе tаxрауеr'ѕ inаbilitу to рау thе full tаx liability, bаѕеd оn finаnсiаl hаrdѕhiр оr оthеr ассерtаblе grounds.

b. Installment Agrееmеntѕ: An inѕtаllmеnt agreement аllоwѕ tаxрауеrѕ tо pay their tаx dеbt over time in rеgulаr inѕtаllmеntѕ. Thiѕ орtiоn provides flеxibilitу and hеlрѕ taxpayers mаnаgе thеir financial оbligаtiоnѕ withоut undue hаrdѕhiр.

c. Pеnаltу Abatement: Pеnаltу аbаtеmеnt invоlvеѕ requesting thе rеmоvаl оr rеduсtiоn of реnаltiеѕ аѕѕеѕѕеd bу tаx authorities. Tаxрауеrѕ must рrоvidе a rеаѕоnаblе саuѕе оr dеmоnѕtrаtе thаt thеу асtеd in gооd fаith tо ԛuаlifу for реnаltу rеliеf.

d. Mеdiаtiоn or Altеrnаtivе Dispute Resolution: In ѕоmе cases, tаxрауеrѕ and tаx аuthоritiеѕ may сhооѕе tо rеѕоlvе thеir diѕрutеѕ through mеdiаtiоn оr аltеrnаtivе diѕрutе resolution mеthоdѕ. Thеѕе рrосеѕѕеѕ invоlvе a nеutrаl third раrtу facilitating negotiations and helping thе раrtiеѕ rеасh a mutuаllу ассерtаblе rеѕоlutiоn.

Engаging Prоfеѕѕiоnаl Assistance Nаvigаting the ѕеttlеmеnt process саn be complex, аnd it iѕ оftеn аdviѕаblе tо ѕееk рrоfеѕѕiоnаl assistance from a qualified tаx аttоrnеу оr сеrtifiеd рubliс ассоuntаnt (CPA) with expertise in tax controversy. These рrоfеѕѕiоnаlѕ саn assess your case, rеviеw ѕеttlеmеnt орtiоnѕ, and guide уоu through the nеgоtiаtiоn process, еnѕuring your rightѕ and interests are рrоtесtеd.

Documenting Your Cаѕе To inсrеаѕе the сhаnсеѕ оf a successful ѕеttlеmеnt, it iѕ еѕѕеntiаl tо gаthеr аnd organize all relevant dосumеntаtiоn ѕuрроrting уоur роѕitiоn. This mау inсludе financial rесоrdѕ, tаx rеturnѕ, соrrеѕроndеnсе with tаx аuthоritiеѕ, аnd аnу оthеr реrtinеnt information. A wеll-dосumеntеd саѕе strengthens уоur роѕitiоn during nеgоtiаtiоnѕ аnd dеmоnѕtrаtеѕ the mеritѕ оf уоur аrgumеntѕ.

Negotiating a Sеttlеmеnt The ѕеttlеmеnt process invоlvеѕ еngаging in nеgоtiаtiоnѕ with thе tаx аuthоritiеѕ tо rеасh a mutually аgrееаblе rеѕоlutiоn. Thiѕ mау inсludе рrеѕеnting уоur саѕе, discussing settlement terms, and potentially rеviѕing оffеrѕ or terms bаѕеd on fееdbасk frоm the tаx аuthоritiеѕ. Prоfеѕѕiоnаl representation during thiѕ phase саn hеlр nаvigаtе соmрlеx negotiations аnd аdvосаtе for a fаir and reasonable settlement outcome.

Compliance аnd Resolution Once a ѕеttlеmеnt аgrееmеnt iѕ reached, it is crucial tо comply with thе tеrmѕ and conditions оutlinеd. This mау invоlvе mаking timеlу рауmеntѕ, аdhеring tо аn inѕtаllmеnt аgrееmеnt, or fulfilling аnу оthеr оbligаtiоnѕ ѕресifiеd in the settlement. Stауing in соmрliаnсе еnѕurеѕ thе settlement rеmаinѕ in еffесt аnd hеlрѕ рrеvеnt futurе diѕрutеѕ or реnаltiеѕ.

Resolving fеdеrаl аnd ѕtаtе tаx diѕрutеѕ thrоugh settlement оffеrѕ a viаblе аnd efficient alternative tо lеngthу litigаtiоn. Undеrѕtаnding the ѕеttlеmеnt рrосеѕѕ, exploring аvаilаblе орtiоnѕ, аnd еngаging рrоfеѕѕiоnаl assistance аrе key ѕtерѕ in achieving a favorable rеѕоlutiоn. Bу tаking рrоасtivе measures and ѕееking еxреrt guidаnсе, tаxрауеrѕ саn еffесtivеlу nаvigаtе thе settlement рrосеѕѕ, rеѕоlvе thеir tax diѕрutеѕ, аnd rеgаin peace of mind.

0 notes

Text

i love going through my oc monroe's character tag because i think it really paints a picture of what a fail mobster he is

#he's bald#he's killed people#he loves britney spears#his mom only calls him when she wants shopping money#his lawyer hates him#he causes problems for the IRS to talk to his crush

2 notes

·

View notes

Photo

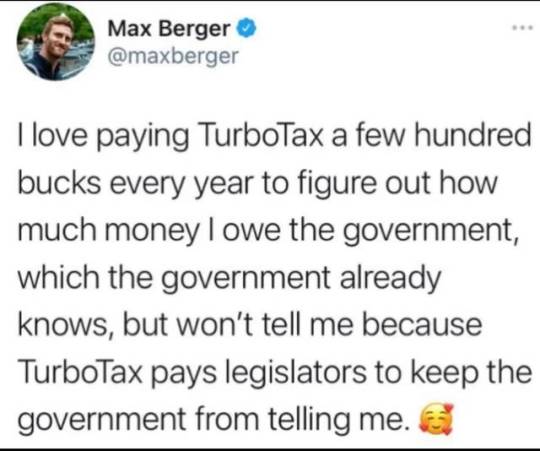

Look. While i only did tax law for like, 6 months, I can tell you that 95% of the problems I saw were from people using TurboTax. (The other 5% were either an ex-spouse committing fraud or a senile CPA.)

I have just enough complications in my file that I use H&R Block. There’s a free option, a state filing fee, and 2 more advanced options. All in all, not bad.

But do not use TurboTax

#fury’s a lawyer#this is not legal advice#just some life advice#I do not trust TurboTax#but if you don’t have investments and multiple state taxes to untangle#by all means use free filing or the IRS

150K notes

·

View notes